UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08188

AB HIGH INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2022

Date of reporting period: April 30, 2022

ITEM 1. REPORTS TO STOCKHOLDERS.

APR 04.30.22

SEMI-ANNUAL REPORT

AB HIGH INCOME FUND

As of January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, the Fund’s annual and semi-annual shareholder reports are no longer sent by mail, unless you specifically requested paper copies of the reports. Instead, the reports are made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at (800) 221 5672. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all AB Mutual Funds you hold.

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We’re pleased to provide this report for the AB High Income Fund (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

At AB, we’re striving to help our clients achieve better outcomes by:

| + | | Fostering diverse perspectives that give us a distinctive approach to navigating global capital markets |

| + | | Applying differentiated investment insights through a connected global research network |

| + | | Embracing innovation to design better ways to invest and leading-edge mutual-fund solutions |

Whether you’re an individual investor or a multibillion-dollar institution, we’re putting our knowledge and experience to work for you every day.

For more information about AB’s comprehensive range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in AB mutual funds—and for placing your trust in our firm.

Sincerely,

Onur Erzan

President and Chief Executive Officer, AB Mutual Funds

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 1 |

SEMI-ANNUAL REPORT

June 8, 2022

This report provides management’s discussion of fund performance for the AB High Income Fund for the semi-annual reporting period ended April 30, 2022.

The Fund’s investment objective is to seek to maximize total returns from price appreciation and income.

NAV RETURNS AS OF APRIL 30, 2022 (unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| AB HIGH INCOME FUND | | | | | | | | |

| | |

| Class A Shares | | | -7.23% | | | | -4.81% | |

| | |

| Class C Shares | | | -7.74% | | | | -5.61% | |

| | |

| Advisor Class Shares1 | | | -7.22% | | | | -4.57% | |

| | |

| Class R Shares1 | | | -7.55% | | | | -5.23% | |

| | |

| Class K Shares1 | | | -7.43% | | | | -4.95% | |

| | |

| Class I Shares1 | | | -7.23% | | | | -4.71% | |

| | |

| Class Z Shares1 | | | -7.19% | | | | -4.51% | |

| | |

Primary Benchmark:

Bloomberg Global High Yield Index (USD hedged) | | | -8.34% | | | | -7.39% | |

| | |

| Blended Benchmark: 33% JPM EMBI Global / 33% JPM GBI-EM / 33% Bloomberg US Corporate HY 2% Issuer Capped Index | | | -9.73% | | | | -8.79% | |

| 1 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

INVESTMENT RESULTS

The table above shows the Fund’s performance compared to its primary benchmark, the Bloomberg Global High Yield Index (USD hedged), and its blended benchmark, which is composed of equal weightings of the JPMorgan Emerging Markets Bond Index Global (“JPM EMBI Global”), the JPMorgan Government Bond Index-Emerging Markets (“JPM GBI-EM”) (local currency-denominated) and the Bloomberg US Corporate High Yield (“HY”) 2% Issuer Capped Index, for the six- and 12-month periods ended April 30, 2022.

During both periods, all share classes outperformed the primary benchmark, before sales charges. Over the six-month period, industry allocation was the main contributor, relative to the benchmark, mostly from off-benchmark exposures to commercial mortgage-backed securities

| | |

| |

2 | AB HIGH INCOME FUND | | abfunds.com |

(“CMBS”) and collateralized mortgage obligations (“CMOs”), and an underweight to real estate investment trusts (“REITs”) that more than offset allocation losses, including high-yield credit default swaps in the US and eurozone. Yield-curve positioning on the two- and 10- to 30-year parts of the US yield curve also contributed. Security selection added to results, as gains within the energy, telecommunications, finance, basic and insurance sectors were greater than losses from selection within electric, banking, consumer cyclical–other and sovereign bonds. Currency decisions were a minor contributor to performance. Country allocation detracted, the result of underweights to the UK and eurozone, along with an overweight to the US.

During the 12-month period, industry allocation contributed most to returns, primarily from positioning in CMBS, CMOs and an underweight to REITs, while an overweight to energy detracted. Security selection also contributed, mostly from selection within the energy, consumer noncyclical, finance, telecommunications and basic sectors, which were partially offset by losses within sovereign bonds, electric, banking and technology. Yield-curve positioning in the US added due to positioning on the two- and 10- to 20-year parts of the curve. Currency decisions were a minor contributor to results. Underweights to the eurozone and UK detracted at the country level during the period.

During both periods, the Fund utilized derivatives in the form of futures, interest rate swaps and interest rate swaptions to manage and hedge duration risk and/or to take active yield-curve positioning. Currency forwards were used to hedge foreign currency exposure and to take active currency risk. Credit default swaps were also utilized to effectively gain exposure to specific sectors. Total return swaps were used to take active credit risk.

MARKET REVIEW AND INVESTMENT STRATEGY

During the six-month period ended April 30, 2022, fixed-income government bond market yields spiked in most markets, which led bond prices to fall on inflation concerns in all regions. Inflation remained elevated and worsened when Russia invaded Ukraine, causing energy and agricultural prices to jump. Major central banks started the process of raising interest rates and ending bond purchases. Relative government bond returns were led by global inflation-linked bonds. Global investment-grade corporate bonds, which typically have longer maturities and are more sensitive to changes in yields than high-yield corporates, trailed global treasuries by a wide margin, except in the eurozone. High-yield corporate bonds also underperformed treasuries, but by a smaller margin. However, high-yield euro-denominated corporates outperformed eurozone treasuries during the period due to ongoing support from the European Central Bank. Emerging-market bonds underperformed the most as the US dollar advanced against most developed- and emerging-market currencies. Securitized assets also underperformed treasuries, but by a lesser extent than investment-grade

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 3 |

corporates, given their lower sensitivity to yield changes. Brent crude oil prices rose sharply from supply concerns and increased demand.

The Fund’s Senior Investment Management Team (the “Team”) continues to seek to maximize total return, utilizing a high-income strategy with a global, multi-sector approach. The Team pursues an attractive risk/return profile by managing currency exposure, and invests in treasury inflation-protected securities, while also seeking to enhance returns with other selective investments in global fixed income and high yield.

INVESTMENT POLICIES

The Fund pursues income opportunities from government, corporate, emerging-market and high-yield sources. It has the flexibility to invest in a broad range of fixed-income securities in both developed- and emerging-market countries. The Fund’s investments may include US and non-US corporate debt securities and sovereign debt securities. The Fund may invest, without limitation, in either US dollar-denominated or non-US dollar-denominated fixed-income securities.

The Adviser selects securities for purchase or sale based on its assessment of the securities’ risk and return characteristics as well as the securities’ impact on the overall risk and return characteristics of the Fund. In making this assessment, the Adviser takes into account various factors, including the credit quality and sensitivity to interest rates of the securities under consideration and of the Fund’s other holdings.

The Fund may invest in debt securities with a range of maturities from short- to long-term. Substantially all of the Fund’s assets may be invested in lower-rated securities, which may include securities having the lowest rating for non-subordinated debt instruments (i.e., rated C by Moody’s Investors Service or CCC+ or lower by S&P Global Ratings and Fitch Ratings, or the equivalent by any nationally recognized statistical rating organization), and unrated securities of equivalent investment quality. The Fund also may invest in investment-grade securities and unrated securities.

The Fund may invest in mortgage-related and other asset-backed securities; loan participations and assignments; inflation-indexed securities; structured securities; variable-, floating- and inverse-floating-rate instruments; and preferred stock, and may use other investment techniques. The Fund may also make short sales of securities or maintain a short position. The Fund may use borrowings or other leverage for investment purposes. The Fund intends, among other things, to enter into transactions such as reverse repurchase agreements and dollar rolls. The Fund may invest, without limit, in derivatives, such as options, futures contracts, forwards or swap agreements.

| | |

| |

4 | AB HIGH INCOME FUND | | abfunds.com |

DISCLOSURES AND RISKS

Benchmark Disclosure

All indices are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The Bloomberg Global High Yield Index (USD hedged) represents non-investment grade fixed-income securities of companies in the US, and developed and emerging markets, hedged to the US dollar. The JPM® EMBI Global (market-capitalization weighted) represents the performance of US dollar-denominated Brady bonds, Eurobonds and trade loans issued by sovereign and quasi-sovereign entities. The JPM GBI-EM represents the performance of local-currency government bonds issued by emerging markets. The Bloomberg US Corporate HY 2% Issuer Capped Index is the 2% Issuer Capped component of the US Corporate HY Index. The Bloomberg US Corporate HY Index represents the performance of fixed-income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million and at least one year to maturity. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s assets will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness) and regional and global conflicts, that affect large portions of the market.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations. The current historically low interest rate environment heightens the risks associated with rising interest rates.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Below Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 5 |

DISCLOSURES AND RISKS (continued)

have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific corporate developments and negative perceptions of the junk bond market generally and may be more difficult to trade than other types of securities.

Duration Risk: Duration is a measure that relates the expected price volatility of a fixed-income security to changes in interest rates. The duration of a fixed-income security may be shorter than or equal to full maturity of a fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

Emerging-Market Risk: Investments in emerging-market countries may have more risk because the markets are less developed and less liquid and are subject to increased economic, political, regulatory or other uncertainties.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

Mortgage-Related and/or Other Asset-Backed Securities Risk: Investments in mortgage-related and other asset-backed securities are subject to certain additional risks. The value of these securities may be particularly sensitive to changes in interest rates. These risks include “extension risk”, which is the risk that, in periods of rising interest rates, issuers may delay the payment of principal, and “prepayment risk”, which is the risk that in periods of falling interest rates, issuers may pay principal sooner than expected, exposing the Fund to a lower rate of return upon reinvestment of principal. Mortgage-backed securities offered by non-governmental issuers and other asset-backed securities may be subject to other risks, such as higher rates of default in the mortgages or assets backing the securities or risks associated with the nature and servicing of mortgages or assets backing the securities.

| | |

| |

6 | AB HIGH INCOME FUND | | abfunds.com |

DISCLOSURES AND RISKS (continued)

Loan Participations and Assignments Risk: When the Fund purchases loan participations and assignments, it is subject to the credit risk associated with the underlying corporate borrower. In addition, the lack of a liquid secondary market for loan participations and assignments may have an adverse impact on the value of such investments and the Fund’s ability to dispose of particular assignments or participations when necessary to meet the Fund’s liquidity needs or in response to a specific economic event such as a deterioration in the creditworthiness of the borrower.

Leverage Risk: To the extent the Fund uses leveraging techniques, its net asset value (“NAV”) may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Derivatives Risk: Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk, which is the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable or unwilling to honor its contractual obligations to the Fund.

Illiquid Investments Risk: Illiquid investments risk exists when certain investments are or become difficult to purchase or sell. Difficulty in selling such investments may result in sales at disadvantageous prices affecting the value of your investment in the Fund. Causes of illiquid investments risk may include low trading volumes, large positions and heavy redemptions of Fund shares. Illiquid investments risk may be higher in a rising interest-rate environment, when the value and liquidity of fixed-income securities generally decline.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

The Fund may invest in mortgage-backed and/or other asset-backed securities, including securities backed by mortgages and assets with an international or emerging-markets origination and securities backed by non- performing loans at the time of investment. Investments in mortgage-backed and other asset-backed securities are subject to certain additional risks. The value of these securities may be particularly sensitive to changes in interest rates. These risks include “extension risk”, which is the risk that, in periods of rising interest rates, issuers may delay the payment of principal, and

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 7 |

DISCLOSURES AND RISKS (continued)

“prepayment risk”, which is the risk that, in periods of falling interest rates, issuers may pay principal sooner than expected, exposing the Fund to a lower rate of return upon reinvestment of principal. Mortgage-backed securities offered by nongovernmental issuers and other asset-backed securities may be subject to other risks, such as higher rates of default in the mortgages or assets backing the securities or risks associated with the nature and servicing of mortgages or assets backing the securities.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| |

8 | AB HIGH INCOME FUND | | abfunds.com |

HISTORICAL PERFORMANCE

AVERAGE ANNUAL RETURNS AS OF APRIL 30, 2022 (unaudited)

| | | | | | | | | | | | |

| | | |

| | | NAV Returns | | | SEC Returns

(reflects applicable

sales charges) | | | SEC Yields1 | |

| | | |

| CLASS A SHARES | | | | | | | | | | | 6.83% | |

| | | |

| 1 Year | | | -4.81% | | | | -8.90% | | | | | |

| | | |

| 5 Years | | | 1.90% | | | | 1.02% | | | | | |

| | | |

| 10 Years | | | 4.46% | | | | 4.01% | | | | | |

| | | |

| CLASS C SHARES | | | | | | | | | | | 6.28% | |

| | | |

| 1 Year | | | -5.61% | | | | -6.51% | | | | | |

| | | |

| 5 Years | | | 1.04% | | | | 1.04% | | | | | |

| | | |

| 10 Years2 | | | 3.62% | | | | 3.62% | | | | | |

| | | |

| ADVISOR CLASS SHARES3 | | | | | | | | | | | 7.39% | |

| | | |

| 1 Year | | | -4.57% | | | | -4.57% | | | | | |

| | | |

| 5 Years | | | 2.16% | | | | 2.16% | | | | | |

| | | |

| 10 Years | | | 4.73% | | | | 4.73% | | | | | |

| | | |

| CLASS R SHARES3 | | | | | | | | | | | 6.73% | |

| | | |

| 1 Year | | | -5.23% | | | | -5.23% | | | | | |

| | | |

| 5 Years | | | 1.47% | | | | 1.47% | | | | | |

| | | |

| 10 Years | | | 4.05% | | | | 4.05% | | | | | |

| | | |

| CLASS K SHARES3 | | | | | | | | | | | 7.04% | |

| | | |

| 1 Year | | | -4.95% | | | | -4.95% | | | | | |

| | | |

| 5 Years | | | 1.80% | | | | 1.80% | | | | | |

| | | |

| 10 Years | | | 4.39% | | | | 4.39% | | | | | |

| | | |

| CLASS I SHARES3 | | | | | | | | | | | 7.37% | |

| | | |

| 1 Year | | | -4.71% | | | | -4.71% | | | | | |

| | | |

| 5 Years | | | 2.16% | | | | 2.16% | | | | | |

| | | |

| 10 Years | | | 4.75% | | | | 4.75% | | | | | |

| | | |

| CLASS Z SHARES3 | | | | | | | | | | | 7.46% | |

| | | |

| 1 Year | | | -4.51% | | | | -4.51% | | | | | |

| | | |

| 5 Years | | | 2.22% | | | | 2.22% | | | | | |

| | | |

| Since Inception4 | | | 3.86% | | | | 3.86% | | | | | |

The Fund’s current prospectus fee table shows the Fund’s total annual operating expense ratios as 0.84%, 1.59%, 0.59%, 1.27%, 0.94%, 0.59% and 0.53% for Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| 1 | SEC yields are calculated based on SEC guidelines for the 30-day period ended April 30, 2022. |

| 2 | Assumes conversion of Class C shares into Class A shares after eight years. |

(footnotes continued on next page)

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 9 |

HISTORICAL PERFORMANCE (continued)

| 3 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 4 | Inception date: 10/15/2013. |

| | |

| |

10 | AB HIGH INCOME FUND | | abfunds.com |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

MARCH 31, 2022 (unaudited)

| | | | |

| |

| | | SEC Returns

(reflects applicable

sales charges) | |

| |

| CLASS A SHARES | | | | |

| |

| 1 Year | | | -3.98% | |

| |

| 5 Years | | | 1.99% | |

| |

| 10 Years | | | 4.45% | |

| |

| CLASS C SHARES | | | | |

| |

| 1 Year | | | -1.45% | |

| |

| 5 Years | | | 2.02% | |

| |

| 10 Years1 | | | 4.07% | |

| |

| ADVISOR CLASS SHARES2 | | | | |

| |

| 1 Year | | | 0.51% | |

| |

| 5 Years | | | 3.13% | |

| |

| 10 Years | | | 5.18% | |

| |

| CLASS R SHARES2 | | | | |

| |

| 1 Year | | | -0.17% | |

| |

| 5 Years | | | 2.44% | |

| |

| 10 Years | | | 4.50% | |

| |

| CLASS K SHARES2 | | | | |

| |

| 1 Year | | | 0.12% | |

| |

| 5 Years | | | 2.77% | |

| |

| 10 Years | | | 4.85% | |

| |

| CLASS I SHARES2 | | | | |

| |

| 1 Year | | | 0.62% | |

| |

| 5 Years | | | 3.16% | |

| |

| 10 Years | | | 5.22% | |

| |

| CLASS Z SHARES2 | | | | |

| |

| 1 Year | | | 0.57% | |

| |

| 5 Years | | | 3.19% | |

| |

| Since Inception3 | | | 4.32% | |

| 1 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 2 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 3 | Inception date: 10/15/2013. |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 11 |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

11/1/2021 | | | Ending

Account Value

4/30/2022 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 927.70 | | | $ | 4.16 | | | | 0.87 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.48 | | | $ | 4.36 | | | | 0.87 | % |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 922.60 | | | $ | 7.67 | | | | 1.61 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,016.81 | | | $ | 8.05 | | | | 1.61 | % |

| Advisor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 927.80 | | | $ | 2.92 | | | | 0.61 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.77 | | | $ | 3.06 | | | | 0.61 | % |

| Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 924.50 | | | $ | 6.11 | | | | 1.28 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.45 | | | $ | 6.41 | | | | 1.28 | % |

| | |

| |

12 | AB HIGH INCOME FUND | | abfunds.com |

EXPENSE EXAMPLE (continued)

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

11/1/2021 | | | Ending

Account Value

4/30/2022 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

| Class K | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 925.70 | | | $ | 4.63 | | | | 0.97 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.98 | | | $ | 4.86 | | | | 0.97 | % |

| Class I | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 927.70 | | | $ | 3.06 | | | | 0.64 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.62 | | | $ | 3.21 | | | | 0.64 | % |

| Class Z | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 928.10 | | | $ | 2.58 | | | | 0.54 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,022.12 | | | $ | 2.71 | | | | 0.54 | % |

| * | Expenses are equal to the classes’ annualized expense ratios multiplied by the average account value over the period, multiplied 181/365 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 13 |

PORTFOLIO SUMMARY

April 30, 2022 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $3,620.6

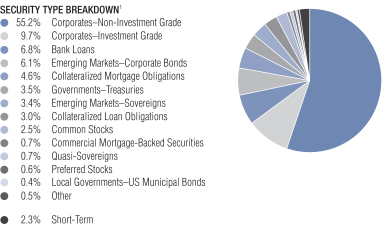

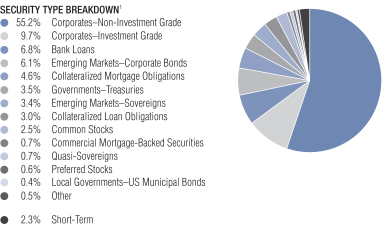

| 1 | All data are as of April 30, 2022. The Fund’s security type breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” securities type weightings represent 0.4% or less in the following security types: Asset-Backed Securities, Governments–Sovereign Bonds, Inflation-Linked Securities, Rights and Warrants. |

| | |

| |

14 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO SUMMARY (continued)

April 30, 2022 (unaudited)

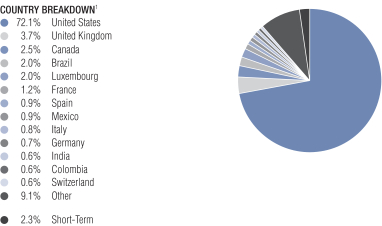

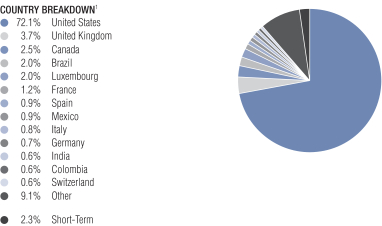

| 1 | All data are as of April 30, 2022. The Fund’s country breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.6% or less in the following: Angola, Argentina, Australia, Bahrain, Bermuda, Chile, China, Czech Republic, Denmark, Dominican Republic, Ecuador, Egypt, El Salvador, Finland, Gabon, Ghana, Guatemala, Hong Kong, Indonesia, Ireland, Israel, Ivory Coast, Jamaica, Jersey (Channel Islands), Macau, Morocco, Netherlands, Nigeria, Norway, Oman, Panama, Peru, Senegal, South Africa, Sweden, Trinidad & Tobago, Turkey, Ukraine, United Republic of Tanzania, Venezuela and Zambia. |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 15 |

PORTFOLIO OF INVESTMENTS

April 30, 2022 (unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CORPORATES - NON-INVESTMENT GRADE – 55.6% | | | | | | | | | | | | |

Industrial – 48.4% | | | | | | | | | | | | |

Basic – 3.4% | | | | | | | | | | | | |

Ahlstrom-Munksjo Holding 3 Oy

3.625%, 02/04/2028(a) | | | EUR | | | | 955 | | | $ | 902,919 | |

4.875%, 02/04/2028(a) | | | U.S.$ | | | | 4,788 | | | | 4,271,339 | |

ASP Unifrax Holdings, Inc.

5.25%, 09/30/2028(a) | | | | | | | 703 | | | | 619,974 | |

7.50%, 09/30/2029(a)(b) | | | | | | | 1,091 | | | | 893,664 | |

Axalta Coating Systems LLC/Axalta Coating Systems Dutch Holding B BV

4.75%, 06/15/2027(a) | | | | | | | 1,485 | | | | 1,410,750 | |

CVR Partners LP/CVR Nitrogen Finance Corp.

6.125%, 06/15/2028(a) | | | | | | | 527 | | | | 514,932 | |

Element Solutions, Inc.

3.875%, 09/01/2028(a) | | | | | | | 2,415 | | | | 2,160,022 | |

ERP Iron Ore, LLC

9.039%, 12/31/2019(c)(d)(e)(f)(g) | | | | | | | 1,355 | | | | 1,028,380 | |

FMG Resources (August 2006) Pty Ltd.

4.375%, 04/01/2031(a) | | | | | | | 12,055 | | | | 10,704,279 | |

4.50%, 09/15/2027(a) | | | | | | | 1,475 | | | | 1,412,094 | |

6.125%, 04/15/2032(a) | | | | | | | 8,381 | | | | 8,335,589 | |

Glatfelter Corp.

4.75%, 11/15/2029(a) | | | | | | | 3,565 | | | | 2,858,456 | |

Graphic Packaging International LLC

3.75%, 02/01/2030(a) | | | | | | | 6,296 | | | | 5,530,081 | |

Guala Closures SpA

3.25%, 06/15/2028(a) | | | EUR | | | | 1,803 | | | | 1,659,879 | |

Illuminate Buyer LLC/Illuminate Holdings IV, Inc.

9.00%, 07/01/2028(a) | | | U.S.$ | | | | 5,122 | | | | 4,931,588 | |

INEOS Quattro Finance 1 PLC

3.75%, 07/15/2026(a) | | | EUR | | | | 108 | | | | 104,092 | |

INEOS Styrolution Group GmbH

2.25%, 01/16/2027(a) | | | | | | | 5,634 | | | | 5,231,171 | |

Ingevity Corp.

3.875%, 11/01/2028(a) | | | U.S.$ | | | | 4,788 | | | | 4,321,892 | |

Intelligent Packaging Holdco Issuer LP

9.00% (9.00% Cash or 9.75% PIK), 01/15/2026(a)(g) | | | | | | | 3,201 | | | | 3,109,638 | |

Intelligent Packaging Ltd. Finco, Inc./Intelligent Packaging Ltd. Co-Issuer LLC

6.00%, 09/15/2028(a) | | | | | | | 4,418 | | | | 4,182,372 | |

Kleopatra Finco SARL

4.25%, 03/01/2026(a)(b) | | | EUR | | | | 5,384 | | | | 4,840,945 | |

| | |

| |

16 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Kobe US Midco 2, Inc.

9.25% (9.25% Cash or 10.00% PIK), 11/01/2026(a)(g) | | | U.S.$ | | | | 6,077 | | | $ | 5,955,566 | |

Magnetation LLC/Mag Finance Corp.

11.00%, 05/15/2018(c)(d)(e)(f)(h) | | | | | | | 16,121 | | | | – 0 | – |

Mercer International, Inc.

5.125%, 02/01/2029 | | | | | | | 2,306 | | | | 2,145,331 | |

Olin Corp.

5.625%, 08/01/2029 | | | | | | | 1,124 | | | | 1,106,031 | |

PIC AU Holdings LLC/PIC AU Holdings Corp.

10.00%, 12/31/2024(a) | | | | | | | 500 | | | | 516,250 | |

PMHC II, Inc.

9.00%, 02/15/2030(a) | | | | | | | 15,730 | | | | 12,825,974 | |

Rimini Bidco SpA

5.25% (EURIBOR 3 Month + 5.25%), 12/14/2026(b)(i) | | | EUR | | | | 6,497 | | | | 5,937,405 | |

SCIL IV LLC/SCIL USA Holdings LLC

4.375%, 11/01/2026(a) | | | | | | | 1,267 | | | | 1,244,233 | |

5.375%, 11/01/2026(a) | | | U.S.$ | | | | 4,506 | | | | 4,112,213 | |

SPCM SA

3.125%, 03/15/2027(a) | | | | | | | 3,640 | | | | 3,223,998 | |

3.375%, 03/15/2030(a) | | | | | | | 4,197 | | | | 3,594,364 | |

Valvoline, Inc.

4.25%, 02/15/2030(a) | | | | | | | 10,847 | | | | 9,427,928 | |

WR Grace Holdings LLC

4.875%, 06/15/2027(a) | | | | | | | 3,382 | | | | 3,179,170 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 122,292,519 | |

| | | | | | | | | | | | |

Capital Goods – 2.8% | | | | | | | | | | | | |

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC

3.25%, 09/01/2028(a) | | | | | | | 6,594 | | | | 5,817,886 | |

4.00%, 09/01/2029(a) | | | | | | | 5,355 | | | | 4,575,633 | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc.

4.125%, 08/15/2026(a) | | | | | | | 2,072 | | | | 1,921,979 | |

5.25%, 04/30/2025(a) | | | | | | | 2,000 | | | | 1,981,300 | |

Bombardier, Inc.

7.50%, 12/01/2024-03/15/2025(a) | | | | | | | 8,052 | | | | 7,853,493 | |

7.875%, 04/15/2027(a) | | | | | | | 2,481 | | | | 2,311,817 | |

Castle UK Finco PLC

5.25% (EURIBOR 3 Month + 5.25%), 05/15/2028(i) | | | EUR | | | | 2,233 | | | | 2,285,032 | |

7.00%, 05/15/2029 | | | GBP | | | | 2,900 | | | | 3,407,752 | |

Cleaver-Brooks, Inc.

7.875%, 03/01/2023(a) | | | U.S.$ | | | | 3,893 | | | | 3,707,587 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 17 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Eco Material Technologies, Inc.

7.875%, 01/31/2027(a) | | | U.S.$ | | | | 5,828 | | | $ | 5,639,407 | |

EnerSys

4.375%, 12/15/2027(a) | | | | | | | 5,050 | | | | 4,707,067 | |

F-Brasile SpA/F-Brasile US LLC

Series XR

7.375%, 08/15/2026(a) | | | | | | | 5,660 | | | | 5,006,540 | |

GFL Environmental, Inc.

4.25%, 06/01/2025(a) | | | | | | | 333 | | | | 323,281 | |

Granite US Holdings Corp.

11.00%, 10/01/2027(a) | | | | | | | 2,757 | | | | 2,843,165 | |

Griffon Corp.

5.75%, 03/01/2028 | | | | | | | 1,264 | | | | 1,128,488 | |

JELD-WEN, Inc.

4.625%, 12/15/2025(a) | | | | | | | 1,036 | | | | 979,832 | |

Madison IAQ LLC

5.875%, 06/30/2029(a) | | | | | | | 2,757 | | | | 2,247,596 | |

Mueller Water Products, Inc.

4.00%, 06/15/2029(a) | | | | | | | 1,183 | | | | 1,074,889 | |

Renk AG/Frankfurt am Main

5.75%, 07/15/2025(a) | | | EUR | | | | 7,486 | | | | 7,821,885 | |

SPX FLOW, Inc.

8.75%, 04/01/2030(a) | | | U.S.$ | | | | 6,760 | | | | 6,085,765 | |

Tervita Corp.

11.00%, 12/01/2025(a) | | | | | | | 5,242 | | | | 5,844,035 | |

Titan Holdings II BV

5.125%, 07/15/2029(a) | | | EUR | | | | 2,767 | | | | 2,614,191 | |

TransDigm, Inc.

4.625%, 01/15/2029 | | | U.S.$ | | | | 3,591 | | | | 3,102,876 | |

4.875%, 05/01/2029 | | | | | | | 5,750 | | | | 5,035,703 | |

8.00%, 12/15/2025(a) | | | | | | | 3,335 | | | | 3,472,239 | |

Triumph Group, Inc.

7.75%, 08/15/2025 | | | | | | | 2,289 | | | | 2,226,870 | |

8.875%, 06/01/2024(a) | | | | | | | 3,221 | | | | 3,331,454 | |

Trivium Packaging Finance BV

3.75%, 08/15/2026(a) | | | EUR | | | | 132 | | | | 133,667 | |

WESCO Distribution, Inc.

7.25%, 06/15/2028(a) | | | U.S.$ | | | | 2,462 | | | | 2,558,560 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 100,039,989 | |

| | | | | | | | | | | | |

Communications - Media – 7.1% | | | | | | | | | | | | |

Advantage Sales & Marketing, Inc.

6.50%, 11/15/2028(a) | | | | | | | 7,124 | | | | 6,515,418 | |

Altice Financing SA

5.75%, 08/15/2029(a) | | | | | | | 25,958 | | | | 21,936,390 | |

AMC Networks, Inc.

4.25%, 02/15/2029 | | | | | | | 8,644 | | | | 7,542,448 | |

| | |

| |

18 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Arches Buyer, Inc.

6.125%, 12/01/2028(a) | | U.S.$ | | | 1,056 | | | $ | 918,777 | |

Banijay Entertainment SASU

3.50%, 03/01/2025(a) | | EUR | | | 815 | | | | 822,193 | |

5.375%, 03/01/2025(a) | | U.S.$ | | | 8,793 | | | | 8,656,062 | |

CCO Holdings LLC/CCO Holdings Capital Corp.

4.50%, 08/15/2030-06/01/2033(a) | | | | | 36,644 | | | | 31,283,818 | |

4.75%, 02/01/2032(a) | | | | | 25,422 | | | | 22,011,786 | |

Clear Channel Outdoor Holdings, Inc.

5.125%, 08/15/2027(a) | | | | | 583 | | | | 548,263 | |

CSC Holdings LLC

4.50%, 11/15/2031(a) | | | | | 6,832 | | | | 5,620,815 | |

5.00%, 11/15/2031(a) | | | | | 7,553 | | | | 5,835,771 | |

5.375%, 02/01/2028(a) | | | | | 4,139 | | | | 3,828,575 | |

5.75%, 01/15/2030(a) | | | | | 20,595 | | | | 17,091,018 | |

7.50%, 04/01/2028(a) | | | | | 2,326 | | | | 2,145,615 | |

DISH DBS Corp.

5.00%, 03/15/2023 | | | | | 1,148 | | | | 1,144,042 | |

5.125%, 06/01/2029 | | | | | 10,639 | | | | 8,308,040 | |

5.25%, 12/01/2026(a) | | | | | 9,108 | | | | 8,377,313 | |

5.75%, 12/01/2028(a) | | | | | 9,476 | | | | 8,499,638 | |

5.875%, 11/15/2024 | | | | | 1,199 | | | | 1,168,103 | |

7.375%, 07/01/2028 | | | | | 6,580 | | | | 5,798,076 | |

7.75%, 07/01/2026 | | | | | 3,040 | | | | 2,902,472 | |

DISH Network Corp.

3.375%, 08/15/2026(j) | | | | | 4,275 | | | | 3,672,304 | |

Gray Escrow II, Inc.

5.375%, 11/15/2031(a) | | | | | 8,103 | | | | 7,097,542 | |

iHeartCommunications, Inc.

6.375%, 05/01/2026 | | | | | 758 | | | | 760,181 | |

8.375%, 05/01/2027 | | | | | 1,375 | | | | 1,360,834 | |

LCPR Senior Secured Financing DAC

6.75%, 10/15/2027(a) | | | | | 4,636 | | | | 4,654,464 | |

Liberty Interactive LLC

3.75%, 02/15/2030(j) | | | | | 2,208 | | | | 1,412,975 | |

McGraw-Hill Education, Inc.

5.75%, 08/01/2028(a) | | | | | 4,714 | | | | 4,207,245 | |

8.00%, 08/01/2029(a) | | | | | 2,114 | | | | 1,892,030 | |

National CineMedia LLC

5.875%, 04/15/2028(a) | | | | | 3,387 | | | | 2,914,595 | |

Outfront Media Capital LLC/Outfront Media Capital Corp.

4.625%, 03/15/2030(a) | | | | | 403 | | | | 359,752 | |

Sinclair Television Group, Inc.

4.125%, 12/01/2030(a) | | | | | 8,939 | | | | 7,425,108 | |

5.50%, 03/01/2030(a) | | | | | 4,371 | | | | 3,603,830 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 19 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Sirius XM Radio, Inc.

4.00%, 07/15/2028(a) | | | U.S.$ | | | | 30,900 | | | $ | 27,940,744 | |

5.50%, 07/01/2029(a) | | | | | | | 110 | | | | 106,022 | |

TEGNA, Inc.

5.00%, 09/15/2029 | | | | | | | 803 | | | | 779,563 | |

Univision Communications, Inc.

4.50%, 05/01/2029(a) | | | | | | | 2,116 | | | | 1,899,581 | |

6.625%, 06/01/2027(a) | | | | | | | 1,134 | | | | 1,140,869 | |

Urban One, Inc.

7.375%, 02/01/2028(a) | | | | | | | 12,257 | | | | 11,881,705 | |

Virgin Media Secured Finance PLC

4.50%, 08/15/2030(a) | | | | | | | 3,734 | | | | 3,236,905 | |

5.50%, 05/15/2029(a) | | | | | | | 333 | | | | 311,806 | |

Ziggo Bond Co. BV

5.125%, 02/28/2030(a) | | | | | | | 985 | | | | 861,140 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 258,473,828 | |

| | | | | | | | | | | | |

Communications - Telecommunications – 2.9% | | | | | | | | | | | | |

Altice France SA/France

5.125%, 07/15/2029(a) | | | | | | | 17,362 | | | | 14,699,231 | |

Connect Finco SARL/Connect US Finco LLC

6.75%, 10/01/2026(a) | | | | | | | 7,696 | | | | 7,503,600 | |

Consolidated Communications, Inc.

5.00%, 10/01/2028(a) | | | | | | | 987 | | | | 807,347 | |

6.50%, 10/01/2028(a) | | | | | | | 10,220 | | | | 8,878,856 | |

DKT Finance ApS

7.00%, 06/17/2023(a) | | | EUR | | | | 3,874 | | | | 4,071,553 | |

9.375%, 06/17/2023(a) | | | U.S.$ | | | | 3,093 | | | | 3,072,490 | |

Embarq Corp.

7.995%, 06/01/2036 | | | | | | | 8,721 | | | | 7,852,854 | |

ESC GCB In Jacks 5.5

5.50%, 08/01/2023(c)(d)(f) | | | | | | | 7,915 | | | | – 0 | – |

Iliad Holding SASU

6.50%, 10/15/2026(a) | | | | | | | 1,449 | | | | 1,392,317 | |

7.00%, 10/15/2028(a) | | | | | | | 1,668 | | | | 1,590,815 | |

Intelsat Ja 9.75 07

9.75%, 07/15/2025(c)(d)(f)(h) | | | | | | | 1,446 | | | | – 0 | – |

Kaixo Bondco Telecom SA

5.125%, 09/30/2029(a) | | | EUR | | | | 3,977 | | | | 3,703,373 | |

Level 3 Financing, Inc.

4.25%, 07/01/2028(a) | | | U.S.$ | | | | 4,459 | | | | 3,772,527 | |

4.625%, 09/15/2027(a) | | | | | | | 3,050 | | | | 2,747,882 | |

Lumen Technologies, Inc.

Series Y

7.50%, 04/01/2024 | | | | | | | 262 | | | | 269,113 | |

| | |

| |

20 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Lumen Technologies, Inc.

4.50%, 01/15/2029(a) | | | U.S.$ | | | | 3,556 | | | $ | 2,814,995 | |

Sprint Capital Corp.

8.75%, 03/15/2032 | | | | | | | 3,300 | | | | 4,194,254 | |

Sprint Corp.

7.625%, 03/01/2026 | | | | | | | 137 | | | | 149,143 | |

Telecom Italia Capital SA

7.20%, 07/18/2036 | | | | | | | 5,713 | | | | 5,152,300 | |

7.721%, 06/04/2038 | | | | | | | 6,995 | | | | 6,620,832 | |

United Group BV

4.875% (EURIBOR 3 Month + 4.88%), 02/01/2029(i) | | | EUR | | | | 5,496 | | | | 5,535,629 | |

Vmed O2 UK Financing I PLC

4.75%, 07/15/2031(a) | | | U.S.$ | | | | 19,380 | | | | 16,595,894 | |

Zayo Group Holdings, Inc.

6.125%, 03/01/2028(a) | | | | | | | 3,088 | | | | 2,589,580 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 104,014,585 | |

| | | | | | | | | | | | |

Consumer Cyclical - Automotive – 2.8% | | | | | | | | | | | | |

Aston Martin Capital Holdings Ltd.

10.50%, 11/30/2025(a) | | | | | | | 5,401 | | | | 5,452,831 | |

15.00% (8.89% Cash and 6.11% PIK), 11/30/2026(a)(g) | | | | | | | 8,693 | | | | 9,285,006 | |

Clarios Global LP/Clarios US Finance Co.

4.375%, 05/15/2026(a) | | | EUR | | | | 1,055 | | | | 1,062,256 | |

Dana, Inc.

4.25%, 09/01/2030 | | | U.S.$ | | | | 3,854 | | | | 3,312,298 | |

Dealer Tire LLC/DT Issuer LLC

8.00%, 02/01/2028(a) | | | | | | | 5,841 | | | | 5,747,820 | |

Exide Technologies

(Exchange Priority)

11.00%, 10/31/2024(c)(d)(f)(h) | | | | | | | 18,493 | | | | – 0 | – |

(First Lien)

11.00%, 10/31/2024(c)(d)(f)(h) | | | | | | | 7,590 | | | | – 0 | – |

Ford Motor Co.

3.25%, 02/12/2032 | | | | | | | 9,212 | | | | 7,479,930 | |

Ford Motor Credit Co. LLC

2.70%, 08/10/2026 | | | | | | | 388 | | | | 346,135 | |

4.95%, 05/28/2027 | | | | | | | 6,465 | | | | 6,285,286 | |

5.125%, 06/16/2025 | | | | | | | 538 | | | | 536,047 | |

Goodyear Tire & Rubber Co. (The)

5.00%, 07/15/2029 | | | | | | | 1,697 | | | | 1,503,620 | |

5.25%, 07/15/2031 | | | | | | | 2,963 | | | | 2,583,886 | |

IHO Verwaltungs GmbH

6.00% (6.00% Cash or 6.75 % PIK), 05/15/2027(a)(g) | | | | | | | 2,107 | | | | 1,989,569 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 21 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Jaguar Land Rover Automotive PLC

5.50%, 07/15/2029(a) | | | U.S.$ | | | | 6,351 | | | $ | 5,370,858 | |

5.875%, 11/15/2024(a) | | | EUR | | | | 667 | | | | 689,934 | |

5.875%, 01/15/2028(a) | | | U.S.$ | | | | 6,393 | | | | 5,571,446 | |

7.75%, 10/15/2025(a) | | | | | | | 6,597 | | | | 6,736,387 | |

Mclaren Finance PLC

7.50%, 08/01/2026(a) | | | | | | | 9,232 | | | | 8,924,188 | |

Meritor, Inc.

6.25%, 06/01/2025(a) | | | | | | | 1,349 | | | | 1,396,702 | |

PM General Purchaser LLC

9.50%, 10/01/2028(a) | | | | | | | 6,681 | | | | 6,380,493 | |

Tenneco, Inc.

5.00%, 07/15/2026 | | | | | | | 2,571 | | | | 2,464,998 | |

7.875%, 01/15/2029(a) | | | | | | | 2,477 | | | | 2,501,583 | |

Titan International, Inc.

7.00%, 04/30/2028 | | | | | | | 7,168 | | | | 7,028,330 | |

ZF Europe Finance BV

2.00%, 02/23/2026(a) | | | EUR | | | | 1,200 | | | | 1,136,140 | |

ZF North America Capital, Inc.

4.75%, 04/29/2025(a) | | | U.S.$ | | | | 9,312 | | | | 9,108,722 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 102,894,465 | |

| | | | | | | | | | | | |

Consumer Cyclical - Entertainment – 3.1% | | | | | | | | | | | | |

Carnival Corp.

4.00%, 08/01/2028(a) | | | | | | | 8,433 | | | | 7,570,641 | |

5.75%, 03/01/2027(a) | | | | | | | 6,463 | | | | 5,838,997 | |

7.625%, 03/01/2026(a) | | | EUR | | | | 1,630 | | | | 1,717,548 | |

9.875%, 08/01/2027(a) | | | U.S.$ | | | | 3,689 | | | | 3,969,180 | |

10.125%, 02/01/2026(a) | | | EUR | | | | 1,630 | | | | 1,868,977 | |

Carnival PLC

1.00%, 10/28/2029 | | | | | | | 737 | | | | 541,277 | |

Cedar Fair LP/Canada’s Wonderland Co./Magnum Management Corp./Millennium Op

5.50%, 05/01/2025(a) | | | U.S.$ | | | | 12,465 | | | | 12,530,300 | |

Cinemark USA, Inc.

5.25%, 07/15/2028(a) | | | | | | | 2,584 | | | | 2,286,643 | |

Lindblad Expeditions LLC

6.75%, 02/15/2027(a) | | | | | | | 1,512 | | | | 1,485,913 | |

Mattel, Inc.

3.75%, 04/01/2029(a) | | | | | | | 7,792 | | | | 7,422,121 | |

Motion Bondco DAC

4.50%, 11/15/2027(a) | | | EUR | | | | 2,973 | | | | 2,806,136 | |

NCL Corp. Ltd.

5.875%, 03/15/2026(a) | | | U.S.$ | | | | 9,466 | | | | 8,701,534 | |

Royal Caribbean Cruises Ltd.

5.375%, 07/15/2027(a) | | | | | | | 6,220 | | | | 5,701,128 | |

| | |

| |

22 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

5.50%, 08/31/2026-04/01/2028(a) | | | U.S.$ | | | | 25,270 | | | $ | 23,144,980 | |

10.875%, 06/01/2023(a) | | | | | | | 3,534 | | | | 3,697,447 | |

11.50%, 06/01/2025(a) | | | | | | | 7,586 | | | | 8,252,051 | |

Six Flags Theme Parks, Inc.

7.00%, 07/01/2025(a) | | | | | | | 1,901 | | | | 1,974,138 | |

Viking Cruises Ltd.

5.875%, 09/15/2027(a) | | | | | | | 4,065 | | | | 3,451,496 | |

7.00%, 02/15/2029(a) | | | | | | | 5,016 | | | | 4,464,094 | |

13.00%, 05/15/2025(a) | | | | | | | 2,788 | | | | 3,054,084 | |

VOC Escrow Ltd.

5.00%, 02/15/2028(a) | | | | | | | 1,018 | | | | 919,155 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 111,397,840 | |

| | | | | | | | | | | | |

Consumer Cyclical - Other – 2.2% | | | | | | | | | | | | |

Adams Homes, Inc.

7.50%, 02/15/2025(a) | | | | | | | 4,216 | | | | 4,127,113 | |

Brookfield Residential Properties, Inc./Brookfield Residential US LLC

4.875%, 02/15/2030(a) | | | | | | | 5,889 | | | | 4,913,408 | |

6.25%, 09/15/2027(a) | | | | | | | 7,295 | | | | 6,841,183 | |

Churchill Downs, Inc.

4.75%, 01/15/2028(a) | | | | | | | 1,528 | | | | 1,430,873 | |

CP Atlas Buyer, Inc.

7.00%, 12/01/2028(a) | | | | | | | 1,842 | | | | 1,538,100 | |

Empire Communities Corp.

7.00%, 12/15/2025(a) | | | | | | | 1,563 | | | | 1,481,221 | |

Everi Holdings, Inc.

5.00%, 07/15/2029(a) | | | | | | | 140 | | | | 126,957 | |

Five Point Operating Co. LP/Five Point Capital Corp.

7.875%, 11/15/2025(a) | | | | | | | 6,001 | | | | 5,966,468 | |

Forestar Group, Inc.

3.85%, 05/15/2026(a) | | | | | | | 2,881 | | | | 2,591,138 | |

Hilton Domestic Operating Co., Inc.

3.625%, 02/15/2032(a) | | | | | | | 2,459 | | | | 2,085,325 | |

Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Esc

4.875%, 07/01/2031(a) | | | | | | | 3,307 | | | | 2,893,903 | |

5.00%, 06/01/2029(a) | | | | | | | 3,417 | | | | 3,080,497 | |

Installed Building Products, Inc.

5.75%, 02/01/2028(a) | | | | | | | 838 | | | | 794,583 | |

International Game Technology PLC

3.50%, 06/15/2026(a) | | | EUR | | | | 1,026 | | | | 1,054,824 | |

Mattamy Group Corp.

4.625%, 03/01/2030(a) | | | U.S.$ | | | | 4,691 | | | | 4,003,125 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 23 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Premier Entertainment Sub LLC/Premier Entertainment Finance Corp.

5.625%, 09/01/2029(a) | | | U.S.$ | | | | 2,350 | | | $ | 1,875,640 | |

5.875%, 09/01/2031(a) | | | | | | | 2,350 | | | | 1,823,514 | |

Shea Homes LP/Shea Homes Funding Corp.

4.75%, 02/15/2028-04/01/2029(a) | | | | | | | 7,822 | | | | 6,882,629 | |

Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp.

5.875%, 05/15/2025(a) | | | | | | | 4,781 | | | | 4,685,702 | |

Taylor Morrison Communities, Inc.

5.75%, 01/15/2028(a) | | | | | | | 1,782 | | | | 1,749,356 | |

5.875%, 06/15/2027(a) | | | | | | | 493 | | | | 489,458 | |

Travel + Leisure Co.

4.50%, 12/01/2029(a) | | | | | | | 3,509 | | | | 3,111,208 | |

4.625%, 03/01/2030(a) | | | | | | | 10,068 | | | | 9,003,536 | |

6.625%, 07/31/2026(a) | | | | | | | 3,533 | | | | 3,613,382 | |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp.

4.25%, 05/30/2023(a) | | | | | | | 333 | | | | 326,556 | |

5.50%, 03/01/2025(a) | | | | | | | 2,020 | | | | 1,954,350 | |

Wynn Resorts Finance LLC/Wynn Resorts Capital Corp.

5.125%, 10/01/2029(a) | | | | | | | 3,075 | | | | 2,694,463 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 81,138,512 | |

| | | | | | | | | | | | |

Consumer Cyclical - Restaurants – 0.8% | | | | | | | | | | | | |

1011778 BC ULC/New Red Finance, Inc.

3.875%, 01/15/2028(a) | | | | | | | 6,965 | | | | 6,407,800 | |

4.00%, 10/15/2030(a) | | | | | | | 8,721 | | | | 7,459,819 | |

4.375%, 01/15/2028(a) | | | | | | | 83 | | | | 76,113 | |

Stonegate Pub Co. Financing PLC

8.00%, 07/13/2025(a) | | | GBP | | | | 963 | | | | 1,218,038 | |

8.25%, 07/31/2025(a) | | | | | | | 6,836 | | | | 8,708,739 | |

Yum! Brands, Inc.

4.625%, 01/31/2032 | | | U.S.$ | | | | 3,367 | | | | 3,072,913 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 26,943,422 | |

| | | | | | | | | | | | |

Consumer Cyclical - Retailers – 2.6% | | | | | | | | | | | | |

Arko Corp.

5.125%, 11/15/2029(a) | | | | | | | 4,612 | | | | 4,088,362 | |

Asbury Automotive Group, Inc.

4.625%, 11/15/2029(a) | | | | | | | 3,368 | | | | 3,034,317 | |

5.00%, 02/15/2032(a) | | | | | | | 1,444 | | | | 1,287,426 | |

Bath & Body Works, Inc.

5.25%, 02/01/2028 | | | | | | | 531 | | | | 513,934 | |

6.625%, 10/01/2030(a) | | | | | | | 3,212 | | | | 3,198,622 | |

| | |

| |

24 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

6.75%, 07/01/2036 | | | U.S.$ | | | | 1,479 | | | $ | 1,426,841 | |

6.875%, 11/01/2035 | | | | | | | 7,429 | | | | 7,258,357 | |

7.50%, 06/15/2029 | | | | | | | 492 | | | | 508,229 | |

BCPE Ulysses Intermediate, Inc.

7.75% (7.75% Cash or 8.50% PIK), 04/01/2027(a)(g) | | | | | | | 2,653 | | | | 2,269,140 | |

Carvana Co.

5.50%, 04/15/2027(a) | | | | | | | 1,469 | | | | 1,202,951 | |

5.875%, 10/01/2028(a)(b) | | | | | | | 4,527 | | | | 3,601,559 | |

FirstCash, Inc.

5.625%, 01/01/2030(a) | | | | | | | 9,711 | | | | 9,034,347 | |

Foundation Building Materials, Inc.

6.00%, 03/01/2029(a) | | | | | | | 1,246 | | | | 1,021,721 | |

Gap, Inc. (The)

3.625%, 10/01/2029(a) | | | | | | | 2,335 | | | | 1,900,706 | |

3.875%, 10/01/2031(a) | | | | | | | 2,335 | | | | 1,868,367 | |

Kontoor Brands, Inc.

4.125%, 11/15/2029(a) | | | | | | | 4,313 | | | | 3,769,711 | |

LBM Acquisition LLC

6.25%, 01/15/2029(a) | | | | | | | 303 | | | | 248,912 | |

Levi Strauss & Co.

3.50%, 03/01/2031(a) | | | | | | | 2,970 | | | | 2,584,591 | |

Michaels Cos, Inc. (The)

5.25%, 05/01/2028(a) | | | | | | | 7,693 | | | | 6,614,757 | |

7.875%, 05/01/2029(a) | | | | | | | 6,100 | | | | 4,842,384 | |

NMG Holding Co., Inc./Neiman Marcus Group LLC

7.125%, 04/01/2026(a) | | | | | | | 139 | | | | 138,751 | |

PetSmart, Inc./PetSmart Finance Corp.

7.75%, 02/15/2029(a) | | | | | | | 1,997 | | | | 1,987,017 | |

Rite Aid Corp.

7.50%, 07/01/2025(a) | | | | | | | 6,326 | | | | 5,425,846 | |

Specialty Building Products Holdings LLC/SBP Finance Corp.

6.375%, 09/30/2026(a) | | | | | | | 4,261 | | | | 4,186,118 | |

SRS Distribution, Inc.

6.125%, 07/01/2029(a) | | | | | | | 1,110 | | | | 979,079 | |

Staples, Inc.

7.50%, 04/15/2026(a) | | | | | | | 2,855 | | | | 2,725,878 | |

10.75%, 04/15/2027(a) | | | | | | | 6,383 | | | | 5,648,217 | |

TPro Acquisition Corp.

11.00%, 10/15/2024(a) | | | | | | | 3,220 | | | | 3,364,540 | |

White Cap Buyer LLC

6.875%, 10/15/2028(a) | | | | | | | 4,257 | | | | 3,923,168 | |

Wolverine World Wide, Inc.

4.00%, 08/15/2029(a) | | | | | | | 5,859 | | | | 4,982,692 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 93,636,540 | |

| | | | | | | | | | | | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 25 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Consumer Non-Cyclical – 6.2% | | | | | | | | | | | | |

180 Medical, Inc.

3.875%, 10/15/2029(a) | | | U.S.$ | | | | 4,968 | | | $ | 4,453,471 | |

AdaptHealth LLC

4.625%, 08/01/2029(a) | | | | | | | 5,234 | | | | 4,459,194 | |

6.125%, 08/01/2028(a) | | | | | | | 1,532 | | | | 1,453,988 | |

AHP Health Partners, Inc.

5.75%, 07/15/2029(a) | | | | | | | 4,713 | | | | 4,272,605 | |

Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC

4.625%, 01/15/2027(a) | | | | | | | 3,290 | | | | 3,081,660 | |

4.875%, 02/15/2030(a) | | | | | | | 2,263 | | | | 2,049,651 | |

7.50%, 03/15/2026(a) | | | | | | | 333 | | | | 350,412 | |

Bausch Health Cos., Inc.

4.875%, 06/01/2028(a) | | | | | | | 10,910 | | | | 9,681,689 | |

6.25%, 02/15/2029(a) | | | | | | | 900 | | | | 656,077 | |

CD&R Smokey Buyer, Inc.

6.75%, 07/15/2025(a) | | | | | | | 419 | | | | 426,552 | |

Charles River Laboratories International, Inc.

3.75%, 03/15/2029(a) | | | | | | | 3,048 | | | | 2,767,367 | |

4.00%, 03/15/2031(a) | | | | | | | 5,304 | | | | 4,740,061 | |

CHS/Community Health Systems, Inc.

4.75%, 02/15/2031(a) | | | | | | | 1,291 | | | | 1,092,458 | |

5.625%, 03/15/2027(a) | | | | | | | 697 | | | | 664,921 | |

6.125%, 04/01/2030(a) | | | | | | | 17,171 | | | | 14,118,069 | |

6.875%, 04/01/2028-04/15/2029(a) | | | | | | | 14,378 | | | | 12,349,152 | |

Cidron Aida Finco SARL

5.00%, 04/01/2028(a) | | | EUR | | | | 949 | | | | 901,379 | |

DaVita, Inc.

3.75%, 02/15/2031(a) | | | U.S.$ | | | | 1,823 | | | | 1,485,300 | |

4.625%, 06/01/2030(a) | | | | | | | 5,297 | | | | 4,617,879 | |

Emergent BioSolutions, Inc.

3.875%, 08/15/2028(a) | | | | | | | 7,410 | | | | 6,288,283 | |

Endo Luxembourg Finance Co. I SARL/Endo US, Inc.

6.125%, 04/01/2029(a) | | | | | | | 1,302 | | | | 1,136,118 | |

Global Medical Response, Inc.

6.50%, 10/01/2025(a) | | | | | | | 2,750 | | | | 2,654,859 | |

Grifols Escrow Issuer SA

3.875%, 10/15/2028(a) | | | EUR | | | | 6,477 | | | | 6,137,132 | |

Gruenenthal GmbH

4.125%, 05/15/2028(a) | | | | | | | 738 | | | | 721,375 | |

IQVIA, Inc.

2.25%, 03/15/2029(a) | | | | | | | 3,948 | | | | 3,645,481 | |

Jazz Securities DAC

4.375%, 01/15/2029(a) | | | U.S.$ | | | | 2,382 | | | | 2,211,531 | |

| | |

| |

26 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc.

7.00%, 12/31/2027(a) | | U.S.$ | | | 10,638 | | | $ | 8,464,275 | |

Lamb Weston Holdings, Inc.

4.125%, 01/31/2030(a) | | | | | 5,418 | | | | 4,832,454 | |

4.375%, 01/31/2032(a) | | | | | 5,802 | | | | 5,209,061 | |

Legacy LifePoint Health LLC

6.75%, 04/15/2025(a) | | | | | 333 | | | | 339,781 | |

Mallinckrodt International Finance SA/Mallinckrodt CB LLC

5.50%, 04/15/2025(a)(d)(k) | | | | | 2,552 | | | | 1,373,870 | |

ModivCare Escrow Issuer, Inc.

5.00%, 10/01/2029(a) | | | | | 643 | | | | 562,850 | |

ModivCare, Inc.

5.875%, 11/15/2025(a) | | | | | 249 | | | | 244,184 | |

Mozart Debt Merger Sub, Inc.

3.875%, 04/01/2029(a) | | | | | 6,982 | | | | 6,104,398 | |

5.25%, 10/01/2029(a) | | | | | 14,103 | | | | 12,268,057 | |

Option Care Health, Inc.

4.375%, 10/31/2029(a) | | | | | 349 | | | | 313,392 | |

Organon & Co./Organon Foreign Debt Co-Issuer BV

5.125%, 04/30/2031(a) | | | | | 3,867 | | | | 3,497,439 | |

Par Pharmaceutical, Inc.

7.50%, 04/01/2027(a) | | | | | 5,068 | | | | 4,627,285 | |

Paysafe Finance PLC/Paysafe Holdings US Corp.

4.00%, 06/15/2029(a) | | | | | 5,267 | | | | 4,289,313 | |

Performance Food Group, Inc.

4.25%, 08/01/2029(a) | | | | | 5,952 | | | | 5,295,120 | |

Post Holdings, Inc.

4.50%, 09/15/2031(a) | | | | | 7,969 | | | | 6,646,137 | |

4.625%, 04/15/2030(a) | | | | | 6,624 | | | | 5,665,050 | |

5.50%, 12/15/2029(a) | | | | | 5,372 | | | | 4,882,681 | |

Primo Water Holdings, Inc.

4.375%, 04/30/2029(a) | | | | | 7,622 | | | | 6,636,911 | |

RegionalCare Hospital Partners Holdings, Inc./LifePoint Health, Inc.

9.75%, 12/01/2026(a) | | | | | 11,464 | | | | 11,775,095 | |

RP Escrow Issuer LLC

5.25%, 12/15/2025(a) | | | | | 2,030 | | | | 1,907,624 | |

Spectrum Brands, Inc.

3.875%, 03/15/2031(a) | | | | | 3,322 | | | | 2,795,510 | |

Tempur Sealy International, Inc.

3.875%, 10/15/2031(a) | | | | | 6,415 | | | | 5,325,785 | |

Tenet Healthcare Corp.

4.375%, 01/15/2030(a) | | | | | 6,811 | | | | 6,197,956 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 27 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Triton Water Holdings, Inc.

6.25%, 04/01/2029(a) | | | U.S.$ | | | | 3,458 | | | $ | 2,866,192 | |

US Acute Care Solutions LLC

6.375%, 03/01/2026(a) | | | | | | | 4,195 | | | | 4,084,533 | |

US Foods, Inc.

4.75%, 02/15/2029(a) | | | | | | | 10,363 | | | | 9,566,847 | |

US Renal Care, Inc.

10.625%, 07/15/2027(a) | | | | | | | 2,233 | | | | 1,941,711 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 224,130,175 | |

| | | | | | | | | | | | |

Energy – 6.5% | | | | | | | | | | | | |

Athabasca Oil Corp.

9.75%, 11/01/2026(a) | | | | | | | 5,996 | | | | 6,363,255 | |

Berry Petroleum Co. LLC

7.00%, 02/15/2026(a) | | | | | | | 2,415 | | | | 2,364,777 | |

Blue Racer Midstream LLC/Blue Racer Finance Corp.

7.625%, 12/15/2025(a) | | | | | | | 2,450 | | | | 2,523,509 | |

Callon Petroleum Co.

8.25%, 07/15/2025 | | | | | | | 253 | | | | 253,835 | |

Callon Petroleum, Co.

9.00%, 04/01/2025(a) | | | | | | | 1,542 | | | | 1,634,520 | |

Cheniere Energy Partners LP

4.50%, 10/01/2029 | | | | | | | 2,089 | | | | 2,000,802 | |

Citgo Holding, Inc.

9.25%, 08/01/2024(a) | | | | | | | 2,595 | | | | 2,578,411 | |

CITGO Petroleum Corp.

6.375%, 06/15/2026(a) | | | | | | | 2,387 | | | | 2,373,279 | |

7.00%, 06/15/2025(a) | | | | | | | 9,430 | | | | 9,370,754 | |

Civitas Resources, Inc.

5.00%, 10/15/2026(a) | | | | | | | 6,059 | | | | 5,774,636 | |

7.50%, 04/30/2026 | | | | | | | 264 | | | | 264,028 | |

CNX Resources Corp.

6.00%, 01/15/2029(a) | | | | | | | 2,061 | | | | 2,035,867 | |

7.25%, 03/14/2027(a) | | | | | | | 876 | | | | 895,020 | |

Comstock Resources, Inc.

6.75%, 03/01/2029(a) | | | | | | | 2,289 | | | | 2,313,345 | |

7.50%, 05/15/2025(a) | | | | | | | 991 | | | | 1,011,528 | |

CQP Holdco LP/BIP-V Chinook Holdco LLC

5.50%, 06/15/2031(a) | | | | | | | 1,684 | | | | 1,555,040 | |

Crescent Energy Finance LLC

7.25%, 05/01/2026(a) | | | | | | | 5,383 | | | | 5,302,189 | |

Diamond Foreign Asset Co./Diamond Finance LLC

9.00% (9.00% Cash or 13.00% PIK), 04/22/2027(a)(g) | | | | | | | 568 | | | | 555,390 | |

| | |

| |

28 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

9.00% (9.00% Cash or 13.00% PIK), 04/22/2027(g) | | U.S.$ | | | 494 | | | $ | 490,076 | |

Encino Acquisition Partners Holdings LLC

8.50%, 05/01/2028(a) | | | | | 8,923 | | | | 8,942,864 | |

EnLink Midstream LLC

5.625%, 01/15/2028(a) | | | | | 940 | | | | 931,562 | |

EnLink Midstream Partners LP

4.15%, 06/01/2025 | | | | | 8,682 | | | | 8,425,580 | |

4.40%, 04/01/2024 | | | | | 333 | | | | 328,611 | |

Series C

6.00%, 12/15/2022(l) | | | | | 12,323 | | | | 9,057,405 | |

EQM Midstream Partners LP

4.50%, 01/15/2029(a) | | | | | 3,683 | | | | 3,314,388 | |

4.75%, 01/15/2031(a) | | | | | 1,913 | | | | 1,709,896 | |

Genesis Energy LP/Genesis Energy Finance Corp.

6.25%, 05/15/2026 | | | | | 2,898 | | | | 2,717,470 | |

7.75%, 02/01/2028 | | | | | 8,431 | | | | 8,110,081 | |

8.00%, 01/15/2027 | | | | | 4,649 | | | | 4,567,498 | |

Global Partners LP/GLP Finance Corp.

6.875%, 01/15/2029 | | | | | 2,289 | | | | 2,216,794 | |

7.00%, 08/01/2027 | | | | | 2,652 | | | | 2,602,776 | |

Gulfport Energy Corp.

6.00%, 10/15/2024(d) | | | | | 2,508 | | | | 251 | |

6.375%, 05/15/2025-01/15/2026(d) | | | | | 18,821 | | | | 1,882 | |

6.625%, 05/01/2023(d) | | | | | 619 | | | | 62 | |

8.00%, 05/17/2026 | | | | | 286 | | | | 294,272 | |

8.00%, 05/17/2026(a) | | | | | 6,422 | | | | 6,616,422 | |

Harbour Energy PLC

5.50%, 10/15/2026(a) | | | | | 3,674 | | | | 3,557,413 | |

Hess Midstream Operations LP

4.25%, 02/15/2030(a) | | | | | 499 | | | | 456,834 | |

Hilcorp Energy I LP/Hilcorp Finance Co.

5.75%, 02/01/2029(a) | | | | | 1,910 | | | | 1,872,983 | |

6.00%, 02/01/2031(a) | | | | | 1,909 | | | | 1,843,215 | |

Ithaca Energy North Sea PLC

9.00%, 07/15/2026(a) | | | | | 8,277 | | | | 8,442,508 | |

ITT Holdings LLC

6.50%, 08/01/2029(a) | | | | | 12,224 | | | | 10,818,577 | |

Moss Creek Resources Holdings, Inc.

7.50%, 01/15/2026(a) | | | | | 9,387 | | | | 8,622,823 | |

Nabors Industries Ltd.

7.25%, 01/15/2026(a) | | | | | 2,551 | | | | 2,496,378 | |

7.50%, 01/15/2028(a) | | | | | 7,663 | | | | 7,373,327 | |

Nabors Industries, Inc.

7.375%, 05/15/2027(a) | | | | | 4,450 | | | | 4,545,413 | |

New Fortress Energy, Inc.

6.75%, 09/15/2025(a) | | | | | 8,081 | | | | 7,947,603 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 29 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

NGL Energy Operating LLC/NGL Energy Finance Corp.

7.50%, 02/01/2026(a) | | | U.S.$ | | | | 9,973 | | | $ | 9,399,482 | |

Occidental Petroleum Corp.

5.875%, 09/01/2025 | | | | | | | 1,346 | | | | 1,382,701 | |

6.125%, 01/01/2031 | | | | | | | 736 | | | | 774,677 | |

8.875%, 07/15/2030 | | | | | | | 558 | | | | 670,298 | |

PBF Holding Co. LLC/PBF Finance Corp.

9.25%, 05/15/2025(a) | | | | | | | 4,196 | | | | 4,348,206 | |

PDC Energy, Inc.

5.75%, 05/15/2026 | | | | | | | 8,038 | | | | 7,824,404 | |

6.125%, 09/15/2024 | | | | | | | 3,611 | | | | 3,620,671 | |

Southwestern Energy Co.

5.375%, 02/01/2029 | | | | | | | 1,844 | | | | 1,822,124 | |

8.375%, 09/15/2028 | | | | | | | 343 | | | | 371,282 | |

Summit Midstream Holdings LLC/Summit Midstream Finance Corp.

8.50%, 10/15/2026(a) | | | | | | | 4,596 | | | | 4,298,944 | |

Sunnova Energy Corp.

5.875%, 09/01/2026(a) | | | | | | | 3,054 | | | | 2,807,709 | |

Sunoco LP/Sunoco Finance Corp.

5.875%, 03/15/2028 | | | | | | | 1,917 | | | | 1,899,008 | |

Talos Production, Inc.

12.00%, 01/15/2026 | | | | | | | 7,783 | | | | 8,377,800 | |

Transocean Phoenix 2 Ltd.

7.75%, 10/15/2024(a) | | | | | | | 3,781 | | | | 3,806,765 | |

Transocean Pontus Ltd.

6.125%, 08/01/2025(a) | | | | | | | 985 | | | | 969,391 | |

Transocean Poseidon Ltd.

6.875%, 02/01/2027(a) | | | | | | | 1,798 | | | | 1,728,479 | |

Transocean, Inc.

7.25%, 11/01/2025(a) | | | | | | | 2,072 | | | | 1,719,648 | |

7.50%, 01/15/2026(a) | | | | | | | 4,613 | | | | 3,787,153 | |

11.50%, 01/30/2027(a) | | | | | | | 2,001 | | | | 1,992,446 | |

Vantage Drilling International

7.125%, 04/01/2023(c)(d)(f) | | | | | | | 8,325 | | | | – 0 | – |

7.50%, 11/01/2019(c)(d)(e)(f) | | | | | | | 8,860 | | | | – 0 | – |

W&T Offshore, Inc.

9.75%, 11/01/2023(a) | | | | | | | 5,273 | | | | 5,241,473 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 234,317,810 | |

| | | | | | | | | | | | |

Other Industrial – 0.0% | | | | | | | | | | | | |

Interface, Inc.

5.50%, 12/01/2028(a) | | | | | | | 1,364 | | | | 1,235,298 | |

| | | | | | | | | | | | |

| | | |

Services – 3.8% | | | | | | | | | | | | |

ADT Security Corp. (The)

4.125%, 08/01/2029(a) | | | | | | | 8,240 | | | | 7,008,924 | |

| | |

| |

30 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Allied Universal Holdco LLC/Allied Universal Finance Corp.

6.00%, 06/01/2029(a) | | U.S.$ | | | 1,397 | | | $ | 1,156,028 | |

6.625%, 07/15/2026(a) | | | | | 1,699 | | | | 1,642,099 | |

9.75%, 07/15/2027(a) | | | | | 7,999 | | | | 7,769,625 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 SARL

3.625%, 06/01/2028(a) | | EUR | | | 1,105 | | | | 1,008,348 | |

4.625%, 06/01/2028(a) | | U.S.$ | | | 2,325 | | | | 2,038,365 | |

4.875%, 06/01/2028(a) | | GBP | | | 3,580 | | | | 3,908,201 | |

ANGI Group LLC

3.875%, 08/15/2028(a) | | U.S.$ | | | 12,814 | | | | 10,176,481 | |

Aptim Corp.

7.75%, 06/15/2025(a) | | | | | 11,051 | | | | 8,668,810 | |

APX Group, Inc.

5.75%, 07/15/2029(a) | | | | | 9,301 | | | | 7,629,802 | |

6.75%, 02/15/2027(a) | | | | | 2,701 | | | | 2,676,558 | |

Block, Inc.

2.75%, 06/01/2026(a) | | | | | 7,220 | | | | 6,593,658 | |

3.50%, 06/01/2031(a) | | | | | 7,394 | | | | 6,190,197 | |

Cars.com, Inc.

6.375%, 11/01/2028(a) | | | | | 4,403 | | | | 4,132,385 | |

CWT Travel Group, Inc.

8.50%, 11/19/2026(a) | | | | | 4,184 | | | | 4,137,103 | |

Elis SA

1.625%, 04/03/2028(a) | | EUR | | | 900 | | | | 837,776 | |

Garda World Security Corp.

9.50%, 11/01/2027(a) | | U.S.$ | | | 495 | | | | 488,956 | |

ION Trading Technologies SARL

5.75%, 05/15/2028(a) | | | | | 5,678 | | | | 5,335,180 | |

Korn Ferry

4.625%, 12/15/2027(a) | | | | | 2,404 | | | | 2,277,790 | |

Millennium Escrow Corp.

6.625%, 08/01/2026(a) | | | | | 8,204 | | | | 7,604,423 | |

MoneyGram International, Inc.

5.375%, 08/01/2026(a) | | | | | 4,855 | | | | 4,950,853 | |

Monitronics International, Inc.

0.00%, 01/04/2020(c)(d)(e)(f) | | | | | 6,914 | | | | – 0 | – |

MPH Acquisition Holdings LLC

5.50%, 09/01/2028(a) | | | | | 4,164 | | | | 3,853,214 | |

5.75%, 11/01/2028(a)(b) | | | | | 17,454 | | | | 15,190,221 | |

Prime Security Services Borrower LLC/Prime Finance, Inc.

5.25%, 04/15/2024(a) | | | | | 135 | | | | 134,776 | |

6.25%, 01/15/2028(a) | | | | | 13,331 | | | | 11,964,770 | |

Sabre GLBL, Inc.

7.375%, 09/01/2025(a) | | | | | 1,580 | | | | 1,599,382 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 31 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

9.25%, 04/15/2025(a) | | | U.S.$ | | | | 673 | | | $ | 718,987 | |

Service Corp. International/US

3.375%, 08/15/2030 | | | | | | | 997 | | | | 861,875 | |

TripAdvisor, Inc.

7.00%, 07/15/2025(a) | | | | | | | 2,089 | | | | 2,144,642 | |

Verisure Midholding AB

5.25%, 02/15/2029(a) | | | EUR | | | | 4,130 | | | | 3,820,079 | |

WASH Multifamily Acquisition, Inc.

5.75%, 04/15/2026(a) | | | U.S.$ | | | | 1,265 | | | | 1,231,906 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 137,751,414 | |

| | | | | | | | | | | | |

Technology – 2.9% | | | | | | | | | | | | |

Ahead DB Holdings LLC

6.625%, 05/01/2028(a) | | | | | | | 3,518 | | | | 3,119,966 | |

Avaya, Inc.

6.125%, 09/15/2028(a) | | | | | | | 10,982 | | | | 10,151,743 | |

Cablevision Lightpath LLC

5.625%, 09/15/2028(a) | | | | | | | 4,374 | | | | 3,755,550 | |

Clarivate Science Holdings Corp.

4.875%, 07/01/2029(a) | | | | | | | 723 | | | | 638,708 | |

CommScope, Inc.

4.75%, 09/01/2029(a) | | | | | | | 7,430 | | | | 6,227,158 | |

Imola Merger Corp.

4.75%, 05/15/2029(a) | | | | | | | 4,868 | | | | 4,544,160 | |

Minerva Merger Sub, Inc.

6.50%, 02/15/2030(a) | | | | | | | 12,687 | | | | 11,671,490 | |

NCR Corp.

5.125%, 04/15/2029(a) | | | | | | | 12,758 | | | | 12,071,376 | |

5.75%, 09/01/2027(a) | | | | | | | 1,558 | | | | 1,505,048 | |

6.125%, 09/01/2029(a) | | | | | | | 1,207 | | | | 1,156,024 | |

Pitney Bowes, Inc.

6.875%, 03/15/2027(a) | | | | | | | 2,627 | | | | 2,427,605 | |

Playtech PLC

4.25%, 03/07/2026(a) | | | EUR | | | | 776 | | | | 812,354 | |

Playtika Holding Corp.