QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number: 1-12181-01 |

Commission file number: 1-12181 |

Protection One, Inc.

(Exact name of registrant as specified in its charter) |

Protection One Alarm Monitoring, Inc.

(Exact name of registrant as specified in its charter) |

Delaware

(State or other jurisdiction of

incorporation or organization) |

93-1063818

(I.R.S. Employer

Identification No.) |

Delaware

(State or other jurisdiction of

incorporation or organization) |

93-1064579

(I.R.S. Employer

Identification No.) |

1035 N. 3rd Street, Suite 101,

Lawrence, KS

(Address of principal executive offices) |

66044

(Zip Code) |

1035 N. 3rd Street, Suite 101,

Lawrence, KS

(Address of principal executive offices) |

66044

(Zip Code) |

785-856-5500

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

| | Name of each exchange on which registered

|

|---|

| None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class

|

|---|

| Common Stock, par value $.01 per share, of Protection One, Inc. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yeso Noý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesý Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yeso Noý

As of June 29, 2007, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was $110,408,286 based on the closing sale price as reported on the NASDAQ Global Market.

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

Class

| | Outstanding at March 10, 2008

|

|---|

| Common Stock, $0.01 par value per share | | 25,306,913 shares |

DOCUMENTS INCORPORATED BY REFERENCE

Document

| | Parts Into Which Incorporated

|

|---|

| Information Statement for the Annual Meeting of Stockholders to be held on or before July 26, 2008 (Information Statement) | | Part I, II, III and IV |

TABLE OF CONTENTS

| |

| | Page

|

|---|

| PART I |

Item 1. |

|

Business |

|

4 |

| Item 1A. | | Risk Factors | | 13 |

| Item 1B. | | Unresolved Staff Comments | | 20 |

| Item 2. | | Properties | | 20 |

| Item 3. | | Legal Proceedings | | 21 |

| Item 4. | | Submission of Matters to a Vote of Security Holders | | 21 |

PART II |

| Item 5. | | Market for Registrant's Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities | | 22 |

| Item 6. | | Selected Financial Data | | 24 |

| Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 26 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 51 |

| Item 8. | | Financial Statements and Supplementary Data | | 52 |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 107 |

| Item 9A. | | Controls and Procedures | | 107 |

| Item 9B. | | Other Information | | 109 |

PART III |

| Item 10. | | Directors and Executive Officers of the Registrants | | 110 |

| Item 11. | | Executive Compensation | | 110 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 110 |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 110 |

| Item 14. | | Principal Accountant Fees and Services | | 110 |

PART IV |

| Item 15. | | Exhibits and Financial Statement Schedules | | 111 |

2

PART 1

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the materials incorporated by reference herein include "forward-looking statements" intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Statements that are not historical fact are forward-looking statements. These forward-looking statements generally can be identified by, among other things, the use of forward-looking language such as the words "estimate," "project," "intend," "believe," "expect," "anticipate," "may," "will," "would," "should," "could," "seeks," "plans," "intends," or other words of similar import or their negatives. Such statements include those made on matters such as our earnings and financial condition, litigation, accounting matters, our business, our efforts to consolidate and reduce costs, our customer account acquisition strategy and attrition, our liquidity and sources of funding and our capital expenditures. All forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements included herein are made only as of the date of this report and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances, except as required by federal securities laws. Certain factors that could cause actual results to differ include: our history of losses, which are likely to continue; principal and interest payment requirements of and restrictive covenants governing our indebtedness; difficulty in integrating the businesses of Protection One and Integrated Alarm Services Group, Inc. ("IASG"); disruption from our merger with IASG, including lost business opportunities and difficulty maintaining relationships with employees, customers and suppliers; competition, including competition from companies that are larger than we are and have greater resources than we do; losses of our customers over time and difficulty acquiring new customers; termination of our marketing alliance with BellSouth; limited access to capital which may affect our ability to invest in the acquisition of new customers; changes in technology that may make our services less attractive or obsolete or require significant expenditures to upgrade; the development of new services or service innovations by our competitors; potential liability for failure to respond adequately to alarm activations; changes in management; the potential for environmental or man-made catastrophes in areas of high customer concentration; changes in conditions affecting the economy or security alarm monitoring service providers generally; and changes in federal, state or local government or other regulations or standards affecting our operations. New factors emerge from time to time, and it is not possible for us to predict all of such factors or the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

See also Item 1A, "Risk Factors" for a discussion of these and other risks and uncertainties that could cause actual results to differ materially from those contained in our forward-looking statements.

INTRODUCTION

Unless the context otherwise indicates, all references in this report to the "Company," "Protection One," "we," "us" or "our" or similar words are to Protection One, Inc., its direct wholly owned subsidiary, Protection One Alarm Monitoring, Inc. and Protection One Alarm Monitoring's wholly owned subsidiaries, and accordingly, there are no separate financial statements for Protection One Alarm Monitoring, Inc. Protection One, Inc. and Protection One Alarm Monitoring are Delaware corporations organized in September 1991.

On April 2, 2007, we completed our acquisition of IASG (the "Merger"), whereby IASG became our wholly owned subsidiary. The acquisition was accounted for under the purchase method and operating results for IASG subsequent to the Merger are included in the consolidated financial statements.

Stockholders and other security holders or buyers of our securities or our other creditors should not assume that material events subsequent to the date of this Form 10-K have not occurred.

3

ITEM 1. BUSINESS

Overview

We are a leading national provider of electronic security alarm monitoring services, providing installation, maintenance and electronic monitoring of alarm systems to single-family residential, commercial, multifamily and wholesale customers. We monitor signals originating from alarm systems designed to detect burglary, fire, medical, hold-up and environmental conditions, and from access control and closed-circuit-television ("CCTV") systems. Most of our monitoring services and a large portion of the maintenance services we provide our customers are governed by multi-year contracts with automatic renewal provisions that provide us with recurring monthly revenue ("RMR"). As of December 31, 2007 we monitored approximately 1.7 million sites. Based on information provided by a leading industry publication, we are the third largest provider of electronic security monitoring services in the United States based on RMR.

We conduct our business through the following operating segments:

- •

- Retail. Our Retail segment provides monitoring and maintenance services for electronic security systems directly to residential and business customers. We also sell and install electronic security systems for homes and businesses through our Retail segment in order to meet their security needs.

- •

- Wholesale. We contract with independent security alarm dealers nationwide to provide alarm system monitoring services to their residential and business customers. We also provide business support services as well as financing assistance for these independent dealers by providing loans secured by alarm contracts and by purchasing alarm contracts.

- •

- Multifamily. We provide monitoring and maintenance services for electronic security systems to tenants of multifamily residences under long-term contracts with building owners and managers.

Our monitoring and related services revenue for the years ended December 31, 2007, 2006 and 2005 and our monitored sites composition at December 31, 2007, 2006 and 2005 were as follows:

| | Percentage of Total

| |

|---|

| | 2007

| | 2006

| | 2005

| |

|---|

Market

| | Monitoring

and Related

Services Revenue

| | Sites

| | Monitoring

and Related

Services Revenue

| | Sites

| | Monitoring

and Related

Services Revenue

| | Sites

| |

|---|

| Retail | | 77.9 | % | 34.5 | % | 81.8 | % | 51.0 | % | 81.2 | % | 50.9 | % |

| Wholesale | | 11.9 | | 49.6 | | 4.5 | | 19.5 | | 4.3 | | 17.7 | |

| Multifamily | | 10.2 | | 15.9 | | 13.7 | | 29.5 | | 14.5 | | 31.4 | |

| | |

| |

| |

| |

| |

| |

| |

| Total | | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

For the year ended December 31, 2007, we generated consolidated revenue of $347.9 million. Retail accounted for 79.8% of consolidated revenue, or $277.5 million, Wholesale accounted for 10.9% of consolidated revenue, or $38.0 million, and Multifamily accounted for 9.3% of consolidated revenue, or $32.4 million. Financial information for the past three years for each of our business segments is presented in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations" and in Item 8, Note 15 "Segment Reporting," and is incorporated herein by reference.

4

Retail

Our Retail segment provides installation, maintenance and monitoring of electronic security systems to single-family residential and commercial customers. Our Retail business serves approximately 602,000 Retail customers with no single customer comprising more than 1% of our total consolidated revenue. Retail serves customers from 66 field locations and two centralized monitoring centers. Except for the customers acquired in the Merger, the majority of our new Retail customers are generated organically through our internal sales force, with less than 2% of our customer additions in 2007 acquired by purchase of customer contracts. Our reliance on an internal sales force enables us to control the sales process from inception and to manage the level of customer care afforded.

Wholesale

Our Wholesale segment provides alarm monitoring services to independent alarm companies. Our Wholesale business serves approximately 4,800 independent alarm monitoring companies representing approximately 865,000 customers. Typically, we act as the sole provider of monitoring services to independent monitoring companies. For the year ended December 31, 2007, our Wholesale business accounted for 10.9% of our consolidated revenue.

Multifamily

Our Multifamily segment provides alarm monitoring services to owners and managers of apartments, condominiums and other multifamily dwellings. We believe Multifamily is the leading national provider of alarm monitoring services to the multifamily sector with approximately 278,000 units in 1,600 properties in 485 cities.

Sources of Revenue

Revenue is primarily generated from providing monitoring services in our Retail, Wholesale and Multifamily segments. For the year ended December 31, 2007, revenue generated from monitoring and related services accounted for 90.1% of our total revenue.

Monitoring revenue is generated based on contracts that we enter into with our residential and commercial Retail and Multifamily customers. The typical initial contract term is three years for residential customers, five years for commercial customers and five to ten years, with an average of eight years, for Multifamily customers, with automatic renewal provisions where permitted. Our Wholesale customer contracts are generally month-to-month agreements. We generate incremental contractual recurring revenue from nearly all of our residential and commercial customers by providing additional services, such as maintenance.

For the year ended December 31, 2007, installation and other revenue, derived principally from the sale of electronic security systems, contributed 9.9% of our total revenue. Electronic security systems typically are provided at a loss in connection with generating new contracts for recurring monitoring services. Approximately $0.5 million, or 1.6%, of installation and other revenue was derived from interest and fees related to our dealer loan program.

Industry and Competition

According to an industry publication, the market for electronic security system sales, leasing, installation, monitoring and service totaled an estimated $32 billion in 2007. Over the past ten years, the industry has grown at an estimated compounded annual rate of 8.6%. Factors driving this growth include heightened security awareness and concerns regarding crime, demographic changes, an increase in dual income households, increased business travel and personal time away from the home, customer

5

acceptance of value-added offerings such as wireless back-up, the rise in video applications and continuing strength in capital spending by businesses.

The industry is comprised of more than 14,000 small and mid-sized, regional participants, the vast majority of which generate annual revenue of less than $500,000. We believe our primary competitors with national scope include the following:

- •

- ADT Security Services, Inc., a subsidiary of Tyco International, Ltd:

- •

- Brinks Home Security Inc., a subsidiary of The Brink's Company;

- •

- Monitronics International, Inc.; and

- •

- Stanley Security Solutions, a subsidiary of The Stanley Works.

Competition in the security alarm industry is based primarily on brand awareness and company reputation, price, quality and reliability of services and systems, product solutions offered and the ability to identify and to solicit prospective customers as they move into homes and businesses or experience major life events such as marriage or the birth of a child. We believe that we compete effectively with other national, regional and local security alarm companies in both the residential and commercial markets.

Operations

Our operations consist principally of installing, servicing and monitoring electronic security systems in the United States for residential and commercial Retail, Wholesale and Multifamily customers.

Centralized Monitoring, Customer Service and Enhanced Services

Intrusion and fire alarm systems include many different types of devices installed at customer premises designed to detect or react to various occurrences or conditions, such as intrusion or the presence of fire or smoke. These devices are connected to a computerized control panel that communicates through wire line and/or wireless communication channels to one of our monitoring facilities. In most systems, control panels can identify the nature of the alarm and the areas within the building where the sensor was activated and can transmit that information to one of our central monitoring stations.

Access control systems provide physical security for a customer facility. They do this by limiting access to areas through locks and door mechanisms that are controlled by a computer or web service. Customers may establish schedules for when doors are unlocked or they may define access to individuals via uniquely identified cards. The cards are electronically validated at each door station through an electronic card reader. By limiting, enabling or disabling each user's card through the central controller, access control systems replace the need to manage keys.

Video solutions provide customers with the ability to monitor remote locations via cameras. Video may be viewed live over a network, recorded on site or sent electronically upon a specified event. Video solutions may be coupled with alarm systems to provide verification of alarm conditions.

Our existing Retail monitoring customer contracts generally have initial terms ranging from three to five years in duration, and, in most states, provide for automatic renewals for a fixed period (typically one year) unless we or the customer elect to cancel the contract at the end of its term. Since 2002, most new single-family residential customers have entered into contracts with an initial term of three years, and most new commercial customers have entered into contracts with an initial term of five

6

years. Multifamily contracts have initial terms that range from five to ten years. Typically, Retail customers sign alarm monitoring contracts that include a bundled monthly charge for monitoring and extended service protection, which covers the costs of normal repairs of the security system. Customers may elect to sign an alarm monitoring contract providing for a reduced monthly charge that excludes extended service protection. A significant percentage of new residential and commercial customers also elect to include line security based on cellular technology in their service bundle. Our Wholesale customer contracts are generally month-to-month contracts.

We provide monitoring services to our customer base from several monitoring facilities. The table below provides additional detail about our monitoring facilities:

Location

| | Approximate Number of

Customers Monitored

| | Primary Markets

|

|---|

| Irving, TX | | 353,000 | | Retail and Multifamily |

Longwood, FL |

|

208,000 |

|

Wholesale |

Wichita, KS |

|

527,000 |

|

Retail |

Cypress, CA |

|

239,000 |

|

Wholesale |

St. Paul, MN |

|

126,000 |

|

Wholesale |

Manasquan, NJ |

|

292,000 |

|

Wholesale |

Our monitoring facilities operate 24 hours per day, seven days a week, including all holidays. Each monitoring facility incorporates the use of communications and computer systems that route incoming alarm signals and telephone calls to operators. Each operator within a monitoring facility monitors a computer screen that presents information concerning the nature of the alarm signal, the customer whose alarm has been activated and the premises at which such alarm is located. Other non-emergency administrative signals are generated by low battery status, arming and disarming of the alarm monitoring system and test signals, and such signals are processed automatically by computer. Depending upon the type of service for which the customer has contracted, monitoring facility personnel respond to alarms by relaying information to local fire or police departments, notifying the customer, or taking other appropriate action, such as dispatching alarm response personnel to the customer premises where this service is available. In advanced video solutions, operators may be presented with a video clip associated with the alarm condition, further enhancing the response capabilities. Customers may also contract for remote video monitoring whereby operators will be prompted on a specified schedule to view live video of customer locations and respond upon abnormal conditions.

All of our monitoring facilities are listed by Underwriters Laboratories, Inc. ("UL") as protective signaling services stations. UL specifications for monitoring facilities include building integrity, back-up computer and power systems, staffing and standard operating procedures. In many jurisdictions, applicable law requires the security and life safety alarms for certain buildings be monitored by UL listed facilities. In addition, such listing is required by certain commercial customers' insurance companies as a condition to insurance coverage.

Our Retail backup facility in Wichita, Kansas is a fully operable resource with the ability to backup all mission critical operations normally performed at our primary Retail monitoring center and our Wholesale center in Longwood, FL. The structure is equipped with diverse voice and data telecommunication paths, backup power that includes standby uninterruptible power supplies, access

7

control, video surveillance and data vaults. In addition, we have deployed hot redundancy for our entire complement of equipment essential in the remote monitoring of the Retail security systems we offer. Furthermore, we have replicated the computer systems that are used to maintain our mission critical applications. This facility was purchased with the ability to be expanded for future internal growth and is actively used for other business-related operations.

Each of our primary Wholesale monitoring facilities operates independently from our Retail and Multifamily facilities. Through our Wholesale monitoring facilities, we provide wholesale monitoring services to independent alarm companies. Under the typical arrangement, alarm companies subcontract monitoring services to us, primarily because they cannot cost-effectively provide their own monitoring service. We may also provide billing and other services. These independent alarm companies retain ownership of the monitoring contracts and are responsible for every other aspect of the relationship with customers, including field repair service. We are in the process of creating one integrated network among our Wholesale monitoring centers that we believe will enable us to deliver a higher level of customer care while improving our efficiency.

Customer care personnel answer non-emergency telephone calls typically regarding services, billing and alarm activation issues. Most business hours customer care functions for our Retail customers are handled by our local Retail branches. During business hours, monitoring facility personnel receive inbound customer calls forwarded from branches when the latter are unable to answer within a specified number of rings. After regular business hours, all customer calls are forwarded to our monitoring facilities.

Customer care personnel in our Retail branches and in our monitoring facilities' help desks assist customers in understanding and resolving minor service and operating issues related to security systems. Branch personnel schedule technician appointments. We also operate a dedicated telesales center in Wichita to address questions that Retail customers or potential customers have about our services, as well as to perform outbound sales and marketing activities.

We offer alarm monitoring and administrative services to dealers, such as billing and collection, as well as new and emerging products and services. Our acquisition and financing solutions provide capital to dealers, allowing them to compete with larger competitors on the initial price of equipment and installation to the end-user. We also provide dealers with access to technical sophistication and back office services that they may not otherwise have (or be able to profitably operate), while allowing them to maintain visible contact with their local customers, the end-users of the alarm.

As a means of increasing revenue and enhancing customer satisfaction, we offer Retail and Wholesale customers an array of enhanced security services discussed below. These services position us as a full service provider and give our sales representatives more features to sell in their solicitation of new customers.

- •

- Web Control and Notification provides our customers an array of tools to manage their alarm, video or access control systems, including options for electronic notification.

- •

- Extended Service Protection, within our Retail segment, covers the costs of normal repairs of the security system.

8

- •

- Supervised Monitoring Service allows the alarm system to send various types of signals containing information on the use of the system, such as which users armed or disarmed the system and at what time of day. This information is supplied to customers for use in connection with the management of their households or businesses. Supervised monitoring service can also include a daily automatic test feature.

- •

- Wireless Back-Up permits the alarm system to send signals over a cellular telephone or dedicated radio system in the event that regular telephone service is interrupted.

- •

- Video Verification and Management allows remote activity verification at customer sites via live or recorded video. This capability is often used to verify alarm events or to provide a reliable and economic alternative to private security services.

- •

- Inspection Service, within our Retail segment, provides our customers with periodic verification of their fire alarm system to ensure the system is functioning as designed and in accordance with the requirements of the local fire jurisdiction.

Retail and Multifamily Branch Operations

We currently maintain approximately 66 field locations in the United States from which we provide some or all of the following services in our Retail and Multifamily segments: security system installation, field repair, customer care, alarm response and sales services. Our nationwide network of branches operates in some of the largest cities in the United States and plays a critical role in enhancing customer satisfaction, reducing customer loss and building brand awareness. Repair services generate revenue primarily through billable field service calls and recurring payments under our extended service protection program. By focusing growth in targeted areas, we hope to increase the density of our customer base, which will permit more effective scheduling and routing of field service technicians and will create economies of scale.

Wholesale Alarm Monitoring Contract Acquisition and Dealer Financing Operations

We provide financing to security alarm dealers in the form of loans or alarm monitoring contract purchases. We structure the payment terms and pricing of both our alarm monitoring contract purchases and loans to provide us with an acceptable internal rate of return. When providing financing to dealers, we obtain a security interest in the underlying alarm monitoring contracts.

In addition to the alarm monitoring contract acquisition and finance process described above, we generally require that dealers use us to monitor all of their alarm monitoring contracts, not just those that have been acquired or financed. This monitoring requirement enables us to control the quality of the monitoring services and reduce the risk of loan default.

Sales and Marketing

Our current customer acquisition strategy for our Retail segment relies primarily on internally generated sales, utilizing personnel in our existing branch infrastructure. The internal sales program for our Retail segment generated $2.3 million, $2.1 million and $1.9 million of new Retail RMR in 2007, 2006 and 2005, respectively. The internal sales program for our Wholesale segment generated $0.8 million, $0.2 million and $0.2 million of new Wholesale RMR in 2007, 2006 and 2005, respectively. We operate a dedicated telesales center from which we respond to questions that customers or potential customers have about our services and provide quality control follow-up calls to customers for whom we recently provided installation or maintenance services.

Since 2002 we have been a partner in a marketing alliance with BellSouth Corporation (now part of AT&T) that offers monitored security services to the residential, single-family market and to businesses in 17 of the larger metropolitan markets in the nine-state AT&T region of the southeastern

9

United States. The marketing alliance with AT&T will end on or before June 30, 2008. AT&T provided us with information about new owners of single-family residences and businesses in its territory and of transfers of existing AT&T customers within its territory. We followed up on the information to create leads for our sales force. We pay AT&T a commission for each new contract generated in the nine-state region, regardless of whether the new contract came directly from an AT&T lead, as well as a recurring royalty based on a percentage of recurring charges. The commission is a direct and incremental cost of acquiring the customer and accordingly, for residential customers and certain commercial customers, is deferred as a customer acquisition cost and amortized over the initial contract term. The recurring royalty is expensed as incurred and is included in the cost of monitoring and related services revenue. We estimate that approximately $0.2 million or 8.0%, $0.2 million or 9.0% and $0.2 million or 8.5% of our new Retail RMR created in the years ended December 31, 2007, 2006 and 2005, respectively, can be attributed to sales arising directly from AT&T leads.

Upon termination of the marketing alliance, we will re-brand our 17 southeast branches as Protection One. For a period of three years following termination of the marketing alliance, unless we agree upon a lump-sum payment, we are required to continue paying a recurring royalty to AT&T for active customers added during the term of the existing agreement. We will, however, no longer be required to pay AT&T a commission for new contracts added in the nine-state region. We expect out of pocket costs for the re-branding will approximate $1.0 million, all of which we expect to incur during 2008. Unless we agree with AT&T to make a one-time payment in 2008 in lieu of royalty payments over the three years following the termination, we do not believe termination of the AT&T marketing alliance will have a material impact on our combined net cash flow from operating and investing activities.

Concurrent with the phase out of the AT&T alliance, we are implementing an integrated marketing program to increase awareness for the Protection One brand name nationally and to generate new lead sources and opportunities. We will reach out to targeted customers, both residential and commercial, through a variety of mediums in a planned and sequenced manner. These channels will include, but are not limited to, on-line programs and placements, third-party purchases and outbound calling and traditional mass communications, such as radio, print and direct mail.

Leads resulting from these activities will flow to our Retail sales professionals who are responsible for identifying new prospects and closing sales of monitoring systems and services. The sales force also generates revenue from selling equipment upgrades and add-ons to existing customers and by competing for those customers who are terminating their relationships with our competitors.

We will continue to analyze opportunities for alliance partnerships which benefit our Retail segment. Our capabilities and reach, technological innovation and proven flexibility in dealing with partners across a variety of industries position us well for consideration by many potential partners. We are disciplined in our assessment of alliance opportunities, considering many factors such as brand impact, sales channel considerations and financial return.

Our Multifamily segment utilizes a salaried and commissioned sales force to produce new accounts. We market our Multifamily services and products primarily to developers, owners and managers of apartment complexes and other multifamily dwellings. Multifamily sales and marketing activities consist of national and regional advertising, nationwide professional field sales efforts, prospective acquisition marketing efforts and professional industry-related association affiliations. Services are sold directly to the property owner, and payment is based on a monthly price per-unit basis. Ongoing service for the duration of the lease includes providing equipment, maintenance, 24-hour monitoring from our central monitoring station, customer service and individual market support. Our Multifamily customer contracts generally have initial terms that fall within a range of five to ten years and average eight years at inception. These contracts typically provide for automatic

10

renewal for fixed multi-year periods (typically five years) unless we or the customer elects to cancel the contract at the end of its term.

Our Wholesale segment employs a salaried and commissioned sales force that is geographically distributed throughout the United States and is responsible for identifying sales opportunities. Our sales force is supported by an internal sales and marketing team that tracks prospects and coordinates selling efforts. We also employ product specialists who assist the sales force in identifying and proposing financing alternatives and billing services and account managers who provide ongoing operational support to our Wholesale customers.

We continually evaluate our customer creation and marketing strategy, including evaluating each respective channel for economic returns, volume and other factors and may shift our strategy or focus, including the elimination of a particular channel.

Attrition

See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Attrition," which is incorporated herein by reference, for more information regarding attrition calculations, the impact of attrition on our operating results and customer attrition by business segment.

Intellectual Property

We own trademarks related to the name and logo for Protection One, Network Multifamily Security, King Central and Criticom Monitoring Services, as well as a variety of trade and service marks related to individual services we provide. While we believe our trademarks, service marks and proprietary information are important to our business, we do not believe our inability to use any one of them, other than the trademarks we own in our name and logo, would have a material adverse effect on our business as a whole.

Regulatory Matters

A number of local governmental authorities have adopted or are considering various measures aimed at reducing the number of false alarms. See Item 1A, "Risk Factors," for additional information. Such measures include:

- •

- requiring permits for individual alarm systems and the revocation of such permits following a specified number of false alarms;

- •

- imposing fines on alarm customers or alarm monitoring companies for false alarms;

- •

- imposing limitations on the number of times the police will respond to alarms at a particular location after a specified number of false alarms;

- •

- requiring further verification of an alarm signal before the police will respond; and

- •

- subjecting alarm monitoring companies to fines or penalties for transmitting false alarms.

Our operations are subject to a variety of other laws, regulations, and licensing requirements of federal, state and local authorities. In certain jurisdictions, we are required to obtain licenses or permits, to comply with standards governing employee selection and training, and to meet certain standards in the conduct of our business.

The alarm industry is also subject to requirements imposed by various insurance, approval, listing and standards organizations. Depending upon the type of customer served, the type of security service provided, and the requirements of applicable local governmental jurisdiction, adherence to the

11

requirements and standards of such organizations is mandatory in some instances and voluntary in others.

Our advertising and sales practices are regulated in the United States by both the Federal Trade Commission and state consumer protection laws. In addition, certain administrative requirements and laws of the jurisdictions in which we operate also regulate such practices. Such laws and regulations include restrictions on the manner in which we promote the sale of our security alarm systems and the obligation to provide purchasers of our alarm systems with rescission rights.

Our alarm monitoring business utilizes wire line and wireless telephone lines, radio frequencies, and broadband data circuits to transmit alarm signals. The cost of telephone lines and the type of equipment which may be used in telephone line transmissions are currently regulated by both federal and state governments. The Federal Communications Commission and state public utilities commissions regulate the operation and utilization of radio frequencies.

Risk Management

The nature of the services we provide potentially exposes us to greater risks of liability for employee acts or omissions, or system failure, than may be inherent in other businesses. Substantially all of our alarm monitoring agreements and other agreements, pursuant to which we sell our products and services, contain provisions limiting liability to customers in an attempt to reduce this risk.

We carry insurance of various types, including general liability and professional liability insurance in amounts management considers adequate and customary for our industry and business. Our loss experience, and the loss experiences of other security service companies, may affect the availability and cost of such insurance. Some of our insurance policies, and the laws of some states, may limit or prohibit insurance coverage for punitive or certain other types of damages, or liability arising from gross negligence.

Employees

At December 31, 2007 we had approximately 3,200 full and part time employees. Our workforce is not unionized. We generally consider our relationship with our employees to be good.

Code of Ethics

We have adopted a code of ethics that applies to all employees, including executive officers and senior financial and accounting employees. It is our policy to comply strictly with the letter and spirit of all laws affecting our business and the conduct of our officers, directors and employees in business matters. We make available the code of ethics, free of charge, on our website atwww.protectionone.com and by responding to requests addressed to our investor relations department. The investor relations department can be contacted by mail at Protection One, Inc., Attn: Investor Relations, 1035 N 3rd Street, Suite 101, Lawrence, KS 66044 or by calling (785) 856-9368.

Access to Company Information

We electronically file our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the Securities and Exchange Commission ("SEC"). The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We make available, free of charge, through our website atwww.protectionone.com, and by responding to requests addressed to our investor relations department, our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The information contained on our website is not part of this document.

12

ITEM 1A. RISK FACTORS

You should read the following risk factors in conjunction with discussions of factors discussed elsewhere in this and other of our filings with the SEC. These cautionary statements are intended to highlight certain factors that may affect our financial condition and results of operations and are not meant to be an exhaustive discussion of risks that apply to public companies with broad operations, such as us.

We have a history of losses, which are likely to continue.

We incurred net losses of $32.2 million, $17.4 million, $15.6 million and $11.4 million for the years ended December 31, 2007 and 2006 and for the periods February 9 to December 31, 2005 and January 1 to February 8, 2005, respectively. Our losses reflect the following, among other factors:

- •

- substantial charges incurred by us for amortization of customer accounts;

- •

- interest incurred on indebtedness;

- •

- expansion of our internal sales and installation efforts;

- •

- Merger-related costs in 2007, recapitalization costs in 2006 and debt restructuring costs in 2005; and

- •

- other charges required to manage operations.

We will continue to incur substantial expenses arising from interest and amortization of customer accounts and we do not expect to attain profitability in the near future.

Our marketing alliance with AT&T, which was used for the generation of many new Retail accounts, will be terminated in 2008.

Beginning in 2002, we had a marketing relationship with BellSouth Corporation ("BellSouth") (now part of AT&T) to offer monitored security services to the residential, single-family market and to businesses in 17 of the larger metropolitan markets in the southeastern United States. Pursuant to notification received from AT&T, that marketing alliance will be terminated at the end of the second quarter of 2008. We estimate that approximately $0.2 million or 8.0%, $0.2 million or 9.0% and $0.2 million or 8.5% of our new Retail RMR created in the year ended December 31, 2007, 2006 and 2005, respectively, can be attributed to sales arising directly from AT&T leads. Termination of the agreement could have a short-term material adverse effect on our ability to generate new customers and RMR in this territory.

We have, and will continue to have, a significant amount of indebtedness. As of December 31, 2007, the face value of our total indebtedness, including capital leases, was approximately $526.0 million. Our level of indebtedness has important consequences. For example, it will:

- •

- limit our ability to borrow money or sell stock to fund our working capital, capital expenditures, acquisitions and debt service requirements;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and future business opportunities;

- •

- make us more vulnerable to a downturn in our business or in the economy or to an increase in interest rates;

- •

- place us at a disadvantage to some of our competitors, which may be less highly leveraged than us; and

13

- •

- require a substantial portion of our cash flow from operations to be used for debt service, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes.

One or a combination of these factors could adversely affect our financial condition. Subject to restrictions in the agreements governing our indebtedness, we may incur additional indebtedness which could increase the risks associated with our already substantial indebtedness.

Restrictive covenants restrict our ability to operate our business and to pursue our business strategies, and our failure to comply with these covenants could result in an acceleration of our indebtedness.

The credit agreement (the "Senior Credit Agreement") governing our senior credit facility, the indenture (the "Senior Secured Notes Indenture") governing our 12% senior secured notes due 2011 (the "Senior Secured Notes") and the credit agreement ("Unsecured Term Loan Agreement") governing the new unsecured term loan facility we entered into in March 2008 contain covenants that restrict our ability to finance future operations or capital needs, to respond to changing business and economic conditions or to engage in other transactions or business activities that may be important to our growth strategy or otherwise important to us. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Debt Obligations," for more information on our indebtedness. Our Senior Credit Agreement, the Senior Secured Notes Indenture and the Unsecured Term Loan Agreement restrict, among other things, our ability to:

- •

- incur additional indebtedness or enter into sale and leaseback transactions;

- •

- pay dividends or make distributions on our capital stock or certain other restricted payments or investments;

- •

- purchase or redeem stock;

- •

- issue stock of our subsidiaries;

- •

- make investments and extend credit;

- •

- engage in transactions with affiliates;

- •

- transfer and sell assets;

- •

- effect a consolidation or merger or sell, transfer, lease or otherwise dispose of all or substantially all of our assets; and

- •

- create liens on our assets to secure debt.

In addition, our senior credit facility requires us to meet certain financial ratios and to repay outstanding borrowings with portions of the proceeds we receive from certain sales of property or assets and specified future debt and equity offerings. Our financial results may be affected by unforeseen adverse events, and we may not be able to meet the financial ratio requirements.

Any breach of the covenants in our Senior Credit Agreement, Unsecured Term Loan Agreement or Senior Secured Notes Indenture could cause a default under such instruments. If there were an event of default under any of our debt instruments that was not cured or waived, the holders of the defaulted debt could cause all amounts outstanding with respect to the debt instrument to be due and payable immediately. Our assets and cash flow would not be sufficient to fully repay borrowings under our outstanding debt instruments if accelerated upon an event of default. If, as or when required, we are unable to repay, refinance or restructure our indebtedness under, or amend the covenants contained in, our Senior Credit Agreement or Senior Secured Notes Indenture, the lenders under our senior credit facility or the trustee under the Senior Secured Notes Indenture could institute

14

foreclosure proceedings against the assets securing borrowings under our senior credit facility or Senior Secured Notes.

Entities affiliated with Quadrangle Group and Monarch Alternative Capital are our principal stockholders and together can exercise a controlling influence over us, which may adversely affect the trading price of our common stock.

Quadrangle Capital Partners LP, Quadrangle Capital Partners-A LP and Quadrangle Select Partners LP (collectively "Quadrangle") and Monarch Debt Recovery Master Fund Ltd and Monarch Opportunities Master Fund Ltd (collectively "Monarch" and together with Quadrangle the "Principal Stockholders"), collectively own approximately 70.0% of our outstanding common stock. Pursuant to a stockholders agreement, subject to the Principal Stockholders, acting together, maintaining a certain threshold of ownership in us, the Principal Stockholders, acting together, will be able to control the election of a majority of our directors and accordingly exercise a controlling influence over our business and affairs, including any determinations with respect to mergers or other business combinations involving us, appointment of our officers, our acquisition or disposition of material assets and our incurrence of indebtedness. Similarly, the Principal Stockholders, acting together, will continue to have the power to determine matters submitted to a vote of our stockholders without the consent of other stockholders and to take other actions that might be favorable to the Principal Stockholders, whether or not these actions would be favorable to us or to our stockholders in general.

We rely on technology that may become obsolete, which could require significant capital expenditures.

Our monitoring services depend upon the technology (hardware and software) of security alarm systems. In order to maintain our customer base that currently uses security alarm components that are or could become obsolete, we may be required to upgrade or implement new technologies that could require significant capital expenditures. For example, we have an installed base of alarm systems that use an analog wireless network for sending signals from the location of the alarm system to our monitoring centers. The carriers that provide the required analog wireless network services have discontinued providing that service or will do so in the near future. As a result, we are upgrading some of the affected alarm systems. The cost and process of this upgrade adversely affected our earnings and cash flow during the last half of 2007 and will adversely affect our earnings and cash flow during the first quarter of 2008 and could adversely affect attrition. In the future, we may not be able to successfully implement new technologies or adapt existing technologies to changing market demands. If we are unable to adapt in response to changing technologies, market conditions or customer requirements in a timely manner, such inability could adversely affect our business.

Shifts in our current and future customers' selection of telecommunications services could increase customer attrition and could adversely impact our earnings and cash flow.

Certain elements of our operating model rely on our customers' selection and continued use of traditional, land-line telecommunications services, which we use to communicate with our monitoring operations. In order to continue to service existing customers who cancel their land-line telecommunications services and to service new customers who do not subscribe to land-line telecommunications services, customers must upgrade to alternative and often more expensive wireless or internet based technologies. Higher costs may reduce the market for new customers of alarm monitoring services, and the trend away from traditional land lines to alternatives may mean more existing customers will cancel service with us. Our Multifamily segment, in particular, has experienced customer cancellations which we believe are due in part to low penetration of land-line based phone services in rental units. Continued shifts in customers' preferences regarding telecommunications services could continue to have an adverse impact on our earnings, cash flow and customer attrition.

15

The failure to successfully integrate IASG's business and operations in the expected time frame may adversely affect the combined company's future results.

The success of the Merger will partially depend on the combined company's ability to realize the anticipated benefits from combining the businesses of Protection One and IASG. Among the most critical of the few remaining integration tasks are the internal control assessment of IASG controls during 2008, the migration of Retail account monitoring to Retail central stations and the completion of an upgrade of the Wholesale central stations to one technology platform.

Integration efforts will divert management attention and could have a material adverse effect on the combined company. As part of the integration process, we continue to integrate the accounting and internal control systems of IASG with ours. As of December 31, 2005, IASG's management and independent auditor determined that IASG did not maintain effective controls over accounts receivable, revenue and deferred revenue accounts and that this control deficiency constituted a material weakness. In its Annual Report on Form 10-K for the fiscal year ended December 31, 2006, IASG concluded that as of December 31, 2006, those material weaknesses had been remediated. While we believe IASG has taken remedial action in response to its material weaknesses, as part of the integration process, we or our independent auditor may identify additional material weaknesses or significant deficiencies in the future.

We may not be able to realize any or all of the anticipated benefits from prior or future acquisitions of portfolio alarm monitoring contracts.

Acquisitions of end-user alarm monitoring contracts involve a number of risks, including the possibility that the acquiring company will not be able to realize the recurring monthly revenue stream it contemplated at the time of acquisition because of higher than expected attrition rates or fraud. Although we generally complete an extensive due diligence process prior to acquiring alarm monitoring contracts and obtain representations and warranties from sellers, we may not detect fraud, if any, on the part of any seller, including the possibility that any seller misrepresented the historical attrition rates of the sold contracts or sold or pledged the contracts to a third party. If the sale of alarm monitoring contracts involves fraud or the representations and warranties are otherwise inaccurate, it may not be possible to recover from the seller damages in an amount sufficient to fully compensate us for any resulting losses. In such event, we may incur significant costs in litigating ownership or breach of acquisition contract terms.

We face continuing competition and pricing pressure from other companies in our industry and, if we are unable to compete effectively with these companies, our sales and profitability could be adversely affected.

We compete with a number of major domestic security monitoring services companies, as well as a large number of smaller, regional competitors. We believe that this competition is a factor in our attrition, limits our ability to raise prices, and, in some cases, requires that we lower prices. Some of our competitors, either alone or in conjunction with their respective parent corporate groups, are larger than we are and have greater financial resources, sales, marketing or operational capabilities or brand recognition than we do. In addition, opportunities to take market share using innovative products, services and sales approaches may attract new entrants to the field. We may not be able to compete successfully with the offerings and sales tactics of other companies, which could result in the loss of customers and, as a result, decreased revenue and operating results.

Our customer acquisition and creation strategies and the competitive market for the acquisition and creation of customer accounts may affect our future profitability.

Prior to 2000, we grew very rapidly by acquiring portfolios of alarm monitoring accounts through acquisitions and dealer purchases. Since the current management team joined us in 2001, our account

16

acquisition strategy has evolved to emphasize our internal sales force, supported by traditional marketing practices and by forming marketing alliances. In addition, we seek to augment our internal efforts with acquisitions when suitable market conditions exist. If our current strategy is not successful, our customer base could continue to decline.

If we are successful executing a customer acquisition strategy emphasizing internal sales, selling costs will increase our expenses and uses of cash. Failure to replace customers lost through attrition or increased use of cash to replace those customers could have a material adverse effect on our business, financial condition, results of operations and ability to service debt obligations. Increased competition from other alarm monitoring companies could require us to reduce our prices for installations, decrease the monitoring fees we charge our customers and take other measures that could reduce our margins. These decreases and other measures could have a material adverse effect on us.

We compete with several companies that have account acquisition and loan programs for independent dealers and some of those competitors are larger than we are and have more capital than we do. Increased competition from other alarm monitoring companies could require us to pay more for account acquisitions and take other measures that could reduce returns from investing in acquisitions of customer accounts. These measures could have a material adverse effect on us.

We experience the loss of accounts as a result of, among other factors:

- •

- relocation of customers;

- •

- customers' inability or unwillingness to pay our charges;

- •

- adverse financial and economic conditions;

- •

- the customers' perceptions of value;

- •

- competition from other alarm service companies;

- •

- Wholesale dealers' perception of channel conflict with us;

- •

- the sale of accounts by Wholesale dealers to third parties who choose to monitor the purchased accounts elsewhere; and

- •

- the purchase of our Wholesale dealers by third parties who choose to monitor elsewhere.

We may experience the loss of newly acquired or created accounts to the extent we do not integrate or adequately service those accounts. Customer loss may not become evident for some time after an acquisition is consummated because some acquired accounts are prepaid on an annual, semiannual or quarterly basis. While attrition rates in our Retail segment had declined significantly prior to the Merger, higher attrition rates from the Retail portfolio acquired from IASG could result in our losing more Retail RMR than we add in the near term. We also expect Multifamily account and RMR losses to exceed additions until the efforts we are making to acquire new accounts and further reduce our rate of attrition become more successful than they have been to date. Wholesale attrition could increase if some of IASG's dealers choose not to be monitored by a company affiliated with us due to perceptions of channel conflict or due to solicitations from former IASG employees. Net losses of customer accounts could materially and adversely affect our business, financial condition and results of operations.

17

Increased adoption of "false alarm" ordinances by local governments may adversely affect our business.

An increasing number of local governmental authorities have adopted, or are considering the adoption of, laws, regulations or policies aimed at reducing the perceived costs to municipalities of responding to false alarm signals. Such measures could include:

- •

- requiring permits for the installation and operation of individual alarm systems and the revocation of such permits following a specified number of false alarms;

- •

- imposing limitations on the number of times the police will respond to alarms at a particular location after a specified number of false alarms;

- •

- requiring further verification of an alarm signal before the police will respond; and

- •

- subjecting alarm monitoring companies to fines or penalties for transmitting false alarms.

Enactment of these measures could adversely affect our future business and operations. For example, concern over false alarms in communities adopting these ordinances could cause a decrease in the timeliness of police response to alarm activations and thereby decrease the propensity of consumers to purchase or maintain alarm monitoring services, and our costs to service affected accounts could increase.

Increased adoption of statutes and governmental policies purporting to void automatic renewal provisions in our customer contracts, or purporting to characterize certain of our charges as unlawful, may adversely affect our business.

Our customer contracts typically contain provisions automatically renewing the term of the contract at the end of the initial term, unless cancellation notice is delivered in accordance with the terms of the contract. If the customer cancels prior to the end of the contract term, other than in accordance with the contract, we may charge the customer the amounts that would have been paid over the remaining term of the contract, or charge an early cancellation fee.

Several states have adopted, or are considering the adoption of statutes, consumer protection policies or legal precedents which purport to void the automatic renewal provisions of our customer contracts, or otherwise restrict the charges we can impose upon contract cancellation. Such initiatives could compel us to increase the length of the initial term of our contracts, and increase our charges during the initial term, and consequently lead to less demand for our services and increase our attrition. Adverse judicial determinations regarding these matters could cause us to incur legal exposure to customers against whom such charges have been imposed, and the risk that certain of our customers may seek to recover such charges through litigation. In addition, the costs of defending such litigation and enforcement actions could have an adverse effect on us.

Due to a concentration of accounts in California, Florida and Texas, we are susceptible to environmental incidents that may negatively impact our results of operations.

Almost 44% of our RMR at December 31, 2007 was derived from customers located in California, Florida and Texas. A major earthquake, hurricane or other environmental disaster in an area of high account concentration could disrupt our ability to serve those customers or render those customers uninterested in continuing to retain us to provide alarm monitoring services.

We are susceptible to downturns in the housing market which may negatively impact our results of operations.

We believe demand for alarm monitoring services in our Retail segment is affected by the turnover in the single family housing market. Downturns in the rate of sale of existing single family homes would reduce opportunities to make sales of new security systems and services and reduce opportunities to

18

take over existing security systems that had previously been monitored by our competitors. These reduced opportunities to add RMR could negatively affect our results of operations.

Declines in rents, occupancy rates and new construction of multifamily dwellings may affect our sales in this marketplace.

We believe demand for alarm monitoring services in the Multifamily segment is tied to the general health of the multifamily housing industry. This industry is dependent upon prevailing rent levels and occupancy rates as well as the demand for construction of new properties. Given the generally cyclical nature of the real estate market, we believe that, in the event of a decline in the market factors described above, it is likely that demand for our alarm monitoring services to multifamily dwellings would also decline, which could negatively impact our results of operations.

We could face liability for our failure to respond adequately to alarm activations.

The nature of the services we provide potentially exposes us to greater risks of liability for employee acts or omissions or system failures than may be inherent in other businesses. In an attempt to reduce this risk, our alarm monitoring agreements and other agreements pursuant to which we sell our products and services contain provisions limiting our liability to customers and third parties. In the event of litigation with respect to such matters, however, these limitations may not be enforced. In addition, the costs of such litigation could have an adverse effect on us.

In the event that adequate insurance is not available or our insurance is not deemed to cover a claim, we could face liability.

We carry insurance of various types, including general liability and professional liability insurance in amounts management considers adequate and customary for the industry. Some of our insurance policies, and the laws of some states, may limit or prohibit insurance coverage for punitive or certain other types of damages, or liability arising from gross negligence. If we incur increased losses related to employee acts or omissions, or system failure, or if we are unable to obtain adequate insurance coverage at reasonable rates, or if we are unable to receive reimbursements from insurance carriers, our financial condition and results of operations could be materially and adversely affected.

Future government regulations or other standards could have an adverse effect on our operations.

Our operations are subject to a variety of laws, regulations and licensing requirements of federal, state and local authorities. In certain jurisdictions, we are required to obtain licenses or permits to comply with standards governing employee selection and training and to meet certain standards in the conduct of our business. The loss of such licenses, or the imposition of conditions to the granting or retention of such licenses, could have an adverse effect on us. In the event that these laws, regulations and/or licensing requirements change, we may be required to modify our operations or to utilize resources to maintain compliance with such rules and regulations. In addition, new regulations may be enacted that could have an adverse effect on us.

The loss of our Underwriter Laboratories listing could negatively impact our competitive position.

All of our alarm monitoring centers are Underwriters Laboratories ("UL") listed. To obtain and maintain a UL listing, an alarm monitoring center must be located in a building meeting UL's structural requirements, have back-up and uninterruptible power supplies, have secure telephone lines and maintain redundant computer systems. UL conducts periodic reviews of alarm monitoring centers to ensure compliance with their regulations. Non-compliance could result in a suspension of our UL listing. The loss of our UL listing could negatively impact our competitive position.

19

We depend on our relationships with alarm system manufacturers and suppliers. If we are not able to maintain or renew these alliances or our manufacturers and suppliers fail to provide us with innovative product offerings, our ability to create new customers and service our existing account base could be negatively affected.

We currently have agreements with certain electronic security system manufacturers and suppliers of hardware for products that we install in customer locations as part of new systems or as replacement parts for existing systems. We may not be able to maintain or renew our existing product sourcing arrangements on terms and conditions acceptable to us, or at all, if one or more of our suppliers discontinue offering a technology we have relied on or if one or more of our suppliers exits the electronic security system market. If we are unable to maintain or renew our existing relationships, we may incur additional costs creating new supplier arrangements and in servicing existing customers

We are also dependent on our electronic security system manufacturers for continued technological innovation. If the electronic security system product families we have invested in fail to keep pace with other manufacturers' and suppliers' technologies, we may incur additional training and inventory costs and our ability to attract new customers and service our existing customers could be adversely affected.

We are dependent upon our experienced senior management, who would be difficult to replace.

The success of our business is largely dependent upon the active participation of our executive officers, who have extensive experience in the industry. As a result, we have entered into employment agreements with each of our executive officers. The terms of these employment agreements are automatically extended for an indefinite number of one-year periods unless either party sends written notice to the other party of its intention not to renew the agreement at least 30 days prior to the expiration of the one-year period. The loss of service of one or more of such officers or the inability to attract or retain qualified personnel for any reason may have an adverse effect on our business.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We maintain our executive offices at 1035 N. 3rd Street, Suite 101, Lawrence, Kansas 66044. We operate primarily from the following facilities, although we also lease office space for our approximately 66 field locations.

Location

| | Approximate

Size (sq. ft.)

| | Lease/Own

| | Principal Purpose

|

|---|

| Irving, TX | | 53,750 | | Lease | | Retail and Multifamily monitoring facility/administrative functions |

| Longwood, FL | | 20,000 | | Lease | | Wholesale monitoring facility/administrative functions |

| Lawrence, KS | | 21,000 | | Lease | | Financial/administrative headquarters |

| Cypress, CA | | 17,000 | | Lease | | Wholesale monitoring facility |

| St. Paul, MN | | 6,550 | | Lease | | Wholesale monitoring facility |

| Manasquan, NJ | | 7,200 | | Own | | Wholesale monitoring facility |

| Wichita, KS | | 50,000 | | Own | | Retail monitoring facility/administrative functions |

| Wichita, KS | | 122,000 | | Own | | Backup Retail monitoring center/administrative functions |

20

ITEM 3. LEGAL PROCEEDINGS

Information on our legal proceedings is set forth in Item 8, Note 12 "Commitments and Contingencies" of the Notes to the Consolidated Financial Statements, which are incorporated herein by reference.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to Protection One's stockholders during the fourth quarter of 2007.

21

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Price Information

Our common stock has been listed on the NASDAQ Global Market under the symbol "PONE" since April 2, 2007. Prior to April 2, 2007, our common stock traded on the OTC Bulletin Board under the symbol "PONN." The table below sets forth for each of the calendar quarters indicated the high and low sales prices per share of our common stock, as reported by the OTC Bulletin Board in 2006 and the first quarter of 2007 and as reported by the NASDAQ Global Market after April 2, 2007. The quotations in 2006 and for the first quarter of 2007 reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| | High

| | Low

|

|---|

| 2006: | | | | | | |

| First Quarter | | $ | 18.00 | | $ | 17.00 |

| Second Quarter | | | 27.00 | | | 14.50 |

| Third Quarter | | | 15.08 | | | 12.10 |

| Fourth Quarter | | | 13.15 | | | 11.50 |

2007: |

|

|

|

|

|

|

| First Quarter | | $ | 21.90 | | $ | 11.25 |

| Second Quarter | | | 18.00 | | | 11.70 |

| Third Quarter | | | 15.67 | | | 11.48 |

| Fourth Quarter | | | 13.99 | | | 9.23 |

Dividend Information

The Unsecured Term Loan Agreement, Senior Secured Notes Indenture and Senior Credit Agreement restrict Protection One Alarm Monitoring's ability to pay dividends or to make other distributions to its corporate parent. Consequently, these agreements restrict our ability to declare or pay any dividend on, or make any other distribution in respect of, our capital stock unless we satisfy the financial and other tests set forth in such agreements. We did not declare or pay any dividends for the year ended December 31, 2007.

On May 12, 2006, we paid a cash dividend of $70.5 million, or $3.86 per share, to all holders of record of our common stock on May 8, 2006, including the Principal Stockholders, which owned approximately 97.1% of the outstanding shares of our common stock at that date. Our board of directors also approved a cash payment of $4.5 million or $2.89 for each vested and unvested option awarded in February 2005 under the 2004 Stock Option Plan, including to members of senior management. This payment is referred to as the "compensatory make-whole payment." Approximately $3.2 million of the compensatory make-whole payment related to options that had not yet vested and accordingly this amount plus related taxes was recorded as compensation expense in the second quarter of 2006 and is reflected as recapitalization costs in the Consolidated Statement of Operations and Comprehensive Loss. Approximately $1.3 million of the compensatory make-whole payment related to vested options and was recorded to additional paid in capital. In addition, the exercise price of each vested and unvested option was reduced by $0.98. Our board of directors decided to pay the compensatory make-whole payment and reduce the option exercise price because the payment of the May 2006 dividend decreased the value of the equity interests of holders of options, as these holders were not otherwise entitled to receive the dividend. Accordingly, our board of directors awarded the same amount to the option holders, on a per share basis, in the form of the compensatory make-whole payment and the reduced option exercise price.

22

Number of Stockholders

As of March 10, 2008, there were approximately 393 stockholders of record who held shares of our common stock.

Securities Authorized for Issuance Under Equity Compensation Plans

The information called for by the item relating to "Securities Authorized for Issuance Under Equity Compensation Plans" is set forth under that heading in Item 12, "Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters" and is incorporated herein by reference.

Performance Graph

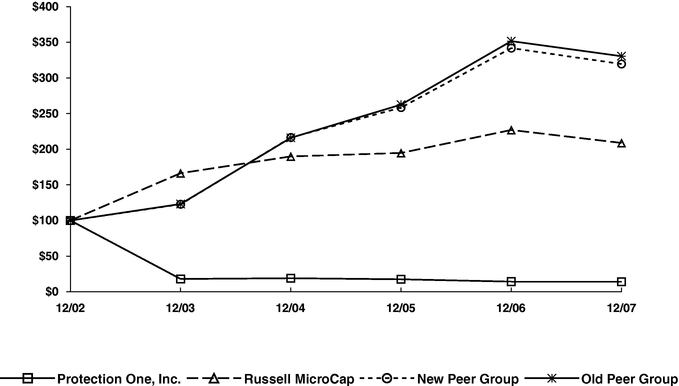

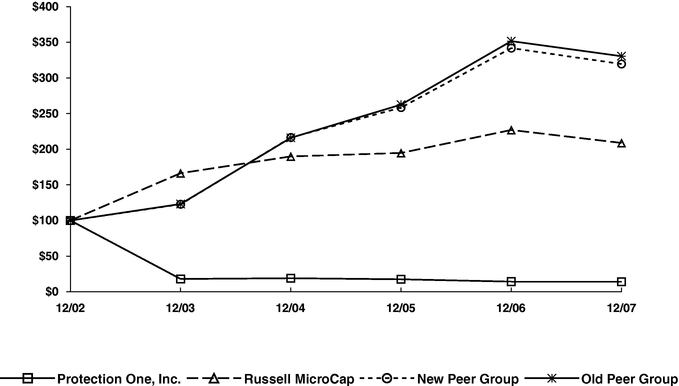

The following chart compares the cumulative total stockholder returns on the Common Stock since December 31, 2002 to (1) the cumulative total returns over the same period of the Russell MicroCap index; (2) the group of companies selected as our peers at the current time ("the new peer group") and (3) our old peer group. The current peer group is comprised of Brinks Company and Devcon International. The old peer group is comprised of Brinks, IASG and Lifeline Systems, Inc. Our peer grouped changed in 2007 due to the Merger and Lifeline Systems, Inc's acquisition by another company. Devcon International was added to our peer group because they are also a publicly traded security services company. The annual returns for the New Peer Group and the Old Peer Group indices are weighted based on the capitalization of each company within the peer group at the beginning of each period for which a return is indicated. The chart assumes the value of the investment in the Common Stock and each index was $100 at December 31, 2002 and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Protection One, Inc., The Russell MicroCap Index,

A New Peer Group And An Old Peer Group

- *

- $100 invested on 12/31/02 in stock or index-including reinvestment of dividends.

- Fiscal year ending December 31.

23

ITEM 6. SELECTED FINANCIAL DATA