UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

The Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Art Ally

The Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-846-7526

Date of fiscal year end: 9/30

Date of reporting period: 9/30/10

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

Letter from the President

September 30, 2010

Arthur D. Ally

Dear Shareholder,

You may recall that last year (2009), in order to improve reporting efficiency and accuracy in tax reporting to our shareholders, Timothy Plan’s Board of Trustees approved changing the Fund Family’s fiscal year from December 31st to September 30th. Therefore, this year’s Annual Report covers the period October 1, 2009 through September 30, 2010.

As you probably have noticed, the markets have been interestingly unsettled over the past twelve months. In fact, the S&P 500 stock index had positive performance in seven of those months and negative performance in five of those months – but, fortunately, with an upward bias. And, I am pleased to report, nearly all of our various funds have performed in line with (at or near) their respective indexes.

We, along with our various fund’s sub-advisors, expect this pattern to continue into 2011 (i.e. unsettled with a slight upward bias) although, as you no doubt realize, we cannot guarantee that outcome. I am confident, however, of a couple of things:

| · | That the mid-term elections could result in a reversal of the liberal bias in Congress to conservative which, if it happens, should be positive for the capital markets, and |

| · | Our sub-advisory teams (i.e. money management firms) remain among the best in the industry and they all continue to honor our overall policy that they manage their respective funds with a conservative bias. |

You will find each of their annual review letters along with their economic outlook in the pages that follow.

Finally, I would once again like to thank you for your moral convictions that led you to the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally,

President

Timothy Plan Fund Performance

Letter from the ManagerSeptember 30, 2010

Aggressive Growth Fund

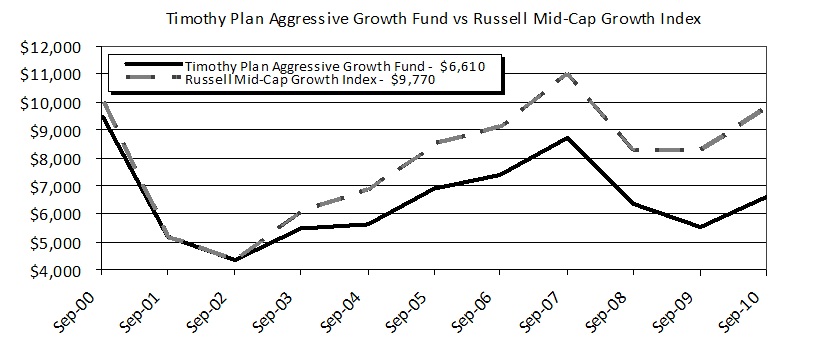

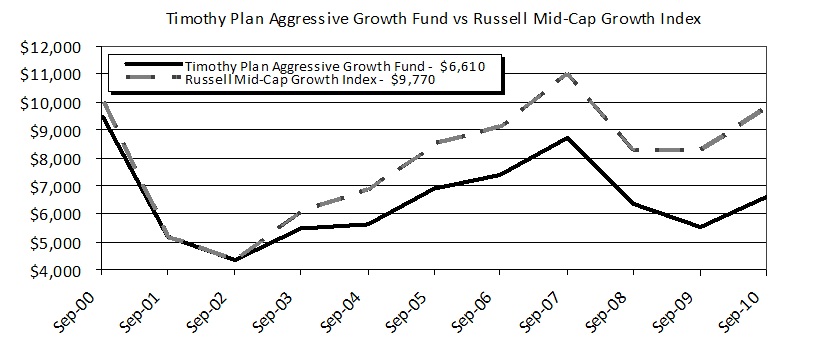

We are pleased to report that the Fund has advanced (pre-tax) 20.18% Class A, 18.94% Class B and 19.14% Class C, over the last twelve months ending September 30, 2010. Our benchmark, the Russell Midcap Index posted an 18.27% gain over the same period. “High quality” issues are beginning to regain a leadership position in this market, and the “low quality” bounce has definitely lost steam after the unprecedented gains in the spring of 2009. As valuations climbed for weaker companies, investors continued to shift towards higher quality in a more meaningful way as these are the companies that have far better prospects for sustained growth. We will continue to focus, as always, on companies that can execute well in periods of turbulence and uncertainty, and grow faster than their peers during periods of expansion. In a gradual and unsteady recovery, we expect investors to continue to favor companies with strong fundamentals and above average growth potential; two key characteristics we apply with our time-tested, bottom-up approach to small and mid cap investing.

CHARTWELL INVESTMENT PARTNERS, LP

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

Aggressive Growth Fund

| | | | | | 5 year | | | Average | | |

| | | 1 Year | | | Average | | | Annual Return | | |

| Fund/Index | | Total Return | | | Annual Return | | | Since Inception | | |

| Timothy Aggressive Growth Fund - Class A (With Sales Charge) | | | 13.63 | % | | | -2.03 | % | | | -4.06 | % | (a) |

| Russell Mid-Cap Growth Index | | | 18.27 | % | | | 2.86 | % | | | -0.23 | % | (a) |

| Timothy Aggressive Growth Fund - Class B | | | 18.94 | % | | | -1.66 | % | | | -4.24 | % | (b) |

| Russell Mid-Cap Growth Index | | | 18.27 | % | | | 2.86 | % | | | -0.04 | % | (b) |

| Timothy Aggressive Growth Fund - Class C* | | | 17.95 | % | | | -1.65 | % | | | 0.65 | % | (c) |

| Russell Mid-Cap Growth Index | | | 18.27 | % | | | 2.86 | % | | | 5.14 | % | (c) |

| (a) For the period October 5, 2000 (commencement of investment in accordance with objective) to September 30, 2010. |

| (b) For the Period October 9, 2000 (commencement of share class operations) to September 30, 2010. |

| (c) For the Period February 3, 2004 (commencement of share class operations) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Russell Mid-Cap Growth Index on October 5, 2000 and held through September 30, 2010. The Russell Mid-Cap Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

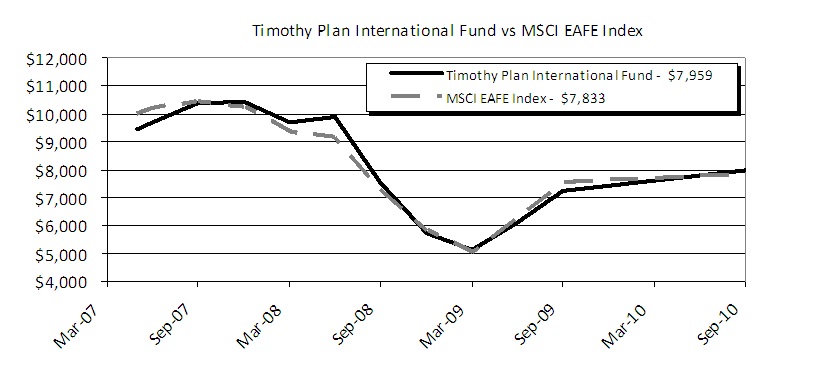

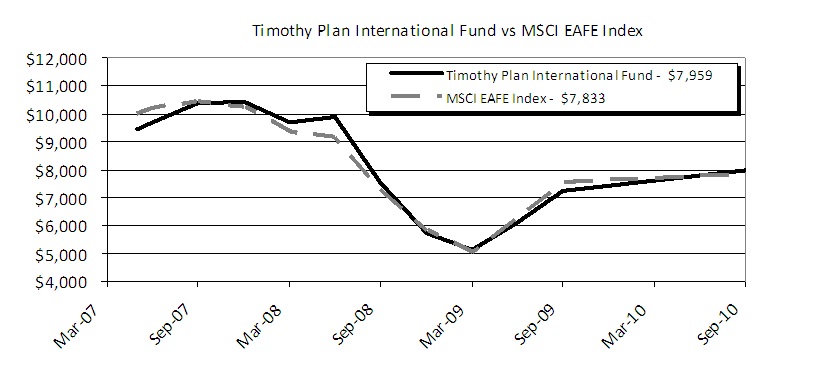

International Fund

The last twelve months have been trying times for market participants as equities experienced a roller coaster ride. The economic rebound and market rally that began in March of 2009 hit the wall in the first half of 2010 due to the European sovereign debt crisis and fears of a double-dip recession. This was followed by a sharp equity rally in the third quarter of 2010.

The portfolio began its fiscal year with a tilt towards cyclical sectors, taking advantage of the economic and equity rebound in the second half of 2009. As more evidence suggested the European sovereign debt crisis was being mishandled by European authorities, we decreased the Fund’s exposure to European financials and the PIIGS countries (Portugal, Ireland, Italy, Greece, Spain). All told, the Fund performed very well versus its respective benchmark, the MSCI EAFE index, during the last twelve months as 8 of the 10 sectors in the Fund outperformed their index returns. The sectors that performed the best during this period for the Fund were Materials and Industrials with exposures to Japanese trading companies and metals and mining companies performing well. Th e Fund’s continued underweight position in Financials was also a positive as the sector proved to be the worst performing in the EAFE benchmark during the last twelve months.

The cash weighting in the Fund proved to be a drag to performance as equity markets rallied. In addition, the Energy and Consumer Discretionary sectors detracted from performance as our Brazilian holding in the energy sector declined as it prepared for the world’s largest equity offering given its vast capital needs. The Fund’s stocks in Japan, Germany, Hong Kong, Singapore, and Canada performed particularly well while those in France, Greece, Australia, and Spain hurt performance during this period. The absolute weight in emerging markets helped the Fund’s performance for the year as emerging market equities continued to outperform the developed markets. We still believe emerging market companies offer superior growth at reasonable valuations and wi ll continue to be selective in our exposure there.

Although developed economies are likely to grow GDP below 2% per annum for the foreseeable future, global growth is likely to remain robust on the back of emerging market economic growth. The world is ever changing and we remain vigilant in finding those companies across the globe whose management teams are taking advantage and benefitting from a shifting global competitive landscape and realizing growth opportunities in new markets around the world.

EAGLE GLOBAL ADVISORS

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

International Fund

| | | | | | 5 year | | | Average | | |

| | | 1 Year | | | Average | | | Annual Return | | |

| Fund/Index | | Total Return | | | Annual Return | | | Since Inception | | (a) |

| Timothy International Fund - Class A (With Sales Charge) | | | -1.79 | % | | | N/A | | | | -8.00 | % | |

| MSCI EAFE Index | | | 3.94 | % | | | N/A | | | | -6.90 | % | |

| Timothy International Fund - Class C* | | | 2.23 | % | | | N/A | | | | -7.18 | % | |

| MSCI EAFE Index | | | 3.94 | % | | | N/A | | | | -6.90 | % | |

| | | | | | | | | | | | | | |

| (a) For the period May 3, 2007 (commencement of investment in accordance with objective) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the MSCI EAFE Index on May 3, 2007 and held through September 30, 2010. The MSCI EAFE Index is a widely recognized unmanaged index of equity prices and is representative of equity market performance of developed countries, excluding the U.S. and Canada. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

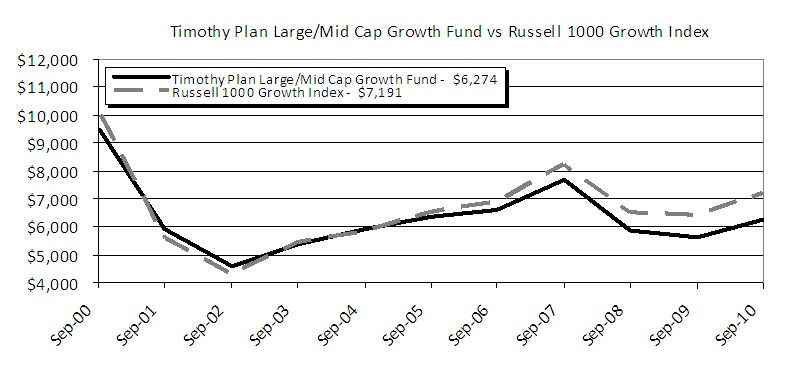

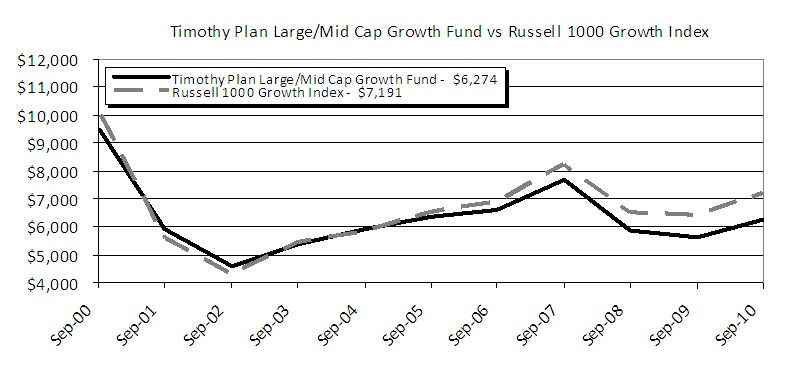

Large/Mid Cap Growth Fund

We are pleased to report that the Fund has advanced (pre-tax) 11.55% Class A, 10.80% Class B and 10.78% Class C, over the last twelve months ending September 30, 2010. Our benchmark, Russell 1000 Growth index, posted a 12.65% gain over the same period of time. “High quality” issues are beginning to regain a leadership position in this market, and the “low quality” bounce has definitely lost steam after the unprecedented gains in the spring of 2009. As valuations climbed for weaker companies, investors continued to shift towards higher quality in a more meaningful way as these companies have far better prospects for sustained growth. We will continue to focus, as always, on companies that can execute well in periods of turbulence and uncertainty, and are expected to grow faster than their peers during periods of expansion. In a gradual and unsteady recovery, we expect investors to continue to favor companies with strong fundamentals and above average growth potential; two key characteristics we apply with our time-tested, bottom-up approach to mid and large cap investing.

CHARTWELL INVESTMENT PARTNERS, LP

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

Large/Mid Cap Growth Fund

| |

| | | | | | 5 year | | | Average | | |

| | | 1 Year | | | Average | | | Annual Return | | |

| Fund/Index | | Total Return | | | Annual Return | | | Since Inception | | |

| Timothy Large/Mid Cap Growth Fund - Class A (With Sales Charge) | | | 5.46 | % | | | -1.39 | % | | | -4.56 | % | (a) |

| Russell 1000 Growth Index | | | 12.65 | % | | | 2.06 | % | | | -3.25 | % | (a) |

| Timothy Large/Mid Cap Growth Fund - Class B | | | 10.80 | % | | | -1.02 | % | | | -4.71 | % | (b) |

| Russell 1000 Growth Index | | | 12.65 | % | | | 2.06 | % | | | -2.98 | % | (b) |

| Timothy Large/Mid Cap Growth Fund - Class C* | | | 9.67 | % | | | -1.05 | % | | | -0.09 | % | (c) |

| Russell 1000 Growth Index | | | 12.65 | % | | | 2.06 | % | | | 2.50 | % | (c) |

| | | | | | | | | | | | | | |

| (a) For the period October 5, 2000 (commencement of investment in accordance with objective) to September 30, 2010. |

| (b) For the Period October 9, 2000 (commencement of share class operations) to September 30, 2010. |

| (c) For the Period February 3, 2004 (commencement of share class operations) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Russell 1000 Growth Index on October 5, 2000 and held through September 30, 2010. The Russell 1000 Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

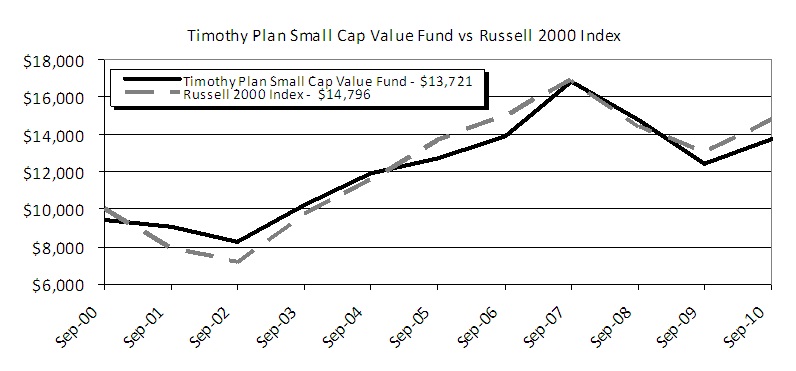

Small Cap Value Fund

We are pleased to provide you with our report for the Timothy Plan Small-Cap Value Fund for the twelve months ending September 30, 2010.

During the past 12 months, small cap equity markets remained especially volatile. 2009 finished with solid gains that were buoyed by better than expected corporate earnings, the Federal Reserve’s commitment to maintaining an accommodative interest rate policy, economic data indicating improvement in consumer spending, industrial production and even housing and employment showed signs of recovery. 2010 however, began with a selloff as investors recognized 2009 gains and viewed sovereign debt problems in Europe, as a reason to grow cautious. Investor optimism was once again revived as global economic data remained supportive of a broad-based recovery, corporate earnings again exceeded expectations and the U.S. Congress passed a healthcare reform bill – an event that at least removed some uncertainty surrounding its potential impact. That rally once again favored high beta, lower- quality securities and continued through May, when Greek sovereign debt was downgraded to junk status. The resulting concern about the health of certain European economies, combined with China’s intentions to slow economic growth, led the market to begin pricing in the potential for a “double dip” global recession. The effects of the BP platform explosion and oil spill in the Gulf of Mexico engendered regulatory uncertainty and served to reinforce expectations that a significant slowdown was likely. The closing quarter of the fiscal year was marked by even more volatility; a sell off in August on fears of a double dip recession led to the largest one month rebound in September since 1939 as equities reached valuation levels relative to bonds not seen in decades.

For the twelve months ending September 30, 2010, the Timothy Plan Small-Cap Value Fund produced a return of 11.7%, while the Russell 2000 Index produced a return of 13.4%. Security selection in Financial Services, Materials & Processing and Technology proved to be detractors. Through much of the last twelve months, stable growers have lagged the market and impacted relative performance across many sectors. Sectors such as Consumer Discretionary, Technology, and Materials & Processing were heavily impacted by the low quality, high beta rally, which had a large impact on relative performance in 2009 and 2010 due to our focus on high quality and lower beta. Individual detractors included companies such as Knight Capital Group, Stifel Financial and Calamos Asset M anagement, which are tied to market performance and fell as investors worried that they may experience margin pressure, weak inflows or revenue weakness. Bank related holdings such as FirstMerit, East West Bancorp and Chemical Financial all experienced weakness in sympathy with the overall banking industry on concerns about poor revenue growth and deteriorating credit quality. However, smaller regional banks have generally performed well when compared to larger market cap banks.

Investors bid down Technology’s ManTech after the resignation of its President and COO despite reporting in line earnings, and new contracts. MKS Instruments also detracted from performance as it experienced the strain of being a more volatile and economically sensitive company. Conversely, top contributor to relative performance, Quest Software, rode higher on strong license revenue growth. Materials & Processing company Northwest Pipe fell on an announced sales decline resulting from volume decreases across their product lines, reduced pricing and less favorable product mix.

Security selection in Producer Durables, Energy and Consumer Discretionary stocks was additive to relative performance. Producer Durables’ A.O. Smith Corp. and BE Aerospace, continue to beat expectations for both earnings and revenues and Genesee & Wyoming has experienced an increase in carload volumes and a more favorable pricing environment while BE Aerospace, Chattem and Casey’s General Store were top performers in Consumer Staples as was Brink’s Home Security Holding in Consumer Discretionary after all received takeover offers at substantial premiums. Energy holding Rex Energy Corp. rose on rumors of a potentially positive joint venture in a Marcellus shale plant in Pennsylvania and Approach Resources reported better earnings and reserves despite issues that tempo rarily curtailed production.

Management of the fund is deeply rooted in our decades old investment philosophy that seeks to deliver a superior rate of return while controlling risk. It remains our firm belief that the discipline of quantifying and managing downside risk is paramount and it will remain a hallmark of the Westwood investment process. We have always focused on companies that maintain a discipline for managing risk and believe those companies not dependent upon the capital markets to recapitalize or fund growth will ultimately benefit from the stress of others. Looking for high quality companies that are typically characterized by strong free cash flow generation, declining debt levels, and rising return on equity will continue to define the core of our investment process. We thank you for your continued confidence.

WESTWOOD MANAGEMENT CORPORATION

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

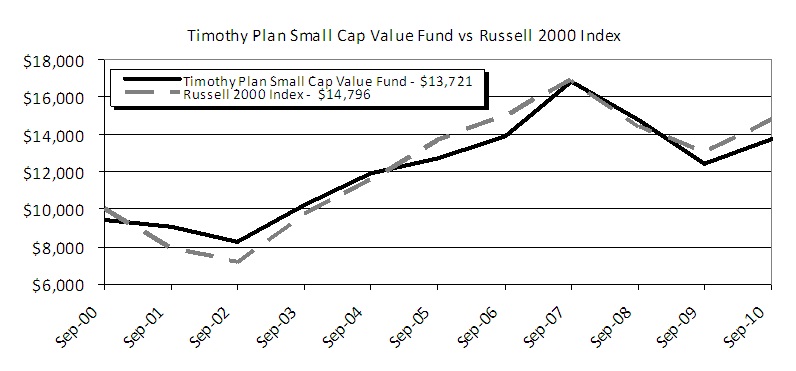

Small Cap Value Fund

| | | | | | 5 year | | | 10 Year | | |

| | | 1 Year | | | Average | | | Average | | |

| Fund/Index | | Total Return | | | Annual Return | | | Annual Return | | |

| Timothy Small Cap Value Fund - Class A (With Sales Charge) | | | 3.96 | % | | | 0.35 | % | | | 3.21 | % | |

| Russell 2000 Index | | | 13.35 | % | | | 1.60 | % | | | 4.00 | % | |

| Timothy Small Cap Value Fund - Class B | | | 9.19 | % | | | 0.76 | % | | | 3.01 | % | |

| Russell 2000 Index | | | 13.35 | % | | | 1.60 | % | | | 4.00 | % | |

| Timothy Small Cap Value Fund - Class C* | | | 8.14 | % | | | 0.77 | % | | | 1.18 | % | (a) |

| Russell 2000 Index | | | 13.35 | % | | | 1.60 | % | | | 3.69 | % | (a) |

| | | | | | | | | | | | | | |

| (a) For the period February 3, 2004 (commencement of share class operations) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Russell 2000 Index on September 30, 2000 and held through September 30, 2010. The Russell 2000 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

Large/Mid Cap Value Fund

We are pleased to provide you with our report for the Timothy Plan Large/Mid-Cap Value Fund for the twelve months ending September 30, 2010.

During the past 12 months, equity markets remained volatile. 2009 finished with solid gains that were buoyed by better than expected corporate earnings, the Federal Reserve’s commitment to maintaining an accommodative interest rate policy, economic data indicating improvement in consumer spending, industrial production and even housing and employment showed signs of recovery. 2010 however, began with a selloff as investors recognized 2009 gains and viewed sovereign debt problems in Europe, as a reason to grow cautious. Investor optimism was once again revived as global economic data remained supportive of a broad-based recovery, corporate earnings again exceeded expectations and the U.S. Congress passed a healthcare reform bill – an event that at least removed some u ncertainty surrounding its potential impact. That rally once again favored high beta, lower- quality securities and continued through May, when Greek sovereign debt was downgraded to junk status. The resulting concern about the health of certain European economies, combined with China’s intentions to slow economic growth, led the market to begin pricing in the potential for a “double dip” global recession and an aversion to all foreign revenue sources through the 2nd quarter 2010. The effects of the BP platform explosion and oil spill in the Gulf of Mexico engendered regulatory uncertainty and served to reinforce expectations that a significant slowdown was likely. The closing quarter of the fiscal year was marked by even more volatility, an improvement in investor sentiment regarding global economic growth and a decline in investor appetite for risk . A sell off in August on fears of a double dip recession led to the largest one month rebound in September since 1939 as equities reached valuation levels relative to bonds not seen in decades.

For the twelve months ending September 30, 2010, the Timothy Plan Large/Mid-Cap Value Fund produced a return of 12.5%, while the S&P 500 Index produced a return of 10.2%. Security selection in the Technology, Consumer Discretionary, Financial Services and Producer Durables stocks aided relative performance. Top performing securities included Sybase and McAfee in Technology, which both received takeover offers at significant premiums. Borg Warner and Advance Auto Parts have performed well as earnings have strengthened on rising global auto demand and market share gains. Producer Durables stocks Deere continues to benefit from strong global agricultural trends while fluctuating optimism over industrial demand has pulled Union Pacific, Emerson Electric and Flowserve generally higher on their leverage to global trends. Financial Services as a whole outperformed the index sector due to a relative underweight in large banking companies which have underperformed on fears continued credit deterioration and most recently, the potential implications resulting from “robo-signings” in home foreclosures. While our smaller banks holdings have fallen in sympathy with their larger peers, our holdings in insurance companies have performed well based on the stability provided by their revenue streams.

Security selection in Health Care, Energy and Materials & Processing proved to be detractors for the prior twelve months. Foster Wheeler, in Material & Processing declined after reporting earnings below expectations, Energy companies EQT fell on lower natural gas prices and disappointment as benefits from the Marcellus shale have been slow to materialize while Anadarko, which has an interest in the BP Gulf of Mexico well, fell on fears of the potential financial impact to the company. National Oilwell Varco and Halliburton offset a portion of the impact as they recovered from summer’s industry-wide concerns over increased regulation that were prompted by the oil spill. Utility holding NextEra Energy, formerly FPL Group, fell after receiving an unfavorable rate ruling from its state regulator and FirstEnergy fell after announcing an acquisition of peer Allegheny Energy.

Management of the fund is deeply rooted in our decades old investment philosophy that seeks to deliver a superior rate of return while controlling risk. It remains our firm belief that the discipline of quantifying and managing downside risk is paramount and it will remain a hallmark of the Westwood investment process. We have always focused on companies that maintain a discipline for managing risk and believe those companies not dependent upon the capital markets to recapitalize or fund growth will ultimately benefit from the stress of others. Looking for high quality companies that are typically characterized by strong free cash flow generation, declining debt levels, and rising return on equity will continue to define the core of our investment process. We thank you for your continued confidence.

WESTWOOD MANAGEMENT CORPORATION

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

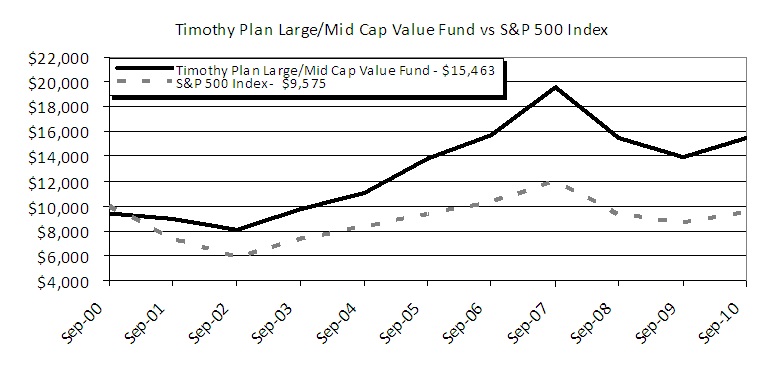

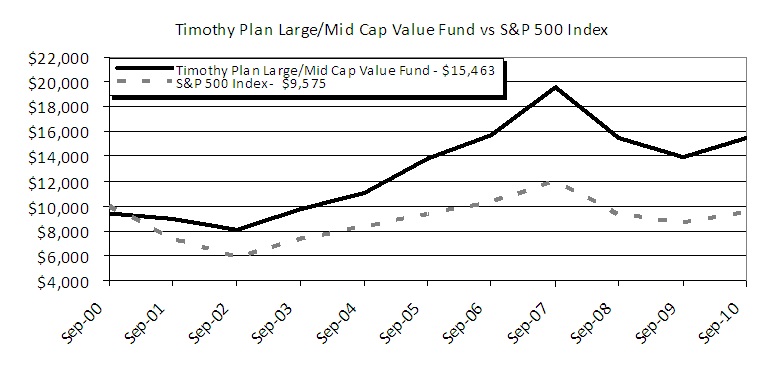

Large/Mid Cap Value Fund

| | | | | | 5 year | | | 10 Year | | |

| | | 1 Year | | | Average | | | Average | | |

| Fund/Index | | Total Return | | | Annual Return | | | Annual Return | | |

| Timothy Large/Mid Cap Value Fund - Class A (With Sales Charge) | | | 4.87 | % | | | 1.16 | % | | | 4.46 | % | |

| S&P 500 Index | | | 10.18 | % | | | 0.64 | % | | | -0.43 | % | |

| Timothy Large/Mid Cap Value Fund - Class B | | | 10.10 | % | | | 1.54 | % | | | 4.25 | % | |

| S&P 500 Index | | | 10.18 | % | | | 0.64 | % | | | 0.32 | % | |

| Timothy Large/Mid Cap Value Fund - Class C* | | | 9.02 | % | | | 1.55 | % | | | 4.65 | % | (a) |

| S&P 500 Index | | | 10.18 | % | | | 0.64 | % | | | 2.12 | % | (a) |

| | | | | | | | | | | | | | |

| (a) For the period February 3, 2004 (commencement of share class operations) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the S&P 500 Index on September 30, 2000 and held through September 30, 2010. The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

Fixed Income Fund

There are numerous reasons to be optimistic that monetary and fiscal policies over the past two years successfully averted a global depression and generated positive economic growth over the past 4 quarters. However, there is also convincing evidence the pace of recovery will remain subdued with below-trend GDP growth keeping interest rates low over the next few quarters.

The U.S. economy, where 70% of GDP is consumer consumption, is dependent on job and income growth. During the past decade, U.S. consumers took on debt as asset prices rose faster than incomes leading them to think there was no need to rein in spending. Now consumers are in a period of austerity after experiencing a damaging recession. Employment growth continues weak confirmed by the lackluster improvement in initial jobless claims, and continuing claims remain at alarmingly historic highs. Worse, an estimated 70% of income growth since 1Q09 has been due to government transfer payments which does not lead to sustainable growth. With the U.S. budget deficit at a 60-year high, the current electoral mood may eliminate additional bail-out funding possibilities. A decline in federal, state, and local government spending will likely be a drag on the recovery.

In reaction to this environment the bond market saw lower rates over the twelve months ended September 30, 2010. While short term rates remained very low, intermediate and longer maturity rates declined sharply especially over the past two quarters. The Treasury ten year reached 2.5% on September 30th having declined from 3.3% twelve months ago. Barclays reports their U.S. Treasury index return at 7.3% over the past year. Corporate bond yields declined more rapidly as investors searched for yield against a background of modest economic improvement and higher corporate earnings. The Barclays Investment Grade Corporate bond index return was 12.3% over the past y ear. Although mortgage rates also declined, their return reported in the Barclays Agency Mortgage Backed Securities index was a more modest 5.7%.

Timothy Fixed Income Fund A shares generated an attractive 7.1% total return over the twelve months ended September 30, 2010, but trailed the 8.2% return of the Barclays Aggregate index. The performance difference was due to the portfolio’s more conservative risk posture. The fund had no exposure to Commercial Mortgage Backed Securities (CMBS) which rebounded 23.2% on the strength of the U.S. Government’s PPIP initiative. However, commercial real estate fundamentals remain poor as delinquency and default rates continue to grow, so the portfolio continues to have no exposure. Also, the portfolio had a lower interest rate risk position that modestly detracted from results. Fund performance was aided by a significant overweight in industrial and utility corporate bonds.

The portfolio is conservatively structured with an average credit quality of AA with an average maturity of 5.7 years as of September 30th. Investment grade corporate bonds continue to be over-weighted to add yield, and the portfolio has a 7% position in Treasury Inflation Protected Securities which are starting to perform well. The portfolio has no exposure to subprime loans or CMBS as all mortgage holdings are in GNMA issues having the full faith and credit of the U.S. Treasury.

BARROW, HANLEY, MEWHINNEY & STRAUSS

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

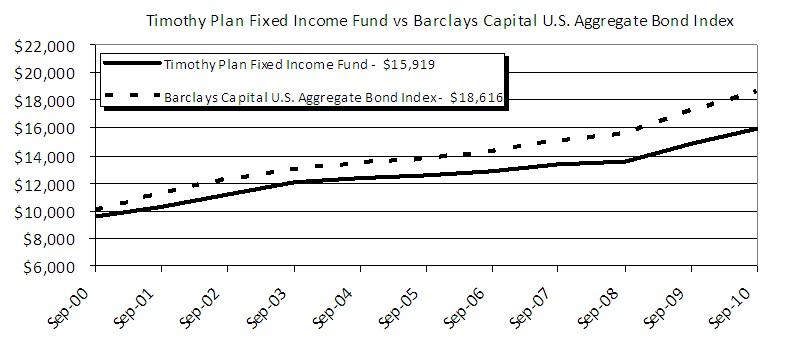

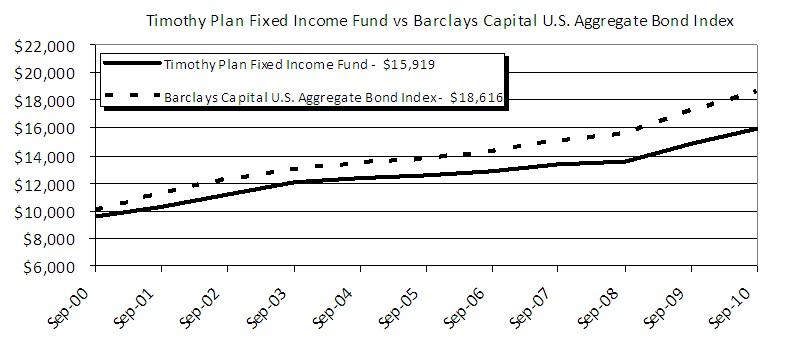

Fixed Income Fund

| |

| | | | | | 5 year | | | 10 Year | | |

| | | 1 Year | | | Average | | | Average | | |

| Fund/Index | | Total Return | | | Annual Return | | | Annual Return | | |

| Timothy Fixed Income Fund - Class A (With Sales Charge) | | | 2.23 | % | | | 3.85 | % | | | 4.76 | % | |

| Barclays Capital U.S. Aggregate Bond Index | | | 8.16 | % | | | 6.20 | % | | | 6.41 | % | |

| Timothy Fixed Income Fund - Class B | | | 6.28 | % | | | 4.04 | % | | | 4.37 | % | |

| Barclays Capital U.S. Aggregate Bond Index | | | 8.16 | % | | | 6.20 | % | | | 6.41 | % | |

| Timothy Fixed Income Fund - Class C* | | | 5.30 | % | | | 4.05 | % | | | 3.39 | % | (a) |

| Barclays Capital U.S. Aggregate Bond Index | | | 8.16 | % | | | 6.20 | % | | | 5.42 | % | (a) |

| | | | | | | | | | | | | | |

| (a) For the period February 3, 2004 (commencement of share class operations) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Barclays Capital U.S. Aggregate Bond Index on September 30, 2000 and held through September 30, 2010. The Barclays Capital U.S. Aggregate Bond Index is a widely recognized, unmanaged index of bond prices. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

High Yield Bond Fund

The pace of U.S. economic recovery will likely remain subdued with below-trend GDP growth keeping interest rates low over the next few quarters. The key determinate to a stronger GDP lies in employment growth which continues to be weak. However, despite slow economic growth over the past four quarters corporate earnings have improved nicely propelling both the stock market and high yield (HY) bonds to higher prices. The S&P 500 is up 10.2% over the trailing twelve months ended September 30, 2010 which has supported a rally in the HY market.

The Barclays Ba/B High Yield index on 9/30/09 had a yield of 8.80% and declined to 6.90% by 9/30/10 generating a 16.8% return. Lower yields were a combination of the lower risk free rate of U.S. Treasuries and tighter yield spreads for HY bonds. For example, the Treasury ten year note declined from 3.3% to 2.5% over the trailing year. The yield spread over Treasuries of the Ba/B index declined from 615 basis points (bps) a year ago to 530 bps on September 30th primarily due to improved company earnings and a declining risk of default. Despite the well publicized but anticipated filing by Blockbuster defaulting on $930 million in HY bonds, the par-weighted default rate in HY has decreased for the 11th consecutive month down to 5.1% from a cyclical high of 13.8% as reported by Moody’s.

Improved HY market conditions allowed $32B in new supply to be sold during September, which was the second largest month on record. New issuance is running at an annual pace of $239B, which would be a new record. Many HY issuers have taken advantage of greatly improved pricing to refinance and eliminate potential liquidity problems by increasing the maturity schedule of their debt.

The Timothy High Yield Fund A shares generated an attractive return of 15.0% for the trailing twelve months ended 9/30/10, but trailed the Barclays Ba/B index benchmark result of 16.8%. This shortfall comes after last fiscal year’s result of 45.1% for the fund’s A shares compared to 38.8% for the Barclays Ba/B index. The portfolio being concentrated in 50 issues can cause performance relative to the benchmark to be somewhat volatile. One common theme to the underperforming issues was downward pressure on natural gas prices. The top five issues detracting from performance included: Dynegy, Energy Future Holdings, Cemex, Omnicare, and Helix Energy. Top five issues aiding performance for the trailing year included: Momentive Performance, Atlas Pipeline, Navistar Intl, N RG Energy, and Crum & Forster (upgraded to investment grade ratings).

The portfolio has an average quality of B1/B+/BB- with an average maturity of 6.9 years. Security selection focuses heavily on manageable debt levels, decent growth prospects, and good liquidity. We maintain our themes of consumers seeking to spend less by “trading down” (pre-paid wireless), yet spending on necessities (Energy). Secured bonds that pledge collateral to back the securities and good covenant protection are stressed in the portfolio holdings. We believe that the high yield fund provides an attractive risk/reward opportunity for investors able to withstand volatility.

BARROW, HANLEY, MEWHINNEY & STRAUSS

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

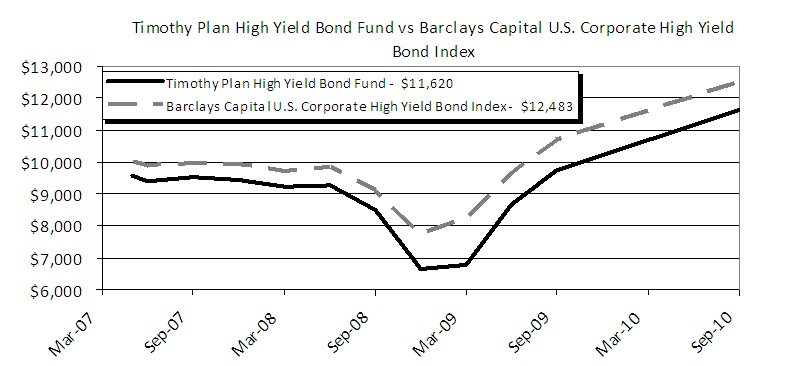

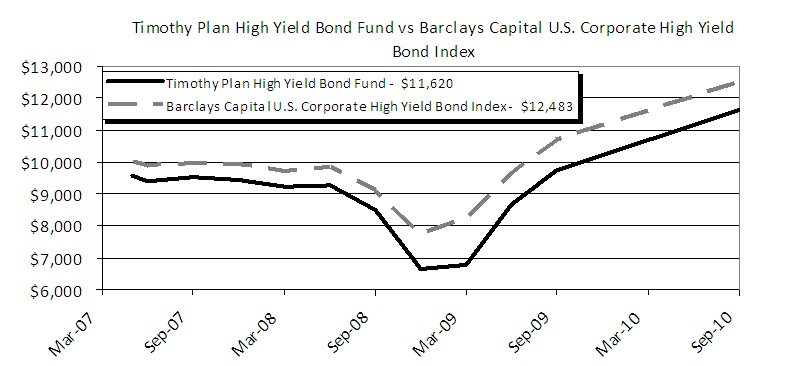

High Yield Bond Fund

| |

| | | | | | 5 year | | | Average | | |

| | | 1 Year | | | Average | | | Annual Return | | |

| Fund/Index | | Total Return | | | Annual Return | | | Since Inception | | (a) |

| Timothy High Yield Bond Fund - Class A (With Sales Charge) | | | 9.81 | % | | | N/A | | | | 3.10 | % | |

| Barclays Capital U.S. Corporate High Yield Bond Index | | | 16.71 | % | | | N/A | | | | 6.73 | % | |

| Timothy High Yield Bond Fund - Class C* | | | 13.21 | % | | | N/A | | | | 3.74 | % | |

| Barclays Capital U.S. Corporate High Yield Bond Index | | | 16.71 | % | | | N/A | | | | 6.73 | % | |

| | | | | | | | | | | | | | |

| (a) For the period May 7, 2007 (commencement of investment in accordance with objective) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | �� | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Barclays Capital U.S. Corporate High Yield Bond Index on May 7, 2007 and held through September 30, 2010. The Barclays Capital U.S. Corporate High Yield Bond Index is a widely recognized, unmanaged index of non-investment grade, fixed rate, taxable corporate bonds. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

Defensive Strategies Fund

Dear Shareholder,

In order to improve reporting efficiency and accuracy in tax reporting to our shareholders, Timothy Plan’s Board of Trustees approved changing the Fund Family’s fiscal year from December 31st to September 30th. Since the Defensive Strategies Fund began operation November 4, 2009, this year’s Annual Report for this Fund covers the period November 4, 2009 through September 30, 2010.

The Defensive Strategies Fund was created in an attempt to do what its name implies, i.e. hedge against a possible scenario of hyper-inflation which could result from the seemingly unbridled spending spree of our leadership in Washington, DC. We have also, however, built in the flexibility to adjust to a possible risk of extreme deflation with the ability to convert our inflation sensitive assets to cash and fixed income securities that should perform well during a deflationary environment. Of course, although we will do our very best to be successful, we cannot guarantee results in either scenario.

While no one can predict future events, I am confident of a couple of things:

| · | The mid-term elections could result in a reversal of the liberal bias in Congress to conservative which, if it happens, should be positive for the capital markets, and |

| · | Our sub-advisory team (i.e. money management firms that manage the various sleeves of this Fund) are, in our opinion, among the best in the industry and they each continue to honor our overall policy that they manage their respective Fund sleeve with a conservative bias. |

Finally, I would once again like to thank you for your moral convictions that led you to become part of the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally

Fund Advisor

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

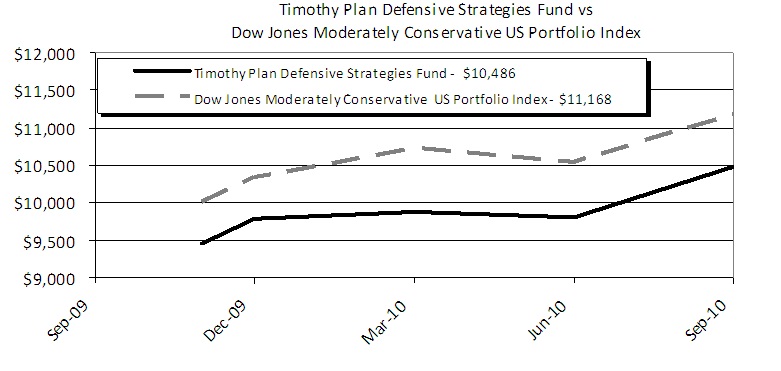

Defensive Strategies Fund

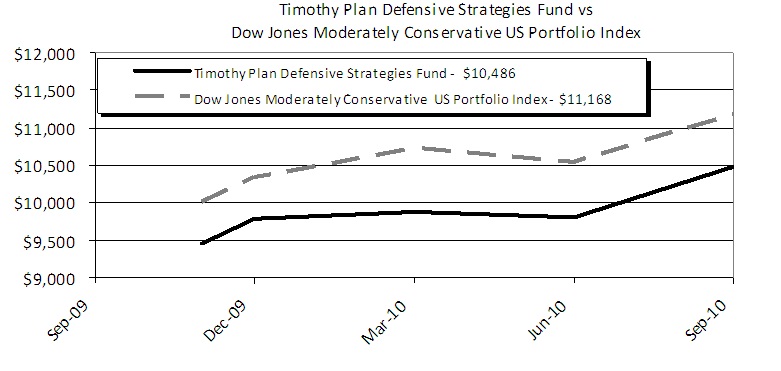

| |

| | | | | | 5 year | | | Average | | |

| | | 1 Year | | | Average | | | Annual Return | | |

| Fund/Index | | Total Return | | | Annual Return | | | Since Inception | | (a) |

| Timothy Defensive Strategies Fund - Class A (With Sales Charge) | | | N/A | | | | N/A | | | | 5.38 | % | |

| Dow Jones Moderately Conservative US Portfolio Index | | | N/A | | | | N/A | | | | 13.00 | % | |

| Timothy Defensive Strategies Fund - Class C* | | | N/A | | | | N/A | | | | 9.08 | % | |

| Dow Jones Moderately Conservative US Portfolio Index | | | N/A | | | | N/A | | | | 13.00 | % | |

| | | | | | | | | | | | | | |

| (a) For the period November 4, 2009 (commencement of investment in accordance with objective) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Dow Jones Moderately Conservative US Portfolio Index on November 4, 2009 and held through September 30, 2010. The Dow Jones Moderately Conservative US Portfolio is a widely recognized, unmanaged index of stocks, bonds and cash. Performance figures include the change in value of the asset classes in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

Strategic Growth Fund

Dear Strategic Growth Fund Shareholder,

Your Strategic Growth Fund is a compilation of several of Timothy’s underlying funds and, as such, its performance is directly related to the performance of those underlying funds. As a review, your specific asset mix is approximately as follows:

· Large/Mid Cap Value Fund | = | | 20.00 | % |

· Small Cap Value Fund | = | | 7.50 | % |

· Large/Mid Cap Growth Fund | = | | 20.00 | % |

· Aggressive Growth Fund | = | | 7.50 | % |

· International Fund | = | | 25.00 | % |

· High Yield Bond Fund | = | | 10.00 | % |

· Defensive Strategies Fund | = | | 10.00 | % |

Since your performance is so directly related to our underlying funds, I am pleased to report that, in my opinion, all of our funds are now managed by firms that are as good as, if not better than, any mutual fund family in the industry. Please refer to each individual manager’s comments within this report for more detailed information as to why the funds under their responsibility performed as they did.

As you probably have noticed, the markets have been interestingly unsettled over the past twelve months. In fact, the S&P 500 stock index had positive performance in seven of those months and negative performance in five of those months – but, fortunately, with an upward bias. And, I am pleased to report, nearly all of our underlying funds have performed in line with (at or near) their respective indexes.

We, along with our various fund’s sub-advisors, expect this pattern to continue into 2011 (i.e. unsettled with a slight upward bias) although we cannot guarantee that outcome. I am hopeful, however, that the mid-term elections could result in a reversal of the liberal bias in Congress to conservative which, if it happens, should be positive for the capital markets.

As you well know, however, no one can guarantee future results. The one thing I can assure you of is that every one of our managers will be working very hard on your behalf.

Sincerely,

Arthur D. Ally,

President

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

Strategic Growth Fund

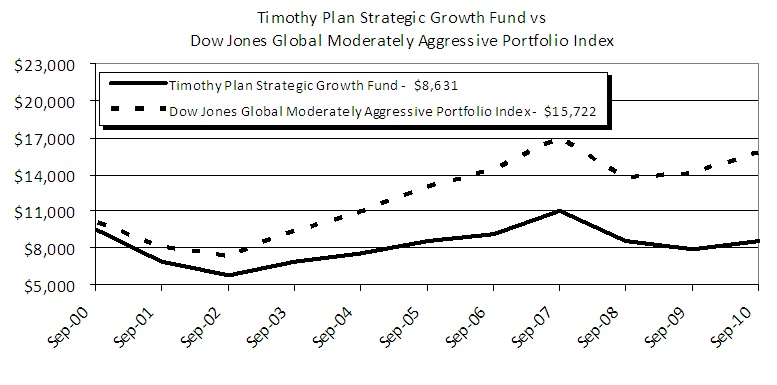

| |

| | | | | | 5 year | | | Average | | |

| | | 1 Year | | | Average | | | Annual Return | | |

| Fund/Index | | Total Return | | | Annual Return | | | Since Inception | | |

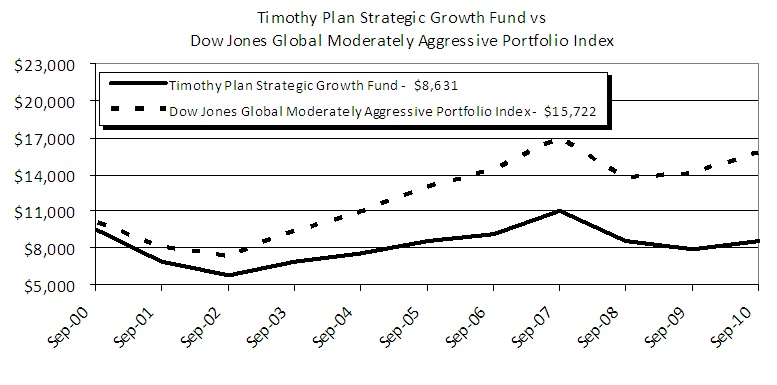

| Timothy Strategic Growth Fund - Class A (With Sales Charge) | | | 2.69 | % | | | -1.04 | % | | | -1.46 | % | (a) |

| Dow Jones Global Moderately Aggressive Portfolio Index | | | 11.72 | % | | | 3.91 | % | | | 4.63 | % | (a) |

| Timothy Strategic Growth Fund - Class B | | | 7.95 | % | | | -0.66 | % | | | -1.62 | % | (b) |

| Dow Jones Global Moderately Aggressive Portfolio Index | | | 11.72 | % | | | 3.91 | % | | | 4.80 | % | (b) |

| Timothy Strategic Growth Fund - Class C* | | | 6.90 | % | | | -0.66 | % | | | 0.84 | % | (c) |

| Dow Jones Global Moderately Aggressive Portfolio Index | | | 11.72 | % | | | 3.91 | % | | | 5.84 | % | (c) |

| | | | | | | | | | | | | | |

| (a) For the period October 5, 2000 (commencement of investment in accordance with objective) to September 30, 2010. |

| (b) For the Period October 9, 2000 (commencement of share class operations) to September 30, 2010. |

| (c) For the Period February 3, 2004 (commencement of share class operations) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Dow Jones Global Moderately Aggressive Portfolio Index on October 5, 2000 and held through September 30, 2010. The Dow Jones Global Moderately Aggressive Portfolio Index is a widely recognized index that measures global stocks, bonds, and cash which are in turn represented by multiple sub-indexes. Performance figures include the change in value of the investments in the indexes and the reinvestment of dividends. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFOR MANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Fund Performance

Letter from the Manager

September 30, 2010

Conservative Growth Fund

Dear Conservative Growth Fund Shareholder,

Your Conservative Growth Fund is a compilation of several of Timothy’s underlying funds and, as such, its performance is directly related to the performance of those underlying funds. As a review, your specific asset mix is approximately as follows:

· Large/Mid Cap Value Fund | = | | 15.00 | % |

· Small Cap Value Fund | = | | 5.00 | % |

· Large/Mid Cap Growth Fund | = | | 12.00 | % |

· Aggressive Growth Fund | = | | 3.00 | % |

· Fixed Income Fund | = | | 30.00 | % |

· International Fund | = | | 10.00 | % |

· High Yield Bond Fund | = | | 10.00 | % |

· Defensive Strategies Fund | = | | 15.00 | % |

Since your performance is so directly related to our underlying funds, I am pleased to report that, in my opinion, all of our funds are now managed by firms that are as good as, if not better than, any mutual fund family in the industry. Please refer to each individual manager’s comments within this report for more detailed information as to why the funds under their responsibility performed as they did.

As you probably have noticed, the markets have been interestingly unsettled over the past twelve months. In fact, the S&P 500 stock index had positive performance in seven of those months and negative performance in five of those months – but, fortunately, with an upward bias. And, I am pleased to report, nearly all of our underlying funds have performed in line with (at or near) their respective indexes.

We, along with our various fund’s sub-advisors, expect this pattern to continue into 2011 (i.e. unsettled with a slight upward bias) although we cannot guarantee that outcome. I am hopeful, however, that the mid-term elections could result in a reversal of the liberal bias in Congress to conservative which, if it happens, should be positive for the capital markets.

As you well know, however, no one can guarantee future results. The one thing I can assure you of is that every one of our managers will be working very hard on your behalf.

Sincerely,

Arthur D. Ally,

President

Timothy Plan Fund Performance

Fund Performance – (Unaudited)

September 30, 2010

Convservative Growth Fund

| |

| | | | | | 5 year | | | Average | | |

| | | 1 Year | | | Average | | | Annual Return | | |

| Fund/Index | | Total Return | | | Annual Return | | | Since Inception | | |

| Timothy Conservative Growth Fund - Class A (With Sales Charge) | | | 2.51 | % | | | 1.07 | % | | | 1.40 | % | (a) |

| Dow Jones Global Moderate Portfolio Index | | | 10.72 | % | | | 4.37 | % | | | 5.23 | % | (a) |

| Timothy Conservative Growth Fund - Class B | | | 7.68 | % | | | 1.46 | % | | | 1.21 | % | (b) |

| Dow Jones Global Moderate Portfolio Index | | | 10.72 | % | | | 4.37 | % | | | 5.35 | % | (b) |

| Timothy Conservative Growth Fund - Class C* | | | 6.50 | % | | | 1.48 | % | | | 2.30 | % | (c) |

| Dow Jones Global Moderate Portfolio Index | | | 10.72 | % | | | 4.37 | % | | | 5.66 | % | (c) |

| | | | | | | | | | | | | | |

| (a) For the period October 5, 2000 (commencement of investment in accordance with objective) to September 30, 2010. |

| (b) For the Period October 9, 2000 (commencement of share class operations) to September 30, 2010. |

| (c) For the Period February 3, 2004 (commencement of share class operations) to September 30, 2010. |

| *With Maximum Deferred Sales Charge | | | | | | | | | | | | | |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s A shares and the Dow Jones Global Moderate Portfolio Index on October 5, 2000 and held through September 30, 2010. The Dow Jones Global Moderate Portfolio Index is a widely recognized index that measures stocks, bonds, and cash which in turn are represented by multiple sub-indexes. Performance figures include the change in value of the investments in the indexes and the reinvestment of dividends. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FU TURE RESULTS.

Timothy Plan Fund Performance

Fund Profile - (Unaudited)

September 30, 2010

Aggressive Growth Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| SBA Communications Corp. - Class A | 3.30% | | Information Technology | 28.58% |

| Cash Equivalent - Fidelity Institutional Money Market Portfolio | 3.02% | | Health Care | 17.60% |

| Gartner, Inc. | 2.90% | | Industrials | 15.28% |

| Sapient Corp. | 2.29% | | Consumer Discretionary | 13.71% |

| NICE Systems, Ltd. (ADR) | 2.21% | | Financials | 7.67% |

| Bruker Corp. | 2.07% | | Telecommunications | 6.24% |

| Discover Financial Services | 1.85% | | Energy | 6.10% |

| Informatica Corp. | 1.84% | | Short-Term Investments | 3.02% |

| Whiting Petroleum Corp. | 1.74% | | Materials | 0.96% |

| Varian Medical Systems, Inc. | 1.58% | | Other Assets Less Liabilities | 0.84% |

| | 22.80% | | | 100.00% |

International Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| Cash Equivalent - Fidelity Institutional Money Market Portfolio | 4.74% | | Financials | 17.33% |

| Henkel AG & Co. KGaA (ADR) | 4.54% | | Industrials | 15.77% |

| Keppel Corp., Ltd. (ADR) | 3.90% | | Consumer Discretionary | 12.51% |

| Fresenius Medical Care AG & Co. KGaA (ADR) | 3.82% | | Consumer Staples | 10.37% |

| BOC Hong Kong (Holdings), Ltd. (ADR) | 3.41% | | Telecommunications | 9.07% |

| Honda Motor Co., Ltd. (ADR) | 3.35% | | Materials | 8.96% |

| Singapore Telecommunications, Ltd. (ADR) | 3.33% | | Energy | 7.38% |

| America Movil SAB de C.V. - Series L (ADR) | 3.26% | | Health Care | 6.69% |

| DBS Group Holdings, Ltd. (ADR) | 3.23% | | Short-Term Investments | 4.74% |

| Canon, Inc. (ADR) | 3.14% | | Utilities | 4.44% |

| | 36.72% | | Information Technology | 3.14% |

| | | | Liabilities in Excess of Other Assets | (0.40)% |

| | | | | 100.00% |

Large/Mid Cap Growth Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| Exxon Mobil Corp. | 3.84% | | Health Care | 20.15% |

| Cash Equivalent - Fidelity Institutional Money Market Portfolio | 3.44% | | Financials | 17.20% |

| Paychex, Inc. | 3.30% | | Information Technology | 15.89% |

| Invesco, Ltd. | 2.69% | | Energy | 12.81% |

| T. Rowe Price Group, Inc. | 2.53% | | Industrials | 12.45% |

| Occidental Petroleum Corp. | 2.11% | | Consumer Discretionary | 8.96% |

| AmerisourceBergen Corp. | 2.09% | | Telecommunications | 4.89% |

| Gartner, Inc. | 2.08% | | Short-Term Investments | 3.44% |

| Medco Health Solutions, Inc. | 1.97% | | Other Assets Less Liabilities | 2.15% |

| Jarden Corp. | 1.93% | | Materials | 2.06% |

| | 25.98% | | | 100.00% |

Timothy Plan Top Ten Holdings / Industries

Fund Profile - (Unaudited)

September 30, 2010

Small Cap Value Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| Cash Equivalent - Fidelity Institutional Money Market Portfolio | 6.69% | | Industrials | 26.63% |

| Wolverine World Wide, Inc. | 2.36% | | Financials | 23.71% |

| CryoLife, Inc. | 2.29% | | Consumer Discretionary | 12.07% |

| Texas Capital Bancshares, Inc. | 2.23% | | Information Technology | 9.58% |

| Sensient Technologies Corp. | 2.22% | | Energy | 8.29% |

| Rollins, Inc. | 2.19% | | Short-Term Investments | 6.69% |

| Genesee & Wyoming, Inc. - Class A | 2.19% | | Consumer Staples | 4.30% |

| ManTech International Corp. - Class A | 2.19% | | Utilities | 4.12% |

| Calamos Asset Management, Inc. - Class A | 2.19% | | Materials | 3.23% |

| Geosources, Inc. | 2.18% | | Health Care | 2.29% |

| | 26.73% | | Liabilities in Excess of Other Assets | (0.91)% |

| | | | | 100.00% |

| | | | | |

Large/Mid Cap Value Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| Exxon Mobil Corp. | 3.54% | | Financials | 26.41% |

| Deere & Co. | 3.29% | | Energy | 20.42% |

| Union Pacific Corp. | 2.91% | | Industrials | 11.68% |

| Emerson Electric Co. | 2.82% | | Health Care | 10.14% |

| BorgWarner, Inc. | 2.70% | | Consumer Staples | 8.88% |

| Flowserve Corp. | 2.66% | | Consumer Discretionary | 8.69% |

| Invesco, Ltd. | 2.62% | | Utilities | 6.79% |

| McKesson Corp. | 2.59% | | Information Technology | 2.56% |

| Advance Auto Parts, Inc. | 2.58% | | Short-Term Investments | 2.16% |

| CA, Inc. | 2.56% | | Materials | 2.12% |

| | 28.27% | | Other Assets Less Liabilities | 0.15% |

| | | | | 100.00% |

Fixed Income Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| Cash Equivalent - Fidelity Institutional Money Market Portfolio | 16.21% | | Government | 27.88% |

| GNMA Pool 4520, 5.00%, 08/20/2039 | 4.69% | | Mortgage-Backed Securities | 25.28% |

| TIPS, 2.00%, 01/15/2014 | 4.22% | | Short-Term Investments | 16.21% |

| U.S. Treasury Note, 3.50%, 05/15/2020 | 4.02% | | Financials | 9.94% |

| GNMA Pool 717072, 5.00%, 05/15/2039 | 3.55% | | TIPS | 6.93% |

| U.S. Treasury Note, 4.75%, 05/15/2014 | 3.46% | | Energy | 6.17% |

| U.S. Treasury Note, 3.875%, 05/15/2018 | 3.34% | | Utilities | 4.97% |

| U.S. Treasury Bond, 3.125%, 05/15/2019 | 3.14% | | Consumer Discretionary | 3.72% |

| GNMA Pool 4541, 5.00%, 09/20/2039 | 2.88% | | Industrials | 2.92% |

| TIPS, 2.50%, 07/15/2016 | 2.72% | | Telecommunications | 0.80% |

| | 48.23% | | Information Technology | 0.79% |

| | | | Liabilities in Excess of Other Assets | (5.61)% |

| | | | | 100.00% |

Timothy Plan Top Ten Holdings / Industries

Fund Profile - (Unaudited)

September 30, 2010

High Yield Bond Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| Omnicare, Inc., 7.75%, 06/01/2020 | 4.54% | | Energy | 35.01% |

| Cricket Communications, Inc., 9.375% 11/01/2014 | 2.64% | | Industrials | 16.89% |

| Goodyear Tire & Rubber Co., 10.50%, 05/15/2016 | 2.51% | | Consumer Discretionary | 10.60% |

| Lyondell Chemical Co., 8.00%, 11/01/2017 | 2.42% | | Utilities | 9.82% |

| United Rentals North America, Inc., 9.25%, 12/15/2019 | 2.40% | | Financials | 9.19% |

| Cloud Peak Energy Resources LLC, 8.50%, 12/15/2019 | 2.38% | | Materials | 5.61% |

| Navistar International Corp., 8.25%, 11/01/2021 | 2.37% | | Telecommunications | 4.92% |

| Nova Chemicals Corp., 8.625%, 11/01/2019 | 2.35% | | Health Care | 4.54% |

| Intergen NV, 9.00%, 06/30/2017 | 2.34% | | Other Assets Less Liabilities | 2.19% |

| Navios Maritime Holdings, Inc., 8.875%, 11/01/2017 | 2.34% | | Short-Term Investments | 1.23% |

| | 26.29% | | | 100.00% |

Defensive Strategies Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| PowerShares DB Agriculture Fund | 8.82% | | TIPS | 44.07% |

| PowerShares DB Energy Fund | 6.62% | | ETFs | 30.92% |

| TIPS, 2.375%, 01/15/2017 | 6.55% | | REITs | 18.52% |

| Cash Equivalent - Fidelity Institutional Money Market Portfolio | 6.13% | | Short-Term Investments | 6.13% |

| PowerShares DB Base Metals Fund | 5.48% | | Consumer Discretionary | 0.18% |

| TIPS, 2.375%, 01/15/2025 | 5.31% | | Other Assets Less Liabilities | 0.18% |

| TIPS, 2.125%, 01/15/2019 | 4.95% | | | 100.00% |

| TIPS, 2.00%, 07/15/2014 | 4.55% | | | |

| TIPS, 2.00%, 01/15/2016 | 4.36% | | | |

| PowerShares DB Commodity Index Tracking Fund | 4.17% | | | |

| | 56.94% | | | |

Money Market Fund

| Top Ten Holdings | | | Industries | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| U.S. Treasury Bill, 0.12%, 10/07/2010 | 11.59% | | U.S. Treasuries | 89.99% |

| U.S. Treasury Bill, 0.10%, 10/14/2010 | 11.20% | | Money Market Instruments | 9.92% |

| U.S. Treasury Bill, 0.13%, 10/21/2010 | 11.20% | | Other Assets Less Liabilities | 0.09% |

| U.S. Treasury Bill, 0.14%, 10/28/2010 | 11.20% | | | 100.00% |

| U.S. Treasury Bill, 0.13%, 11/04/2010 | 11.20% | | | |

| U.S. Treasury Bill, 0.13%, 11/12/2010 | 11.20% | | | |

| U.S. Treasury Bill, 0.13%, 11/18/2010 | 11.20% | | | |

| U.S. Treasury Bill, 0.15%, 11/26/2010 | 11.20% | | | |

| Cash Equivalent - Fidelity Institutional Money Market Portfolio | 9.92% | | | |

| | 99.91% | | | |

Timothy Plan Top Ten Holdings / Industries

Fund Profile - (Unaudited)

September 30, 2010

| Strategic Growth Fund | | | Conservative Growth Fund | |

| | | | | |

| Asset Allocation | | | Asset Allocation | |

| (% of Net Assets) | | | (% of Net Assets) | |

| | | | | |

| International | 25.22% | | Fixed Income | 29.88% |

| Large/Mid Cap Growth | 20.23% | | Defensive Strategies | 14.97% |

| Large/Mid Cap Value | 19.94% | | Large/Mid Cap Value | 14.97% |

| High Yield Bond | 9.69% | | Large/Mid Cap Growth | 12.03% |

| Defensive Strategies | 9.67% | | International | 10.03% |

| Aggressive Growth | 7.67% | | High Yield Bond | 9.95% |

| Small Cap Value | 7.52% | | Small Cap Value | 5.05% |

| Short-Term Investments | 0.13% | | Aggressive Growth | 3.04% |

| Liabilities in Excess of Other Assets | (0.07)% | | Other Assets Less Liabilities | 0.08% |

| | 100.00% | | | 100.00% |

| | | | | |

Timothy Plan Top Ten Holdings / Industries

Expense Examples – (Unaudited)

September 30, 2010

As a shareholder of a Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs”, (in dollars) of investing in each Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of April 1, 2010, through September 30, 2010.

Actual Expenses

The first line of the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

AGGRESSIVE GROWTH FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,048.36 | | | $ | 9.46 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,015.83 | | | $ | 9.31 | |

| Actual - Class B | | $ | 1,000.00 | | | $ | 1,042.02 | | | $ | 13.27 | |

| Hypothetical - Class B ** | | $ | 1,000.00 | | | $ | 1,012.07 | | | $ | 13.08 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,044.03 | | | $ | 13.29 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,012.07 | | | $ | 13.08 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.84% for Class A, 2.59% for Class B, and 2.59% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Aggressive Growth Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 4.84% for Class A, 4.20% for Class B, and 4.40% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

** Assumes a 5% return before expenses.

INTERNATIONAL FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 985.93 | | | $ | 8.62 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,016.39 | | | $ | 8.75 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 983.14 | | | $ | 12.33 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,012.63 | | | $ | 12.51 | |

Timothy Plan Expense Examples

Expense Examples – (Unaudited)

September 30, 2010

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.73% for Class A and 2.48% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The International Fund’s ending account value on the first line of each share class in the table is based on its actual total return of -1.41% for Class A and -1.69% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

LARGE/MID CAP GROWTH FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,006.72 | | | $ | 8.34 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,016.75 | | | $ | 8.39 | |

| Actual - Class B | | $ | 1,000.00 | | | $ | 1,001.81 | | | $ | 12.05 | |

| Hypothetical - Class B ** | | $ | 1,000.00 | | | $ | 1,013.03 | | | $ | 12.12 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,003.62 | | | $ | 12.10 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,012.99 | | | $ | 12.16 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.66% for Class A, 2.40% for Class B, and 2.41% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Large/Mid Cap Growth Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 0.67% for Class A, 0.18% for Class B, and 0.36% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

SMALL CAP VALUE FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 982.58 | | | $ | 7.87 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,017.13 | | | $ | 8.01 | |

| Actual - Class B | | $ | 1,000.00 | | | $ | 977.91 | | | $ | 11.56 | |

| Hypothetical - Class B ** | | $ | 1,000.00 | | | $ | 1,013.38 | | | $ | 11.77 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 979.06 | | | $ | 11.58 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,013.37 | | | $ | 11.78 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.58% for Class A, 2.33% for Class B, and 2.33 % for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Small Cap Value Fund’s ending account value on the first line of each share class in the table is based on its actual total return of -1.74% for Class A, -2.21% for Class B, and -2.09% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

LARGE/MID CAP VALUE FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,023.34 | | | $ | 8.02 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,017.14 | | | $ | 8.00 | |

| Actual - Class B | | $ | 1,000.00 | | | $ | 1,019.05 | | | $ | 11.79 | |

| Hypothetical - Class B ** | | $ | 1,000.00 | | | $ | 1,013.39 | | | $ | 11.75 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,019.08 | | | $ | 11.80 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,013.38 | | | $ | 11.77 | |

Timothy Plan Expense Examples

Expense Examples – (Unaudited)

September 30, 2010

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.58% for Class A, 2.33% for Class B, and 2.33% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Large/Mid Cap Value Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 2.33 % for Class A, 1.91% for Class B, and 1.91% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

FIXED INCOME FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,052.44 | | | $ | 6.23 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,019.00 | | | $ | 6.13 | |

| Actual - Class B | | $ | 1,000.00 | | | $ | 1,048.70 | | | $ | 10.04 | |

| Hypothetical - Class B ** | | $ | 1,000.00 | | | $ | 1,015.26 | | | $ | 9.88 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,049.47 | | | $ | 10.08 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,015.23 | | | $ | 9.91 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.21% for Class A, 1.96% for Class B, and 1.96% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Fixed Income Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 5.24% for Class A, 4.87% for Class B, and 4.95% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

HIGH YIELD BOND FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,060.11 | | | $ | 7.32 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,017.96 | | | $ | 7.17 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,057.13 | | | $ | 11.20 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,014.18 | | | $ | 10.97 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.42% for Class A and 2.17% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The High Yield Bond Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 6.01% for Class A and 5.71% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

DEFENSIVE STRATEGIES FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,061.21 | | | $ | 7.76 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,017.54 | | | $ | 7.60 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,056.36 | | | $ | 11.66 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,013.73 | | | $ | 11.41 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.50% for Class A and 2.26% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Defensive Strategies Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 6.12% for Class A and 5.64% for Class C for the period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

Timothy Plan Expense Examples

Expense Examples – (Unaudited)

September 30, 2010

MONEY MARKET FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,000.45 | | | $ | 0.25 | |

| Hypothetical ** | | $ | 1,000.00 | | | $ | 1,024.82 | | | $ | 0.25 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.05%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Money Market Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 0.05% for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

STRATEGIC GROWTH FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,014.06 | | | $ | 5.58 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,019.52 | | | $ | 5.60 | |

| Actual - Class B | | $ | 1,000.00 | | | $ | 1,009.92 | | | $ | 9.35 | |

| Hypothetical - Class B ** | | $ | 1,000.00 | | | $ | 1,015.77 | | | $ | 9.38 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,009.95 | | | $ | 9.35 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,015.76 | | | $ | 9.38 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.11% for Class A, 1.86% for Class B, and 1.86% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Strategic Growth Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 1.41% for Class A, 0.99% for Class B, and 1.00% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

CONSERVATIVE GROWTH FUND

| | | | | | | | | Expenses Paid During Period* | |

| | | | | | | | | | |

| | | | | | | | | 4/1/2010 through | |

| | | 4/1/2010 | | | 9/30/2010 | | | 9/30/2010 | |

| | | | | | | | | | |

| Actual - Class A | | $ | 1,000.00 | | | $ | 1,031.54 | | | $ | 5.67 | |

| Hypothetical - Class A ** | | $ | 1,000.00 | | | $ | 1,019.49 | | | $ | 5.64 | |

| Actual - Class B | | $ | 1,000.00 | | | $ | 1,028.33 | | | $ | 9.45 | |

| Hypothetical - Class B ** | | $ | 1,000.00 | | | $ | 1,015.75 | | | $ | 9.39 | |

| Actual - Class C | | $ | 1,000.00 | | | $ | 1,027.16 | | | $ | 9.47 | |

| Hypothetical - Class C ** | | $ | 1,000.00 | | | $ | 1,015.73 | | | $ | 9.42 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.11% for Class A, 1.86% for Class B, and 1.86% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the partial year period). The Conservative Growth Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 3.15% for Class A, 2.83% for Class B, and 2.72% for Class C for the six-month period of April 1, 2010, to September 30, 2010. |

| | ** Assumes a 5% return before expenses. |

Timothy Plan Expense Examples

Schedule of Investments | Aggressive Growth | | | |

| As of September 30, 2010 | | | |

| | | | | | |

| Common Stocks - 96.14% | | | |

| Number of Shares | | Fair Value | |

| | | | | | |

| | | BANKS - 0.93% | | | |

| | 3,640 | | Signature Bank * | | $ | 141,378 | |

| | | | | | | | |

| | | | CHEMICALS - 0.96% | | | | |

| | 9,192 | | Solutia, Inc. * | | | 147,256 | |

| | | | | | | | |

| | | | CONSUMER GOODS - 2.27% | | | | |

| | 6,899 | | Jarden Corp. | | | 214,766 | |

| | 3,200 | | Steven Madden, Ltd. * | | | 131,392 | |

| | | | | | | 346,158 | |

| | | | | | | | |

| | | | EDUCATION - 2.18% | | | | |

| | 2,738 | | DeVry, Inc. | | | 134,737 | |

| | 6,845 | | K12, Inc. * | | | 198,710 | |

| | | | | | | 333,447 | |

| | | | | | | | |