UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

The Pantry, Inc.

(Name of registrant as specified in its charter)

Not Applicable

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | |

| | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | (4) | | Proposed maximum aggregate value of the transaction: |

| | |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | (3) | | Filing Party: |

| | |

| | (4) | | Date Filed: |

On March 3, 2014, The Pantry, Inc. (the “Company”) issued a press release indicating that it had mailed a brochure to the Company’s stockholders urging stockholders to vote for the Company’s director nominees at the Company’s 2014 Annual Meeting of Stockholders. Copies of the press release and brochure are set forth below.

THE PANTRY MAILS ADDITIONAL MATERIALS TO STOCKHOLDERS

Urges Stockholders to Vote WHITE Proxy Card

CARY, N.C. – March 3, 2014 – The Pantry, Inc. (NASDAQ: PTRY), a leading independently operated convenience store chain in the southeastern U.S., today mailed to all stockholders additional materials recommending that all stockholders voteFOR The Pantry’s highly qualified and experienced director nominees on theWHITE proxy card. The mailing has been filed with the Securities and Exchange Commission and is available on the Company’s website atwww.thepantry.com.

Selected highlights are below:

YOUR BOARD AND MANAGEMENT TEAM ARE LEADING THE COMPANY FORWARD

With 1,538 stores in 13 states, The Pantry is thefourth largest independently operated convenience store retailer in the U.S. Our footprint is concentrated in southeastern markets with high population growth, giving ussignificant upside potentialas a leader in these regions.

OVER THE LAST TWO YEARS, THE PANTRY’S BOARD AND MANAGEMENT

TEAM HAVE IMPLEMENTED MEANINGFUL CHANGES TO POSITION THE

COMPANY FOR SUSTAINED, PROFITABLE GROWTH.

| | • | | Brought in new CEO, Dennis Hatchell, in 2012 to lead the Company |

| | • | | Attracted leading talent to The Pantry to further strengthen the senior leadership team |

| | • | | Reduced debt through continued discipline around capital expenditures and strong free cash flow |

| | • | | Completed a strategic and in-depth operational review supported by a globally recognized consulting firm to identify key areas of focus to create meaningful stockholder value |

| | • | | Increased same-store sales through a more effective merchandise mix |

| | • | | Initiated a significant remodel program to enhance store base and strengthen brand |

| | • | | Utilized new store opportunities and acquisitions to accelerate growth and strengthen The Pantry’s competitive position in key markets |

The Board of Directors remains committed to providing oversight and empowering the company’s management team to continue delivering results and creating value for all stockholders.

VOTEFORTHE CONTINUED SUCCESS OF A PROFITABLE QSR STRATEGY

Your Board and management team are focused onenhancing store growth and profitability through continued build-out of Quick-Service Restaurants (QSRs).

Our successes so far include:

| | • | | Strong relationships with top-tier franchisors such as Subway |

| | • | | Our new partnership with Little Caesars: five locations opened, three in construction and 10 more approved |

| | • | | Opened eight new QSRs in 2013 with more than 20 QSR build-outs planned for 2014 |

| | • | | 223 QSRs in operation today, with over 500 additional sites identified for potential QSR expansion |

Your Board and management team have a deep understanding of the significant QSR opportunities ahead. We have studied QSR market dynamics carefully, and know that the optimal strategy for success is not an “urgent build plan” but a measured expansion with our top-tier QSR partners, taking into account market availability, brand popularity, construction costs, and other startup expenses.We are currently targeting 20 new QSRs in 2014 and 40-50 new QSRs per year thereafter, and continue to pursue this opportunity in a thoughtful way that will best enhance stockholder value.

VOTEFOR A CLEAR STRATEGY TO ENHANCE FUEL PERFORMANCE

| | • | | Despite the competitive marketplace, approximately 75% of our market is made up of small chains or single stores, allowing us to leverage our significant scale |

| | • | | Our strategy is to stabilize, then regain gallon market share |

| | • | | Improvement in market share will not be at the expense of profitability |

| | • | | Recently implemented state-of-the-art technology and cost management tools to optimize fuel pricing and minimize volatility |

| | • | | Installed electronic fuel price signs in nearly 1,000 stores, with plans to add 150 more in fiscal 2014 |

| | • | | Utilizing technology and analytics to realize early success from several initiatives underway in test markets |

| | • | | The current Board and management team have been deliberate and careful in implementing changes to our fuel strategy, given the significant competition in the marketplace |

VOTEFOR A DISCIPLINED CAPITAL ALLOCATION POLICY

The Pantry has generated strong free cash flow year-after-year by prudently managing capital expenditures during periods of transition and ramping up investments in projects in periods of growth. The resulting strong free cash flow has allowed usto reduce total debt by $368 million, or 28%, since 2008. Today, with a new leadership team that iscommitted to maintaining rigorous cost discipline, we are pursuing selective opportunities that will strengthen the Company’s position in leader markets and enhance free cash flow.

YOUR BOARD IS ALWAYS INTERESTED IN ADDING NEW MEMBERS WITH RELEVANT KNOWLEDGE AND EXPERTISE, AND HAS RECENTLY TAKEN PROACTIVE STEPS TO EXPAND ITS RANKS.

appointed in May 2013:

Kathleen most recently served as Division President of Store Operation and Development at Dollar General Corporation, where she led a team of 90,000 store employees, 100 directors and 14 Vice Presidents. Her previous experience also includes having served as the President and COO of E-Z Serve Corporation (southeastern U.S. c-store chain) and Vice President and General Manager at 7-Eleven Corporation.

nominated in January 2014:

Tad most recently served as Chairman and CEO of Harris Teeter Supermarkets, a leading food retailer in the southeastern United States with 216 stores and $4.1 billion of revenue. Tad brings nearly two decades of operational and executive management experience in the supermarket industry and southeastern U.S.

Your Board is also currently evaluating additional independent director candidates who possess significant senior management experience in the fuels business, to assist the Board in its oversight of this important area.

BY CONTRAST, THE DISSIDENT STOCKHOLDER GROUP LED BY JCP HAS BEEN UNABLE TO DEMONSTRATE HOW THEIR DIRECTOR NOMINEES WOULD DO ANYTHING TO IMPROVE THE VALUE OF YOUR INVESTMENT AND HAS SHOWN NO INTEREST IN CREATING LONG-TERM VALUE.

| | • | | They haveNOTarticulated any plan to drive growth or improve profitability |

| | • | | Their nominees doNOThave relevant operating experience within the convenience store, QSR or fuel sectors |

| | • | | They didNOTengage with the Company in a constructive dialogue with specific recommendations—instead pursuing a costly, disruptive proxy contest |

VOTE FOR SOLID FINANCIAL PERFORMANCE AND SIGNIFICANT EARNINGS UPSIDE

The Pantry’s most recent earnings results indicate that its strategy is taking hold. Among other things, the Company’s achievements included:

| | • | | Upward trend in merchandise same-store sales with the latest quarter showing the largest increase since Q3 2012; |

| | • | | Rapid growth in proprietary food service revenue; and |

| | • | | Implementation of management disciplines and technology to aggressively address our fuel market share underperformance |

The Pantry is solidly positioned to continue delivering results and create value for all stockholders.

|

Your Vote Is Important, No Matter How Many Or How Few Shares You Own. If you have questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies: INNISFREE M&A INCORPORATED Stockholders Call Toll-Free: (888) 750-5834 Banks and Brokers May Call Collect: (212) 750-5833 REMEMBER: We urge you NOT to sign any Gold proxy card sent to you by JCP Investment Management, LLC. If you have already done so, you have every right to change your vote by signing, dating and returning the enclosed WHITE proxy card TODAY in the postage-paid envelope provided. If you hold your shares in Street-name, your custodian may also enable voting by telephone or by Internet—please follow the simple instructions provided on your WHITE proxy card. |

Safe Harbor Statement

Statements made by the Company in this letter relating to future plans, events, or financial condition or performance are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by the use of words such as “expect,” “plan,” “anticipate,” “intend,” “outlook,” “guidance,” “believes,” “should,” “target,” “goal,” “forecast,” “will,” “may” or words of similar meaning. These forward-looking statements are based on the Company’s current plans and expectations and involve a number of risks and uncertainties that could cause actual results and events to vary materially from the results and events anticipated or implied by such forward-looking statements. Any number of factors could affect actual results and events, including, without limitation, the potential cost and management distraction attendant to the dissident group’s nomination of director nominees at the 2014 Annual Meeting of Stockholders, the ability of management to increase profitability as a result of technology enhancements, cost management efforts and store remodels, and new store openings and acquisitions. These and other risk factors are discussed in the Company’s most recent Annual Report on Form 10-K and in its other filings with the U.S. Securities and Exchange Commission (the “SEC”), and should be considered carefully. Readers are cautioned not to place undue reliance on such forward looking statements. In addition, the forward-looking statements included in this letter are based on the Company’s estimates and plans as of March 2, 2014. While the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so.

Important Additional Information

The Pantry has filed a definitive proxy statement and form of white proxy card with the SEC on February 13, 2014 and commenced mailing the definitive proxy statement and white proxy card to The Pantry’s stockholders in connection with its 2014 Annual Meeting of Stockholders.THE PANTRY STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD, AND ANY OTHER PROXY MATERIALS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE AS THEY CONTAIN IMPORTANT INFORMATION. The Pantry, its directors and certain of its executive officers are deemed to be participants in the solicitation of proxies from The Pantry’s stockholders in connection with the matters to be considered at The Pantry’s 2014 Annual Meeting of Stockholders. Information regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the definitive proxy statement and other materials filed with the SEC in connection with The Pantry’s 2014 Annual Meeting of Stockholders. Stockholders may obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by The Pantry with the SEC for no charge at the SEC’s website at www.sec.gov. Copies are also available at no charge at The Pantry’s website at www.thepantry.com, by writing to The Pantry at 305 Gregson Drive, Cary, North Carolina 27511, Attention: Secretary or by calling The Pantry’s proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834.

The Pantry, Inc.

Andrew Hinton, 919-774-6700

Innisfree M&A Incorporated

Scott Winter / Jonathan Salzberger, 212-750-5833

Joele Frank, Wilkinson Brimmer Katcher

Matt Sherman / Andrew Siegel, 212-355-4449

###

The Pantry, Inc.

KANGAROO EXPRESS®

VOTE FOR THE

PANTRY BOARD NOMINEES ON THE

WHITE PROXY CARD

You have the opportunity to help determine the future of The Pantry and your investment in the Company. You - the stockholders of The Pantry - will decide whether the Company continues on its proven path of stockholder value creation led by its Board and management team, or is diverted by the self-serving, opportunistic agenda advocated by the dissident group led by JCP Investment Management, LLC.

If you have any questions or need assistance voting your shares, please contact

Innisfree M&A Incorporated, which is assisting the Company in this matter, at (888) 750-5834.

FORWARD-LOOKING STATEMENTS SAFE HARBOR

Statements made by the Company in this letter relating to future plans, events, or financial condition or performance are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by the use of words such as “expect,” “plan,” “anticipate,” “intend,” “outlook,” “guidance,” “believes,” “should,” “target,” “goal,” “forecast,” “will,” “may” or words of similar meaning. These forward-looking statements are based on the Company’s current plans and expectations and involve a number of risks and uncertainties that could cause actual results and events to vary materially from the results and events anticipated or implied by such forward-looking statements. Any number of factors could affect actual results and events, including, without limitation, the potential cost and management distraction attendant to the dissident group’s nomination of director nominees at the 2014 Annual Meeting of Stockholders, the ability of management to increase profitability as a result of technology enhancements, cost management efforts and store remodels, and new store openings and acquisitions. These and other risk factors are discussed in the Company’s most recent Annual Report on Form 10-K and in its other filings with the U.S. Securities and Exchange Commission (the “SEC”), and should be considered carefully. Readers are cautioned not to place undue reliance on such forward looking statements. In addition, the forward-looking statements included in this letter are based on the Company’s estimates and plans as of February 26, 2014. While the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so.

IMPORTANT ADDITIONAL INFORMATION

The Pantry has filed a definitive proxy statement and form of white proxy card with the SEC on February 13, 2014 and commenced mailing the definitive proxy statement and white proxy card to The Pantry’s stockholders in connection with its 2014 Annual Meeting of Stockholders. THE PANTRY STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD, AND ANY OTHER PROXY MATERIALS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE AS THEY CONTAIN IMPORTANT INFORMATION. The Pantry, its directors and certain of its executive officers are deemed to be participants in the solicitation of proxies from The Pantry’s stockholders in connection with the matters to be considered at The Pantry’s 2014 Annual Meeting of Stockholders. Information regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the definitive proxy statement and other materials filed with the SEC in connection with The Pantry’s 2014 Annual Meeting of Stockholders. Stockholders may obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by The Pantry with the SEC for no charge at the SEC’s website at www.sec.gov. Copies are also available at no charge at The Pantry’s website at www.thepantry.com, by writing to The Pantry at 305 Gregson Drive, Cary, North Carolina 27511, Attention: Secretary or by calling The Pantry’s proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834.

YOUR BOARD AND MANAGEMENT TEAM ARE LEADING THE COMPANY FORWARD

With 1,538 stores in 13 states, The Pantry is the fourth largest independently operated convenience store retailer in the U.S. Our footprint is concentrated in southeastern markets with high population growth, giving us significant upside potential as a leader in these regions.

OVER THE LAST TWO YEARS, THE PANTRY’S BOARD AND MANAGEMENT TEAM HAVE IMPLEMENTED MEANINGFUL CHANGES TO POSITION THE COMPANY FOR SUSTAINED, PROFITABLE GROWTH.

Brought in new CEO, Dennis Hatchell, in 2012 to lead the Company

Attracted leading talent to The Pantry to further strengthen the senior leadership team

Reduced debt through continued discipline around capital expenditures and strong free cash flow

Completed a strategic and in-depth operational review supported by a globally recognized consulting firm to identify key areas of focus to create meaningful stockholder value

Increased same-store sales through a more effective merchandise mix

Initiated a significant remodel program to enhance store base and strengthen brand

Utilized new store opportunities and acquisitions to accelerate growth and strengthen The Pantry’s competitive position in key markets

THE BOARD OF DIRECTORS REMAINS COMMITTED TO PROVIDING OVERSIGHT AND EMPOWERING THE COMPANY’S MANAGEMENT TEAM TO CONTINUE DELIVERING RESULTS AND CREATING VALUE FOR ALL STOCKHOLDERS.

VOTE FOR A CLEAR STRATEGY TO DELIVER STOCKHOLDER VALUE

The Pantry’s Board and management team are committed to executing a strategy to unlock the potential of the Company’s powerful convenience store platform. We have well-defined goals and a clear path to achieve them.

Increase Same-Store Sales New Stores, Remodels, QSRs and Acquisitions

Focused in Leader Markets

Increase Sales per Customer with Continuing Focus on Expense Management

Categories and Items That Are Site Specific

Optimize Fuel Performance Well-Trained, Engaged Employees

1

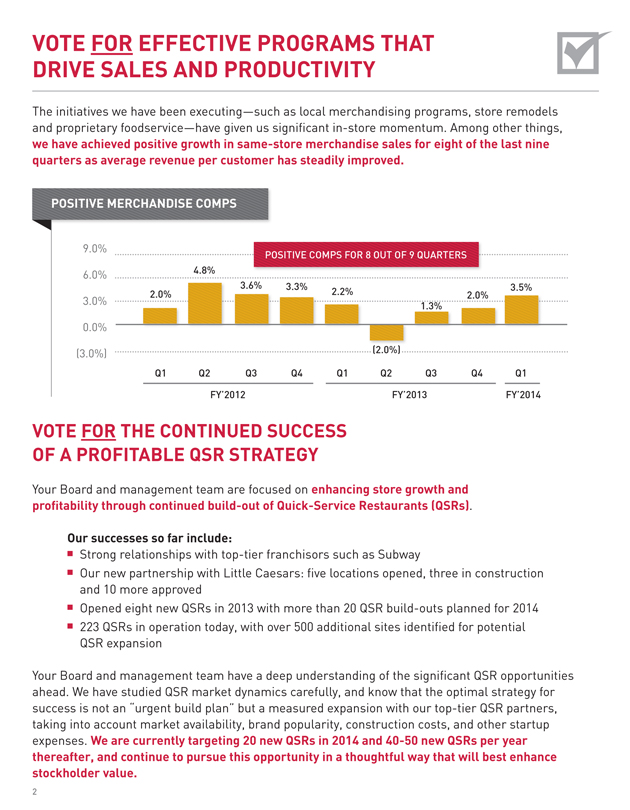

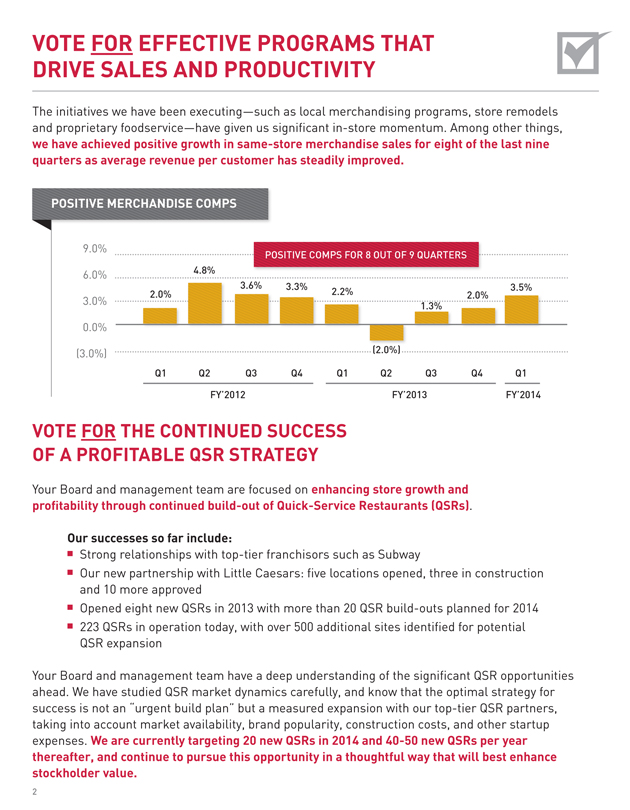

VOTE FOR EFFECTIVE PROGRAMS THAT DRIVE SALES AND PRODUCTIVITY

The initiatives we have been executing - such as local merchandising programs, store remodels and proprietary foodservice - have given us significant in-store momentum. Among other things, we have achieved positive growth in same-store merchandise sales for eight of the last nine quarters as average revenue per customer has steadily improved.

POSITIVE MERCHANDISE COMPS

9.0% POSITIVE COMPS FOR 8 OUT OF 9 QUARTERS

6.0% 4.8%

3.0% 3.6% 3.3% 3.5%

0.0% 2.0% 2.2% 2.0%

(3.0%) 1.3%

(2.0%)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

FY’2012 FY’2013 FY’2014

VOTE FOR THE CONTINUED SUCCESS OF A PROFITABLE QSR STRATEGY

Your Board and management team are focused on enhancing store growth and profitability through continued build-out of Quick-Service Restaurants (QSRs).

Our successes so far include:

Strong relationships with top-tier franchisors such as Subway

Our new partnership with Little Caesars: five locations opened, three in construction and 10 more approved

Opened eight new QSRs in 2013 with more than 20 QSR build-outs planned for 2014

223 QSRs in operation today, with over 500 additional sites identified for potential

QSR expansion

Your Board and management team have a deep understanding of the significant QSR opportunities ahead. We have studied QSR market dynamics carefully, and know that the optimal strategy for success is not an “urgent build plan” but a measured expansion with our top-tier QSR partners, taking into account market availability, brand popularity, construction costs, and other startup expenses. We are currently targeting 20 new QSRs in 2014 and 40-50 new QSRs per year thereafter, and continue to pursue this opportunity in a thoughtful way that will best enhance stockholder value.

2

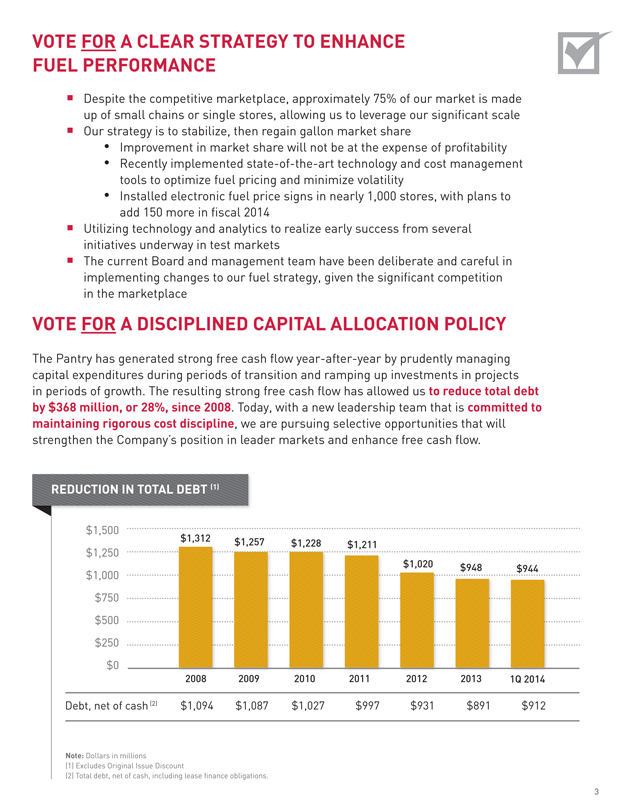

VOTE FOR A CLEAR STRATEGY TO ENHANCE FUEL PERFORMANCE

Despite the competitive marketplace, approximately 75% of our market is made up of small chains or single stores, allowing us to leverage our significant scale

Our strategy is to stabilize, then regain gallon market share

Improvement in market share will not be at the expense of profitability

Recently implemented state-of-the-art technology and cost management tools to optimize fuel pricing and minimize volatility

Installed electronic fuel price signs in nearly 1,000 stores, with plans to add 150 more in fiscal 2014

Utilizing technology and analytics to realize early success from several initiatives underway in test markets

The current Board and management team have been deliberate and careful in implementing changes to our fuel strategy, given the significant competition in the marketplace

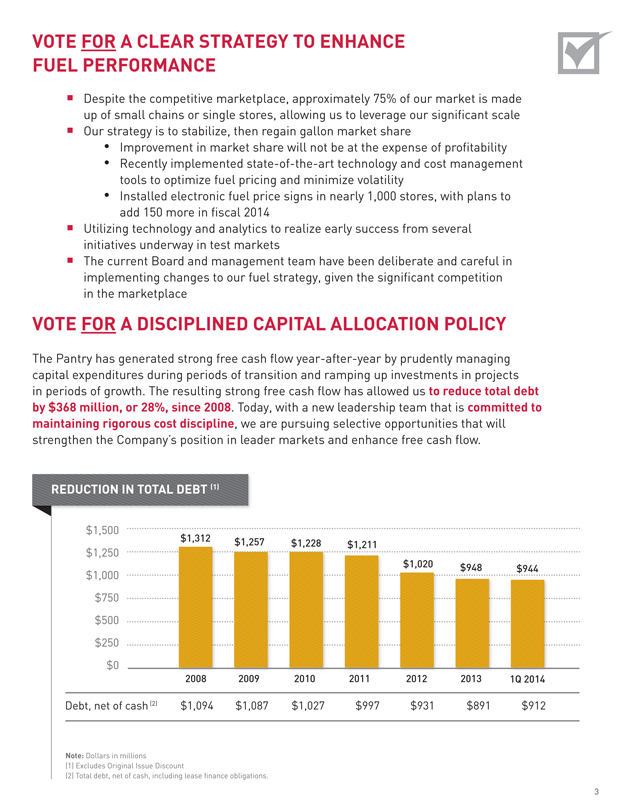

VOTE FOR A DISCIPLINED CAPITAL ALLOCATION POLICY

The Pantry has generated strong free cash flow year-after-year by prudently managing capital expenditures during periods of transition and ramping up investments in projects in periods of growth. The resulting strong free cash flow has allowed us to reduce total debt by $368 million, or 28%, since 2008. Today, with a new leadership team that is committed to maintaining rigorous cost discipline, we are pursuing selective opportunities that will strengthen the Company’s position in leader markets and enhance free cash flow.

REDUCTION IN TOTAL DEBT (1)

$1,500 $1,250 $1,312 $1,257 $1,228 $1,211

$1,000

$750

$1,020

$948

$944

$500

$250

$0

2008 2009 2010 2011 2012 2013 1Q 2014

Debt, net of cash (2) $1,094 $1,087 $1,027 $997 $931 $891 $912

Note: Dollars in millions

(1) Excludes Original Issue Discount

(2) Total debt, net of cash, including lease finance obligations.

3

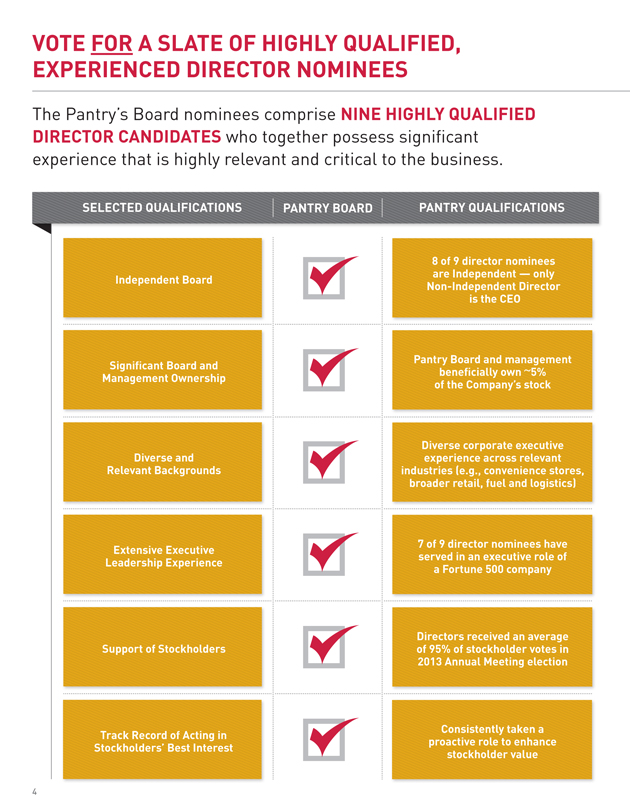

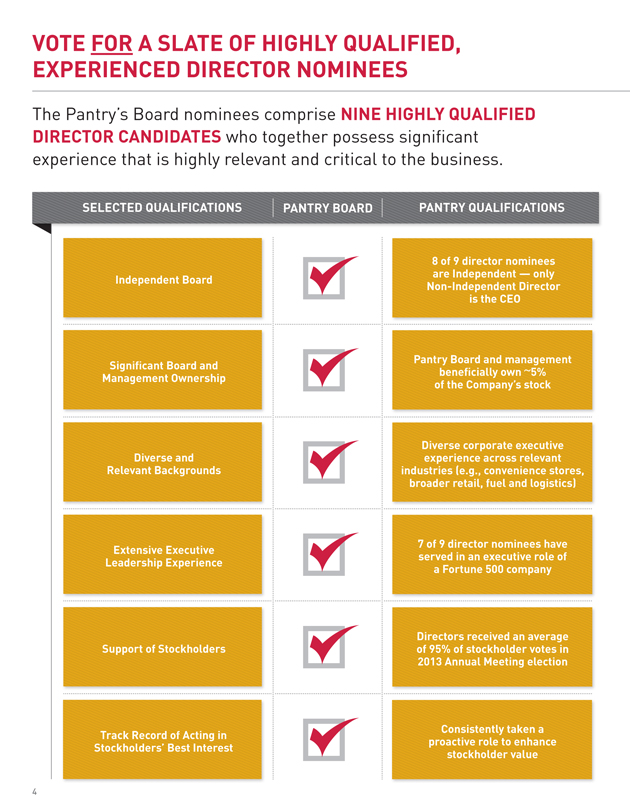

VOTE FOR A SLATE OF HIGHLY QUALIFIED, EXPERIENCED DIRECTOR NOMINEES

The Pantry’s Board nominees comprise NINE HIGHLY QUALIFIED DIRECTOR CANDIDATES who together possess significant experience that is highly relevant and critical to the business.

SELECTED QUALIFICATIONS PANTRY BOARD PANTRY QUALIFICATIONS

8 of 9 director nominees

Independent Board

are Independent - only

Non-Independent Director

is the CEO

Pantry Board and management

Significant Board and

beneficially own ~5%

Management Ownership

of the Company’s stock

Diverse corporate executive

Diverse and

experience across relevant

Relevant Backgrounds

industries (e.g., convenience stores,

broader retail, fuel and logistics)

Extensive Executive

7 of 9 director nominees have

Leadership Experience

served in an executive role of

a Fortune 500 company

Directors received an average

Support of Stockholders

of 95% of stockholder votes in

2013 Annual Meeting election

Track Record of Acting in

Consistently taken a

Stockholders’ Best Interest

proactive role to enhance

stockholder value

4

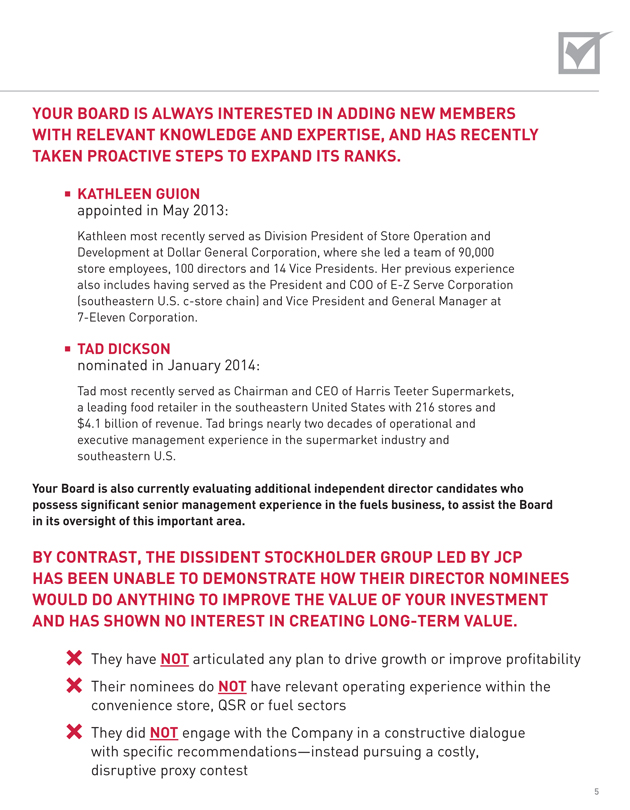

YOUR BOARD IS ALWAYS INTERESTED IN ADDING NEW MEMBERS WITH RELEVANT KNOWLEDGE AND EXPERTISE, AND HAS RECENTLY TAKEN PROACTIVE STEPS TO EXPAND ITS RANKS.

KATHLEEN GUION

appointed in May 2013:

Kathleen most recently served as Division President of Store Operation and

Development at Dollar General Corporation, where she led a team of 90,000

store employees, 100 directors and 14 Vice Presidents. Her previous experience

also includes having served as the President and COO of E-Z Serve Corporation

(southeastern U.S. c-store chain) and Vice President and General Manager at

7-Eleven Corporation.

TAD DICKSON

nominated in January 2014:

Tad most recently served as Chairman and CEO of Harris Teeter Supermarkets,

a leading food retailer in the southeastern United States with 216 stores and

$4.1 billion of revenue. Tad brings nearly two decades of operational and

executive management experience in the supermarket industry and

southeastern U.S.

Your Board is also currently evaluating additional independent director candidates who possess significant senior management experience in the fuels business, to assist the Board in its oversight of this important area.

BY CONTRAST, THE DISSIDENT STOCKHOLDER GROUP LED BY JCP HAS BEEN UNABLE TO DEMONSTRATE HOW THEIR DIRECTOR NOMINEES WOULD DO ANYTHING TO IMPROVE THE VALUE OF YOUR INVESTMENT AND HAS SHOWN NO INTEREST IN CREATING LONG-TERM VALUE.

They have NOT articulated any plan to drive growth or improve profitability

Their nominees do NOT have relevant operating experience within the convenience store, QSR or fuel sectors

They did NOT engage with the Company in a constructive dialogue with specific recommendations-instead pursuing a costly, disruptive proxy contest

5

VOTE FOR SOLID

FINANCIAL PERFORMANCE AND SIGNIFICANT

EARNINGS UPSIDE

The Pantry’s most recent earnings results indicate

that its strategy is taking hold. Among other things,

the Company’s achievements included:

Upward trend in merchandise same-store sales with the

latest quarter showing the largest increase since Q3 2012;

Rapid growth in proprietary food service revenue; and

Implementation of management disciplines and technology

to aggressively address our fuel market share underperformance

The Pantry is solidly positioned to continue delivering

results and create value for all stockholders.

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN

If you have questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies:

INNISFREE M&A INCORPORATED

Stockholders Call Toll-Free: (888) 750-5834 Banks and Brokers Call Collect: (212) 750-5833

REMEMBER:

We urge you NOT to sign any Gold proxy card sent to you by JCP Investment Management, LLC. If you have already done so, you have every right to change your vote by signing, dating and returning the enclosed WHITE proxy card TODAY in the postage-paid envelope provided. If you hold your shares in Street-name, your custodian may also enable voting by telephone or by Internet-please follow the simple instructions provided on your WHITE proxy card.