UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional materials |

| |

| ¨ | Soliciting Material under Rule 14a-12 |

CALPINE CORPORATION

(Name of Registrant as Specified in Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of filing fee (Check the appropriate box):

| |

| ¨ | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

_______________________________________________________________________________________________

| |

| (2) | Aggregate number of securities to which transaction applies: |

_______________________________________________________________________________________________

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

_______________________________________________________________________________________________

| |

| (4) | Proposed maximum aggregate value of transaction: |

_______________________________________________________________________________________________

_______________________________________________________________________________________________

| |

| ¨ | Fee paid previously with preliminary materials. |

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously paid: |

_______________________________________________________________________________________________

| |

| (2) | Form, Schedule or Registration Statement No.: |

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

April 2, 2012

To our Shareholders:

It is our pleasure to invite you to attend our 2012 Annual Meeting of Shareholders. The meeting will be held at 8:00 a.m. (Central Time) on May 15, 2012 at our corporate headquarters, located at 717 Texas Avenue, 10th Floor, Houston, Texas 77002.

The following Notice of Annual Meeting of Shareholders outlines the business to be conducted at the meeting.

This year we are again using the Internet as our primary means of furnishing proxy materials to shareholders. Accordingly, most shareholders will not receive paper copies of our proxy materials. We instead sent shareholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose. We encourage you to review these materials and vote your shares.

You may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. If you attend the Annual Meeting, you may vote your shares in person, even if you have previously voted your proxy. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible to ensure that your shares will be represented and voted at the Annual Meeting.

We are proud that you have chosen to invest in Calpine Corporation. On behalf of our management and directors, thank you for your continued support and confidence in 2012.

Very truly yours,

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OF

CALPINE CORPORATION

717 Texas Avenue, Suite 1000

Houston, Texas 77002

| |

| Date of Meeting: | May 15, 2012 |

| |

| Time: | 8:00 a.m. (Central Time) |

| |

| Place: | 717 Texas Avenue, 10th Floor, Houston, Texas 77002 |

| |

| Items of Business: | We are holding the 2012 Annual Meeting of Shareholders (the “Annual Meeting”) for the following purposes: |

| |

| • | to elect nine directors to serve on our Board of Directors until the 2013 annual meeting of shareholders; |

| |

| • | to ratify the selection of PricewaterhouseCoopers LLP (“PWC”) as our independent registered public accounting firm for the year ending December 31, 2012; |

| |

| • | to approve, on an advisory basis, named executive officer compensation; and |

| |

| • | to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The proxy statement describes these items in more detail. As of the date of this notice, we have not received notice of any other matters that may be properly presented at the Annual Meeting.

| |

| Record Date: | March 20, 2012 |

| |

| Voting: | We strongly encourage you to vote. Please vote as soon as possible, even if you plan to attend the Annual Meeting in person. You have three options for submitting your vote before the Annual Meeting: Internet, telephone, or mail. In accordance with New York Stock Exchange (“NYSE”) rules, your broker will not be able to vote your shares with respect to any non-routine matters (including the election of directors) if you have not given your broker specific instructions to do so. The only routine matter to be voted on at the Annual Meeting is the ratification of the selection of our independent registered public accounting firm for the current year (Proposal No. 2). The election of directors (Proposal No. 1) and the advisory vote to approve named executive officer compensation (Proposal No. 3) are considered non-routine matters under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with such proposals. |

Date These Proxy Materials Are First Being Made

| |

| Available on the Internet: | On or about April 2, 2012 |

By order of the Board of Directors

W. Thaddeus Miller

Corporate Secretary

April 2, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL

MEETING OF SHAREHOLDERS TO BE HELD ON MAY 15, 2012:

The Notice of Annual Meeting of Shareholders, the Proxy Statement and the 2011 Annual Report are available at www.proxyvote.com.

TABLE OF CONTENTS

|

| |

| Notice of Annual Meeting of Shareholders of Calpine Corporation | Cover |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 15, 2012 | Cover |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

2012 Proxy Summary

To assist you in reviewing our 2011 performance, we would like to call your attention to key elements of our proxy statement. The following description is only a summary that highlights more detailed information contained elsewhere in this proxy statement. For more complete information about these topics, please review our Annual Report on Form 10-K and the complete proxy statement.

Annual Meeting of Shareholders

| |

| • | Time and Date: 8:00 a.m. (Central Time), May 15, 2012 |

| |

| • | Place: 717 Texas Avenue, 10th Floor |

Houston, Texas 77002

| |

| • | Record Date: March 20, 2012 |

| |

| • | Voting: Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each other matter to be voted on. |

| |

| • | Admission: No admission card is required to enter Calpine's annual meeting. Please follow the advance registration instructions on page 4. |

Meeting Agenda

| |

| • | Election of nine directors |

| |

| • | Ratification of PWC as auditors for 2012 |

| |

| • | Advisory resolution to approve named executive officer compensation |

| |

| • | Any other business that may properly come before the meeting |

Voting Matters and Board Recommendations

|

| | |

| Item | Activity | Board Vote Recommendation |

| 1 | Election of Directors | FOR EACH NOMINEE |

| 2 | Ratification of PWC as Auditor for 2012 | FOR |

| 3 | Advisory Resolution to Approve Named Executive Officer Compensation | FOR |

Board Nominees

The following table provides summary information about each nominee. Each director is elected annually by a plurality of votes cast, which means that the nine nominees receiving the highest number of “FOR” votes will be elected directors.

|

| | | | | | | |

| | | Director | Principal | | Committee Memberships |

| Name | Age | Since | Occupation | Independent | AC | CC | NGC |

| Frank Cassidy | 65 | 2008 | Retired President and Chief Operating Officer, PSEG Power LLC | X | | C | |

| Jack A. Fusco | 49 | 2008 | President and Chief Executive Officer, Calpine Corporation | | | | |

| Robert C. Hinckley | 64 | 2008 | Chairman and Managing Director, MCL Intellectual Property LLC | X | F | | X |

| David C. Merritt | 57 | 2006 | President, BC Partners, Inc. | X | F, C | | |

| W. Benjamin Moreland | 48 | 2008 | President and Chief Executive Officer, Crown Castle International Corp. | X | F | | |

| Robert A. Mosbacher, Jr. | 60 | 2009 | Chairman, Mosbacher Energy Company | X | | X | X |

| William E. Oberndorf | 58 | 2011 | Founding Partner, SPO Advisory Corp. | X | | X | |

| Denise M. O'Leary | 54 | 2008 | Private Venture Capital Investor | X | | X | C |

| J. Stuart Ryan | 53 | 2008 | Chief Executive Officer, Aggregates USA and Founding Owner and President, Rydout, LLC | X | | | X |

_______________________

AC Audit Committee F Financial Expert

C Chair NGC Nominating and Governance Committee

CC Compensation Committee

Attendance

Each director nominee is a current director and attended at least 75% of the aggregate of all meetings of the Board and each committee on which he or she sits.

Auditors

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of PWC as our independent auditor for 2012. Set forth below is summary information with respect to PWC's fees for services provided in 2011 and 2010.

|

| | | | | | | | | |

| | 2011 | | | 2010 | |

| | (in millions) | |

| Audit Fees | $ | 6.8 |

| | | $ | 8.4 |

| |

Approval, on an Advisory Basis, of Named Executive Officer Compensation

Our Board of Directors recommends that shareholders vote to approve, on an advisory basis, the compensation paid to our named executive officers as described in this proxy.

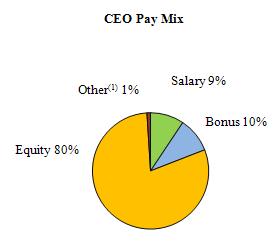

The Compensation Committee believes that the compensation program for our named executive officers emphasizes at-risk, performance-based compensation without motivating excessive risk taking. The Compensation Committee believes that our executive compensation program also helps Calpine to recruit, retain and motivate a highly talented team of executives with the requisite set of skills and experience to successfully lead the Company in creating value for our shareholders. We believe that the mix and structure of compensation strikes an appropriate balance to promote long-term returns without motivating or rewarding excessive risk taking. The compensation objectives and principles that govern the Company's compensation decisions include:

| |

| • | Alignment with Shareholders' Interests |

Our long-term incentive awards are equity-based, linking a significant portion of our named executive officers' pay to the value and appreciation in the value of our share price.

A significant portion of compensation for our named executive officers is linked to performance through appreciation of the price of our common stock and the achievement of corporate performance goals and certain financial and operating metrics that we believe drive the value of our share price.

| |

| • | Emphasis on Performance Over Time |

The compensation program for our named executive officers is designed to mitigate excessive short-term decision making and risk taking. The value of long-term incentives is substantially greater than the annual cash incentive bonus and our annual incentive plan limits the maximum cash incentive bonus that can be earned in a given year. The Compensation Committee also retains the discretionary power to reduce annual incentive awards below calculated values.

| |

| • | Recruitment, Retention and Motivation of Key Leadership Talent |

We provide an appropriate combination of fixed and variable compensation designed not only to attract and motivate the most talented executives for Calpine, but also to encourage retention by vesting equity awards over three to five years.

Executive Compensation Elements

|

| |

| Type | Purpose |

| Base Salary | To provide a minimum, fixed level of cash compensation for the named executive officers to compensate executives for services rendered during the fiscal year. |

| Annual Cash Incentives | To drive achievement of annual corporate goals including key financial and operating results and strategic goals that drive value for shareholders. |

| Long-Term Incentives | Equity grants, which generally consist of stock options and restricted stock, directly align executive officers' interests with the interests of shareholders by rewarding increases in the value of our share price. |

| Post-Employment Compensation | Severance benefits are designed to help retain qualified employees, maintain a stable work environment and provide financial security to certain employees of the Company in the event of a change in control or in the event of a termination of employment in connection with or without a change in control. Retirement benefits are intended to assist employees in preparing financially for retirement, to offer benefits that are competitive and to provide a benefits structure that allows for reasonable certainty of future costs. |

2011 Compensation Summary

Set forth below is the 2011 compensation for each our named executive officers.

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Non-Equity | | | | |

| | | | | | | Stock | | Option | | Incentive Plan | | All Other | | |

| | | Principal | | Salary | | Awards | | Awards | | Compensation | | Compensation | | Total |

| Name | | Position | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) |

| Jack A. Fusco | | President and CEO | | 1,068,790 |

| | — | | — | | 1,013,557 |

| | 53,039 |

| | 2,135,386 |

|

| Zamir Rauf | | EVP and CFO | | 530,995 |

| | — | | 818,882 |

| | 451,419 |

| | 12,250 |

| | 1,813,546 |

|

| John B. Hill | | EVP and COO | | 651,439 |

| | — | | — | | 565,110 |

| | 20,130 |

| | 1,236,679 |

|

| W. Thaddeus Miller | | EVP and CLO | | 758,753 |

| | — | | — | | 640,347 |

| | 12,250 |

| | 1,411,350 |

|

| Jim D. Deidiker | | SVP and CAO | | 375,938 |

| | 100,257 |

| | 241,734 |

| | 212,267 |

| | 12,250 |

| | 942,446 |

|

2013 Annual Meeting

Deadline for shareholder proposals: December 4, 2012

CALPINE CORPORATION

717 Texas Avenue, Suite 1000

Houston, Texas 77002

PROXY STATEMENT

PROXY SOLICITATION AND VOTING INFORMATION

Our Board of Directors (“Board” or “Board of Directors”) solicits your proxy for our 2012 Annual Meeting of Shareholders (the “Annual Meeting”) to be held at our corporate headquarters on May 15, 2012, at 8:00 a.m. (Central Time) at 717 Texas Avenue, 10th Floor, Houston, Texas 77002, and any adjournment or postponement of the meeting, for the purposes set forth in the Notice of Annual Meeting of Shareholders.

Questions and Answers About the Annual Meeting and Voting

Why am I receiving these proxy materials?

The proxy materials include our Notice of Annual Meeting of Shareholders, proxy statement and 2011 annual report. If you requested printed versions of these materials by mail, these materials also include the proxy card or voting instructions form for the Annual Meeting. Our Board of Directors has made these materials available to you in connection with the solicitation of proxies by the Board. The proxies will be used at our Annual Meeting, or any adjournment or postponement thereof. We made these materials available to shareholders beginning on or about April 2, 2012.

Our shareholders are invited to attend the Annual Meeting and vote on the proposals described in this proxy statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may vote by completing, signing, dating and returning a proxy card or by executing a proxy via the Internet or by telephone.

How can I access the proxy materials on the Internet?

In accordance with U.S. Securities and Exchange Commission (the “SEC”) rules, we are using the Internet as the primary means of furnishing proxy materials to shareholders. Accordingly, most shareholders will not receive paper copies of our proxy materials. We instead sent shareholders a Notice of Internet Availability of the Proxy Materials (the “Notice”) with instructions for accessing the proxy materials including the Notice of Annual Meeting of Shareholders, proxy statement and 2011 annual report, via the Internet and voting via the Internet or by telephone. The Notice was mailed on or about April 2, 2012. The Notice also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose. Additionally, and in accordance with SEC rules, you may access our proxy materials at www.proxyvote.com.

The Notice provides you with instructions regarding how to:

| |

| • | view the proxy materials for the Annual Meeting on the Internet and execute a proxy; and |

| |

| • | instruct us to send future proxy materials to you in printed form or electronically by e-mail. |

Choosing to receive future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the impact of our annual meetings on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

Who can vote?

Only shareholders of record of our common stock at the close of business on March 20, 2012 (the “record date”), may vote, either in person or by proxy, at the Annual Meeting. On the record date, we had 482,805,609 shares of common stock outstanding. You are entitled to one vote for each share of common stock that you owned on the record date. The shares of common stock held in our treasury, which are not considered outstanding, will not be voted.

What am I voting on?

You will be voting on each of the following:

| |

| • | to elect nine directors to serve on our Board; |

| |

| • | to ratify the selection of PWC to serve as our independent registered public accounting firm for the year ended December 31, 2012; |

| |

| • | to approve, on an advisory basis, named executive officer compensation; and |

| |

| • | to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

As of the date of this proxy statement, the Board knows of no other matters that will be brought before the Annual Meeting.

How do I vote?

You may vote using one of the following methods:

| |

| • | Over the Internet. If you have access to the Internet, we encourage you to vote in this manner. Refer to your Notice for instructions on voting via the Internet. |

| |

| • | By telephone. You can vote by calling the toll-free telephone number on your proxy card or voting instructions form. |

| |

| • | By mail. For those shareholders who request to receive a paper proxy card or voting instructions form in the mail, you can complete, sign and return the proxy card or voting instructions form. |

| |

| • | In person at the Annual Meeting. All shareholders of record may vote in person at the Annual Meeting. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it with your ballot to be able to vote at the Annual Meeting. Even if you plan to be present at the Annual Meeting, we encourage you to vote your shares by proxy via the Internet, by telephone or by mail in order to record your vote promptly, as we believe voting this way is convenient. |

The Notice provides instructions on how to access your proxy card or voting instructions form, which contain instructions on how to vote via the Internet or by telephone. For those shareholders who request to receive a paper proxy card or voting instructions form in the mail, instructions for voting via the Internet, by telephone or by mail are set forth on the proxy card or voting instructions form. Please follow the directions on these materials carefully.

How do I know if I am a beneficial owner of shares?

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Those instructions are contained in a “voting instructions form.” If you request printed copies of the proxy materials by mail, you will receive a voting instructions form.

Can I change my mind after I vote?

You may change your vote at any time before the polls close at the Annual Meeting. You may do this by using one of the following methods:

| |

| • | Voting again by telephone or over the Internet prior to 11:59 p.m., Eastern Time, on May 14, 2012 |

| |

| • | Giving timely written notice to the Corporate Secretary of our Company |

| |

| • | Delivering a timely later-dated proxy |

| |

| • | Voting in person at the Annual Meeting |

If you hold your shares through a broker, bank, or other nominee, you may revoke any prior voting instructions by contacting that firm or by voting in person via legal proxy at the Annual Meeting.

How many votes must be present to hold the Annual Meeting?

In order for us to conduct the Annual Meeting, the holders of a majority of the shares of the common stock outstanding as of March 20, 2012, must be present at the Annual Meeting in person or by proxy. This is referred to as a quorum. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its client) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. Your shares will be counted as present at the Annual Meeting if you do one of the following:

| |

| • | Vote via the Internet or by telephone |

| |

| • | Return a properly executed proxy by mail (even if you do not provide voting instructions) |

| |

| • | Attend the Annual Meeting and vote in person |

What vote is required to adopt each of the proposals?

Each share of our common stock outstanding on the record date is entitled to one vote on each of the nine director nominees and one vote on each other matter. Directors will be elected by a plurality of votes, which means that the nine nominees receiving the highest number of “FOR” votes will be elected directors. Approval of each of the other matters on the agenda requires the affirmative vote of the majority of the shares of common stock present or represented by proxy.

Will my shares be voted if I do not provide my proxy?

If you hold your shares directly in your own name, your shares will not be voted if you do not vote them or provide a proxy.

If your shares are held in the name of a brokerage firm or other nominee, under rules of the NYSE, your broker may vote your shares on “routine” matters even if you do not provide a proxy. The only routine matter to be voted on at the Annual Meeting is the ratification of the selection of our independent registered public accounting firm for the current year. If a brokerage firm votes your shares on these matters in accordance with these rules, your shares will count as present at the Annual Meeting for purposes of establishing a quorum and will count as “FOR” votes or “AGAINST” votes, as the case may be, depending on how the broker votes. If a brokerage firm signs and returns a proxy on your behalf that does not contain voting instructions, your shares will count as present at the Annual Meeting for quorum purposes and will be voted in connection with the selection of PWC as our independent public accounting firm for the current year, but will not count as a “FOR” vote for any other matter, including the election of directors.

How are abstentions and broker non-votes counted?

A “broker non-vote” occurs when a broker, bank or other nominee that holds our common stock for a beneficial owner returns a proxy to us but cannot vote the shares it holds as to a particular matter because it has not received voting instructions from the beneficial owner and the matter to be voted on is not “routine” under the NYSE rules. Abstentions and broker non-votes are not treated as votes cast on a proposal. Therefore, an abstention or broker non-vote generally will not have the effect of a vote for or against the proposal and will not be counted in determining the number of votes required for approval, though they will be counted as present at the Annual Meeting in determining the presence of a quorum.

What if I return my proxy but do not provide voting instructions?

If you hold your shares directly in your own name, and you sign and return your proxy card (including over the Internet or by telephone) but do not include voting instructions, your proxy will be voted as the Board recommends on each proposal.

When will the voting results be announced?

We will announce preliminary voting results at the Annual Meeting. We will report final results on our website at www.calpine.com and in a filing with the SEC on a Form 8-K.

Annual Meeting Admission

Only shareholders and certain other permitted attendees may attend the Annual Meeting. If you plan to attend the Annual Meeting in person, we ask that you also complete and return the reservation form attached to the end of the proxy statement. Please note that space limitations make it necessary to limit attendance to shareholders and one guest. Admission to the Annual Meeting will be on a first-come, first-served basis. Proof of Calpine Corporation stock ownership as of the record date, along with photo identification, will be required for admission. Shareholders holding stock in an account at a brokerage firm, bank, broker-dealer or other similar organization (“street name” holders) will need to bring a copy of a brokerage statement reflecting their stock ownership as of the record date. No cameras, recording equipment, electronic devices, use of cell phones, BlackBerry phones or other smart phones, large bags or packages will be permitted at the Annual Meeting.

Expenses of Solicitation

We pay all costs of soliciting proxies, including the cost of preparing, assembling and mailing the Notice, proxy statement and proxy. In addition to solicitation of proxies by mail, solicitation may be made personally, by telephone or by other electronic means. We may pay persons holding shares for others their expenses for sending proxy materials to their principals. While we presently intend that solicitations will be made only by directors, officers and employees of the Company, we may retain outside solicitors to assist in the solicitation of proxies. Any expenses incurred in connection with the use of outside solicitors will be paid by us.

Householding

To reduce the expense of delivering duplicate proxy materials to our shareholders, we are relying on the SEC rules that permit us to deliver only one set of proxy materials, including our proxy statement, our 2011 annual report and the Notice, to multiple shareholders who share an address unless we receive contrary instructions from any shareholder at that address. This practice, known as “householding,” reduces duplicate mailings, saving printing and postage costs as well as natural resources. Each shareholder retains a separate right to vote on all matters presented at the Annual Meeting.

If you wish to receive a separate copy of the 2011 annual report or other proxy materials, free of charge, or if you wish to receive separate copies of future annual reports or proxy materials, please mail your request to Calpine Corporation, 717 Texas Avenue, Suite 1000, Houston, Texas 77002, attention: Investor Relations, or call us at (713) 830-2000.

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees for Election as Directors

Upon recommendation of our Nominating and Governance Committee, our Board has nominated nine directors to serve on our Board of Directors until the 2013 annual meeting of shareholders and until their successors have been elected and qualified. Each nominee currently serves on our Board of Directors; eight are non-management directors and one serves as the President and Chief Executive Officer of the Company. The size of our Board is currently set at nine members and our directors are authorized to fill any vacancy on the Board.

If, at the time of the annual meeting, any nominee is unable or unwilling to serve as a director, the persons named as proxy holders will vote your proxy for the election of such substitute candidate as may be designated by the Board of Directors in accordance with Article III of our bylaws to fill the vacancy. The Board of Directors has no reason to believe any of the nominees will be unable or unwilling to serve if elected.

Our bylaws provide that the affirmative vote of a plurality of the shares present and voting is required to elect a director, which means that the nine nominees receiving the highest numbers of “FOR” votes at the Annual Meeting by the holders of shares of our common stock will be elected as directors.

Director Changes in 2011

Effective January 1, 2011, the Board of Directors appointed William E. Oberndorf to serve as a member of the Board until the next regularly scheduled annual election of directors. Mr. Oberndorf was elected to serve as a member of the Board during the annual election of directors at the 2011 annual meeting of shareholders.

The Board of Directors recommends you vote “FOR” each of the nominees described below.

Set forth in the table below is a list of our directors, together with certain biographical information, including their ages as of the date of this proxy statement.

|

| | |

| Name | Age | Principal Occupation |

| Frank Cassidy | 65 | Retired President and Chief Operating Officer, PSEG Power LLC |

| Jack A. Fusco | 49 | President and Chief Executive Officer, Calpine Corporation |

| Robert C. Hinckley | 64 | Chairman and Managing Director, MCL Intellectual Property LLC |

| David C. Merritt | 57 | President, BC Partners, Inc. |

| W. Benjamin Moreland | 48 | President and Chief Executive Officer, Crown Castle International Corp. |

| Robert A. Mosbacher, Jr. | 60 | Chairman, Mosbacher Energy Company |

| William E. Oberndorf | 58 | Founding Partner, SPO Advisory Corp. |

| Denise M. O'Leary | 54 | Private Venture Capital Investor |

| J. Stuart Ryan | 53 | Chief Executive Officer, Aggregates USA and Founding Owner and President, Rydout, LLC |

Frank Cassidy became a director of the Company on January 31, 2008. From 1969 to his retirement in 2007, Mr. Cassidy was employed at Public Service Enterprise Group, Inc. (“PSEG”), an energy and energy services company. From 1999 to 2007, Mr. Cassidy served as President and Chief Operating Officer of PSEG Power LLC, the wholesale energy subsidiary of PSEG. From 1996 to 1999, Mr. Cassidy was President and Chief Executive Officer of PSEG Energy Technologies, Inc. Prior to 1996, Mr. Cassidy held various positions of increasing responsibility at the Public Service Electric and Gas Company. Mr. Cassidy obtained a Bachelor of Science degree in Electrical Engineering from the New Jersey Institute of Technology and a Master of Business Administration degree from Rutgers University. Mr. Cassidy is the Chairman of the Compensation Committee. Mr. Cassidy's almost 40 years of diversified experience in the power generation and energy industries in various positions of increasing responsibility with PSEG provide him with strong insight, particularly with regard to power operations, power sector strategy, management and corporate governance matters, and make him a qualified member of our Board and effective Chairman of our Compensation Committee.

Jack A. Fusco has served as President and Chief Executive Officer of the Company and as a member of its Board of Directors since August 10, 2008. From July 2004 to February 2006, Mr. Fusco served as the Chairman and Chief Executive Officer of Texas Genco LLC. From 2002 through July 2004, Mr. Fusco was an exclusive energy investment advisor for Texas Pacific Group. From November 1998 until February 2002, he served as President and Chief Executive Officer of Orion Power Holdings, Inc. Prior to his founding of Orion Power Holdings, Inc., Mr. Fusco was a Vice President at Goldman Sachs Power, an affiliate of Goldman, Sachs & Co. Prior to joining Goldman Sachs, Mr. Fusco was employed by Pacific Gas & Electric Company or its affiliates in various engineering and management roles for approximately 13 years. Mr. Fusco served as a director on the board of Foster Wheeler Ltd., a global engineering and construction contractor and power equipment supplier, until February 2009 and Graphics Packaging Holdings, a paper and packaging company, until 2008. Mr. Fusco obtained a Bachelor of Science degree in Mechanical Engineering from California State University, Sacramento. Mr. Fusco's current management and leadership roles in the operation of Calpine Corporation coupled with more than 30 years of experience in the power industry, including as former Chief Executive Officer of two independent power companies, provide him with strong insight, particularly with regard to commercial and power operations, power sector strategy, commodities and management matters and make Mr. Fusco a valuable member of our Board.

Robert C. Hinckley became a director of the Company on January 31, 2008. From 1999 to 2001, Mr. Hinckley was an advisor to Xilinx, Inc., a supplier of programmable logic devices, and from 1991 to 1999 he was the Vice President, Strategic Plans and Programs as well as General Counsel and Secretary of Xilinx, Inc. In 1994, he also served as Xilinx's Chief Operating Officer. Prior to joining Xilinx, Mr. Hinckley was the Senior Vice President and Chief Financial Officer of Spectra Physics, Inc. Mr. Hinckley spent 11 years on active duty in the U.S. Navy. Mr. Hinckley obtained a Bachelor of Science degree from the U.S. Naval Academy. Mr. Hinckley is an adjunct Professor of Law at Tulane Law School and is a member of the Law School Dean's Advisory Board. He earned his Juris Doctorate degree from Tulane University Law School. Mr. Hinckley currently serves as the Chairman and Managing Director of MCL Intellectual Property LLC and participates as a member of the board of directors and advisory boards of several privately held companies. Mr. Hinckley is a member of both the Audit Committee and the Nominating and Governance Committee. Mr. Hinckley's legal expertise, including service as corporate general counsel and as a member of other boards of directors provide him with strong insight, particularly with regard to legal and corporate governance matters, and make him a valuable member of our Board and of our Audit Committee and Nominating and Governance Committee.

David C. Merritt became a director of the Company on February 8, 2006. Mr. Merritt is President and owner of BC Partners, Inc. and served as Senior Vice President and Chief Financial Officer of iCRETE LLC from October 2007 to March 12, 2009. From October 2003 until September 2007, he served as Managing Director of Salem Partners LLC, an investment banking firm. Mr. Merritt was an audit and consulting partner of KPMG LLP from 1985 to 1999. Mr. Merritt also serves as a director of Outdoor Channel Holdings, Inc., where he serves as a member of the Audit Committee; Charter Communications, Inc., where he also serves as a member of the Audit Committee; and Buffets Restaurants Holdings, Inc. Mr. Merritt obtained a Bachelor of Science degree in Business and Accounting from California State University, Northridge. Mr. Merritt's knowledge and expertise in accounting developed during his 14 years as a partner in a major accounting firm and his service on other boards of directors, including as chairman of other board audit committees provide him with strong insight, particularly with regard to accounting and financial matters, and make him a valuable member of the Board and effective Chairman of our Audit Committee.

W. Benjamin Moreland became a director of the Company on January 31, 2008. Since 1999, Mr. Moreland has been employed by Crown Castle International Corp., a provider of wireless communications infrastructure in Australia, Puerto Rico and the U.S., in various capacities, including his current position as President and Chief Executive Officer and, prior to that, as Executive Vice President and Chief Financial Officer. Mr. Moreland is also a director at Crown Castle International. Prior to joining Crown Castle International, he held various positions in corporate finance and real estate investment banking with Chase Manhattan Bank from 1984 to 1999. Mr. Moreland obtained a Bachelor of Business Administration degree from the University of Texas and a Master of Business Administration degree from the University of Houston. Mr. Moreland is a member of the Audit Committee. Mr. Moreland's successful leadership and executive experience as a Chief Executive Officer and Chief Financial Officer provide him with strong insight, particularly with regard to finance, equity markets, valuation and management matters, and make him a valuable member of our Board and of our Audit Committee.

Robert A. Mosbacher, Jr. has been a director of the Company since February 11, 2009. Mr. Mosbacher is the Chairman of Mosbacher Energy Company, a privately-held independent oil and gas exploration and production company located in Houston, Texas. Prior to that, Mr. Mosbacher was appointed by President George W. Bush in 2005 as the President and Chief Executive Officer of the Overseas Private Investment Corporation (“OPIC”), an independent U.S. government agency that helps small, medium and large American businesses expand into developing nations and emerging markets around the globe; he served in that position through January 2009. From 1986 until 2005, he served as President and Chief Executive Officer of Mosbacher Energy Company. From 1995 to 2003, Mr. Mosbacher also served as Vice Chairman of Mosbacher Power Group LLC. From August 1999 to October 2005, Mr. Mosbacher served as a Director of the Devon Energy Corporation. He also served on Devon's Compensation Committee from June 2003 to October 2005. In April 2009, Mr. Mosbacher resumed his role as a director of Devon, and in June 2009 he resumed his role as a member of Devon's Compensation Committee and the Nominating and Governance Committee.

Mr. Mosbacher obtained a Bachelor of Arts degree in Political Science from Georgetown University and a Juris Doctorate from Southern Methodist University. Mr. Mosbacher is a member of the Compensation Committee and the Nominating and Governance Committee. Mr. Mosbacher's extensive and varied management experience in the energy sector including natural gas and independent power generation, his experience with the Federal government at OPIC, and his service as a member of other boards and board committees provide him with strong insight, particularly with regard to energy, management and government and community relations matters, and make him a valuable member of our Board and of our Compensation Committee and Nominating and Governance Committee.

William E. Oberndorf was appointed by the Board to become a director of the Company on January 1, 2011. Mr. Oberndorf is a founding partner of SPO Advisory Corp., which is an owner of a number of businesses in a broad range of industries with an asset orientation. Mr. Oberndorf has served on the boards of numerous public and private companies. He currently serves as chairman of the board of Aggregates U.S.A. and Rosewood Hotels & Resorts. Mr. Oberndorf is also a member of the investment committee of Hotel Equity Funds and is a director emeritus of Plum Creek Timber Co. Mr. Oberndorf is a former board member of Taft Broadcasting Company, Voyager Learning Company, where he served as chairman, and Wometco Cable Television Corporation. Mr. Oberndorf received his Bachelor of Arts degree from Williams College and his Master of Business Administration from the Stanford Graduate School of Business. Mr. Oberndorf is a member of the Compensation Committee. Mr. Oberndorf's knowledge and understanding of capital markets as a result of his experiences as a private equity and a venture capital investor as well as his experience serving as a director and member of committees of other boards of directors provide him with strong insight, particularly with regard to capital allocation financing, capital markets and business strategy, and make him a valuable member of our Board and of our Compensation Committee.

Denise M. O'Leary became a director of the Company on January 31, 2008. Since 1996, she has been a private venture capital investor in a variety of early stage companies. From 1983 to 1996, Ms. O'Leary was an associate, then general partner, at Menlo Ventures, a venture capital firm providing long-term capital and management services to development stage companies. From 2002 to 2006, Ms. O'Leary was a member of the Board of Directors of Chiron Corporation, at which time the company was sold to Novartis AG. Ms. O'Leary is also a director of U.S. Airways Group, Inc., where she serves as a member of the Compensation Committee, and Medtronic, Inc., where she also serves as a member of the Compensation Committee. She obtained a Bachelor of Science degree in Industrial Engineering from Stanford University and obtained a Master in Business Administration from Harvard Business School. Ms. O'Leary is the Chairman of the Nominating and Governance Committee and a member of the Compensation Committee. Ms. O'Leary's knowledge and understanding of capital markets as a result of her experiences as a venture capital investor as well as her experience serving as a director and member of committees of other boards of directors provide her with strong insight, particularly with regard to corporate governance, ethics and financial matters, and make her a valuable member of our Board and of our Compensation Committee and Chair of our Nominating and Governance Committee.

J. Stuart Ryan became a director of the Company on January 31, 2008. In July 2011, Mr. Ryan became the Chief Executive Officer of Aggregates USA. He is also the founding owner and President of Rydout, LLC, a private investment firm focused on the energy and power industries since February 2003. He also has been a venture partner with SPO Advisory Corp. since 2003. In 2010, Mr. Ryan joined the Advisory Board of Banyan Energy, Inc., a venture stage company developing optical concentrators for solar modules. From 1986 through 2003, Mr. Ryan held various management positions with The AES Corporation, a global power company, including Executive Vice President from February 2000 and Chief Operating Officer from February 2002. Mr. Ryan earned a Bachelor of Science degree from Lehigh University and a Master of Business Administration degree from Harvard University. Mr. Ryan serves on the Lehigh University Board of Trustees and its Engineering Advisory Counsel. Mr. Ryan was appointed Chairman of the Board effective November 3, 2010. Mr. Ryan is also a member of the Nominating and Governance Committee. Mr. Ryan's extensive industry knowledge and experience spanning more than 20 years in the power and energy industries provide him with strong insight, particularly with regard to power sector, strategy, commodities, management and financial matters, and make him an effective Chairman of our Board and a valuable member of our Nominating and Governance Committee.

BOARD MEETINGS AND BOARD COMMITTEE INFORMATION

Meetings

During 2011, the Board of Directors held four meetings. In 2011, all directors attended at least 75% of the aggregate of meetings of the Board and the committees on which they served. It is our policy that all members of our Board attend our annual meetings of shareholders. Each director attended our 2011 annual meeting.

Committees and Committee Charters

Our Board of Directors has established the following standing committees: an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The charter of each of these Committees is available on our website at www.calpine.com/about/oc_corpgov_committees.asp. You may also request printed copies of the charter(s) by sending a written request to our Corporate Secretary at the address set forth on the cover of this proxy statement. From time to time, the Board will create special committees to address specific matters such as financial or corporate transactions. During 2011, the Board held five special committee meetings to address various ad hoc corporate matters.

The following table identifies the individual members of our Board serving on the Audit Committee, the Compensation Committee and the Nominating and Governance Committee:

|

| | | | | |

| Director | Audit Committee | | Compensation Committee | | Nominating and Governance Committee |

| Frank Cassidy | — | | Chair | | — |

| Jack A. Fusco | — | | — | | — |

| Robert C. Hinckley | X | | — | | X |

| David C. Merritt | Chair | | — | | — |

| W. Benjamin Moreland | X | | — | | — |

| Robert A. Mosbacher, Jr. | — | | X | | X |

| William E. Oberndorf | — | | X | | — |

| Denise M. O'Leary | — | | X | | Chair |

| J. Stuart Ryan | — | | — | | X |

Audit Committee

The Audit Committee meets a minimum of four times a year, and holds such additional meetings as it deems necessary to perform its responsibilities. In 2011, the Audit Committee held seven meetings.

The Audit Committee has direct responsibility for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm engaged to prepare an audit report, to perform other audits, and to perform review or attest services for us. The independent registered public accounting firm reports directly to the Audit Committee. Annually, the Audit Committee recommends that the Board request shareholder ratification of the appointment of the independent registered public accounting firm. The Audit Committee also has direct responsibility to retain, evaluate and, when appropriate, to terminate the independent registered public accounting firm. The Audit Committee is also responsible for the pre-approval of all audit and permitted non-audit services performed by our independent registered public accounting firm.

The Audit Committee acts on behalf of the Board in monitoring and overseeing the performance of our internal audit function, and our chief accounting officer has direct access to the Audit Committee. The Audit Committee also oversees the operation of our internal controls covering the integrity of our financial statements and reports, compliance with laws, regulations and corporate policies, and the qualifications, performance and independence of our independent registered public accounting firm. The Audit Committee is also responsible for determining whether any waiver of our Code of Conduct will be permitted, and for reviewing and determining whether to approve any related party transactions required to be disclosed pursuant to Item 404(a) of Regulation S-K. The responsibilities and activities of the Audit Committee are further described in “Report of the Audit Committee” and the Audit Committee charter.

The Board of Directors has determined that the Audit Committee consists entirely of directors who meet the independence requirements of the NYSE listing standards and the rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has also determined that each member of the Audit Committee has sufficient knowledge and understanding of the Company's financial statements to serve on the Audit Committee and is financially literate within the meaning of the NYSE listing standards as interpreted by the Board. The Board has further determined that each member of the Audit Committee satisfies the definition of “audit committee financial expert” as defined under the federal securities laws.

Compensation Committee

The Compensation Committee meets a minimum of four times a year and holds additional meetings as it deems necessary to perform its responsibilities. In 2011, the Compensation Committee held four meetings.

The Compensation Committee has authority for reviewing and approval of total compensation, including determining salaries, performance-based incentives, and other matters related to the compensation of our executive officers. The Compensation Committee is responsible for administering our equity plans, including reviewing and granting equity awards to our executive officers. It also establishes and evaluates the achievement of any related performance goals. The Compensation Committee's recommendations concerning equity plans are subject to approval of our entire Board.

The Compensation Committee also reviews and approves corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluates the Chief Executive Officer's performance in light of those goals and objectives and determines and approves the Chief Executive Officer's compensation level on the basis of its evaluation. While the Compensation Committee has overall responsibility for executive compensation matters, as specified in its charter, the Compensation Committee reports its preliminary conclusions with respect to the performance evaluation and compensation decisions regarding our Chief Executive Officer to the other independent directors of our Board in executive session and solicits their input prior to finalizing its conclusions.

The Compensation Committee is also generally responsible for overseeing our employee compensation and benefit policies and programs, our management development and succession programs, the development and oversight of a succession plan for the position of Chief Executive Officer and our diversity and inclusion programs.

As further described in the Compensation Discussion and Analysis section of this proxy statement, our management provides information, analysis and recommendations for the Compensation Committee's decision-making process in connection with the amount and form of executive compensation, except that no member of management may participate in the decision-making process with respect to his or her own compensation. The Compensation Discussion and Analysis discusses the role of our Chief Executive Officer in determining or recommending the amount and form of executive compensation. In addition, the Compensation Discussion and Analysis addresses the role of management and of the Compensation Committee's independent compensation advisor, Pay Governance, in determining and recommending executive compensation. The responsibilities and activities of the Compensation Committee are further described under “Compensation Discussion & Analysis” and, “Report of the Compensation Committee” and in the Compensation Committee charter.

Our Board of Directors has determined that the Compensation Committee consists entirely of directors who meet the independence requirements of the NYSE listing standards.

Nominating and Governance Committee and Director Nominations

The Nominating and Governance Committee meets a minimum of four times a year and holds such additional meetings as it deems necessary to perform its responsibilities. In 2011, the Nominating and Governance Committee held four meetings.

The Nominating and Governance Committee's principal responsibilities are to assist the Board in reviewing and identifying individuals qualified to become Board members, consistent with the criteria established by the Board for director candidates, and to recommend to the Board nominees for directors for the next annual meeting of shareholders and to fill vacancies on the Board.

In carrying out its responsibilities, the Nominating and Governance Committee considers proposals from a number of sources, including recommendations for nominees from shareholders submitted upon written notice to the chairman of the Nominating and Governance Committee, c/o Corporate Secretary, Calpine Corporation, 717 Texas Avenue, Suite 1000, Houston, Texas 77002. When considering a person to be recommended for nomination as a director, the Nominating and Governance Committee evaluates, among other factors, experience, accomplishments, education, skills, personal and professional integrity, diversity of the Board (in all aspects of that term) and the candidate's ability to devote the necessary time for service as a director (including directorships and other positions held at other corporations and organizations).

The Nominating and Governance Committee has no specific policy on director diversity. However, the Board reviews diversity of viewpoints, background, experience, accomplishments, education and skills when evaluating nominees. The Board believes that such diversity is important because it provides varied perspectives, which promotes active and constructive discussion among Board members and between the Board and management, resulting in more effective oversight of management's formulation and implementation of strategic initiatives. The Board believes this diversity is demonstrated in the range of experiences, qualifications and skills of the current members of the Board. In the Board's executive sessions and in annual performance

evaluations conducted by the Board and its committees, the Board from time to time considers whether the Board's composition promotes a constructive and collegial environment. In determining whether an incumbent director should stand for re-election, the Nominating and Governance Committee considers the above factors, as well as that director's personal and professional integrity, attendance, preparedness, participation and candor, the individual's satisfaction of the criteria for the nomination of directors set forth in our Corporate Governance Guidelines and other relevant factors as determined by the Board.

Our Nominating and Governance Committee also reviews non-employee director compensation and benefits on an annual basis and makes recommendations to the Board. The Nominating and Governance Committee also oversees evaluations of the Board and committees of the Board and, unless performed by the Compensation Committee, our senior managers.

Finally, the Nominating and Governance Committee has the responsibility to develop and recommend to the Board a set of corporate governance guidelines and propose changes to such guidelines from time to time as may be appropriate. See “Corporate Governance Matters — Corporate Governance Guidelines.” The responsibilities and activities of the Nominating and Governance Committee are further described in the Nominating and Governance Committee charter.

Our Board of Directors has determined that the Nominating and Governance Committee consists entirely of directors who meet the independence requirements of the NYSE listing standards.

Compensation Committee Interlocks and Insider Participation

None of the current members of our Compensation Committee (whose names appear under “— Report of the Compensation Committee”) is, or has ever been, an officer or employee of the Company or any of its subsidiaries. In addition, during the last fiscal year, no executive officer of the Company served as a member of the board of directors or the compensation committee of any other entity that has one or more executive officers serving on our Board or our Compensation Committee.

REPORT OF THE AUDIT COMMITTEE

On behalf of the Board of Directors of Calpine Corporation (the “Company”), the Audit Committee oversees the operation of the Company's system of internal controls in respect of the integrity of its financial statements and reports, compliance with laws, regulations and corporate policies, and the qualifications, performance and independence of its independent registered public accounting firm. The Audit Committee's function is one of oversight, recognizing that the Company's management is responsible for preparing its financial statements, and the Company's independent registered public accounting firm is responsible for auditing those financial statements.

Consistent with this oversight responsibility, the Audit Committee has reviewed and discussed with management the audited financial statements of the Company for the year ended December 31, 2011, and management's assessment of internal control over financial reporting as of December 31, 2011.

The Audit Committee has also discussed with PWC the matters required to be discussed by the Statement on Auditing Standards No. 61 (as amended), as adopted by Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T. The Audit Committee has also received the written disclosures in the letter from PWC required by the applicable requirements of the PCAOB regarding PWC's independence and has discussed with PWC their independence.

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements for the year ended December 31, 2011, be included in its annual report on Form 10-K for the fiscal year then ended. The Audit Committee has selected PricewaterhouseCoopers LLP as our independent registered public accounting firm and has asked the shareholders to ratify the selection.

David C. Merritt (Chair)

Robert C. Hinckley

W. Benjamin Moreland

The Report of the Audit Committee does not constitute soliciting material, and shall not be deemed to be filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates the Report of the Audit Committee by reference therein.

CORPORATE GOVERNANCE MATTERS

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines covering, among other things, the duties and responsibilities of and independence standards applicable to our directors. The Corporate Governance Guidelines cover a number of other matters, including the Board's role in overseeing executive compensation, compensation and expenses for non-management directors, communications between shareholders and directors, Board committee structures and assignments and review and approval of related person transactions. A copy of our Corporate Governance Guidelines is available on our website at www.calpine.com/about/oc_corpgov.asp. You may also request a printed copy of the guidelines free of charge by sending a written request to our Corporate Secretary at the address on the cover of this proxy statement.

Board Leadership Structure

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board believes that, given the dynamic and competitive environment in which we operate, the right Board leadership structure may vary as circumstances warrant. Upon emergence from Chapter 11 bankruptcy in 2008, the newly constituted Board believed that the interests of Calpine and its shareholders would be better served by separating the positions of Chief Executive Officer and Chairman of the Board. The Board believed as the Company transitioned from Chapter 11 bankruptcy it would be important to have:

| |

| • | the Chief Executive Officer and management focused on managing the business and strategic direction of the Company; |

| |

| • | the Board of Directors providing independent oversight of management and the Chief Executive Officer; and |

| |

| • | the Chairman of the Board of Directors providing guidance. |

At present, the Board has chosen to continue separating the two roles. We believe that our current leadership structure promotes balance between the authority of those who oversee our business and those who manage it on a day-to-day basis, particularly given the continuing concentration of ownership between our two major shareholders. Nevertheless, the Board recognizes that it is important to retain the organizational flexibility to determine whether the roles of the Chairman of the Board and Chief Executive Officer should be separated or combined in one individual. The Board periodically evaluates whether the Board leadership structure should be changed in light of specific circumstances applicable to us.

Code of Conduct and Ethics

Our Code of Conduct and Corporate Governance Guidelines regulate related party transactions and apply to all directors, officers and employees. The Code of Conduct requires that each individual deal fairly, honestly and constructively with governmental and regulatory bodies, customers, suppliers and competitors, and it prohibits any individual's taking unfair advantage through manipulation, concealment, abuse of privileged information or misrepresentation of material facts. Further, it imposes an express duty to act in the best interests of the Company and to avoid influences, interests or relationships that could give rise to an actual or apparent conflict of interest. If any question as to a potential conflict of interest arises, employees are directed to notify their supervisors and the Chief Legal Officer and, in the case of directors and the Chief Executive Officer, they are to notify the Audit Committee of our Board of Directors. We require our executives to comply with our Code of Conduct as a condition of employment.

Our Code of Conduct also prohibits directors, officers and employees from competing with us, using Company property or information, or such employee's position, for personal gain, and taking corporate opportunities for personal gain. Waivers of our Code of Conduct must be explicit. The director, officer or employee seeking a waiver must provide his supervisor and the Chief Legal Officer with all pertinent information and, if the Chief Legal Officer recommends approval of a waiver, it shall present such information and the recommendation to the Audit Committee of our Board of Directors. A waiver may only be granted if (i) the Audit Committee is satisfied that all relevant information has been provided and (ii) adequate controls have been instituted to assure that the interests of the Company remain protected. In the case of our Chief Executive Officer and our directors, any waiver must also be approved by both the Audit Committee and the Nominating and Governance Committee. Any waiver that is granted, and the basis for granting the waiver, will be publicly communicated as appropriate, including posting on our website, as soon as practicable. We granted no waivers under our Code of Conduct in 2011. The Code of Conduct is posted on our website at http://www.calpine.com/about/oc_corpgov.asp. You may also request a printed copy of the Code of Conduct free of charge by sending a written request to our Corporate Secretary at the address listed on the cover of this proxy statement. We intend to post any amendments and any waivers of our Code of Conduct on our website within four business days.

Director Independence

Our independent directors are: Frank Cassidy, Robert C. Hinckley, David C. Merritt, W. Benjamin Moreland, Robert A. Mosbacher, Jr., William E. Oberndorf, Denise M. O'Leary and J. Stuart Ryan. With eight independent directors out of nine total directors, the Board has satisfied its objective as set forth in the Corporate Governance Guidelines to have at least three-quarters of the Board consist of independent directors, as well as NYSE listing standards requiring that at least a majority of the Board consist of independent directors.

For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with us. The Board considers the following transactions, relationships and arrangements in determining director independence (which are included in our Corporate Governance Guidelines). Under these guidelines, a member of the Board of Directors may be considered independent if such member has not been employed by the Company within the last three years (other than as interim Chairman of the Board of Directors or interim Chief Executive Officer) and:

| |

| • | does not have an immediate family member that has been employed by the Company as an executive officer within the last three years; |

| |

| • | has not received more than $120,000 in direct compensation from the Company within the last three years other than for services as a member of the Board of Directors, interim Chairman of the Board of Directors or interim Chief Executive Officer; |

| |

| • | is not, and has not been within the last three years, an executive officer or an employee of a significant customer or supplier of the Company; |

| |

| • | is not, and has not been within the last three years, affiliated with or employed by the Company's present or former internal or external auditor; |

| |

| • | is not affiliated with any not-for-profit entity which, in the business judgment of the Board of Directors, receives significant contributions from the Company; |

| |

| • | is not employed as an executive officer of a public company at which an executive officer of the Company serves as a member of such public company's board of directors; |

| |

| • | has not had any of the relationships described above with any affiliate of the Company; |

| |

| • | is not a member of the immediate family of any individual, or have an immediate family member, with any of the relationships described in the bulleted paragraphs above (where an “immediate family member” includes spouse, parents, children, siblings, mothers-in-law, fathers-in-law, sons-in-law, daughters-in-law, brothers-in-law, sisters-in-law and anyone (other than a domestic employee) who shares the director's or other individual's home); and |

| |

| • | has no other material relationship which, in the business judgment of the Board of Directors, would impair his or her ability to exercise independent judgment. |

Notwithstanding the foregoing, each member of the Board of Directors must meet any mandatory qualifications for membership on the Board, and the Board as a whole must meet the minimum independence requirements imposed by any exchange or market on which our common stock is listed and any other laws and regulations applicable to us. Each member of the Board of Directors is required to promptly advise the Chairman of the Board (or the Lead Director if one has been appointed as described below) and the Nominating and Governance Committee of any matters which, at any time, may affect such member's qualifications for membership under the criteria imposed by any applicable exchange or market, any other laws and regulations or these guidelines, including, but not limited to, such member's independence.

In reaching its determinations, the Board reviewed the categorical standards listed above, the corporate governance rules of the NYSE and the individual circumstances of each director and determined that each of the directors identified above as independent satisfied each standard. In particular, in determining that Messrs. Oberndorf and Ryan are independent directors, the Board considered the beneficial ownership of shares by such directors, or entities deemed to be controlled by such directors or by which such directors are employed or are otherwise related (other than shares or options to purchase shares granted to such directors as compensation for their services as directors), including the fact that Messrs. Ryan and Oberndorf are affiliated with a stockholder that holds approximately 16.1% of the common stock of Calpine. In this context, the Board reviewed the NYSE's position that the NYSE does not view ownership of even a significant amount of stock, by itself, as a bar to an independence finding.

Business Relationships and Related Party Transactions Policy

We have adopted a written policy regarding approval requirements for related person transactions. Under our related person transactions policy, our Chief Legal Officer is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions and for then determining, based on the relevant facts and circumstances, whether a related person has a direct or indirect material interest in the transaction. Under our policy, transactions (i) that involve directors, director nominees, executive officers, significant shareholders or other “related persons” in which the Company is or will be a participant and (ii) of the type that must be disclosed under the SEC's rules must be referred by the Chief Legal Officer to our Audit Committee for the purpose of determining whether such transactions are in the best interests of the Company. Under our policy, it is the responsibility of the individual directors, director nominees, executive officers and holders of five percent or more of the Company's Common Stock to promptly report to our Chief Legal Officer all proposed or existing transactions in which the Company and they, or any related person of theirs, are parties or participants. The Chief Legal Officer (or the Chief Executive Officer, in the event the transaction in question involves the Chief Legal Officer or a related person of the Chief Legal Officer) is then required to furnish to the Chairman of the Audit Committee reports relating to any transaction that, in the Chief Legal Officer's judgment, may require reporting pursuant to the SEC's rules or may otherwise be the type of transaction that should be brought to the attention of the Audit Committee. The Audit Committee considers material facts and circumstances concerning the transaction in question, consults with counsel and other advisors as it deems advisable and makes a determination or recommendation to the Board of Directors and appropriate officers of the Company with respect to the transaction in question. In its review, the Audit Committee considers the nature of the related person's interest in the transaction, the material terms of the transaction, the relative importance of the transaction to the related person, the relative importance of the transaction to the Company and any other matters deemed important or relevant. Upon receipt of the Audit Committee's recommendation, the Board of Directors or officers, take such action as deemed appropriate in light of their respective responsibilities under applicable laws and regulations.

Chairman/Lead Director, Executive Sessions of Independent Directors and Communications with the Board

Our Corporate Governance Guidelines provide that a Chairman will be selected annually by a majority of the entire Board of Directors. The Chairman is to be selected from among the independent directors provided that, if the Board of Directors determines that it is appropriate to have, and selects, a Chairman that is not independent, the Board of Directors shall also select a Lead Director from among the independent directors. The Chairman and the Lead Director, if any, will have such duties and responsibilities as may be set forth in the Corporate Governance Guidelines from time to time. Mr. Ryan is our current Chairman.

Under our Corporate Governance Guidelines, non-management directors hold an executive session without management at each regularly scheduled Board meeting. Our Corporate Governance Guidelines also require that, at least once each year, the independent members of the Board of Directors (if different from the non-management directors) meet in executive session.

A majority of our independent directors has approved procedures with respect to the receipt, review and processing of, and any response to, written communications sent by shareholders and other interested persons to our Board of Directors. Such communications may be addressed to:

Calpine Corporation

717 Texas Avenue, Suite 1000

Houston, Texas 77002

Attn: Corporate Secretary

Interested parties may also send communications by e-mail addressed to the Board, individual director(s) or committee (s) at Board_of_Directors@calpine.com.

Our Corporate Secretary is authorized to open and review any mail or other correspondence received that is addressed to the Board, a committee or any individual director. If, upon opening any correspondence, the Corporate Secretary determines that it contains materials unrelated to the business or operations of the Company or to the Board's functions, including magazines, solicitations or advertisements, the contents may be discarded.

Any interested party, including any employee, may make confidential, anonymous submissions regarding questionable accounting or auditing matters or internal accounting controls and may communicate directly with the Chairman (or Lead Director) by letter to the above address, marked for the attention of the Chairman or Lead Director, as applicable. Any written communication regarding accounting, internal accounting controls or other financial matters are processed in accordance with procedures adopted by the Audit Committee.

The Board's Role in Risk Oversight

In the normal course of its business, Calpine is exposed to a variety of risks, including (i) financial risks relating to changes in commodity prices and interest rates, (ii) operational risks, including long-term changes in commodity prices, risks of changing technology affecting the Company's resource base, governmental policy decisions, and increasing competition from renewable sources of power generation, (iii) legislative and regulatory risks, including those related to climate change and air emissions, and (iv) general economic, credit and investment risks.

The full Board of Directors oversees the Company's risk management policies with an emphasis on understanding the key enterprise risks affecting the Company's business. In addition, the Board monitors the ways in which the Company attempts to prudently mitigate risks, to the extent reasonably practicable and consistent with the Company's long-term strategies.

The Company has a Risk Management Committee, chaired by the Chief Risk Officer, consisting of key operating, finance, legal and control executives. The committee meets throughout the year to review risk exposures and controls. At least annually, the Chief Risk Officer presents a comprehensive review of the Company's corporate risk policy to the full Board of Directors, discussing the risk control organization and risk control practices. The full Board of Directors also receives updates at other meetings during the year on any particular matters relating to risk controls that management believes need to be brought to the attention of the Board of Directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS

The following table sets forth certain information known to the Company regarding the beneficial ownership of its common stock as of March 7, 2012, by (i) each person known by the Company to be the beneficial owner of more than 5% of the outstanding shares of its common stock, (ii) each of our directors and nominees, (iii) each of our named executive officers and (iv) all of our executive officers and directors serving as of March 7, 2012, as a group. Unless otherwise stated, the address of each named executive officer and director is c/o Calpine Corporation, Suite 1000, 717 Texas Avenue, Houston, Texas 77002.

|

| | | | | | | | | | | |

| Name | Common Shares Beneficially Owned(1) | | Shares Individuals Have the Right to Acquire Within 60 Days | | Total Number of Shares Beneficially Owned(1) | | Percent of Class |

SPO Advisory Corp.(2) | 77,658,337 |

| | 15,323 |

| | 77,673,660 |