Calpine Announces Updated Valuation Analysis

(SAN JOSE, Calif. and HOUSTON, Texas) Nov. 19, 2007 – Calpine Corporation [OTC Pink Sheets: CPNLQ] and its affiliated debtors and debtors in possession (collectively, “Calpine”) announced today the release of an updated valuation analysis (the “Updated Valuation Analysis”) of the total enterprise value of reorganized Calpine and its subsidiaries upon their emergence from Chapter 11 (“Reorganized Calpine”), in connection with the Bankruptcy Court’s hearing to confirm Calpine’s Chapter 11 plan of reorganization, which is scheduled to begin on Dec. 17, 2007. The Updated Valuation Analysis was prepared by Miller Buckfire & Co., LLC (“Miller Buckfire”), Calpine’s financial advisor, and supersedes the June 20, 2007, valuation analysis set forth in Calpine’s disclosure statement, which was approved by the Bankruptcy Court on Sept. 26, 2007.

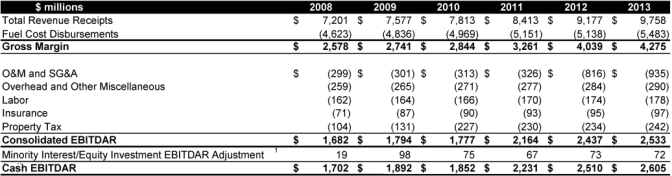

In preparing its Updated Valuation Analysis, Miller Buckfire reviewed, among other things, certain operating and financial forecasts prepared by Calpine’s management, including an updated projection of cash earnings before interest, taxes, depreciation, amortization, operating rent, and restructuring charges (“Cash EBITDAR”) as of Nov. 1, 2007, for the period Jan. 1, 2008 through Dec. 31, 2013, which is attached as Exhibit 1. The Cash EBITDAR projections, which were developed as part of Calpine’s ongoing efforts to update and refine its comprehensive business plan, show increases in Calpine’s projected Cash EBITDAR as compared to Calpine’s previous Cash EBITDAR projections included in Exhibit 12 in the June 20 supplement to Calpine’s plan of reorganization. The Cash EBITDAR projections are based on the forecasted consolidated financial results of Calpine (or Reorganized Calpine, as applicable) and its non-debtor affiliates, and take into account, among other things: forward curves for power and gas as of June 29, 2007; updated plant operating characteristics; contracts entered into at certain of Calpine’s facilities since Calpine’s April 2007 business plan; long-term gas price projections; market data, including regional supply and demand and the construction costs of power facilities in the markets in which Calpine operates; certain developments with carbon regulations that are projected to impact Calpine’s operations; and decreased corporate overhead and selling, general, and administrative expense estimates.

-more-

Calpine Announces Updated Valuation Analysis

Page 2

November 19, 2007

As discussed in its Updated Valuation Analysis and based upon an assumed emergence from Chapter 11 on Dec. 31, 2007, Miller Buckfire estimates that the total enterprise value of Reorganized Calpine will range from $18.3 billion to $20.4 billion, with a midpoint of $19.35 billion. Although Calpine’s Cash EBITDAR projections have increased, the Updated Valuation Analysis shows a decrease of approximately $900 million in Reorganized Calpine’s estimated midpoint total enterprise value compared to Miller Buckfire’s June 20 estimated midpoint total enterprise value. This decrease is a result of, among other things, a general decrease in the market enterprise value of the Selected Companies (as defined in the Updated Valuation Analysis) and a general increase in market volatility, both partially offset by the increases in Calpine’s updated Cash EBITDAR projections.

At the confirmation hearing, Calpine will take the position that Reorganized Calpine’s total enterprise value upon its emergence from Chapter 11 is $19.35 billion, based on the midpoint total enterprise value set forth in the Updated Valuation Analysis. However, as described in Calpine’s disclosure statement, the Bankruptcy Court will determine the total enterprise value of Reorganized Calpine following the confirmation hearing, and, as a result, it is possible that the Bankruptcy Court will find that Reorganized Calpine’s total enterprise value will be materially higher or lower than $19.35 billion.

Using the midpoint total enterprise value in Miller Buckfire’s Updated Valuation Analysis and Calpine’s litigation-risk assessment of allowed claims, Calpine estimates that (1) general unsecured creditors will recover 96.7% of their allowed principal plus pre- and post-petition interest claims, and (2) shareholders will receive no recovery on account of their common stock. Using the same midpoint total enterprise value and Calpine’s “low-claims” estimate, Calpine estimates that (1) unsecured creditors will be paid their allowed principal plus pre- and post-petition interest claims in full, and (2) shareholders will receive $0.41 on account of each share of common stock. Using the same midpoint total enterprise value and Calpine’s “high-claims” estimate, Calpine estimates that post-petition interest claims will not be paid, and therefore (1) general unsecured creditors will recover 88.0% of their allowed principal plus pre- and post-petition interest claims (which recovery is equivalent to 99.7% of allowed principal plus pre-petition interest claims), and (2) shareholders will receive no recovery on account of their common stock. Despite these estimates, no assurances can be made regarding the actual recoveries to creditors and shareholders because, among other things, the Bankruptcy Court has not finally adjudicated all of the claims asserted against Calpine and has yet to determine Reorganized Calpine’s total enterprise value.

The summary of the Updated Valuation Analysis set forth herein does not purport to be a complete description of the Updated Valuation Analysis prepared by Miller Buckfire and remains subject to the reservations, assumptions, and disclosures set forth in the Updated Valuation Analysis.

The Updated Valuation Analysis, Calpine’s plan of reorganization and disclosure statement, and Calpine’s plan supplement are available for viewing at http://www.kccllc.net/calpine and at http://www.calpine.com.

-more-

Calpine Announces Updated Valuation Analysis

Page 3

November 19, 2007

The conclusions in the Updated Valuation Analysis should not be ascribed to the Official Committee of Unsecured Creditors or the Official Committee of Equity Security Holders appointed in Calpine’s Chapter 11 cases (each, a “Committee”). Each Committee has developed its own separate analysis and determinations regarding the valuation of Reorganized Calpine, which will be available for viewing at http://www.kccllc.net/calpine, and will present its position to the Bankruptcy Court at the confirmation hearing.

The projections discussed herein have been prepared by Calpine’s management with the assistance of their advisors. The projections were not prepared to comply with the guidelines for prospective financial statements published by the American Institute of Certified Public Accountants and the rules and regulations of the United States Securities and Exchange Commission. Calpine’s independent accountants have neither examined nor compiled the accompanying projections and accordingly, do not express an opinion or any other form of assurance with respect to the projections, assume no responsibility for the projections, and disclaim any association with the projections.

Calpine Corporation is helping meet the needs of an economy that demands more and cleaner sources of electricity. Founded in 1984, Calpine is a major U.S. power company, capable of delivering nearly 24,000 megawatts of clean, cost-effective and reliable electricity to customers and communities in 18 states in the U.S. The company owns, leases and operates low-carbon, natural gas-fired and renewable geothermal power plants. Using advanced technologies, Calpine generates electricity in a reliable and environmentally responsible manner for the customers and communities it serves. Please visit www.calpine.com for more information.

In addition to historical information, this release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “intend,” “expect,” “anticipate,” “plan,” “may,” “will” and similar expressions to identify forward-looking statements. Such statements include, among others, those concerning our expected financial performance and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and that a number of risks and uncertainties could cause actual results to differ materially from those anticipated in the forward-looking statements.

-more-

Calpine Announces Updated Valuation Analysis

Page 4

November 19, 2007

Such risks and uncertainties include, but are not limited to: (i) the risks and uncertainties associated with our chapter 11 cases and Companies’ Creditors Arrangement Act (CCAA) proceedings of certain of Calpine’s Canadian affiliates, including our ability to successfully reorganize and emerge from chapter 11; (ii) our ability to implement our business plan; (iii) financial results that may be volatile and may not reflect historical trends; (iv) seasonal fluctuations of our results; (v) potential volatility in earnings associated with fluctuations in prices for commodities such as natural gas and power; (vi) our ability to manage liquidity needs and comply with covenants related to our existing financing obligations and anticipated exit financing; (vii) the direct or indirect effects on our business of our impaired credit including increased cash collateral requirements in connection with the use of commodity contracts; (viii) transportation of natural gas and transmission of electricity; (ix) the expiration or termination of our power purchase agreements and the related results on revenues; (x) risks associated with the operation of power plants including unscheduled outages; (xi) factors that impact the output of our geothermal resources and generation facilities, including unusual or unexpected steam field well and pipeline maintenance and variables associated with the waste water injection projects that supply added water to the steam reservoir; (xii) risks associated with power project development and construction activities; (xiii) our ability to attract, retain and motivate key employees; (xiv) our ability to attract and retain customers and contract counterparties; (xv) competition; (xvi) risks associated with marketing and selling power from plants in the evolving energy markets; (xvii) present and possible future claims, litigation and enforcement actions; (xviii) effects of the application of laws or regulations, including changes in laws or regulations or the interpretation thereof; and (xix) other risks identified from time-to-time in Calpine’s reports and registration statements filed with the SEC, including, without limitation, the risk factors identified in its Annual Report on Form 10-K for the year ended December 31, 2006 and Quarterly Reports on Form 10-Q. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements and Calpine undertakes no obligation to update any such statements. Any financial projections, while presented with numerical specificity, are necessarily based on a variety of estimates and assumptions which, though considered reasonable by Calpine, may not be realized and are inherently subject to significant business, economic, competitive, industry, regulatory, market, and financial uncertainties and contingencies, many of which are beyond Calpine’s control. Calpine cautions that no representations can be made or are made as to whether the actual results will be within the range set forth in the projections, to the accuracy of these projections or to Calpine’s ability to achieve the projected results. Some assumptions inevitably will not materialize. Further, events and circumstances occurring subsequent to the date on which these projections were prepared may be different from those assumed, or alternatively, may have been unanticipated and thus the occurrence of these events may affect financial results in a materially adverse or materially beneficial manner. Calpine does not intend to update or otherwise revise these projections to reflect events or circumstances existing or arising after the date hereof or to reflect the occurrence of unanticipated events. The projections therefore, may not be relied upon as a guaranty or other assurance of the actual results that may occur. Unless specified otherwise, all information set forth in this release is as of today’s date and Calpine undertakes no duty to update this information. For additional information about Calpine’s chapter 11 reorganization or general business operations, please refer to Calpine’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006, Calpine’s Quarterly Reports on Form 10-Q, and any other recent Calpine report to the Securities and Exchange Commission. These filings are available by visiting the Securities and Exchange Commission’s website at http://www.sec.gov or Calpine’s website at http://www.calpine.com.

###

EXHIBIT 1

Cash EBITDAR Projections as of November 1, 2007