- MLM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Martin Marietta Materials (MLM) DEF 14ADefinitive proxy

Filed: 19 Apr 18, 12:00am

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ | Definitive Proxy Statement | |||

☐ | Definitive Additional Materials | |||

☐ | Soliciting Material pursuant to Rule 14a-12 | |||

Martin Marietta Materials, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

☒ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies:

| |||

| ||||

(2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

(4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

(5) | Total fee paid: | |||

| ||||

☐ | Fee paid previously with preliminary materials. | |||

| ||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid:

| |||

| ||||

(2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

(3) | Filing Party:

| |||

| ||||

(4) | Date Filed:

| |||

| ||||

|

April 18, 2018 |

Dear Fellow Shareholder:

On behalf of the Martin Marietta Board of Directors and executive officers, it is my pleasure to invite you to our 2018 Annual Meeting of Shareholders.

Strong Financial Performance 2017 was an exceptional year for Martin Marietta. We established several new financial records and demonstrated the earnings power of our strategically-positioned assets, driven by a more durable, construction-centric recovery. We delivered record revenues, profitability and earnings per diluted share for both the fourth quarter and full year 2017, building on the momentum created by record performance in prior years. And, as always, we achieved these results while remaining committed to the safety, ethics, integrity and values that are the hallmark of Martin Marietta.

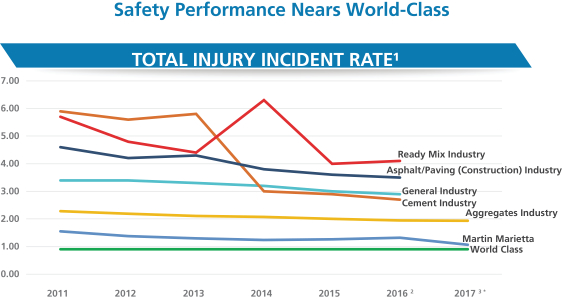

World-Class Safety Performance Our 2017 safety performance was the best in Martin Marietta’s history. Through the hard work and focus of our employees, safety awareness has been elevated across the Company, yielding impressive results. Our employees know world-class safety performance is possible; and, importantly, 2017’s results demonstrate this goal is attainable. Specifically, half of our operating divisions exceeded the |

|

world-class Total Injury Incident Rate (TIIR) (i.e., a TIIR of 0.90 or lower), and company-wide, with a Lost Time Incident Rate (LTIR) of 0.13, we bested the world-class LTIR of 0.20 or lower.

Shareholder Engagement and Governance

Our investor outreach in 2017 extended to 86 meetings with 296 investor groups, and conversations with most of our top 20 shareholders. We visited with our shareholders across the United States and in Toronto, Amsterdam, Brussels, The Hague, London, Edinburgh and Paris. We also issued our third Sustainability Report in 2017 -Building. Caring. Growing. - in response to our shareholders’ request that we share our story on the efforts and improvements we are making in this important aspect. From our world-class safety programs and performance, to our targeted and intentional support of education and health, and environmental programs that ensure operational excellence, we have a solid foundation and an exciting opportunity to build upon.

We also have a commitment to sound corporate governance and independent leadership in our boardroom. In this regard, we made several important changes to our corporate governance. First, our Board adopted a proxy access bylaw in response to the favorable advisory vote of a majority of our shareholders at our 2017 annual meeting of shareholders. Second, our Board adopted formal guidelines and policies relating to Stock Ownership for Board members and executive officers, Hedging and Pledging of Stock for Board members and executive officers, and Clawbacks for executive officers, which you can read more about in the attached proxy statement. Our Board continues to review our governance policies to ensure we are able to create appropriate value for our shareholders.

Board Member Changes

We also are nominating for election a new Board member in 2018, namely Smith W. Davis, a partner with the law firm of Akin Gump Strauss Hauer & Feld LLP in Washington DC. Mr. Davis is an expert in legal and regulatory matters, as well as governance, environmental and compensation matters. We are delighted to nominate Mr. Davis to our Board, who brings a strong background and adds a new and diverse perspective to our Board mix.

Proxy Voting

Becauseyour proxy vote matters, I urge you to cast it promptly - even if you plan to attend the Annual Meeting. We encourage you to vote so that your shares will be represented and voted at the meeting.

Thank you for your continued support of Martin Marietta.

Sincerely,

C. Howard Nye

Chairman of the Board, President and Chief Executive Officer

MARTIN MARIETTA MATERIALS, INC.

2710 Wycliff Road, Raleigh, North Carolina 27607

Notice of Annual Meeting of Shareholders

To Be Held May 17, 2018

To Our Shareholders:

The Annual Meeting of Shareholders of Martin Marietta Materials, Inc. will be held on Thursday, May 17, 2018, at 11:30 a.m. at our principal office located at 2710 Wycliff Road, Raleigh, North Carolina. At the meeting, the holders of our outstanding common stock will act on the following matters:

| (1) | Election as Directors the seven (7) nominees named in the attached proxy statement, each to serve their respective term as described in the attached proxy statement, and until their successors are duly elected and qualified; |

| (2) | Ratification of the appointment of PricewaterhouseCoopers LLP as independent auditors for 2018; |

| (3) | Advisory vote to approve the compensation of our named executive officers; and |

| (4) | Any other business that may properly come before the meeting. |

All holders of record of Martin Marietta common stock (NYSE: MLM) at the close of business on March 9, 2018 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements of the meeting.

The Board of Directors unanimously recommends that you vote FOR proposals 1, 2, and 3.

This notice and the accompanying proxy statement are being first mailed to shareholders on or about April 18, 2018. We have enclosed our 2017 Annual Report to Shareholders. The report is not part of the proxy soliciting materials for the Annual Meeting.

Whether or not you expect to attend the meeting, we hope you willdate and sign the enclosed proxy card and mail it promptly in the enclosed stamped envelope. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option.

Sincerely,

Roselyn R. Bar

Executive Vice President, General

Counsel and Secretary

Raleigh, North Carolina

April 18, 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL SHAREHOLDER MEETING TO BE HELD ON MAY 17, 2018:

Martin Marietta’s proxy statement, form of proxy card and 2017 Annual Report to Shareholders are also available atir.martinmarietta.com/investor-relations/reports-filings.

| 1 | ||||

| 6 | ||||

| 8 | ||||

| 13 | ||||

| Security Ownership of Certain Beneficial Owners and Management | 15 | |||

| 16 | ||||

| Corporate Governance Matters | 17 | |||

| 17 | ||||

| 21 | ||||

| Proposal 2 – Independent Auditors | 27 | |||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| Audit Committee Report | 29 | |||

| Management Development and Compensation Committee Report | 30 | |||

| Compensation Committee Interlocks and Insider Participation in Compensation Decisions | 30 | |||

| Compensation Discussion and Analysis | 31 | |||

| 31 | ||||

| 31 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 48 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

This Proxy Summary highlights information about Martin Marietta that can be found elsewhere in this proxy statement. It does not contain all of the information you should consider in voting your shares. We encourage you to read the entire proxy statement for more detailed information on each topic prior to casting your vote. This proxy statement, the proxy card, and the notice of meeting are being sent commencing on approximately April 18, 2018 to shareholders of record on March 9, 2018.

2018 Annual Meeting of Shareholders

Meeting Date: |

May 17, 2018 |

Place: |

2710 Wycliff Road, Raleigh, NC | |||||

Time: | 11:30 am ET

| Record Date: | March 9, 2018 | |||||

Your vote is important. You may vote in person at the Annual Meeting or submit a proxy over the internet. If you have received a paper copy of the proxy card (or if you request a paper copy of the materials), you may submit a proxy by telephone or by mail.

| Via the Internet

www.voteproxy.com. |

| In Person

Attend the Annual Meeting and vote by ballot. | |||||

| By Telephone

1-800-PROXIES(1-800-776-9437) in the United States or1-718-921-8500 from outside the United States. |

| By Mail

Sign, date and mail your proxy card in the envelope provided. | |||||

If you submit your proxy by telephone or over the internet, you do not need to return your proxy card by mail.

PROPOSALS AND VOTING RECOMMENDATIONS

| ||||||||

| Proposal | Description | Board Voting Recommendation | Page | |||||

1 | Election of Seven Director Nominees |

| 8 | |||||

2 | Ratification of the appointment of PricewaterhouseCoopers LLP as independent auditors |

| 27 | |||||

3 | Advisory Vote on Company’s Executive Compensation |

| 63 | |||||

|

|

2018 PROXY STATEMENT

|

1

|

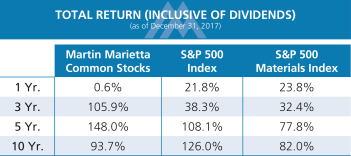

Shareholders Benefit from Martin Marietta’s Record 2017 Performance

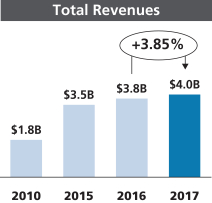

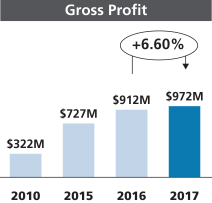

| Record total revenues of almost $4.0 billionup 3.9% from 2016 |

| Record gross profit of $972 millionup 6.6%, and a 24.5% gross margin |

| Record operating earnings of $700 millionup 3.4% |

| Record net earnings attributable to Martin Marietta of $713.4 million, anincrease of 68% over 2016 |

| Record earnings before interest, taxes, depreciation and amortization (EBITDA) of$1.004 billion, up 3% from 2016 |

| Record earnings attributable to common shareholders per diluted share of$11.25. |

| ||

| ||

* Reconciliation of Net Earnings Attributable to Martin Marietta to EBITDA is included in Appendix B.

2

|

2018 PROXY STATEMENT

|  |

Corporate Governance Highlights: Creating Sustainable Long-Term Shareholder Value

Recent Updates

| • | Our shareholders have the ability to nominate director candidates and have those nominees included in our proxy statement, subject to meeting the requirements in our Bylaws, a shareholder right known asproxy access |

| • | Declassified Boardphase-in continues—Directors elected annually in 2017 and 2018 to serveone-year terms |

| • | Adoption ofStock Ownership Guidelines |

| • | Adoption ofHedging and Pledging Policy |

| • | Adoption ofClawback Policy |

Board of Directors

| • | Lead Independent Director |

| • | 10 Directors/Nominees; 9 arenon-employees; 9 are independent |

| • | Key committee Chairs are independent |

| • | Executive sessions ofnon-management Directors at each regularly-scheduled meeting |

| • | All Directors attended 100% of all Board and committee meetings in 2017 |

| • | Limited membership on other public company boards |

| • | Code of Ethical Business Conduct and ethics program that reports to a Board Committee |

| • | Regular Board self-assessments and Director peer review |

| • | Risk oversight by full Board and Committees |

Shareholder Interest

| • | Majority voting standard for uncontested Director elections |

| • | No shareholder rights plan |

| • | Annual advisory vote to ratify independent auditor |

| • | Annual advisory vote to approve executive compensation |

| • | Longstanding active shareholder engagement |

| • | We publish annually aSustainability Report that discusses our commitment to our shareholders, employees and the communities that we serve |

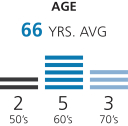

Board Composition

We nominated for election at our 2018 annual meeting of shareholders a new Director to the Board who has extensive experience in regulatory and legal matters. We were recognized in 2017 and 2015 at theWomen’s Forum of New Yorkat its Biennial Breakfast of Corporate Champions for our Board diversity. We were also recognized by2020 Women on Boardsas a Winning ‘W’ Company forseven consecutive yearsfor championing board diversity.

|

|  | ||

These charts assume that Smith W. Davis is elected at the annual meeting of shareholders.

|

2018 PROXY STATEMENT

|

3

|

Board Attendance

In 2017, all directors attended 100% of the total Board and committee meetings to which they were assigned. All directors attended the May 2017 Annual Meeting.

Our Compensation Approach

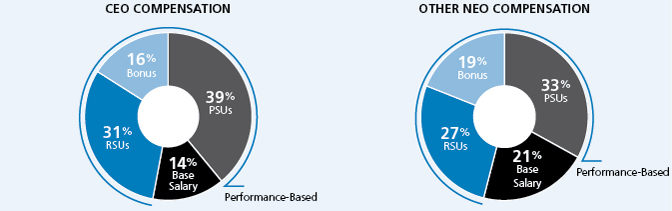

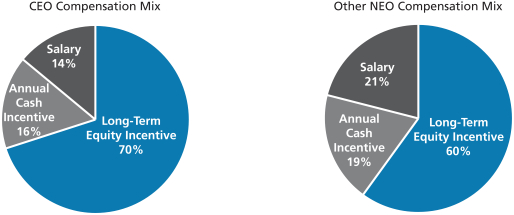

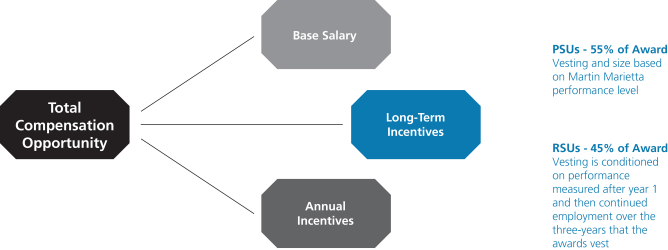

A substantial portion of compensation paid to our named executive officers (NEOs) is variable and performance-based. We use the 50th percentile of our comparator group as a reference point when determining target compensation, but target pay is set based on a variety of factors and actual pay realized by our NEOs is dependent on our financial, operational and other related performance. Based on our record levels of performance in 2017, variable compensation payable under both our short-term and long-term incentive plans exceeded the target amounts established for each NEO, which is consistent with ourpay-for-performance philosophy.All compensation paid to our CEO and other NEOs in 2017 was performance-based other than base salary: 86% of our CEO’s compensation was performance-based and approximately 80% of our NEOs compensation was performance based.*

| * | Based on grant date value of PSUs and RSUs. Other NEO Compensation includes Mr. Nickolas, who commenced employment with the Company in August 2017. |

4

|

2018 PROXY STATEMENT

|  |

Shareholder Rights and Governance Practices

Will any other matters be presented at the Annual Meeting?

At the time this proxy statement was filed with the Securities and Exchange Commission, the Board of Directors was not aware that any matters not referred to herein would be presented for action at the Annual Meeting. If any other matters properly come before the meeting, it is intended that the persons named in the enclosed proxy will vote the shares represented by proxies on such matters in accordance with the recommendation of the Board of Directors, or, if no recommendation is given, in their own discretion. It is also intended that discretionary authority will be exercised with respect to the vote on any matters incident to the conduct of the meeting.

What are the Board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation, as well as a description of each proposal, is set forth in this proxy statement. The Board recommends a vote:

| • | FORthe election of the nominated slate of Directors; |

| • | FOR the ratification of the selection of PricewaterhouseCoopers LLP as independent auditors; and |

| • | FOR the approval, on anon-binding advisory basis, of the compensation of our NEOs as described in this proxy statement. |

|

2018 PROXY STATEMENT

|

5

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements as defined in the Securities Exchange Act of 1934 and is subject to the safe harbors created therein. The forward-looking statements contained herein are generally identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on the beliefs and assumptions of our management and on currently available information. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our annual report on Form10-K for the fiscal year ended December 31, 2017. We undertake no responsibility to publicly update or revise any forward-looking statement.

The Board of Directors currently consists of nine members, eight of whom arenon-employee Directors. At the 2016 Annual Meeting, shareholders approved the Board of Directors’ proposal to amend our Articles of Incorporation to phase out the classification of the terms of our Directors and to provide instead for the annual election of our Directors. Prior to the charter amendment, our Board of Directors was divided into three classes, with each class serving three-year terms. Commencing with the 2017 Annual Meeting of Shareholders, our Directors are elected toone-year terms of office after the current terms of the Directors of each class expire at this 2018 Annual Meeting of Shareholders and the 2019 Annual Meeting.

The Board of Directors has nominated seven persons for election as Directors to serve aone-year term expiring in 2019. Unless otherwise directed, proxies will be voted in favor of these nominees. Each nominee has agreed to serve if elected. Each of the nominees, except Mr. Davis, is currently serving as a Director. Should any nominee become unable to serve as a Director, the persons named in the enclosed form of proxy will, unless otherwise directed, vote for the election of such other person for such position as the present Board of Directors may recommend in place of such nominee. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Under our Bylaws, nominations of persons for election to the Board of Directors may be made at an Annual Meeting of Shareholders by the Board of Directors and by any shareholder who complies with the notice procedures set forth in the Bylaws. As described in the proxy statement for our 2017 Annual Meeting, for a nomination to be properly made by a shareholder at the 2018 Annual Meeting, the shareholder’s notice must have been sent to, and received by, our Secretary at our principal executive offices between January 17, 2018 and February 16, 2018. No such notice was received during this period. Should any of the following nominees be unavailable for election by reason of death or other unexpected occurrence, the proxy, to the extent permitted by applicable law, may be voted with discretionary authority in connection with the nomination by the Board of Directors and the election of any substitute nominee.

Working closely with the full Board, the Nominating and Corporate Governance Committee develops criteria for open Board positions. In developing these criteria, the Committee takes into account a variety of factors, which may include: the current composition of the Board and expected retirements from the Board; the range of talents, experiences and skills that would best complement those already represented on the Board; and the need for financial or other specialized expertise. Applying these criteria, the Committee considers candidates for Board membership suggested by Committee members, other Board members, and management. The Committee has also retained a third-party executive search firm to identify and review candidates from time to time.

Once the Committee has identified a prospective nominee, it makes an initial determination as to whether to conduct a full evaluation. In making this determination, the Committee takes into account various information, including information provided at the time of the candidate recommendation, the Committee’s own knowledge, and information obtained through inquiries to third parties to the extent the Committee deems appropriate. The preliminary determination is based primarily on the need for additional Board members and the likelihood that the prospective nominee can satisfy the criteria that the Committee has established. If the Committee determines, in consultation with the Chairman, President and CEO and other Directors as appropriate, that additional consideration is warranted, it may request management or a third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the specific criteria that it has established for the position, as well as the standards and qualifications set out in the Company’sCorporate Governance Guidelines, including:

| • | the ability of the prospective nominee to represent the interests of the shareholders of the Company; |

| • | the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; |

6

|

2018 PROXY STATEMENT

|  |

| • | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards, as specifically set out in the Company’sCorporate Governance Guidelines; |

| • | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board; and |

| • | the extent to which the prospective nominee helps the Board reflect the diversity of the Company’s shareholders, employees, customers and the communities in which it operates. |

If the Committee decides, on the basis of its preliminary review, to proceed with further consideration, members of the Committee, the Chairman, President and CEO, as well as other members of the Board as appropriate, interview the nominee. After completing this evaluation and interview, the Committee makes a recommendation to the full Board, which makes the final determination whether to nominate or appoint the new Director after considering the Committee’s report. A background check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

In selecting nominees for Director, the Board seeks to achieve a mix of members who together bring experience and personal backgrounds relevant to the Company’s strategic priorities and the scope and complexity of the Company’s business. The Board also seeks demonstrated ability to manage complex issues that involve a balance of risk and reward. The background information on current nominees beginning on page 8 sets out how each of the current nominees contributes to the mix of experience and qualifications the Board seeks. In making its recommendations with respect to the nomination forre-election of existing Directors at the annual shareholders meeting, the Committee assesses the composition of the Board at the time and considers the extent to which the Board continues to reflect the criteria set forth above.

The following sets forth the age and certain other biographical information for each of the nominees for election and for each of the other members of the Board of Directors as of the date of this proxy statement.

|

2018 PROXY STATEMENT

|

7

|

Election of Directors

Nominees for Election to the Board of Directors for a Term Continuing Until 2019:

◆SUE W. COLE

Director Since: 2002

Age: 67

Chair of the Nominating and Corporate Governance Committee and member of the Management Development and Compensation Committee. |

Ms. Cole is the managing partner of SAGE Leadership & Strategy, LLC, an advisory firm for businesses, organizations and individuals relating to strategy, governance and leadership development. Ms. Cole was previously a principal of Granville Capital Inc., a registered investment advisor, from 2006 to 2011, and before that she was the Regional CEO, Mid-Atlantic Region, of U.S. Trust Company, N.A., where she was responsible for the overall strategic direction, growth, and leadership of its North Carolina, Philadelphia and Washington, D.C. offices. Ms. Cole previously held various positions in the U.S. Trust Company, N.A. and its predecessors. Ms. Cole has previously served on the public-company board of UNIFI, Inc. She has also been active in community and charitable organizations, including previously serving as Chairman of the North Carolina Chamber, on the Investment Committee of the University of North Carolina at Greensboro and as a member on the North Carolina Economic Development Board. Ms. Cole attended the University of North Carolina at Greensboro where she earned a Bachelor of Science degree in Business Administration and a Masters in Business Administration in Finance. |

Key attributes, experience and skills:

• Valuable experience in executive compensation, corporate governance, human resources, finance and financial statements, and customer service

• Chief executive officer of several financial services businesses as well as severalnon-profit organizations

• Strong leadership skills and familiarity with North Carolina, an important state for the Company |

◆SMITH W. DAVIS

Age: 70 |

Mr. Davis is a senior partner at Akin Gump Strauss Hauer & Feld LLP, an international law firm, where he provides counsel on a wide variety of legislative and regulatory matters, including those before a variety of congressional committees. Mr. Davis joined Akin Gump in 1979 and his practice has included advising on legal matters relating to environmental issues, financial institutions, mergers and acquisitions, and pension reform. Mr. Davis also has served on the law firm’s compensation and management committees. Prior to joining Akin Gump, Mr. Davis served as a counsel to the House Judiciary Committee. Mr. Davis attended Yale University where he received a Bachelors of Arts degree, magna cum laude and Yale Law School where he received his Juris Doctor degree. |

Key attributes, experience and skills:

• Extensive experience in legal, compliance, and corporate governance

• Strong leadership skills and expertise in governmental and regulatory issues, safety, health and environmental matters, mergers and acquisitions, executive compensation, financial affairs, and risk assessment.

• Brings new perspective to the Board on diversity and corporate citizenship |

8

|

2018 PROXY STATEMENT

|  |

Director Nominees ◆ Proposal 1: Election of Directors

◆JOHN J. KORALESKI

Director Since: 2016

Age: 67

Member of the Audit Committee, Executive Committee and Management Development and Compensation Committee. |

Mr. Koraleski joined the Martin Marietta Board in 2016. Mr. Koraleski served from February 2015 through his retirement in September 2015 as executive Chairman of the Board of the Union Pacific Corporation (UP), which through its subsidiaries operates North America’s premier railroad franchise, covering 23 states across the westerntwo-thirds of the United States. Prior to that, he was named President and Chief Executive Officer of the UP in March 2012, elected as a Director of the UP in July 2012 and appointed Chairman of the Board in 2014. Since joining the Union Pacific (Railroad) in 1972, Mr. Koraleski held a number of executive positions in the UP and the Railroad, including, Executive Vice President – Marketing and Sales from 1999 to 2012, Executive Vice President – Finance and Information Technology, Chief Financial Officer and Controller. Mr. Koraleski served as the Chairman of The Bridges Investment Fund, Inc., a general equity fund whose primary investment objective is to seek long-term capital appreciation, from 2005 through March 2012 and is a past Chairman of the Association of American Railroads. Mr. Koraleski earned a Bachelor’s and Master’s degree in business administration from the University of Nebraska at Omaha. |

Key attributes,

• Experience with the demands and challenges associated with managing a large publicly-traded organization from his experience as Chairman and CEO of Union Pacific

• Extensive knowledge of financial system management, public company accounting, disclosure requirements and financial markets

• Valuable expertise in talent management, compensation, governance and succession planning

• Understanding of complex logistic operations, safety and rail operations

• Broad strategic analysis and experience with acquisitions, integration, marketing and information technologies |

◆DAVID G. MAFFUCCI

Director Since: 2005

Age: 67

Chair of the Audit Committee and member of the Ethics, Environment, Safety and Health Committee. |

Mr. Maffucci is a Director of Domtar Corporation, which designs, manufactures, markets and distributes a wide variety of fiber-based products, including communication papers, specialty and packaging papers, market pulp and absorbent hygiene products. He is currently the Chair of its Audit Committee and a member of its Finance Committee and Nominating and Corporate Governance Committee. Mr. Maffucci previously served as Executive Vice President and Chief Financial Officer of Xerium Technologies, Inc., a manufacturer and supplier of consumable products used in paper production, from 2009 to 2010, as well as on its Board of Directors from 2008 until 2010, serving on its Audit and Compensation Committees from 2008 to 2009. On March 30, 2010, Xerium Technologies, Inc. filed a voluntary petition for relief under Chapter 11 of the Federal bankruptcy laws as part of a “pre-arranged” restructuring plan with the support of its lenders. On May 25, 2010, Xerium Technologies, Inc. emerged from Chapter 11 protection. Mr. Maffucci also served as Executive Vice President and Chief Financial Officer of Bowater Incorporated. Mr. Maffucci previously worked at KPMG and is a Certified Public Accountant. He received his Bachelor’s degree from Sacred Heart University. |

Key attributes,

• Extensive financial experience with a large public accounting firm

• Accounting principles and practices, auditing, internal control over financial reporting, and risk management processes

|

|

2018 PROXY STATEMENT

|

9

|

Proposal 1: Election of Directors ◆ Director Nominees

◆MICHAEL J. QUILLEN Director Since: 2008 Age: 69 Lead Independent Director, Chair of the Management Development and Compensation Committee, Member of the Executive Committee and the Nominating and Corporate Governance Committee. |

Mr. Quillen was the founder and served as Chief Executive Officer of Alpha Natural Resources, Inc. (ANR), a leading Appalachian coal supplier, since its formation in 2004 until its merger with Foundation Coal Holdings, Inc. in July 2009, and served as President and Chairman of ANR from 2006 to 2009, and non-Executive Chairman until May 2012. Mr. Quillen held senior executive positions in the coal industry throughout his career at Pittston/Pittston Coal Sales Corp., AMVEST Corporation, NERCO Coal Corporation, Addington, Inc. and Mid-Vol Leasing, Inc. He has also served as Chairman (Rector) of the Board of Visitors of Virginia Polytechnic Institute and State University from July 2012 to June 2014 and was reappointed to an additional four-year term on the Board of Governors in July 2014. He was Chairman of the Audit and Finance Committee of Virginia Polytechnic Institute and State University from July 2010 to June 2012. He also served on the Virginia Port Authority from 2003 to 2012 and as Chairman from July 2011 to December 2012. Mr. Quillen attended Virginia Polytechnic Institute and State University, earning both Bachelor’s and Master’s degrees in Civil Engineering. |

Key attributes, • Valuable business, leadership, management, financial, and mergers and acquisitions experience

• Extensive experience related to mining companies, governmental and regulatory issues, safety, health and environmental matters

• Tremendous insight and expertise with respect to strategic analysis, the natural resources industry, and energy

• Wealth of knowledge related to transportation |

◆DONALD W. SLAGER

Director Since: 2016

Age: 56

Member of the Finance Committee and the Nominating and Corporate Governance Committee. |

Mr. Slager serves as President and Chief Executive Officer of Republic Services, Inc., a service provider in the non-hazardous solid waste industry, holding this position since January 2011. Prior to this, he served as President and Chief Operating Officer of Republic from December 2008 until his promotion to CEO. Prior to that, Mr. Slager served in the same capacity for Allied Waste Industries, Inc. (“Allied Waste”), from 2005 to 2008, prior to its merger with Republic Services. Mr. Slager was Executive Vice President and Chief Operating Officer of Allied Waste between 2003 and 2004. Prior to that, Mr. Slager held varying positions of increasing responsibility with Allied Waste. Mr. Slager also has served as a Director of Republic since 2010. Mr. Slager previously served as an independent Director of UTi Worldwide Inc. (UTi) from 2009 to January 2016, where he served as Chairman of the Nominating and Corporate Governance Committee and as a member of both the Compensation and Risk Committees. UTi, a former NYSE listed company, was an international, non-asset-based supply chain services and solutions company providing air and ocean freight forwarding, contract logistics, customs brokerage, distribution, inbound logistics, truckload brokerage and other supply chain management services until it was acquired by DSV A/S a third-party logistics services provider, in January 2016. Mr. Slager has completed the Northwestern University Kellogg School Advanced Executive Program and holds a certificate from the Stanford University Board Consortium Development Program. |

Key attributes, experience and skills:

• More than 13 years ofC-Suite experience

• More than 26 years of general management experience in a complex, capital intensive and logistics business

• Extensive experience in mergers and acquisitions, integration, and strategic development and analysis

• Valuable experience from his membership on two publicly-traded board of directors |

10

|

2018 PROXY STATEMENT

|  |

Director Nominees ◆ Proposal 1: Election of Directors

◆STEPHEN P. ZELNAK, JR. Director Since: 1993

Age: 73

Chair of the Finance Committee and Member of the Ethics, Environment, Safety and Health Committee. |

Mr. Zelnak currently serves as Chairman of the Board of Beazer Homes USA, Inc., a geographically diversified homebuilder with active operations in 13 states within three geographic regions in the United States. He previously served as Chief Executive Officer of Martin Marietta from 1993 to 2009, President from 1993 to 2006, Chairman of the Board from 1997 through 2009, Executive Chairman from January 2010 to May 2010, and non-Executive Chairman from May 2010 until May 2014. Mr. Zelnak joined Martin Marietta Corporation in 1981 and was responsible for the aggregates operations since 1982. Mr. Zelnak is also Chairman and majority owner of ZP Enterprises, LLC, a private investment firm. In addition to community and charitable organizations, Mr. Zelnak has served as Chairman of the North Carolina Chamber and the National Stone, Sand and Gravel Association. He currently serves on the Advisory Board of the College of Management at North Carolina State University and is a Trustee Emeritus of the Georgia Tech Foundation Board. Mr. Zelnak received a Bachelor’s degree from Georgia Institute of Technology and Master’s degrees in Administrative Science and Business Administration from the University of Alabama system. |

Key attributes, experience and skills:

• Former Chairman and CEO of Martin Marietta

• Extensive mentorship, business and operating experience

• Knowledge of all aspects of Martin Marietta and the construction aggregates industry

• Broad strategic and financial experience

• Knowledge of the homebuilding industry and factors that impact construction |

| The Board Unanimously Recommends a Vote “FOR” All Nominees for Election to the Board of Directors |

|

2018 PROXY STATEMENT

|

11

|

Proposal 1: Election of Directors ◆ Director Nominees

Other Directors Whose Terms Continue Until 2019:

◆C. HOWARD NYE

Director Since: 2010

Age: 55

Chairman of the Board and Chair of the Executive Committee |

Mr. Nye has served as Chairman of the Board since 2014 and as President and Chief Executive Officer of Martin Marietta since January 1, 2010. He previously served as President and Chief Operating Officer of Martin Marietta from August 2006 to 2009. From 2003 to 2006, Mr. Nye served as Executive Vice President of Hanson Aggregates North America, a producer of aggregates for the construction industry, and in other managerial roles since 1993. Mr. Nye is also currently an independent Director of CREE, Inc., a multi-national manufacturer and market-leading innovator of lighting-class LEDs, LED lighting, and semiconductor solutions for wireless and power applications, where he serves as a member on the Compensation Committee and Chair of the Governance and Nominations Committee. Mr. Nye has also been active in a number of various business, civic, and education organizations, including serving as Chairman of the Steering Committee, as a member of the Executive Committee and Nominating & Leadership Development Committee and past Chairman of the Board of Directors of the National Stone, Sand & Gravel Association, Vice Chairman of the Board of Directors of the American Road & Transportation Builders Association (ARTBA), and a member of the Board of Directors of the United States Chamber of Commerce. Mr. Nye has also been a gubernatorial appointee to the North Carolina Mining Commission. Mr. Nye received a Bachelor’s degree from Duke University and a Juris Doctor degree from Wake Forest University. |

Key attributes, experience and skills:

• Extensive knowledge of the construction aggregates industry

• Extensive leadership, business, operating, marketing, mergers and acquisitions, legal, customer-relations, and safety and environmental experience

• Understands the competitive nature of the business and has strong management skills and broad executive experience

• Broad strategic vision for the future growth of Martin Marietta |

◆LAREE E. PEREZ

Director Since: 2004

Age: 64

Chair of the Ethics, Environment, Safety and |

Ms. Perez is an investment consultant with DeRoy & Devereaux, an independent investment adviser, where she has provided client consulting services since 2015. She was previously Owner and Managing Partner of The Medallion Company, LLC, a consulting firm, from 2003 to 2015. Ms. Perez was previously a Director of GenOn Energy, Inc., one of the largest power producers in the United States, from 2002 to 2012, and served as the Chairman of the Audit Committee of GenOn Energy, Inc. from 2002 to 2007 and a member of its Audit and Risk and Finance Oversight Committees from 2008 to 2012. Previously, she was Vice President of Loomis, Sayles & Company, L.P. and co-founder, President and Chief Executive Officer of Medallion Investment Company, Inc. In addition to civic and charitable organizations, Ms. Perez recently served as Vice Chairman of the Board of Regents at Baylor University and previously served on the Board of Trustees of New Mexico State University, where she was also Chairman of the Board. Ms. Perez earned a Bachelor’s degree from Baylor University in Finance and Economics. |

Key attributes, experience and skills:

• Significant business, financial and private investment experience

• Significant expertise with respect to financial statements, corporate finance, accounting and capital markets, mergers and acquisitions, and strategic analysis

• Insight into auditing best practices

• Familiarity with the southwestern United States |

12

|

2018 PROXY STATEMENT

|  |

Director Nominees ◆ Proposal 1: Election of Directors

◆DENNIS L. REDIKER

Director Since: 2003

Age: 74

Member of the Audit Committee and the Finance Committee |

Mr. Rediker served as the President and Chief Operating Officer of Utility Composite Solutions International, a developer and maker of composite materials for utility and municipal lighting applications, from 2011 until its sale to Highland Industries in 2016. He is currently providing consulting and transition services to Highland Industries. From 2009 to 2011, Mr. Rediker served as the President and Chief Operating Officer of B4C, LLC, a developer and maker of ceramic materials for defense and aerospace applications. He previously served as President and Chief Executive Officer and Director of The Standard Register Company, and as the Chief Executive Officer and a Director of English China Clays, plc. Mr. Rediker received a Bachelor’s degree from the University of California at Santa Barbara in electrical engineering. |

Key attributes, experience and skills:

• Significant operating, financial, leadership, strategic, audit, and marketing experience

• Extensive experience in mergers and acquisitions, environmental and safety, and customer service

• Expertise in corporate strategy |

Martin Marietta uses a combination of cash and stock-based compensation to attract and retain qualified candidates to serve on the Board of Directors. In setting Director compensation, Martin Marietta considers the significant amount of time that Directors expend in fulfilling their duties to Martin Marietta as well as the skill level required by Martin Marietta of members of the Board. The Board determines reasonable compensation for Directors upon recommendation of the Management Development and Compensation Committee of the Board, which retains an independent compensation consultant to assist it in making each recommendation.

Cash Compensation Paid to Board Members

The cash-based elements of annual Director compensation for fiscal year 2017 paid in quarterly installments, measured from the end of the month during which the Annual Meeting of Shareholders is held. were as follows.

Annual Board cash retainer | $ | 100,000 | ||||||

Annual committee chair retainer1 | $ | 8,000 | ||||||

Annual Audit Committee chair retainer2 | $ | 15,000 | ||||||

Annual Audit Committee member retainer1 | $ | 5,000 | ||||||

Annual Lead Director retainer3 | $ | 25,000 |

| 1 | This is in addition to the annual retainer in view of increased responsibilities |

| 2 | This is in addition to the annual retainer and the annual Audit Committee member retainer, but in lieu of the annual committee chair retainer in view of increased responsibilities |

| 3 | This is in addition to the annual retainer and the annual committee chair retainers in view of increased responsibilities |

The Company reimburses Directors for the travel expenses of, or provides transportation on Company aircraft for, Board and Committee meetings, meetings with management or independent consultants or advisors, and other Company-related events, such as Investor Day and meetings with potential Board candidates. Martin Marietta’s plane was used to transport some Directors to and from Board and committee meetings, but no Directors received personal use of Martin Marietta’s plane or other perquisites and personal benefits in 2017.

Equity Compensation Paid to Board Members

Non-employee Directors received an award of restricted stock units (RSUs) with a value of $100,000 (rounded up to the nearest RSU) based on the closing price as of the date of grant, which was generally immediately following the 2017 Annual Meeting of Shareholders in May 2017. In 2017, this award was 437 RSUs. The RSUs granted to the Directors in 2017 were fully vested upon award. Directors are required to defer at least 50% of the RSUs until retirement from the Board. Directors may choose to voluntarily defer an additional portion of their RSUs, and any RSUs that are not so deferred are settled in shares of common stock of Martin Marietta as soon as practicable following the grant date. The RSUs were awarded under the Martin Marietta Amended and Restated Stock-Based Award Plan (the “Stock Plan”), which was approved by shareholders on May 19, 2016. The Stock Plan provides that, during any calendar year, nonon-employee Director may be granted (i) restricted shares and other full-value stock-based awards, including RSUs, in respect of more than 7,000 shares of common stock of Martin Marietta or (ii) options or stock appreciation rights in respect of more than 20,000 shares of common stock of Martin Marietta.

|

2018 PROXY STATEMENT

|

13

|

Proposal 1: Election of Directors ◆ Director Compensation

The Directors do not have voting or investment power for their respective RSUs.

Deferred Compensation Program for Board Members

The Common Stock Purchase Plan for Directors provides thatnon-employee Directors may elect to receive all or a portion of their fees earned in 2017 in the form of Martin Marietta’s common stock units. If deferral is elected, there is a mandatory deferral minimum time of three years with, subject to certain restrictions, redeferrals at each Director’s election up to the date the person ceases to be a Director or the date that is one year and one month following the date that the person ceases to be a Director. Directors may elect to receive payment of the

deferred amount in a single lump sum or in equal annual installments for a period up to ten years. Amounts deferred under the plan in common stock are credited toward units of common stock at a 20% discount from the fair market value of the common stock (the closing price of the common stock as reported in theWall Street Journal) on the date the Director fees would otherwise be paid. There are no matching contributions made by Martin Marietta. Dividend equivalents are paid on the units at the same rate as dividends are paid to all shareholders. The Directors do not have voting or investment power for their respective common stock units. Directors may also elect to defer their fees into a cash-based account on the same basis. Amounts deferred under the plan in cash are credited with interest at the prime rate as of January 1 of that year.

Director Compensation Table

The table below summarizes the compensation paid by Martin Marietta to each person who served as anon-employee Director during the fiscal year ended December 31, 2017.

Name1 (a) | Fees Paid in Cash ($)2 (b) | Stock ($)3 (c) | Change in Pension Earnings ($)5 (f) | All Other ($)6 (g) | Total ($) (h) | |||||||||

Sue W. Cole | 108,000 | 100,195 | 12,565 | 68,449 | 289,209 | |||||||||

John J. Koraleski | 105,000 | 100,195 | 34 | 1,432 | 206,661 | |||||||||

David G. Maffucci | 120,000 | 100,195 | 7,403 | 34,872 | 262,470 | |||||||||

William E. McDonald7 | 25,000 | — | 6,279 | 33,774 | 65,053 | |||||||||

Laree E. Perez | 113,000 | 100,195 | 5,721 | 23,959 | 242,875 | |||||||||

Michael J. Quillen | 133,000 | 100,195 | 5,387 | 61,748 | 300,330 | |||||||||

Dennis L. Rediker | 105,000 | 100,195 | 9,683 | 37,691 | 252,569 | |||||||||

Donald W. Slager | 100,000 | 100,195 | 44 | 1,499 | 201,738 | |||||||||

Stephen P. Zelnak, Jr. | 108,000 | 100,195 | 4,178 | 37,215 | 249,588 | |||||||||

| 1 | Mr. Nye, who is the Chief Executive Officer of Martin Marietta and a member of the Board of Directors, is not included in this table because he is not compensated separately for his service as a Director. The compensation received by Mr. Nye as an employee of Martin Marietta is shown in the Summary Compensation Table on page 51. |

| 2 | The amounts in column (b) reflect fees earned in 2017. Some of these fees were deferred pursuant to the Common Stock Purchase Plan for Directors in the form of common stock units. The number of units of common stock credited in 2017 to each of the Directors under the Common Stock Purchase Plan for Directors and the grant date fair value for these awards determined in accordance with FASB ASC Topic 718, which includes the 20% discount, are as follows: Ms. Cole, 630 units and $108,337 value, respectively; Mr. Koraleski, 0; Mr. Maffucci, 141 units and $24,249 value, respectively; Mr. McDonald, 145 units and $25,050 value, respectively; Ms. Perez, 0; Mr. Quillen, 776 units and $133,441 value, respectively; Mr. Rediker, 124 units and $21,326 value, respectively; Mr. Slager, 0; and Mr. Zelnak, 316 units and $54,344 value, respectively. The number of units credited to each of the Directors as of December 31, 2017, including units accumulated under the plan for all years of service as a Director, is as follows: Ms. Cole, 15,252; Mr. Koraleski, 0; Mr. Maffucci, 9,036; Mr. McDonald, 6,507; Ms. Perez, 5,258; Mr. Quillen, 7,593; Mr. Rediker, 9,833; and Mr. Zelnak, 6,197. The 20% discount from the market price of Martin Marietta’s common stock used in converting to common stock is reported in column (g). |

| 3 | Each Director who was serving immediately following the 2017 Annual Meeting of Shareholder received 437 RSUs in 2017. The amounts in column (c) reflect the grant date fair value for these awards determined in accordance with FASB ASC Topic 718. The RSUs fully vested upon award and will be distributed to the Director upon retirement, except Mr. Maffucci, Ms. Perez and Mr. Quillen each received a distribution of 219 unrestricted shares of common stock and deferred the distribution of 218 RSUs until retirement. As of December 31, 2017, each Director held RSUs in the amounts as follows: Ms. Cole, 8,944; Mr. Koraleski, 939; Mr. Maffucci, 7,675; Ms. Perez, 8,725; Mr. Quillen, 8,725; Mr. Rediker, 8,944; Mr. Slager, 978; and Mr. Zelnak, 7,565. As of December 31, 2017, each Director held options for common stock in the amounts as follows: Ms. Cole, 3,000; Mr. Koraleski, 0; Mr. Maffucci, 0; Ms. Perez, 3,000; Mr. Quillen, 3,000; Mr. Rediker, 0; Mr. Slager, 0; and Mr. Zelnak, 0. |

| 4 | The amounts in column (f) reflect interest paid on fees deferred in cash under the Common Stock Purchase Plan for Directors. |

| 5 | The amounts in column (g) reflect for each Director: (i) an amount equal to the 20% discount from the market price of Martin Marietta’s common stock used in converting fees deferred in 2017 into common stock units pursuant to the Common Stock Purchase Plan for Directors, and (ii) the dollar value of dividend equivalents paid in 2017 on common stock units held under the plan. The Directors did not receive perquisites or other personal benefits in 2017. |

| 6 | Mr. McDonald retired at the 2017 Annual Meeting of Shareholders in accordance with the Bylaws that provide for retirement following the Director’s 75th birthday. |

14

|

2018 PROXY STATEMENT

|  |

Beneficial Owners and Management

How much stock do Martin Marietta’s Directors and executive officers own?

The following table sets forth information as of March 9, 2018 with respect to the shares of common stock that are beneficially owned by the Directors, the Chief Executive Officer, the Chief Financial Officer, and the three other named executive officers who are listed in the Summary Compensation Table on page 51 of this proxy statement, individually, and by all Directors and executive officers of Martin Marietta as a group.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership1 | Deferred and Restricted Units5 | Total | |||||||||

Roselyn R. Bar | 48,0962 | 19,808 | 67,904 | |||||||||

Sue W. Cole | 33,9883,4 | — | 33,988 | |||||||||

Daniel L. Grant | 3,9052 | 13,308 | 17,213 | |||||||||

John J. Koraleski | 1,6003 | — | 1,600 | |||||||||

Anne H. Lloyd6 | 58,7802 | 21,673 | 80,453 | |||||||||

David G. Maffucci | 17,2383 | — | 17,238 | |||||||||

Donald A. McCunniff | 13,6952 | 14,689 | 28,384 | |||||||||

James A. J. Nickolas | — | 8,317 | 8,317 | |||||||||

C. Howard Nye | 131,5972 | 66,810 | 198,407 | |||||||||

Laree E. Perez | 14,2023 | — | 14,202 | |||||||||

Michael J. Quillen | 20,2833 | — | 20,283 | |||||||||

Dennis L. Rediker | 18,8103 | — | 18,810 | |||||||||

Donald W. Slager | 9783 | — | 978 | |||||||||

Stephen P. Zelnak, Jr. | 13,8453 | — | 13,845 | |||||||||

All Directors and executive officers as a group (15 individuals including those named above) | 392,3413,4 | 158,785 | 551,126 | |||||||||

| 1 | As to the shares reported, unless indicated otherwise, (i) beneficial ownership is direct, and (ii) the person indicated has sole voting and investment power. None of the Directors or named executive officers individually own in excess of one percent of the shares of common stock outstanding. All Directors and executive officers as a group own 0.75% of the shares of common stock outstanding as of March 9, 2018. None of the shares reported are pledged as security. |

| 2 | The number of shares owned for each of Mr. Nye, Ms. Bar, Mr. McCunniff, Mr. Grant, Ms. Lloyd and all Directors and executive officers as a group assumes that options held by each of them covering shares of common stock in the amounts indicated, which are currently exercisable within 60 days of March 9, 2018, have been exercised: Mr. Nye, 61,163; Ms. Bar, 16,865; Mr. McCunniff, 8,647; Mr. Grant, 767; Ms. Lloyd, 20,667 and all Directors and executive officers as a group, 97,112. |

| 3 | Amounts reported include (1) compensation paid on an annual basis that Directors have received in common stock units that are deferred pursuant to the Amended and Restated Martin Marietta Materials, Inc. Common Stock Purchase Plan for Directors and (2) RSUs that each Director received in 2017 as part of their compensation. The Directors do not have voting or investment power for their respective common stock units and RSUs. The number of common stock units credited to each of the Directors pursuant to the Common Stock Purchase Plan as of March 9, 2018 is as follows: Ms. Cole, 15,418; Mr. Koraleski, 161; Mr. Maffucci, 9,073; Ms. Perez, 5,258; Mr. Quillen, 7,457; Mr. Rediker, 9,866; Mr. Slager, 0; and Mr. Zelnak, 6,280. Amounts reported also include 3,000 options for common stock held by each of Ms. Cole and Mr. Quillen. |

| 4 | Includes an approximation of the number of shares in IRA account. |

| 5 | The amounts reported include common stock units credited to each of the NEOs in connection with (i) their deferral of a portion of their cash bonus under the Martin Marietta Materials, Inc. Incentive Stock Plan, and (ii) RSUs (not including any performance-based share units (PSUs) granted under the Stock Plan that are subject to forfeiture in accordance with the terms of the plan, each in the following amounts: Mr. Nye, 16,550 and 50,260, respectively; Ms. Bar, 2,813 and 16,995, respectively; Mr. Nickolas, 0 and 8,317, respectively; Mr. McCunniff, 1,440 and 13,249, respectively; Mr. Grant, 1,750 and 11,558, respectively; Ms. Lloyd, 3,119 and 18,554, respectively; and all Directors and executive officers as a group, 23,875 and 113,237 respectively. There are no voting rights associated with the stock units. |

| 6 | Ms. Lloyd retired as Executive Vice President – Chief Financial Officer as of December 31, 2017. The amounts reported reflect ownership as of May 24, 2017 and includes restricted stock awards that vested and were distributed before March 9, 2018. |

|

2018 PROXY STATEMENT

|

15

|

Security Ownership of Certain Beneficial Ownership and Management ◆ Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires Directors and officers of Martin Marietta and persons who own more than 10% of the common stock to file with the Securities and Exchange Commission initial reports of ownership and reports in changes in ownership of the common stock. Directors, officers and more than 10% shareholders are required by Securities and Exchange Commission regulations to furnish to Martin Marietta copies of all Section 16(a) reports filed. Based solely on its review of copies of reports furnished to Martin Marietta and written representations of Directors and officers, the company believes that during fiscal year 2017, such filing requirements were satisfied.

Who are the largest owners of Martin Marietta’s stock?

The following table sets forth information with respect to the shares of common stock which are held by persons known to Martin Marietta to be the beneficial owners of more than 5% of such stock as of March 9, 2018. To the best of Martin Marietta’s knowledge, based on filings with the Securities and Exchange Commission as noted below, no person beneficially owned more than 5% of any class of Martin Marietta’s outstanding voting securities at the close of business on March 9, 2018, except for those shown below.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||

The Vanguard Group1 100 Vanguard Boulevard V26 Malvern, PA 19355 | 6,510,846 | 10.35% | ||

BlackRock, Inc.2 55 East 52nd Street New York, NY 10055 | 3,861,669 | 6.1% |

| 1 | As reported in Schedule 13G/A reporting beneficial ownership as of December 31, 2017 filed with the Securities and Exchange Commission on February 9, 2018, indicating sole power to vote 88,098 shares, shared power to vote 12,310 shares, sole power to dispose of 6,410,973 shares, and shared power to dispose of 99,873 shares. |

| 2 | As reported in Schedule 13G/A reporting beneficial ownership as of December 31, 2017 filed with the Securities and Exchange Commission on January 25, 2018, indicating sole power to vote 3,337,349 shares and sole power to dispose of 3,861,669 shares. |

16

|

2018 PROXY STATEMENT

|  |

Corporate Governance Philosophy

Martin Marietta has a culture dedicated to ethical business behavior and responsible corporate activity, which we believe promotes the long-term interests of shareholders. This commitment is reflected in ourCorporate Governance Guidelines, posted and available for public viewing on Martin Marietta’s website atwww.martinmarietta.com, which set forth a flexible framework within which the Board, assisted by its Committees, directs the affairs of Martin Marietta. TheGuidelines address, among other things, the composition and functions of the Board of Directors, director qualifications and independence, Chief Executive Officer performance evaluation and management succession, Board Committees and the selection of new Directors.

Martin Marietta’sCode of Ethical Business Conduct has been in place since the 1980s and is regularly updated. It and applies to all Board members, officers, and employees, providing our policies and expectations on a number of topics, including our commitment to good citizenship, promoting a positive and safe work environment,

avoiding conflicts of interest, honoring the confidentiality of sensitive information, preservation and use of Company assets, compliance with all laws, and operating with integrity in all that we do. To implement theCode of Ethical Business Conduct, Board members, officers, and employees participate regularly in ethics training. There have been no waivers from any provisions of ourCode of Ethical Business Conduct to any Board member or executive officer.

In addition, the Board believes that accountability to shareholders is a mark of good governance and critical to Martin Marietta’s success. To that end, management regularly engages with shareholders on a variety of topics throughout the year, including sustainability and governance, to ensure we are addressing their questions and concerns, to seek input and to provide perspective on Company policies and practices. Feedback received during these discussions is shared with the Board and directly impacts deliberations on material topics. See discussion of our shareholder outreach on page 34.

The chart below provides a snapshot of Martin Marietta’s governance highlights.

|

2018 PROXY STATEMENT

|

17

|

Corporate Governance Matters ◆ Corporate Governance Philosophy

Who are Martin Marietta’s Independent Directors?

All of Martin Marietta’s Directors and nominee arenon-employee Directors except Mr. Nye. Mr. Nye does not sit in the executive sessions of the independent Directors unless invited to attend for a specific discussion nor does he participate in any action of the Board relating to any executive compensation which he may receive.

In assessing the independence of its members and nominee, the Board has adopted for Martin Marietta a set ofGuidelines for Director’s Independence. The Guidelines are posted and available for public viewing on Martin Marietta’s website atwww.martinmarietta.com. These Guidelines reflect the rules of the New York Stock Exchange, applicable requirements of the SEC, and other standards determined by the Board to be important in assessing the independence of Board members. The Board has determined that, other than Mr. Nye, all members of the Board and Mr. Davis are “independent” under these Guidelines, resulting in more thantwo-thirds of the Board being independent. The Board of Directors has determined that no Director or nominee (except Mr. Nye), or any person or organization with which the Director or nominee has any affiliation, has a relationship with Martin Marietta that may interfere with his or her independence from Martin Marietta and its management. In making this “independence” determination, the Board considered other entities with which the Directors and Mr. Davis were affiliated and any business Martin Marietta had done with such entities.

Do the independent Directors ever meet without management?

Martin Marietta’sCorporate Governance Guidelines adopted by the Board provide that at least two Board meetings each year will include an executive session of thenon-employee Directors to discuss such topics as they may choose, including a discussion of the performance of Martin Marietta’s Chairman and Chief Executive Officer. In 2017, Martin Marietta’snon-employee Directors met at each regularly scheduled Board meeting, consisting of four times in executive session without management, in addition to executive sessions held by committees of the Board. In addition, at least once a year the independent Directors meet in executive session.

What is the Board’s leadership structure?

OurCorporate Governance Guidelines provide that the Board’s policy as to whether the Chairman and CEO positions should be separate is to adopt the practice that best serves the Company’s needs at any particular time. The Nominating and Corporate Governance Committee and the Board discussed board leadership alternatives in connection with combining the Chairman and CEO roles.

The Board believes that, at the present time, the Company is best served by allocating governance responsibilities between a combined Chairman and CEO and a Lead Independent Director

with robust responsibilities. This structure allows the Company to present a single face to our constituencies through the combined Chairman and CEO position while at the same time providing an active role and voice for the independent directors through the Lead Independent Director.

| REASONS FOR COMBINED CHAIR AND CEO |

Key highlights:

• The independent Board members believe that Mr. Nye has extensive experience in all facets of the construction materials industry, in both the U.S. and with global competitors.

• Mr. Nye has been effective in creating shareholder value through strategic acquisitions and divestitures, with achievement of expected synergies.

• Mr. Nye hasin-depth knowledge of safety, environmental, and regulatory considerations that impact the business and oversight of management.

• Mr. Nye has demonstrated his leadership and vision to guide the Board in its oversight of management with the development of two five-year strategic plans, with the current Strategic Operating Analysis and Review (SOAR 2020) discussed with and approved by the Board in August 2015.

• Mr. Nye has engaged in an active investor relations program, including the Company’s Investor Day presentations, and leads the Board in understanding the perspective of the Company’s shareholders.

• Strong independent directors and nominee comprise 90% of the Board, and open communications exist between Mr. Nye and the independent directors.

|

As a result of Mr. Nye’s tenure at Martin Marietta and strong performance as a leader since his election as CEO, the Board believes he is uniquely qualified through his experience, education and expertise to be the person who promotes strong and visionary leadership for our Board as well as important recognition as the leader of Martin Marietta by our customers, employees and other constituencies. The Board also believes that Mr. Nye’s serving as both Chairman and CEO is appropriate taking into consideration the size and nature of our business, Mr. Nye’s effective and careful formulation and execution of our strategic plan, his established working relationship and open communication with our other Directors, both during meetings and in the intervals between meetings, the significant board-level experience of our independent Directors as a whole, the strong independent leadership and accountability to shareholders provided by 90% of our Directors (including the Board’s nominee for Director, Mr. Davis) being independent, the independent leadership provided by our Committee chairs, and our Board culture in which Mr. Nye and the other Directors are able to thoughtfully debate different points of view and reach consensus in an efficient manner.

18

|

2018 PROXY STATEMENT

|  |

Corporate Governance Philosophy ◆ Corporate Governance Matters

Does the Board have a Lead Independent Director?

In deciding that a combined Chairman and Chief Executive Officer position is the appropriate leadership structure for the Company at this time, the Nominating and Corporate Governance Committee and Board also recognized the benefit of independent leadership to enhance the effectiveness of the Board’s oversight role and communications between the Board and Mr. Nye. Accordingly, in November 2014, ourCorporate Governance Guidelineswere revised to provide that in the event the Chairman and Chief Executive Officer positions are held by one person, our independent Directors may designate a Lead Independent Director from among the independent Directors. The designation of the Lead Independent Director is to be made annually, although with the expectation of the Board that the Lead Independent Director will bere-appointed for multiple, consecutiveone-year terms. Michael J. Quillen currently serves as the Lead Independent Director.

The responsibilities of the Lead Independent Director include:

| • | Presiding at Board meetings when the Chairman is not present. |

| • | Presiding at executive sessions of thenon-management Directors and the independent Directors, with or without the attendance of the Chairman, and meeting separately with the Chairman after executive sessions to review the matters discussed during the executive sessions. |

| • | Acting as a liaison between the Chairman and the independent Directors. |

| • | Suggesting to the Chairman agenda items for Board meetings and consulting with the Chairman regarding Board meeting schedules. |

| • | Calling, where necessary, meetings of independent Directors and executive sessions. |

| • | Being available to meet with shareholders and other key constituents. |

| • | Acting as a resource for, and counsel to, the Chairman. |

In addition, the Lead Independent Director attended and met with shareholders at the Company-sponsored Investor Days.

What is the Board’s role in risk oversight?

Our Board currently has eight independent members and only onenon-independent member, Mr. Nye. In addition, Mr. Davis, who is nominated for election, is independent. A number of our independent Board members are serving or have served as members of senior management of other public companies, have served as directors of other public companies, and otherwise have experience and/or educational backgrounds that we believe qualify them to effectively assess risk. Each of our Board Committees, including our key committees of Audit, Management Development and Compensation, and Nominating and Corporate Governance Committees, are comprised solely of independent Directors, each with a different independent

Director serving as Chair of the Committee (other than the Executive Committee, which does not meet on a regular basis).

The Board has overall responsibility for oversight of risk management. The Board believes that an effective risk management system will (1) timely identify the material risks that Martin Marietta faces, (2) communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board Committee, (3) determine whether the risk is excessive or appropriate under the circumstances and designed to achieve a legitimate corporate goal, (4) implement risk management responses consistent with Martin Marietta’s risk profile, and (5) integrate risk management into Martin Marietta’s decision-making.

The Board delegates certain responsibilities to Board Committees to assist in fulfilling its risk oversight responsibilities. Each of the Committees reports regularly to the full Board of Directors as to actions taken and topics discussed. In addition, the Board regularly reviews with management the most significant risks facing Martin Marietta, the probabilities of those risks occurring, the steps taken to mitigate any impact of risks, and management’s general risk management strategy. In addition, the Board encourages management to promote a corporate culture that incorporates risk management into Martin Marietta’sday-to-day operations.

The Board has designated the Audit Committee to take the lead in overseeing risks related to financial reporting, financial statements, internal control environment, internal audit, independent audit, cybersecurity, and accounting processes. The Finance Committee evaluates risks associated with Martin Marietta’s capital structure, including credit and liquidity risks. The Management Development and Compensation Committee oversees aspects of risk related to the annual performance evaluation of our Chief Executive Officer, succession planning and ensuring that executive compensation is appropriate to meet Martin Marietta’s objectives. That Committee’s assessment of the design features of our executive compensation program that reduce the risk of excessive risk-taking are discussed in theCompensation Discussion and Analysis on page 31. The Nominating and Corporate Governance Committee oversees aspects of risk related to the composition of the Board and its Committees, Board performance and best practices in corporate governance. The Ethics, Environment, Safety and Health Committee monitors risks in key areas of Martin Marietta’s sustainability program, including health, safety, and the environment as well as the Company’s ethics program.

While the Board oversees Martin Marietta’s risk management, the executive officers are responsible for theday-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company and is appropriate whether the positions of Chairman and Chief Executive Officer are separate or held by the same individual.

|

2018 PROXY STATEMENT

|

19

|

Corporate Governance Matters ◆ Corporate Governance Philosophy

How would interested parties make their concerns known to the independent Directors?

The Board of Directors provides a process for shareholders and other interested parties to send communications to the Board. Shareholders and other interested parties may communicate anonymously and confidentially with the Board through Martin Marietta’s Ethics Hotline at1-800-209-4508. The Board has also designated the Corporate Secretary to facilitate communications to the Board. Shareholders and other interested parties may communicate directly with the Board of Directors, or directly withnon-management Directors, or an individual Director, including the Lead Independent Director, by writing to Martin Marietta, Attn: Corporate Secretary, 2710 Wycliff Road, Raleigh, North Carolina 27607-3033.

All communications by shareholders or other interested parties addressed to the Board will be sent directly to Board members. While Martin Marietta’s Ethics Office and the Corporate Secretary may review, sort, and summarize these communications, all direct communications will be presented to thenon-management Directors unless there is instruction from them to filter such communications (and in such event, any communication that has been filtered out will be made available to any non-employee Director who wishes to review it).

Martin Marietta and its Board of Directors will continue to review and evaluate the process by which shareholders or other

interested persons communicate with Martin Marietta and the Board and may adopt other or further processes and procedures in this regard. If so, Martin Marietta will identify those policies and procedures on our website atwww.martinmarietta.com.

How often did the Board meet during 2017?

Martin Marietta’s Board of Directors held five meetings during 2017, four of which were regularly scheduled meetings and one of which was a special meeting. There were also a total of 24 committee meetings in 2017. In addition, management confers frequently with its Directors on an informal basis to discuss Company affairs.

How many times did Directors attend meetings of the Board and its Committees?

In 2017, all Directors attended 100% of the meetings of the Board of Directors. All Directors attended 100% of the meetings of the committees of the Board on which they served (during the periods that they served).

Will the Directors attend the Annual Meeting?

Martin Marietta’s Directors are expected to attend Martin Marietta’s Annual Meeting of Shareholders. In 2017, all Directors attended the Annual Meeting in May.

20

|

2018 PROXY STATEMENT

|  |

Board Committees ◆ Corporate Governance Matters

Martin Marietta’s Board of Directors has six standing committees: the Audit Committee, the Ethics, Environment, Safety and Health Committee, the Executive Committee, the Finance Committee, the Management Development and Compensation Committee, and the Nominating and Corporate Governance Committee. Each committee has a written charter

that describes its purposes, membership, meeting structure, authority and responsibilities. These charters are reviewed by the respective committee on an annual basis with any recommended changes adopted upon approval by our Board. The charters of our six standing committees are posted on our website.

Below is a summary of our current committee structure and membership information.

| Director | Audit Committee | Ethics, Environment, Health Committee | Executive Committee | Finance Committee | Management Compensation | Nominating Governance | ||||||||

Sue W. Cole |  | Chair | ||||||||||||

John J. Koraleski Financial Expert |

|

|

|

|

| |||||||||

David G. Maffucci Financial Expert |

Chair |

| ||||||||||||

C. Howard Nye | Chair | |||||||||||||

Laree E. Perez Financial Expert |

|

Chair | ||||||||||||

Michael J. Quillen Lead Independent Director |

|

|

Chair |

|

| |||||||||

Dennis L. Rediker Financial Expert |

|

| ||||||||||||

Donald W. Slager |

|

| ||||||||||||

Stephen P. Zelnak, Jr. |

|

Chair | ||||||||||||

Number of Meetings |

8 |

2 |

0 |

5 |

|

6 |

|

3 | ||||||

TheExecutive Committee held no meetings during 2017. It has the authority to act during the intervals between the meetings of the Board of Directors and may exercise the powers of the Board in the management of the business and affairs of Martin Marietta as may be authorized by the Board of Directors,

except to the extent such powers are by statute, the Articles of Incorporation or Bylaws reserved to the full Board. The Committee’s current members are Directors Nye (Chair), Koraleski, and Quillen.