QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2003 |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

1-12181-01

(Commission File Number) | | 1-12181

(Commission File Number) |

Protection One, Inc.

(Exact Name of Registrant as Specified in Charter) |

|

Protection One Alarm Monitoring, Inc.

(Exact Name of Registrant as Specified in Charter) |

Delaware

(State of Other Jurisdiction

of Incorporation or Organization) |

|

Delaware

(State of Other Jurisdiction

of Incorporation or Organization) |

93-1063818

(I.R.S. Employer Identification No.) |

|

93-1064579

(I.R.S. Employer Identification No.) |

818 S. Kansas Avenue, Topeka, Kansas 66612

(Address of Principal Executive Offices,

Including Zip Code) |

|

818 S. Kansas Avenue, Topeka, Kansas 66612

(Address of Principal Executive Offices,

Including Zip Code) |

(785) 575-1707

(Registrant's Telephone Number,

Including Area Code) |

|

(785) 575-1707

(Registrant's Telephone Number,

Including Area Code) |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

| | Name of Each Exchange On Which Registered

|

|---|

| None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class

|

|---|

| Common Stock, par value $.01 per share, of Protection One, Inc. |

Indicate by check mark whether each of the registrants (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that such registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of each registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of common stock of Protection One, Inc. held by nonaffiliates on June 30, 2003 (based on the last sale price of such shares on the New York Stock Exchange) was $11,790,755.

As of March 15, 2004, Protection One, Inc. had 98,282,679 shares of Common Stock outstanding, par value $0.01 per share. As of such date, Protection One Alarm Monitoring, Inc. had outstanding 110 shares of Common Stock, par value $0.10 per share, all of which shares were owned by Protection One, Inc. Protection One Alarm Monitoring, Inc. meets the conditions set forth in General Instructions I (1)(a) and (b) for Form 10-K and is therefore filing this form with the reduced disclosure format set forth therein. Protection One's sole asset is Protection One Alarm Monitoring and Protection One Alarm Monitoring's wholly owned subsidiaries, as such there are no separate financial statements for Protection One Alarm Monitoring, Inc.

TABLE OF CONTENTS

| |

| | Page

|

|---|

| PART I |

| Item 1. | | Business | | 3 |

| Item 2. | | Properties | | 21 |

| Item 3. | | Legal Proceedings | | 21 |

| Item 4. | | Submission of Matters to a Vote of Security Holders | | 22 |

PART II |

| Item 5. | | Market for Registrant's Common Equity and Related Stockholder Matters | | 22 |

| Item 6. | | Selected Financial Data | | 23 |

| Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 25 |

| Item 7A. | | Qualitative and Quantitative Disclosure About Market Risk | | 50 |

| Item 8. | | Financial Statements and Supplementary Data | | 51 |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 96 |

| Item 9A. | | Controls and Procedures | | 96 |

PART III |

| Item 10. | | Directors and Executive Officers of the Registrants | | 97 |

| Item 11. | | Executive Compensation | | 100 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management | | 109 |

| Item 13. | | Certain Relationships and Related Transactions | | 110 |

| Item 14. | | Principal Accountant Fees and Services | | 110 |

PART IV |

| Item 15. | | Exhibits, Financial Statement Schedules and Reports on Form 8-K | | 111 |

2

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the materials incorporated by reference herein include "forward-looking statements" intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified as such because the context of the statement includes words such as we "believe," "expect," "anticipate," "will" or other words of similar import. Similarly, statements herein that describe our objectives, plans or goals also are forward-looking statements. Such statements include those made on matters such as our earnings and financial condition, litigation, accounting matters, our business, our efforts to consolidate and reduce costs, our customer account acquisition strategy and attrition, our efforts to implement new financial and human resources software, our liquidity and sources of funding and our capital expenditures. All forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, among others, the factors discussed in Item 1, "Business—Risk Factors." We continue to face liquidity problems caused by our significant debt burdens and continuing net losses. The consummation of the sale of its ownership interests in us by Westar Energy, Inc., which we refer to as Westar Energy, our former majority owner that beneficially owned approximately 88% of the our common stock, to POI Acquisition, L.L.C. and POI Acquisition I, Inc., entities formed by Quadrangle Capital Partners L.P., Quadrangle Select Partners L.P., Quadrangle Capital Partners-A L.P. and Quadrangle Master Funding Ltd., which we refer to collectively as Quadrangle, and the assignment of Westar's rights and obligations as the lender under our revolving credit facility with its wholly owned subsidiary, Westar Industries, Inc., to POI Acquisition, L.L.C., is expected to materially adversely affect our financial position, results of operations and liquidity, and we may need to restructure our indebtedness in an out-of-court proceeding and/or seek the protection of federal bankruptcy laws to reorganize our debts. Statements made in the Form 10-K regarding the sale by Westar Energy and its possible effects on us also constitute forward-looking statements. The forward-looking statements included herein are made only as of the date of this report and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

ITEM 1. BUSINESS

Unless the context otherwise indicates, all references in this report to the "Company," "Protection One," "we," "us" or "our" or similar words are to Protection One, Inc., its direct wholly owned subsidiary, Protection One Alarm Monitoring, Inc. and Protection One Alarm Monitoring's wholly owned subsidiaries. Protection One's sole asset is Protection One Alarm Monitoring and Protection One Alarm Monitoring's wholly owned subsidiaries, and accordingly, there are no separate financial statements for Protection One Alarm Monitoring, Inc. Each of Protection One and Protection One Alarm Monitoring is a Delaware corporation organized in September 1991.

Westar's Sale of Our Stock and Assignment of its Rights and Obligations in the Revolving Credit Facility

Westar Energy is a public electric utility and is regulated by the Kansas Corporation Commission, or KCC. Westar Energy, along with its wholly owned subsidiary, Westar Industries, Inc., which we refer to collectively as Westar, owned approximately 88% of the common stock of Protection One and provided us with a revolving credit facility.

On February 17, 2004, Westar Industries, Inc. consummated the sale of approximately 87% of the issued and outstanding shares of our common stock to POI Acquisition I, Inc., a wholly owned subsidiary of POI Acquisition, L.L.C. POI Acquisition, L.L.C. and POI Acquisition I, Inc. are entities formed by Quadrangle. Approximately 1% of our common stock, representing shares underlying

3

restricted stock units granted to current and former employees of Westar, was retained by Westar. As part of the sale transaction, Westar also assigned its rights and obligations as the lender under our revolving credit facility, which had an outstanding principal balance of $215.5 million, to POI Acquisition, L.L.C. Quadrangle paid approximately $122.2 million to Westar as consideration for the common stock, revolving credit facility and accrued interest, and Westar could receive up to an additional $39.2 million that is contingent upon certain potential post-closing events.

In addition, pursuant to the terms of the purchase agreement governing the sale transaction, dated as of December 23, 2003, among POI Acquisition, L.L.C., Westar Industries and Westar Energy, Westar's designees on our Board of Directors, Bruce A. Akin, James T. Clark, Greg Greenwood, Larry D. Irick and William B. Moore, resigned from our Board of Directors, effective as of the closing of the sale transaction.

In connection with the closing of the sale transaction described above, we announced, among other things, the (i) retention of Houlihan Lokey Howard & Zukin Capital to assist us with our evaluation of the effects of the sale transactions, (ii) execution of two standstill agreements with POI Acquisition, L.L.C. and POI Acquisition I, Inc., and (iii) deferral of payment of the semi-annual interest payment due on February 17, 2004 on the outstanding $190.9 million aggregate principal amount of our 73/8% senior notes due in 2005.

We also announced that Donald A. Johnston resigned from our Board of Directors, effective as of the closing of the sale transaction.

See further discussion relating to this sale and its impact on us in "Matters to Consider" below.

Matters to Consider

We have reported losses for the past several years. Westar Energy has consummated the sale of its equity interest in us and the assignment of its rights and obligations in the credit facility that it provided to us to Quadrangle. We refer to such credit facility as the revolving credit facility. A primary financing source for us has been the revolving credit facility, and additional credit under such facility has been eliminated by a standstill agreement executed by Quadrangle and us. Payments made to us by Westar Energy under a tax sharing agreement between Westar and us were another important source of liquidity for us, and except for amounts owed with respect to losses we incurred prior to leaving the Westar consolidated tax group as a result of Westar selling its interest in us, we will no longer receive payments from Westar Energy under the tax sharing agreement. We have evaluated these conditions and events in establishing our operating plans. In addition to the plans and strategies noted under "Overview" below, we plan to carefully monitor the level of investment in new customer accounts and continue control of operating expenses and capital expenditures. The sale by Westar Energy will have a material adverse effect upon our financial position and liquidity, and we may need to restructure our indebtedness in an out-of-court proceeding and/or seek the protection of federal bankruptcy laws to reorganize. See "Risk Factors," below, for a further discussion of these and other important matters.

We continue to face liquidity problems caused by our significant debt burden and continuing net losses. Absent recapitalization and restructuring our debts, management believes our projected cash flow will be insufficient to support our current debt balances, which may be accelerated or which we are required to offer to repurchase as a result of the change in control, and related interest obligations. Our independent public accountants included in their report on our consolidated financial statements for the fiscal year ended December 31, 2003 explanatory language that describes the significant uncertainty about our ability to continue as a going concern due to recurring losses from operations, deficiency in working capital, inability to obtain ongoing financing and breach of covenants on outstanding debt subsequent to year end.

4

We have retained Houlihan Lokey Howard & Zukin Capital as our financial advisor and have begun preliminary discussions regarding a proposed restructuring with Quadrangle and its affiliates, the lenders under our revolving credit facility, and certain holders of our publicly-held debt. If an agreement with such parties is reached, a resulting restructuring plan may be presented for judicial approval under Chapter 11 of the U.S. Bankruptcy Code, which provides for companies to reorganize and continue to operate as going concerns. Discussions with Quadrangle and other debt holders are in the preliminary stages, and there can be no assurance that an agreement regarding financial restructuring will be reached or what other actions we may need to take, including selling assets, to meet our liquidity needs.

As part of the restructuring initiative, we have deferred payment of the semi-annual interest payment that was due on February 17, 2004 on the outstanding $190.9 million aggregate principal amount of our 73/8% senior notes. If we do not make this interest payment within the 60-day interest payment grace period available under the 73/8% senior notes, the trustee or the holders of such senior notes may seek to exercise certain remedies available to them under the indenture governing the notes, including, without limitation, acceleration of the indebtedness, which acceleration, if not rescinded or satisfied, would cause cross defaults under our other debt instruments. If such acceleration should occur, we do not have the funds available to repay the indebtedness, and we could be forced to seek relief under the U.S. Bankruptcy Code or an out-of-court restructuring.

In addition, as a result of Westar's sale of its interests in us, the indenture relating to our 135/8% senior subordinated discount notes requires us to give notice of our intention to repurchase the notes, which had aggregate outstanding principal of $29.9 million as of March 15, 2004, within 30 days following the date of a change in control, and to consummate the repurchase within 60 days of such notification. We have not given notice of our intention to repurchase these notes, and this inaction constitutes a covenant breach under the notes' indenture, which breach, if not cured within 30 days after receipt of appropriate notice, would constitute an event of default under the indenture. Furthermore, upon any such event of default, the trustee or the holders of such senior subordinated discount notes may seek to exercise certain remedies available to them under the indenture governing the notes, including, without limitation, acceleration of the notes, which acceleration, if not rescinded or satisfied, would cause a cross default to be triggered under the indenture for our 81/8% senior subordinated notes, which had aggregate outstanding principal of $110.3 million as of March 15, 2004. If such acceleration and cross default should occur, we do not have the funds available to repay the indebtedness, and we could be forced to seek relief under the U.S. Bankruptcy Code or an out-of-court restructuring.

Furthermore, as a result of Westar's sale of its interests in us, the $215.5 million outstanding under the revolving credit facility is in default. We entered into a standstill agreement with Quadrangle, pursuant to which, among other things, Quadrangle agreed to waive the change in control default and other specified covenant breaches for a period not to exceed 90 days, and we agreed that we could not borrow any additional amounts under the revolving credit facility. Upon the expiration or termination of this standstill agreement, Quadrangle may exercise its rights under the revolving credit facility and declare the indebtedness to be due and payable. Furthermore, acceleration of our revolving credit facility, if not rescinded or satisfied, would cause cross defaults under our other debt instruments. If such acceleration should occur, we would not have the funds available to repay the indebtedness, and we could be forced to seek relief under the U.S. Bankruptcy Code or an out-of-court restructuring.

Stockholders and other security holders or buyers of our securities or our other creditors should not assume that material events subsequent to the date of this Form 10-K have not occurred. If we seek an out-of-court restructuring, there can be no assurances as to whether or not such restructuring would be successful.

5

See also "Risk Factors," below, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources," Item 8, Note 5 "Long-Term Debt," Item 8, Note 15 "Subsequent Events" and Item 8, Note 17 "Going Concern and Management's Plans" for further discussion.

Overview

Protection One is a leading provider of property monitoring services, providing electronic monitoring and maintenance of alarm systems to approximately 1.0 million customers as of December 31, 2003. Our revenues are generated primarily from recurring monthly payments for monitoring and maintaining the alarm systems that are installed in our customers' homes and businesses. We provide our services to single family residential, commercial, wholesale and multifamily residential customers. At December 31, 2003, our customer base composition was as follows:

Market Segment

| | Percentage of Total

| |

|---|

| Single family and commercial | | 53.1 | % |

| Wholesale | | 14.9 | |

| | |

| |

| Protection One North America Total | | 68.0 | |

| Multifamily/Apartment | | 32.0 | |

| | |

| |

| Total | | 100.0 | % |

| | |

| |

Our company is divided into two business segments:

Protection One North America, which we refer to as North America, generated approximately $239.0 million, or 86.3%, of our revenues in 2003 and is comprised of our retail alarm monitoring business, which serves residential and commercial customers directly, and our wholesale monitoring business, which provides alarm monitoring services to independent alarm companies.

Network Multifamily, which we refer to as Multifamily, generated approximately $38.1 million, or 13.7%, of our revenues in 2003 and is comprised of our alarm monitoring business servicing apartments, condominiums and other multifamily dwellings.

Financial information for each of our business segments is presented in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Segment Information" and in Item 8, Note 13 "Segment Reporting" and is incorporated herein by reference.

Our operating strategy continues to be to improve returns on invested capital by realizing economies of scale from increasing customer density in the largest urban markets in North America. We plan to accomplish this goal by: (i) retaining our customers by providing superior customer service from our monitoring facilities and our branches; and (ii) using our national presence, strategic alliances, such as our alliance with BellSouth Telecommunications, as discussed in "Sales and Marketing" below, and strong local operations to persuade the most desirable residential and commercial prospects to enter into long term agreements with us on terms that permit us to achieve appropriate returns on capital.

�� New software will be required. During 2003 we began the process of replacing our accounting, human resources, inventory management, and accounts payable software. Implementation of new software is required as a result of Westar's disposition of its investment in us and has commenced in the first quarter of 2004.

Payment of transaction-related bonuses and fees. In order to retain the services of numerous employees who, as a result of Westar's interest in exploring strategic alternatives for divesting its ownership interest in us, may have felt uncertain about our future ownership, management and

6

direction, we entered into retention and severance arrangements in 2003 with approximately 190 employees to provide incentives for these employees to remain with us through the sales process. On October 31, 2003, we paid approximately $5.1 million to those employees who fulfilled their obligation related to the retention agreement. Additional severance amounts of up to an aggregate of approximately $11.0 million may also be paid under these arrangements to those employees, if any, who are terminated within a defined period following the change in control that occurred on February 17, 2004. No significant amounts have been expensed by us relating to the severance arrangements.

Upon the change in control on February 17, 2004, an additional $11.0 million was paid to executive management. In addition, upon the change in control, fees and expenses of $3.5 million were paid to the financial advisor to our Special Committee of the Board of Directors. As of December 31, 2003, no amounts had been expensed relating to these additional payments to executive management or to the financial advisor to our Special Committee. As of December 31, 2003, we had expensed approximately $1.2 million for legal and other professional fees related to the change in control. In addition, in February 2004 we recorded an expense of $1.6 million for director and officer insurance coverage that lapsed upon the change in control.

Attrition and customer creation. In 2003, we had a net loss of 25,378 customers in our customer base. Our North America segment had a net loss of 31,295 customers while our Multifamily segment had a net increase of 5,917 customers. The North America segment decline resulted from attrition, the decision to add new customers at reasonable costs through our internal sales force and our focus on operational efficiencies. Our customer acquisition strategy for our North America segment relies primarily on our internal sales force, which generated 50,731 accounts in 2003 compared to 45,642 accounts in 2002, and our marketing alliance with BellSouth Telecommunications, Inc., which we refer to as BellSouth. See "Sales and Marketing" and "Attrition" below.

Dispute regarding tax sharing payments. We have been a member of Westar's consolidated tax group since 1997. During that time, Westar made payments to us for tax benefits attributable to us and utilized by Westar in its consolidated tax return pursuant to the terms of a tax sharing agreement. Following the consummation of the sale of Westar's ownership interests in us, we are no longer a part of the Westar consolidated tax group.

We and Westar did not, however, terminate our tax sharing agreement, and based on discussions with Westar and its counsel, there are several areas of potential dispute between us regarding Westar's obligations under the terms of the tax sharing agreement. The most material of these potential disputes involve (i) the amount of any tax sharing payments that would be due to us if Westar decides in the future to elect to treat the sale of its interests in us as a sale of assets under the Internal Revenue Code, (ii) the proper treatment under the tax sharing agreement of tax obligations or benefits arising out of the transaction in which Westar sold its ownership interests in us, including the impact on future tax sharing payments to us related to the cancellation of indebtedness income generated by a partial write down of the revolving credit facility prior to closing or the assignment of the revolving credit facility for less than the full amount outstanding under the facility at closing and (iii) whether tax sharing payments due to us when Westar was subject to alternative minimum tax should be calculated at the alternative minimum tax rate of 20% or the normal statutory rate of 35% to the extent that Westar has utilized or is reasonably expected to be able to utilize the associated alternative minimum tax credits or otherwise has received full benefits at normal statutory rates from our losses. We believe that we have strong positions with respect to these items and will aggressively pursue our positions. If we prevail, we may realize additional tax sharing payments from Westar.

Operations

Our operations consist principally of installing, servicing and monitoring premise intrusion and fire alarms.

7

Centralized Monitoring, Common Technology Platform and Customer Service

Customer Security Alarm Systems. Security alarm systems include many different types of devices installed at customers' premises designed to detect or react to various occurrences or conditions, such as intrusion or the presence of fire or smoke. These devices are connected to a computerized control panel that communicates through wireline and/or wireless phone lines to a monitoring facility. In most systems, control panels can identify the nature of the alarm and the areas within a building where the sensor was activated and can transmit that information to a central monitoring station.

Customer Contracts. Our existing alarm monitoring customer contracts generally have initial terms ranging from two to ten years in duration, and, in most states, provide for automatic renewals for a fixed period (typically one year) unless we or the customer elect to cancel the contract at the end of its term. Since 2002, most new single family residential customers have been entering into contracts with an initial term of three years and, for most new commercial customers, the initial term is five years. Typically, customers sign alarm monitoring contracts that include a bundled monthly charge for monitoring and extended service protection, which covers the normal costs of repair of the security system. Customers may elect to sign an alarm monitoring contract that excludes extended service protection at a reduced monthly charge. A significant percentage of new residential and commercial customers are also electing to include line security based on cellular technology in their service bundle.

Monitoring Facilities. We provide monitoring services to our customer base from four monitoring facilities. The table below provides additional detail about our monitoring centers:

Location

| | Approximate Number of

Customers Monitored

| | Primary Markets

|

|---|

| Irving, TX | | 330,000 | | Multifamily |

| Longwood, FL | | 140,000 | | Wholesale/Residential |

| Wichita, KS | | 530,000 | | Residential/Commercial/Wholesale |

| Portland, ME | | 40,000 | | Commercial/Residential |

Our monitoring facilities operate 24 hours per day, seven days a week, including all holidays. Each monitoring facility incorporates the use of communications and computer systems that route incoming alarm signals and telephone calls to operators. Each operator within a monitoring facility monitors a computer screen that presents information concerning the nature of the alarm signal, the customer whose alarm has been activated and the premises on which such alarm is located. Other non-emergency administrative signals are generated by low battery status, arming and disarming of the alarm monitoring system and test signals, and such signals are processed automatically by computer. Depending upon the type of service for which the customer has contracted, monitoring facility personnel respond to alarms by relaying information to the local fire or police departments, notifying the customer, or taking other appropriate action, such as dispatching alarm response personnel to the customer's premises where this service is available.

All of our primary monitoring facilities are listed by Underwriters Laboratories, Inc., or UL, as protective signaling services stations. UL specifications for monitoring facilities include building integrity, back-up computer and power systems, staffing and standard operating procedures. In many jurisdictions, applicable law requires that security alarms for certain buildings be monitored by UL listed facilities. In addition, such listing is required by certain commercial customers' insurance companies as a condition to insurance coverage.

8

Backup Facility. Our backup facility is in Wichita, Kansas and is a highly secure concrete building. This fully operable resource has the ability to backup all mission critical operations normally performed at our primary monitoring center. The structure is equipped with diverse voice and data telecommunication paths, backup power which includes standby UPS, access control, video surveillance and data vaults. In addition, we have deployed hot redundancy for our entire compliment of equipment essential in the remote monitoring of security systems we offer. Furthermore, we have replicated the computer systems that are used to maintain our mission critical applications. This facility was purchased with the ability to be expanded for future internal growth and is actively used for other business related operations.

Wholesale Monitoring. Through our monitoring facilities in Longwood and Wichita, we provide wholesale monitoring services to independent alarm companies. Under the typical arrangement, alarm companies subcontract monitoring services to us, primarily because they cannot cost-effectively provide their own monitoring service. We may also provide billing and other services. These independent alarm companies retain ownership of monitoring contracts and are responsible for every other aspect of the relationship with customers, including field repair service.

Customer Care Services. Customer care personnel answer non-emergency telephone calls typically regarding service, billing and alarm activation issues. Most business-hours customer care functions are handled by our branches. During business hours, monitoring facility personnel receive inbound customer calls forwarded from branches when the latter are unable to answer within a specified number of rings. After-hours, all customer calls are forwarded to the monitoring facilities.

Customer care personnel in our branches and in our monitoring facilities at help desks assist customers in understanding and resolving minor service and operating issues related to security systems. Branch personnel schedule technician appointments. We also operate a dedicated telesales center in Wichita to address questions that customers or potential customers have about our services, as well as to perform outbound sales and marketing activities.

Enhanced Services. As a means of increasing revenues and enhancing customer satisfaction, we offer customers an array of enhanced security services, including extended service protection, supervised monitoring services and telephone line security based on wireless technology. These services position us as a full service provider and give our sales representatives more features to sell in their solicitation of new customers. Enhanced services include:

- •

- Extended Service Protection, which covers the normal costs of repair of the security system during regular business hours.

- •

- Supervised Monitoring Service, which allows the alarm system to send various types of signals containing information on the use of the system, such as which users armed or disarmed the system and at what time of the day. This information is supplied to customers for use in connection with the management of their households or businesses. Supervised monitoring service can also include a daily automatic test feature.

- •

- Wireless Back-Up, which permits the alarm system to send signals over a cellular telephone or dedicated radio system in the event that regular telephone service is interrupted.

Branch Operations

We maintain approximately fifty-five service branches in North America from which we provide field repair, customer care, alarm response and sales services, and eleven satellite locations from which we provide field repair services. Our nationwide network of branches operates in some of the largest cities in the United States and plays a critical role in enhancing customer satisfaction, reducing customer loss and building brand awareness. Repair services generate revenues primarily through

9

billable field service calls and recurring payments under our extended service protection program. By focusing growth in targeted areas we hope to increase the density of our customer base which will permit more effective scheduling and routing of field service technicians and will create economies of scale.

Sales and Marketing

Our current customer acquisition strategy for our North America segment relies primarily on internally generated sales. In June 2001, we notified most of our remaining domestic dealers that we were terminating our dealer arrangement with them and therefore would not be extending or renewing their contracts. The number of accounts being purchased through our dealer program decreased to 135 accounts in 2003 from 1,135 and 7,501 accounts in 2002 and 2001, respectively.

Our internal sales program for our North America segment was started in February 2000 on a commission only basis with a goal of creating accounts at a cost lower than our external programs. In 2001, we revised and enhanced our internal sales program, and in 2002, enhanced the benefits package for our sales force. This program utilizes our existing branch infrastructure in approximately fifty-five markets. The internal sales program for our North America segment generated 50,731 accounts and 45,642 accounts in 2003 and 2002, respectively. We operate a dedicated telesales center in Wichita from which we respond to questions that customers or potential customers have about our services, support the alliance with BellSouth and provide quality control follow-up calls to customers for whom we recently provided installation or maintenance services.

We are a partner in a marketing alliance with BellSouth to offer monitored security services to the residential, single family market and to small businesses in seventeen of the larger metropolitan markets in the nine-state BellSouth region. The marketing alliance agreement may be terminated by either party upon 180 days notice or earlier upon occurrence of certain events.

Under this agreement, we operate as "BellSouth Security Systems from Protection One" from our branches in the nine-state BellSouth region. BellSouth provides us with information about new owners of single family residences in its territory and of transfers of existing BellSouth customers within its territory. We follow up on the information to create leads for our sales force. We also market directly to small businesses. We pay BellSouth an upfront royalty for each new contract and a recurring royalty based on a percentage of recurring charges. Approximately one-fifth of our new accounts created in 2003 and one-fourth of our new accounts created in 2002 were produced from this arrangement. Should we make an assignment for the benefit of creditors, should an order for relief under Chapter 11 of the United States Bankruptcy Code be entered by a United States Court against us or should a trustee or receiver of any substantial part of our assets be appointed by any court, or if we are in default with respect to any of the covenants relating to financial performance set forth in the 73/8% senior notes, BellSouth may seek to terminate the alliance, which could have a material adverse impact on our operating results and on our ability to generate new customers in this territory.

Sales professionals are responsible for identifying new prospects and closing new sales of monitoring systems and services. The sales force also generates revenue from selling equipment upgrades and add-ons to existing customers and by competing for those customers who are terminating their relationships with our competitors.

Our Multifamily segment utilizes a salaried and commissioned sales force to produce new accounts. Multifamily markets its services and products primarily to developers, owners and managers of apartment complexes and other multifamily dwellings. Multifamily sales and marketing activities consist of national and regional advertising, nationwide professional field sales efforts, prospective acquisition marketing efforts and professional industry-related association affiliation. Services are sold directly to the property owner, and payment is based on a monthly price on a per-unit basis. Ongoing service for the duration of the lease includes equipment, maintenance, 24-hour monitoring from our

10

central monitoring station, customer service and individual market support. Property owner contracts generally have initial terms ranging from five to ten years in duration, and provide for automatic renewal for a fixed period (typically five years) unless Multifamily or the customer elects to cancel the contract at the end of its term.

We continually evaluate our customer creation and marketing strategy, including evaluating each respective channel for economic returns, volume and other factors and may shift our strategy or focus, including the elimination of a particular channel.

Attrition

Customer attrition has a direct impact on our results of operations since it affects our revenues, amortization expense and cash flow. We define attrition as a ratio, the numerator of which is the gross number of lost customer accounts for a given period, net of the adjustments described below, and the denominator of which is the average number of accounts for a given period. In some instances, we use estimates to derive attrition data. We make adjustments to lost accounts primarily for the net change, either positive or negative, in our wholesale base and for accounts which are covered under a purchase price holdback and are "put" back to the seller. We reduce the gross accounts lost during a period by the amount of the guarantee provided for in the purchase agreements with sellers. In some cases, the amount of the purchase holdback may be less than actual attrition experience. Adjustments to lost accounts for purchase holdbacks have been decreasing because we are purchasing fewer accounts in the types of transactions that create holdbacks. We do not reduce the gross accounts lost during a period by "move in" accounts, which are accounts where a new customer moves into the premises equipped with the Company's security system and vacated by a prior customer, or "competitive takeover" accounts, which are accounts where the owner of a premise monitored by a competitor requests that we provide monitoring services.

Our actual attrition experience shows that the relationship period with any individual customer can vary significantly. Customers' service can be discontinued for a variety of reasons, including relocation, non-payment, customers' perception of value and competition. A portion of the acquired customer base can be expected to discontinue service every year. Any significant change in the pattern of our historical attrition experience would have a material effect on our results of operations.

We monitor attrition each quarter based on an annualized and trailing twelve-month basis. This method utilizes each segment's average customer account base for the applicable period in measuring attrition. Therefore, in periods of customer account growth, customer attrition may be understated and, in periods of customer account decline, customer attrition may be overstated.

Customer attrition by business segment for the years ended December 31, 2003, 2002 and 2001 is summarized below:

| | Customer Account Attrition

| |

|---|

| | December 31, 2003

| | December 31, 2002

| | December 31, 2001

| |

|---|

| | Annualized

Fourth

Quarter

| | Trailing

Twelve

Month

| | Annualized

Fourth

Quarter

| | Trailing

Twelve

Month

| | Annualized

Fourth

Quarter

| | Trailing

Twelve

Month

| |

|---|

| North America(a) | | 10.3 | % | 10.5 | % | 14.0 | % | 13.1 | % | 22.6 | % | 18.7 | % |

| North America, excluding wholesale(a) | | 14.6 | % | 14.5 | % | 14.2 | % | 16.2 | % | 26.6 | % | 22.7 | % |

| Multifamily | | 6.5 | % | 5.8 | % | 7.2 | % | 6.6 | % | 7.7 | % | 6.3 | % |

| Total Company(a) | | 9.1 | % | 9.0 | % | 11.9 | % | 11.2 | % | 18.5 | % | 15.5 | % |

- (a)

- Does not include the Canguard operation, which we sold in July 2002.

11

Attrition decreased in our North America segment in 2003 compared to 2002 for a variety of reasons including:

- •

- a focus by our sales force on obtaining high quality customers;

- •

- an increase in the investment required by customers to purchase our systems;

- •

- an emphasis on customer service and attrition reduction by branch and monitoring center personnel; and

- •

- legal action taken against competitors who illegally solicit our customers.

Competition

The security alarm industry is highly competitive. In North America, there are only four alarm companies that offer services across the United States with the remainder being either large regional or small, privately held alarm companies. Based on total annual revenues in 2003, we believe the top four alarm companies in North America are:

- •

- ADT Security Services, a subsidiary of Tyco International, Inc.

- •

- Brink's Home Security Inc., a subsidiary of The Brink's Company

- •

- Protection One, Inc.

- •

- Honeywell Security Monitoring, a division of Honeywell, Inc.

Competition in the security alarm industry is based primarily on market visibility, price, reputation for quality of services and systems, services offered and the ability to identify and to solicit prospective customers as they move into homes and businesses. We believe that we compete effectively with other national, regional and local security alarm companies due to our ability to offer integrated alarm system installation, monitoring, repair and enhanced services, our reputation for reliable equipment and services, our affinity alliance with BellSouth and our prominent presence in the areas surrounding our branch offices.

Intellectual Property

We own trademarks related to the name and logo for Protection One and Network Multifamily Security as well as a variety of trade and service marks related to individual services we provide. While we believe our trademarks and service marks and proprietary information are important to our business, other than the trademarks we own in our name and logo, we do not believe our inability to use any one of them would have a material adverse effect on our business as a whole.

Regulatory Matters

A number of local governmental authorities have adopted or are considering various measures aimed at reducing the number of false alarms. See "Risk Factors" below. Such measures include:

- •

- permitting of individual alarm systems and the revocation of such permits following a specified number of false alarms;

- •

- imposing fines on alarm customers for false alarms;

- •

- imposing limitations on the number of times the police will respond to alarms at a particular location after a specified number of false alarms;

- •

- requiring further verification of an alarm signal before the police will respond; and

- •

- subjecting alarm monitoring companies to fines or penalties for transmitting false alarms.

12

Our operations are subject to a variety of other laws, regulations, and licensing requirements of federal, state, and local authorities. In certain jurisdictions, we are required to obtain licenses or permits, to comply with standards governing employee selection and training, and to meet certain standards in the conduct of our business.

The alarm industry is also subject to requirements imposed by various insurance, approval, listing and standards organizations. Depending upon the type of customer served, the type of security service provided, and the requirements of the applicable local governmental jurisdiction, adherence to the requirements and standards of such organizations is mandatory in some instances and voluntary in others.

Our advertising and sales practices are regulated in the United States by both the Federal Trade Commission and state consumer protection laws. In addition, certain administrative requirements and laws of the jurisdictions in which we operate also regulate such practices. Such laws and regulations include restrictions on the manner in which we promote the sale of our security alarm systems and the obligation to provide purchasers of our alarm systems with rescission rights.

Our alarm monitoring business utilizes wireline and wireless telephone lines and radio frequencies to transmit alarm signals. The cost of telephone lines, and the type of equipment which may be used in telephone line transmission, are currently regulated by both federal and state governments. The Federal Communications Commission and state public utilities commissions regulate the operation and utilization of radio frequencies.

Risk Management

The nature of the services provided by Protection One potentially exposes us to greater risks of liability for employee acts or omissions, or system failure, than may be inherent in other businesses. Substantially all of our alarm monitoring agreements, and other agreements, pursuant to which we sell our products and services contain provisions limiting liability to customers in an attempt to reduce this risk.

We carry insurance of various types, including general liability and errors and omissions insurance in amounts management considers adequate and customary for our industry and business. Our loss experience, and the loss experiences at other security service companies, may affect the availability and cost of such insurance. Some of our insurance policies, and the laws of some states, may limit or prohibit insurance coverage for punitive or certain other types of damages, or liability arising from gross negligence.

Employees

At December 31, 2003, we had approximately 2,300 full-time employees. Our workforce is not unionized.

Access to Company Information

We electronically file our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the Securities and Exchange Commission, or SEC. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We make available, free of charge, through our website atwww.protectionone.com, and by responding to requests addressed to our investor relations department, our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The information contained on our website is not part of this document.

13

RISK FACTORS

Cautionary Statements Regarding Future Results of Operations

You should read the following risk factors in conjunction with discussions of factors discussed elsewhere in this and other of our filings with the SEC. These cautionary statements are intended to highlight certain factors that may affect our financial condition and results of operations and are not meant to be an exhaustive discussion of risks that apply to public companies with broad operations, such as us.

Introduction

We have reported losses for the past several years. Westar, the former owner of 88% of our common stock, has consummated the sale of its equity interest in us and the assignment of its rights and obligations in our revolving credit facility to Quadrangle. Additionally, a primary financing source has been the revolving credit facility, and additional credit available under such facility has been eliminated by, among other things, a standstill agreement executed by Quadrangle and us. We have evaluated these conditions and events in establishing our operating plans. In addition to the plans and strategies noted below, we plan to monitor carefully the level of investment in new customer accounts and to continue control of operating expenses and capital expenditures. Absent recapitalization and restructuring our debts, management believes that cash flow from operations, coupled with receipts, if any, under the tax sharing agreement and proceeds from asset sales, if any, will be insufficient to support our current debt balances, which may be accelerated as a result of the change in control, and related interest obligations. (See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.") Consummation of the sale by Westar could have a material adverse effect upon our financial position and liquidity, and we may need to restructure our indebtedness in an out-of-court proceeding and/or seek the protection of federal bankruptcy laws to reorganize. See further discussion of these and other important matters below.

The Westar sale transaction and assignment of rights and obligations under the revolving credit facility triggered an obligation to offer to repurchase our 135/8% senior subordinated discount notes which have outstanding principal of $29.9 million.

As a result of the sale transaction, the indenture relating to our 135/8% senior subordinated discount notes requires us to give notice of our intention to repurchase the notes, which had aggregate outstanding principal of $29.9 million as of March 15, 2004, within 30 days following the date of a change in control, and to consummate the repurchase within 60 days of such notification. Under the terms of this indenture, because we have not offered to repurchase such notes, our inaction constitutes a covenant breach, which breach, if not cured within 30 days after receipt of appropriate notice, would constitute an event of default under the notes' indenture. Furthermore, upon any such event of default, the trustee or the holders of such senior subordinated discount notes may seek to exercise certain remedies available to them under the indenture governing the notes, including, without limitation, acceleration of the notes, which acceleration, if not rescinded or satisfied, would cause a cross default to be triggered under the indenture for our 81/8% senior subordinated notes, which had aggregate outstanding principal of $110.3 million as of March 15, 2004. If such acceleration and cross default should occur, we do not have the funds available to repay the indebtedness, and we could be forced to seek relief under the U.S. Bankruptcy Code or an out-of-court restructuring.

The Westar sale transaction and assignment of rights and obligations under the revolving credit facility triggered a change in control provision in our revolving credit facility.

As a result of the sale transaction, the $215.5 million outstanding under the revolving credit facility is in default. We entered into a standstill agreement with Quadrangle, however, pursuant to which,

14

among other things, Quadrangle agreed to waive the change in control default and other specified covenant breaches for a period not to exceed 90 days, and we agreed, among other things, that we could not borrow any additional amounts under the revolving credit facility. Upon the expiration of this standstill agreement, Quadrangle may exercise its rights under the Credit Facility and declare the indebtedness to be due and payable. We do not have the funds available to repay the revolving credit facility, and such non-payment would trigger a cross default under the indentures for our other publicly-held debt. If this should occur, we could be forced to seek relief under the U.S. Bankruptcy Code or an out-of-court restructuring.

Holders of our 73/8% senior notes and 81/8% senior subordinated notes may assert that Westar's sale transaction and assignment of rights and obligations under the revolving credit facility triggered the change in control provisions in those indentures.

As a result of the sale transaction, certain holders of our 73/8% senior notes, which had aggregate outstanding principal of $190.9 million as of March 15, 2004, and 81/8% senior subordinated notes, which had aggregate outstanding principal of $110.3 million as of March 15, 2004, may assert that a change in control triggering event has occurred as defined in the respective indentures. A change of control triggering event consists of a change in control coupled with the withdrawal of the rating of the notes or two ratings downgrades by one of certain specified rating agencies provided that such withdrawal or downgrade occurs within 90 days after the date of public notice of the occurrence of a change in control or the intention to effect a change in control. Such an event would require that we repurchase the notes within 60 days of mailing such offer to repurchase at 101% of aggregate principal amount plus accrued interest. We do not have the available funds to repurchase the notes. If such a triggering event should occur, we do not have the funds available to repurchase the indebtedness, and we could be forced to seek relief under the U.S. Bankruptcy Code or an out-of-court restructuring.

A financial restructuring, whether administered though a court proceeding or out-of-court, could substantially dilute or cancel, in whole or in part, the interests of our stockholders.

If we were to restructure or reorganize our debts or seek relief under the U.S. Bankruptcy Code, such actions could have a material adverse impact on our common stockholders as we believe they would be subordinate to our senior and subordinated debt in such proceedings.

The Westar sale transaction and assignment of rights and obligations under the revolving credit facility will force us to implement new financial and human resource systems.

As a result of the sale transaction, we will be forced to purchase our own accounting and human resource systems and transition from the Westar systems within (i) six months from the date of close of the sale for the human resource system and (ii) 12 months from the date of close of the sale for the accounting system. We estimate the cost to replace those systems to be approximately $2.6 million. We can give no assurances that we will be able to complete such transitions in the time allotted or within our estimated costs. Failure to do so could have a material adverse impact on our financial condition and results of operations.

The Westar sale transaction and assignment of rights and obligations under the revolving credit facility was accompanied by the resignation of a majority of the members of our Board of Directors, and no new employment agreements have been entered into with executive management.

As required by the terms of the sale transaction, five Westar-designated members of our Board of Directors resigned concurrently with the closing of the sale transaction. Another director resigned concurrently for personal reasons, leaving only three directors. Additionally, we entered into a standstill agreement with Quadrangle, which, among other things, prohibits Quadrangle from appointing directors to the Board for a period not to exceed 90 days if certain conditions are met. We can make

15

no guarantees that we can attract additional directors to our Board. Additionally, executive management has not entered into new employment agreements with us, and upon fulfilling their minimum contractual obligations under their old agreements, may leave after six months has elapsed from the date of the change in control.

Quadrangle is our principal stockholder and can exercise a controlling influence over us.

Quadrangle owns approximately 87% of the outstanding common stock of Protection One as of February 17, 2004. Upon the expiration of the standstill agreement, it will be able to direct the election of all of our directors and exercise a controlling influence over our business and affairs, including any determinations with respect to mergers or other business combinations involving us, appointment of our officers, our acquisition or disposition of material assets and our incurrence of indebtedness. Similarly, Quadrangle will continue to have the power to determine matters submitted to a vote of our stockholders without the consent of other stockholders, to accelerate obligations under the revolving credit facility and to take other actions that might be favorable to Quadrangle, whether or not these actions would be favorable to us or our stockholders generally.

The Westar sale transaction and assignment of rights and obligations under the revolving credit facility may cause us to focus on short term goals at the expense of long-term goals.

As a result of the sale transaction and the possibility that we may enter into an out-of-court restructuring or seek relief under the U.S. Bankruptcy Code, we may focus on business strategies that are in the short-term best interests of us, our stockholders and our creditors but not necessarily in our collective long-term best interests. This could mean, for example, that a substantial amount of management time may be spent developing relationships with creditors and vendors instead of building the company, its business and its assets for the long-term. As a result, during this period of time, we may experience difficulty developing new long-term customers and maintaining relationships with companies with which we do business who may feel uncertain about our future ownership, management and direction. In addition, we may be unable to retain the services of some of our key employees who may also feel uncertain about our future ownership, management and direction.

We obtain administrative services from and share information technology systems with Westar Energy through our shared services agreement which, when terminated, may result in increased costs for us.

Westar Energy provides us certain administrative services pursuant to a services agreement, which we refer to as the administrative services agreement (see Item 8, Note 6 "Related Party Transactions"), including accounting, tax, audit, human resources, legal, purchasing and facilities services. The administrative services agreement provides for continuation of the services during an agreed-upon transition period following the sale of Westar's interest in us. Our cost of obtaining these services from either a third party or by hiring sufficient staff to perform those services internally may increase and we will incur significant costs to procure and to develop replacement information technology systems.

We have a history of losses, which are likely to continue.

We incurred net losses of $34.4 million in 2003, $880.9 million in 2002 and $86.0 million in 2001. These losses reflect the following, among other factors:

- •

- our customer base and revenues have declined since 1999;

- •

- substantial charges incurred by us for amortization of purchased customer accounts and, in 2002, an impairment charge to purchased accounts;

- •

- interest incurred on indebtedness;

- •

- expansion of our internal sales and installation efforts.

16

- •

- other charges required to manage operations; and

- •

- amortization of goodwill in 2001 and impairment charges for 2002.

We will continue to incur substantial interest expense unless we significantly reduce our debt, which, absent restructuring, is unlikely given our expected cash flow. We do not expect to attain profitability in the foreseeable future unless we significantly reduce our interest expense and our amortization charges for purchased customer accounts.

We have deferred tax assets that we do not expect to be able to utilize.

Westar Energy has in the past made payments to us for current tax benefits utilized by Westar Energy in its consolidated tax return pursuant to a tax sharing agreement, which has been an important source of liquidity for us. As a result of the sale transaction whereby Westar sold its investment in us, a substantial portion of our net deferred tax assets, which were $286.3 million at December 31, 2003, are not expected to be realizable and we are not expected to be in a position to record a tax benefit for losses incurred. We will be required to record a non-cash charge against income for the portion of our net deferred tax assets we determine not to be realizable. This charge will be material and will have a material adverse effect on our financial condition and results of operations. In addition, as a result of the sale, except for amounts owed with respect to losses we incurred prior to leaving the Westar consolidated tax group as a result of Westar selling its interest in us, we will no longer receive payments from Westar Energy. In 2003 and 2002, we received aggregate payments from Westar Energy of $20.0 million and $1.7 million, respectively. The loss of these payments will have a material adverse effect on our cash flow. There are several areas of potential dispute between us regarding Westar's obligations under the terms of the tax sharing agreement. See "Overview—Dispute regarding tax sharing payments" above.

The Westar sale transaction may adversely affect our tax position after the closing.

If Westar does not elect to treat the sale of its equity interest in us to Quadrangle as a sale of assets, the sale of our stock will constitute a more-than-50-percent change in ownership of the Company within the meaning of Internal Revenue Code Section 382. As a result, our use of pre-closing tax losses (if any such losses are not used by the Westar consolidated tax group) and certain "built-in losses" in our assets (generally the excess of the tax basis of such assets over their fair market value) will be significantly limited after the closing of the sale transaction. Such limits will have a material adverse effect on our tax position after the closing.

If Westar elects to treat the sale of its equity interests in us to Quadrangle as a sale of assets, the deemed sale of assets will cause a reduction in the tax basis of our assets to an amount generally equal to the deemed asset sale price. Such a reduction will be significant in amount and will have a material adverse effect on our tax position after the closing of the sale transaction.

Our debt agreements impose operational restrictions on us.

The indentures governing our public indebtedness require us to satisfy certain financial covenants in order to borrow additional funds. The most restrictive of these covenants are set forth below:

- •

- Total debt to annualized EBITDA for the most recent quarter must be less than 6.0 to 1.0;

- •

- EBITDA to interest expense for the most recent quarter must be greater than 2.25 to 1.0; and

- •

- Senior debt to annualized EBITDA for the most recent quarter must be less than 4.0 to 1.0.

In each case, the ratio reflects the impact of acquisitions and other capital investments for the entire period covered by the calculation. These debt instruments contain restrictions based on "EBITDA". The definition of EBITDA varies among the various indentures. EBITDA is generally

17

derived by adding to income (loss) before income taxes, the sum of interest expense and depreciation and amortization expense. However, under the varying definitions of the indentures, additional adjustments are required. Below are the our actual ratios for the quarter ended December 31, 2003:

- •

- Total debt to annualized EBITDA was 4.1 to 1.0;

- •

- EBITDA to interest expense was 3.1 to 1.0; and

- •

- Senior debt to annualized EBITDA was 3.0 to 1.0.

The indentures contain other covenants that impose operational restrictions on us which are not as burdensome to us as those listed above and none are based solely on credit ratings. A violation of these restrictions would result in an event of default which would allow the lenders to declare all amounts outstanding immediately due and payable.

We have a substantial amount of debt, which, among other things, could constrain our growth.

We have, and will likely continue to have, a large amount of consolidated indebtedness. The terms of various indentures and credit agreements discussed above governing our indebtedness limit our ability to incur additional indebtedness that we might need in the future in order to fund creation of customer accounts.

In addition, you should be aware that:

- •

- As of December 31, 2003, we had outstanding total indebtedness of $547.4 million, of which $331.9 million was long-term indebtedness. See "Risk Factors," above, for discussion regarding potential impacts on our debt from our change in control;

- •

- As of December 31, 2003 and March 15, 2004 we had $215.5 million of debt outstanding under our revolving credit facility with Quadrangle bearing interest at a weighted average floating interest rate before fees of 7.8%; and

- •

- We have not made our semi-annual interest payment on our 73/8% senior notes that was due February 17, 2004. Should we fail to make such payment within the 60 day grace period, this will constitute an event of default and the indebtedness under such notes could be accelerated. Additionally, this acceleration would trigger a cross default with respect to our other debt instruments.

Our present high level of indebtedness could have negative consequences on, without limitation:

- •

- Our ability to obtain additional financing in the future for working capital, acquisitions or creation of customer accounts, capital expenditures, general corporate purposes or other purposes;

- •

- Our ability to withstand a downturn in our business or the economy generally; and

- •

- Our ability to compete against other less leveraged companies.

As discussed in "Matters to Consider," above, our revolving credit facility is in default due to the sale by Westar of its investment in us on February 17, 2004. Furthermore, the indentures governing our debt securities require that we offer to repurchase the securities in certain circumstances following a change of control:

- •

- The 135/8% senior subordinated discount notes require us to make a repurchase offer at approximately 101% of principal amount, plus accrued interest, in the event of a change in control, and we have not made such an offer; and

- •

- The 73/8% senior notes and 81/8% senior subordinated notes require us to make a repurchase offer at 101% of principal amount, plus interest, in the event of a change in control coupled

18

As of December 31, 2003, we had outstanding $29.9 million principal amount of the 135/8% senior subordinated discount notes, $190.9 million principal amount of the 73/8% senior notes and $110.3 million principal amount of the 81/8% senior subordinated notes.

We recorded impairment charges in 2002 and additional charges may be recorded in the future.

In the first quarter of 2002, we recorded an impairment charge to write-down goodwill and customer accounts to their estimated fair values. The amount of this charge was approximately $765.2 million, net of $190.7 million tax, of which approximately $543.6 million, net of $72.3 million tax, was related to goodwill and approximately $221.6 million, net of $118.4 million tax, was related to customer accounts. In addition, we recorded a $90.7 million impairment charge, net of $13.3 million tax, in the fourth quarter of 2002 to reflect the impairment of all remaining goodwill of our North America segment. The tax benefits from these impairments increased our deferred tax assets by $204.0 million, most of which are not expected to be realized due to Westar's sale of our common stock. For further information on these impairment charges, see Item 8, Note 14 "Impairment Charges." We have $41.8 million of goodwill associated with our Multifamily segment and $244.7 million in customer accounts recorded on our December 31, 2003 balance sheet. The remaining amount of goodwill will be required to be tested annually for impairment. We established July 1 as our annual impairment testing date. We completed our annual impairment testing during the third quarter of 2003 on our Multifamily segment and determined that no additional impairment of goodwill was required as of July 1, 2003. Our North America segment has no goodwill and, therefore, did not require testing as of July 1, 2003. No impairment charge was recorded in 2003. If we fail future impairment tests for either goodwill or customer accounts, we will be required to recognize additional impairment charges on these assets in the future. Any such impairment charges could be material.

The competitive market for the acquisition and creation of accounts may affect our future profitability.

Prior to 2000, we grew very rapidly by acquiring portfolios of alarm monitoring accounts through acquisitions and dealer purchases. Our current strategy is to reduce the cost of acquiring new accounts by utilizing other customer account acquisition channels such as our internal sales force augmented by traditional marketing support. We compete with major companies, some of which have greater financial resources than we do, or which may be willing to offer higher prices than us to purchase customer accounts or to increase the amount of investment to create a new customer. The effect of competition may be to reduce the purchase opportunities available to us, or to increase the price we pay for or invest in customer accounts, which could have a material adverse effect on our return on investment in such accounts, and on our results of operations, financial condition and ability to service debt.

Should we seek debt relief either under the U.S. Bankruptcy Code or by way of an out-of-court restructuring, we expect our competitors to use our actions to their advantage in competing against us for residential and, in particular, commercial sales. Homeowners and businesses that might have contracted with us may be unwilling to do so while we are restructuring our debts.

We lose some of our customers over time, and the loss of customers may increase if we restructure.

We experience the loss of accounts as a result of, among other factors:

- •

- relocation of customers;

- •

- adverse financial and economic conditions;

19

- •

- the customers' perception of value; and

- •

- competition from other alarm service companies.

We may experience the loss of newly acquired or created accounts to the extent we do not integrate or adequately service those accounts. Because some acquired accounts are prepaid on an annual, semiannual or quarterly basis, customer loss may not become evident for some time after an acquisition is consummated. An increase in the rate of customer loss could have a material adverse effect on our results of operations and financial condition.

During 2003 our focus on strengthening our operations resulted in a net loss of 25,378 customers or a 2.4% decrease in our customer base from January 1, 2003. During 2002, our change in focus from growth to strengthening our operations, resulted in a net loss of 59,625 customers or a 5.3% decrease in our customer base from January 1, 2002. While our attrition rate is decreasing, we continue to lose customers at a faster rate than our rate of adding customers. Some of the reasons for the decrease in attrition in 2003 are discussed in "Business—Attrition," above. The net loss of customers was the primary cause of our decline in monitoring and related service revenues in the North America segment of $13.9 million in 2003 and $47.5 million in 2002. We expect this trend will continue until the efforts we are making to acquire new accounts and further reduce our rate of attrition become more successful than they have been to date. Until we are able to reverse this trend, net losses of customer accounts will materially and adversely affect our business, financial condition and results of operations.

Should we seek debt relief either under the U.S. Bankruptcy Code or by way of an out-of-court restructuring, we expect to experience higher attrition from customers unwilling to continue relying on us to provide security monitoring services even though we do not expect our capabilities to provide such services to be affected.

Our customer acquisition strategies may not be successful which would adversely affect our business.

The customer account acquisition strategy we are now employing relies primarily on our internal sales force and making alliances such as our strategic alliance with BellSouth. We have changed our acquisition strategy several times over the past few years attempting to decrease the cost of adding customers and to decrease the rate of attrition from new accounts. While our present strategy resulted in some improvement in 2003, there can be no assurance that this strategy will be successful. If the strategy is not successful, our customer base could continue to decline. If successful, the selling costs related to this strategy will increase our expenses and uses of cash. Failure to economically replace customers lost through attrition or increased cash needs could have a material adverse effect on our business, financial condition, results of operations and ability to service debt obligations.

Should we make an assignment for the benefit of creditors, should an order for relief under Chapter 11 of the United States Bankruptcy Code be entered by a United States Court against us or should a trustee or receiver of any substantial part of our assets be appointed by any court, or if we are in default with respect to any of the covenants relating to financial performance set forth in the 73/8% senior notes, BellSouth may seek to terminate their alliance with us, which could have a material adverse impact on our operating results.

Increased adoption of non-response or verification-required policies by police departments may adversely affect our business.

As noted under "Regulatory Matters" above, an increasing number of local governmental authorities have adopted, or are considering the adoption of laws, regulations or policies aimed at reducing the perceived costs to municipalities of responding to false alarm signals. Such initiatives could increase the costs of providing our services, and consequently lead to less demand for alarm monitoring

20

services in general and increase our attrition. Additionally, we will incur greater costs in monitoring, evaluating and attempting to effect the outcome of these initiatives.

A restructuring under the U.S. Bankruptcy Code may affect our ability to maintain, renew or obtain licenses required under state and local regulations.

We hold numerous state and local licenses and permits for the conduct of our business. Should we become involved in a proceeding under the U.S. Bankruptcy Code, our ability to maintain and renew such licenses and permits could be impaired if governmental authorities seek to terminate such licenses and permits, which could materially and adversely affect our operations.

Declines in new construction of multifamily dwellings may affect our sales in this marketplace.

Demand for alarm monitoring services in the multifamily alarm monitoring market is primarily tied to the construction of new multifamily structures. We believe that developers of multifamily dwellings view the provision of alarm monitoring services as an added feature that can be used in marketing newly developed condominiums, apartments and other multifamily structures. Accordingly, we anticipate that the growth in the multifamily alarm monitoring market will continue so long as there is a demand for new multifamily dwellings. However, the real estate market in general is cyclical and, in the event of a decline in the market for new multifamily dwellings, it is likely that demand for our alarm monitoring services to multifamily dwellings would also decline, which could negatively impact our results of operations.

We are susceptible to macroeconomic downturns which may negatively impact our results of operations.

Like other businesses, we are susceptible to macroeconomic downturns in the United States or abroad that may affect the general economic climate and our performance or that of our customers. Similarly, the price of our securities is subject to volatility due to fluctuations in general market conditions, differences in our results of operations from estimates and projections generated by the investment community and other factors beyond our control.

ITEM 2. PROPERTIES

We maintain our executive offices at 818 S. Kansas Avenue, Topeka, Kansas 66612. We operate primarily from the following facilities, although we also lease office space for our approximately fifty-five service branch offices and eleven satellite branches.

Location

| | Size (sq. ft.)

| | Lease/Own

| | Principal Purpose

|

|---|

| Irving, TX | | 53,750 | | Lease | | Multifamily monitoring facility/administrative headquarters/corporate legal center |

| Longwood, FL | | 11,020 | | Lease | | Monitoring facility/administrative functions |

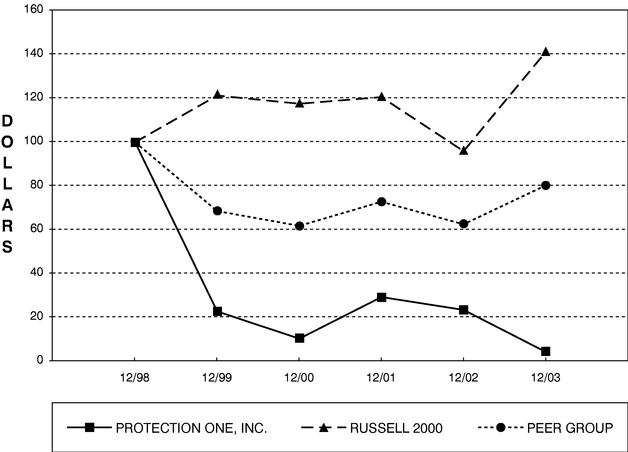

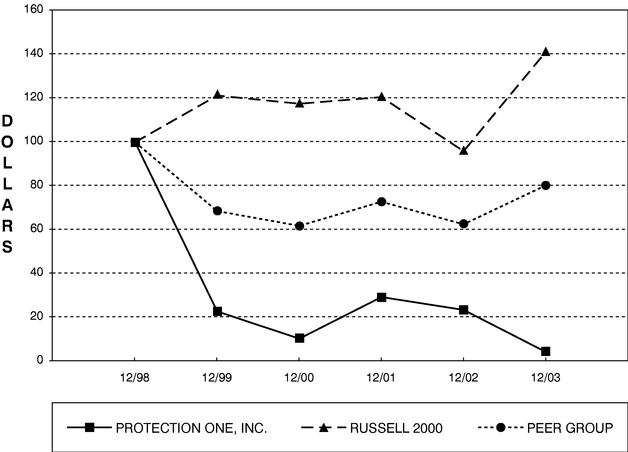

| Portland, ME | | 9,000 | | Lease | | Monitoring facility/local branch |