UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08188

AB HIGH INCOME FUND, INC.

(Exact name of registrant as specified in charter)

66 Hudson Boulevard East

New York, New York 10005

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

66 Hudson Boulevard East

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Please scan QR code for Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AGDAX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $98 | 0.90% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

Over the 12-month period, all share classes outperformed the Bloomberg Global Aggregate Bond Index (the "benchmark”). Security selection added the most to relative outperformance, mainly due to selections in US asset-backed securities, investment-grade corporate bonds, US agency mortgage-backed securities and US commercial mortgage-backed securities. Sector allocation also contributed, namely off-benchmark exposure to agency risk sharing securities and an underweight to US Treasuries, which offset losses from an underweight to US investment-grade corporates and off-benchmark positioning in US inflation-linked securities. Yield-curve positioning also contributed to results, mainly from an overweight to the six-month part of the US curve and an underweight to the 30-year part of the US curve, partially offset by losses from overweights to the two- and 20-year parts of the curve. Country allocation and currency decisions were minor detractors to performance.

During the 12-month period, the Fund used derivatives in the form of interest rate futures to manage and hedge duration risk and/or take active yield-curve positioning. Currency forwards were used to hedge foreign currency exposure and to take active currency risk. Credit default swaps were also utilized to effectively obtain high-yield credit/sector exposure. Total return swaps were used to create synthetic high-yield exposure in the Fund. Purchased options and written options were utilized as part of put spread for downside protection.

Top contributors to performance:

Top detractors from performance:

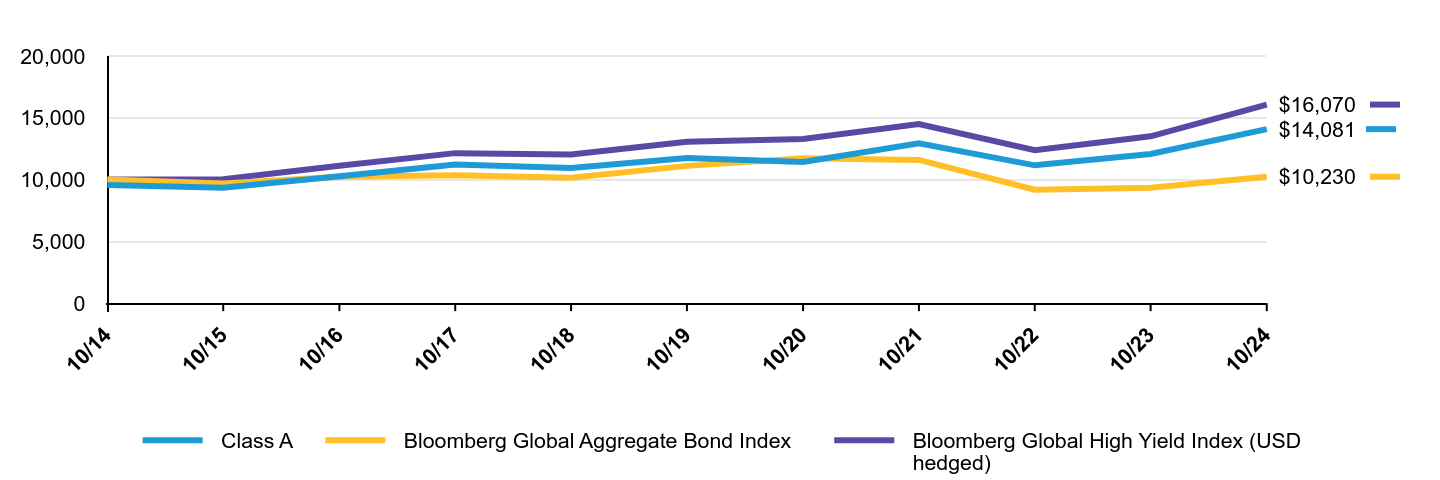

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund’s investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class A | Bloomberg Global Aggregate Bond Index | Bloomberg Global High Yield Index (USD hedged) |

|---|

| 10/14 | $9,572 | $10,000 | $10,000 |

| 10/15 | $9,336 | $9,693 | $10,026 |

| 10/16 | $10,267 | $10,234 | $11,122 |

| 10/17 | $11,222 | $10,355 | $12,141 |

| 10/18 | $10,940 | $10,143 | $12,026 |

| 10/19 | $11,741 | $11,110 | $13,052 |

| 10/20 | $11,425 | $11,736 | $13,282 |

| 10/21 | $12,944 | $11,590 | $14,487 |

| 10/22 | $11,154 | $9,181 | $12,381 |

| 10/23 | $12,070 | $9,339 | $13,503 |

| 10/24 | $14,081 | $10,230 | $16,070 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charges) | 16.67% | 3.70% | 3.94% |

| Class A (with sales charges) | 11.65% | 2.81% | 3.48% |

| Bloomberg Global Aggregate Bond Index | 9.54% | -1.64% | 0.23% |

| Bloomberg Global High Yield Index (USD hedged) | 19.02% | 4.25% | 4.86% |

| The addition of the Bloomberg Global Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as a regulatorily required. |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AGDAX-A for the most recent performance information.

| Net Assets | $3,214,629,464 |

| # of Portfolio Holdings | 1,018 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $15,311,275 |

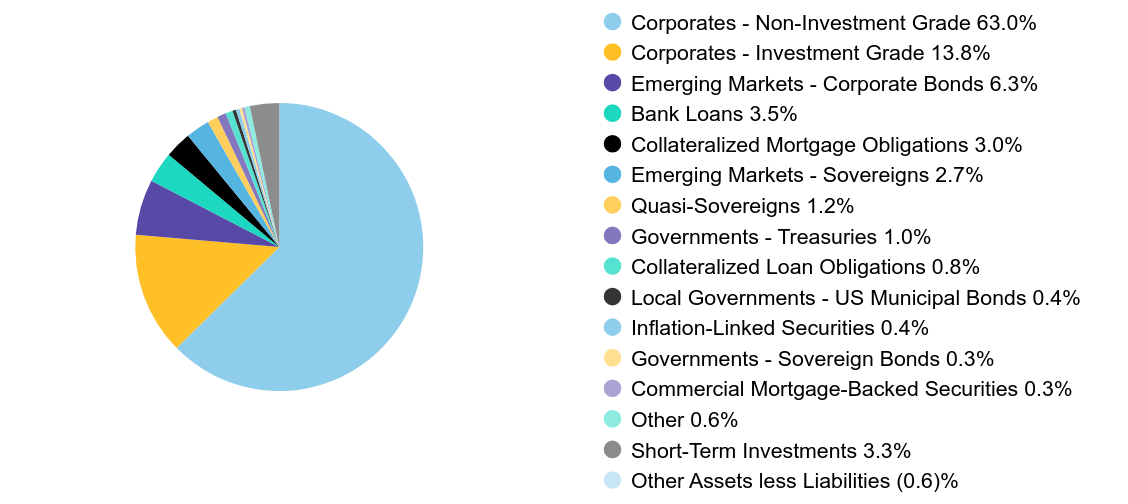

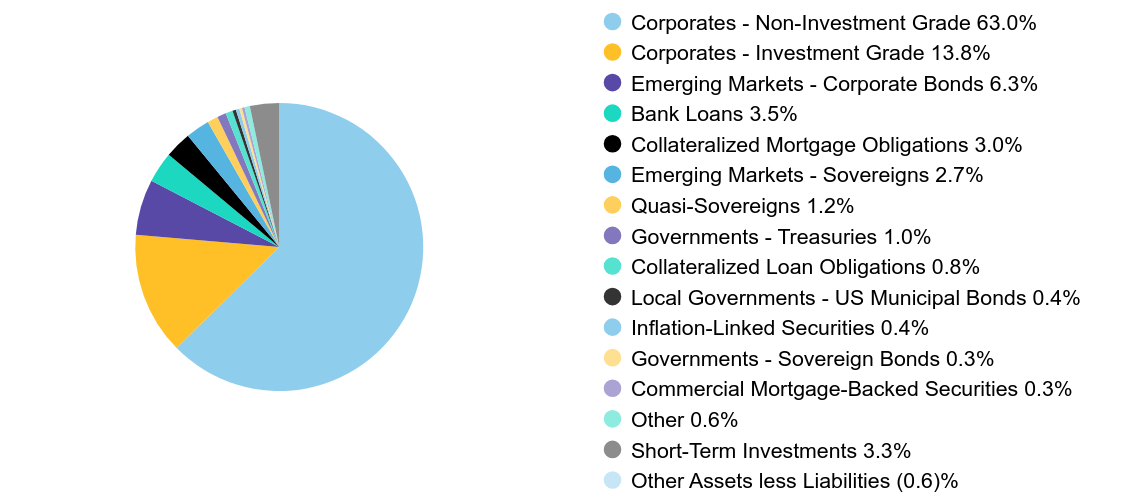

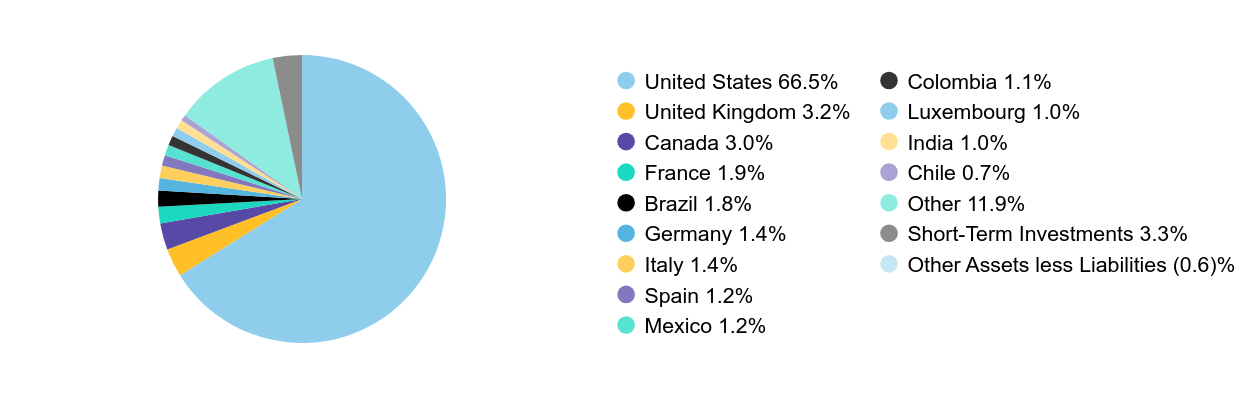

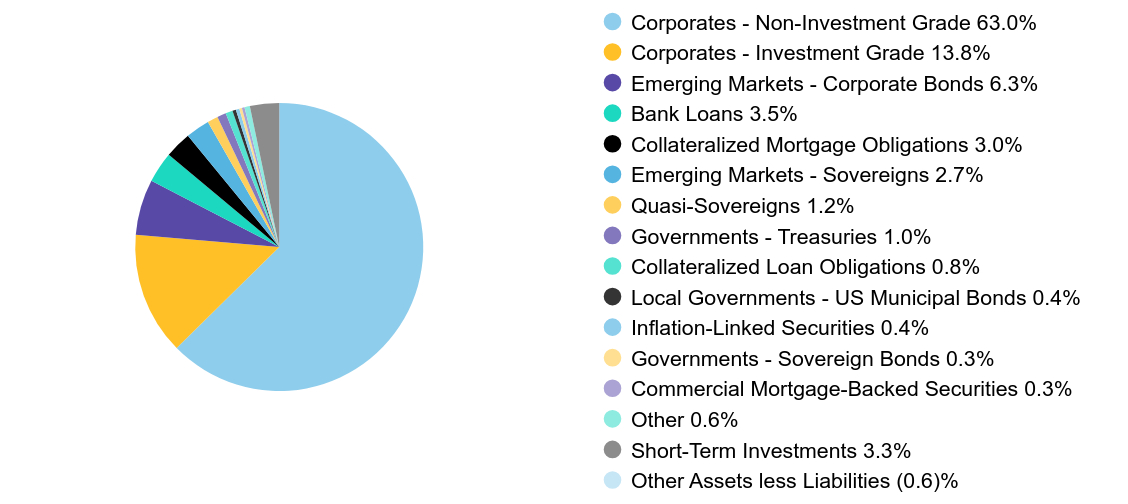

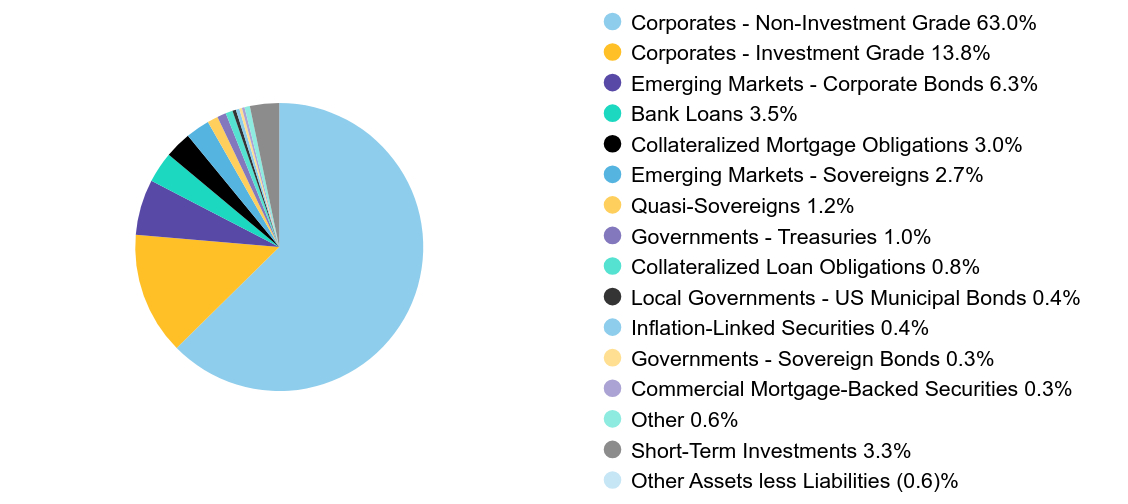

Graphical Representation of Holdings

| Value | Value |

|---|

| Corporates - Non-Investment Grade | 63.0% |

| Corporates - Investment Grade | 13.8% |

| Emerging Markets - Corporate Bonds | 6.3% |

| Bank Loans | 3.5% |

| Collateralized Mortgage Obligations | 3.0% |

| Emerging Markets - Sovereigns | 2.7% |

| Quasi-Sovereigns | 1.2% |

| Governments - Treasuries | 1.0% |

| Collateralized Loan Obligations | 0.8% |

| Local Governments - US Municipal Bonds | 0.4% |

| Inflation-Linked Securities | 0.4% |

| Governments - Sovereign Bonds | 0.3% |

| Commercial Mortgage-Backed Securities | 0.3% |

| Other | 0.6% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

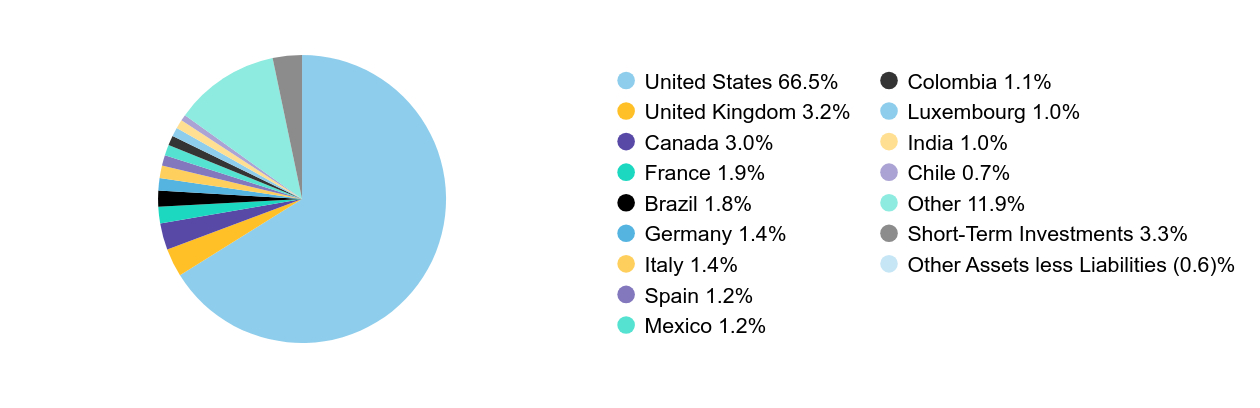

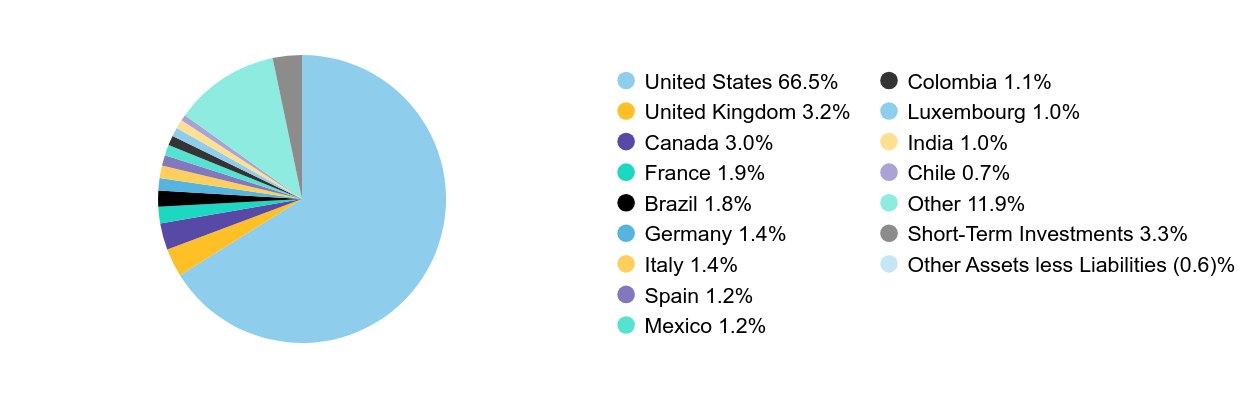

| Value | Value |

|---|

| United States | 66.5% |

| United Kingdom | 3.2% |

| Canada | 3.0% |

| France | 1.9% |

| Brazil | 1.8% |

| Germany | 1.4% |

| Italy | 1.4% |

| Spain | 1.2% |

| Mexico | 1.2% |

| Colombia | 1.1% |

| Luxembourg | 1.0% |

| India | 1.0% |

| Chile | 0.7% |

| Other | 11.9% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AGDAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AGDAX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AGDYX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $71 | 0.65% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

Over the 12-month period, all share classes outperformed the Bloomberg Global Aggregate Bond Index (the "benchmark”). Security selection added the most to relative outperformance, mainly due to selections in US asset-backed securities, investment-grade corporate bonds, US agency mortgage-backed securities and US commercial mortgage-backed securities. Sector allocation also contributed, namely off-benchmark exposure to agency risk sharing securities and an underweight to US Treasuries, which offset losses from an underweight to US investment-grade corporates and off-benchmark positioning in US inflation-linked securities. Yield-curve positioning also contributed to results, mainly from an overweight to the six-month part of the US curve and an underweight to the 30-year part of the US curve, partially offset by losses from overweights to the two- and 20-year parts of the curve. Country allocation and currency decisions were minor detractors to performance.

During the 12-month period, the Fund used derivatives in the form of interest rate futures to manage and hedge duration risk and/or take active yield-curve positioning. Currency forwards were used to hedge foreign currency exposure and to take active currency risk. Credit default swaps were also utilized to effectively obtain high-yield credit/sector exposure. Total return swaps were used to create synthetic high-yield exposure in the Fund. Purchased options and written options were utilized as part of put spread for downside protection.

Top contributors to performance:

Top detractors from performance:

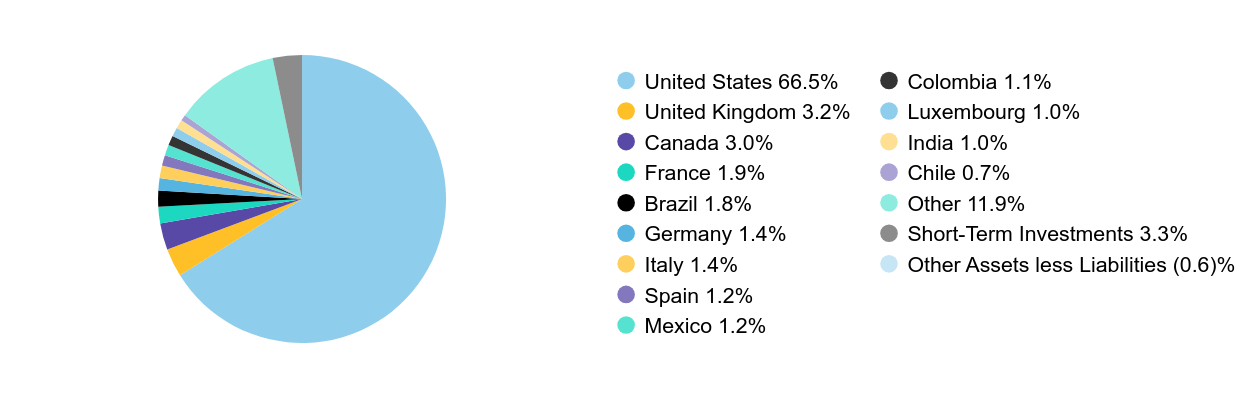

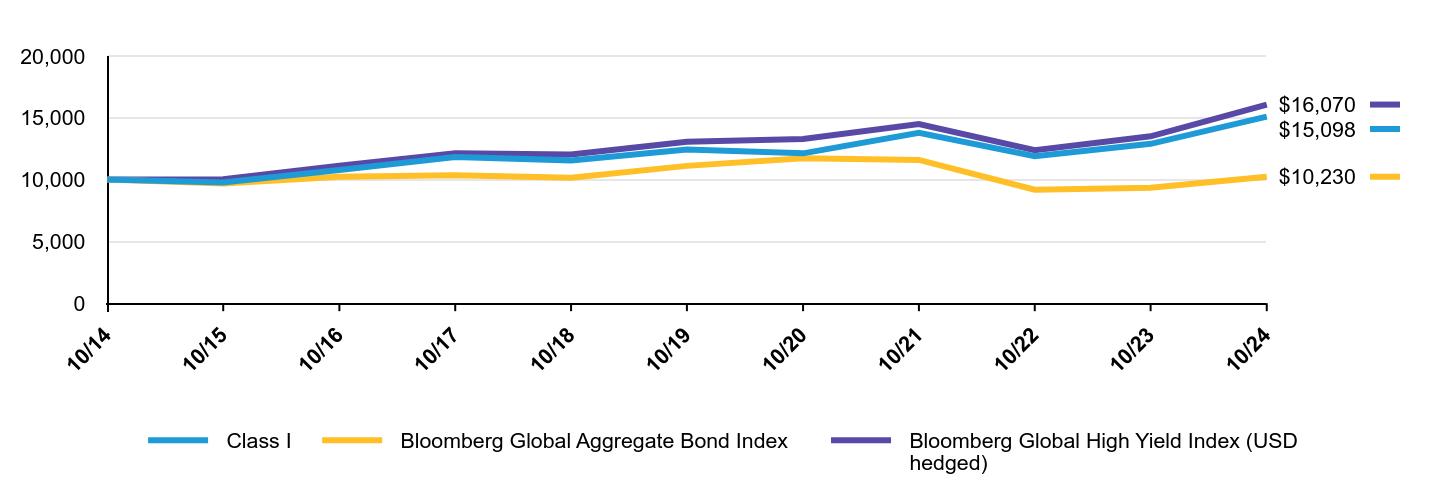

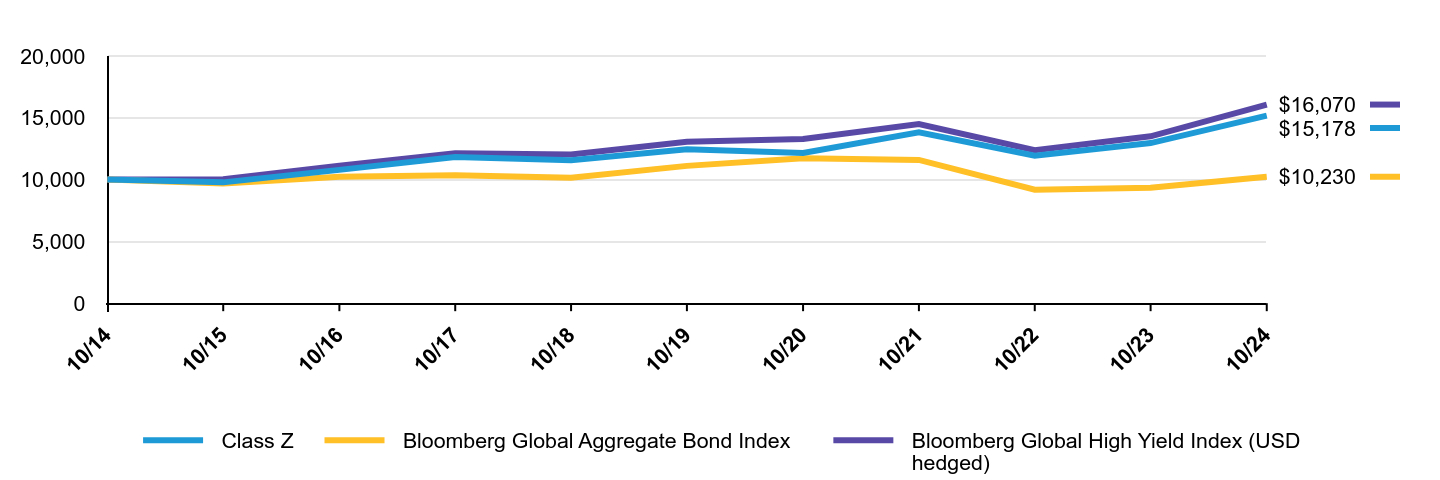

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund’s investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Advisor Class | Bloomberg Global Aggregate Bond Index | Bloomberg Global High Yield Index (USD hedged) |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,770 | $9,693 | $10,026 |

| 10/16 | $10,773 | $10,234 | $11,122 |

| 10/17 | $11,803 | $10,355 | $12,141 |

| 10/18 | $11,536 | $10,143 | $12,026 |

| 10/19 | $12,410 | $11,110 | $13,052 |

| 10/20 | $12,105 | $11,736 | $13,282 |

| 10/21 | $13,767 | $11,590 | $14,487 |

| 10/22 | $11,881 | $9,181 | $12,381 |

| 10/23 | $12,886 | $9,339 | $13,503 |

| 10/24 | $15,068 | $10,230 | $16,070 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class | 16.94% | 3.96% | 4.18% |

| Bloomberg Global Aggregate Bond Index | 9.54% | -1.64% | 0.23% |

| Bloomberg Global High Yield Index (USD hedged) | 19.02% | 4.25% | 4.86% |

| The addition of the Bloomberg Global Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as a regulatorily required. |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AGDYX-A for the most recent performance information.

| Net Assets | $3,214,629,464 |

| # of Portfolio Holdings | 1,018 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $15,311,275 |

Graphical Representation of Holdings

| Value | Value |

|---|

| Corporates - Non-Investment Grade | 63.0% |

| Corporates - Investment Grade | 13.8% |

| Emerging Markets - Corporate Bonds | 6.3% |

| Bank Loans | 3.5% |

| Collateralized Mortgage Obligations | 3.0% |

| Emerging Markets - Sovereigns | 2.7% |

| Quasi-Sovereigns | 1.2% |

| Governments - Treasuries | 1.0% |

| Collateralized Loan Obligations | 0.8% |

| Local Governments - US Municipal Bonds | 0.4% |

| Inflation-Linked Securities | 0.4% |

| Governments - Sovereign Bonds | 0.3% |

| Commercial Mortgage-Backed Securities | 0.3% |

| Other | 0.6% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

| Value | Value |

|---|

| United States | 66.5% |

| United Kingdom | 3.2% |

| Canada | 3.0% |

| France | 1.9% |

| Brazil | 1.8% |

| Germany | 1.4% |

| Italy | 1.4% |

| Spain | 1.2% |

| Mexico | 1.2% |

| Colombia | 1.1% |

| Luxembourg | 1.0% |

| India | 1.0% |

| Chile | 0.7% |

| Other | 11.9% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AGDYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AGDYX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AGDCX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $177 | 1.64% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

Over the 12-month period, all share classes outperformed the Bloomberg Global Aggregate Bond Index (the "benchmark”). Security selection added the most to relative outperformance, mainly due to selections in US asset-backed securities, investment-grade corporate bonds, US agency mortgage-backed securities and US commercial mortgage-backed securities. Sector allocation also contributed, namely off-benchmark exposure to agency risk sharing securities and an underweight to US Treasuries, which offset losses from an underweight to US investment-grade corporates and off-benchmark positioning in US inflation-linked securities. Yield-curve positioning also contributed to results, mainly from an overweight to the six-month part of the US curve and an underweight to the 30-year part of the US curve, partially offset by losses from overweights to the two- and 20-year parts of the curve. Country allocation and currency decisions were minor detractors to performance.

During the 12-month period, the Fund used derivatives in the form of interest rate futures to manage and hedge duration risk and/or take active yield-curve positioning. Currency forwards were used to hedge foreign currency exposure and to take active currency risk. Credit default swaps were also utilized to effectively obtain high-yield credit/sector exposure. Total return swaps were used to create synthetic high-yield exposure in the Fund. Purchased options and written options were utilized as part of put spread for downside protection.

Top contributors to performance:

Top detractors from performance:

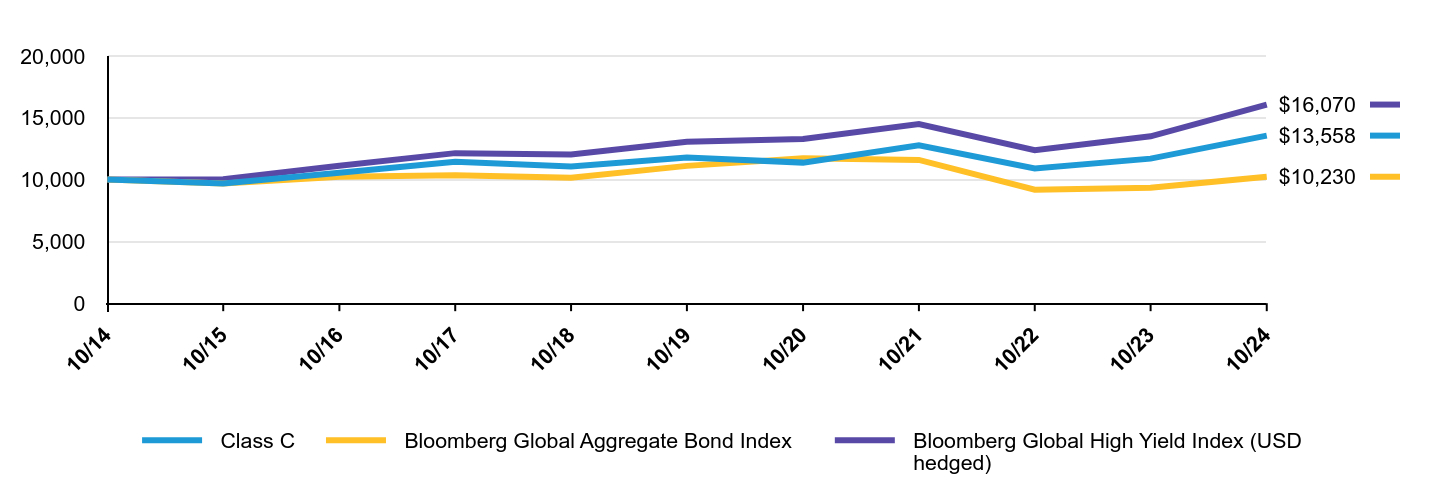

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund’s investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class C | Bloomberg Global Aggregate Bond Index | Bloomberg Global High Yield Index (USD hedged) |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,683 | $9,693 | $10,026 |

| 10/16 | $10,552 | $10,234 | $11,122 |

| 10/17 | $11,436 | $10,355 | $12,141 |

| 10/18 | $11,069 | $10,143 | $12,026 |

| 10/19 | $11,780 | $11,110 | $13,052 |

| 10/20 | $11,373 | $11,736 | $13,282 |

| 10/21 | $12,777 | $11,590 | $14,487 |

| 10/22 | $10,900 | $9,181 | $12,381 |

| 10/23 | $11,695 | $9,339 | $13,503 |

| 10/24 | $13,558 | $10,230 | $16,070 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charges) | 15.93% | 2.85% | 3.09% |

| Class C (with sales charges) | 14.93% | 2.85% | 3.09% |

| Bloomberg Global Aggregate Bond Index | 9.54% | -1.64% | 0.23% |

| Bloomberg Global High Yield Index (USD hedged) | 19.02% | 4.25% | 4.86% |

| The addition of the Bloomberg Global Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as a regulatorily required. |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AGDCX-A for the most recent performance information.

| Net Assets | $3,214,629,464 |

| # of Portfolio Holdings | 1,018 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $15,311,275 |

Graphical Representation of Holdings

| Value | Value |

|---|

| Corporates - Non-Investment Grade | 63.0% |

| Corporates - Investment Grade | 13.8% |

| Emerging Markets - Corporate Bonds | 6.3% |

| Bank Loans | 3.5% |

| Collateralized Mortgage Obligations | 3.0% |

| Emerging Markets - Sovereigns | 2.7% |

| Quasi-Sovereigns | 1.2% |

| Governments - Treasuries | 1.0% |

| Collateralized Loan Obligations | 0.8% |

| Local Governments - US Municipal Bonds | 0.4% |

| Inflation-Linked Securities | 0.4% |

| Governments - Sovereign Bonds | 0.3% |

| Commercial Mortgage-Backed Securities | 0.3% |

| Other | 0.6% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

| Value | Value |

|---|

| United States | 66.5% |

| United Kingdom | 3.2% |

| Canada | 3.0% |

| France | 1.9% |

| Brazil | 1.8% |

| Germany | 1.4% |

| Italy | 1.4% |

| Spain | 1.2% |

| Mexico | 1.2% |

| Colombia | 1.1% |

| Luxembourg | 1.0% |

| India | 1.0% |

| Chile | 0.7% |

| Other | 11.9% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AGDCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AGDCX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AGDIX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $71 | 0.65% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

Over the 12-month period, all share classes outperformed the Bloomberg Global Aggregate Bond Index (the "benchmark”). Security selection added the most to relative outperformance, mainly due to selections in US asset-backed securities, investment-grade corporate bonds, US agency mortgage-backed securities and US commercial mortgage-backed securities. Sector allocation also contributed, namely off-benchmark exposure to agency risk sharing securities and an underweight to US Treasuries, which offset losses from an underweight to US investment-grade corporates and off-benchmark positioning in US inflation-linked securities. Yield-curve positioning also contributed to results, mainly from an overweight to the six-month part of the US curve and an underweight to the 30-year part of the US curve, partially offset by losses from overweights to the two- and 20-year parts of the curve. Country allocation and currency decisions were minor detractors to performance.

During the 12-month period, the Fund used derivatives in the form of interest rate futures to manage and hedge duration risk and/or take active yield-curve positioning. Currency forwards were used to hedge foreign currency exposure and to take active currency risk. Credit default swaps were also utilized to effectively obtain high-yield credit/sector exposure. Total return swaps were used to create synthetic high-yield exposure in the Fund. Purchased options and written options were utilized as part of put spread for downside protection.

Top contributors to performance:

Top detractors from performance:

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund’s investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class I | Bloomberg Global Aggregate Bond Index | Bloomberg Global High Yield Index (USD hedged) |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,774 | $9,693 | $10,026 |

| 10/16 | $10,783 | $10,234 | $11,122 |

| 10/17 | $11,819 | $10,355 | $12,141 |

| 10/18 | $11,555 | $10,143 | $12,026 |

| 10/19 | $12,434 | $11,110 | $13,052 |

| 10/20 | $12,123 | $11,736 | $13,282 |

| 10/21 | $13,785 | $11,590 | $14,487 |

| 10/22 | $11,894 | $9,181 | $12,381 |

| 10/23 | $12,895 | $9,339 | $13,503 |

| 10/24 | $15,098 | $10,230 | $16,070 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 17.08% | 3.96% | 4.21% |

| Bloomberg Global Aggregate Bond Index | 9.54% | -1.64% | 0.23% |

| Bloomberg Global High Yield Index (USD hedged) | 19.02% | 4.25% | 4.86% |

| The addition of the Bloomberg Global Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as a regulatorily required. |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AGDIX-A for the most recent performance information.

| Net Assets | $3,214,629,464 |

| # of Portfolio Holdings | 1,018 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $15,311,275 |

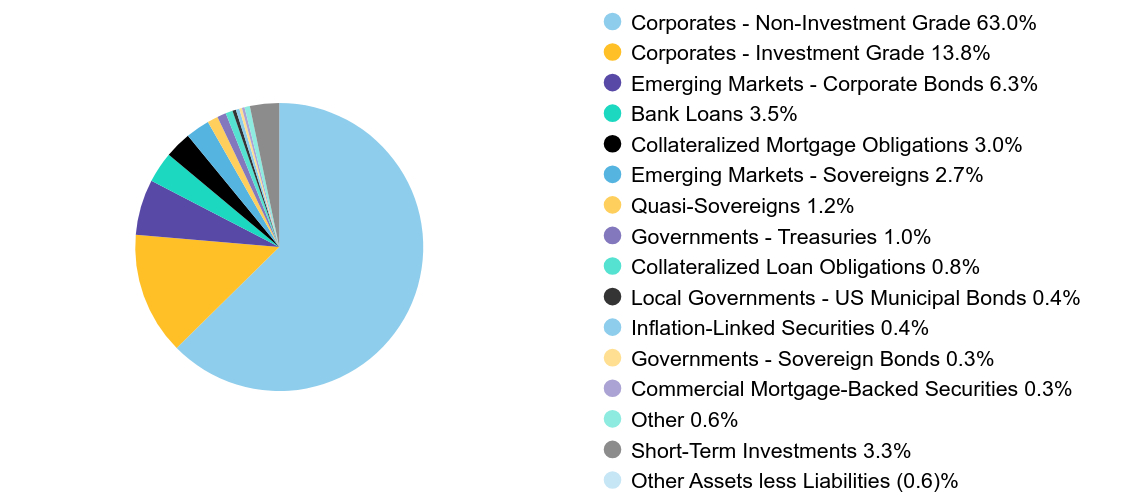

Graphical Representation of Holdings

| Value | Value |

|---|

| Corporates - Non-Investment Grade | 63.0% |

| Corporates - Investment Grade | 13.8% |

| Emerging Markets - Corporate Bonds | 6.3% |

| Bank Loans | 3.5% |

| Collateralized Mortgage Obligations | 3.0% |

| Emerging Markets - Sovereigns | 2.7% |

| Quasi-Sovereigns | 1.2% |

| Governments - Treasuries | 1.0% |

| Collateralized Loan Obligations | 0.8% |

| Local Governments - US Municipal Bonds | 0.4% |

| Inflation-Linked Securities | 0.4% |

| Governments - Sovereign Bonds | 0.3% |

| Commercial Mortgage-Backed Securities | 0.3% |

| Other | 0.6% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

| Value | Value |

|---|

| United States | 66.5% |

| United Kingdom | 3.2% |

| Canada | 3.0% |

| France | 1.9% |

| Brazil | 1.8% |

| Germany | 1.4% |

| Italy | 1.4% |

| Spain | 1.2% |

| Mexico | 1.2% |

| Colombia | 1.1% |

| Luxembourg | 1.0% |

| India | 1.0% |

| Chile | 0.7% |

| Other | 11.9% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AGDIX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AGDIX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

Annual Shareholder Report

This annual shareholder report contains important information about the AB High Income Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AGDZX-A. You can also request this information by contacting us at (800) 227 4618.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $64 | 0.59% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

Over the 12-month period, all share classes outperformed the Bloomberg Global Aggregate Bond Index (the "benchmark”). Security selection added the most to relative outperformance, mainly due to selections in US asset-backed securities, investment-grade corporate bonds, US agency mortgage-backed securities and US commercial mortgage-backed securities. Sector allocation also contributed, namely off-benchmark exposure to agency risk sharing securities and an underweight to US Treasuries, which offset losses from an underweight to US investment-grade corporates and off-benchmark positioning in US inflation-linked securities. Yield-curve positioning also contributed to results, mainly from an overweight to the six-month part of the US curve and an underweight to the 30-year part of the US curve, partially offset by losses from overweights to the two- and 20-year parts of the curve. Country allocation and currency decisions were minor detractors to performance.

During the 12-month period, the Fund used derivatives in the form of interest rate futures to manage and hedge duration risk and/or take active yield-curve positioning. Currency forwards were used to hedge foreign currency exposure and to take active currency risk. Credit default swaps were also utilized to effectively obtain high-yield credit/sector exposure. Total return swaps were used to create synthetic high-yield exposure in the Fund. Purchased options and written options were utilized as part of put spread for downside protection.

Top contributors to performance:

Top detractors from performance:

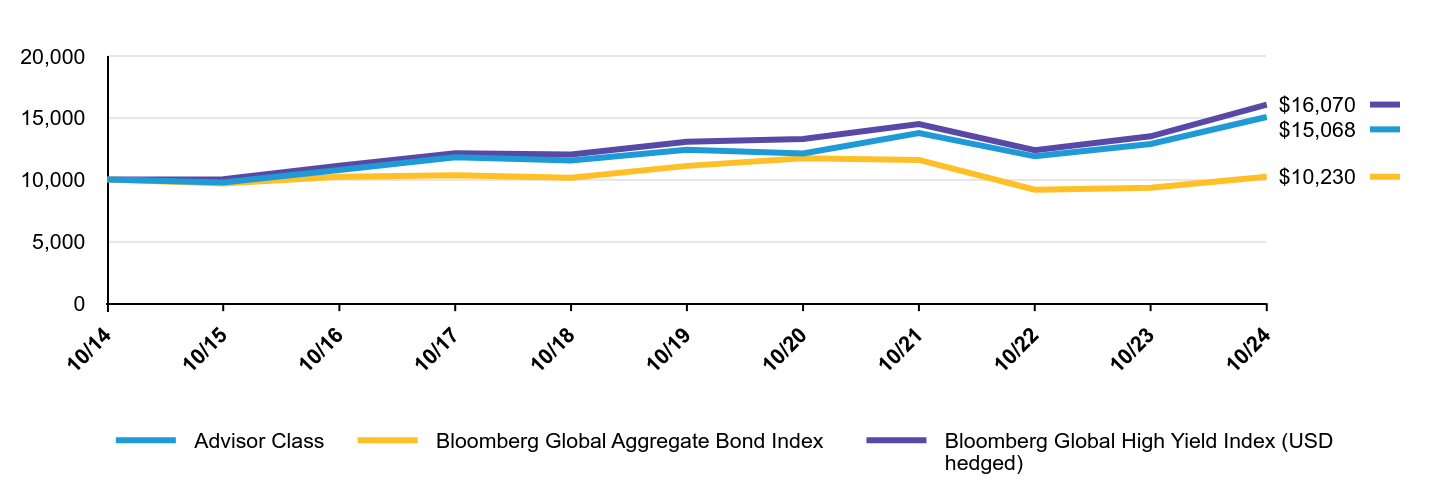

The following graph shows the performance of hypothetical $10,000 investments in the Fund, a broad-based securities market index and an additional index that corresponds to the Fund’s investment strategies, over the most recently completed 10 fiscal years of the Fund, or since inception, if shorter. The Fund's performance reflects applicable sales charges and assumes the reinvestment of dividends.

| Class Z | Bloomberg Global Aggregate Bond Index | Bloomberg Global High Yield Index (USD hedged) |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,775 | $9,693 | $10,026 |

| 10/16 | $10,787 | $10,234 | $11,122 |

| 10/17 | $11,825 | $10,355 | $12,141 |

| 10/18 | $11,566 | $10,143 | $12,026 |

| 10/19 | $12,455 | $11,110 | $13,052 |

| 10/20 | $12,149 | $11,736 | $13,282 |

| 10/21 | $13,824 | $11,590 | $14,487 |

| 10/22 | $11,939 | $9,181 | $12,381 |

| 10/23 | $12,954 | $9,339 | $13,503 |

| 10/24 | $15,178 | $10,230 | $16,070 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Class Z | 17.16% | 4.03% | 4.26% |

| Bloomberg Global Aggregate Bond Index | 9.54% | -1.64% | 0.23% |

| Bloomberg Global High Yield Index (USD hedged) | 19.02% | 4.25% | 4.86% |

| The addition of the Bloomberg Global Aggregate Bond Index broad-based benchmark provides a comparison of the Fund's performance against the broader market as a regulatorily required. |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

Visit https://www.abfunds.com/link/AB/AGDZX-A for the most recent performance information.

| Net Assets | $3,214,629,464 |

| # of Portfolio Holdings | 1,018 |

| Portfolio Turnover Rate | 50% |

| Total Advisory Fees Paid | $15,311,275 |

Graphical Representation of Holdings

| Value | Value |

|---|

| Corporates - Non-Investment Grade | 63.0% |

| Corporates - Investment Grade | 13.8% |

| Emerging Markets - Corporate Bonds | 6.3% |

| Bank Loans | 3.5% |

| Collateralized Mortgage Obligations | 3.0% |

| Emerging Markets - Sovereigns | 2.7% |

| Quasi-Sovereigns | 1.2% |

| Governments - Treasuries | 1.0% |

| Collateralized Loan Obligations | 0.8% |

| Local Governments - US Municipal Bonds | 0.4% |

| Inflation-Linked Securities | 0.4% |

| Governments - Sovereign Bonds | 0.3% |

| Commercial Mortgage-Backed Securities | 0.3% |

| Other | 0.6% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

| Value | Value |

|---|

| United States | 66.5% |

| United Kingdom | 3.2% |

| Canada | 3.0% |

| France | 1.9% |

| Brazil | 1.8% |

| Germany | 1.4% |

| Italy | 1.4% |

| Spain | 1.2% |

| Mexico | 1.2% |

| Colombia | 1.1% |

| Luxembourg | 1.0% |

| India | 1.0% |

| Chile | 0.7% |

| Other | 11.9% |

| Short-Term Investments | 3.3% |

| Other Assets less Liabilities | (0.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AGDZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618.

Information Regarding the Review and Approval of the Fund’s Advisory Agreement

Information regarding the Fund’s Board of Directors’/Trustees’ review of the advisory agreement is available on the Fund’s website https://www.abfunds.com/link/AB/AGDZX-A. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

ITEM 2. CODE OF ETHICS.

(a) The registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer and principal accounting officer. A copy of the registrant’s code of ethics is filed herewith as Exhibit 19(a)(1).

(b) During the period covered by this report, no material amendments were made to the provisions of the code of ethics adopted in 2(a) above.

(c) During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s Board of Directors has determined that independent directors Garry L. Moody, Marshall C. Turner, Jr., Jorge A. Bermudez and Carol C. McMullen qualify as audit committee financial experts.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a)—(c) The following table sets forth the aggregate fees billed* by the independent registered public accounting firm Ernst & Young LLP, for the Fund’s last two fiscal years, for professional services rendered for: (i) the audit of the Fund’s annual financial statements included in the Fund’s annual report to stockholders; (ii) assurance and related services that are reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under (i), which include advice and education related to accounting and auditing issues, quarterly press release review (for those Funds that issue quarterly press releases), and preferred stock maintenance testing (for those Funds that issue preferred stock); and (iii) tax compliance, tax advice and tax return preparation.

| | | | | | | | | | | | | | | | |

| | | | | | Audit Fees | | | Audit-Related

Fees | | | Tax Fees | |

AB High Income | | | 2023 | | | $ | 169,203 | | | $ | - | | | $ | 37,079 | |

| | | 2024 | | | $ | 169,203 | | | $ | - | | | $ | 34,553 | |

(d) Not applicable.

(e) (1) Beginning with audit and non-audit service contracts entered into on or after May 6, 2003, the Fund’s Audit Committee policies and procedures require the pre-approval of all audit and non-audit services provided to the Fund by the Fund’s independent registered public accounting firm. The Fund’s Audit Committee policies and procedures also require pre-approval of all audit and non-audit services provided to the Adviser and Service Affiliates to the extent that these services are directly related to the operations or financial reporting of the Fund.

(e) (2) No percentage of services addressed by (b) and (c) of this Item 4 were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. No amounts are reported for Item 4 (d).

(f) Not applicable.

(g) The following table sets forth the aggregate non-audit services provided to the Fund, the Fund’s Adviser and entities that control, are controlled by or under common control with the Adviser that provide ongoing services to the Fund: (“Service Affiliates”):

| | | | | | | | | | | | |

| | | | | | All Fees for

Non-Audit Services

Provided to the

Portfolio, the Adviser

and Service Affiliates | | | Total Amount of

Foregoing Column Pre-

approved by the Audit

Committee

(Portion Comprised of

Audit Related Fees)

(Portion Comprised of

Tax Fees) | |

| | | | | | | | | | | | |

AB High Income | | | 2023 | | | $ | 1,798,109 | | | $ | 37,079 | |

| | | | | | | | | | $ | - | |

| | | | | | | | | | $ | (37,079 | ) |

| | | 2024 | | | $ | 2,058,859 | | | $ | 34,553 | |

| | | | | | | | | | $ | - | |

| | | | | | | | | | $ | (34,553 | ) |

(h) The Audit Committee of the Fund has considered whether the provision of any non-audit services not pre-approved by the Audit Committee provided by the Fund’s independent registered public accounting firm to the Adviser and Service Affiliates is compatible with maintaining the auditor’s independence.

(i) Not applicable.

(j) Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to the registrant.

ITEM 6. INVESTMENTS.

Please see Schedule of Investments contained in the Report to Shareholders included under Item 7 of this Form N-CSR.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

OCT 10.31.24

ANNUAL FINANCIAL STATEMENTS AND ADDITIONAL INFORMATION

AB HIGH INCOME FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

PORTFOLIO OF INVESTMENTS

October 31, 2024

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CORPORATES - NON-INVESTMENT GRADE – 63.0% | | | | | | | | | | | | |

Industrial – 55.4% | | | | | | | | | | | | |

Basic – 4.4% | | | | | | | | | | | | |

Alcoa Nederland Holding BV

7.125%, 03/15/2031(a) | | | U.S.$ | | | | 3,049 | | | $ | 3,180,914 | |

Arsenal AIC Parent LLC

8.00%, 10/01/2030(a) | | | | | | | 2,679 | | | | 2,818,564 | |

ASP Unifrax Holdings, Inc.

7.10% (7.10% Cash or 5.85% Cash and 1.25% PIK), 09/30/2029(a)(b) | | | | | | | 7,888 | | | | 4,679,870 | |

10.425% (10.425% Cash and 11.175% PIK), 09/30/2029(a)(b) | | | | | | | 11,494 | | | | 11,517,199 | |

Cleveland-Cliffs, Inc.

7.00%, 03/15/2032(a) | | | | | | | 10,852 | | | | 10,864,498 | |

Constellium SE

3.125%, 07/15/2029(a) | | | EUR | | | | 4,303 | | | | 4,381,113 | |

3.75%, 04/15/2029(a) | | | U.S.$ | | | | 1,336 | | | | 1,208,999 | |

CVR Partners LP/CVR Nitrogen Finance Corp.

6.125%, 06/15/2028(a) | | | | | | | 3,051 | | | | 2,918,462 | |

Element Solutions, Inc.

3.875%, 09/01/2028(a) | | | | | | | 8,518 | | | | 8,204,574 | |

ERP Iron Ore LLC

9.04%, 12/31/2019(b)(c)(d)(e)(f) | | | | | | | 1,355 | | | | – 0 | – |

FMG Resources August 2006 Pty Ltd.

4.375%, 04/01/2031(a) | | | | | | | 12,398 | | | | 11,279,922 | |

4.50%, 09/15/2027(a) | | | | | | | 1,475 | | | | 1,437,243 | |

5.875%, 04/15/2030(a) | | | | | | | 308 | | | | 306,503 | |

6.125%, 04/15/2032(a) | | | | | | | 8,694 | | | | 8,719,432 | |

Graphic Packaging International LLC

3.50%, 03/15/2028(a) | | | | | | | 4,133 | | | | 3,862,198 | |

6.375%, 07/15/2032(a) | | | | | | | 5,973 | | | | 6,030,628 | |

INEOS Finance PLC

6.375%, 04/15/2029(a)

| | | EUR | | | | 4,341 | | | | 4,883,194 | |

7.50%, 04/15/2029(a) | | | U.S.$ | | | | 3,563 | | | | 3,683,113 | |

INEOS Quattro Finance 2 PLC

8.50%, 03/15/2029 (a) | | | EUR | | | | 6,160 | | | | 7,112,993 | |

9.625%, 03/15/2029(a) | | | U.S.$ | | | | 600 | | | | 636,060 | |

INEOS Styrolution Ludwigshafen GmbH

2.25%, 01/16/2027(a) | | | EUR | | | | 111 | | | | 117,099 | |

Ingevity Corp.

3.875%, 11/01/2028(a) | | | U.S.$ | | | | 3,288 | | | | 3,029,905 | |

Intelligent Packaging Ltd. Finco, Inc./Intelligent Packaging Ltd. Co-Issuer LLC

6.00%, 09/15/2028(a) | | | | | | | 7,119 | | | | 7,021,707 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 1 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Magnetation LLC/Mag Finance Corp.

11.00%, 05/15/2023(c)(d)(e)(f)(g) | | | U.S.$ | | | | 16,121 | | | $ | – 0 | – |

Olympus Water US Holding Corp.

9.75%, 11/15/2028(a) | | | | | | | 6,092 | | | | 6,465,200 | |

Pactiv Evergreen Group Issuer, Inc./Pactiv Evergreen Group Issuer LLC

4.00%, 10/15/2027(a) | | | | | | | 2,090 | | | | 1,996,797 | |

Reno de Medici SpA

8.48% (EURIBOR 3 Month + 5.00%),

04/15/2029(a)(h) | | | EUR | | | | 2,400 | | | | 2,373,874 | |

SCIL IV LLC/SCIL USA Holdings LLC

4.375%, 11/01/2026(a) | | | | | | | 554 | | | | 599,600 | |

5.375%, 11/01/2026(a) | | | U.S.$ | | | | 7,442 | | | | 7,356,182 | |

SNF Group SACA

3.125%, 03/15/2027(a) | | | | | | | 1,487 | | | | 1,413,904 | |

Vallourec SACA

7.50%, 04/15/2032(a) | | | | | | | 2,315 | | | | 2,426,499 | |

Vibrantz Technologies, Inc.

9.00%, 02/15/2030(a) | | | | | | | 5,197 | | | | 4,868,327 | |

WR Grace Holdings LLC

4.875%, 06/15/2027(a) | | | | | | | 4,674 | | | | 4,584,115 | |

5.625%, 08/15/2029(a) | | | | | | | 1,965 | | | | 1,814,401 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 141,793,089 | |

| | | | | | | | | | | | |

Capital Goods – 5.0% | | | | | | | | | | | | |

Arcosa, Inc.

6.875%, 08/15/2032(a) | | | | | | | 4,465 | | | | 4,579,917 | |

ARD Finance SA

5.00% (5.00% Cash or 5.75% PIK),

06/30/2027(a)(b) | | | EUR | | | | 5,856 | | | | 1,259,826 | |

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC

4.00%, 09/01/2029(a) | | | U.S.$ | | | | 5,355 | | | | 4,698,666 | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc.

2.125%, 08/15/2026(a) | | | EUR | | | | 3,208 | | | | 2,948,629 | |

Ball Corp.

2.875%, 08/15/2030 | | | U.S.$ | | | | 2,910 | | | | 2,531,426 | |

6.00%, 06/15/2029 | | | | | | | 5,894 | | | | 5,986,504 | |

Bombardier, Inc.

7.25%, 07/01/2031(a) | | | | | | | 3,007 | | | | 3,108,807 | |

7.50%, 02/01/2029(a) | | | | | | | 5,184 | | | | 5,401,488 | |

7.875%, 04/15/2027(a) | | | | | | | 1,643 | | | | 1,645,366 | |

8.75%, 11/15/2030(a) | | | | | | | 5,839 | | | | 6,329,632 | |

Calderys Financing LLC

11.25%, 06/01/2028(a) | | | | | | | 7,661 | | | | 8,189,019 | |

Crown Americas LLC

5.25%, 04/01/2030 | | | | | | | 890 | | | | 875,660 | |

| | |

| |

2 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Eco Material Technologies, Inc.

7.875%, 01/31/2027(a) | | | U.S.$ | | | | 9,570 | | | $ | 9,633,405 | |

EnerSys

4.375%, 12/15/2027(a) | | | | | | | 5,050 | | | | 4,873,088 | |

6.625%, 01/15/2032(a) | | | | | | | 2,704 | | | | 2,777,208 | |

Enviri Corp.

5.75%, 07/31/2027(a) | | | | | | | 5,339 | | | | 5,143,346 | |

Esab Corp.

6.25%, 04/15/2029(a) | | | | | | | 2,372 | | | | 2,413,888 | |

F-Brasile SpA/F-Brasile US LLC Series XR

7.375%, 08/15/2026(a) | | | | | | | 5,660 | | | | 5,665,113 | |

GFL Environmental, Inc.

6.75%, 01/15/2031(a) | | | | | | | 1,891 | | | | 1,946,983 | |

Griffon Corp.

5.75%, 03/01/2028 | | | | | | | 300 | | | | 294,557 | |

Husky Injection Molding Systems Ltd./Titan Co-Borrower LLC

9.00%, 02/15/2029(a) | | | | | | | 1,345 | | | | 1,380,430 | |

IMA Industria Macchine Automatiche SpA

6.93% (EURIBOR 3 Month + 3.75%),

04/15/2029(a)(h) | | | EUR | | | | 2,560 | | | | 2,804,813 | |

LSB Industries, Inc.

6.25%, 10/15/2028(a)(i) | | | U.S.$ | | | | 5,922 | | | | 5,734,735 | |

Madison IAQ LLC

5.875%, 06/30/2029(a) | | | | | | | 1,225 | | | | 1,161,562 | |

MIWD Holdco II LLC/MIWD Finance Corp.

5.50%, 02/01/2030(a) | | | | | | | 6,823 | | | | 6,515,860 | |

Paprec Holding SA

7.25%, 11/17/2029(a) | | | EUR | | | | 1,797 | | | | 2,063,034 | |

Summit Materials LLC/Summit Materials Finance Corp.

7.25%, 01/15/2031(a) | | | U.S.$ | | | | 1,910 | | | | 1,985,712 | |

Terex Corp.

6.25%, 10/15/2032(a) | | | | | | | 3,104 | | | | 3,089,101 | |

TransDigm, Inc.

4.625%, 01/15/2029 | | | | | | | 3,591 | | | | 3,410,850 | |

4.875%, 05/01/2029 | | | | | | | 3,750 | | | | 3,576,607 | |

6.00%, 01/15/2033(a) | | | | | | | 14,975 | | | | 14,842,697 | |

6.75%, 08/15/2028(a) | | | | | | | 13,090 | | | | 13,384,065 | |

6.875%, 12/15/2030(a) | | | | | | | 4,009 | | | | 4,113,094 | |

7.125%, 12/01/2031(a) | | | | | | | 3,530 | | | | 3,658,859 | |

Trinity Industries, Inc.

7.75%, 07/15/2028(a) | | | | | | | 5,072 | | | | 5,248,309 | |

Triumph Group, Inc.

9.00%, 03/15/2028(a) | | | | | | | 7,505 | | | | 7,825,775 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 161,098,031 | |

| | | | | | | | | | | | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 3 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Communications - Media – 6.7% | | | | | | | | | | | | |

AMC Networks, Inc.

4.25%, 02/15/2029 | | | U.S.$ | | | | 4,017 | | | $ | 2,769,359 | |

10.25%, 01/15/2029(a) | | | | | | | 6,140 | | | | 6,321,145 | |

Arches Buyer, Inc.

6.125%, 12/01/2028(a) | | | | | | | 1,056 | | | | 930,217 | |

Banijay Entertainment SAS

7.00%, 05/01/2029(a) | | | EUR | | | | 2,077 | | | | 2,367,075 | |

8.125%, 05/01/2029(a) | | | U.S.$ | | | | 2,903 | | | | 3,006,190 | |

CCO Holdings LLC/CCO Holdings Capital Corp.

4.25%, 02/01/2031(a) | | | | | | | 2,542 | | | | 2,205,987 | |

4.25%, 01/15/2034(a) | | | | | | | 995 | | | | 796,439 | |

4.50%, 08/15/2030(a) | | | | | | | 23,087 | | | | 20,605,107 | |

4.50%, 05/01/2032 | | | | | | | 2,750 | | | | 2,337,503 | |

4.50%, 06/01/2033(a) | | | | | | | 14,442 | | | | 12,008,608 | |

4.75%, 03/01/2030(a) | | | | | | | 1,939 | | | | 1,764,441 | |

4.75%, 02/01/2032(a) | | | | | | | 25,772 | | | | 22,305,829 | |

6.375%, 09/01/2029(a) | | | | | | | 5,119 | | | | 5,069,109 | |

Clear Channel Outdoor Holdings, Inc.

5.125%, 08/15/2027(a) | | | | | | | 583 | | | | 566,387 | |

CSC Holdings LLC

4.625%, 12/01/2030(a) | | | | | | | 4,460 | | | | 2,240,753 | |

5.00%, 11/15/2031(a) | | | | | | | 330 | | | | 160,910 | |

5.375%, 02/01/2028(a) | | | | | | | 7,472 | | | | 6,394,285 | |

5.50%, 04/15/2027(a) | | | | | | | 4,961 | | | | 4,415,305 | |

5.75%, 01/15/2030(a) | | | | | | | 17,196 | | | | 9,099,243 | |

7.50%, 04/01/2028(a) | | | | | | | 2,183 | | | | 1,438,474 | |

11.25%, 05/15/2028(a) | | | | | | | 2,417 | | | | 2,356,574 | |

11.75%, 01/31/2029(a) | | | | | | | 2,095 | | | | 2,043,403 | |

DISH DBS Corp.

5.125%, 06/01/2029 | | | | | | | 10,429 | | | | 6,926,820 | |

5.25%, 12/01/2026(a) | | | | | | | 11,885 | | | | 11,000,679 | |

5.75%, 12/01/2028(a) | | | | | | | 10,549 | | | | 9,232,380 | |

7.375%, 07/01/2028(j) | | | | | | | 6,580 | | | | 4,818,388 | |

DISH Network Corp.

3.375%, 08/15/2026(k) | | | | | | | 4,275 | | | | 3,562,766 | |

Gray Television, Inc.

5.375%, 11/15/2031(a) | | | | | | | 2,960 | | | | 1,773,532 | |

LCPR Senior Secured Financing DAC

5.125%, 07/15/2029(a)(j) | | | | | | | 4,643 | | | | 3,902,090 | |

6.75%, 10/15/2027(a) | | | | | | | 8,724 | | | | 8,177,772 | |

McGraw-Hill Education, Inc.

5.75%, 08/01/2028(a) | | | | | | | 4,558 | | | | 4,470,238 | |

Paramount Global

6.25%, 02/28/2057 | | | | | | | 1,211 | | | | 1,086,399 | |

6.375%, 03/30/2062 | | | | | | | 4,680 | | | | 4,334,088 | |

| | |

| |

4 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Radiate Holdco LLC/Radiate Finance, Inc.

4.50%, 09/15/2026(a) | | | U.S.$ | | | | 5,030 | | | $ | 4,363,941 | |

Sinclair Television Group, Inc.

5.50%, 03/01/2030(a) | | | | | | | 1,549 | | | | 1,066,950 | |

Sirius XM Radio, Inc.

4.00%, 07/15/2028(a) | | | | | | | 9,796 | | | | 9,161,355 | |

Univision Communications, Inc.

4.50%, 05/01/2029(a) | | | | | | | 5,716 | | | | 5,078,079 | |

7.375%, 06/30/2030(a) | | | | | | | 8,775 | | | | 8,421,283 | |

8.50%, 07/31/2031(a) | | | | | | | 4,216 | | | | 4,143,653 | |

Urban One, Inc.

7.375%, 02/01/2028(a) | | | | | | | 1,724 | | | | 1,279,108 | |

Virgin Media Secured Finance PLC

4.50%, 08/15/2030(a) | | | | | | | 3,049 | | | | 2,670,411 | |

VZ Secured Financing BV

5.00%, 01/15/2032(a) | | | | | | | 5,961 | | | | 5,367,284 | |

Ziggo Bond Co. BV

5.125%, 02/28/2030(a)(j) | | | | | | | 4,106 | | | | 3,716,310 | |

Ziggo BV

4.875%, 01/15/2030(a) | | | | | | | 900 | | | | 834,833 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 216,590,702 | |

| | | | | | | | | | | | |

Communications - Telecommunications – 3.0% | | | | | | | | | | | | |

Altice Financing SA

5.75%, 08/15/2029(a) | | | | | | | 11,729 | | | | 9,575,986 | |

Altice France Holding SA

4.00%, 02/15/2028(a) | | | EUR | | | | 1,210 | | | | 314,509 | |

6.00%, 02/15/2028(a) | | | U.S.$ | | | | 1,308 | | | | 353,923 | |

10.50%, 05/15/2027(a) | | | | | | | 9,715 | | | | 2,946,245 | |

Altice France SA

5.125%, 01/15/2029(a) | | | | | | | 1,214 | | | | 911,280 | |

5.125%, 07/15/2029(a) | | | | | | | 18,806 | | | | 14,070,024 | |

5.50%, 01/15/2028(a) | | | | | | | 1,537 | | | | 1,188,872 | |

5.50%, 10/15/2029(a) | | | | | | | 6,460 | | | | 4,878,326 | |

8.125%, 02/01/2027(a) | | | | | | | 1,968 | | | | 1,629,339 | |

Frontier Communications Holdings LLC

8.625%, 03/15/2031(a) | | | | | | | 2,925 | | | | 3,140,719 | |

Level 3 Financing, Inc.

10.75%, 12/15/2030(a) | | | | | | | 7,606 | | | | 8,522,551 | |

11.00%, 11/15/2029(a) | | | | | | | 6,411 | | | | 7,235,286 | |

Lorca Telecom Bondco SA

4.00%, 09/18/2027(a) | | | EUR | | | | 2,680 | | | | 2,909,987 | |

Optics Bidco SpA

7.72%, 06/04/2038(a) | | | U.S.$ | | | | 4,715 | | | | 5,007,506 | |

Telecom Italia Capital SA

7.72%, 06/04/2038 | | | | | | | 2,280 | | | | 2,377,876 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 5 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

United Group BV

3.625%, 02/15/2028(a) | | | EUR | | | | 752 | | | $ | 788,537 | |

4.00%, 11/15/2027(a) | | | | | | | 1,816 | | | | 1,946,565 | |

4.625%, 08/15/2028(a) | | | | | | | 344 | | | | 366,765 | |

6.75%, 02/15/2031(a) | | | | | | | 2,127 | | | | 2,349,290 | |

7.79% (EURIBOR 3 Month + 4.25%),

02/01/2029(a)(h) | | | | | | | 1,531 | | | | 1,659,871 | |

Vmed O2 UK Financing I PLC

4.25%, 01/31/2031(a) | | | U.S.$ | | | | 1,405 | | | | 1,207,597 | |

4.75%, 07/15/2031(a) | | | | | | | 12,630 | | | | 10,937,809 | |

7.75%, 04/15/2032(a) | | | | | | | 9,196 | | | | 9,229,162 | |

Windstream Services LLC/Windstream Escrow Finance Corp.

8.25%, 10/01/2031(a) | | | | | | | 3,091 | | | | 3,129,412 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 96,677,437 | |

| | | | | | | | | | | | |

Consumer Cyclical - Automotive – 2.6% | | | | | | | | | | | | |

Allison Transmission, Inc.

3.75%, 01/30/2031(a) | | | | | | | 3,049 | | | | 2,700,894 | |

5.875%, 06/01/2029(a) | | | | | | | 3,279 | | | | 3,272,799 | |

Aston Martin Capital Holdings Ltd.

10.00%, 03/31/2029(a) | | | | | | | 7,323 | | | | 7,103,019 | |

Dana, Inc.

4.25%, 09/01/2030 | | | | | | | 3,854 | | | | 3,361,667 | |

Exide Technologies (Exchange Priority)

11.00%, 10/31/2024(c)(e)(f)(g)(l) | | | | | | | 18,493 | | | | – 0 | – |

Exide Technologies (First Lien)

11.00%, 10/31/2024(c)(e)(f)(g)(l) | | | | | | | 7,590 | | | | – 0 | – |

Garrett Motion Holdings, Inc./Garrett LX I SARL

7.75%, 05/31/2032(a) | | | | | | | 6,597 | | | | 6,582,295 | |

Goodyear Tire & Rubber Co. (The)

5.25%, 04/30/2031 | | | | | | | 978 | | | | 859,370 | |

5.25%, 07/15/2031 | | | | | | | 2,865 | | | | 2,515,549 | |

IHO Verwaltungs GmbH

6.375% (6.375% Cash or 7.125% PIK),

05/15/2029(a)(b) | | | | | | | 200 | | | | 193,362 | |

6.75% (6.75% Cash or 7.50% PIK),

11/15/2029(a)(b) | | | EUR | | | | 2,189 | | | | 2,416,801 | |

7.00% (7.00% Cash or 7.75% PIK),

11/15/2031(a)(b) | | | | | | | 2,285 | | | | 2,505,892 | |

7.75% (7.75% Cash or 8.50% PIK),

11/15/2030(a)(b) | | | U.S.$ | | | | 2,652 | | | | 2,645,291 | |

8.00% (8.00% Cash or 8.75% PIK),

11/15/2032(a)(b) | | | | | | | 1,652 | | | | 1,658,707 | |

8.75% (8.75% Cash or 9.50% PIK),

05/15/2028(a)(b) | | | EUR | | | | 1,751 | | | | 2,021,109 | |

| | |

| |

6 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Mclaren Finance PLC

7.50%, 08/01/2026(a) | | | U.S.$ | | | | 9,232 | | | $ | 9,009,669 | |

PM General Purchaser LLC

9.50%, 10/01/2028(a) | | | | | | | 5,980 | | | | 6,067,253 | |

Real Hero Merger Sub 2, Inc.

6.25%, 02/01/2029(a) | | | | | | | 5,613 | | | | 4,896,328 | |

Tenneco, Inc.

8.00%, 11/17/2028(a) | | | | | | | 8,316 | | | | 7,694,824 | |

Titan International, Inc.

7.00%, 04/30/2028 | | | | | | | 7,168 | | | | 6,945,974 | |

ZF Finance GmbH Series E

3.75%, 09/21/2028(a) | | | EUR | | | | 100 | | | | 103,434 | |

ZF North America Capital, Inc.

6.75%, 04/23/2030(a) | | | U.S.$ | | | | 3,974 | | | | 3,917,706 | |

6.875%, 04/14/2028(a) | | | | | | | 4,588 | | | | 4,627,167 | |

6.875%, 04/23/2032(a) | | | | | | | 883 | | | | 862,633 | |

7.125%, 04/14/2030(a) | | | | | | | 1,539 | | | | 1,545,434 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 83,507,177 | |

| | | | | | | | | | | | |

Consumer Cyclical - Entertainment – 2.5% | | | | | | | | | | | | |

Carnival Corp.

5.75%, 03/01/2027(a) | | | | | | | 1,522 | | | | 1,526,313 | |

5.75%, 01/15/2030(a) | | | EUR | | | | 892 | | | | 1,030,032 | |

Cedar Fair LP/Canada’s Wonderland Co./Magnum Management Corp./Millennium Op

5.25%, 07/15/2029 | | | U.S.$ | | | | 30 | | | | 28,896 | |

Lindblad Expeditions LLC

6.75%, 02/15/2027(a) | | | | | | | 1,512 | | | | 1,518,545 | |

Loarre Investments SARL

6.50%, 05/15/2029(a) | | | EUR | | | | 2,240 | | | | 2,508,136 | |

Merlin Entertainments Group US Holdings, Inc.

7.375%, 02/15/2031(a) | | | U.S.$ | | | | 2,218 | | | | 2,175,995 | |

Motion Bondco DAC

4.50%, 11/15/2027(a) | | | EUR | | | | 2,973 | | | | 2,939,117 | |

Motion Finco SARL

7.375%, 06/15/2030(a) | | | | | | | 1,092 | | | | 1,187,182 | |

NCL Corp., Ltd.

5.875%, 03/15/2026(a) | | | U.S.$ | | | | 4,909 | | | | 4,902,320 | |

5.875%, 02/15/2027(a) | | | | | | | 3,375 | | | | 3,371,444 | |

8.125%, 01/15/2029(a) | | | | | | | 3,062 | | | | 3,241,327 | |

Royal Caribbean Cruises Ltd.

5.375%, 07/15/2027(a) | | | | | | | 6,220 | | | | 6,207,655 | |

5.50%, 08/31/2026(a) | | | | | | | 5,098 | | | | 5,102,578 | |

5.50%, 04/01/2028(a) | | | | | | | 20,172 | | | | 20,172,700 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 7 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

SeaWorld Parks & Entertainment, Inc.

5.25%, 08/15/2029(a) | | | U.S.$ | | | | 4,269 | | | $ | 4,102,497 | |

Six Flags Entertainment Corp./DE

7.25%, 05/15/2031(a) | | | | | | | 3,967 | | | | 4,065,860 | |

Viking Cruises Ltd.

5.875%, 09/15/2027(a) | | | | | | | 2,430 | | | | 2,415,008 | |

7.00%, 02/15/2029(a) | | | | | | | 6,171 | | | | 6,217,283 | |

9.125%, 07/15/2031(a) | | | | | | | 3,056 | | | | 3,301,848 | |

VOC Escrow Ltd.

5.00%, 02/15/2028(a) | | | | | | | 3,618 | | | | 3,519,462 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 79,534,198 | |

| | | | | | | | | | | | |

Consumer Cyclical - Other – 4.1% | | | | | | | | | | | | |

Brookfield Residential Properties, Inc./Brookfield Residential US LLC

4.875%, 02/15/2030(a) | | | | | | | 5,889 | | | | 5,483,091 | |

6.25%, 09/15/2027(a) | | | | | | | 6,404 | | | | 6,356,042 | |

Builders FirstSource, Inc.

4.25%, 02/01/2032(a) | | | | | | | 2,040 | | | | 1,825,800 | |

6.375%, 06/15/2032(a) | | | | | | | 2,339 | | | | 2,355,518 | |

6.375%, 03/01/2034(a) | | | | | | | 4,668 | | | | 4,701,453 | |

CD&R Smokey Buyer, Inc./Radio Systems Corp.

9.50%, 10/15/2029(a) | | | | | | | 2,238 | | | | 2,266,833 | |

Churchill Downs, Inc.

4.75%, 01/15/2028(a) | | | | | | | 2,523 | | | | 2,447,025 | |

5.75%, 04/01/2030(a) | | | | | | | 2,035 | | | | 2,002,772 | |

Cirsa Finance International SARL

6.50%, 03/15/2029(a) | | | EUR | | | | 1,375 | | | | 1,571,752 | |

Forestar Group, Inc.

3.85%, 05/15/2026(a) | | | U.S.$ | | | | 2,881 | | | | 2,808,841 | |

Great Canadian Gaming Corp.

8.75%, 11/15/2029(a) | | | | | | | 2,882 | | | | 2,889,205 | |

Hilton Domestic Operating Co., Inc.

3.625%, 02/15/2032(a) | | | | | | | 6,167 | | | | 5,418,003 | |

5.875%, 04/01/2029(a) | | | | | | | 4,497 | | | | 4,535,490 | |

5.875%, 03/15/2033(a) | | | | | | | 6,091 | | | | 6,098,029 | |

6.125%, 04/01/2032(a) | | | | | | | 2,576 | | | | 2,602,579 | |

Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Esc

4.875%, 07/01/2031(a) | | | | | | | 1,162 | | | | 1,038,331 | |

5.00%, 06/01/2029(a) | | | | | | | 6,848 | | | | 6,417,625 | |

6.625%, 01/15/2032(a) | | | | | | | 2,352 | | | | 2,351,840 | |

Installed Building Products, Inc.

5.75%, 02/01/2028(a) | | | | | | | 838 | | | | 832,401 | |

Marriott Ownership Resorts, Inc.

4.50%, 06/15/2029(a) | | | | | | | 1,338 | | | | 1,240,772 | |

| | |

| |

8 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Masterbrand, Inc.

7.00%, 07/15/2032(a) | | | U.S.$ | | | | 3,776 | | | $ | 3,867,846 | |

Mattamy Group Corp.

4.625%, 03/01/2030(a) | | | | | | | 5,478 | | | | 5,126,502 | |

MGM Resorts International

4.75%, 10/15/2028 | | | | | | | 3,315 | | | | 3,202,699 | |

5.50%, 04/15/2027 | | | | | | | 4,584 | | | | 4,573,613 | |

Miller Homes Group Finco PLC

7.00%, 05/15/2029(a) | | | GBP | | | | 2,900 | | | | 3,648,560 | |

8.79% (EURIBOR 3 Month + 5.25%),

05/15/2028(a)(h) | | | EUR | | | | 2,233 | | | | 2,459,308 | |

Miter Brands Acquisition Holdco, Inc./MIWD Borrower LLC

6.75%, 04/01/2032(a) | | | U.S.$ | | | | 1,314 | | | | 1,336,665 | |

Shea Homes LP/Shea Homes Funding Corp.

4.75%, 02/15/2028 | | | | | | | 3,292 | | | | 3,143,106 | |

4.75%, 04/01/2029 | | | | | | | 4,530 | | | | 4,294,449 | |

Standard Industries, Inc./NY

4.75%, 01/15/2028(a) | | | | | | | 2,310 | | | | 2,227,651 | |

Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp.

5.875%, 05/15/2025(a) | | | | | | | 4,781 | | | | 4,769,102 | |

Taylor Morrison Communities, Inc.

5.125%, 08/01/2030(a) | | | | | | | 328 | | | | 317,817 | |

5.75%, 01/15/2028(a) | | | | | | | 304 | | | | 303,920 | |

5.875%, 06/15/2027(a) | | | | | | | 294 | | | | 295,628 | |

Thor Industries, Inc.

4.00%, 10/15/2029(a) | | | | | | | 2,054 | | | | 1,874,220 | |

Travel & Leisure Co.

4.50%, 12/01/2029(a) | | | | | | | 3,509 | | | | 3,277,792 | |

4.625%, 03/01/2030(a) | | | | | | | 10,068 | | | | 9,387,452 | |

6.625%, 07/31/2026(a) | | | | | | | 3,533 | | | | 3,560,405 | |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp.

5.25%, 05/15/2027(a) | | | | | | | 2,353 | | | | 2,335,798 | |

Wynn Resorts Finance LLC/Wynn Resorts Capital Corp.

5.125%, 10/01/2029(a) | | | | | | | 5,631 | | | | 5,466,829 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 130,712,764 | |

| | | | | | | | | | | | |

Consumer Cyclical -

Restaurants – 0.5% | | | | | | | | | | | | |

1011778 BC ULC/New Red Finance, Inc.

3.875%, 01/15/2028(a) | | | | | | | 4,965 | | | | 4,729,668 | |

4.00%, 10/15/2030(a) | | | | | | | 4,938 | | | | 4,462,364 | |

4.375%, 01/15/2028(a) | | | | | | | 3,132 | | | | 3,014,982 | |

6.125%, 06/15/2029(a) | | | | | | | 5,000 | | | | 5,082,711 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 17,289,725 | |

| | | | | | | | | | | | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 9 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Consumer Cyclical - Retailers – 3.3% | | | | | | | | | | | | |

Arko Corp.

5.125%, 11/15/2029(a) | | | U.S.$ | | | | 4,612 | | | $ | 4,251,600 | |

Asbury Automotive Group, Inc.

4.50%, 03/01/2028 | | | | | | | 3,049 | | | | 2,945,844 | |

4.625%, 11/15/2029(a) | | | | | | | 5,503 | | | | 5,153,057 | |

5.00%, 02/15/2032(a) | | | | | | | 340 | | | | 312,936 | |

Bath & Body Works, Inc.

6.625%, 10/01/2030(a) | | | | | | | 1,243 | | | | 1,245,195 | |

6.75%, 07/01/2036 | | | | | | | 1,479 | | | | 1,482,830 | |

6.875%, 11/01/2035 | | | | | | | 9,394 | | | | 9,530,923 | |

Beacon Roofing Supply, Inc.

6.50%, 08/01/2030(a) | | | | | | | 1,082 | | | | 1,099,905 | |

Carvana Co.

5.50%, 04/15/2027(a) | | | | | | | 1,469 | | | | 1,365,395 | |

13.00% (11.00% Cash or 13.00% PIK),

06/01/2030(a)(b)(i) | | | | | | | 7,229 | | | | 7,894,615 | |

Cougar JV Subsidiary LLC

8.00%, 05/15/2032(a) | | | | | | | 7,797 | | | | 8,148,315 | |

CT Investment GmbH

6.375%, 04/15/2030(a) | | | EUR | | | | 1,681 | | | | 1,886,184 | |

FirstCash, Inc.

6.875%, 03/01/2032(a) | | | U.S.$ | | | | 6,830 | | | | 6,921,588 | |

Foundation Building Materials, Inc.

6.00%, 03/01/2029(a)(j) | | | | | | | 1,246 | | | | 1,103,592 | |

Global Auto Holdings Ltd/AAG FH UK Ltd.

8.375%, 01/15/2029(a) | | | | | | | 4,213 | | | | 3,946,602 | |

8.75%, 01/15/2032(a) | | | | | | | 3,363 | | | | 3,068,456 | |

Group 1 Automotive, Inc.

4.00%, 08/15/2028(a) | | | | | | | 3,468 | | | | 3,249,914 | |

6.375%, 01/15/2030(a) | | | | | | | 1,276 | | | | 1,281,116 | |

Hanesbrands, Inc.

4.875%, 05/15/2026(a) | | | | | | | 2,095 | | | | 2,070,760 | |

Kontoor Brands, Inc.

4.125%, 11/15/2029(a) | | | | | | | 3,885 | | | | 3,617,210 | |

LCM Investments Holdings II LLC

4.875%, 05/01/2029(a) | | | | | | | 5,229 | | | | 4,939,782 | |

Michaels Cos., Inc. (The)

7.875%, 05/01/2029(a) | | | | | | | 3,047 | | | | 1,624,314 | |

Penske Automotive Group, Inc.

3.75%, 06/15/2029 | | | | | | | 1,215 | | | | 1,109,602 | |

PetSmart, Inc./PetSmart Finance Corp.

7.75%, 02/15/2029(a) | | | | | | | 3,529 | | | | 3,427,475 | |

Sonic Automotive, Inc.

4.625%, 11/15/2029(a) | | | | | | | 9,350 | | | | 8,583,983 | |

4.875%, 11/15/2031(a) | | | | | | | 525 | | | | 471,333 | |

| | |

| |

10 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Staples, Inc.

10.75%, 09/01/2029(a) | | | U.S.$ | | | | 9,047 | | | $ | 8,755,738 | |

12.75%, 01/15/2030(a) | | | | | | | 2,487 | | | | 1,980,356 | |

White Cap Buyer LLC

6.875%, 10/15/2028(a) | | | | | | | 2,257 | | | | 2,266,856 | |

Wolverine World Wide, Inc.

4.00%, 08/15/2029(a) | | | | | | | 798 | | | | 682,253 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 104,417,729 | |

| | | | | | | | | | | | |

Consumer Non-Cyclical – 7.8% | | | | | | | | | | | | |

1375209 BC Ltd.

9.00%, 01/30/2028(a) | | | | | | | 2,355 | | | | 2,348,020 | |

AdaptHealth LLC

5.125%, 03/01/2030(a) | | | | | | | 2,000 | | | | 1,833,977 | |

Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC

4.625%, 01/15/2027(a) | | | | | | | 3,290 | | | | 3,225,067 | |

4.875%, 02/15/2030(a) | | | | | | | 2,263 | | | | 2,211,909 | |

5.875%, 02/15/2028(a) | | | | | | | 1,997 | | | | 2,000,362 | |

6.50%, 02/15/2028(a) | | | | | | | 6,117 | | | | 6,222,075 | |

Bausch & Lomb Corp.

8.375%, 10/01/2028(a) | | | | | | | 11,521 | | | | 12,106,162 | |

Bausch Health Cos., Inc.

4.875%, 06/01/2028(a) | | | | | | | 18,590 | | | | 14,338,003 | |

5.75%, 08/15/2027(a) | | | | | | | 255 | | | | 211,650 | |

6.25%, 02/15/2029(a) | | | | | | | 4,386 | | | | 2,732,791 | |

7.25%, 05/30/2029(a) | | | | | | | 1,562 | | | | 983,993 | |

11.00%, 09/30/2028(a) | | | | | | | 1,156 | | | | 1,063,878 | |

CAB SELAS

3.375%, 02/01/2028(a) | | | EUR | | | | 4,859 | | | | 4,891,173 | |

Cheplapharm Arzneimittel GmbH

7.50%, 05/15/2030(a) | | | | | | | 3,400 | | | | 3,920,762 | |

CHS/Community Health Systems, Inc.

4.75%, 02/15/2031(a) | | | U.S.$ | | | | 1,291 | | | | 1,077,275 | |

5.625%, 03/15/2027(a) | | | | | | | 697 | | | | 679,565 | |

6.00%, 01/15/2029(a) | | | | | | | 11,502 | | | | 10,830,930 | |

6.125%, 04/01/2030(a) | | | | | | | 7,452 | | | | 5,832,116 | |

6.875%, 04/01/2028(a) | | | | | | | 1,066 | | | | 882,167 | |

DaVita, Inc.

3.75%, 02/15/2031(a) | | | | | | | 2,393 | | | | 2,082,357 | |

4.625%, 06/01/2030(a) | | | | | | | 17,477 | | | | 16,075,986 | |

Elanco Animal Health, Inc.

6.65%, 08/28/2028(i) | | | | | | | 8,293 | | | | 8,518,661 | |

Embecta Corp.

5.00%, 02/15/2030(a) | | | | | | | 6,541 | | | | 5,929,692 | |

Emergent BioSolutions, Inc.

3.875%, 08/15/2028(a) | | | | | | | 5,910 | | | | 4,754,981 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 11 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Endo Finance Holdings, Inc.

8.50%, 04/15/2031(a) | | U.S.$ | | | 3,735 | | | $ | 3,994,553 | |

Fortrea Holdings, Inc.

7.50%, 07/01/2030(a) | | | | | 1,476 | | | | 1,453,060 | |

Grifols SA

3.875%, 10/15/2028(a) | | EUR | | | 8,212 | | | | 8,086,762 | |

7.50%, 05/01/2030(a) | | | | | 1,900 | | | | 2,156,004 | |

Gruenenthal GmbH

6.75%, 05/15/2030(a) | | | | | 3,233 | | | | 3,744,175 | |

Iceland Bondco PLC

9.04% (EURIBOR 3 Month + 5.50%),

12/15/2027(a)(h) | | | | | 1,447 | | | | 1,601,000 | |

10.875%, 12/15/2027(a) | | GBP | | | 430 | | | | 594,066 | |

IQVIA, Inc.

2.25%, 03/15/2029(a) | | EUR | | | 3,082 | | | | 3,156,775 | |

6.50%, 05/15/2030(a) | | U.S.$ | | | 898 | | | | 926,083 | |

Lamb Weston Holdings, Inc.

4.125%, 01/31/2030(a) | | | | | 3,671 | | | | 3,408,226 | |

Medline Borrower LP

3.875%, 04/01/2029(a) | | | | | 6,982 | | | | 6,535,526 | |

5.25%, 10/01/2029(a) | | | | | 14,103 | | | | 13,667,792 | |

ModivCare, Inc.

5.00%, 10/01/2029(a)(j) | | | | | 3,280 | | | | 2,239,831 | |

MPH Acquisition Holdings LLC

5.50%, 09/01/2028(a) | | | | | 3,721 | | | | 2,540,823 | |

5.75%, 11/01/2028(a) | | | | | 12,657 | | | | 5,727,676 | |

Neogen Food Safety Corp.

8.625%, 07/20/2030(a) | | | | | 3,395 | | | | 3,675,882 | |

Neopharmed Gentili SpA

7.125%, 04/08/2030(a) | | EUR | | | 1,890 | | | | 2,152,625 | |

Newell Brands, Inc.

4.875%, 06/01/2025 | | U.S.$ | | | 748 | | | | 748,000 | |

5.70%, 04/01/2026(i) | | | | | 2,156 | | | | 2,161,146 | |

6.375%, 09/15/2027 | | | | | 1,346 | | | | 1,362,455 | |

6.375%, 05/15/2030 | | | | | 614 | | | | 617,324 | |

6.625%, 05/15/2032 | | | | | 800 | | | | 802,887 | |

7.00%, 04/01/2046(i) | | | | | 1,969 | | | | 1,825,169 | |

Organon & Co./Organon Foreign Debt Co-Issuer BV

4.125%, 04/30/2028(a) | | | | | 9,089 | | | | 8,611,221 | |

5.125%, 04/30/2031(a) | | | | | 7,607 | | | | 6,936,077 | |

6.75%, 05/15/2034(a) | | | | | 1,123 | | | | 1,126,720 | |

7.875%, 05/15/2034(a) | | | | | 714 | | | | 736,733 | |

Owens & Minor, Inc.

4.50%, 03/31/2029(a) | | | | | 42 | | | | 37,833 | |

6.625%, 04/01/2030(a) | | | | | 5,879 | | | | 5,615,937 | |

| | |

| |

12 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Performance Food Group, Inc.

4.25%, 08/01/2029(a) | | | U.S.$ | | | | 328 | | | $ | 306,940 | |

Post Holdings, Inc.

4.50%, 09/15/2031(a) | | | | | | | 5,969 | | | | 5,435,876 | |

4.625%, 04/15/2030(a) | | | | | | | 414 | | | | 387,123 | |

5.50%, 12/15/2029(a) | | | | | | | 2,155 | | | | 2,101,947 | |

6.25%, 02/15/2032(a) | | | | | | | 1,216 | | | | 1,231,139 | |

6.25%, 10/15/2034(a) | | | | | | | 2,495 | | | | 2,466,356 | |

Primo Water Holdings, Inc.

4.375%, 04/30/2029(a) | | | | | | | 9,327 | | | | 8,778,500 | |

Sotera Health Holdings LLC

7.375%, 06/01/2031(a) | | | | | | | 4,522 | | | | 4,626,211 | |

Spectrum Brands, Inc.

3.875%, 03/15/2031(a) | | | | | | | 683 | | | | 600,501 | |

Surgery Center Holdings, Inc.

7.25%, 04/15/2032(a) | | | | | | | 3,065 | | | | 3,154,583 | |

Tenet Healthcare Corp.

6.125%, 06/15/2030 | | | | | | | 1,026 | | | | 1,029,336 | |

Triton Water Holdings, Inc.

6.25%, 04/01/2029(a) | | | | | | | 3,651 | | | | 3,606,661 | |

US Acute Care Solutions LLC

9.75%, 05/15/2029(a) | | | | | | | 218 | | | | 222,396 | |

US Foods, Inc.

4.75%, 02/15/2029(a) | | | | | | | 314 | | | | 302,595 | |

5.75%, 04/15/2033(a) | | | | | | | 1,278 | | | | 1,258,882 | |

6.875%, 09/15/2028(a) | | | | | | | 282 | | | | 290,355 | |

Viking Baked Goods Acquisition Corp.

8.625%, 11/01/2031(a) | | | | | | | 3,095 | | | | 3,084,515 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 249,879,829 | |

| | | | | | | | | | | | |

Energy – 7.7% | | | | | | | | | | | | |

Antero Midstream Partners LP/Antero Midstream Finance Corp.

5.375%, 06/15/2029(a) | | | | | | | 290 | | | | 283,121 | |

5.75%, 03/01/2027(a) | | | | | | | 280 | | | | 279,371 | |

5.75%, 01/15/2028(a) | | | | | | | 350 | | | | 348,193 | |

Berry Petroleum Co. LLC

7.00%, 02/15/2026(a) | | | | | | | 1,215 | | | | 1,185,566 | |

Blue Racer Midstream LLC/Blue Racer Finance Corp.

7.00%, 07/15/2029(a) | | | | | | | 1,816 | | | | 1,860,362 | |

7.25%, 07/15/2032(a) | | | | | | | 1,608 | | | | 1,660,105 | |

Buckeye Partners LP

3.95%, 12/01/2026 | | | | | | | 30 | | | | 28,829 | |

4.125%, 03/01/2025(a) | | | | | | | 21 | | | | 20,874 | |

6.875%, 07/01/2029(a) | | | | | | | 6,006 | | | | 6,101,355 | |

CITGO Petroleum Corp.

6.375%, 06/15/2026(a) | | | | | | | 2,387 | | | | 2,390,028 | |

| | |

| |

| abfunds.com | | AB HIGH INCOME FUND | 13 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

7.00%, 06/15/2025(a) | | U.S.$ | | | 9,430 | | | $ | 9,440,096 | |

Civitas Resources, Inc.

5.00%, 10/15/2026(a) | | | | | 6,160 | | | | 6,051,033 | |

8.375%, 07/01/2028(a) | | | | | 5,582 | | | | 5,771,611 | |

8.625%, 11/01/2030(a) | | | | | 1,307 | | | | 1,373,418 | |

8.75%, 07/01/2031(a) | | | | | 4,169 | | | | 4,367,919 | |

CNX Resources Corp.

6.00%, 01/15/2029(a) | | | | | 4,714 | | | | 4,673,505 | |

7.25%, 03/01/2032(a) | | | | | 2,660 | | | | 2,739,679 | |

7.375%, 01/15/2031(a) | | | | | 350 | | | | 360,129 | |

Comstock Resources, Inc.

6.75%, 03/01/2029(a) | | | | | 1,289 | | | | 1,234,834 | |

Crescent Energy Finance LLC

7.375%, 01/15/2033(a) | | | | | 705 | | | | 683,661 | |

7.625%, 04/01/2032(a) | | | | | 2,034 | | | | 2,008,943 | |

9.25%, 02/15/2028(a) | | | | | 3,557 | | | | 3,735,213 | |

Encino Acquisition Partners Holdings LLC

8.50%, 05/01/2028(a) | | | | | 2,570 | | | | 2,583,464 | |

Genesis Energy LP/Genesis Energy Finance Corp.

7.75%, 02/01/2028 | | | | | 5,793 | | | | 5,849,521 | |

Global Partners LP/GLP Finance Corp.

6.875%, 01/15/2029 | | | | | 6,162 | | | | 6,150,330 | |

7.00%, 08/01/2027 | | | | | 2,149 | | | | 2,153,904 | |

Hess Midstream Operations LP

4.25%, 02/15/2030(a) | | | | | 4,243 | | | | 3,962,361 | |

5.125%, 06/15/2028(a) | | | | | 2,208 | | | | 2,161,703 | |

Hilcorp Energy I LP/Hilcorp Finance Co.

5.75%, 02/01/2029(a) | | | | | 1,324 | | | | 1,270,355 | |

6.00%, 02/01/2031(a) | | | | | 1,772 | | | | 1,676,172 | |

6.25%, 04/15/2032(a) | | | | | 318 | | | | 298,384 | |

7.25%, 02/15/2035(a) | | | | | 4,398 | | | | 4,315,120 | |

8.375%, 11/01/2033(a) | | | | | 5,423 | | | | 5,670,132 | |

Howard Midstream Energy Partners LLC

7.375%, 07/15/2032(a) | | | | | 2,060 | | | | 2,100,457 | |

8.875%, 07/15/2028(a) | | | | | 2,565 | | | | 2,706,510 | |

ITT Holdings LLC

6.50%, 08/01/2029(a) | | | | | 10,492 | | | | 9,696,107 | |

Kodiak Gas Services LLC

7.25%, 02/15/2029(a) | | | | | 6,018 | | | | 6,191,485 | |

Matador Resources Co.

6.25%, 04/15/2033(a) | | | | | 1,927 | | | | 1,886,926 | |

6.50%, 04/15/2032(a) | | | | | 2,445 | | | | 2,422,496 | |

Moss Creek Resources Holdings, Inc.

8.25%, 09/01/2031(a) | | | | | 3,473 | | | | 3,406,298 | |

Murphy Oil Corp.

6.00%, 10/01/2032 | | | | | 2,693 | | | | 2,592,419 | |

| | |

| |

14 | AB HIGH INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Nabors Industries Ltd.

7.50%, 01/15/2028(a)(j) | | U.S.$ | | | 3,831 | | | $ | 3,646,877 | |

Nabors Industries, Inc.

7.375%, 05/15/2027(a) | | | | | 2,304 | | | | 2,307,767 | |