February 2023 / Confidential INVESTOR PRESENTATION

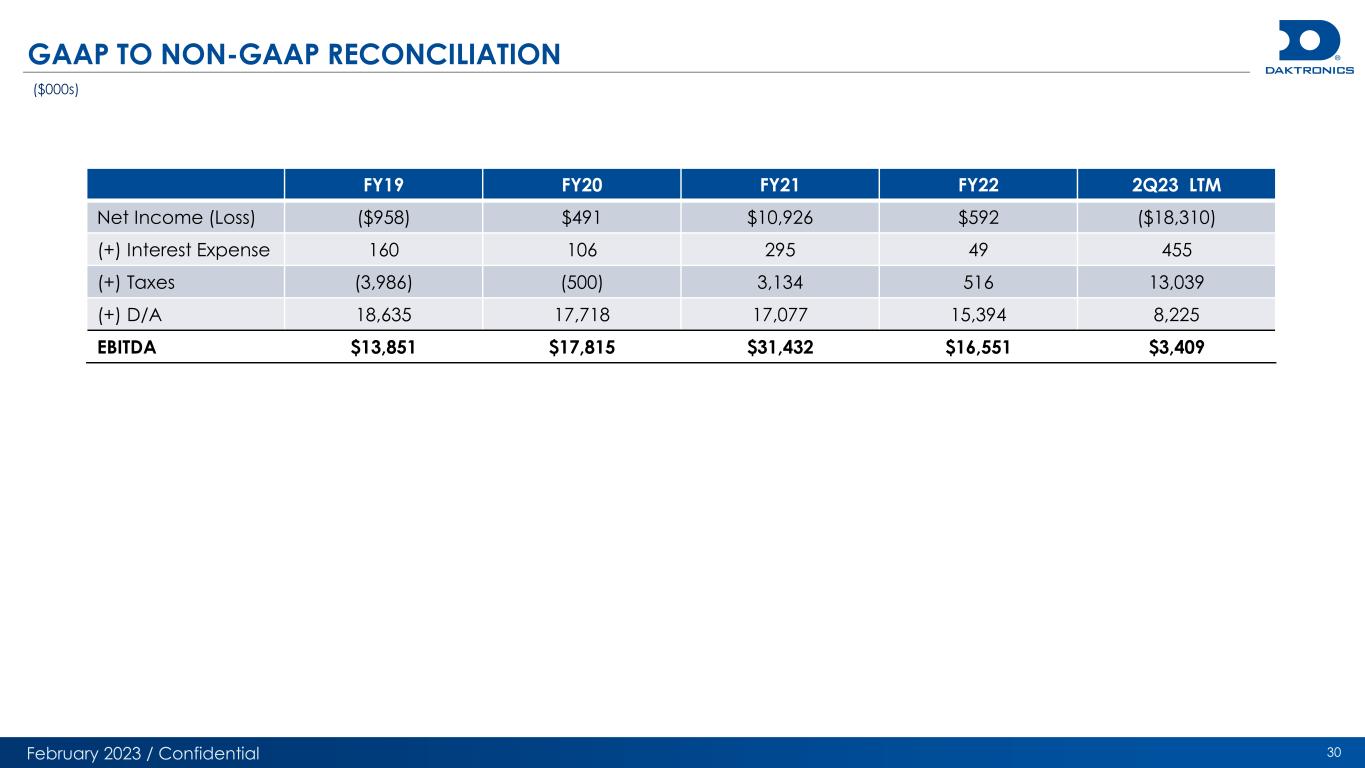

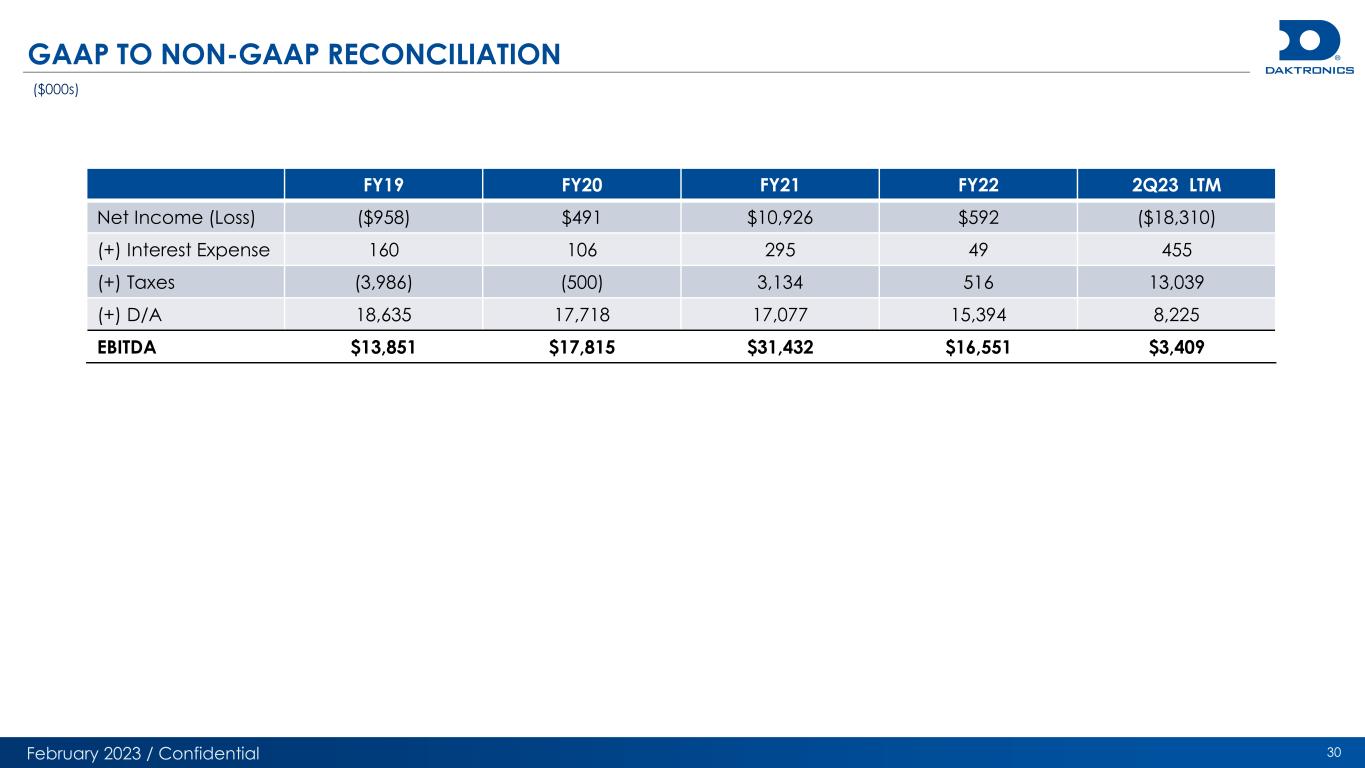

February 2023 / Confidential 1 DISCLAIMER This Investor Presentation, including any oral statements made in connection herewith (the “Presentation”), is provided for informational purposes only and has been prepared by Daktronics, Inc. (the “Company” or “Daktronics”) and is being furnished to a limited number of parties solely for the purpose of considering a transaction with the Company (the “Potential Transaction”). This Presentation is intended solely for investors that are, and by receiving this Presentation, the recipient expressly confirms that they are, qualified institutional buyers or institutions, entities or persons that are accredited investors (as such terms are defined under the rules of the U.S. Securities and Exchange Commission (the “SEC”)). This Presentation does not constitute a commitment on the part of the Company to provide the recipient with access to any additional information or to execute the Potential Transaction. The information in this Presentation has not been independently verified. None of the Company, their respective affiliates or their respective employees, directors, officers, contractors, advisors, members, successors, representatives or agents make any representation or warranty as to the accuracy or completeness of this Presentation, and shall have no liability for any representations or warranties (expressed or implied) contained in, or for any omissions from or errors in, this Presentation or any other written or oral communications transmitted to the recipient in the course of its evaluation of the Company. Only those representations and warranties as may be contained in a definitive agreement relating to the Potential Transaction shall have any legal effect. The information in this Presentation is valid as of the date hereof and is subject to change. The Company is under no obligation to update, amend or supplement this Presentation or any information contained herein and disclaims any obligation to do so except as required by law. The information in this Presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact are forward-looking statements. The words “anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,” “may,” “model,” “plan,” “potential,” “project,” “seek,” “should,” “target,” “will,” “would” and similar expressions that predict or indicate future events or trends are intended to identify forward-looking statements, but the absence of such words does not mean a statement is not forward-looking. The forward-looking statements in this Presentation relate to, among other things, the Company’s future operations, strategies, financial results or other developments and preliminary terms of the Potential Transaction, general market conditions and other aspects of the Company’s business and prospects and those of other industry participants. The forward-looking statements are based on assumptions and analyses made by the Company in light of the Company’s experience and perception of historical trends, current conditions, expected future developments, and other factors that the Company believes are appropriate under the circumstances. These statements are subject to numerous known and unknown risks and uncertainties which may cause actual results to be materially different from any future results or performance expressed or implied by the forward-looking statements. Additional information concerning such risks and uncertainties can be found in the Company’s periodic filings with the SEC, including Annual Report on Form 10-K for the fiscal year ended April 30, 2022, and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. This Presentation contains material non-public information, and the viewing of these materials may have implications under U.S. securities laws. By accepting this Presentation, recipients are acknowledging they are (i) aware that the United States securities laws restrict persons with material non-public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information and (ii) familiar with the Exchange Act and the rules and regulations promulgated thereunder, and that they will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b-5 thereunder. This Presentation contains certain non-GAAP financial measures of the Company. These non-GAAP financial measures, which include EBITDA and EBITDA Margin, have been presented in order to aid understanding in the Company’s financial performance. Non-GAAP financial measures used in this presentation are not meant to be a substitute for comparable GAAP measures and are not intended to be considered in isolation from, in substitution for, or superior to the Company’s financial measures prepared in accordance with GAAP. The Company defines EBITDA as net income (loss) plus interest, taxes, depreciation, and amortization. The Company defines EBITDA Margin as EBITDA divided by net sales. See the appendix for a reconciliation of these measures to the Company’s most comparable GAAP financial measures. Additionally, this Presentation also contains the metrics orders and backlog, which are not measures defined by GAAP, and out methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. Backlog represents the dollar value of orders for integrated electronic display systems and related products and services which are expected to be recognized in net sales in the future. Orders are contractually binding commitments from customers. Orders are included in backlog when we are in receipt of an executed contract and any required depots or security and have not yet been recognized into net sales. This Presentation does not include a reconciliation of orders or backlog, as it is impractical to do so without unreasonable effort. This Presentation is being made available only to parties who have signed and returned a confidentiality agreement with the Company in connection with the Potential Transaction (the “Confidentiality Agreement”) and recipients are therefore bound by the Confidentiality Agreement in respect of all information contained in this Presentation. In the event of a discrepancy between the Presentation (including the disclaimer) and the Confidentiality Agreement, the Confidentiality Agreement will govern. The Company reserves the right, at any time, to negotiate with one or more interested parties or to enter into a definitive agreement with respect to, or to determine not to proceed with, any Potential Transaction, without prior notice to any other interested parties. The Company reserves the right to terminate, at any time, and for any or no reason, further participation by any party and to modify any other procedures. The Company shall have no legal commitment or obligation to any recipient of this Presentation unless and until a definitive agreement for the Potential Transaction has been fully negotiated, executed, delivered and approved by the Company and such recipient. This Presentation shall not constitute an offer, nor a solicitation of an offer, of the sale or purchase of securities, nor shall any securities of the Company be offered or sold, in any jurisdiction in which such an offer, solicitation or sale would be unlawful. Neither the SEC nor any state securities commission has approved or disapproved of the transactions contemplated hereby or determined if this Presentation is truthful or complete. Any representation to the contrary is a criminal offense. Recipients of this Presentation should not construe the contents hereof to constitute legal, tax, regulatory, financial, accounting or other advice. Any recipient of this Presentation should seek advice from its own independent tax advisor, legal counsel and/or other advisor with respect to such matters. By accepting this Presentation, the recipient agrees that neither the recipient nor the recipient’s agents or representatives will directly contact the Company or any of its directors, officers, employees, shareholders, customers, suppliers or related parties or affiliates at any time with respect to the Potential Transaction or the information herein. Although all information and opinions expressed in this Presentation, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, the Company has not independently verified the information and makes no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith estimates of the Company, which are derived from its review of internal sources as well as the independent sources described above. This Presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding any Potential Transaction. The Company owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with the Company, or an endorsement or sponsorship by or of the Company. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks and trade names.

TABLE OF CONTENTS 2 Overview of Daktronics 3 Key Investment Highlights 13 Appendix 22 February 2023 / Confidential

February 2023 / Confidential Overview of Daktronics 3

February 2023 / Confidential SITUATION AND TRANSACTION OVERVIEW Daktronics, Inc. (“Daktronics” or the “Company”), a South Dakota corporation, is an industry leader in dynamic audio-visual communication systems for sports, advertising, and transportation segments ◼ Founded in 1968 and headquartered in Brookings, South Dakota In the calendar year 2022, Daktronics achieved sales increases and continued to fulfill customers' orders despite capacity constraints, a challenging labor environment, and operational disruptions driven by exogenous circumstances ◼ Significantly improved order flow, with Q2 FY2023 net sales of $187 million, a 14% YoY increase, and a contracted order backlog standing at over $463 million(1)(2) The Company's Board recently formed a Strategy and Financing Review Committee (the "Committee") to address the Company’s near-term credit needs and to examine alternatives for improving the Company’s longer-term financial structure and liquidity profile The Committee is exploring new financing options to establish a healthy long-term capital structure ◼ The Company is targeting $75 million in new money financing 4 1) Daktronics’ operates on a 52- or 53-week fiscal year, with its fiscal year ending on the Saturday closest to April 30 of each year. 2) Orders and backlog are not measures defined by GAAP, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 30, 2022.

February 2023 / Confidential 5 KEY INVESTMENT CONSIDERATIONS Large and Diverse Worldwide Customer Base Industry Leader in Dynamic Audio-Visual Communication Systems Experienced Leadership Team with Clear Roadmap for Operational Improvement Strong Asset Base and Manufacturing Footprint Broadest Range of Product Solutions Among Competitors 1 Cash Generation Opportunity with Streamlined Cost Structure and Enhanced Margins Consistent Top Line Revenue and Strong Order Backlog 3 Low Leverage Presents Financing Capacity 2 4 5 7 6 8

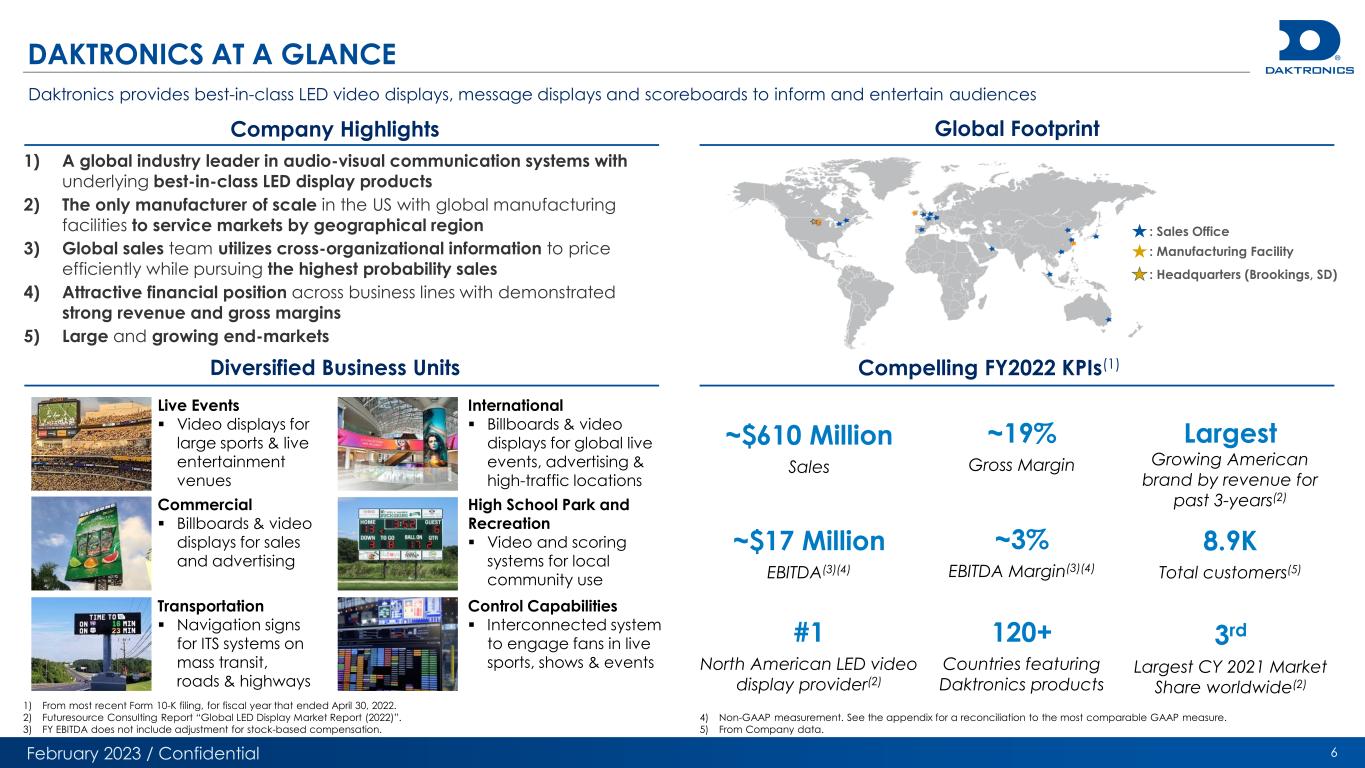

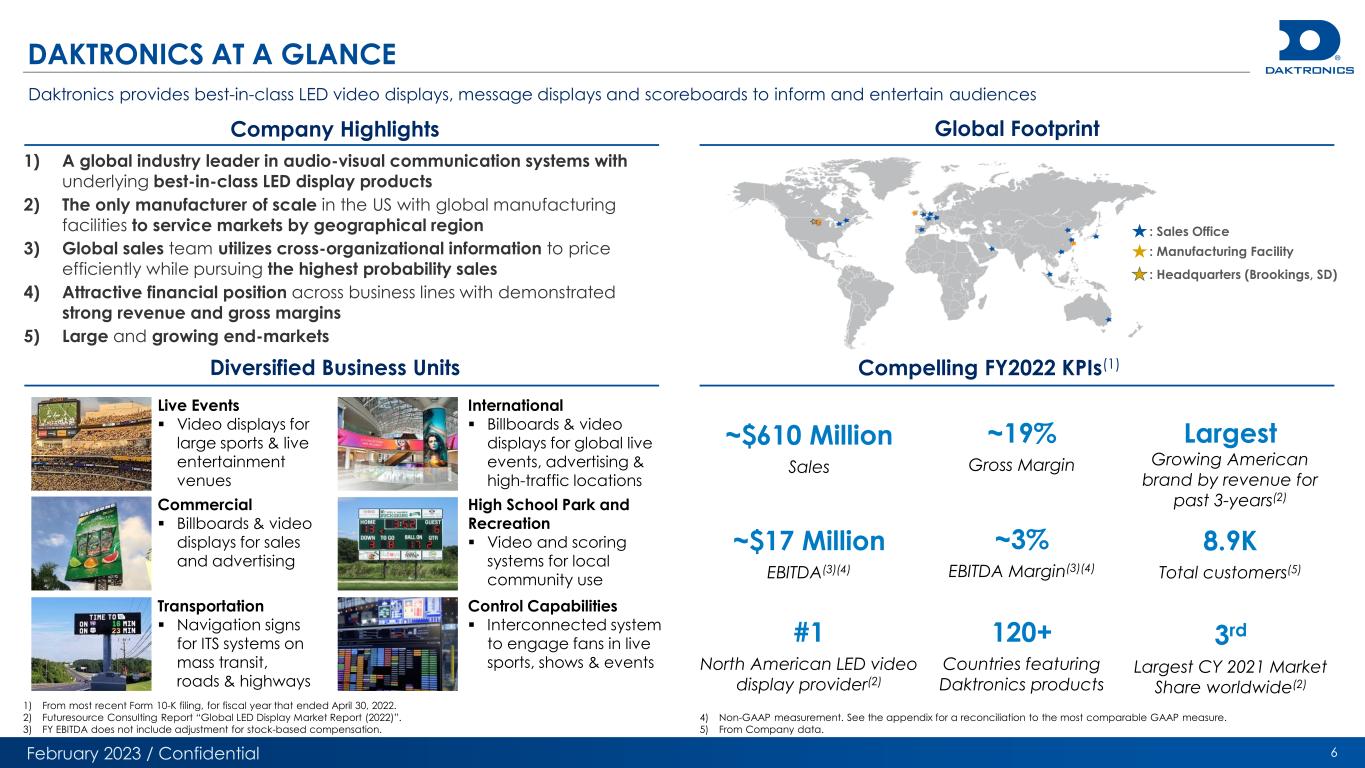

February 2023 / Confidential Live Events ▪ Video displays for large sports & live entertainment venues DAKTRONICS AT A GLANCE High School Park and Recreation ▪ Video and scoring systems for local community use Transportation ▪ Navigation signs for ITS systems on mass transit, roads & highways Compelling FY2022 KPIs(1) ~19% Gross Margin ~3% EBITDA Margin(3)(4) 120+ Countries featuring Daktronics products 8.9K Total customers(5) 1) A global industry leader in audio-visual communication systems with underlying best-in-class LED display products 2) The only manufacturer of scale in the US with global manufacturing facilities to service markets by geographical region 3) Global sales team utilizes cross-organizational information to price efficiently while pursuing the highest probability sales 4) Attractive financial position across business lines with demonstrated strong revenue and gross margins 5) Large and growing end-markets : Sales Office : Manufacturing Facility : Headquarters (Brookings, SD) Daktronics provides best-in-class LED video displays, message displays and scoreboards to inform and entertain audiences Global Footprint Commercial ▪ Billboards & video displays for sales and advertising 1) From most recent Form 10-K filing, for fiscal year that ended April 30, 2022. 2) Futuresource Consulting Report “Global LED Display Market Report (2022)”. 3) FY EBITDA does not include adjustment for stock-based compensation. Largest Growing American brand by revenue for past 3-years(2) Company Highlights Diversified Business Units 6 ~$610 Million Sales ~$17 Million EBITDA(3)(4) #1 North American LED video display provider(2) 3rd Largest CY 2021 Market Share worldwide(2) Control Capabilities ▪ Interconnected system to engage fans in live sports, shows & events International ▪ Billboards & video displays for global live events, advertising & high-traffic locations 4) Non-GAAP measurement. See the appendix for a reconciliation to the most comparable GAAP measure. 5) From Company data.

February 2023 / Confidential THROUGH THE YEARS 1994: Company goes public and shares of DAKT first traded on NASDAQ 1996: Reached >$50M annual sales 2000: First center- hung video display at Xcel Energy Center. Reached >$100M sales 2010 2008: Provided products for Beijing Olympics Reached $500M sales 2000 1998: First Display in an NFL stadium 2013: Wembley stadium(1) LED video display 1986: Company Reached >$10M in annual sales 1970 1990 1980 1968: Company founded by Drs. Aelred Kurtenbach and Duane Sander in Brookings, SD 1980: Selected to provide scoring equipment for the Winter Olympics in Lake Placid 1984: Installed first large matrix color marquee at Caesars Palace in Las Vegas 2020 1978: Reached $1M annual sales 2020: Built and opened Daktronics showroom 2016: Acquired ADFLOW Networks(2) 1) Wembley Stadium is located London, England and is the second largest stadium in Europe with a 90,000-person capacity. 2) Data Display specializes in provides the technology, systems, components and analytics behind state-of-the-art retail displays. 3) ADFLOW Networks specializes in delivering digital media solutions to leading retailers and convenience stores in the US. 7 2022: Integrated display systems in 84 professional sports stadiums viewed by millions of fans 2014: Acquired Data Display(2)

February 2023 / Confidential 8 THE ONLY FULL-SERVICE MANUFACTURER OF LED SCREENS OUTSIDE OF CHINA 1) Note: The Company is entertaining an SLB of the Redwood Falls Facility. ▪ Daktronics established its own extensive on-site Reliability Lab that puts every component through rigorous testing ▪ The lab supports Daktronics Design for Reliability process which includes up to 60 testing steps, far greater than the industry standard ▪ Long display lifetime that produces stand-out messages with high- contrast, true-to-life images is crucial for creating an impression on customers Lower quality LEDs are unable to maintain the all-white color ▪ Key placement of manufacturing facilities in the US, Ireland and China promote regional service & support for all orders & customers ▪ Maintains quality control of all products with in-house expertise, highly skilled labor, and state-of-the-art facilities ▪ Continuous service and support post-sale provides critical needs to customers and results in continuous business from top customers ▪ Experienced executive team and manufacturing process with an established global presence to meet large product orders and service more complex projects Key Manufacturing Facilities Location Owned or Leased Square Footage (000s) Brookings Factory Brookings, SD, USA Owned 765 Sioux Falls Factory Sioux Falls, SD, USA Leased 277 Redwood Falls Factory(1) Redwood Falls, MN, USA Owned 151 Shanghai Factory Shanghai, China Leased 137 Ireland Factory Ennistymon, Ireland Owned 62 Manufacturer that Best Addresses Customer Needs Daktronics Reliability Lab Manufacturing Process

February 2023 / Confidential 9 DEPENDABLE LED MARKET OPPORTUNITY Source: Futuresource Consulting Report “Global LED Display Market Report (2022)”. 1) Ultra Narrow Pixel Pitch (UNPP) defined as less than or equal to 0.9mm pixel pitch. 2) Narrow Pixel Pitch (NPP) defined as equal to or greater than 1.0mm and equal to or less than 2.5mm pixel pitch. 3) Standard defined as equal to or greater than 2.6mm pixel pitch. 4) FY2022 DAKT North America orders includes the Net Sales of Commercial, Live Events, HSPR and Transportation business segments in the US and Canada / North America total addressable market, as calculated in the Futuresource “Global LED Display Market Report (2022)”. 5) FY2022 DAKT International business segment Net Sales / the sum of the international total addressable market excluding China and North America, as calculated in the Futuresource “Global LED Display Market Report (2022)”. $6.4 $7.6 $9.4 $19.5 2020 2021 2022 2026 UNPP LED NPP LED Standard Monochrome/Tri-Colour LED $5.6 $7.0 $8.7 $18.8 2020 2021 2022 2026 Americas EMEA APAC▪ 2022 annual LED market growth rebounded to 26.6% after global lockdowns caused a 4.6% slowdown in FY 2021 ▪ Growth expected to continue in the high-teens to low-20% through CY 2026 ▪ Corporate & education, stadiums & venues and control room verticals comprise 58% of the 2021 LED video display market ▪ Projected LED market growth to be led by: ▪ APAC: 21% CAGR with 35% originating outside of China and the remaining regions expect ~20% growth by 2026 ▪ Americas: 26% CAGR led by the US which comprises over 70% of the regional market ▪ Daktronics: has a strong position in the Americas, the second largest market outside of China with 45% of total addressable market in North America as of 2021 ($US Billions) 45.1% 54.9% Daktronics North America Market Share Competitor North America Market Share 4.9% 95.1% Daktronics International Market Share Competitor International Market Share Daktronics 2021 Total Addressable Market Presence (1) (2) (4) (5)(3) Increased Global Demand Bolsters Pipeline & Stable Cash Flows Worldwide LED Video Display Sales by Region Worldwide LED Display Market by Type $1.7 bn International Market excluding China North America $1.2bn Market

February 2023 / Confidential 468 Number of Global Sales and Marketing Employees 10 HIGHLY EFFECTIVE GLOBAL SALES TEAM AND STRATEGY Strategic Sales Organizational Structure High Complexity Approach: ▪ Larger, complex systems with high visibility and prominence (also called “Large Sports Venue” or “Spectacular”) ▪ Symbiotic relationship and creative tension between product, project and sales teams ensure highest probability targeting to arrive at the optimal price and win sales at acceptable margins ▪ No commission incentive – salaried with discretionary bonus to incentive smartest targeting and higher margin sales High Consistency Approach: ▪ Smaller, more standard systems installed & supported in a more common way ▪ These systems are often dispersed across broad geographic areas and require some type of infrastructure for support ▪ Repeatability from use the same / similar configurations creates an expertise in different teams that supports creation of a partner network ▪ Loyal AV and sign sales partnership program deliver unmatched experiences and unsurpassed reliability ensuring exceptional quality to the final assembly FY 2022 KPIs ~$610 Million Global Sales 8.9K Total Customers 264 Of the top 300 customers are recurring during FY 2020 – FY 2022 Source: Company data. 1) Futuresource Consulting Report “Global LED Display Market Report (2022)”. Leverages Global Relationships With Repeat Customers ▪ Long-Term Customer Relationships: Demonstrated success drives continued sales opportunities ▪ Leverage: Strategically expand offering to grow profitably in adjacent Customer Types, Venues, AV Systems, and Geographies ▪ Demand Prioritization: High priority market verticals based on profitability and growth opportunities ▪ Unified Sales Coordinator Support: Provides real time quotes, details, mechanical information, and order booking ▪ Diversified Product Specialization: Overlapping expertise across complex and consistent sales projects ensure customer satisfaction & delivery Live Events (LE) High complexity International (Intl) High complexity High School Parks, Recreation (HSPR) High consistency Commercial (Comm) High consistency Transportation Divisional or Corporate (Shared) 35% Revenue growth for the past 3-years (1) 503 Number of Global Customer Service Employees

February 2023 / Confidential 11 UNPRECEDENTED CHALLENGES… Product Warranties ◼ Product issue from mechanical device failure built prior to FY14 ◼ FY16 – FY19: Recognized cost of $23mm to preserve key customer relationships Tariffs on Chinese Imports ◼ U.S. trade actions (2019) led to volatility in supply and price of Chinese parts (i.e., steel / aluminum) ◼ FY20 – FY22: adverse impact of ~$15mm, in aggregate − 0.4% - 1.2% of revenue spent per year Investment in Design ◼ FY18 – FY20: Strategic investments of ~$10mm per year in development of Narrow Pixel Pitch (NPP) − Accounted for ~1.7% of revenue during time period ◼ 4Q20: Series A Investment (initial ~12% ownership) in X Display Company (XDC) COVID-19 ◼ 4Q20 – FY21: ~$100mm reductions in sales due to government mandated shutdowns and lack of orders from customer base − Cost savings methods include reduction in workforce, benefit packages, and travel expenses Global Supply Chain ◼ 1Q23: Drastic supply shortages in Field Programmable Data Arrays (FPGA) and other parts − Received ~10% of devices needed to fill outstanding orders − Forced to overpay in other markets and redesign module in millions 1) Daktronics’ operates on a 52- or 53-week fiscal year, with its fiscal year ending on the Saturday closest to April 30 of each year. $518 $552 $616 $570 $587 $611 $570 $609 $482 $611 5.9% 6.6% 5.1% 0.4% 2.6% 2.0% (0.8%) 0.0% 4.0% 1.0% -2% 0% 2% 4% 6% 8% 10% - $100 $200 $300 $400 $500 $600 $700 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 O p e ra ti n g I n c o m e ( Lo ss ) S A LE S 10 Year History: Sales and Operating Income (%)(1) Sales Operating Income(Loss) % of Sales

February 2023 / Confidential 12 ...AND HOW THE COMPANY IS ADDRESSING THEM Current Near-Term Strategies are Catalyzing Demand, Retention and Fulfillment Demand Prioritization Predictability in Operations Focus on DifferentiationLiquidity Enhancement Program ◼ Prioritizing market verticals that are: − Higher profitability, with opportunity to grow − Aligned with specialized capabilities / capacities ◼ Across the board price increases in December 2022 − Future increases planned to maintain and protect margin ◼ Near-term high priority market verticals include − High school stadiums − Transportation, over the road signage ◼ Predictability is key to the Company’s long-term relationships ◼ Recent focus has been on: − Stabilizing parts availability − Supply chain improvement − The consolidation of customer facing tools to Salesforce − On-going factory automation to increase capacity − Retention of the highest performing workers during this tight labor market ◼ Protect and improve profitability of core business ◼ Extend the Daktronics proprietary protocol differentiation across product tiers ◼ Drive Narrow Pixel Pitch (NPP) growth through AV integrators ◼ Create a profitable control system revenue stream focusing on the capability for a software as a service model ◼ Balance development investments and prune the product portfolio ◼ Focusing on cash generation by unlocking ~$463mm backlog(1), which requires: − Manufacturing improvements to reduce personnel costs and catalyze overall productivity − Prudent management of operating expenses to drive margin expansion ◼ Normalizing inventory levels and reestablish a steady supply base ◼ Aggressively managing working capital accounts and maintaining organic price increases ◼ Concentrating capital investments and maximizing asset returns ◼ Exploring additional sources of outside liquidity $135mm Orders $201mm Backlog $183mm Orders $463mm Backlog Demand Trending Towards Pre-Covid levels(1) 2Q FY2021 2Q FY2023 1) Orders and backlog are not measures defined by GAAP, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 30, 2022.

February 2023 / Confidential Key Investment Highlights 13

February 2023 / Confidential 14 INDUSTRY LEADER IN DYNAMIC AUDIO-VISUAL COMMUNICATION SYSTEMS 1) Non-GAAP measure. See the appendix for a reconciliation to the most comparable GAAP measure. 2) FY2022 DAKT North American (“NA”) orders includes the US and Canada is the sum of the Commercial, Live Events, HSPR and Transportation business segments / the NA total addressable market, as calculated in the Futuresource “Global LED Display Market Report (2022)”. 3) FY2022 DAKT International business segment revenue / the sum of the international total addressable market excluding China, as calculated in the Futuresource “Global LED Display Market Report (2022)”. ~$610 Million in FY2022 Sales ~$17 Million in FY2022 EBITDA(1) Worldwide Reach of over 120 Countries 5 Facilities Across the Globe 45% Market Share in North America(2) ~6% Market Share Internationally (excl. China)(3) Daktronics is uniquely positioned to deliver value

February 2023 / Confidential Wholly Owned, Global Manufacturing Global Reach US Market Share US Gov’t & Defense contracts Control Capabilities High Complexity Products High Consistency Products 15 BROADEST RANGE OF PRODUCT SOLUTIONS AMONG COMPETITORS Daktronics Serves the Broadest Customer Base With Competitive Solutions in Every Category

February 2023 / Confidential Source: Company data. 1) 3-Year total denotes sum of business from Customers from FY2020 to FY2022. 2) Orders and backlog are not measures defined by GAAP, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 30, 2022. 4.1K+ New customers 16 LARGE AND DIVERSE WORLDWIDE CUSTOMER BASE Customer Retail Channel FY 2022 Revenue 3-Year Total(1) Customer A International $17,809 $31,963 Customer B Commercial 17,333 42,324 Customer C Live Events 15,116 19,426 Customer D Commercial 14,229 36,002 Customer E Live Events 13,820 13,974 Customer F Live Events & On Premise 10,159 15,221 Customer G International 9,615 9,722 Customer H Transportation 9,569 12,263 Customer I International 7,920 7,920 Customer A to I Revenue $115,572 $188,817 % of Total Revenue 18.9% 11.1% Customer Relationship Snapshot Daktronics Select Customer BaseFY 2022 Daktronics Customer Relationship Snapshot ($ 000’s) ~$610 Million Global sales(1) 10% Sales derived internationally 15.9% Currency originates from non-USD(2) 91 Customers with $1M+ orders $463 Million Order backlog(2) 8.9K Total customers

February 2023 / Confidential $282 $353 $472 $469 $463 $- $100 $200 $300 $400 $500 2Q22 3Q22 4Q22 1Q23 2Q23 Backlog 17 CONSISTENT TOP LINE GROWTH AND STRONG ORDER BACKLOG Gross Profit (%) Consolidated Order Backlog 59 39 48 57 69 33 24 27 36 42 34 40 47 40 37 14 16 20 20 17 24 21 19 20 22 $164 $140 $162 $172 $187 20% 16% 18% 15% 17% 10% 15% 20% 25% 30% $- $50 $100 $150 $200 2Q22 3Q22 4Q22 1Q23 2Q23 Live Events HSPR Commercial Transportation International Gross Profit (%) (1) 1) Orders and backlog are not measures defined by GAAP, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 30, 2022.

February 2023 / Confidential 18 CASH GENERATION OPPORTUNITY WITH STREAMLINED COST STRUCTURE AND ENHANCED MARGINS Daktronics is Addressing its Operational, Commercial and Financial Challenges Through its Liquidity Enhancement Program 1) Orders and backlog are not measures defined by GAAP, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 30, 2022. Increase in Product Sourcing and Tariff Costs COVID-19 Related Sales Decline Significant Demand Resurgence and Persistent Supply and Labor Shortages 1) Focus on cash generation by realizing ~$463mm backlog(1), which requires: – Leveraging manufacturing improvements / automation to reduce personnel costs and catalyze overall productivity – Prudent management of operating expenses to drive margin expansion 2) Normalize inventory levels and reestablish a consistent supply base 3) Aggressively manage working capital accounts and continue organic price increases 4) Concentrate capital investments and maximize asset returns 5) Explore additional sources of outside liquidity In Response to Macro Economic Headwinds, Daktronics has Implemented a Liquidity Enhancement Program to: $0 $50 $100 $150 $200 Inventory has Leveled Off $168mm CY2021 Average: $81mm Semiconductor Supply Chain is Normalizing 2H FY2022 – 1H FY2023 2H FY2023 10% of requested FGPA devices received 10,000+ FGPA devices offered by suppliers $100s Cost per unit $10-15 Cost trending towards pre-COVID pricing Global Supply Chain Distributions and Significant Working Capital Requirements Unprecedented Inflation

February 2023 / Confidential 19 STRONG ASSET BASE AND MANUFACTURING FOOTPRINT ~2,250 Employees in North America 5 Dedicated Manufacturing Facilities 13 Dedicated Distribution, Sales & Support Offices Location Owned or Leased Square Footage Activity Brookings, SD Owned 765K Corporate Office, Manufacturing, Sales, Service Redwood Falls, MN Owned 151K Manufacturing, Sales, Service, Office Ennistymon, Ireland Owned 62K Manufacturing, Sales, Service, Office Sioux Falls, SD Leased 277K Manufacturing, Sales, Service, Office Shanghai, China Leased 152K Manufacturing, Sales, Service, Office Summary : Sales Office : Manufacturing Facility : Headquarters (Brookings, SD)

February 2023 / Confidential 20 EXPERIENCED LEADERSHIP TEAM WITH CLEAR ROADMAP FOR OPERATIONAL IMPROVEMENT Reece A. Kurtenbach President & CEO President & CEO since 2013 Prior to assuming his current role, he served at Daktronics since 1991 28+ Years of Executive Engineering and Manufacturing Experience Sheila Anderson CFO & Treasurer CFO & Treasurer since 2012 Prior to assuming her current role, she served at Daktronics since 2002 25+ Years of Accounting and Corporate Finance Experience Brad Wiemann Executive Vice President Executive Vice President since 2012 Prior to assuming his current role, he served at Daktronics since 1993 30+ Years of Engineering and Business Development Experience Matt Kurtenbach VP of Manufacturing VP of Manufacturing since 2001 Prior to assuming his current role, he was the General Manager of Star Circuits, Inc. 22+ Years of Executive Manufacturing Experience Sarah Rose VP of Global Services VP of Global Services since 2014 Prior to assuming her current role, she served at Daktronics since 1997 25+ Years of Executive Customer Service and Integration Experience Picture Brett Wendler VP of Development VP of Design and Development since 2013 Prior to assuming his current role, he served at Daktronics since 1992 30+ Years of Executive Product Development Experience

February 2023 / Confidential 21 LOW LEVERAGE PRESENTS FINANCING CAPACITY Historical Debt Balance 1Q21 – 2Q23A(1) EBITDA and EBITDA Margin FY2019 – LTM2023A(2) Revenue and Gross Profit Margin 1Q21 – 2Q23A 1) Historically low leverage profile 2) Additional liquidity required to fund inventory levels, operations, and capital expenditures 3) Significant overcapitalization with current working capital balance exceeding $118 million 4) Growth coming from assets that self generate cash over a relatively short production / fulfillment cycle 5) Healthy medium-term outlook between near-term price increases and strong order backlog of $463 million(3) $144 $127 $94 $117 $145 $164 $140 $162 $172 $187 25% 26% 25% 24% 22% 20% 16% 18% 15% 17% 10% 15% 20% 25% 30% 35% $- $50 $100 $150 $200 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Revenue Gross Profit (%) 1) Funded debt for each quarter excludes outstanding Letters of Credit. 2) FY EBITDA does not include adjustment for stock-based compensation. 3) Orders and backlog are not measures defined by GAAP, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 30, 2022. 4) Non-GAAP measure. See the appendix for a reconciliation to the most comparable GAAP measure. $14 $18 $31 $17 $4 2.4% 2.9% 6.5% 2.7% 0.6% 0% 2% 4% 6% 8% $- $10 $20 $30 $40 FY19 FY20 FY21 FY22 2Q23 LTM EBITDA EBITDA Margin $15 $15 $15 $- $- $- $- $- $24 $26 $- $10 $20 $30 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Funded Debt (4)(4) Opportunity Highlights $Millions $Millions $Millions

February 2023 / Confidential Appendix 22

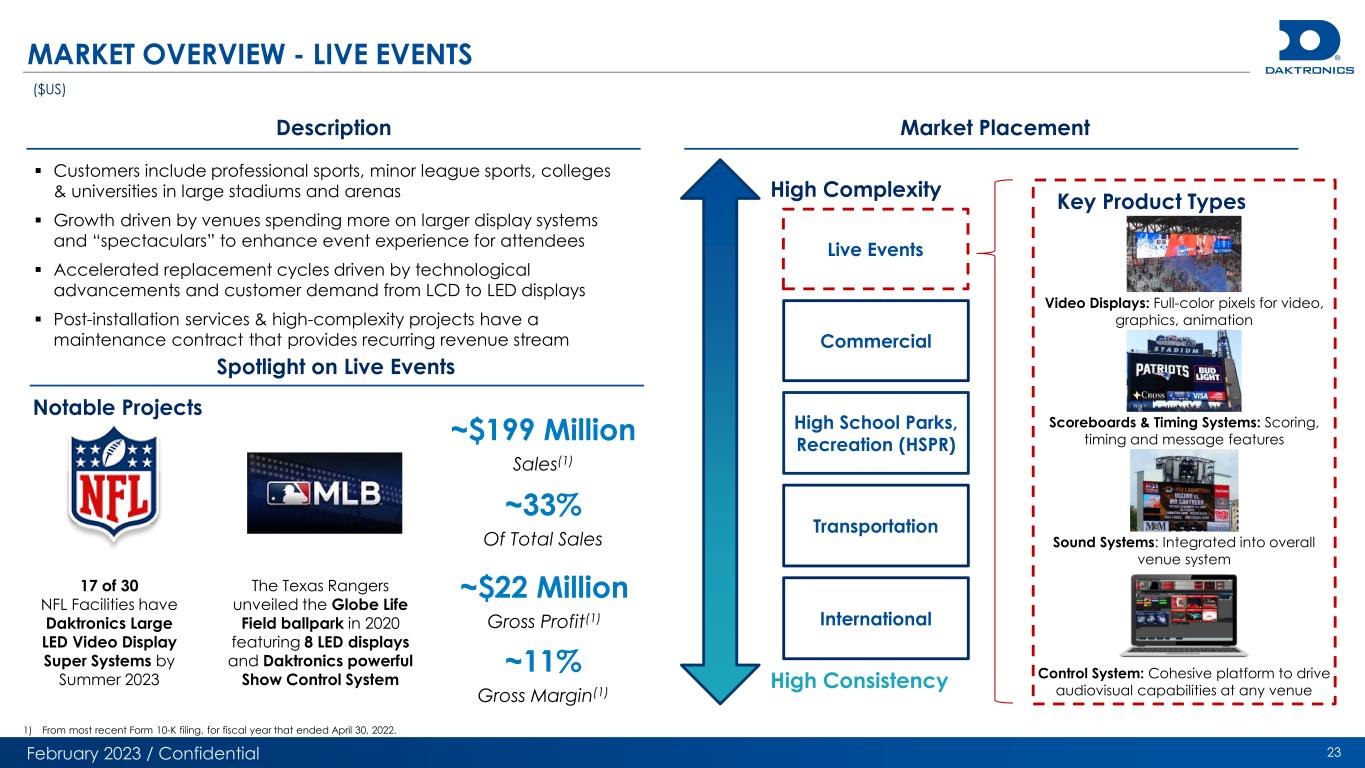

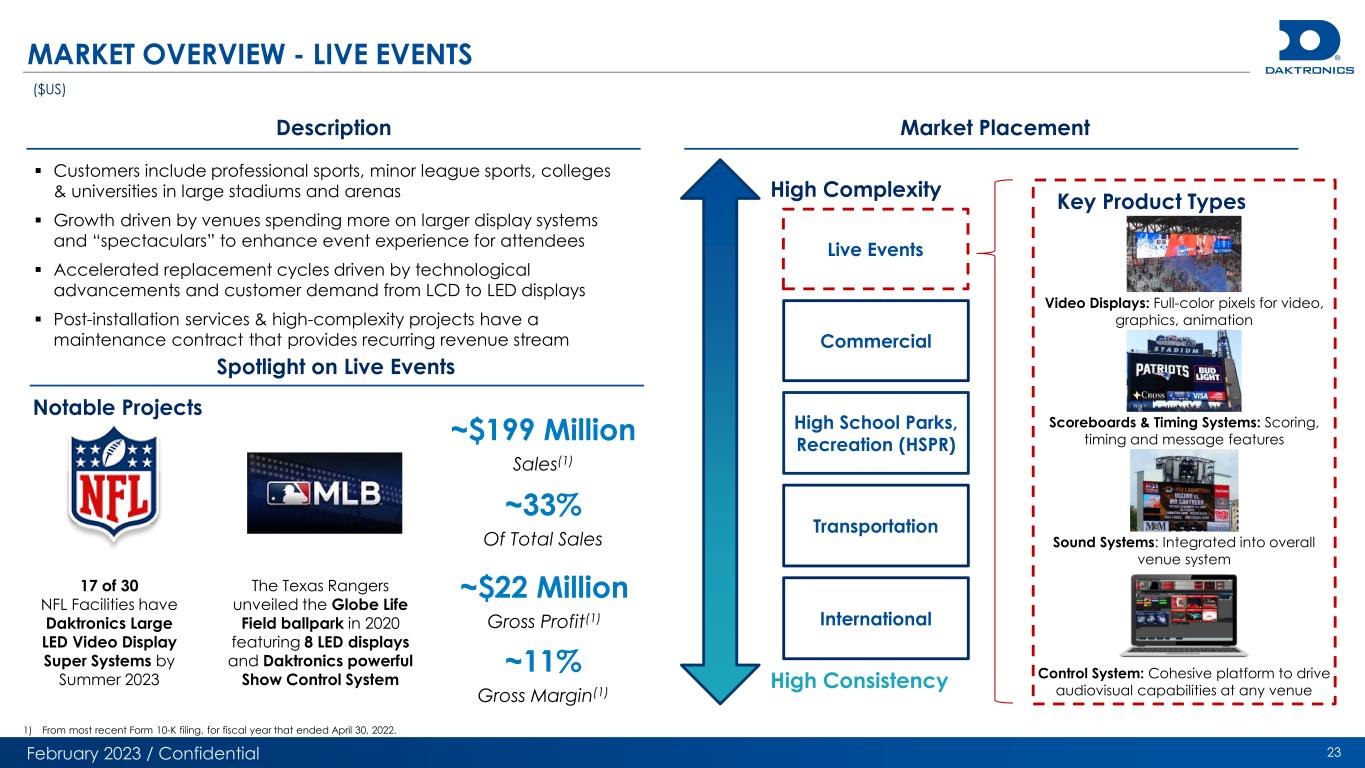

February 2023 / Confidential 23 MARKET OVERVIEW - LIVE EVENTS ($US) ~$199 Million Sales(1) ~$22 Million Gross Profit(1) Description Market Placement Key Product Types Notable Projects ▪ Customers include professional sports, minor league sports, colleges & universities in large stadiums and arenas ▪ Growth driven by venues spending more on larger display systems and “spectaculars” to enhance event experience for attendees ▪ Accelerated replacement cycles driven by technological advancements and customer demand from LCD to LED displays ▪ Post-installation services & high-complexity projects have a maintenance contract that provides recurring revenue stream 17 of 30 NFL Facilities have Daktronics Large LED Video Display Super Systems by Summer 2023 The Texas Rangers unveiled the Globe Life Field ballpark in 2020 featuring 8 LED displays and Daktronics powerful Show Control System ~33% Of Total Sales ~11% Gross Margin(1) Live Events Commercial International Transportation High School Parks, Recreation (HSPR) High Complexity High Consistency Spotlight on Live Events Scoreboards & Timing Systems: Scoring, timing and message features Video Displays: Full-color pixels for video, graphics, animation Sound Systems: Integrated into overall venue system Control System: Cohesive platform to drive audiovisual capabilities at any venue 1) From most recent Form 10-K filing, for fiscal year that ended April 30, 2022.

February 2023 / Confidential 24 MARKET OVERVIEW - COMMERCIAL ($US) ~$154 Million Sales(1) ~$32 Million Gross Profit(1) Description Market Placement Key Product Types Notable Projects ~25% Of Total Sales ~21% Gross Margin(1) Live Events Commercial International High School Parks, Recreation (HSPR) High Complexity High Consistency Spotlight on Commercial Market ▪ Customers include sign & billboard companies, national retailers, quick-serve restaurants, casinos, shopping malls & petroleum retailers ▪ Customers who rely on advertising revenues to drive sales are increasing their capital spend on digital solutions through ▪ Out of home advertising & increased customer foot-traffic drives sales that increases capital spending on high-complexity solutions Approved as a franchise vendor in 2008 and have grown the relationship over the years. Selected as 2021 Equipment Vendor of the year. Penn National Gaming hired Daktronics to provide LED displays for 7 Hollywood Casino locations across the US Spectaculars: Extraordinary, highly complex LED displays in high-traffic areas for building facades Video Displays & Billboards: Banner displays for retail environments Fuel Price Displays: Outdoor fuel price displays with advertising Dynamic Messaging Systems: Messaging displays for advertising campaigns 1) From most recent Form 10-K filing, for fiscal year that ended April 30, 2022. Transportation

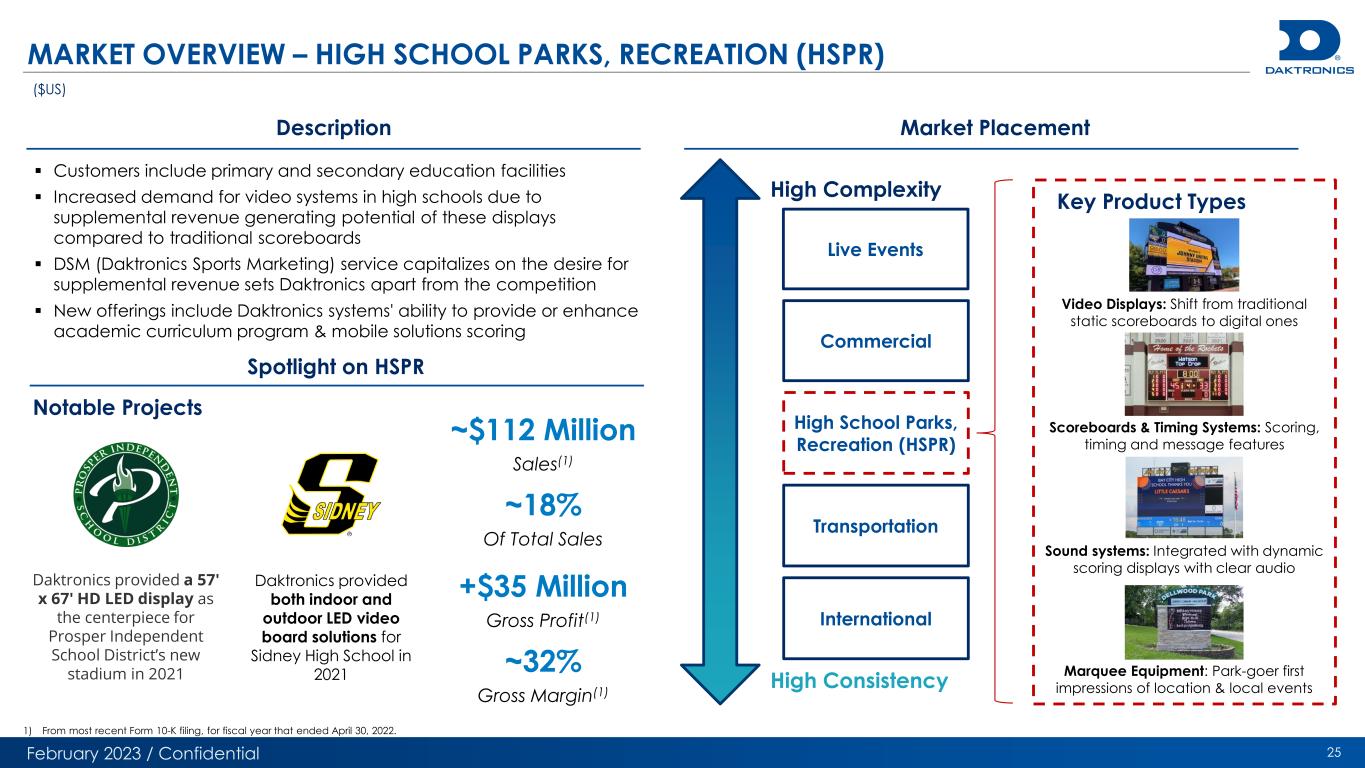

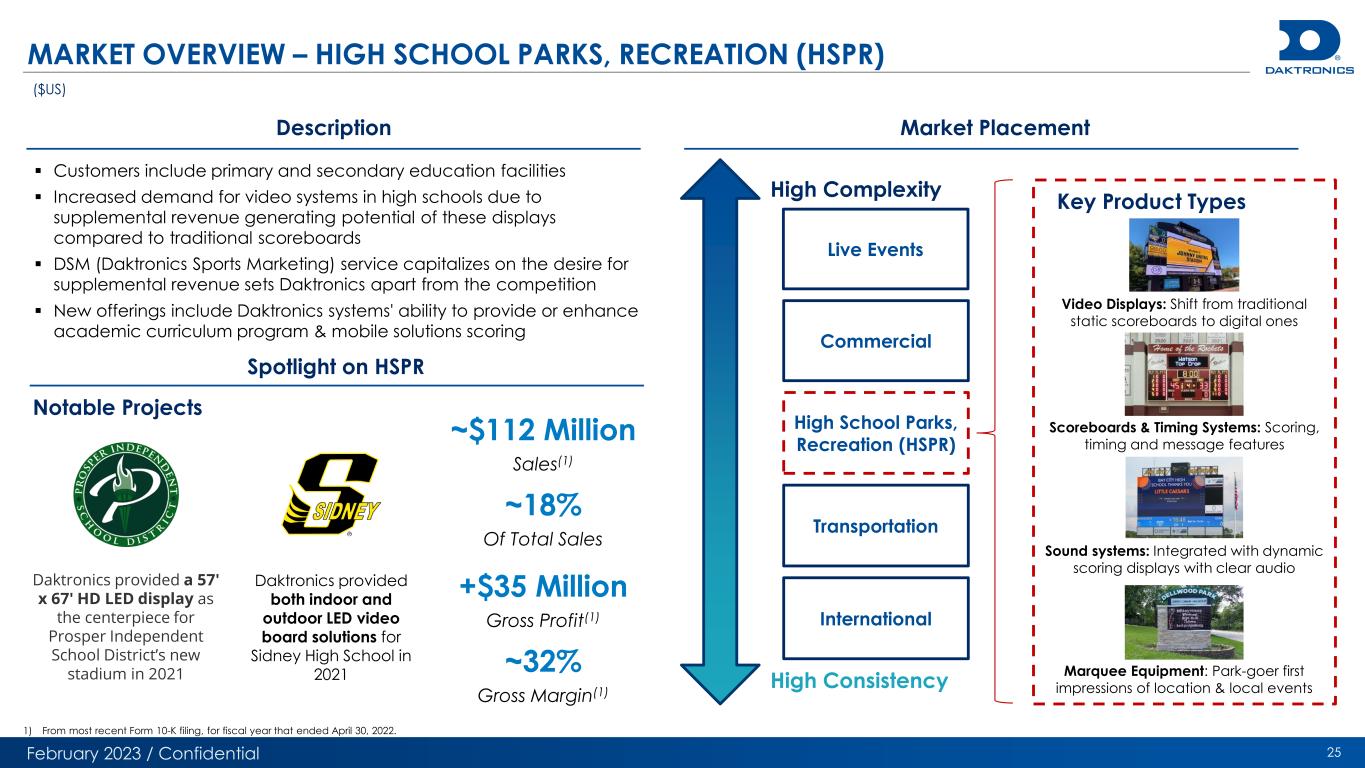

February 2023 / Confidential 25 MARKET OVERVIEW – HIGH SCHOOL PARKS, RECREATION (HSPR) ($US) ~$112 Million Sales(1) +$35 Million Gross Profit(1) Description Market Placement Key Product Types Notable Projects ~18% Of Total Sales ~32% Gross Margin(1) Live Events Commercial International Transportation High School Parks, Recreation (HSPR) High Complexity High Consistency Spotlight on HSPR ▪ Customers include primary and secondary education facilities ▪ Increased demand for video systems in high schools due to supplemental revenue generating potential of these displays compared to traditional scoreboards ▪ DSM (Daktronics Sports Marketing) service capitalizes on the desire for supplemental revenue sets Daktronics apart from the competition ▪ New offerings include Daktronics systems' ability to provide or enhance academic curriculum program & mobile solutions scoring Daktronics provided a 57' x 67' HD LED display as the centerpiece for Prosper Independent School District’s new stadium in 2021 Daktronics provided both indoor and outdoor LED video board solutions for Sidney High School in 2021 1) From most recent Form 10-K filing, for fiscal year that ended April 30, 2022. Video Displays: Shift from traditional static scoreboards to digital ones Sound systems: Integrated with dynamic scoring displays with clear audio Marquee Equipment: Park-goer first impressions of location & local events Scoreboards & Timing Systems: Scoring, timing and message features

February 2023 / Confidential ▪ Customers include government transportation departments, industry contractors, airlines, mass transit and other related customers ▪ Expanded use of dynamic messaging systems in public transportation and airport terminals for advertising and wayfinding ▪ Growth driven by government funding and investment in infrastructure projects as well as advertising needs ▪ Infrastructure Investment and Jobs Act of 2021 is expected to positively impact State and Federal transportation spending 26 MARKET OVERVIEW – TRANSPORTATION ($US) ~$63 Million Sales(1) +$18 Million Gross Profit(1) Description Market Placement Key Product Types Notable Projects ~10% Of Total Sales ~29% Gross Margin(1) Live Events Commercial International Transportation High School Parks, Recreation (HSPR) High Complexity High Consistency Spotlight on Transportation Solutions Daktronics supported Fort Lauderdale- Hollywood International Airport remodel with ~100 signs over roadways and inside the facility Daktronics provided the Nevada DOT first of its kind large format displays for an ATM project and currently building phase two 1) From most recent Form 10-K filing, for fiscal year that ended April 30, 2022. Concourse Displays: wayfinding, ticketing, flight information & video walls Video Walls: Traffic centers utilize dynamic video walls & marquee displays Dynamic Messaging Signs: Displays for freeways, arterial roads & toll booths Variable Message Signs, LCD & LED: platform arrival and departure messaging

February 2023 / Confidential 27 MARKET OVERVIEW – INTERNATIONAL ($US) ~$83 Million Sales(1) +9 Million Gross Profit(1) Description Market Placement Key Product Types Notable Projects ~14% Of Total Sales +11% Gross Margin(1) Live Events Commercial International Transportation High School Parks, Recreation (HSPR) High Complexity High Consistency Spotlight on International Market ▪ Customers include companies focused on sports, advertising, transportation and retail around the world but excludes the United States & Canada ▪ Growth to be achieved through penetration of established sales networks and broadening products suited to individual markets ▪ Wide range of product offerings coupled with global presence provide competitive positioning & growth potential across Europe, Central & South America, the Middle East, Africa & Asia-Pacific Daktronics provided ~50 LED video displays to enhance Dubai’s Marina Mall indoor facility in 2021 Daktronics installed the world’s longest high- definition straight-run stadium video display for Accor Stadium Sydney AUS in 2022 1) From most recent Form 10-K filing, for fiscal year that ended April 30, 2022. Spectaculars: Billboard and displays light up branded cities, urban sprawls with advertising & videos Sports & Live Events: Video & ribbon displays for scoring, timing and message features for immersive fan experiences Transportation: Wayfinding displays through highways, trains & airports Commercial: Video and banner displays for retail advertising environments

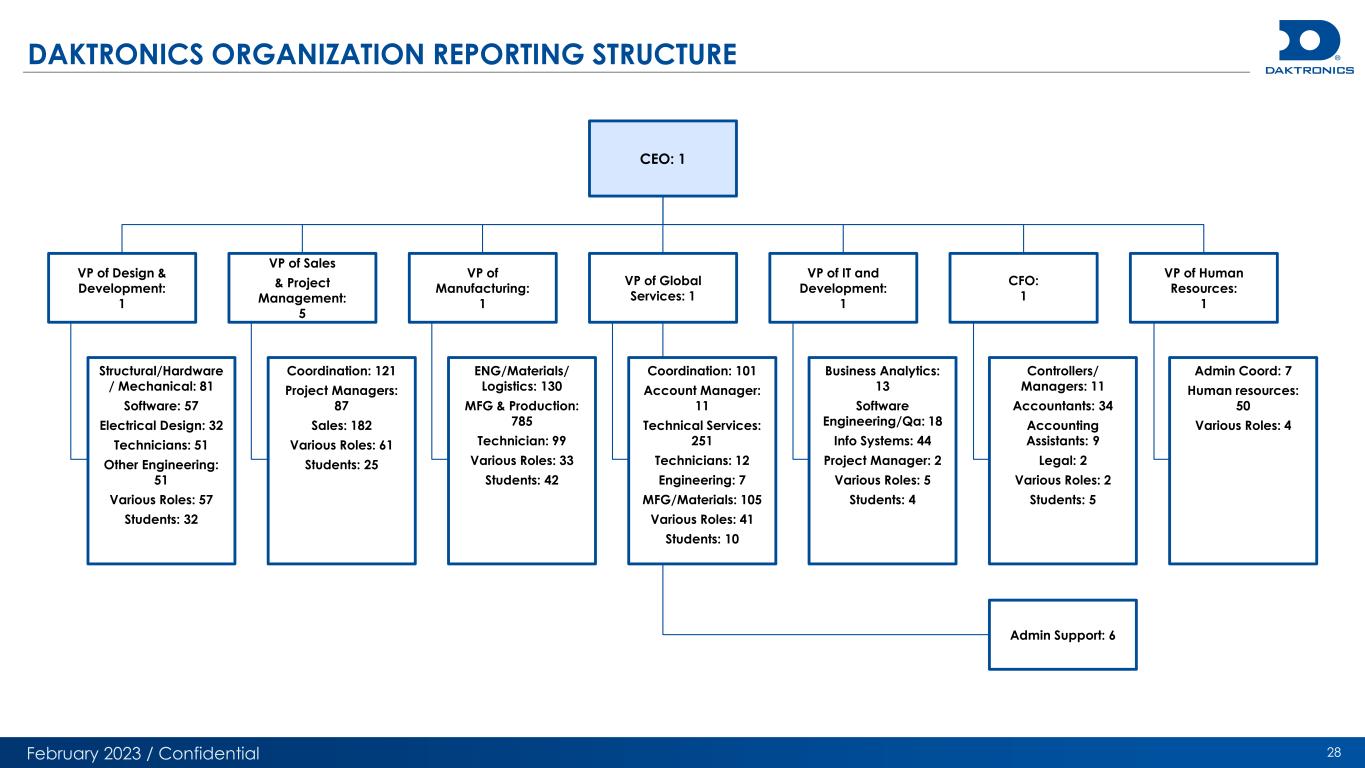

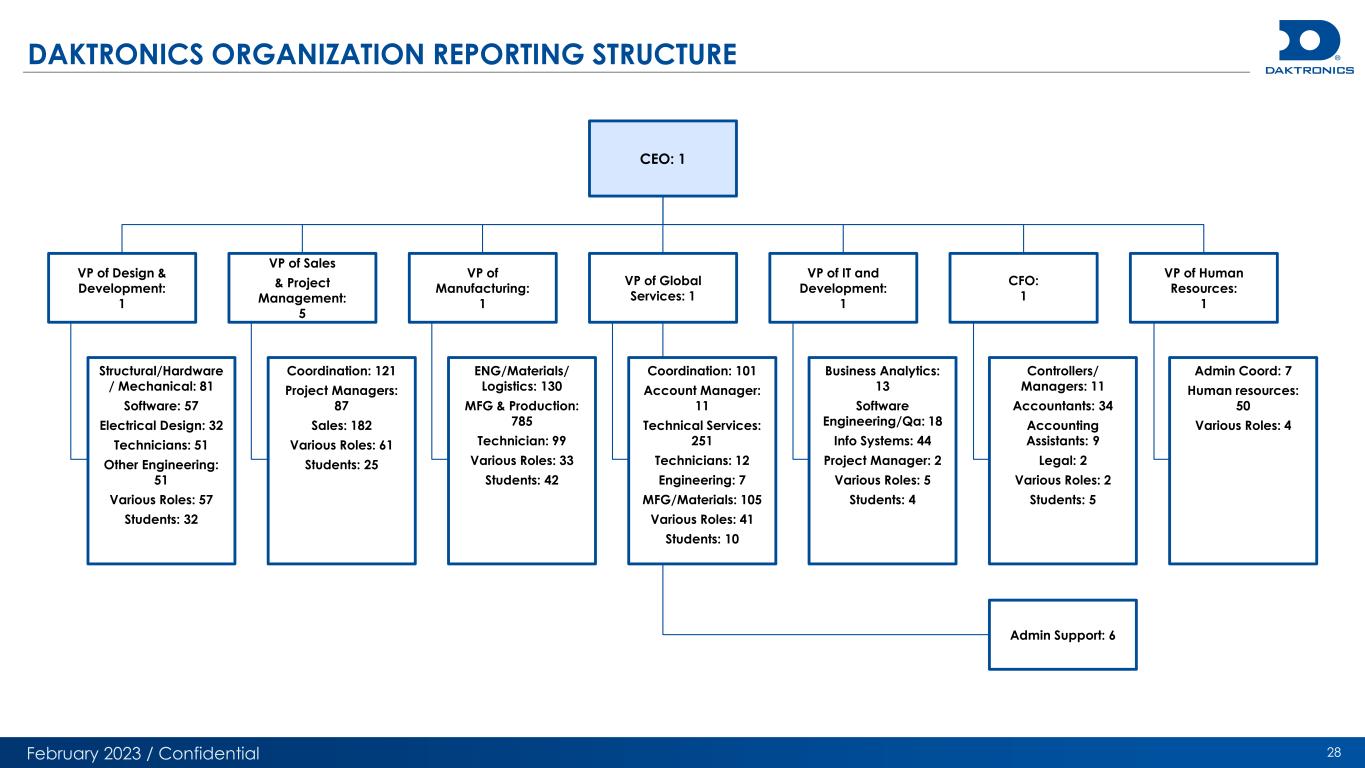

February 2023 / Confidential DAKTRONICS ORGANIZATION REPORTING STRUCTURE 28 CEO: 1 VP of Design & Development: 1 VP of Sales & Project Management: 5 VP of Manufacturing: 1 VP of Global Services: 1 VP of IT and Development: 1 CFO: 1 VP of Human Resources: 1 Structural/Hardware / Mechanical: 81 Software: 57 Electrical Design: 32 Technicians: 51 Other Engineering: 51 Various Roles: 57 Students: 32 Coordination: 121 Project Managers: 87 Sales: 182 Various Roles: 61 Students: 25 ENG/Materials/ Logistics: 130 MFG & Production: 785 Technician: 99 Various Roles: 33 Students: 42 Coordination: 101 Account Manager: 11 Technical Services: 251 Technicians: 12 Engineering: 7 MFG/Materials: 105 Various Roles: 41 Students: 10 Business Analytics: 13 Software Engineering/Qa: 18 Info Systems: 44 Project Manager: 2 Various Roles: 5 Students: 4 Controllers/ Managers: 11 Accountants: 34 Accounting Assistants: 9 Legal: 2 Various Roles: 2 Students: 5 Admin Coord: 7 Human resources: 50 Various Roles: 4 Admin Support: 6

February 2023 / Confidential 29 SIMPLIFIED ORGANIZATIONAL STRUCTURE 1) Current capital structure data as of FY Q2 2023, unless otherwise noted. 2) Share price as of 1/20/23. 3) Total debt excludes $7mm Letters of Credit balance. Daktronics, Inc. (United States) Daktronics Installation Inc. Other International Subsidiaries X Display Company Technology Limited (Ireland) Miortech Holding BV (Netherlands) U.S Entity US Based Borrower Foreign Corporation – Minority Owned Legend Current Capital Structure(1) Foreign Corporation Market Capitalization(2): $218mm Total Debt(3): $26mm Total Cash and Cash Equivalents: $6mm Implied Enterprise Value: $238mm

February 2023 / Confidential 30 GAAP TO NON-GAAP RECONCILIATION FY19 FY20 FY21 FY22 2Q23 LTM Net Income (Loss) ($958) $491 $10,926 $592 ($18,310) (+) Interest Expense 160 106 295 49 455 (+) Taxes (3,986) (500) 3,134 516 13,039 (+) D/A 18,635 17,718 17,077 15,394 8,225 EBITDA $13,851 $17,815 $31,432 $16,551 $3,409 ($000s)