Exhibit 99.1

Albemarle Corporation Investor Presentation

November 2015

ALBEMARLE

Forward Looking Statements

Some of the information presented in this presentation and the discussions that follow, including, without limitation, statements with respect to the transaction with Rockwood and the anticipated consequences and benefits of the transaction, product development, changes in productivity, market trends, price, expected growth and earnings, input costs, surcharges, tax rates, stock repurchases, dividends, cash flow generation, costs and cost synergies, portfolio diversification, economic trends, outlook and all other information relating to matters that are not historical facts may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. There can be no assurance that actual results will not differ materially.

Factors that could cause actual results to differ materially include, without limitation: changes in economic and business conditions; changes in financial and operating performance of our major customers and industries and markets served by us; the timing of orders received from customers; the gain or loss of significant customers; competition from other manufacturers; changes in the demand for our products; limitations or prohibitions on the manufacture and sale of our products; availability of raw materials; changes in the cost of raw materials and energy; changes in our markets in general; fluctuations in foreign currencies; changes in laws and government regulation impacting our operations or our products; the occurrence of claims or litigation; the occurrence of natural disasters; the inability to maintain current levels of product or premises liability insurance or the denial of such coverage; political unrest affecting the global economy; political instability affecting our manufacturing operations or joint ventures; changes in accounting standards; the inability to achieve results from our global manufacturing cost reduction initiatives as well as our ongoing continuous improvement and rationalization programs; changes in the jurisdictional mix of our earnings and changes in tax laws and rates; changes in monetary policies, inflation or interest rates; volatility and substantial uncertainties in the debt and equity markets; technology or intellectual property infringement; decisions we may make in the future; the ability to successfully operate and integrate Rockwood’s operations and realize estimated synergies; and the other factors detailed from time to time in the reports we file with the SEC, including those described under “Risk Factors” in the joint proxy statement / prospectus we filed in connection with the transaction with Rockwood, and in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this presentation. We assume no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws. ALBEMARLE

Non-GAAP Financial Measures

It should be noted that adjusted net income attributable to Albemarle Corporation (“adjusted earnings”), adjusted diluted earnings per share, adjusted effective income tax rates, segment operating profit, segment income, EBITDA, adjusted EBITDA, adjusted EBITDA by operating segment, EBITDA margin and adjusted EBITDA margin are financial measures that are not required by, or presented in accordance with, accounting principles generally accepted in the United States, or GAAP. These measures are presented here to provide additional useful measurements to review our operations, provide transparency to investors and enable period-to-period comparability of financial performance.

A description of these and other non-GAAP financial measures that we use to evaluate our operations and financial performance, and reconciliation of these non-GAAP financial measures to the most directly comparable financial measures calculated and reported in accordance with GAAP, can be found in the Appendix to this presentation, which is posted in the Investors section of our website at www.albemarle.com, under “Non-GAAP Reconciliations” under “Financials.”

Albemarle: Compelling Investment Opportunity• A premier specialty chemicals company» #1 or #2 market positions in all core businesses• Solid growth opportunities in all core segments» Refining Solutions » Chemetall Surface Treatment» Performance Chemicals (lithium, bromine, polyolefin catalysts, curatives)• Differentiated industry positions» World’s best raw material reserves for bromine and lithium» Applications leadership in Refining Solutions and Chemetall Surface Treatment » Performance-based, technologies that deliver innovative solutions to our customers• Outstanding cash generation capacity » Rapid deleveraging » Ongoing dividend increases and return of cash to shareholders» Investments to drive future growth Growth opportunities, strong margins and cash flow drive shareholder value4 ALBEMARLE

Leadership Across Attractive Growth SegmentsPerformance ChemicalsChemetall Surface Refining Solutions 2 Treatment Lithium Bromine PCSGlobal #1 #1/2 #1/2 #1/2 #2RankingTTM 3Q 2015 $494 $793 $328 $762 $819Sales(1) $206 $234 $99 $212 $196Adj. EBITDA (1) 42% 30% 30% 28% 24%% Margin 2.0x – 3.0x ~1.0x 1.0x – 1.5x 1.0x – 2.0x 1.0x – 2.0xGrowthGDP GDP GDP GDP GDP• Mineral extraction and processing businesses • Technology and applications driven• Low cost position on global cost curve • Critical customer serviceCharacteristics• Vertically integrated • Ability to differentiate offering • High demand growth • Strong free cash flowKey CompetitorsSource: Company information.(1) Non-Gaap measure. See non-GAAP reconciliations in Appendix.(2) PCS segment also includes Curatives. Note: PCS is considered by management estimates to have leading positions in organometallics, MAO, and custom single site catalysts/metallocenes5 ALBEMARLE

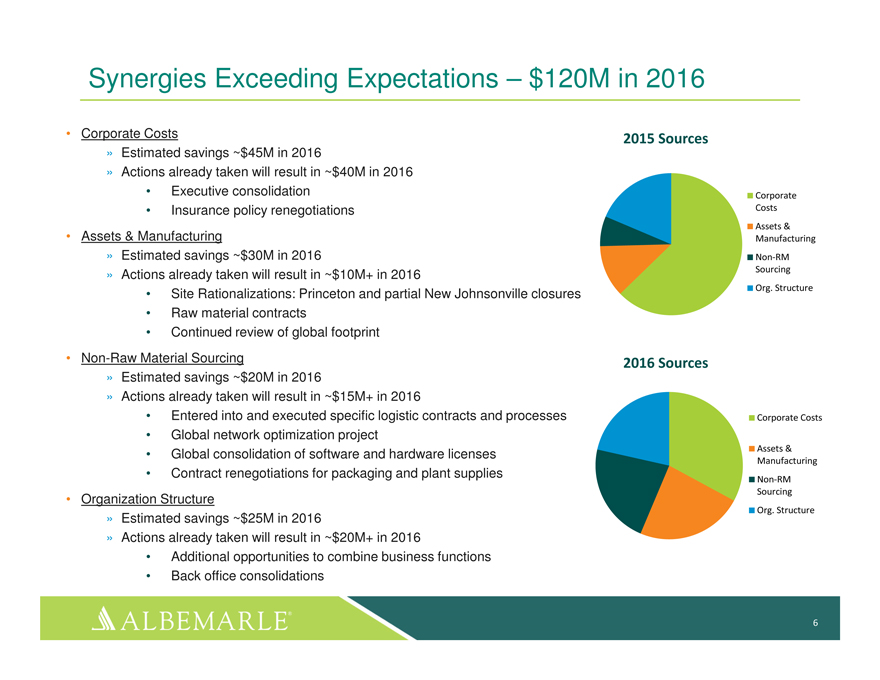

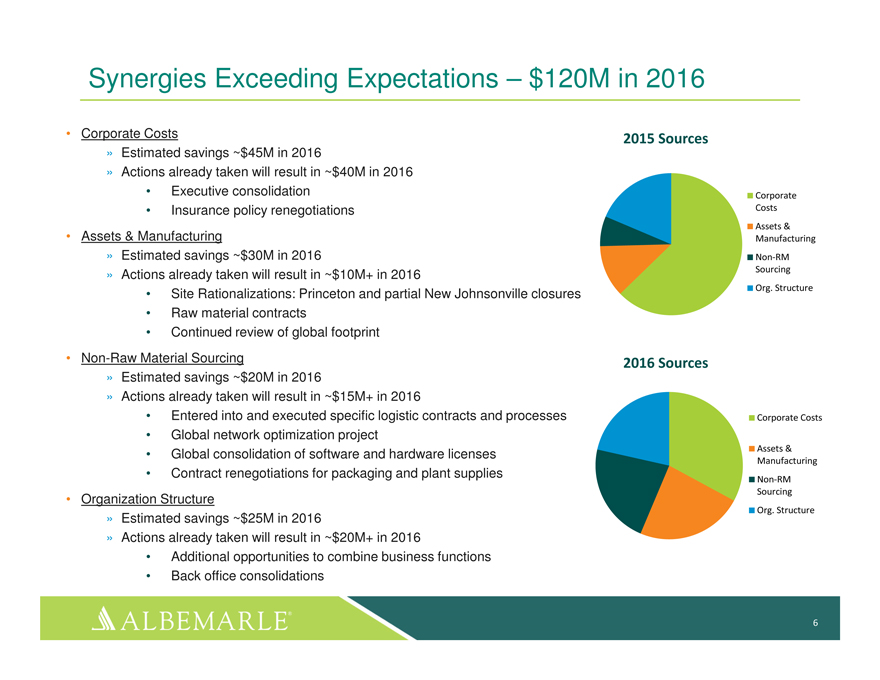

Synergies Exceeding Expectations – $120M in 2016

• | | Corporate Costs 2015 Sources |

» Estimated savings ~$45M in 2016

» Actions already taken will result in ~$40M in 2016

• | | Executive consolidation Corporate |

• | | Insurance policy renegotiations Costs |

Assets &

• | | Assets & Manufacturing Manufacturing |

» Estimated savings ~$30M in 2016 Non-RM

» Actions already taken will result in ~$10M+ in 2016 Sourcing

Org. Structure

• | | Site Rationalizations: Princeton and partial New Johnsonville closures |

• | | Continued review of global footprint |

• | | Non-Raw Material Sourcing 2016 Sources |

» Estimated savings ~$20M in 2016

» Actions already taken will result in ~$15M+ in 2016

• | | Entered into and executed specific logistic contracts and processes Corporate Costs |

• | | Global network optimization project |

Assets &

• | | Global consolidation of software and hardware licenses |

Manufacturing

• | | Contract renegotiations for packaging and plant supplies |

Non-RM Sourcing

Org. Structure

» Estimated savings ~$25M in 2016

» Actions already taken will result in ~$20M+ in 2016

• | | Additional opportunities to combine business functions |

• | | Back office consolidations |

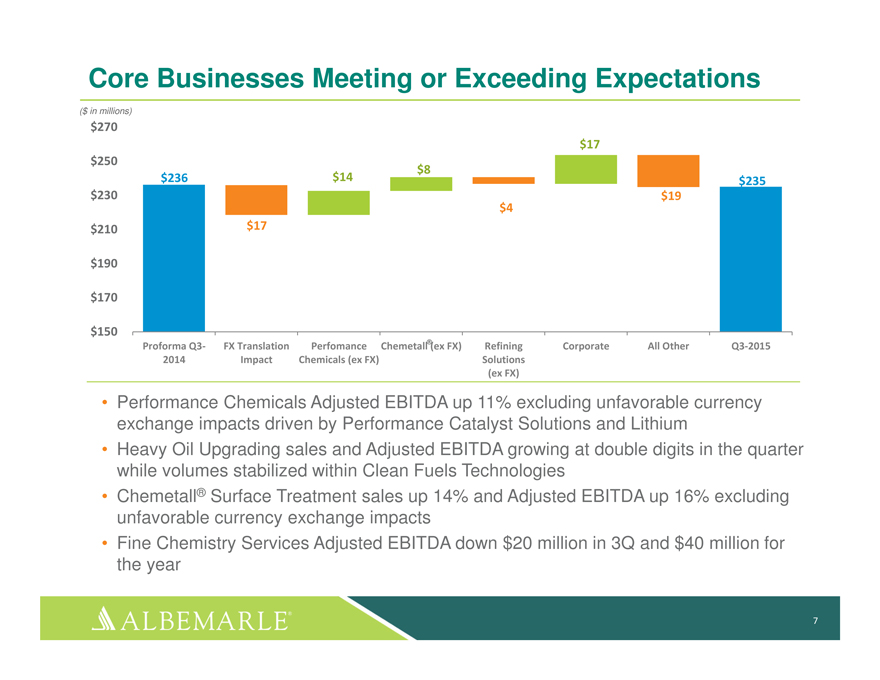

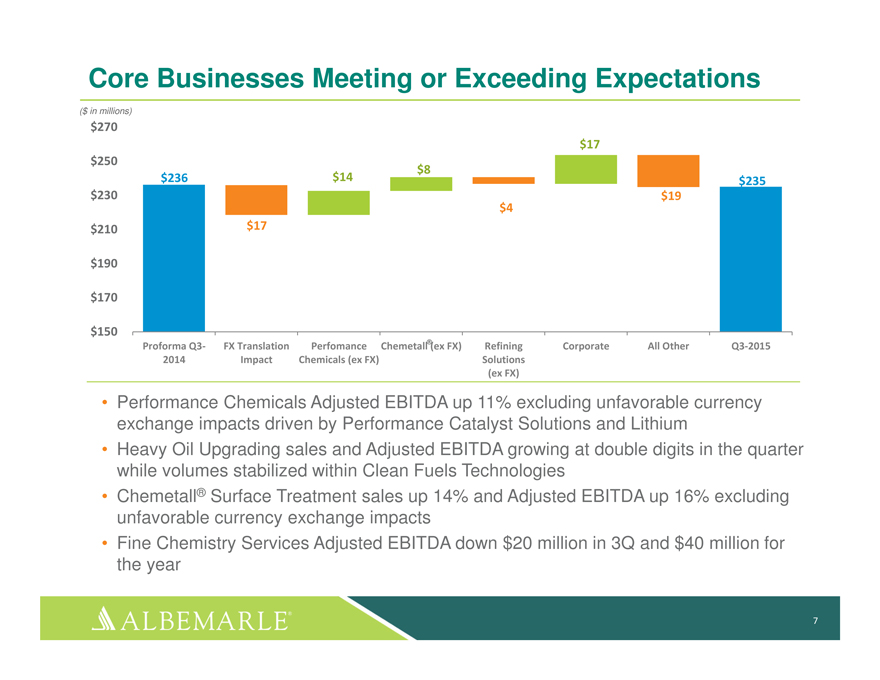

Core Businesses Meeting or Exceeding Expectations

($ in millions)

$270 $17 $250 $8 $236 $14 $235 $230 $19 $4 $210 $17

$190

$170

$150

Proforma Q3- FX Translation Perfomance Chemetall®(ex FX) Refining Corporate All Other Q3-2015 2014 Impact Chemicals (ex FX) Solutions (ex FX)

• | | Performance Chemicals Adjusted EBITDA up 11% excluding unfavorable currency exchange impacts driven by Performance Catalyst Solutions and Lithium |

• | | Heavy Oil Upgrading sales and Adjusted EBITDA growing at double digits in the quarter while volumes stabilized within Clean Fuels Technologies |

• | | Chemetall® Surface Treatment sales up 14% and Adjusted EBITDA up 16% excluding unfavorable currency exchange impacts |

• | | Fine Chemistry Services Adjusted EBITDA down $20 million in 3Q and $40 million for the year |

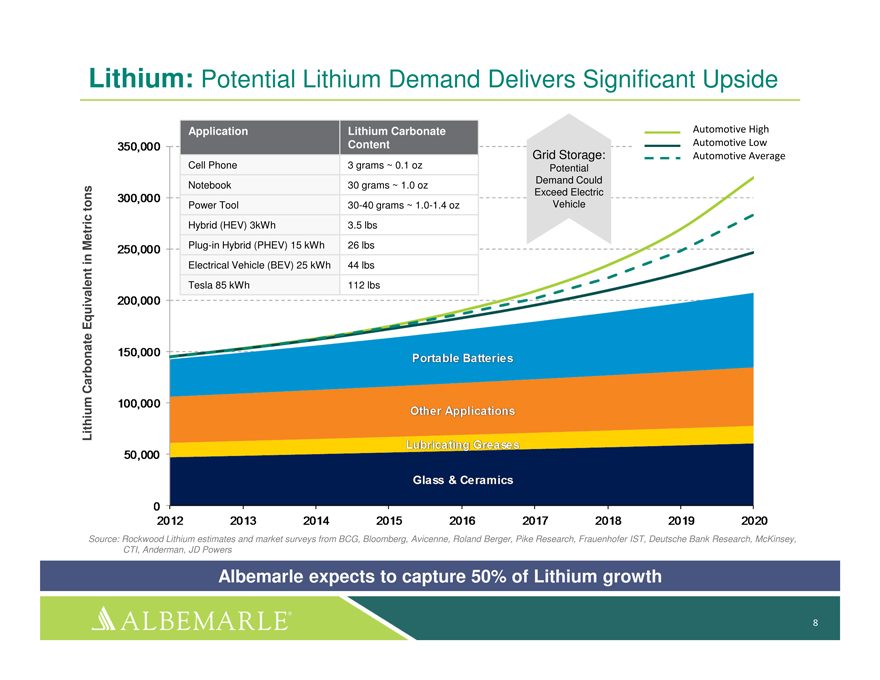

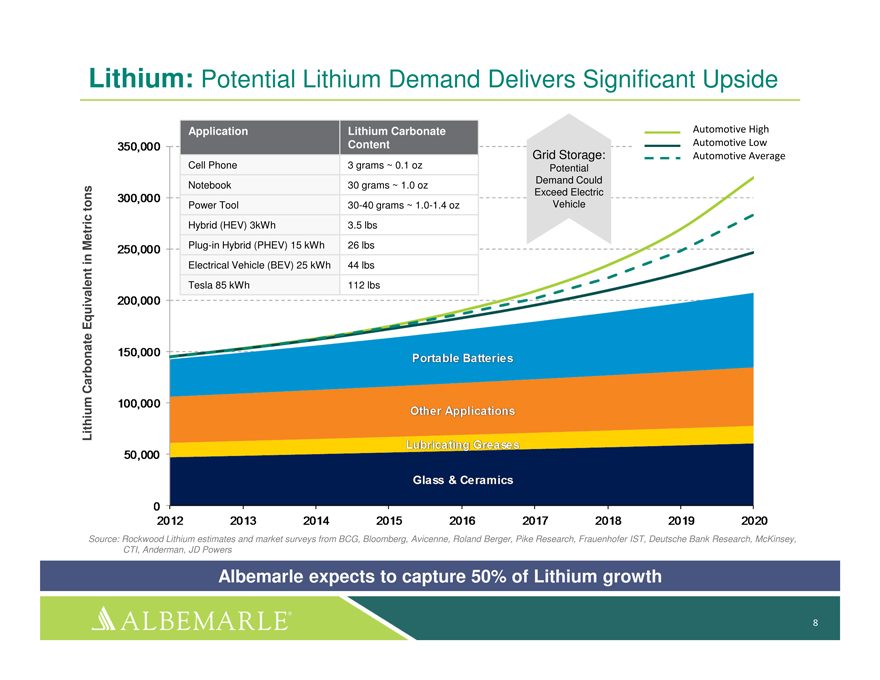

Lithium: Potential Lithium Demand Delivers Significant Upside

Application Lithium Carbonate Automotive High

Content Automotive Low Grid Storage: Automotive Average

Cell Phone 3 grams ~ 0.1 oz Potential Demand Could Notebook 30 grams ~ 1.0 oz Exceed Electric tons Power Tool 30-40 grams ~ 1.0-1.4 oz Vehicle Hybrid (HEV) 3kWh 3.5 lbs Metric Plug-in Hybrid (PHEV) 15 kWh 26 lbs

in

Electrical Vehicle (BEV) 25 kWh 44 lbs Equivalent Tesla 85 kWh 112 lbs

Carbonate Lithium

Source: Rockwood Lithium estimates and market surveys from BCG, Bloomberg, Avicenne, Roland Berger, Pike Research, Frauenhofer IST, Deutsche Bank Research, McKinsey, CTI, Anderman, JD Powers

Albemarle expects to capture 50% of Lithium growth

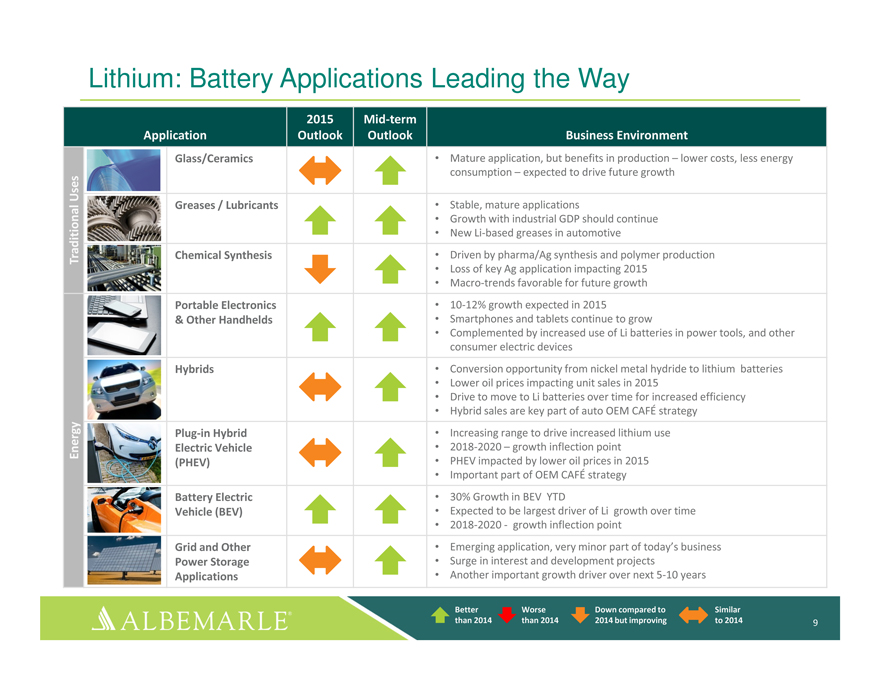

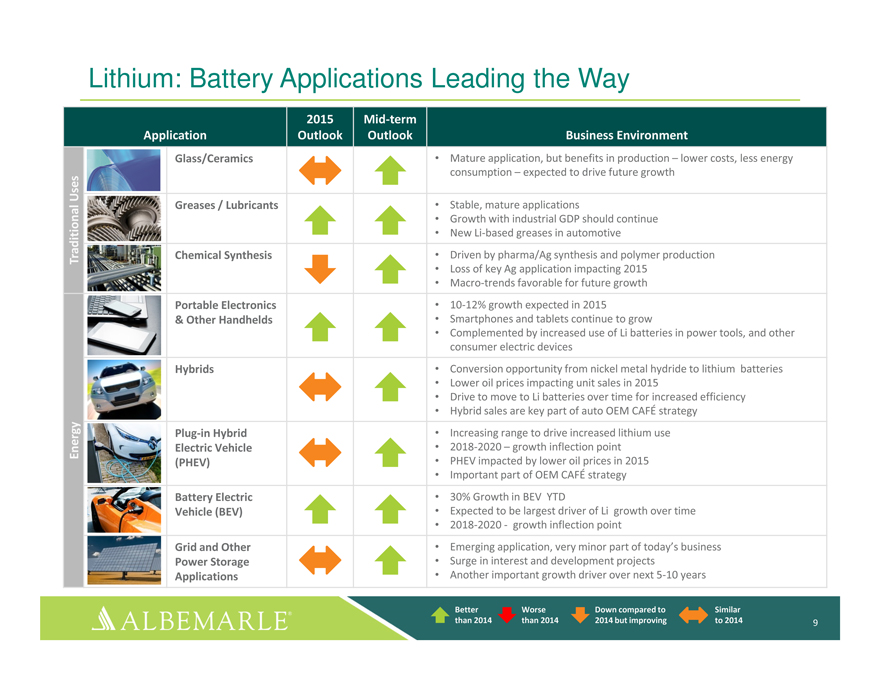

Lithium: Battery Applications Leading the Way

2015 Mid-term

Application Outlook Outlook Business Environment

Glass/Ceramics • Mature application, but benefits in production – lower costs, less energy Uses consumption – expected to drive future growth Greases / Lubricants • Stable, mature applications

• | | Growth with industrial GDP should continue |

• | | New Li-based greases in automotive |

Traditional Chemical Synthesis • Driven by pharma/Ag synthesis and polymer production

• | | Loss of key Ag application impacting 2015 |

• | | Macro-trends favorable for future growth |

Portable Electronics • 10-12% growth expected in 2015

& Other Handhelds • Smartphones and tablets continue to grow

• | | Complemented by increased use of Li batteries in power tools, and other consumer electric devices |

Hybrids • Conversion opportunity from nickel metal hydride to lithium batteries

• | | Lower oil prices impacting unit sales in 2015 |

• | | Drive to move to Li batteries over time for increased efficiency |

• | | Hybrid sales are key part of auto OEM CAFÉ strategy |

Plug-in Hybrid • Increasing range to drive increased lithium use Energy Electric Vehicle • 2018-2020 – growth inflection point (PHEV) • PHEV impacted by lower oil prices in 2015

• | | Important part of OEM CAFÉ strategy |

Battery Electric • 30% Growth in BEV YTD

Vehicle (BEV) • Expected to be largest driver of Li growth over time

• | | 2018-2020—growth inflection point |

Grid and Other • Emerging application, very minor part of today’s business Power Storage • Surge in interest and development projects Applications • Another important growth driver over next 5-10 years

Better Worse Down compared to Similar than 2014 than 2014 2014 but improving to 2014 9 ALBEMARLE

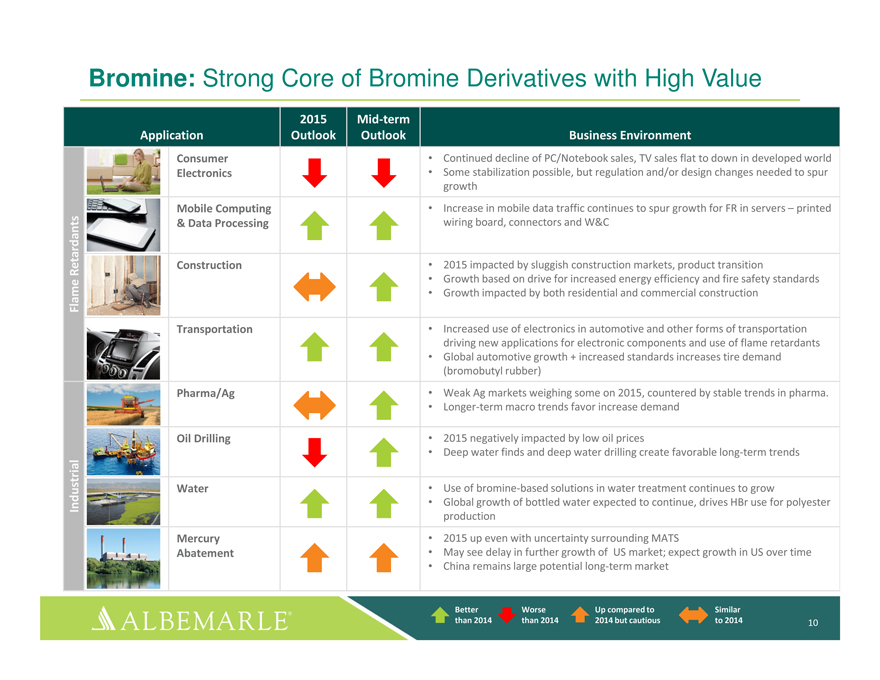

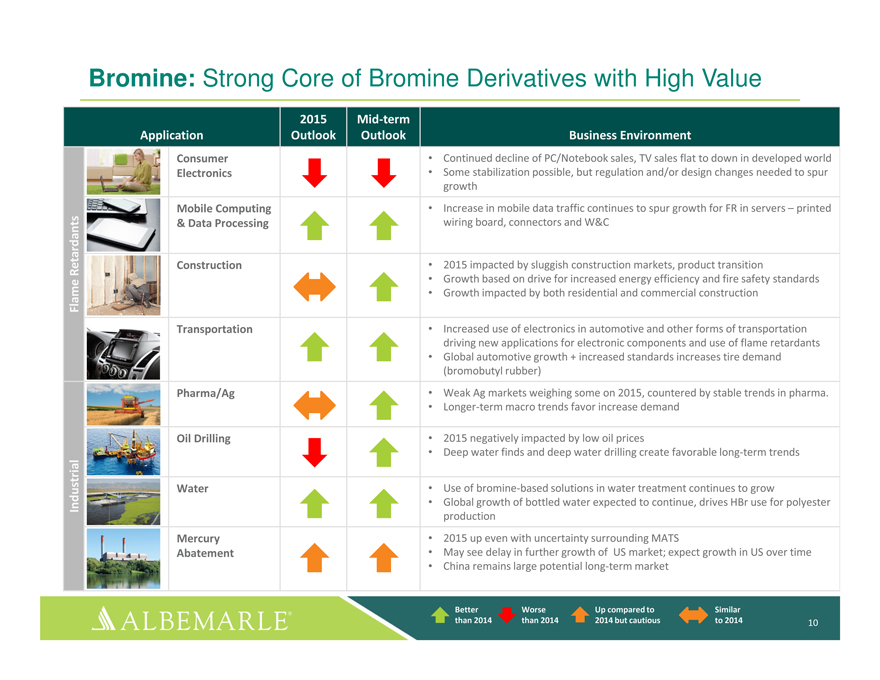

Bromine: Strong Core of Bromine Derivatives with High Value

2015 Mid-term

Application Outlook Outlook Business Environment

Consumer • Continued decline of PC/Notebook sales, TV sales flat to down in developed world Electronics • Some stabilization possible, but regulation and/or design changes needed to spur growth

Mobile Computing • Increase in mobile data traffic continues to spur growth for FR in servers – printed

& Data Processing wiring board, connectors and W&C

Retardants Construction • 2015 impacted by sluggish construction markets, product transition

• Growth based on drive for increased energy efficiency and fire safety standards Flame • Growth impacted by both residential and commercial construction Transportation • Increased use of electronics in automotive and other forms of transportation driving new applications for electronic components and use of flame retardants

• | | Global automotive growth + increased standards increases tire demand (bromobutyl rubber) |

Pharma/Ag • Weak Ag markets weighing some on 2015, countered by stable trends in pharma.

• | | Longer-term macro trends favor increase demand |

Oil Drilling • 2015 negatively impacted by low oil prices

• | | Deep water finds and deep water drilling create favorable long-term trends |

Water • Use of bromine-based solutions in water treatment continues to grow

Industrial • Global growth of bottled water expected to continue, drives HBr use for polyester production

Mercury • 2015 up even with uncertainty surrounding MATS

Abatement • May see delay in further growth of US market; expect growth in US over time

• | | China remains large potential long-term market |

Better Worse Up compared to Similar than 2014 than 2014 2014 but cautious to 2014 10 ALBEMARLE

Refining Solutions: Leadership Across Key Applications

2015 Mid-term

Application Outlook Outlook Business Environment

Vacuum Gas Oil • ~-2% CAGR for next 5 years

(VGO) • Closure of Western European refineries / few global additions

Max Propylene • ~6% CAGR till 2020

• | | Global On-purpose propylene production from FCC to balance propylene shortage Upgrading from ethane crackers Oil Resid ~2% CAGR for next 5 years |

• Transportation Fuel demand growth – increased gasoline use

• | | Largest segment – more “bottom of the barrel” conversion Heavy Emerging countries (Middle East, China, Asia) investments Distillates ~3% CAGR for the next 5 years |

• | | 2015 decline due to oil price decline (cash conservation) and increased use of tight oil (less need) |

• | | Proliferation of 50 & 10 ppm sulfur spec. (ME, Asia, China, Latam) |

Vacuum Gas Oil • ~2% CAGR till 2020 (VGO) • Fewer first fills in 2015

• | | Tighter Sulfur specs driving VGO HPC demand |

• | | Growth of hydrocracker feedstock but decline in FCC feedstock |

Reactivation • 50% JV with IFPN (France)

Technologies Technology • Cash conservation from low oil prices increases rejuvenation & reactivation

• Expansion in emerging markets

Fuel • Metals pricing can swing demand up or down Resid • ~10% CAGR for the next 5 year

Clean • Bottom of the barrel conversion to pretreat feedstock for FCC and hydrocrackers

• | | Addition of new units in ME and China |

Better Worse Up compared to Similar than 2014 than 2014 2014 but cautious to 2014 11 ALBEMARLE

Chemetall Surface Treatment: Focused on the customer

2015 Mid-term

Application Outlook Outlook Business Environment

Automotive OEM • Good incremental growth in EU and NA, new lines in SA, moderate growth in India

• | | Lower demand in China, weakness in Russia and Brazil |

• | | Automotive growth in developing world favorable over time |

• | | Chemetall Surface Treatment well–positioned for global growth |

Automotive • Will track global auto trends over time Transportation Components • Increasing penetration across value chain

Aerospace • Increasing air traffic demand and OEM order book both favorable

• | | Trends expected to continue for several years |

Coil • Global demand about neutral in 2015, more positive view over time. Demand shifts and exports make global capability important

• | | Aluminum coil applications growing nicely, esp. in automotive and food packaging |

• | | Automotive body panels offer both short and medium term opportunity |

Metal (Cold) • Low oil prices impacting tube mill production. Wire mill production also slowing. Both will Forming rebound over time

• | | This area remains strong in Asia |

Industrial General • Broad segment covering many applications and types of customers

Industry • Overall industrial environment just “OK” globally – some differences by region

• | | New technologies and new sales geographies drive Chemetall Surface Treatment growth |

Aluminum • Construction industry recovery in EMEA, North America and Asia OK Finishing • Segment offers much opportunity for growth

• | | Chemal acquisition will lead to product line expansion in anodizing applications. |

Better Worse Up compared to Similar than 2014 than 2014 2014 but cautious to 2014 12 ALBEMARLE

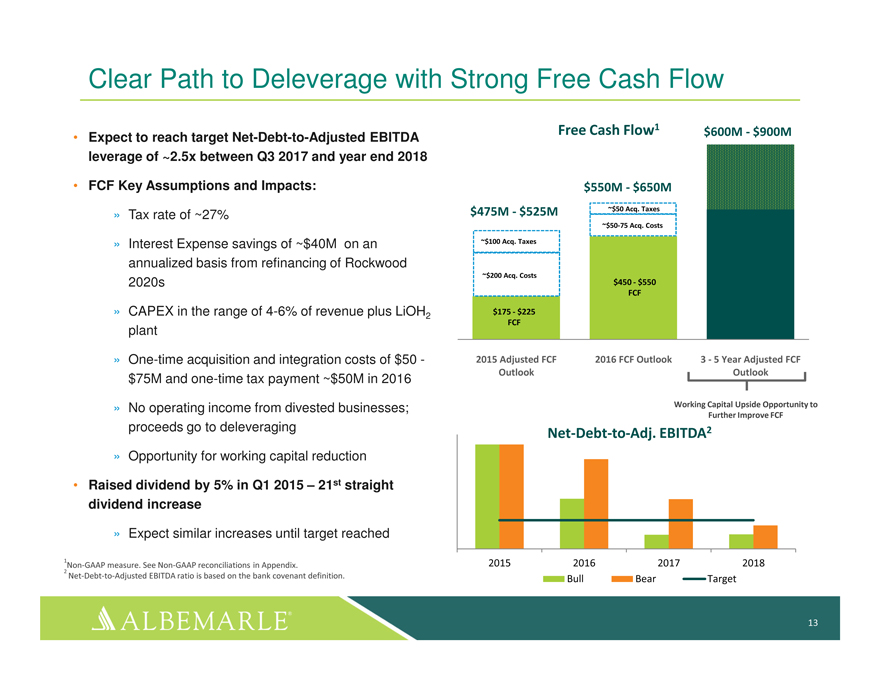

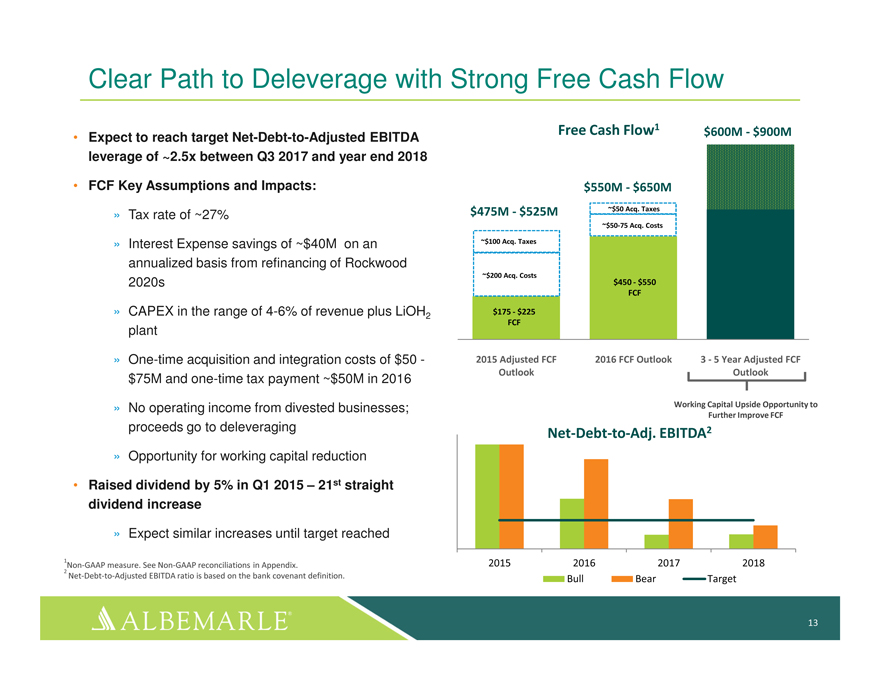

Clear Path to Deleverage with Strong Free Cash Flow

Free Cash Flow1 $600M—$900M

• Expect to reach target Net-Debt-to-Adjusted EBITDA leverage of ~2.5x between Q3 2017 and year end 2018

• | | FCF Key Assumptions and Impacts: $550M—$650M |

$475M—$525M ~$50 Acq. Taxes

» Tax rate of ~27%

~$50-75 Acq. Costs

» Interest Expense savings of ~$40M on an ~$100 Acq. Taxes annualized basis from refinancing of Rockwood

~$200 Acq. Costs

2020s $450—$550 FCF

» CAPEX in the range of 4-6% of revenue plus LiOH $175—$225

plant

» One-time acquisition and integration costs of $50—2015 Adjusted FCF 2016 FCF Outlook 3—5 Year Adjusted FCF

Outlook Outlook

$75M and one-time tax payment ~$50M in 2016

» No operating income from divested businesses; Working Capital Upside Opportunity to

Further Improve FCF

proceeds go to deleveraging 2

Net-Debt-to-Adj. EBITDA

» Opportunity for working capital reduction

• Raised dividend by 5% in Q1 2015 – 21st straight dividend increase

» Expect similar increases until target reached

Non-GAAP measure. See Non-GAAP reconciliations in Appendix.

Net-Debt-to-Adjusted EBITDA ratio is based on the bank covenant definition. Bull Bear Target

13 ALBEMARLE

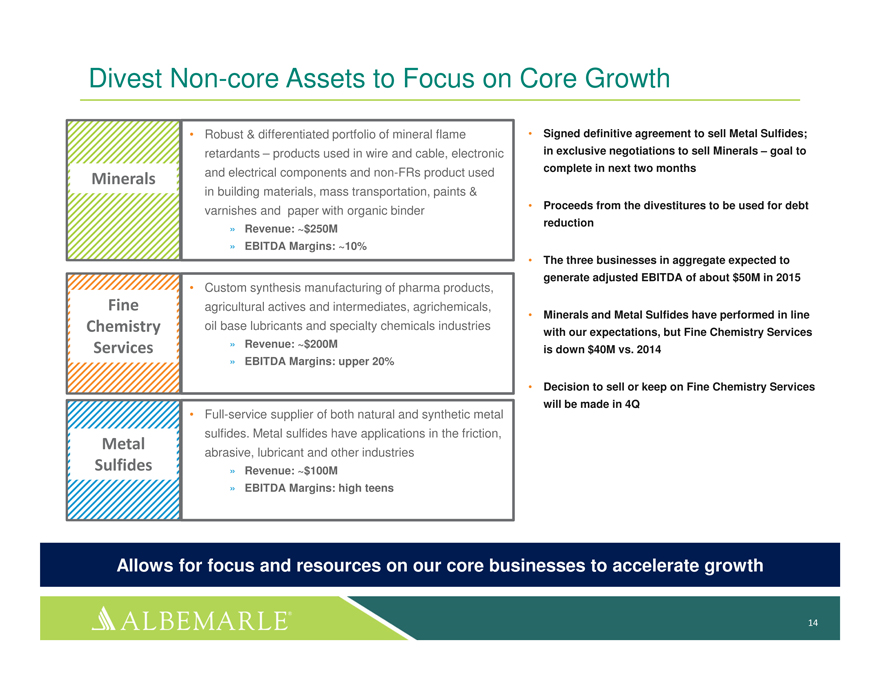

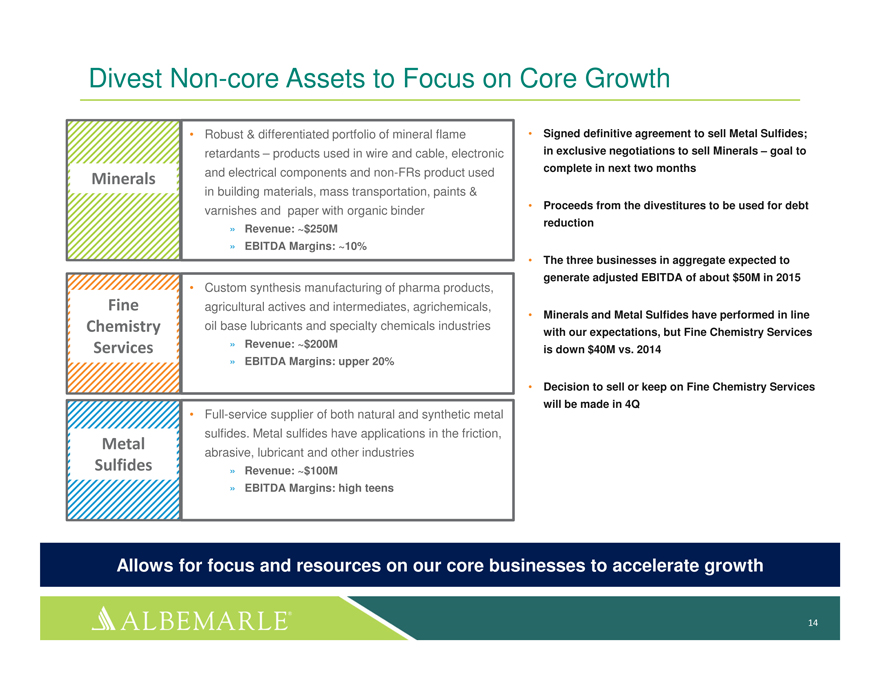

Divest Non-core Assets to Focus on Core Growth

• Robust & differentiated portfolio of mineral flame • Signed definitive agreement to sell Metal Sulfides; retardants – products used in wire and cable, electronic in exclusive negotiations to sell Minerals – goal to and electrical components and non-FRs product used complete in next two months

Minerals

in building materials, mass transportation, paints &

• Proceeds from the divestitures to be used for debt varnishes and paper with organic binder reduction

»Revenue: ~$250M

»EBITDA Margins: ~10%

• The three businesses in aggregate expected to generate adjusted EBITDA of about $50M in 2015

Custom synthesis manufacturing of pharma products,

Fine agricultural actives and intermediates, agrichemicals, • Minerals and Metal Sulfides have performed in line Chemistry oil base lubricants and specialty chemicals industries with our expectations, but Fine Chemistry Services Services »Revenue: ~$200M is down $40M vs. 2014

»EBITDA Margins: upper 20%

• Decision to sell or keep on Fine Chemistry Services will be made in 4Q

Full-service supplier of both natural and synthetic metal sulfides. Metal sulfides have applications in the friction,

Metal

abrasive, lubricant and other industries

Sulfides »Revenue: ~$100M

»EBITDA Margins: high teens

Allows for focus and resources on our core businesses to accelerate growth

14 ALBEMARLE

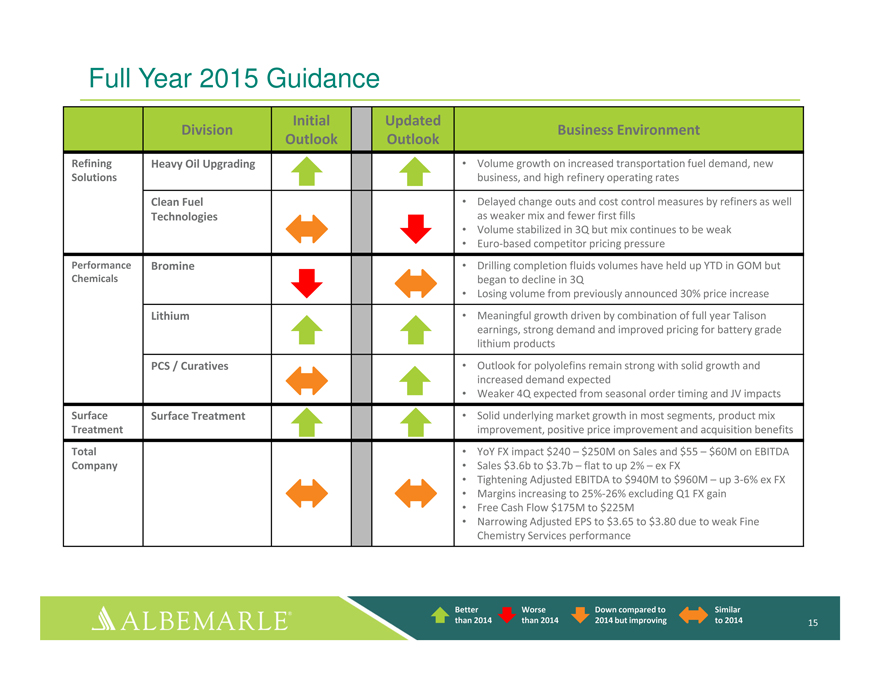

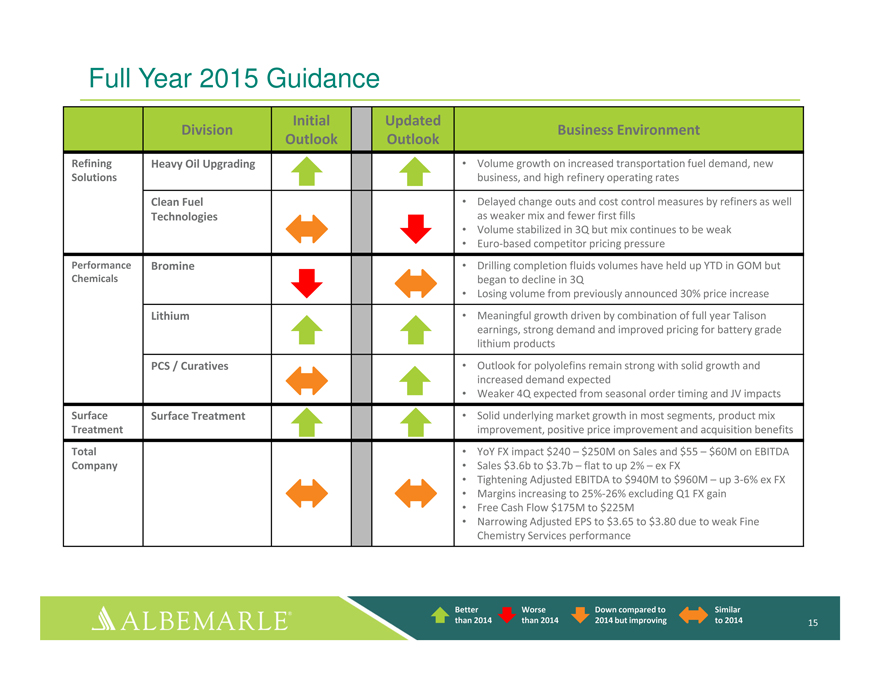

Full Year 2015 Guidance

Initial Updated

Division Business Environment Outlook Outlook

Refining Heavy Oil Upgrading • Volume growth on increased transportation fuel demand, new Solutions business, and high refinery operating rates

Clean Fuel • Delayed change outs and cost control measures by refiners as well Technologies as weaker mix and fewer first fills

• | | Volume stabilized in 3Q but mix continues to be weak |

• | | Euro-based competitor pricing pressure |

Performance Bromine • Drilling completion fluids volumes have held up YTD in GOM but Chemicals began to decline in 3Q

• | | Losing volume from previously announced 30% price increase |

Lithium • Meaningful growth driven by combination of full year Talison earnings, strong demand and improved pricing for battery grade lithium products

PCS / Curatives • Outlook for polyolefins remain strong with solid growth and increased demand expected

• | | Weaker 4Q expected from seasonal order timing and JV impacts |

Surface Surface Treatment • Solid underlying market growth in most segments, product mix Treatment improvement, positive price improvement and acquisition benefits

Total • YoY FX impact $240 – $250M on Sales and $55 – $60M on EBITDA Company • Sales $3.6b to $3.7b – flat to up 2% – ex FX

• | | Tightening Adjusted EBITDA to $940M to $960M – up 3-6% ex FX |

• | | Margins increasing to 25%-26% excluding Q1 FX gain |

• | | Free Cash Flow $175M to $225M |

• | | Narrowing Adjusted EPS to $3.65 to $3.80 due to weak Fine Chemistry Services performance |

Better Worse Down compared to Similar than 2014 than 2014 2014 but improving to 2014 15 ALBEMARLE

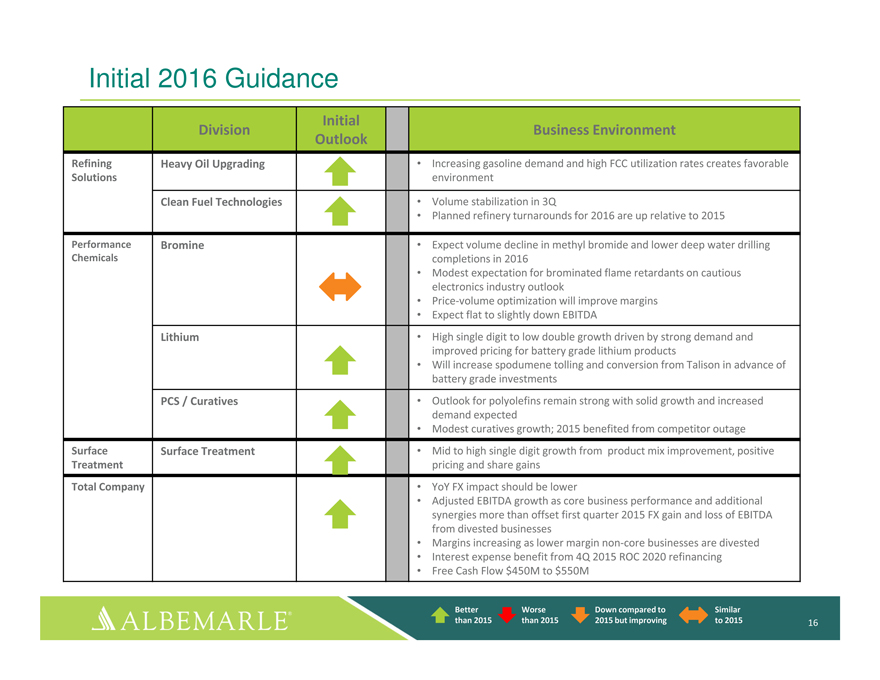

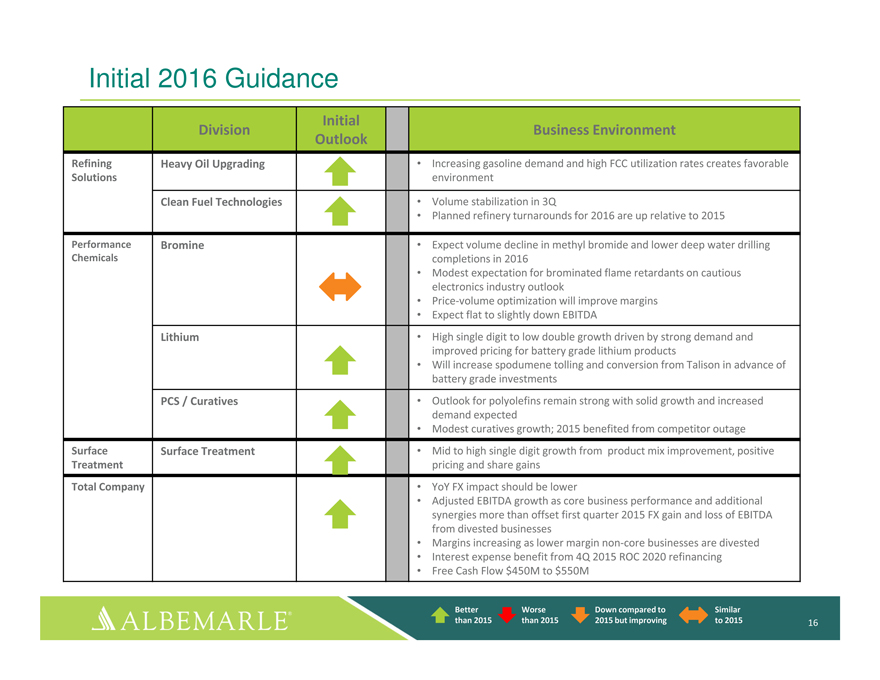

Initial 2016 Guidance

Initial

Division Business Environment Outlook

Refining Heavy Oil Upgrading • Increasing gasoline demand and high FCC utilization rates creates favorable Solutions environment

Clean Fuel Technologies • Volume stabilization in 3Q

• | | Planned refinery turnarounds for 2016 are up relative to 2015 |

Performance Bromine • Expect volume decline in methyl bromide and lower deep water drilling Chemicals completions in 2016

• | | Modest expectation for brominated flame retardants on cautious electronics industry outlook |

• | | Price-volume optimization will improve margins |

• | | Expect flat to slightly down EBITDA |

Lithium • High single digit to low double growth driven by strong demand and improved pricing for battery grade lithium products

• | | Will increase spodumene tolling and conversion from Talison in advance of battery grade investments |

PCS / Curatives • Outlook for polyolefins remain strong with solid growth and increased demand expected

• | | Modest curatives growth; 2015 benefited from competitor outage |

Surface Surface Treatment • Mid to high single digit growth from product mix improvement, positive Treatment pricing and share gains

Total Company • YoY FX impact should be lower

• | | Adjusted EBITDA growth as core business performance and additional synergies more than offset first quarter 2015 FX gain and loss of EBITDA from divested businesses |

• | | Margins increasing as lower margin non-core businesses are divested |

• | | Interest expense benefit from 4Q 2015 ROC 2020 refinancing |

• | | Free Cash Flow $450M to $550M |

Better Worse Down compared to Similar than 2015 than 2015 2015 but improving to 2015 16 ALBEMARLE

www.albemarle.com

ALB LISTED NYSE

17 ALBEMARLE

Non-GAAP Financial Measures

It should be noted that adjusted net income attributable to Albemarle Corporation (“adjusted earnings”), adjusted diluted earnings per share, adjusted effective income tax rates, segment operating profit, segment income, EBITDA, adjusted EBITDA, adjusted EBITDA by operating segment, EBITDA margin and adjusted EBITDA margin are financial measures that are not required by, or presented in accordance with, accounting principles generally accepted in the United States, or GAAP. These measures are presented here to provide additional useful measurements to review our operations, provide transparency to investors and enable period-to-period comparability of financial performance.

A description of these and other non-GAAP financial measures that we use to evaluate our operations and financial performance, and reconciliation of these non-GAAP financial measures to the most directly comparable financial measures calculated and reported in accordance with GAAP, can be found herein.

18 ALBEMARLE

APPENDIX

Non-GAAP Reconciliations

19 ALBEMARLE

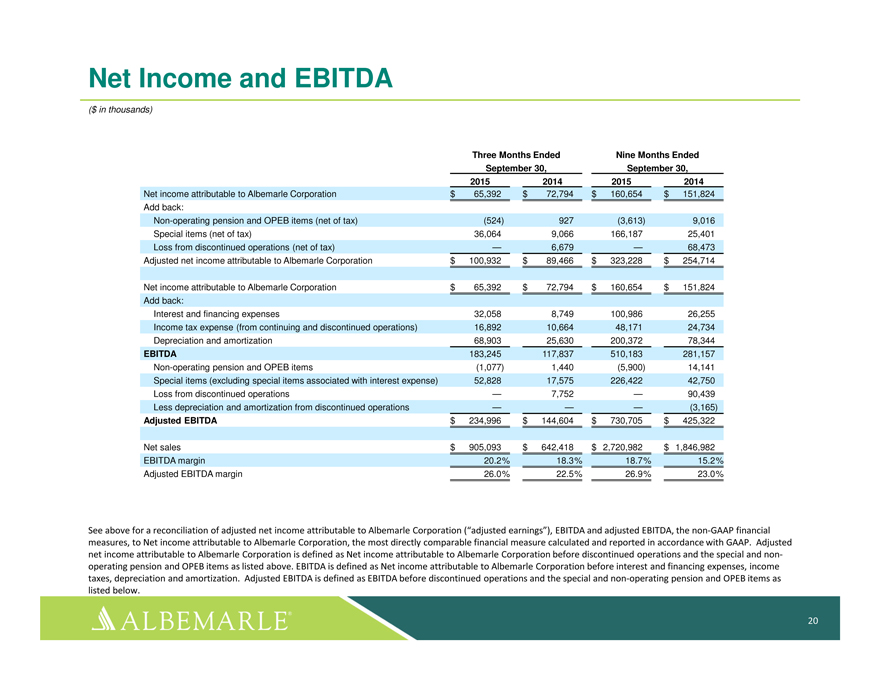

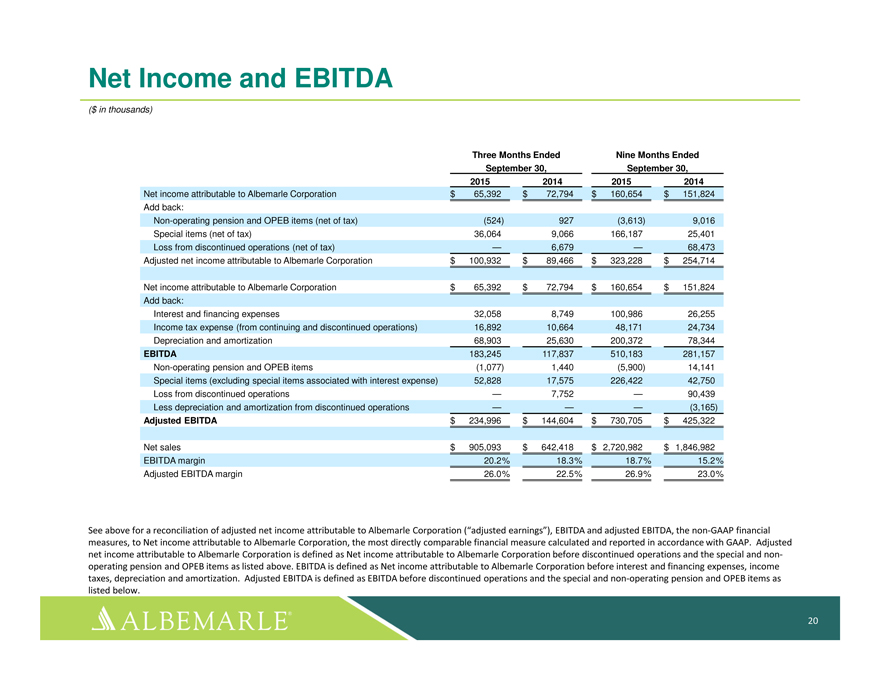

Net Income and EBITDA

($ in thousands)

Three Months Ended Nine Months Ended September 30, September 30, 2015 2014 2015 2014

Net income attributable to Albemarle Corporation $ 65,392 $ 72,794 $ 160,654 $ 151,824 Add back: Non-operating pension and OPEB items (net of tax) (524) 927 (3,613) 9,016 Special items (net of tax) 36,064 9,066 166,187 25,401 Loss from discontinued operations (net of tax) — 6,679 — 68,473 Adjusted net income attributable to Albemarle Corporation $ 100,932 $ 89,466 $ 323,228 $ 254,714

Net income attributable to Albemarle Corporation $ 65,392 $ 72,794 $ 160,654 $ 151,824 Add back: Interest and financing expenses 32,058 8,749 100,986 26,255 Income tax expense (from continuing and discontinued operations) 16,892 10,664 48,171 24,734 Depreciation and amortization 68,903 25,630 200,372 78,344 EBITDA 183,245 117,837 510,183 281,157 Non-operating pension and OPEB items (1,077) 1,440 (5,900) 14,141 Special items (excluding special items associated with interest expense) 52,828 17,575 226,422 42,750 Loss from discontinued operations — 7,752 — 90,439 Less depreciation and amortization from discontinued operations — — — (3,165) Adjusted EBITDA $ 234,996 $ 144,604 $ 730,705 $ 425,322

Net sales $ 905,093 $ 642,418 $ 2,720,982 $ 1,846,982 EBITDA margin 20.2% 18.3% 18.7% 15.2% Adjusted EBITDA margin 26.0% 22.5% 26.9% 23.0%

See above for a reconciliation of adjusted net income attributable to Albemarle Corporation (“adjusted earnings”), EBITDA and adjusted EBITDA, the non-GAAP financial measures, to Net income attributable to Albemarle Corporation, the most directly comparable financial measure calculated and reported in accordance with GAAP. Adjusted net income attributable to Albemarle Corporation is defined as Net income attributable to Albemarle Corporation before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as Net income attributable to Albemarle Corporation before interest and financing expenses, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed below.

20 ALBEMARLE

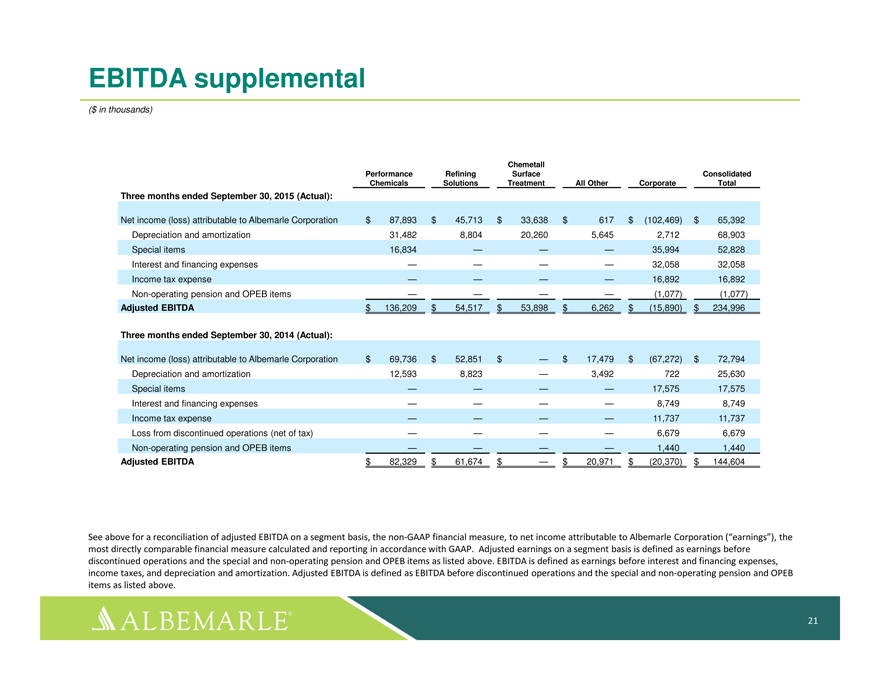

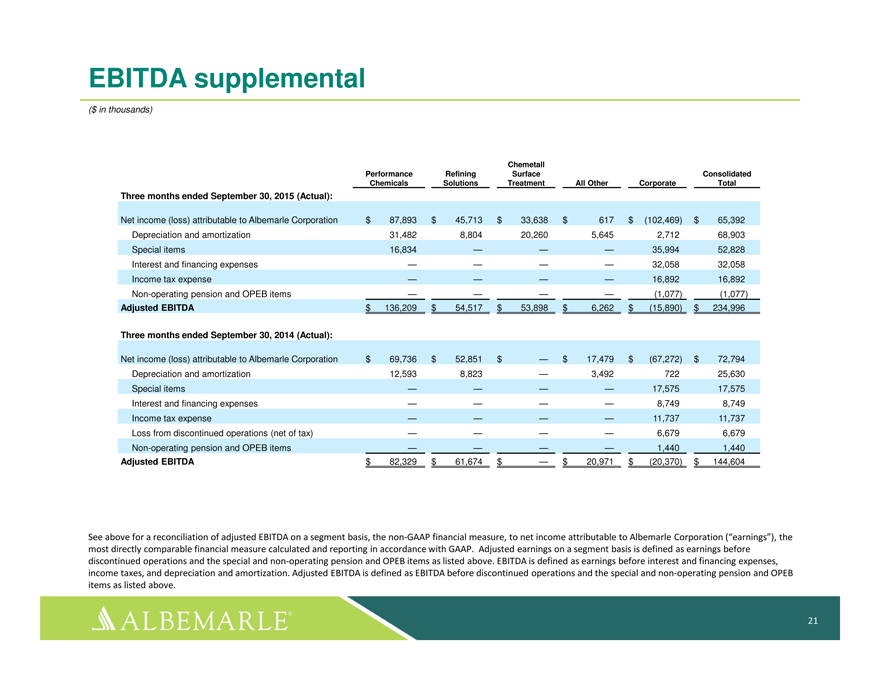

EBITDA supplemental

($ in thousands)

Chemetall

Performance Refining Surface Consolidated Chemicals Solutions Treatment All Other Corporate Total

Three months ended September 30, 2015 (Actual):

Net income (loss) attributable to Albemarle Corporation $ 87,893 $ 45,713 $ 33,638 $ 617 $ (102,469) $ 65,392 Depreciation and amortization 31,482 8,804 20,260 5,645 2,712 68,903 Special items 16,834 — — — 35,994 52,828 Interest and financing expenses — — — — 32,058 32,058 Income tax expense — — — — 16,892 16,892 Non-operating pension and OPEB items — — — — (1,077) (1,077) Adjusted EBITDA $ 136,209 $ 54,517 $ 53,898 $ 6,262 $ (15,890) $ 234,996

Three months ended September 30, 2014 (Actual):

Net income (loss) attributable to Albemarle Corporation $ 69,736 $ 52,851 $ — $ 17,479 $ (67,272) $ 72,794 Depreciation and amortization 12,593 8,823 — 3,492 722 25,630 Special items — — — — 17,575 17,575 Interest and financing expenses — — — — 8,749 8,749 Income tax expense — — — — 11,737 11,737 Loss from discontinued operations (net of tax) — — — — 6,679 6,679 Non-operating pension and OPEB items — — — — 1,440 1,440 Adjusted EBITDA $ 82,329 $ 61,674 $ — $ 20,971 $ (20,370) $ 144,604

See above for a reconciliation of adjusted EBITDA on a segment basis, the non-GAAP financial measure, to net income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reporting in accordance with GAAP. Adjusted earnings on a segment basis is defined as earnings before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as earnings before interest and financing expenses, income taxes, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed above.

21 ALBEMARLE

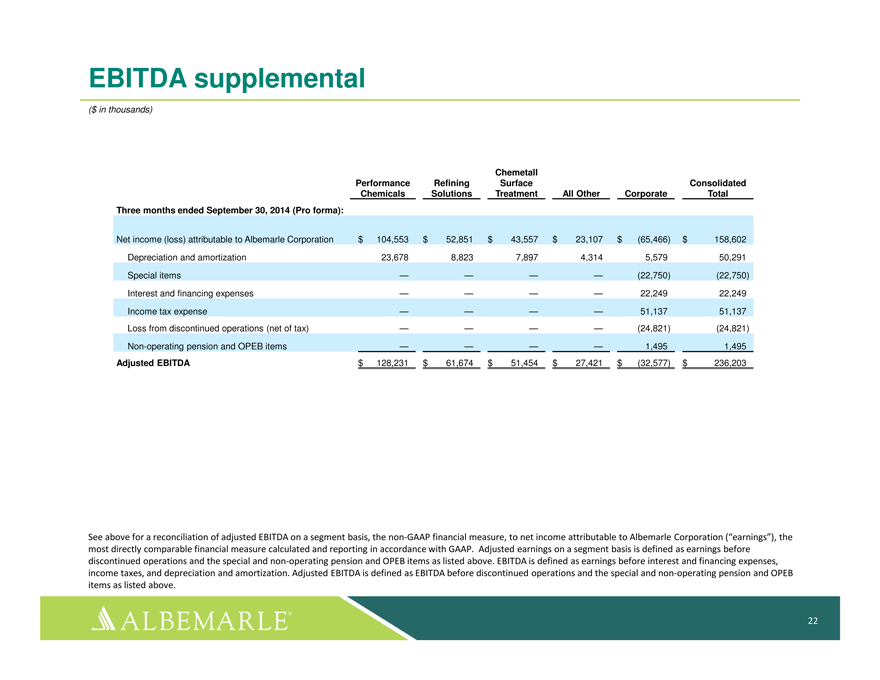

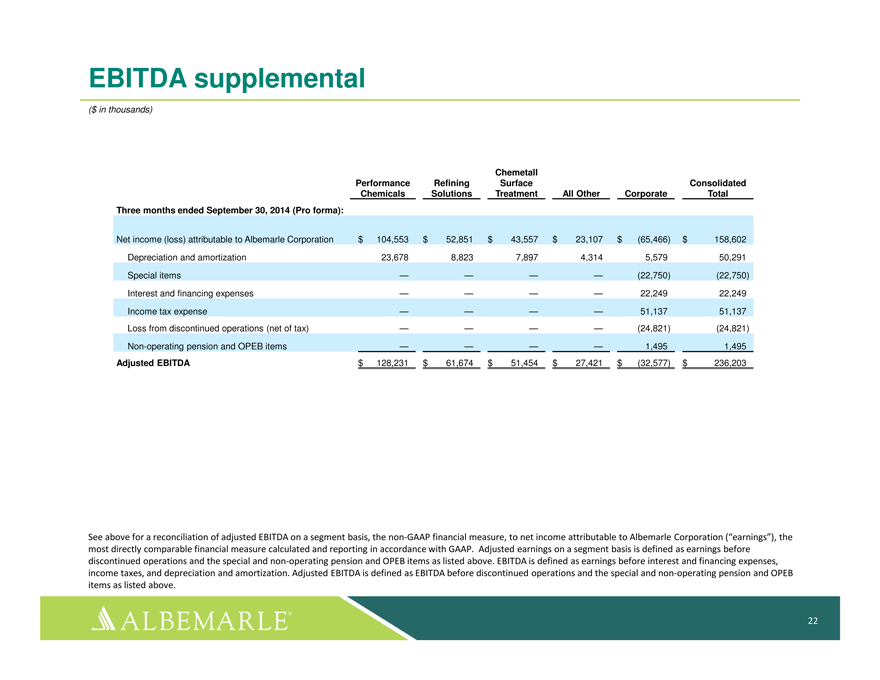

EBITDA supplemental

($ in thousands)

Chemetall

Performance Refining Surface Consolidated Chemicals Solutions Treatment All Other Corporate Total

Three months ended September 30, 2014 (Pro forma):

Net income (loss) attributable to Albemarle Corporation $ 104,553 $ 52,851 $ 43,557 $ 23,107 $ (65,466) $ 158,602 Depreciation and amortization 23,678 8,823 7,897 4,314 5,579 50,291 Special items — — — — (22,750) (22,750) Interest and financing expenses — — — — 22,249 22,249 Income tax expense — — — — 51,137 51,137 Loss from discontinued operations (net of tax) — — — — (24,821) (24,821) Non-operating pension and OPEB items — — — — 1,495 1,495 Adjusted EBITDA $ 128,231 $ 61,674 $ 51,454 $ 27,421 $ (32,577) $ 236,203

See above for a reconciliation of adjusted EBITDA on a segment basis, the non-GAAP financial measure, to net income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reporting in accordance with GAAP. Adjusted earnings on a segment basis is defined as earnings before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as earnings before interest and financing expenses, income taxes, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed above.

22 ALBEMARLE

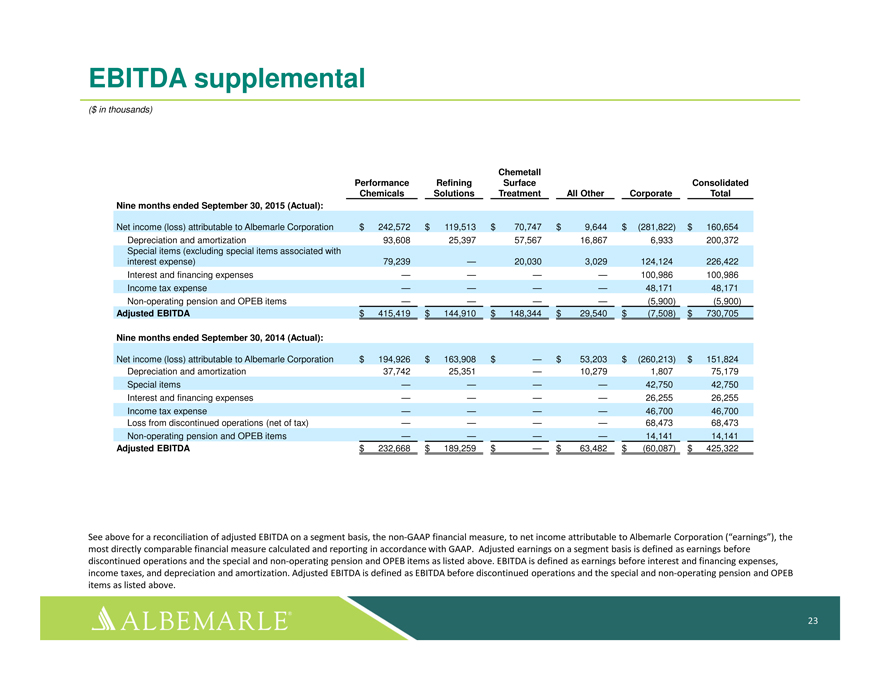

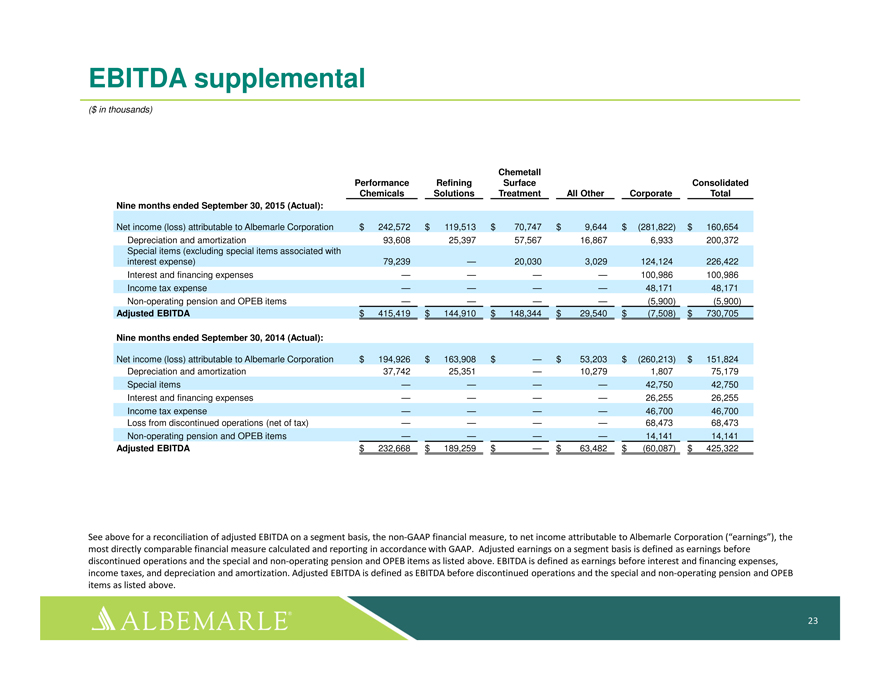

EBITDA supplemental

($ in thousands)

Chemetall

Performance Refining Surface Consolidated Chemicals Solutions Treatment All Other Corporate Total Nine months ended September 30, 2015 (Actual):

Net income (loss) attributable to Albemarle Corporation $ 242,572 $ 119,513 $ 70,747 $ 9,644 $ (281,822) $ 160,654 Depreciation and amortization 93,608 25,397 57,567 16,867 6,933 200,372 Special items (excluding special items associated with interest expense) 79,239 — 20,030 3,029 124,124 226,422 Interest and financing expenses — — — — 100,986 100,986 Income tax expense — — — — 48,171 48,171 Non-operating pension and OPEB items — — — — (5,900) (5,900) Adjusted EBITDA $ 415,419 $ 144,910 $ 148,344 $ 29,540 $ (7,508) $ 730,705

Nine months ended September 30, 2014 (Actual):

Net income (loss) attributable to Albemarle Corporation $ 194,926 $ 163,908 $ — $ 53,203 $ (260,213) $ 151,824 Depreciation and amortization 37,742 25,351 — 10,279 1,807 75,179 Special items — — — — 42,750 42,750 Interest and financing expenses — — — — 26,255 26,255 Income tax expense — — — — 46,700 46,700 Loss from discontinued operations (net of tax) — — — — 68,473 68,473 Non-operating pension and OPEB items — — — — 14,141 14,141 Adjusted EBITDA $ 232,668 $ 189,259 $ — $ 63,482 $ (60,087) $ 425,322

See above for a reconciliation of adjusted EBITDA on a segment basis, the non-GAAP financial measure, to net income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reporting in accordance with GAAP. Adjusted earnings on a segment basis is defined as earnings before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as earnings before interest and financing expenses, income taxes, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed above.

23 ALBEMARLE

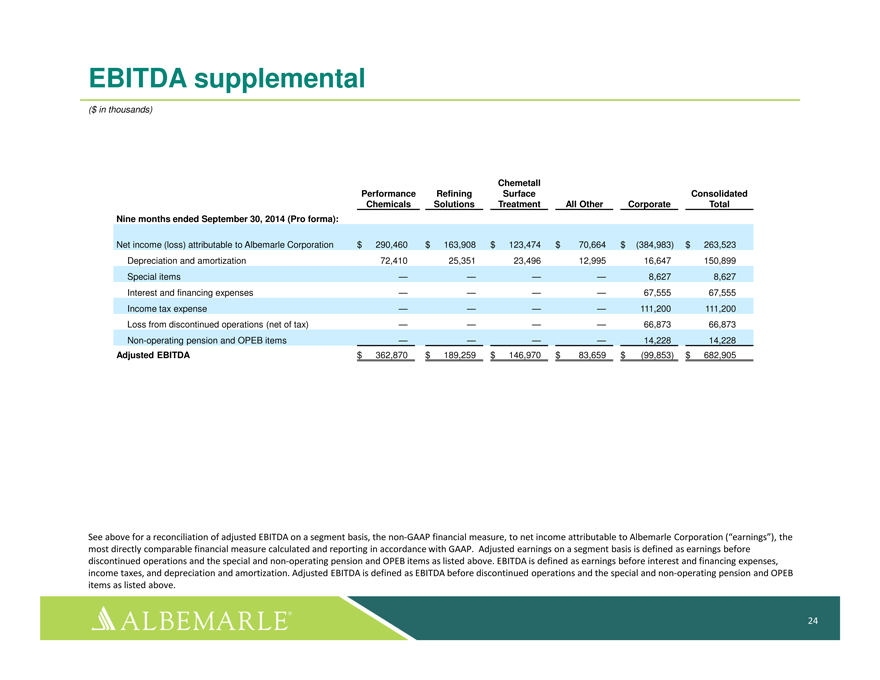

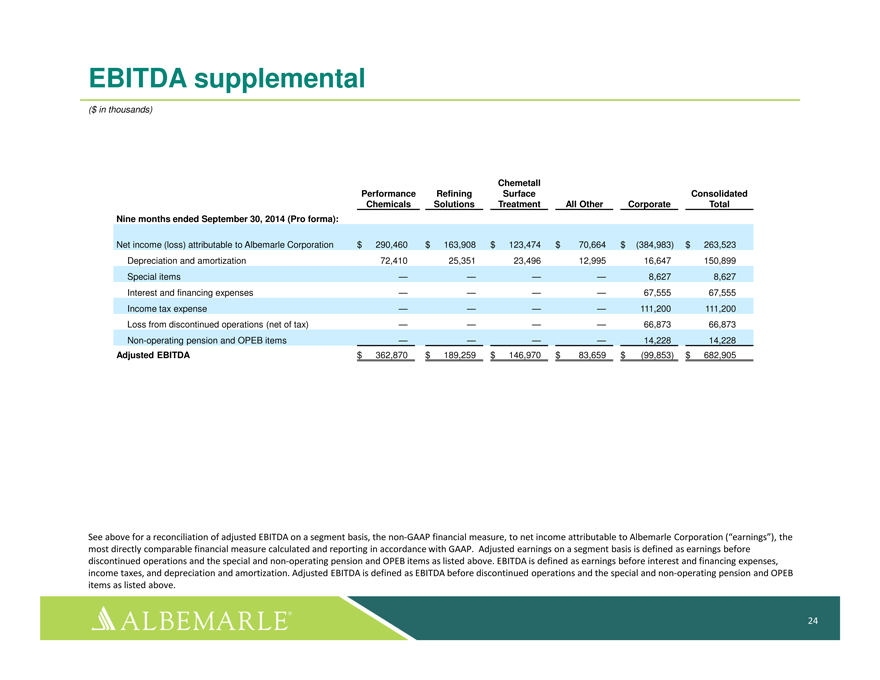

EBITDA supplemental

($ in thousands)

Chemetall

Performance Refining Surface Consolidated Chemicals Solutions Treatment All Other Corporate Total Nine months ended September 30, 2014 (Pro forma):

Net income (loss) attributable to Albemarle Corporation $ 290,460 $ 163,908 $ 123,474 $ 70,664 $ (384,983) $ 263,523 Depreciation and amortization 72,410 25,351 23,496 12,995 16,647 150,899 Special items — — — — 8,627 8,627 Interest and financing expenses — — — — 67,555 67,555 Income tax expense — — — — 111,200 111,200 Loss from discontinued operations (net of tax) — — — — 66,873 66,873

Non-operating pension and OPEB items — — — — 14,228 14,228 Adjusted EBITDA $ 362,870 $ 189,259 $ 146,970 $ 83,659 $ (99,853) $ 682,905

See above for a reconciliation of adjusted EBITDA on a segment basis, the non-GAAP financial measure, to net income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reporting in accordance with GAAP. Adjusted earnings on a segment basis is defined as earnings before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as earnings before interest and financing expenses, income taxes, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed above.

24 ALBEMARLE

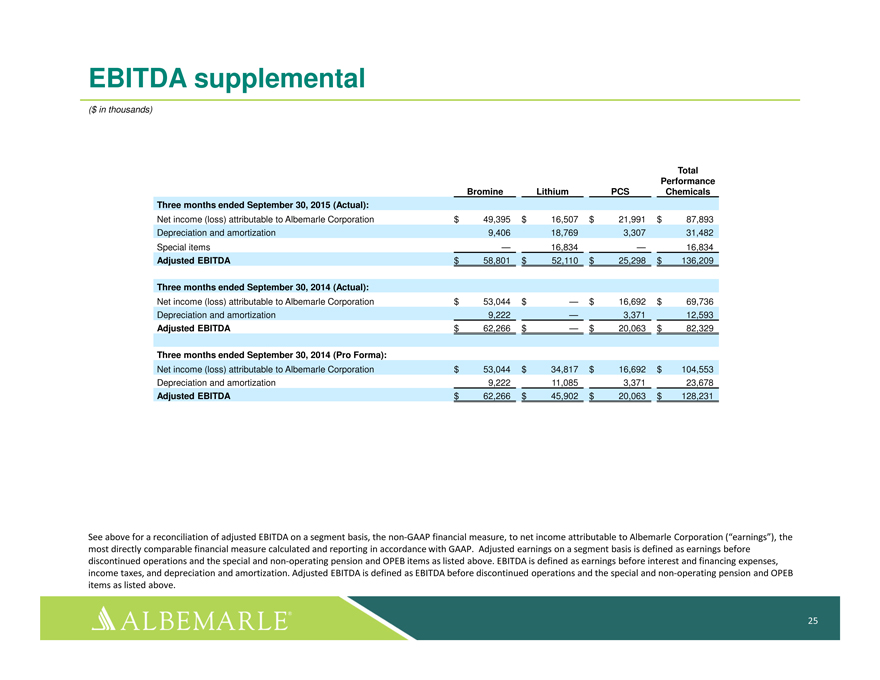

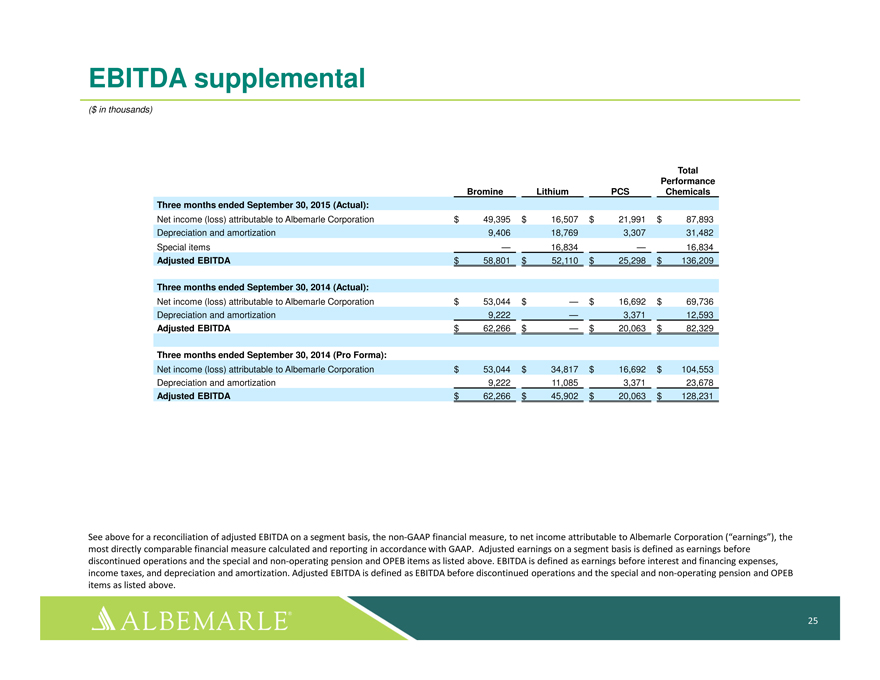

EBITDA supplemental

($ in thousands)

Total Performance Bromine Lithium PCS Chemicals Three months ended September 30, 2015 (Actual):

Net income (loss) attributable to Albemarle Corporation $ 49,395 $ 16,507 $ 21,991 $ 87,893 Depreciation and amortization 9,406 18,769 3,307 31,482 Special items — 16,834 — 16,834 Adjusted EBITDA $ 58,801 $ 52,110 $ 25,298 $ 136,209

Three months ended September 30, 2014 (Actual):

Net income (loss) attributable to Albemarle Corporation $ 53,044 $ — $ 16,692 $ 69,736 Depreciation and amortization 9,222 — 3,371 12,593 Adjusted EBITDA $ 62,266 $ — $ 20,063 $ 82,329

Three months ended September 30, 2014 (Pro Forma):

Net income (loss) attributable to Albemarle Corporation $ 53,044 $ 34,817 $ 16,692 $ 104,553 Depreciation and amortization 9,222 11,085 3,371 23,678 Adjusted EBITDA $ 62,266 $ 45,902 $ 20,063 $ 128,231

See above for a reconciliation of adjusted EBITDA on a segment basis, the non-GAAP financial measure, to net income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reporting in accordance with GAAP. Adjusted earnings on a segment basis is defined as earnings before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as earnings before interest and financing expenses, income taxes, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed above.

25 ALBEMARLE

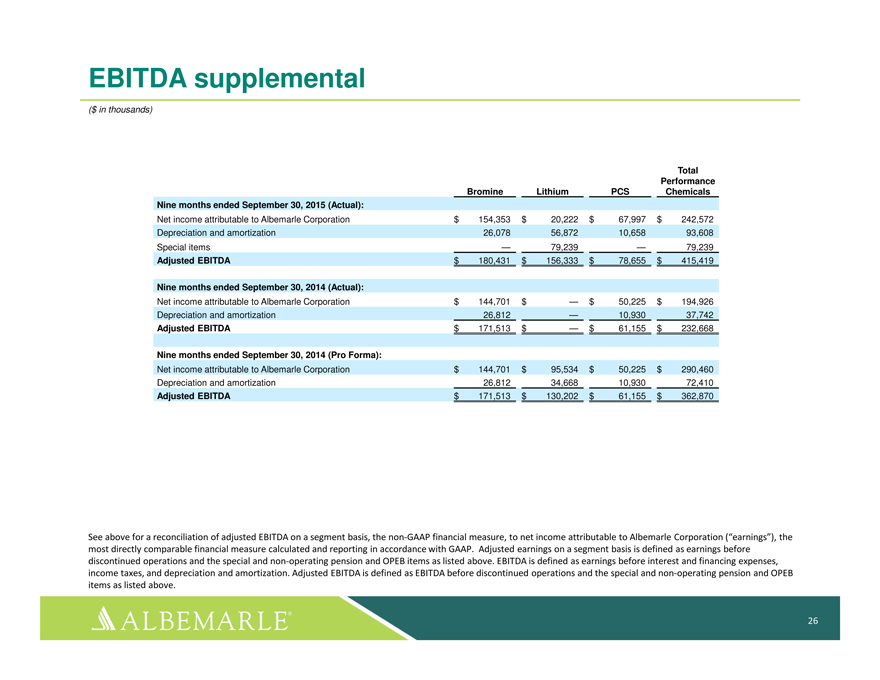

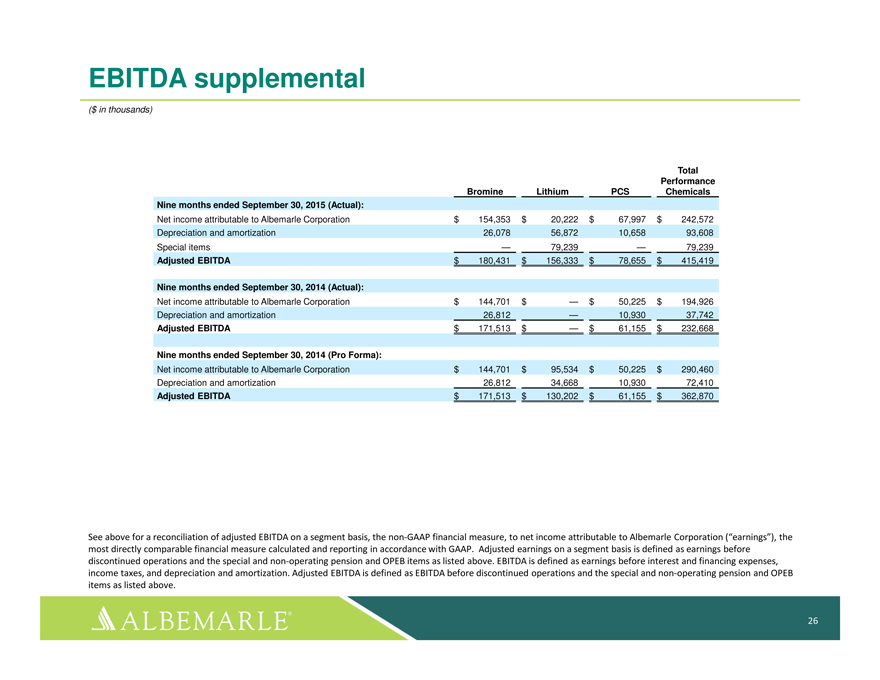

EBITDA supplemental

($ in thousands)

Total Performance Bromine Lithium PCS Chemicals Nine months ended September 30, 2015 (Actual):

Net income attributable to Albemarle Corporation $ 154,353 $ 20,222 $ 67,997 $ 242,572 Depreciation and amortization 26,078 56,872 10,658 93,608 Special items — 79,239 — 79,239 Adjusted EBITDA $ 180,431 $ 156,333 $ 78,655 $ 415,419

Nine months ended September 30, 2014 (Actual):

Net income attributable to Albemarle Corporation $ 144,701 $ — $ 50,225 $ 194,926 Depreciation and amortization 26,812 — 10,930 37,742 Adjusted EBITDA $ 171,513 $ — $ 61,155 $ 232,668

Nine months ended September 30, 2014 (Pro Forma):

Net income attributable to Albemarle Corporation $ 144,701 $ 95,534 $ 50,225 $ 290,460 Depreciation and amortization 26,812 34,668 10,930 72,410 Adjusted EBITDA $ 171,513 $ 130,202 $ 61,155 $ 362,870

See above for a reconciliation of adjusted EBITDA on a segment basis, the non-GAAP financial measure, to net income attributable to Albemarle Corporation (“earnings”), the most directly comparable financial measure calculated and reporting in accordance with GAAP. Adjusted earnings on a segment basis is defined as earnings before discontinued operations and the special and non-operating pension and OPEB items as listed above. EBITDA is defined as earnings before interest and financing expenses, income taxes, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA before discontinued operations and the special and non-operating pension and OPEB items as listed above.

26 ALBEMARLE

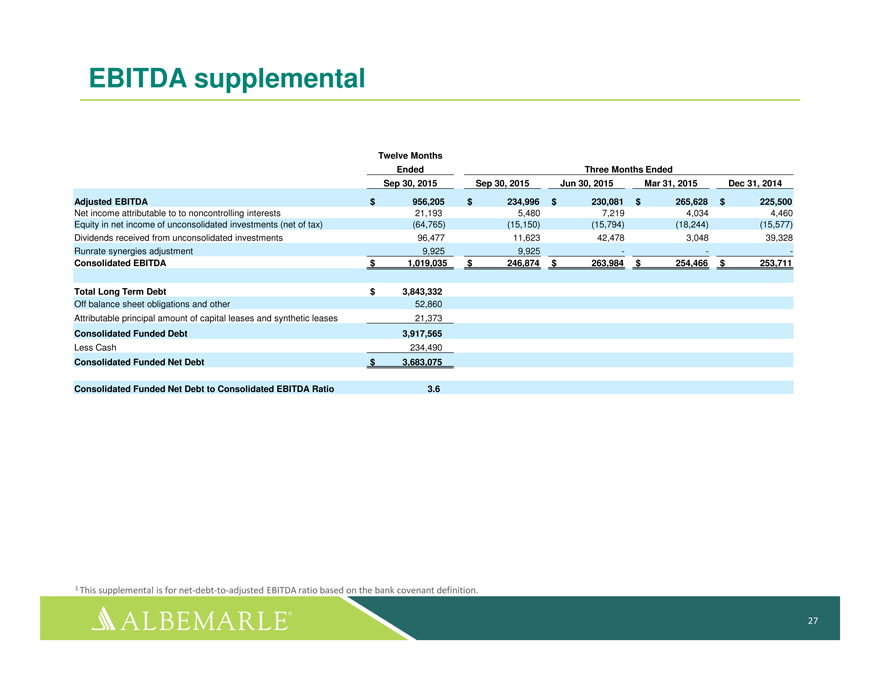

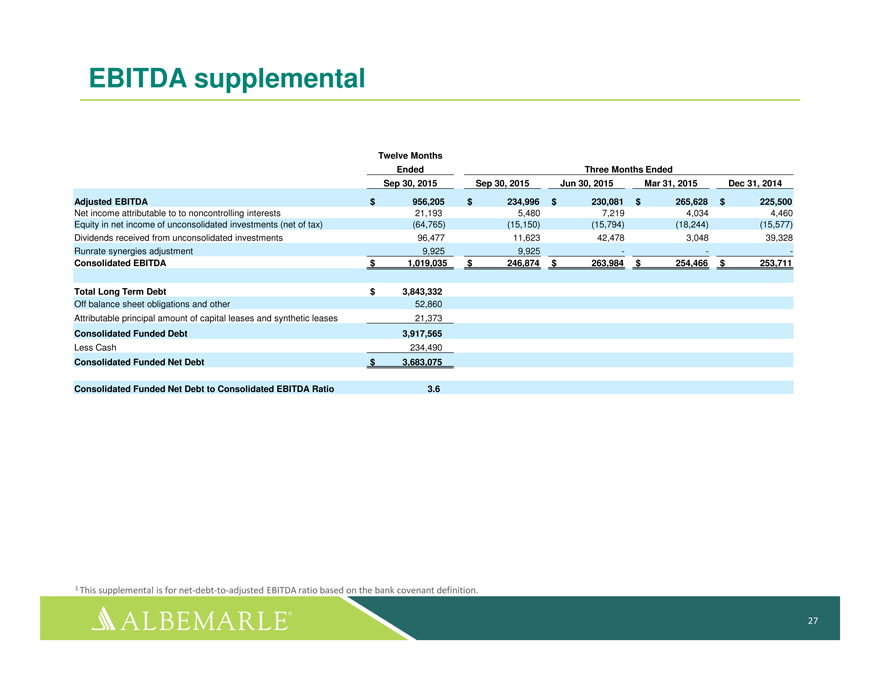

EBITDA supplemental

Twelve Months

Ended Three Months Ended

Sep 30, 2015 Sep 30, 2015 Jun 30, 2015 Mar 31, 2015 Dec 31, 2014

Adjusted EBITDA $ 956,205 $ 234,996 $ 230,081 $ 265,628 $ 225,500

Net income attributable to to noncontrolling interests 21,193 5,480 7,219 4,034 4,460 Equity in net income of unconsolidated investments (net of tax) (64,765) (15,150) (15,794) (18,244) (15,577) Dividends received from unconsolidated investments 96,477 11,623 42,478 3,048 39,328 Runrate synergies adjustment 9,925 9,925 — -

Consolidated EBITDA $ 1,019,035 $ 246,874 $ 263,984 $ 254,466 $ 253,711

Total Long Term Debt $ 3,843,332

Off balance sheet obligations and other 52,860 Attributable principal amount of capital leases and synthetic leases 21,373

Consolidated Funded Debt 3,917,565

Less Cash 234,490

Consolidated Funded Net Debt $ 3,683,075

Consolidated Funded Net Debt to Consolidated EBITDA Ratio 3.6

1 | | This supplemental is for net-debt-to-adjusted EBITDA ratio based on the bank covenant definition. |

27 ALBEMARLE

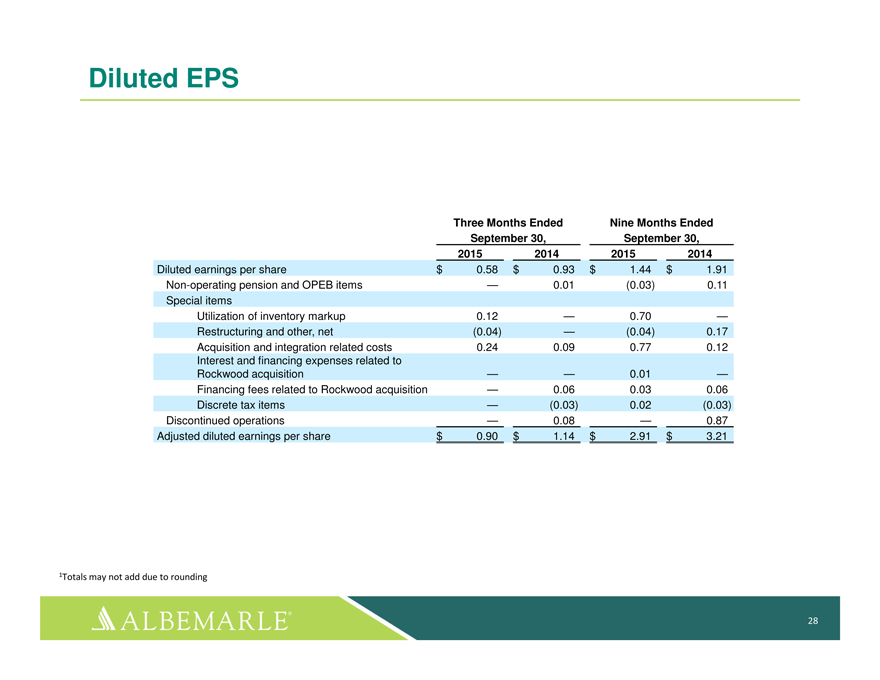

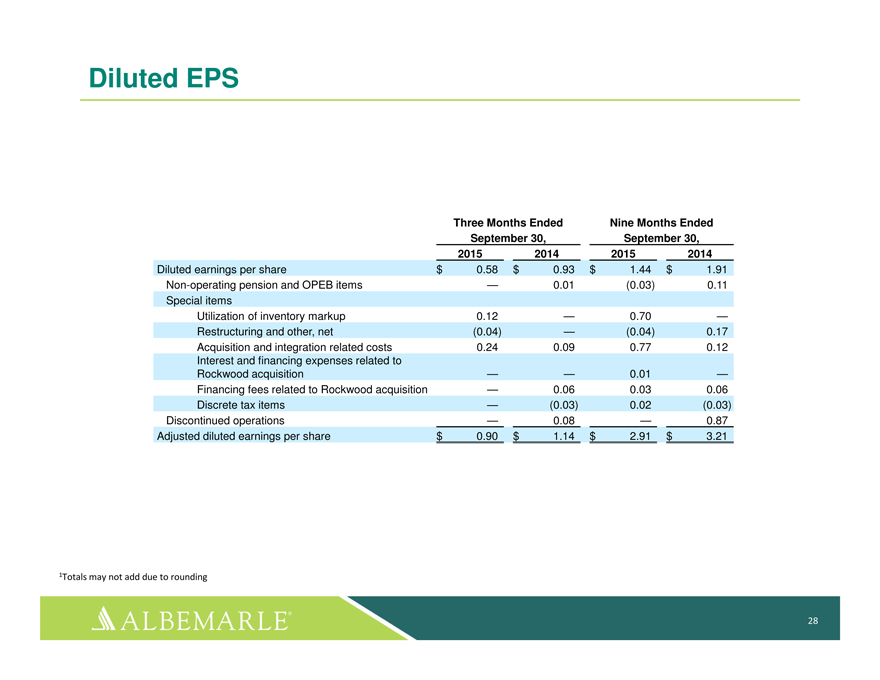

Diluted EPS

Three Months Ended Nine Months Ended September 30, September 30, 2015 2014 2015 2014

Diluted earnings per share $ 0.58 $ 0.93 $ 1.44 $ 1.91 Non-operating pension and OPEB items — 0.01 (0.03) 0.11 Special items Utilization of inventory markup 0.12 — 0.70 — Restructuring and other, net (0.04) — (0.04) 0.17 Acquisition and integration related costs 0.24 0.09 0.77 0.12 Interest and financing expenses related to Rockwood acquisition — — 0.01 — Financing fees related to Rockwood acquisition — 0.06 0.03 0.06 Discrete tax items — (0.03) 0.02 (0.03) Discontinued operations — 0.08 — 0.87 Adjusted diluted earnings per share $ 0.90 $ 1.14 $ 2.91 $ 3.21

1Totals may not add due to rounding

28 ALBEMARLE

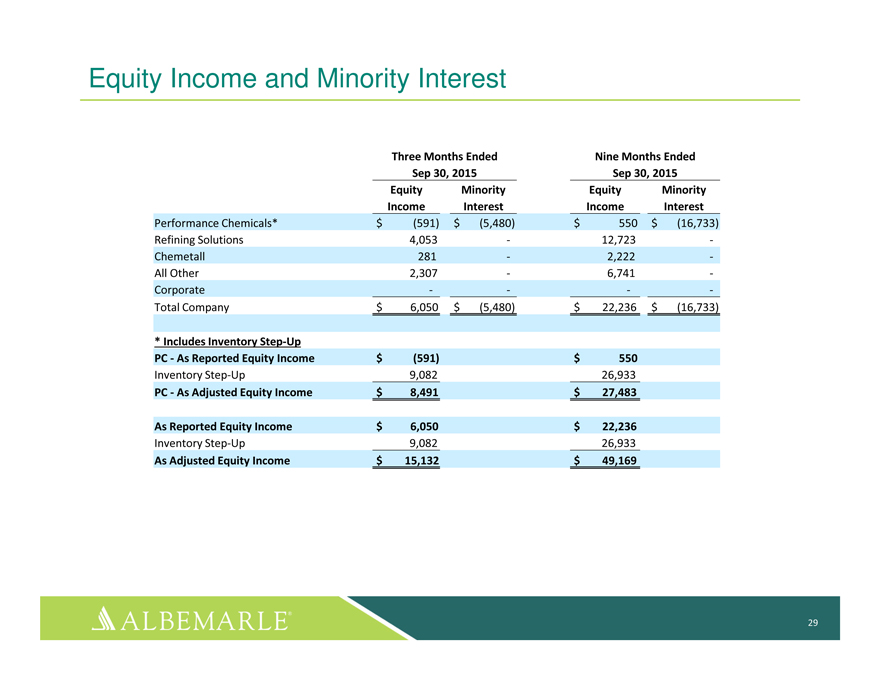

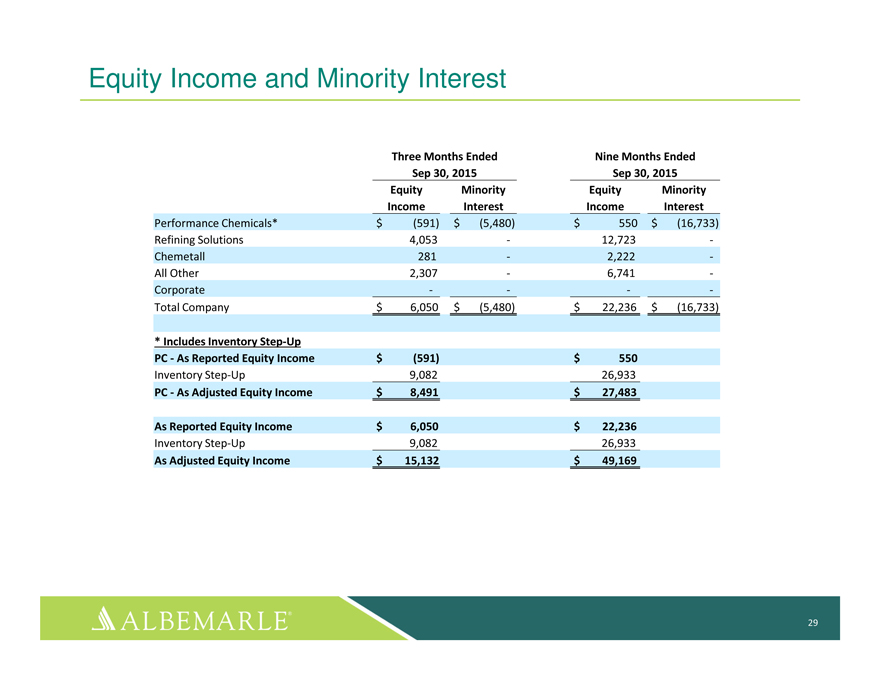

Equity Income and Minority Interest

Three Months Ended Nine Months Ended Sep 30, 2015 Sep 30, 2015 Equity Minority Equity Minority Income Interest Income Interest

Performance Chemicals* $ (591) $ (5,480) $ 550 $ (16,733) Refining Solutions 4,053—12,723 -Chemetall 281—2,222 -All Other 2,307—6,741 -Corporate — —Total Company $ 6,050 $ (5,480) $ 22,236 $ (16,733)

* | | Includes Inventory Step-Up |

PC—As Reported Equity Income $ (591) $ 550

Inventory Step-Up 9,082 26,933

PC—As Adjusted Equity Income $ 8,491 $ 27,483

As Reported Equity Income $ 6,050 $ 22,236

Inventory Step-Up 9,082 26,933

As Adjusted Equity Income $ 15,132 $ 49,169

29 ALBEMARLE

www.albemarle.com

albe LISTED NYSE ALBEMARLE