| | |

OMB APPROVAL |

|

OMB Number: | | 3235-0570 |

|

Expires: | | Nov. 30, 2005 |

|

Estimated average burden

|

hours per response: 5.0 |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08228

Timothy Plan

(Exact name of registrant as specified in charter)

| | |

| 1304 W. Fairbanks Ave. Winter Park, FL | | 32789 |

|

| (Address of principal executive offices) | | (Zip code) |

Arthur Ally

(Name and address of agent for service)

Registrant’s telephone number, including area code: (407) 644-1986

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | | [INSERT ANNUAL REPORT] |

Annual Report

December 31, 2003

Timothy Plan Family of Funds:

Aggressive Growth Fund

Large/Mid-Cap Growth Fund

Small-Cap Value Fund

Large/Mid-Cap Value Fund

Fixed-Income Fund

Money Market Fund

Strategic Growth Fund

Conservative Growth Fund

LETTER FROM THE PRESIDENT

December 31, 2003

ARTHUR D. ALLY

Dear Timothy Plan Shareholder:

It seems like only yesterday that I was writing these comments for the year ended 12-31-02. I must say, however, that this one is a lot less painful to write. I am sure those of you who were with us during the years of 2000, 2001, and 2002 vividly recall the negative market environment we all suffered. In fact, that existed right on through the first quarter of 2003, but then, the pendulum finally began to swing back to positive territory.

Although I will leave market comments to our various sub-advisors (see their letters enclosed,) I must confess that I was very happy with our overall 2003 performance and am looking forward to what I believe will be a pleasant 2004.

Our various funds may not be top performers at any given time but, given the quality of our money management sub-advisory firms, we are confident that we should be able to compete with any other funds over full market cycles. Of course, in this industry we cannot (and must not) ever make any guarantees of that fact.

In the meantime, the mission of Timothy goes on. You might be interested to know that we have created a six module seminar series on Biblical Stewardship that will be presented by a variety of Christian financial planners all over the country. We have been burdened for some time over the lack of teaching in this critical area in the church, even though God’s Word says more about that subject than any other by a very large margin. We are hopeful that this new seminar series will fill that void. In fact, if any of you have an interest in this series being presented in your church, please let us know. You can either email us at info@timothyplan.com or call us at 1-800-846-7526.

Once again, thanks for being part of the Timothy Plan family.

Sincerely,

Arthur D. Ally,

President

Letter From The President [1]

RETURNS FOR THE YEAR ENDED

December 31, 2003

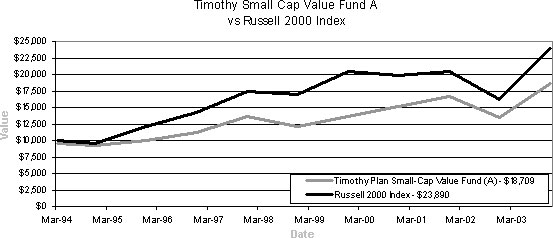

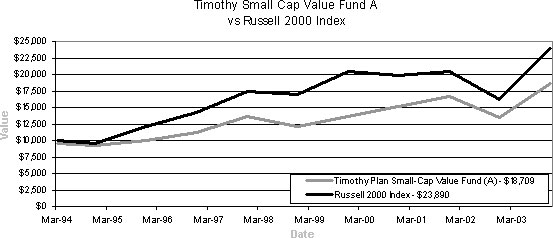

TIMOTHY PLAN SMALL CAP VALUE FUND

| | | | | | | | | |

Fund/Index

| | 12 Month Total Return

| | | 5 Year Average

Annual Return

| | | Average Annual

Total Return Since Inception

| |

Timothy Small Cap Value Fund – Class A (a) (With sales charge) | | 31.53 | % | | 7.84 | % | | 6.62 | % |

Russell 2000 Index (a) | | 47.25 | % | | 7.13 | % | | 9.32 | % |

Timothy Small Cap Value Fund – Class B (b) (With CDSC) | | 30.88 | % | | 7.92 | % | | 7.03 | % |

Russell 2000 Index (b) | | 47.25 | % | | 7.13 | % | | 8.95 | % |

| (a) | For the period March 24, 1994 (commencement of investment in accordance with objective) to December 31, 2003. |

| (b) | For the period August 25, 1995 (commencement of investment in accordance with objective) to December 31, 2003. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell 2000 Index on March 24, 1994 and held through December 31, 2003. The Russell 2000 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [2]

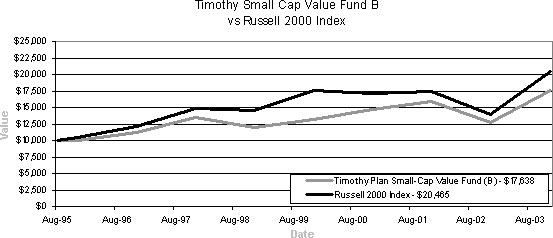

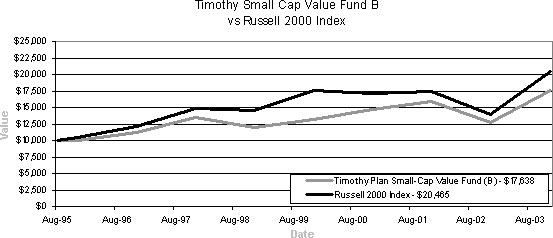

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN SMALL CAP VALUE FUND

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Russell 2000 Index on August 25, 1995 and held through December 31, 2003. The Russell 2000 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [3]

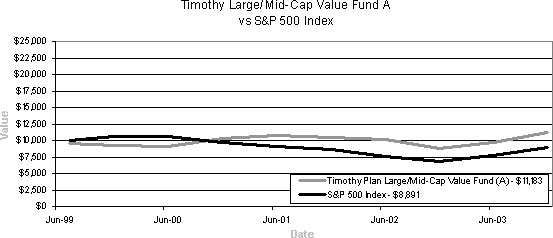

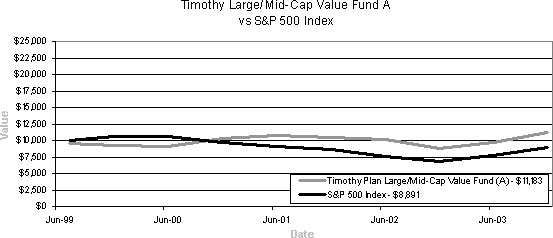

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

| | | | | | | | |

Fund/Index

| | 12 Month Total Return

| | | 5 Year Average Annual Return

| | Average Annual Total Return Since Inception

| |

Timothy Large/Mid – Cap Value Fund – Class A (e) (With sales charge) | | 21.27 | % | | N/A | | 2.53 | % |

S&P 500 Index (e) | | 28.69 | % | | N/A | | -3.61 | % |

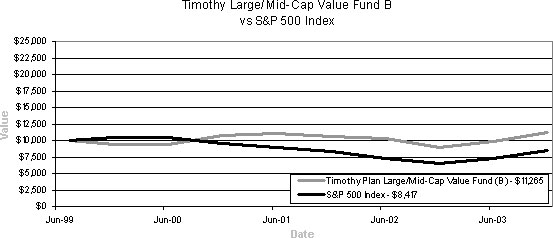

Timothy Large/Mid – Cap Value Fund – Class B (f) (With CDSC) | | 20.56 | % | | N/A | | 2.48 | % |

S&P 500 Index (f) | | 28.69 | % | | N/A | | -3.79 | % |

| (e) | For the period July 14, 1999 (commencement of investment in accordance with objective) to December 31, 2003. |

| (f) | For the period July 15, 1999 (commencement of investment in accordance with objective) to December 31, 2003. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on July 14, 1999 and held through December 31, 2003. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [4]

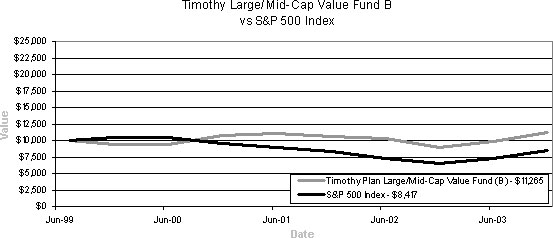

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the S&P 500 Index on July 15, 1999 and held through December 31, 2003. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [5]

RETURNS FOR THE YEAR ENDED

December 31, 2003

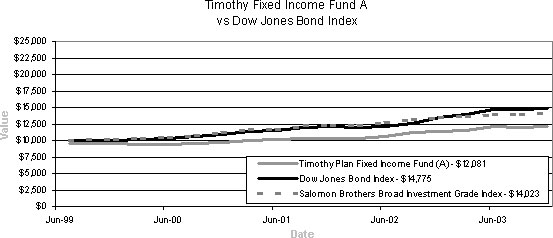

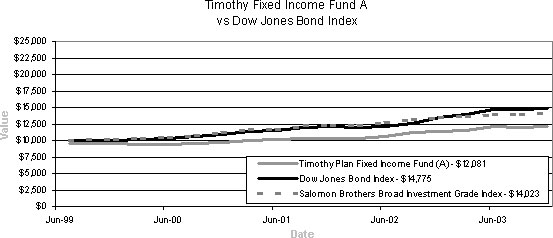

TIMOTHY PLAN FIXED INCOME FUND

| | | | | | | | |

Fund/Index

| | 12 Month Total Return

| | | 5 Year Average

Annual Return

| | Average Annual

Total Return Since Inception

| |

Timothy Fixed Income Fund – Class A (c) (With sales charge) | | 1.21 | % | | N/A | | 4.32 | % |

Dow Jones Bond Index (c) | | 9.87 | % | | N/A | | 9.13 | % |

Salomon Brothers Broad Investment Grade Index (c) | | 4.21 | % | | N/A | | 7.95 | % |

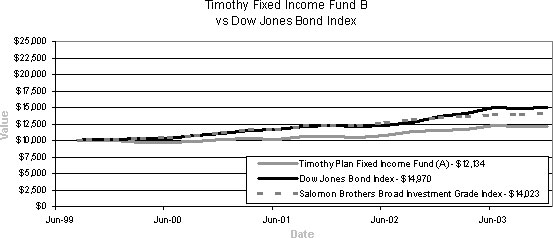

Timothy Fixed Income Fund – Class B (d) (With CDSC) | | -0.31 | % | | N/A | | 4.26 | % |

Dow Jones Bond Index (d) | | 9.87 | % | | N/A | | 9.58 | % |

Salomon Brothers Broad Investment Grade Index (d) | | 4.21 | % | | N/A | | 7.95 | % |

| (c) | For the period July 14, 1999 (commencement of investment in accordance with objective) to December 31, 2003. |

| (d) | For the period August 5, 1999 (commencement of investment in accordance with objective) to December 31, 2003. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Dow Jones Bond Index on July 14, 1999 and held through December 31, 2003. The Dow Jones Bond Index is widely recognized, unmanaged index of bond prices. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [6]

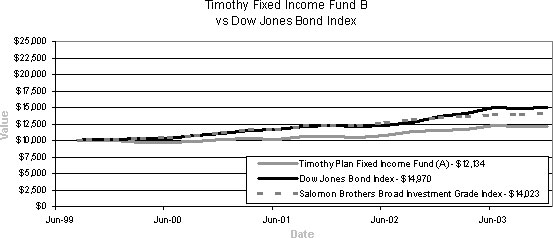

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN FIXED INCOME FUND

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Dow Jones Bond Index on August 5, 1999 and held through December 31, 2003. The Dow Jones Bond Index is widely recognized, unmanaged index of bond prices. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [7]

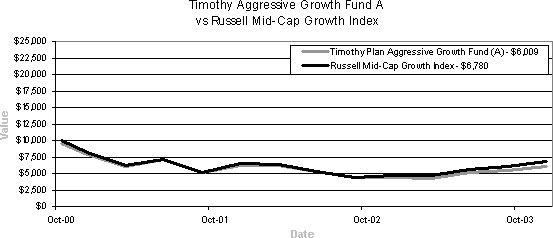

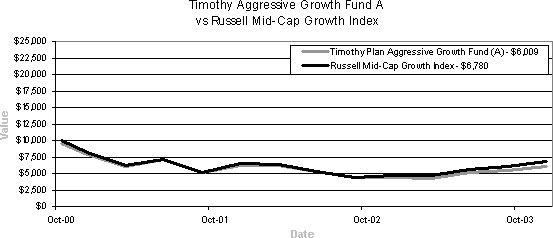

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN AGGRESSIVE GROWTH FUND

| | | | | | | | |

Fund/Index

| | 12 Month Total Return

| | | 5 Year Average

Annual Return

| | Average Annual

Total Return Since Inception

| |

Timothy Aggressive Growth Fund – Class A (g) (With sales charge) | | 31.74 | % | | N/A | | -14.57 | % |

Russell Mid Cap Growth Index (g) | | 42.71 | % | | N/A | | -11.31 | % |

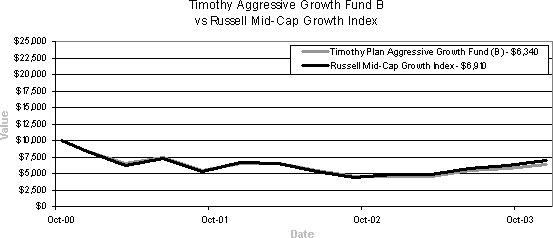

Timothy Aggressive Growth Fund – Class B (h) (With CDSC) | | 31.26 | % | | N/A | | -14.36 | % |

Russell Mid Cap Growth Index (h) | | 42.71 | % | | N/A | | -10.82 | % |

| (g) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

| (h) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell Mid Cap Growth Index on October 5, 2000 and held through December 31, 2003. The Russell Mid Cap Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [8]

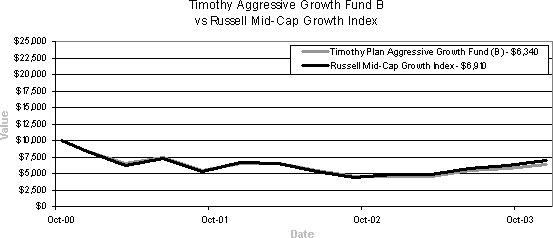

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN AGGRESSIVE GROWTH FUND

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Russell Mid Cap Growth Index on October 9, 2000 and held through December 31, 2003. The Russell Mid Cap Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [9]

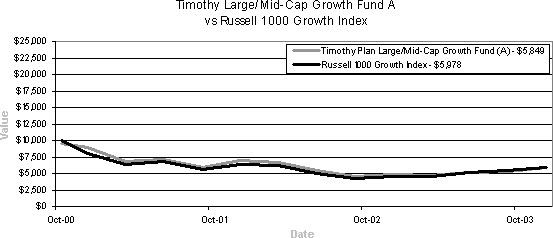

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN LARGE/MID CAP GROWTH FUND

| | | | | | | | |

Fund/Index

| | 12 Month Total Return

| | | 5 Year Average

Annual Return

| | Average Annual

Total Return Since Inception

| |

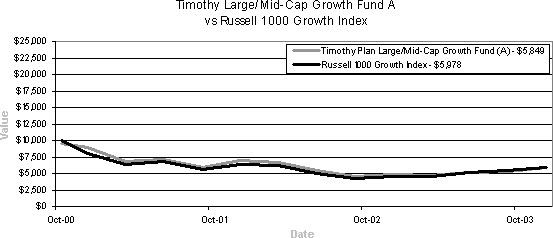

Timothy Large/Mid Cap Growth Fund – Class A (i) (With sales charge) | | 13.74 | % | | N/A | | -15.28 | % |

Russell 1000 Growth Index (i) | | 29.75 | % | | N/A | | -14.69 | % |

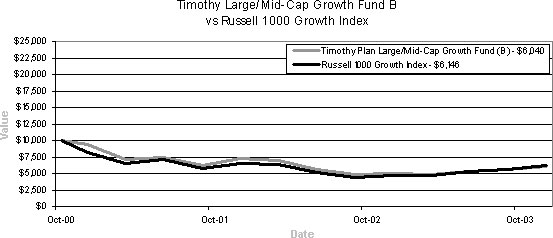

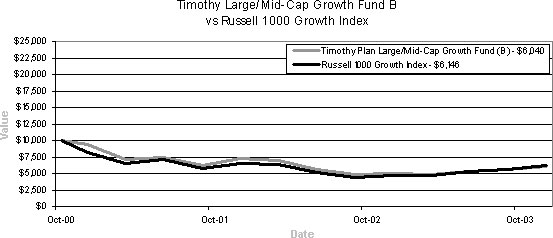

Timothy Large/Mid Cap Growth Fund – Class B (j) (With CDSC) | | 13.40 | % | | N/A | | -15.00 | % |

Russell 1000 Growth Index (j) | | 29.75 | % | | N/A | | -14.00 | % |

| (i) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

| (j) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell 1000 Growth Index on October 5, 2000 and held through December 31, 2003. The Russell 1000 Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [10]

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN LARGE/MID CAP GROWTH FUND

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Russell 1000 Growth Index on October 9, 2000 and held through December 31, 2003. The Russell 1000 Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [11]

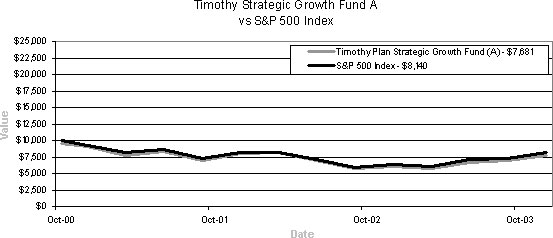

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN STRATEGIC GROWTH FUND

| | | | | | | | |

Fund/Index

| | 12 Month Total Return

| | | 5 Year Average

Annual Return

| | Average Annual

Total Return Since Inception

| |

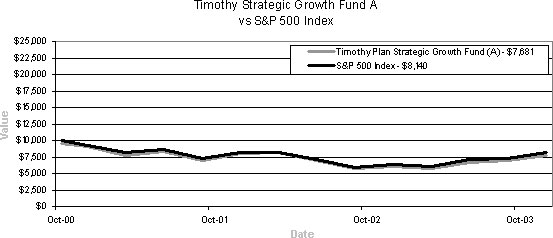

Timothy Strategic Growth Fund – Class A (m) (With sales charge) | | 21.09 | % | | N/A | | -7.84 | % |

S&P 500 Index (m) | | 28.69 | % | | N/A | | -6.16 | % |

Timothy Strategic Growth Fund – Class B (n) (With CDSC) | | 20.23 | % | | N/A | | -7.54 | % |

S&P 500 Index (n) | | 28.69 | % | | N/A | | -5.47 | % |

| (m) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

| (n) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on October 5, 2000 and held through December 31, 2003. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [12]

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN STRATEGIC GROWTH FUND

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the S&P 500 Index on October 9, 2000 and held through December 31, 2003. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [13]

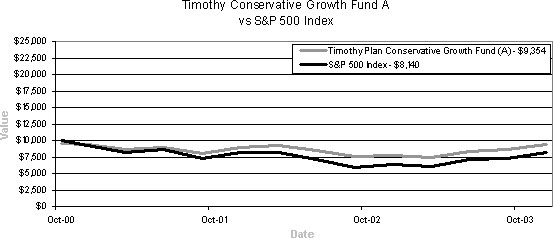

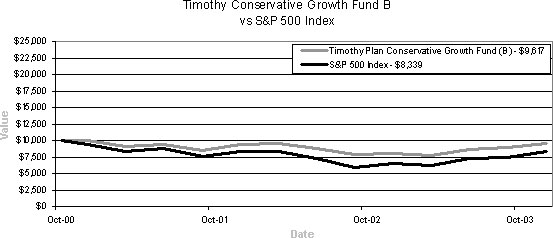

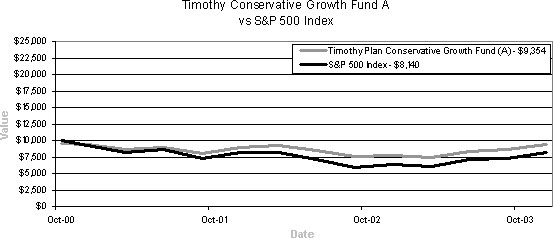

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN CONSERVATIVE GROWTH FUND

| | | | | | | | |

Fund/Index

| | 12 Month Total Return

| | | 5 Year Average

Annual Return

| | Average Annual

Total Return Since Inception

| |

Timothy Conservative Growth Fund – Class A (k) (With sales charge) | | 13.91 | % | | N/A | | -2.05 | % |

S&P 500 Index (k) | | 28.69 | % | | N/A | | -6.16 | % |

Timothy Conservative Growth Fund – Class B (l) (With CDSC) | | 14.20 | % | | N/A | | -1.81 | % |

S&P 500 Index (l) | | 28.69 | % | | N/A | | -5.47 | % |

| (k) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

| (l) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2003. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on October 5, 2000 and held through December 31, 2003. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [14]

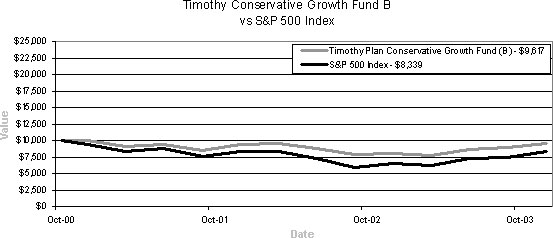

RETURNS FOR THE YEAR ENDED

December 31, 2003

TIMOTHY PLAN CONSERVATIVE GROWTH FUND

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the S&P 500 Index on October 9, 2000 and held through December 31, 2003. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [15]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2003

TIMOTHY PLAN FAMILY OF FUNDS

| | | | | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Arthur D. Ally* 1304 W Fairbanks Avenue Winter Park, FL | | Chairman and President | | Indefinite; Trustee and President since 1994 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1942 | | President and controlling shareholder of Covenant Funds, Inc. (“CFI”), a holding company. President and general partner of Timothy Partners, Ltd. (“TPL”), the investment adviser and principal underwriter to each Fund. CFI is also the managing general partner of TPL. | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Joseph E. Boatwright** 1410 Hyde Park Drive Winter Park, FL | | Trustee, Secretary | | Indefinite; Trustee and Secretary since 1995 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1930 | | Retired Minister. Currently serves as a consultant to the Greater Orlando Baptist Association. Served as Senior Pastor to Aloma Baptist Church from 1970-1996. | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Jock M. Sneddon** 6001 Vineland Drive Orlando, FL | | Trustee | | Indefinite; Trustee since 1997 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

| | | Physician, Florida Hospital Centra Care. | | None |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [16]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2003

TIMOTHY PLAN FAMILY OF FUNDS

| | | | | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Mathew D. Staver** 210 East Palmetto Avenue Longwood, FL 32750 | | Trustee | | Indefinite; Trustee since 2000 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1956 | | Attorney specializing in free speech, appellate practice and religious liberty constitutional law. Founder of Liberty Counsel, a religious civil liberties education and legal defense organization. Host of two radio programs devoted to religious freedom issues. Editor of a monthly newsletter devoted to religious liberty topics. Mr. Staver has argued before the United States Supreme Court and has published numerous legal articles. | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Bill Dodson 7120 N Whitney Avenue Fresno, CA 93720 | | Trustee | | Trustee from 2001 - 12/01/03 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1960 | | Vice President – Sales, CPCF, Inc. a registered broker-dealer and a subsidiary of the California Baptist Foundation and the California Southern Baptist Convention. Mr. Dodson is a General Securities Principal (Series 24) and licensed minister. Mr. Dodson has previous experience as a General Securities Representative (Series 7) with two national brokerage firms. | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

W. Thomas Fyler, Jr. 640 Ft. Washington Avenue Suite 6C New York, NY 10040 | | Trustee | | Trustee from 1998 - 12/01/03 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1957 | | President, controlling shareholder of W.T. Fyler, Jr./Ephesus, Inc., a New York State registered investment advisory firm. Founding member of the National Association of Christian Financial Consultants. | | None |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [17]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2003

TIMOTHY PLAN FAMILY OF FUNDS

| | | | | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Mark A. Minnella 1215 Fern Ridge Parkway Suite 110 Creve Coeur, MO 63141 | | Trustee | | Trustee from 2000 - 12/01/03 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1955 | | Principal and co-founder of Integrity Investors, LLC., a registered investment advisory firm. Co-founder, President and director of the National Association of Christian Financial Consultants. Mr. Minnella is a Registered Investment Principal (NASD Series 24), and a registered investment adviser (NASD Series 65). | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Charles E. Nelson 1145 Cross Creek Circle Altamonte Springs, FL | | Trustee | | Indefinite; Trustee since 2000 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1934 | | Certified Public Accountant. Director of Operations, National Multiple Sclerosis Society Mid Florida Chapter. Formerly Director of Finance, Hospice of the Comforter, Inc. Formerly Comptroller, Florida United Methodist Children’s Home, Inc. Formerly Credit Specialist with the Resolution Trust Corporation and Senior Executive Vice President, Barnett Bank of Central Florida, N.A. Formerly managing partner, Arthur Andersen, CPA firm, Orlando, Florida branch. | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Wesley W. Pennington 442 Raymond Avenue Longwood, FL | | Trustee | | Indefinite; Trustee and Treasurer since 1994 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1930 | | Retired Air Force Officer. Past President, Westwind Holdings, Inc., a development company, since 1997. Past President and controlling shareholder, Weston, Inc., a fabric treatment company, form 1979-1997. President, Designer Services Group 1980-1988. | | None |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [18]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2003

TIMOTHY PLAN FAMILY OF FUNDS

| | | | | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Scott Preissler, Ph.D. P O Box 50434 Indianapolis, IN 46250 | | Trustee | | Indefinate; New as of 1/1/04 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1960 | | President and CEO of Christian Stewardship Association where he has been affiliated for the past 14 years. | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Alan M. Ross 11210 West Road Roswell, Ga 30075 | | Trustee | | Indefinate; New as of 1/1/04 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1951 | | Founder and CEO of Corporate Development Institute which he founded five years ago. Previously he served as President and CEO of Fellowship of Companies for Christ and has authored three books: Beyond World Class, Unconditional Excellence, Breaking Through to Prosperity. | | None |

| | | |

Name, Age and Address

| | Position(s) Held With Trust

| | Term of Office and Length of Time Served

| | Number of Portfolios in Fund

Complex Overseen by Trustee

|

Robert Scraper P O Box 1315 Houston, Tx 77251 | | Trustee | | Indefinate; New as of 1/1/04 | | 11 |

| | | Principal Occupation During Past 5 Years

| | Other Directorships Held by Trustee

|

Born: 1946 | | Senior Vice President - Investments for Frost National Bank of Texas since 1987. | | None |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [19]

LETTER FROM THE MANAGER

December 31, 2003

SMALL CAP VALUE FUND

For 2003, the Timothy Plan returned 38.81% versus 47.25% for the Russell 2000. As you can see, the year 2003 turned out to be a challenging year for us in terms of outperforming the Russell 2000.

The crux of the performance issue was confined to the early part of the year: during that period, there was a capitulation decline followed by a significant short covering rally in the equity markets, where the stocks that had gone down the most from 3/00 through 3/03 went up the most; low quality stocks did well; high valuation stocks did well; high volatility stocks did well; the stocks of companies who lose money did well.

It was very difficult to outperform the Russell 2000 during this period if one owned high quality stocks (as the Timothy Plan Small Cap Value Fund does) and if one exercised price disciplines, which Awad did.

The remainder of the year was more of a traditional relative value environment and during this period, Timothy performed competitively relative to the Russell 2000.

The current consensus is that 2004 will bring another good year. Of course, the consensus can always be wrong.

Looking at both positives and negatives on the horizon, it seems to me that the prudent approach is to be carefully optimistic by sticking to companies with good balance sheets, sound business models, understandable accounting, good governance and attractive valuations. Our goal, and our strategy, is to position the Fund to benefit from such a portfolio structure.

James D. Awad

Chairman

Awad Asset Management

Letter From The Manager [20]

SCHEDULE OF INVESTMENTS

As of December 31, 2003

COMMON STOCKS - 94.74%

| | | | | |

number of shares

| | | | market value

|

| | | | | | |

| | | APPLICATION SOFTWARE - 2.21% | | | |

33,000 | | BARRA, Inc. | | $ | 1,171,170 |

| | | | |

|

|

| | | BALL & ROLLER BEARINGS - 3.20% | | | |

65,600 | | Kaydon Corp. | | | 1,695,104 |

| | | | |

|

|

| | | CANNED, FROZEN & PRESERVED FRUIT, VEGETABLES & FOOD SPECIALTIES - 2.47% | | | |

38,000 | | Corn Products International, Inc. | | | 1,309,100 |

| | | | |

|

|

| | | CONSUMER CREDIT REPORTING, COLLECTION AGENCIES - 3.14% | | | |

72,900 | | NCO Group, Inc. * | | | 1,659,933 |

| | | | |

|

|

| | | DIVERSIFIED HOLDINGS - 1.89% | | | |

100,000 | | Quanta Holdings ^ | | | 1,000,000 |

| | | | |

|

|

| | | ELECTRIC & OTHER SERVICES COMBINED - 3.44% | | | |

59,500 | | ALLETE, Inc. | | | 1,820,700 |

| | | | |

|

|

| | | HEALTH CARE SOFTWARE - 3.04% | | | |

60,000 | | Covance Inc. * | | | 1,608,000 |

| | | | |

|

|

| | | HEALTH CARE SUPPLIES - 1.07% | | | |

30,000 | | Sola International Inc. * | | | 564,000 |

| | | | |

|

|

| | | INVESTMENT COMPANIES - 2.58% | | | |

70,000 | | MCG Capital Corp. | | | 1,365,000 |

| | | | |

|

|

| | | MEDICAL SERVICES - 3.50% | | | |

75,000 | | Inverseek Research Group, Inc. * | | | 1,854,750 |

| | | | |

|

|

| | | MISCELLANEOUS ELECTRICAL MACHINERY, EQUIPMENT & SUPPLIES - 4.12% | | | |

104,000 | | Rayovac Corp. * | | | 2,178,800 |

| | | | |

|

|

| | | MISCELLANEOUS PLASTIC PRODUCTS - 4.19% | | | |

90,000 | | Spartech Corp. | | | 2,217,600 |

| | | | |

|

|

| | | PHARMACEUTICAL PREPARATIONS - 2.18% | | | |

45,300 | | K-V Pharmaceutical Co. - Class A * | | | 1,155,150 |

| | | | |

|

|

| | | PHOTOGRAPHIC EQUIPMENT & SUPPLIES - 1.60% | | | |

91,800 | | Concord Camera Corp. * | | | 849,150 |

| | | | |

|

|

| | | PUBLISHING - 4.19% | | | |

63,000 | | Interactive Data Corporation * | | | 1,043,280 |

45,000 | | John Wiley & Sons, Inc., Class A | | | 1,171,350 |

| | | | |

|

|

| | | | | | 2,214,630 |

| | | | |

|

|

| | | REIT - HOTELS - 2.06% | | | |

100,000 | | Highland Hospitality Corp.* | | | 1,090,000 |

| | | | |

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [21]

SCHEDULE OF INVESTMENTS

As of December 31, 2003

COMMON STOCKS - 94.74% (cont.)

| | | | | |

number of shares

| | | | market value

|

| | | RETAIL-EATING PLACES - 5.47% | | | |

62,000 | | Brinker Intl, Inc. * | | $ | 2,055,920 |

29,500 | | Ruby Tuesday, Inc. | | | 840,455 |

| | | | |

|

|

| | | | | | 2,896,375 |

| | | | |

|

|

| | | RETAIL-FAMILY CLOTHING STORES - 3.41% | | | |

64,700 | | Stage Stores, Inc. * | | | 1,805,130 |

| | | | |

|

|

| | | SERVICES - BUSINESS SERVICES - 7.15% | | | |

68,000 | | Sourcecorp,Inc. * | | | 1,742,840 |

50,000 | | Startek, Inc. | | | 2,039,500 |

| | | | |

|

|

| | | | | | 3,782,340 |

| | | | |

|

|

| | | SERVICES - DATA PROCESSING - 5.21% | | | |

57,500 | | Ceridian Corporation * | | | 1,204,050 |

119,000 | | infoUSA, Inc. * | | | 882,980 |

45,000 | | The BISYS Group, Inc.* | | | 669,600 |

| | | | |

|

|

| | | | | | 2,756,630 |

| | | | |

|

|

| | | SERVICES - DIVERSIFIED/COMMERCIAL - 3.93% | | | |

92,000 | | The Brink’s Company | | | 2,080,120 |

| | | | |

|

|

| | | SPECIAL INDUSTRY MACHINERY - 2.76% | | | |

143,000 | | Axcelis Technologies, Inc. * | | | 1,461,460 |

| | | | |

|

|

| | | SPECIALTY STORES - 5.71% | | | |

48,500 | | Sonic Automotive, Inc. | | | 1,111,620 |

61,000 | | United Auto Group, Inc. | | | 1,909,300 |

| | | | |

|

|

| | | | | | 3,020,920 |

| | | | |

|

|

| | | STATE COMMERCIAL BANKS - 3.21% | | | |

42,000 | | North Fork Bancorp, Inc. | | | 1,699,740 |

| | | | |

|

|

| | | TECHNOLOGY DISTRIBUTION - 2.10% | | | |

28,000 | | Tech Data Corporation * | | | 1,111,320 |

| | | | |

|

|

| | | TELEPHONE & TELEGRAPH APPARATUS - 3.39% | | | |

55,000 | | Plantronics, Inc. * | | | 1,795,750 |

| | | | |

|

|

| | | TELECOMMUNICATIONS - 4.28% | | | |

39,500 | | Allstream, Inc. Cl B Ltd Voting | | | 2,265,325 |

| | | | |

|

|

| | | THRIFTS & MORTGAGE FINANCE - 3.24% | | | |

46,000 | | The PMI Group, Inc. | | | 1,712,580 |

| | | | |

|

|

| | | Total Common Stocks (cost $37,631,989) | | | 50,140,777 |

| | | | |

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [22]

SCHEDULE OF INVESTMENTS

As of December 31, 2003

SHORT-TERM INVESTMENTS - 5.29%

| | | | | | |

number of shares

| | | | market value

| |

479,541 | | Federated Cash Trust Series II Treasury | | $ | 479,541 | |

2,319,030 | | First American Treasury Obligations Fund Class A | | | 2,319,030 | |

| | | | |

|

|

|

| | | Total Short-Term Investments (cost $2,798,571) | | | 2,798,571 | |

| | | | |

|

|

|

| | | TOTAL INVESTMENTS - 100.03% (identified cost $40,430,560) | | | 52,939,348 | |

| | | LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.03)% | | | (16,833 | ) |

| | | | |

|

|

|

| | | NET ASSETS - 100.00% | | $ | 52,922,515 | |

| | | | |

|

|

|

| * | Non-income producing securities |

| ^ | SEC Rule 144A security. Such securities are traded only among qualified institutional buyers. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [23]

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2003

ASSETS

| | | |

| | | amount

|

Investments in Securities at Value (identified cost $40,430,560) [NOTE 1] | | $ | 52,939,348 |

| |

Receivables: | | | |

Interest | | | 808 |

Dividends | | | 198,243 |

Fund Shares Sold | | | 68,881 |

| | |

|

|

Total Assets | | $ | 53,207,280 |

| | |

|

|

| |

LIABILITIES | | | |

| |

| | | amount

|

Accrued Advisory Fees | | | 37,358 |

Accrued 12b-1 Fees | | | 22,668 |

Payable for Fund Shares Redeemed | | | 177,667 |

Accrued Expenses | | | 47,072 |

| | |

|

|

Total Liabilities | | $ | 284,765 |

| | |

|

|

| |

NET ASSETS | | | |

| |

| | | amount

|

Class A Shares: | | | |

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 2,212,202 shares outstanding) | | $ | 34,184,840 |

Net Asset Value and Redemption Price Per Class A Share ($34,184,840/2,212,202 shares) | | $ | 15.45 |

Offering Price Per Share ($15.45/0.9475) | | $ | 16.31 |

Class B Shares: | | | |

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 1,284,314 shares outstanding) | | $ | 18,737,675 |

Net Asset Value and Offering Price Per Class B Share ($18,737,675/1,284,314 shares) | | $ | 14.59 |

Maximum Redemption Price Per Class B Share ($14.59 x 0.95) | | $ | 13.86 |

| |

Net Assets | | $ | 52,922,515 |

| | |

|

|

| |

SOURCES OF NET ASSETS | | | |

| |

| | | amount

|

At December 31, 2003, Net Assets Consisted of: | | | |

Paid-in Capital | | $ | 40,070,284 |

Accumulated Net Realized Gain on Investments | | | 343,443 |

Net Unrealized Appreciation in Value of Investments | | | 12,508,788 |

| | |

|

|

Net Assets | | $ | 52,922,515 |

| | |

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [24]

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2003

INVESTMENT INCOME

| | | | |

| | | amount

| |

Interest | | $ | 15,929 | |

Dividends | | | 457,008 | |

| | |

|

|

|

Total Investment Income | | | 472,937 | |

| | |

|

|

|

| |

EXPENSES | | | | |

| |

| | | amount

| |

Investment Advisory Fees [NOTE 3] | | | 358,203 | |

Fund Accounting, Transfer Agency, & Administration Fees | | | 133,681 | |

12b-1 Fess (Class A = $66,308, Class B =$116,605) [NOTE 3] | | | 182,913 | |

Service Fees (Class B) [NOTE 3] | | | 38,868 | |

Auditing Fees | | | 30,079 | |

Legal Expense | | | 4,620 | |

Registration Fees | | | 38,925 | |

Insurance Expense | | | 5,524 | |

Custodian Fees | | | 14,956 | |

Printing Expense | | | 10,455 | |

Miscellaneous Expense | | | 16,066 | |

| | |

|

|

|

Total Net Expenses | | | 834,290 | |

| | |

|

|

|

Net Investment (Loss) | | | (361,353 | ) |

| | |

|

|

|

| |

REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| |

| | | amount

| |

Net Realized Gain on Investments | | | 404,190 | |

Change in Unrealized Appreciation of Investments | | | 14,360,903 | |

| | |

|

|

|

Net Realized and Unrealized Gain on Investments | | | 14,765,093 | |

| | |

|

|

|

Increase in Net Assets Resulting from Operations | | $ | 14,403,740 | |

| | |

|

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [25]

STATEMENT OF CHANGES IN NET ASSETS

INCREASE (DECREASE) IN NET ASSETS

| | | | | | | | |

| | | year ended

12/31/03

| | | year ended

12/31/02

| |

Operations: | | | | | | | | |

Net Investment Income (Loss) | | $ | (361,353 | ) | | $ | (289,491 | ) |

Net Change in Unrealized Appreciation (Depreciation) of Investments | | | 14,360,903 | | | | (8,276,735 | ) |

Net Realized Gain (Loss) on Investments | | | 404,190 | | | | (42,848 | ) |

| | |

|

|

| |

|

|

|

Increase (Decrease) in Net Assets (resulting from operations) | | | 14,403,740 | | | | (8,609,074 | ) |

| | |

|

|

| |

|

|

|

Distributions to Shareholders From: | | | | | | | | |

Net Capital Gains: | | | | | | | | |

Class A | | | — | | | | (10,661 | ) |

Class B | | | — | | | | (7,238 | ) |

| | |

|

|

| |

|

|

|

Total Net Distributions | | | — | | | | (17,899 | ) |

| | |

|

|

| |

|

|

|

Capital Share Transactions: | | | | | | | | |

Proceeds from Shares Sold: | | | | | | | | |

Class A | | | 5,160,950 | | | | 9,346,918 | |

Class B | | | 1,586,031 | | | | 3,251,284 | |

Dividends Reinvested: | | | | | | | | |

Class A | | | — | | | | 7,026 | |

Class B | | | — | | | | 6,948 | |

Cost of Shares Redeemed: | | | | | | | | |

Class A | | | (2,831,326 | ) | | | (3,430,730 | ) |

Class B | | | (2,509,798 | ) | | | (2,724,918 | ) |

| | |

|

|

| |

|

|

|

Increase in Net Assets (resulting from capital share transactions) | | | 1,405,857 | | | | 6,456,528 | |

| | |

|

|

| |

|

|

|

Total Increase (Decrease) in Net Assets | | | 15,809,597 | | | | (2,170,445 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of Year | | | 37,112,918 | | | | 39,283,363 | |

| | |

|

|

| |

|

|

|

End of Year | | $ | 52,922,515 | | | $ | 37,112,918 | |

| | |

|

|

| |

|

|

|

Shares of Capital Stock of the Fund Sold and Redeemed: | | | | | | | | |

Shares Sold: | | | | | | | | |

Class A | | | 413,932 | | | | 728,940 | |

Class B | | | 134,512 | | | | 257,853 | |

Shares Reinvested: | | | | | | | | |

Class A | | | — | | | | 632 | |

Class B | | | — | | | | 657 | |

Shares Redeemed: | | | | | | | | |

Class A | | | (233,248 | ) | | | (267,247 | ) |

Class B | | | (220,892 | ) | | | (223,459 | ) |

| | |

|

|

| |

|

|

|

Net Increase in Number of Shares Outstanding | | | 94,304 | | | | 497,376 | |

| | |

|

|

| |

|

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [26]

FINANCIAL HIGHLIGHTS

The table below set forth financial data for one share of capital stock outstanding throughout each year presented.

SMALL-CAP VALUE FUND - CLASS A SHARES

| | | | | | | | | | | | | | | | | | | | |

| | | year

ended

12/31/03

| | | year

ended

12/31/02

| | | year

ended

12/31/01

| | | year

ended

12/31/00

| | | year

ended

12/31/99

| |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value at Beginning of Year | | $ | 11.13 | | | $ | 13.79 | | | $ | 12.61 | | | $ | 12.26 | | | $ | 10.89 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | (0.07 | ) | | | (0.05 | ) | | | (0.09 | ) | | | (0.05 | ) | | | (0.02 | ) |

Net Realized and Unrealized Gain (Loss) on Investments | | | 4.39 | | | | (2.60 | ) | | | 1.30 | | | | 1.43 | | | | 1.39 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | 4.32 | | | | (2.65 | ) | | | 1.21 | | | | 1.38 | | | | 1.37 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less Distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from Realized Gains | | | — | | | | (0.01 | ) | | | (0.03 | ) | | | (1.03 | ) | | | — | |

Dividends from Net Investment Income | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Distributions | | | — | | | | (0.01 | ) | | | (0.03 | ) | | | (1.03 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value at End of Year | | $ | 15.45 | | | $ | 11.13 | | | $ | 13.79 | | | $ | 12.61 | | | $ | 12.26 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return (A) | | | 38.81 | % | | | (19.25 | )% | | | 9.66 | % | | | 11.23 | % | | | 12.58 | % |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (in 000s) | | $ | 34,185 | | | $ | 22,603 | | | $ | 21,632 | | | $ | 15,217 | | | $ | 13,377 | |

| | | | | |

Ratio of Expenses to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Before Reimbursement of Expenses by Advisor | | | 1.71 | % | | | 1.75 | % | | | 1.89 | % | | | 1.97 | % | | | 2.22 | % |

After Reimbursement of Expenses by Advisor | | | 1.71 | % | | | 1.75 | % | | | 1.89 | % | | | 1.76 | % | | | 1.60 | % |

| | | | | |

Ratio of Net Investment (Loss) to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Before Reimbursement of Expenses by Advisor | | | (0.55 | )% | | | (0.46 | )% | | | (0.80 | )% | | | (0.48 | )% | | | (0.82 | )% |

After Reimbursement of Expenses by Advisor | | | (0.55 | )% | | | (0.46 | )% | | | (0.80 | )% | | | (0.27 | )% | | | (0.20 | )% |

| | | | | |

Portfolio Turnover | | | 47.99 | % | | | 66.95 | % | | | 61.41 | % | | | 99.17 | % | | | 78.79 | % |

| (A) | Total Return Calculation Does Not Reflect Sales Load. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [27]

FINANCIAL HIGHLIGHTS

The table below set forth financial data for one share of capital stock outstanding throughout each year presented.

SMALL-CAP VALUE FUND - CLASS B SHARES

| | | | | | | | | | | | | | | | | | | | |

| | | year

ended

12/31/03

| | | year

ended

12/31/02

| | | year

ended

12/31/01

| | | year

ended

12/31/00

| | | year

ended

12/31/99

| |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value at Beginning of Year | | $ | 10.59 | | | $ | 13.22 | | | $ | 12.19 | | | $ | 11.88 | | | $ | 10.70 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | (0.16 | ) | | | (0.14 | ) | | | (0.22 | ) | | | (0.10 | ) | | | (0.11 | ) |

Net Realized and Unrealized Gain (Loss) on Investments | | | 4.16 | | | | (2.48 | ) | | | 1.28 | | | | 1.39 | | | | 1.29 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | 4.00 | | | | (2.62 | ) | | | 1.06 | | | | 1.29 | | | | 1.18 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less Distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from Realized Gains | | | — | | | | (0.01 | ) | | | (0.03 | ) | | | (0.98 | ) | | | — | |

Dividends from Net Investment Income | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Distributions | | | — | | | | (0.01 | ) | | | (0.03 | ) | | | (0.98 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value at End of Year | | $ | 14.59 | | | $ | 10.59 | | | $ | 13.22 | | | $ | 12.19 | | | $ | 11.88 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return (A) | | | 37.77 | % | | | (19.85 | )% | | | 8.77 | % | | | 10.87 | % | | | 11.03 | % |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (in 000s) | | $ | 18,738 | | | $ | 14,509 | | | $ | 17,651 | | | $ | 16,631 | | | $ | 14,351 | |

| | | | | |

Ratio of Expenses to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Before Reimbursement of Expenses by Advisor | | | 2.47 | % | | | 2.49 | % | | | 2.72 | % | | | 2.72 | % | | | 2.72 | % |

After Reimbursement of Expenses by Advisor | | | 2.47 | % | | | 2.49 | % | | | 2.72 | % | | | 2.51 | % | | | 2.35 | % |

| | | | | |

Ratio of Net Investment Income (Loss) to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Before Reimbursement of Expenses by Advisor | | | (1.39 | )% | | | (1.12 | )% | | | (1.78 | )% | | | (1.23 | )% | | | (1.34 | )% |

After Reimbursement of Expenses by Advisor | | | (1.39 | )% | | | (1.12 | )% | | | (1.78 | )% | | | (1.02 | )% | | | (0.97 | )% |

| | | | | |

Portfolio Turnover | | | 47.99 | % | | | 66.95 | % | | | 61.41 | % | | | 99.17 | % | | | 78.79 | % |

| (A) | Total Return Calculation Does Not Reflect Redemption Fee. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [28]

LETTER FROM THE MANAGER

December 31, 2003

LARGE/MID CAP VALUE FUND

The Timothy Large/Mid-Cap Value Fund posted a solid gain in 2003, slightly lagging the surging S&P 500 and Russell 1000 Value indices. The market was led by lower-quality companies, many of which participate in the technology and telecom sectors, as speculation trumped investment. We were under-weighted in these sectors, but are confident that the market will rotate, once again, toward higher-quality issues. In this regard, we were pleased with the fund’s overall performance given our focus on higher-quality stocks and look forward to coming periods.

From the depths of despair at the end of March, the stock market roared to a strong year as it climbed the proverbial “wall of worry” yet again. The economic highlight of the year was a sparkling 8.2% GDP number for the third quarter, which was reflected in stronger-than-expected corporate earnings growth. More importantly, revenue growth was apparent throughout a broad spectrum of companies, which should quell concerns that recent earnings gains were largely driven by cost cuts and that earnings growth could not be sustained on cost cutting alone. This, in turn, led to continued exceptional productivity gains. Finally, various job growth statistics gained traction such that, by year-end, investors, economists and consumers were all in a holiday mood. Even scrooge-like corporate chieftains and CFOs were talking about increased capital investment for 2004.

What is most amazing is the huge rise in confidence that we will experience sustainable domestic economic growth in the 4% range for the year 2004 in what is now increasingly being viewed as a synchronized global recovery. There exist signs of a 10% increase in capital expenditures for 2004, when just a few months ago anything more than a nominal increase seemed problematic. The ISM manufacturing report for December had the factory index at the highest reading for this particular index since 1983. All major component indexes, including production and orders, showed increases, while inventories and imports showed a decline. That certainly bodes well for increased production and job growth in the first quarter of 2004. The tax cuts, low interest rates, low inflation and deficit spending have certainly ignited the economy.

Clearly, monetary and fiscal policies remain stimulative. The real Fed Funds rate (the nominal rate less inflation) is still negative, and the fiscal stimulus put in place last year with the third tax cut by the Bush Administration should provide one more kick when tax refunds are sent in the first half of 2004. Accelerated depreciation allowances for capital investment should contribute to economic activity. Although job growth was problematic in 2003, the situation is likely to improve as productivity decelerates and corporate profit gains embolden CEOs.

Going forward, we anticipate the economy will post solid growth and continue to broaden. We expect the market to continue to perform well relative to fixed income and other assets, and that healthcare, which lagged in 2003, and energy issues should perform well in 2004. Finally, as mentioned above, we anticipate a rotation from lower-quality to higher-quality issues during the new year.

Fox Asset Management LLC

Letter From The Manager [29]

SCHEDULE OF INVESTMENTS

As of December 31, 2003

COMMON STOCKS - 87.82%

| | | | |

number of shares

| | | | market value

|

| | | COMPUTERS - MEMORY DEVICES - 1.02% | | |

30,000 | | Western Digital Corp.* | | $353,700 |

| | | | |

|

| | | CRUDE PETROLEUM & NATURAL GAS - 5.63% | | |

18,000 | | Anadarko Petroleum Corp. | | 918,180 |

12,705 | | Apache Corp. | | 1,030,376 |

| | | | |

|

| | | | | 1,948,556 |

| | | | |

|

| | | DRUG DISTRIBUTION - 4.93% | | |

13,000 | | AmerisourceBergen Corporation | | 729,950 |

16,000 | | Cardinal Health, Inc. | | 978,560 |

| | | | |

|

| | | | | 1,708,510 |

| | | | |

|

| | | ELECTRIC LIGHTING & WIRING EQUIPMENT - 2.17% | | |

13,000 | | Cooper Industries, Inc., Class A | | 753,090 |

| | | | |

|

| | | ELECTRIC SERVICES - 1.76% | | |

20,000 | | American Electric Power Co., Inc. | | 610,200 |

| | | | |

|

| | | ELECTRONIC INSTRUMENTS - 1.87% | | |

10,000 | | Emerson Electric Co. | | 647,500 |

| | | | |

|

| | | ENERGY - 1.97% | | |

13,000 | | Royal Dutch Petroleum Company GDR | | 681,070 |

| | | | |

|

| | | GENERAL INDUSTRIAL MACHINERY & EQUIPMENT - 3.14% | | |

16,000 | | Ingersoll-Rand Company Ltd. | | 1,086,080 |

| | | | |

|

| | | INSURANCE - 5.72% | | |

25,000 | | Dean Fods Co.* | | 821,750 |

20,000 | | PartnerRe Ltd. | | 1,161,000 |

| | | | |

|

| | | | | 1,982,750 |

| | | | |

|

| | | MEDICAL - HOSPITALS - 5.18% | | |

35,000 | | Community Health Care* | | 930,300 |

36,000 | | Health Management Associates, Inc. | | 864,000 |

| | | | |

|

| | | | | 1,794,300 |

| | | | |

|

| | | METAL MINING - 1.93% | | |

6,000 | | Rio Tinto Plc (a) | | 667,860 |

| | | | |

|

| | | MILLWOOD, VENEER, PLYWOOD & STRUCTURAL WOOD MEMBERS - 2.83% | | |

35,700 | | Masco Corp. | | 978,537 |

| | | | |

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [30]

SCHEDULE OF INVESTMENTS

As of December 31, 2003

COMMON STOCKS - 87.82% (Cont.)

| | | | | |

number of shares

| | | | market value

|

| | | MISCELLANEOUS CHEMICAL PRODUCTS - 1.65% | | | |

18,000 | | Cabot Corp. | | $ | 573,120 |

| | | | |

|

|

| | | MISCELLANEOUS INDUSTRIAL & COMMERCIAL MACHINERY & EQUIPMENT - 2.57% | | | |

12,000 | | ITT Industries, Inc. | | | 890,520 |

| | | | |

|

|

| | | MISCELLANEOUS SHOPPING GOODS STORES - 1.16% | | | |

24,000 | | Office Depot, Inc. * | | | 401,040 |

| | | | |

|

|

| | | NATIONAL COMMERCIAL BANKS - 3.88% | | | |

15,000 | | Compass Bancshares, Inc. | | | 589,650 |

23,000 | | SouthTrust Corp. | | | 752,790 |

| | | | |

|

|

| | | | | | 1,342,440 |

| | | | |

|

|

| | | NATURAL GAS TRANSMISSION & DISTRIBUTION - 1.86% | | | |

15,000 | | Equitable Resources, Inc. | | | 643,800 |

| | | | |

|

|

| | | OIL COMPANY - EXPLORATION & PRODUCTION - 2.15% | | | |

13,000 | | Devon Energy Corp. | | | 744,380 |

| | | | |

|

|

| | | PUBLIC BUILDING AND RELATED FURNITURE - 2.48% | | | |

14,000 | | Lear Corp. | | | 858,620 |

| | | | |

|

|

| | | RADIO TELEPHONE COMMUNICATIONS - 2.58% | | | |

14,000 | | Dominion Resources, Inc. | | | 893,620 |

| | | | |

|

|

| | | REAL ESTATE INVESTMENT TRUSTS - 1.80% | | | |

15,000 | | Mack-Cali Realty Corp. | | | 624,300 |

| | | | |

|

|

| | | RETAIL - DRUG STORES & PROPRIETARY STORES - 3.75% | | | |

36,000 | | CVS Corp. | | | 1,300,320 |

| | | | |

|

|

| | | RETAIL-EATING PLACES - 2.55% | | | |

20,000 | | Outback Steakhouse, Inc. | | | 884,200 |

| | | | |

|

|

| | | RETAIL-GROCERY STORES - 2.67% | | | |

50,000 | | Kroger Co. * | | | 925,500 |

| | | | |

|

|

| | | SCIENTIFIC INSTRUMENTS- 1.92% | | | |

20,000 | | Waters Corp.* | | | 663,200 |

| | | | |

|

|

| | | SPECIAL INDUSTRY MACHINERY - 1.63% | | | |

20,000 | | Veeco Instruments, Inc. * | | | 564,000 |

| | | | |

|

|

| | | STATE COMMERCIAL BANK - 2.84% | | | |

15,000 | | Bank of New York, Inc. | | | 496,800 |

28,000 | | The Colonial Bancgroup, Inc. | | | 484,960 |

| | | | |

|

|

| | | | | | 981,760 |

| | | | |

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [31]

SCHEDULE OF INVESTMENTS

As of December 31, 2003

COMMON STOCKS - 87.82% (Cont.)

| | | | | |

number of shares

| | | | market value

|

| | | SURETY INSURANCE - 2.65% | | | |

15,500 | | MBIA, Inc. | | $ | 918,065 |

| | | | |

|

|

| | | TRANSPORTATION - RAILROAD - 3.87% | | | |

15,000 | | Canadian Pacific Railway Ltd | | | 422,250 |

13,200 | | Union Pacific Corp. | | | 917,136 |

| | | | |

|

|

| | | | | | 1,339,386 |

| | | | |

|

|

| | | UNSUPPORTED PLASTICS FILM & SHEET - 3.44% | | | |

22,000 | | Sealed Air Corp. * | | | 1,191,080 |

| | | | |

|

|

| | | UTILITIES - 1.90% | | | |

15,000 | | Public Service Enterprise Group Incorporated | | | 657,000 |

| | | | |

|

|

| | | WHOLESALE-DRUGS PROPRIETARIES & DRUGGISTS’ SUNDRIES - 2.32% | | | |

25,000 | | McKesson Corp. | | | 804,000 |

| | | | |

|

|

| | | Total Common Stocks (cost $24,018,448) | | | 30,412,504 |

| | | | |

|

|

SHORT-TERM INVESTMENTS - 8.84% | | | |

number of shares

| | | | market value

|

1,530,000 | | Federated Cash Trust Series II Treasury Fund | | | 1,530,000 |

1,530,000 | | First American Treasury Obligations Fund, Class A | | | 1,530,000 |

| | | | |

|

|

| | | Total Short-Term Investments (cost $3,060,000) | | | 3,060,000 |

| | | | |

|

|

| | | TOTAL INVESTMENTS - 96.66% (identified cost $27,078,448) | | | 33,472,504 |

| | | OTHER ASSETS AND LIABILITIES, NET - 3.34% | | | 1,157,897 |

| | | | |

|

|

| | | NET ASSETS - 100.00% | | $ | 34,630,401 |

| | | | |

|

|

| * | Non-income producing securities |

| (a) | American Depositary Receipt |

| GDR | - Global Depositary Receipt |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [32]

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2003

ASSETS

| | | | |

| | | amount

| |

Investments in Securities at Value (identified cost $27,078,448) [NOTE 1] | | $ | 33,472,504 | |

Cash | | | 1,034,469 | |

Receivables: | | | | |

Interest | | | 654 | |

Dividends | | | 28,767 | |

Fund Shares Sold | | | 154,885 | |

Fund Shares Commission Receivable from Advisor | | | 1,535 | |

| | |

|

|

|

Total Assets | | $ | 34,692,814 | |

| | |

|

|

|

| |

LIABILITIES | | | | |

| |

| | | amount

| |

Accrued Advisory Fees | | $ | 24,359 | |

Accrued 12b-1 Fees | | | 10,455 | |

Payable for Fund Shares Redeemed | | | 11,094 | |

Accrued Expenses | | | 16,505 | |

| | |

|

|

|

Total Liabilities | | $ | 62,413 | |

| | |

|

|

|

| |

NET ASSETS | | | | |

| |

| | | amount

| |

Class A Shares: | | | | |

Net Assets (unlimited shares of $0.001 par beneficial interest authorized;2,519,970 shares outstanding) | | $ | 29,373,813 | |

Net Asset Value and Redemption price Per Class A Share ($29,373,813 /2,519,970 shares) | | $ | 11.66 | |

Offering Price Per Share ($11.66 / 0.9475) | | $ | 12.31 | |

Class B Shares: | | | | |

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 471,931 shares outstanding) | | $ | 5,256,588 | |

Net Asset Value and Offering Price Per Class B Share ($5,256,588 / 471,931 shares) | | $ | 11.14 | |

Redemption Price Per Share ($11.14 x 0.95) | | $ | 10.58 | |

| |

Net Assets | | $ | 34,630,401 | |

| | |

|

|

|

| |

SOURCES OF NET ASSETS | | | | |

| |

| | | amount

| |

At December 31, 2003, Net Assets Consisted of: | | | | |

Paid-in Capital | | $ | 30,622,451 | |

Net Accumulated Realized Loss on Investments | | | (2,386,106 | ) |

Net Unrealized Appreciation in Value of Investments | | | 6,394,056 | |

| | |

|

|

|

Net Assets | | $ | 34,630,401 | |

| | |

|

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [33]

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2003

INVESTMENT INCOME

| | | | |

| | | amount

| |

Interest | | $ | 7,503 | |

Dividends | | | 444,333 | |

| | |

|

|

|

Total Investment Income | | | 451,836 | |

| | |

|

|

|

| |

EXPENSES | | | | |

| |

| | | amount

| |

Investment Advisory Fees [NOTE 3] | | | 220,308 | |

Fund Accounting, Transfer Agency, & Administration Fees | | | 73,968 | |

12b-1 Fees (Class A = $54,190, Class B = $31,818) [NOTE 3] | | | 86,008 | |

Registration Fees | | | 17,363 | |

Custodian Fees | | | 8,982 | |

Auditing Fees | | | 12,414 | |

Servicing Fees (Class B) [NOTE 3] | | | 10,606 | |

Insurance Expense | | | 3,201 | |

Legal fees | | | 2,800 | |

Printing Expense | | | 9,044 | |

Miscellaneous Expense | | | 13,504 | |

| | |

|

|

|

Total Net Expenses | | | 458,198 | |

| | |

|

|

|

Net Investment Income | | | (6,362 | ) |

| | |

|

|

|

| |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| |

| | | amount

| |

Net Realized Loss on Investments | | | (2,007,875 | ) |

Change in Unrealized Appreciation of Investments | | | 8,760,648 | |

| | |

|

|

|

Net Realized and Unrealized Gain (Loss) on Investments | | | 6,752,773 | |

| | |

|

|

|

Increase in Net Assets Resulting from Operations | | $ | 6,746,411 | |

| | |

|

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [34]

STATEMENT OF CHANGES IN NET ASSETS

INCREASE (DECREASE) IN NET ASSETS

| | | | | | | | |

| | | year ended

12/31/03

| | | year ended

12/31/02

| |

Operations: | | | | | | | | |

Net Investment (Loss) | | $ | (6,362 | ) | | $ | (9,849 | ) |

Net Change in Unrealized Appreciation (Depreciation) of Investments | | | 8,760,648 | | | | (3,360,595 | ) |

Net Realized (Loss) on Investments | | | (2,007,875 | ) | | | (225,785 | ) |

| | |

|

|

| |

|

|

|

Increase (Decrease) in Net Assets (resulting from operations) | | | 6,746,411 | | | | (3,596,229 | ) |

| | |

|

|

| |

|

|

|

Distributions to Shareholders From: | | | | | | | | |

Net Realized Gains | | | | | | | | |

Class A | | | — | | | | — | |

Class B | | | — | | | | — | |

Net Income: | | | | | | | | |

Class A | | | — | | | | — | |

Class B | | | — | | | | — | |

| | |

|

|

| |

|

|

|

Total Distribution | | | — | | | | — | |

| | |

|

|

| |

|

|

|

Capital Share Transactions: | | | | | | | | |

Proceeds from Shares Sold: | | | | | | | | |

Class A | | | 7,698,937 | | | | 9,987,080 | |

Class B | | | 1,010,636 | | | | 1,423,017 | |

Dividends Reinvested: | | | | | | | | |

Class A | | | — | | | | — | |

Class B | | | — | | | | — | |

Cost of Shares Redeemed: | | | | | | | | |

Class A | | | (1,871,381 | ) | | | (3,102,811 | ) |

Class B | | | (618,894 | ) | | | (579,499 | ) |

| | |

|

|

| |

|

|

|

Increase in Net Assets (resulting from capital share transactions) | | | 6,219,298 | | | | 7,727,787 | |

| | |

|

|

| |

|

|

|

Total Increase in Net Assets | | | 12,965,709 | | | | 4,131,558 | |

| | |

Net Assets: | | | | | | | | |

Beginning of Year | | | 21,664,692 | | | | 17,533,134 | |

| | |

|

|

| |

|

|

|

End of Year | | $ | 34,630,401 | | | $ | 21,664,692 | |

| | |

|

|

| |

|

|

|

Shares of Capital Stock of the Fund Sold and Redeemed: | | | | | | | | |

Shares Sold: | | | | | | | | |

Class A | | | 760,502 | | | | 976,004 | |

Class B | | | 106,213 | | | | 145,864 | |

Shares Reinvested: | | | | | | | | |

Class A | | | — | | | | — | |

Class B | | | — | | | | — | |

Shares Redeemed: | | | | | | | | |

Class A | | | (201,057 | ) | | | (295,672 | ) |

Class B | | | (68,824 | ) | | | (61,386 | ) |

| | |

|

|

| |

|

|

|

Net Increase in Number of Shares Outstanding | | | 596,834 | | | | 764,810 | |

| | |

|

|

| |

|

|

|

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [35]

FINANCIAL HIGHLIGHTS

The table below set forth financial data for one share of capital stock outstanding throughout each period presented.

LARGE/MID-CAP VALUE FUND - CLASS A SHARES

| | | | | | | | | | | | | | | | | | | | |

| | | year ended

12/31/03

| | | year ended

12/31/02

| | | year

ended

12/31/01

| | | year

ended

12/31/00

| | | period

ended

12/31/99 (B)

| |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value at Beginning of Period | | $ | 9.11 | | | $ | 10.83 | | | $ | 10.83 | | | $ | 9.68 | | | $ | 10.00 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | 0.01 | | | | 0.01 | | | | (0.02 | ) | | | 0.04 | | | | 0.02 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 2.54 | | | | (1.73 | ) | | | 0.06 | | | | 1.16 | | | | (0.30 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | 2.55 | | | | (1.72 | ) | | | 0.04 | | | | 1.20 | | | | (0.28 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less Distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from Realized Gains | | | — | | | | — | | | | (0.04 | ) | | | (0.02 | ) | | | (0.02 | ) |

Dividends from Net Investment Income | | | — | | | | — | | | | — | | | | (0.03 | ) | | | (0.02 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Distributions | | | — | | | | — | | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value at End of Period | | $ | 11.66 | | | $ | 9.11 | | | $ | 10.83 | | | $ | 10.83 | | | $ | 9.68 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return(A) (D) | | | 27.99 | % | | | (15.88 | )% | | | 0.33 | % | | | 12.35 | % | | | (3.28 | )% |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Period (in 000s) | | $ | 29,374 | | | $ | 17,856 | | | $ | 13,858 | | | $ | 4,493 | | | $ | 846 | |

Ratio of Expenses to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Before Reimbursement of Expenses by Advisor | | | 1.64 | % | | | 1.76 | % | | | 1.70 | % | | | 2.70 | % | | | 4.69 | %(C) |

After Reimbursement of Expenses by Advisor | | | 1.64 | % | | | 1.76 | % | | | 1.70 | % | | | 1.65 | % | | | 1.60 | %(C) |

| | | | | |

Ratio of Net Investment Income (Loss) to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Before Reimbursement of Expenses by Advisor | | | 0.10 | % | | | 0.11 | % | | | (0.20 | )% | | | (0.30 | )% | | | (2.34 | )%(C) |

After Reimbursement of Expenses by Advisor | | | 0.10 | % | | | 0.11 | % | | | (0.20 | )% | | | 0.67 | % | | | 0.75 | %(C) |

Portfolio Turnover | | | 39.44 | % | | | 36.79 | % | | | 26.44 | % | | | 50.98 | % | | | 8.02 | % |

| (A) | Total Return Calculation Does Not Reflect Sales Load. |

| (B) | For the Period July 14, 1999 (Commencement of Operations) to December 31, 1999. |

| (D) | For Periods Of Less Than One Full Year, Total Returns Are Not Annualized. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [36]

FINANCIAL HIGHLIGHTS

The table below set forth financial data for one share of capital stock outstanding throughout each period presented.

LARGE/MID-CAP VALUE FUND - CLASS B SHARES

| | | | | | | | | | | | | | | | | | | | |

| | | year

ended

12/31/03

| | | year

ended

12/31/02

| | | year

ended

12/31/01

| | | year

ended

12/31/00

| | | period

ended

12/31/99(B)

| |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value at Beginning of Period | | $ | 8.77 | | | $ | 10.50 | | | $ | 10.60 | | | $ | 9.36 | | | $ | 10.00 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | (0.06 | ) | | | (0.06 | ) | | | (0.12 | ) | | | 0.01 | | | | 0.02 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 2.43 | | | | (1.67 | ) | | | 0.06 | | | | 1.28 | | | | (0.62 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | 2.37 | | | | (1.73 | ) | | | (0.06 | ) | | | 1.29 | | | | (0.60 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less Distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from Realized Gains | | | — | | | | — | | | | (0.04 | ) | | | (0.02 | ) | | | (0.02 | ) |

Dividends from Net Investment Income | | | — | | | | — | | | | — | | | | (0.03 | ) | | | (0.02 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Distributions | | | — | | | | — | | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value at End of Year | | $ | 11.14 | | | $ | 8.77 | | | $ | 10.50 | | | $ | 10.60 | | | $ | 9.36 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return(A) (D) | | | 27.02 | % | | | (16.48 | )% | | | (0.61 | )% | | | 13.73 | % | | | (4.78 | )% |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Period (in 000s) | | $ | 5,257 | | | $ | 3,809 | | | $ | 3,675 | | | $ | 2,665 | | | $ | 525 | |

| | | | | |

Ratio of Expenses to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Before Reimbursement of Expenses by Advisor | | | 2.42 | % | | | 2.55 | % | | | 2.66 | % | | | 3.45 | % | | | 5.87 | %(C) |