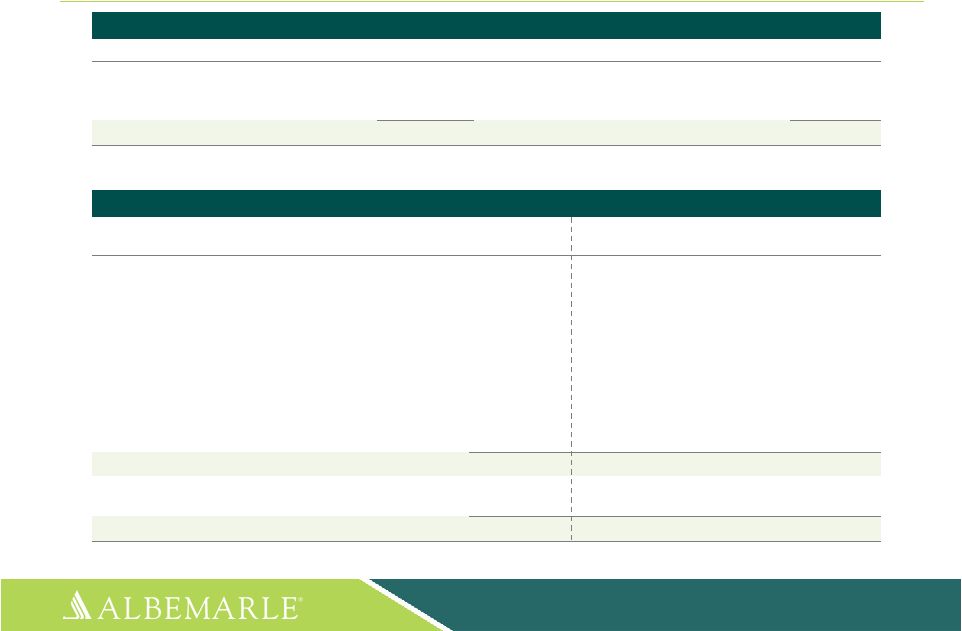

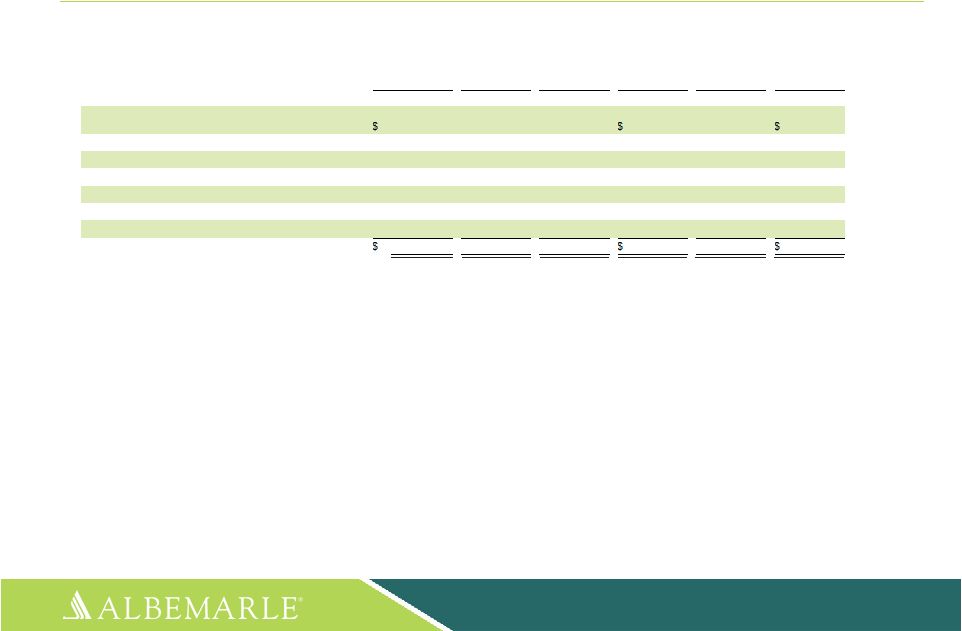

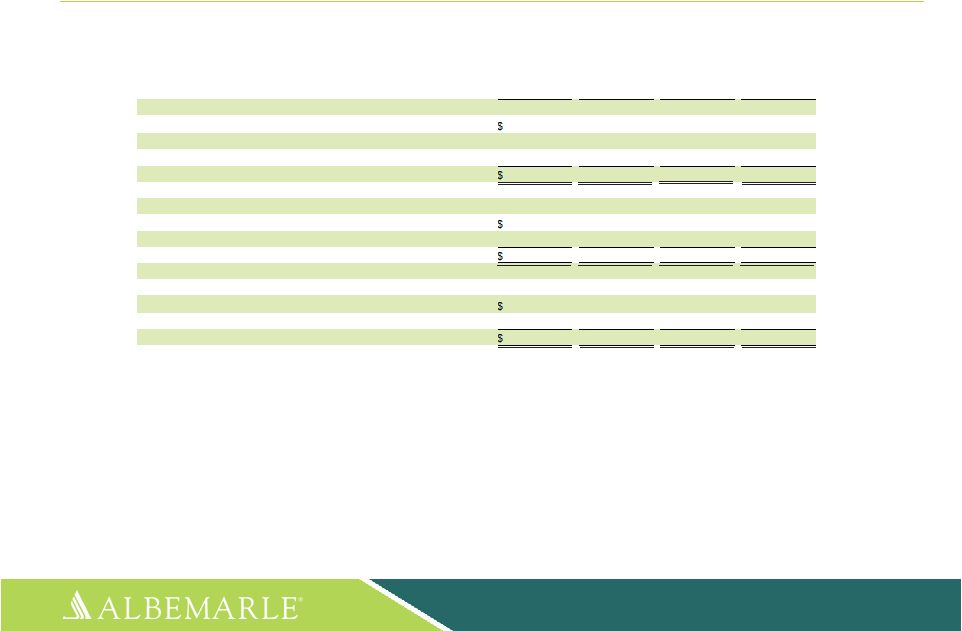

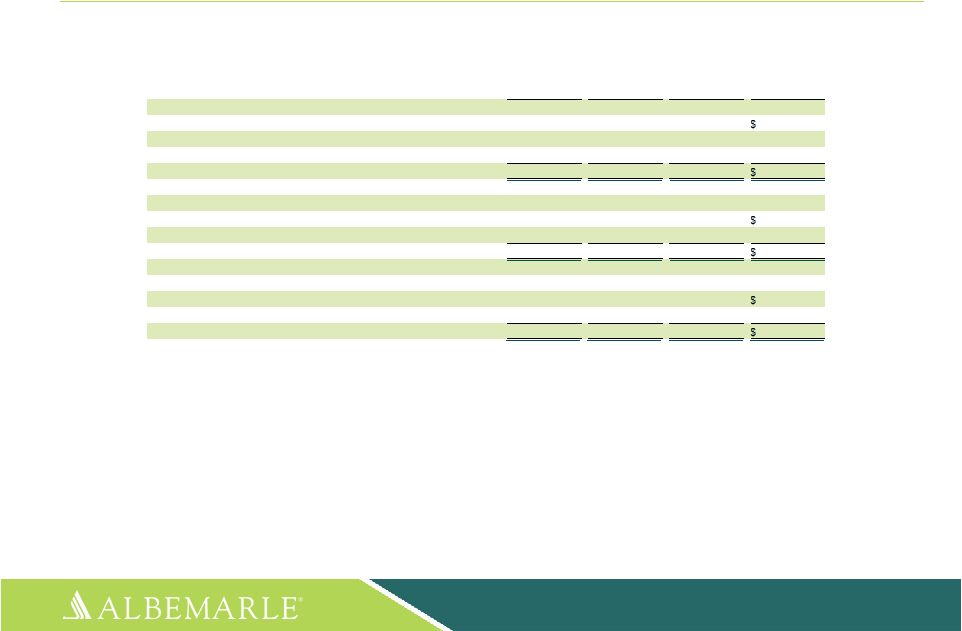

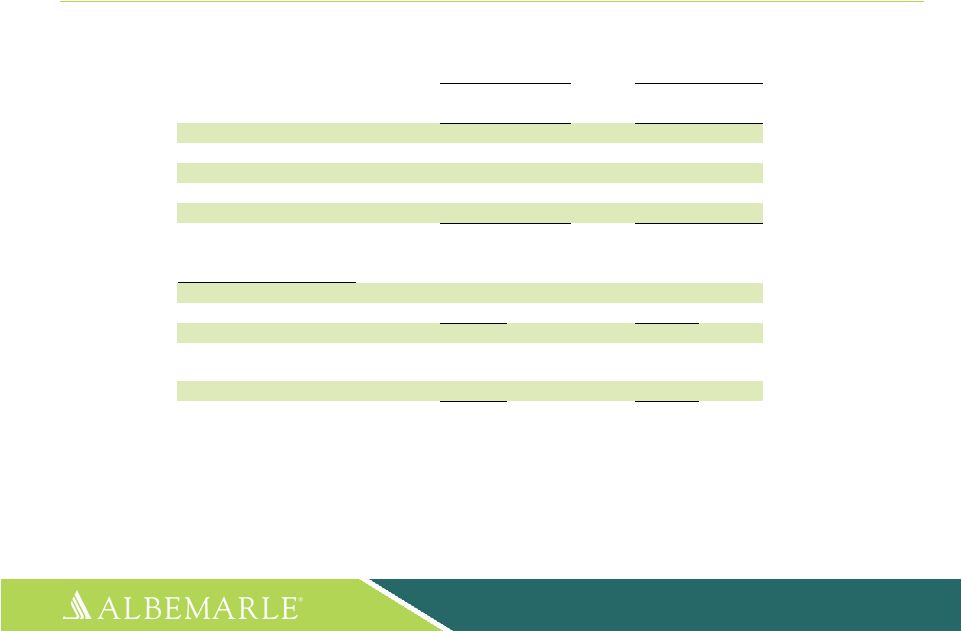

Net Income and EBITDA 69 ($ in thousands) See above for a reconciliation of adjusted net income attributable to Albemarle Corporation (“adjusted earnings”), EBITDA and adjusted EBITDA, the non-GAAP financial measures, to Net income attributable to Albemarle Corporation, the most directly comparable financial measure calculated and reported in accordance with GAAP. Adjusted net income attributable to Albemarle Corporation is defined as Net income attributable to Albemarle Corporation before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as Net income attributable to Albemarle Corporation before interest and financing expenses, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed below. Three Months Ended Six Months Ended June 30, June 30, 2015 2014 2015 2014 Net income attributable to Albemarle Corporation $ 52,147 $ 22,447 $ 95,262 $ 79,030 Add back: Non-operating pension and OPEB items (net of tax) (862) (855) (3,089) 8,089 Special items (net of tax) 43,807 5,189 130,123 16,334 Loss from discontinued operations (net of tax) — 60,025 — 61,794 Adjusted net income attributable to Albemarle Corporation $ 95,092 $ 86,806 $ 222,296 $ 165,247 Net income attributable to Albemarle Corporation $ 52,147 $ 22,447 $ 95,262 $ 79,030 Add back: Interest and financing expenses 33,182 8,733 68,928 17,506 Income tax expense (from continuing and discontinued operations) 17,139 1,624 31,279 14,070 Depreciation and amortization 67,483 24,905 131,469 52,714 EBITDA 169,951 57,709 326,938 163,320 Non-operating pension and OPEB items (1,314) (1,370) (4,823) 12,701 Special items (excluding special items associated with interest expense) 61,444 8,175 173,594 25,175 Loss from discontinued operations — 80,174 — 82,687 Less depreciation and amortization from discontinued operations — — — (3,165) Adjusted EBITDA $ 230,081 $ 144,688 $ 495,709 $ 280,718 Net sales $ 931,485 $ 604,721 $ 1,815,889 $ 1,204,564 EBITDA margin 18.2% 9.5% 18.0% 13.6% Adjusted EBITDA margin 24.7% 23.9% 27.3% 23.3% |