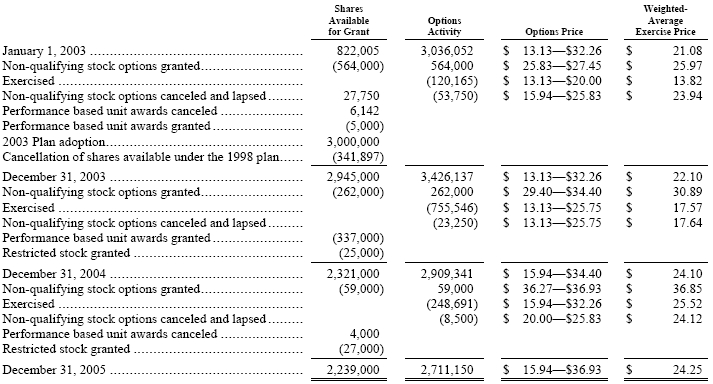

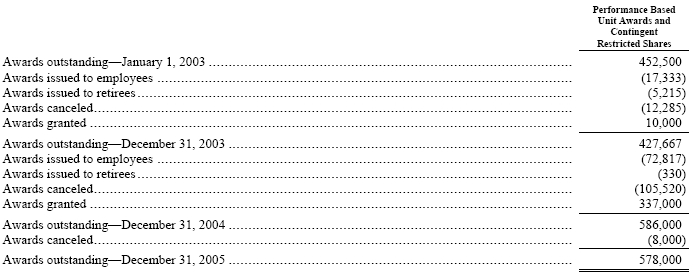

In 2002, 16,000 other restricted incentive awards were granted and vest over a fixed period as defined in the agreements. Of the 16,000 awards granted in 2002, 5,333, 5,334 and 5,333 of these awards were vested and issued during 2005, 2004 and 2003, respectively. In addition, 62,000 shares of non-performance based restricted stock were granted in previous years, which vest over a fixed period. Of these 62,000 shares, 20,000 shares were vested and issued in 2003, 2002 and 2001, and 2,000 shares were cancelled in 2002. In December 2003, performance based unit awards granted in 1998 and 2000 were modified by the Executive Compensation Committee to waive further vesting after the earned awards were determined for the performance period. Total awards of 36,403 shares and equivalent values in cash were awarded to eligible participants in early 2004 and 94,850 performance unit awards contingent on performance criteria were cancelled.

During 2005, 7,000 and 20,000 shares of non-performance based restricted stock were granted and cliff vest over three and five years, respectively. During 2004, 25,000 shares of non-performance based restricted stock were granted and cliff vest after three years. In addition, total awards of 165 shares and equivalent values in cash were awarded to retirees in 2004 and 8,000 and 10,670 performance unit awards were cancelled during 2005 and 2004, respectively.

NOTE 12—Commitments and Contingencies:

In the ordinary course of business, we have commitments in connection with various activities, the most significant of which are as follows:

Service Agreements

We are parties to various agreements with NewMarket Corporation, or NewMarket, (formerly Ethyl Corporation), dated as of February 28, 1994, pursuant to which we agreed with NewMarket to coordinate certain facilities and services of adjacent operating facilities at plants in Pasadena, Texas, Baton Rouge, Louisiana and Feluy, Belgium. In addition, we are parties to agreements providing for the blending of NewMarket’s additive products and the production of antioxidants and manganese-based antiknock compounds at the Orangeburg, South Carolina plant. On January 21, 2003, we purchased NewMarket’s antioxidants working capital, patents and other intellectual property. Our billings to NewMarket in 2005, 2004 and 2003 in connection with their agreements amounted to $11,259, $9,330 and $9,166, respectively. NewMarket’s billings to us in 2005, 2004 and 2003, in connection with these agreements, amounted to $2,127, $1,842 and $1,819, respectively. At December 31, 2005, we had receivables from NewMarket of $2,237 and payables to NewMarket of $71.

We are parties to agreements with MEMC Pasadena, Inc., or MEMC Pasadena, dated as of July 31, 1995 and subsequently revised effective May 31, 1997, pursuant to which we provide certain utilities and services to the MEMC Pasadena site that is located at our Pasadena plant and on which MEMC Pasadena’s electronic materials facility is located. MEMC Pasadena agreed to reimburse us for all the costs and expenses plus a percentage fee incurred as a result of these agreements. Our billings to MEMC Pasadena, in connection with these agreements amounted to $13,318 on 2005, $10,562 in 2004, and $10,018 in 2003. MEMC Pasadena’s billings to us in 2005, 2004 and 2003, in connection with these agreements, amounted to $1,923, $1,624 and $2,463, respectively. At December 31, 2005, we had receivables from MEMC Pasadena of $2,705 and payables to MEMC Pasadena of $206.

In 2005, we were parties to operating and service agreements with BP, p.l.c. or its affiliates, or BP, dated as of March 1, 1996, pursuant to which we provided operating and support services, certain utilities and products to BP, and BP provided operating and support services, certain utilities and products for our use. Our billings to BP in 2005, 2004, and 2003, in connection with these agreements, amounted to $50,476, $43,495, and $39,598, respectively. BP’s billings to us in 2005, 2004 and 2003, in connection with these agreements, amounted to $17,627, $16,231 and $14,563, respectively. At December 31, 2005, we had receivables from BP of $3,536 and payables to BP of $1,611. BP ceased supplying Albemarle with services and utilities under those agreements in December 2005 and ceased supplying Albemarle raw materials on February 28, 2006, at which time the agreements were terminated.

We are parties to agreements with Rhodia or its affiliates to numerous operating and service agreements, dated July 23, 2003, pursuant to which we provide operating and support services, certain utilities and products to Rhodia, and Rhodia provides operating and support services, certain utilities and products to us. Our billings to Rhodia in 2005 and 2004 in connection with these agreements amounted to $15,964 and $13,594, respectively. Rhodia’s billings to us in 2005 and 2004, in connection with these agreements, amounted to $11,052 and $11,478, respectively. At December 31, 2005, we had receivables from Rhodia of $2,996 and payables to Rhodia of $1,333.

Environmental

Environmental liabilities at December 31, 2005, 2004 and 2003:

Recorded liabilities decreased $4,843 from December 31, 2004 primarily due to foreign exchange and reduction of reserves for certain environmental sites. The increase of $4,617 from December 31, 2003 is primarily due to additional indemnified liabilities associated with acquired sites and the inclusion of a reserve amounting to $700 related to pump and treat costs at our Thann, France facility that are currently in arbitration. In 2003, we adopted SFAS No. 143,”Accounting for Asset Retirement Obligations”; a

60

reclassification of certain environmental obligations previously accounted for under FASB Statement of Position 96-1 were recorded to other noncurrent liabilities. See Note 21, “Cumulative Effect of a Change in Accounting Principle, Net.”

The amounts recorded represent our future remediation and other anticipated environmental liabilities. Although it is difficult to quantify the potential financial impact of compliance with environmental protection laws, management estimates (based on the latest available information) there is a reasonable possibility that future environmental remediation costs associated with our past operations, in excess of amounts already recorded, could be up to approximately $12,000 before income taxes.

We believe that any sum we may be required to pay in connection with environmental remediation matters in excess of the amounts recorded should occur over a period of time and should not have a material adverse effect upon results of operations, financial condition or cash flows on a consolidated annual basis although any such sum could have a material adverse impact in a particular quarterly reporting period.

Rental Expense

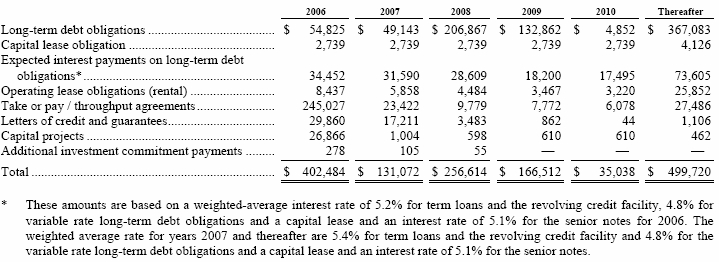

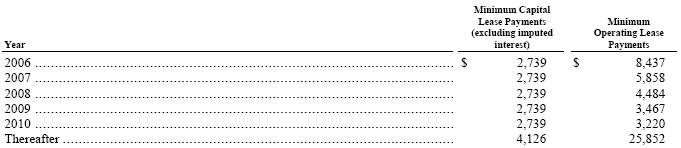

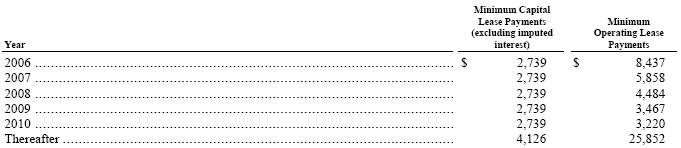

Our rental expenses include a capital lease related to machinery and equipment at JBC and a number of operating lease agreements, primarily for office space, transportation equipment and storage facilities. The following schedule details the future non-cancelable minimum lease payments for the next five years and thereafter:

Rental expense was approximately $24,802 for 2005, $19,336 for 2004 and $16,250 for 2003. Rental expense is shown net of rental income of $74 and $365 for 2005 and 2003, respectively. There was no rental income in 2004.

Litigation

On April 2, 2004, Albemarle Overseas Development Company, or AODC, one of our wholly owned subsidiaries, initiated a Request for Arbitration against Aventis S.A., the predecessor in interest to Sanofi Aventis, or Aventis, through the International Chamber of Commerce, International Court of Arbitration, Paris, France. The dispute arises out of a 1992 Stock Purchase Agreement, or Agreement, between AODC and a predecessor to Aventis under which 100% of the stock of Potasse et Produits Chimiques, S.A., now known as Albemarle PPC, or APPC, was acquired by AODC. The dispute relates to a chemical facility in Thann, France, owned by APPC, where the French government has required a detailed risk study of groundwater contamination, and in 2005 instructed APPC to conduct a number of additional tests and studies and take certain measures with respect to the containment of certain contamination at and the emission of certain materials from the Thann facility. By reason of certain intervening assignments of rights, Albemarle France SAS, another wholly owned subsidiary of Albemarle Corporation, was substituted for ADOC as the party in interest in the arbitration.

The Request for Arbitration requests indemnification by Aventis for certain costs incurred by APPC, in connection with any environmental claims of the French government for the APPC facility and a declaratory judgment as to the liability of Aventis under the Agreement for costs to be incurred in the future by APPC in connection with such claims. Under the terms of the Agreement, we believe that Aventis is obligated to indemnify AODC and APPC, and hold them harmless from certain claims, losses, damages, costs or any other present or prospective liabilities arising out of certain soil and groundwater contamination at the site in Thann.

Arbitration hearings related to the question of liability took place in June 2005 and we currently expect a response from the arbitration panel in 2006.

At this time, it is not possible to predict what additional studies or measures, if any, the French government may require since these matters are in the initial stages and environmental matters are subject to many uncertainties. We believe, however, that we are entitled to be fully indemnified by Aventis for all liabilities arising from these matters, but no assurance can be given that we will

61

prevail in the arbitration. If we do not prevail in the arbitration and the government requires additional remediation, the costs of remediation could be significant.

In addition, we are involved from time to time in legal proceedings of types regarded as common in our businesses, particularly administrative or judicial proceedings seeking remediation under environmental laws, such as Superfund, products liability and premises liability litigation. We maintain a financial accrual for these proceedings that includes defense costs and potential damages, as estimated by our general counsel. We also maintain insurance to mitigate certain of such risks.

Other

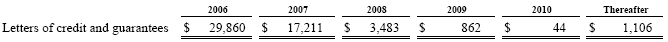

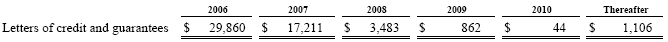

The following table summarizes our unused letters of credit and guarantee agreements:

We also have contracts with certain of our customers, which serve as guarantees on product delivery and performance according to customer specifications that can cover both shipments on an individual basis as well as blanket coverage of multiple shipments under customer supply contracts, are executed through certain financial institutions. The financial coverage provided by these guarantees is typically based on a percentage of net sales value.

In connection with the our remediation of a local landfill site as required by the German environmental authorities, we have pledged certain of our land and housing facilities at our Bergheim, Germany plant site with a recorded value of $5,279.

NOTE 13—Pension Plans and Other Postretirement Benefits:

We have certain noncontributory defined benefit pension plans covering certain U.S., Belgian, French, German, Japanese and the Netherlands employees. The benefits for these plans are based primarily on compensation and/or years of service. The funding policy for each plan complies with the requirements of relevant governmental laws and regulations. The pension information for all periods presented includes amounts related to salaried and hourly plans.

Our U.S. defined benefit plan for non-represented employees was closed to new participants effective March 31, 2004. In 2005, the defined benefit plan for non-represented employees was further amended to provide that for participants who retire on or after December 31, 2010, final average earnings shall be determined as of December 31, 2010, except that for participants who retire on or after December 31, 2015, final average earnings shall be determined as of December 31, 2012, and for participants who retiree on or after December 31, 2020, final average earnings shall be determined as of December 31, 2014.

On March 31, 2004, a new defined contribution pension plan for U.S. non-represented employees hired after March 31, 2004 was adopted. The new annual contribution to the defined contribution plan is based on 5% of eligible employee compensation and amounted to $1,371 and $509 in 2005 and 2004, respectively. A defined contribution pension plan for employees in the United Kingdom is also in existence. The annual contribution to the United Kingdom defined contribution plan is based on a percentage of eligible employee compensation and amounted to $536 and $544 in 2005 and 2004, respectively.

As a result of our refinery catalysts business acquisition, we assumed the obligation under the defined benefit plan that covers employees in the Netherlands and the actual plan assets were transferred beginning in 2005 and to be completed in early 2006. The benefits for this plan will be based primarily on employee compensation and/or years of service.

Pension coverage for the employees of our other foreign subsidiaries is provided through separate plans. The plans are funded in conformity with the funding requirements of applicable governmental regulations. The pension cost, actuarial present value of benefit obligations and plan assets for all plans are combined in the other pension disclosure information presented.

Postretirement medical benefits and life insurance is provided for certain groups of U.S. retired employees. Medical and life insurance benefit costs are funded principally on a pay-as-you-go basis. Although the availability of medical coverage after retirement varies for different groups of employees, the majority of employees who retire before becoming eligible for Medicare can continue group coverage by paying a portion of the cost of a monthly premium designed to cover the claims incurred by retired employees subject to a cap on payments allowed. The availability of group coverage for Medicare-eligible retirees also varies by employee group with coverage designed either to supplement or coordinate with Medicare. Retirees generally pay a portion of the cost of the coverage. Plan assets for retiree life insurance are held under an insurance contract and reserved for retiree life insurance benefits. As a result of the acquisition of the refinery catalysts business, we assumed the obligation for postretirement medical benefits for employees in the

62

Netherlands who will retire after August 2009. The benefit costs are funded principally on a pay-as-you-go basis. In 2005, the postretirement medical benefit available to U.S. employees was changed to provide that employees who are under age 50 as of December 31, 2005 would no longer be eligible for a company paid retiree medical premium subsidy. Employees who are of age 50 and above as of December 31, 2005 and who retire after January 1, 2006 will have their retiree medical premium subsidy capped.

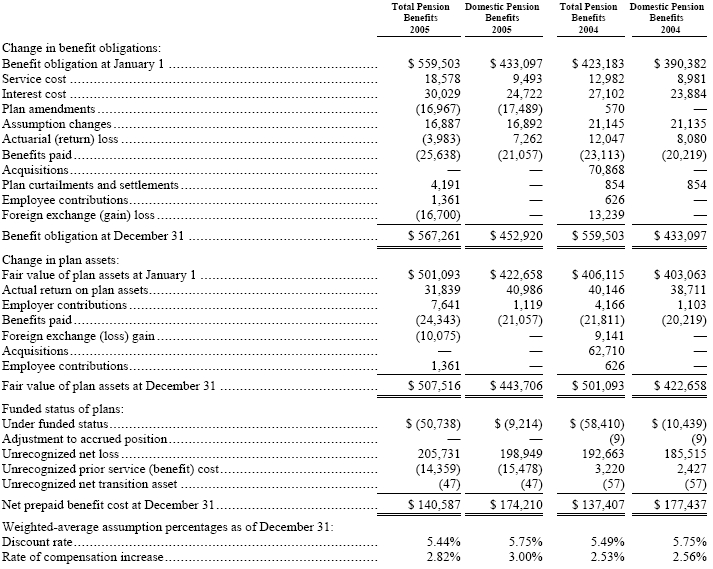

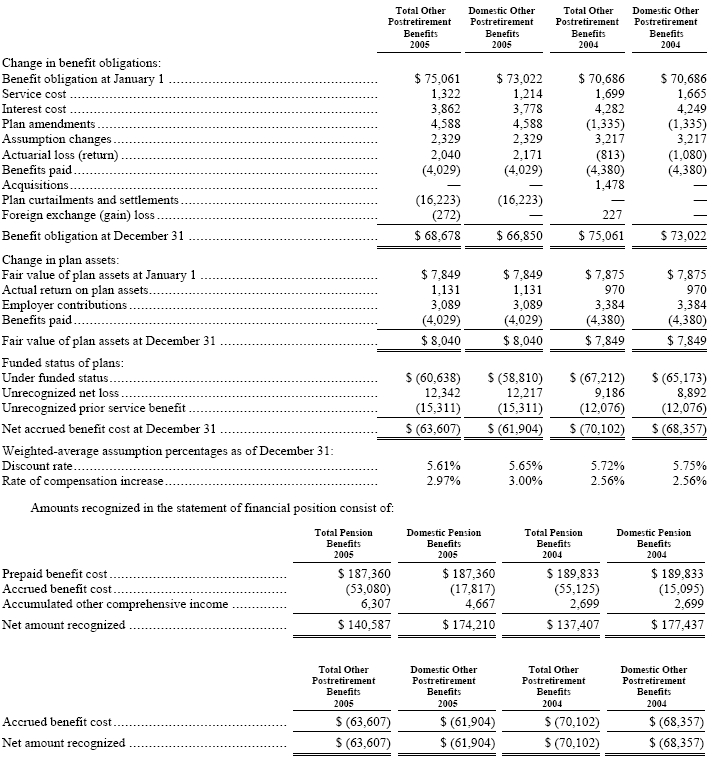

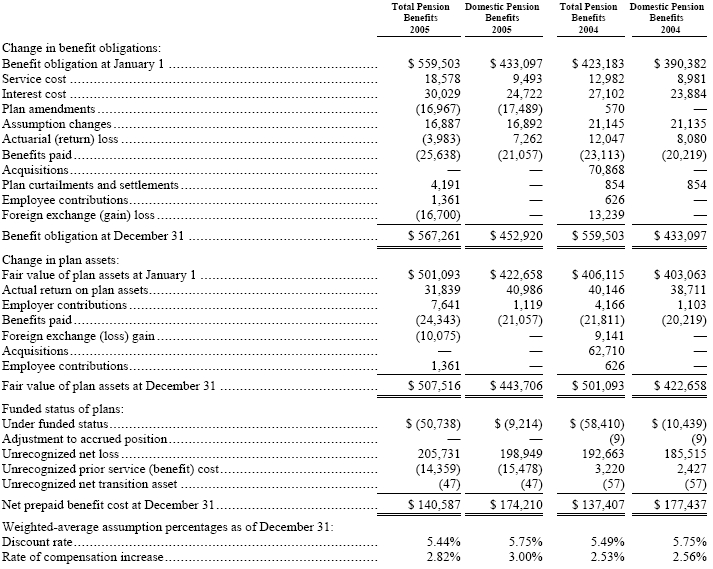

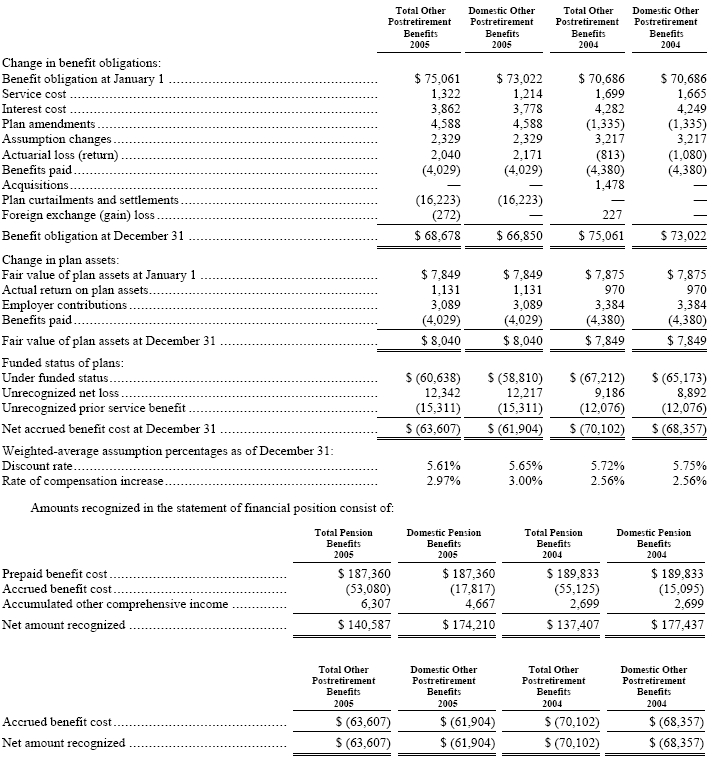

The following provides a reconciliation of benefit obligations, plan assets, and funded status of the plans, as well as a summary of significant assumptions:

63

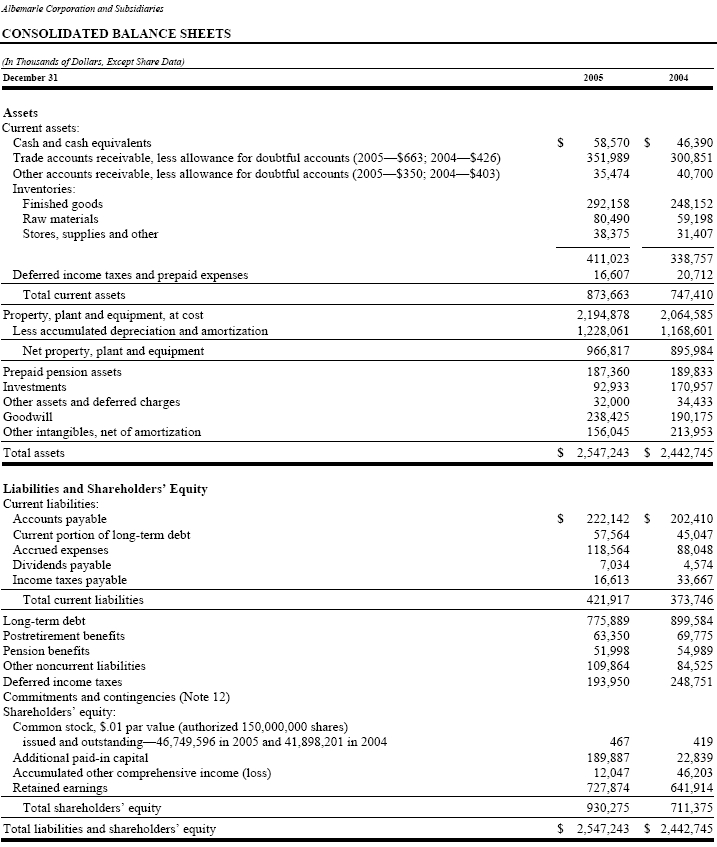

The accumulated benefit obligation for all defined benefit pension plans was $523,699 and $497,257 at December 31, 2005 and 2004, respectively. The net prepaid (accrued) benefit cost related to pensions is included in “prepaid pension assets” and “pension benefits” in the consolidated balance sheets. The accrued postretirement benefit cost is included in “accrued expenses” and “postretirement benefits” in the consolidated balance sheets.

64

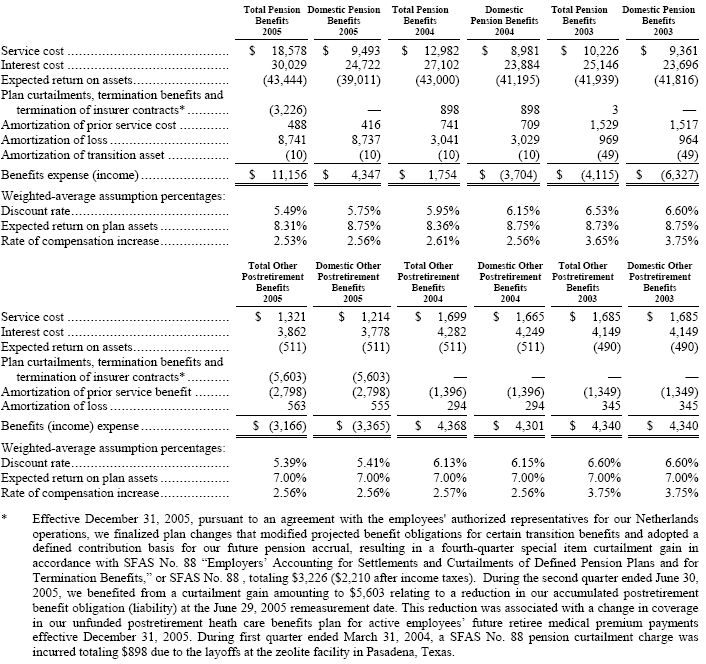

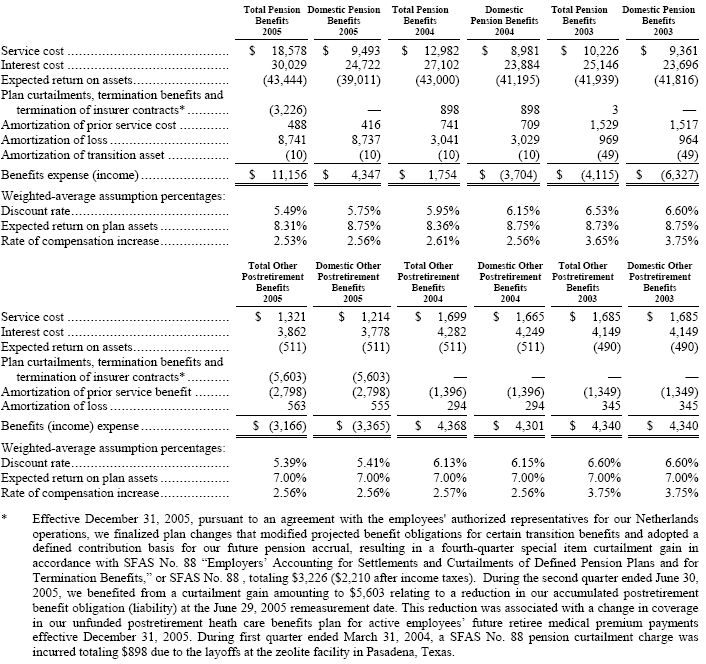

The components of pension and postretirement benefits expense (income) are as follows:

In estimating the expected return on plan assets, consideration is given for past performance and future expectations for the types of investments held by the plan as well as the expected long term allocation of plan assets to these investments. At December 31, 2005, the expected rates of return on pension plan assets for domestic plans and other postretirement benefit plan assets were 8.75% and 7.00%, respectively. There was no change in these rates from December 31, 2004. At December 31, 2005 and 2004, the weighted-average expected rate of return on pension plan assets for foreign plans was 5.94% and 5.95%, respectively.

65

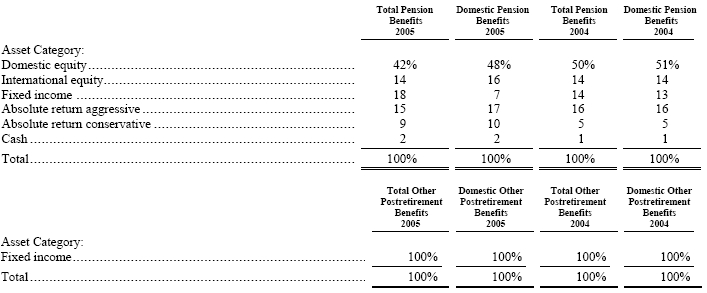

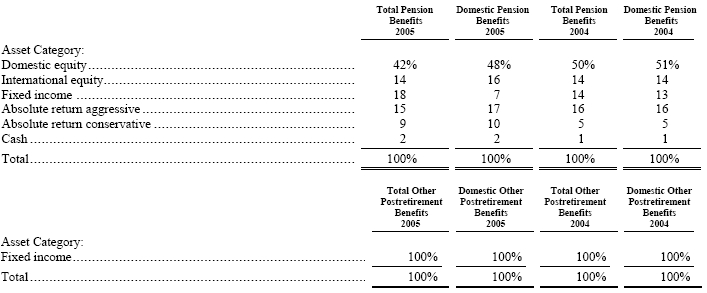

The pension and other postretirement benefit plan weighted-average asset allocations at December 31, 2005 and 2004, by asset category are as follows:

The investment objective of the U.S. pension plan assets is maximum return with a strong emphasis on preservation of capital. Assets should participate in rising markets, with defensive action in declining markets expected to an even greater degree. Target asset allocations include 60% in long equity managers and the remaining 40% in asset classes that provide diversification from traditional long equity holdings. Depending on market conditions, the broad asset class targets may range 10%. These asset classes include, but are not limited to hedge fund of funds, bonds and other fixed income vehicles, high yield equities and distressed debt. Foreign plan assets are invested with insurance companies.

Equity securities include Albemarle common stock in the amount of $844 and $672 (0.2% and 0.1% of total plan assets) at December 31, 2005 and 2004, respectively, for pension benefits. There were no investments in Albemarle common stock at December 31, 2005 or 2004 for other postretirement benefits.

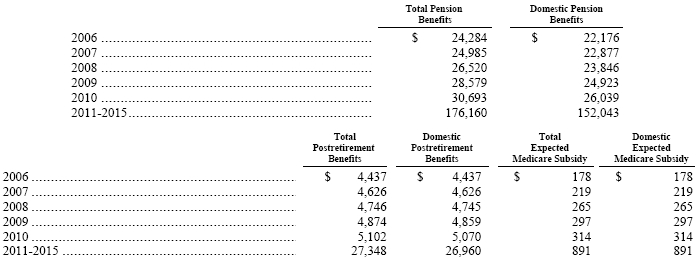

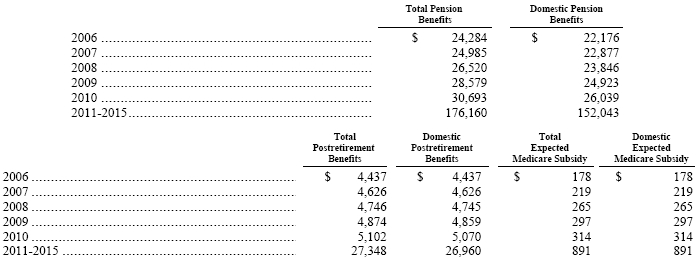

We have not determined the expected 2006 pension funding; however, only one of the foreign plans has an estimated contribution of $438 and there are no other required minimum contributions to the plans. Current expectations are to contribute approximately $4,206 to the other postretirement benefit plan in 2006.

66

The current forecast of benefit payments, which reflect expected future service, amounts to:

We have a supplemental executive retirement plan, or the SERP, which provides unfunded supplemental retirement benefits to certain management or highly compensated employees. The SERP provides for incremental pension payments to offset the limitations imposed by federal income tax regulations. Expenses relating to the SERP of $1,578, $1,357 and $1,481 were recorded for the years ended December 31, 2005, 2004 and 2003, respectively. The accumulated benefit obligation for the SERP recognized in the consolidated balance sheet at December 31, 2005 and 2004 was $13,962 and $11,200, respectively. The benefit expenses and obligations of this SERP are included in the tables above. Benefits of $1,231 are expected to be paid to SERP retirees in 2006. In 2005, the SERP was amended to reflect the same changes as the U.S. qualified defined benefit plan. For participants who retire on or after December 31, 2010, final average earnings shall be determined as of December 31, 2010, except that for participants who retire on or after December 15, 2015, final average earnings shall be determined as of December 31, 2012, and for participants who retire on or after December 31, 2020, final average earnings shall be determined as of December 31, 2014.

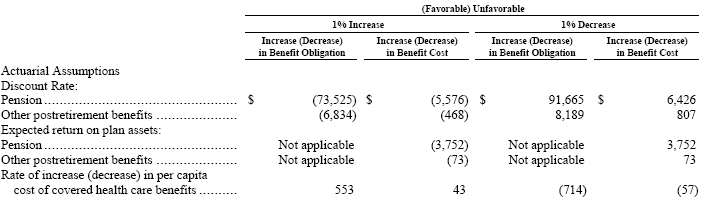

At December 31, 2005, the previously assumed rate of increase in the per capita cost of covered health care benefits for U.S. retirees was increased. The assumed health care cost trend rate for 2005 for pre-65 coverage was 9% per year, dropping by 1% per year to an ultimate rate of 5%, while the trend rate for post-65 coverage was 10% per year, dropping by 1% per year to an ultimate rate of 5%. The assumed health care cost trend rate for 2004 for pre-65 coverage was 9% per year, dropping by 1% per year to an ultimate rate of 6%, the trend rate for post-65 coverage was 11% per year, dropping by 1% per year to an ultimate rate of 6%. For 2006, the trend rate for pre-65 coverage is 9% per year, dropping by 1% per year to an ultimate rate of 5%; the trend rate for post-65 coverage is 10% per year, dropping by 1% per year to an ultimate rate of 5%. The postretirement medical benefits provided to employees in the Netherlands who retire after August 2009 includes an assumed increase in benefits of 1.5% per year.

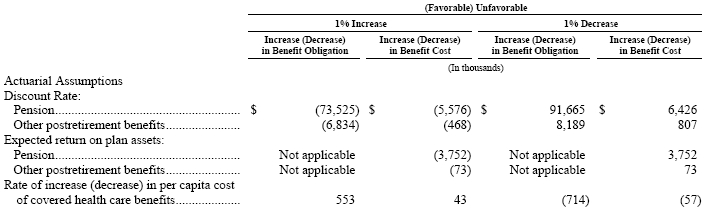

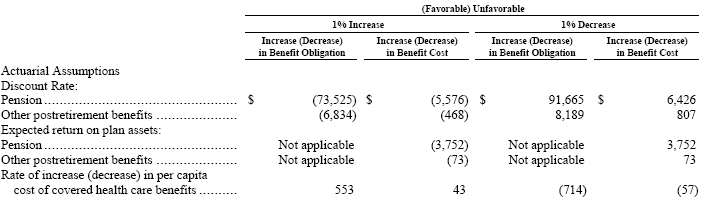

The effect of a 1% increase in the U.S. health care cost trend rate would increase the total service and interest components by $43 and would increase the benefit obligation by $553. A 1% decrease in the U.S. heath care cost trend rate would decrease the total service and interest components by $57 and would decrease the benefit obligation by $714.

67

A variance in the assumptions discussed above would have an impact on the projected benefit obligations, the accrued other postretirement benefit liabilities, and the annual net periodic pension and other postretirement benefit cost. The following table reflects the sensitivities associated with a hypothetical change in certain assumptions, primarily in the U.S.:

Other Postemployment Benefits

Certain postemployment benefits to former or inactive employees who are not retirees are funded on a pay-as-you-go basis. These benefits include salary continuance, severance and disability health care and life insurance which are accounted for under SFAS No. 112 “Employers’ Accounting for Postemployment Benefits.” The accrued postemployment benefit liability was $668 and $847 at December 31, 2005 and 2004, respectively.

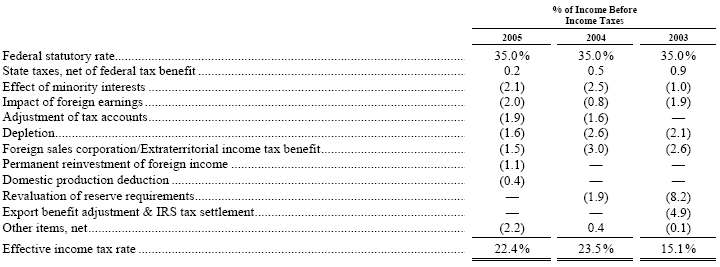

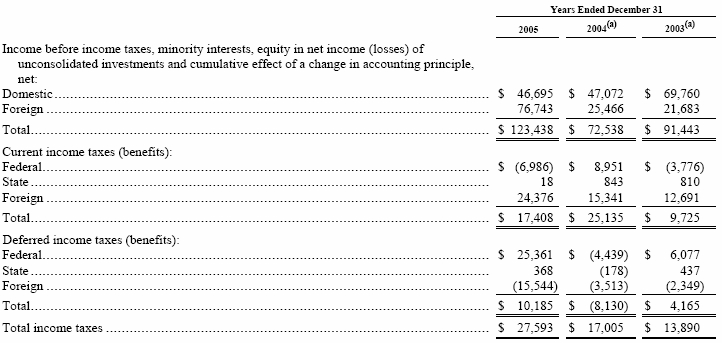

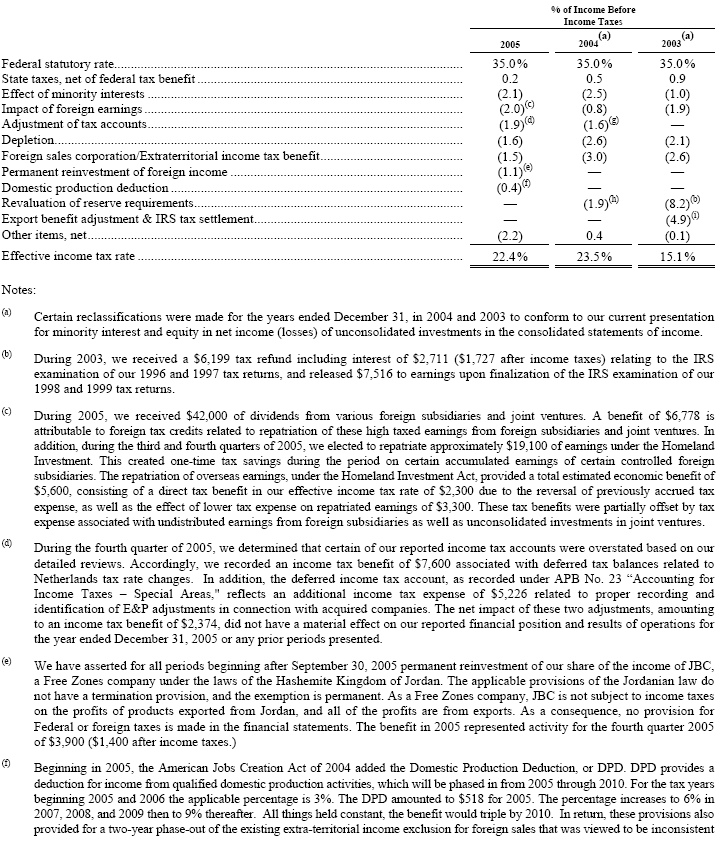

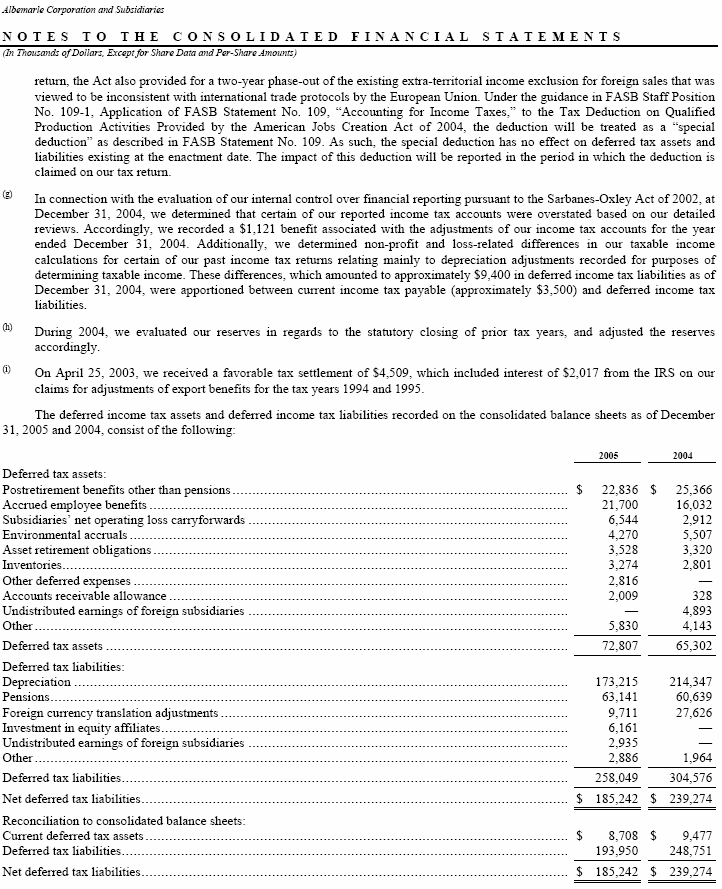

NOTE 14—Income Taxes:

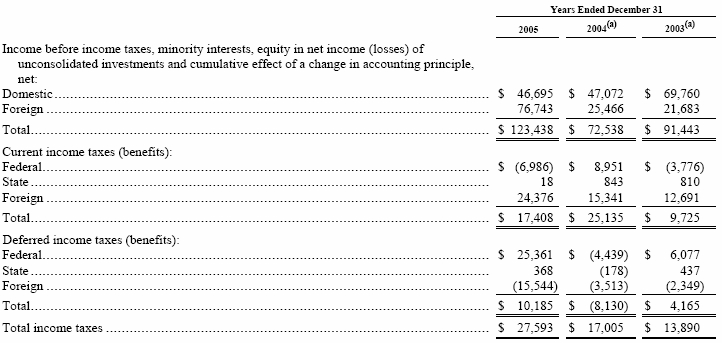

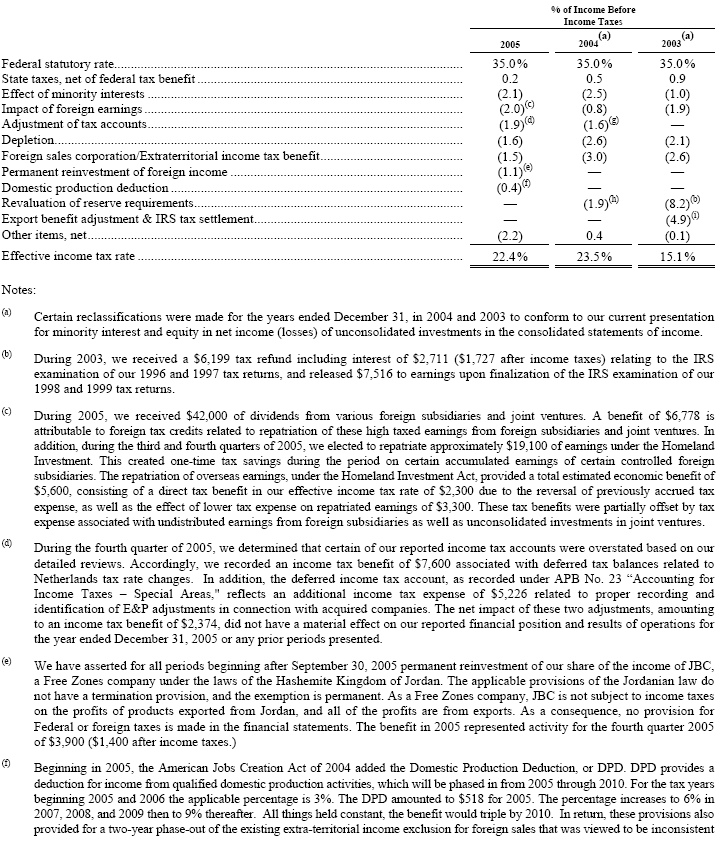

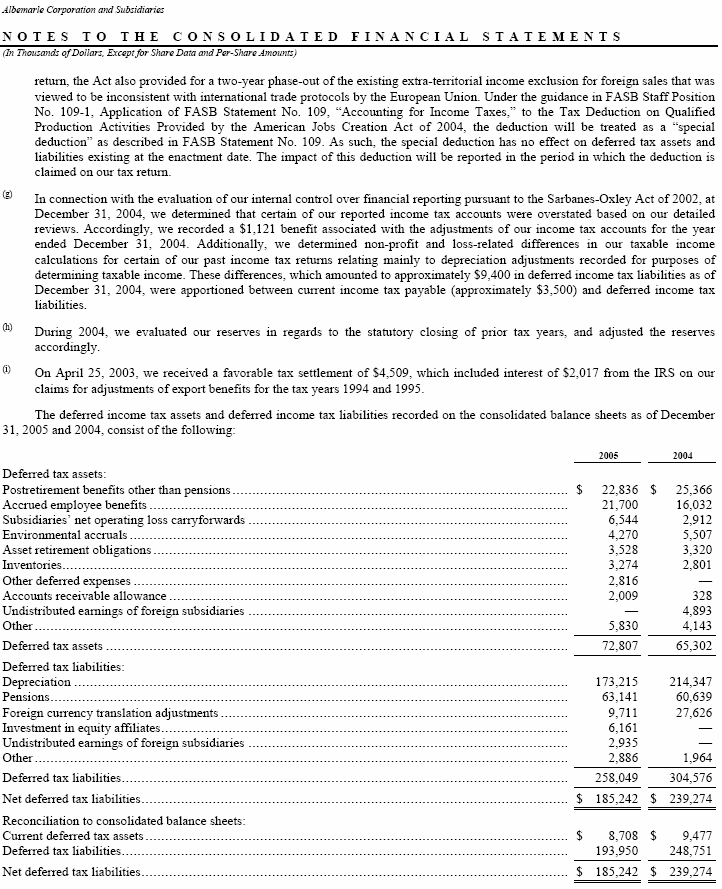

Income before income taxes, minority interests, equity in net income (losses) of unconsolidated investments and cumulative effect of a change in accounting principle, net and current and deferred income taxes (benefits) are composed of the following:

68

69

We currently have three foreign entities that have generated net operating losses, or NOL, of $6,540 through December 31, 2005. We have not established valuation allowances on these outstanding NOL amounts as each of the respective foreign jurisdictions has indefinite carry forward periods which will be utilized based upon our current tax planning.

70

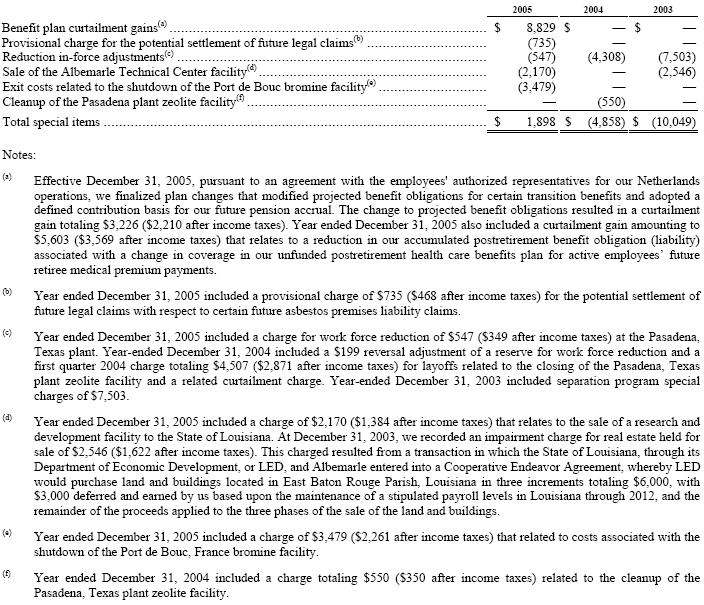

NOTE 15—Special Items:

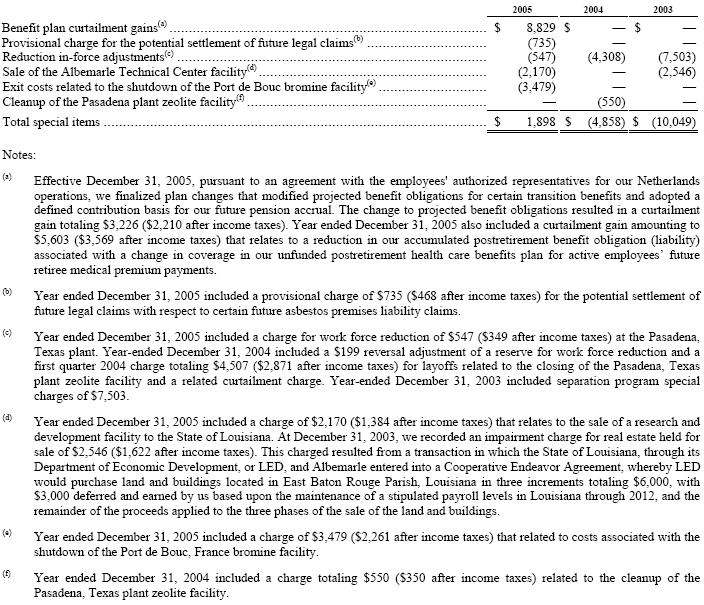

Special items, included in the consolidated statements of income for the years ended December 31, consist of the following:

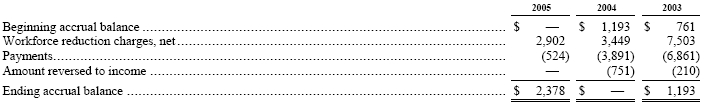

The following table summarizes the workforce reduction charges outlined above.

71

Year ended December 31, 2005 included special charges of $547 relating to the layoff of eight employees at our Pasadena, Texas plant and $2,355 relating to the layoff of fifteen employees associated with the closing of our Port de Bouc, France bromine facility.

In 2004 and 2003, we reduced operating costs through separate involuntary separation programs that resulted in special charges of $3,449 and $7,503, respectively. The 2004 and 2003 programs impacted a total of 53 and 89 salaried employees, respectively.

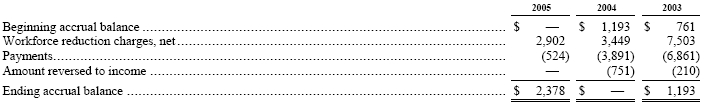

NOTE 16—Fair Value of Financial Instruments:

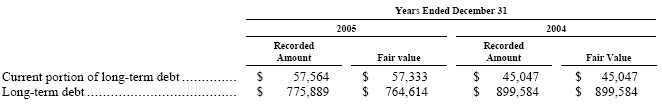

In assessing the fair value of financial instruments, we use methods and assumptions that are based on market conditions and other risk factors existing at the time of assessment. Fair value information for our financial instruments is as follows:

Cash and Cash Equivalents, Accounts and Other Receivables and Accounts Payable—The carrying value approximates fair value due to their short-term nature.

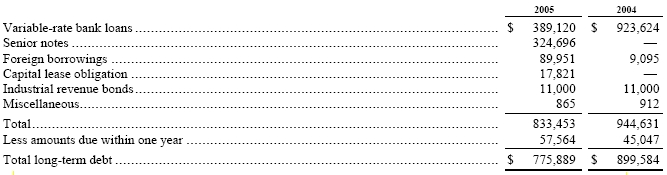

Long-Term Debt—The carrying value of long-term debt reported in the accompanying consolidated balance sheets at December 31, 2005 and 2004, with the exceptions of the senior notes which we sold on January 20, 2005 and the JBC foreign currency denominated debt, approximates fair value since substantially all of the long-term debt bears interest based on prevailing variable market rates currently available in the countries in which we have borrowings. See Note 10, “Long-Term Debt.”

Foreign Currency Exchange Contracts—The fair values of our forward currency exchange contracts are estimated based on current settlement values. The fair value of the forward contracts represented a net asset position of $19 at December 31, 2005. At December 31, 2004, there were no outstanding forward contracts.

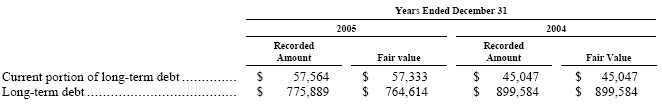

NOTE 17—Acquisitions:

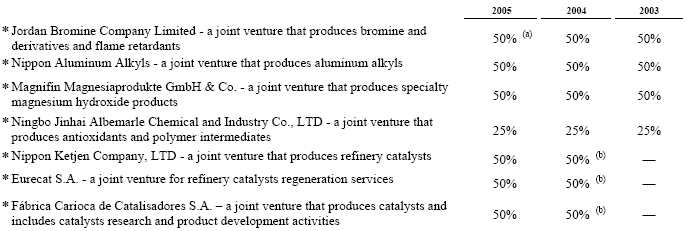

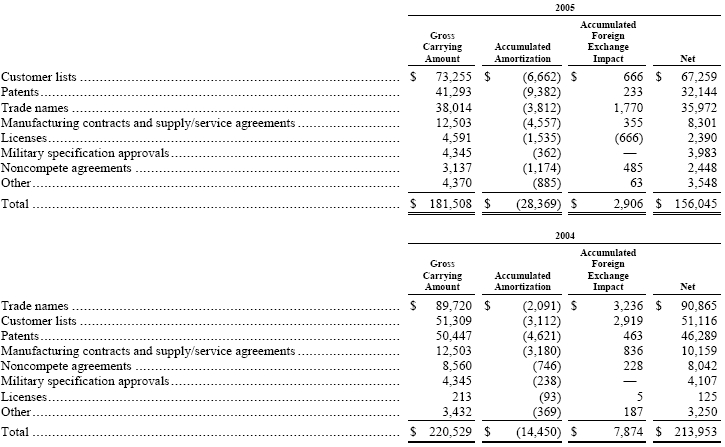

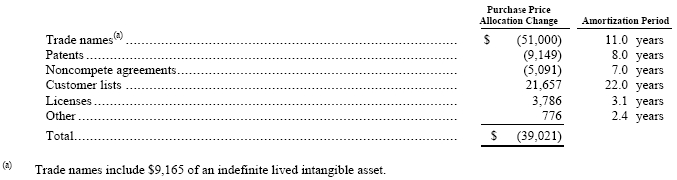

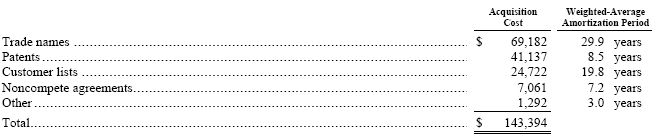

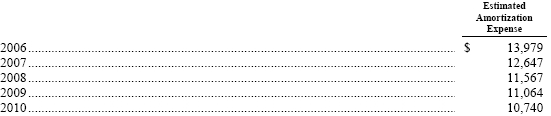

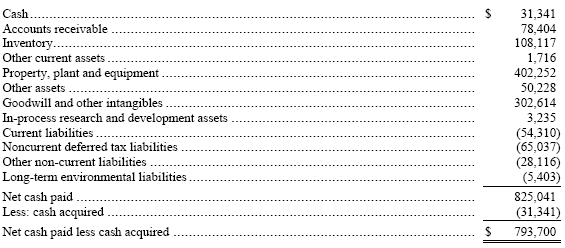

On July 31, 2004, we completed the acquisition of the refinery catalysts business of Akzo Nobel N.V. for approximately $763,000, including expenses, at applicable exchange rates, funded by a combination of a bridge loan and long-term financing. During 2004 and 2005, we adjusted the purchase price by approximately $23,000 and $8,000, respectively, due primarily to payments to Akzo Nobel as part of the post-closing working capital adjustments. During 2005, significant progress was made in the determination of the final purchase price allocation versus the estimated allocation at December 31, 2004. However, none of the changes made to the December 31, 2004 allocation were material to our financial position or results of operations. Following this acquisition, we transferred our existing polyolefin catalysts business from the Polymer Chemicals segment, which was renamed Polymer Additives, to a newly created Catalysts segment, which also included the assets acquired from Akzo Nobel. Our operations are now managed and reported as three operating segments: Polymer Additives; Catalysts; and Fine Chemicals. Additionally, we acquired 50% ownership of non-consolidated joint ventures in Brazil (Fábrica Carioca de Catalisadores S.A.), Japan (Nippon Ketjen Co., Ltd.) and France (Eurecat S.A. with affiliates in the United States, Saudi Arabia and Italy). The acquisition was accounted for by the purchase method of accounting, and accordingly, the operating results have been included in our consolidated results of operations from the date of acquisition. See Note 18, “Pro Forma Financial Information (Unaudited).”

72

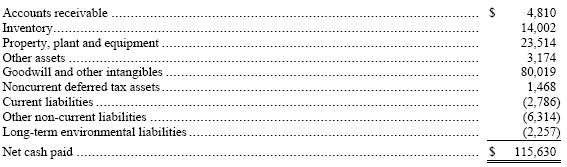

The final purchase price allocation is summarized below.

Effective January 1, 2004, we acquired the business assets (including inventory), customer lists and other intangibles of Taerim International Corporation, or Taerim, and formed Albemarle Korea Corporation located in Seoul. Taerim was formerly Albemarle’s Korean distributor and representative. The acquisition was accounted for by the purchase method of accounting, and accordingly, the operating results have been included in our consolidated results of operations from the date of acquisition. The acquisition purchase price totaled $3,337, payable in cash and long-term payables due over five years.

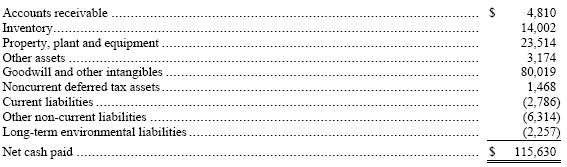

On December 2, 2003, we acquired the bromine fine chemicals business of Atofina Chemicals, Inc., or Atofina, through our wholly owned subsidiary Albemarle Chemicals SAS for $8,473. The transaction included the transfer to Albemarle of Atofina’s production site in Port de Bouc, France, as well as a long-term supply agreement with Atofina for certain fine chemicals. The acquisition was accounted for by the purchase method of accounting, and accordingly, the operating results have been included in our consolidated results of operations from the date of acquisition. See Note 18, “Pro Forma Financial Information (Unaudited).” A summary of the purchase price allocation, which was finalized during the fourth quarter of 2004, is included in the summary below.

On July 23, 2003, we acquired Rhodia’s global organophosphorus and ammonium polyphosphate flame retardants businesses, through our wholly owned subsidiary Albemarle Virginia Corporation, for $80,578. As part of this transaction, we acquired a production site in Avonmouth, United Kingdom. We will be supplied with flame retardants and intermediates manufactured at Rhodia’s sites in Charleston, S.C., and Oldbury and Widnes in the United Kingdom. The acquisition was accounted for by the purchase method of accounting, and accordingly, the operating results have been included in our consolidated results of operations from the date of acquisition. See Note 18, “Pro Forma Financial Information (Unaudited).” A summary of the purchase price allocation, which was finalized in 2004, is included in the summary below.

On January 21, 2003, we acquired NewMarket’s fuel and lubricant antioxidants working capital, patents and other intellectual property for $26,579. The acquisition was accounted for by the purchase method of accounting, and accordingly, the operating results have been included in our consolidated results of operations from the date of acquisition. A summary of the final purchase price allocation is included in the summary below.

73

A summary of the assets acquired and liabilities assumed for the NewMarket, Rhodia and Atofina acquisitions, which were acquired on January 21, 2003, July 23, 2003 and December 2, 2003, respectively, is presented as follows.

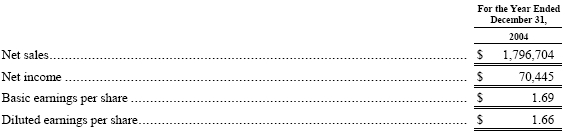

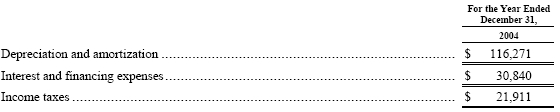

NOTE 18—Pro Forma Financial Information (Unaudited):

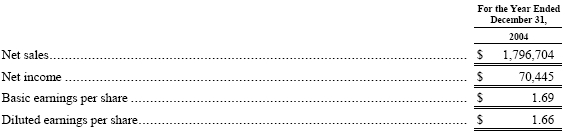

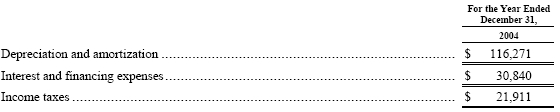

The following unaudited pro forma data summarizes the results of operations for the year ended December 31, 2004 as if the acquisition of the refinery catalysts business, which was acquired on July 31, 2004, had been completed as of the beginning of the period presented. The pro forma data gives effect to actual operating results prior to the acquisition, and includes adjustments for tangible and intangible asset depreciation and amortization, interest expense, various other income (expenses) statement accounts and related income tax effects associated with the acquisition. Additionally, non-recurring items associated with refinery catalysts business acquisition, including acquired inventory step-up charges of $13,400 ($8,536 after income taxes, or 20 cents per diluted share), in-process research & development, or R&D, charges of $3,000, or 7 cents per diluted share, and acquisition-related Euro-denominated hedge contract net losses for the year ended December 31, 2004 totaling $12,848 ($8,184 after income taxes, or 19 cents per diluted share), are reflected in the pro forma data for the period presented. These pro forma amounts do not purport to be indicative of the results that would have actually been obtained if the acquisition had occurred as of the beginning of the period presented or that may be obtained in the future.

The above pro forma data includes pro forma amounts for depreciation and amortization, interest expense and income taxes as follows:

74

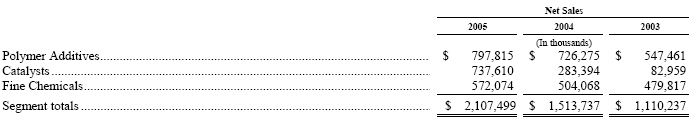

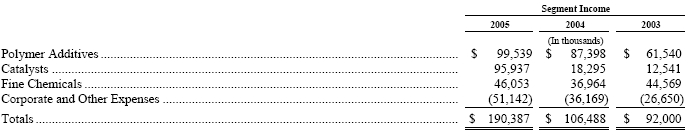

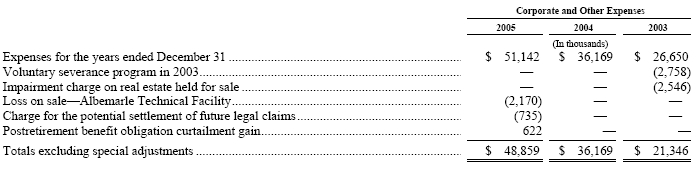

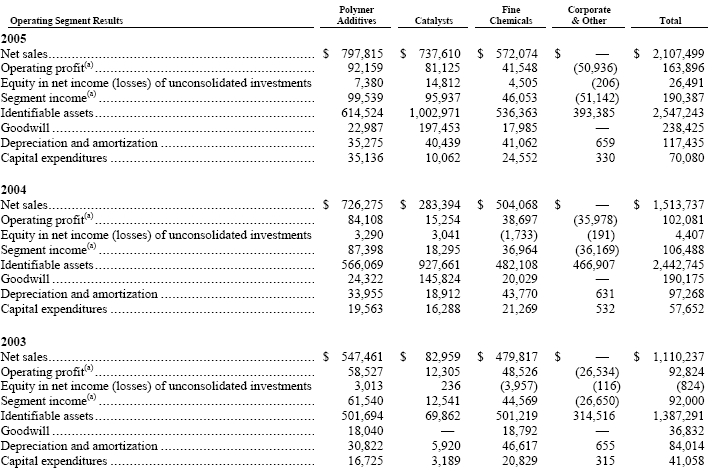

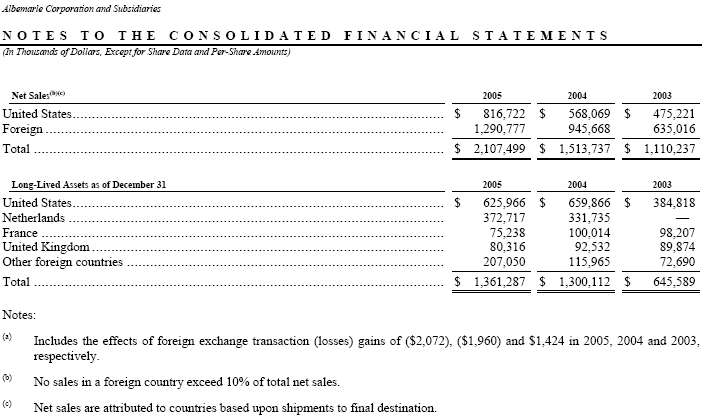

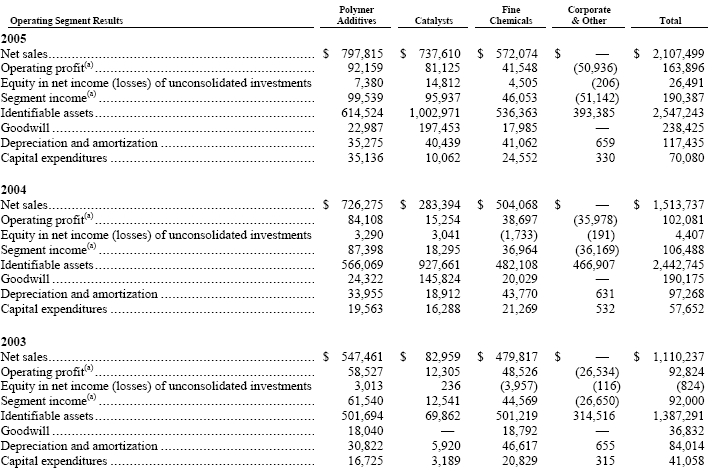

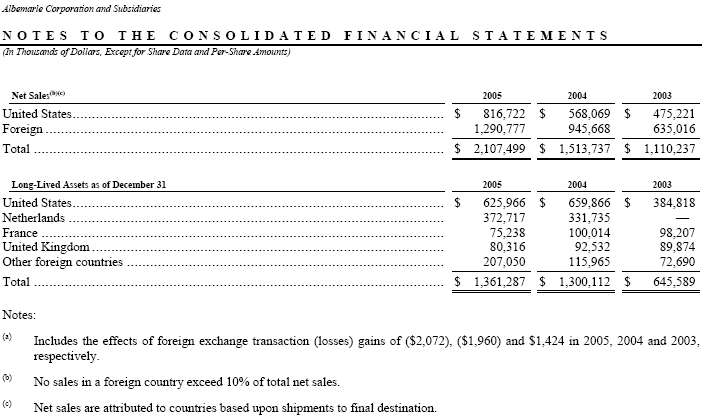

NOTE 19—Operating Segments and Geographic Area Information:

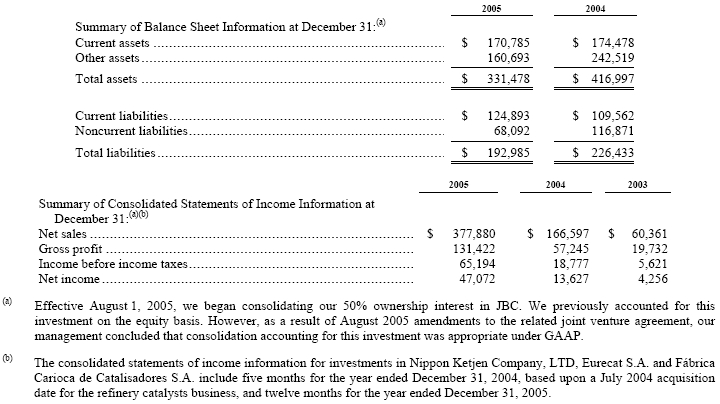

Effective January 1, 2005, we revised the way we evaluate the performance of our segment results to reflect the manner in which the chief operating decision maker reviews our three segments (See Note 1). Segment income represents income before income taxes, minority interests, equity in net income (losses) of consolidated investments and cumulative effect of a change in accounting principle, net before interest and financing expenses and “other income (expenses), net,” plus equity in net income (losses) of consolidated investments. Segment income results for 2004 and 2003 were reclassified to conform to the new presentation. Effective August 1, 2005, we began consolidating our 50% ownership interest in JBC (See Note 7). JBC was reported as “equity in net income (losses) of unconsolidated investments” for the first seven months of 2005. Segment income for the year ended December 31, 2005 reflects the five-month impact of this change. Segment data continues to include intersegment transfers of raw materials at cost and foreign exchange transaction gains and losses, as well as allocations for certain corporate costs.

Summarized financial information concerning our reportable segments is shown in the following table. The “Corporate & Other” column includes corporate-related items not allocated to the reportable segments.

75

Polymer Additives’ net sales from external customers include flame retardants (annual net sales of $581,507, $531,935 and $397,056 for 2005, 2004 and 2003, respectively) and stabilizers and curatives (annual net sales of $216,308, $194,340 and $150,405 for 2005, 2004 and 2003, respectively). Catalysts’ net sales from external customers include polyolefin catalysts (annual net sales of $103,250, $98,862 and $82,959 for 2005, 2004 and 2003, respectively) and refinery catalysts (annual net sales of $634,360 and $184,532 for 2005 and 2004, respectively.) Fine Chemicals’ net sales from external customers include performance chemicals (annual net sales of $375,364, $285,554 and $293,293 for 2005, 2004 and 2003, respectively) and fine chemistry services and intermediates business (annual net sales of $196,710, $218,514 and $186,524 for 2005, 2004 and 2003, respectively).

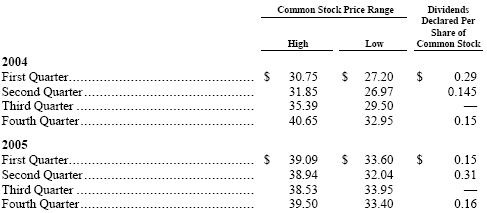

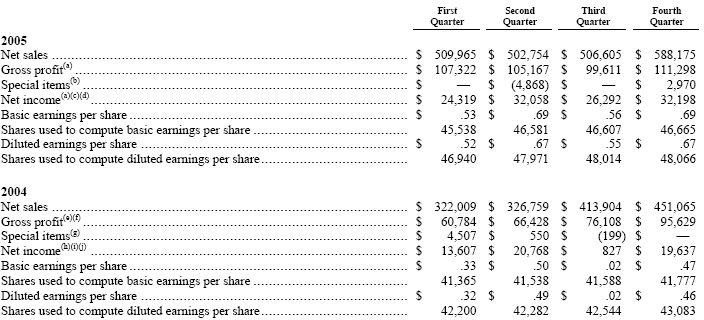

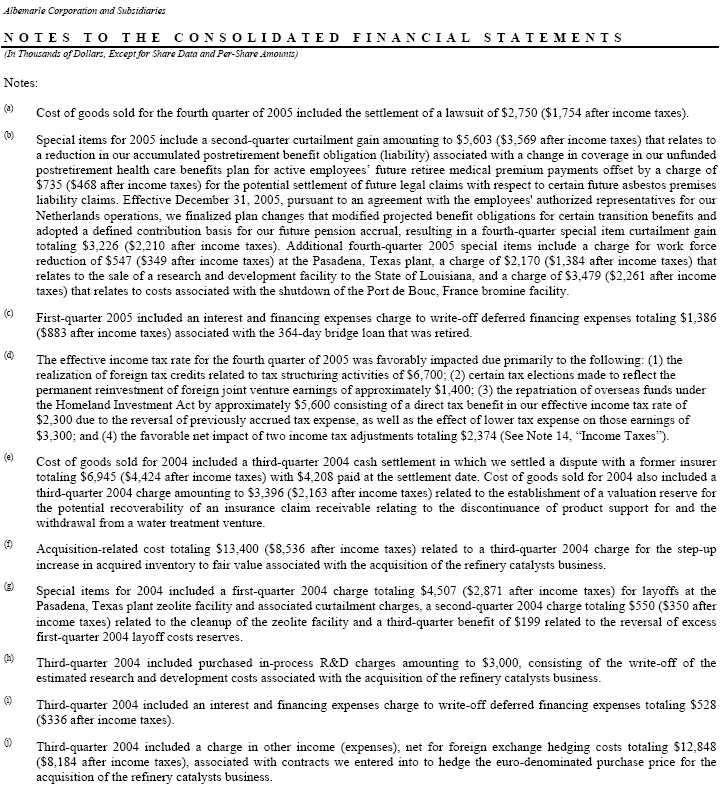

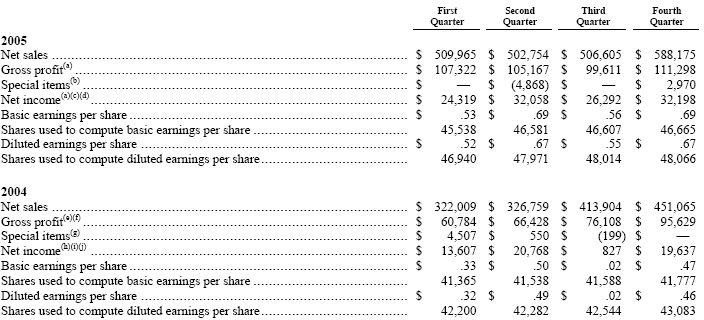

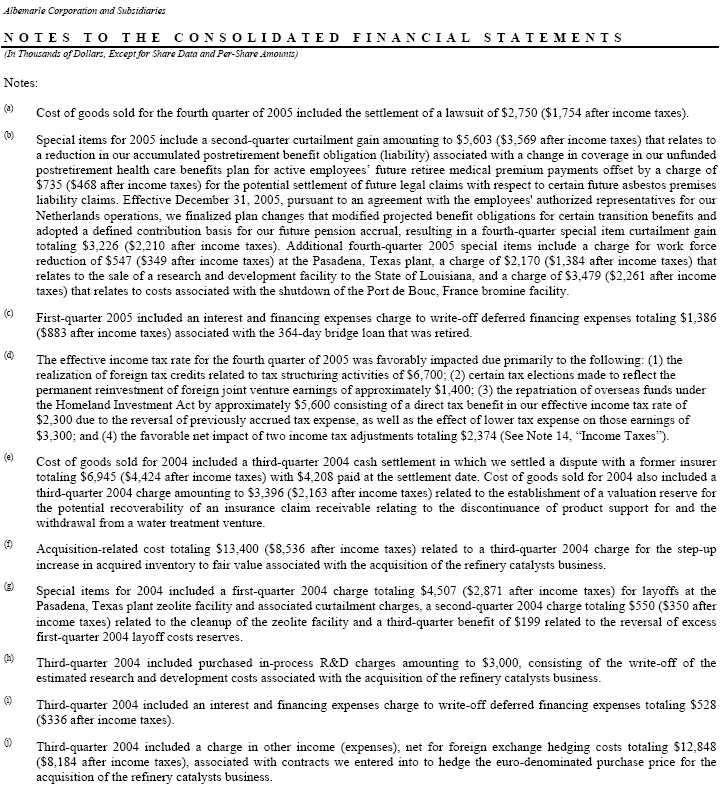

NOTE 20—Quarterly Financial Summary (Unaudited):

76

77

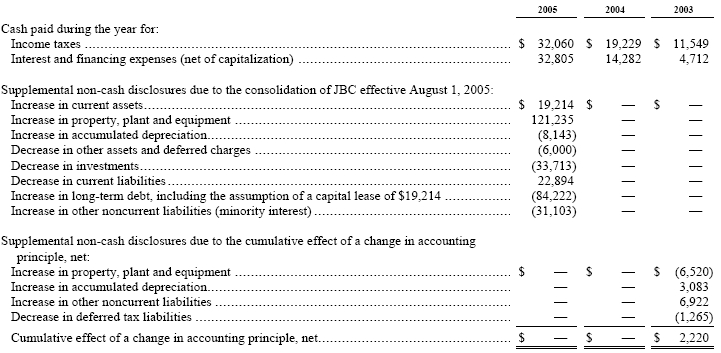

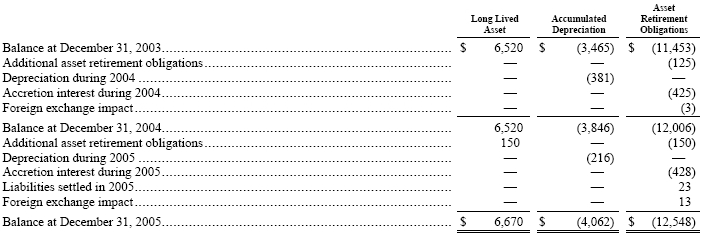

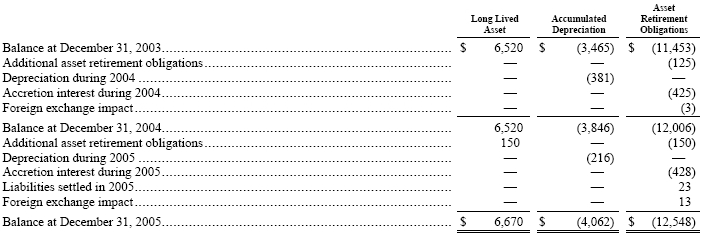

NOTE 21—Cumulative Effect of a Change in Accounting Principle, Net:

On January 1, 2003, we adopted SFAS No. 143, “Accounting for Asset Retirement Obligations,” or SFAS No. 143, which addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. Upon its initial adoption, SFAS No. 143 required us to recognize the fair value of our liabilities for asset retirement obligations for identified assets for which there are future retirement obligations. These future obligations were comprised primarily of the cost of closing various facilities and of capping brine wells. The financial statement impact at adoption of SFAS No. 143 on our consolidated statements of income was reflected as a cumulative effect of a change in accounting principle amounting to $3,485 ($2,220 after income taxes of $1,265). The following table reflects the changes in the beginning and ending carrying amounts associated with the long-lived assets and asset retirement obligations under SFAS No. 143 for 2004 and 2005:

NOTE 22—Cost of Goods Sold:

Cost of goods sold for 2004 included a third-quarter 2004 cash settlement in which we settled a dispute with a former insurer totaling $6,945 ($4,424 after income taxes) with $4,208 paid at the settlement date. Cost of goods sold for 2004 also included a third-quarter 2004 charge amounting to $3,396 ($2,163 after income taxes) related to the establishment of a valuation reserve for the potential recoverability of an insurance claim receivable relating to the discontinuance of product support for and the withdrawal from a water treatment venture.

NOTE 23—Acquisition Related Costs:

During the third quarter of 2004, we acquired the refinery catalysts business. In connection with the acquisition, we incurred certain acquisition-related costs including a costs of goods sold charge totaling $13,400 ($8,536 after income taxes), which related to the step-up increase in acquired inventory to fair value associated with acquisition; a charge to other income (expenses), net for foreign exchange hedging costs totaling $12,848 ($8,184 after income taxes), associated with contracts entered into by us to hedge the Euro-denominated purchase price for the acquisition; purchased in-process R&D charges amounting to $3,000 associated with the write off of deferred research and development costs of the acquired business, and a charge to interest and financing expenses to write-off deferred financing expenses totaling $528 ($336 net of income taxes).

78

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

NONE.

Item 9A. Controls and Procedures.

Under the supervision and with the participation of Albemarle’s management, including the principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended) (the “Exchange Act”), as of the end of the period covered by this report. Based on this evaluation, our principal executive officer and our principal financial officer concluded that, as of end of the period covered by this report, our disclosure controls and procedures are effective to ensure that information required to be disclosed by us in the reports that it files or submits under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Management’s Report on the Consolidated Financial Statements

Albemarle Corporation’s management has prepared the consolidated financial statements and related notes appearing on pages38 through 78 in conformity with accounting principles generally accepted in the United States. In so doing, Albemarle’s management makes informed judgments and estimates of the expected effects of events and transactions. Actual results may differ from management’s judgments and estimates. Financial data appearing elsewhere in this Annual Report on Form 10-K is consistent with these consolidated financial statements.

The consolidated financial statements included in the Annual Report on Form 10-K have been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm. Their audit was made in accordance with the standards of the Public Company Accounting Oversight Board (United States) as stated in their report which appears herein. The Audit Committee of the Board of Directors, composed only of independent directors, meets with management, the outsourced independent internal auditors and the independent registered public accounting firm to discuss accounting, auditing and financial reporting matters. The independent registered pubic accounting firm is retained by the Audit Committee.

Management’s Report on Internal Control over Financial Reporting

The management of Albemarle Corporation (the “Company”) is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Exchange Act Rule 13a-15(f) and 15d-15(f).

The Company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States. Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The Company’s management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2005. In making this assessment, management used the criteria for effective internal control over financial reporting set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in “Internal Control-Integrated Framework.” Based on the assessment, management concluded that, as of December 31, 2005, the Company’s internal control over financial reporting was effective based on those criteria.

Management’s assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2005 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report, which appears on page 37.

79

Changes in Internal Control over Financial Reporting

No change in our internal control over financial reporting (as such term is defined in Exchange Act Rule 13a-15(f)) occurred during the fiscal quarter ended December 31, 2005 that materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

NONE

PART III

Item 10. Directors and Executive Officers of the Registrant.

The information contained in our definitive Proxy Statement for its 2006 Annual Meeting of Shareholders to be filed with the SEC pursuant to Regulation 14A under the Exchange Act (the “Proxy Statement”) under the caption “Proposal No. 1 -Election of Directors” concerning directors and persons nominated to become directors of Albemarle and under the caption “Section 16(a) Beneficial Ownership Reporting Compliance” is incorporated herein by reference. The names, ages and biographies of all executive officers and other certain officers of Albemarle as of March 1, 2006 are set forth below. The term of office of each officer is until the meeting of the Board of Directors following the next annual shareholders’ meeting (April 19, 2006).

| Name | | Age | | Position |

|

| William M. Gottwald | | 58 | | Chairman of the Board of Directors |

|

| Floyd D. Gottwald, Jr. | | 83 | | Vice Chairman of the Board of Directors and Chairman of the Executive Committee |

|

| Mark C. Rohr | | 54 | | President and Chief Executive Officer |

|

| Richard J. Diemer, Jr. | | 47 | | Senior Vice President and Chief Financial Officer |

|

| Luther C. Kissam, IV | | 41 | | Senior Vice President, General Counsel and Secretary |

|

| George A. Newbill | | 63 | | Senior Vice President—Manufacturing Operations |

|

| John M. Steitz | | 47 | | Senior Vice President—Business Operations |

|

| John G. Dabkowski | | 57 | | Vice President—Polymer Additives |

|

| Jack P. Harsh | | 53 | | Vice President—Human Resources |

|

| Raymond Hurley | | 53 | | Vice President—Catalysts |

|

| John J. Nicols | | 42 | | Vice President—Fine Chemicals |

|

| C. Kevin Wilson | | 44 | | Treasurer |

|

| Ronald C. Zumstein | | 44 | | Vice President—Health, Safety and Environment |

William M. Gottwald was elected Chairman of our board of directors on March 28, 2001, having previously served as Vice President—Corporate Strategy of our company since 1996. Dr. Gottwald joined our company in 1996 after being associated with Ethyl Corporation (provider of value-added manufacturing and supply solutions to the chemical industry and subsidiary of NewMarket Corporation) for 15 years in several assignments, including Senior Vice President and President of Whitby, Inc., an Ethyl subsidiary. Dr. Gottwald has been a member of our board of directors since 1999. He is also a director of Tredegar Corporation.

Floyd D. Gottwald, Jr. was elected Vice Chairman of our board of directors and Chairman of our Executive Committee on October 1, 2002, having previously served as Chairman of our Executive Committee and Chief Executive Officer of our company from March 28, 2001 through September 30, 2002, and Chairman of our board of directors and Executive Committee and Chief Executive Officer of our company prior thereto. Mr. Gottwald has been a member of our board of directors since 1994.

80

Mark C. Rohr was elected President and Chief Executive Officer of our company effective October 1, 2002. Mr. Rohr served as President and Chief Operating Officer of our company from January 1, 2000 through September 30, 2002. Previously, Mr. Rohr served as Executive Vice President—Operations of our company from March 22, 1999 through December 31, 1999. Before joining our company, Mr. Rohr served as Senior Vice President, Specialty Chemicals of Occidental Chemical Corporation (chemical manufacturer with interests in basic chemicals, vinyls, petrochemicals and specialty products and subsidiary of Occidental Petroleum Corporation).

Richard J. Diemer, Jr. joined our company on August 15, 2005, and was elected Senior Vice President and Chief Financial Officer effective September 1, 2005. Before joining our company, he served as the Senior Portfolio Manager – Equities at Honeywell International, Inc. (provider of aerospace products and services, control technologies for buildings, home and industry, automotive products, turbochargers and specialty materials) since December 2004. Prior to that, he was Vice President – Equity Research from March 2002 to December 2004 and Chief Financial Officer of Honeywell Specialty Materials, L.L.C.(subsidiary of Honeywell International, Inc.) from July 2000 to March 2002.

Luther C. Kissam, IV was appointed Senior Vice President, General Counsel and Secretary effective December 16, 2005. He served as Vice President, General Counsel and Secretary until his promotion, having joined our company effective September 30, 2003. Before joining our company, Mr. Kissam served as Vice President, General Counsel and Secretary of Merisant Company. (manufacturer and marketer of sweetener and consumer food products), having previously served as Associate General Counsel of Monsanto Company (provider of agricultural products and solutions).

George A. Newbill was promoted to Senior Vice President—Manufacturing Operations of our company effective January 1, 2004. He served as Vice President—Manufacturing Operations of our company from May 1, 2003 until his promotion, having previously served as Vice President—Sourcing Organization from January 1, 2000 until May 1, 2003 and Vice President—Manufacturing since 1993. Mr. Newbill joined our company in June 1965.

John M. Steitz was appointed to Senior Vice President—Business Operations of our company effective January 1, 2004. Mr. Steitz served as Vice President—Business Operations of our company from October 2002 until his current appointment. From July 2000 until October 2002, Mr. Steitz served as Vice President—Fine Chemicals on a global basis. Before joining our company, he was Vice President and General Manager—Pharmaceutical Chemicals of Mallinckrodt, Incorporated (global provider of specialty healthcare products in the areas of diagnostic imaging, respiratory care and pain relief, and business unit of Tyco Healthcare) for 22 years.

John G. Dabkowski joined our company in June 1973 and has served as Vice President—Polymer Additives since September 23, 2004, having previously served as Vice President—Polymer Chemicals of our company since September 1997. Previously, he served as Vice President and General Manager of Specialty Chemicals from March 1994 until September 1997.

Jack P. Harsh was elected Vice President—Human Resources of our company effective December 1, 1998. Mr. Harsh joined our company effective November 16, 1998, from Union Carbide Corporation (producer of chemicals and polymers and subsidiary of The Dow Chemical Company), where he directed human resources for the solvents, intermediates and monomers business and supply-chain planning organization.

Raymond Hurley was elected Vice President—Catalysts on September 23, 2004. Before our acquisition of the Akzo Nobel refinery catalysts business, Mr. Hurley served as President of the Akzo Catalysts Business. Mr. Hurley joined Akzo Nobel as Technology Manager for Metal Soaps, Coatings and PVC in 1983, having previously spent five years as chemist/lab manager with Tenneco Chemicals.

John J. Nicols joined our company in February 1990 and has served as Vice President—Fine Chemicals of our company since June 2002. Previously, Mr. Nicols served as a Divisional Vice President since March 2002, and Global Business Director since February 1999.

C. Kevin Wilson joined our company in May 2004 and was elected Treasurer effective July 1, 2004. Before joining our company, Mr. Wilson served as Vice President and Treasurer of Solutia Inc. (specialty chemicals manufacturer) from January 2001 until May 2004, having previously served as Assistant Treasurer and Director, Finance of Solutia from August 1997 until January 2001. Previously, Mr. Wilson served as the Director of International Treasury for Mallinckrodt Incorporated from 1994 until August 1997.

Ronald C. Zumstein was elected Vice President—Health, Safety and Environment of our company effective March 1, 2003. Previously, Dr. Zumstein served as Plant Manager since March 1, 1999.

81

Code of Conduct

We have adopted a code of business conduct and ethics for directors, officers and employees, known as the Code of Conduct. The Code of Conduct is available on our website at http://www.albemarle.com. Shareholders may also request a free copy of the Code of Conduct from: Albemarle Corporation, Attention: Investor Relations, 330 South Fourth Street, Richmond, Virginia 23219. We will disclose any amendments to, or waivers from, a provision of our Code of Conduct that applies to the principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions that relates to any element of the Code of Conduct as defined in Item 406 of Regulation S-K by posting such information on our website.

New York Stock Exchange Certifications

Because our common stock is listed on the New York Stock Exchange, or NYSE, our chief executive officer is required to make, and he has made, an annual certification to the NYSE stating that he was not aware of any violation by us of the corporate governance listing standards of the NYSE. Our chief executive officer made his annual certification to that effect to the NYSE as of May 20, 2005. In addition, we have filed, as exhibits to this Annual Report on Form 10-K, the certifications of our principal executive officer and principal financial officer required under Sections 906 and 302 of the Sarbanes Oxley Act of 2002 to be filed with the Securities and Exchange Commission regarding the quality of our public disclosure.

Item 11. Executive Compensation.

This information is contained in the Proxy Statement under the captions “Proposal No.1—Election of Directors—Compensation of Directors,” “Compensation of Executive Officers” and “Agreements with Executive Officers” and are incorporated herein by reference.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

This information is contained in the Proxy Statement under the captions “Compensation of Executive Officers—Equity Compensation Plan Information” and “Stock Ownership” and is incorporated herein by reference.

Item 13. Certain Relationships and Related Transactions.

This information is contained in the Proxy Statement under the caption “Certain Relationships and Related Transactions” and is incorporated herein by reference.

Item 14. Principal Accountant Fees and Services.

This information is contained in the Proxy Statement under the caption “Audit Committee Report —Fees Billed by PricewaterhouseCoopers” and is incorporated herein by reference.

PART IV

Item 15. Exhibits and Financial Statement Schedules.

(a)(1) The following consolidated financial and informational statements of the registrant are included in Part II Item 8 onpages 37 to 78:

Report of Independent Registered Public Accounting Firm

Consolidated Balance Sheets as of December 31, 2005 and 2004

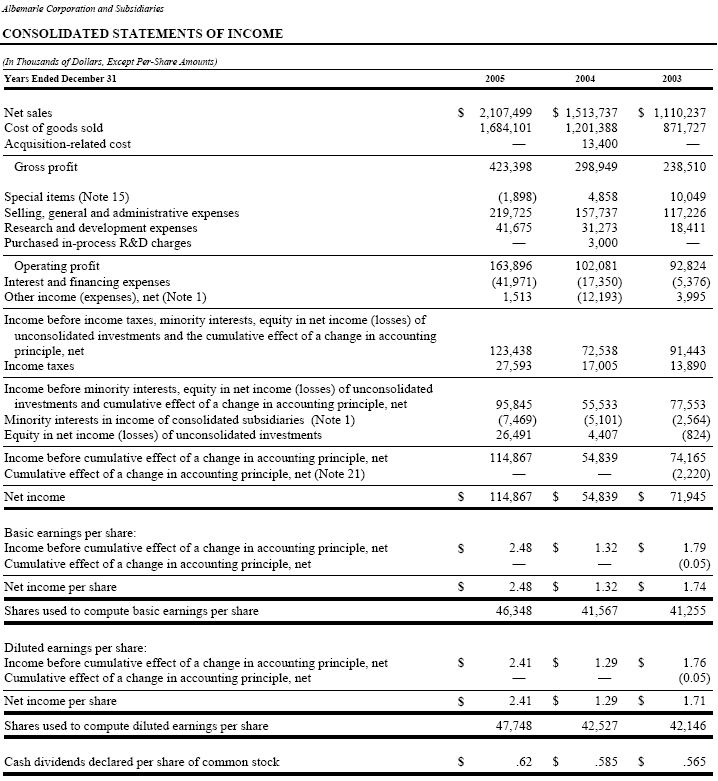

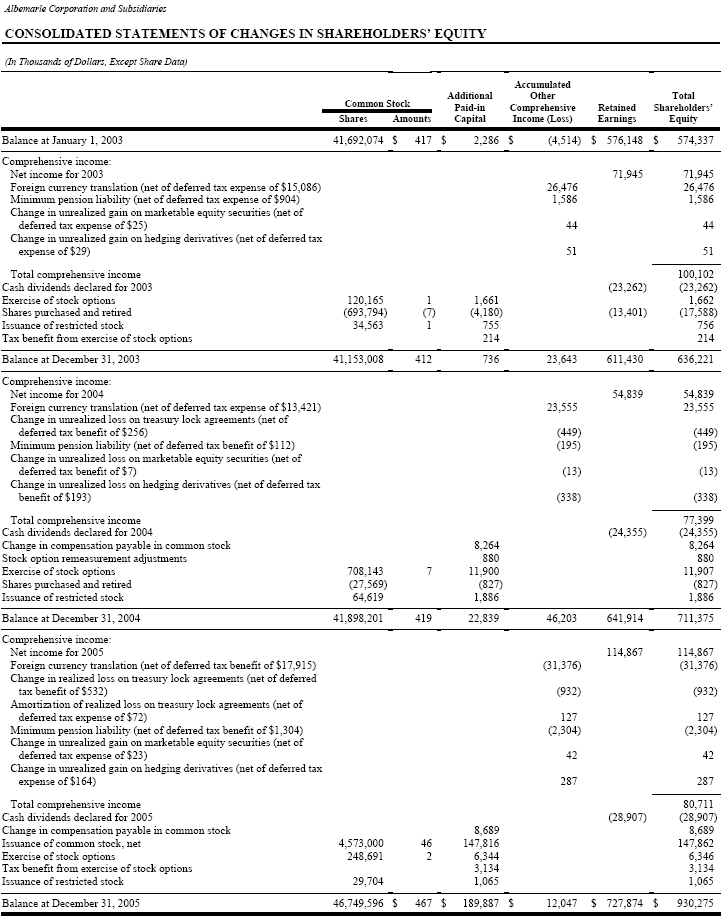

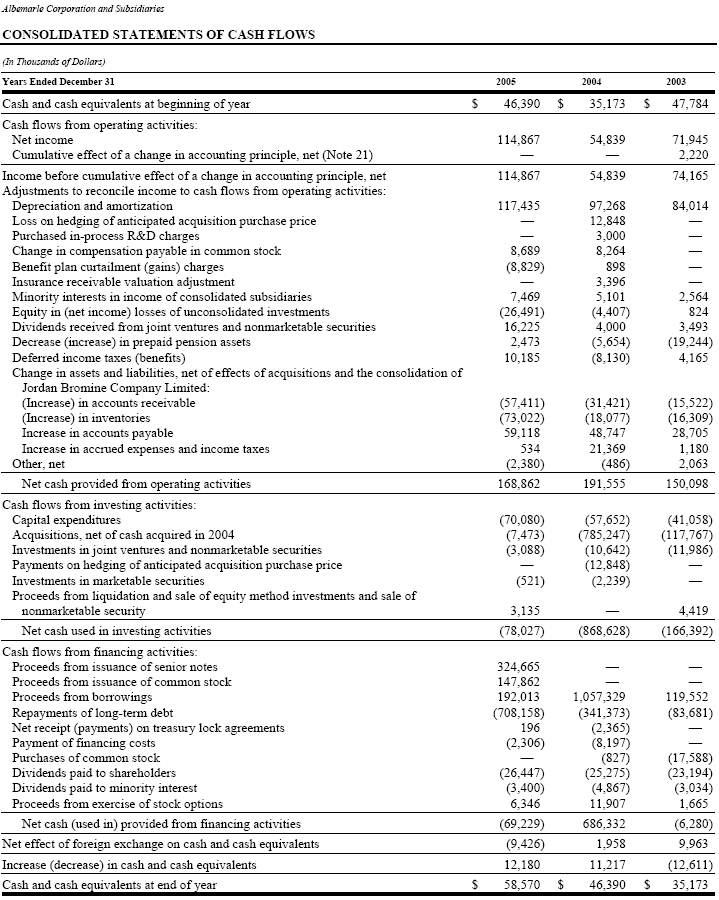

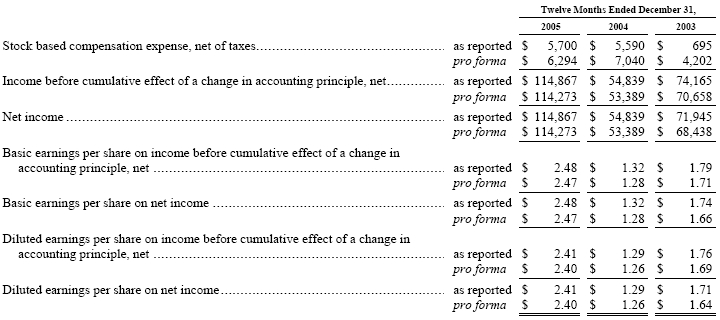

Consolidated Statements of Income, Changes in Shareholders’ Equity and Cash Flows for the years ended December 31, 2005, 2004 and 2003

Notes to the Consolidated Financial Statements

(a)(2) No Financial Statement Schedules are provided in accordance with Item 14(a)(2) as the information is either not applicable, not required or has been furnished in the Consolidated Financial Statements or Notes thereto.

| (a)(3) | | | Exhibits

|

| | | The following documents are filed as exhibits to this Form 10-K pursuant to Item 601 of Regulation S-K:

|

| 2.1 | — | | International Share and Business Sale Agreement, dated as of July 16, 2004, by and between Albemarle CatalystsInternational, L.L.C., Albemarle Corporation and Akzo Nobel, N.V. [filed as Exhibit 2.1 to the Company’s Current |

82

| | | Report on Form 8-K (No. 1-12658) filed on July 16, 2004, and incorporated herein by reference].

| |

| 3.1 | — | | Amended and Restated Articles of Incorporation (including Amendment thereto) [filed as Exhibit 3.1 to the Company’s Registration Statement on Form S-3 (Registration No. 333-119723) and incorporated herein by reference].

|

|

| 3.2 | — | | Bylaws of the registrant [filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on December 21, 2005, and incorporated herein by reference].

|

|

| 4.1 | — | | Indenture, dated as of January 20, 2005, between the Company and The Bank of New York, as trustee [filed as Exhibit 4.1 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on January 20, 2005, and incorporated herein by reference].

|

|

| 4.2 | — | | First Supplemental Indenture, dated as of January 20, 2005, between the Company and The Bank of New York, as trustee [filed as Exhibit 4.2 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on January 20, 2005,and incorporated herein by reference].

|

|

| 4.3 | — | | Form of Global Security for the 5.10% Senior Notes due 2015 (included as Exhibit A to Exhibit 4.2 hereto). |

| |

| 10.1 | — | | Credit Agreement, dated as of July 29, 2004, among Albemarle Corporation, Albemarle Catalysts International, L.L.C. and certain other subsidiaries of the Company and the Lenders thereto [filed as Exhibit 10.1.1 to the Company’s Quarterly Report on Form 10-Q (No. 1-12658) for the Second Quarter Ended June 30, 2004, and incorporated herein by reference].

|

|

| 10.2 | — | | First Amendment to Credit Agreement, dated as of July 8, 2005, among the Company, Albemarle Catalysts, certain subsidiaries of the Company, as guarantors, the lenders named and identified therein and Bank of America, N.A., as Administrative Agent [filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on July 12, 2005, and incorporated herein by reference].

|

|

| 10.3 | — | | 364-Day Credit Agreement dated as of July 29, 2004, among Albemarle Catalysts International, L.L.C., as Borrower, Albemarle Corporation and certain subsidiaries of the Company and the Lenders thereto [filed as Exhibit 10.1.2 to the Company’s Quarterly Report on Form 10-Q (No. 1-12658) for the Second Quarter Ended June 30, 2004, and incorporated herein by reference]. |

| |

| 10.4 | — | | Albemarle Corporation 1994 Omnibus Stock Incentive Plan, adopted on February 8, 1994 [filed as Exhibit 10.1 to the Company’s Registration Statement on Form S-1 (No. 33-77452), and incorporated herein by reference].

|

|

| 10.5 | — | | Amendment to the Albemarle Corporation 1994 Omnibus Stock Incentive Plan, adopted December 30, 2002, filed as Exhibit 10.2.1 to the Company’s Form 10-K for the year ended December 31, 2002 (No. 1-12658), and incorporated herein by reference].

|

|

| 10.6 | — | | Albemarle Corporation 1998 Incentive Plan, adopted April 22, 1998, and amended effective January 1, 2003 [filed as Exhibit 10.8 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 (No. 1-12658), and incorporated herein by reference].

|

|

| 10.7 | — | | Amendment to the Albemarle Corporation 1998 Omnibus Stock Incentive Plan, adopted as of October 1, 2003 [filed as Exhibit 10.7.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2003 (No. 1-12658), and incorporated herein by reference]. |

| |

| 10.8 | — | | Compensation Arrangement with Mark C. Rohr, dated February 26, 1999 [filed as Exhibit 10.9 to the Company’s Annual Report on Form 10-K for the year ended December 31, 1999 (No. 1-12658), and incorporated herein by reference]. |

| |

| 10.9 | — | | Amendment to Compensation Arrangement with Mark C. Rohr, dated March 4, 2005 [filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on March 8, 2005, and incorporated herein by reference].

|

|

| *10.10 — | Compensation Arrangement with Luther C. Kissam, IV, dated August 29, 2003.

|

|

| 10.11— | Albemarle Corporation 2003 Incentive Plan, adopted January 31, 2003 and approved by the shareholders on March 26,2003 [filed as Annex A to the Company’s Definitive Proxy Statement on 14A for 2002 (No. 1-12658), and incorporated herein by reference].

|

|

| 10.12— | Albemarle Corporation Directors’ Deferred Compensation Plan, approved by shareholders on April 24, 1996 [filed asExhibit 10.11 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2003 (No. 1-12658), and incorporated herein by reference]. |

83

| 10.13 — | | 2006 Named Executive Officer Salary Information [filed as Item 1.01 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on December 14, 2005, and incorporated herein by reference].

|

|

| *10.14 — | | Summary of Director’ Compensation.

|

|

| 10.15 — | | Form of Stock Option Agreement [filed as Exhibit 10.14 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 (No. 1-12658), and incorporated herein by reference].

|

|

| 10.16 — | | Form of Restricted Stock Agreement [filed as Exhibit 10.14 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 (No. 1-12658), and incorporated herein by reference].

|

|

| 10.17 — | | Form of Performance Unit Agreement [filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K (No. 1- 2658), filed February 23, 2006, and incorporated herein by reference].

|

|

| 10.18 — | | Compensation Arrangement with Richard J. Diemer, Jr., dated as of July 26, 2005 [filed as Exhibit 10.8.4 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on August 2, 2005, and incorporated herein by reference]. |

| |

| 10.19 — | | Amended and Restated Albemarle Corporation Supplemental Executive Retirement Plan, effective as of January 1, 2005 [filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on December 14, 2005, and incorporated herein by reference].

|

|

| 10.20 — | | Amended and Restated Albemarle Corporation Executive Deferred Compensation Plan, effective as of January 1, 2005 [filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on December 14, 2005, and incorporated herein by reference].

|

|

| 10.21 — | | Stock Purchase Agreement, dated as of January 30, 2006, between the Company and Floyd D. Gottwald, Jr. [filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on February 2, 2006, and incorporated herein by reference]. |

| |

| 10.22 — | | Stock Purchase Agreement, dated as of January 30, 2006, between the Company and John D. Gottwald [filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K (No. 1-12658) filed on February 2, 2006, and incorporated herein by reference].

|

|

| *12.1 — | | Statement of Computation of Ratio of Earnings to Fixed Charges.

|

|

| *21.1 — | | Significant Subsidiaries of the Company.

|

|

| *23.1 — | | Consent of PricewaterhouseCoopers LLP. |

| |

| *31.1 — | | Certification of Chief Executive Officer pursuant to Rule 13a-15(e) and 15d-15(e) of the Securities Exchange Act, as amended. |

| |

| *31.2 — | | Certification of Chief Financial Officer pursuant to Rule 13a-15(e) and 15d-15(e) of the Securities Exchange Act, as amended.

|

| | |

| *32.1 — | | Certification of Chief Executive Officer pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

| | |

| *32.2 — | | Certification of Chief Financial Officer pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

|

| *99.1 — | | Five-Year Summary. |

| _________________ |

* Included with this filing. |

84

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| ALBEMARLECORPORATION |

| (Registrant) |

| By: | /s/ WILLIAMM. GOTTWALD |

| | (William M. Gottwald)

Chairman of the Board |

Dated: March 13, 2006

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities indicated as of March 13, 2006.

| Signature | | Title |

| |

| /s/ WILLIAMM. GOTTWALD | | Chairman of the Board and Director |

| (William M. Gottwald) | | |

| |

| /s/ FLOYDD. GOTTWALD, JR. | | Vice Chairman of the Board, Chairman of the Executive |

| (Floyd D. Gottwald, Jr.) | | Committee and Director |

| |

| /s/ MARKC. ROHR | | President, Chief Executive Officer and Director (principal |

| (Mark C. Rohr) | | executive officer) |

| |

| /S/ RICHARDJ. DIEMER, JR. | | Senior Vice President and Chief Financial Officer |

| (Richard J. Diemer, Jr.) | | (principal financial and accounting officer) |

| |

| /s/ J. ALFREDBROADDUS, JR. | | Director |

| (J. Alfred Broaddus, Jr.) | | |

| |

| /s/ JOHND. GOTTWALD | | Director |

| (John D. Gottwald) | | |

| |

| /s/ R. WILLIAMIDEIII | | Director |

| (R. William Ide III) | | |

| |

| /s/ RICHARDL. MORRILL | | Director |

| (Richard L. Morrill) | | |

| |

| /s/ SEYMOURS. PRESTONIII | | Director |

| (Seymour S. Preston III) | | |

| |

| /s/ JOHNSHERMAN, JR. | | Director |

| (John Sherman, Jr.) | | |

| |

| /s/ CHARLESE. STEWART | | Director |

| (Charles E. Stewart) | | |

| |

| /s/ ANNEM. WHITTEMORE | | Director |

| (Anne M. Whittemore) | | |

85