|

Filed by Health Net, Inc. Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Health Net, Inc. Commission File No. 1-12718 Posted on Company website on September 22, 2015

|

Health Net, Inc. Q2 2015 Investor Presentation 8/4/15

|

|

Cautionary Statements FORWARD LOOKING STATEMENTS This material may contain certain forward-looking statements with respect to the financial condition, results of operations and business of Centene, Health Net and the combined businesses of Centene and Health Net and certain plans and objectives of Centene and Health Net with respect thereto, including the expected benefits of the proposed merger. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements often use words such as “anticipate”, “target”, “expect”, “estimate”, “intend”, “plan”, “goal”, “believe”, “hope”, “aim”, “continue”, “will”, “may”, “would”, “could” or “should” or other words of similar meaning or the negative thereof. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in forward-looking statements. Such factors include, but are not limited to, the expected closing date of the transaction; the possibility that the expected synergies and value creation from the proposed merger will not be realized, or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the merger making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred; changes in economic conditions, political conditions, changes in federal or state laws or regulations, including the Patient Protection and Affordable Care Act and the Health Care Education Affordability Reconciliation Act and any regulations enacted thereunder, provider and state contract changes, the outcome of pending legal or regulatory proceedings, reduction in provider payments by governmental payors, the expiration of Centene’s or Health Net’s Medicare or Medicaid managed care contracts by federal or state governments and tax matters; the possibility that the merger does not close, including, but not limited to, due to the failure to satisfy the closing conditions, including the receipt of approval of both Centene’s stockholders and Health Net’s stockholders; the risk that financing for the transaction may not be available on favorable terms; and risks and uncertainties discussed in the reports that Centene and Health Net have filed with the Securities and Exchange Commission (the “SEC”). These forward-looking statements reflect Centene’s and Health Net’s current views with respect to future events and are based on numerous assumptions and assessments made by Centene and Health Net in light of their experience and perception of historical trends, current conditions, business strategies, operating environments, future developments and other factors they believe appropriate. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. The factors described in the context of such forward-looking statements in this announcement could cause Centene’s and Health Net’s plans with respect to the proposed merger, actual results, performance or achievements, industry results and developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct and persons reading this presentation are therefore cautioned not to place undue reliance on these forward-looking statements which speak only as of the date of this presentation. Neither Centene nor Health Net assumes any obligation to update the information contained in this presentation (whether as a result of new information, future events or otherwise), except as required by applicable law. These risks, as well as other risks associated with the merger, are more fully discussed in Health Net and Centene’s definitive joint proxy statement/prospectus filed with the SEC on September 21, 2015 in connection with the merger. A further list and description of risks and uncertainties can be found in Centene’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its reports on Form 10-Q and Form 8-K as well as in Health Net’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its reports on Form 10-Q and Form8-K.

|

|

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The proposed merger transaction involving Centene and Health Net will be submitted to the respective stockholders of Centene and Health Net for their consideration. In connection with the proposed merger, Centene prepared a registration statement on Form S-4 that included a definitive joint proxy statement/prospectus for the stockholders of Centene and Health Net filed with the SEC on September 21, 2015, which will be mailed to each of the respective stockholders of Centene and Health Net. Each of Centene and Health Net will also file certain other documents regarding the merger with the SEC. Centene and Health Net urge investors and stockholders to read the definitive joint proxy statement/prospectus, as well as other documents filed with the SEC, because they will contain important information. Investors and security holders may receive the registration statement containing the joint proxy statement/prospectus and other documents free of charge at the SEC’s web site, www.sec.gov. These documents can also be obtained (when they are available) free of charge from Centene upon written request to the Investor Relations Department, Centene Plaza, 7700 Forsyth Blvd., St. Louis, MO 63105, (314) 725-4477, or from Centene’s website, www.centene.com/investors/, or from Health Net upon written request to the Investor Relations Department, Health Net, Inc., 21650 Oxnard Street, Woodland Hills, CA 91367, (800) 291-6911, or from Health Net’s website, www.healthnet.com/InvestorRelations.

PARTICIPANTS IN SOLICITATION

Centene, Health Net and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the respective stockholders of Centene and Health Net in favor of the merger. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective stockholders of Centene and Health Net in connection with the proposed merger is set forth in the definitive joint proxy statement/prospectus filed with the SEC. You can find information about Centene’s executive officers and directors in its definitive proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2015. You can find information about Health Net’s executive officers and directors in its definitive proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2015. You can obtain free copies of these documents from Centene and Health Net using the contact information above.

NO OFFER OR SOLICITATION

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

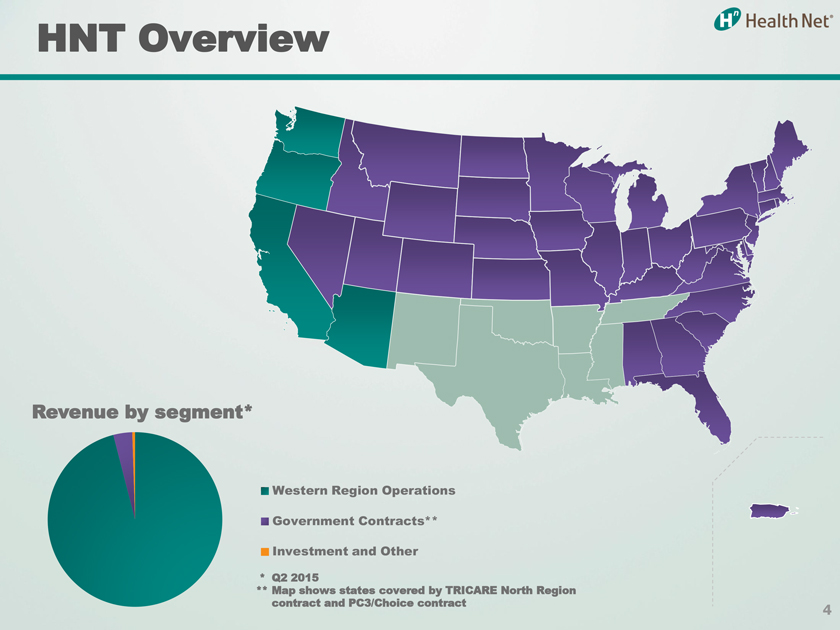

HNT Overview Revenue by segment* Western Region Operations Government Contracts**

Investment and Other * Q2 2015 ** Map shows states covered by TRICARE North Region contract and PC3/Choice contract 4

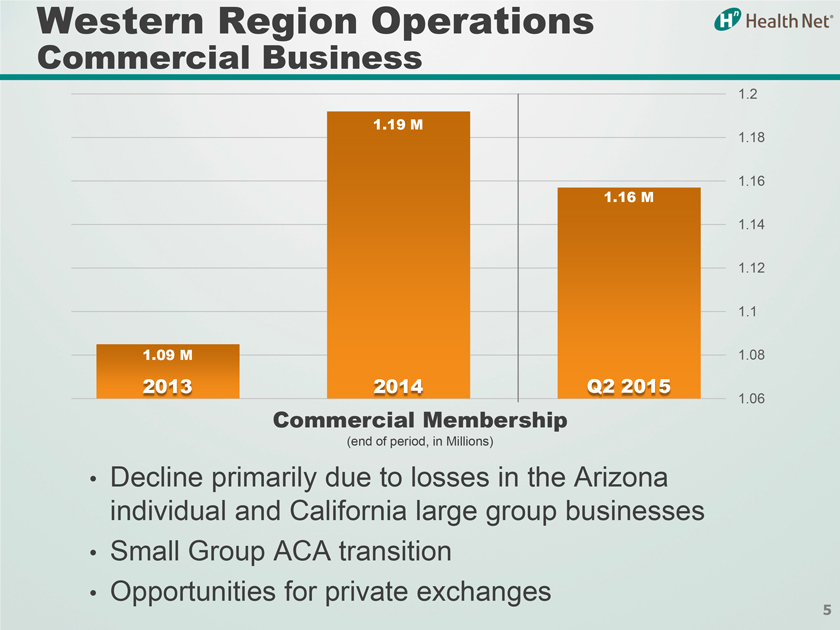

Western Region Operations Commercial Business

| | • | | Decline primarily due to losses in the Arizona individual and California large group businesses |

| | • | | Small Group ACA transition |

| | • | | Opportunities for private exchanges |

1.06 1.08 1.1 1.12 1.14

1.16 1.18 1.2

2013 2014 Q2 2015 1.16 M 1.19 M

1.09 M Commercial Membership (end of period, in Millions) 5

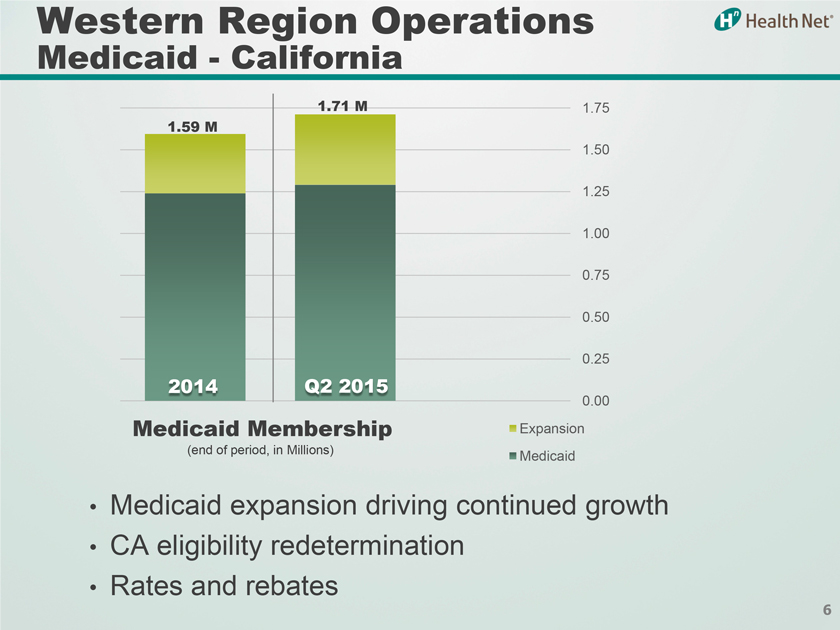

0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 Expansion

Medicaid Western Region Operations Medicaid—California

| | • | | Medicaid expansion driving continued growth |

| | • | | CA eligibility redetermination |

2014

Q2 2015 1.59 M 1.71 M Medicaid Membership (end of period, in Millions) 6

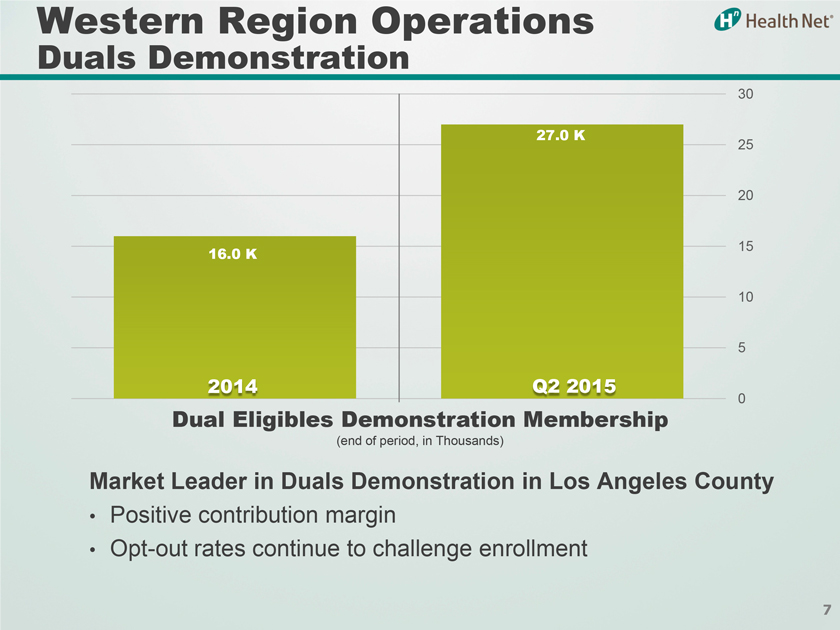

Western Region Operations Duals Demonstration Market Leader in Duals Demonstration in Los Angeles County

| | • | | Positive contribution margin |

| | • | | Opt-out rates continue to challenge enrollment |

0 5 10 15 20 25 30 2014 Q2 2015

16.0 K 27.0 K Dual Eligibles Demonstration Membership (end of period, in Thousands) 7

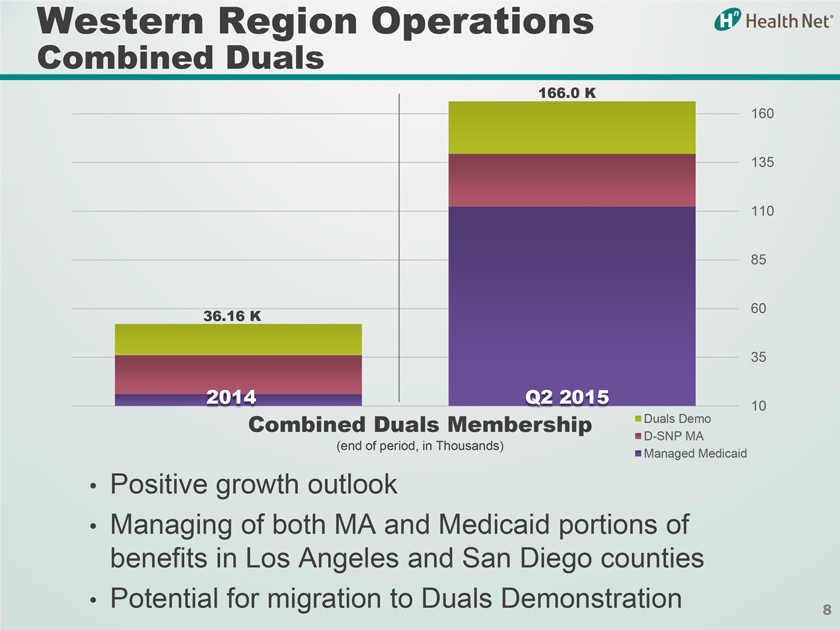

Western Region Operations Combined Duals

| | • | | Positive growth outlook |

| | • | | Managing of both MA and Medicaid portions of benefits in Los Angeles and San Diego counties |

| | • | | Potential for migration to Duals Demonstration |

10 35 60 85 110 135 160 Duals Demo D-SNP MA Managed Medicaid

2014 Q2 2015 166.0 K 36.16 K Combined Duals Membership (end of period, in Thousands) 8

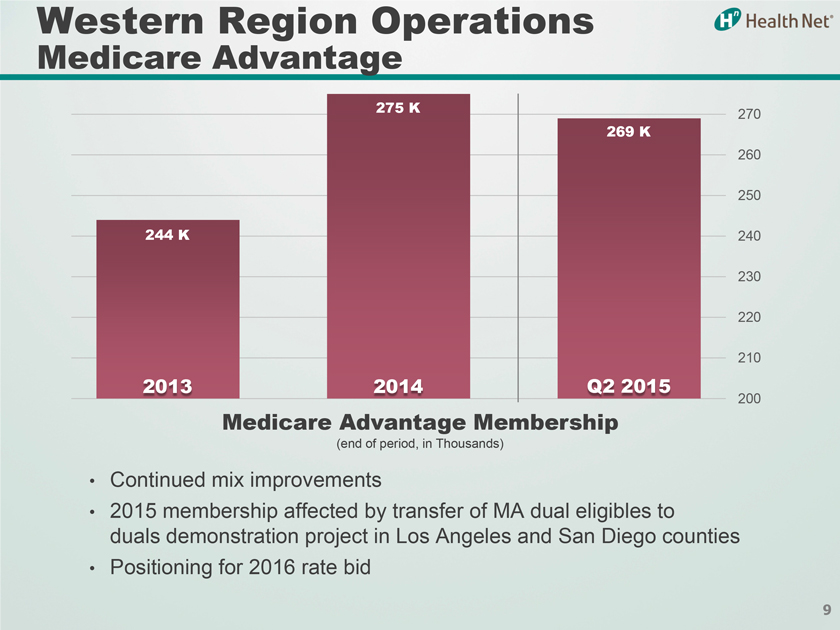

Western Region Operations Medicare Advantage

| | • | | Continued mix improvements |

| | • | | 2015 membership affected by transfer of MA dual eligibles to duals demonstration project in Los Angeles and San Diego counties |

| | • | | Positioning for 2016 rate bid |

200 210 220 230 240 250 260 270

2013 2014 Q2 2015 269 K 275 K 244 K Medicare Advantage Membership (end of period, in Thousands) 9

360 Degree Solutions 10

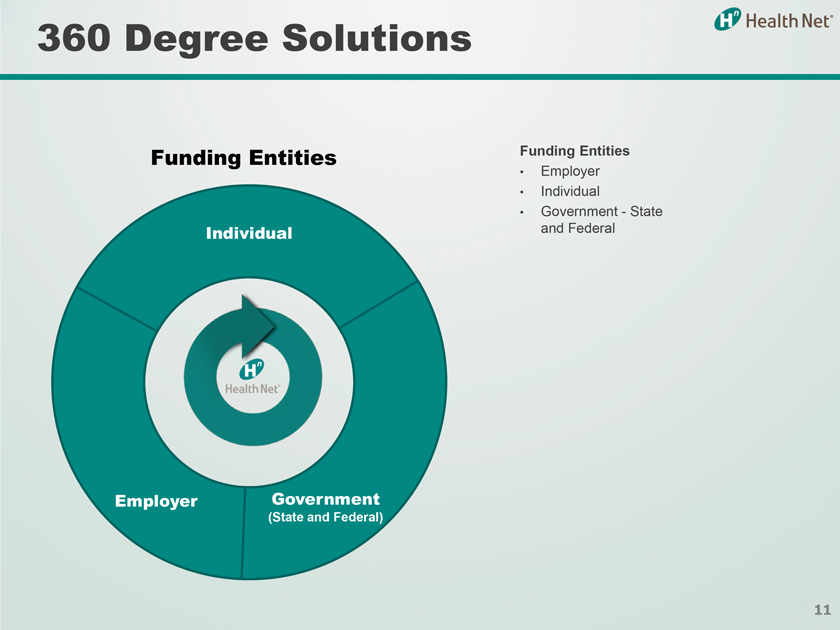

360 Degree Solutions Employer Individual Government (State and Federal) Funding Entities

Funding Entities

| | • | | Government—State and Federal |

11

Medicaid Duals 360 Degree Solutions Commercial Product Mix Medicare Š Funding Entities Š Employer Š Individual Š Government—State and Federal Product Mix Š Commercial Š Medicaid Š Medicare Š Duals 12

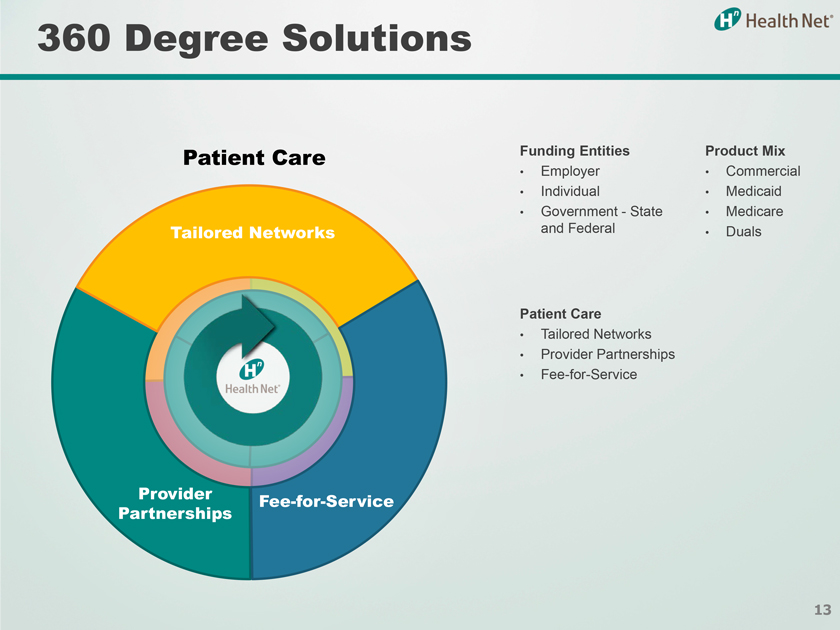

360 Degree Solutions Patient Care Tailored Networks Provider Partnerships Fee-for-Service Funding Entities Š Employer Š Individual Š Government—State and Federal Product Mix Š Commercial Š Medicaid Š Medicare Š Duals Patient Care Š Tailored Networks Š Provider Partnerships Š Fee-for-Service 13

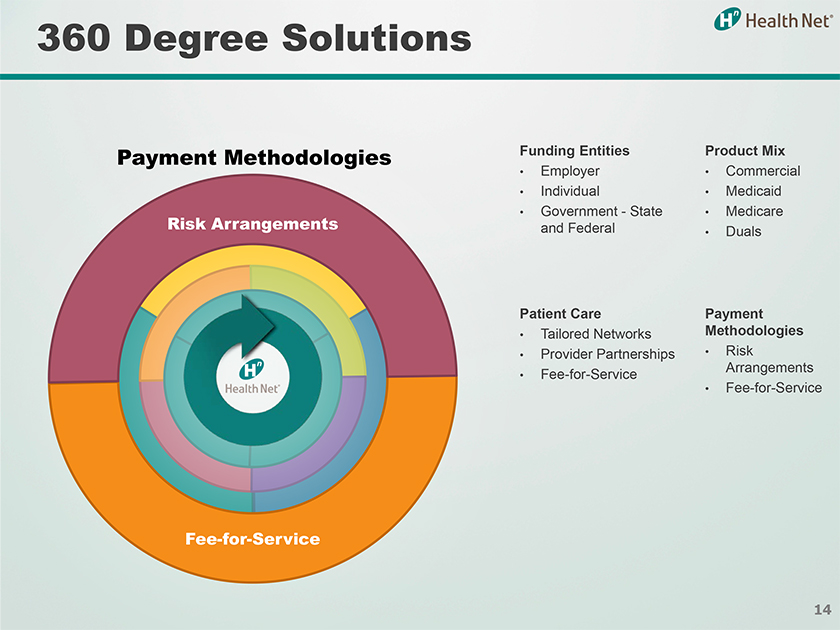

360 Degree Solutions Payment Methodologies Funding Entities Š Employer Š Individual Š Government—State and Federal Product Mix Š Commercial Š Medicaid Š Medicare Š Duals Patient Care Š Tailored Networks Š Provider Partnerships Š Fee-for-Service Payment Methodologies Š Risk Arrangements Š Fee-for-Service Š Risk Arrangements Š Fee-for-Service 14

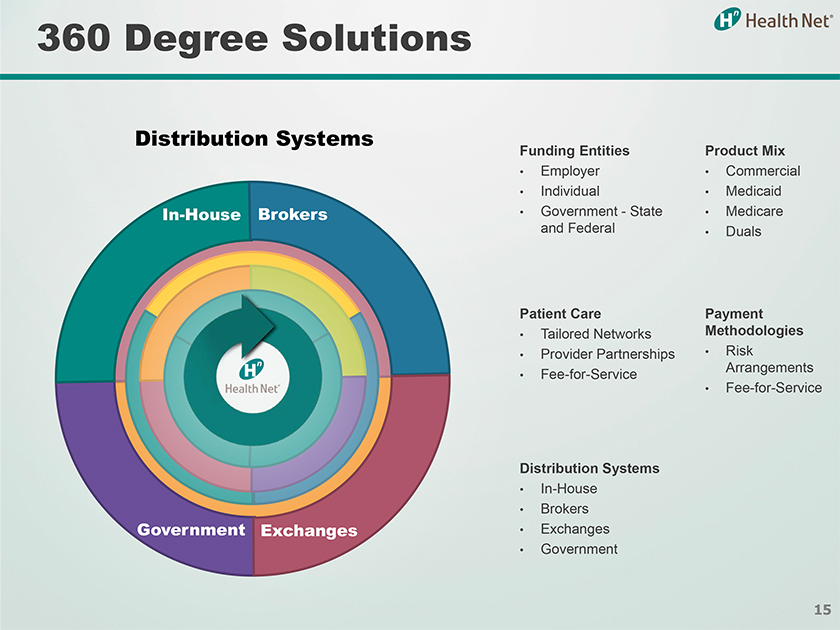

360 Degree Solutions Distribution Systems

Funding Entities Š Employer Š Individual Š Government—State and Federal Product Mix Š Commercial Š Medicaid Š Medicare Š Duals Patient Care Š Tailored Networks Š Provider Partnerships Š Fee-for-Service Payment Methodologies Š Risk Arrangements Š Fee-for-Service Distribution Systems Š In-House Š Brokers Š Exchanges Š Government Brokers Government In-House Exchanges 15

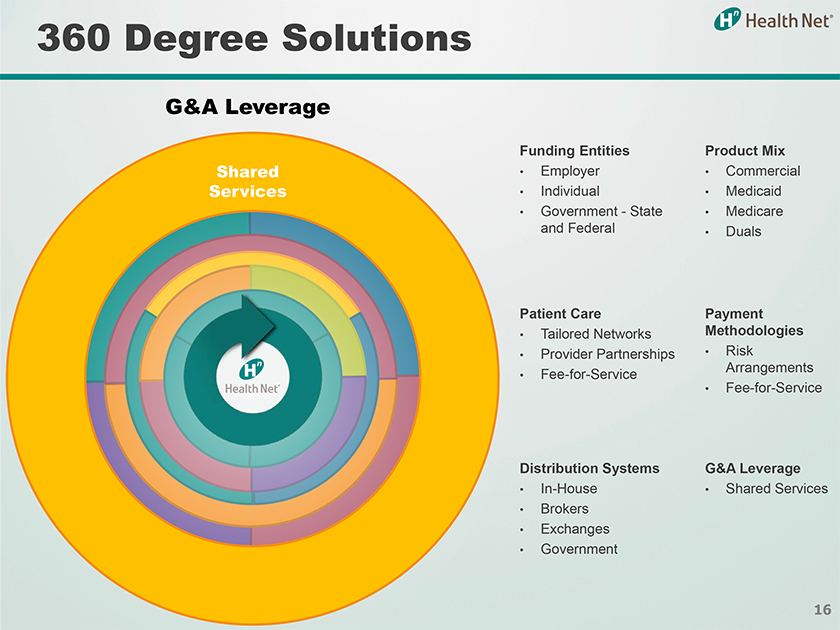

360 Degree Solutions Shared Services G&A Leverage Funding Entities Š Employer Š Individual Š Government—State and Federal Product Mix Š Commercial Š Medicaid Š Medicare Š Duals Patient Care Š Tailored Networks Š Provider Partnerships Š Fee-for-Service Payment Methodologies Š Risk Arrangements Š Fee-for-Service Distribution Systems Š In-House Š Brokers Š Exchanges Š Government G&A Leverage Š Shared Services 16

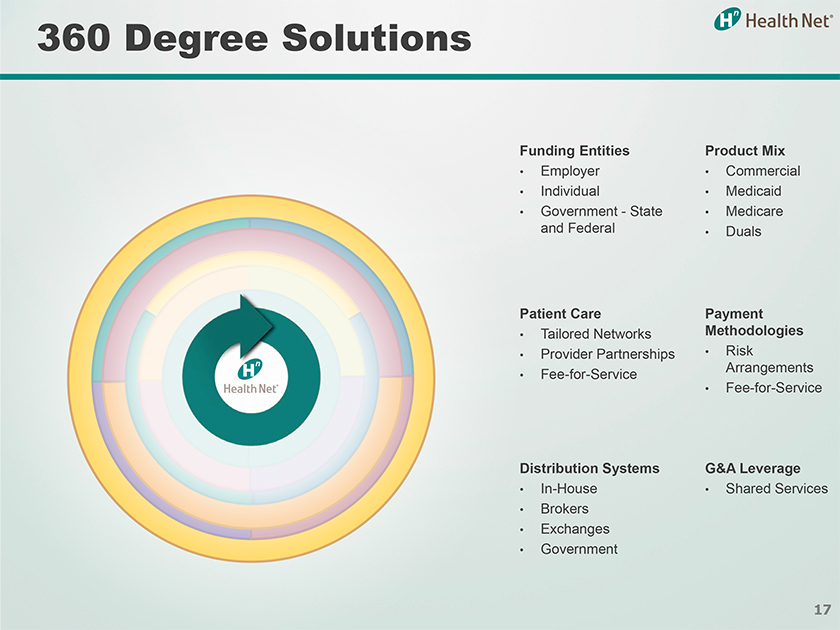

360 Degree Solutions Funding Entities Š Employer Š Individual Š Government—State and Federal Product Mix Š Commercial Š Medicaid Š Medicare Š Duals Patient Care Š Tailored Networks Š Provider Partnerships Š Fee-for-Service Payment Methodologies Š Risk Arrangements Š Fee-for-Service Distribution Systems Š In-House Š Brokers Š Exchanges Š Government G&A Leverage Š Shared Services 17

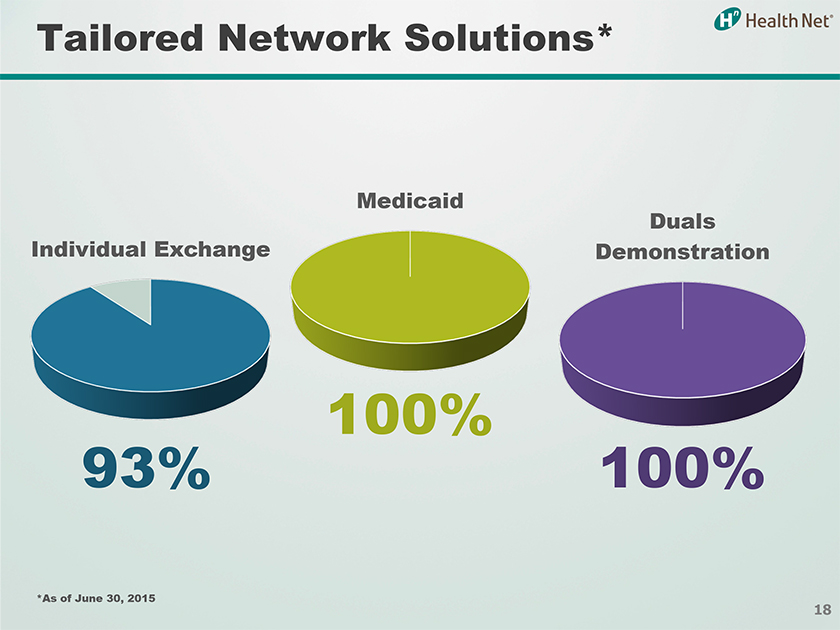

Tailored Network Solutions* Individual Exchange Medicaid Duals Demonstration 93% 100% 100% *As of June 30, 2015 18

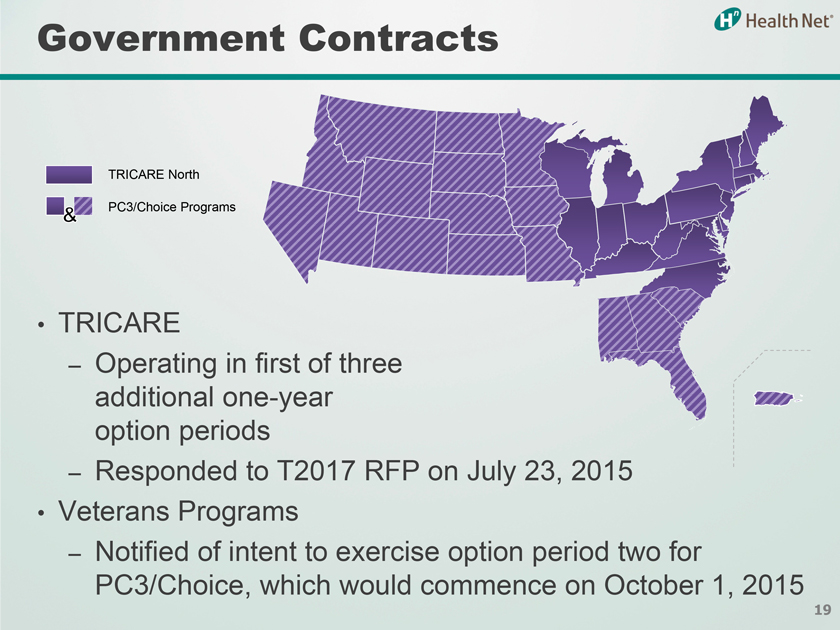

Government Contracts

–Operating in first of three additional one-year option periods

–Responded to T2017 RFP on July 23, 2015

–Notified of intent to exercise option period two for PC3/Choice, which would commence on October 1, 2015

TRICARE North PC3/Choice Programs 19

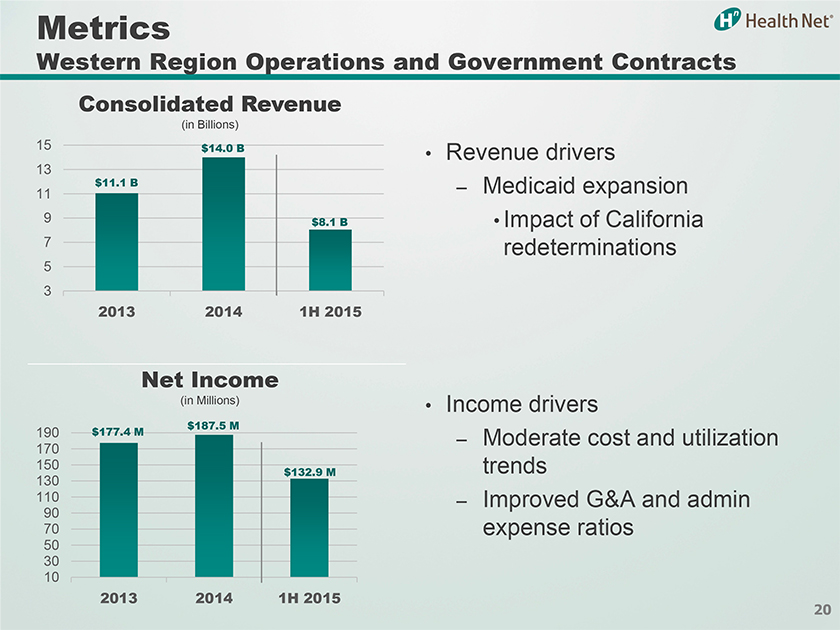

Metrics Western Region Operations and Government Contracts

–Medicaid expansion

| | • | | Impact of California redeterminations |

–Moderate cost and utilization trends

–Improved G&A and admin expense ratios

3 5 7 9 11 13

15

2013

2014 1H 2015 10 30 50 70 90 110 130

150

170

190

2013 2014 1H 2015 $11.1 B $14.0 B $8.1 B $177.4 M $187.5 M $132.9 M Consolidated Revenue (in Billions) Net Income (in Millions) 20

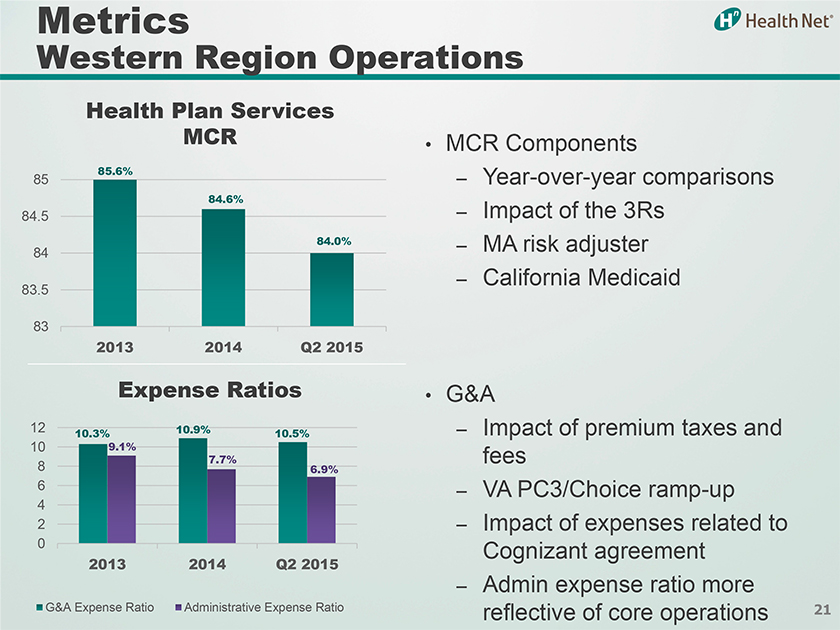

Metrics Western Region Operations 83 83.5 84 84.5 85 2013 2014 Q2 2015

0

2 4 6 8 10 12 2013 2014 Q2 2015 G&A Expense Ratio

Administrative Expense Ratio

–Year-over-year comparisons

–Impact of the 3Rs

–MA risk adjuster

–California Medicaid

–Impact of premium taxes and fees

–VA PC3/Choice ramp-up

–Impact of expenses related to Cognizant agreement

–Admin expense ratio more reflective of core operations

85.6% 84.6% 84.0%

10.5%

10.9% 10.3% 7.7% 6.9% 9.1% Health Plan Services MCR Expense Ratios 21

2015 Outlook

| | • | | Continued growth in Medicaid |

| | • | | Continued rightsizing of MA business |

| | • | | Cognizant efforts suspended |

| | • | | VA PC3/Choice operations ramp-up |

22

Recent Events

| | • | | Announced definitive merger agreement with Centene Corporation on July 2, 2015 |

–Centene to acquire all issued and outstanding shares of Health Net

–Subject to approval by Centene and Health Net shareholders and other customary closing conditions

–Transaction expected to close in early 2016

23

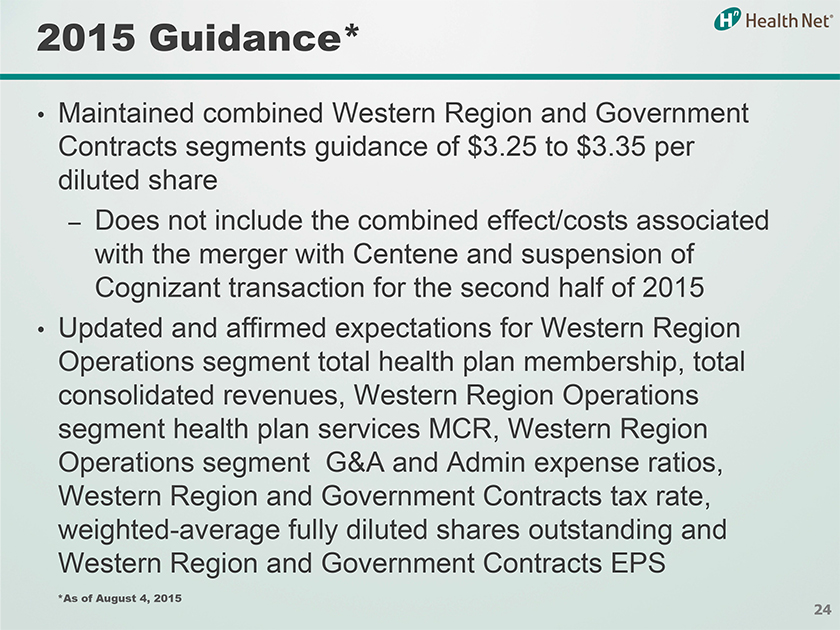

2015 Guidance*

| | • | | Maintained combined Western Region and Government Contracts segments guidance of $3.25 to $3.35 per diluted share |

–Does not include the combined effect/costs associated with the merger with Centene and suspension of Cognizant transaction for the second half of 2015

| | • | | Updated and affirmed expectations for Western Region Operations segment total health plan membership, total consolidated revenues, Western Region Operations segment health plan services MCR, Western Region Operations segment G&A and Admin expense ratios, Western Region and Government Contracts tax rate, weighted-average fully diluted shares outstanding and Western Region and Government Contracts EPS |

*As of August 4, 2015 24

Health Net, Inc. Q2 2015 Investor Presentation