UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-08226

Templeton Global Investment Trust

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Alison Baur,

One Franklin Parkway,

San Mateo,

CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(954)527-7500

Date of fiscal year end: 12/31

Date of reporting period: 06/30/24

Item 1. Reports to Stockholders.

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not Applicable.

| | |

Templeton Global Balanced Fund | |

| Class A [TAGBX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Templeton Global Balanced Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $60 | 1.20% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $323,668,389 |

Total Number of Portfolio Holdings* | 132 |

Portfolio Turnover Rate | 31.30% |

| * | Does not include derivatives, except purchased options, if any. |

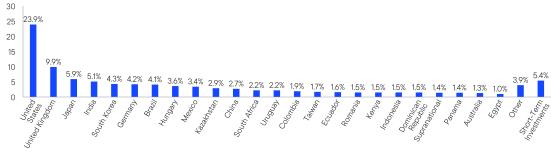

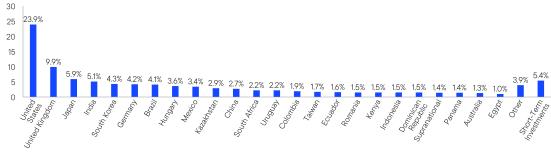

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Templeton Global Balanced Fund | PAGE 1 | 325-STSR-0824 |

23.99.95.95.14.34.24.13.63.42.92.72.22.21.91.71.61.51.51.51.51.41.41.31.03.95.4

| | |

Templeton Global Balanced Fund | |

| Class A1 [TINCX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Templeton Global Balanced Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A1 | $60 | 1.20% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $323,668,389 |

Total Number of Portfolio Holdings* | 132 |

Portfolio Turnover Rate | 31.30% |

| * | Does not include derivatives, except purchased options, if any. |

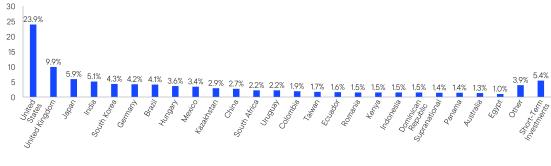

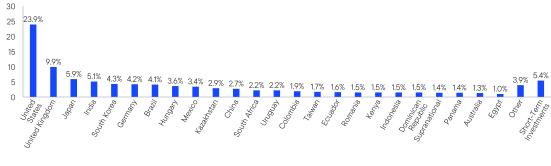

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Templeton Global Balanced Fund | PAGE 1 | 425-STSR-0824 |

23.99.95.95.14.34.24.13.63.42.92.72.22.21.91.71.61.51.51.51.51.41.41.31.03.95.4

| | |

Templeton Global Balanced Fund | |

| Class C [FCGBX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Templeton Global Balanced Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $97 | 1.95% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $323,668,389 |

Total Number of Portfolio Holdings* | 132 |

Portfolio Turnover Rate | 31.30% |

| * | Does not include derivatives, except purchased options, if any. |

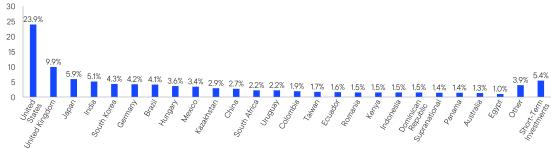

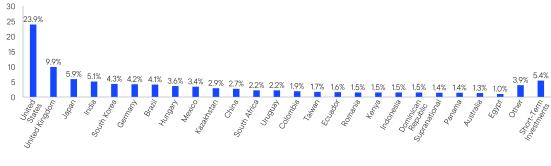

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Templeton Global Balanced Fund | PAGE 1 | 225-STSR-0824 |

23.99.95.95.14.34.24.13.63.42.92.72.22.21.91.71.61.51.51.51.51.41.41.31.03.95.4

| | |

Templeton Global Balanced Fund | |

| Class C1 [TCINX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Templeton Global Balanced Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C1 | $80 | 1.60% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $323,668,389 |

Total Number of Portfolio Holdings* | 132 |

Portfolio Turnover Rate | 31.30% |

| * | Does not include derivatives, except purchased options, if any. |

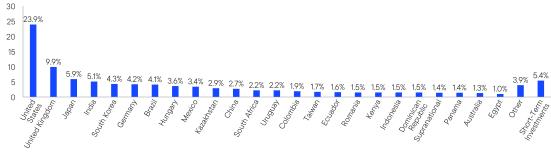

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Templeton Global Balanced Fund | PAGE 1 | 525-STSR-0824 |

23.99.95.95.14.34.24.13.63.42.92.72.22.21.91.71.61.51.51.51.51.41.41.31.03.95.4

| | |

Templeton Global Balanced Fund | |

Class R true |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Templeton Global Balanced Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R | $72 | 1.45% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $323,668,389 |

Total Number of Portfolio Holdings* | 132 |

Portfolio Turnover Rate | 31.30% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Templeton Global Balanced Fund | PAGE 1 | 825-STSR-0824 |

23.99.95.95.14.34.24.13.63.42.92.72.22.21.91.71.61.51.51.51.51.41.41.31.03.95.4

| | |

Templeton Global Balanced Fund | |

| Class R6 [FGGBX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Templeton Global Balanced Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $43 | 0.86% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $323,668,389 |

Total Number of Portfolio Holdings* | 132 |

Portfolio Turnover Rate | 31.30% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Templeton Global Balanced Fund | PAGE 1 | 359-STSR-0824 |

23.99.95.95.14.34.24.13.63.42.92.72.22.21.91.71.61.51.51.51.51.41.41.31.03.95.4

| | |

Templeton Global Balanced Fund | |

| Advisor Class [TZINX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Templeton Global Balanced Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $47 | 0.95% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $323,668,389 |

Total Number of Portfolio Holdings* | 132 |

Portfolio Turnover Rate | 31.30% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Templeton Global Balanced Fund | PAGE 1 | 625-STSR-0824 |

23.99.95.95.14.34.24.13.63.42.92.72.22.21.91.71.61.51.51.51.51.41.41.31.03.95.4

Item 2. Code of Ethics.

N/A

Item 3. Audit Committee Financial Expert.

N/A

Item 4. Principal Accountant Fees and Services.

N/A

Item 5. Audit Committee of Listed Registrants.

N/A

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSRS.

(b) N/A

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Templeton

Global

Balanced

Fund

Financial

Statements

and

Other

Important

Information

Semi-Annual

|

June

30,

2024

Financial

Statements

and

Other

Important

Information—Semiannual

Financial

Highlights

and

Schedule

of

Investments

2

Financial

Statements

17

Notes

to

Financial

Statements

21

Changes

In

and

Disagreements

with

Accountants

34

Results

of

Meeting(s)

of

Shareholders

34

Remuneration

Paid

to

Directors,

Officers

and

Others

34

Board

Approval

of

Management

and

Subadvisory

Agreements

34

Templeton

Global

Investment

Trust

Financial

Highlights

Templeton

Global

Balanced

Fund

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

*

2020

a

2019

a

Class

A

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$2.48

$2.26

$2.72

$2.82

$2.84

$2.77

Income

from

investment

operations

b

:

Net

investment

income

c

.............

0.06

0.08

0.07

0.05

0.07

0.11

Net

realized

and

unrealized

gains

(losses)

(0.05)

0.23

(0.46)

(0.09)

(0.04)

0.08

Total

from

investment

operations

........

0.01

0.31

(0.39)

(0.04)

0.03

0.19

Less

distributions

from:

Net

investment

income

..............

(0.06)

—

—

—

(0.05)

(0.12)

Tax

return

of

capital

................

—

(0.09)

(0.07)

(0.06)

—

—

Total

distributions

...................

(0.06)

(0.09)

(0.07)

(0.06)

(0.05)

(0.12)

Net

asset

value,

end

of

period

..........

$2.43

$2.48

$2.26

$2.72

$2.82

$2.84

Total

return

d

.......................

0.46%

13.80%

(14.28)%

(1.54)%

1.49%

6.96%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.24%

1.32%

1.32%

1.30%

1.30%

1.22%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

1.20%

1.23%

1.20%

1.20%

1.26%

1.19%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.20%

1.20%

1.20%

f

1.20%

f

1.26%

f

1.19%

f

Net

investment

income

...............

4.91%

3.53%

2.80%

1.89%

2.85%

3.81%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$186,747

$206,734

$210,786

$302,724

$354,879

$465,915

Portfolio

turnover

rate

................

31.30%

61.11%

56.93%

52.63%

74.03%

26.62%

*Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV

from

January

1,

2021

through

April

27,

2021.

a

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Templeton

Global

Investment

Trust

Financial

Highlights

Templeton

Global

Balanced

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

*

2020

a

2019

a

Class

A1

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$2.49

$2.27

$2.73

$2.83

$2.84

$2.77

Income

from

investment

operations

b

:

Net

investment

income

c

.............

0.06

0.08

0.07

0.05

0.07

0.11

Net

realized

and

unrealized

gains

(losses)

(0.06)

0.23

(0.46)

(0.09)

(0.03)

0.08

Total

from

investment

operations

........

—

0.31

(0.39)

(0.04)

0.04

0.19

Less

distributions

from:

Net

investment

income

..............

(0.06)

—

—

—

(0.05)

(0.12)

Tax

return

of

capital

................

—

(0.09)

(0.07)

(0.06)

—

—

Total

distributions

...................

(0.06)

(0.09)

(0.07)

(0.06)

(0.05)

(0.12)

Net

asset

value,

end

of

period

..........

$2.43

$2.49

$2.27

$2.73

$2.83

$2.84

Total

return

d

.......................

0.05%

13.75%

(14.21)%

(1.53)%

1.49%

7.33%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.24%

1.32%

1.32%

1.30%

1.30%

1.22%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

1.20%

1.23%

1.20%

1.20%

1.26%

1.19%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.20%

1.20%

1.20%

f

1.20%

f

1.26%

f

1.19%

f

Net

investment

income

...............

4.67%

3.53%

2.80%

1.89%

2.86%

3.81%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$93,612

$104,309

$108,558

$165,287

$198,816

$252,990

Portfolio

turnover

rate

................

31.30%

61.11%

56.93%

52.63%

74.03%

26.62%

*Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV

from

January

1,

2021

through

April

27,

2021.

a

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Templeton

Global

Investment

Trust

Financial

Highlights

Templeton

Global

Balanced

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

*

2020

a

2019

a

Class

C

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$2.48

$2.26

$2.71

$2.81

$2.82

$2.75

Income

from

investment

operations

b

:

Net

investment

income

c

.............

0.05

0.06

0.05

0.03

0.05

0.09

Net

realized

and

unrealized

gains

(losses)

(0.06)

0.23

(0.45)

(0.10)

(0.03)

0.08

Total

from

investment

operations

........

(0.01)

0.29

(0.40)

(0.07)

0.02

0.17

Less

distributions

from:

Net

investment

income

..............

(0.05)

—

—

—

(0.03)

(0.10)

Tax

return

of

capital

................

—

(0.07)

(0.05)

(0.03)

—

—

Total

distributions

...................

(0.05)

(0.07)

(0.05)

(0.03)

(0.03)

(0.10)

Net

asset

value,

end

of

period

..........

$2.42

$2.48

$2.26

$2.71

$2.81

$2.82

Total

return

d

.......................

(0.35)%

12.90%

(14.68)%

(2.37)%

0.68%

6.55%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.99%

2.07%

2.08%

2.04%

2.04%

1.97%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

1.95%

1.98%

1.95%

1.95%

2.00%

1.94%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.95%

1.95%

1.95%

f

1.95%

f

2.00%

f

1.94%

f

Net

investment

income

...............

4.07%

2.74%

2.02%

1.12%

2.02%

3.06%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$11,130

$13,259

$18,904

$39,982

$83,658

$139,231

Portfolio

turnover

rate

................

31.30%

61.11%

56.93%

52.63%

74.03%

26.62%

*Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV

from

January

1,

2021

through

April

27,

2021.

a

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Templeton

Global

Investment

Trust

Financial

Highlights

Templeton

Global

Balanced

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

*

2020

a

2019

a

Class

C1

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$2.50

$2.27

$2.73

$2.83

$2.84

$2.77

Income

from

investment

operations

b

:

Net

investment

income

c

.............

0.05

0.07

0.06

0.04

0.06

0.10

Net

realized

and

unrealized

gains

(losses)

(0.05)

0.24

(0.46)

(0.10)

(0.03)

0.08

Total

from

investment

operations

........

—

0.31

(0.40)

(0.06)

0.03

0.18

Less

distributions

from:

Net

investment

income

..............

(0.06)

—

—

—

(0.04)

(0.11)

Tax

return

of

capital

................

—

(0.08)

(0.06)

(0.04)

—

—

Total

distributions

...................

(0.06)

(0.08)

(0.06)

(0.04)

(0.04)

(0.11)

Net

asset

value,

end

of

period

..........

$2.44

$2.50

$2.27

$2.73

$2.83

$2.84

Total

return

d

.......................

(0.16)%

13.71%

(14.61)%

(2.06)%

1.01%

6.82%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.64%

1.72%

1.72%

1.68%

1.70%

1.62%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

1.60%

1.63%

1.60%

1.60%

1.66%

1.59%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.60%

1.60%

1.60%

f

1.60%

f

1.66%

f

1.59%

f

Net

investment

income

...............

4.39%

3.07%

2.39%

1.46%

2.32%

3.41%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$1,116

$1,340

$1,876

$3,535

$13,050

$27,765

Portfolio

turnover

rate

................

31.30%

61.11%

56.93%

52.63%

74.03%

26.62%

*Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV

from

January

1,

2021

through

April

27,

2021.

a

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Templeton

Global

Investment

Trust

Financial

Highlights

Templeton

Global

Balanced

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

*

2020

a

2019

a

Class

R

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$2.50

$2.27

$2.74

$2.84

$2.85

$2.78

Income

from

investment

operations

b

:

Net

investment

income

c

.............

0.06

0.08

0.06

0.05

0.07

0.10

Net

realized

and

unrealized

gains

(losses)

(0.06)

0.23

(0.46)

(0.10)

(0.03)

0.08

Total

from

investment

operations

........

—

0.31

(0.40)

(0.05)

0.04

0.18

Less

distributions

from:

Net

investment

income

..............

(0.06)

—

—

—

(0.05)

(0.11)

Tax

return

of

capital

................

—

(0.08)

(0.07)

(0.05)

—

—

Total

distributions

...................

(0.06)

(0.08)

(0.07)

(0.05)

(0.05)

(0.11)

Net

asset

value,

end

of

period

..........

$2.44

$2.50

$2.27

$2.74

$2.84

$2.85

Total

return

d

.......................

(0.07)%

13.92%

(14.77)%

(1.77)%

1.68%

6.66%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.49%

1.57%

1.58%

1.53%

1.43%

1.47%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

1.45%

1.48%

1.45%

1.44%

1.40%

1.44%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

........

1.45%

1.45%

1.45%

f

1.44%

f

1.40%

f

1.44%

f

Net

investment

income

...............

4.61%

3.30%

2.58%

1.66%

2.63%

3.56%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$638

$647

$596

$1,206

$1,591

$2,348

Portfolio

turnover

rate

................

31.30%

61.11%

56.93%

52.63%

74.03%

26.62%

*Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV

from

January

1,

2021

through

April

27,

2021.

a

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Templeton

Global

Investment

Trust

Financial

Highlights

Templeton

Global

Balanced

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

*

2020

a

2019

a

Class

R6

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$2.49

$2.27

$2.73

$2.83

$2.85

$2.78

Income

from

investment

operations

b

:

Net

investment

income

c

.............

0.06

0.09

0.07

0.06

0.08

0.12

Net

realized

and

unrealized

gains

(losses)

(0.05)

0.22

(0.45)

(0.09)

(0.04)

0.08

Total

from

investment

operations

........

0.01

0.31

(0.38)

(0.03)

0.04

0.20

Less

distributions

from:

Net

investment

income

..............

(0.07)

—

—

—

(0.06)

(0.13)

Tax

return

of

capital

................

—

(0.09)

(0.08)

(0.07)

—

—

Total

distributions

...................

(0.07)

(0.09)

(0.08)

(0.07)

(0.06)

(0.13)

Net

asset

value,

end

of

period

..........

$2.43

$2.49

$2.27

$2.73

$2.83

$2.85

Total

return

d

.......................

0.23%

14.12%

(13.90)%

(1.19)%

1.87%

7.32%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

........

0.92%

1.00%

0.98%

1.01%

0.99%

0.92%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

0.86%

0.92%

0.90%

0.86%

0.90%

0.84%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

........

0.86%

0.89%

0.90%

f

0.86%

f

0.90%

f

0.84%

f

Net

investment

income

...............

5.26%

3.86%

3.10%

2.23%

3.18%

4.16%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$3,236

$3,541

$2,388

$3,227

$4,624

$6,080

Portfolio

turnover

rate

................

31.30%

61.11%

56.93%

52.63%

74.03%

26.62%

*

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV

from

January

1,

2021

through

April

27,

2021.

a

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Templeton

Global

Investment

Trust

Financial

Highlights

Templeton

Global

Balanced

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

*

2020

a

2019

a

Advisor

Class

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$2.50

$2.27

$2.74

$2.84

$2.85

$2.78

Income

from

investment

operations

b

:

Net

investment

income

c

.............

0.06

0.09

0.07

0.06

0.08

0.12

Net

realized

and

unrealized

gains

(losses)

(0.06)

0.23

(0.46)

(0.09)

(0.03)

0.08

Total

from

investment

operations

........

—

0.32

(0.39)

(0.03)

0.05

0.20

Less

distributions

from:

Net

investment

income

..............

(0.06)

—

—

—

(0.06)

(0.13)

Tax

return

of

capital

................

—

(0.09)

(0.08)

(0.07)

—

—

Total

distributions

...................

(0.06)

(0.09)

(0.08)

(0.07)

(0.06)

(0.13)

Net

asset

value,

end

of

period

..........

$2.44

$2.50

$2.27

$2.74

$2.84

$2.85

Total

return

d

.......................

0.17%

14.48%

(14.32)%

(1.28)%

1.75%

7.57%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

........

0.99%

1.07%

1.07%

1.05%

1.04%

0.97%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

0.95%

0.98%

0.95%

0.95%

1.00%

0.94%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

........

0.95%

0.95%

0.95%

f

0.95%

f

1.00%

f

0.94%

f

Net

investment

income

...............

5.08%

3.77%

3.04%

2.14%

3.00%

4.06%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$27,188

$29,498

$32,777

$57,537

$77,426

$141,277

Portfolio

turnover

rate

................

31.30%

61.11%

56.93%

52.63%

74.03%

26.62%

*

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV

from

January

1,

2021

through

April

27,

2021.

a

Includes

the

consolidated

operations

of

FT

Holdings

Corporation

IV.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Templeton

Global

Investment

Trust

Schedule

of

Investments

(unaudited),

June

30,

2024

Templeton

Global

Balanced

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

.

a

a

Industry

Shares

a

Value

a

Common

Stocks

52.1%

China

2.6%

a

Alibaba

Group

Holding

Ltd.

.........

Broadline

Retail

278,500

$

2,510,076

Lenovo

Group

Ltd.

...............

Technology

Hardware,

Storage

&

Peripherals

2,106,000

2,955,555

Prosus

NV

.....................

Broadline

Retail

84,605

3,008,847

8,474,478

Germany

4.1%

Deutsche

Post

AG

................

Air

Freight

&

Logistics

77,050

3,129,201

Deutsche

Telekom

AG

.............

Diversified

Telecommunication

Services

179,505

4,512,580

Infineon

Technologies

AG

..........

Semiconductors

&

Semiconductor

Equipment

56,040

2,056,973

Siemens

AG

....................

Industrial

Conglomerates

18,872

3,513,051

13,211,805

Hungary

0.9%

Richter

Gedeon

Nyrt.

.............

Pharmaceuticals

108,183

2,810,215

Japan

5.7%

Mitsubishi

Electric

Corp.

...........

Electrical

Equipment

261,700

4,194,426

SoftBank

Corp.

..................

Wireless

Telecommunication

Services

521,900

6,383,838

Sumitomo

Mitsui

Financial

Group,

Inc.

.

Banks

119,600

8,029,390

18,607,654

Netherlands

0.8%

SBM

Offshore

NV

................

Energy

Equipment

&

Services

163,943

2,509,440

South

Africa

0.0%

b,c,d

K2016470219

South

Africa

Ltd.

,

A

....

Broadline

Retail

32,900,733

—

b,c,d

K2016470219

South

Africa

Ltd.

,

B

....

Broadline

Retail

4,646,498

—

—

South

Korea

4.2%

KB

Financial

Group,

Inc.

...........

Banks

40,024

2,270,887

Samsung

Electronics

Co.

Ltd.

.......

Technology

Hardware,

Storage

&

Peripherals

125,905

7,391,491

Shinhan

Financial

Group

Co.

Ltd.

....

Banks

114,693

3,988,442

13,650,820

Switzerland

0.6%

Adecco

Group

AG

................

Professional

Services

54,593

1,811,216

Taiwan

1.7%

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

......................

Semiconductors

&

Semiconductor

Equipment

181,300

5,360,665

United

Kingdom

9.6%

AstraZeneca

plc

.................

Pharmaceuticals

53,845

8,380,394

Barratt

Developments

plc

..........

Household

Durables

705,586

4,190,732

e

HSBC

Holdings

plc

,

ADR

..........

Banks

111,200

4,837,200

Imperial

Brands

plc

...............

Tobacco

197,565

5,055,657

Lloyds

Banking

Group

plc

..........

Banks

6,757,552

4,660,974

Unilever

plc

.....................

Personal

Care

Products

72,427

3,975,484

31,100,441

United

States

21.9%

Alphabet,

Inc.

,

A

.................

Interactive

Media

&

Services

48,375

8,811,506

Bank

of

America

Corp.

............

Banks

171,380

6,815,783

BP

plc

.........................

Oil,

Gas

&

Consumable

Fuels

731,538

4,404,601

CNH

Industrial

NV

................

Machinery

358,934

3,636,002

Delta

Air

Lines,

Inc.

...............

Passenger

Airlines

149,451

7,089,956

DuPont

de

Nemours,

Inc.

..........

Chemicals

55,237

4,446,026

Templeton

Global

Investment

Trust

Schedule

of

Investments

(unaudited)

Templeton

Global

Balanced

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Industry

Shares

a

Value

a

Common

Stocks

(continued)

United

States

(continued)

Fidelity

National

Information

Services,

Inc.

.........................

Financial

Services

98,808

$

7,446,171

Medtronic

plc

...................

Health

Care

Equipment

&

Supplies

39,900

3,140,529

PNC

Financial

Services

Group,

Inc.

(The)

........................

Banks

27,965

4,347,998

Shell

plc

.......................

Oil,

Gas

&

Consumable

Fuels

141,560

5,102,018

Stanley

Black

&

Decker,

Inc.

........

Machinery

31,422

2,510,304

Target

Corp.

....................

Consumer

Staples

Distribution

&

Retail

30,159

4,464,738

UnitedHealth

Group,

Inc.

...........

Health

Care

Providers

&

Services

8,936

4,550,747

Wells

Fargo

&

Co.

................

Banks

70,544

4,189,608

70,955,987

Total

Common

Stocks

(Cost

$

140,067,356

)

.....................................

168,492,721

Principal

Amount

*

a

a

a

a

a

Corporate

Bonds

0.0%

South

Africa

0.0%

b

,f

,g

,h

K2016470219

South

Africa

Ltd.

,

Senior

Secured

Note

,

144A,

PIK,

3

%

,

12/31/22

.....................

Broadline

Retail

2,851,217

—

Senior

Secured

Note

,

144A,

PIK,

8

%

,

12/31/22

.....................

Broadline

Retail

2,929,327

EUR

—

b

,f

,g

,h

K2016470260

South

Africa

Ltd.

,

Senior

Secured

Note

,

144A,

PIK,

25

%

,

12/31/22

.....................

Broadline

Retail

1,782,466

—

—

Total

Corporate

Bonds

(Cost

$

4,389,520

)

.......................................

—

a

a

Industry

Principal

Amount

*

a

Value

Foreign

Government

and

Agency

Securities

38.7%

Australia

1.3%

New

South

Wales

Treasury

Corp.

,

Senior

Bond

,

2

%

,

3/08/33

........

3,030,000

AUD

1,610,627

Treasury

Corp.

of

Victoria

,

h

Senior

Bond

,

Reg

S,

2.25

%

,

9/15/33

2,270,000

AUD

1,205,415

Senior

Bond

,

2.25

%

,

11/20/34

.....

2,680,000

AUD

1,372,770

4,188,812

Brazil

4.0%

Brazil

Notas

do

Tesouro

Nacional

,

10

%

,

1/01/27

..................

35,450,000

BRL

6,111,316

10

%

,

1/01/31

..................

14,887,000

BRL

2,410,065

10

%

,

1/01/33

..................

4,483,000

BRL

713,068

F

,

10

%

,

1/01/29

................

21,143,000

BRL

3,527,184

12,761,633

Colombia

1.9%

Colombia

Government

Bond

,

Senior

Bond

,

9.85

%

,

6/28/27

............

83,000,000

COP

19,275

Colombia

Titulos

de

Tesoreria

,

B

,

13.25

%

,

2/09/33

.............

3,803,300,000

COP

1,042,777

B

,

7.25

%

,

10/18/34

.............

6,802,000,000

COP

1,289,057

B

,

6.25

%

,

7/09/36

..............

2,213,000,000

COP

368,183

Templeton

Global

Investment

Trust

Schedule

of

Investments

(unaudited)

Templeton

Global

Balanced

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Colombia

(continued)

Colombia

Titulos

de

Tesoreria,

(continued)

B

,

9.25

%

,

5/28/42

..............

16,928,000,000

COP

$

3,403,100

6,122,392

Dominican

Republic

1.5%

h

Dominican

Republic

Government

Bond

,

Senior

Bond

,

144A,

5.3

%

,

1/21/41

..

2,030,000

1,727,389

Senior

Bond

,

144A,

6.4

%

,

6/05/49

..

760,000

714,065

Senior

Bond

,

144A,

5.875

%

,

1/30/60

2,634,000

2,241,356

4,682,810

Ecuador

1.5%

h

Ecuador

Government

Bond

,

Senior

Bond

,

144A,

3.5

%

,

7/31/35

..

6,275,000

3,138,456

Senior

Note

,

144A,

6

%

,

7/31/30

....

2,846,000

1,809,766

4,948,222

Egypt

1.0%

Egypt

Government

Bond

,

25.151

%

,

4/16/27

...............

101,600,000

EGP

2,102,219

h

Senior

Bond

,

144A,

8.75

%

,

9/30/51

.

1,030,000

778,133

h

Senior

Bond

,

144A,

7.5

%

,

2/16/61

..

510,000

343,046

3,223,398

El

Salvador

0.0%

†

h

El

Salvador

Government

Bond

,

Senior

Bond

,

144A,

7.65

%

,

6/15/35

.......

100,000

72,781

Gabon

0.9%

h

Gabon

Government

Bond

,

Senior

Bond

,

144A,

6.95

%

,

6/16/25

.

2,210,000

2,030,976

Senior

Bond

,

144A,

6.625

%

,

2/06/31

680,000

513,489

Senior

Bond

,

144A,

7

%

,

11/24/31

...

500,000

377,481

2,921,946

Ghana

0.5%

f

Ghana

Government

Bond

,

PIK,

8.35

%

,

2/16/27

.............

5,607,304

GHS

232,118

PIK,

8.5

%

,

2/15/28

..............

5,615,579

GHS

201,448

PIK,

8.65

%

,

2/13/29

.............

5,582,696

GHS

177,462

PIK,

5

%

,

2/12/30

...............

5,590,923

GHS

163,073

PIK,

8.95

%

,

2/11/31

.............

5,041,252

GHS

135,710

PIK,

9.1

%

,

2/10/32

..............

5,048,670

GHS

128,172

PIK,

9.25

%

,

2/08/33

.............

5,056,094

GHS

122,673

PIK,

9.4

%

,

2/07/34

..............

4,482,962

GHS

105,288

PIK,

9.55

%

,

2/06/35

.............

4,489,544

GHS

103,133

PIK,

9.7

%

,

2/05/36

..............

4,496,131

GHS

101,856

PIK,

9.85

%

,

2/03/37

.............

4,502,722

GHS

101,241

PIK,

10

%

,

2/02/38

..............

4,509,319

GHS

101,132

1,673,306

Hungary

2.7%

Hungary

Government

Bond

,

1

%

,

11/26/25

..................

1,242,000,000

HUF

3,125,340

Templeton

Global

Investment

Trust

Schedule

of

Investments

(unaudited)

Templeton

Global

Balanced

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Hungary

(continued)

Hungary

Government

Bond,

(continued)

3

%

,

10/27/27

..................

106,800,000

HUF

$

258,939

4.75

%

,

11/24/32

................

2,203,700,000

HUF

5,215,653

8,599,932

India

5.0%

India

Government

Bond

,

Senior

Bond

,

7.26

%

,

8/22/32

......

664,300,000

INR

8,071,160

Senior

Bond

,

7.18

%

,

8/14/33

......

221,200,000

INR

2,677,613

Senior

Note

,

7.1

%

,

4/18/29

.......

448,200,000

INR

5,393,687

16,142,460

Indonesia

1.5%

Indonesia

Government

Bond

,

FR82

,

7

%

,

9/15/30

..............

4,273,000,000

IDR

261,098

FR87

,

6.5

%

,

2/15/31

............

4,108,000,000

IDR

243,142

FR91

,

6.375

%

,

4/15/32

..........

11,532,000,000

IDR

678,367

FR95

,

6.375

%

,

8/15/28

..........

28,742,000,000

IDR

1,728,394

FR96

,

7

%

,

2/15/33

..............

29,362,000,000

IDR

1,785,568

4,696,569

Kazakhstan

2.8%

Kazakhstan

MEOKAM

,

10.67

%

,

1/21/26

................

159,600,000

KZT

325,001

15.35

%

,

11/18/27

...............

27,100,000

KZT

60,824

Kazakhstan

MEUKAM

,

9

%

,

7/03/27

...................

365,400,000

KZT

703,322

10.4

%

,

4/12/28

................

225,400,000

KZT

444,208

15.3

%

,

3/03/29

................

833,280,000

KZT

1,909,938

10.55

%

,

7/28/29

................

54,200,000

KZT

105,310

11

%

,

2/04/30

..................

127,900,000

KZT

252,543

10.3

%

,

3/17/31

................

1,747,020,000

KZT

3,298,824

14

%

,

5/12/31

..................

215,190,000

KZT

481,566

Senior

Bond

,

5.5

%

,

9/20/28

.......

388,700,000

KZT

638,086

Senior

Bond

,

7.68

%

,

8/13/29

......

564,500,000

KZT

980,009

9,199,631

Kenya

1.5%

h

Kenya

Government

Bond

,

Senior

Note

,

144A,

9.75

%

,

2/16/31

............

4,990,000

4,793,269

Mexico

3.3%

Mexican

Bonos

,

M

,

10

%

,

11/20/36

...............

4,570,000

MXN

251,697

M

,

Senior

Bond

,

7.75

%

,

11/23/34

...

14,160,000

MXN

666,713

Mexican

Bonos

Desarr

Fixed

Rate

,

M

,

7.5

%

,

5/26/33

...............

86,420,000

MXN

4,069,116

M

,

Senior

Bond

,

8.5

%

,

5/31/29

.....

13,800,000

MXN

710,566

M

,

Senior

Bond

,

8.5

%

,

11/18/38

....

8,380,000

MXN

406,321

M

,

Senior

Bond

,

7.75

%

,

11/13/42

...

18,030,000

MXN

794,779

Petroleos

Mexicanos

,

Senior

Note

,

6.84

%

,

1/23/30

................

4,240,000

3,735,211

10,634,403

Templeton

Global

Investment

Trust

Schedule

of

Investments

(unaudited)

Templeton

Global

Balanced

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Mongolia

0.7%

h

Mongolia

Government

Bond

,

Senior

Bond

,

144A,

4.45

%

,

7/07/31

.

1,450,000

$

1,224,525

Senior

Note

,

144A,

5.125

%

,

4/07/26

.

200,000

194,200

Senior

Note

,

144A,

3.5

%

,

7/07/27

..

1,000,000

901,500

2,320,225

Panama

1.3%

Panama

Government

Bond

,

Senior

Bond

,

6.4

%

,

2/14/35

.......

590,000

560,430

Senior

Bond

,

6.7

%

,

1/26/36

.......

2,650,000

2,578,128

Senior

Bond

,

6.875

%

,

1/31/36

.....

1,150,000

1,125,841

4,264,399

Romania

1.5%

h

Romania

Government

Bond

,

144A,

2.875

%

,

4/13/42

................

6,920,000

EUR

4,833,484

South

Africa

2.1%

South

Africa

Government

Bond

,

Senior

Bond

,

8.875

%

,

2/28/35

.....

88,070,000

ZAR

4,098,502

Senior

Bond

,

8.5

%

,

1/31/37

.......

25,320,000

ZAR

1,095,376

Senior

Bond

,

9

%

,

1/31/40

........

40,170,000

ZAR

1,741,228

6,935,106

Sri

Lanka

0.3%

g

,h

Sri

Lanka

Government

Bond

,

Senior

Bond

,

144A,

6.2

%

,

5/11/27

..

1,400,000

825,222

Senior

Bond

,

144A,

6.75

%

,

4/18/28

.

200,000

118,090

Senior

Bond

,

144A,

7.85

%

,

3/14/29

.

200,000

119,100

1,062,412

Supranational

1.3%

i

Asian

Development

Bank

,

Senior

Note

,

11.2

%

,

1/31/25

.................

17,931,000,000

COP

4,309,386

Uruguay

2.1%

j

Uruguay

Government

Bond

,

Index

Linked,

Senior

Bond

,

3.7

%

,

6/26/37

......................

49,088,471

UYU

1,294,422

Index

Linked,

Senior

Bond

,

3.875

%

,

7/02/40

......................

204,566,172

UYU

5,519,012

6,813,434

Total

Foreign

Government

and

Agency

Securities

(Cost

$

131,321,458

)

............

125,200,010

U.S.

Government

and

Agency

Securities

1.2%

United

States

1.2%

U.S.

Treasury

Bonds

,

3.375

%,

8/15/42

................

3,020,000

2,551,664

3.75

%,

11/15/43

................

1,550,000

1,370,418

3,922,082

Total

U.S.

Government

and

Agency

Securities

(Cost

$

4,208,693

)

..................

3,922,082

Templeton

Global

Investment

Trust

Schedule

of

Investments

(unaudited)

Templeton

Global

Balanced

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Industry

Shares

a

Value

a

a

a

a

a

a

Escrows

and

Litigation

Trusts

0.0%

b,c

K2016470219

South

Africa

Ltd.,

Escrow

Account

......................

168,113

$

—

Total

Escrows

and

Litigation

Trusts

(Cost

$

–

)

...................................

—

Total

Long

Term

Investments

(Cost

$

279,987,027

)

...............................

297,614,813

Short

Term

Investments

5.3%

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

4.1%

Egypt

4.1%

k

Egypt

Treasury

Bills

,

3/04/25

......................

316,200,000

EGP

5,625,044

3/18/25

......................

432,175,000

EGP

7,623,619

13,248,663

Total

Foreign

Government

and

Agency

Securities

(Cost

$

13,080,585

)

..............

13,248,663

Shares

Money

Market

Funds

1.0%

United

States

1.0%

l,m

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio

,

4.972

%

.........

3,284,416

3,284,416

Total

Money

Market

Funds

(Cost

$

3,284,416

)

...................................

3,284,416

n

Investments

from

Cash

Collateral

Received

for

Loaned

Securities

0.2%

Money

Market

Funds

0.2%

l,m

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio

,

4.972

%

.........

536,000

536,000

Total

Investments

from

Cash

Collateral

Received

for

Loaned

Securities

(Cost

$

536,000

)

...................................................................

536,000

a

a

a

a

a

Total

Short

Term

Investments

(Cost

$

16,901,001

)

................................

17,069,079

a

a

a

Total

Investments

(Cost

$

296,888,028

)

97.3

%

...................................

$314,683,892

Other

Assets,

less

Liabilities

2.7

%

.............................................

8,984,497

Net

Assets

100.0%

...........................................................

$323,668,389

a

a

a

Templeton

Global

Investment

Trust

Schedule

of

Investments

(unaudited)

Templeton

Global

Balanced

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

*

The

principal

amount

is

stated

in

U.S.

dollars

unless

otherwise

indicated.

†

Rounds

to

less

than

0.1%

of

net

assets.

a

Variable

interest

entity

(VIE).

See

the

Fund’s

notes

to

financial

statements