Albemarle Corporation Supplement to 8-K Filed Jan 9th, 2017 Key Terms of Albemarle’s Amended Lithium Production Rights Agreement (“Amended Agreement”) with the Chilean Economic Development Agency (“CORFO”) 1 Exhibit 99.1

Forward-Looking Statements 2 Some of the information in these materials, including, without limitation, Albemarle Corporation’s performance in connection with, resources available pursuant to, or costs or obligations in connection with, the amended agreement, product development, and all other information relating to matters that are not historical facts may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. There can be no assurance that actual results will not differ materially. Factors that could cause actual results to differ materially include, without limitation, any of those described under "Risk Factors" in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this presentation. We assume no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws.

Key Terms of the Amended Agreement1 • Provides for a new quota that, in combination with the original quota, allows Albemarle Corporation (“Albemarle”) to produce more than 80,000 metric tons of lithium carbonate equivalent (LCE) on an annual basis through 2043. • Albemarle agrees to invest in a third lithium carbonate plant in Chile with production capacity of at least 20,000-24,000 metric tons/year. Albemarle expects this plant to be completed by early 2020. • Provides for an additional quota to feed a lithium hydroxide plant with production capacity of at least 5,000 metric tons/year should Albemarle construct a lithium hydroxide plant in Chile. • Royalties or "commissions" will be paid to the Chilean Economic Development Agency (“CORFO”) on every ton of product sold from Chilean production according to the schedule on Slide 4. • Over half of Albemarle's original quota of 200,000 metric tons of equivalent metallic lithium remains as of January 1st, 2017. Commencing on January 1, 2017, and continuing for approximately 5 years, Albemarle will pay a commission on the production still remaining under the original quota, Thereafter, Albemarle will no longer pay any commissions on the lithium produced at the original 24,000 MT carbonate plant, allowing Albemarle to produce the then-remaining metric tons of the original quota on a commission-free basis as per the terms of the original agreement with CORFO. • If Chile develops a local downstream industry that requires battery grade lithium salts, Albemarle agrees to allocate a portion of its production of those salts for sale to those local downstream producers at price that is tied to Albemarle's export sales price, essentially a “most favored nation's clause.” Initially the volume would be capped at 15% of Albemarle's annual production, with that percentage growing over time to a cap of 25%. This provision would not be applicable to companies that produce lithium salts in Chile. • A portion of the commissions will be paid into a fund that will be used to develop R&D to benefit the Atacama, the country of Chile, and local industry. • Albemarle makes certain commitments to the local communities in the Atacama to use in local development projects equal to 3.5% of sales from Chilean production. • Total payments in 2017 are expected to be less than $50 million. Proprietary Information of Albemarle Corporation 3 The terms of the Amended Agreement are consistent with: 1) the terms outlined in the MOU2 announced February 1st, 2016. 2) Albemarle’s initial 2017 guidance for strong Lithium growth with Adjusted EBITDA margins >40%. 1 Amended Lithium Production Rights Agreement between Albemarle and CORFO, announced January 4th, 2017. 2 Memorandum of Understanding with the Chilean Government (announced Feb 1st, 2016).

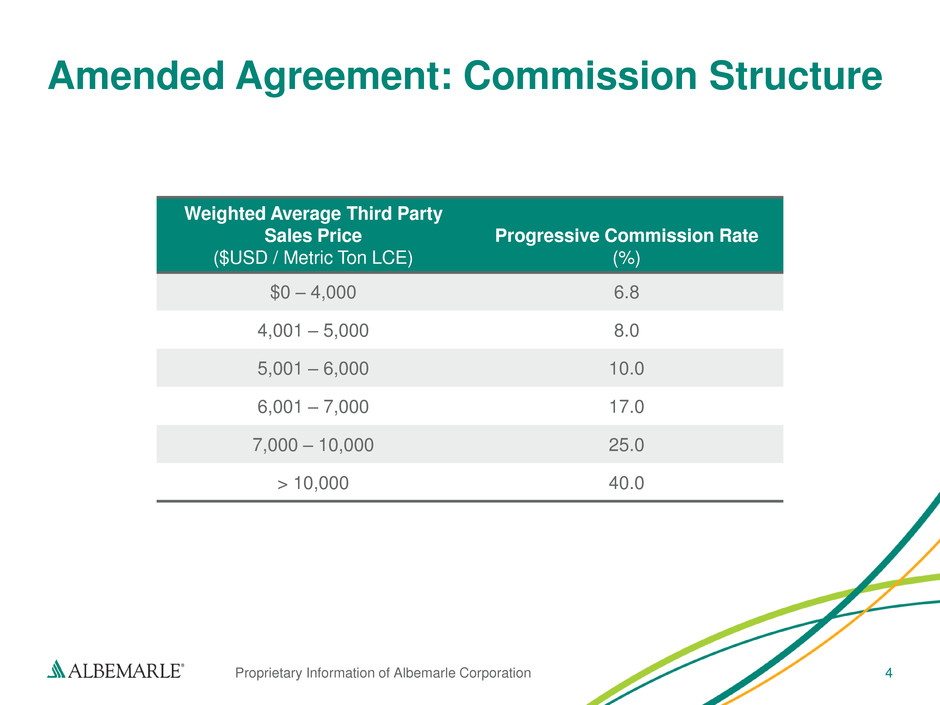

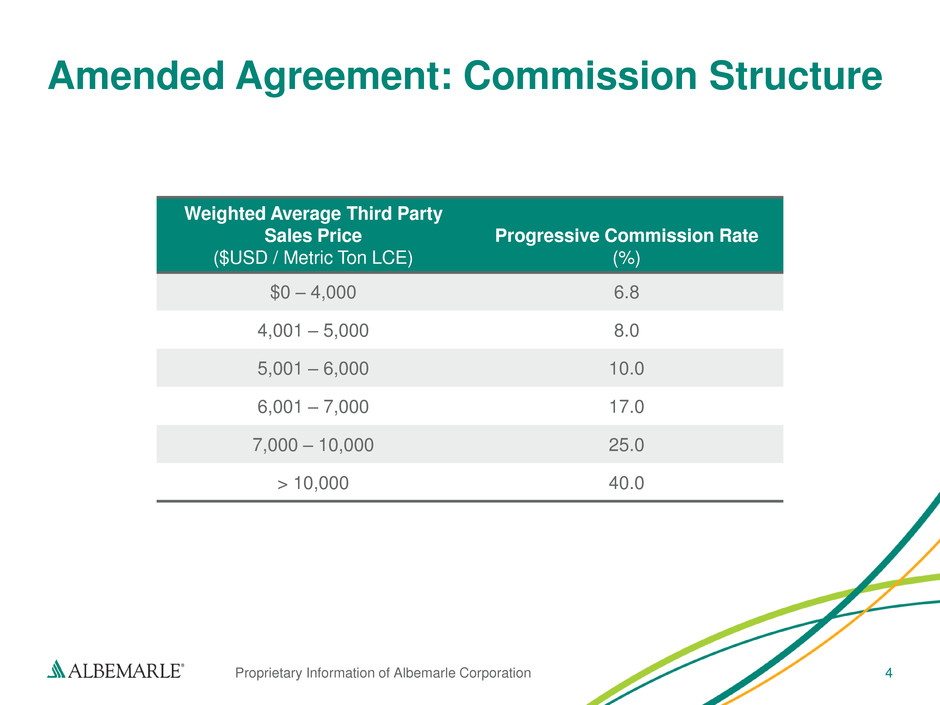

Amended Agreement: Commission Structure Proprietary Information of Albemarle Corporation 4 Weighted Average Third Party Sales Price ($USD / Metric Ton LCE) Progressive Commission Rate (%) $0 – 4,000 6.8 4,001 – 5,000 8.0 5,001 – 6,000 10.0 6,001 – 7,000 17.0 7,000 – 10,000 25.0 > 10,000 40.0

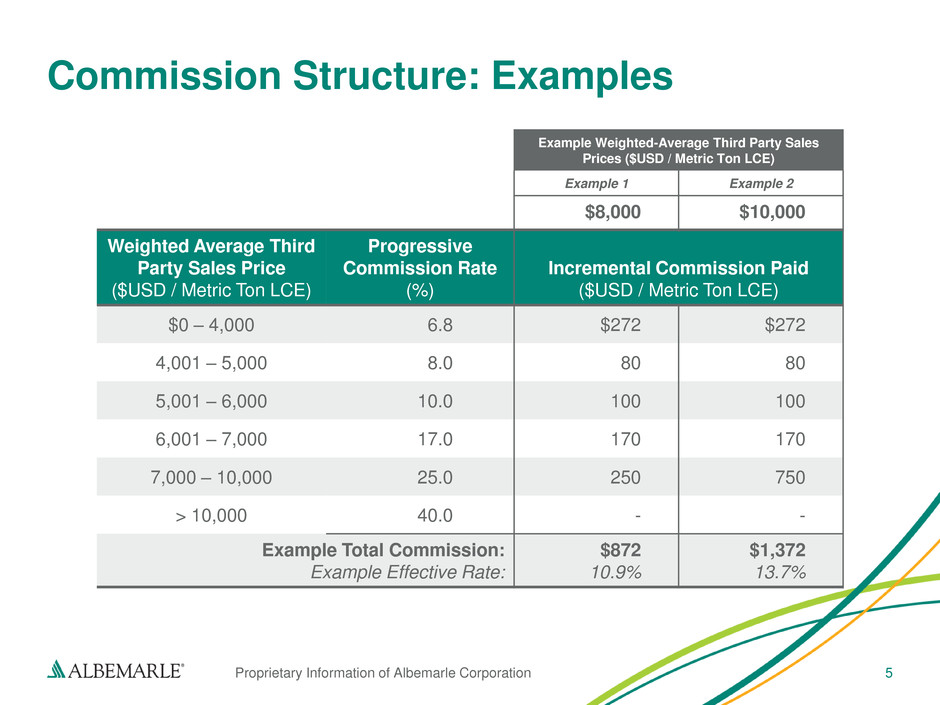

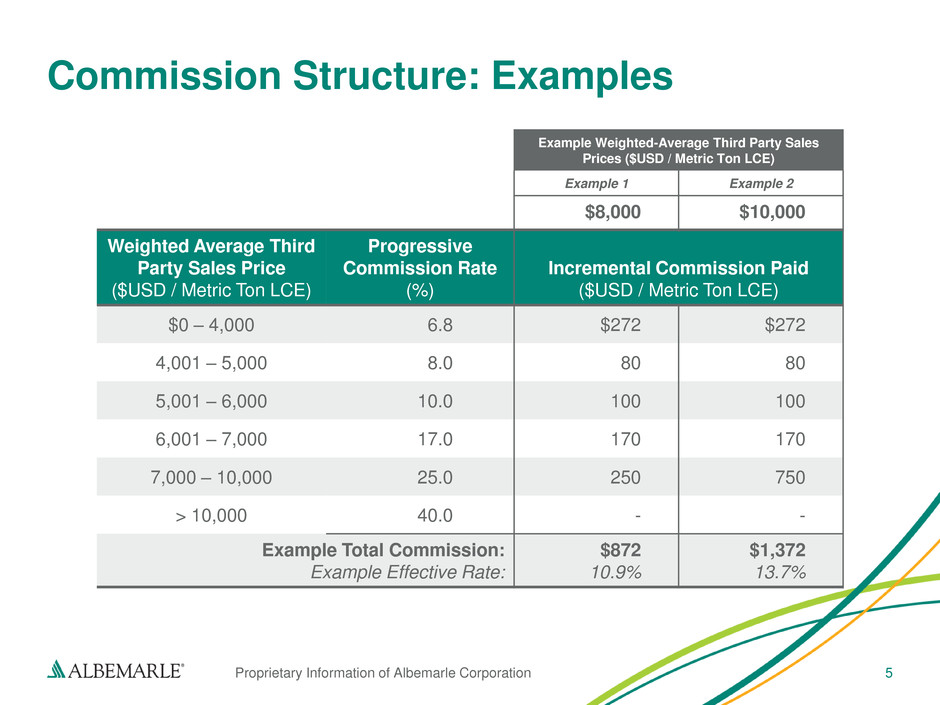

Commission Structure: Examples Proprietary Information of Albemarle Corporation 5 Weighted Average Third Party Sales Price ($USD / Metric Ton LCE) Progressive Commission Rate (%) Incremental Commission Paid ($USD / Metric Ton LCE) $0 – 4,000 6.8 $272 $272 4,001 – 5,000 8.0 80 80 5,001 – 6,000 10.0 100 100 6,001 – 7,000 17.0 170 170 7,000 – 10,000 25.0 250 750 > 10,000 40.0 - - Example Total Commission: Example Effective Rate: $872 10.9% $1,372 13.7% Example Weighted-Average Third Party Sales Prices ($USD / Metric Ton LCE) Example 1 Example 2 $8,000 $10,000

6 www.albemarle.com