Exhibit 99.1

DSP Group Files Investor Presentation;

Challenges Starboard’s Claims

SAN JOSE, Calif., May 15, 2013 — DSP Group®, Inc. (Nasdaq: DSPG), a leading global provider of wireless chipset solutions for converged communications, today announced that it has filed a presentation with the U.S. Securities and Exchange Commission. The presentation, available from the investor relations section of the Company’s Web site (http://www.dspg.com), discusses in detail the Company’s strategies to improve performance, the superb qualifications of DSP Group’s director candidates and the Company’s progress in positioning itself for expected growth in its key markets.

The Company’s presentation challenges the claims made by Starboard Value and Opportunity Fund in its presentation dated May 13, 2013. In the Company’s opinion, Starboard’s presentation is a clever combination of distortions and deceptions that misrepresents the activist hedge fund’s true intentions but reviles that Starboard does not have any real business plans for the Company. Starboard’s presentation also ignores the Company’s successful operational turnaround and fails to acknowledge the benefits of the Company’s research and development investments and the resulting potential for long-term stockholder value.

Starboard Has Already Appointed Two Directors to the Company’s Board:

Starboard’s proxy fight is about seeking to gain a majority on the Company’s board of directors. Starboard has already appointed two directors to the DSP Group board, and they have nominated three more candidates for election. Starboard claims that it is merely seeking to ensure that alternative viewpoints are presented to the Board. If this were Starboard’s only objective, the activist hedge fund would not have rejected the Company’s settlement offer of four of ten seats on the Board, along with significant committees representation and leadership.

Starboard rejected this settlement proposal—a proposal that, based on our review of prior Starboard settlement agreements, offered them a better deal than they have ever received in other negotiated resolutions. Their rejection of this offer is proof that they want more.

Starboard Misrepresents the Facts, So We’re Correcting the Record:

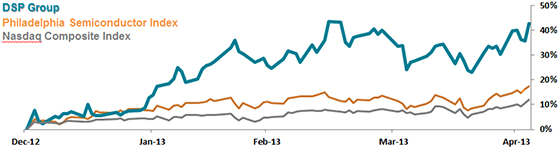

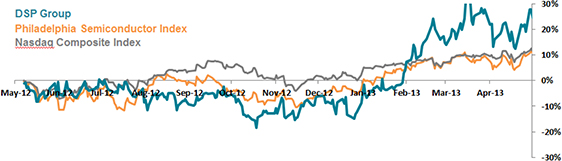

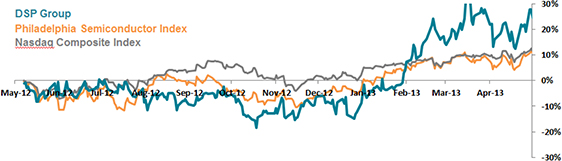

| | • | | The Company’s stock performance year-to-date and for the trailing twelve months is significantly better than the performance of the NASDAQ Composite Index and the Philadelphia Semiconductor Index for the same periods. Since the Company independently undertook to restructure its cost structure in July 2011, DSP Group’s stock has outperformed these indexes and its relevant peer group (including Broadcom, PMC Sierra, Vitesse Semiconductor, Mindspeed and Sigma Designs). Starboard’s claims about the performance of our stock are misleading and ignore the stock’s performance when compared to relevant benchmark indexes and our peer group. |

| | • | | DSP Group has completed six consecutive quarters of operational improvements, measured across all key metrics. The Company returned to GAAP profitability in the first quarter of 2013 and returned to non-GAAP profitability for the year ended December 31, 2012. Starboard’s claims that the Company’s operating performance has been “abysmal” are entirely false and ignore our recent operating success. |

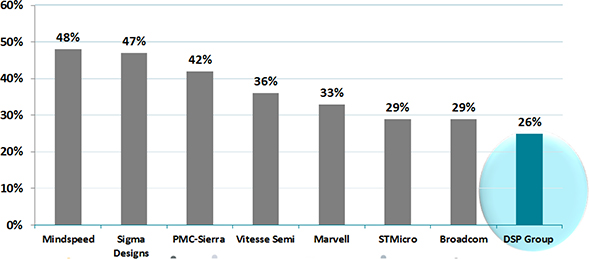

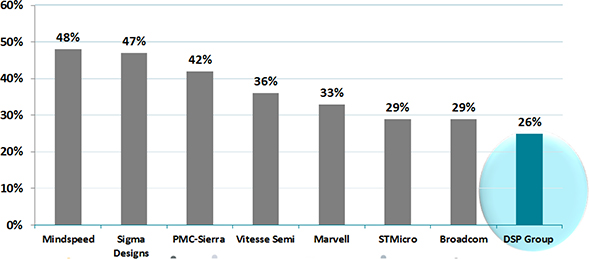

| | • | | Contrary to what Starboard asserts, DSP Group invests significantly less than its peers in R&D as a percentage of revenues, and the Company’s R&D efforts have been productive, with the launch of three new products in key growth markets since the beginning of 2013. Starboard’s claims that the Company overspends on R&D are simply incorrect when compared to the relevant set of peers. In addition, it is misleading of Starboard to include the Company’s acquisition of a DECT operating division of NXP Semiconductors (including employees, sales, offices and other infrastructure), as part of DSP Group’s historical R&D expenditure. Without this investment, the Company would not have achieved a 70% market share in the cordless phone segment as the US market has transitioned to DECT in the last 5 years. |

| | • | | DSP Group is committed to the highest standards of corporate governance and transparency, especially when it comes to transactions with CEVA, which spun off from the Company in 2002.None of the board members were involved in negotiating this transaction that was totally immaterial in its size. Moreover, the questions raised by Starboard in respect to getting back to the licensing business just proves their complete ignorance in respect to our business and to the core competencies of the company, and contradicts their own claim that the Company spends too much on R&D, a typical R&D expense of an IP licensing company is 35% to 45% of revenues. |

| | • | | The Board has included Starboard’s current designees—Tom Lacey and Kenneth Traub—in all deliberations of the full Board.Contrary to Starboard’s claims,they have been neither “excluded” nor “isolated” from the Board’s decision-making process. In fact, they have voted alongside all other Board members in all business decisions made by the Board. Moreover, the Board has a policy of inviting all directors, and not merely committee members, to observe all committee meetings. Both of Starboard’s current Board designees have attended committee meetings andStarboard’s claims that Messrs. Lacey and Traub were not permitted to observe meetings are false. |

As set out in the Company’s presentation in greater detail, DSP Group and its director candidates are confident that the Company’s R&D investments are poised to deliver durable value for the Company’s stockholders in the coming years. The Company’s strategy will maximize stockholder value and we urge you to vote theGOLD proxy card to support DSP Group’s nominees for election to the Board at the 2013 annual meeting of stockholders.

DSP Group’s TTM and YTD stock performance charts as well as DSP Group’s R&D spend as compared to its peers can be found inAppendix A (http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MTg1OTQwfENoaWxkSUQ9LTF8VHlwZT0z&t=1)

Appendix A:

YTD—DSP Group Shares Have Outperformed Relevant Indexes

TTM—DSP Group Shares Have Outperformed Relevant Indexes

2012 R&D Expense As % Of Revenues, Comparison To SoC Peer Group Comparison

Important Additional Information

The Company has filed with the U.S. Securities and Exchange Commission (“SEC”) and provided to its stockholders a definitive proxy statement and a proxy supplement in connection with its 2013 annual meeting of stockholders. STOCKHOLDERS ARE URGED TO READ THIS PROXY STATEMENT, THIS PROXY SUPPLEMENT AND OTHER RELEVANT DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN THEIR ENTIRETY BECAUSE THEY CONTAIN, OR WILL CONTAIN, IMPORTANT INFORMATION. Stockholders will be able to obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov and through the website maintained by the Company at http://ir.dspg.com. The Company, its directors and certain of its officers may be deemed to be participants in the solicitation of the Company’s stockholders in connection with its 2013 annual meeting. Information regarding the names, affiliations and direct and indirect interests (by security holdings or otherwise) of these persons can be found in the Company’s definitive proxy statement and proxy supplement for its 2013 annual meeting, which were filed with the SEC on April 22, 2013 and May 6, 2013, respectively. Stockholders may obtain a free copy of the proxy statement, the proxy supplement and other documents filed by the Company with the SEC from the sources listed above.

About DSP Group

DSP Group®, Inc. (NASDAQ:DSPG) is a leading global provider of wireless chipset solutions for converged communications. Delivering semiconductor system solutions with software and reference designs, DSP Group enables OEMs/ODMs, consumer electronics (CE) manufacturers and service providers to cost-effectively develop new revenue-generating products with fast time to market. At the forefront of semiconductor innovation and operational excellence for over two decades, DSP Group provides a broad portfolio of wireless chipsets integrating DECT/CAT-iq, DECT ULE, Wi-Fi, PSTN, HDClear™, video and VoIP technologies. DSP Group enables converged voice, audio, video and data connectivity across diverse mobile, consumer and enterprise products – from mobile devices, connected multimedia screens, and home automation & security to cordless phones, VoIP systems, and home gateways. Leveraging industry-leading experience and expertise, DSP Group partners with CE manufacturers and service providers to shape the future of converged communications at home, office and on the go.

For more information, visit www.dspg.com.

Contacts:

| | | | |

Investor Relations Christopher Basta Director of Investor Relations, DSP Group Work: 1-408-240-6844 Cell: 1-631-796-5644 chris.basta@dspg.com | | Daniel H. Burch, CEO MacKenzie Partners, Inc. Work: 1-212-929-5748 Cell: 1-516-429-2722 dburch@mackenziepartners.com Paul R. Schulman, EVP MacKenzie Partners, Inc. Work: 1- 212.929.5364 Cell: 1- 203.856.6080 pschulman@mackenziepartners.com | | Media Relations

Mike Sitrick and Jeff Lloyd Sitrick And Company Work: 1-310- 788-2850 Jeff_Lloyd@sitrick.com Mike_Sitrick@sitrick.com |