December 1, 2022

Ken Schuler and Craig Arakawa

Division of Corporation Finance

Office of Industrial Applications and Services

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: Albemarle Corporation

Form 10-K for Fiscal Year Ended December 31, 2021

Filed February 22, 2022

File No. 001-12658

Dear Mr. Schuler and Mr. Arakawa:

We are responding to the comments received from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission” or the “SEC”) by letter dated November 3, 2022 (the “November Comment Letter”) in connection with the Annual Report on Form 10-K of Albemarle Corporation (the “Company” or “we” or “us” or “our”) for the fiscal year ended December 31, 2021, filed on February 22, 2022 and amended on March 2, 2022 (the “2021 Form 10-K”).

For your convenience, the numbered responses of the Company and related captions contained in bold-type in this letter correspond to the numbered paragraphs and related captions in the November Comment Letter. The questions are followed by the Company’s response thereto.

2021 Form 10-K

Mineral Properties, page 24

1. We note your responses to comments 1 through 4, 6 and 7 indicating you will revise your disclosures in your Form 10-K for the year ended December 31, 2022 and associated exhibits to comply with these comments. Due to the number of modifications to bring your filing to minimal compliance with Item 1300 of Regulation S-K, please amend your Form 10-K for the fiscal year ended December 31, 2021 to include your proposed revisions. Please revise to provide the:

•production disclosure proposed in your response to comment 1,

•resources disclosure proposed in your response to comment 2,

•resource and reserve disclosure proposed in your response to comment 3,

•metric tonne disclosure proposed in your response to comment 4,

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 2

•attributable resources and reserves disclosure proposed in your response to comment 6, and

•disclosure of key assumptions such as cutoff grade, price, and operating costs proposed in your response to comment 7.

For each of the revisions made in response to the aforementioned prior comments, please

also identify for us the location of the respective revisions made in your amended filing.

Response

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, an amendment to the 2021 Form 10-K (the “Form 10-K/A”) that includes the revisions proposed in the Company’s October 12, 2022 letter to the Staff (the “October Response Letter”) that are referenced in the first comment of the November Comment Letter. Concurrently with filing the Form 10-K/A, the Company will file a supplementary response to the November Comment Letter identifying the location of the revisions made in the Form 10-K/A. The Company considered these matters in preparing its original disclosures, but based on its initial interpretation of Item 601(b)(96) and subpart 1300 of Regulation S-K (the “Mining Disclosure Rules”), the Company determined that this information was not material and did not appear relevant to the Company’s business (e.g., since several of its larger extraction sites, such as the Dead Sea, are not traditional mines). However, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will file the Form 10-K/A to make the revisions.

Greenbushes, Australia, page 30

2. We note your response to comment 5 stating in future filings you will include some of the information presented. Please amend your Form 10-K for the year ended December 31, 2021 and associated exhibits to include this explanation, disclose your cutoff grade calculation as an incremental or marginal cutoff grade and discuss the variance in sustaining capital as used in the cutoff grade compared to the resultant sustaining capital estimate found in Section 18.

Response

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, the Form 10-K/A and a revised technical report for the Company’s Greenbushes property that disclose the cutoff grade calculation as an incremental or marginal cutoff grade and discuss the variance in sustaining capital as used in the cutoff grade compared to the resultant sustaining capital estimate found in Section 18 of such technical report. These revisions reflect information that the Company did not include in its original disclosures based on its initial interpretation of the Mining Disclosure Rules and that does not materially change the Company’s overall disclosures; however, the Company acknowledges the SEC’s interpretation of the Mining Disclosure Rules during the first year of their application and will file the Form 10-K/A and revise the technical report to make the revisions.

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 3

9A. Controls and Procedures, page 127

3. In light of the revisions to your S-K 1300 disclosures and related technical reports, please reassess your conclusion that your disclosure controls and procedures were effective as of December 31, 2021.

Response

The Company advises the Staff that it has reassessed its conclusion that its disclosure controls and procedures were effective as of December 31, 2021. As part of this reassessment, the Company’s management carefully considered a number of factors, including established Commission guidance on such controls and procedures, the overall design of the Company’s disclosure controls and procedures, and the information contained in the 2021 Form 10-K and related technical reports in relation to the comments raised by the Staff. Following this reassessment and as further described below, the Company’s management concluded that the Staff comments were reflective of conscious decisions made within the framework of the Company’s disclosure controls and procedures during the first year of compliance with the Mining Disclosure Rules rather than material errors or substantive omissions. The Company’s disclosure decisions were based upon its interpretations of the Mining Disclosure Rules and resulted from, among other things, consultation with two third-party experts which were each assisting numerous other companies in complying with the Mining Disclosure Rules during their first year of application as well as the Company’s participation in roundtable discussions with other registrants with mining operations. Additionally, the Company’s management believes that the additional information to be included in the Form 10-K/A and revised technical reports requested by the Staff on the whole constitutes useful information, but that such information does not materially change the Company’s overall disclosures. As a result, the Company’s management again reached the conclusion that the Company’s disclosure controls and procedures were effective as of December 31, 2021.

Rule 13a-15 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires issuers to maintain disclosure controls and procedures and requires each issuer’s management to evaluate the effectiveness of the issuer’s disclosure controls and procedures as of the end of each fiscal quarter. In the Adopting Release for Rule 13a-15 (Certification of Disclosure, SEC Release No. 33-8124; 34-46427, August 29, 2002), the Commission noted that Rule 13a-15 “require[s] an issuer to maintain disclosure controls and procedures to provide reasonable assurance that the issuer is able to record, process, summarize and report the information required in the issuer’s Exchange Act reports.” The Commission stated that these disclosure controls and procedures should: (i) “ensure timely collection and evaluation of information potentially subject to disclosure” under the requirements of Regulation S-K and other Exchange Act rules; (ii) “capture information that is relevant to an assessment of the need to disclose developments and risks that pertain to the issuer’s businesses”; and (iii) “cover information that must be evaluated in the context of the disclosure requirement of Exchange Act Rule 12b-20.” Further, the Staff has recognized that the effectiveness of internal control systems is subject to inherent limitations, including the exercise of judgment (Commission Guidance Regarding Management’s Report on Internal Control Over Financial Reporting Under Section 13(a) or 15(d) of the Securities Exchange Act of 1934,

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 4

SEC Release No. 33-8810, 34-55929, June 27, 2007). In reassessing its disclosure controls and procedures, which are described further below, the Company did not find any failure in the timely collection and evaluation of information subject to disclosure under the Exchange Act, the capture of information relevant to assessing the need to disclose business developments and risks, or covering information that must be evaluated in the context of Rule 12b-20. Instead, the Company found that the Staff’s comments were generally reflective of conscious decisions and the exercise of judgment by the Company in preparing its disclosures called for by the Mining Disclosure Rules during their first year of application. The Company believes these decisions and judgments are an inherent part of all disclosure controls and procedures and are not evidence of the Company’s disclosure controls and procedures failing to provide reasonable assurance in meeting their objectives.

The Company’s disclosure controls and procedures are designed with numerous protocols and features the Company believes provide reasonable assurance that information required to be disclosed is reported accurately and in a timely fashion:

•The Company’s SEC reporting team is responsible for gathering information for and preparing Exchange Act reports. The SEC reporting team utilizes disclosure checklists to ensure the appropriate information is included in such reports and regularly meets internally and with third-party experts, including the Company’s outside legal counsel and the qualified persons described below, to discuss the Exchange Act reports, ensure that the Exchange Act reports include all required information, and update the Exchange Act reports based on discussion and input from the Company’s Disclosure Committee and third-party experts.

•The Company’s Disclosure Committee, which includes the Company’s Chief Financial Officer and Chief Accounting Officer, as well as members of the Company’s Finance, Legal and Tax teams and representatives of each global business unit, meets on a quarterly basis and more frequently as appropriate to review the information included in the Company’s Exchange Act reports and discuss particular items and disclosure topics. The variety of expertise represented on the Disclosure Committee is in recognition of the wide variety of subject matters that are addressed in Exchange Act reports. Additionally, the Disclosure Committee’s process is reviewed by the Company’s Director of Controls and Audit.

•Material disclosure items noted by the Disclosure Committee are discussed with the Company’s Board of Directors and/or Audit and Finance Committee, as appropriate.

The Company believes its preparation for compliance with the Mining Disclosure Rules was thorough and appropriately conducted within the framework of its disclosure controls and procedures. The process of preparing the 2021 Form 10-K and related technical reports included, among other things, the following:

•Engaging SRK Consulting (U.S.), Inc. (“SRK”) and RPS Energy Canada Ltd. and RESPEC Consulting Inc. (together, “RPS”) in early 2020 to begin preparing the technical reports. The

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 5

Company selected SRK and RPS as qualified persons (“QPs”) on the basis of their experience with hard rock and solution mining, their experience with lithium, their experience working with U.S. public companies on Exchange Act disclosures, their experience with compliance under other CRIRSCO-based mining codes (including Australia, Chile, and Canada), and their internal controls and processes to support sufficient and appropriate disclosures. Additionally, SRK and RPS were already familiar with the Company’s operations from prior engagements.

•Meeting with representatives of SRK and RPS hundreds of times over approximately two years in developing disclosures under the Mining Disclosure Rules. The Company’s participants in such meetings included representatives from its various business units, Lithium and Bromine Resource Development teams, SEC reporting team, internal audit team and in-house legal department. With respect to disclosure controls and procedures, these meetings addressed oversight of the QPs to ensure their processes and procedures were appropriately applied, review of proposed disclosures, review of the QPs’ Mining Disclosure Rules checklists, discussion regarding the QPs’ recommendations on disclosures, and ensuring that information that was included in the 2021 Form 10-K and related technical reports was both material and relevant to the Company’s business.

•Discussing with the QPs as to how their other clients were responding to the new Mining Disclosure Rules to ensure that the Company’s disclosures would be consistent with industry practice. The Company’s management also participated in several industry roundtables in which the Mining Disclosure Rules and the underlying disclosure controls and procedures were discussed.

In light of its reassessment of its disclosure controls and procedures, including their application to the Mining Disclosure Rules, the Company does not believe that the Staff’s comments are indicative of ineffective disclosure controls and procedures. The Company is committed to best practices in its public disclosures and, as a result, will defer to and accommodate the Staff’s positions, but the Company does not believe that any such deference or accommodation indicates a failure of its disclosure controls and procedures in preparing the original disclosures or an acknowledgment that the additional information to be included in the Form 10-K/A or revised technical reports constitutes material information that was omitted by the Company.

In reviewing the Staff’s comment letter of September 14, 2022 (the “September Comment Letter”), the Company found it helpful to categorize the Staff’s comments regarding the Mining Disclosure Rules into roughly four categories as described further below: (i) matters of interpretation of the new rules in their first year of application, (ii) the deliberate exclusion of information the Company did not consider to be material and did not appear relevant to its business, (iii) requests for additional explanation or information that the Company did not include in its original disclosures based on its initial interpretation of the Mining Disclosure Rules, and (iv) minor deviations from the Mining Disclosure Rules made in the exercise of the Company’s judgment as to disclosure most fitting for its particular business and which do not render the related disclosures inadequate or misleading.

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 6

(i)The following issues were evaluated by the Company in preparing its original disclosures and reflect its initial interpretation of the Mining Disclosure Rules:

othe Company interpreted the requirement to disclose aggregate annual production to mean all properties’ production of a product rather than the aggregate production of each individual site (comment 1 in the September Comment Letter);

othe Company provided information regarding its attributable ownership in footnotes and narrative disclosure rather than in tables reporting resources and reserves (comments 3, 6, 12, and 13 in the September Comment Letter);

ocertain QP opinions were not explicitly included in technical reports where the Company believed that the QP’s satisfactory view of the subject matter could have been inferred from the report (comments 20, 24, 25, 26, and 27 in the September Comment Letter); and

othe Company did not interpret the rule regarding market studies in a technical report to require a particular amount of information, including a five-year historical review of commodity price (comment 29 in the September Comment Letter).

These items were duly considered by the Company in preparing its disclosures and reflect the Company’s initial interpretation of the Mining Disclosure Rules in the first year of their application and are being amended based on further guidance and clarification of interpretation form the Staff. The Company therefore believes these issues reflect differing interpretations of the Mining Disclosure Rules and are not indicative of deficiencies in the Company’s disclosure controls and procedures.

(ii)The following information identified by certain comments in the September Comment Letter was not included in the 2021 Form 10-K and related technical reports because the Company, in consultation with its QPs, determined that the information was not material and did not appear relevant to the Company’s particular business:

oadditional detail regarding key assumptions and other information, such as cutoff grade, price, and operating costs, which information was otherwise available in the technical reports or did not materially affect the information presented (comment 7 in the September Comment Letter);

ocutoff grade estimates for the Company’s bromine properties, which were not considered material because the concentration of the brine significantly exceeded the applicable cutoff grade and since several of the Company’s larger extraction sites, such as the Dead Sea, are not traditional mines (comments 15, 17, and 19 in the September Comment Letter);

odefinitions of accuracy of capital and operating cost estimates with respect to the Company’s bromine operations, which do not alter the related economic analysis presented in the corresponding technical reports (comments 18 and 21 in the September Comment Letter);

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 7

ostratigraphic columns for deposits that are not stratigraphic in nature (comment 23 in the September Comment Letter); and

okey assumptions and material assumptions regarding capital and operating costs and economic analysis in technical reports, which do not affect the conclusions or disclosure with respect to such costs and economic analysis (comments 30 and 31 in the September Comment Letter).

Since the above items reflect judgments made by the Company after due consideration in preparing disclosures under the Mining Disclosure Rules for the first time, the Company does not believe that they are indicative of deficiencies in the Company’s disclosure controls and procedures.

(iii)The following comments in the September Comment Letter reflect requests for additional explanation or information that the Company did not include in its original disclosures based on its initial interpretation of the Mining Disclosure Rules:

othe request for additional documentation supporting certain components of the Company’s life of mine sustaining capital calculation (comment 5 in the September Comment Letter);

othe request for an explanation as to the difference in the mining cost presented in the Greenbushes technical report in the context of pit optimization compared to in the resource and reserve section (comment 10 in the September Comment Letter); and

othe request for annual numerical values for the Company’s life of mine production schedule to support the graphs provided in the corresponding sections of the technical reports (comment 28 in the September Comment Letter).

Since the above items do not represent information necessarily required by the Mining Disclosure Rules, based on the Company’s initial interpretation of such rules, the Company does not believe these items are indicative of deficiencies in its disclosure controls and procedures.

(iv)The following issues raised in the September Comment Letter identify minor deviations from the Mining Disclosure Rules that were made in the exercise of the Company’s judgment as to disclosure most fitting for the particular nature of its mining operations:

oin some cases, specific terminology prescribed by a rule was not used (e.g., proven or probable, or measured, indicated and/or inferred), although the Company nonetheless believes that the terminology used in the technical reports was effective in conveying the required information to investors given the nature of its extraction sites (comments 2, 6, 14, and 16 in the September Comment Letter); and

othe inclusion in certain technical reports of disclaimers by the QP, which the QP considered to be standard industry practice and which the Company does not believe

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 8

caused a substantive change to the reports (comment 22 in the September Comment Letter).

Since the Company duly considered the above issues in preparing its original disclosures, it does not believe that they are indicative of deficiencies in its disclosure controls and procedures.

Aside from the comments categorized above, which topics were consciously reviewed and considered by the Company in its preparation of its original disclosures, the September Comment Letter also: (i) identified an error in the presentation of expansionary capital, which the Company considers to have been immaterial in amount and which did not impact the related net economics and reserve statement (comment 11 in the September Comment Letter), and (ii) requested that the Company be consistent in reporting resources as million metric tonne units versus thousand metric tonne units across certain of its disclosures (comment 4 in the September Comment Letter). The Company does not consider either of these items to be material such that they may be indicative of deficiencies in its disclosure controls and procedures.

The Company respectfully notes that, given that in some cases multiple comments in the September Comment Letter pertain to a single issue, we believe that the actual number of comments in the September Comment Letter is not, in and of itself, indicative of significant disclosure deficiencies with respect to the 2021 Form 10-K and related technical reports.

Exhibits 96.1 Greenbush

Pit Optimization, page ET-115

4. We note your response to comment 10 providing an explanation to the variance between the cutoff estimation costs and the operating costs found in your technical report. Please amend your exhibit to include this explanation with your cutoff grade estimation costs.

Response

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, a revised technical report that includes the revisions proposed in the October Response Letter that are referenced in the fourth comment of the November Comment Letter. The Company believes these revisions provide additional background relating to the Company’s disclosures that the Company did not include in its original disclosures based on its initial interpretation of the Mining Disclosure Rules and does not materially change the Company’s overall disclosures; however, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will file the Form 10-K/A and revise the technical report to make the revisions.

Exhibits 96.1 Greenbush

Expansionary Capital Costs, page ET-208

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 9

5. We note your response to comment 11 stating you identified the errors in Tables 18-2 and 18-3. Please amend your exhibit and correct these tables.

Response

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, a revised technical report that includes the corrections proposed in the October Response Letter that are referenced in the fifth comment of the November Comment Letter. The Company acknowledges that this comment relates to erroneous disclosure, but believes that the errors were immaterial since they did not relate to the summary presentation of life of mine capital costs or impact the related net economics or reserve statement.

Exhibit 96.2 Wodgina

Mineral Resource and Mineral Reserve Estimates, page EU-10

6. We note your response to comment 12 stating in future filings you will disclose your resources and reserves based on your attributable ownership. Please amend your exhibits to report your resources and reserves based on your attributable ownership.

Response

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, a revised technical report that includes the revisions proposed in the October Response Letter that are referenced in the sixth comment of the November Comment Letter. The Company believes these revisions reflect differing interpretations of the Mining Disclosure Rules, as the Company described its percentage ownership of these sites in the 2021 Form 10-K and noted that the presentation of the resources and reserves were shown at 100%; however, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will revise the technical report to make the revisions.

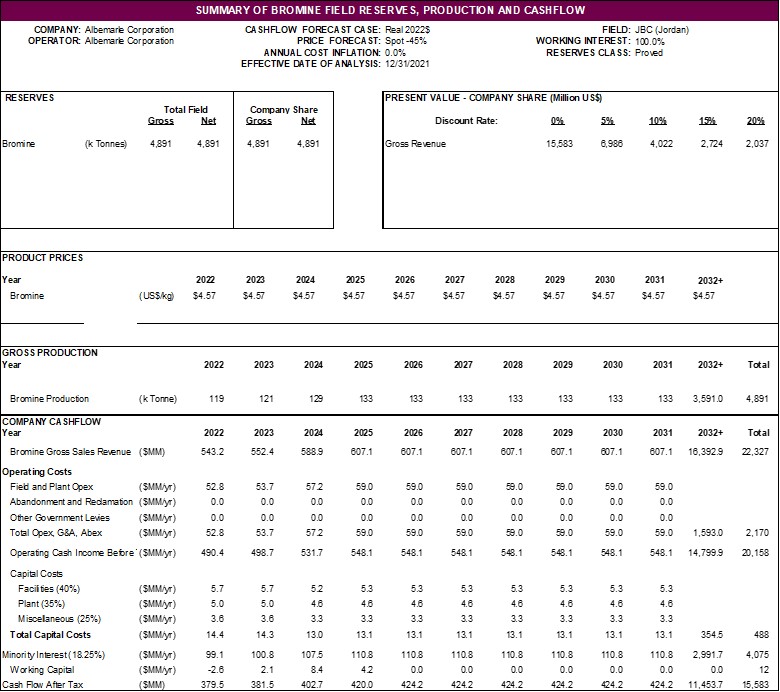

Exhibit 96.5 Jordan Bromine

Mineral Resource Estimates, page EX-8

7. We note your responses to comments 13 through 18 stating in future filings you will provide revised disclose in your technical report to comply with Item 1300 of Regulation S-K. Please amend your exhibit to:

•report your resources and reserves based on your attributable ownership in response to comment 13,

•report your measured, indicated and/or inferred mineral resources, specifying the volume, concentration, and contained bromine based on initial evaporation pond intake in response to comment 14,

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 10

•report your cut-off grade estimate for your resources with details about parameters, prices, and costs, similar to your example in response to comment 15,

•report the volume, concentration, and contained bromine of your reserves, similar to your example in response to comment 16,

•report your cut-off grade estimate for your reserves with details about parameters, prices, and costs in response to comment 17, and

•provide the additional disclosure regarding capital, operating costs estimates, and accuracy in response to comment 18.

Please also identify for us the location of the respective revisions made to your amended exhibit.

Response

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, a revised technical report that includes the revisions proposed in the October Response Letter that are referenced in the seventh comment of the November Comment Letter. Concurrently with filing the revised technical report, the Company will file a supplementary response to the November Comment Letter identifying the location of the revisions made in the technical report. As noted previously, the Company believes that these revisions reflect differing interpretations of the Mining Disclosure Rules, information that is not material and did not appear relevant to the Company’s business, or minor deviations from the rules made in the exercise of the Company’s judgment, and do not materially change the Company’s overall disclosures; however, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will file a revised technical report to make the revisions.

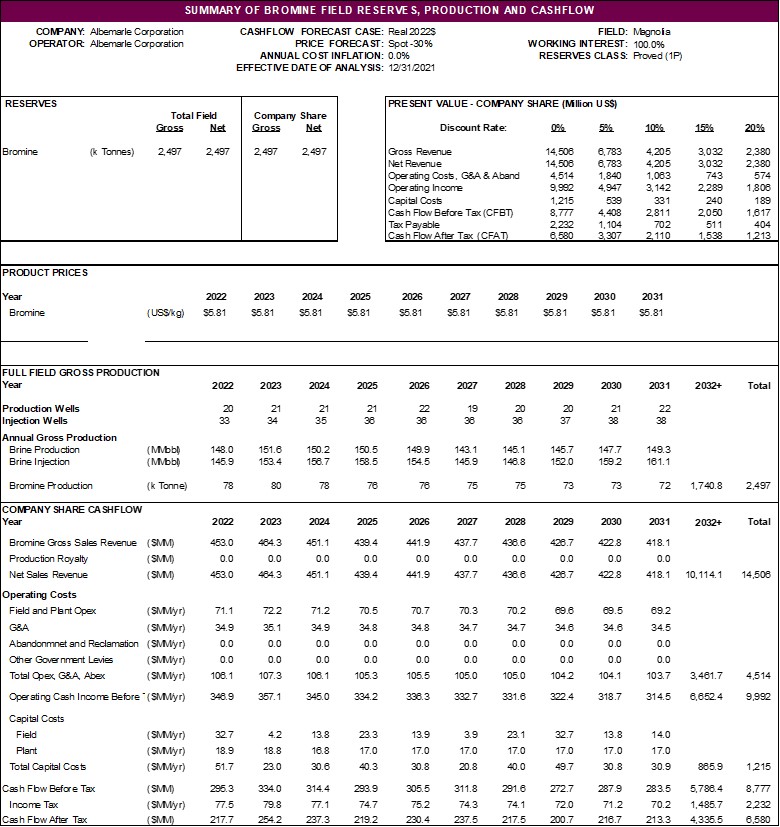

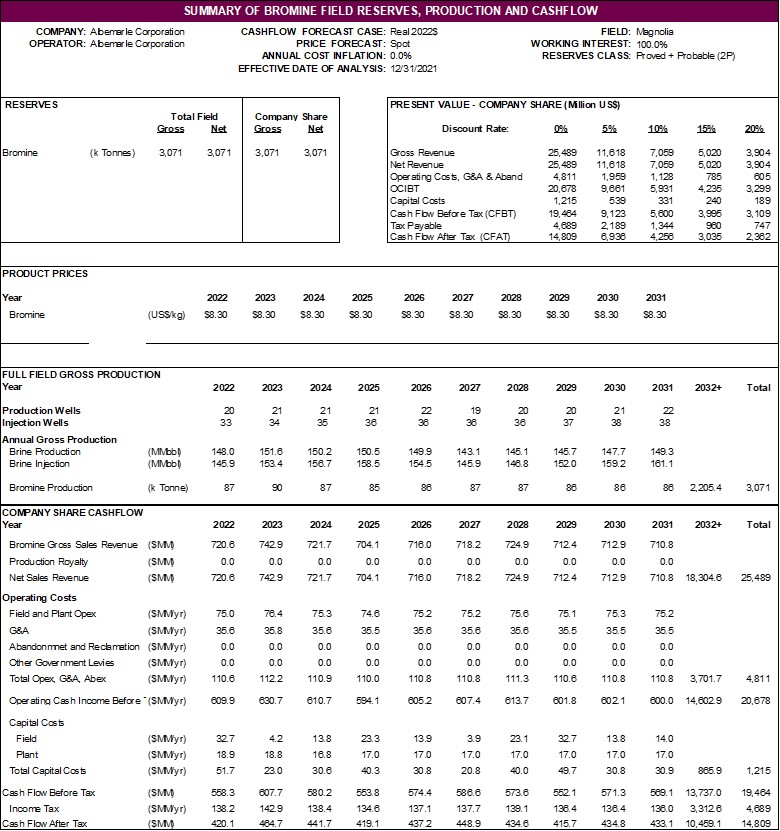

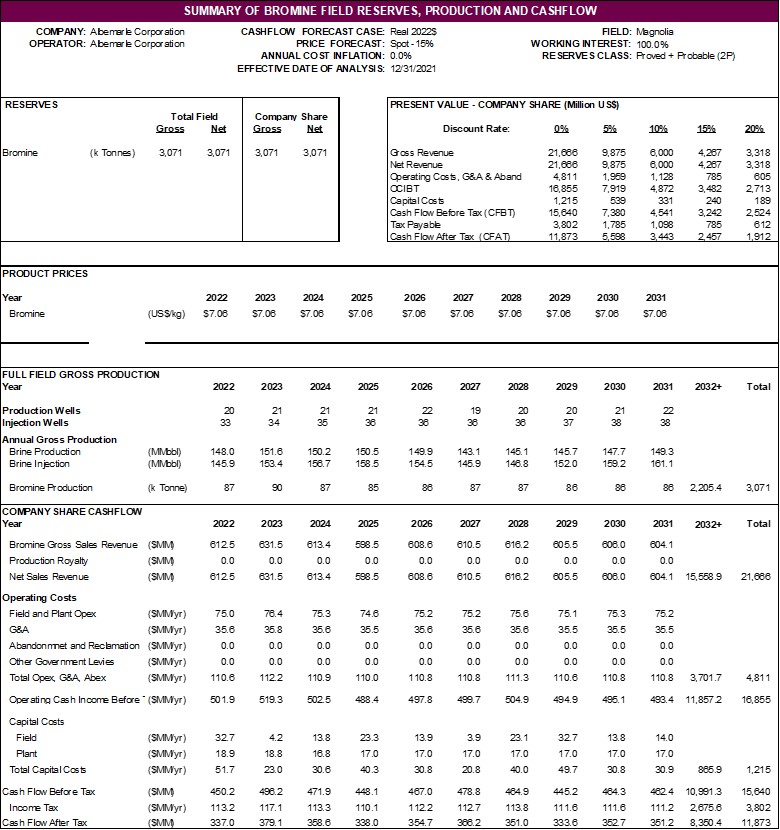

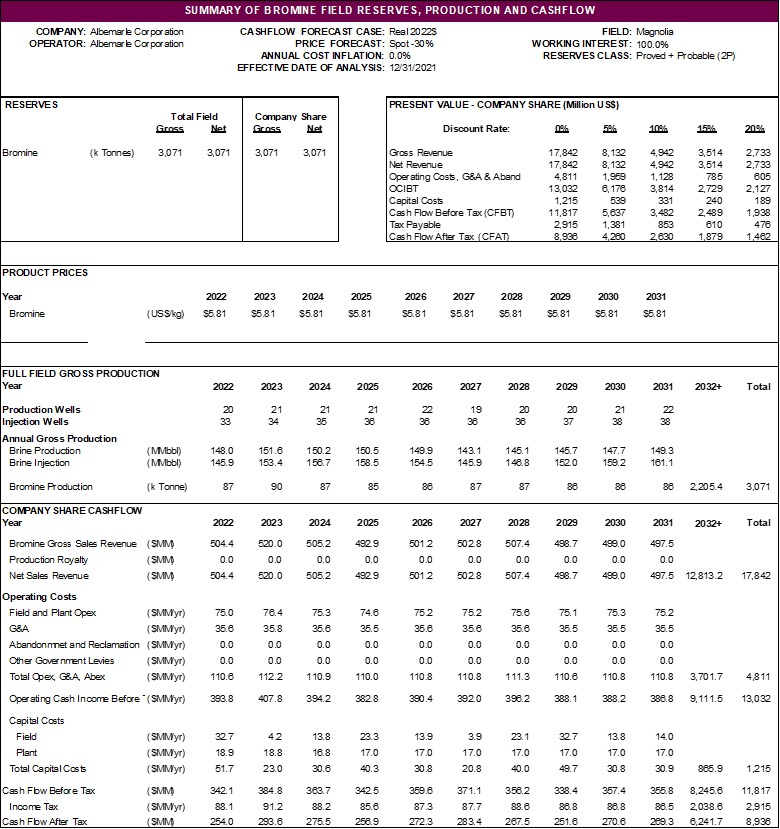

Exhibit 96.6 Magnolia

Mineral Reserve Estimates, page EY-43

8. We note your responses to comments 19 through 21 stating in future filings you will provide revised disclose in your technical report to comply with Item 1300 of Regulation S-K. Please amend your exhibit to disclose:

•the cut-off grade estimate for your reserves with details about parameters, prices, and costs, similar to your example in response to comment 19,

•your qualified person’s opinion on your environmental compliance plans, similar to your example in response to comment 2, and

•your capital and operating costs estimates with the associated estimate of accuracy, similar to your example provided in response to comment 21

Please also identify for us the location of the respective revisions made to your amended

exhibit.

Response

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 11

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, a revised technical report that includes the revisions proposed in the October Response Letter that are referenced in the eighth comment of the November Comment Letter. Concurrently with filing the revised technical report, the Company will file a supplementary response to the November Comment Letter identifying the location of the revisions made in the technical report. The Company believes that these revisions reflect differing interpretations of the Mining Disclosure Rules or information that is not material and did not appear relevant to the Company’s business (i.e., mineral extraction at Magnolia is not done through a traditional mining site), and therefore do not materially change the Company’s overall disclosures; however, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will file a revised technical report to make the revisions.

Exhibits 96.1, 96.2, 96.3, 96.4, 96.5 and 96.6

General, page EZ-0

9. We note your responses to comments 22 through 29 stating in future filings you will provide revised disclose in your technical reports to comply with Item 1300 of Regulation S-K. Please amend your exhibits to:

•exclude all non-compliant disclaimers in response to comment 22,

•include a geologic cross-section and stratigraphic column for each property in response to comment 23,

•include the qualified person’s opinion on the adequacy of sample preparation, security, and analytical procedures, similar to your example in your response to comment 24,

•include the estimated metallurgical recoveries and the qualified person’s opinion on the adequacy of information, similar to your examples in your response to comment 25,

•include the qualified person’s opinion, similar to your examples in your response to comment 26,

•include the qualified person’s opinion in regards to modifying factors affecting your reserves, similar to your examples in your response to comment 27,

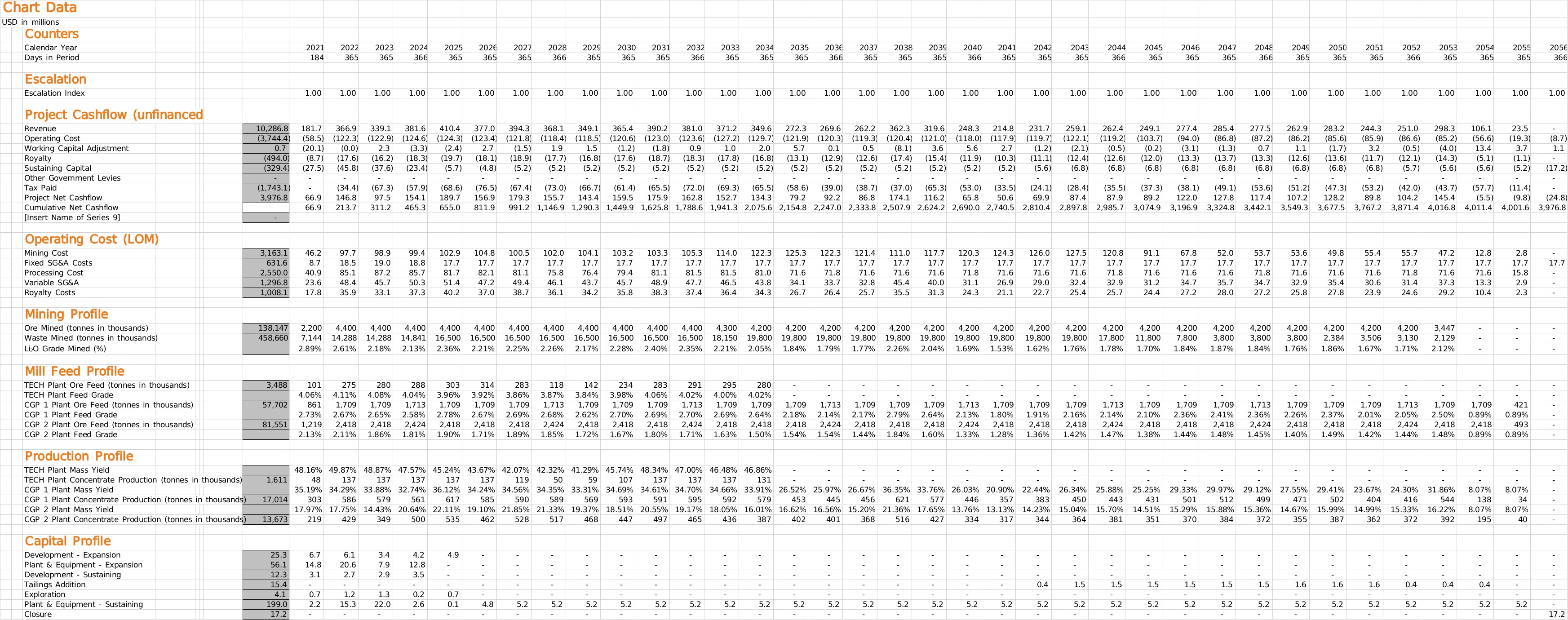

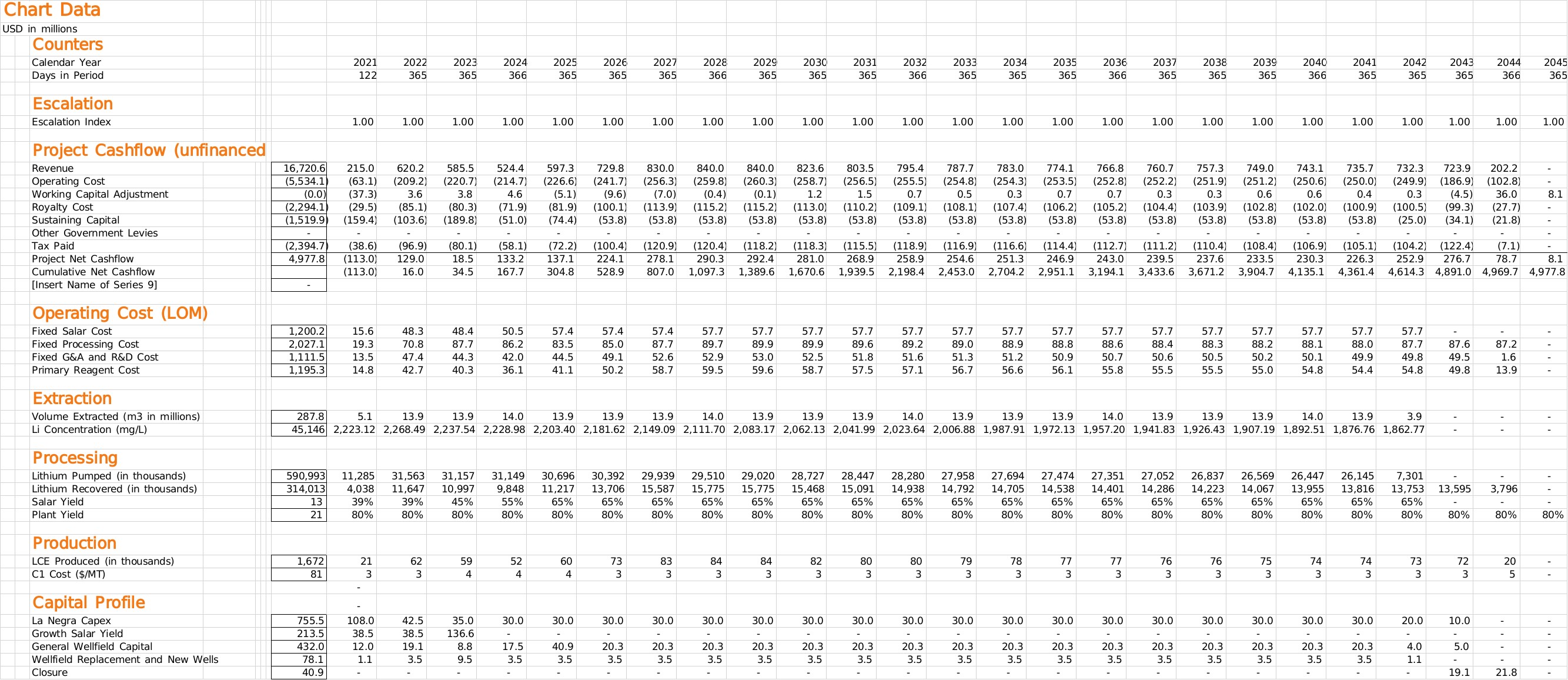

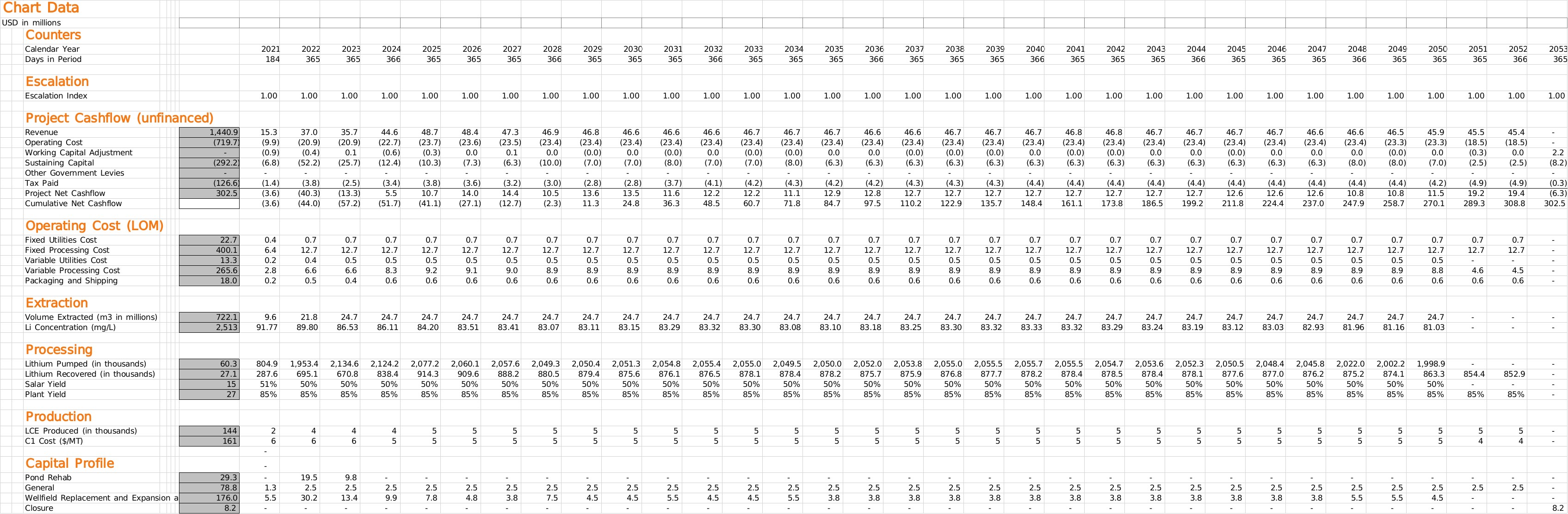

•include the annual numerical values for your life of mine production schedules, similar to your examples provided in Exhibits A, B and C in your response to comment 28, and

•include the five-year historical review of the commodity price with your price projection, similar to your examples in your response to comment 29.

Please also identify for us the location of the respective revisions made to your amended exhibit.

Response

The Company acknowledges the Staff’s comment and will file, no later than December 19, 2022, revised technical reports that include the revisions proposed in the October Response Letter that are referenced in the ninth comment of the November Comment Letter. Concurrently with filing the revised technical reports, the Company will file a supplementary response to the November Comment Letter identifying the

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 12

location of the revisions made in the technical reports. The Company believes that these revisions reflect differing interpretations of the Mining Disclosure Rules, information that is not material and did not appear relevant to the Company’s business, requests for additional information that the Company did not include in its original disclosures based on its initial interpretation of the Mining Disclosure Rules, or minor deviations from the rules made in the exercise of the Company’s judgment, and do not materially change the Company’s overall disclosures; however, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will file revised technical reports to make the revisions.

Exhibits 96.1, 96.2, 96.3, 96.4, 96.5 and 96.6A

Capital and Operating Cost, page EZ-8

10. We note your response to comment 30 stating in future filings you will provide additional details regarding capital and operating costs by major line items, including operational costs disclosed by major cost centers and annual reclamation costs. Please amend your exhibits to include the details regarding capital and operating costs by line items, including operational costs disclosed by major cost center and annual reclamation costs. Please note combining columns is acceptable, provided all numeric values are identical for the combined columns and a statement regarding this practice is included with your presentation.

Response

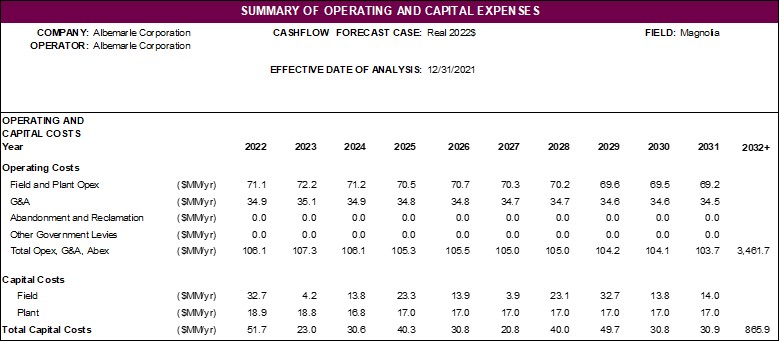

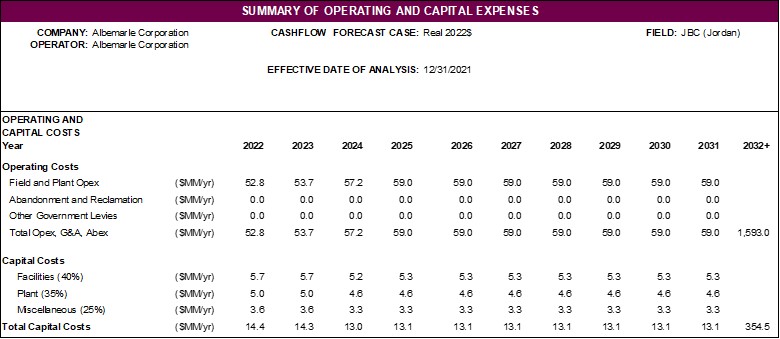

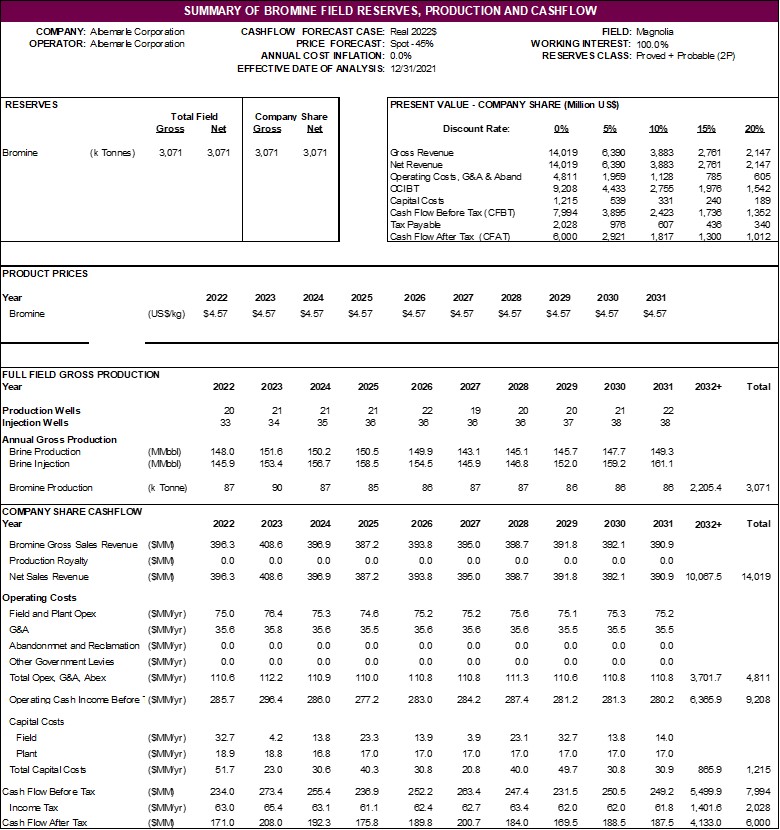

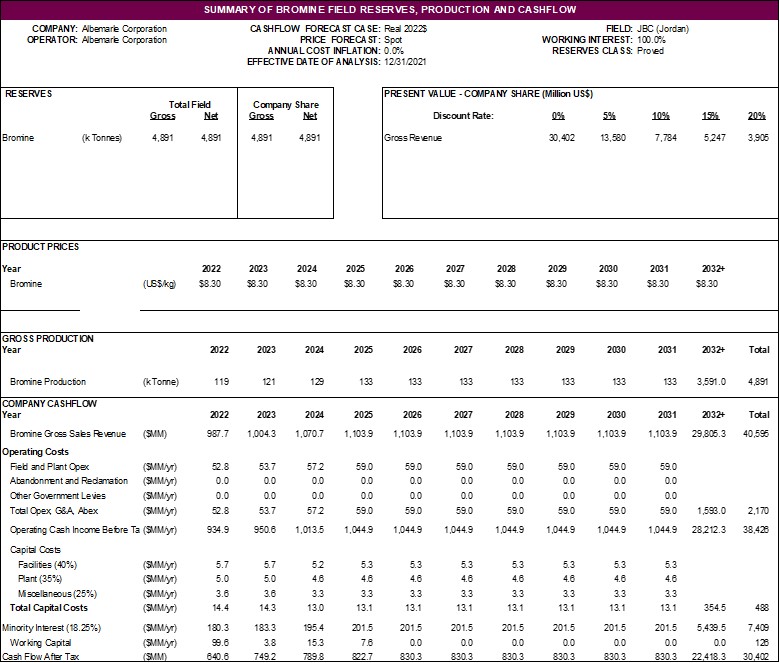

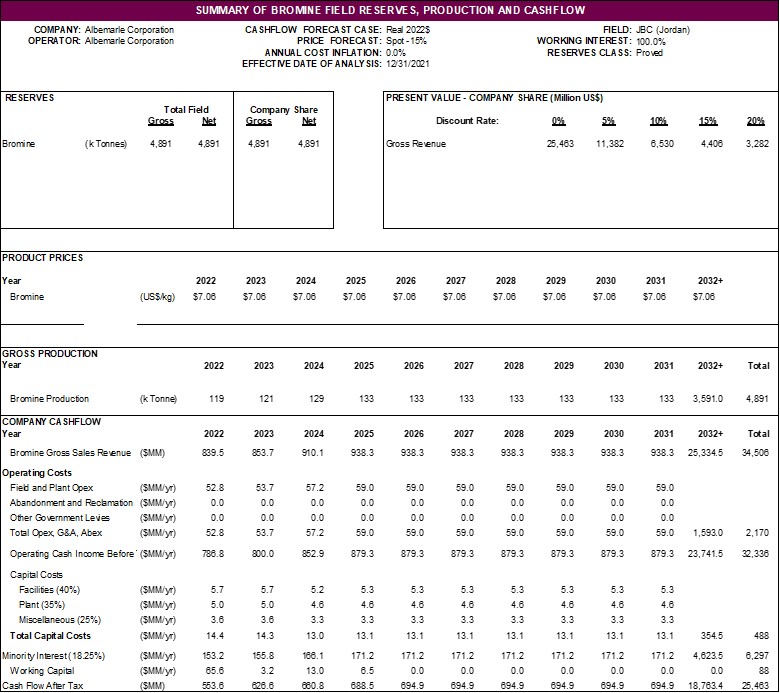

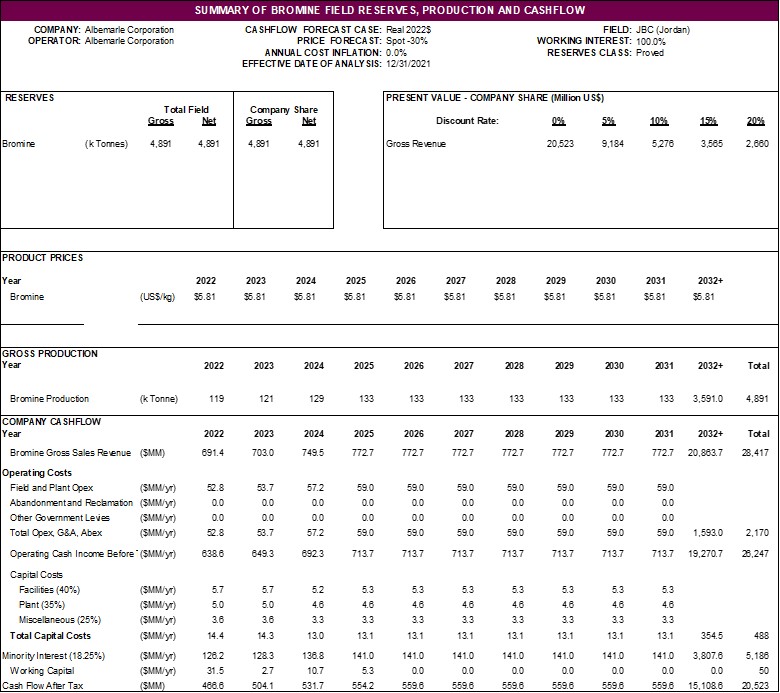

The Company has updated its tables of operating and capital costs included in its technical reports for its Magnolia and Jordan bromine operations to provide detail regarding operating costs with respect to field and plant expenses, G&A, and abandonment and reclamation and detail regarding capital costs with respect to plant, facilities, and other expenses, as set forth in Exhibit A hereto. The Company will include these tables in the revised technical reports that it will file no later than December 19, 2022. The Company believes that the information contained in the updated tables reflect information that is not material to the Company’s overall disclosures; however, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will file revised technical reports that include the updated tables.

Exhibits 96.1, 96.2, 96.3, 96.4, 96.5 and 96.6A

Economic Analysis, page EZ-9

11. We note your response to comment 31 stating in future filings you will provide numerical values for your annual cash flow, including annual production, salable product quantities, revenues, major cost centers, taxes & royalties, capital, and final closure costs. Please amend your exhibits to include numerical values for our annual cash flow, including your annual production, salable product quantities, revenues, major cost centers, taxes & royalties, capital, and final closure costs. Please note combining columns is acceptable, provided all numeric

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 13

values are identical for the combined columns and a statement regarding this practice is included with your presentation.

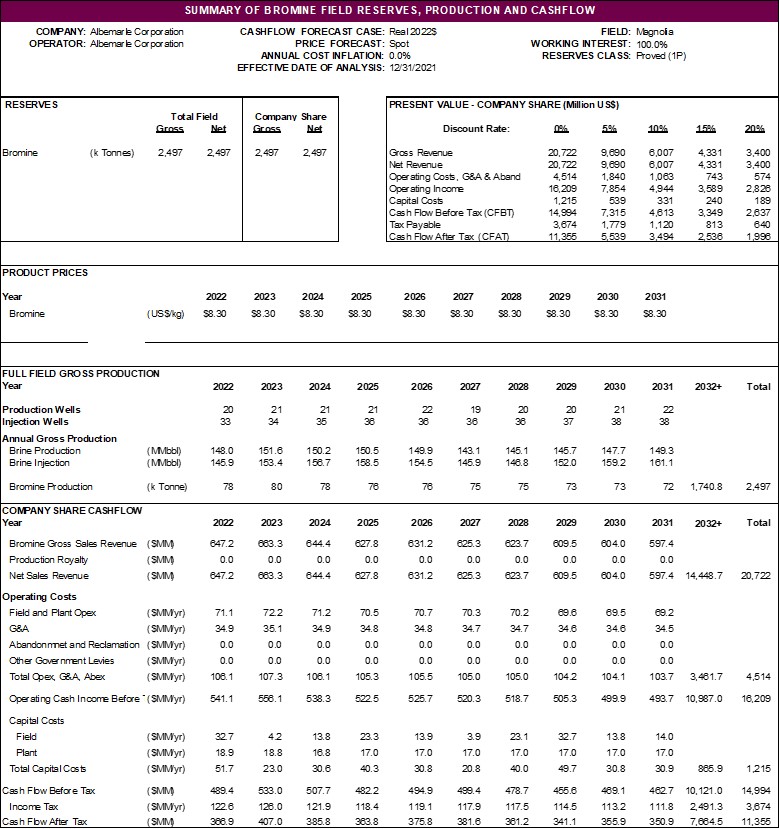

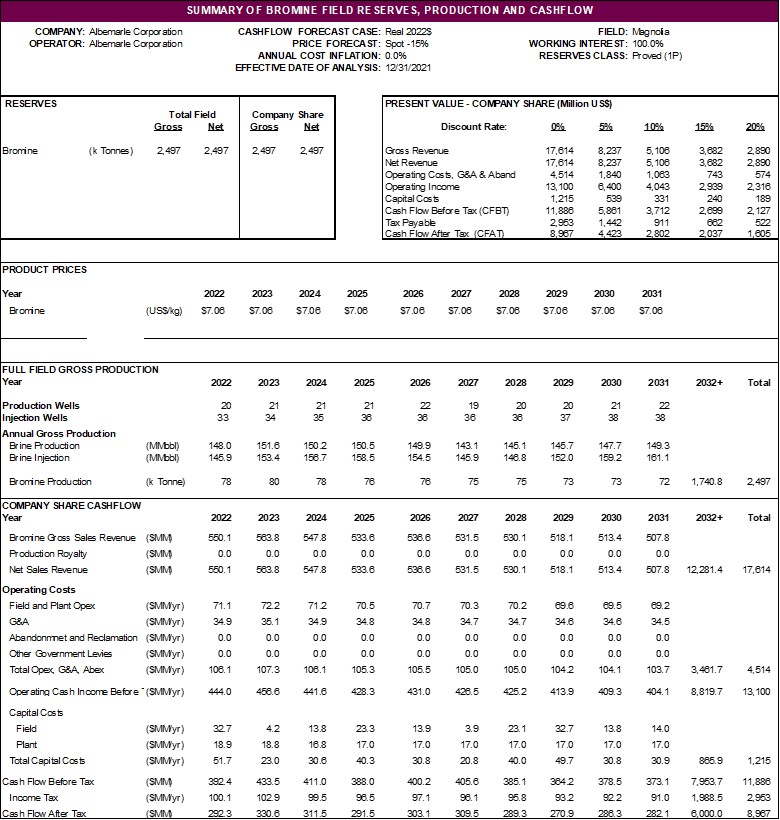

Response

As discussed on its telephone call with the Staff on November 16, 2022, the Company has updated its tables presenting annual cash flow to provide detail regarding royalties, taxes and other government levies, as set forth in Exhibit B hereto. The Company will include these tables in the revised technical reports it will file no later than December 19, 2022. The Company believes that the information contained in the updated tables reflect information that is not material to the Company’s overall disclosures; however, the Company acknowledges the Staff’s interpretation of the Mining Disclosure Rules during the first year of their application and will file revised technical reports that include the updated tables.

***

Mr. Schuler and Mr. Arakawa

December 1, 2022

Page 14

The Company appreciates the efforts of the Staff in reviewing its response to the November Comment Letter. We are fully committed to working with the Commission to respond to your comments and to provide you with all the information you require. Accordingly, should you have any questions regarding the Company’s response to your comments, please contact Scott Tozier at (980) 299-5596.

Sincerely,

ALBEMARLE CORPORATION

| | |

| /s/ SCOTT A. TOZIER |

| Scott A. Tozier |

| Executive Vice President, Chief Financial Officer |

cc: J. Kent Masters

Chairman, President and Chief Executive Officer

Albemarle Corporation

Karen G. Narwold

Executive Vice President, Chief Administrative Officer

Albemarle Corporation

John C. Barichivich III

Vice President, Corporate Controller and Chief Accounting Officer

Albemarle Corporation

Sean M. Jones

K&L Gates LLP

Exhibit A

Capital and Operating Cost Tables

Magnolia

Jordan Bromine

Exhibit B

Cash Flow Tables

Magnolia

Table 19-6: Annual Cash Flow Summary – Proved Reserves – Spot Prices

Table 19-7: Annual Cash Flow Summary – Proved Reserves – Spot Prices less 15%

Table 19-8: Annual Cash Flow Summary – Proved Reserves – Spot Prices less 30%

Table 19-9: Annual Cash Flow Summary – Proved Reserves – Spot Prices less 45%

Table 19-10: Annual Cash Flow Summary – Proved + Probable Reserves – Spot Prices

Table 19-11: Annual Cash Flow Summary – Proved + Probable Reserves – Spot Prices less 15%

Table 19-12: Annual Cash Flow Summary – Proved + Probable Reserves – Spot Prices less 30%

Table 19-13: Annual Cash Flow Summary – Proved + Probable Reserves – Spot Prices less 45%

Jordan Bromine

Table 19-1: Annual Cash Flow Summary – Proved Reserves – Spot Prices

Table 19-2: Annual Cash Flow Summary – Proved Reserves – Spot Prices less 15%

Table 19-3: Annual Cash Flow Summary – Proved Reserves – Spot Prices less 30%

Table 19-4: Annual Cash Flow Summary – Proved Reserves – Spot Prices less 45%

Greenbushes

Salar de Atacama

Silver Peak