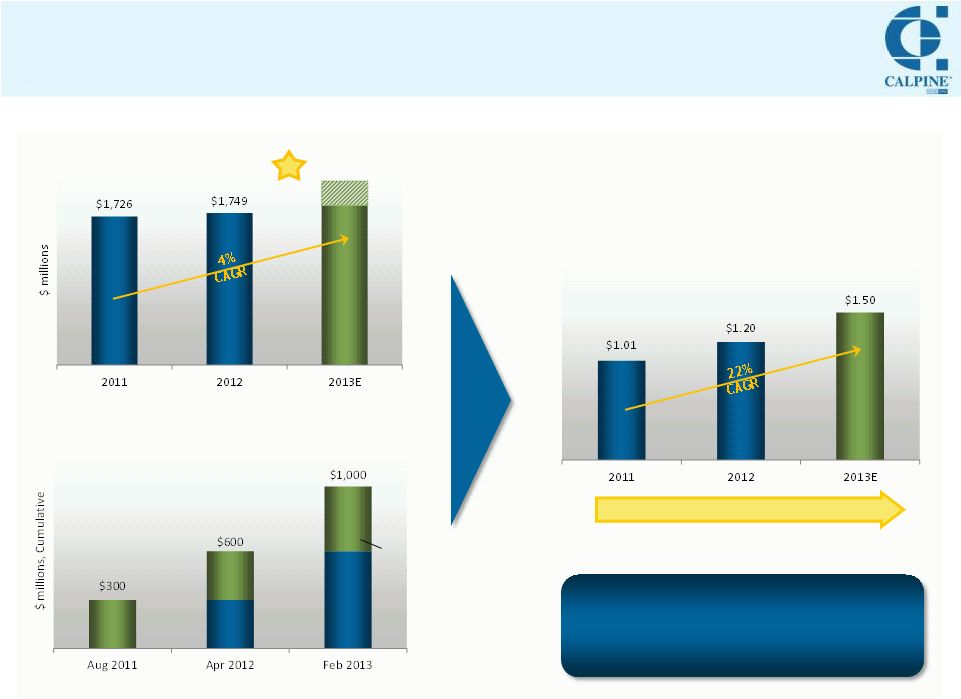

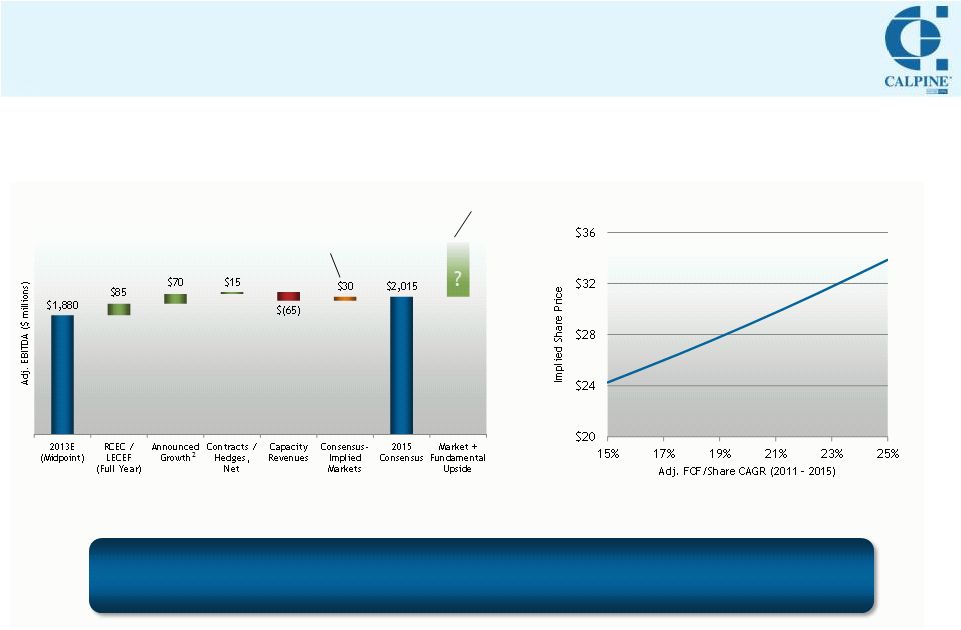

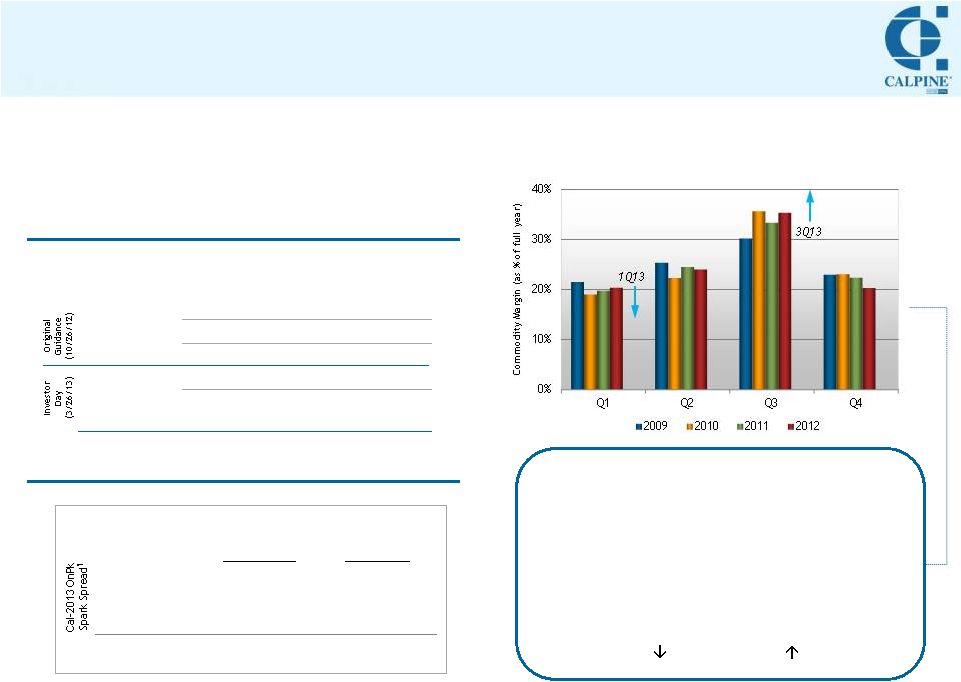

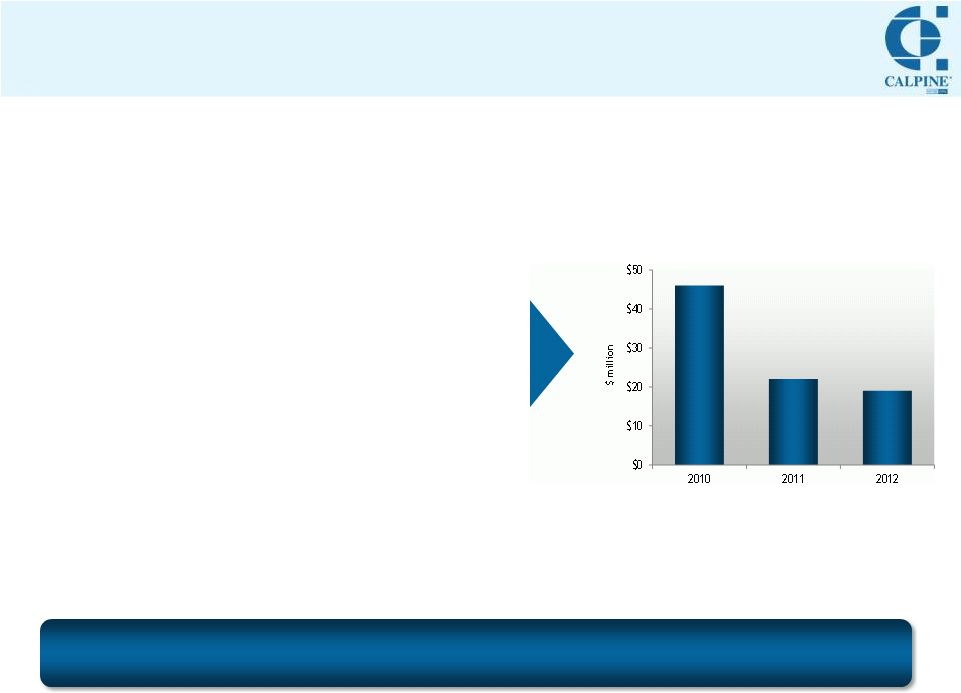

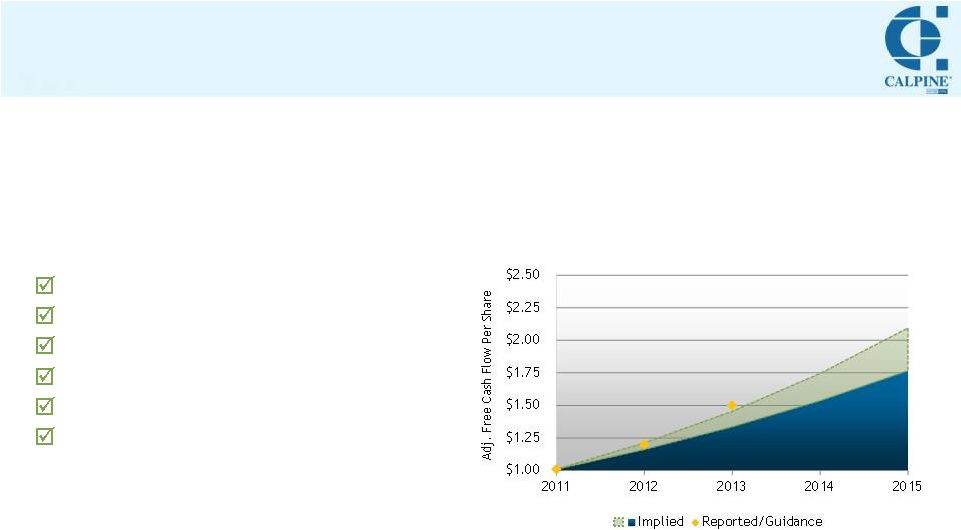

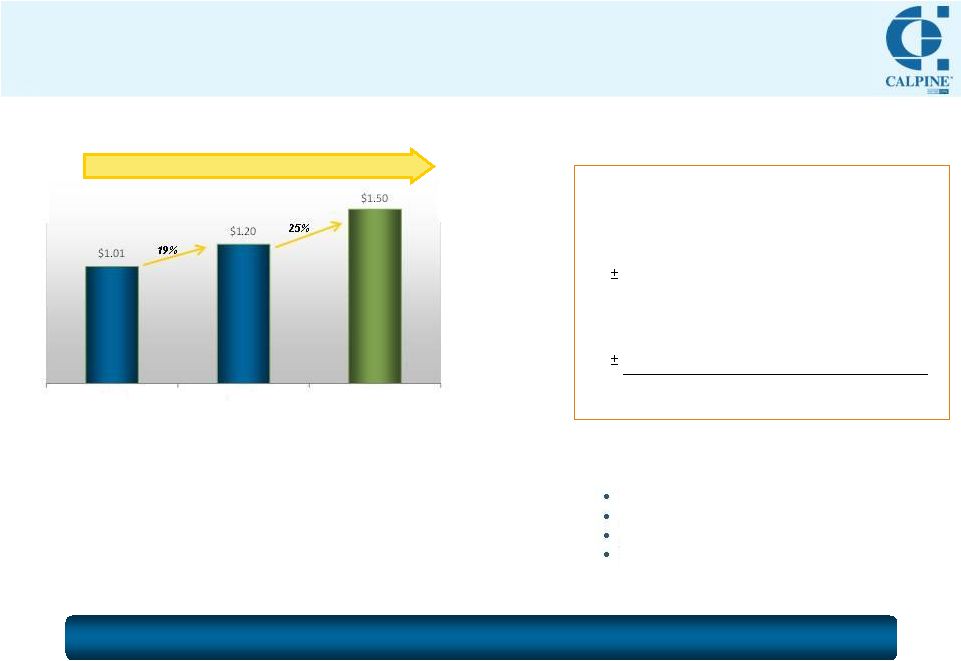

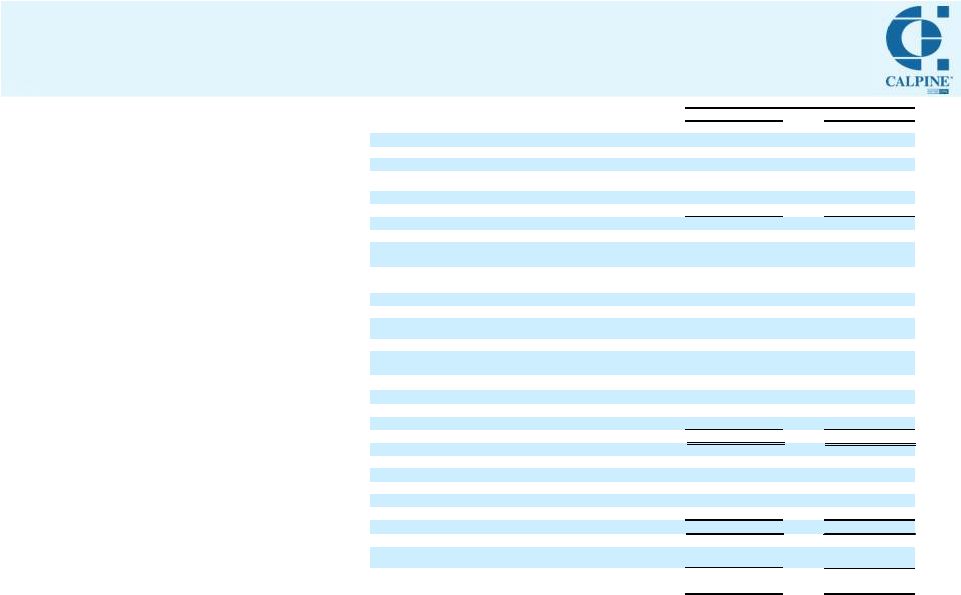

68 Adjusted EBITDA represents net income (loss) attributable to Calpine before net income (loss) attributable to the noncontrolling interest, interest, taxes, depreciation and amortization, adjusted for certain non-cash or non-recurring items as detailed in the following reconciliation. Adjusted EBITDA is presented because our management uses Adjusted EBITDA (i) as a measure of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends; (ii) as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations; and (iii) in communications with our Board of Directors, shareholders, creditors, analysts and investors concerning our financial performance. We believe Adjusted EBITDA is also used by and is useful to investors and other users of our financial statements in evaluating our operating performance because it provides them with an additional tool to compare business performance across companies and across periods. Adjusted EBITDA is not a measure calculated in accordance with U.S. GAAP, and should be viewed as a supplement to and not a substitute for our results of operations presented in accordance with U.S. GAAP. Adjusted EBITDA is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP as an indicator of operating performance. Furthermore, Adjusted EBITDA is not necessarily comparable to similarly-titled measures reported by other companies. Adjusted Free Cash Flow represents net income (loss) attributable to Calpine before net income (loss) attributable to the noncontrolling interest, interest, taxes, depreciation and amortization, as adjusted, less operating lease payments, major maintenance expense and maintenance capital expenditures, net cash interest, cash taxes, and other adjustments, including non-recurring items. Adjusted Free Cash Flow is a performance measure and is not intended to represent net income (loss), the most directly comparable U.S. GAAP measure, or liquidity and is not necessarily comparable to similarly titled measures reported by other companies. _________ (1)Depreciation and amortization expense in the income from operations calculation on our Consolidated Statements of Operations excludes amortization of other assets. (2)Included on our Consolidated Statements of Operations in (income) from unconsolidated investments in power plants. (3)Adjustments to reflect Adjusted EBITDA from unconsolidated investments include unrealized (gain) loss on mark-to-market activity of nil for each of the three months ended December 31, 2012 and 2011, respectively, and nil and $1 million for the years ended December 31, 2012 and 2011, respectively. (4)Includes $42 million and $192 million in major maintenance expense for the three months and year ended December 31, 2012, respectively, and $35 million and $183 million in maintenance capital expenditures for the three months and year ended December 31, 2012, respectively. Includes $27 million and $201 million in major maintenance expense for the three months and year end December 31, 2011, respectively, and $35 million and $196 million in maintenance capital expenditures for the three months and year ended December 31, 2011, respectively. (5)Includes commitment, letter of credit and other bank fees from both consolidated and unconsolidated investments, net of capitalized interest and interest income. Reg G Reconciliation: Adjusted EBITDA and Adjusted Free Cash Flow Net income (loss) attributable to Calpine $ 199 $ (190) Net income attributable to the noncontrolling interest Income tax expense (benefit) Debt extinguishment costs and other (income) expense, net (Gain) loss on interest rate derivatives Interest expense, net of interest income Income from operations $ 1,002 $ 800 Add: Adjustments to reconcile income from operations to Adjusted EBITDA: Depreciation and amortization expense, excluding deferred financing costs (1) Major maintenance expense Operating lease expense Unrealized (gain) loss on commodity derivative mark- to-market activity (Gain) on sale of assets, net Adjustments to reflect Adjusted EBITDA from unconsolidated investments (2)(3) Stock-based compensation expense (Gain) loss on dispositions of assets Acquired contract amortization Other Total Adjusted EBITDA $ 1,749 $ 1,726 Less: Operating lease payments Major maintenance expense and capital expenditures (4) Cash interest, net (5) Cash taxes Other Adjusted Free Cash Flow (6) $ 564 $ 489 Weighted average shares of common stock outstanding (diluted, in thousands) Adjusted Free Cash Flow Per Share (diluted) $ 2011 Year Ended December 31, 2012 $ 1.20 471,343 485,381 8 11 757 781 11 13 34 35 375 397 7 25 12 16 14 8 31 36 25 24 82 25 (222) — 200 205 34 35 564 552 725 751 45 115 14 145 — 1 19 (22) (6)Excludes a decrease in working capital of $91 million and $107 million for the three months and year ended December 31, 2012, respectively, and a decrease in working capital of $8 million and increase in working capital of $13 million for the three months and year ended December 31, 2011, respectively. Adjusted Free Cash Flow, as reported, excludes changes in working capital, such that it is calculated on the same basis as our guidance. 1.01 |