Exhibit 99.1

Albemarle To Acquire Akzo Refinery Catalysts

A New Global

Chemicals

Leader Emerges

Mark C. Rohr, President & CEO

May 4, 2004

Chicago

Caution Statement

Some of the information presented in the pages of this presentation constitutes forward-looking comments within the meaning of the Private Securities Litigation Reform Act of 1995. Although Albemarle Corporation believes its expectations are based on reasonable assumptions within the bounds of its knowledge of its business and operations, there can be no assurance that actual results will not differ materially from its expectations.

Factors which could cause actual results to differ from expectations include, without limitation, the timing of orders received from customers, the gain or loss of significant customers, competition from other manufacturers, changes in demand for the Company’s products, increases in the cost of the product, changes in the market in general, fluctuations in foreign currencies, and significant changes in new product introduction resulting in an increase in capital project requests and approvals leading to capital spending.

Such statements also include, but are not limited to, statements about the proposed acquisition by Albemarle Corporation of Akzo Nobel’s refinery catalyst business, including financial and operating results, the parties’ plans, beliefs, expectations and intentions and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of management and are subject to significant risks and uncertainties. Actual results may vary materially from those set forth in the forward-looking statements. The following factors, among others, could affect the consummation of the proposed transaction: execution of a definitive sale and purchase agreement, the advice from Akzo Nobel’s Works Council, the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Act and the receipt of other competition law clearances. The following factors, among others, could affect the anticipated results: consummation of the financing on terms favorable to the Company, the ability to integrate successfully the acquired business within the expected timeframes or at all, and ongoing operations of the business.

Additional factors that could cause Albemarle’s results to differ materially from those described in the forward-looking statements can be found in Albemarle’s Annual Report on Form 10-K for the year ended December 31, 2003.

1

Today’s Objectives

• Describe Albemarle’s background

• Present the strategy driving our growth

• Discuss the rationale for the acquisition & related financing plan

• Describe our ability to execute in a changing environment

• Provide a detailed review of our business

• Provide insight into our financial discipline

• Provide detailed review of refinery catalyst business

2

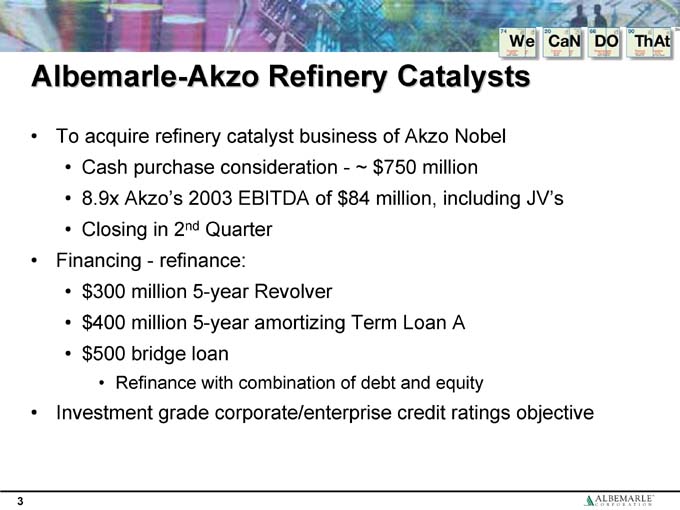

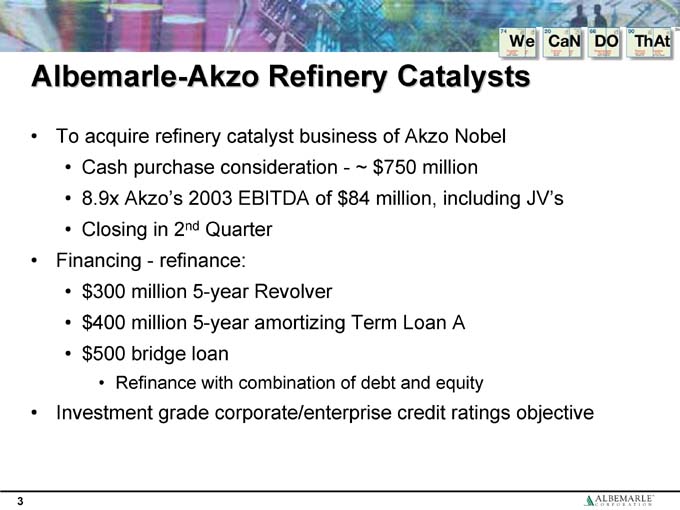

Albemarle-Akzo Refinery Catalysts

• To acquire refinery catalyst business of Akzo Nobel

• Cash purchase consideration—~ $750 million

• 8.9x Akzo’s 2003 EBITDA of $84 million, including JV’s

• Closing in 2nd Quarter

• Financing—refinance:

•$ 300 million 5-year Revolver

•$ 400 million 5-year amortizing Term Loan A

•$ 500 bridge loan

• Refinance with combination of debt and equity

• Investment grade corporate/enterprise credit ratings objective

3

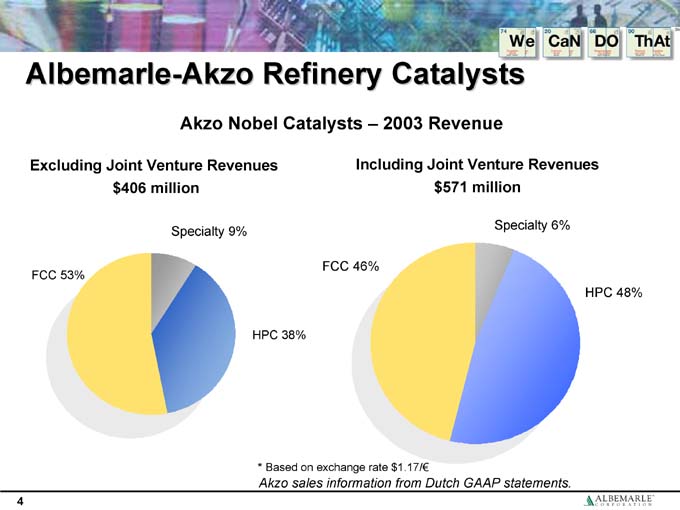

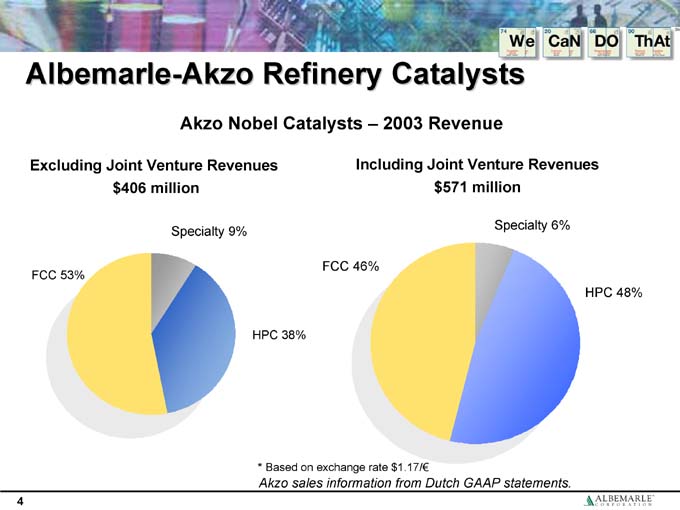

Albemarle-Akzo Refinery Catalysts

Akzo Nobel Catalysts – 2003 Revenue

Excluding Joint Venture Revenues $406 million

FCC 53%

Specialty 9%

HPC 38%

Including Joint Venture Revenues $571 million

FCC 46%

Specialty 6%

HPC 48%

* Based on exchange rate $1.17/€

Akzo sales information from Dutch GAAP statements.

4

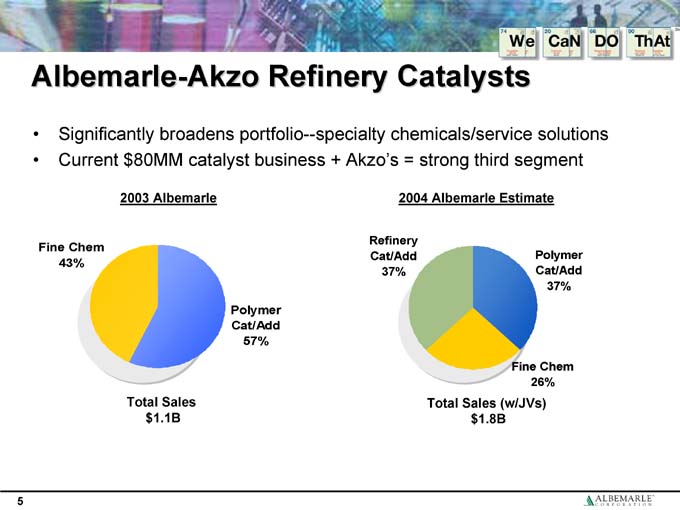

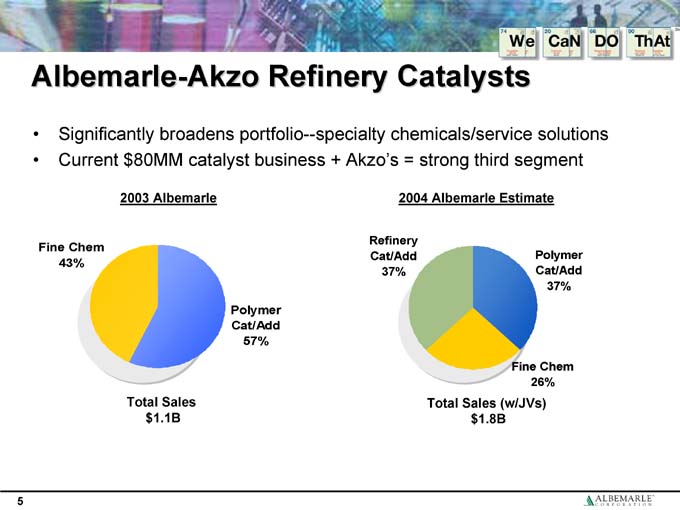

Albemarle-Akzo Refinery Catalysts

• Significantly broadens portfolio—specialty chemicals/service solutions

• Current $80MM catalyst business + Akzo’s = strong third segment

2003 Albemarle

Fine Chem 43%

Polymer Cat/Add 57%

Total Sales $1.1B

2004 Albemarle Estimate

Refinery Cat/Add 37%

Polymer Cat/Add 37%

Fine Chem 26%

Total Sales (w/JVs) $1.8B

5

Specialty Chemical Position

Pro-Forma Albemarle

Net Sales—2003

EBITDA Margin %—2003

* Lubrizol has announced its acquisition of Noveon – Source FactSet, as of April 17, 2004

6

Overview of Albemarle Corporation

A New Global Chemicals Leader Emerges

7

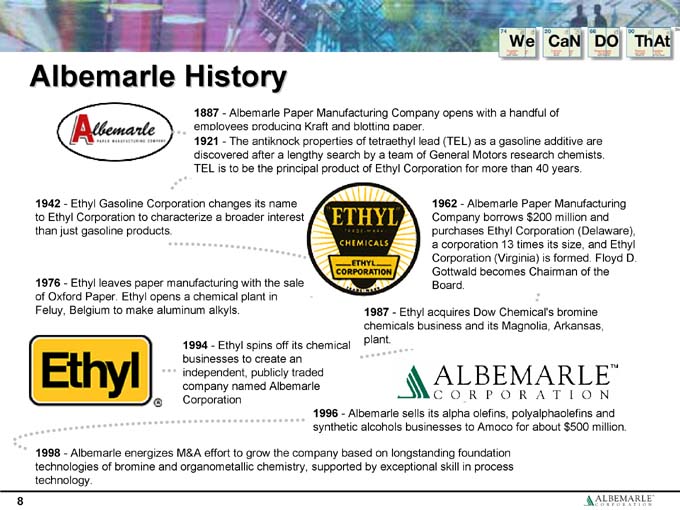

Albemarle History

1887—Albemarle Paper Manufacturing Company opens with a handful of employees producing Kraft and blotting paper.

1921—The antiknock properties of tetraethyl lead (TEL) as a gasoline additive are discovered after a lengthy search by a team of General Motors research chemists. TEL is to be the principal product of Ethyl Corporation for more than 40 years.

1942—Ethyl Gasoline Corporation changes its name to Ethyl Corporation to characterize a broader interest than just gasoline products.

1962—Albemarle Paper Manufacturing Company borrows $200 million and purchases Ethyl Corporation (Delaware), a corporation 13 times its size, and Ethyl Corporation (Virginia) is formed. Floyd D. Gottwald becomes Chairman of the Board.

1976—Ethyl leaves paper manufacturing with the sale of Oxford Paper. Ethyl opens a chemical plant in Feluy, Belgium to make aluminum alkyls.

1987—Ethyl acquires Dow Chemical’s bromine chemicals business and its Magnolia, Arkansas, plant.

1994—Ethyl spins off its chemical businesses to create an independent, publicly traded company named Albemarle Corporation

1996—Albemarle sells its alpha olefins, polyalphaolefins and synthetic alcohols businesses to Amoco for about $500 million.

1998—Albemarle energizes M&A effort to grow the company based on longstanding foundation technologies of bromine and organometallic chemistry, supported by exceptional skill in process technology.

8

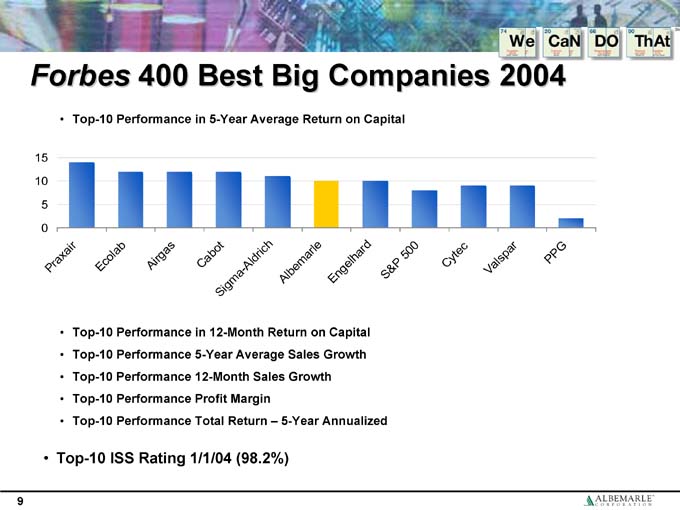

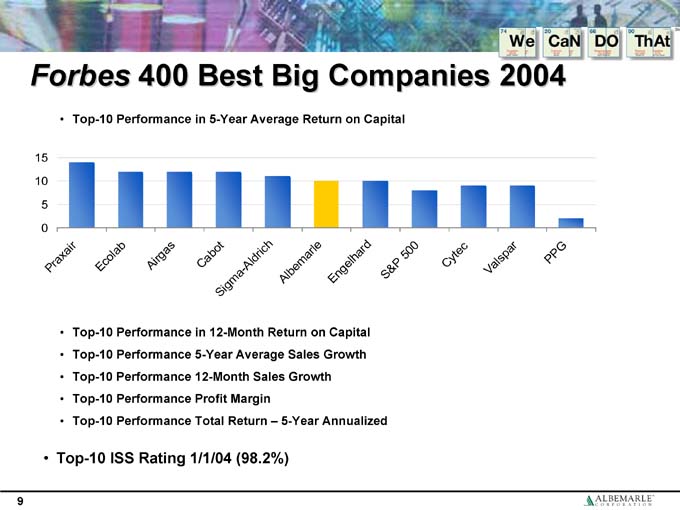

Forbes 400 Best Big Companies 2004

• Top-10 Performance in 5-Year Average Return on Capital

Praxair

Ecolab

Airgas

Cabot

Sigma—Aldrich

Albemarle

Engelhard

S&P500

Cytec

Valspar

PPG

• Top-10 Performance in 12-Month Return on Capital

• Top-10 Performance 5-Year Average Sales Growth

• Top-10 Performance 12-Month Sales Growth

• Top-10 Performance Profit Margin

• Top-10 Performance Total Return – 5-Year Annualized

• Top-10 ISS Rating 1/1/04 (98.2%)

9

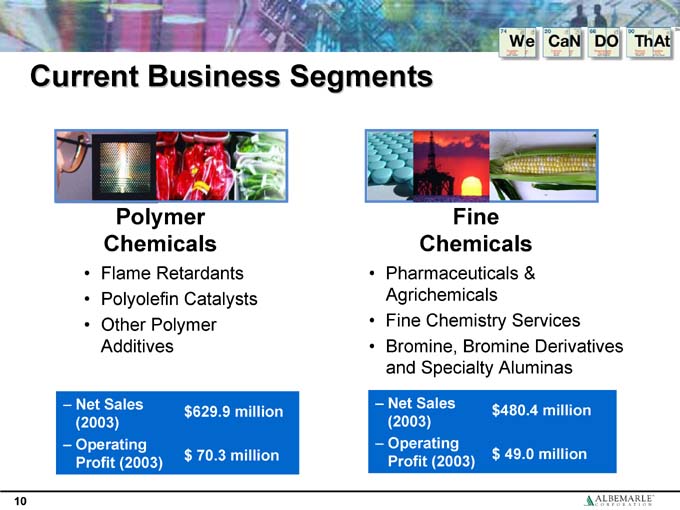

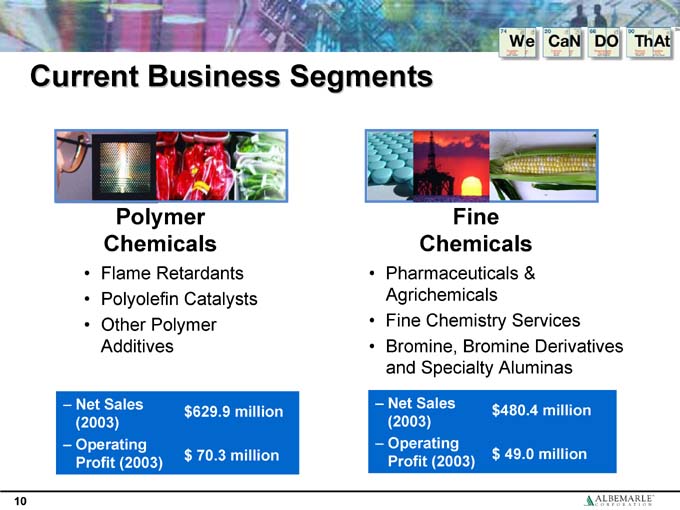

Current Business Segments

Polymer Chemicals

• Flame Retardants

• Polyolefin Catalysts

• Other Polymer Additives

– Net Sales $629.9 million (2003)

– Operating $ 70.3 million Profit (2003)

Fine Chemicals

• Pharmaceuticals & Agrichemicals

• Fine Chemistry Services

• Bromine, Bromine Derivatives and Specialty Aluminas

– Net Sales $480.4 million (2003)

– Operating $ 49.0 million Profit (2003)

10

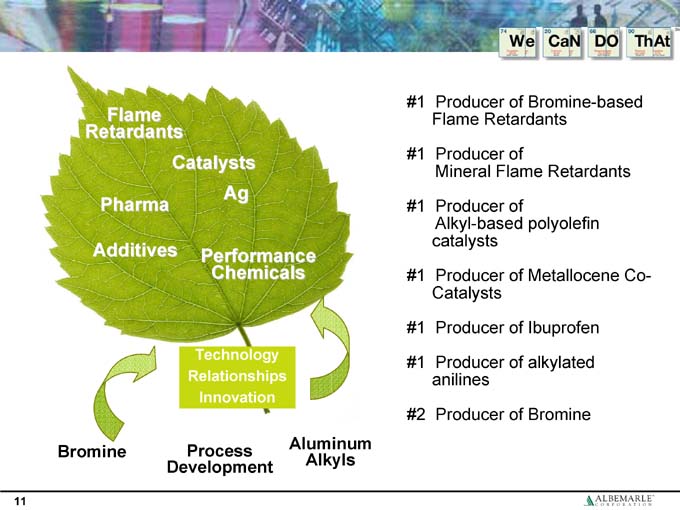

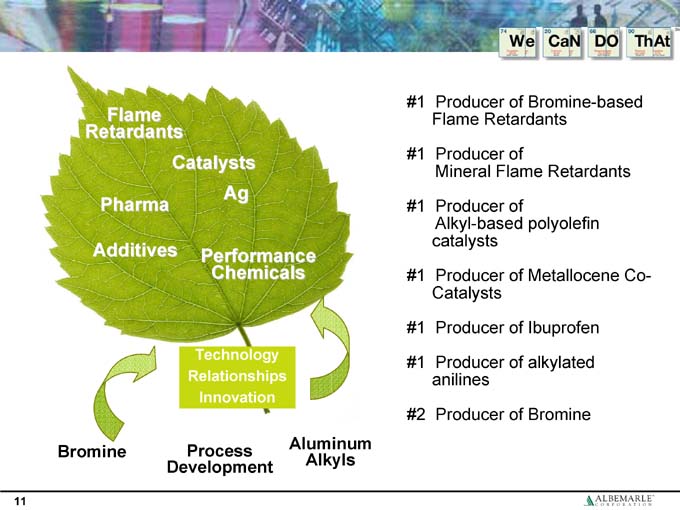

Flame Retardants

Catalysts Ag

Pharma

Additives

Performance Chemicals

Technology Relationships Innovation

Bromine

Process Development

Aluminum Alkyls

#1 Producer of Bromine-based Flame Retardants

#1 Producer of Mineral Flame Retardants

#1 Producer of Alkyl-based polyolefin catalysts

#1 Producer of Metallocene Co-Catalysts

#1 Producer of Ibuprofen

#1 Producer of alkylated anilines

#2 Producer of Bromine

11

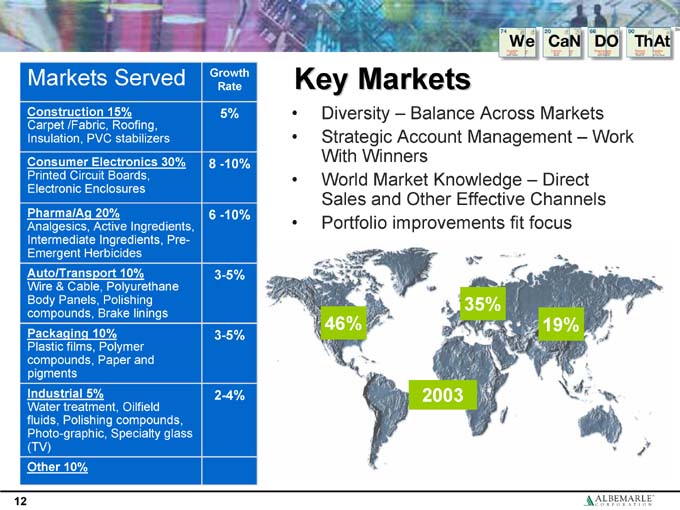

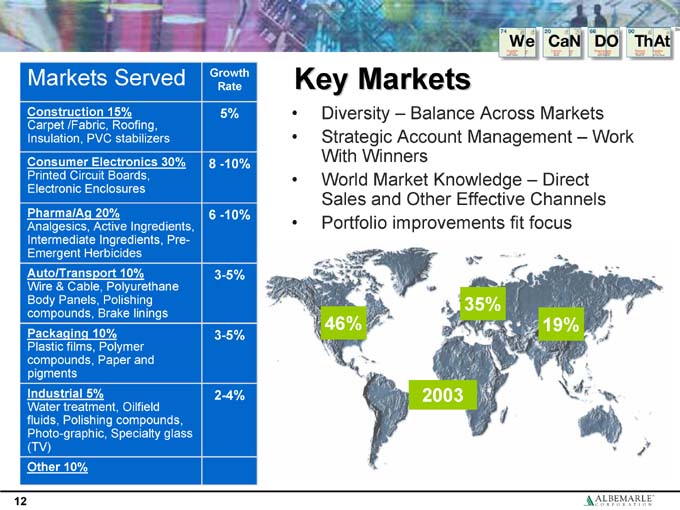

Key Markets

• Diversity – Balance Across Markets

• Strategic Account Management – Work With Winners

• World Market Knowledge – Direct Sales and Other Effective Channels

• Portfolio improvements fit focus

46%

35%

19%

2003

Markets Served Growth

Rate

Construction 15% 5%

Carpet /Fabric, Roofing,

Insulation, PVC stabilizers

Consumer Electronics 30% 8 -10%

Printed Circuit Boards,

Electronic Enclosures

Pharma/Ag 20% 6 -10%

Analgesics, Active Ingredients,

Intermediate Ingredients, Pre-

Emergent Herbicides

Auto/Transport 10% 3-5%

Wire & Cable, Polyurethane

Body Panels, Polishing

compounds, Brake linings

Packaging 10% 3-5%

Plastic films, Polymer

compounds, Paper and

pigments

Industrial 5% 2-4%

Water treatment, Oilfield

fluids, Polishing compounds,

Photo-graphic, Specialty glass

(TV)

Other 10%

12

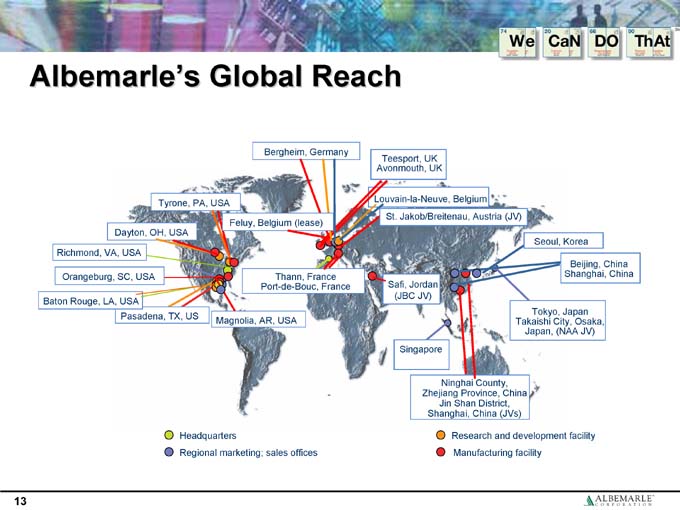

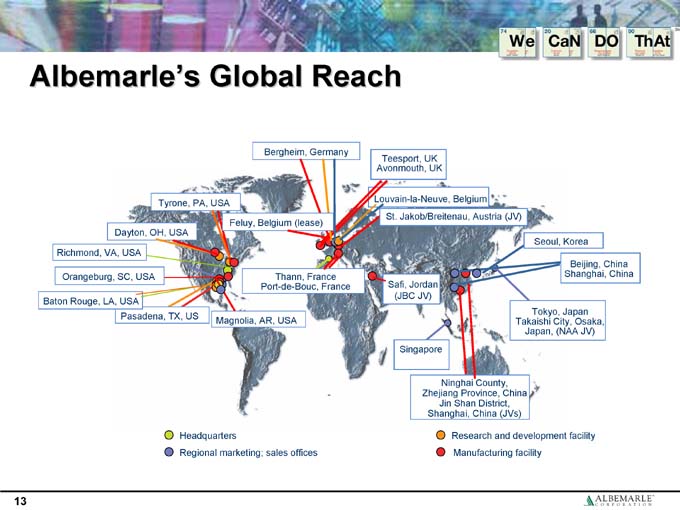

Albemarle’s Global Reach

Bergheim, Germany

Teesport, UK Avonmouth, UK

Louvain-la-Neuve, Belgium

St. Jakob/Breitenau, Austria (JV)

Seoul, Korea

Beijing, China Shanghai, China

Tokyo, Japan Takaishi City, Osaka, Japan, (NAA JV)

Ninghai County, Zhejiang Province, China Jin Shan District, Shanghai, China (JVs)

Singapore

Safi, Jordan (JBC JV)

Thann, France Port-de-Bouc, France

Feluy, Belgium (lease)

Magnolia, AR, USA

Pasadena, TX, US

Baton Rouge, LA, USA

Orangeburg, SC, USA

Richmond, VA, USA

Dayton, OH, USA

Tyrone, PA, USA

Headquarters

Regional marketing; sales offices

Research and development facility

Manufacturing facility

13

Albemarle Strategic Overview

• Specialty Chemicals experience natural rotation through market maturity and technology innovation

• Winners successfully manage rotation by providing innovative solutions of tangible value to their customers

• Opportunities Identification: Innovate, Acquire, Integrate and Manage new businesses and new assets

• Past 5 years — acquisition program added $57 million EBITDA + > $300 million of sales, offsetting rotation in our “foundation” business

• Successful business execution has created strong cash flow—permitting acquisitions to accelerate growth

Akzo Refinery Catalysts fit Albemarle’s acquisition model and further complement the existing business

14

Smart Execution Yields Growth

27% of 2003 Revenue from Recent Acquisitions

1999

Tender Offer For A&W; Created Cash Gain

Formed Jordan Br Co; Started Project for ‘02 Startup

2000

Acquired Ferro BrPS FR Bus

Took ownership In Jinhai Polymer & Expanded 2X

2001

Acquired Martinswerk—Largest mineral-based Global FR Business

Acquired ChemFirst Fine Chemicals; Integrated with ALB to form ALB Fine Chemistry Services

2002

Formed Stannica JV with Atofina

Announced China Trading Company

2003

Acquired lube and fuel anti-oxidants of Ethyl

Acquired Phosphorus Flame Retardants of Rhodia

Acquired Atofina S.A. Bromine Fine Chemicals

2004

Acquired assets of Korean distributor of Albemarle; other products

Acquiring petroleum refining catalyst business of Akzo Nobel

15

General Business Overview

A New Global Chemicals Leader Emerges

16

Fine Chemicals

A New Global Chemicals Leader Emerges

17

Fine Chemicals 2003

Life Sciences

40% of FC Sales

Maximize Value Of Our 4 Actives

Serve Market w/ Broad FCSI Capabilities:

• Intermediates

• Contract Research

• Custom Manufacture

Industrial Specialties

25% of FC Sales

Manage for Cash

Bromine Chemicals

35% of FC Sales

#1 Bromine Company In The World

18

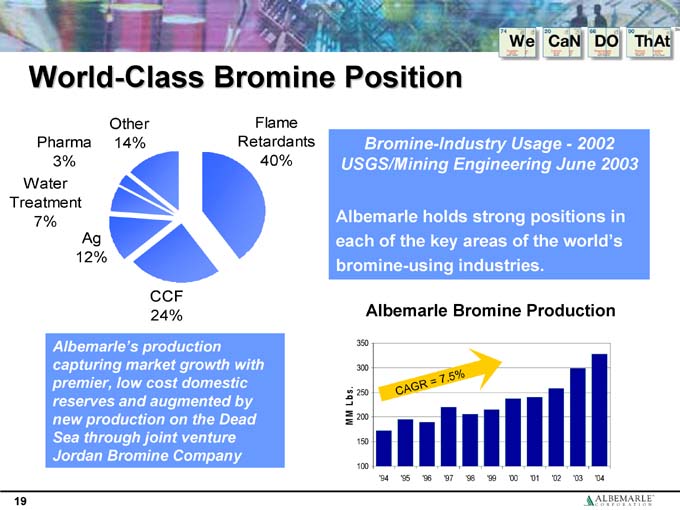

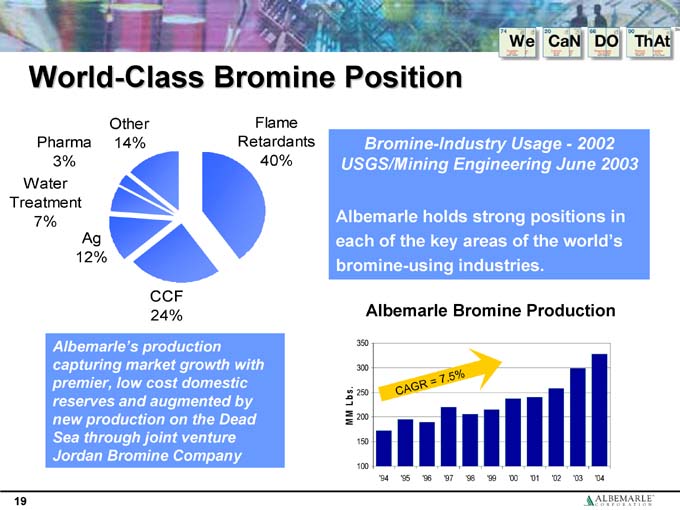

World-Class Bromine Position

Other 14%

Pharma 3%

Water Treatment 7%

Ag 12%

CCF 24%

Flame Retardants 40%

Albemarle’s production capturing market growth with premier, low cost domestic reserves and augmented by new production on the Dead Sea through joint venture Jordan Bromine Company

Bromine-Industry Usage—2002 USGS/Mining Engineering June 2003

Albemarle holds strong positions in each of the key areas of the world’s bromine-using industries.

Albemarle Bromine Production

19

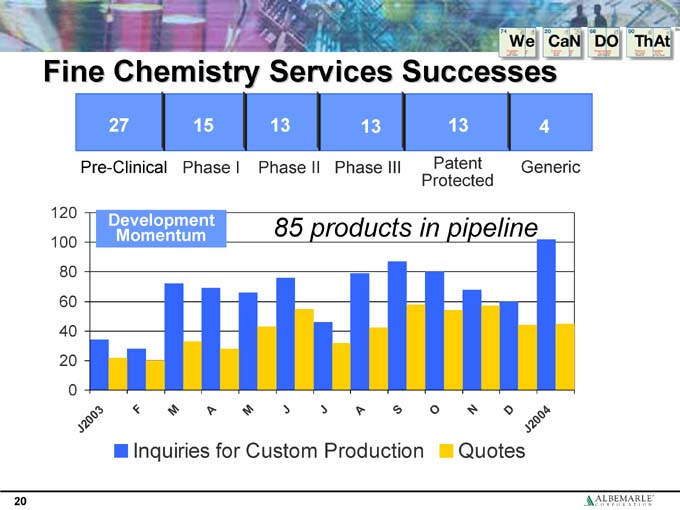

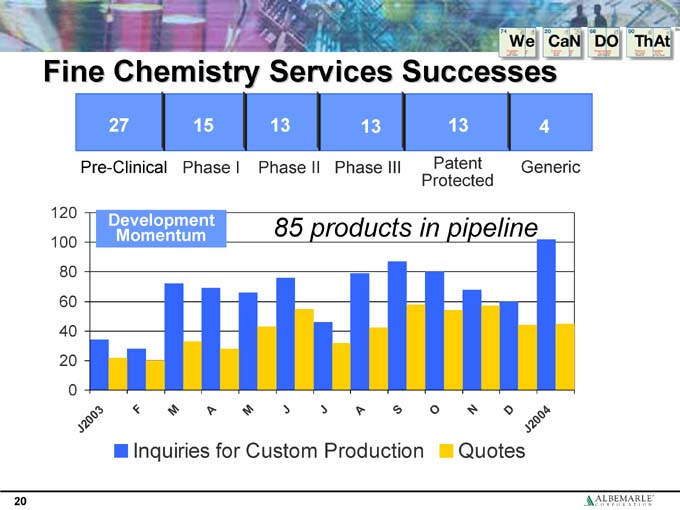

Fine Chemistry Services Successes

27

Pre-Clinical

15

Phase

13

Phase II

13

Phase III

13

Patent Protected

4

Generic

85 products in pipeline

Inquiries for Custom Production Quotes

20

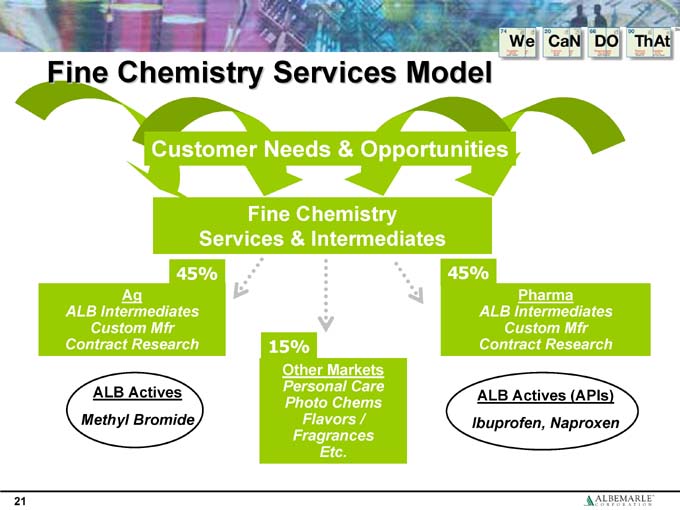

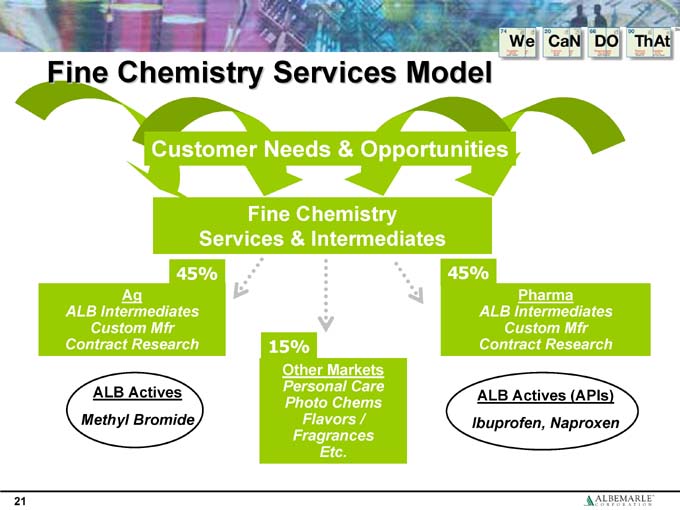

Fine Chemistry Services Model

Customer Needs & Opportunities

Fine Chemistry Services & Intermediates

45%

Ag

ALB Intermediates Custom Mfr Contract Research

15%

Other Markets

Personal Care Photo Chems Flavors / Fragrances Etc.

45%

Pharma

ALB Intermediates Custom Mfr Contract Research

ALB Actives

Methyl Bromide

ALB Actives (APIs)

Ibuprofen, Naproxen

21

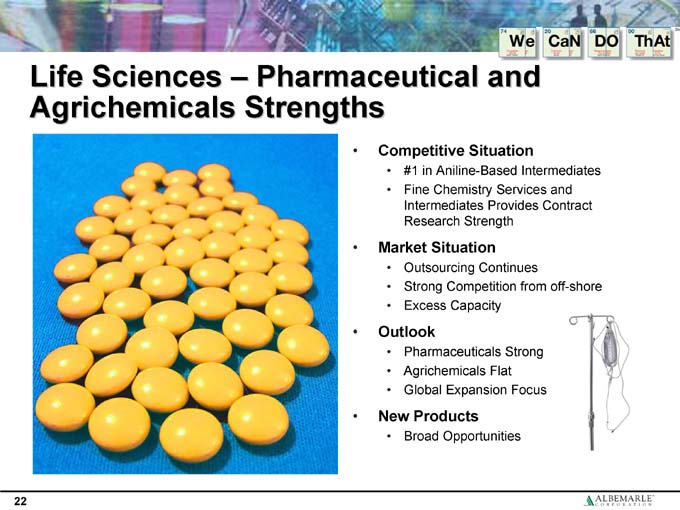

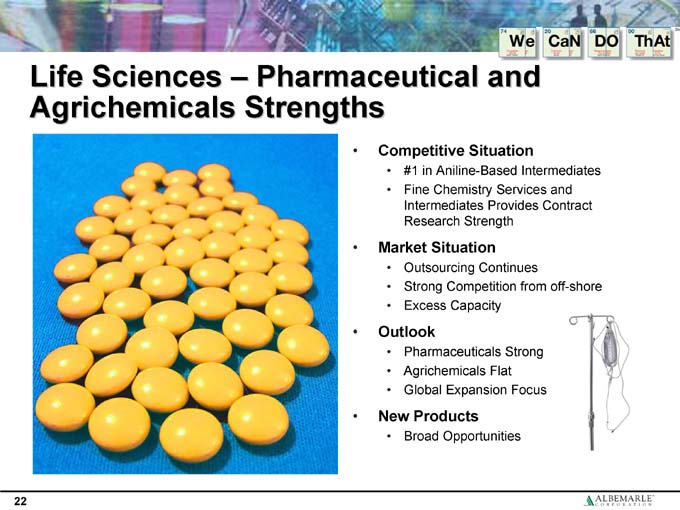

Life Sciences – Pharmaceutical and Agrichemicals Strengths

• Competitive Situation

• #1 in Aniline-Based Intermediates

• Fine Chemistry Services and Intermediates Provides Contract Research Strength

• Market Situation

• Outsourcing Continues

• Strong Competition from off-shore

• Excess Capacity

• Outlook

• Pharmaceuticals Strong

• Agrichemicals Flat

• Global Expansion Focus

• New Products

• Broad Opportunities

22

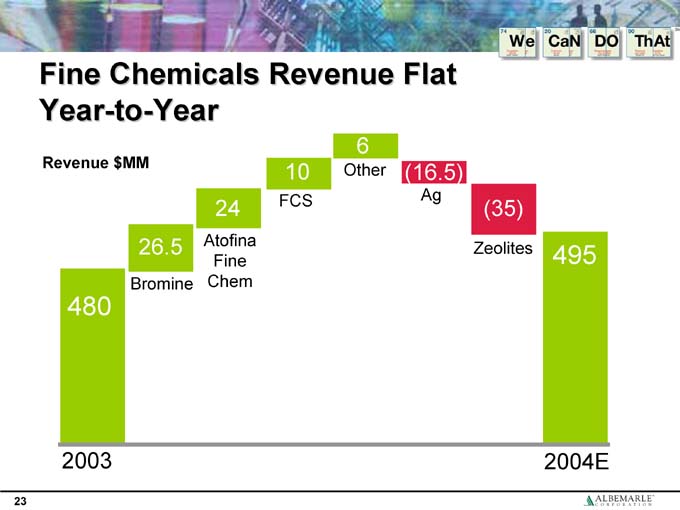

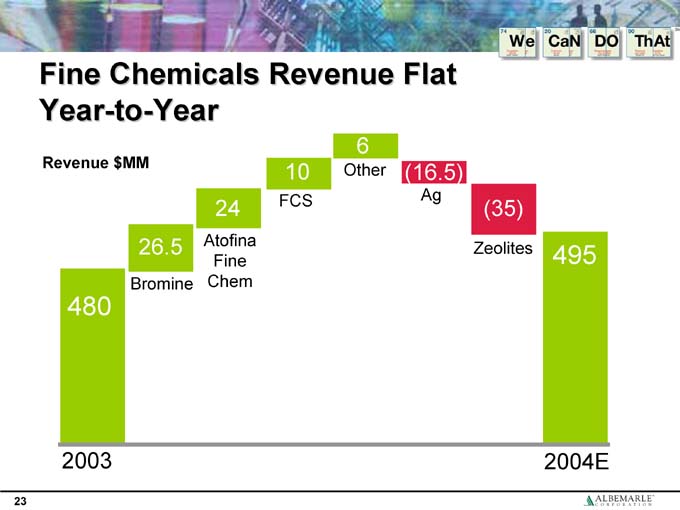

Fine Chemicals Revenue Flat Year-to-Year

Revenue $MM

480

2003

26.5

Bromine

24

Atofina Fine Chem

10

FCS

6

Other

(16.5)

Ag

(35)

Zeolites

495

2004E

23

Polymer Chemicals

A New Global Chemicals Leader Emerges

24

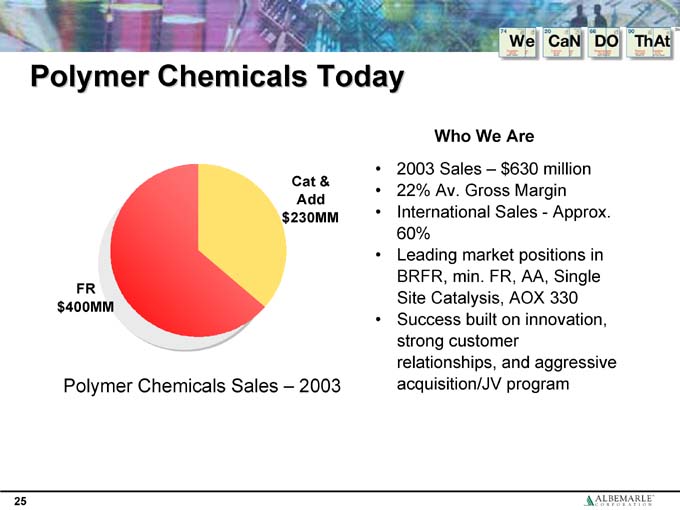

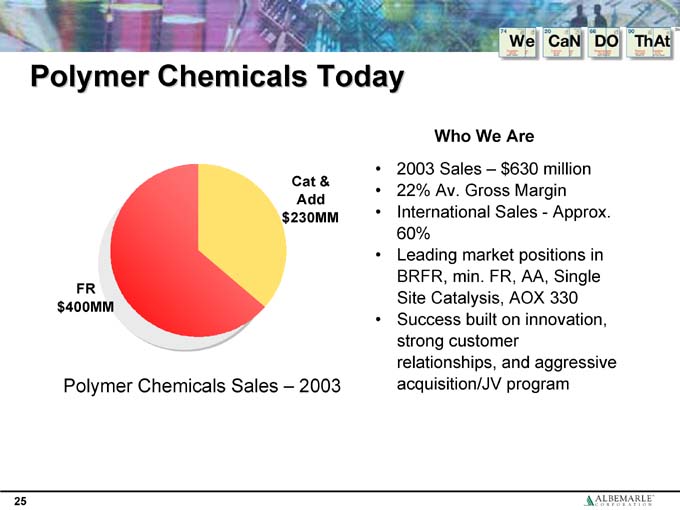

Polymer Chemicals Today

FR $400MM

Cat & Add $230MM

Polymer Chemicals Sales – 2003

Who We Are

• 2003 Sales – $630 million

• 22% Av. Gross Margin

• International Sales—Approx. 60%

• Leading market positions in BRFR, min. FR, AA, Single Site Catalysis, AOX 330

• Success built on innovation, strong customer relationships, and aggressive acquisition/JV program

25

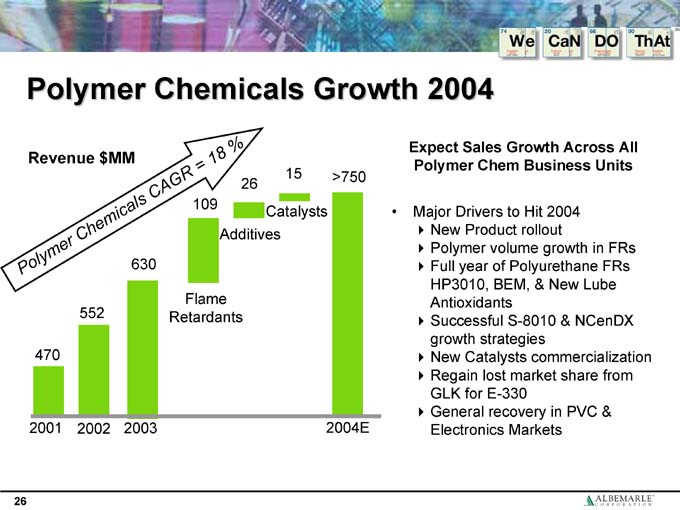

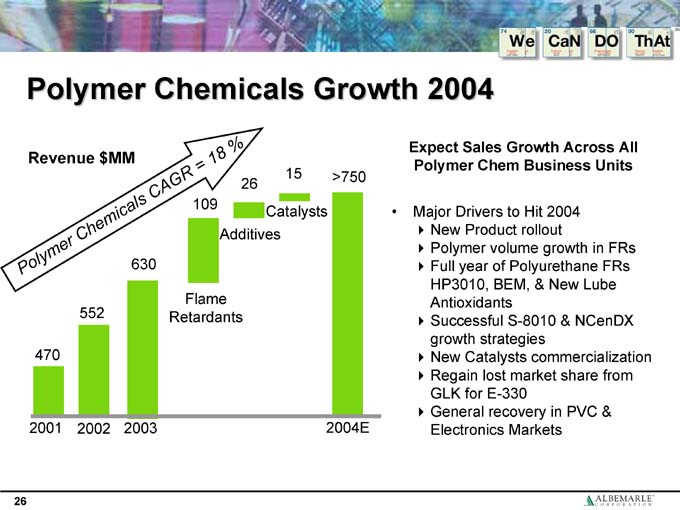

Polymer Chemicals Growth 2004

Revenue $MM

470

2001

552

2002

630

2003

109

Flame Retardants

26

Additives

15

Catalysts

>750

2004E

Expect Sales Growth Across All Polymer Chem Business Units

• Major Drivers to Hit 2004

_ New Product rollout

_ Polymer volume growth in FRs

_ Full year of Polyurethane FRs HP3010, BEM, & New Lube Antioxidants

_ Successful S-8010 & NCenDX growth strategies

_ New Catalysts commercialization

_ Regain lost market share from GLK for E-330

_ General recovery in PVC & Electronics Markets

26

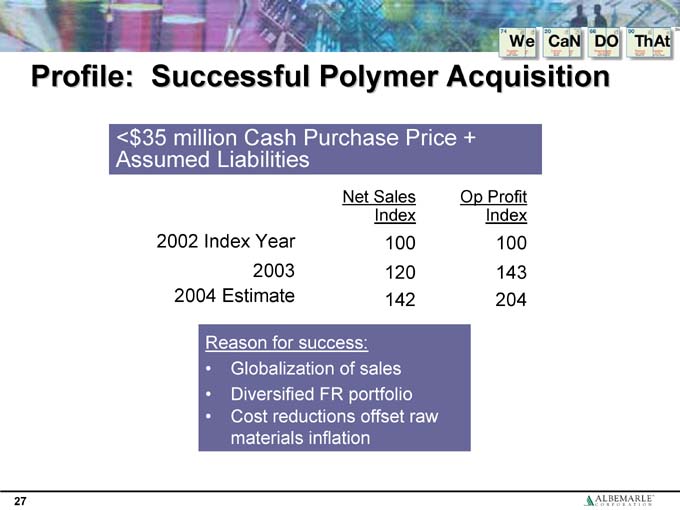

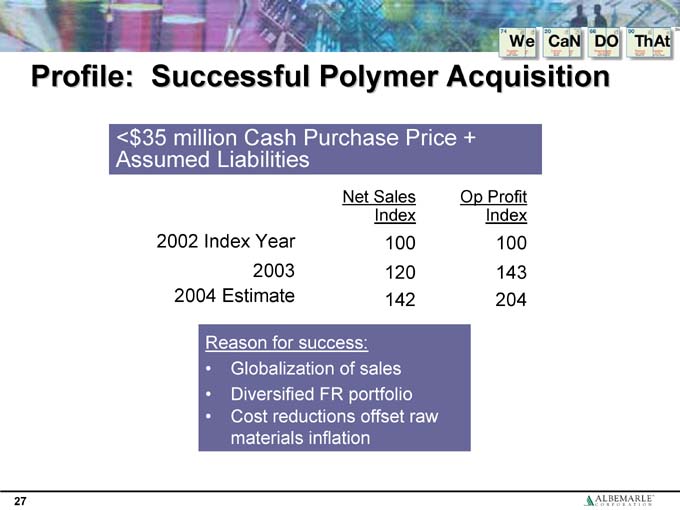

Profile: Successful Polymer Acquisition

<$35 million Cash Purchase Price + Assumed Liabilities

Net Sales Op Profit

Index Index

2002 Index Year 100 100

2003 120 143

2004 Estimate 142 204

Reason for success:

• Globalization of sales

• Diversified FR portfolio

• Cost reductions offset raw materials inflation

27

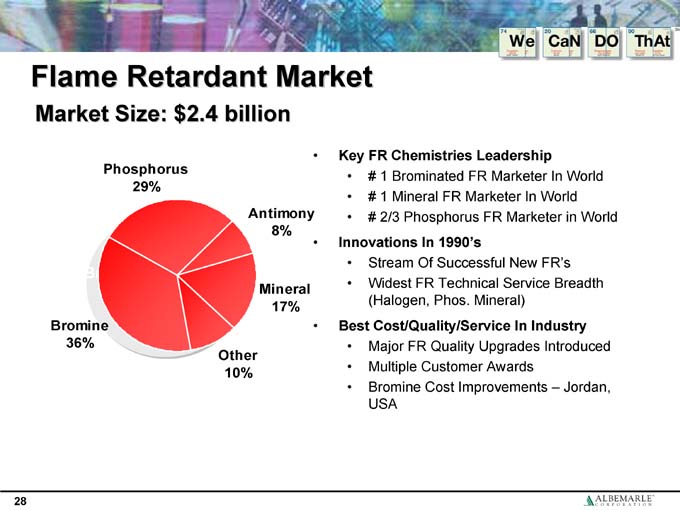

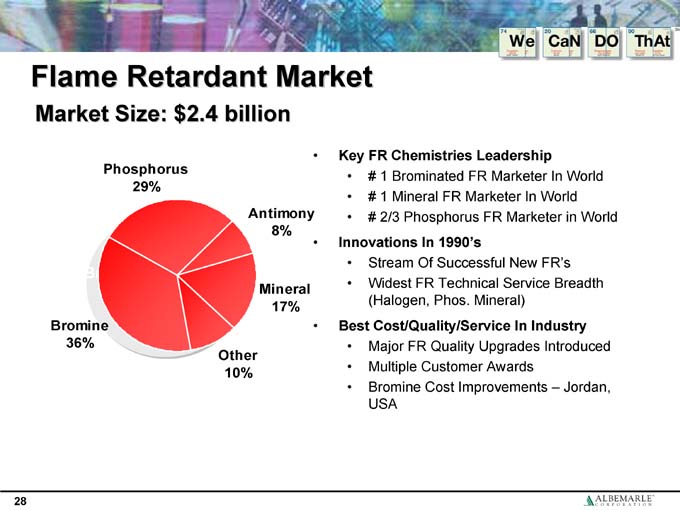

Flame Retardant Market

Market Size: $2.4 billion

Phosphorus 29%

Antimony 8%

Bromine 36%

Other 10%

Mineral 17%

Key FR Chemistries Leadership

• # 1 Brominated FR Marketer In World

• # 1 Mineral FR Marketer In World

• # 2/3 Phosphorus FR Marketer in World

Innovations In 1990’s

• Stream Of Successful New FR’s

• Widest FR Technical Service Breadth (Halogen, Phos. Mineral)

Best Cost/Quality/Service In Industry

• Major FR Quality Upgrades Introduced

• Multiple Customer Awards

• Bromine Cost Improvements – Jordan, USA

28

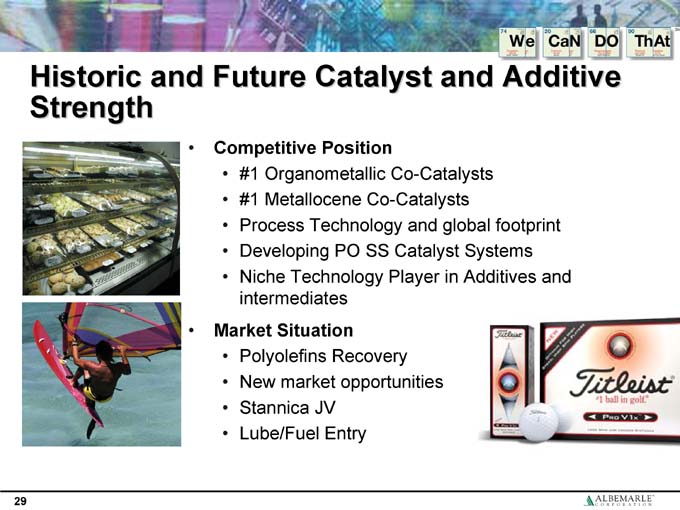

Historic and Future Catalyst and Additive Strength

• Competitive Position

• #1 Organometallic Co-Catalysts

• #1 Metallocene Co-Catalysts

• Process Technology and global footprint

• Developing PO SS Catalyst Systems

• Niche Technology Player in Additives and intermediates

• Market Situation

• Polyolefins Recovery

• New market opportunities

• Stannica JV

• Lube/Fuel Entry

29

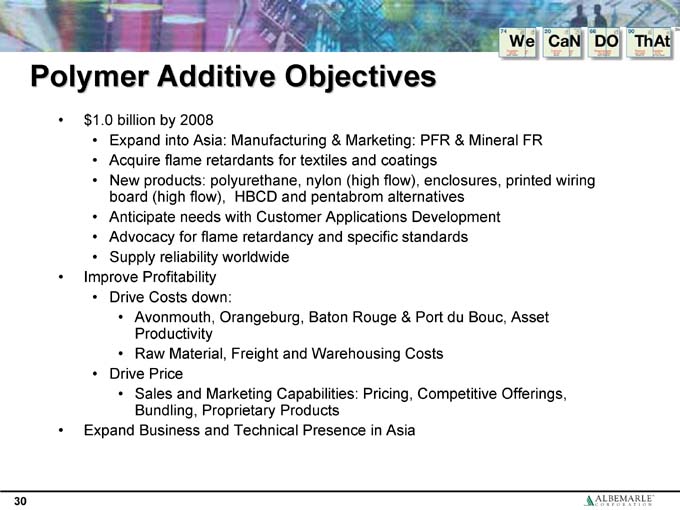

Polymer Additive Objectives

•$ 1.0 billion by 2008

• Expand into Asia: Manufacturing & Marketing: PFR & Mineral FR

• Acquire flame retardants for textiles and coatings

• New products: polyurethane, nylon (high flow), enclosures, printed wiring board (high flow), HBCD and pentabrom alternatives

• Anticipate needs with Customer Applications Development

• Advocacy for flame retardancy and specific standards

• Supply reliability worldwide

• Improve Profitability

• Drive Costs down:

• Avonmouth, Orangeburg, Baton Rouge & Port du Bouc, Asset Productivity

• Raw Material, Freight and Warehousing Costs

• Drive Price

• Sales and Marketing Capabilities: Pricing, Competitive Offerings, Bundling, Proprietary Products

• Expand Business and Technical Presence in Asia

30

Consolidated Current Albemarle

A New Global Chemicals Leader Emerges

31

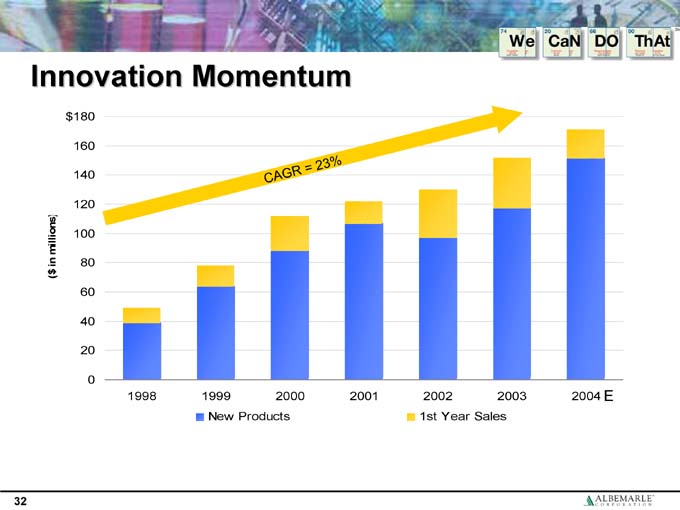

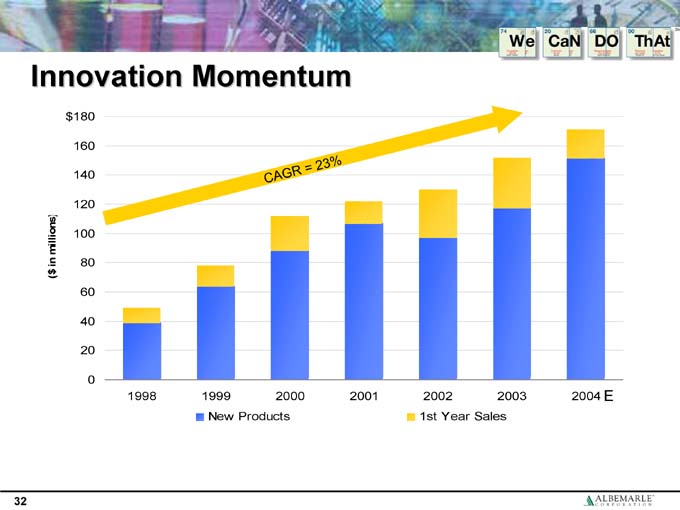

Innovation Momentum

1998 1999 2000 2001 2002 2003 2004 E

New Products 1st Year Sales

32

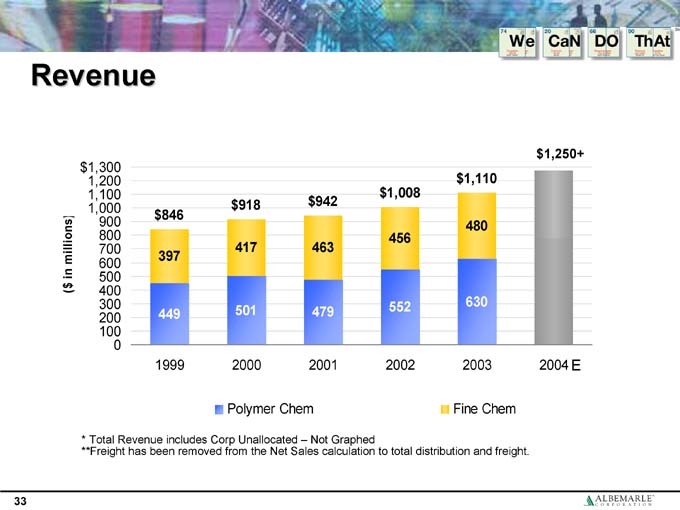

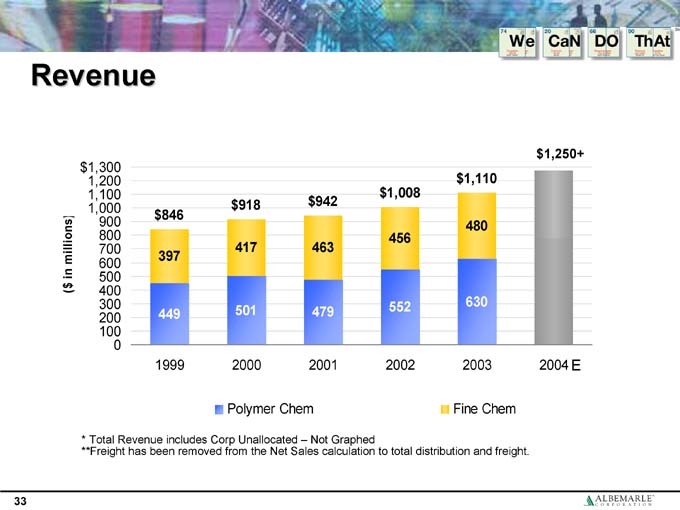

Revenue

($ in milliions)

$846 397 449 1999

$918 417 501 2000

$942 463 479 2001

$1,008 456 552 2002

$1,110 480 630 2003

$1,250+ 2004 E

Polymer Chem Fine Chem

* Total Revenue includes Corp Unallocated – Not Graphed

**Freight has been removed from the Net Sales calculation to total distribution and freight.

33

Akzo Catalysts Overview

A New Global Chemicals Leader Emerges

34

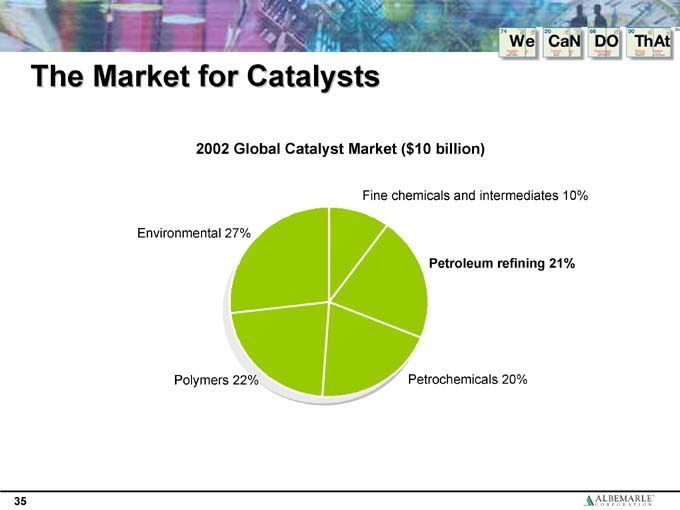

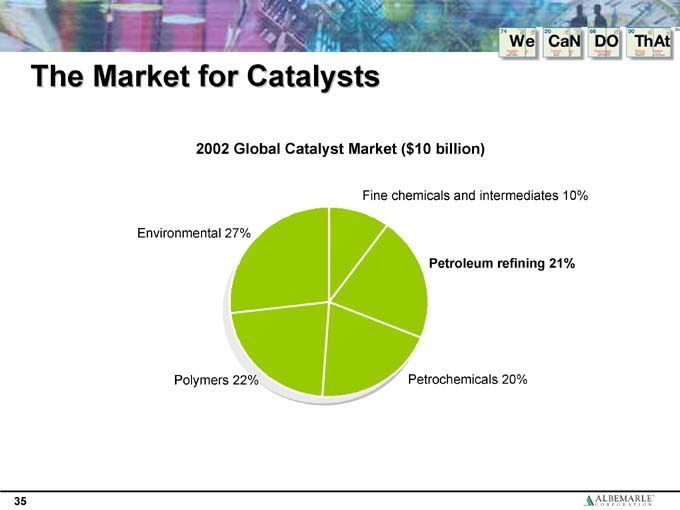

The Market for Catalysts

2002 Global Catalyst Market ($10 billion)

Environmental 27%

Polymers 22%

Petrochemicals 20%

Petroleum refining 21%

Fine chemicals and intermediates 10%

35

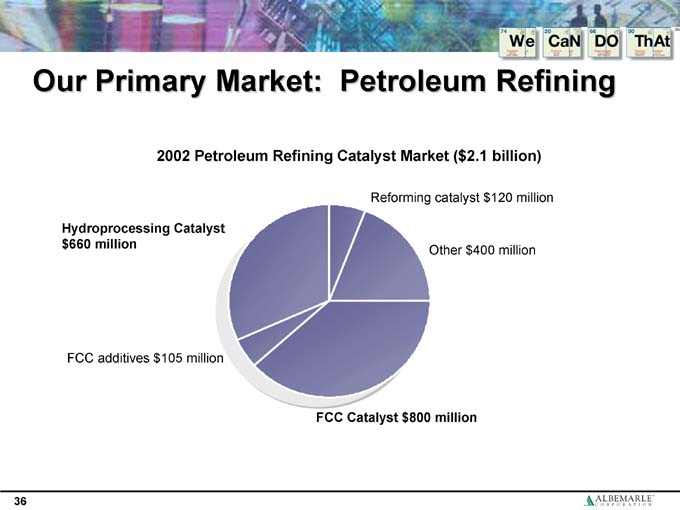

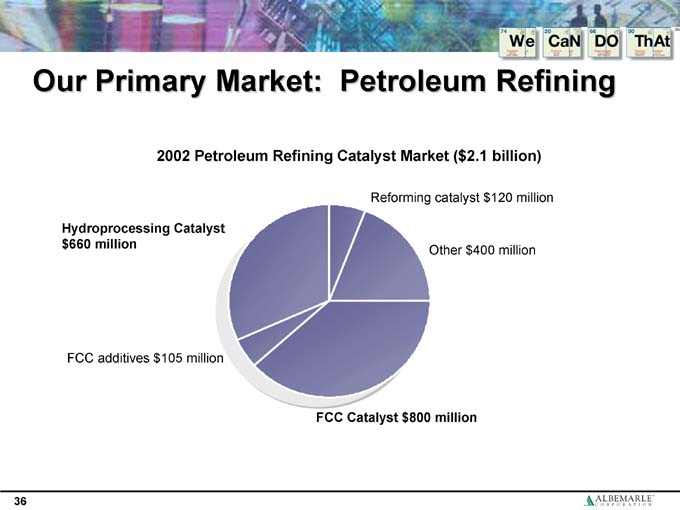

Our Primary Market: Petroleum Refining

2002 Petroleum Refining Catalyst Market ($2.1 billion)

Reforming catalyst $120 million

Other $400 million

FCC Catalyst $800 million

FCC additives $105 million

Hydroprocessing Catalyst $660 million

36

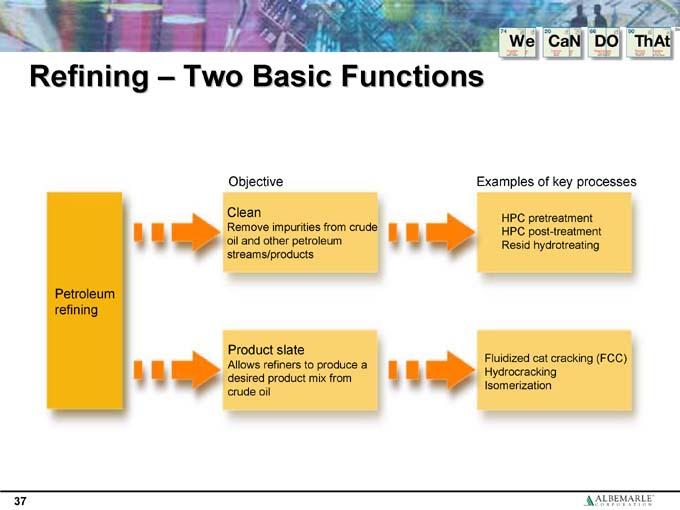

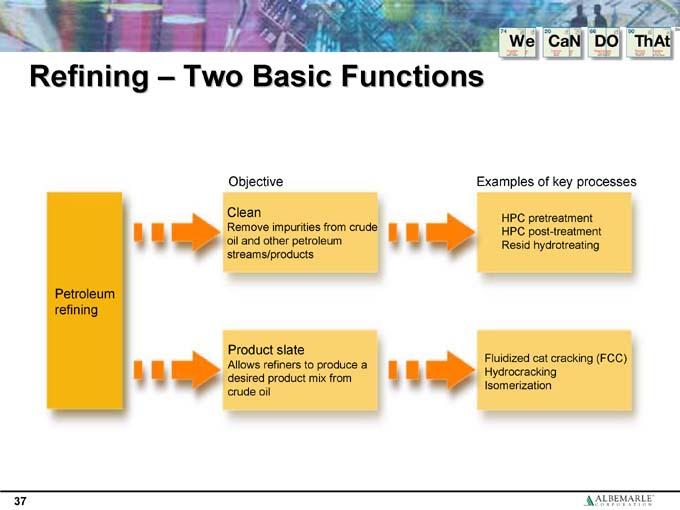

Refining – Two Basic Functions

Petroleum refining

Objective

Clean

Remove impurities from crude oil and other petroleum streams/products

Product slate

Allows refiners to produce a desired product mix from crude oil

Examples of key processes

HPC pretreatment

HPC post-treatment

Resid hydrotreating

Fluidized cat cracking (FCC)

Hydrocracking

Isomerization

37

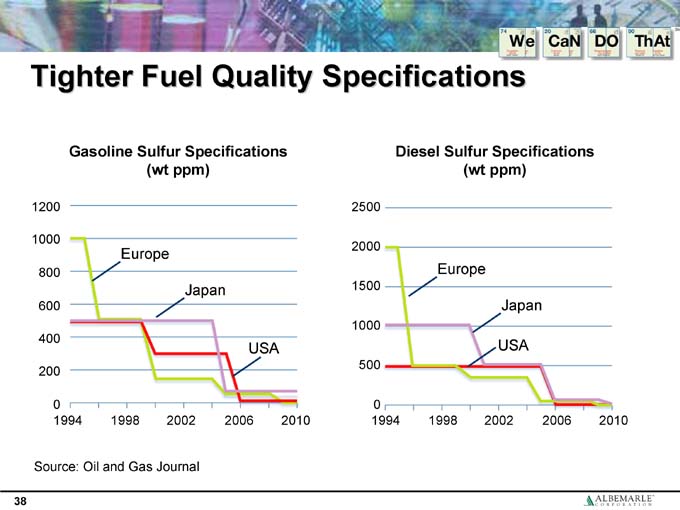

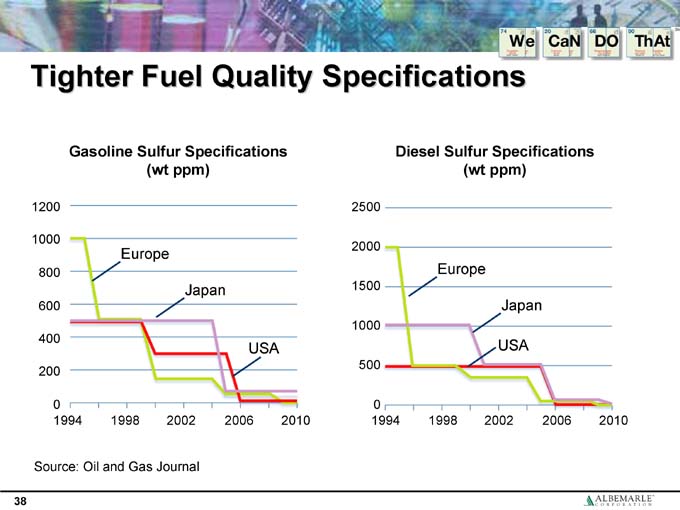

Tighter Fuel Quality Specifications

Gasoline Sulfur Specifications (wt ppm)

Europe

Japan

USA

Diesel Sulfur Specifications (wt ppm)

Europe

Japan

USA

Source: Oil and Gas Journal

38

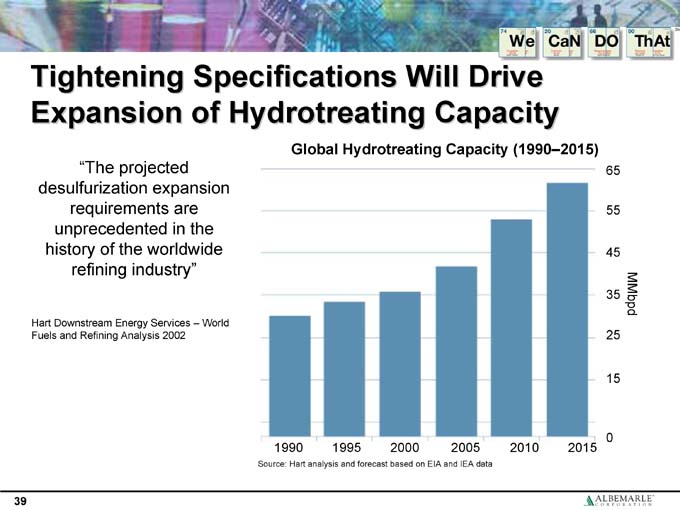

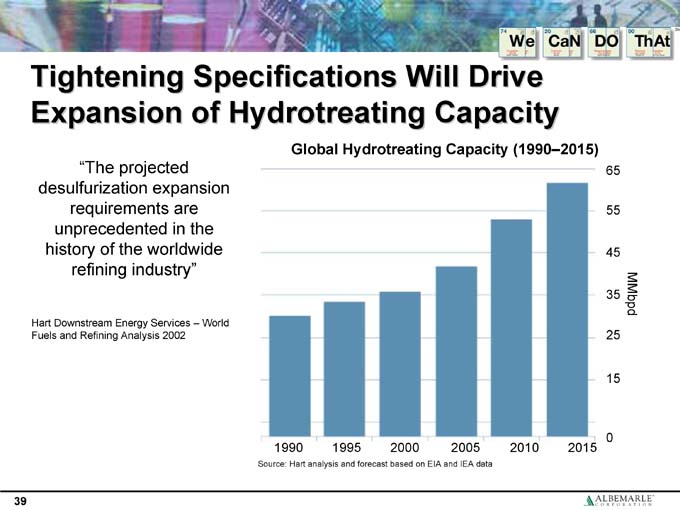

Tightening Specifications Will Drive Expansion of Hydrotreating Capacity

“The projected desulfurization expansion requirements are unprecedented in the history of the worldwide refining industry”

Hart Downstream Energy Services – World Fuels and Refining Analysis 2002

Global Hydrotreating Capacity (1990–2015)

Source: Hart analysis and forecast based on EIA and IEA data

39

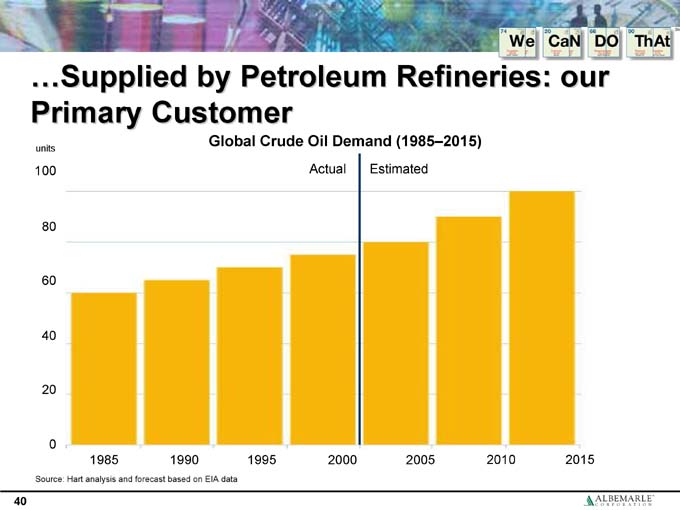

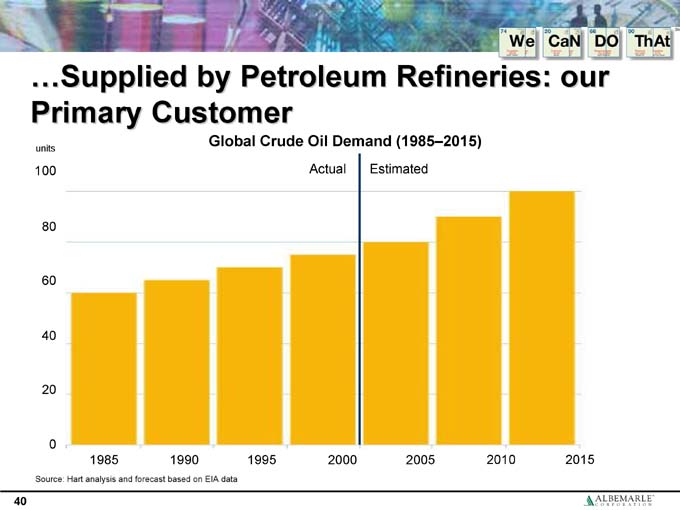

…Supplied by Petroleum Refineries: our Primary Customer

Global Crude Oil Demand (1985–2015) units

Actual Estimated

Source: Hart analysis and forecast based on EIA data

40

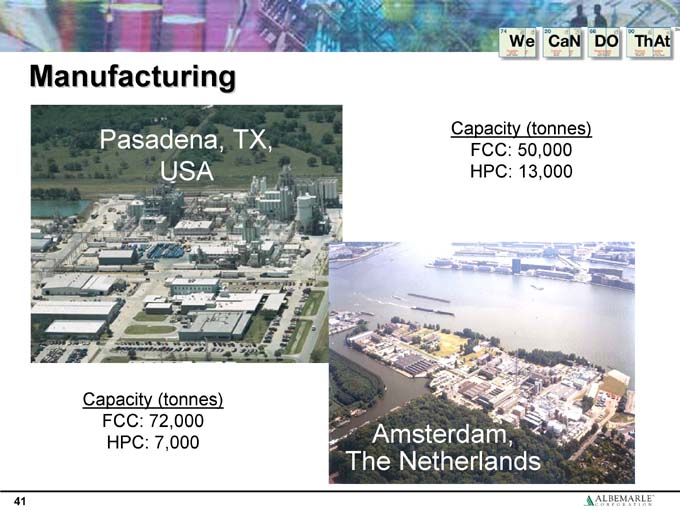

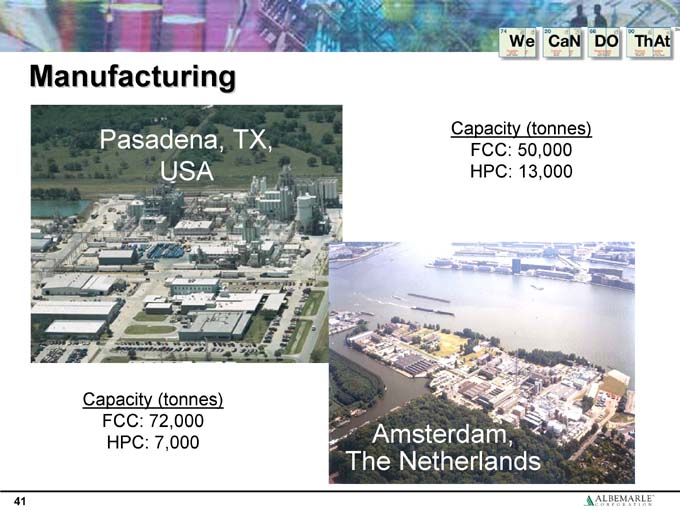

Manufacturing

Pasadena, TX, USA

Capacity (tonnes) FCC: 72,000 HPC: 7,000

Capacity (tonnes) FCC: 50,000 HPC: 13,000

Amsterdam, The Netherlands

41

Joint Ventures – Strategic Advantage in a Global Market

Capacity: 10,000 HPC t/yr

Capacity: 32,500 FCC t/yr

• Leverages technology and R&D – single global program

• Extends the reach of our business

• Provides regional advantage – knowledge of local industry culture, market needs and regulatory environment

• Enhances diversity in the organization

• Broadens our service offering

• Part of the technology family of Akzo

42

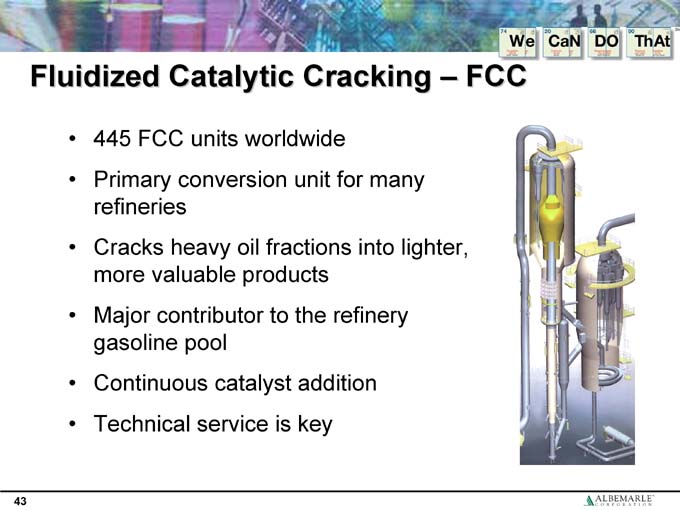

Fluidized Catalytic Cracking – FCC

• 445 FCC units worldwide

• Primary conversion unit for many refineries

• Cracks heavy oil fractions into lighter, more valuable products

• Major contributor to the refinery gasoline pool

• Continuous catalyst addition

• Technical service is key

43

HPC Business

• More than 2,000 units worldwide

• Batch process – typical cycle length, 1 to 2 years

• Unit taken out of service during catalyst change

• Catalyst loading tailored to individual units

• Joint venture support

44

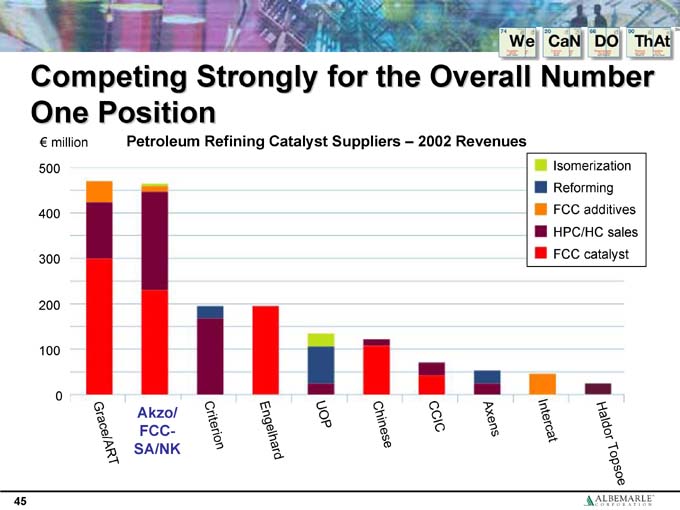

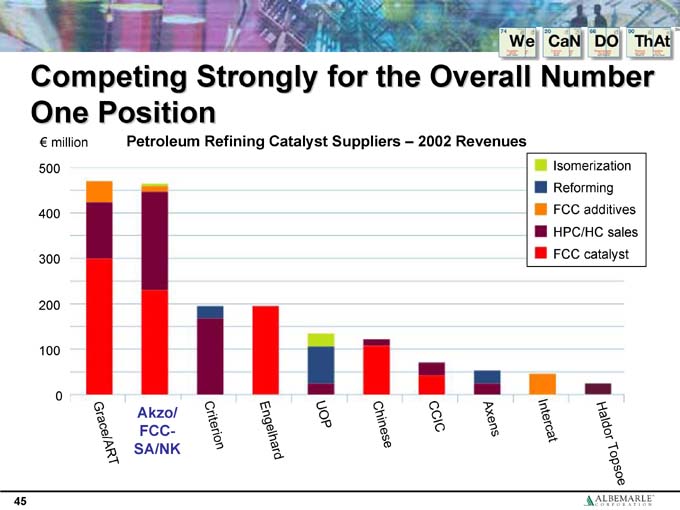

Competing Strongly for the Overall Number One Position

€ million

Petroleum Refining Catalyst Suppliers – 2002 Revenues

Isomerization

Reforming

FCC additives

HPC/HC sales

FCC catalyst

45

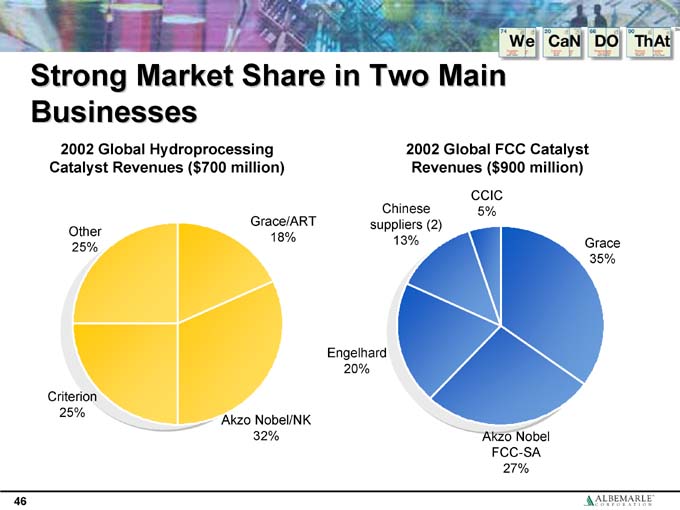

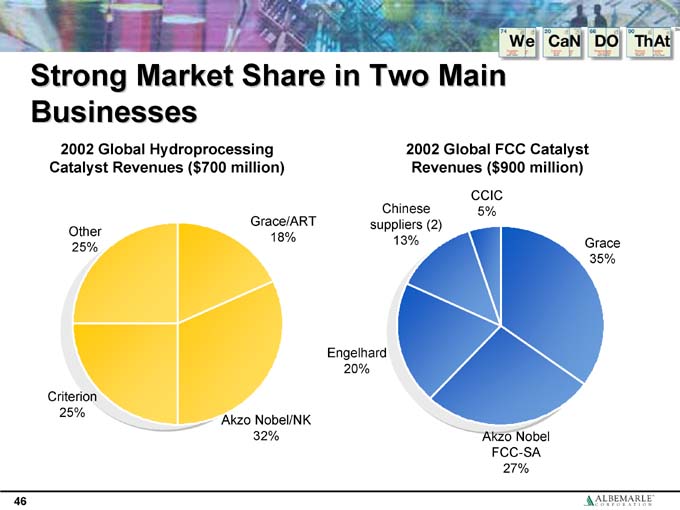

Strong Market Share in Two Main Businesses

2002 Global Hydroprocessing Catalyst Revenues ($700 million)

Other 25%

Criterion 25%

Grace/ART 18%

Akzo Nobel/NK 32%

2002 Global FCC Catalyst Revenues ($900 million)

CCIC 5%

Chinese suppliers (2) 13%

Engelhard 20%

Akzo Nobel FCC-SA 27%

Grace 35%

46

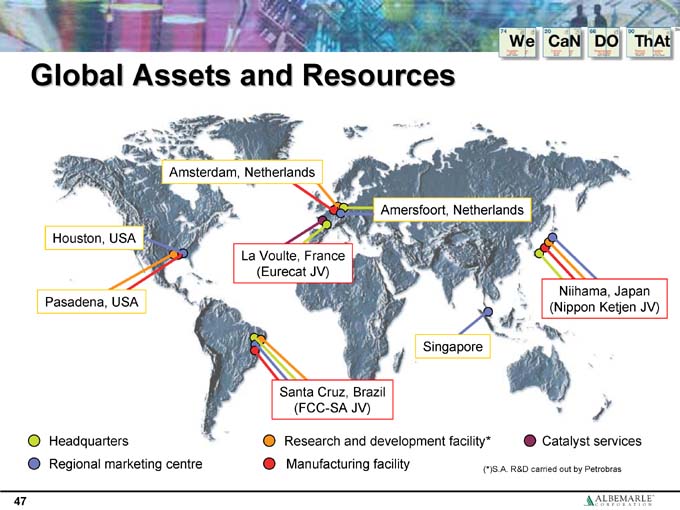

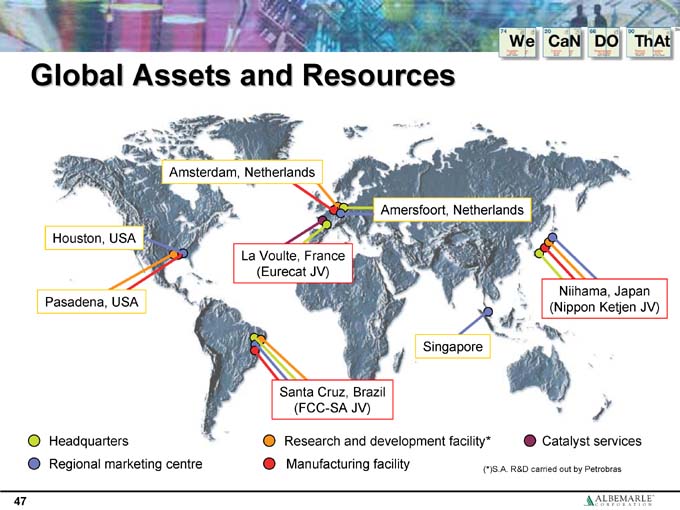

Global Assets and Resources

Houston, USA

Pasadena, USA

Amsterdam, Netherlands

Amersfoort, Netherlands

La Voulte, France (Eurecat JV)

Santa Cruz, Brazil (FCC-SA JV)

Singapore

Niihama, Japan (Nippon Ketjen JV)

Headquarters

Research and development facility*

Catalyst services

Regional marketing centre

Manufacturing facility

(*)S.A. R&D carried out by Petrobras

47

Commitment to Technology

• 5–6% of sales revenue allocated to R&D

• 168 R&D personnel (total employees 827)

• Technology integral to sales and marketing

• Global R&D network aligned with manufacturing and marketing

• FCC – Amsterdam, Pasadena, Brazil (Petrobras)

• HPC – Amsterdam, Japan (Nippon Ketjen)

• New catalysts and advanced materials –Amsterdam

• Collaboration

48

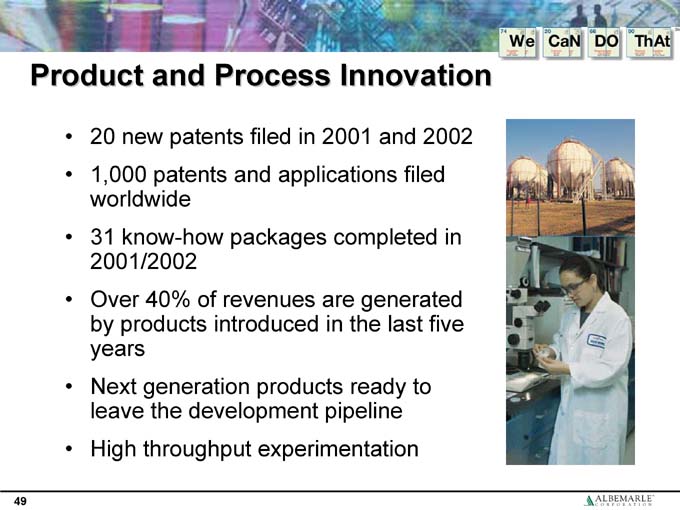

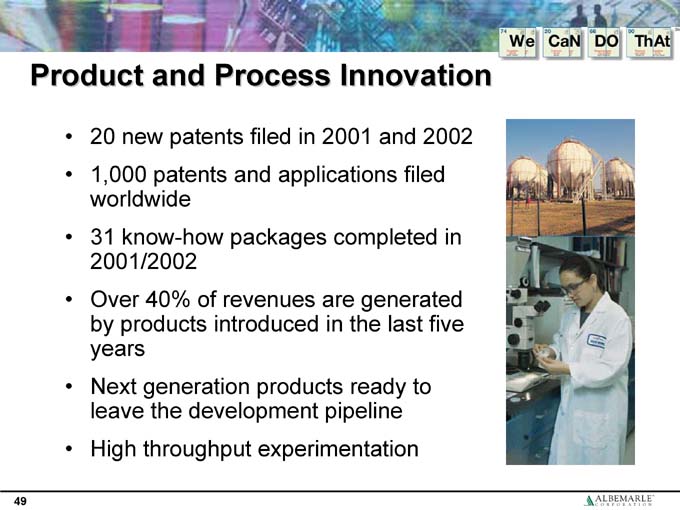

Product and Process Innovation

• 20 new patents filed in 2001 and 2002

• 1,000 patents and applications filed worldwide

• 31 know-how packages completed in 2001/2002

• Over 40% of revenues are generated by products introduced in the last five years

• Next generation products ready to leave the development pipeline

• High throughput experimentation

49

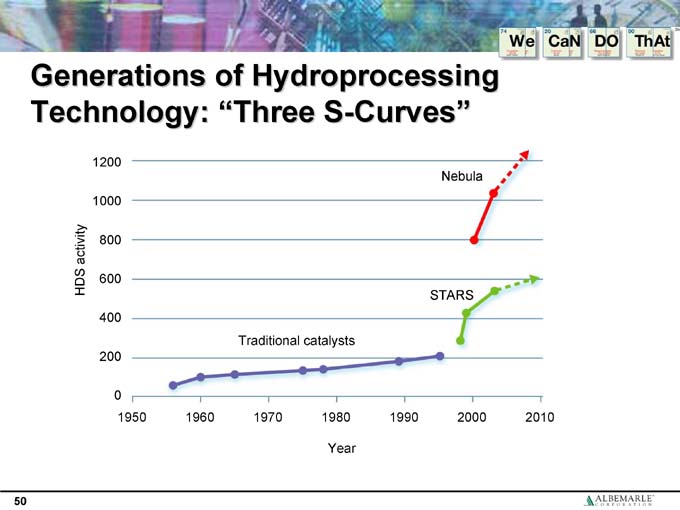

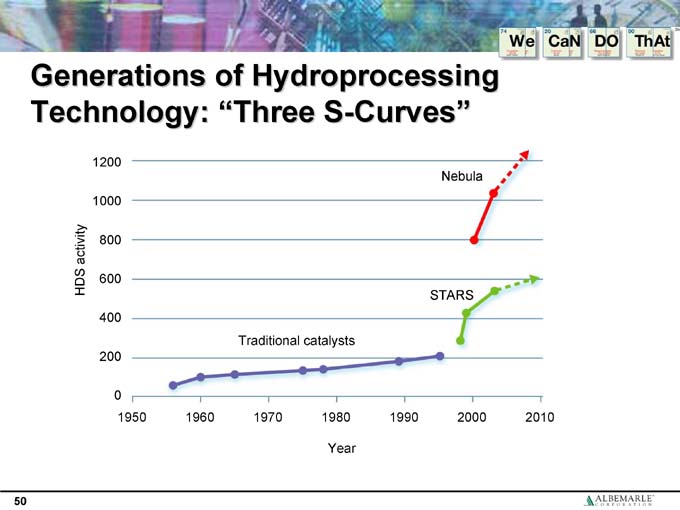

Generations of Hydroprocessing Technology: “Three S-Curves”

Nebula

STARS

Traditional catalysts

1950 1960 1970 1980 1990 2000 2010

Year

50

Albemarle’s New Business

A New Global Chemicals Leader Emerges

51

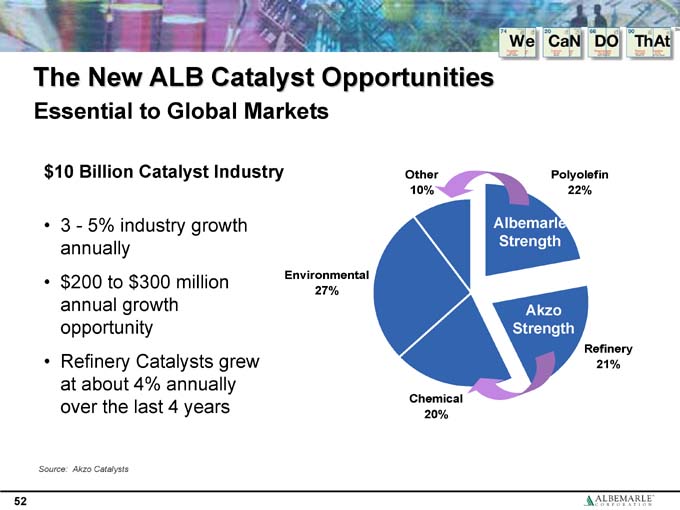

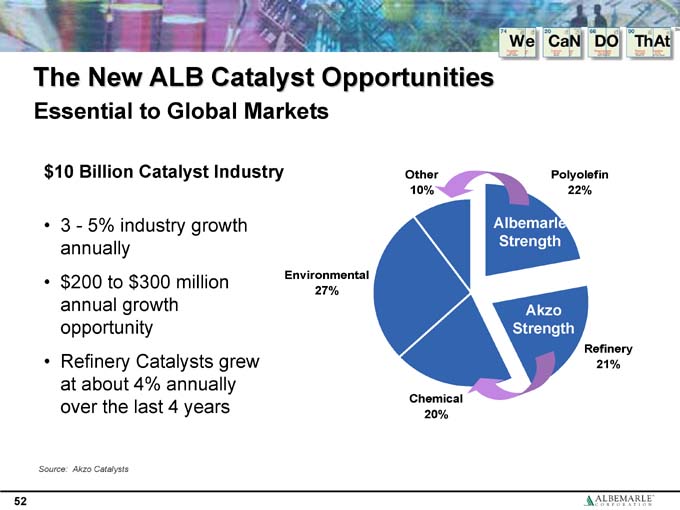

The New ALB Catalyst Opportunities

Essential to Global Markets $10 Billion Catalyst Industry

• 3—5% industry growth annually

•$ 200 to $300 million annual growth opportunity

• Refinery Catalysts grew at about 4% annually over the last 4 years

Environmental 27%

Chemical 20%

Akzo Strength

Refinery 21%

Albemarle Strength

Polyolefin 22%

Other 10%

Source: Akzo Catalysts

52

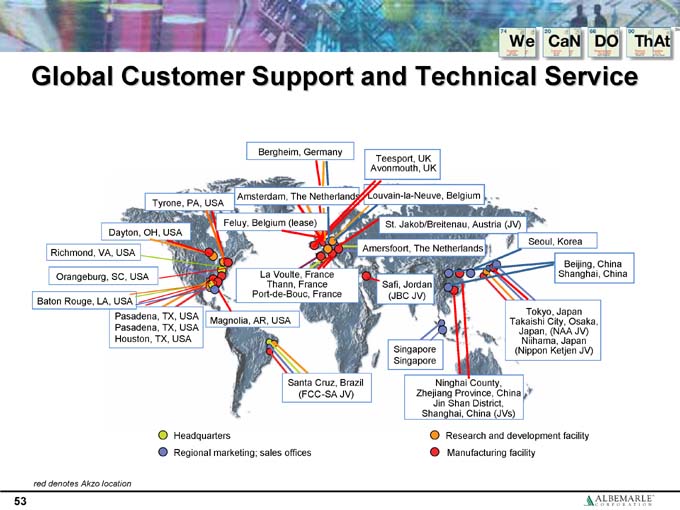

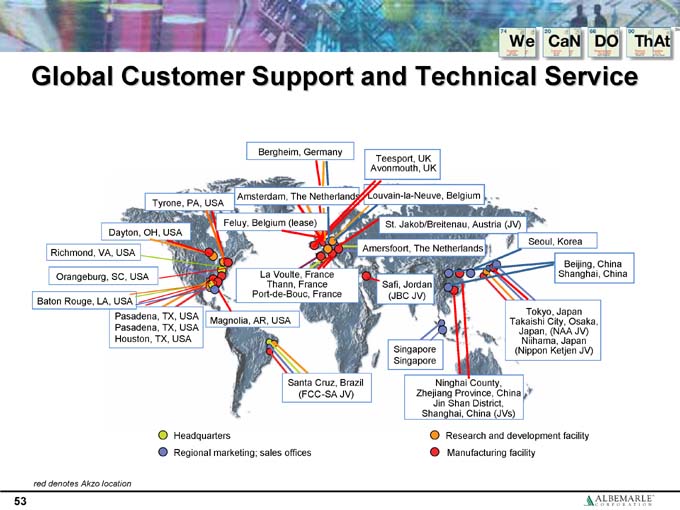

Global Customer Support and Technical Service

Bergheim, Germany

Teesport, UK Avonmouth, UK

Tyrone, PA, USA

Amsterdam, The Netherlands

Louvain-la-Neuve, Belgium

St. Jakob/Breitenau, Austria (JV)

Seoul, Korea

Beijing, China Shanghai, China

Tokyo, Japan Takaishi City, Osaka, Japan, (NAA JV) Niihama, Japan (Nippon Ketjen JV)

Ninghai County, Zhejiang Province, China Jin Shan District, Shanghai, China (JVs)

Singapore Singapore

Safi, Jordan (JBC JV)

La Voulte, France Thann, France Port-de-Bouc, France

Magnolia, AR, USA

Santa Cruz, Brazil (FCC-SA JV)

Pasadena, TX, USA Pasadena, TX, USA Houston, TX, USA

Baton Rouge, LA, USA

Orangeburg, SC, USA

Richmond, VA, USA

Dayton, OH, USA

Feluy, Belgium (lease)

Headquarters

Research and development facility

Regional marketing; sales offices

Manufacturing facility red denotes Akzo location

53

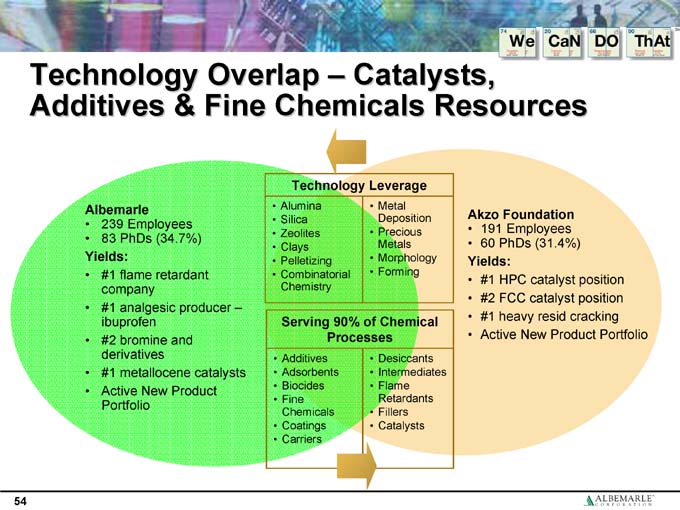

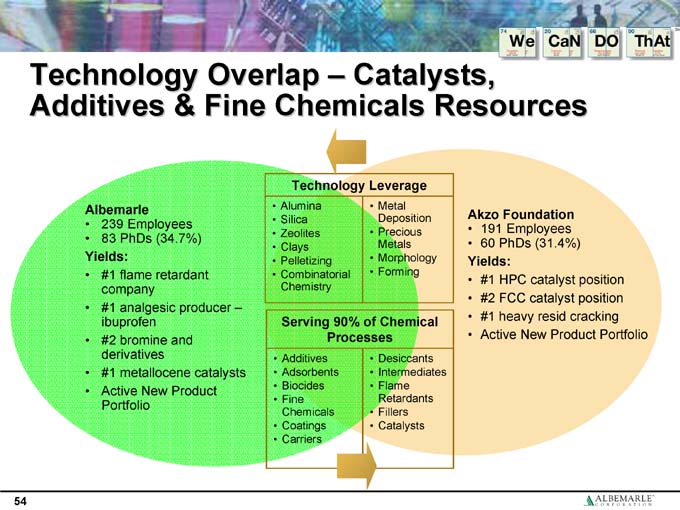

Technology Overlap – Catalysts, Additives & Fine Chemicals Resources

Albemarle

• 239 Employees

• 83 PhDs (34.7%)

Yields:

• #1 flame retardant company

• #1 analgesic producer –ibuprofen

• #2 bromine and derivatives

• #1 metallocene catalysts

• Active New Product Portfolio

Technology Leverage

• Alumina

• Silica

• Zeolites

• Clays

• Pelletizing

• Combinatorial Chemistry

• Metal Deposition

• Precious Metals

• Morphology

• Forming

Serving 90% of Chemical Processes

• Additives

• Adsorbents

• Biocides

• Fine Chemicals

• Coatings

• Carriers

• Desiccants

• Intermediates

• Flame Retardants

• Fillers

• Catalysts

Akzo Foundation

• 191 Employees

• 60 PhDs (31.4%)

Yields:

• #1 HPC catalyst position

• #2 FCC catalyst position

• #1 heavy resid cracking

• Active New Product Portfolio

54

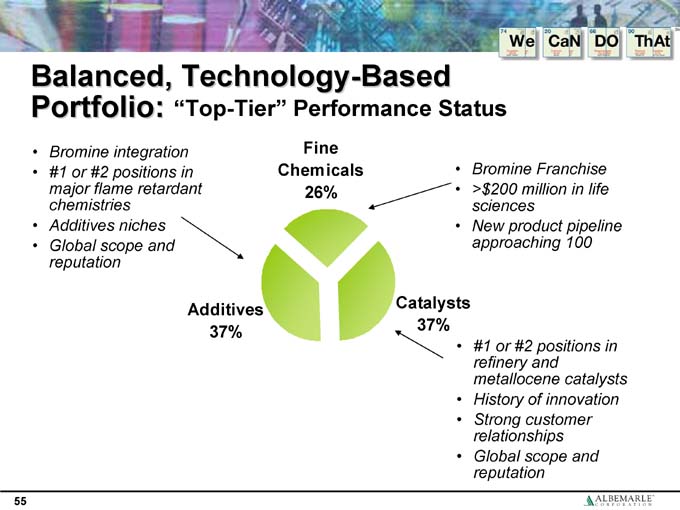

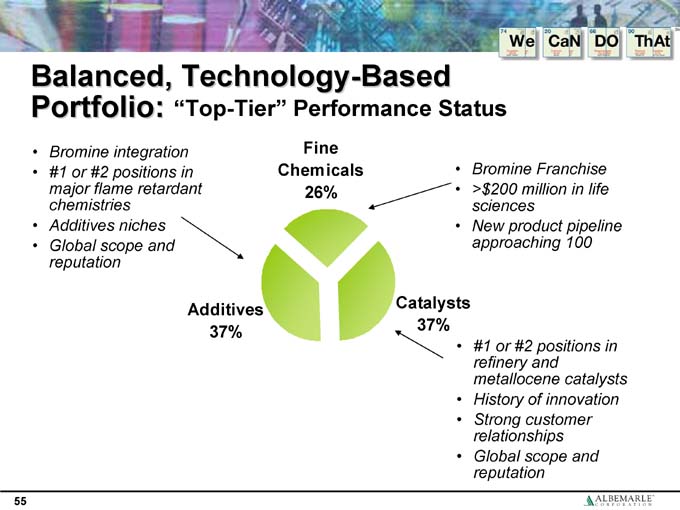

Balanced, Technology-Based

Portfolio: “Top-Tier” Performance Status

Additives 37%

• Bromine integration

• #1 or #2 positions in major flame retardant chemistries

• Additives niches

• Global scope and reputation

Fine Chemicals 26%

• Bromine Franchise

• >$200 million in life sciences

• New product pipeline approaching 100

Catalysts 37%

• #1 or #2 positions in refinery and metallocene catalysts

• History of innovation

• Strong customer relationships

• Global scope and reputation

55

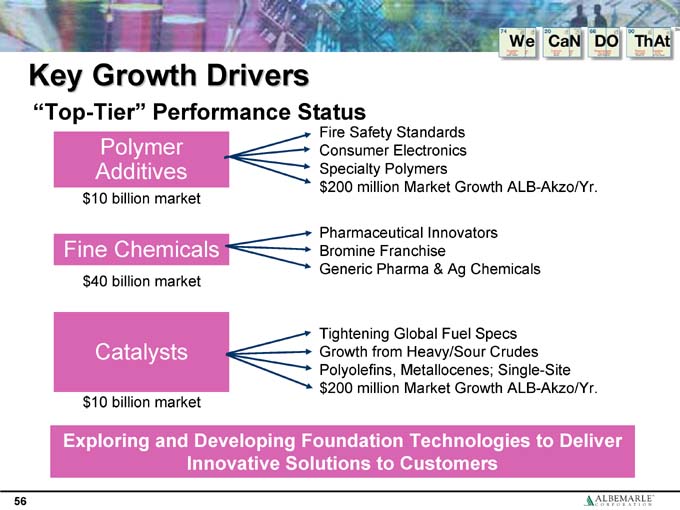

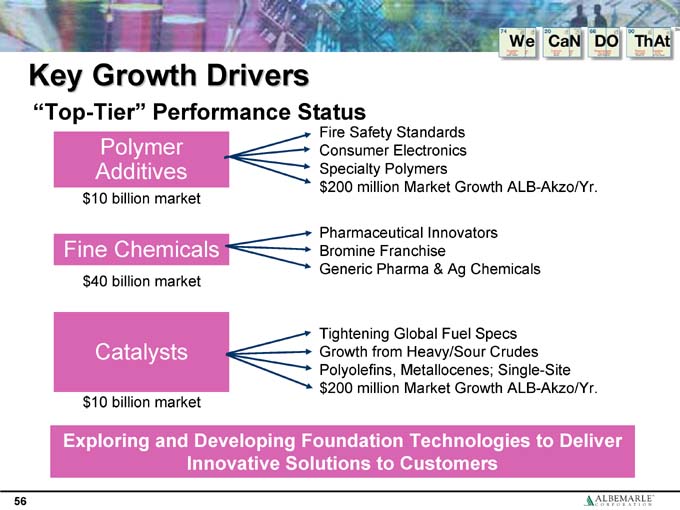

Key Growth Drivers

“Top-Tier” Performance Status

Polymer Additives

$10 billion market

Fire Safety Standards

Consumer Electronics

Specialty Polymers

$200 million Market Growth ALB-Akzo/Yr.

Fine Chemicals

$40 billion market

Pharmaceutical Innovators

Bromine Franchise

Generic Pharma & Ag Chemicals

Catalysts

$10 billion market

Tightening Global Fuel Specs

Growth from Heavy/Sour Crudes

Polyolefins, Metallocenes; Single-Site

$200 million Market Growth ALB-Akzo/Yr.

Exploring and Developing Foundation Technologies to Deliver Innovative Solutions to Customers

56

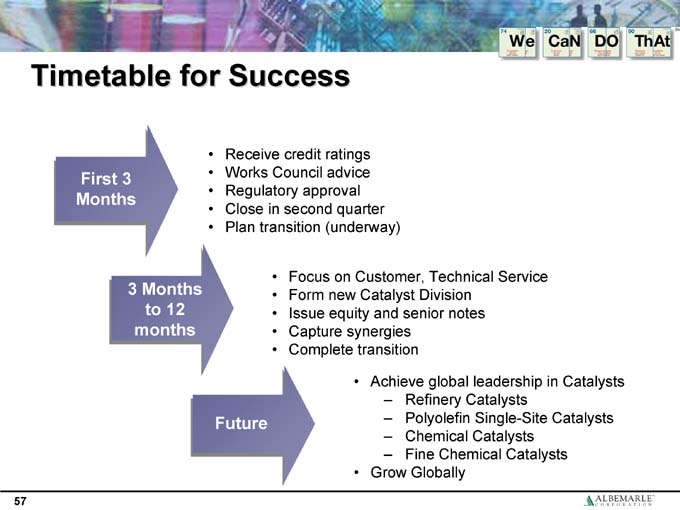

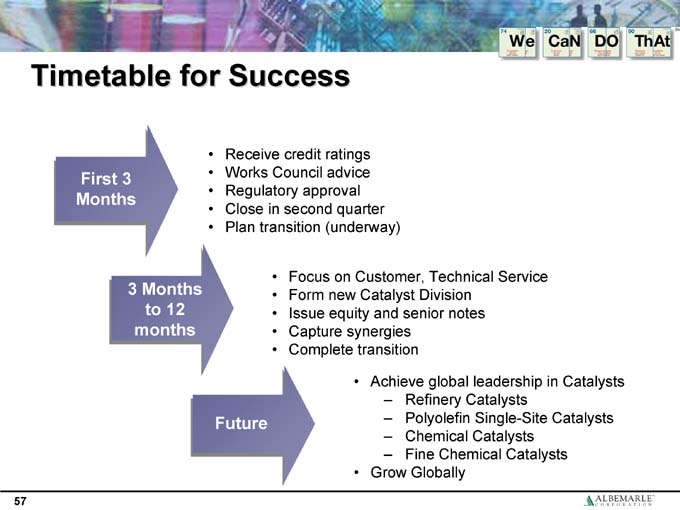

Timetable for Success

First 3 Months

• Receive credit ratings

• Works Council advice

• Regulatory approval

• Close in second quarter

• Plan transition (underway)

3 Months to 12 months

• Focus on Customer, Technical Service

• Form new Catalyst Division

• Issue equity and senior notes

• Capture synergies

• Complete transition

Future

• Achieve global leadership in Catalysts

– Refinery Catalysts

– Polyolefin Single-Site Catalysts

– Chemical Catalysts

– Fine Chemical Catalysts

• Grow Globally

57

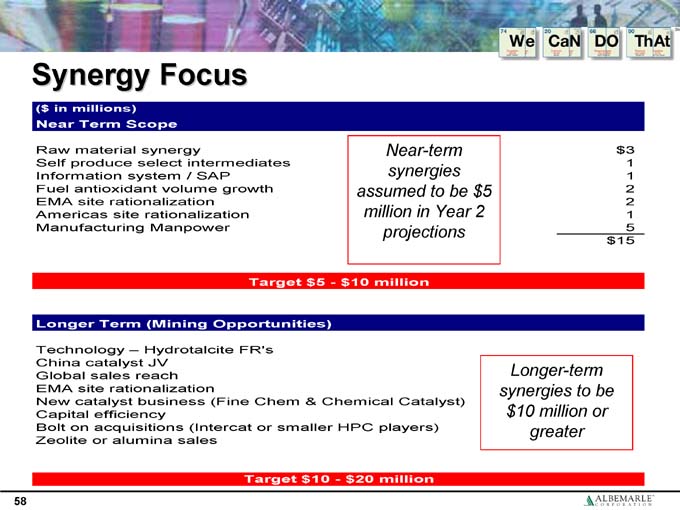

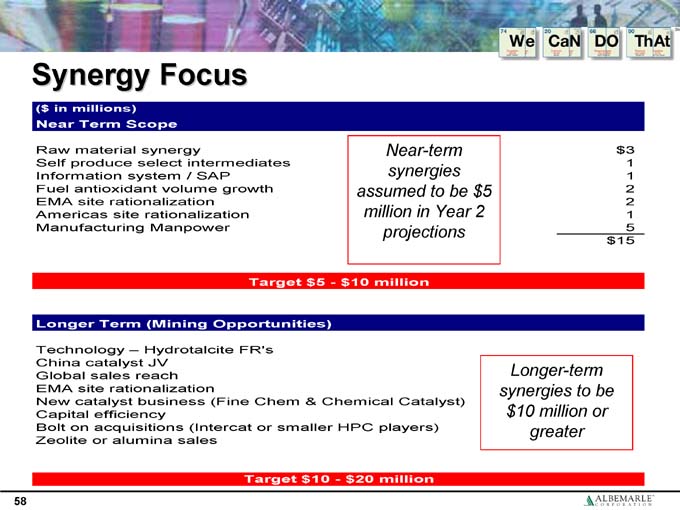

Synergy Focus

($ in millions)

Near Term Scope

Raw material synergy $3

Self produce select intermediates 1

Information system / SAP 1

Fuel antioxidant volume growth 2

EMA site rationalization 2

Americas site rationalization 1

Manufacturing Manpower 5

$ 15

Near-term synergies assumed to be $5 million in Year 2 projections

Target $5—$10 million

Longer Term (Mining Opportunities)

Technology – Hydrotalcite FR’s

China catalyst JV

Global sales reach

EMA site rationalization

New catalyst business (Fine Chem & Chemical Catalyst)

Capital efficiency

Bolt on acquisitions (Intercat or smaller HPC players)

Zeolite or alumina sales

Longer-term synergies to be $10 million or greater

Target $10—$20 million

58

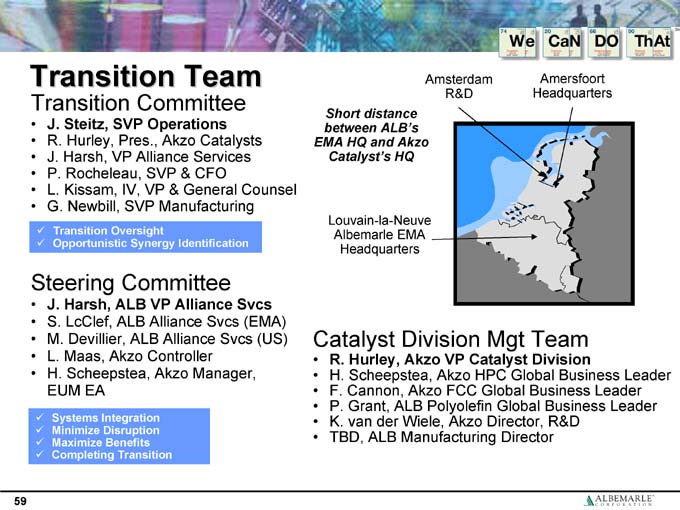

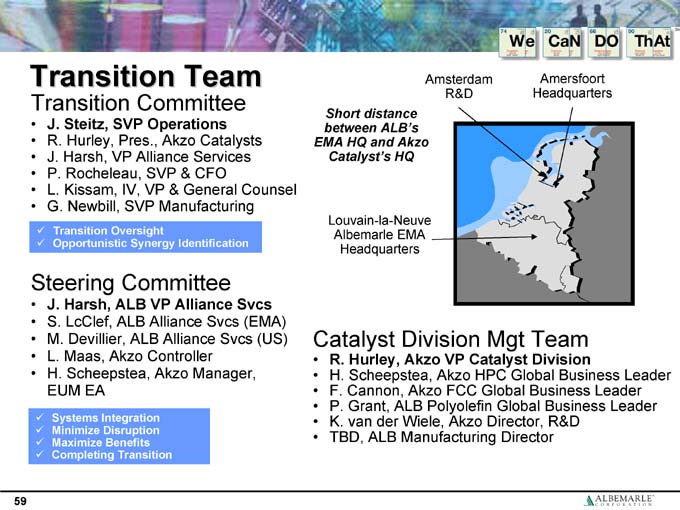

Transition Team

Transition Committee

• J. Steitz, SVP Operations

• R. Hurley, Pres., Akzo Catalysts

• J. Harsh, VP Alliance Services

• P. Rocheleau, SVP & CFO

• L. Kissam, IV, VP & General Counsel

• G. Newbill, SVP Manufacturing

Transition Oversight

Opportunistic Synergy Identification

Steering Committee

J. Harsh, ALB VP Alliance Svcs

S. LcClef, ALB Alliance Svcs (EMA)

M. Devillier, ALB Alliance Svcs (US)

L. Maas, Akzo Controller

H. Scheepstea, Akzo Manager, EUM EA

Systems Integration

Minimize Disruption

Maximize Benefits

Completing Transition

Catalyst Division Mgt Team

• R. Hurley, Akzo VP Catalyst Division

• H. Scheepstea, Akzo HPC Global Business Leader

• F. Cannon, Akzo FCC Global Business Leader

• P. Grant, ALB Polyolefin Global Business Leader

• K. van der Wiele, Akzo Director, R&D

• TBD, ALB Manufacturing Director

Short distance between ALB’s EMA HQ and Akzo Catalyst’s HQ

Louvain-la-Neuve Albemarle EMA

Headquarters

Amsterdam R&D

Amersfoort Headquarters

59

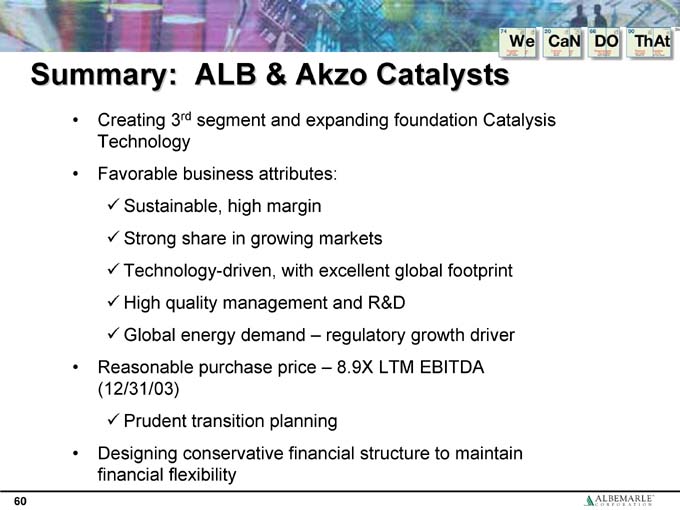

Summary: ALB & Akzo Catalysts

• Creating 3rd segment and expanding foundation Catalysis Technology

• Favorable business attributes:

Sustainable, high margin

Strong share in growing markets

Technology-driven, with excellent global footprint

High quality management and R&D

Global energy demand – regulatory growth driver

• Reasonable purchase price – 8.9X LTM EBITDA (12/31/03)

Prudent transition planning

• Designing conservative financial structure to maintain financial flexibility

60

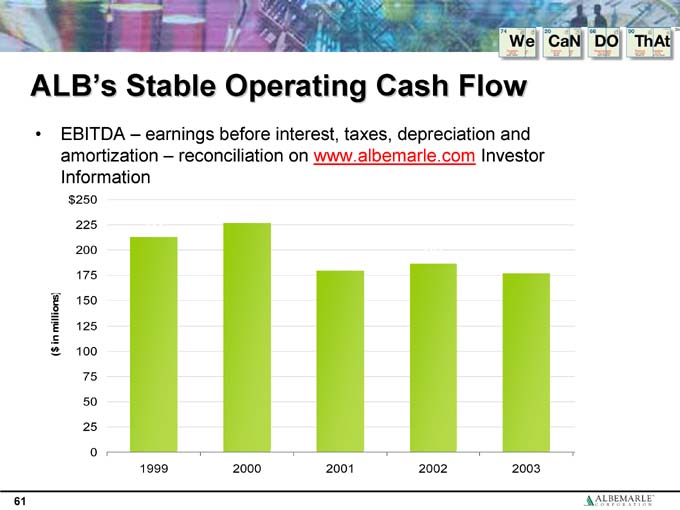

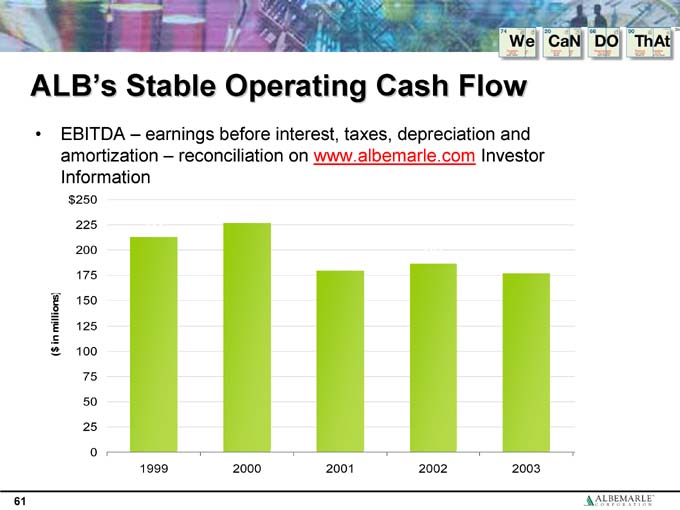

ALB’s Stable Operating Cash Flow

• EBITDA – earnings before interest, taxes, depreciation and amortization – reconciliation on www.albemarle.com Investor Information

61

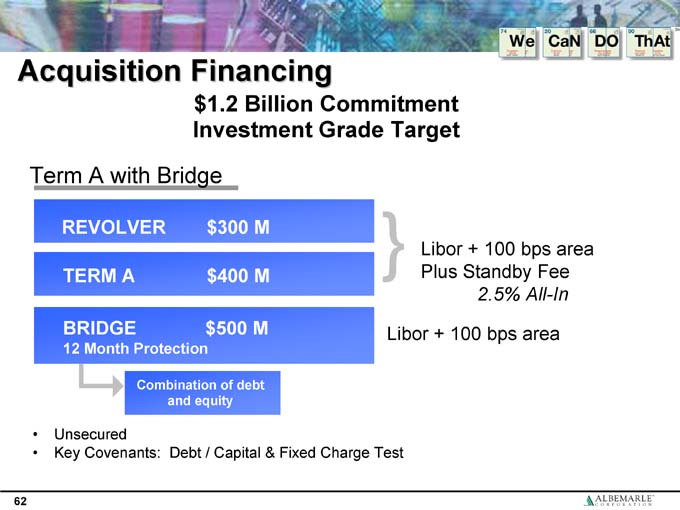

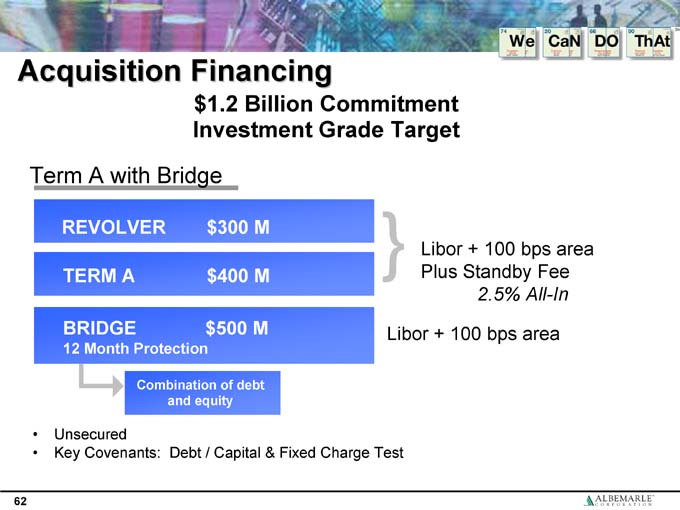

Acquisition Financing

$1.2 Billion Commitment Investment Grade Target

Term A with Bridge

REVOLVER $300 M

TERM A $400 M

BRIDGE $500 M

12 Month Protection

Combination of debt and equity

Libor + 100 bps area Plus Standby Fee

2.5% All-In

Libor + 100 bps area

• Unsecured

• Key Covenants: Debt / Capital & Fixed Charge Test

62

Creating Value in the Chemicals Sector

• Technology breadth, geographic profile, and discipline provides the framework to capture and create value

• Portfolio generates high EBITDA margins over a sustained period of time. Historically, “excess” cash flow for share repurchase and acquisitions creates significant value

• Cost reduction, acceleration of product development and M&A activity meets rise of global competition, with acquisitions playing a key role in expanding foundation technologies and market access

63