UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

1304 West Fairbanks Avenue Winter Park, FL | 32789 | |

| (Address of principal executive offices) | (Zip code) |

Citco Mutual Fund Services

83 General Warren Blvd., Suite 200

Malvern, PA 19355

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-846-7526

Date of fiscal year end: 12/31/2004

Date of reporting period: 12/31/2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | The Annual Report to Shareholders for the period ended December 31, 2004 pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended, (the “1940 Act”) C17 CFR 270.30e-1 is filed herewith. |

| Annual Report | ||

| December 31, 2004 | ||

| Timothy Plan Family of Funds: | ||

Small-Cap Value Fund | ||

Large/Mid-Cap Value Fund | ||

Fixed Income Fund | ||

Aggressive Growth Fund | ||

Large/Mid-Cap Growth Fund | ||

Strategic Growth Fund | ||

Conservative Growth Fund | ||

Money Market Fund | ||

Patriot Fund | ||

LETTER FROM THE PRESIDENT

December 31, 2004

ARTHUR D. ALLY

Dear Timothy Plan Shareholder:

I remember my dad once telling me that, as you get older, time speeds up. Although logic would explain that there are still 24 hours in a day and 365 days in a year, I’m beginning to think that dad was right. Even though the year 2004 was a leap year with 366 days, it seemed a lot shorter than 2003 which seemed a lot shorter than 2002, etc.

As usual, I will leave specific market comments to our various sub-advisors. However, from my perspective, our overall performance in 2004 was respectable. Although not as good as 2003, it was a whole lot better than 2002, 2001, and 2000 – the years the market experienced some serious correction. And, for what it’s worth, I have a feeling that 2005 – even with its rough start – could prove to be mildly positive. Of course, in this industry, we cannot (and must not) ever make any guarantees of that fact.

We continue to have confidence in our various sub-advisor money managers although we do plan to recommend one change in 2005. While performance will vary from year to year, we believe that good money managers will produce competitive returns over full market cycles. Our commitment to our shareholders continues to be that we take our role as managers of our managers very seriously.

In another vein, I am pleased to report that our mission continues to be on track. The Biblical Stewardship Seminar Series that we launched last year is beginning to have an impact. We have trained nearly 200 Christian financial planners and 50 ministry leaders to date and have certified them to teach this program in the churches and ministries in their respective communities or circles of influence. Once again, if any of you have an interest in having this seminar series presented to your church or ministry, please call us at 1-800-846-7526 or email us at info@timothyplan.com.

Thanks again for being part of the Timothy Plan family.

Sincerely,

Arthur D. Ally,

President

Letter From The President [1]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN SMALL CAP VALUE FUND

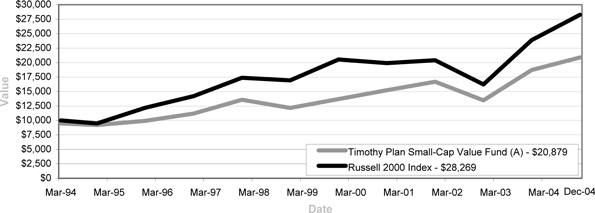

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Small Cap Value Fund – Class A (a) (With sales charge) | 5.74 | % | 7.65 | % | 7.07 | % | |||

Russell 2000 Index (a) | 18.33 | % | 6.60 | % | 10.12 | % | |||

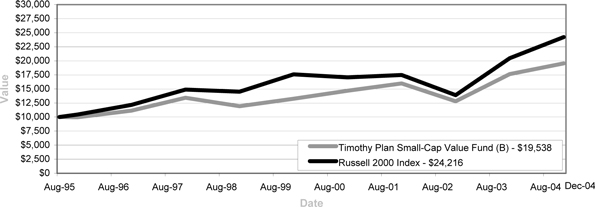

Timothy Small Cap Value Fund – Class B (b) (With CDSC) | 5.17 | % | 7.85 | % | 7.42 | % | |||

Russell 2000 Index (b) | 18.33 | % | 6.60 | % | 9.91 | % | |||

Timothy Small Cap Value Fund – Class C (c) (With CDSC) | N/A | N/A | 7.56 | % | |||||

Russell 2000 Index (c) | 18.33 | % | 6.60 | % | 14.83 | % |

| (a) | For the period March 24, 1994 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period August 25, 1995 (commencement of investment in accordance with objective) to December 31, 2004. |

| (c) | For the period February 2, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

Timothy Small Cap Value Fund A

vs Russell 2000 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell 2000 Index on March 24, 1994 and held through December 31, 2004. The Russell 2000 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [2]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN SMALL CAP VALUE FUND

Timothy Small Cap Value Fund B

vs Russell 2000 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Russell 2000 Index on August 25, 1995 and held through December 31, 2004. The Russell 2000 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [3]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

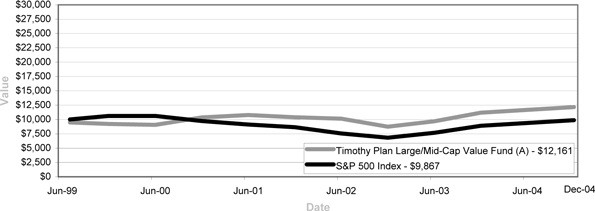

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Since Inception | ||||||

Timothy Large/Mid- Cap Value Fund – Class A (a) (With sales charge) | 3.04 | % | 4.57 | % | 3.64 | % | |||

S&P 500 Index (a) | 10.88 | % | -2.30 | % | -1.11 | % | |||

Timothy Large/Mid- Cap Value Fund – Class B (b) (With CDSC) | 2.59 | % | 5.10 | % | 3.67 | % | |||

S&P 500 Index (b) | 10.88 | % | -2.30 | % | -1.26 | % | |||

Timothy Large/Mid- Cap Value Fund – Class C (c) (With CDSC) | N/A | N/A | 9.88 | % | |||||

S&P 500 Index (c) | N/A | N/A | 9.34 | % |

| (a) | For the period July 14, 1999 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period July 15, 1999 (commencement of investment in accordance with objective) to December 31, 2004. |

| (c) | For the period February 2, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

Timothy Large/Mid-Cap Value Fund A

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on July 14, 1999 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [4]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

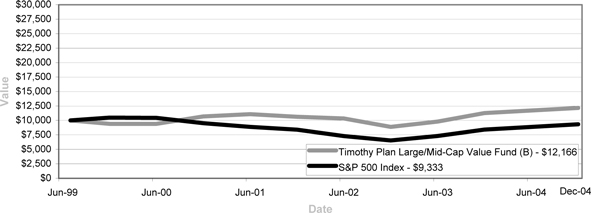

Timothy Large/Mid-Cap Value Fund B

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the S&P 500 Index on July 15, 1999 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [5]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN FIXED INCOME FUND

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Fixed Income Fund – Class A (a) (With sales charge) | -0.96 | % | 4.68 | % | 4.16 | % | |||

Dow Jones Bond Index (a) | 6.25 | % | 9.37 | % | 8.59 | % | |||

Salomon Brothers Broad Investment Grade Index (a) | 4.48 | % | 7.73 | % | 7.29 | % | |||

Timothy Fixed Income Fund – Class B (b) (With CDSC) | -2.56 | % | 4.41 | % | 4.13 | % | |||

Dow Jones Bond Index (b) | 6.25 | % | 9.37 | % | 9.11 | % | |||

Salomon Brothers Broad Investment Grade Index (b) | 4.48 | % | 7.73 | % | 7.29 | % | |||

Timothy Fixed Income Fund – Class C (c) (With CDSC) | N/A | N/A | 1.20 | % | |||||

Dow Jones Bond Index (c) | N/A | N/A | N/A | ||||||

Salomon Brothers Broad Investment Grade Index (c) | N/A | N/A | N/A |

| (a) | For the period July 14, 1999 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period August 5, 1999 (commencement of investment in accordance with objective) to December 31, 2004. |

| (c) | For the period February 2, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

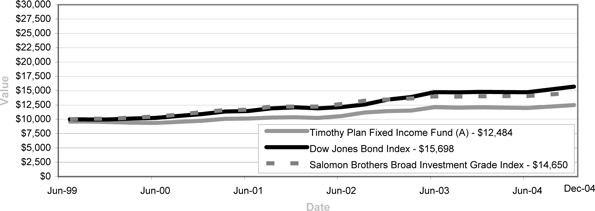

Timothy Fixed Income Fund A

vs Dow Jones Bond Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Dow Jones Bond Index on July 14, 1999 and held through December 31, 2004. The Dow Jones Bond Index is widely recognized, unmanaged index of bond prices. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [6]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN FIXED INCOME FUND

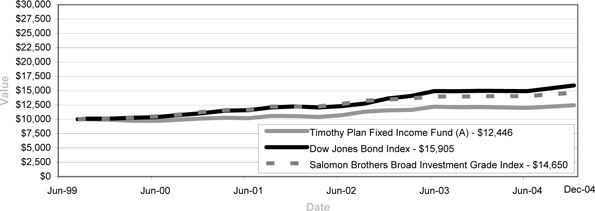

Timothy Fixed Income Fund B

vs Dow Jones Bond Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Dow Jones Bond Index on August 5, 1999 and held through December 31, 2004. The Dow Jones Bond Index is widely recognized, unmanaged index of bond prices. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [7]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN AGGRESSIVE GROWTH FUND

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | |||||

Timothy Aggressive Growth Fund – Class A (a) (With sales charge) | 3.87 | % | N/A | -9.39 | % | |||

Russell Mid Cap Growth Index (a) | 15.48 | % | N/A | -5.61 | % | |||

Timothy Aggressive Growth Fund – Class B (b) (With CDSC) | 3.44 | % | N/A | -9.35 | % | |||

Russell Mid Cap Growth Index (b) | 15.48 | % | N/A | -5.19 | % | |||

Timothy Aggressive Growth Fund – Class C (c) (With CDSC) | N/A | N/A | 7.62 | % | ||||

Russell Mid Cap Growth Index (c) | N/A | N/A | 13.11 | % |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (c) | For the period February 2, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

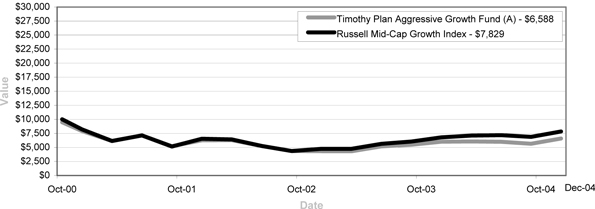

Timothy Aggressive Growth Fund A

vs Russell Mid-Cap Growth Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell Mid Cap Growth Index on October 5, 2000 and held through December 31, 2004. The Russell Mid Cap Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [8]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN AGGRESSIVE GROWTH FUND

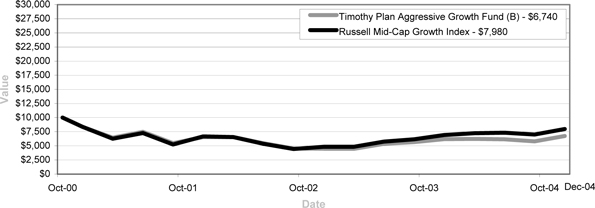

Timothy Aggressive Growth Fund B

vs Russell Mid-Cap Growth Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Russell Mid Cap Growth Index on October 9, 2000 and held through December 31, 2004. The Russell Mid Cap Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [9]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN LARGE/MID CAP GROWTH FUND

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Since Inception | |||||

| Timothy Large/Mid Cap Growth Fund – Class A (a) (With sales charge) | 2.74 | % | N/A | -10.20 | % | |||

| Russell 1000 Growth Index (a) | 6.30 | % | N/A | -10.14 | % | |||

| Timothy Large/Mid Cap Growth Fund – Class B (b) (With CDSC) | 2.24 | % | N/A | -10.12 | % | |||

| Russell 1000 Growth Index (b) | 6.30 | % | N/A | -9.57 | % | |||

| Timothy Large/Mid Cap Growth Fund – Class C (c) (With CDSC) | N/A | N/A | 4.15 | % | ||||

| Russell 1000 Growth Index (c) | N/A | N/A | 4.16 | % |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (c) | For the period February 2, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

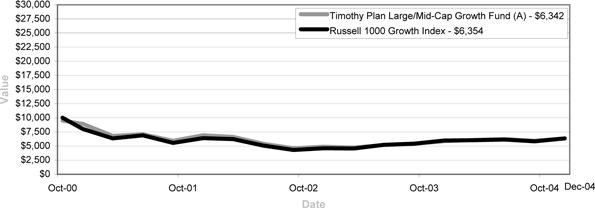

Timothy Large/Mid-Cap Growth Fund A

vs Russell 1000 Growth Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell 1000 Growth Index on October 5, 2000 and held through December 31, 2004. The Russell 1000 Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [10]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN LARGE/MID CAP GROWTH FUND

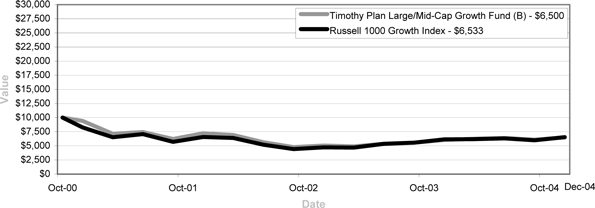

Timothy Large/Mid-Cap Growth Fund B

vs Russell 1000 Growth Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the Russell 1000 Growth Index on October 9, 2000 and held through December 31, 2004. The Russell 1000 Growth Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [11]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN STRATEGIC GROWTH FUND

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | |||||

Timothy Strategic Growth Fund – Class A (a) (With sales charge) | 2.42 | % | N/A | -4.28 | % | |||

S&P 500 Index (a) | 10.88 | % | N/A | -2.39 | % | |||

Timothy Strategic Growth Fund – Class B (b) (With CDSC) | 2.02 | % | N/A | -4.18 | % | |||

S&P 500 Index (b) | 10.88 | % | N/A | -1.83 | % | |||

Timothy Strategic Growth Fund – Class C (c) (With CDSC) | N/A | N/A | -7.54 | % | ||||

S&P 500 Index (c) | N/A | N/A | 9.34 | % |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (c) | For the period February 2, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

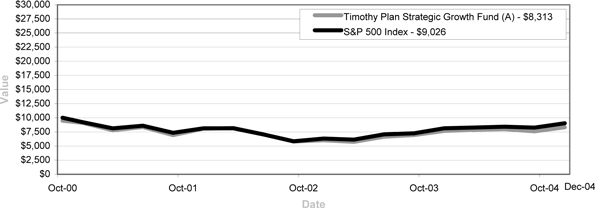

Timothy Strategic Growth Fund A

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on October 5, 2000 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [12]

RETURNS FOR THE YEAR ENDED

December 31, 2004

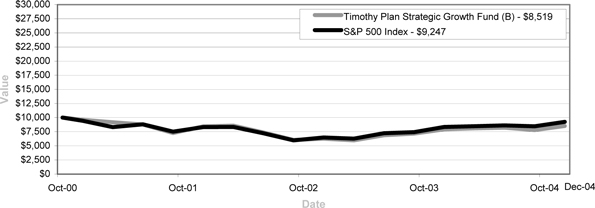

TIMOTHY PLAN STRATEGIC GROWTH FUND

Timothy Strategic Growth Fund B

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the S&P 500 Index on October 9, 2000 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [13]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN CONSERVATIVE GROWTH FUND

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | |||||

| Timothy Conservative Growth Fund – Class A (a) (With sales charge) | 0.83 | % | N/A | -0.12 | % | |||

| S&P 500 Index (a) | 10.88 | % | N/A | -2.39 | % | |||

| Timothy Conservative Growth Fund – Class B (b) (With CDSC) | 0.43 | % | N/A | -0.08 | % | |||

| S&P 500 Index (b) | 10.88 | % | N/A | -1.83 | % | |||

| Timothy Conservative Growth Fund – Class C (c) (With CDSC) | N/A | N/A | 4.17 | % | ||||

| S&P 500 Index (c) | N/A | N/A | 9.34 | % |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2004. |

| (c) | For the period February 2, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

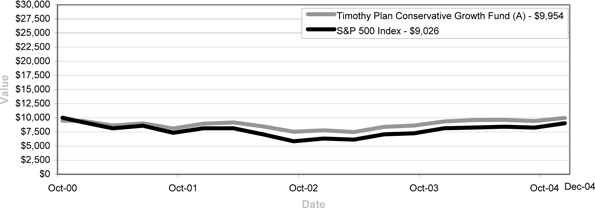

Timothy Conservative Growth Fund A

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on October 5, 2000 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [14]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN CONSERVATIVE GROWTH FUND

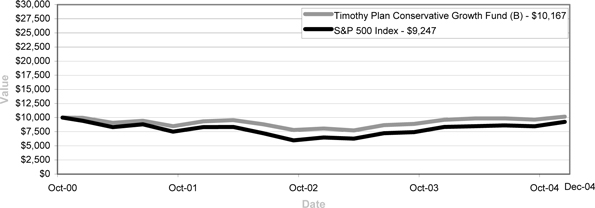

Timothy Conservative Growth Fund B

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the S&P 500 Index on October 9, 2000 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [15]

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN PATRIOT FUND

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||

Timothy Patriot Fund – Class A (a) (With sales charge) | N/A | N/A | -0.12 | % | |||

S&P 500 Index (a) | N/A | N/A | -2.39 | % | |||

Timothy Patriot Growth Fund – Class C (b) (With CDSC) | N/A | N/A | 4.17 | % | |||

S&P 500 Index (b) | N/A | N/A | 9.34 | % |

| (a) | For the period May 1, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

| (b) | For the period May 1, 2004 (commencement of investment in accordance with objective) to December 31, 2004. |

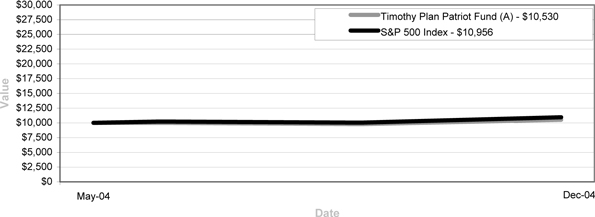

Timothy Patriot Fund A

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on May 1, 2004 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [16]

RETURNS FOR THE YEAR ENDED

December 31, 2004

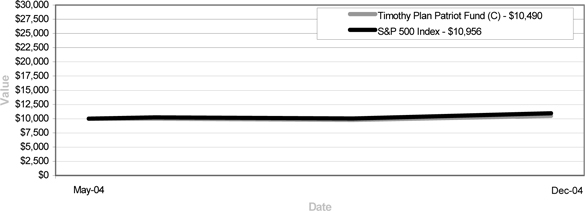

TIMOTHY PLAN PATRIOT FUND

Timothy Patriot Fund C

vs S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund B shares, and the S&P 500 Index on May 1, 2004 and held through December 31, 2004. The S&P 500 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [17]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2004

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Arthur D. Ally* 1304 W Fairbanks Avenue Winter Park, FL | Chairman and President | Indefinite; Trustee and President since 1994 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1942 | President and controlling shareholder of Covenant Funds, Inc. (“CFI”), a holding company. President and general partner of Timothy Partners, Ltd. (“TPL”), the investment adviser and principal underwriter to each Fund. CFI is also the managing general partner of TPL. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Joseph E. Boatwright** 1410 Hyde Park Drive Winter Park, FL | Trustee, Secretary | Indefinite; Trustee and Secretary since 1995 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1930 | Retired Minister. Currently serves as a consultant to the Greater Orlando Baptist Association. Served as Senior Pastor to Aloma Baptist Church from 1970-1996. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Mathew D. Staver** 210 East Palmetto Avenue Longwood, FL 32750 | Trustee | Indefinite; Trustee since 2000 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1956 | Attorney specializing in free speech, appellate practice and religious liberty constitutional law. Founder of Liberty Counsel, a religious civil liberties education and legal defense organization. Host of two radio programs devoted to religious freedom issues. Editor of a monthly newsletter devoted to religious liberty topics. Mr. Staver has argued before the United States Supreme Court and has published numerous legal articles. | None | ||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Officers and Trustees [18]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2004

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Richard W. Copeland 631 Palm Springs Drive Altamonte Springs, FL 32701 | Trustee | Trustee from 2005, new as of 2/25/2005 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1947 | Principal of Richard W. Copeland, Attoney at Law for 31 years specializing in tax and estate planning. B.A. from Mississippi College, JD and LLM Taxation from University of Miami. Associate Professor Stetson University for past 29 years. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Bill Johnson 903 S. Stewart Street Fremont, MI 48412 | Trustee | Trustee from 2005, new as of 2/25/2005 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1946 | President (and Founder) of American Decency Association, Freemont, MI since 1999. Previously served as Michigan State Director for American Family Association (1987-1999). Previously a public school teacher for 18 years. B.S. from Michigan State University and a Masters of Religious Education from Grand Rapids Baptist Seminary. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Kathryn Tindal Martinez 4398 New Broad Street Orlando, FL 32814 | Trustee | Trustee from 2005, new as of 2/25/2005 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1949 | Served on board of directors from 1991 to present, including House of Hope, B.E.T.A., Childrens’ Home Society, and Susan B. Anthony List. Previously a private school teacher and insurance adjuster. B.A. received from Florida State University State University and MAT from Rollins College, FL. | None | ||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Officers and Trustees [19]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2004

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

John C. Mulder 2925 Professional Place Colorado Springs, CO 80904 | Trustee | Trustee from 2005, new as of 2/25/2005 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1950 | President Christian Community Foundation and National Foundation since 2001. Prior: 22 years of executive experience for a group of banks and a trust company. B.A. in Economics from Wheaton College and MBA from University of Chicago. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Charles E. Nelson 1145 Cross Creek Circle Altamonte Springs, FL | Trustee | Indefinite; Trustee since 2000 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1934 | Certified Public Accountant. Director of Operations, National Multiple Sclerosis Society Mid Florida Chapter. Formerly Director of Finance, Hospice of the Comforter, Inc. Formerly Comptroller, Florida United Methodist Children’s Home, Inc. Formerly Credit Specialist with the Resolution Trust Corporation and Senior Executive Vice President, Barnett Bank of Central Florida, N.A. Formerly managing partner, Arthur Andersen, CPA firm, Orlando, Florida branch. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Wesley W. Pennington 442 Raymond Avenue Longwood, FL | Trustee | Indefinite; Trustee since 1994 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1930 | Retired Air Force Officer. Past President, Westwind Holdings, Inc., a development company, since 1997. Past President and controlling shareholder, Weston, Inc., a fabric treatment company, form 1979-1997. President, Designer Services Group 1980-1988. | None | ||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Officers and Trustees [20]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2004

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Scott Preissler, Ph.D. P O Box 50434 Indianapolis, IN 46250 | Trustee | Indefinite; New as of 1/1/04 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Born: 1960 | President and CEO of Christian Stewardship Association where he has been affiliated for the past 14 years. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Alan M. Ross 11210 West Road Roswell, Ga 30075 | Trustee | Indefinite; New as of 1/1/04 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Born: 1951 | Founder and CEO of Corporate Development Institute which he founded five years ago. Previously he served as President and CEO of Fellowship of Companies for Christ and has authored three books: Beyond World Class, Unconditional Excellence, Breaking Through to Prosperity. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Dr. David J. Tolliver 4000 E. Maplewood Drive Excelsior Springs, MO 64024 | Trustee | Trustee from 2005, new as of 2/25/2005 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Born: 1951 | Senior Pastor Pisgah Baptist Church, Excelsior Springs, MO since 1999. Previously pastored three churches in St. Louis, MO area (1986-1999). Currently serves on Board of Trustees Midwestern Baptist Theological Seminary. Past President Missouri Baptist Convention (2003-2004) | None | ||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Officers and Trustees [21]

LETTER FROM THE MANAGER

December 31, 2004

SMALL CAP VALUE FUND

For the year ending December 31, 2004, the Timothy Plan Small Cap Value Fund returned 11.60% versus 18.33% for the Russell 2000. The Fund trailed the Russell because of the quality and valuation standards maintained by Awad; if we had relaxed these constraints we might have done better but this would not have been the right long-term decision. Awad’s focus is on risk-adjusted returns.

The stocks that had a positive effect on returns were: Brinks, Swift Energy, Champion Enterprises, InfoUSA and Stage Stores. The stocks that had a negative effect on returns were: Startek, Sourcecorp, Axcelis, K-V Pharmaceutical and MCG Capital.

All is well that ends well! After a frustrating start, 2004 ended with a sprint, creating the probability that 2005 will get off to a good start. The markets are being supported by economic growth, profit growth, takeovers and tolerable levels of inflation and interest rates.

Conversely, some resistance is being applied by volatile energy prices, dollar instability, geopolitical tension and slight cyclical upticks in interest rates. Balancing out these facts leaves investors with a “glass-is-half-full” mindset, leading to a reasonable upward bias for equity prices as we close out 2004 and begin 2005. The momentum of growth in profits is likely to lead to continued gains in prices in early 2005. Lurking in the background, though, are the structural issues regarding the trade deficit, the federal deficit and the demographic issues surrounding Social Security and Medicare. Any remedy to these issues require a combination of tax increases and spending cuts, both of which are concretionary to the economy.

The financial markets will be watching closely to see if the Administration is willing to take credible action to address these issues and the report card will be the dollar. If the Administration acts credibly, we could have a mutli-year bull market. If the Administration does not act credibly, financial assets will react with skepticism. We will be reporting to you on these issues during 2005.

Meanwhile, we believe reasonably priced small cap equities with good growth prospects should provide good absolute and relative returns in 2005, just as they have for the past several years. In our view, investors will continue to gravitate towards securities which show earnings growth and are selling at reasonable valuations – characteristics which have been more often found in the small cap arena in recent years. Examples of new positions we have established which we believe meet these criteria are URS Corp. (design engineering), Dendrite International (cost saving software for the pharmaceutical industry and Sirva (relocation services). All are solid growing companies selling at attractive valuations and not well followed by Wall Street.

When investors hold strategically attractive companies, sometimes they are rewarded by having the companies taken over, as happened with Awad’s holdings in Barra, Allstream, Inversek and Sola during 2004. This is a distinctive plus for those who invest intelligently in the small cap arena.

Awad Asset Management finished 2004 with record assets under management. We will return your confidence with greater than ever effort. We look forward to doing well for the Timothy Plan in 2005.

James D. Awad

Chairman, Awad Asset Management

Letter From The Manager [22]

TOP TEN HOLDINGS/INDUSTRIES

December 31, 2004

TIMOTHY PLAN SMALL CAP VALUE FUND

FUND PROFILE:

| Top Ten Holdings | |||

| (% of Net Assets) | |||

URS Corp. | 3.80 | % | |

UNOVA, Inc. | 3.68 | % | |

Stage Stores, Inc. | 3.65 | % | |

CBRL Group | 3.50 | % | |

Interactive Data Corp. | 3.47 | % | |

Spartech Corp. | 3.47 | % | |

KV Pharmaceutical Co. | 3.43 | % | |

CommScope, Inc. | 3.37 | % | |

John Wiley & Sons, Inc. | 3.30 | % | |

PMI Group, Inc. | 3.23 | % | |

| 34.90 | % | ||

| Industries | |||

| (% of Net Assets) | |||

Industrial | 19.86 | % | |

Consumer, Cyclical | 18.31 | % | |

Consumer, Non-cyclical | 17.93 | % | |

Financial | 16.27 | % | |

Technology | 8.45 | % | |

Communications | 7.54 | % | |

Energy | 7.11 | % | |

Basic Materials | 3.47 | % | |

Other Assets less Liabilities, Net | 1.06 | % | |

| 100.00 | % | ||

EXPENSE EXAMPLE:

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs,” (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2004, through December 31, 2004.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Timothy Plan Top Ten Holdings / Industries [23]

TOP TEN HOLDINGS/INDUSTRIES

December 31, 2004

TIMOTHY PLAN SMALL CAP VALUE FUND

Hypothetical example for comparison purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account Value 7/1/04 | Ending Account Value 12/31/04 | Expenses Paid During Period* July 1, 2004 Through 12/31/04 | |||||||

Actual - Class A | $ | 1,000.00 | $ | 1,034.30 | $ | 7.72 | |||

Hypothetical - Class A (5% return before expenses) | 1,000.00 | 1,017.55 | 7.66 | ||||||

Actual - Class B | $ | 1,000.00 | $ | 1,030.70 | $ | 11.49 | |||

Hypothetical - Class B (5% return before expenses) | 1,000.00 | 1,013.83 | 11.39 | ||||||

Actual - Class C | $ | 1,000.00 | $ | 1,030.70 | $ | 11.49 | |||

Hypothetical - Class C (5% return before expenses) | 1,000.00 | 1,013.83 | 11.39 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.51% for Class A, 2.25% for Class B, and 2.25% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/366 days (to reflect the one-half year period). The Fund’s ending account value on the first line in the table is based on its actual total return of 3.43% for Class A, 3.07% for Class B, and 3.07% for Class C for the six-month period of July 1, 2004, to December 31, 2004. |

Timothy Plan Top Ten Holdings / Industries [24]

SMALL-CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 98.94%

number of shares | market value | ||||

| AUTOMOBILE & TRUCK PARTS - 2.16% | |||||

| 64,500 | Adesa, Inc. | $ | 1,368,690 | ||

| BALL & ROLLER BEARINGS - 3.08% | |||||

| 59,100 | Kaydon Corp. | 1,951,482 | |||

| BUILDING - MOBILE HOME MANUFACTURED HOUSING - 2.93% | |||||

| 157,000 | Champion Enterprises, Inc.* | 1,855,740 | |||

| CONSUMER CREDIT REPORTING, COLLECTION AGENCIES - 2.28% | |||||

| 55,700 | NCO Group, Inc.* | 1,439,845 | |||

| DIVERSIFIED HOLDINGS - 2.38% | |||||

| 163,000 | Quanta Capital Holdings, Ltd.* | 1,502,860 | |||

| DIVERSIFIED MANUFACTURING - 3.10% | |||||

| 111,000 | Federal Signal Corp. | 1,960,260 | |||

| FINANCIAL SERVICES - 1.50% | |||||

| 45,000 | MoneyGram International, Inc. | 951,300 | |||

| INDUSTRIAL AUTOMATION/ROBOTICS - 3.68% | |||||

| 92,100 | UNOVA, Inc.* | 2,329,209 | |||

| INVESTMENT COMPANIES - 2.84% | |||||

| 105,000 | MCG Capital Corp. | 1,798,650 | |||

| MISCELLANEOUS CAPITAL GOODS - 0.80% | |||||

| 25,000 | Lennox International, Inc. | 508,750 | |||

| MISCELLANEOUS PLASTIC PRODUCTS - 3.47% | |||||

| 81,000 | Spartech Corp. | 2,194,290 | |||

| OIL & GAS OPERATIONS - 7.11% | |||||

| 78,000 | Comstock Resources, Inc.* | 1,719,900 | |||

| 50,000 | Energy Partners, Ltd.* | 1,013,500 | |||

| 61,000 | Swift Energy Co.* | 1,765,340 | |||

| 4,498,740 | |||||

| PHARMACEUTICAL PREPARATIONS - 3.43% | |||||

| 98,300 | K-V Pharmaceutical Co. - Class A* | 2,167,515 | |||

| PUBLISHING - 6.77% | |||||

| 101,000 | Interactive Data Corp.* | 2,195,740 | |||

| 60,000 | John Wiley & Sons, Inc. - Class A | 2,090,400 | |||

| 4,286,140 | |||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [25]

SMALL-CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 98.94% (cont.)

number of shares | market value | ||||

| REAL ESTATE - OPERATIONS - 3.49% | |||||

| 155,000 | Aames Investment Corp. | $ | 1,644,550 | ||

| 40,000 | Sunterra Corp.* | 561,600 | |||

| 2,206,150 | |||||

| REIT - HOTELS - 2.35% | |||||

| 132,500 | Highland Hospitality Corp. | 1,489,300 | |||

| RETAIL - FAMILY CLOTHING STORES - 3.66% | |||||

| 55,700 | Stage Stores, Inc.* | 2,312,664 | |||

| RETAIL - RESTAURANTS - 3.51% | |||||

| 53,000 | CBRL Group, Inc. | 2,218,050 | |||

| SERVICES - BUSINESS SERVICES - 6.60% | |||||

| 35,040 | Charles River Laboratories, Inc.* | 1,612,191 | |||

| 53,900 | Sourcecorp, Inc.* | 1,030,029 | |||

| 54,000 | Startek, Inc. | 1,536,300 | |||

| 4,178,520 | |||||

| SERVICES - DATA PROCESSING - 2.97% | |||||

| 168,000 | infoUSA, Inc. | 1,879,920 | |||

| SERVICES - DIVERSIFIED/COMMERCIAL - 3.10% | |||||

| 49,700 | The Brink’s Co. | 1,964,144 | |||

| SERVICES - ENGINEERING - 3.80% | |||||

| 75,000 | URS Corp.* | 2,407,500 | |||

| SOFTWARE & PROGRAMMING - 2.21% | |||||

| 72,000 | Dendrite International, Inc.* | 1,396,800 | |||

| SPECIAL INDUSTRY MACHINERY - 1.77% | |||||

| 138,000 | Axcelis Technologies, Inc.* | 1,121,940 | |||

| SPECIALTY STORES - 4.75% | |||||

| 48,500 | Sonic Automotive, Inc. | 1,202,800 | |||

| 61,000 | United Auto Group, Inc. | 1,804,990 | |||

| 3,007,790 | |||||

| STATE COMMERCIAL BANKS - 2.87% | |||||

| 63,000 | North Fork Bancorp, Inc. | 1,817,550 | |||

| TECHNOLOGY DISTRIBUTION - 2.58% | |||||

| 36,000 | Tech Data Corp.* | 1,634,400 | |||

| TELECOMMUNICATIONS EQUIPMENT - 3.37% | |||||

| 113,000 | CommScope, Inc.* | 2,135,700 | |||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [26]

SMALL-CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 98.94% (cont.)

number of shares | market value | |||||

| TELECOMMUNICATIONS SERVICES - 0.87% | ||||||

| 13,372 | Manitoba Telecome Services, Inc. | $ | 548,279 | |||

| THRIFTS & MORTGAGE FINANCE - 3.23% | ||||||

| 49,000 | The PMI Group, Inc. | 2,045,750 | ||||

| TRANSPORTATION - TRUCKING - 2.28% | ||||||

| 75,000 | Sirva, Inc.* | 1,441,500 | ||||

| Total Common Stocks (cost $49,786,569) | 62,619,428 | |||||

| SHORT-TERM INVESTMENTS - 4.21% | ||||||

number of shares | market value | |||||

| 2,661,608 | First American Treasury Obligations Fund Class A | $ | 2,661,608 | |||

| Total Short-Term Investments (cost $2,661,608) | 2,661,608 | |||||

| TOTAL INVESTMENTS - 103.15% (identified cost $52,448,177) | 65,281,036 | |||||

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (3.15%) | (1,991,350 | ) | ||||

| NET ASSETS - 100.00% | $ | 63,289,686 | ||||

| * | Non-income producing securities |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [27]

SMALL-CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2004

ASSETS | |||

| amount | |||

Investments in Securities at Value (identified cost $52,448,177) [NOTE 1] | $ | 65,281,036 | |

Receivables: | |||

Interest | 2,236 | ||

Dividends | 124,029 | ||

Fund Shares Sold | 122,062 | ||

Prepaid expenses | 4,560 | ||

Total Assets | $ | 65,533,923 | |

LIABILITIES | |||

| amount | |||

Accrued Advisory Fees | $ | 43,365 | |

Accrued 12b-1 Fees Class A | 8,643 | ||

Accrued 12b-1 Fees Class B | 15,366 | ||

Accrued 12b-1 Fees Class C | 1,079 | ||

Payable for Fund Shares Redeemed | 37,184 | ||

Payable for Capital Gains Distributed | 2,098,740 | ||

Accrued Expenses | 39,860 | ||

Total Liabilities | $ | 2,244,237 | |

NET ASSETS | |||

| amount | |||

Class A Shares: | |||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 2,728,384 shares outstanding) | $ | 42,542,477 | |

Net Asset Value and Redemption Price Per Class A Share ($42,542,477 / 2,728,384 shares) | $ | 15.59 | |

Offering Price Per Share ($15.59 / 0.9475) | $ | 16.45 | |

Class B Shares: | |||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 1,330,722 shares outstanding) | $ | 19,305,707 | |

Net Asset Value and Offering Price Per Class B Share ($19,305,707 / 1,330,722 shares) | $ | 14.51 | |

Maximum Redemption Price Per Class B Share ($14.51 x 0.95) | $ | 13.78 | |

Class C Shares: | |||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 99,105 shares outstanding) | $ | 1,441,502 | |

Net Asset Value and Offering Price Per Class C Share ($1,441,502 / 99,105 shares) | $ | 14.55 | |

Maximum Redemption Price Per Class C Share ($14.55 x 0.99) | $ | 14.40 | |

Net Assets | $ | 63,289,686 | |

SOURCES OF NET ASSETS | |||

| amount | |||

At December 31, 2004, Net Assets Consisted of: | |||

Paid-in Capital | $ | 50,441,456 | |

Accumulated Net Realized Gain on Investments | 15,371 | ||

Net Unrealized Appreciation in Value of Investments | 12,832,859 | ||

Net Assets | $ | 63,289,686 | |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [28]

SMALL-CAP VALUE FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2004

INVESTMENT INCOME | ||||

| amount | ||||

Interest | $ | 15,220 | ||

Dividends | 675,624 | |||

Total Investment Income | 690,844 | |||

EXPENSES | ||||

| amount | ||||

Investment Advisory Fees [NOTE 3] | 492,033 | |||

Fund Accounting, Transfer Agency, & Administration Fees | 130,882 | |||

12b-1 Fees (Class A = $95,999, Class B =$142,070, Class C=$4,079) [NOTE 3] | 242,148 | |||

Service Fees (Class B =$47,357, Class C=$1,360) [NOTE 3] | 48,717 | |||

Auditing Fees | 16,619 | |||

Insurance Expense | 5,053 | |||

Legal Expense | 11,347 | |||

Registration Fees | 12,782 | |||

Custodian Fees | 10,159 | |||

Printing Expense | 8,737 | |||

Miscellaneous Expense | 28,735 | |||

Total Net Expenses | 1,007,212 | |||

Net Investment Loss | (316,368 | ) | ||

REALIZED AND UNREALIZED GAIN ON INVESTMENTS | ||||

| amount | ||||

Net Realized Gain on Investments | 6,384,899 | |||

Change in Unrealized Appreciation of Investments | 324,071 | |||

Net Realized and Unrealized Gain on Investments | 6,708,970 | |||

Increase in Net Assets Resulting from Operations | $ | 6,392,602 | ||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [29]

SMALL-CAP VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

INCREASE (DECREASE) IN NET ASSETS

year ended | year ended | |||||||

Operations: | ||||||||

Net Investment Loss | $ | (316,368 | ) | $ | (361,353 | ) | ||

Net Change in Unrealized Appreciation of Investments | 324,071 | 14,360,903 | ||||||

Net Realized Gain on Investments | 6,384,899 | 404,190 | ||||||

Increase in Net Assets (resulting from operations) | 6,392,602 | 14,403,740 | ||||||

Distributions to Shareholders From: | ||||||||

Net Capital Gains: | ||||||||

Class A | (4,258,469 | ) | — | |||||

Class B | (1,991,237 | ) | — | |||||

Class C | (146,897 | ) | — | |||||

Total Distributions | (6,396,603 | ) | — | |||||

Capital Share Transactions: | ||||||||

Proceeds from Shares Sold: | ||||||||

Class A | 10,647,610 | 5,160,950 | ||||||

Class B | 1,071,107 | 1,586,031 | ||||||

Class C | 1,368,600 | — | ||||||

Dividends Reinvested: | ||||||||

Class A | 2,329,931 | — | ||||||

Class B | 1,823,234 | — | ||||||

Class C | 144,696 | — | ||||||

Cost of Shares Redeemed: | ||||||||

Class A | (4,733,101 | ) | (2,831,326 | ) | ||||

Class B | (2,254,072 | ) | (2,509,798 | ) | ||||

Class C | (26,833 | ) | — | |||||

Increase in Net Assets (resulting from capital share transactions) | 10,371,172 | 1,405,857 | ||||||

Total Increase in Net Assets | 10,367,171 | 15,809,597 | ||||||

Net Assets: | ||||||||

Beginning of Year | 52,922,515 | 37,112,918 | ||||||

End of Year | $ | 63,289,686 | $ | 52,922,515 | ||||

Shares of Capital Stock of the Fund Sold and Redeemed: | ||||||||

Shares Sold: | ||||||||

Class A | 663,367 | 413,932 | ||||||

Class B | 70,431 | 134,512 | ||||||

Class C | 90,914 | — | ||||||

Shares Reinvested: | �� | |||||||

Class A | 149,450 | — | ||||||

Class B | 125,740 | — | ||||||

Class C | 9,952 | — | ||||||

Shares Redeemed: | ||||||||

Class A | (296,635 | ) | (233,248 | ) | ||||

Class B | (149,763 | ) | (220,892 | ) | ||||

Class C | (1,761 | ) | — | |||||

Net Increase in Number of Shares Outstanding | 661,695 | 94,304 | ||||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [30]

SMALL-CAP VALUE FUND

FINANCIAL HIGHLIGHTS

The table below set forth financial data for one share of capital stock outstanding throughout each year presented.

SMALL-CAP VALUE FUND - CLASS A SHARES

| year ended 12/31/04 | year ended 12/31/03 | year ended 12/31/02 | year ended 12/31/01 | year ended 12/31/00 | ||||||||||||||||

Per Share Operating Performance: | ||||||||||||||||||||

Net Asset Value at Beginning of Year | $ | 15.45 | $ | 11.13 | $ | 13.79 | $ | 12.61 | $ | 12.26 | ||||||||||

Income from Investment Operations: | ||||||||||||||||||||

Net Investment Loss | (0.04 | ) | (0.07 | ) | (0.05 | ) | (0.09 | ) | (0.05 | ) | ||||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 1.83 | 4.39 | (2.60 | ) | 1.30 | 1.43 | ||||||||||||||

Total from Investment Operations | 1.79 | 4.32 | (2.65 | ) | 1.21 | 1.38 | ||||||||||||||

Less Distributions: | ||||||||||||||||||||

Dividends from Realized Gains | (1.65 | ) | — | (0.01 | ) | (0.03 | ) | (1.03 | ) | |||||||||||

Dividends from Net Investment Income | — | — | — | — | — | |||||||||||||||

Total Distributions | (1.65 | ) | — | (0.01 | ) | (0.03 | ) | (1.03 | ) | |||||||||||

Net Asset Value at End of Year | $ | 15.59 | $ | 15.45 | $ | 11.13 | $ | 13.79 | $ | 12.61 | ||||||||||

Total Return (A) | 11.60 | % | 38.81 | % | (19.25 | )% | 9.66 | % | 11.23 | % | ||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||

Net Assets, End of Year (in 000s) | $ | 42,542 | $ | 34,185 | $ | 22,603 | $ | 21,632 | $ | 15,217 | ||||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement of Expenses by Advisor | 1.48 | % | 1.71 | % | 1.75 | % | 1.89 | % | 1.97 | % | ||||||||||

After Reimbursement of Expenses by Advisor | 1.48 | % | 1.71 | % | 1.75 | % | 1.89 | % | 1.76 | % | ||||||||||

Ratio of Net Investment (Loss) to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement of Expenses by Advisor | (0.30 | )% | (0.55 | )% | (0.46 | )% | (0.80 | )% | (0.48 | )% | ||||||||||

After Reimbursement of Expenses by Advisor | (0.30 | )% | (0.55 | )% | (0.46 | )% | (0.80 | )% | (0.27 | )% | ||||||||||

Portfolio Turnover | 57.59 | % | 47.99 | % | 66.95 | % | 61.41 | % | 99.17 | % | ||||||||||

| (A) | Total Return Calculation Does Not Reflect Redemption Fee. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [31]

SMALL-CAP VALUE FUND

FINANCIAL HIGHLIGHTS

The table below set forth financial data for one share of capital stock outstanding throughout each year presented.

SMALL-CAP VALUE FUND - CLASS B SHARES

| year ended 12/31/04 | year ended 12/31/03 | year ended 12/31/02 | year ended 12/31/01 | year ended 12/31/00 | ||||||||||||||||

Per Share Operating Performance: | ||||||||||||||||||||

Net Asset Value at Beginning of Year | $ | 14.59 | $ | 10.59 | $ | 13.22 | $ | 12.19 | $ | 11.88 | ||||||||||

Income from Investment Operations: | ||||||||||||||||||||

Net Investment Loss | (0.15 | ) | (0.16 | ) | (0.14 | ) | (0.22 | ) | (0.10 | ) | ||||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 1.72 | 4.16 | (2.48 | ) | 1.28 | 1.39 | ||||||||||||||

Total from Investment Operations | 1.57 | 4.00 | (2.62 | ) | 1.06 | 1.29 | ||||||||||||||

Less Distributions: | ||||||||||||||||||||

Dividends from Realized Gains | (1.65 | ) | — | (0.01 | ) | (0.03 | ) | (0.98 | ) | |||||||||||

Dividends from Net Investment Income | — | — | — | — | — | |||||||||||||||

Total Distributions | (1.65 | ) | — | (0.01 | ) | (0.03 | ) | (0.98 | ) | |||||||||||

Net Asset Value at End of Year | $ | 14.51 | $ | 14.59 | $ | 10.59 | $ | 13.22 | $ | 12.19 | ||||||||||

Total Return (A) | 10.78 | % | 37.77 | % | (19.85 | )% | 8.77 | % | 10.87 | % | ||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||

Net Assets, End of Period (in 000s) | $ | 19,306 | $ | 18,738 | $ | 14,509 | $ | 17,651 | $ | 16,631 | ||||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement of Expenses by Advisor | 2.23 | % | 2.47 | % | 2.49 | % | 2.72 | % | 2.72 | % | ||||||||||

After Reimbursement of Expenses by Advisor | 2.23 | % | 2.47 | % | 2.49 | % | 2.72 | % | 2.51 | % | ||||||||||

Ratio of Net Investment (Loss) to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement of Expenses by Advisor | (1.05 | )% | (1.39 | )% | (1.12 | )% | (1.78 | )% | (1.23 | )% | ||||||||||

After Reimbursement of Expenses by Advisor | (1.05 | )% | (1.39 | )% | (1.12 | )% | (1.78 | )% | (1.02 | )% | ||||||||||

Portfolio Turnover | 57.59 | % | 47.99 | % | 66.95 | % | 61.41 | % | 99.17 | % | ||||||||||

| (A) | Total Return Calculation Does Not Reflect Sales Load. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [32]

SMALL-CAP VALUE FUND

FINANCIAL HIGHLIGHTS

The table below set forth financial data for one share of capital stock outstanding throughout each year presented.

SMALL-CAP VALUE FUND - CLASS C SHARES

period ended 12/31/04 (D) | ||||

Per Share Operating Performance: | ||||

Net Asset Value at Beginning of Period | $ | 15.00 | ||

Income from Investment Operations: | ||||

Net Investment Loss | (0.05 | ) | ||

Net Realized and Unrealized Gain on Investments | 1.25 | |||

Total from Investment Operations | 1.20 | |||

Less Distributions: | ||||

Dividends from Realized Gains | (1.65 | ) | ||

Dividends from Net Investment Income | — | |||

Total Distributions | (1.65 | ) | ||

Net Asset Value at End of Period | $ | 14.55 | ||

Total Return (A) (B) | 8.02 | % | ||

Ratios/Supplemental Data: | ||||

Net Assets, End of Period (in 000s) | $ | 1,442 | ||

Ratio of Expenses to Average Net Assets: | ||||

Before Reimbursement of Expenses by Advisor | 2.23 | %(C) | ||

After Reimbursement of Expenses by Advisor | 2.23 | %(C) | ||

Ratio of Net Investment Income (Loss) to Average Net Assets: | ||||

Before Reimbursement of Expenses by Advisor | (1.05 | )%(C) | ||

After Reimbursement of Expenses by Advisor | (1.05 | )%(C) | ||

Portfolio Turnover | 57.59 | % | ||

| (A) | Total Return Calculation Does Not Reflect Redemption Fee. |

| (B) | For Periods Of Less Than A Full Year, The Total Return Is Not Annualized |

| (C) | Annualized |

| (D) | For the Period February 3, 2004 (Commencement of Operations) to December 31, 2004 |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Small-Cap Value Fund [33]

LETTER FROM THE MANAGER

December 31, 2004

LARGE/MID CAP VALUE FUND

After an extraordinary performance in the last quarter of 2003, the stock market moved at a more sustainable pace of gains in the first quarter of 2004. Across the capitalization spectrum, value stocks outperformed growth stocks for the quarter as well as the trailing 12 month period.

After modest gains in the first quarter of 2004, the second quarter initially witnessed an equity price correction followed by a rally to finish the quarter slightly higher. During the quarter, investors clearly struggled with the uncertainty of the current investment climate, which included the most telegraphed rate increase in history. The question was not if rates would rise, but by how much and how fast? Determined to keep a “measured pace”, the Fed’s initial move was to tighten the Fed Funds rate by ¼ point in late June.

The growth rate of earnings slowed in the third quarter, and the markets reacted predictably, with modest losses for the broad market indices and slight gains for the value indices. Below the surface, however, many divergent crosscurrents became apparent; most notably, defensive sectors such as Consumer Staples and Healthcare still failed to react to this slower earnings environment.

After a flat start to the quarter in October, the markets surged in response to the election results as well as a retreat in energy prices. In fact, the strong upward move in November and December accounted for the entire quarter’s performance, and indeed the entire year’s performance.

While we believe the removal of election uncertainty was important for the market, we remain cautious about extrapolating the recent gains into 2005. Likewise, the benefits from the significant decline in energy prices may be temporary as well, as energy prices remain high historically. In short, we are appreciative of the euphoric markets, but we are not intoxicated by them.

As might be expected in such a strong market move, our more conservatively managed large/mid capitalization portfolio underperformed the S&P500 Index during the last quarter. This can be attributed, in part, to our overweight position in Energy and our underweight in Technology.

On the economic front, overall U.S. growth continued at an above-trend pace. Payrolls picked up, albeit inconsistently; inflation increased, although still well contained; and the Federal Reserve continued its “measured” pace of interest rate hikes. These hikes in short-term interest rates led to further flattening of the yield curve as investors remain generally unconcerned about the impact of inflationary forces on longer-term maturities.

In summary, we believe earnings will continue to grow, but at a slower and more sustainable pace than was achieved in 2004. High energy prices and still rising healthcare costs continue to create headwinds for corporate America, while consumer spending will likely slow as income growth is partially offset by the effect of higher interest rates and a decline in fiscal stimulus. A slowing growth environment, combined with equity valuations that remain high by historical standards, support a more defensive posture with an emphasis on higher quality equities. While we admit we have been somewhat early in this regard, we continue to believe that the market will rotate towards stronger balance sheets, lower valuations, and more sustainable earnings growth. This should serve us well as it has over the long-run.

Fox Asset Management LLC

Letter From The Manager [34]

TOP TEN HOLDINGS/INDUSTRIES

December 31, 2004

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

FUND PROFILE:

Top Ten Holdings (% of Net Assets) | Industries (% of Net Assets) | |||||||

International Rectifier Corp. | 3.99 | % | Industrial | 20.12 | % | |||

CVS Corp. | 3.57 | % | Energy | 14.23 | % | |||

Dean Foods Co. | 3.50 | % | Financial | 13.05 | % | |||

Union Pacific Corp. | 3.47 | % | Consumer, Non-cyclical | 12.71 | % | |||

Apache Corp. | 3.24 | % | Consumer, Cyclical | 11.54 | % | |||

Ingersoll-Rand Co. | 3.22 | % | Basic Materials | 8.50 | % | |||

Masco Corp. | 3.08 | % | Utilities | 7.23 | % | |||

Mack-Cali Reality | 3.04 | % | Technology | 5.90 | % | |||

BJ’s Wholesale Club, Inc. | 3.03 | % | Other Assets less Liabilities, Net | 6.72 | % | |||

PartnerRe Ltd. | 3.01 | % | ||||||

| 33.15 | % | 100.00 | % | |||||

EXPENSE EXAMPLE:

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs,” (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2004, through December 31, 2004.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Timothy Plan Top Ten Holdings / Industries [35]

TOP TEN HOLDINGS/INDUSTRIES

December 31, 2004

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

Hypothetical example for comparison purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account Value 7/1/04 | Ending Account Value 12/31/04 | Expenses Paid During Period* July 1, 2004 Through 12/31/04 | |||||||

Actual - Class A | $ | 1,000.00 | $ | 1,052.30 | $ | 8.15 | |||

Hypothetical - Class A (5% return before expenses) | 1,000.00 | 1,017.19 | 8.01 | ||||||

Actual - Class B | $ | 1,000.00 | $ | 1,048.00 | $ | 11.99 | |||

Hypothetical - Class B (5% return before expenses) | 1,000.00 | 1,013.42 | 11.79 | ||||||

Actual - Class C | $ | 1,000.00 | $ | 1,047.90 | $ | 11.99 | |||

Hypothetical - Class C (5% return before expenses) | 1,000.00 | 1,013.42 | 11.79 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.58% for Class A, 2.33% for Class B, and 2.33% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/366 days (to reflect the one-half year period). The Fund’s ending account value on the first line in the table is based on its actual total return of 5.23% for Class A, 4.80% for Class B, and 4.79% for Class C for the six-month period of July 1, 2004, to December 31, 2004. |

Timothy Plan Top Ten Holdings / Industries [36]

LARGE / MID-CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 93.28%

number of shares | market value | ||||

| COATINGS/PAINT - 2.18% | |||||

| 55,500 | RPM International, Inc. | $ | 1,091,130 | ||

| CRUDE PETROLEUM & NATURAL GAS - 8.90% | |||||

| 21,400 | Anadarko Petroleum Corp. | 1,386,934 | |||

| 32,000 | Apache Corp. | 1,618,240 | |||

| 37,000 | Devon Energy Corp. | 1,440,040 | |||

| 4,445,214 | |||||

| DRUG DISTRIBUTION - 2.23% | |||||

| 19,000 | AmerisourceBergen Corp. | 1,114,920 | |||

| ELECTRIC LIGHTING & WIRING EQUIPMENT - 1.77% | |||||

| 13,000 | Cooper Industries, Inc. - Class A | 882,570 | |||

| ELECTRIC SERVICES - 1.93% | |||||

| 28,000 | American Electric Power Co., Inc. | 961,520 | |||

| ELECTRONIC COMPONENT-SEMICONDUCTOR - 3.99% | |||||

| 44,700 | International Rectifer Corp.* | 1,992,279 | |||

| FINANCIAL SERVICES - 2.98% | |||||

| 14,200 | Countrywide Financial Corp. | 525,542 | |||

| 28,000 | IndyMac Bancorp, Inc. | 964,600 | |||

| 1,490,142 | |||||

| FOOD - 3.50% | |||||

| 53,000 | Dean Foods Co.* | 1,746,350 | |||

| FURNITURE & FIXTURES - 3.08% | |||||

| 42,100 | Masco Corp. | 1,537,913 | |||

| GENERAL INDUSTRIAL MACHINERY & EQUIPMENT - 3.22% | |||||

| 20,000 | Ingersoll-Rand Company Ltd. | 1,606,000 | |||

| INSURANCE - PROPERTY & CASUALTY - 3.01% | |||||

| 24,300 | PartnerRe Ltd. | 1,505,142 | |||

| MEDICAL - HOSPITALS - 4.46% | |||||

| 35,000 | Community Health Care* | 975,800 | |||

| 55,000 | Health Management Associates, Inc. | 1,249,600 | |||

| 2,225,400 | |||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [37]

LARGE / MID-CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 93.28% (Cont.)

| number of shares | market value | ||||

| METAL MINING - 4.92% | |||||

| 9,000 | Rio Tinto Plc (A) | $ | 1,072,890 | ||

| 44,000 | Alcoa, Inc. | 1,382,480 | |||

| 2,455,370 | |||||

| MISCELLANEOUS CHEMICAL PRODUCTS - 1.39% | |||||

| 18,000 | Cabot Corp. | 696,240 | |||

| MISCELLANEOUS INDUSTRIAL & COMMERCIAL MACHINERY & EQUIPMENT - 2.03% | |||||

| 12,000 | ITT Industries, Inc. | 1,013,400 | |||

| NATIONAL COMMERCIAL BANKS - 1.46% | |||||

| 15,000 | Compass Bancshares, Inc. | 730,050 | |||

| OIL COMPANY - INTEGRATED - 2.79% | |||||

| 37,000 | Marathon Oil Corp. | 1,391,570 | |||

| OIL REFINING & MARKETING - 2.55% | |||||

| 28,000 | Valero Energy Corp. | 1,271,200 | |||

| PUBLIC BUILDING AND RELATED FURNITURE - 1.96% | |||||

| 16,000 | Lear Corp. | 976,160 | |||

| RADIO TELEPHONE COMMUNICATIONS - 2.71% | |||||

| 20,000 | Dominion Resources, Inc. | 1,354,800 | |||

| REAL ESTATE INVESTMENT TRUSTS - 3.04% | |||||

| 33,000 | Mack-Cali Realty Corp. | 1,518,990 | |||

| RETAIL - DISCOUNT - 3.03% | |||||

| 52,000 | BJ’s Wholesale Club* | 1,514,760 | |||

| RETAIL - DRUG STORES & PROPRIETARY STORES - 3.57% | |||||

| 39,500 | CVS Corp. | 1,780,265 | |||

| RETAIL - EATING PLACES - 2.99% | |||||

| 32,600 | Outback Steakhouse, Inc. | 1,492,428 | |||

| SCIENTIFIC INSTRUMENTS - 1.87% | |||||

| 20,000 | Waters Corp.* | 935,800 | |||

| SPECIAL INDUSTRY MACHINERY - 1.92% | |||||

| 45,600 | Veeco Instruments, Inc.* | 960,792 | |||

| STATE COMMERCIAL BANK - 1.40% | |||||

| 33,000 | The Colonial Bancgroup, Inc. | 700,590 | |||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [38]

LARGE / MID-CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 93.28% (Cont.)

number of shares | market value | |||||

| SURETY INSURANCE - 1.14% | ||||||

| 9,000 | MBIA, Inc. | $ | 569,520 | |||

| TRANSPORTATION - RAILROAD - 3.47% | ||||||

| 25,800 | Union Pacific Corp. | 1,735,050 | ||||

| TRANSPORTATION - TRUCKING - 2.01% | ||||||

| 18,000 | Yellow Roadway Corp.* | 1,002,780 | ||||

| UNSUPPORTED PLASTICS FILM & SHEET - 2.67% | ||||||

| 25,000 | Sealed Air Corp.* | 1,331,750 | ||||

| UTILITIES - 2.59% | ||||||

| 25,000 | Public Service Enterprise Group, Inc. | 1,294,250 | ||||

| WHOLESALE - DRUGS PROPRIETARIES & DRUGGISTS’ SUNDRIES - 2.52% | ||||||

| 40,000 | McKesson Corp. | 1,258,400 | ||||

| Total Common Stocks (cost $35,934,485) | 46,582,745 | |||||

| SHORT-TERM INVESTMENTS - 6.81% | ||||||

number of shares | market value | |||||

| 2,156,000 | Federated Cash Trust Series II Treasury Fund | 2,156,000 | ||||

| 1,243,017 | First American Treasury Obligations Fund, Class A | 1,243,017 | ||||

| Total Short-Term Investments (cost $3,399,017) | 3,399,017 | |||||

| TOTAL INVESTMENTS - 100.09% (identified cost $39,333,502) | 49,981,762 | |||||

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.09%) | (46,445 | ) | ||||

| NET ASSETS - 100.00% | $ | 49,935,317 | ||||

| * | Non-income producing securities |

| (A) | American Depositary Receipt |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [39]

LARGE / MID-CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2004

ASSETS |

| |||

| amount | ||||

Investments in Securities at Value (identified cost $39,333,502) [NOTE 1] | $ | 49,981,762 | ||

Receivables: | ||||

Interest | 2,570 | |||

Dividends | 23,578 | |||

Fund Shares Sold | 33,005 | |||

Fund Share Commission Receivable from Advisor | 264 | |||

Prepaid Expenses | 5,737 | |||

Total Assets | $ | 50,046,916 | ||

LIABILITIES |

| |||

| amount | ||||

Accrued Advisory Fees | $ | 34,819 | ||

Accrued 12b-1 Fees Class A | 8,908 | |||

Accrued 12b-1 Fees Class B | 4,727 | |||

Accrued 12b-1 Fees Class C | 969 | |||

Payable for Fund Shares Redeemed | 33,305 | |||

Accrued Expenses | 28,871 | |||

Total Liabilities | $ | 111,599 | ||

NET ASSETS |

| |||

| amount | ||||

Class A Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 3,401,653 shares outstanding) | $ | 43,119,570 | ||

Net Asset Value and Redemption Price Per Class A Share ($43,119,570 / 3,401,653 shares) | $ | 12.68 | ||

Offering Price Per Share ($12.68 / 0.9475) | $ | 13.38 | ||

Class B Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 469,289 shares outstanding) | $ | 5,641,927 | ||

Net Asset Value and Offering Price Per Class B Share ($5,641,927 / 469,289 shares) | $ | 12.02 | ||

Redemption Price Per Share ($12.02 x 0.95) | $ | 11.42 | ||

Class C Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 97,510 shares outstanding) | $ | 1,173,820 | ||

Net Asset Value and Offering Price Per Class C Share ($1,173,820 / 97,510 shares) | $ | 12.04 | ||

Redemption Price Per Share ($12.04 x 0.99) | $ | 11.92 | ||

Net Assets | $ | 49,935,317 | ||

SOURCES OF NET ASSETS |

| |||

| amount | ||||

At December 31, 2004, Net Assets Consisted of: | ||||

Paid-in Capital | $ | 41,919,721 | ||

Accumulated Net Realized Loss on Investments | (2,632,664 | ) | ||

Net Unrealized Appreciation in Value of Investments | 10,648,260 | |||

Net Assets | $ | 49,935,317 | ||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Large/Mid-Cap Value Fund [40]

LARGE / MID-CAP VALUE FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2004

INVESTMENT INCOME |

| |||

| amount | ||||

Interest | $ | 18,219 | ||

Dividends (Net foreign tax of $1,246) | 568,766 | |||

Total Investment Income | 586,985 | |||

EXPENSES |

| |||

| amount | ||||

Investment Advisory Fees [NOTE 3] | 353,446 | |||

Fund Accounting, Transfer Agency, & Administration Fees | 90,301 | |||

12b-1 Fees (Class A = $89,217, Class B = $40,814, Class C = $3,672) [NOTE 3] | 133,703 | |||

Service Fees (Class B = $13,605, Class C = $1,224) [NOTE 3] | 14,829 | |||

Registration Fees | 10,822 | |||

Custodian Fees | 6,228 | |||

Auditing Fees | 30,385 | |||

Legal Fees | 8,704 | |||