Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | |

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2009 |

| OR |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

|

Commission file number: 1-12181-01

Protection One, Inc.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or Other Jurisdiction of

Incorporation or Organization) | | 93-1063818

(I.R.S. Employer Identification No.) |

1035 N. 3rd Street, Suite 101,

Lawrence, KS

(Address of Principal Executive Offices) |

|

66044

(Zip Code) |

785-856-5500

(Registrant's Telephone Number, Including Area Code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

|---|

| Common Stock, par value $.01 per share, of Protection One, Inc. | | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yeso Noý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yeso Noý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesý Noo

Indicate by check mark whether each registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yeso Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a smaller

reporting company) | | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yeso Noý

As of June 30, 2009, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was $31,226,063 based on the closing sale price as reported on the NASDAQ Global Market.

The number of outstanding shares of the registrant's common stock, $0.01 par value per share, as of March 5, 2010 was 25,333,371.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

| Document | | Parts Into Which Incorporated |

|---|

| Information Statement for the Annual Meeting of Stockholders to be held on or before July 25, 2010 (Information Statement) | | Part I, II, III and IV |

Table of Contents

TABLE OF CONTENTS

| | | | |

| |

| | Page |

|---|

| | PART I | | |

Item 1. | | Business | |

5 |

Item 1A. | | Risk Factors | | 13 |

Item 1B. | | Unresolved Staff Comments | | 20 |

Item 2. | | Properties | | 20 |

Item 3. | | Legal Proceedings | | 20 |

| | PART II | | |

Item 5. | | Market for Registrant's Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities | | 21 |

Item 6. | | Selected Financial Data | | 23 |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 25 |

Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 51 |

Item 8. | | Financial Statements and Supplementary Data | | 52 |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 94 |

Item 9A. | | Controls and Procedures | | 94 |

Item 9B. | | Other Information | | 96 |

| | PART III | | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | 97 |

Item 11. | | Executive Compensation | | 97 |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 97 |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 97 |

Item 14. | | Principal Accounting Fees and Services | | 97 |

| | PART IV | | |

Item 15. | | Exhibits, Financial Statement Schedules | | 98 |

2

Table of Contents

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the materials incorporated by reference herein include "forward-looking statements" intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Statements that are not historical fact are forward-looking statements. These forward-looking statements generally can be identified by, among other things, the use of forward-looking language such as the words "estimate," "project," "intend," "believe," "expect," "anticipate," "may," "will," "would," "should," "could," "seeks," "plans," "intends," or other words of similar import or their negatives. Such statements include those made on matters such as our earnings and financial condition, our process to explore strategic alternatives, litigation, accounting matters, our business, our efforts to consolidate and reduce costs, our customer account acquisition strategy and attrition, our liquidity and sources of funding and our capital expenditures. All forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements included herein are made only as of the date of this report and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances, except as required by federal securities laws. Certain factors that could cause actual results to differ include:

- •

- our substantial indebtedness and restrictive covenants governing our indebtedness;

- •

- our history of losses;

- •

- a change in ownership of the company or other effects from the process to explore and evaluate strategic alternatives;

- •

- changes in technology that may make our services less attractive or obsolete or require significant expenditures to upgrade;

- •

- loss of a relationship with alarm system manufacturers, suppliers and third party service providers;

- •

- competition, including competition from companies that are larger than we are and have greater resources than we do;

- •

- the development of new services or service innovations by our competitors;

- •

- losses of our customers over time and difficulty acquiring new customers;

- •

- changes in federal, state or local government or other regulations or standards affecting our operations;

- •

- limited access to capital which may affect our ability to invest in the acquisition of new customers;

- •

- the potential for environmental or man-made catastrophes in areas of high customer concentration;

- •

- changes in conditions affecting the economy or security alarm monitoring service providers generally;

- •

- potential liability for failure to respond adequately to alarm activations; and

- •

- changes in management.

New factors emerge from time to time, and it is not possible for us to predict all of such factors or the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

See also Item 1A, "Risk Factors" for a discussion of these and other risks and uncertainties that could cause actual results to differ materially from those contained in our forward-looking statements.

3

Table of Contents

INTRODUCTION

Unless the context otherwise indicates, all references in this report to the "Company," "Protection One," "we," "us" or "our" or similar words are to Protection One, Inc. and its wholly owned subsidiaries. Protection One, Inc. is a Delaware corporation organized in September 1991.

Stockholders and other security holders or buyers of our securities or our other creditors should not assume that material events subsequent to the date of this Form 10-K have not occurred.

On January 20, 2010, we announced the commencement of a process to explore and evaluate strategic alternatives, including a possible sale of the Company. There can be no assurance that this review of strategic alternatives will result in us pursuing any transaction, or that any transaction pursued will be completed.

4

Table of Contents

ITEM 1. BUSINESS.

Overview

We are a leading national provider of electronic security alarm monitoring services, providing installation, maintenance and electronic monitoring of alarm systems to single-family residential, commercial, multifamily and wholesale customers. We monitor signals from burglary, fire, medical and environmental alarm systems and manage information from access control and closed-circuit-television ("CCTV") systems. Most of our monitoring services revenue and a large portion of the maintenance services we provide our customers are governed by multi-year contracts with automatic renewal provisions that provide us with recurring monthly revenue ("RMR"). As of December 31, 2009 we monitored approximately 1.4 million sites. Based on information provided by a leading industry publication, we are the third largest provider of electronic security monitoring services in the United States based on RMR.

We conduct our business through the following operating segments:

- •

- Retail. Our Retail segment provides monitoring and maintenance services for electronic security systems directly to residential and business customers. We also sell and install electronic security systems for homes and businesses through our Retail segment in order to meet their security needs. Our Retail business serves approximately 540,000 Retail customers with no single customer comprising more than 1% of our total consolidated revenue. Retail serves customers from 60 field locations and two centralized monitoring centers. Except for the customers acquired in our merger with Integrated Alarm Services Group, Inc. ("IASG") on April 2, 2007 (the "Merger"), the majority of our new Retail customers are generated organically through our internal sales force, with approximately 3.4% of our customer additions in 2009 acquired by purchase of customer contracts. Our Retail segment accounted for 80.2% of our RMR at December 31, 2009, of which 30.2% was attributable to commercial customers. Our Retail business accounted for 78.6% of our consolidated revenue for the year ended December 31, 2009.

- •

- Wholesale. We contract with independent security alarm dealers nationwide to provide alarm system monitoring services to their residential and business customers. We also provide business support services as well as financing assistance for these independent dealers by providing loans secured by alarm contracts and by purchasing alarm contracts. Our top 10 wholesale dealers, based on RMR, accounted for 28.7% of wholesale monitored sites and 13.0% of Wholesale RMR as of December 31, 2009. For the year ended December 31, 2009, our Wholesale business accounted for 13.6% of our consolidated revenue. Our Wholesale business serves approximately 4,600 independent alarm monitoring companies representing approximately 677,000 monitored sites.

- •

- Multifamily. We provide monitoring and maintenance services for electronic security systems to tenants of multifamily residences, including apartments, condominiums and other multifamily dwellings, under long-term contracts with building owners and managers. For the year ended December 31, 2009, our Multifamily segment accounted for 7.8% of our consolidated revenue. Our Multifamily segment serves approximately 213,000 units in more than 1,300 properties in 461 cities.

5

Table of Contents

Our RMR and our monitored sites composition at December 31, 2009, 2008 and 2007 were as follows:

| | | | | | | | | | | | | | | | | | | |

| | Percentage of Total | |

|---|

| | 2009 | | 2008 | | 2007 | |

|---|

Segment | | RMR | | Sites | | RMR | | Sites | | RMR | | Sites | |

|---|

Retail | | | 80.2 | % | | 37.8 | % | | 76.8 | % | | 31.8 | % | | 77.3 | % | | 34.5 | % |

Wholesale | | | 12.1 | | | 47.3 | | | 15.0 | | | 54.9 | | | 13.5 | | | 49.6 | |

Multifamily | | | 7.7 | | | 14.9 | | | 8.2 | | | 13.3 | | | 9.2 | | | 15.9 | |

| | | | | | | | | | | | | | |

Total | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | |

The table below identifies our consolidated revenue by segment for the periods presented (dollars in thousands):

| | | | | | | | | | | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2009 | | 2008 | | 2007 | |

|---|

Segment | | Revenue | | Percent | | Revenue | | Percent | | Revenue | | Percent | |

|---|

Retail | | $ | 289,315 | | | 78.6 | % | $ | 291,795 | | | 78.4 | % | $ | 277,490 | | | 79.8 | % |

Wholesale | | | 50,188 | | | 13.6 | | | 49,477 | | | 13.3 | | | 37,978 | | | 10.9 | |

Multifamily | | | 28,549 | | | 7.8 | | | 30,749 | | | 8.3 | | | 32,403 | | | 9.3 | |

| | | | | | | | | | | | | | |

Total | | $ | 368,052 | | | 100.0 | % | $ | 372,021 | | | 100.0 | % | $ | 347,871 | | | 100.0 | % |

| | | | | | | | | | | | | | |

Financial information for the past three years for each of our business segments is presented in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations" and in Note 16 of the Notes to Consolidated Financial Statements, included in Part II of this Annual Report on Form 10-K, and is incorporated herein by reference.

Sources of Revenue

Revenue is primarily generated from providing monitoring and maintenance services in our Retail, Wholesale and Multifamily segments. For the year ended December 31, 2009, revenue generated from monitoring and related services accounted for approximately 90% of our total revenue.

Monitoring revenue is generated based on our contracts with residential and commercial Retail, Wholesale and Multifamily customers. The initial contract term is typically three years for residential customers, five years for commercial customers and five to ten years, with an average of eight years, for Multifamily customers, with automatic renewal provisions where permitted. Our Wholesale customer contracts are generally month-to-month agreements. We generate incremental contractual recurring revenue from the majority of our residential and commercial customers by providing additional services, such as maintenance.

For the year ended December 31, 2009, installation and other revenue, derived principally from the sale of electronic security systems, contributed approximately 10% of our total revenue. Electronic security systems typically are sold at a loss in connection with generating new contracts for recurring monitoring services.

Industry and Competition

According to an industry publication and industry analysts, the market for electronic security system sales, leasing, installation, monitoring and service totaled an estimated $44.7 billion in 2009 with the monitoring and service market accounting for an estimated $16.3 billion. While total revenue for

6

Table of Contents

the industry was slightly lower in 2009 compared to 2008, monitoring and service revenue increased approximately 3%.

The industry is comprised of small and mid-sized regional participants, the vast majority of which generate annual revenue of less than $500,000. The top five companies, based on RMR, comprise approximately 36% of the industry's RMR. We believe our primary competitors with national scope include the following:

- •

- ADT Security Services, Inc., a subsidiary of Tyco International, Ltd:

- •

- Broadview Security, which is under agreement to be acquired by a subsidiary of Tyco International Ltd.;

- •

- Monitronics International, Inc.; and

- •

- Stanley Security Solutions, a subsidiary of The Stanley Works.

Competition in the security alarm industry is based primarily on brand awareness and company reputation, price, quality and reliability of services and systems, product solutions offered and the ability to identify and solicit prospective customers as they move into homes and businesses or experience major life events such as marriage or the birth of a child. We believe that we compete effectively with other national, regional and local security alarm companies in both the residential and commercial markets.

Centralized Monitoring, Customer Service and Enhanced Services

Intrusion and fire alarm systems include many different types of devices installed at customer premises designed to detect or react to various occurrences or conditions, such as intrusion, environmental issues like a water leakage or the presence of fire or smoke. These devices are connected to a computerized control panel that communicates through wire line and/or wireless communication channels to one of our monitoring facilities. In most systems, control panels can identify the nature of the alarm and the areas within the building where the sensor was activated and can transmit that information to one of our central monitoring stations.

Access control systems provide physical security for a customer facility. They do this by limiting access to areas through locks and door mechanisms that are controlled by a computer or web service. Customers may establish schedules when doors are unlocked or they may define access to individuals via uniquely identified cards. The cards are electronically validated at each door through an electronic card reader. By limiting, enabling or disabling each user's card through the central controller, access control systems replace the need to manage keys.

Video solutions provide customers with the ability to monitor remote locations via cameras. Video may be viewed live over a network, recorded on site or sent electronically upon a specified event. Video solutions may be coupled with alarm systems to provide verification of alarm conditions.

Web control and notification provides our customers an array of tools to manage their alarm, video or access control systems, including options for electronic notification.

Our existing Retail monitoring customer contracts generally have initial terms ranging from three to five years in duration, and, in most states, provide for automatic renewals unless we or the customer elect to cancel the contract at the end of its term. New single-family residential customers typically have an initial contract term of three years, and most new commercial customers typically have an initial contract term of five years. The majority of our Retail customers sign alarm monitoring contracts

7

Table of Contents

that include a bundled monthly charge for monitoring and extended service protection, which covers the costs of normal repairs of the security system. Customers may elect to sign an alarm monitoring contract providing for a reduced monthly charge that excludes extended service protection. A significant percentage of new residential and commercial customers also elect to include cellular backup technology for line security in their service bundle. Multifamily contracts have initial terms that range from five to ten years with an average of eight years. Our Wholesale customer contracts are generally month-to-month contracts.

We provide monitoring services to our customer base from several monitoring facilities. The table below provides additional detail about our monitoring facilities:

| | | | | |

Location | | Approximate Number of

Customer Sites Monitored | | Primary Markets |

|---|

| Irving, TX | | | 298,000 | | Retail and Multifamily |

Longwood, FL |

|

|

237,000 |

|

Wholesale |

Wichita, KS |

|

|

456,000 |

|

Retail |

Cypress, CA |

|

|

203,000 |

|

Wholesale |

Manasquan, NJ |

|

|

237,000 |

|

Wholesale |

Our monitoring facilities operate 24 hours per day, seven days a week, including all holidays. Each monitoring facility incorporates the use of communications and computer systems that route incoming alarm signals and telephone calls to operators. Each operator within a monitoring facility monitors a computer screen that presents information concerning the nature of the alarm signal, the customer whose alarm has been activated and the premises at which such alarm is located. Other non-emergency administrative signals are generated by low battery status, arming and disarming of the alarm monitoring system and test signals, with such signals processed automatically by computer. Depending upon the type of service for which the customer has contracted, monitoring facility personnel respond to alarms by relaying information to local fire or police departments, notifying the customer, or taking other appropriate action, such as dispatching alarm response personnel to the customer premises where this service is available. In advanced video solutions, operators may be presented with a video clip associated with the alarm condition, further enhancing the response capabilities. Customers may also contract for remote video monitoring whereby operators will be prompted on a specified schedule to view live video of customer locations and respond upon abnormal conditions.

All of our monitoring facilities are listed by Underwriters Laboratories, Inc. ("UL") as protective signaling services stations. UL specifications for monitoring facilities include building integrity, back-up computer and power systems, staffing and standard operating procedures. In many jurisdictions, applicable law requires the security and life safety alarms for certain buildings be monitored by UL listed facilities. In addition, such listing is required by certain commercial customers' insurance companies as a condition to insurance coverage.

Our Retail backup facility in Wichita, Kansas is a fully operable resource with the ability to backup all mission critical operations normally performed at our primary Retail monitoring centers. The facility is equipped with diverse voice and data telecommunication paths, backup power that includes standby uninterruptible power supplies, access control, video surveillance and data vaults. In addition, we have deployed hot redundancy for our entire complement of equipment essential in the remote monitoring

8

Table of Contents

of the Retail security systems we offer. Furthermore, we have replicated the computer systems that are used to maintain our mission critical applications.

Each of our primary Wholesale monitoring facilities operates independently from our Retail and Multifamily facilities. Through our Wholesale monitoring facilities, we provide wholesale monitoring services to independent alarm companies. Under the typical arrangement, alarm companies subcontract monitoring services to us, primarily because they cannot cost-effectively provide their own monitoring service. We may also provide billing and other services. These independent alarm companies retain ownership of the monitoring contracts and are responsible for every other aspect of the relationship with customers, including field repair service. We have recently created one integrated network among our Wholesale monitoring centers that we believe will enable us to deliver a higher level of customer care while improving our efficiency. Our Wholesale monitoring centers are supported by redundant application databases in each location.

Customer care personnel answer non-emergency telephone calls typically regarding services, billing and alarm activation issues. Customer care functions for our Retail customers are handled primarily by representatives in our monitoring facilities.

Customer care personnel assist customers in understanding and resolving minor service and operating issues related to security systems and also schedule technician appointments. We also operate a dedicated telesales center to address questions that Retail customers or potential customers have about our services.

We currently maintain approximately 60 field locations in the United States from which we provide some or all of the following services in our Retail and Multifamily segments: security system installation, field repair, alarm response and sales services. Our nationwide network of branches operates in some of the largest cities in the United States and plays a critical role in enhancing customer satisfaction, reducing customer loss and building brand awareness. Repair services generate revenue primarily through billable field service calls and recurring payments under our extended service protection program. By focusing growth in targeted areas, we hope to increase the density of our customer base, to permit more effective scheduling and routing of field service technicians and create economies of scale.

We offer alarm monitoring and administrative services to dealers, such as billing and collection, as well as new and emerging products and services. We also provide dealers with access to technical sophistication and back office services that they may not otherwise have (or be able to profitably operate), while allowing them to maintain visible contact with their local customers, the end-users of the alarm.

We provide financing to security alarm dealers in the form of loans or alarm monitoring contract purchases. We structure the payment terms and pricing of both our alarm monitoring contract purchases and loans to provide us with an acceptable internal rate of return. When providing financing to dealers, we obtain a security interest in the underlying alarm monitoring contracts. We generally require that dealers use us to monitor all of their alarm monitoring contracts, not just those that have been acquired or financed. This monitoring requirement enables us to control the quality of the monitoring services and reduce the risk of loan default.

9

Table of Contents

As a means of increasing revenue and enhancing customer satisfaction, we offer Retail and Wholesale customers an array of enhanced security services discussed below. These services position us as a full service provider and give our sales representatives more features to sell in their solicitation of new customers.

- •

- Web Control and Notification provides our customers an array of tools to manage their alarm, video or access control systems, including options for electronic notification.

- •

- Extended Service Protection covers the costs of normal repairs of the security system for our residential and business customers.

- •

- Supervised Monitoring Service allows the alarm system to send various types of signals containing information on the use of the system, such as which users armed or disarmed the system and at what time of day. This information is supplied to customers for use in connection with the management of their households or businesses. Supervised monitoring service can also include a daily automatic test feature.

- •

- Wireless Back-Up permits the alarm system to send signals over a cellular telephone or dedicated radio system in the event that regular telephone service is interrupted.

- •

- Video Verification and Management allows remote activity verification at customer sites via live or recorded video. This capability is often used to verify alarm events or to provide a reliable and economic alternative to private security services.

- •

- Inspection Service, within our Retail segment, provides our customers with periodic verification of their fire alarm system to ensure the system is functioning as designed and in accordance with the requirements of the local fire jurisdiction.

Sales and Marketing

Our Retail, Wholesale and Multifamily segments market our services to these customer segments through limited, but separate internal sales and installation branch networks. Our current customer acquisition strategy for our Retail segment relies primarily on internally generated sales, utilizing personnel in our existing branch infrastructure. The internal sales program for our Retail segment generated $1.8 million of new Retail RMR in 2009 and $2.3 million of new Retail RMR in each of 2008 and 2007. We operate a dedicated telesales center from which we respond to questions that customers or potential customers have about our services and provide quality control follow-up calls to customers for whom we recently provided installation or maintenance services. In late 2009 we created an internal sales group to sell systems and services over the phone. We plan to continue to analyze opportunities for alliance partnerships which benefit our Retail segment.

Our integrated marketing program focuses on awareness for the Protection One® brand name nationally and generation of new lead sources and opportunities. We reach out to targeted customers, both residential and commercial, through a variety of mediums in a planned and sequenced manner. These channels include, but are not limited to, on-line programs and placements, third-party purchases and outbound calling and traditional mass communications, such as radio, print and direct mail.

Leads resulting from these activities are directed to our internal sales representatives and branch-based Retail sales professionals for closing sales of monitoring systems and services. The sales force also generates revenue from selling equipment upgrades and add-ons to existing customers and by competing for those customers who are terminating their relationships with our competitors.

Our Wholesale segment employs a salaried and commissioned sales force that is geographically distributed throughout the United States and is responsible for identifying sales opportunities. This

10

Table of Contents

sales force is supported by an internal sales and marketing team that tracks prospects and coordinates selling efforts. We also employ financial product specialists who assist the sales force in identifying and proposing financing alternatives and billing services and account managers who provide ongoing operational support to our Wholesale customers.

Our Multifamily segment sales force has reduced its focus on developing new multi-dwelling unit customers and plans to maintain a lower level of investment in sales expense and in new customer systems until economic conditions become more favorable. In 2009 and 2008, Multifamily made other related operating cost reductions to keep costs in line with revenue. Multifamily remains focused on serving the needs of its existing customer base.

We continually evaluate our customer creation and marketing strategy, including evaluating each respective channel for economic returns, volume and other factors and may shift our strategy or focus, including the elimination of a particular channel.

Attrition

See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Attrition," which is incorporated herein by reference, for more information regarding attrition calculations, the impact of attrition on our operating results and customer attrition by business segment.

Intellectual Property

We own trademarks related to the name and logo for Protection One, Network Multifamily Security, King Central and Criticom Monitoring Services, as well as a variety of trade and service marks related to individual services we provide. While we believe our trademarks, service marks and proprietary information are important to our business, we do not believe our inability to use any one of them, other than the trademarks we own in our name and logo, would have a material adverse effect on our business as a whole.

Regulatory Matters

A number of local governmental authorities have adopted or are considering various measures aimed at reducing the number of false alarms. See Item 1A, "Risk Factors," for additional information. Such measures include:

- •

- requiring permits for individual alarm systems and the revocation of such permits following a specified number of false alarms;

- •

- imposing fines on alarm customers or alarm monitoring companies for false alarms;

- •

- imposing limitations on the number of times the police will respond to alarms at a particular location after a specified number of false alarms;

- •

- requiring further verification of an alarm signal before the police will respond; and

- •

- imposing fines or penalties on alarm monitoring companies for transmitting false alarms.

Our operations are subject to a variety of other laws, regulations, and licensing requirements of federal, state and local authorities. In certain jurisdictions, we are required to obtain licenses or permits, to comply with standards governing employee selection and training, and to meet certain standards in the conduct of our business.

11

Table of Contents

The alarm industry is also subject to requirements imposed by various insurance, approval, listing and standards organizations. Depending upon the type of customer served, the type of security service provided, and the requirements of applicable local governmental jurisdiction, adherence to the requirements and standards of such organizations is mandatory in some instances and voluntary in others.

Our advertising and sales practices are regulated in the United States by both the Federal Trade Commission and state consumer protection laws. In addition, certain administrative requirements and laws of the jurisdictions in which we operate also regulate such practices. Such laws and regulations include restrictions on the manner in which we promote the sale of our security alarm systems and the obligation to provide purchasers of our alarm systems with rescission rights.

Our alarm monitoring business utilizes wire line and wireless telephone lines, radio frequencies, and broadband data circuits to transmit alarm signals. The cost of telephone lines and the type of equipment which may be used in telephone line transmissions are currently regulated by both federal and state governments. The Federal Communications Commission and state public utilities commissions regulate the operation and utilization of radio frequencies.

Risk Management

The nature of the services we provide potentially exposes us to greater risks of liability for employee acts or omissions, or system failure, than may be inherent in other businesses. Substantially all of our alarm monitoring agreements and other agreements, pursuant to which we sell our products and services, contain provisions limiting liability to customers in an attempt to reduce this risk.

We carry insurance of various types, including general liability and professional liability insurance in amounts management considers adequate and customary for our industry and business. Our loss experience, and the loss experiences of other security service companies, may affect the availability and cost of such insurance. Some of our insurance policies, and the laws of some states, may limit or prohibit insurance coverage for punitive or certain other types of damages, or liability arising from gross negligence.

Employees

At December 31, 2009 we had approximately 2,600 full and part time employees. Our workforce is not unionized. We generally consider our relationship with our employees to be good.

Code of Ethics

We have adopted a code of ethics that applies to all employees, including executive officers and senior financial and accounting employees. It is our policy to comply strictly with the letter and spirit of all laws affecting our business and the conduct of our officers, directors and employees in business matters. We make available the code of ethics, free of charge, on our website atwww.protectionone.com and by responding to requests addressed to our investor relations department. The investor relations department can be contacted by mail at Protection One, Inc., Attn: Investor Relations, 1035 N. 3rd Street, Suite 101, Lawrence, KS 66044 or by calling (785) 856-9368.

Access to Company Information

We electronically file our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the Securities and Exchange Commission ("SEC"). The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically.

12

Table of Contents

We make available, free of charge, through our website atwww.protectionone.com, and by responding to requests addressed to our investor relations department, our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We also make available through our website other important information and news about Protection One and provide users with an opportunity to register to receive automatic, electronic delivery of Protection One news alerts. The information contained on our website is not part of this document.

ITEM 1A. RISK FACTORS

You should read the following risk factors in conjunction with discussions of factors discussed elsewhere in this and other of our filings with the SEC. These cautionary statements are intended to highlight certain factors that may affect our financial condition and results of operations and are not meant to be an exhaustive discussion of risks that apply to public companies with broad operations, such as us.

We have a substantial amount of indebtedness, which could have a material adverse effect on our financial condition and our ability to obtain financing in the future or to react to changes in our business.

We have, and will continue to have, a substantial amount of indebtedness, which requires significant principal and interest payments. As of December 31, 2009, the face value of our total indebtedness, including capital leases, was approximately $447.3 million, and our cash interest expense for the year ended December 31, 2009 was $47.0 million. Our level of indebtedness could limit our ability to operate our business and impair our competitive position. For example, it could:

- •

- limit our ability to obtain debt or equity financing to fund working capital, capital expenditures, acquisitions and debt service requirements;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and future business opportunities;

- •

- make us more vulnerable to a downturn in our business or in the economy or to an increase in interest rates;

- •

- place us at a disadvantage to some of our competitors that may be less highly leveraged than us; and

- •

- require a substantial portion of our cash flow from operations to be used for debt service, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes.

One or a combination of these factors could adversely affect our financial condition. Subject to restrictions in the agreements governing our indebtedness, we may incur additional indebtedness which could increase the risks associated with our already substantial amount of indebtedness.

Restrictive covenants restrict our ability to operate our business and to pursue our business strategies, and our failure to comply with these covenants could result in an acceleration of our indebtedness.

The credit agreement governing our senior credit facility (as amended, the "Senior Credit Agreement") and the credit agreement governing our unsecured term loan facility ("Unsecured Term Loan Agreement") contain covenants that restrict our ability to finance future operations or capital needs, to respond to changing business and economic conditions or to engage in other transactions or business activities that may be important to our growth strategy or otherwise important to us. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Debt Obligations," for more information on our indebtedness. Our

13

Table of Contents

Senior Credit Agreement and the Unsecured Term Loan Agreement restrict, among other things, our ability to:

- •

- incur additional indebtedness or enter into sale and leaseback transactions;

- •

- pay any cash dividends or make distributions on our capital stock or certain other restricted payments or investments;

- •

- purchase or redeem stock;

- •

- issue stock of our subsidiaries;

- •

- make investments and extend credit;

- •

- engage in transactions with affiliates;

- •

- transfer and sell assets;

- •

- effect a consolidation or merger or sell, transfer, lease or otherwise dispose of all or substantially all of our assets; and

- •

- create liens on our assets to secure debt.

In addition, our Senior Credit Agreement requires us to meet certain financial ratios and to repay outstanding borrowings with portions of the proceeds we receive from certain sales of property or assets and specified future debt and equity offerings. Our financial results may be affected by unforeseen adverse events, and we may not be able to meet the financial ratio requirements.

Any breach of the covenants in our Senior Credit Agreement or Unsecured Term Loan Agreement could cause a default under such instruments. If there were an event of default under any of our debt instruments that was not cured or waived, the holders of the defaulted debt could cause all amounts outstanding with respect to the debt instrument to be due and payable immediately. Our assets and cash flow would not be sufficient to fully repay borrowings under our outstanding debt instruments if accelerated upon an event of default. If, as or when required, we are unable to repay, refinance or restructure our indebtedness under, or amend the covenants contained in our Senior Credit Agreement, the lenders under our senior credit facility could institute foreclosure proceedings against the assets securing borrowings under our senior credit facility.

We have a history of losses.

We recorded net income of $17.5 million for the year ended December 31, 2009, and net losses of $50.5 million and $32.2 million for the years ended December 31, 2008 and 2007, respectively. The net income in 2009 is primarily the result of our settlement agreement with Westar. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations-Significant Activities." Our results of operations reflect the following, among other factors:

- •

- substantial charges incurred by us for amortization of customer accounts;

- •

- interest incurred on indebtedness;

- •

- loss on retirement of debt in 2008;

- •

- Merger-related costs in 2007; and

- •

- other charges required to manage operations.

We will continue to incur substantial interest expenses. As long as we continue to add to our existing customer base, we will incur substantial amortization of customer accounts.

14

Table of Contents

Our Board of Directors has announced its intention to explore and evaluate strategic alternatives, which could include a sale of the Company.

On January 20, 2010, our Board of Directors announced commencement of a process to explore and evaluate strategic alternatives, including a possible sale of the Company. There can be no assurance that this review of strategic alternatives will result in pursuit of any transaction, or that any transaction pursued by the Company will be completed. We may be unable to retain the services of some of our key employees and may experience difficulty in obtaining new customers and maintaining relationships with suppliers and other service providers due to the uncertainty of the process and changes that may occur as a result of the process. The market price of our stock may be volatile as we explore strategic alternatives, and volatility may persist or be increased if and when a decision to pursue a specific transaction is announced or we announce that we are no longer exploring strategic alternatives.

The price of our common stock may continue to fluctuate or decline over time.

The price at which our common stock trades may fluctuate substantially or decline due to:

- •

- our historical and anticipated quarterly and annual operating results;

- •

- loss of one or more significant customers;

- •

- significant acquisitions, strategic alliances, joint ventures or capital commitments by us or our competitors;

- •

- legal or regulatory matters;

- •

- additions or departures of any key employee;

- •

- investor perceptions of our company and comparable companies;

- •

- our ability to comply with financial covenants in our Senior Credit Agreement or Unsecured Term Loan Agreement;

- •

- the large number of shares held by the Principal Stockholders;

- •

- our process to explore strategic alternatives;

- •

- price and volume fluctuations in the overall stock market; and

- •

- general market conditions and trends.

Entities affiliated with Quadrangle Group and Monarch Alternative Capital are our principal stockholders and together can exercise a controlling influence over us, which may adversely affect the trading price of our common stock.

Quadrangle Capital Partners LP, Quadrangle Capital Partners-A LP and Quadrangle Select Partners LP (collectively "Quadrangle") and Monarch Debt Recovery Master Fund Ltd and Monarch Opportunities Master Fund Ltd (collectively "Monarch" and together with Quadrangle the "Principal Stockholders"), collectively own approximately 70% of our outstanding common stock. Pursuant to a stockholders agreement, subject to the Principal Stockholders, acting together, maintaining a certain threshold of ownership in us, the Principal Stockholders will be able to control the election of a majority of our directors and accordingly exercise a controlling influence over our business and affairs, including any determinations with respect to mergers or other business combinations involving us, appointment of our officers, our acquisition or disposition of material assets and our incurrence of indebtedness. Similarly, the Principal Stockholders, acting together, will continue to have the power to determine matters submitted to a vote of our stockholders without the consent of other stockholders and to take other actions that are in the interests of the Principal Stockholders. There can be no assurance that the interests of the Principal Stockholders will coincide with our interests or the interests of our other stockholders.

15

Table of Contents

We rely on technology that may become obsolete, which could require significant capital expenditures.

Our monitoring services depend upon the technology (hardware and software) of security alarm systems. In order to maintain our customer base that currently uses security alarm components that are or could become obsolete, we may be required to upgrade or implement new technologies that could require significant capital expenditures. In the future, we may not be able to successfully implement new technologies or adapt existing technologies to changing market demands. If we are unable to adapt in response to changing technologies, market conditions or customer requirements in a timely manner, such inability could adversely affect our business.

Shifts in our current and future customers' selection of telecommunications services could increase customer attrition and could adversely impact our earnings and cash flow.

Certain elements of our operating model rely on our customers' selection and continued use of traditional, land-line telecommunications services, which we use to communicate with our monitoring operations. In order to continue to service existing customers who cancel their land-line telecommunications services and to service new customers who do not subscribe to land-line telecommunications services, some customers must upgrade to alternative and often more expensive wireless or internet based technologies. Higher costs may reduce the market for new customers of alarm monitoring services, and the trend away from traditional land lines to alternatives may mean more existing customers will cancel service with us. Our Multifamily segment, in particular, has experienced customer cancellations which we believe are due in part to low penetration of land-line based phone services in rental units. Continued shifts in customers' preferences regarding telecommunications services could continue to have an adverse impact on our earnings, cash flow and customer attrition.

We depend on our relationships with alarm system manufacturers and suppliers and our hosted services suppliers. If we are not able to maintain or renew these alliances or our manufacturers and suppliers fail to provide us with innovative product offerings or hosted services, our ability to create new customers and service our existing account base could be negatively affected.

We currently have agreements with certain electronic security system manufacturers and suppliers of hardware for products that we install in customer locations as part of new systems or as replacement parts for existing systems. We may not be able to maintain or renew our existing product sourcing arrangements on terms and conditions acceptable to us, or at all, if one or more of our suppliers discontinue offering a technology we have relied on or if one or more of our suppliers exits the electronic security system market. If we are unable to maintain or renew our existing relationships, we may incur additional costs creating new supplier arrangements and in servicing existing customers.

We are also dependent on our electronic security system manufacturers for continued technological innovation. If the electronic security system product families we have invested in fail to keep pace with other manufacturers' and suppliers' technologies, we may incur additional training and inventory costs and our ability to attract new customers and service our existing customers could be adversely affected.

We depend on third party suppliers to provide our e-Secure and cellular backup services. If those services become unavailable or if the price for those services fluctuates significantly, we may lose existing customers and have difficulty attracting new customers.

We face continuing competition and pricing pressure from other companies in our industry and, if we are unable to compete effectively with these companies, our sales and profitability could be adversely affected.

We compete with a number of major domestic security monitoring services companies, as well as a large number of smaller, regional competitors. We believe that this competition is a factor in our attrition, limits our ability to raise prices, and, in some cases, requires that we lower prices. Some of our competitors, either alone or in conjunction with their respective parent corporate groups, are larger

16

Table of Contents

than we are and have greater financial resources, sales, marketing or operational capabilities or brand recognition than we do. In addition, opportunities to take market share using innovative products, services and sales approaches may attract new entrants to the field. We may not be able to compete successfully with the offerings and sales tactics of other companies, which could result in the loss of customers and, as a result, decreased revenue and operating results.

We may not be able to realize any or all of the anticipated benefits from prior or future acquisitions of portfolio alarm monitoring contracts.

Acquisitions of end-user alarm monitoring contracts involve a number of risks, including the possibility that the acquiring company will not be able to realize the recurring monthly revenue stream it contemplated at the time of acquisition because of higher than expected attrition rates or fraud. Although we generally complete an extensive due diligence process prior to acquiring alarm monitoring contracts and obtain representations and warranties from sellers, we may not detect fraud, if any, on the part of any seller, including the possibility that any seller misrepresented the historical attrition rates of the sold contracts or sold or pledged the contracts to a third party. If the sale of alarm monitoring contracts involves fraud or the representations and warranties are otherwise inaccurate, it may not be possible to recover from the seller damages in an amount sufficient to fully compensate us for any resulting losses. In such event, we may incur significant costs in litigating ownership or breach of acquisition contract terms.

Our customer acquisition and creation strategies and the competitive market for the acquisition and creation of customer accounts may affect our future profitability.

Our account acquisition strategy has evolved to emphasize our internal sales force, supported by traditional marketing practices and by forming marketing alliances. In addition, we seek to augment our internal efforts with acquisitions when suitable market conditions exist. The success or failure of our current strategy could impact our customer base.

If we are successful executing a customer acquisition strategy emphasizing internal sales, selling costs will increase our expenses and uses of cash. Failure to replace customers lost through attrition or increased use of cash to replace those customers could have a material adverse effect on our business, financial condition, results of operations and ability to service debt obligations. Increased competition from other alarm monitoring companies could require us to reduce our prices for installations, decrease the monitoring fees we charge our customers and take other measures that could reduce our margins. These decreases and other measures could have a material adverse effect on us.

We compete with several companies that have account acquisition and loan programs for independent dealers and some of those competitors are larger than we are and have more capital than we do. Increased competition from other alarm monitoring companies could require us to pay more for account acquisitions and take other measures that could reduce returns from investing in acquisitions of customer accounts. These measures could have a material adverse effect on us.

Loss of customer accounts could materially adversely affect our operations.

We experience the loss of accounts as a result of, among other factors:

- •

- customers' inability or unwillingness to pay our charges;

- •

- adverse financial and economic conditions, the impact of which may be particularly acute among our small business and multifamily customers;

- •

- relocation of customers;

- •

- the customers' perceptions of value;

- •

- competition from other alarm service companies;

17

Table of Contents

- •

- declines in occupancy rates for Multifamily dwellings;

- •

- Wholesale dealers' perception of channel conflict with us;

- •

- the sale of accounts by Wholesale dealers to third parties who choose to monitor the purchased accounts elsewhere;

- •

- the purchase of our Wholesale dealers by third parties who choose to monitor elsewhere; and

- •

- large Wholesale customers who have the scale to monitor their own accounts cost-effectively and may choose to do so for cost and other reasons.

We may experience the loss of newly acquired or created accounts to the extent we do not integrate or adequately service those accounts. Customer loss may not become evident for some time after an acquisition is consummated because some acquired accounts are prepaid on an annual, semiannual or quarterly basis. Retail RMR and attrition rates could be impacted by higher attrition rates from the retail portfolio acquired from IASG. We also expect Multifamily account and RMR losses to exceed additions until the efforts we are making to further reduce our rate of attrition become more successful than they have been to date. Wholesale attrition could increase if our largest Wholesale customers, who have the scale to monitor their own accounts in a cost effective manner, chose to do so for cost or other reasons. Loss of a large Wholesale dealer could result in a significant reduction in RMR. Net losses of customer accounts could materially and adversely affect our business, financial condition and results of operations.

Increased adoption of "false alarm" ordinances by local governments may adversely affect our business.

An increasing number of local governmental authorities have adopted, or are considering the adoption of, laws, regulations or policies aimed at reducing the perceived costs to municipalities of responding to false alarm signals. Such measures could include:

- •

- requiring permits for the installation and operation of individual alarm systems and the revocation of such permits following a specified number of false alarms;

- •

- imposing limitations on the number of times the police will respond to alarms at a particular location after a specified number of false alarms;

- •

- requiring further verification of an alarm signal before the police will respond; and

- •

- subjecting alarm monitoring companies to fines or penalties for transmitting false alarms.

Enactment of these measures could adversely affect our future business and operations. For example, concern over false alarms in communities adopting these ordinances could cause a decrease in the timeliness of police response to alarm activations. As a result, the propensity of consumers to purchase or maintain alarm monitoring services could decrease and our costs to service affected accounts could increase.

Increased adoption of statutes and governmental policies purporting to void automatic renewal provisions in our customer contracts, or purporting to characterize certain of our charges as unlawful, may adversely affect our business.

Our customer contracts typically contain provisions automatically renewing the term of the contract at the end of the initial term, unless cancellation notice is delivered in accordance with the terms of the contract. If the customer cancels prior to the end of the contract term, other than in accordance with the contract, we may charge the customer the amounts that would have been paid over the remaining term of the contract, or charge an early cancellation fee.

Several states have adopted, or are considering the adoption of, consumer protection policies or legal precedents which purport to void the automatic renewal provisions of our customer contracts, or otherwise restrict the charges we can impose upon contract cancellation. Such initiatives could compel

18

Table of Contents

us to increase the length of the initial term of our contracts, increase our charges during the initial term, or both, and consequently lead to less demand for our services and increase our attrition. Adverse judicial determinations regarding these matters could cause us to incur legal exposure to customers against whom such charges have been imposed, and the risk that certain of our customers may seek to recover such charges through litigation. In addition, the costs of defending such litigation and enforcement actions could have an adverse effect on us.

Due to a concentration of accounts in California, Florida and Texas, we are susceptible to environmental incidents that may negatively impact our results of operations.

Almost 44% of our RMR at December 31, 2009 was derived from customers located in California, Florida and Texas. A major earthquake, hurricane or other environmental disaster in an area of high account concentration could disrupt our ability to serve those customers or render those customers uninterested in continuing to retain us to provide alarm monitoring services.

We are susceptible to downturns in the housing market which may negatively impact our results of operations.

We believe demand for alarm monitoring services in our Retail segment is affected by the turnover in the single family housing market. Downturns in the rate of sale of existing single family homes would reduce opportunities to make sales of new security systems and services and reduce opportunities to take over existing security systems that had previously been monitored by our competitors. These reduced opportunities to add RMR could negatively affect our results of operations.

Declines in rents, occupancy rates and new construction of multifamily dwellings may affect our sales in this marketplace.

We believe demand for alarm monitoring services in the Multifamily segment is tied to the general health of the multifamily housing industry. This industry is dependent upon prevailing rent levels and occupancy rates as well as the demand for construction of new properties. Given the generally cyclical nature of the real estate market, we believe that, in the event of a decline in the market factors described above, it is likely that demand for our alarm monitoring services to multifamily dwellings would also decline, which could negatively impact our results of operations.

We could face liability for our failure to respond adequately to alarm activations.

The nature of the services we provide potentially exposes us to greater risks of liability for employee acts or omissions or system failures than may be inherent in other businesses. In an attempt to reduce this risk, our alarm monitoring agreements and other agreements pursuant to which we sell our products and services contain provisions limiting our liability to customers and third parties. In the event of litigation with respect to such matters, however, these limitations may not be enforced. In addition, judgments against us and the costs of such litigation could have an adverse effect on us.

In the event that adequate insurance is not available or our insurance is not deemed to cover a claim, we could face liability.

We carry insurance of various types, including general liability and professional liability insurance, in amounts management considers adequate and customary for the industry. Some of our insurance policies, and the laws of some states, may limit or prohibit insurance coverage for punitive or certain other types of damages, or liability arising from gross negligence. If we incur increased losses related to employee acts or omissions, or system failure, or if we are unable to obtain adequate insurance coverage at reasonable rates, or if we are unable to receive reimbursements from insurance carriers, our financial condition and results of operations could be materially and adversely affected.

19

Table of Contents

Future government regulations or other standards could have an adverse effect on our operations.

Our operations are subject to a variety of laws, regulations and licensing requirements of federal, state and local authorities. In certain jurisdictions, we are required to obtain licenses or permits to comply with standards governing employee selection and training and to meet certain standards in the conduct of our business. The loss of such licenses, or the imposition of conditions to the granting or retention of such licenses, could have an adverse effect on us. In the event that these laws, regulations and/or licensing requirements change, we may be required to modify our operations or to utilize resources to maintain compliance with such rules and regulations. In addition, new regulations may be enacted that could have an adverse effect on us.

The loss of our Underwriter Laboratories listing could negatively impact our competitive position.

All of our alarm monitoring centers are Underwriters Laboratories ("UL") listed. To obtain and maintain a UL listing, an alarm monitoring center must be located in a building meeting UL's structural requirements, have back-up and uninterruptible power supplies, have secure telephone lines and maintain redundant computer systems. UL conducts periodic reviews of alarm monitoring centers to ensure compliance with their regulations. Non-compliance could result in a suspension of our UL listing. The loss of our UL listing could negatively impact our competitive position.

We are dependent upon our experienced senior management, who would be difficult to replace.

The success of our business is largely dependent upon the active participation of our executive officers, who have extensive experience in the industry. The loss of service of one or more of such officers or the inability to attract or retain qualified personnel for any reason may have an adverse effect on our business.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

We maintain our executive offices at 1035 N. 3rd Street, Suite 101, Lawrence, Kansas 66044. We operate primarily from the following facilities, although we also lease office space for our approximately 60 field locations.

| | | | | | | |

Location | | Approximate

Size (sq. ft.) | | Lease/Own | | Principal Purpose |

|---|

| Irving, TX | | | 53,750 | | Lease | | Retail and Multifamily monitoring facility/administrative functions |

| Longwood, FL | | | 20,000 | | Lease | | Wholesale monitoring facility/administrative functions |

| Lawrence, KS | | | 21,000 | | Lease | | Financial/administrative headquarters |

| Cypress, CA | | | 17,000 | | Lease | | Wholesale monitoring facility |

| Manasquan, NJ | | | 7,200 | | Own | | Wholesale monitoring facility |

| Wichita, KS | | | 50,000 | | Own | | Retail monitoring facility/administrative functions |

| Wichita, KS | | | 122,000 | | Own | | Backup Retail monitoring center/administrative functions |

ITEM 3. LEGAL PROCEEDINGS.

Information on our legal proceedings is set forth in Item 8, Note 13 of the Notes to the Consolidated Financial Statements, included in Part II of this Annual Report on Form 10-K, which are incorporated herein by reference.

20

Table of Contents

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Price Information

Our common stock has been listed on the NASDAQ Global Market under the symbol "PONE" since April 2, 2007. The table below sets forth for each of the calendar quarters indicated the high and low sales prices per share of our common stock, as reported by the NASDAQ Global Market.

| | | | | | | |

| | High | | Low | |

|---|

2009: | | | | | | | |

First Quarter | | $ | 5.17 | | $ | 0.83 | |

Second Quarter | | | 4.99 | | | 1.95 | |

Third Quarter | | | 4.84 | | | 3.04 | |

Fourth Quarter | | | 7.00 | | | 4.36 | |

2008: | | | | | | | |

First Quarter | | $ | 13.00 | | $ | 8.52 | |

Second Quarter | | | 11.50 | | | 6.84 | |

Third Quarter | | | 10.12 | | | 6.43 | |

Fourth Quarter | | | 9.47 | | | 4.13 | |

Dividend Information

We are prohibited from paying cash dividends to our stockholders under covenants contained in our Senior Credit Agreement. We did not declare or pay any dividends for the years ended December 31, 2009 or 2008. Any future determination to pay dividends will be at the discretion of our board of directors, subject to compliance with covenants in current and future agreements governing our indebtedness, and will depend upon our results of operations, financial condition, capital requirements and other factors that our board of directors deems relevant. We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness, and therefore we do not anticipate paying any cash dividends in the foreseeable future.

Number of Stockholders

As of March 5, 2010, there were approximately 436 stockholders of record who held shares of our common stock.

21

Table of Contents

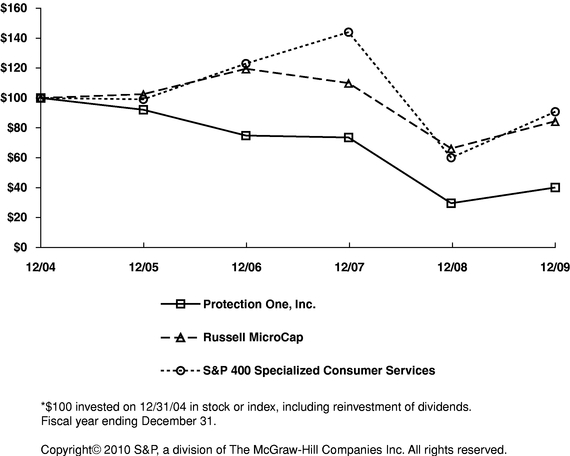

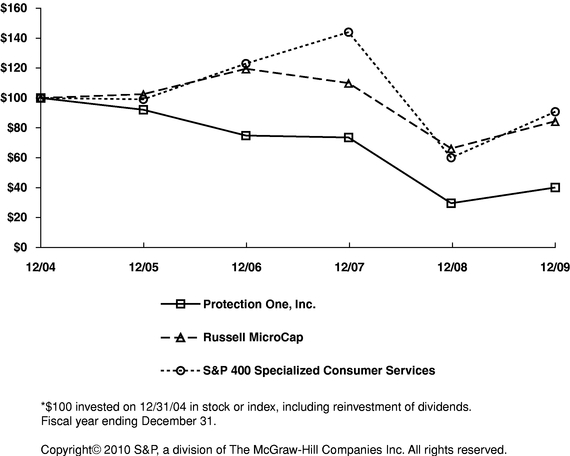

Performance Graph

The following chart compares the cumulative total stockholder returns on the Common Stock since December 31, 2004 to (1) the cumulative total returns over the same period of the Russell MicroCap index and (2) the S&P 400 Specialized Consumer Services index. The chart assumes the value of the investment in the Common Stock and each index was $100 at December 31, 2004 and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Protection One, Inc., The Russell MicroCap Index

And S&P 400 Specialized Consumer Services

22

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA.

The selected consolidated financial data set forth below should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the audited consolidated financial statements and notes to the financial statements of Protection One, Inc., which can be found in Item 8.

As a result of the Principal Stockholders obtaining over 95% of our common stock on February 8, 2005, we "pushed down" the Principal Stockholders' basis to a proportionate amount of our underlying assets and liabilities acquired based on the estimated fair market values of the assets and liabilities. The primary changes to the balance sheet reflect (1) the reduction of deferred customer acquisition costs and revenue, which were subsumed into the estimated fair market value adjustment for customer accounts; (2) adjustments to the carrying values of debt to estimated fair market value (or the Principal Stockholders' basis in the case of the credit facility); (3) adjustments to historical goodwill to reflect goodwill arising from the push down accounting adjustments; (4) the recording of a value for our trade names; and (5) an increase to the equity section from these adjustments. The primary changes to the income statement include (1) the reduction in installation and other revenue due to a lower level of amortization from the reduced amortizable base of deferred customer acquisition revenue; (2) the reduction in installation and other costs of revenue and selling expenses due to a lower level of amortization from the reduced amortizable base of deferred customer acquisition costs; (3) an increase in interest expense due to amortization of debt discounts arising from differences in fair values and carrying values of our debt instruments; and (4) the reduction in amortization related to the reduction in the amortizable base of customer accounts. Due to the impact of the changes resulting from the push down accounting, the statement of operations data and cash flow data presentations for 2005 results are separated into two periods: (1) the period prior to the February 8, 2005 consummation of the exchange transaction and (2) the period beginning after that date utilizing the new basis of accounting. The results are further separated by a heavy black line to indicate the effective date of the new basis of accounting.

23

Table of Contents

The condensed financial data set forth below includes the financial results for IASG subsequent to the Merger. See Note 9 of the Notes to Consolidated Financial Statements, included in Part II of this Annual Report on Form 10-K, for additional information related to the Merger. All amounts are in thousands, except per share data, unless otherwise noted.

| | | | | | | | | | | | | | | | | | | | | |

| | SELECTED CONSOLIDATED FINANCIAL DATA | |

|---|

| | Year Ended

December 31,

2009 | | Year Ended

December 31,

2008 | | Year Ended

December 31,

2007 | | Year Ended

December 31,

2006 | | February 9

through

December 31,

2005 | |

| | January 1

through

February 8,

2005 | |

|---|

Statements of operations data | | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 368,052 | | $ | 372,021 | | $ | 347,871 | | $ | 270,552 | | $ | 234,481 | | | | $ | 28,543 | |

Cost of revenue (exclusive of amortization and depreciation shown below) | | | 150,268 | | | 159,730 | | | 140,705 | | | 101,387 | | | 81,059 | | | | | 10,714 | |

Selling, general and administrative expenses | | | 127,403 | | | 136,813 | | | 125,398 | | | 103,916 | | | 86,014 | | | | | 12,093 | |

Merger-related costs | | | — | | | — | | | 4,344 | | | — | | | — | | | | | — | |

Change in control, restructuring, recapitalization and corporate consolidation costs | | | — | | | — | | | — | | | 4,472 | | | 2,339 | | | | | 5,939 | |

Amortization and depreciation expense | | | 50,096 | | | 64,275 | | | 62,064 | | | 41,667 | | | 43,742 | | | | | 6,638 | |

Impairment of trade name | | | — | | | 925 | | | — | | | — | | | — | | | | | — | |

| | | | | | | | | | | | | | | | |

Operating income (loss) | | | 40,285 | | | 10,278 | | | 15,360 | | | 19,110 | | | 21,327 | | | | | (6,841 | ) |

Interest expense, net | | | 45,311 | | | 47,745 | | | 46,977 | | | 35,900 | | | 30,634 | | | | | 4,544 | |

(Gain) loss on retirement of debt | | | (1,956 | ) | | 12,788 | | | — | | | — | | | 6,657 | | | | | — | |

Gain on settlement agreement | | | (22,867 | ) | | — | | | — | | | — | | | — | | | | | — | |

Other income | | | — | | | (54 | ) | | (90 | ) | | (52 | ) | | (688 | ) | | | | (15 | ) |

| | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 19,797 | | | (50,201 | ) | | (31,527 | ) | | (16,738 | ) | | (15,276 | ) | | | | (11,370 | ) |

Income tax expense | | | 2,290 | | | 341 | | | 713 | | | 667 | | | 312 | | | | | 35 | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 17,507 | | $ | (50,542 | ) | $ | (32,240 | ) | $ | (17,405 | ) | $ | (15,588 | ) | | | $ | (11,405 | ) |

| | | | | | | | | | | | | | | | |

Basic and diluted net income (loss) per share of common stock(a) | | $ | 0.69 | | $ | (2.00 | ) | $ | (1.37 | ) | $ | (0.95 | ) | $ | (0.86 | ) | | | $ | (5.80 | ) |

| | | | | | | | | | | | | | | | |

Weighted average number of shares of common stock outstanding(a) | | | 25,324,440 | | | 25,310,364 | | | 23,525,652 | | | 18,233,221 | | | 18,198,571 | | | | | 1,965,654 | |

Consolidated balance sheet data | | | | | | | | | | | | | | | | | | | | | |

Working capital (deficit) | | $ | (18,406 | ) | $ | (1,777 | ) | $ | 5,555 | | $ | (4,990 | ) | $ | (5,067 | ) | | | | | |

Customer accounts, net | | | 203,453 | | | 237,718 | | | 282,396 | | | 200,371 | | | 232,875 | | | | | | |

Goodwill | | | 43,853 | | | 41,604 | | | 41,604 | | | 12,160 | | | 12,160 | | | | | | |

Total assets | | | 571,895 | | | 639,054 | | | 672,717 | | | 443,953 | | | 436,302 | | | | | | |

Long term debt, including capital leases, net of current portion | | | 436,550 | | | 523,927 | | | 521,180 | | | 391,991 | | | 321,293 | | | | | | |

Total stockholders' equity (deficiency in assets) | | | (59,063 | ) | | (80,250 | ) | | (22,517 | ) | | (79,943 | ) | | 8,067 | | | | | | |

Cash flow data | | | | | | | | | | | | | | | | | | | | | |

Cash flows provided by operations | | $ | 105,397 | | $ | 59,654 | | $ | 57,664 | | $ | 49,527 | | $ | 40,413 | | | | $ | 3,710 | |

Cash flows used in investing activities | | | (31,792 | ) | | (48,357 | ) | | (34,670 | ) | | (36,687 | ) | | (24,151 | ) | | | | (2,473 | ) |

Cash flows used in financing activities | | | (86,420 | ) | | (13,413 | ) | | (6,595 | ) | | (8,133 | ) | | (50,134 | ) | | | | — | |

- (a)

- On May 12, 2006, a cash dividend of $3.86 per share was paid to all holders of record of common stock on May 8, 2006. Loss per share and weighted average number of shares presented give retroactive effect to the one-share-for-fifty shares reverse stock split on February 8, 2005.

24

Table of Contents

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Overview

We are a leading national provider of electronic security alarm monitoring services, providing installation, maintenance and electronic monitoring of alarm systems to single-family residential, commercial, multifamily and wholesale customers. We monitor signals from burglary, fire, medical and environmental alarm systems and manage information from access control and CCTV systems.