EXHIBIT 99.1 Bank of America Bank of America 38 38 th th Annual Annual Investment Conference Investment Conference Jay Gellert Chief Executive Officer Health Net, Inc. September 16, 2008 |

2 Cautionary Statement Cautionary Statement All statements in this presentation, other than statements of historical information, may be deemed to be forward-looking statements and as such are subject to a number of risks and uncertainties. These statements are based on management’s analysis, judgment, belief and expectation only as of the date of this presentation, and are subject to uncertainty and changes in circumstances. Without limiting the foregoing, statements including the words “believes,” “anticipates,” “plans,” “expects,” “may,” “should,” “could,” “estimate,” “intend” and other similar expressions are intended to identify forward-looking statements. Actual results could differ materially due to, among other things, rising health care costs, negative prior period claims reserve developments, trends in medical care ratios, unexpected utilization patterns or unexpectedly severe or widespread illnesses, membership declines, rate cuts affecting our Medicare or Medicaid business, issues relating to provider contracts, litigation costs, regulatory issues, operational issues, health care reform and general business conditions. Additional factors that could cause actual results to differ materially from those reflected in the forward- looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included within the company's most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q for the first and second quarters of 2008 filed with the SEC. Audience participants are cautioned not to place undue reliance on these forward-looking statements. The company undertakes no obligation to publicly revise any of its forward-looking statements to reflect events or circumstances that arise after the date of this presentation. |

3 Non-GAAP Measures Non-GAAP Measures • This presentation includes quarterly and full year income statement measurements that are not calculated and presented in accordance with Generally Accepted Accounting Principles. Audience participants should refer to the reconciliation table available in the company’s second quarter 2008 earnings press release, available on the company’s Web site at www.healthnet.com which reconciles certain non-GAAP financial information to GAAP financial information. • Management believes that the non-GAAP financial information discussed in this presentation is useful as it provides the audience a basis to better understand the company’s results by excluding items that are not indicative of our core operating results for the periods presented. , |

4 Company Profile Company Profile • National health benefits company serving commercial and government (Medicare, Medicaid and TRICARE) customers • Provide health care benefits to approximately 6.7 million individuals across the country • Offer mental health and pharmacy benefit management services to approximately 10.3 million individuals Northeast region: CT, NJ, NY Western region: AZ, CA, OR, WA |

5 Diverse Medical Membership Base Diverse Medical Membership Base 2Q08 Premium Revenue Contribution Commercial 51% Medicare 24% TRICARE 18% Medicaid 7% |

6 2008 Issues 2008 Issues • Higher flu costs • Prior period development from 2007 • Higher than expected Medicare costs in 2008 • Higher than expected commercial costs in 2008 • Lower than planned commercial enrollment • California Medicaid rate reduction |

7 Key Responses Key Responses • More conservative cost assumptions • 2H08 commercial pricing • 2009 Medicare bid • Continued solid performance in Medi-Cal • Ongoing G&A improvement |

8 Commercial Business Commercial Business • Solid commercial franchises • Stable provider networks in all regions • Continued pricing discipline • Gross margin improvement in 2H08 and 2009 • Continue to diversify and refresh product portfolio • Leverage all distribution channels |

9 Medicare Medicare • Submitted 2009 bid focused on margin improvement in both PDP and MA • Grow network-model MA plans/products – Reduced focus on PFFS • Continue to build on PDP experience and strengths • Opportunities for growth through other lines of business |

10 Medicaid Medicaid • Opportunities for growth through geographic expansion and reform • 781,000 members • New Jersey: – 44,000 members in 13 counties • California: – 737,000 members – Medicaid in 10 counties – Healthy Families Program in 44 counties – State may expand Medicaid managed care program to 11 more counties |

11 Federal Services Federal Services • TRICARE North Managed Care Contract • Department of Veterans Affairs – Claims repricing – Community-based Outpatient Clinic Program – DRG Recovery Audit Contract • Partnering with MHN to provide behavioral health services to military beneficiaries • Opportunities – Dubai Health Authority support – Expand existing capabilities to new markets and programs • TRICARE Reprocurement |

12 Margin Improvement Opportunities Margin Improvement Opportunities • Multiple systems • Inefficient ancillary systems – Enrollment and billing – Call centers • Aging technology • Reliant on manual processes and workarounds • Multiple data warehouses – Inconsistent operational metrics – Redundant analytical functions • High cost locations Result is higher G&A PMPM than Result is higher G&A PMPM than other key competitors other key competitors 2006 Membership Adjusted G&A PMPM* *HNT Strategy Group Analysis $20 $22 $25 $27 $15 $18 $21 $24 $27 $30 Low Median High HNT National and Regional Players |

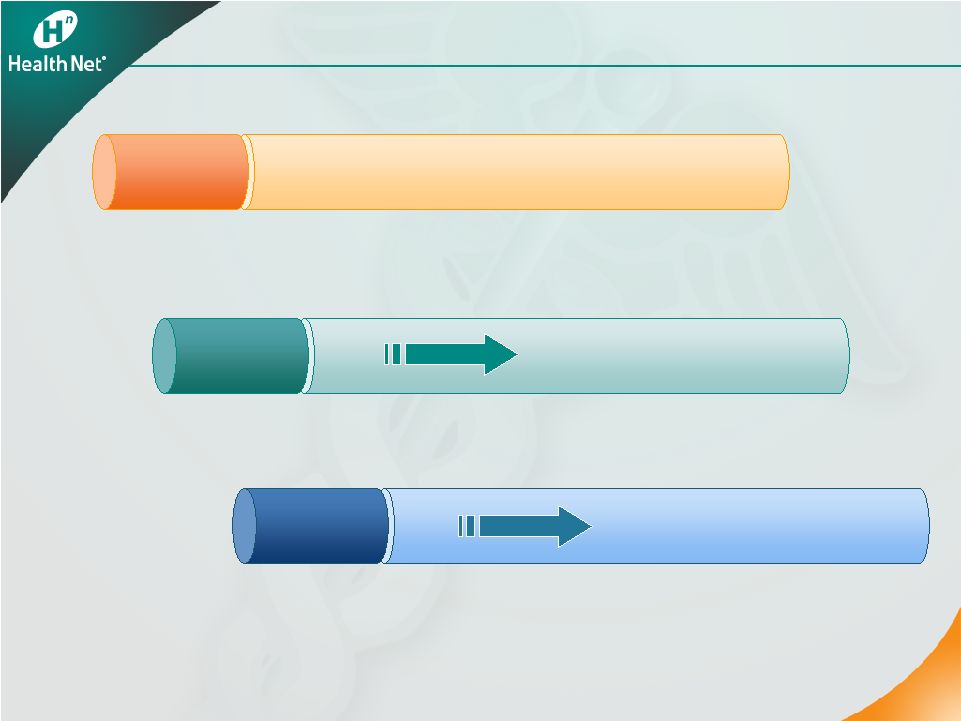

13 Investment for the Future Investment for the Future Additional labor Consultants Accelerated depreciation Employee termination costs Contract termination costs Technology write-downs IT systems migration Outsourcing IT systems migration Outsourcing Performance improvements and efficiencies Year of Investment 2008 2008 $50 M in savings 2009 2009 $100 M in savings 2010 2010 |

14 • Annual goal: repurchase 3 to 5 percent of shares outstanding • Approximately $203 million in remaining authority • Repurchased approximately 33 million shares at an average price of $35.18 since the inception of the share repurchase program in May 2002 14 As of 6/30/2008 Share Repurchase Share Repurchase |

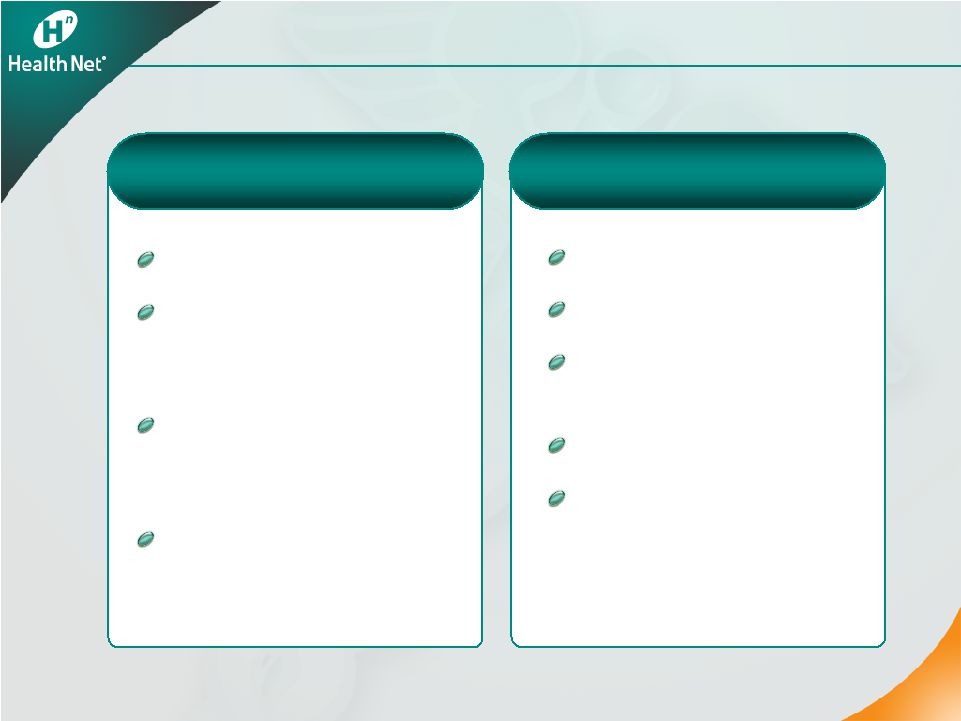

15 Well-Positioned for Potential Change Well-Positioned for Potential Change Stable networks Solid commercial franchises with expanding margins Growing and diversified government business Positioned to restore earnings momentum Medicare TRICARE Medicaid and the uninsured Low-cost products Behavioral health opportunities Positioned to Respond to Environmental Changes Positioned to Respond to Environmental Changes Positioned for Growth Positioned for Growth |