The Pantry, Inc.

Morgan Keegan 2008 Equity Conference

September 5, 2008

0

Safe Harbor Statement

Some of the statements in this presentation constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than those of historical facts included herein,

including those related to the company’s financial outlook, goals, business

strategy, projected plans and objectives of management for future operations

and liquidity, are forward-looking statements. These forward-looking

statements are based on the company’s plans and expectations and involve a

number of risks and uncertainties that could cause actual results to vary

materially from the results and events anticipated or implied by such forward-

looking statements. Please refer to the company’s Annual Report on Form

10-K and its other filings with the SEC for a discussion of significant risk

factors applicable to the company. In addition, the forward-looking

statements included in this presentation are based on the company’s

estimates and plans as of the date of this presentation. While the company

may elect to update these forward-looking statements at some point in the

future, it specifically disclaims any obligation to do so.

1

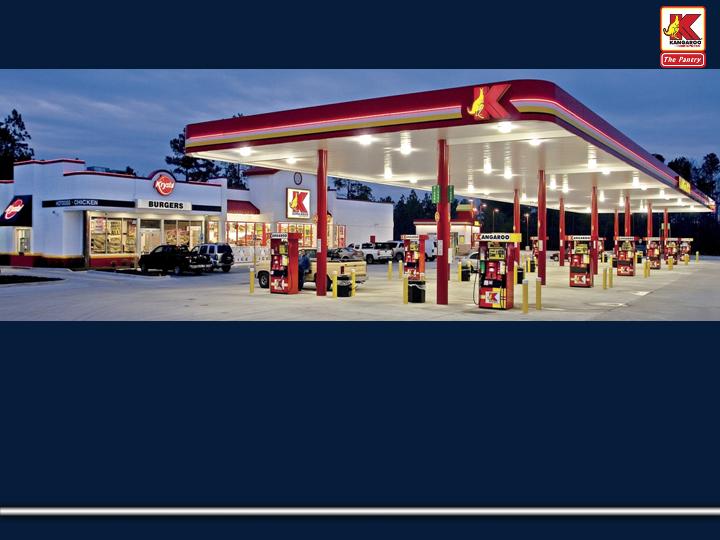

Our Business

Leading independently operated

convenience store chain in the

Southeast and 3 rd largest in the U.S.

1,660 stores located across 11

states

Primarily branded Kangaroo Express

Last twelve months as of June 26,

2008 sales of $8.5 billion and LTM

EBITDA of $218 million

Stores offer a broad selection of

merchandise, motor fuel and food

service offerings designed to meet

convenience needs of consumers

2

Leading market positions in attractive Southeastern markets

Significant scale advantages vs. primary competitors

Benefiting from consumer trends toward convenience formats

Leveraging infrastructure to drive profitability and future growth

Attractive sector growth and consolidation potential

Key Investment Highlights

Strong Cash Flow Generation to Reinvest in Our Business, De-lever and Drive Earnings Growth

3

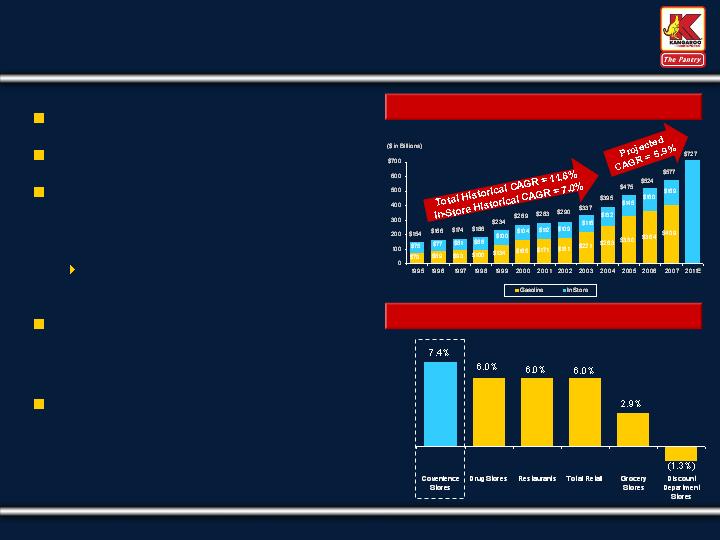

4

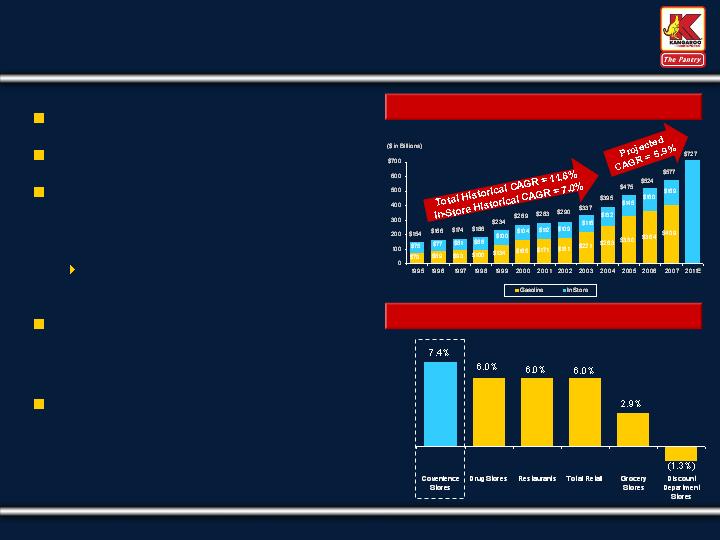

5-Year In-Store Sales CAGR vs. Other Sectors (1)(2)

Large and rapidly growing sector

Defensive growth characteristics

Increasing consumer demand for

smaller-box, fill-in convenience

shopping

Relative to hypermarkets, large

supermarkets, etc.

Increasing amount of food

consumed away-from-home and

on-the-run

Highly fragmented market with

ample consolidation opportunities

Attractive Industry Fundamentals

_____________________

(1) Source: NACS 2007 NACS State of the Industry Report and Retail Forward, Inc.

(2) Source: Retail Forward, Inc. CAGR for 5-year period from 2001-2006.

U.S. C-Store Sales and Growth (1)

PA0021GM_1.WOR

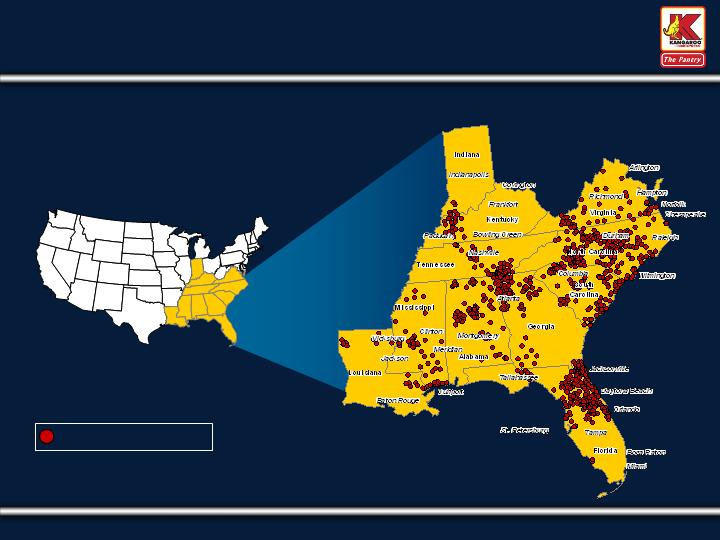

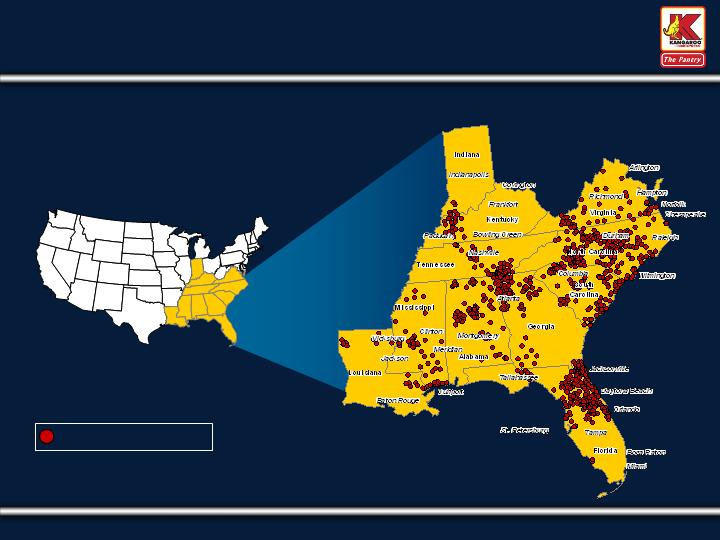

1,660 Stores Located in Eleven Southeastern States as of June 26, 2008

Leading Convenience Store Retailer Concentrated in

the Southeastern United States

NY0010DP_1.WOR

Pantry Store Locations

_____________________

Note: Map as of fiscal year ended September 27, 2007.

5

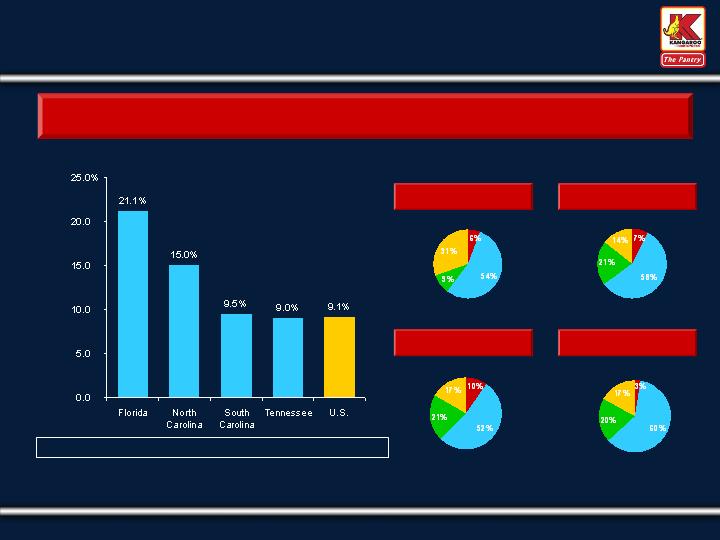

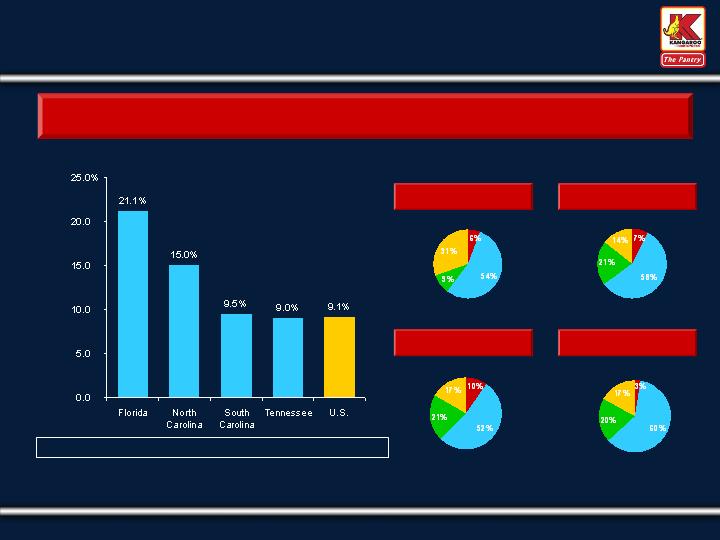

Key Markets Possess Highly Attractive Growth

Characteristics

_____________________

(1) Source: U.S. Census Bureau and 2007 NACS State of the Industry Report.

(2) Note: Pantry’s store counts as of quarter ended June 26, 2008.

Core Markets Projected to Experience Rapid Growth Throughout Next Several Years;

High Degree of Fragmentation Provides Continued Consolidation Opportunities

Pantry

1 Store

Operators

2-50 Store

Operators

>50 Store

Operators

Pantry

1 Store

Operators

2-50 Store

Operators

>50 Store

Operators

Pantry

1 Store

Operators

2-50 Store

Operators

>50 Store

Operators

Pantry

1 Store

Operators

2-50 Store

Operators

>50 Store

Operators

Florida

(7,356 stores)

North Carolina

(5,447 stores)

South Carolina

(2,872 stores)

Tennessee

(3,697 stores)

Population Growth CAGRs (2005-2015) (1)

(2) Pantry Stores: 455 388 282 104 1,660

Market Fragmentation (1)

6

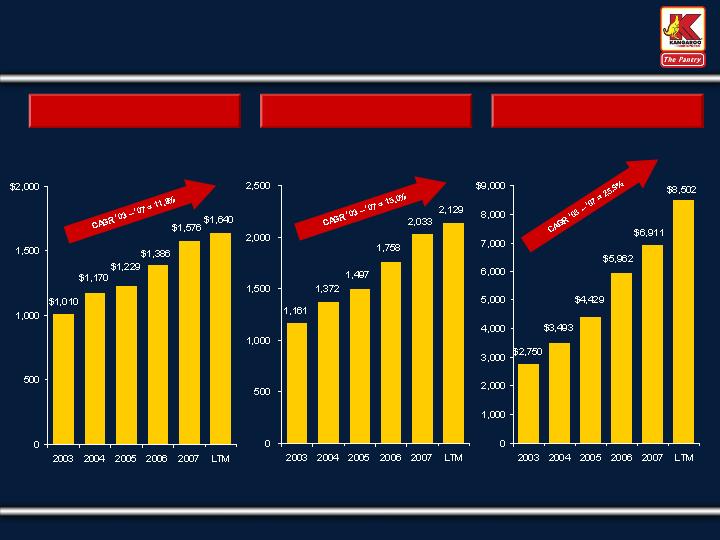

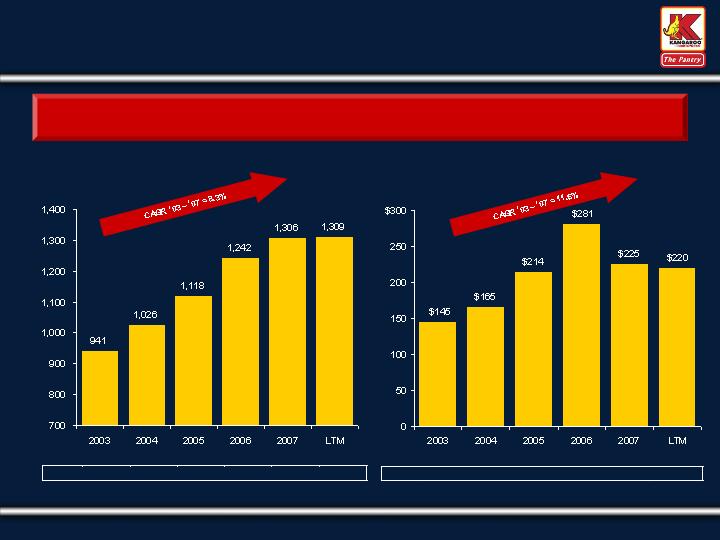

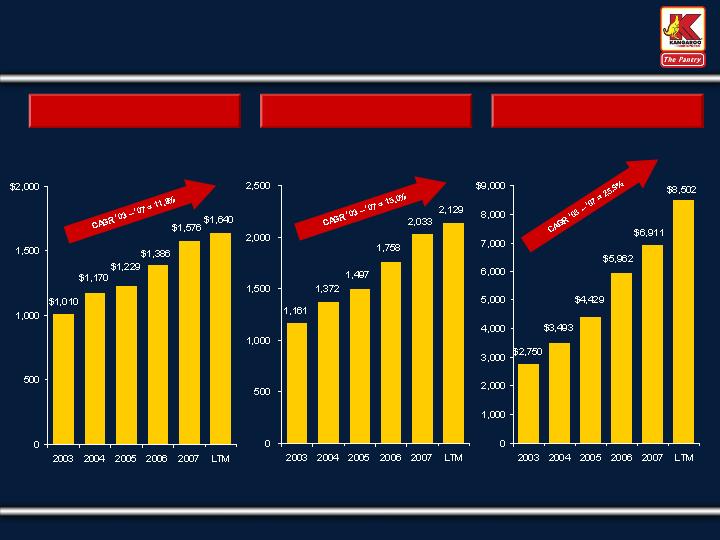

Merchandise Revenue

($ in mm)

(Gallons in mm)

Fiscal Year

Fiscal Year

_____________________

Note: Fiscal year ends in September. Last twelve months as of June 26, 2008.

($ in mm)

Retail Gas Gallons Sold

Total Revenue

Fiscal Year

Strong Track Record of Top Line Growth…

7

Reported EBITDA

Gross Profit

$511

$591

$663

$779

$811

$826

Fiscal Year

Fiscal Year

_____________________

Note: Fiscal year ends in September. Last twelve months as of June 26, 2008.

($ in mm)

($ in mm)

…And Substantial EBITDA Generation

’03-’07

CAGR

11.6%

12.5%

8

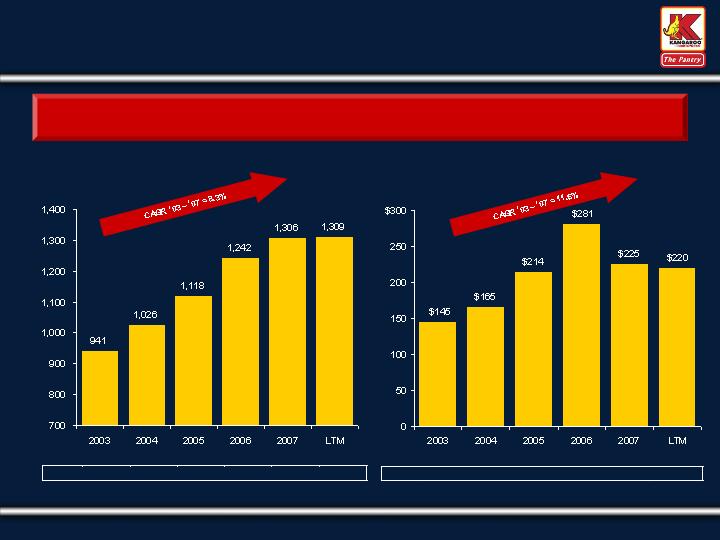

Average Merchandise Sales per Store

($ in Thousands)

Improved Store Portfolio and Stronger Consumer Offering

Have Driven Increased Average Merchandise Sales per Store

_____________________

Note: Fiscal year ends in September. Last twelve months for the quarter ending June 26, 2008.

Fiscal Year

Strong Growth in Merchandise Sales Per Store

9

Stores

1,258

1,361

1,400

1,493

1,644

1,6

60

Merchandise Gross Margin

Fiscal Year

Superior Merchandise Offering Leads to Above Average Margins

Industry

Avg.(1):

30.6%

_____________________

Note: Fiscal year ends in September. Last twelve months for the quarter ending June 26, 2008.

(1) Industry average for 2007 based on the 2008 NACS State of the Industry Report.

Consistently Strong Merchandise Margins

Proprietary branded offerings

Private label products in high velocity

categories

Selective expansion of nationally branded

quick service restaurants (QSRs)

Leveraging scale with merchandise

vendors

10

Merch. Comps

2.1%

3.4%

5.3%

4.9%

2.3%

N

/

A

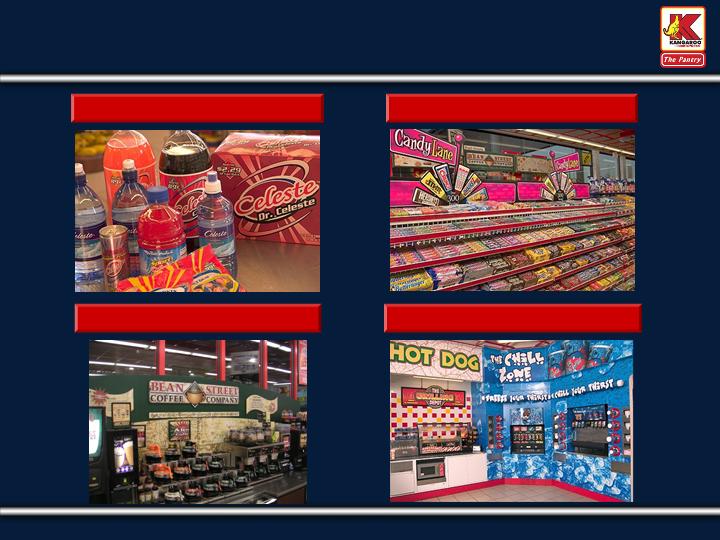

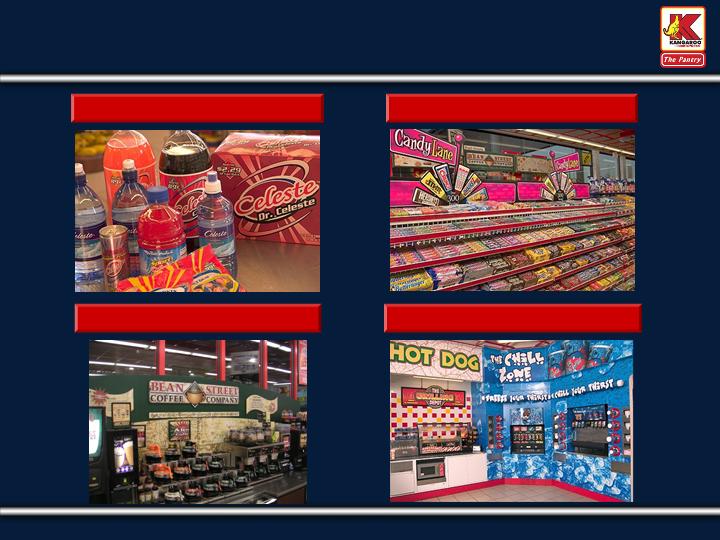

Celeste

Bean Street Coffee

Proprietary Merchandise and Food Service Concepts

Drive Revenue and Margins

Candy Lane

Grilling Depot & Chill Zone

11

We Currently Operate 236 Nationally Branded and

Proprietary Quick Service Restaurants

QSR Food Service Offering Differentiates Our

Stores and Drives Traffic and Margins

12

We Balance Average Gallons Sold Per Store and Gasoline Margins

to Maximize Overall Gross Profit Dollars

Gasoline Strategy Maximizes Fuel Gross Profit Dollars

Average Gallons Sold per Store

Retail Gasoline Gross Profit $

Fiscal Year

Fiscal Year

_____________________

Note: Fiscal year ends in September. Last twelve months for the quarter ending June 26, 2008.

(1) Net of credit card fees and repairs and maintenance. Last twelve months excludes per gallon loss on hedging operations in Q2 and Q3 of 1.6¢ and 0.3¢, respectively.

(Gallons in Thousands)

($ in mm)

13

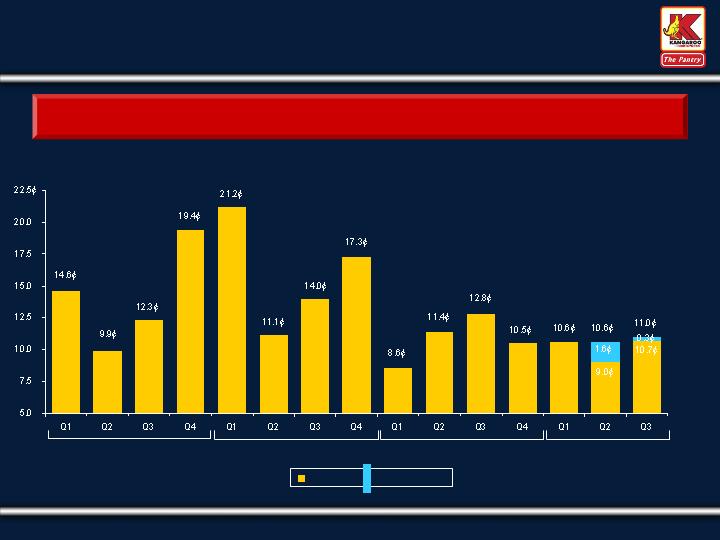

A

/

N

1.0%

3.1%

4.7%

2.0%

0.7%

Comps

CPG

(1)

12.5

¢

12.0

¢

14.3

¢

15.9

¢

10.9

¢

10.

7

¢

Note: Fiscal year ends in September. Graph updated through September 2, 2008.

Source: FactSet. Data represent average futures contract price per barrel of light sweet crude and national average retail price per gasoline gallon.

FY2005

FY2006

FY2007

(Peak)

Avg. Crude Oil Price per Barrel

Avg. Retail Price per Gasoline Gallon

14

FY2008

Recent Inflation and Volatility in Oil and Gas Prices

%

3 Month

s

Prior to Peak

Since

Peak

Oil

+

33

%

(2

5

%)

Gas

+23%

(

1

2

%)

Recent Margins Impacted by Higher Credit Card Fees and Fuel Maintenance Expenses,

As Well As Losses on Fuel Hedging Activities in Q2 and Q3 2008

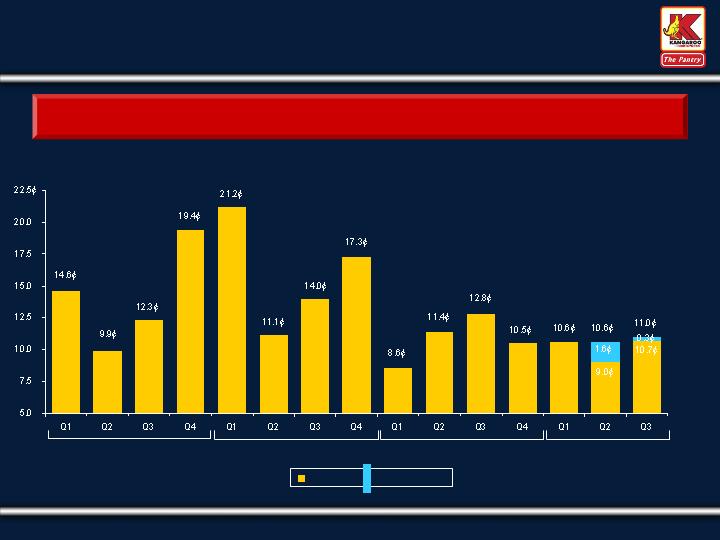

Our Quarterly Retail Gasoline CPG (Net of Credit Card Fees and Repairs and Maintenance)

FY2005

FY2006

FY2007

FY2008

_____________________

Note: Fiscal year ends September.

(1) Q2 and Q3 include per gallon loss on hedging operations of 1.6¢ and 0.3¢, respectively.

Gasoline CPG Can Be Volatile on a Quarterly Basis…

(1)

Net CPG

Hedging Loss

(1)

15

Fiscal Year

_____________________

Note: Fiscal year ends in September. Shaded area represents average historical CPG range.

CPG is net of credit card fees and repairs and maintenance

…But Annual CPG Tends to Remain Relatively Stable

Annual Net CPG Margins Typically Range from 10¢ – 13¢

16

Current Operating Initiatives Intended to Address Challenging

Environment and Improving Strategic Flexibility

Return to Growth Focus

Collectively, We Believe These Actions Have Better Positioned Us to Leverage Our Operating

Model and Drive Top-line and Earnings Growth when the Market Environment Improves

Consumer

Headwinds

Increasing vendor-supported promotional activity

Focusing promotions on high-velocity, high-return categories

Margin / Profitability

Pressure

Financial Flexibility

Accelerated ethanol roll-out

Fuel price strategy maximizing total gross profit dollars

Meaningfully reducing store level and corporate overhead

Bolstered liquidity by accessing delayed draw on term loan

Substantially reduced non-essential capex

Temporarily suspended share repurchases

Challenge

Key Initiatives / Action Taken

17

Reorganized field management structure to streamline operations

Improved overall quality / efficiency of staffing

Improved store-level controllable expenses

Reduced bad check expense

Lowered cash over and short by moving to prepaid on gasoline

Tangible financial results achieved, more expected throughout the year

Reduced store operating expenses in Q3 by $6.4 million or 4.8%

Reduced corporate overhead spend in Q3 by $4.8 million or 17.6% despite adding 16

stores

Lowered FY08 OG&A guidance by $28mm-$33mm from our original FY08 guidance

Initiative Maximizes Operating Expense Leverage and Better Positions Us for Profitable Growth

as Market Conditions Improve

Focus on Reducing Operating Expenses

18

Lease Finance Obligations Cause Valuation and

Leverage Confusion

Adjusting EBITDA by Treating Sale-Leasebacks as Operating Leases and Subtracting Sale-

Leaseback Rent Allows for Better Comparison to Other Retailers

Balance Sheet Data as of 6/26/08

19

Reported

Adjustments

Adjusted

Total Debt

(ex. Lease Finance Obligations)

$848

$84

8

Cash

($1

62

)

($1

62

)

Net Debt

(ex. Lease Finance Obligations)

$

686

$

686

Lease Finance Obligations

$4

6

2

($4

6

2

)

–

Total Net Debt

$1,

148

($46

2

)

$

686

Market Cap

8

/

19

/08

$

408

$

408

Enterprise Value

$1,

55

6

($46

2

)

$

1,094

L

TM EBITDA as o

f

6

/2

6

/

08

$2

1

8

($4

6

)

$1

7

3

EV /

EBITDA Multiple

7

.

1

x

6

.

3

x

Total Net Debt/EBITDA

5.

3

x

4

.

0

x

Meaningful liquidity

$162 million in cash-on-hand

$225 million revolver – $0 drawn, over $142 million available after LOCs

Long-term debt profile; earliest maturity is the convertible debt in November 2012

Covenant-light bank facility – financial flexibility (1)

6.5x Adj. Net Debt / EBITDAR Leverage – Currently 5.8x

2.25x Interest Coverage – Currently 2.53x

_____________________

Note: Balance Sheet data as of June 26, 2008.

(1) Per credit facility covenant calculations (8x rent methodology).

Meaningful Liquidity / Financial Flexibility

20

Merchandise revenues expected to grow to $1.62 – $1.65 billion

Merchandise gross margin expected to be between 36.8% and 37.0%

Retail gas gallons sold expected to be approximately 2.1 billion gallons

Retail gas margin expected between 10 and 12 cents per gallon

Operating, general and administrative expenses expected between $605 –

$610 million

Capital expenditures expected to be $90 million

Full Year Impact of 2007 Acquisitions Driving Revenue Growth in 2008;

Continuing Discipline on Expenses Should Lower OG&A and Drive Earnings

Fiscal 2008 Financial Outlook Unchanged

21

Leading market positions in attractive Southeastern markets

Significant scale advantages vs. primary competitors

Benefiting from consumer trends toward convenience formats

Leveraging infrastructure to drive profitability and future growth

Attractive sector growth and consolidation potential

Key Investment Highlights

Strong Cash Flow Generation to Reinvest in Our Business, De-lever and Drive Earnings Growth

22

23

Reconciliation of Non-GAAP Measures

_____________________

Note: Fiscal year ends in September. Last twelve months as of June 26, 2008.

Adjusted EBITDA/EBITDA Reconciled to Net Income

($ in mm)

LTM

Jun

-

08

2007

2006

2005

2004

2003

Adjusted EBITDA

$173

$178

$254

$189

$150

$127

Payments made for lease finance obligations

46

36

25

24

23

13

Cumulative effect adjustment

-

-

-

-

-

(3)

Reported EBITDA

$218

$214

$279

$214

$173

$136

Interest

expense, net and loss on extinguishment of debt

(88)

(

74

)

(

56

)

(

54

)

(

87

)

(

60

)

Depreciation and amortization

(108)

(

96

)

(

76

)

(

64

)

(

61

)

(

56

)

Provision for income taxes

(8)

(

17

)

(

57

)

(

37

)

(

9

)

(

9

)

Net income

$15

$27

$89

$58

$16

$11

24

Reconciliation of Non-GAAP Measures

_____________________

Note: Fiscal year ends in September. Last twelve months as of June 26, 2008.

Adjusted EBITDA/EBITDA Reconciled to Cash Flows

($ in mm)

L

TM

Jun

-

08

2007

2006

2005

2004

2003

Adjusted EBITDA

$

173

$

178

$254

$189

$150

$127

Payments made for lease finance obligations

4

6

36

25

24

23

13

Cumulative effect adjustment

-

-

-

-

-

(3)

Reported EBITDA

$

218

$214

$279

$214

$173

$136

Interest

expense, net and loss on extinguishment of debt

(88)

(

74

)

(

56

)

(

54

)

(

87

)

(

60

)

Provision for income taxes

(

8

)

(17)

(57)

(37)

(9)

(9)

Non

-

cash stock based compensation

3

4

3

-

-

-

Changes in operating assets and liabilities

8

8

(13)

(7)

-

(20)

Non

-

cash

loss on extinguishment of debt

-

2

2

-

23

3

Other

6

4

(3)

19

17

19

Net cash provided by operating activities

$

140

$141

$154

$134

$117

$69

Net cash used in investing activities

($150)

($529)

($219)

($166)

($227)

($24)

Net cash provided by (used in) fina

ncing activities

$94

$339

$74

$36

$145

(

$14

)

The Pantry, Inc.

Morgan Keegan 2008 Equity Conference

September 5, 2008

25