| Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, D.C. 20006 Telephone 202-822-9611 Fax 202-822-0140 www.stradley.com |

Christopher J. Zimmerman, Esq.

(202) 419-8402

czimmerman@stradley.com

October 22, 2019

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549-9303

| Attention: | | Ms. Kimberly Browning, Esquire |

| | | | |

| | | Re: | Bridgeway Funds, Inc. |

| | | | File Nos. 033-72416 and 811-08200 |

Dear Ms. Browning:

On behalf of Bridgeway Funds, Inc. (the “Registrant”) and its series, the Blue Chip Fund (the “Fund”), below you will find the Registrant’s responses to the comments conveyed by you on October 2, 2019 with regard to Post-Effective Amendment No. 57 (the “Amendment”) to the Registrant’s registration statement on Form N-1A. The Amendment was filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 29, 2019, pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”), and Rule 485(a)(1) under the Securities Act of 1933, as amended (the “Securities Act”).

Below we have provided your comments and the Registrant’s response to each comment. These responses will be incorporated into a post-effective amendment filing to be made pursuant to Rule 485(b) of the Securities Act. Capitalized terms not otherwise defined in this letter have the meanings assigned to the terms in the Registration Statement. Additionally, since the post-effective amendment filing will include a combined prospectus and statement of additional information along with several other series of the Registrant, all disclosure references to “Fund” is in the plural, as applicable.

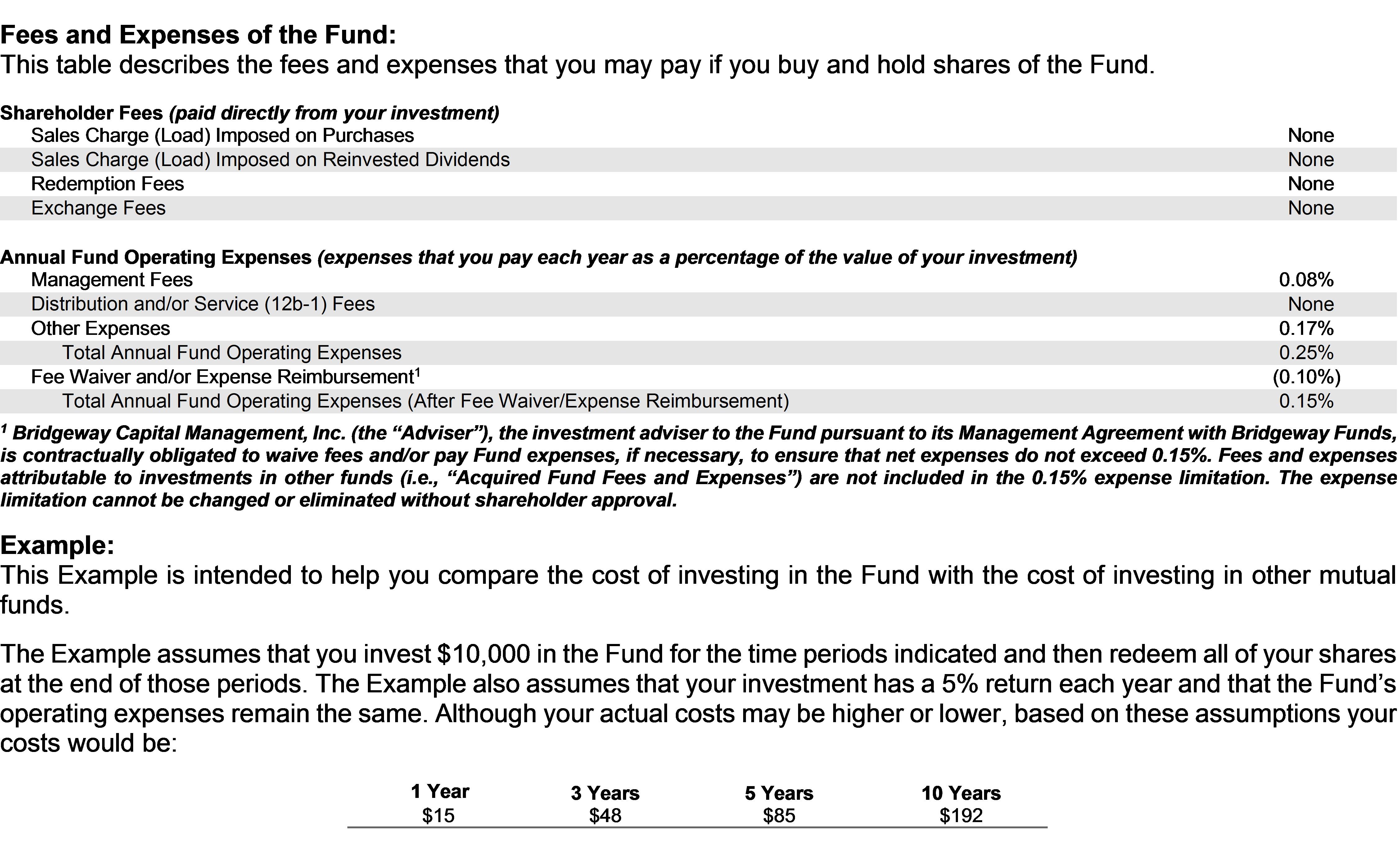

In addition, pursuant to your request, (i) we are filing this letter in response to your comments at least one week prior to the effective date of the forthcoming post-effective amendment filing to be made pursuant to Rule 485(b); and (ii) we have attached Appendix A, which includes the Fees and Expenses Table and the Example Table of the Fund.

U.S. Securities and Exchange Commission

Page 2

Prospectus

Fees and Expenses of the Fund

1) Comment: Please revise the footnote to the fees and expense table to disclose that the Management Agreement between Bridgeway Capital Management, Inc. (the “Adviser”) and the Fund has a term of at least one year from the filing of the Registrant’s Registrant Statement.

Response: The relevant portion of the footnote states, “The expense limitation cannot be changed or eliminated without shareholder approval.” Form N-1A Item 3 Instruction 3(e) states that if the expense limitation agreement is effective for at least one year from the date of the prospectus, to disclose, among other things, the period for which the agreement is expected to continue.

The expense limitation for the Fund is included within the Fund’s Management Agreement. As such, the expense limitation cannot be changed without shareholder approval and Registrant expects that the expense limitation will continue in perpetuity (unless shareholders vote to approve any change to it). Therefore, Registrant believes that the disclosure is accurate as written as it discloses the period for which the agreement is expected to continue (i.e., until changed or eliminated by shareholders).

Registrant believes that such an expense limitation, which requires shareholder approval to modify or terminate, provides a high level of certainty to shareholders with respect to a reasonable expectation of fees of the Fund.

As such, Registrant believes that no changes to the disclosure are required.

2) Comment: With regard to the following sentence, “The expense limitation cannot be changed or eliminated without shareholder approval” in the footnote to the fees and expense table, please supplementally disclose the terms of the expense limitation and, in particular, how the expense limitation is enforced.

Response: See Response 1 above. Shareholder approval would be required to modify or terminate the expense limitation agreement.

3) Comment: With regard to the reference to Acquired Fund Fees and Expenses (“AFFE”) in the footnote to the fees and expense table, please note that there are otherwise no references to investments in other registered investment companies as currently described in the principal investment strategies of the Fund. Please advise the Staff as to the percentage of the Fund’s investments in other registered investment companies, and if considered principal, please disclose in the Principal Investment Strategies section, or otherwise explain the reference to AFFE included in the footnote.

U.S. Securities and Exchange Commission

Page 3

Response: As of the end of the fiscal year dated June 30, 2019, the Fund had invested approximately 0.07% of the Fund’s net assets in other registered investment companies, primarily in a cash sweep vehicle. Investing in other registered investment companies is not considered by the Fund as a principal investment strategy of the Fund.

The reference to AFFE is included as the Fund may invest in other registered investment companies. If, in the future, the Fund invests in other investment companies as a principal investment strategy, consideration will be given as to appropriate disclosure within the Principal Investment Strategies of the Fund.

As such, Registrant believes that no changes to the disclosure are required.

4) Comment: With regard to the footnote to the fees and expenses table, please supplementally confirm that there is no recoupment of fees. If there is recoupment of fees, please add this disclosure to the footnote and the section “Management of the Fund”.

Response: The expense limitation with respect to the Fund does not permit the recoupment of fees by the Adviser.

As such, Registrant believes that no changes to the disclosure are required.

Principal Investment Strategies

5) Comment: (i) Please revise the Form N-1A Item 4 Principal Investment Strategies to make clear how the Adviser chooses which securities to buy and sell to achieve the Fund’s investment objective. (ii) Please also revise the Form N-1A Item 4 Principal Investment Strategies to summarize the information included in response to Form N-1A Item 9 Principal Investment Strategies. For instance, the Item 9 disclosure states that, “income will almost exclusively be derived from dividends paid by the companies held in the Fund’s portfolio.” The Staff notes that there is no corresponding Item 4 reference. (iii) In addition, note that risk disclosure states that, “The Adviser uses statistical analyses and models to select investments for the Fund.” There does not appear to be such reference included in the Item 4 Principal Investment Strategies or Item 9 Principal Investment Strategies.

Response: (i) In response to the Staff’s comment, Registrant has revised the first sentence in the second paragraph as follows: “The Adviser selects stocks within the blue-chip category using a statistical approach that primarily considers market capitalization.” (ii) Registrant has revised the Form N-1A Item 4 Principal Investment Strategies to include a summary of the referenced disclosure. (iii) Please see the reference to the revisions to (i) above.

6) Comment: It is the Staff’s view that the term “blue-chip stocks” is not solely defined by market capitalization, as suggested by the current disclosure in the principal investment strategies. Please provide further disclosure regarding the factors that the Adviser may

U.S. Securities and Exchange Commission

Page 4

use to determine “blue-chip stocks” (e.g., national reputation for quality, profitability, and the ability to operate in good times and in bad).

Response: In response to the Staff’s comment, Registrant has included the following sentence immediately after the definition of “blue-chip stocks:” “These stocks tend to be well-known and established companies.”

7) Comment: Regarding the term “reasonable industry diversification”, (i) please disclose a definition for this and provide the source for this definition (e.g., “as determined by the Adviser”); and (ii) if the Fund has established allocation percentages (i.e., sector or industry), please disclose such percentages.

Response: (i) Registrant has added “as determined by the Adviser” after “reasonable industry diversification.” (ii) The Fund has not established sector or industry allocation percentages. As such, Registrant believes that no other changes to the disclosure are required.

Principal Investment Risks

8) Comment: Please (i) reformat the risk disclosure so that each individual risk is under a separate heading; and (ii) order risks by importance (see Speech delivered by Director, Division of Investment Management, Dalia Blass at the ICI Securities Law Developments Conference on October 25, 2018).

Response: (i) Registrant has revised the disclosure to include headings for each risk. (ii) Registrant has reviewed the request by the Staff and, specifically, the order of the risks included in the Fund’s prospectus and has revised the order of the risks.

9) Comment: For risks related to investments in large companies, please revise the disclosure to make it evident that large companies do not have the same growth potential of smaller companies and that shareholders have less overall influence than they would in smaller companies.

Response: Registrant has revised the risk disclosure as requested.

10) Comment: Please ensure that the risk disclosure is customized to the Fund’s strategy. For example, the futures risk may be considered too general and should be customized (see Letter from Barry Miller, Associate Director, Division of Investment Management, to Karrie McMillan, General Counsel, Investment Company Institute on July 30, 2010).

Response: Registrant has revised the risk disclosure to indicate that the Fund will only invest in futures (as opposed to derivatives in general), as referenced in the first sentence of the applicable risk disclosure.

U.S. Securities and Exchange Commission

Page 5

11) Comment: Please review the statement that states, “The Fund will invest a high percentage of its assets in a small number of companies, which may add to Fund volatility,” as this statement does not appear to correlate with the investment strategy, which suggest that only under certain circumstances will the Fund invest a high percentage of assets in a small number of companies (i.e., “At times, however, the Fund may hold more or fewer stocks as a result of corporate actions such as spin-off or mergers and acquisitions.”).

Response: Registrant has revised the risk disclosure to state: “The Fund seeks to hold the stocks of approximately 35 companies. As a result, the The Fund invests will invest a high percentage of its assets in a smaller number of companies, which may add to the Fund’s volatility.”

Management of the Fund – Portfolio Managers

12) Comment: Please disclose that the team is jointly and primarily responsible for the day-to-day management of the Fund, if accurate.

Response: Registrant has revised the sentence as follows: “The Fund is team managed jointly and primarily by the Adviser’s investment management team.”

Additional Fund Information

13) Comment: For the section “Additional Fund Information,” please consider including further sub-headings, such as with respect to principal versus non-principal investment strategies.

Response: Registrant has considered the Staff’s request and believes that no changes are required.

Additional Fund Information – Fund Composition

14) Comment: With regard to the market capitalization ranges, please (i) confirm whether the market capitalization of Fund companies is greater than $5 billion (note that, if less than $5 billion, the Staff may have additional comments) and (ii) the amounts use a range of time or are a snapshot as of September 30.

Response: (i) Registrant notes that the market capitalization of Fund companies is greater than $5 billion (i.e., between $93 billion and $1.06 trillion). (ii) Registrant notes that the amounts used is a snapshot in time (i.e., “as of September 30”).

Additional Fund Information – Who Should Invest

U.S. Securities and Exchange Commission

Page 6

15) Comment: “Due to the low-cost nature the Fund” appears to be a blanket statement. Additional information should be included in the disclosure or the reference should be removed.

Response: Registrant has removed the reference.

Additional Fund Information – Principal Risks

16) Comment: To the extent that any of the risks disclosed in this section are principal, please confirm supplementally that they are disclosed in the Form N-1A Item 4 Principal Risks.

Response: Registrant so confirms.

Additional Fund Information – Temporary Investments

17) Comment: Per Form N-1A Item 9(b)(1), Instruction 6, disclose, if applicable, that the Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions.

Response: Registrant has revised the section as follows:

Each Fund generally will be fully invested in accordance with its objective and strategies. However, each Fund may invest without limit in cash or money market equivalents pending investment of cash balances or in anticipation of possible redemptions. Each Fund may also, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. The use of temporary investments and temporary defensive positions therefore is not a principal strategy as it prevents a Fund from fully pursuing its investment objective, and the Fund may miss potential upswings.

Additional Fund Information – Selective Disclosure of Portfolio Holdings

18) Comment: Per Form N-1A Item 9(d), please state that a description of the Fund’s policies and procedures with respect to the disclosure of the Fund’s portfolio securities is available on the Fund’s website, if applicable.

Response: Registrant confirms that such policies and procedures are not included on the Fund’s website. As such, Registrant believes that no changes to the disclosure are required.

Management of the Fund – Who Manages the Bridgeway Funds?

U.S. Securities and Exchange Commission

Page 7

19) Comment: Please confirm that the statement, “For the fiscal year ended June 30, 2019, the Adviser received an investment management fee 0.0% of the Fund’s average daily net assets…”, is accurate.

Response: Registrant so confirms.

Management of the Fund – Who is the Investment Management Team?

20) Comment: Where applicable, please revise the biographical information of each portfolio manager to clarify the portfolio manager’s business experience during the past 5 years, as required by Form N-1A, Item 10(a)(2). For instance, the disclosure states that John Montgomery “founded the Adviser in 1993” but it does not suggest that he has worked at the Adviser on a continuous basis since that time.

Response: Registrant has revised the disclosure as follows:

John founded the Adviser in 1993 and has worked at the Adviser since its inception.

Management of the Fund – Code of Ethics

21) Comment: Please clarify the “Code of Ethics” section, as it appears vague and should be more understandable to readers. For instance, please include disclosure as to the policies that are in place or how the Adviser otherwise intends to achieve the desired results.

Response: Registrant has elected to remove the Code of Ethics section as Form N-1A does not require it to be disclosed in the statutory prospectus.

22) Comment: Please revise the current disclosure to replace “trade” with “purchase or hold” as this is the language used in Form N-1A, Item 17(e).

Response: As referenced in response to Comment 21, Registrant has elected to remove the Code of Ethics section in its entirety. As a result, Registrant believes that no further changes are required in response to this Comment.

Shareholder Information – Net Asset Value (NAV)

23) Comment: Please see Comment 3 and the AFFE reference. If appropriate, please update the disclosure elsewhere or remove the reference as to whether the Fund invests in other registered investment companies.

Response: Registrant has added the following disclosure to the section:

To the extent the Funds invest in other investment companies, the NAV of the investment companies in which each Fund invests will be included in the calculation of the Fund’s

U.S. Securities and Exchange Commission

Page 8

NAV. The prospectuses of those investment companies explain the circumstances under which those investment companies will use fair value pricing and the effects of using fair value pricing.

24) Comment: For purposes of plain English, please consider creating a new paragraph after the fourth sentence in the second paragraph.

Response: Registrant has added a new paragraph as requested.

25) Comment: The Staff notes that the Fund uses the terms “proper form” and “good order” interchangeably. Please revise to use a consistent term.

Response: Registrant has revised to replace “proper form” with “good order” where applicable.

26) Comment: Regarding the reference to foreign securities, please confirm whether the Fund invests in foreign securities. If not, please remove.

Response: As previously referenced, the Fund will be included in a post-effective amendment filing to be made pursuant to Rule 485(b), which will include a combined prospectus and statement of additional information with several other series of the Registrant. Some of those series may invest in foreign securities, and, as a result, Registrant does not intend to remove such reference from this section.

Shareholder Information – Policy Regarding Excessive or Short-Term Trading of Fund Shares

27) Comment: Pursuant to Form N-1A, Item 11(e)(4)(ii), please disclose whether the Fund accommodates frequent purchases and redemptions of Fund shares by Fund shareholders. It appears that the Registrant already notes that it discourages such frequent purchases and redemptions.

Response: Registrant has revised a portion of the sentence as follows:

The Funds do not accommodate market timing and are not designed for professional market timing organizations . . .

28) Comment: Regarding the term “restrict,” please add a plain English disclosure of what this term means. In the context of an “exchange,” which includes both a purchase and a redemption, please add disclosure, as appropriate, describing how the Fund rejects or restricts redemption requests in light of Section 22(e) of the 1940 Act.

Response: Registrant has revised a portion of the sentence as follows:

U.S. Securities and Exchange Commission

Page 9

The Funds reserve the right to reject or restrict any specific purchase order, including exchange purchases, and exchange request with respect to market timers and reserves the right to determine . . .

29) Comment: With respect to reducing the risk of market timing, please consider adding, if appropriate, any other information as set forth in Form N-1A Item 11(e)(4)(iii).

Response: Registrant has reviewed the information set forth in Form N-1A Item 11(e)(4)(iii). Registrant believes that no changes to the disclosure are required.

Shareholder Information – Purchasing Shares

30) Comment: With regard to the statement that “purchase orders will not be processed unless the account application and purchase payment are received in good order”, please disclose whom the application and purchase payment must be received by (note that, in other instances, it is stated that the Fund or its agent must receive in good order).

Response: Registrant has revised the sentence as follows:

Purchase orders will not be processed unless the account application and purchase payment are received by the Funds or its agent in good order by 4 p.m. Eastern time.

Shareholder Information – Directly From the Funds – Buying Shares

31) Comment: Please disclose that shares must be purchased in good order by 4 p.m. Eastern time.

Response: Please see the revisions made in response to Comment 30.

Shareholder Information – Cancelled or Failed Payments

32) Comment: Please clarify the following statement, “You will be responsible for any losses or expenses incurred by the Fund or the transfer agent…” Does this apply even if the Fund or the transfer agent is responsible? Is there any limit to responsibility? Please state that this statement only applies if the check or the ACH transfer does not clear.

Response: Registrant has revised the sentence as follows:

You will be responsible for any direct losses or expenses incurred by the Funds or the transfer agent as a result of a check or an ACH transfer that does not clear…”

Shareholder Information – Redemption of Very Large Amounts

U.S. Securities and Exchange Commission

Page 10

33) Comment: Please (i) disclose whether redemptions in-kind will be pro-rata slices of the Fund’s portfolio or individual securities or a representative basket of securities (see p. 294 of the adopting release for Investment Company Liquidity Risk Management Programs, Investment Company Act Release No. 32315 (October 13, 2016));(ii) specify the types of securities (i.e., liquid or illiquid) that the Fund may pay the shareholder as part or all of the redemption proceeds above $250,000 in-kind; and (iii) disclose the risks of redemption when the shareholder redeems in-kind (i.e. the shareholder will bear market risk, taxes, and brokerage expenses).

Response: (i), (ii), (iii) Registrant has added the following sentences to the section:

Redemptions-in-kind will either be done through a distribution of a pro rata slice of the Fund’s portfolio of securities, selected individual portfolio securities, or a representative basket of portfolio securities, and may consist of illiquid securities to the extent held by the Fund. If the Fund pays your redemption proceeds by a distribution of securities, you could incur brokerage or other charges in converting the securities to cash and will bear any market risks associated with such securities until they are converted into cash.

Statement of Additional Information

Additional Information on Portfolio Instruments, Strategies, Risks and Investment Polices

34) Comment: Please confirm supplementally that anything considered principal in this section is included in the prospectus’ Principal Strategies and Risks sections, and if not, please revise.

Response: Registrant so confirms.

35) Comment: The following sentence does not appear to be accurate with respect to Section 18(f) borrowing from banks, “If any percentage restriction or requirement described below, except for the illiquid securities restriction, is satisfied at the time of investment, a later increase or decrease in such percentage that results from a relative change in value or from a change in the Fund’s total assets, will not constitute a violation of such restriction or requirement.”

Response: Registrant has revised the sentence as follows:

If any percentage restriction or requirement described below, except for the illiquid securities restriction and borrowings from banks, is satisfied at the time of investment, a later increase or decrease in such percentage that results from a relative change in value or from a change in the Fund’s total assets, will not constitute a violation of such restriction or requirement.

Additional Information on Portfolio Instruments, Strategies, Risks and Investment Polices – Securities Lending

U.S. Securities and Exchange Commission

Page 11

36) Comment: Please enhance the securities lending disclosure by stating (i) that the costs of securities lending is not included in the prospectus fee table, (ii) that, if accurate, the Fund is responsible for the entire risk of loss of reinvesting the cash collateral, (iii) how the net income from securities lending is split, and (iv) the maximum amount of assets that can be lent by the Fund.

Response: Registrant notes that the Fund has not engaged in securities lending over the course of the last year. As previously referenced, the Fund will be included in a post-effective amendment filing to be made pursuant to Rule 485(b), which will include a combined prospectus and statement of additional information with several other series of the Registrant. Enhanced securities lending disclosure that complies with Item 19(i) is included with respect to those funds. Registrant believes that the disclosure, in general, may address comments (i) through (iii), although Registrant will revise the current disclosure to address comment (iv).

Additional Information on Portfolio Instruments, Strategies, Risks and Investment Polices – Other Registered Investment Companies

37) Comment: Please confirm whether the Fund invests in other registered investment companies.

Response: As previously referenced in response to Comment 3, Registrant has limited investments in other registered investment companies. Investing in other registered investment companies is not considered by the Registrant as a principal investment strategy of the Fund.

As previously referenced, Registrant notes the Amendment was filed solely with respect to the Fund, but that that Fund will be included in a post-effective amendment filing to be made pursuant to Rule 485(b), which will include a combined prospectus and statement of additional information with several other series of the Registrant. Some of those series may invest in other registered investment companies and, as a result, Registrant does not intend to remove such reference from this section.

Additional Information on Portfolio Instruments, Strategies, Risks and Investment Polices – Exchange-Traded Notes

38) Comment: Please confirm that the Fund does not invest in exchange-traded notes.

Response: Registrant so confirms.

Additional Information on Portfolio Instruments, Strategies, Risks and Investment Polices – Liquidity Risk

U.S. Securities and Exchange Commission

Page 12

39) Comment: Please enhance the liquidity risk disclosure. For instance, please consider providing further information as to what gives rise to liquidity risk (e.g., economic conditions).

Response: Registrant has revised the liquidity risk disclosure as follows:

When there is little or no active trading market for specific types of securities or instruments, it can become more difficult to sell the securities or instruments at or near their perceived value. An inability to sell a portfolio position can adversely affect a Fund’s value or prevent a Fund from being able to take advantage of other investment opportunities. Liquidity risk also includes the risk that a Fund will experience significant net redemptions of its shares at a time when it cannot find willing buyers for its portfolio securities or instruments or can sell its portfolio securities or instruments only at a material loss. To meet redemption requests, a Fund may be forced to sell other securities or instruments that are more liquid, but at unfavorable times and conditions. Investments in foreign securities tend to have more exposure to liquidity risk than domestic securities. Liquidity risk can be more pronounced in periods of market turmoil.

Additional Information on Portfolio Instruments, Strategies, Risks and Investment Polices – Borrowing

40) Comment: Please confirm that the Fund does not conduct short sales. If it does, please consider adding appropriate disclosure. In addition, please note that all comments herein provided by the Staff would apply if the Fund, in the future, invests in any instrument.

Response: Registrant confirms that the Fund does not conduct short sales. Registrant also hereby acknowledges the Staff’s comment.

Investment Policies and Restrictions

41) Comment: Please confirm that Restriction Number 3 is accurate.

Response: Registrant believes that each of the statements of Restriction Number 3 are accurate.

42) Comment: Please explain the reference to “Aggressive Investors 1 Fund” in Restriction Number 5.

Response: As previously referenced, Fund will be included in a post-effective amendment filing to be made pursuant to Rule 485(b), which will include a combined prospectus and statement of additional information with several other series of the Registrant. One of these series is the Aggressive Investors 1 Fund.

As such, Registrant believes that no changes to the disclosure are required.

U.S. Securities and Exchange Commission

Page 13

Management of Bridgeway Funds – Fund Leadership Structure

43) Comment: For the references to the amount of times each committee met over the past year, please update to reflect the most recent fiscal year.

Response: Registrant confirms that such information will be revised and updated prior to the post-effective amendment filing to be made pursuant to Rule 485(b).

In connection with the Registrant’s responses to the SEC Staff’s comments on the Registration Statement, as requested by the Staff, the Registrant acknowledges that the Registrant is responsible for the adequacy of the disclosure in the Registrant’s filings, notwithstanding any review, comments, action, or absence of action by the Staff.

Please do not hesitate to contact me at (202) 419-8402 or Michael E. Schapiro at (202) 507-5163, if you have any questions or wish to discuss any of the responses presented above.

| | | | | | | Respectfully submitted, |

| | | | | | | |

| | | | | | | |

| | | | | | | /s/ Christopher J. Zimmerman

|

| | | | | | | Christopher J. Zimmerman, Esquire |

| cc: | Tammira Philippe, Bridgeway Capital Management, Inc. |

| | Prufesh R. Modhera, Esquire |

| | Michael E. Schapiro, Esquire |

U.S. Securities and Exchange Commission

Page 14

APPENDIX A