UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

1304 West Fairbanks Avenue Winter Park, FL | 32789 | |

| (Address of principal executive offices) | (Zip code) |

Citco Mutual Fund Services

83 General Warren Blvd., Suite 200

Malvern, PA 19355

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-846-7526

Date of fiscal year end: 12/31/2004

Date of reporting period: 12/31/2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | The Annual Report to Shareholders for the period ended December 31, 2004 pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended, (the “1940 Act”) C17 CFR 270.30e-1 is filed herewith. |

THE TIMOTHY PLAN

small-cap variable series

Annual Report

December 31, 2004

LETTER FROM THE PRESIDENT

December 31, 2004

ARTHUR D. ALLY

Dear Timothy Plan Small Cap Variable Series Shareholder:

I remember my dad once telling me that, as you get older, time speeds up. Although logic would explain that there are still 24 hours in a day and 365 days in a year, I’m beginning to think that dad was right. Even though the year 2004 was a leap year with 366 days, it seemed a lot shorter than 2003 which seemed a lot shorter than 2002, etc.

As usual, I will leave specific market comments to our sub-advisor, Jim Awad. However, from my perspective, our overall performance in 2004 was respectable. Although not as good as 2003, it was a whole lot better than 2002 – the year the market experienced some serious correction. And, for what it’s worth, I have a feeling that 2005 – even with its rough start – will prove to be mildly positive. Of course, in this industry, we cannot (and must not) ever make any guarantees of that fact.

We continue to have confidence in our sub-advisor. While performance will vary from year to year, we believe that good money managers will produce competitive returns over full market cycles. Our commitment to our shareholders continues to be that we take our role as managers of our managers very seriously.

In another vein, I am pleased to report that our mission continues to be on track. The Biblical Stewardship Seminar Series that we launched last year is beginning to have an impact. We have trained nearly 200 Christian financial planners and 50 ministry leaders to date and have certified them to teach this program in the churches and ministries in their respective communities or circles of influence. Once again, if any of you have an interest in having this seminar series presented to your church or ministry, please call us at 1-800-846-7526 or email us at info@timothyplan.com.

Thanks again for being part of the Timothy Plan family.

| Sincerely, |

|

Arthur D. Ally, President |

LETTER FROM THE MANAGER

December 31, 2004

JAMES D. AWAD

For the year ending December 31, 2004, the Timothy Plan Small Cap Variable Series returned 11.46% versus 18.33% for the Russell 2000. The Fund trailed the Russell because of the quality and valuation standards maintained by Awad; if we had relaxed these constraints we might have done better but this would not have been the right long-term decision. Awad’s focus is on risk-adjusted returns.

The stocks that had a positive effect on returns were: Brinks, Swift Energy, Champion Enterprises, InfoUSA and Stage Stores. The stocks that had a negative effect on returns were: Startek, Sourcecorp, Axcelis, K-V Pharmaceutical and MCG Capital.

All is well that ends well! After a frustrating start, 2004 ended with a sprint, creating the possibility that 2005 will get off to a good start. The markets are being supported by economic growth, profit growth, takeovers and tolerable levels of inflation and interest rates.

Conversely, some resistance is being applied by volatile energy prices, dollar instability, geopolitical tension and slight cyclical upticks in interest rates. Balancing out these facts leaves investors with a “glass-is-half-full” mindset, leading to a reasonable upward bias for equity prices as we close out 2004 and begin 2005. The momentum of growth in profits is likely to lead to continued gains in prices in early 2005. Lurking in the background, though, are the structural issues regarding the trade deficit, the federal deficit and the demographic issues surrounding Social Security and Medicare. Any remedy to these issues require a combination of tax increases and spending cuts, both of which are concretionary to the economy.

The financial markets will be watching closely to see if the Administration is willing to take credible action to address these issues and the report card will be the dollar. If the Administration acts credibly, we could have a mutli-year bull market. If the Administration does not act credibly, financial assets will react with skepticism. We will be reporting to you on these issues during 2005.

Meanwhile, we believe reasonably priced small cap equities with good growth prospects should provide good absolute and relative returns in 2005, just as they have for the past several years. In our view, investors will continue to gravitate towards securities which show earnings growth and are selling at reasonable valuations – characteristics which have been more often found in the small cap arena in recent years. Examples of new positions we have established which we believe meet these criteria are URS Corp. (design engineering), Dendrite International (cost saving software for the pharmaceutical industry and Sirva (relocation services). All are solid growing companies selling at attractive valuations and not well followed by Wall Street.

When investors hold strategically attractive companies, sometimes they are rewarded by having the companies taken over, as happened with Awad’s holdings in Barra, Allstream, Inversek and Sola during 2004. This is a distinctive plus for those who invest intelligently in the small cap arena.

Awad Asset Management finished 2004 with record assets under management. We will return your confidence with greater than ever effort. We look forward to doing well for the Timothy Plan in 2005.

| /s/ JAMES D. AWAD |

James D. Awad Chairman, Awad Asset Management |

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2004

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Arthur D. Ally* 1304 W Fairbanks Avenue Winter Park, FL | Chairman and President | Indefinite; Trustee and President since 1994 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

| Born: 1942 | President and controlling shareholder of Covenant Funds, Inc. (“CFI”), a holding company. President and general partner of Timothy Partners, Ltd. (“TPL”), the investment adviser and principal underwriter to each Fund. CFI is also the managing general partner of TPL. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Joseph E. Boatwright** 1410 Hyde Park Drive Winter Park, FL | Trustee, Secretary | Indefinite; Trustee and Secretary since 1995 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

| Born: 1930 | Retired Minister. Currently serves as a consultant to the Greater Orlando Baptist Association. Served as Senior Pastor to Aloma Baptist Church from 1970-1996. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Jock M. Sneddon** 6001 Vineland Drive Orlando, FL | Trustee | Indefinite; Trustee since 1997 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

| Physician, Florida Hospital Centra Care. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Mathew D. Staver** 210 East Palmetto Avenue Longwood, FL 32750 | Trustee | Indefinite; Trustee since 2000 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

| Born: 1956 | Attorney specializing in free speech, appellate practice and religious liberty constitutional law. Founder of Liberty Counsel, a religious civil liberties education and legal defense organization. Host of two radio programs devoted to religious freedom issues. Editor of a monthly newsletter devoted to religious liberty topics. Mr. Staver has argued before the United States Supreme Court and has published numerous legal articles. | None | ||||

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2004

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Bill Dodson 7120 N Whitney Avenue Fresno, CA 93720 | Trustee | Trustee from 2001 - 12/01/03 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

Born: 1960 | Vice President – Sales, CPCF, Inc. a registered broker-dealer and a subsidiary of the California Baptist Foundation and the California Southern Baptist Convention. Mr. Dodson is a General Securities Principal (Series 24) and licensed minister. Mr. Dodson has previous experience as a General Securities Representative (Series 7) with two national brokerage firms. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

W. Thomas Fyler, Jr. 640 Ft. Washington Avenue Suite 6C New York, NY 10040 | Trustee | Trustee from 1998 - 12/01/03 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

Born: 1957 | President, controlling shareholder of W.T. Fyler, Jr./Ephesus, Inc., a New York State registered investment advisory firm. Founding member of the National Association of Christian Financial Consultants. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Mark A. Minnella 1215 Fern Ridge Parkway Suite 110 Creve Coeur, MO 63141 | Trustee | Trustee from 2000 - 12/01/03 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

Born: 1955 | Principal and co-founder of Integrity Investors, LLC., a registered investment advisory firm. Co-founder, President and director of the National Association of Christian Financial Consultants. Mr. Minnella is a Registered Investment Principal (NASD Series 24), and a registered investment adviser (NASD Series 65). | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Charles E. Nelson 1145 Cross Creek Circle Altamonte Springs, FL | Trustee | Indefinite; Trustee since 2000 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships | |||||

Born: 1934 | Certified Public Accountant. Director of Operations, National Multiple Sclerosis Society Mid Florida Chapter. Formerly Director of Finance, Hospice of the Comforter, Inc. Formerly Comptroller, Florida United Methodist Children’s Home, Inc. Formerly Credit Specialist with the Resolution Trust Corporation and Senior Executive Vice President, Barnett Bank of Central Florida, N.A. Formerly managing partner, Arthur Andersen, CPA firm, Orlando, Florida branch. | None | ||||

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2004

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Wesley W. Pennington 442 Raymond Avenue Longwood, FL | Trustee | Indefinite; Trustee and Treasurer since 1994 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1930 | Retired Air Force Officer. Past President, Westwind Holdings, Inc., a development company, since 1997. Past President and controlling shareholder, Weston, Inc., a fabric treatment company, form 1979-1997. President, Designer Services Group 1980-1988. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Scott Preissler, Ph.D. P O Box 50434 Indianapolis, IN 46250 | Trustee | Indefinite; New as of 1/1/04 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1960 | President and CEO of Christian Stewardship Association where he has been affiliated for the past 14 years. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Alan M. Ross 11210 West Road Roswell, Ga 30075 | Trustee | Indefinite; New as of 1/1/04 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1951 | Founder and CEO of Corporate Development Institute which he founded five years ago. Previously he served as President and CEO of Fellowship of Companies for Christ and has authored three books: Beyond World Class, Unconditional Excellence, Breaking Through to Prosperity. | None | ||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios | |||

Robert Scraper P O Box 1315 Houston, Tx 77251 | Trustee | Indefinite; New as of 1/1/04 | 11 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Born: 1946 | Senior Vice President - Investments for Frost National Bank of Texas since 1987. | None | ||||

RETURNS FOR THE YEAR ENDED

December 31, 2004

TIMOTHY PLAN SMALL CAP VARIABLE SERIES

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception May 22, 1998 | ||||||

Timothy Plan Small Cap Variable Series (a) | 11.46 | % | 9.40 | % | 10.46 | % | |||

Russell 2000 Index (a) | 18.33 | % | 6.60 | % | 6.93 | % | |||

| (a) | For the period May 22, 1998 (commencement of investment in accordance with objective) to December 31, 2004. |

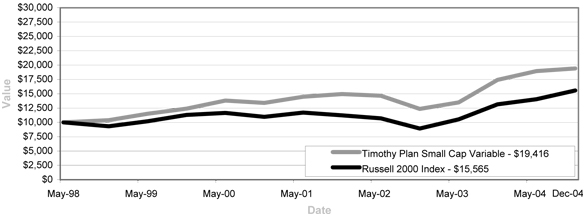

Timothy Small Cap Variable

vs Russell 2000 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund, and the Russell 2000 Index on May 22, 1998 and held through December 31, 2004. The Russell 2000 Index is widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

TOP TEN HOLDINGS/INDUSTRIES/EXPENSE EXAMPLE

December 31, 2004

TIMOTHY PLAN SMALL CAP VARIABLE SERIES

FUND PROFILE:

Top Ten Holdings

(% of Net Assets)

Spartech Corp. | 3.90 | % | |

CommScope, Inc. | 3.67 | % | |

Stage Stores, Inc. | 3.66 | % | |

infoUSA, Inc. | 3.52 | % | |

KV Pharmaceutical Co. | 3.27 | % | |

Brink’s Co. | 3.20 | % | |

UNOVA, Inc. | 3.18 | % | |

Interactive Data Corp. | 3.13 | % | |

Champion Enterprises, Inc. | 3.06 | % | |

CBRL Group | 3.01 | % | |

| 33.60 | % | ||

Industries

(% of Net Assets)

Consumer, Cyclical | 17.97 | % | |

Consumer, Non-cyclical | 17.59 | % | |

Industrial | 16.39 | % | |

Technology | 9.08 | % | |

Financial | 8.41 | % | |

Communications | 7.27 | % | |

Energy | 7.14 | % | |

Basic Materials | 3.90 | % | |

Other Assets less Liabilities, Net | 12.25 | % | |

| 100.00 | % | ||

EXPENSE EXAMPLE:

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs,” (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2004, through December 31, 2004.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

TOP TEN HOLDINGS/INDUSTRIES/EXPENSE EXAMPLE

December 31, 2004

TIMOTHY PLAN SMALL CAP VARIABLE SERIES

Hypothetical example for comparison purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

Beginning 7/1/04 | Ending 12/31/04 | During Period* July 1, 2004 Through 12/31/04 | |||||||

Actual - Class A | $ | 1,000.00 | $ | 1,024.40 | $ | 6.11 | |||

Hypothetical - Class A (5% return before expenses) | 1,000.00 | 1,019.00 | 6.09 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.20%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/366 days (to reflect the one-half year period). The Fund’s ending account value on the first line in the table is based on its actual total return of 2.44% for the six-month period of July 1, 2004, to December 31, 2004. |

SMALL CAP VARIABLE SERIES

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 87.75%

| number of shares | market value | ||||

AUTOMOBILE & TRUCK PARTS - 2.29% | |||||

| 6,000 | Adesa, Inc. | $ | 127,320 | ||

BALL & ROLLER BEARINGS - 2.97% | |||||

| 5,000 | Kaydon Corp. | 165,100 | |||

BUILDING - MOBILE HOME MANUFACTURED HOUSING - 3.06% | |||||

| 14,400 | Champion Enterprises, Inc.* | 170,208 | |||

CONSUMER CREDIT REPORTING, COLLECTION AGENCIES - 1.58% | |||||

| 3,400 | NCO Group, Inc.* | 87,890 | |||

DIVERSIFIED HOLDINGS - 2.49% | |||||

| 1 | Allete | 37 | |||

| 15,000 | Quanta Capital Holdings, Ltd.* | 138,300 | |||

| 138,337 | |||||

DIVERSIFIED MANUFACTURING - 2.86% | |||||

| 9,000 | Federal Signal Corp. | 158,940 | |||

FINANCIAL SERVICES - 1.14% | |||||

| 3,000 | MoneyGram International, Inc. | 63,420 | |||

INDUSTRIAL AUTOMATION/ROBOTICS - 3.18% | |||||

| 7,000 | UNOVA, Inc.* | 177,030 | |||

INVESTMENT COMPANIES - 2.93% | |||||

| 9,500 | MCG Capital Corp. | 162,735 | |||

MISCELLANEOUS CAPITAL GOODS - 0.73% | |||||

| 2,000 | Lennox International, Inc. | 40,700 | |||

MISCELLANEOUS PLASTIC PRODUCTS - 3.89% | |||||

| 8,000 | Spartech Corp. | 216,720 | |||

OIL & GAS OPERATIONS - 7.14% | |||||

| 7,000 | Comstock Resources, Inc.* | 154,350 | |||

| 5,000 | Energy Partners, Ltd.* | 101,350 | |||

| 4,900 | Swift Energy Co.* | 141,806 | |||

| 397,506 | |||||

PHARMACEUTICAL PREPARATIONS - 3.27% | |||||

| 8,250 | K-V Pharmaceutical Co. - Class A* | 181,912 | |||

PUBLISHING - 5.63% | |||||

| 8,000 | Interactive Data Corp.* | 173,920 | |||

| 4,000 | John Wiley & Sons, Inc. - Class A | 139,360 | |||

| 313,280 | |||||

The accompanying notes are an integral part of these financial statements.

SMALL CAP VARIABLE SERIES

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 87.75% (cont.)

| number of shares | market value | ||||

| REAL ESTATE - OPERATIONS - 0.63% | |||||

| 2,500 | Sunterra Corp.* | $ | 35,100 | ||

| RETAIL - FAMILY CLOTHING STORES - 3.66% | |||||

| 4,900 | Stage Stores, Inc.* | 203,448 | |||

| RETAIL - RESTAURANTS - 3.01% | |||||

| 4,000 | CBRL Group, Inc. | 167,400 | |||

| SERVICES - BUSINESS SERVICES - 7.32% | |||||

| 3,360 | Charles River Laboratories, Inc.* | 154,594 | |||

| 5,120 | Sourcecorp, Inc.* | 97,843 | |||

| 5,450 | Startek, Inc. | 155,052 | |||

| 407,489 | |||||

| SERVICES - DATA PROCESSING - 3.52% | |||||

| 17,500 | infoUSA, Inc.* | 195,825 | |||

| SERVICES - DIVERSIFIED/COMMERCIAL - 3.20% | |||||

| 4,500 | The Brink’s Co. | 177,840 | |||

| SERVICES - ENGINEERING - 1.73% | |||||

| 3,000 | URS Corp.* | 96,300 | |||

| SOFTWARE & PROGRAMMING - 2.23% | |||||

| 6,400 | Dendrite International, Inc.* | 124,160 | |||

| SPECIAL INDUSTRY MACHINERY - 2.19% | |||||

| 15,000 | Axcelis Technologies, Inc.* | 121,950 | |||

| SPECIALTY STORES - 5.16% | |||||

| 4,900 | Sonic Automotive, Inc. | 121,520 | |||

| 5,600 | United Auto Group, Inc. | 165,704 | |||

| 287,224 | |||||

| TECHNOLOGY DISTRIBUTION - 2.45% | |||||

| 3,000 | Tech Data Corp.* | 136,200 | |||

| TELECOMMUNICATIONS EQUIPMENT - 3.67% | |||||

| 10,800 | CommScope, Inc.* | 204,120 | |||

The accompanying notes are an integral part of these financial statements.

SMALL CAP VARIABLE SERIES

SCHEDULE OF INVESTMENTS

As of December 31, 2004

COMMON STOCKS - 87.75% (cont.)

| number of shares | market value | ||||

| TELECOMMUNICATIONS SERVICES - 1.09% | |||||

| 1,481 | Manitoba Telecome Services, Inc. | $ | 60,724 | ||

| THRIFTS & MORTGAGE FINANCE - 3.00% | |||||

| 4,000 | The PMI Group, Inc. | 167,000 | |||

| TRANSPORTATION - TRUCKING - 1.73% | |||||

| 5,000 | Sirva, Inc.* | 96,100 | |||

Total Common Stocks (cost $3,896,667) | 4,881,978 | ||||

| SHORT-TERM INVESTMENTS - 9.42% | |||||

| number of shares | market value | ||||

| 262,000 | Federated Cash Trust Series II Treasury | 262,000 | |||

| 262,000 | First American Treasury Obligations Fund, Class A | 262,000 | |||

| Total Short-Term Investments (cost $524,000) | 524,000 | ||||

| TOTAL INVESTMENTS - 97.17% (identified cost $4,420,667) | 5,405,978 | ||||

| OTHER ASSETS AND LIABILITIES, NET - 2.83% | 157,442 | ||||

| NET ASSETS - 100.00% | $ | 5,563,420 | |||

| * | Non-income producing secruity |

The accompanying notes are an integral part of these financial statements.

SMALL CAP VARIABLE SERIES

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2004

| ASSETS | |||

| amount | |||

Investments in Securities at Value (identified cost $4,420,667) [NOTE 1] | $ | 5,405,978 | |

Cash | 153,216 | ||

Receivables: | |||

Interest | 318 | ||

Dividends | 8,711 | ||

Due from Advisor | 5,214 | ||

Total Assets | $ | 5,573,437 | |

| LIABILITIES | |||

| amount | |||

Payable for Fund Shares Redeemed | $ | 3,524 | |

Accrued Expenses | 6,493 | ||

Total Liabilities | $ | 10,017 | |

| NET ASSETS | |||

| amount | |||

Net Assets | $ | 5,563,420 | |

| SOURCES OF NET ASSETS | |||

| amount | |||

At December 31, 2004, Net Assets Consisted of: | |||

Paid-in Capital | $ | 4,204,401 | |

Accumulated Net Realized Gain on Investments | 373,708 | ||

Net Unrealized Appreciation in Value of Investments | 985,311 | ||

Net Assets | $ | 5,563,420 | |

Shares of Capital Stock Outstanding (No Par Value, Unlimited Shares Authorized) | 330,661 | ||

Net Asset Value, Offering and Redemption Price Per Share ($5,563,420 / 330,661 Shares) | $ | 16.83 | |

The accompanying notes are an integral part of these financial statements.

SMALL CAP VARIABLE SERIES

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2004

INVESTMENT INCOME

| amount | ||||

Interest | $ | 2,057 | ||

Dividends (Net of Foreign Tax of $ 3,163) | 58,012 | |||

Total Investment Income | 60,069 | |||

| EXPENSES | ||||

| amount | ||||

Investment Advisory Fees [Note 3] | 53,974 | |||

Fund Accounting, Transfer Agency, & Administration Fees | 12,024 | |||

Custodian Fees | 2,934 | |||

Printing Fees | 777 | |||

Auditing Fees | 3,233 | |||

Insurance Expense | 533 | |||

Participation Fees | 10,795 | |||

Legal Expense | 1,009 | |||

Miscellaneous Expense | 2,595 | |||

Total Expenses | 87,874 | |||

Expenses Waived by Advisor [Note 3] | (23,105 | ) | ||

Total Net Expenses | 64,769 | |||

Net Investment Loss | (4,700 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| amount | ||||

Net Realized Gain on Investments | 793,735 | |||

Change in Unrealized Appreciation of Investments | (210,033 | ) | ||

Net Realized and Unrealized Gain on Investments | 583,702 | |||

Increase in Net Assets Resulting from Operations | $ | 579,002 | ||

The accompanying notes are an integral part of these financial statements.

SMALL CAP VARIABLE SERIES

STATEMENTS OF CHANGES IN NET ASSETS

INCREASE (DECREASE) IN NET ASSETS

year ended 12/31/2004 | year ended 12/31/2003 | |||||||

Operations: | ||||||||

Net Investment Loss | $ | (4,700 | ) | $ | (8,868 | ) | ||

Net Realized Gain (Loss) on Investments | 793,735 | (405,169 | ) | |||||

Net Change in Unrealized Appreciation of Investments | (210,033 | ) | 2,068,297 | |||||

Increase in Net Assets (resulting from operations) | 579,002 | 1,654,260 | ||||||

Distributions to Shareholders: | ||||||||

Net Investment Income | — | — | ||||||

Realized Gains | — | — | ||||||

Total Distributions to Shareholders | — | — | ||||||

Capital Share Transactions: | ||||||||

Proceeds from Shares Sold | 227,902 | 259,399 | ||||||

Dividends Reinvested | — | — | ||||||

Cost of Shares Redeemed | (543,700 | ) | (1,452,354 | ) | ||||

Decrease in Net Assets (resulting from capital share transactions) | (315,798 | ) | (1,192,955 | ) | ||||

Total Increase in Net Assets | 263,204 | 461,305 | ||||||

Net Assets: | ||||||||

Beginning of Year | 5,300,216 | 4,838,911 | ||||||

End of Year | $ | 5,563,420 | $ | 5,300,216 | ||||

Shares of Capital Stock of the Fund Sold and Redeemed: | ||||||||

Shares Sold | 14,509 | 22,825 | ||||||

Shares Reinvested | — | — | ||||||

Shares Redeemed | (34,941 | ) | (124,115 | ) | ||||

Net Decrease in Number of Shares Outstanding | (20,432 | ) | (101,290 | ) | ||||

The accompanying notes are an integral part of these financial statements.

SMALL CAP VARIABLE SERIES

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each year presented.

year ended 12/31/04 | year ended 12/31/03 | year ended 12/31/02 | year ended 12/31/01 | year ended 12/31/00 | ||||||||||||||||

Per Share Operating Performance: | ||||||||||||||||||||

Net Asset Value, Beginning of Year | $ | 15.10 | $ | 10.70 | $ | 13.05 | $ | 12.29 | $ | 12.37 | ||||||||||

Income from Investment Operations: | ||||||||||||||||||||

Net Investment Income (Loss) | (0.01 | ) | (0.03 | ) | (0.01 | ) | (0.02 | ) | 0.07 | |||||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 1.74 | 4.43 | (2.26 | ) | 1.42 | 0.94 | ||||||||||||||

Total from Investment Operations | 1.73 | 4.40 | (2.27 | ) | 1.40 | 1.01 | ||||||||||||||

Less Distributions: | ||||||||||||||||||||

Dividends from Net Investment Income | — | — | — | — | (0.08 | ) | ||||||||||||||

Dividends from Realized Gains | — | — | — | (0.64 | ) | (1.01 | ) | |||||||||||||

Return of Capital Distribution | — | — | (0.08 | ) | — | — | ||||||||||||||

Total Distributions | — | — | (0.08 | ) | (0.64 | ) | (1.09 | ) | ||||||||||||

Net Asset Value at End of Year | $ | 16.83 | $ | 15.10 | $ | 10.70 | $ | 13.05 | $ | 12.29 | ||||||||||

Total Return (a) | 11.46 | % | 41.12 | % | (17.38 | %) | 11.48 | % | 8.16 | % | ||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||

Net Assets, End of Year (in 000s) | $ | 5,563 | $ | 5,300 | $ | 4,839 | $ | 5,114 | $ | 3,326 | ||||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver of Expenses by Advisor | 1.63 | % | 1.56 | % | 1.82 | % | 2.00 | % | 1.83 | % | ||||||||||

After Reimbursement and Waiver of Expenses by Advisor | 1.20 | % | 1.20 | % | 1.20 | % | 1.20 | % | 1.20 | % | ||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver of Expenses by Advisor | (0.52 | )% | (0.55 | )% | (0.73 | )% | (0.94 | %) | 0.11 | % | ||||||||||

After Reimbursement and Waiver of Expenses by Advisor | (0.09 | )% | (0.19 | )% | (0.11 | )% | (0.14 | %) | 0.74 | % | ||||||||||

Portfolio Turnover | 63.35 | % | 51.95 | % | 69.14 | % | 67.40 | % | 85.82 | % | ||||||||||

| (a) | For Periods of Less Than One Full Year, Total Returns Are Not Annualized. |

The accompanying notes are an integral part of these financial statements.

NOTES TO FINANCIAL STATEMENTS

December 31, 2004

SMALL CAP VARIABLE SERIES

Note 1 – Significant Accounting Policies

The Timothy Plan Small-Cap Variable Series (the “Fund”) was organized as a diversified series of The Timothy Plan (the “Trust”). The Trust is an open-ended investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated December 16, 1993 (the “Trust Agreement”). The Fund’s primary objective is long-term capital growth, with a secondary objective of current income. The Fund seeks to achieve its investment objective by investing primarily in common stocks and American Depositary Receipts (ADRs) while abiding by ethical standards established for investments by the Fund. The Fund is one of a series of funds currently authorized by the Board of Trustees. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America for investment companies.

| A. | Security Valuation. |

Investments in securities traded on a national securities exchange are valued at the NASDAQ official closing price on the last business day of the period. Securities for which quotations are not available are valued at fair market value as determined in good faith by each Fund’s investment manager, in conformity with guidelines adopted by and subject to the review and supervision of the Board of Trustees. Unlisted securities, or listed securities in which there were no sales, are valued at the closing bid. Short-term obligations with remaining maturities of 60 days or less are valued at cost plus accrued interest, which approximates market value.

| B. | Investment Income and Securities Transactions. |

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Cost is determined and gains and losses are based on the identified cost basis for both financial statement and federal income tax purposes. Dividend income and distributions to shareholders are reported on the ex-dividend date. Interest income and expenses are accrued daily.

| C. | Net Asset Value Per Share. |

Net asset value per share of the capital stock of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of its net assets by the number of Fund shares outstanding.

| D. | Federal Income Taxes. |

It is the policy of the Fund to comply with all requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

| E. | Use of Estimates. |

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| F. | Reclassifications. |

Accounting principles generally accepted in the United States of America require that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on the net assets or net asset value per share. For the year ended December 31, 2004, the Fund increased accumulated net investment loss and decreased paid-in-capital by $4,700.

Note 2 – Purchases and Sales of Securities

Purchases and sales of securities, other than short-term investments, aggregated $3,112,219 and $3,748,851 respectively, for the year ended December 31, 2004.

Note 3 – Investment Management Fee and Other Transactions with Affiliates

Timothy Partners, LTD., (“TPL”) is the investment Advisor for the Fund pursuant to an investment Advisory Agreement (the “Agreement”) effective February 27, 2004. Under the terms of the Agreement, TPL receives a fee, accrued daily and paid monthly, at an annual rate of 1.00% of the average daily net assets of the Fund. The Advisor has voluntarily agreed to reduce fees payable to it by the Fund and reimburse other expenses to the extent necessary to limit the Fund’s aggregate annual operating expenses, excluding brokerage commissions and other portfolio transaction expenses, interest, taxes, capital

NOTES TO FINANCIAL STATEMENTS

December 31, 2004

SMALL CAP VARIABLE SERIES

expenditures and extraordinary expenses, to 1.20% of average daily net assets through December 31, 2004. As a result, the Advisor has waived a portion of their fee and reimbursed the Fund for expenses in excess of the limit in the amount of $23,105 for the year ended April 30, 2005. There is no guarantee that the Advisor will waive fees and/or reimburse expenses in the future.

At December 31, 2004, the cumulative amounts available for reimbursement that has been paid and/or waived by the Advisor on behalf of the Fund are as follows:

funds | |||

Small-Cap Variable Series | $ | 75,003 | |

At December 31, 2004, the Advisor may recapture a portion of the above amounts no later than the dates as stated below:

funds | 12/31/05 | 12/31/06 | 12/31/07 | ||||||

Small-Cap Variable Series | $ | 34,673 | $ | 17,225 | $ | 23,105 | |||

Note 4 – Unrealized Appreciation (Depreciation)

At December 31, 2004, the cost for federal income tax purposes is $4,420,667. At December 31, 2004, the composition of gross unrealized appreciation (depreciation) of investment securities for tax purposes is as follows:

| Appreciation | Depreciation | Net Appreciation | |||||||

The Timothy Plan Small-Cap Variable Series | $ | 1,044,478 | ($59,167 | ) | $ | 985,311 | |||

Note 5 – Distributions to Shareholders

There were no distributions paid during the years ended December 31, 2004 and 2003.

Small-Cap Variable Fund | |||

As of December 31, 2004, the components of distributable earnings on a tax basis were as follows: | |||

Undistributed Ordinary Income | $ | — | |

Accumulated Long-term Capital Gains | 373,708 | ||

Unrealized Appreciation | 985,311 | ||

| $ | 1,359,019 | ||

Note 6 – N-Q Disclosure & Proxy Procedures

The SEC has adopted the requirement that all Funds file a complete schedule of investments with the SEC for their first and third fiscal quarters on Form N-Q for fiscal quarters ending after July 9, 2004. For the Timothy Plan Funds this would be for the fiscal quarters ending March 31 and September 30. The Form N-Q filing must be made within 60 days of the end of the quarter. The Timothy Plan Funds’ Forms N-Q will be available on the SEC’s website at http://sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC (call 1-800-732-0330 for information on the operation of the Public Reference Room).

The Trust has adopted Portfolio Proxy Voting Policies and Procedures under which the Portfolio’s vote proxies related to securities (“portfolio proxies”) held by the Portfolios. A description of the Trust’s Portfolio Proxy Voting Policies and Procedures is available (i) without charge, upon request, by calling the Company toll-free at 800-846-7526 and (ii) on the SEC’s website at www.sec.gov n addition, the fund will be required to file new Form N-PX, with its complete voting record for the 12 months ended June 30th, no later than August 31st of each year. The first such filing was due August 31, 2004. Once filed, the Trusts’s Form N-PX will be available (i) without charge, upon request, by calling the Company toll-free at 800-846-7526 and (ii) on the SEC’s website at www.sec.gov.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

SMALL CAP VARIABLE SERIES

To the Shareholders and Board of Trustees

The Timothy Plan

Winter Park, Florida

We have audited the accompanying statement of assets and liabilities of The Timothy Plan Small-Cap Variable Series (“the Fund”), a series of shares of The Timothy Plan, including the portfolio of investments, as of December 31, 2004, and the related statements of operations for the year then ended, the changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (US). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2004, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Timothy Plan Small-Cap Variable Series as of December 31, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

|

| TAIT, WELLER & BAKER |

| Philadelphia, Pennsylvania |

February 18, 2005 |

1304 West Fairbanks Avenue

Winter Park, FL 32789

(800) TIM-PLAN

(800) 846-7526

Visit the Timothy Plan web site on the internet at:

www.timothyplan.com

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective Prospectus which includes details regarding the Fund’s objectives, policies, expenses and other information. Distributed by Timothy Partners, Ltd.

| ITEM 2. | CODE OF ETHICS. |

(a) The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) During the period covered by this report, there were no amendments to any provision of the code of ethics.

(c) During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics.

(d) The registrant’s code of ethics is filed herewith.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

The registrant’s Board of Trustees has determined that Charles Nelson, a member of the registrant’s Board of Trustees and Audit Committee, qualifies as an audit committee financial expert. Mr. Nelson is “independent” as that term is defined in paragraph (a)(2) of this item’s instructions.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

The aggregate audit fees billed to The Timothy Plan. for the last two fiscal years by the principal accountant were $79,500. and $73,000, respectively.

Audit-Related Fees. There were no audit related fees, other than those noted under “Audit Fees” Disclosure, billed to The Timothy Plan for the last two fiscal years by the principal accountant.

Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance were $24,000. and $22,000., respectively.

All Other Fees. There were no aggregate fees billed in the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this Item.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS |

Included in the Annual Report to Shareholders filed under Item 1 of this form.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANY |

Not Applicable

| ITEM 9. | PURCHASE OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There has been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

| ITEM 11. | CONTROLS AND PROCEDURES |

| a. | The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act and Rule 15d-15(b) under the Securities Exchange Act of 1934, as amended. |

| b. | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the registrant’s last fiscal half-year (the registrant’s second fiscal half-year in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

ITEM 12. EXHIBITS.

| (a | )(1) | Code of Ethics required to be disclosed under item 2 is attached hereto. | |

| (a | )(2) | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto. | |

| (b | ) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is attached hereto. | |

SIGNATURES

[See General Instruction F]

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Timothy Plan. | ||

| By | /s/ ARTHUR D. ALLY | |

| Arthur D. Ally, PRESIDENT | ||

Date 3/7/2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ ARTHUR D. ALLY | |

| Arthur D. Ally, PRESIDENT | ||

Date 3/7/2005

| By | /s/ ARTHUR D. ALLY | |

| Arthur D. Ally, TREASURER | ||

Date 3/7/2005

| * | Print the name and title of each signing officer under his or her signature. |