- AVB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

AvalonBay Communities (AVB) 8-KFinancial statements and exhibits

Filed: 19 Jun 02, 12:00am

Exhibit 99.2

Planned Evolution

Customer Evolution

Knowing and Serving Our Customer

• Projected growth from “empty nester” baby boomers and

“echo-boomers”

![]()

1

Planned Evolution

Outsized Performance

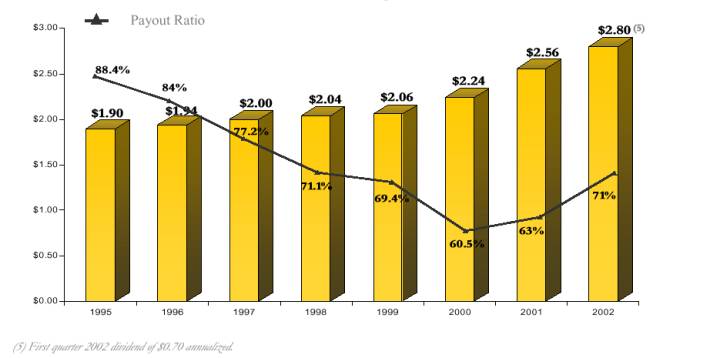

Dividends - Safety and Growth

![]()

2

Market Research: Application

Short-Term

Corporate Profits % Change vs. Year Ago

3

Market Research: Application

Short-Term

Consumer Confidence

4

Market Research: Application

Short-Term

GDP Growth

![]()

5

Market Research: Application

Short-Term

Annual Employment Growth

6

Market Research: Application

Short-Term

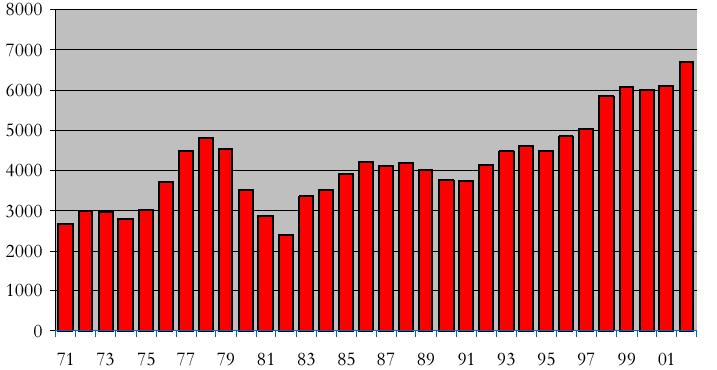

Single-Family Home Sales

7

Market Research: Application

Short-Term

New Supply as a % Total Inventory

8

Market Research: Application

Short-Term

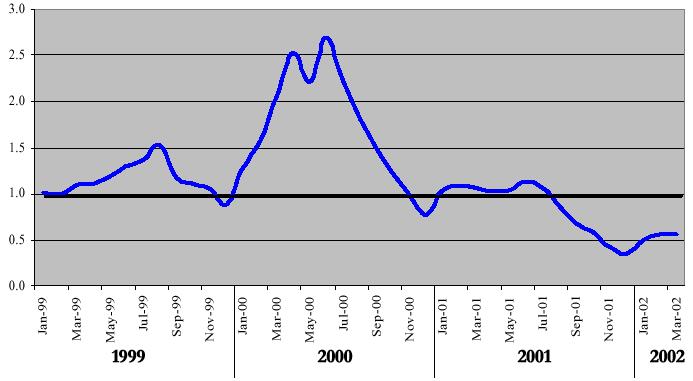

Demand/Supply Ratio

9

Market Research: Application

Short-Term

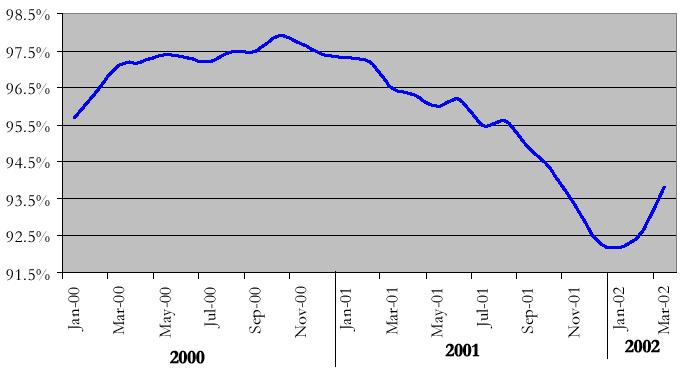

Occupancy (REIS)

10

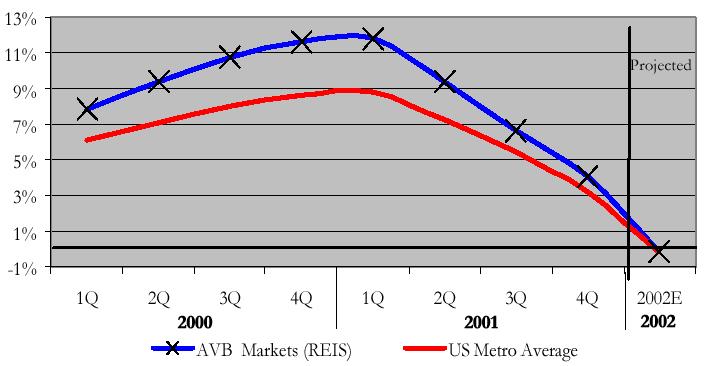

Market Research: Application

Short-Term

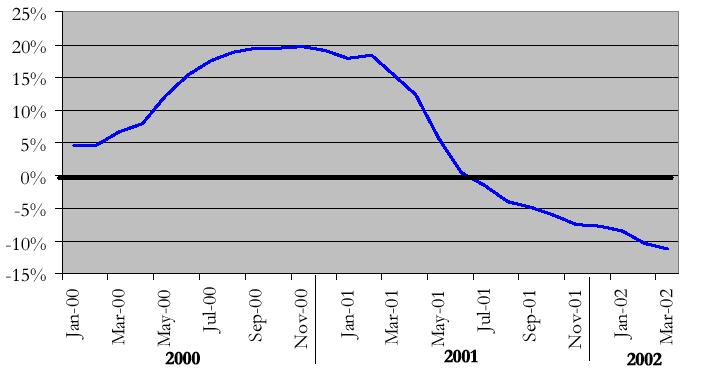

Annualized Rental Rate Growth (REIS)

11

Market Research: Application

Short-Term

Traffic/Available Homes

![]()

12

Market Research: Application

Short-Term

Economic Occupancy

![]()

13

Market Research: Application

Short-Term

Market Rent Growth

![]()

14

Market Research: Application

Longer-Term

Average Annual Employment Growth (1998 – 2003)

Source: Economy.com (non-farm, non-construction employment)

![]()

15

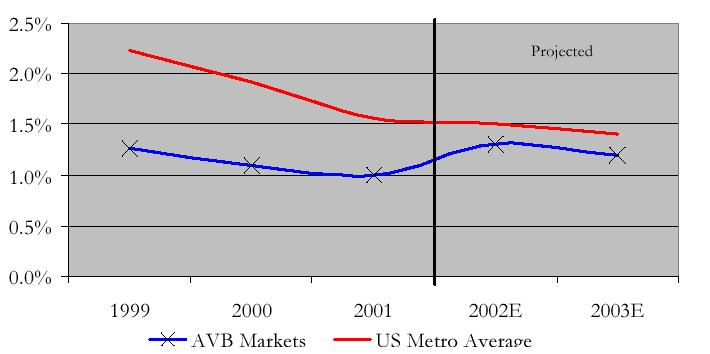

Market Research: Application

Longer-Term

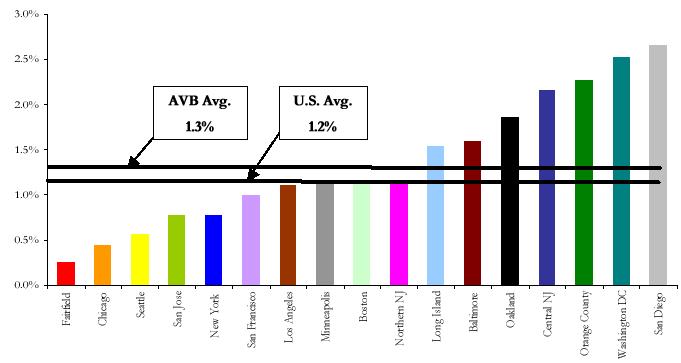

Completions as % of Inventory (1998-2003)

Defined as New Supply as % Total Apartment Inventory

Source: Reis Reports/AVB

![]()

16

Market Research: Application

Longer-Term

Demand/Supply (1998 – 2003)

Source: REIS, Economy.com, AVB

D/S= (Household Growth/Employ. Growth) x Employ. ) / New Supply

![]()

17

Market Research: Application

Longer-Term

Housing Affordability (4Q01)

Source: NAHB. Based on % of households that can afford median sales price.

![]()

18

Market Research: Application

Longer-Term

Market Rent Growth (1998 – 2003)

Source: REIS Reports

![]()

19

AVB Resident Profile

73% of Residents in $50,000+ Income Bracket

Household Income |

| Percent |

|

< $25,000 |

| 7% |

|

$25,000 - $49,999 |

| 20% |

|

$50,000 - $74,999 |

| 24% |

|

$75,000 - $99,999 |

| 20% |

|

$100,000 or more |

| 29% |

|

![]()

20

What is the right approach at AVB?

| Ø | Operating Excellence is our Competitive Advantage |

|

|

|

| |

Ø | Operating Excellence will Maximize Shareholder Value |

| |

|

|

| |

Ø | Customer Knowledge and Service fall within Operating Excellence |

|

![]()

21

What is the right approach at AVB?

|

|

|

|

| Where we want to be |

| |

|

|

|

![]()

22

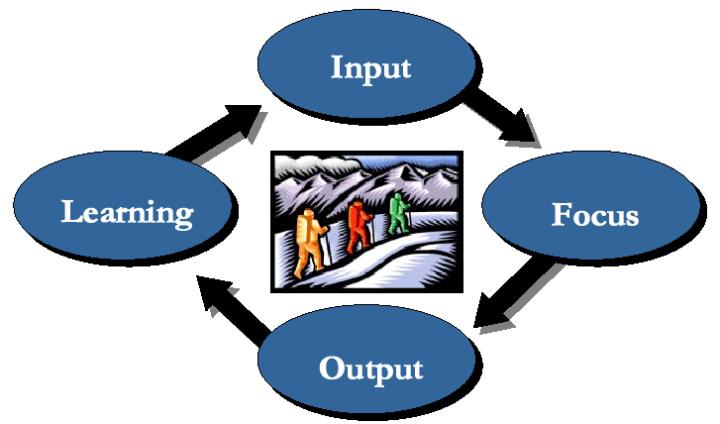

The Customer Focus Journey

![]()

23

How will this affect our Residents?

Customer Focus |

| Emotional Bond with Brand |

| Customer |

|

![]()

24

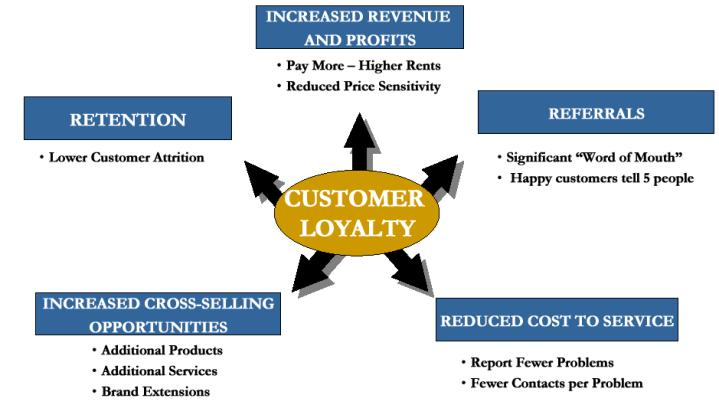

How will Customer Focus benefit AVB?

![]()

25

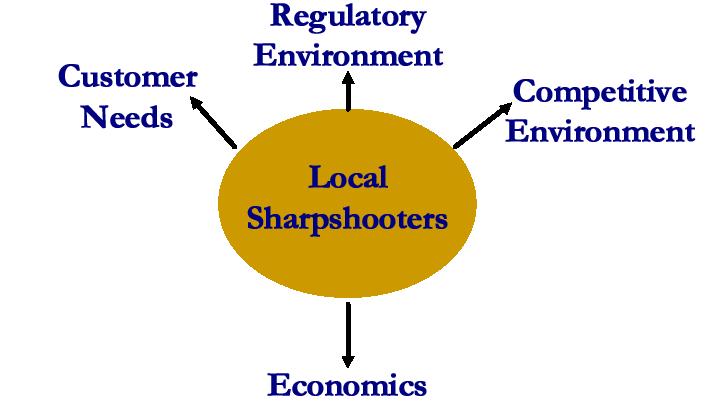

Decentralized Execution

![]()

26

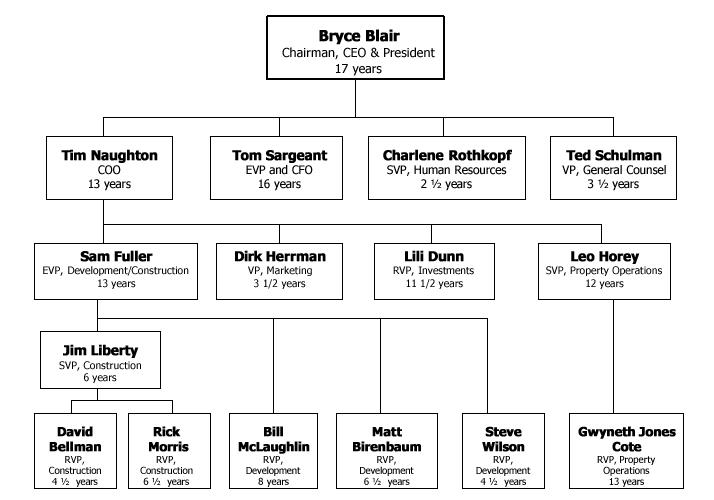

Experienced Management Team

![]()

27

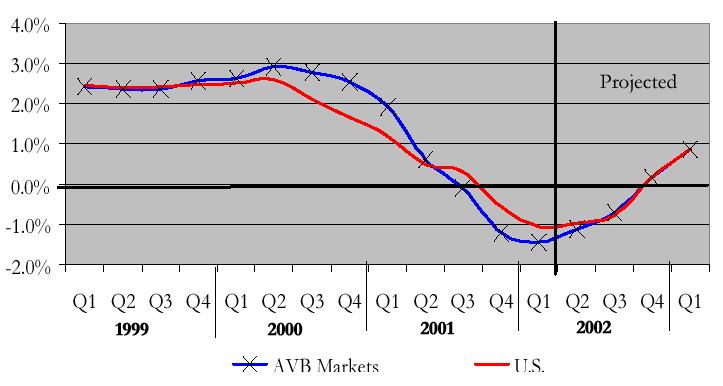

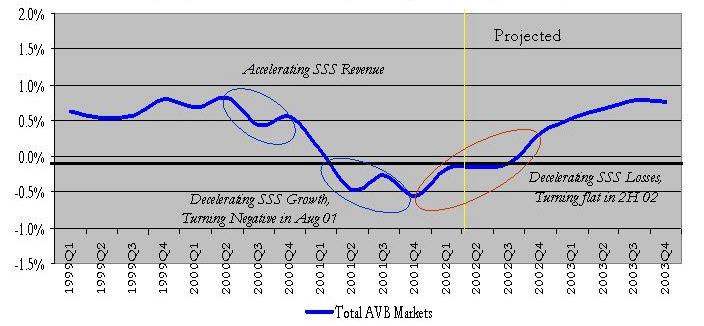

Business Update

Market & Operating Trends

Employment Growth (by sequential quarter)

1999 | 2000 | 2001 | 2002 | 2003

![]()

28

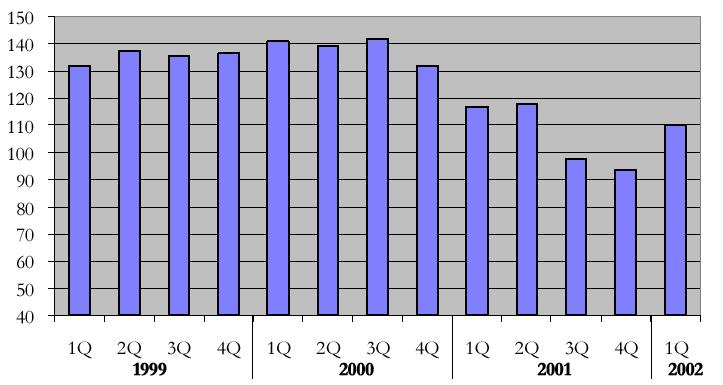

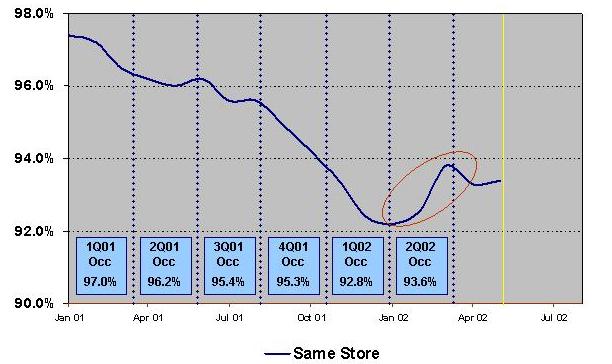

Business Update

Average Economic Occupancy

![]()

29

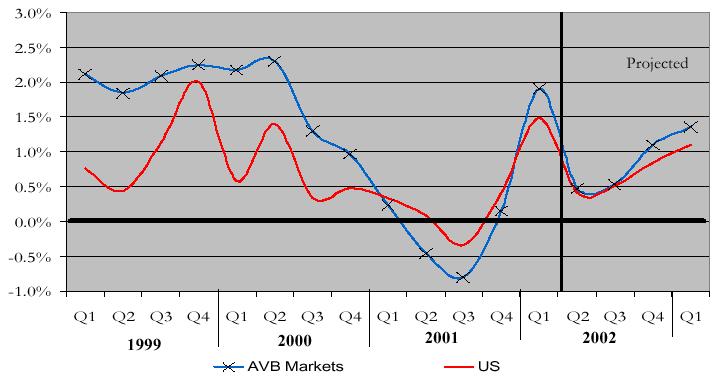

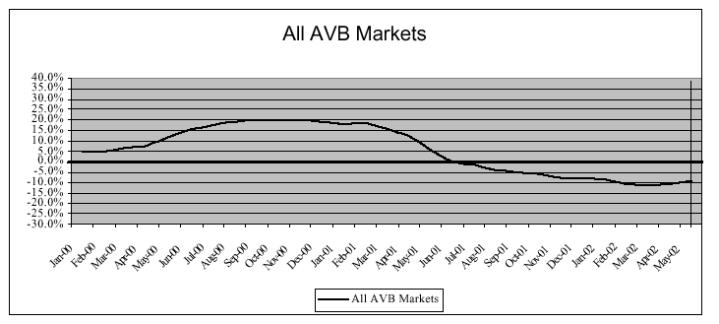

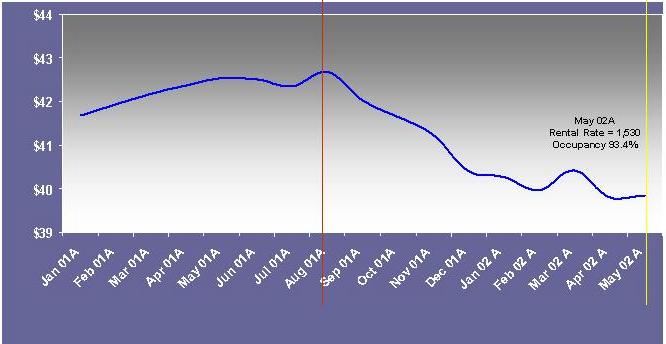

Business Update

Annual Market Rent Growth

May 2002

![]()

30

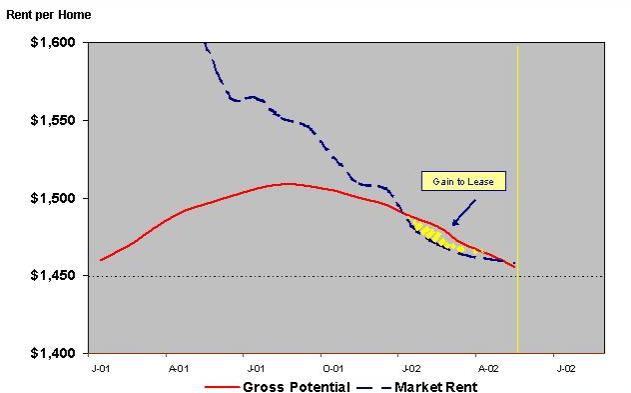

Business Update

Market Rent & Gross Potential Per Apt

![]()

31

Business Update

Same Store Revenue

Historical

$ Millions per month

![]()

32