UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

HEALTH NET, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

HEALTH NET,

INC.

NOTICE OF

2009 ANNUAL

MEETING

AND

PROXY

STATEMENT

April 8, 2009

Dear Stockholders:

It is a pleasure to invite you to attend the 2009 Annual Meeting of Stockholders of Health Net, Inc. to be held at 21281 Burbank Boulevard in Woodland Hills, California 91367 on Thursday, May 21, 2009, at 10:00 a.m. (Pacific Time). For your convenience, we are offering a live webcast of the Annual Meeting on our Internet Web site,www.healthnet.com.

Each item of business described in the accompanying Notice of Annual Meeting and Proxy Statement will be discussed during the Annual Meeting. In addition, a report on our business operations will be presented at the Annual Meeting. Stockholders who attend the Annual Meeting will have an opportunity to ask questions at the meeting; those who participate in the live webcast may submit questions during the meeting via the Internet.

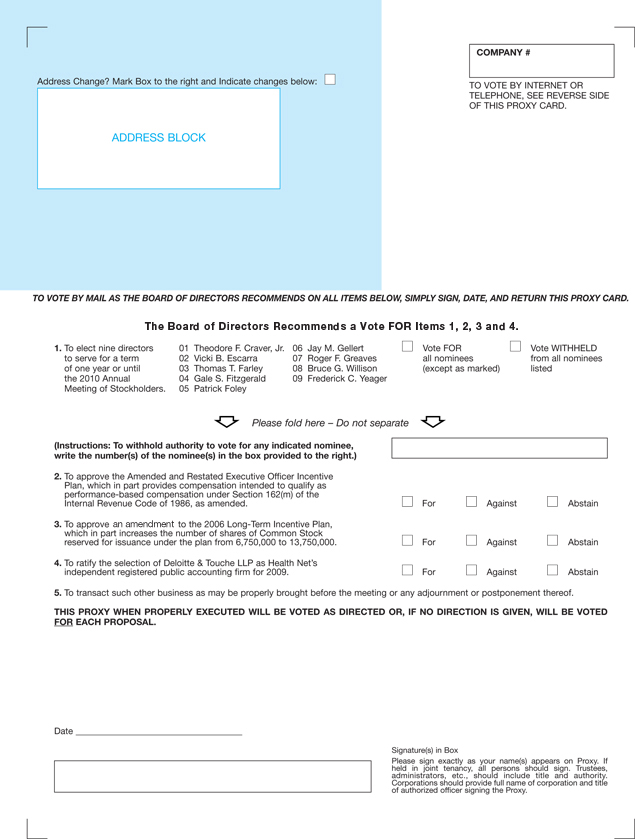

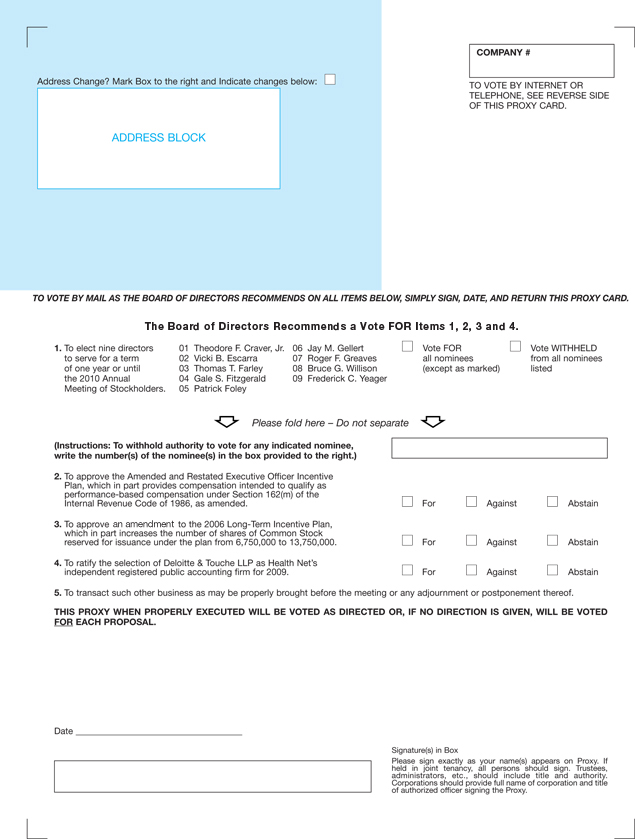

It is important that you vote your shares whether or not you plan to attend the Annual Meeting. We urge you to carefully review the proxy statement and to vote your choices either on the enclosed proxy card, by telephone or via the Internet. You may return your proxy card by mail by using the enclosed self-addressed, postage-paid envelope. If you choose this method, please sign and date your proxy card and return it as soon as possible. Alternatively, you may vote your shares by telephone by calling 1-800-560-1965, or over the Internet athttp://www.eproxy.com/hnt. If you vote by telephone or over the Internet, your electronic vote authorizes the named proxies in the same manner as if you returned a signed and dated proxy card by mail. If you do attend the Annual Meeting in person, your proxy can be revoked at your request.

We look forward to your attendance at the Annual Meeting.

Sincerely,

Jay M. Gellert

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Health Net, Inc. will hold its 2009 Annual Meeting of Stockholders on Thursday, May 21, 2009 at 10:00 a.m. (Pacific Time) at 21281 Burbank Boulevard in Woodland Hills, California 91367, for the following purposes:

| | 1. | To elect the following nine directors to serve for a term of one year or until the 2010 Annual Meeting of Stockholders: Theodore F. Craver, Jr., Vicki B. Escarra, Thomas T. Farley, Gale S. Fitzgerald, Patrick Foley, Jay M. Gellert, Roger F. Greaves, Bruce G. Willison and Frederick C. Yeager. |

| | 2. | To approve the Amended and Restated Executive Officer Incentive Plan, which, in part, provides compensation intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended. |

| | 3. | To approve an amendment to the 2006 Long-Term Incentive Plan, which, in part, increases the number of shares of Common Stock reserved for issuance under the plan from 6,750,000 to 13,750,000. |

| | 4. | To ratify the selection of Deloitte & Touche LLP as Health Net’s independent registered public accounting firm for 2009. |

| | 5. | To transact such other business as may be properly brought before the meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed Friday, March 27, 2009, as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the Annual Meeting.

At the Annual Meeting, each share of Common Stock, $.001 par value per share, of Health Net represented at the Annual Meeting will be entitled to one vote on each matter properly brought before the Annual Meeting. Jay M. Gellert and Linda V. Tiano, Esq. have been appointed as proxy holders, with full rights of substitution, for the holders of Common Stock.

By Order of the Board of Directors,

Linda V. Tiano, Esq.

Senior Vice President, General Counsel and

Secretary

April 8, 2009

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the 2009 Annual Meeting of Stockholders of Health Net, Inc. in person. However, to ensure your representation at the Annual Meeting, please mark, sign and date the enclosed proxy card and return it as soon as possible in the enclosed self-addressed, postage-paid envelope. Alternatively, you may vote your shares by telephone by calling 1-800-560-1965, or over the Internet athttp://www.eproxy.com/hnt. If you vote by telephone or over the Internet, your electronic vote authorizes the named proxies in the same manner as if you returned a signed and dated proxy card by mail. If you attend the Annual Meeting in person, you may vote at the meeting even if you have previously returned a proxy.

Table of Contents

PROXY STATEMENT

FOR THE 2009 ANNUAL MEETING

OF STOCKHOLDERS

TO BE HELD

MAY 21, 2009

MEETING AND VOTING INFORMATION

General

The accompanying proxy is solicited by the Board of Directors of Health Net, Inc. (“Health Net,” “we,” “us” or “our”) for use at our 2009 Annual Meeting of Stockholders (the “Annual Meeting” or “2009 Annual Meeting”) to be held on Thursday, May 21, 2009 at 10:00 a.m. (Pacific Time) at 21281 Burbank Boulevard, Woodland Hills, California 91367, and at any continuation, adjournments or postponements thereof. Directions to attend the meeting can be found on our Internet Web site,www.healthnet.com. We expect to mail this proxy statement and accompanying proxy card beginning on or about April 8, 2009 to all stockholders entitled to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 21, 2009. This proxy statement and our 2008 Annual Report on Form 10-K are available on our Internet Web site address athttp://www.healthnet.com/InvestorRelations/2009Proxy. This Web site address contains the following documents: the notice of the Annual Meeting, this proxy statement, including the proxy card, and the 2008 Annual Report on Form 10-K. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

We are offering a live webcast of the Annual Meeting on our Internet Web site,www.healthnet.com. The webcast of the Annual Meeting will consist of live sound, real-time access to printed material and the ability of stockholders to submit questions during the question and answer period. To participate in the webcast of the Annual Meeting, a stockholder should log on towww.healthnet.com on Thursday, May 21, 2009 shortly before 10:00 a.m. (Pacific Time) and follow the instructions provided under the “Investor Relations” section of the Web site. Stockholders willnot be permitted to vote over the Internet during the Annual Meeting.

Who Can Vote; Outstanding Shares

Only holders of record of our Common Stock, $.001 par value per share (“Common Stock”), at the close of business on March 27, 2009 (the “Record Date”) are entitled to vote at the Annual Meeting. Each share of Common Stock represented at the Annual Meeting is entitled to one vote on each matter properly brought before the Annual Meeting. As of the Record Date, we had outstanding 103,851,724 shares of Common Stock.

In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting, and for 10 days prior to the Annual Meeting in the Investor Relations department at our corporate office at 21650 Oxnard Street, Woodland Hills, California 91367, between the hours of 9:00 a.m. and 4:00 p.m. Pacific time.

Quorum and Votes Required

Our bylaws require that the holders of a majority of the total number of shares entitled to vote be present in person or by proxy in order for the business of the Annual Meeting to be transacted. Abstentions and “broker non-votes” will be counted for purposes of determining the presence or absence of a quorum for the transaction

1

of business at the Annual Meeting. “Broker non-votes” occur when a bank, broker or other nominee holding shares for a beneficial owner does not vote those shares on a particular proposal because it does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Participation by a stockholder in the live webcast of the Annual Meeting will not be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

Stockholder approval of each proposal requires the following votes:

| | • | | Proposal 1—Election of Directors. Under our bylaws, the persons receiving a plurality of the votes cast in person or by proxy, up to the number of directors to be elected, will be elected. Thus, the nine nominees receiving the greatest number of votes will be elected directors. Because only nine nominees have been named, proxies cannot be voted for a number of persons greater than nine. Abstentions will not be counted in determining which nominees received the largest number of votes cast. Brokers generally have discretionary authority to vote on the election of directors and thus broker non-votes are not expected to result from the vote on election of directors. However, if any broker non-votes result from the vote on election of directors, such non-votes will not affect the outcome of the election. Stockholders eligible to vote at the Annual Meeting do not have cumulative voting rights with respect to the election of directors. |

| | • | | Proposal 2 and Proposal 3—Approval of the Amended and Restated Executive Officer Incentive Plan and Approval of the Amendment to the 2006 Long-Term Incentive Plan. Approval of proposals 2 and 3 is governed by the New York Stock Exchange, or NYSE, listing standards. The NYSE listing standards require that, to be approved, each of proposals 2 and 3 must receive the affirmative vote of the holders of a majority of shares of Common Stock cast on such proposal, in person or by proxy; provided that the votes cast on the proposal represent over 50% of the total outstanding shares of Common Stock entitled to vote on the proposal. Votes“FOR” and“AGAINST”and abstentions count as votes cast, while broker non-votes do not count as votes cast. All outstanding shares, including broker non-votes, count as shares entitled to vote. Thus, the total sum of votes“FOR,” plus votes“AGAINST,” plus abstentions, which is referred to as the “NYSE Votes Cast,” must be greater than 50% of the total outstanding shares of our Common Stock. Broker non-votes could impair our ability to satisfy the requirement that votes cast represent over 50% of our outstanding shares of Common Stock. Once the NYSE Votes Cast threshold is satisfied, the number of votes“FOR” the proposal must be greater than 50% of NYSE Votes Cast. Thus, abstentions have the same affect as a vote against the proposals. Brokers do not have discretionary authority to vote shares on proposals 2 and 3 without direction from the beneficial owner. |

| | • | | Proposal 4—Ratification of Selection of Independent Registered Public Accounting Firm. Approval of proposal 4, the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm, requires the affirmative vote of a majority of the votes cast. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the vote on this proposal. |

Voting by Proxy

If you hold your shares of Common Stock as a record holder, you may vote by specifying your choices by marking the appropriate spaces on the enclosed proxy card, signing and dating the card and returning it in the enclosed self-addressed, postage-paid envelope. Alternatively, you may vote your shares by telephone by calling 1-800-560-1965, or over the Internet athttp://www.eproxy.com/hntbefore12:00 p.m. (Central Time) on May 20, 2009. If you vote by telephone or over the Internet, your electronic vote authorizes the named proxies in the same manner as if you returned a signed and dated proxy card by mail.Voting over the Internet or telephone will not be permitted after 12:00 p.m. (Central Time) on Wednesday, May 20, 2009.

Instructions on how to submit a proxy via the Internet and telephone are located on the attachment to the proxy card included with this proxy statement. The Internet and telephone voting procedures are designed to authenticate our stockholders by use of a control number located on the attachment to the proxy card included herewith.

2

If you hold your shares through a bank, broker or other nominee, check the instructions provided by that entity to determine which voting options are available to you. Please be aware that any costs related to voting over the Internet, such as Internet access charges, will be your responsibility.

All properly signed proxies that are received before the polls are closed at the Annual Meeting and that are not revoked will be voted at the Annual Meeting according to the instructions indicated on the proxies or, if no direction is indicated, they will be voted“FOR”the election of each of the nine nominees for director and proposal 4 and no action will be taken with respect to proposals 2 and 3.

Voting in Person

If you are a stockholder of record and plan to attend the Annual Meeting and wish to vote in person, you will be given a ballot at the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee, and you wish to vote in person at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the record holder of the shares (your broker or other nominee) authorizing you to vote at the Annual Meeting.

Revocability of Proxies

Any stockholder giving a proxy has the power to revoke it at any time before the proxy is voted at the Annual Meeting. A proxy may be revoked in any of the following three ways:

| | (1) | By delivering to our Corporate Secretary (at our executive offices at 21650 Oxnard Street, Woodland Hills, California 91367) a signed written notice of revocation bearing a later date than the proxy, stating that the proxy is revoked before 6:00 p.m. (Central Time) on May 20, 2009; |

| | (2) | By duly executing a subsequently dated proxy relating to the same shares of Common Stock and delivering it to our Corporate Secretary or submitting it by telephone by calling 1-800-560-1965, or electronically via the Internet athttp://www.eproxy.com/hntbefore 12:00 p.m. (Central Time) on May 20, 2009; or |

| | (3) | By attending the Annual Meeting in person and voting such shares during the Annual Meeting, although attendance at the Annual Meeting will not, by itself, revoke a proxy. |

If your shares are held by a broker bank or other nominee, you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so.

Solicitation

We will bear the entire cost of the solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy and any additional materials furnished to stockholders. Proxies may be solicited by directors, officers and a small number of our regular employees personally or by mail, telephone or telegraph, but such persons will not be specially compensated for such service. We have retained MacKenzie Partners, Inc. to assist in the solicitation of proxies for a fee of approximately $10,000 plus reasonable out-of-pocket costs and expenses. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians that hold shares of our Common Stock of record for beneficial owners for forwarding to such beneficial owners. We may also reimburse persons representing beneficial owners for their costs of forwarding the solicitation material to such owners.

Assistance

If you need assistance in completing your proxy card or have questions regarding the Annual Meeting, please contact our Investor Relations department at (800) 291-6911.

Your vote is important. Please sign, date and return a proxy card (or vote your shares over the Internet or by telephone) promptly so your shares can be represented, even if you plan to attend the Annual Meeting in person. The voting results will be included in our Quarterly Report on Form 10-Q for the second quarter ended June 30, 2009.

3

INTRODUCTION

We are an integrated managed care organization that delivers managed health care services through health plans and government sponsored managed care plans. We operate and conduct our businesses through subsidiaries of Health Net, Inc., which is among the nation’s largest publicly traded managed health care companies. Unless the context otherwise requires, the terms “Company,” “Health Net,” “we,” “us,” and “our” refer to Health Net, Inc. and its subsidiaries.

Our health plans and government contracts subsidiaries provide health benefits through our health maintenance organizations (“HMOs”), insured preferred provider organizations (“PPOs”) and point-of-service (“POS”) plans to approximately 6.7 million individuals across the country through group, individual, Medicare, (including the Medicare prescription drug benefit commonly referred to as “Part D”), Medicaid, TRICARE and Veterans Affairs programs. Our behavioral health services subsidiary, Managed Health Network, provides behavioral health, substance abuse and employee assistance programs to approximately 6.9 million individuals, including our own health plan members. Our subsidiaries also offer managed health care products related to prescription drugs and offer managed health care product coordination for multi-region employers and administrative services for self-funded benefits programs. In addition, we own health and life insurance companies licensed to sell PPO, POS, exclusive provider organization and indemnity products, as well as auxiliary non-health products such as life and accidental death and dismemberment, dental, vision, behavioral health and disability insurance, including our Medicare Part D Pharmacy coverage under Medicare.

We were incorporated in 1990. Our current operations are the result of the April 1, 1997 merger transaction (the “FHS Combination”) involving Health Systems International, Inc. (“HSI”) and Foundation Health Corporation (“FHC”). We changed our name to Health Net, Inc. in November 2000. Prior to the FHS Combination, we were the successor to the business conducted by Health Net of California, Inc., now our HMO subsidiary in California, and HMO and PPO networks operated by QualMed, Inc. (“QualMed”), which combined with us in 1994 to create HSI.

The mailing address of our principal executive office is 21650 Oxnard Street, Woodland Hills, CA 91367, and our Internet Web site address iswww.healthnet.com.

PROPOSAL 1—ELECTION OF DIRECTORS

General; Board Structure

Our certificate of incorporation provides for directors to be elected on an annual basis. Under our certificate of incorporation and bylaws, the Board of Directors will consist of between three and twenty members, with the exact number to be fixed from time to time by the Board of Directors. The number of members constituting the Board of Directors has been fixed by the Board of Directors at twelve.

Our Board of Directors currently consists of nine members. Assuming the election of each of the director nominees at the Annual Meeting, the Board will continue to consist of nine members. We have engaged a third party search firm to assist the Governance Committee of our Board of Directors in the process of identifying and evaluating potential new director candidates.

Our bylaws contain certain mandatory retirement and resignation provisions that apply to members of our Board of Directors. Specifically, a director will be deemed to have retired and resigned from the Board of Directors effective immediately prior to the first annual meeting of stockholders occurring after such director attains seventy-two years of age. However, with respect to members of the Board of Directors who were serving as of February 4, 1999, this retirement and resignation applies once such director reaches seventy-five years of age. Additionally, the Board of Directors has the power to waive the application of these provisions on a case-by-case basis by affirmative vote of two-thirds of the directors after considering all of the applicable facts and circumstances. The Board of Directors has waived the application of such provisions with respect to Patrick Foley (who is seventy-seven years of age and was a member of the Board of Directors on February 4, 1999) for one year. None of the other director nominees are affected by this mandatory retirement provision.

4

Our bylaws also provide that a director who has held office for any period of nine consecutive years after October 14, 2003, shall not be qualified to be elected as a director at the first annual meeting of stockholders occurring after the end of such ninth consecutive year and shall be deemed to have retired and resigned from the Board of Directors effective immediately upon the completion of such ninth consecutive year in office; provided, however, that the Board of Directors shall have the power to waive the application of such provisions to a given director on a case-by-case basis by an affirmative vote of two-thirds of the directors after considering all of the applicable facts and circumstances. This provision does not affect any of the director nominees.

Director Nominees

At the Annual Meeting, stockholders will elect nine directors. Each director will be re-elected to hold office for a term of one year or until the 2010 Annual Meeting of Stockholders. Each elected director will continue in office until such director’s successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Pursuant to our bylaws, the Governance Committee of our Board of Directors has designated the following nine nominees for election. Each of the nominees has consented to serve as a director if elected. There are no family relationships among any directors. The following table sets forth certain information with respect to the nominees:

| | | | | | | | |

Name | | Age | | Director

Since | | Principal Occupation or Employment | | Position(s) with Health Net |

Theodore F. Craver, Jr.(1)(4) | | 57 | | 2004 | | Chairman, President and Chief Executive Officer of Edison International | | Director |

Vicki B. Escarra(2)(3) | | 54 | | 2006 | | President and Chief Executive Officer of Feed America | | Director |

Thomas T. Farley(1)(2)(4) | | 74 | | 1997 | | Senior Partner of Petersen & Fonda, P.C. | | Director |

Gale S. Fitzgerald(1)(3) | | 58 | | 2001 | | Former Chair and Chief Executive Officer of the Computer Task Group, Inc. | | Director |

Patrick Foley(2)(3)(4) | | 77 | | 1997 | | Former Chairman, President and Chief Executive Officer of DHL Airways, Inc. and Director of various companies | | Director |

Jay M. Gellert | | 55 | | 1999 | | Our President and Chief Executive Officer | | President and Chief Executive Officer, Director |

Roger F. Greaves | | 71 | | 1997 | | Our Chairman of the Board, Former Co-President and Co-Chief Executive Officer and Director of various companies | | Chairman of the Board |

Bruce G. Willison(2)(3)(4) | | 60 | | 2000 | | President and director of Grandpoint Capital, Inc., Former Dean and Current Professor in Management, UCLA Anderson School of Management | | Director |

Frederick C. Yeager(1)(3) | | 67 | | 2004 | | Senior Vice President, Finance of Time Warner, Inc. | | Director |

| (1) | Current member of the Audit Committee |

| (2) | Current member of the Governance Committee |

| (3) | Current member of the Compensation Committee |

| (4) | Current member of the Finance Committee |

As set forth under “Meeting and Voting Information—Quorum and Votes Required,” the persons receiving a plurality of the votes cast, up to the number of directors to be elected, shall be elected. Abstentions and broker non-votes will not be counted, and stockholders eligible to vote at the Annual Meeting do not have cumulative voting rights with respect to the election of directors. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the election of each of the nine nominees named above. Since only nine nominees have been named, proxies cannot be voted for a number of persons greater than nine.

It is expected that the nominees named above will stand for election at the 2009 Annual Meeting of Stockholders, but if any of the nominees declines or is unable to do so, the proxies will be voted for another person or persons designated by the Governance Committee of our Board of Directors.

The Board of Directors recommends a vote

“FOR” each named nominee.

5

Information Concerning Current Members of the Board of Directors and Nominees

Mr. Craver has served as our director since March 2004. Mr. Craver has served in many different capacities at Edison International (“Edison”), an international electric power generator, distributor and structured finance provider since 1996. Since August 2008, Mr. Craver has served as Chairman, President and Chief Executive Officer of Edison International, having been President of such entity since April 2008. Prior to that, Mr. Craver was Chairman and Chief Executive Officer of Edison Mission Group since 2005, one of the principal subsidiaries of Edison International that owns and operates independent power production facilities, and Chief Executive Officer of Edison Capital, an Edison company that is a provider of capital and financial services. Mr. Craver has served as Executive Vice President, Chief Financial Officer and Treasurer of Edison International since January 2000, and in other financial and executive management positions since 1996. From 1984 to 1996, Mr. Craver held various financial management positions at First Interstate Bancorp, including Executive Vice President and Corporate Treasurer and Executive Vice President and Chief Financial Officer of a banking subsidiary. Mr. Craver served in various capital markets trading, underwriting and marketing positions at Bankers Trust Company of New York from 1980 to 1984 and at Security Pacific National Bank from 1973 to 1980. Mr. Craver is also currently a director of Edison Electric Institute and the Electric Power Research Institute, both industry trade organizations, and of the Autry National Center, a non-profit organization.

Ms. Escarra has served as our director since July 2006. Ms Escarra has served as President and CEO of Feed America since March 2006. Prior thereto, Ms. Escarra had a 30-year career at Delta Air Lines, Inc. (“Delta”). Most recently, from May 2001 until October 2004, Ms. Escarra served as Delta’s Executive Vice President and Chief Marketing Officer. Ms. Escarra is a former director of A.G. Edwards Inc. and former Chair of the Board of the Atlanta Convention and Visitors Bureau.

Mr. Farley has served as our director since April 1997. Previously, he served as a director of HSI since January 1994. Mr. Farley served as a director of QualMed from February 1991 until February 1995 and is a senior partner in the law firm of Petersen & Fonda, P.C., Pueblo, Colorado. Mr. Farley was formerly President of the governing board of Colorado State University, the University of Southern Colorado and Ft. Lewis College and Chairman of the Colorado Wildlife Commission. He served as Minority Leader of the Colorado House of Representatives from 1967 to 1975. Mr. Farley was a director of the Public Service Company of Colorado, a public gas and electric company, from 1983 to 1997, and is a former director of Colorado Public Radio. Mr. Farley is a current director/advisor of Wells Fargo Bank of Pueblo and Sunset, and a member of the Board of Regents of Santa Clara University, a Jesuit institution. He was recently appointed by the Governor of Colorado to the Board of Governors, the nine member governing board of the Colorado State University System.

Ms. Fitzgerald has served as our director since March 2001. From July 2002 through October 2002, Ms. Fitzgerald served as President and Chief Executive Officer of QP Group, a procurement solutions company. From October 1994 to June 2000, Ms. Fitzgerald served as Chair and Chief Executive Officer of Computer Task Group, Inc., an international information technology services firm. Ms. Fitzgerald also served on the Board of Directors of Kaleida Health System in Buffalo, New York from 1995 to 2002, and was Vice Chair from 2000 to 2002, and served on the Advisory Board of the University of Buffalo’s School of Management from 1993 to 2001. Ms. Fitzgerald served on the Boards of Directors of the Information Technology Services (“ITS”) Division of Information Technology Association of America (“ITAA”) and of ITAA from 1992 to 2002, and was Chair of the ITS Board from 1998 to 2002. Ms. Fitzgerald is a director of Diebold, Inc., Chair of Diebold’s governance committee and a member of its compensation committee. Diebold is a public company which specializes in providing integrated self-service delivery systems and services. Ms. Fitzgerald is a director and a member of the audit committee of Cross Country Healthcare, Inc., a healthcare staffing company. Ms Fitzgerald is also a founding partner and director of TranSpend, Inc. a privately held firm focused on total spend optimization.

Mr. Foley has served as our director since April 1997.Mr. Foley served as a director of FHC from 1996 until the FHS Combination in April 1997. Mr. Foley served as Chairman and Chief Executive Officer of DHL Airways, Inc. from September 1988 through July 1999.

6

Mr. Gellert has served as our director since February 1999 and has served as our President and Chief Executive Officer since August 1998. Previously Mr. Gellert served as our President and Chief Operating Officer from May 1997 until August 1998. From April 1997 to May 1997, Mr. Gellert served as our Executive Vice President and Chief Operating Officer. Mr. Gellert served as President and Chief Operating Officer of HSI from June 1996 until March 1997. He served on the Board of Directors of HSI from June 1996 to April 1997. Prior to joining HSI, Mr. Gellert directed Shattuck Hammond Partners Inc.’s strategic advisory engagements in the area of integrated delivery systems development, managed care network formation and physician group practice integration. Prior to joining Shattuck Hammond Partners Inc., Mr. Gellert was an independent consultant, and from 1988 to 1991, he served as President and Chief Executive Officer of Bay Pacific Health Corporation. From 1985 to 1988, he was Senior Vice President and Chief Operating Officer for California Healthcare System. Mr. Gellert has been a director of Ventas, Inc. since August 2001. Mr. Gellert is currently Chairman of America’s Health Insurance Plans.

Mr. Greaves has served as our director since April 1997 and was appointed Chairman of the Board of Directors in January 2004. Mr. Greaves served as a director of HSI from January 1994 until the FHS Combination in April 1997. Mr. Greaves served as our Co-Chairman of the Board of Directors, Co-President and Co-Chief Executive Officer from January 1994 (upon consummation of the HSI Combination) until March 1995. Prior to January 1994, Mr. Greaves served as Chairman of the Board of Directors, President and Chief Executive Officer of H.N. Management Holdings, Inc. (a predecessor to Health Net) since its incorporation in June 1990. Mr. Greaves currently serves as Chairman of the Board of Directors of Health Net of California, Inc. (“HN California”), our subsidiary. Mr. Greaves also served a prior term as Chairman of the Board of Directors of HN California, and concurrently served as President and Chief Executive Officer of HN California. Prior to joining HN California, Mr. Greaves held various management roles at Blue Cross of Southern California, including Vice President of Human Resources and Assistant to the President, and held various management positions at Allstate Insurance Company from 1962 until 1968. Mr. Greaves serves as an Honorary Member of the Board of Trustees of California State University at Long Beach.

Mr. Willison has served as our director since December 2000. Mr. Willison currently serves as President and a director of Grandpoint Capital, Inc., a bank-holding company, since January 2009. Mr. Willison served as Dean, UCLA Anderson School of Management from July 1999 to January 2007, and is currently a Professor in Management of UCLA Anderson School of Management. From April 1996 to October 1998, Mr. Willison served as President and Chief Operating Officer of H.F. Ahmanson, Inc. (Home Savings of America). Prior thereto, Mr. Willison was Chairman, President and Chief Executive Officer of First Interstate Bank of California from February 1991 to April 1996. Mr. Willison is also a director of Move, Inc. and is a trustee of SunAmerica’s Seasons and Series Trusts.

Mr. Yeager has served as our director since March 2004. Mr. Yeager has served as Senior Vice President, Finance of Time Warner, Inc., a media and entertainment company, since December 2000, and since January 2009, has served as Chairman of the Time Warner’s Investment Committee, a trustee of Time Warner’s U.K. Pension Plans. From December 2000 to January 2009, Mr. Yeager led teams responsible for global strategic sourcing, supplier diversity and investment of employee benefits assets, and served as the chair of the Time Warner Investment Committee. From May 1995 to December 2000, Mr. Yeager was Vice President, Finance and Development for Time Warner and led teams responsible for financial and business planning, mergers and acquisitions, treasury, capital structure planning and capital markets transactions, and for managing Time Warner’s relationships with commercial and investment banks and debt-rating agencies. Prior thereto, Mr. Yeager had a 27-year career with Ford Motor Company where he held executive and management positions in the Finance Staff, the Treasurer’s Office, the Product Development Group, the Financial Services Group, Ford of Europe and Ford Motor Credit Company. Mr. Yeager began his career at Ford in 1968 as an Operations Research Analyst.

7

EXECUTIVE OFFICERS

The following sets forth certain biographical information with respect to our executive officers, as of March 27, 2009, and all individuals who served as our executive officers during 2008.

| | | | |

Name | | Age | | Position |

Jay M. Gellert | | 55 | | President and Chief Executive Officer |

James E. Woys | | 50 | | Executive Vice President, Chief Operating Officer |

Joseph C. Capezza, CPA | | 54 | | Executive Vice President, Chief Financial Officer |

Patricia T. Clarey | | 55 | | Senior Vice President, Chief Regulatory and External Relations Officer |

Stephen D. Lynch | | 58 | | Former President, Health Plan Division |

Karin D. Mayhew | | 58 | | Senior Vice President of Organization Effectiveness |

John P. Sivori | | 45 | | President of Regional Health Plans and Health Net Pharmaceutical Services |

Linda V. Tiano, Esq. | | 51 | | Senior Vice President, General Counsel and Secretary |

Steven D. Tough | | 58 | | President of Health Plans and Government Programs |

David W. Olson | | 58 | | Former Senior Vice President, Corporate Communications |

Mr. Gellert has served as our President and Chief Executive Officer since August 1998. Previously, Mr. Gellert served as our President and Chief Operating Officer from May 1997 until August 1998. From April 1997 to May 1997, Mr. Gellert served as our Executive Vice President and Chief Operating Officer. Mr. Gellert served as President and Chief Operating Officer of HSI from June 1996 until March 1997. He served on the Board of Directors of HSI from June 1996 to April 1997. Mr. Gellert has been our director since March 1999. Prior to joining HSI, Mr. Gellert directed Shattuck Hammond Partners Inc.’s strategic advisory engagements in the area of integrated delivery systems development, managed care network formation and physician group practice integration. Prior to joining Shattuck Hammond Partners Inc., Mr. Gellert was an independent consultant, and from 1988 to 1991, he served as President and Chief Executive Officer of Bay Pacific Health Corporation. From 1985 to 1988, Mr. Gellert was Senior Vice President and Chief Operating Officer for California Healthcare System. Mr. Gellert has been a director of Ventas, Inc. since August 2001. Mr. Gellert is currently Chairman of America’s Health Insurance Plans.

Mr. Woys has served as our Executive Vice President, Chief Operating Officer since November 2007. Previously, Mr. Woys served as our Interim Chief Financial Officer from November 2006 until November 2007, and served as President, Government and Specialty Services from October 2005 until November 2007. Prior thereto, he served as President of Health Net Federal Services from February 2001 to October 2005. Mr. Woys served as Chief Operating Officer and President of Health Net Federal Services from November 1999 to February 2001. Mr. Woys served as Chief Operating Officer and Senior Vice President for Foundation Health Federal Services from February 1998 to November 1999. Mr. Woys served as Senior Vice President of Foundation Health Federal Services from January 1995 to February 1998. From January 1990 to January 1995, Mr. Woys served as Vice President and Chief Financial Officer of the Government Division of FHC. Mr. Woys served as Director of Corporate Finance/Tax for FHC from October 1986 to January 1990. Prior to Mr. Woys’ employment with FHC, he was employed by Price Waterhouse from 1982 to 1986 and by Arthur Andersen & Co. from 1980 to 1982.

Mr. Capezza has served as our Executive Vice President, Chief Financial Officer since November 1, 2007. Prior to joining Health Net, Mr. Capezza served as Chief Financial Officer at Harvard Pilgrim Health Care from January 2002 to October 2007. From June 2000 to December 2001, Mr. Capezza served as Senior Vice President and Chief Financial Officer at Group Health Incorporated. Prior thereto, Mr. Capezza had a long career with Reliance Insurance Group, where he served as Senior Vice President and Chief Financial Officer at Reliance Reinsurance Corp. from February 1990 to May 2000. From 1985 to 1990, Mr. Capezza served as Vice President and Chief Financial Officer at Willcox Incorporated Reinsurance Intermediaries, and from 1983 to 1985, Mr. Capezza served as Vice President and Controller at Skandia America Reinsurance Company. From 1976 to 1983, Mr. Capezza served as General Practice Manager—Insurance Industry Specialist at Coopers & Lybrand, LLP.

8

Ms. Clareyhas served as our Senior Vice President, Chief Regulatory and External Relations Officer since June 2008. Previously, Ms. Clarey served as Chief Operating Officer of our Health Plan Division and Health Net of California from April 2006 through May 2008. In 2003, Ms. Clarey left us to serve as a member of the senior leadership team for the campaign for Arnold Schwarzenegger for Governor of California, and after his election served as Governor Schwarzenegger’s Chief of Staff. Prior thereto, from March 2001 to November 2003, Ms. Clarey served as our Vice President of Government Relations. Prior to her service at Health Net, from 1998 through 2001 Ms. Clarey held senior management positions at Transamerica Corporation, and from 1991 to 1998 she served as deputy chief of staff to former California Governor Pete Wilson. Ms. Clary is currently a director of California Public Employees’ Retirement System, State Personnel Board and California Foundation on the Environment and the Economy.

Mr. Lynchserved as our President, Health Plan Division from November 2007 until November 8, 2008. On November 8, 2008, Mr. Lynch announced he would retire from the Company effective February 28, 2009. From November 2008 until February 28, 2009, Mr. Lynch served as our Special Advisor, Health Plan Division. Previously, Mr. Lynch served as our President, Regional Health Plans since January 2005. Prior thereto, Mr. Lynch served as Chief Operating Officer for our Western Region since June 2004. Mr. Lynch served as President, Health Net of Oregon from August 2001 to June 2004.

Ms. Mayhew has served as our Senior Vice President of Organization Effectiveness since April 1999. Prior to joining us, Ms. Mayhew served as Senior Vice President, Organization Development of Southern New England Telecommunications Company (“SNET”), a northeast regional information, entertainment and telecommunications company based in Connecticut. Prior thereto, Ms. Mayhew served in various capacities at SNET, including Vice President, Human Resources, since 1972.

Mr. Sivori has served as our President of Regional Health Plans and Health Net Pharmaceutical Services since November 2008. Previously, Mr. Sivori served as our President of Health Net Pharmaceutical Services from September 2001 to November 2008. Prior thereto, Mr. Sivori was appointed Senior Vice President and Chief Financial Officer of Integrated Pharmaceutical Services, now Health Net Pharmaceutical Services, from December 1998 until September 2001. Mr. Sivori originally joined FHC in August 1994 and held various senior management positions prior to December 1998.

Ms. Tianohas served as our Senior Vice President, General Counsel and Secretary since February 1, 2007. Ms. Tiano served as Senior Vice President and General Counsel for WellChoice, Inc., the parent of Empire Blue Cross and Blue Shield of New York, from September 1995 to December 2005. Following WellChoice’s acquisition by WellPoint, Inc. in late 2005, Ms. Tiano served as Vice President and Deputy General Counsel for the East Region and National Accounts for WellPoint until November 1, 2006. Before WellChoice, Ms. Tiano was Vice President and General Counsel of MVP Health Plan in New York (“MVP”) from August 1992 to September 1995. Prior to MVP, Ms. Tiano was a partner in the New York office of Epstein Becker & Green.

Mr. Tough has served as our President of Health Plans and Government Programs since November 2008, the President of Health Net Federal Services since January 2006, and the President of our Government and Specialty Services division since February 2008. From 1978 to 1998, Mr. Tough spent 20 years at FHC, nine of which he served as President and Chief Operating Officer of our Government and Specialty Services groups. Upon leaving FHC in 1998, and prior to joining us in 2008, Mr. Tough started his own firm providing health care consulting services to a variety of companies, and served as President and CEO of the California Association of Health Plans and President, Western Region, MAXIMUS Health Care Services Group, a health care services organization.

Mr. Olson served as our Senior Vice President, Corporate Communications from May 1999 until his retirement from Health Net effective June 1, 2008. Mr. Olson was previously Vice President, Investor and Public Relations for HSI, one of Health Net’s predecessor companies.

9

Certain Relationships and Related Party Transactions

We have adopted a written Related Party Transaction Policy (the “Policy”), which Policy has been approved by the Audit Committee of the Board of Directors (“Audit Committee”) in accordance with its charter. The Policy outlines our policies and procedures for the review, approval or ratification of certain transactions in which any of our directors or director nominees, our executive officers, holders of more than five percent (5%) of any class of our voting securities, or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest. The Policy provides, among other things, for any proposed related party transaction to be submitted to the Audit Committee, or under delegated authority to the Chair of the Audit Committee (the “Chair”) for approval. The factors to be considered by the Audit Committee, or Chair, as applicable, when reviewing such related party transaction shall include, but are not limited to, the following: (i) the benefits to Health Net; (ii) the impact on a director’s independence in the event the related party is a member of the board, an immediate family member of a member of the Board or an entity in which a member of the Board is a partner, shareholder or executive officer; (iii) the availability of other sources for comparable products or services; (iv) the terms of the transaction; and (v) the terms available to unrelated third parties or to employees generally.

The Policy also provides that if we find that a related party transaction is ongoing that did not receive prior approval by the Audit Committee, or Chair, as applicable, then such transaction will be promptly submitted to the Audit Committee or Chair, for consideration of all of the relevant facts and circumstances available, and taking into account the same factors as described above, to determine whether the transaction should be ratified, amended or terminated. If a related party transaction is completed that did not receive prior approval, the Audit Committee, or Chair, as applicable, shall evaluate the transaction, taking into account the same factors as described above, to determine if rescission of the transaction is appropriate. In the case of an ongoing or completed related party transaction that did not receive prior approval in accordance with the Policy, the General Counsel shall evaluate our controls and procedures to ascertain the reason(s) the transaction was not submitted for prior approval and whether any changes to these procedures are recommended. The Chair shall report to the Audit Committee at the next Audit Committee meeting any approval, ratification, amendment or rescission of a related party transaction made by such Chair under his or her delegated authority pursuant to the Policy.

On March 28, 2007, the Audit Committee, in accordance with the Policy, pre-approved the following related party transaction: Jonathan Mayhew, the step-son of our Senior Vice President of Organization Effectiveness, is the President and the 55% equity owner of two limited liability companies (the “LLCs”) that entered into a contract with Health Net to provide certain disability advocacy services to eligible health plan members (the “Agreement”). In 2008, we paid the LLCs, for services provided pursuant to the Agreement, approximately $2,000,000. During 2008 the Agreement was amended several times. These amendments were brought to the attention of the Audit Committee in accordance with the Policy.

In addition, we reimburse the expenses of Erika Greaves, the spouse of our Chairman of the Board, related to her attendance (including the costs of travel, food and lodging) at Celebration of Children meetings and events. Mrs. Greaves serves as a volunteer for Celebration of Children, which is a company sponsored charity program. In 2008, we reimbursed Mrs. Greaves approximately $22,094 in connection with her attendance at Celebration of Children meetings and events.

10

CORPORATE GOVERNANCE

Corporate Governance Guidelines and Code of Conduct

Members of our Board of Directors are elected by the holders of Common Stock and represent the interests of all stockholders. Our Board of Directors meets periodically to review significant developments affecting us and to act on matters requiring Board approval. Although the Board of Directors delegates many matters to others, it reserves certain powers and functions to itself.

Our Board of Directors has established Corporate Governance Guidelines that it follows in matters of corporate governance. In addition, the Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, directors and officers, including our principal executive officer, principal financial officer and principal accounting officer. Our Corporate Governance Guidelines and Code of Business Conduct and Ethics are published on our Web site atwww.healthnet.com and are available in print upon written request, addressed to our Corporate Secretary.

Board Meetings and Committees; Annual Meeting Attendance

Our Board of Directors met a total of twenty four times in 2008. Each member of our Board of Directors was present for 75% or more of the combined total of (i) all meetings of the Board of Directors held in 2008 (during the period he/she served as a director) and (ii) all meetings of all committees of the Board of Directors held in 2008 on which he/she served (during the period he/she served). Our non-management directors meet in executive session without management on a regularly scheduled basis, but not less frequently than quarterly. The non-executive Chairman presides at such executive sessions, or in his absence, a non-management director designated by our non-executive Chairman. In addition, it is our policy that each of our directors attend the Annual Meeting. All of our current directors, excluding Mr. Foley, were in attendance at the 2008 Annual Meeting.

Director Independence

On an annual basis, with the assistance of the Governance Committee, our Board of Directors reviews the independence of all directors and affirmatively makes a determination as to the independence of each director. To assist in making this determination, the Board has adopted independence guidelines which are designed to conform to, or be more exacting than, the independence requirements set forth in the listing standards of the NYSE. The director independence guidelines are published on our Web site atwww.healthnet.com and are available in print upon written request, addressed to our Corporate Secretary . In addition to applying these guidelines, the Board considers any and all additional relevant facts and circumstances in making an independence determination.

Our Board of Directors has determined that the following directors qualify as independent under NYSE listing standards: Theodore F. Craver, Jr., Vicki B. Escarra, Thomas T. Farley, Gale S. Fitzgerald, Patrick Foley, Roger F. Greaves, Bruce G. Willison and Frederick C. Yeager. Under the NYSE listing standards, no director qualifies as independent unless the Board of Directors affirmatively determines that the director has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. In making such determination the Board of Directors reviewed all current and past relationships between Health Net and members of the Board of Directors and their immediate family members. Additionally, the Board of Directors reviewed and considered certain expense reimbursements paid by Health Net to members of the Board of Directors or their immediate family members, which were determined to be either directly related to a bona fide business purpose or immaterial in amount.

In determining that Mr. Greaves is independent, the Board considered the following additional factors: (i) Mr. Greaves’ prior employment with Health Net, which ended more than thirteen years ago; (ii) the lifetime health benefits from Health Net (or any successor) that Mr. Greaves and his spouse received in conjunction with his retirement from Health Net as an employee; and (iii) the fact that his wife serves as a volunteer with Celebration of Children, a Health Net-sponsored charity, and receives certain expense reimbursements related to such service. In light of the significant time period since Mr. Greaves’ resignation and the fact that his receipt of

11

health benefits is in no way contingent upon continued service to Health Net, the business purpose of the expense reimbursements, and the fact that Mrs. Greaves receives no salary compensation (only reimbursement of documented expenses) for her service to Celebration of Children, the Board determined that these were not material relationships under NYSE listing standards and therefore determined Mr. Greaves to be independent under such standards.

Committees of the Board of Directors

Our bylaws establish the following standing committees of the Board of Directors: the Audit Committee, the Governance Committee, the Compensation Committee and the Finance Committee. Our bylaws further provide that additional committees may be established by resolution adopted by a majority of the Board. From time to time, the Board establishes various ad hoc committees by resolution. A majority of the Board of Directors selects the directors to serve on the committees of the Board of Directors upon recommendation of the Governance Committee.

Audit Committee.

The Audit Committee of our Board of Directors currently consists of Messrs. Craver (Chairman), Farley, Yeager and Ms. Fitzgerald. Each of the current members of the Audit Committee served on the Audit Committee from January 2008 to December 2008. Our Board of Directors has determined that all current Audit Committee members are financially literate under the NYSE listing standards and that all current members of the Audit Committee are independent under NYSE listing standards and under the requirements of SEC Rule 10A-3. Messrs. Craver and Yeager have each been determined by the Board to be an “audit committee financial expert,” as defined by SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002. Our Audit Committee held eleven meetings in 2008.

Audit Committee Responsibilities. The Audit Committee is governed by a charter, a current copy of which is available on our Web site atwww.healthnet.com. A copy of the charter is also available in print to stockholders upon request, addressed to our Corporate Secretary. Pursuant to the Audit Committee charter, the Audit Committee is responsible for, among other things:

| | • | | appointing, compensating, retaining, terminating and overseeing the work of any registered public accounting firm (“independent auditors”) engaged to prepare or issue an audit report or perform other audit or non-audit services for us; |

| | • | | pre-approving all audit services and permitted non-audit services, including the proposed fees related thereto, to be performed for us by the independent auditors; |

| | • | | obtaining and reviewing, at least annually, a report from the independent auditors with respect to matters affecting the independent auditors’ internal quality-control procedures, independence and other material issues surrounding the auditing process; |

| | • | | reviewing and discussing with the independent auditors their annual audit plan (for annual and quarterly reporting purposes), including the timing and scope of audit activities, and monitoring such plan’s progress and results during the year; |

| | • | | reviewing with management and the independent auditors our practices with respect to, among other things: the disclosures in our annual audited financial statements and quarterly financial statements; the process surrounding certain accounting estimates; treatment of significant transactions not a part of our regular operations; significant adjustments to our financial statements; risk assessment; risk management; and our critical accounting policies; |

| | • | | reviewing and resolving all disagreements, problems or difficulties between our independent auditors and management regarding financial reporting; |

| | • | | reviewing and reporting to the Board on the performance and the independence of the independent auditors; |

12

| | • | | reviewing, on a regular basis, the adequacy and effectiveness of our accounting and internal control policies and procedures, through inquiry and discussions with management and the independent auditors; |

| | • | | reviewing the Audit Committee’s involvement and interaction with our internal audit function; the services provided by our internal audit function; and the controls that management has established to protect the integrity of the quarterly reporting process; |

| | • | | reviewing our policies relating to the ethical handling of conflicts of interest and reviewing transactions between us and members of our management; |

| | • | | monitoring compliance with our Code of Business Conduct, including discussing with management and the independent auditors established standards of conduct and performance, and deviations therefrom; and |

| | • | | reviewing with management, at the request of the Board, significant financial matters affecting us, whether or not related to a review of quarterly or annual financial statements. |

Governance Committee.

The Governance Committee of our Board of Directors is currently comprised of Messrs. Willison (Chairman), Farley, Foley, and Ms. Escarra. Each of the current members of the Governance Committee served on the Governance Committee from January 2008 to December 2008. Each of the current members of the Governance Committee is independent under NYSE listing standards. The Governance Committee held five meetings in 2008.

Governance Committee Responsibilities. The Governance Committee is governed by a charter, a current copy of which is available on our Web site atwww.healthnet.com. A copy of the charter is also available in print to stockholders upon request, addressed to our Corporate Secretary. Pursuant to the Governance Committee charter, the Governance Committee is responsible for, among other things:

| | • | | establishing procedures for evaluating the credentials and suitability of potential director nominees proposed by our management or stockholders; |

| | • | | reviewing qualifications of candidates for Board membership from whatever source received and identifying individuals qualified to serve as our directors, consistent with the criteria established by the Board of Directors; |

| | • | | selecting individuals qualified to serve as director nominees for election by the stockholders at each annual meeting of our stockholders; |

| | • | | nominating qualified individuals to fill vacancies on the Board of Directors which occur between annual meetings of our stockholders; |

| | • | | reviewing annually the relationship each director has with us (i.e. directly, as a partner, shareholder or officer of an organization that has a relationship with us) and the categorical director independence standards adopted by the Board; |

| | • | | recommending individual Board members for designation as members of committees on the Board of Directors; |

| | • | | advising the Board of Directors with respect to the Board’s procedures and committees; |

| | • | | developing and recommending to the Board of Directors a set of corporate governance guidelines applicable to us and advising the Board of Directors with respect to the corporate governance guidelines applicable to us; |

| | • | | overseeing the evaluation of the Board of Directors and our management; and |

| | • | | evaluating our succession plans for the Chairman of the Board, Chief Executive Officer and other senior officers. |

13

In addition, the Governance Committee has responsibility for consideration and recommendation to the Board of Directors the compensation of the Board of Directors. Periodically, the Governance Committee reviews compensation survey data for peer board of director compensation and determines whether any adjustments to the Board of Directors’ compensation are appropriate, and if yes, recommends such adjustments to the Board of Directors. Historically, reviews and adjustments to the Board of Directors’ compensation have occurred less frequently than annually.

The Governance Committee selects director nominees on the basis of the nominee’s possession of such knowledge, experience, skills, expertise and diversity so as to enhance the Board’s ability to manage and direct our affairs and business, including, when applicable, to enhance the ability of the committees of the Board of Directors to fulfill their duties and/or to satisfy any independence requirements imposed by law, regulation, NYSE listing standards and our bylaws and other corporate governance documents.

The Governance Committee identifies potential director nominees from many sources. The Governance Committee asks current directors and executive officers to notify the Committee if they become aware of persons meeting the criteria described above who may be available to serve on the Board. From time to time, the Governance Committee also engages third party search firms that specialize in identifying director candidates. The Governance Committee is currently working with a third party search firm to assist the Governance Committee in the process of identifying and evaluating potential new director candidates. The Governance Committee also considers director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Governance Committee will take into consideration the needs of the Board of Directors and the qualifications of the candidate. The Governance Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a director candidate considered by the Governance Committee for inclusion on the slate of nominees, a stockholder must submit the recommendation in writing and must include the following information:

| | • | | the name and record address of the stockholder; |

| | • | | evidence of number of shares of our Common Stock which are owned beneficially or of record by the stockholder and the length of time owned; |

| | • | | the name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of Health Net; and |

| | • | | the candidate’s signed consent to be named as a director if selected by the Governance Committee and nominated by the Board of Directors. |

The stockholder’s recommendation and information described above must be sent to our Corporate Secretary at 21650 Oxnard Street, Woodland Hills, California 91367 and received by the Secretary not less than 120 days prior to the anniversary date of our most recent annual meeting of stockholders.

Once a person has been identified by the Governance Committee as a potential candidate, the Governance Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Governance Committee determines that the candidate warrants further consideration, the Chairman of the Governance Committee or another member of the Governance Committee contacts the candidate. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors, the Governance Committee requests information from the candidate, reviews the person’s accomplishments and qualifications, including in light of any other candidates that the Governance Committee might be considering, and conducts one or more interviews with the candidate. In certain instances, Governance Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Governance Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

14

In connection with the 2009 Annual Meeting and in accordance with the above guidelines, the Governance Committee nominated for re-election each of the following nine nominees: Ms. Escarra, Ms. Fitzgerald and Messrs. Craver, Farley, Foley, Gellert, Greaves, Willison and Yeager.

Compensation Committee.

The Compensation Committee currently consists of Ms. Fitzgerald (Chair), Ms. Escarra and Messrs. Foley, Willison and Yeager. Each of the current members of the Compensation Committee served on the Compensation Committee from January 2008 through December 2008. Each of the current members of the Compensation Committee is intended to qualify as a “non-employee director” within the meaning of Section 16 of the Exchange Act, an “outside director” for Section 162(m) purposes and independent under NYSE listing standards. Mr. Greaves, in his capacity as Chairman of the Board, regularly attends Compensation Committee meetings but, since he is not a member of the Compensation Committee, he does not vote on any Compensation Committee actions. In 2008, our Compensation Committee held nine meetings.

Compensation Committee Responsibilities. The Compensation Committee is governed by a charter, a current copy of which is available on our Web site atwww.healthnet.com. A copy of the charter is also available in print to stockholders upon request, addressed to our Corporate Secretary. Pursuant to the Compensation Committee charter, the Compensation Committee is responsible for, among other things:

| | • | | evaluating annually the performance of the Chief Executive Officer (the “CEO”) in light of the goals and objectives of our executive compensation plans, and, either as a committee or together with other independent directors (as directed by the Board), determining and recommending for approval by the independent directors of the Board of Directors, the CEO’s compensation level based on this evaluation, which recommendation is subject to ratification, modification or rejection by the independent directors of the Board of Directors; |

| | • | | evaluating annually the performance of our most highly compensated officer (other than the CEO) (for 2008, the EVP, Chief Operating Officer) in light of the goals and objectives of our executive compensation plans, and recommending to the Board such officer’s compensation level, which recommendation is subject to ratification, modification or rejection by the Board of Directors; |

| | • | | evaluating annually the performance of our senior officers who occupy jobs that the Compensation Committee, solely for purposes of evaluating compensation, determines to have the highest impact on us (the “Senior Officers”), including the “Executive Officers” listed previously herein (excluding the CEO and the second most highly compensated officer, as provided above), and approving each such Senior Officer’s compensation level; |

| | • | | reviewing and approving, on a general and policy level basis only, the compensation and benefits of officers, managers and employees other than the CEO, our second mostly highly compensated officer and the Senior Officers, and advising the Board of Directors of actions taken; |

| | • | | reviewing the goals and objectives of our compensation plans and other employee benefit plans, including incentive-compensation and equity-based plans, and amend, or recommend that the Board amend, these goals and objectives if the Compensation Committee deems it appropriate; |

| | • | | reviewing and approving any severance or termination arrangements to be made with any of our Senior Officers; |

| | • | | reviewing perquisites or other personal benefits to our Senior Officers and recommending any changes to the Board of Directors; and |

| | • | | performing such duties and responsibilities as may be assigned to the Board of Directors or the Compensation Committee under the terms of any compensation or other employee benefit plan, including any incentive-compensation or equity-based plan. |

As provided in its charter, the Compensation Committee has the responsibility to review at least annually the performance of the CEO, the second-highest paid executive officer and the Senior Officers (the “Oversight

15

Positions”). The Compensation Committee has the authority to approve the compensation for all Oversight Positions, except that the Board of Directors has the responsibility to determine the compensation for the CEO and second-highest paid executive. When making such determination, the Board of Directors takes into consideration the Compensation Committee’s recommendation regarding the compensation for the CEO and second-highest paid executive, and may choose to ratify, modify or reject such recommendation. The annual performance review of the Oversight Positions occurs in the first quarter of the calendar year following the previous 12-month performance period, and such review cannot be delegated to anyone other than the Compensation Committee. The Compensation Committee reviews all relevant data when determining, and recommending to the Board of Directors, as the case may be, executive compensation including, but not limited to, salary survey/market data for the job; individual and Health Net’s overall performance compared to our business plan; relative performance to our peer group; industry factors during the performance period; and the executive’s compensation progression over time compared to their development, expected future contributions to our success and retention concerns. The CEO and his direct reports have the responsibility to review and approve all executive compensation, other than the “Oversight Positions”, on an annual basis. This annual review process includes the same relevant factors listed above. The Compensation Committee is not responsible for considering or determining compensation for the Board of Directors, this is the responsibility of the Governance Committee and Board of Directors as discussed above in the “Governance Committee” section of this proxy.

The Compensation Committee is committed to staying apprised of current issues and emerging trends, and ensuring that Health Net’s executive compensation program remains aligned with best practice. To this end, the Compensation Committee has directly selected and retained the services of the consulting firm Semler Brossy Consulting Group, Inc. to assist the Compensation Committee in evaluating executive compensation matters. The Compensation Committee has the sole authority, as it deems appropriate, to retain or terminate the compensation consultant in order to assist the Compensation Committee in carrying out its responsibilities, including sole authority to approve the compensation consultant’s fees and other retention terms that relate to the compensation consultant’s work. The compensation consultant reports directly and exclusively to the Compensation Committee. During 2008, the Compensation Committee directed Semler Brossy to provide the following services:

| | • | | survey benchmarking analysis; |

| | • | | peer group competitive review; |

| | • | | a review of market trends in executive compensation; |

| | • | | review of the compensation committee charter; |

| | • | | review of equity ownership guidelines; |

| | • | | guidance on retirement provisions for outstanding equity awards; and |

| | • | | advice regarding competitive levels of executive base salaries, annual performance-based incentive cash awards and annual equity awards, and advice regarding managements proposed salary structure and equity grant guidelines for 2009. |

For a full discussion of the services that the consulting firm provides to our Compensation Committee to assist it in structuring and evaluating our executive compensation programs, plans and practices, see the “Compensation Discussion and Analysis” section of this proxy.

Finance Committee.

The Finance Committee of the Board of Directors currently consists of Messrs. Foley (Chairman), Craver, Farley and Willison. Each of the current members of the Finance Committee served on the Finance Committee from January 2008 through December 2008. In 2008, our Finance Committee held nine meetings.

Finance Committee Responsibilities. The Finance Committee is responsible for, among other things:

| | • | | reviewing our investment policies and guidelines; |

16

| | • | | monitoring the performance of our investment portfolio; |

| | • | | reviewing, in coordination with the Audit Committee, our financial structure and operations in light of our long-term objectives; |

| | • | | reviewing and recommending to the Board of Directors appropriate action on proposed acquisitions and divestitures; |

| | • | | establishing appropriate authority levels for various officials of Health Net with respect to mergers and acquisitions transactions, divestiture transactions and capital expenditures; and |

| | • | | reviewing and recommending appropriate action with respect to our short- and long-term debt structure. |

17

DIRECTORS’ COMPENSATION

Directors’ Compensation Table for 2008

| | | | | | | | | | | |

Name | | Fees Earned

or Paid

in Cash

($)(1) | | | Option

Awards

($)(2) | | | All Other

Compensation

($) | | | Total ($) |

Theodore F. Craver, Jr. | | 128,000 | | | 105,469 | (3) | | 0 | | | 233,469 |

Vicki Escarra | | 99,000 | | | 93,808 | (4) | | 0 | | | 192,808 |

Thomas T. Farley | | 126,000 | | | 105,469 | (5) | | 0 | | | 231,469 |

Gale S. Fitzgerald | | 128,000 | (6) | | 105,469 | (7) | | 0 | | | 233,469 |

Patrick Foley | | 108,000 | | | 105,469 | (8) | | 0 | | | 213,469 |

Roger F. Greaves | | 220,000 | | | 105,469 | (9) | | 18,967 | (10) | | 344,436 |

Bruce G. Willison | | 122,000 | (6) | | 105,469 | (11) | | 0 | | | 227,469 |

Frederick C. Yeager | | 122,000 | | | 105,469 | (12) | | 0 | | | 227,469 |

| (1) | Consists of all fees earned by each non-employee director for his or her services to us during 2008. |

| (2) | Consists of compensation cost recognized in our financial statements for 2008 with respect to awards granted in 2008 and prior fiscal years under Financial Accounting Standards Board Statement of Financial Accounting Standards No. 123 (revised 2004),Share-Based Payment (“FAS 123R”), excluding the effect of estimated forfeitures related to service-based vesting conditions. SeeNotes to Consolidated Financial Statements, Note 2-Summary of Significant Accounting Policies Share-Based Compensation Expense andNote 8-Long-Term Equity Compensationof our 2008 Form 10-K for a description of the valuation used in determining this amount. |

| (3) | During 2008, Mr. Craver received an option grant of 11,600 shares of our Common Stock on May 9, 2008, with an aggregate grant date fair market value of $122,058. SeeNotes to Consolidated Financial Statements, Note 8-Long-Term Equity Compensation of our 2008 Form 10-K for a discussion of the assumptions used in determining grant date fair market value. As of December 31, 2008, Mr. Craver held 42,627 options to acquire shares of our Common Stock, 23,527 of which were exercisable. |

| (4) | During 2008, Ms. Escarra received an option grant of 11,600 shares of our Common Stock on May 9, 2008, with an aggregate grant date fair market value of $122,058. SeeNotes to Consolidated Financial Statements, Note 8-Long-Term Equity Compensation of our 2008 Form 10-K for a discussion of the assumptions used in determining grant date fair market value. As of December 31, 2008, Ms. Escarra held 24,813 options to acquire shares of our Common Stock, 6,905 of which were exercisable. |

| (5) | During 2008, Mr. Farley received an option grant of 11,600 shares of our Common Stock on May 9, 2008, with an aggregate grant date fair market value of $122,058. See Notes to Consolidated Financial Statements, Note 8-Long-Term Equity Compensation of our 2008 Form 10-K for a discussion of the assumptions used in determining grant date fair market value. As of December 31, 2008, Mr. Farley held 51,600 options to acquire shares of our Common Stock, 32,500 of which were exercisable. |

| (6) | The amount shown was deferred under the non-employee director deferred compensation plan. |

| (7) | During 2008, Ms. Fitzgerald received an option grant of 11,600 shares of our Common Stock on May 9, 2008, with an aggregate grant date fair market value of $122,058. SeeNotes to Consolidated Financial Statements, Note 8-Long-Term Equity Compensation of our 2008 Form 10-K for a discussion of the assumptions used in determining grant date fair market value. As of December 31, 2008, Ms. Fitzgerald held 65,395 options to acquire shares of our Common Stock, 46,295 of which were exercisable. |

| (8) | During 2008, Mr. Foley received an option grant of 11,600 shares of our Common Stock on May 9, 2008, with an aggregate grant date fair market value of $122,058. See Notes to Consolidated FinancialStatements, Note 8-Long-Term Equity Compensation of our 2008 Form 10-K for a discussion of the assumptions used in determining grant date fair market value. As of December 31, 2008, Mr. Foley held 81,600 options to acquire shares of our Common Stock, 62,500 of which were exercisable. |

18