UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

The Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Bill Murphy

Unified Fund Services, Inc.

2960 N. Meridian St., Ste 300

Indianapolis, IN 46208

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-846-7526

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

ANNUAL REPORT

DECEMBER 31, 2007

TIMOTHY PLAN FAMILY OF FUNDS: | ||

Conservative Growth Portfolio Variable Series

Strategic Growth Portfolio Variable Series | ||

LETTER FROM THE PRESIDENT

December 31, 2007

ARTHUR D. ALLY

Dear Strategic Growth Variable and Conservative Growth Variable Shareholder,

Since I am expected to comment on performance, I am pleased to report that 2007 turned out to be a good year for Timothy Plan. In most cases the Funds that comprise your asset-allocation investment out-performed their appropriate market index but there were two notable exceptions – our Large/Mid-Cap Growth Fund and Aggressive Growth Fund.

Our Board of Trustees have had these two Funds under review for quite a while and finally reached the conclusion that a change of money managers would be in the best interests of our shareholders. Shareholders of those two funds approved the change in December and Chartwell Investment Partners, an impressive growth money management firm, assumed sub-advisory responsibility over those funds January 1, 2008. We believe Chartwell to be one of the best, top-tier growth management firms in the industry.

This action completes our efforts to upgrade the managers of all our underlying funds and, I believe, we can now state with complete confidence that, in our opinion, all of our Funds are managed by firms that are as good as, if not better than, any mutual fund family in the industry.

I should also point out that we added two new funds to our family May – an International Fund and a High-Yield Bond Fund. As a result, we recommended a reconfiguration of our asset-allocation mix to incorporate these two new funds. This was approved by our shareholders and became effective May 1, 2007. Therefore, as described within this report, Strategic Growth Variable invests in six of our underlying funds while Conservative Growth Variable invests in seven different funds.

As a review, here is what we ask of our various fund managers – in priority order:

| 1. | Do not violate our moral and ethical screens. We provide them with our continuously updated screen list and they apply their economic analysis to any company not on our screen list. |

| 2. | Preservation of principal is job #1 – ahead of performance. This does not mean that the value of your investment will not decline during times of market declines. What it does mean is that we expect them to manage our funds as conservatively as reasonably possible. Then, |

| 3. | Out-perform your market index over a full market cycle – which we consider to be approximately five years or so. |

I want to assure you, in conclusion, that Timothy is serious about our mission (to genuinely screen our investments) and our commitment to continuously pursue Kingdom Class quality in everything we do. Thank you for being part of the Timothy Plan family.

| Sincerely, |

|

| Arthur D. Ally, |

| President |

Timothy Plan Letter from the President [1]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (Unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Arthur D. Ally* 1055 Maitland Center Commons Maitland, FL

Born: 1942 | Chairman and President | Indefinite; Trustee and President since 1994 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| President and controlling shareholder of Covenant Funds, Inc. (“CFI”), a holding company. President and general partner of Timothy Partners, Ltd. (“TPL”), the investment adviser and principal underwriter to each Fund. CFI is also the managing general partner of TPL. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Joseph E. Boatwright* 1410 Hyde Park Drive Winter Park, FL

Born: 1930 | Trustee, Secretary | Indefinite; Trustee and Secretary since 1995 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Retired Minister. Currently serves as a consultant to the Greater Orlando Baptist Association. Served as Senior Pastor to Aloma Baptist Church from 1970-1996. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Mathew D. Staver* 210 East Palmetto Avenue Longwood, FL

Born: 1956 | Trustee | Indefinite; Trustee since 2000 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Attorney specializing in free speech, appellate practice and religious liberty constitutional law. Founder of Liberty Counsel, a religious civil liberties education and legal defense organization. Host of two radio programs devoted to religious freedom issues. Editor of a monthly newsletter devoted to religious liberty topics. Mr. Staver has argued before the United States Supreme Court and has published numerous legal articles. | None | |||||

| * | Interested Trustee of the Trust |

Timothy Plan Officers and Trustee [2]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (Unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Richard W. Copeland 631 Palm Springs Drive Altamonte Springs, FL

Born: 1947 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Principal of Richard W. Copeland, Attoney at Law for 31 years specializing in tax and estate planning. B.A. from Mississippi College, JD and LLM Taxation from University of Miami. Associate Professor Stetson University for past 29 years. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Bill Johnson 903 S. Stewart Street Fremont, MI

Born: 1946 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| President (and Founder) of American Decency Association, Freemont, MI since 1999. Previously served as Michigan State Director for American Family Association (1987-1999). Previously a public school teacher for 18 years. B.S. from Michigan State University and a Masters of Religious Education from Grand Rapids Baptist Seminary. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Kathryn Tindal Martinez 4398 New Broad Street Orlando, FL

Born: 1949 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Served on board of directors from 1991 to present, including House of Hope, B.E.T.A., Childrens' Home Society, and Susan B. Anthony List. Previously a private school teacher and insurance adjuster. B.A. received from Florida State University State University and MAT from Rollins College, FL. | None | |||||

Timothy Plan Officers and Trustee [3]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (Unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

John C. Mulder 2925 Professional Place Colorado Springs, CO

Born: 1950 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| President WaterStone “Formerly, Christian Community Foundation and National Foundation” since 2001. Prior: 22 years of executive experience for a group of banks and a trust company. B.A. in Economics from Wheaton College and MBA from University of Chicago. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Charles E. Nelson 1145 Cross Creek Circle Altamonte Springs, FL

Born: 1934 | Trustee | Indefinite; Trustee since 2000 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Certified Public Accountant. Director of Operations, National Multiple Sclerosis Society Mid Florida Chapter. Formerly Director of Finance, Hospice of the Comforter, Inc. Formerly Comptroller, Florida United Methodist Children’s Home, Inc. Formerly Credit Specialist with the Resolution Trust Corporation and Senior Executive Vice President, Barnett Bank of Central Florida, N.A. Formerly managing partner, Arthur Andersen, CPA firm, Orlando, Florida branch. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Wesley W. Pennington 442 Raymond Avenue Longwood, FL

Born: 1930 | Trustee | Indefinite; Trustee since 1994 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Retired Air Force Officer. Past President, Westwind Holdings, Inc., a development company, since 1997. Past President and controlling shareholder, Weston, Inc., a fabric treatment company, from 1979-1997. President, Designer Services Group 1980-1988. | None | |||||

Timothy Plan Officers and Trustee [4]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (Unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Scott Preissler, Ph.D. 608 Pintail Place Flower Mound, TX

Born: 1960 | Trustee | Indefinite; Trustee since 2004 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

Chairman Biblical Stewardship Dept. South Western Baptist Theological Seminary. Previously, President and CEO of Christian Stewardship Association where he was affiliated for 14 years. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Alan M. Ross 11210 West Road Roswell, GA

Born: 1951 | Trustee | Indefinite; Trustee since 2004 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Founder and CEO of Corporate Development Institute which he founded five years ago. Previously he served as President and CEO of Fellowship of Companies for Christ and has authored three books: Beyond World Class, Unconditional Excellence, Breaking Through to Prosperity. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of Time Served | Number of Portfolios in Fund Complex Overseen by Trustee | |||

Dr. David J. Tolliver 4000 E. Maplewood Drive Excelsior Springs, MO

Born: 1951 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| Executive Director Missouri Baptist Convention. Previously, Senior Pastor Pisgah Baptist Church, Excelsior Springs, MO since 1999. Previously pastored three churches in St. Louis, MO area (1986-1999). Currently serves on Board of Trustees Midwestern Baptist Theological Seminary. Past President Missouri Baptist Convention (2003-2004) | None | |||||

Timothy Plan Officers and Trustee [5]

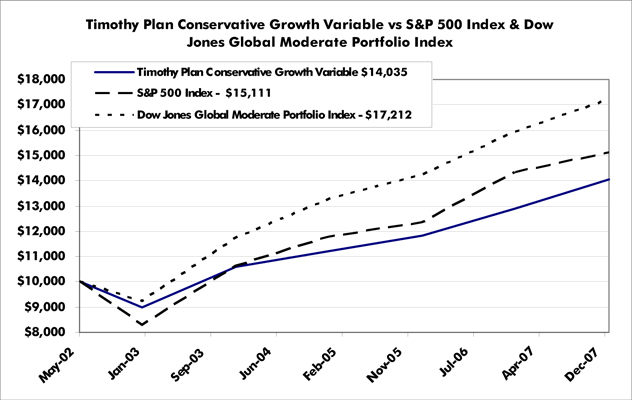

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

RETURNS FOR THE YEAR ENDED

December 31, 2007

Fund/Index | 1 Year | 5 Year | Average Annual Total Return Since Inception May 1, 2002 | ||||||

Timothy Plan Conservative Growth Portfolio Variable Series | 8.82 | % | 9.29 | % | 6.16 | % | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 7.55 | % | |||

Dow Jones Global Moderate Portfolio Index | 8.02 | % | 3.28 | % | 10.05 | % |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund, and the S&P 500 Index on May 1, 2002 and held through December 31, 2007 The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. . The Dow Jones Global Moderate Portfolio Index is a widely recognized index that measures global stocks, bonds, and cash which in turn are represented by multiple subindexes. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Hypothetical Performance Graph [6]

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

FUND PROFILE

December 31, 2007

FUND PROFILE (Unaudited):

Industries

(% of Net Assets)

Fixed Income | 30.12 | % | |

Mid & Large Cap Value | 19.87 | % | |

International | 14.98 | % | |

Small-Cap Value | 10.03 | % | |

High Yield Bond | 10.02 | % | |

Mid & Large Cap Growth | 9.97 | % | |

Aggressive Growth | 4.98 | % | |

Cash & Equivalents | 0.63 | % | |

Liabilities in Excess of Other Assets | (0.60 | )% | |

| 100.00 | % | ||

EXPENSE EXAMPLE (Unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs,” (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2007, through December 31, 2007.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on you account during this period.

Timothy Plan Top Ten Holdings / Industries [7]

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

FUND PROFILE

December 31, 2007

Hypothetical example for comparison purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses my not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account Value July 1, 2007 | Ending Account Value December 31, 2007 | Expenses Paid During Period* July 1, 2007 Through December 31, 2007 | |||||||

Actual | $ | 1,000.00 | $ | 1,018.55 | $ | 3.40 | |||

Hypothetical (5% return before expenses) | 1,000.00 | $ | 1,021.84 | $ | 3.40 | ||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.67%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/365 days (to reflect the partial year period.) The Fund’s ending account value in the first line in the table is based on its actual total return of 1.93% for the six-month period of July 1, 2007, to December 31, 2007. |

Timothy Plan Top Ten Holdings / Industries [8]

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

SCHEDULE OF INVESTMENTS

As of December 31, 2007

MUTUAL FUNDS (A) - 99.97%

number of shares | market value | |||||

| 279,999 | Timothy Aggressive Growth Fund | $ | 1,901,190 | |||

| 1,151,974 | Timothy Fixed Income Fund | 11,508,215 | ||||

| 401,310 | Timothy High Yield Bond Fund | 3,828,495 | ||||

| 519,635 | Timothy International Fund | 5,721,187 | ||||

| 552,705 | Timothy Large/Mid-Cap Growth Fund | 3,808,141 | ||||

| 490,364 | Timothy Large/Mid-Cap Value Fund | 7,590,830 | ||||

| 288,840 | Timothy Small-Cap Value Fund | 3,832,909 | ||||

| �� | ||||||

| Total Mutual Funds (cost $38,424,700) | 38,190,967 | |||||

SHORT-TERM INVESTMENTS - 0.63% |

| |||||

number of shares | market value | |||||

| 242,424 | Fidelity Institutional Money Market, 4.95% (B) | 242,424 | ||||

| Total Short-Term Investments (cost $242,424) | 242,424 | |||||

| Total Investments (cost $38,667,124) - 100.60% | $ | 38,433,391 | ||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (0.60)% | (228,657 | ) | ||||

| Net Assets - 100.00% | $ | 38,204,734 | ||||

| (A) | Affiliated Funds - Class A Shares. |

| (B) | Variable rate security; the rate shown represents the yield at December 31, 2007. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Conservative Growth Variable Fund [9]

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2007

ASSETS | ||||

| amount | ||||

Investments in Unaffiliated Securities at Market Value (cost $242,424) [NOTE 1] | $ | 242,424 | ||

Investments in Affiliated Securities at Market Value (cost $38,424,700) [NOTE 1] | 38,190,967 | |||

Receivables: | ||||

For Fund Shares Sold | 89,787 | |||

For Investments Sold | 73,530 | |||

Interest | 616 | |||

Prepaid Expenses | 117 | |||

Total Assets | 38,597,441 | |||

LIABILITIES | ||||

| amount | ||||

Payable for Fund Shares Redeemed | $ | 62,452 | ||

Payable for Investments Purchased | 298,530 | |||

Payable to Adviser | 3,177 | |||

Payable to Affiliates | 7,941 | |||

Accrued Expenses | 20,607 | |||

Total Liabilities | 392,707 | |||

NET ASSETS | ||||

| amount | ||||

Net Assets | $ | 38,204,734 | ||

SOURCES OF NET ASSETS | ||||

| amount | ||||

At December 31, 2007, Net Assets Consisted of: | ||||

Paid-in Capital | $ | 34,722,755 | ||

Accumulated Undistributed Net Investment Income | 885,592 | |||

Accumulated Undistributed Net Realized Gain on Investments | 2,830,120 | |||

Net Unrealized Depreciation in Value of Investments | (233,733 | ) | ||

Net Assets | $ | 38,204,734 | ||

Shares of Capital Stock Outstanding (No Par Value, Unlimited Shares Authorized) | 2,946,128 | |||

Net Asset Value, Offering and Redemption Price Per Share ($38,204,734 / 2,946,128 Shares) | $ | 12.97 | ||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Conservative Growth Variable Fund [10]

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2007

INVESTMENT INCOME

| amount | |||

Interest from Affiliated Funds | $ | 46,283 | |

Interest from Unaffiliated Funds | 8,811 | ||

Dividends from Affiliated Funds | 1,037,456 | ||

Total Investment Income | 1,092,550 | ||

EXPENSES

| amount | ||

Investment Advisory Fees [Note 3] | 32,945 | |

Fund Accounting , Transfer Agency & Administration Fees | 57,143 | |

Participation Fees | 82,362 | |

Miscellaneous Expense | 12,188 | |

Custodian Fees | 9,080 | |

Audit Fees | 8,869 | |

CCO Fees | 2,892 | |

Trustee Expense | 2,116 | |

Insurance Expense | 1,278 | |

Legal Expense | 589 | |

Total Expenses | 209,462 | |

Net Investment Income | 883,088 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

| amount | ||||

Net Realized Gain on Investments in Affiliated Funds | 1,638,708 | |||

Capital Gain Distributions from Affiliated Funds | 1,191,013 | |||

Change in Unrealized Appreciation (Depreciation) of Investments | (1,066,886 | ) | ||

Net Realized and Unrealized Gain on Investments | 1,762,835 | |||

Increase in Net Assets Resulting from Operations | $ | 2,645,923 | ||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Conservative Growth Variable Fund [11]

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

STATEMENTS OF CHANGES IN NET ASSETS

INCREASE (DECREASE) IN NET ASSETS

| year ended 12/31/07 | year ended 12/31/06 | |||||||

Operations: | ||||||||

Net Investment Income | $ | 883,088 | $ | 726,463 | ||||

Net Realized Gain on Investments | 1,638,708 | 55,700 | ||||||

Capital Gain Distributions from Investment Companies | 1,191,013 | 671,428 | ||||||

Change in Unrealized Appreciation (Depreciation) of Investments | (1,066,886 | ) | 345,744 | |||||

Net Increase in Net Assets (resulting from operations) | 2,645,923 | 1,799,335 | ||||||

Distributions to Shareholders: | ||||||||

Net Investment Income | — | (727,875 | ) | |||||

Net Realized Gains | (686,780 | ) | (597,832 | ) | ||||

Total Distributions to Shareholders | (686,780 | ) | (1,325,707 | ) | ||||

Capital Share Transactions: | ||||||||

Proceeds from Shares Sold | 13,753,659 | 13,154,180 | ||||||

Dividends Reinvested | 686,780 | 1,325,707 | ||||||

Cost of Shares Redeemed | (4,917,795 | ) | (1,827,179 | ) | ||||

Increase in Net Assets (resulting from capital share transactions) | 9,522,644 | 12,652,708 | ||||||

Total Increase in Net Assets | 11,481,787 | 13,126,336 | ||||||

Net Assets: | ||||||||

Beginning of year | 26,722,947 | 13,596,611 | ||||||

End of year | $ | 38,204,734 | $ | 26,722,947 | ||||

Accumulated Undistributed Net Investment Income | $ | 885,592 | $ | 2,504 | ||||

Shares of Capital Stock of the Fund Sold and Redeemed: | ||||||||

Shares Sold | 1,070,273 | 1,083,035 | ||||||

Shares Reinvested | 53,404 | 108,843 | ||||||

Shares Redeemed | (378,303 | ) | (150,773 | ) | ||||

Net Increase in Number of Shares Outstanding | 745,374 | 1,041,105 | ||||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Conservative Growth Variable Fund [12]

CONSERVATIVE GROWTH PORTFOLIO VARIABLE SERIES

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each period presented.

| year ended 12/31/07 | year ended 12/31/06 | year ended 12/31/05 | year ended 12/31/04 | year ended 12/31/03 | ||||||||||||||||

Per Share Operating Performance: | ||||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 12.14 | $ | 11.72 | $ | 11.18 | $ | 10.55 | $ | 8.97 | ||||||||||

Income from Investment Operations: | ||||||||||||||||||||

Net Investment Income | 0.30 | 0.35 | 0.05 | (A) | 0.03 | (A) | 0.02 | (A) | ||||||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 0.77 | 0.73 | 0.55 | 0.60 | 1.56 | |||||||||||||||

Total from Investment Operations | 1.07 | 1.08 | 0.60 | 0.63 | 1.58 | |||||||||||||||

Less Distributions: | ||||||||||||||||||||

Dividends from Net Investment Income | — | (0.36 | ) | (0.03 | ) | — | — | |||||||||||||

Dividends from Realized Gains | (0.24 | ) | (0.30 | ) | (0.03 | ) | — | — | ||||||||||||

Total Distributions | (0.24 | ) | (0.66 | ) | (0.06 | ) | — | — | ||||||||||||

Net Asset Value at End of Period | $ | 12.97 | $ | 12.14 | $ | 11.72 | $ | 11.18 | $ | 10.55 | ||||||||||

Total Return (B) | 8.82 | % | 9.16 | % | 5.33 | % | 5.97 | % | 17.61 | % | ||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||

Net Assets, End of Period (in 000s) | $ | 38,205 | $ | 26,723 | $ | 13,597 | $ | 6,396 | $ | 3,683 | ||||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver / Recoupment of Expenses by Advisor (C) | 0.64 | % | 0.72 | % | 0.78 | % | 0.65 | % | 0.85 | % | ||||||||||

After Reimbursement and Waiver / Recoupment of Expenses by Advisor (C) | 0.64 | % | 0.72 | % | 0.85 | % | 0.85 | % | 0.85 | % | ||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver / Recoupment of Expenses by Advisor (C)(D) | 2.68 | % | 3.59 | % | 0.48 | % | 0.74 | % | 0.36 | % | ||||||||||

After Reimbursement and Waiver / Recoupment of Expenses by Advisor (C)(D) | 2.68 | % | 3.59 | % | 0.41 | % | 0.54 | % | 0.36 | % | ||||||||||

Portfolio Turnover | 34.60 | % | 2.04 | % | 1.25 | % | 2.26 | % | 2.30 | % | ||||||||||

| (A) | Net Investment Income was calculated using average shares method. |

| (B) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

Total return would have been lower if certain expenses had not been reimbursed or waived for the years in which waiver/reimbursement occurred. .

| (C) | These ratios exclude the impact of expenses of the underlying security holdings as represented in the schedule of investments. |

| (D) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Conservative Growth Variable Fund [13]

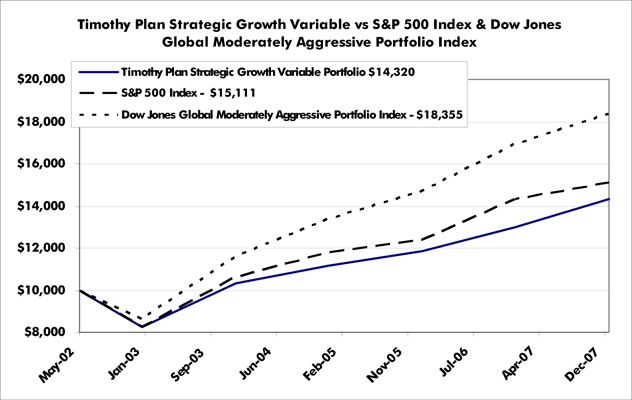

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

RETURNS FOR THE YEAR ENDED

December 31, 2007

Fund/Index | 1 Year | 5 Year | Average Annual Total Return Since Inception May 6, 2002 | ||||||

Timothy Plan Strategic Growth Portfolio Variable Series | 10.13 | % | 11.66 | % | 6.53 | % | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 7.55 | % | |||

Dow Jones Global Moderately Aggressive Portfolio Index | 8.33 | % | 16.23 | % | 11.30 | % |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund, and the S&P 500 Index on May 6, 2002 and held through December 31, 2007. The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. The Dow Jones Global Moderately Aggressive Portfolio Index is a widely recognized index that measures global stocks, bonds, and cash which in turn are represented by multiple subindexes. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Hypothetical Performance Graph [14]

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

FUND PROFILE

December 31, 2007

FUND PROFILE (Unaudited):

Industries

(% of Net Assets)

International | 24.83 | % | |

Mid & Large Cap Growth | 19.83 | % | |

Mid & Large Cap Value | 19.76 | % | |

Small Cap Value | 12.48 | % | |

Aggressive Growth | 12.37 | % | |

High Yield Bond | 9.97 | % | |

Money Market | 0.29 | % | |

Other Assets less Liabilities | 0.47 | % | |

| 100.00 | % | ||

EXPENSE EXAMPLE (Unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs,” (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2007, through December 31, 2007.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on you account during this period.

Timothy Plan Top Ten Holdings / Industries [15]

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

FUND PROFILE

December 31, 2007

Hypothetical example for comparison purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses my not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account Value July 1, 2007 | Ending Account Value December 31, 2007 | Expenses Paid During Period* July 1, 2007 Through December 31, 2007 | |||||||

Actual | $ | 1,000.00 | $ | 1,007.07 | $ | 3.25 | |||

Hypothetical (5% return before expenses) | 1,000.00 | 1,021.97 | 3.27 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.64%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/365 days (to reflect the one-half year period.) The Fund’s ending account value in the first line in the table is based on its actual total return of 0.71% for the six-month period of July 1, 2007, to December 31, 2007. |

Timothy Plan Top Ten Holdings / Industries [16]

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

SCHEDULE OF INVESTMENTS

As of December 31, 2007

MUTUAL FUNDS (A) - - 99.24%

number of shares | market value | ||||

349,330 | Timothy Aggressive Growth Fund | $ | 2,371,948 | ||

200,279 | Timothy High Yield Bond Fund | 1,910,665 | |||

432,200 | Timothy International Fund | 4,758,524 | |||

551,663 | Timothy Large/Mid-Cap Growth Fund | 3,800,956 | |||

244,708 | Timothy Large/Mid-Cap Value Fund | 3,788,086 | |||

180,192 | Timothy Small-Cap Value Fund | 2,391,146 | |||

Total Mutual Funds (cost $18,902,310) | 19,021,325 | ||||

SHORT TERM INVESTMENTS - 0.29% | |||||

number of shares | market value | ||||

55,282 | Timothy Plan Money Market Fund, 3.34% (A)(B) | 55,282 | |||

Total Short-Term Investments (cost $55,282) | 55,282 | ||||

Total Investments (cost $18,957,592) - 99.53% | $ | 19,076,607 | |||

OTHER ASSETS LESS LIABILITIES - 0.47% | 89,918 | ||||

Net Assets - 100.00% | $ | 19,166,525 | |||

| (A) | Affiliated Funds - Class A Shares. |

| (B) | Variable rate security; the rate shown represents the yield at December 31, 2007. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Strategic Growth Variable Fund [17]

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2007

ASSETS | |||

| amount | |||

Investments in Affililated Securities at Market Value (cost $18,957,592) [NOTE 1] | $ | 19,076,607 | |

Receivables: | |||

Fund Shares Sold | 155,863 | ||

For Investments Sold | 65,153 | ||

Interest | 295 | ||

Prepaid Expenses | 64 | ||

Total Assets | 19,297,982 | ||

LIABILITIES | |||

| amount | |||

Payable for Fund Shares Redeemed | $ | 269 | |

Payable for Investments Purchased | 115,153 | ||

Payable to Adviser | 1,587 | ||

Payable to Affiliates | 3,968 | ||

Accrued Expenses | 10,480 | ||

Total Liabilities | 131,457 | ||

NET ASSETS | |||

| amount | |||

Net Assets | $ | 19,166,525 | |

SOURCES OF NET ASSETS | |||

| amount | |||

At December 31, 2007, Net Assets Consisted of: | |||

Paid-in Capital | $ | 16,620,258 | |

Accumulated Undistributed Net Investment Income | 263,057 | ||

Accumulated Undistributed Net Realized Gain on Investments | 2,164,195 | ||

Net Unrealized Appreciation in Value of Investments | 119,015 | ||

Net Assets | $ | 19,166,525 | |

Shares of Capital Stock Outstanding (No Par Value, Unlimited Shares Authorized) | 1,494,054 | ||

Net Asset Value, Offering and Redemption Price Per Share ($19,166,525 / 1,494,054 Shares) | $ | 12.83 | |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Strategic Growth Variable Fund [18]

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

STATEMENT OF OPERATIONS

For the year ended December 31, 2007

INVESTMENT INCOME

| amount | ||||

Interest from Affiliated Funds | $ | 4,343 | ||

Dividends from Affiliated Funds | 362,462 | |||

Total Investment Income | 366,805 | |||

EXPENSES | ||||

| amount | ||||

Investment Advisory Fees [Note 3] | 16,330 | |||

Fund Accounting, Transfer Agency & Administration Fees | 28,169 | |||

Participation Fees | 40,826 | |||

Miscellaneous Expense | 7,195 | |||

Audit Fees | 3,888 | |||

Custodian Fees | 3,728 | |||

CCO Fees | 1,435 | |||

Trustee Expense | 1,186 | |||

Insurance Expense | 690 | |||

Legal Expense | 301 | |||

Total Expenses | 103,748 | |||

Net Investment Income | 263,057 | |||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| amount | ||||

Net Realized Gain on Investments in Affiliated Funds | 1,284,421 | |||

Capital Gain Distributions from Affiliated Funds | 907,026 | |||

Change in Unrealized Appreciation (Depreciation) of Investments | (971,690 | ) | ||

Net Realized and Unrealized Gain on Investments | 1,219,757 | |||

Increase in Net Assets Resulting from Operations | $ | 1,482,814 | ||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Strategic Growth Variable Fund [19]

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

STATEMENTS OF CHANGES IN NET ASSETS

INCREASE (DECREASE) IN NET ASSETS

| year ended 12/31/07 | year ended 12/31/06 | |||||||

Operations: | ||||||||

Net Investment Income | $ | 263,057 | $ | 261,404 | ||||

Net Realized Gain on Investments | 1,284,421 | 106,125 | ||||||

Capital Gain Distributions from Investment Companies | 907,026 | 661,173 | ||||||

Change in Unrealized Appreciation (Depreciaton) of Investments | (971,690 | ) | 99,726 | |||||

Net Increase in Net Assets (resulting from operations) | 1,482,814 | 1,128,428 | ||||||

Distributions to Shareholders: | ||||||||

Net Income | — | (261,404 | ) | |||||

Net Realized Gains | (654,294 | ) | (540,046 | ) | ||||

Total Distributions to Shareholders | (654,294 | ) | (801,450 | ) | ||||

Capital Share Transactions: | ||||||||

Proceeds from Shares Sold | 7,452,190 | 4,758,582 | ||||||

Dividends Reinvested | 654,294 | 801,450 | ||||||

Cost of Shares Redeemed | (4,039,305 | ) | (1,276,179 | ) | ||||

Increase in Net Assets (resulting from capital share transactions) | 4,067,179 | 4,283,853 | ||||||

Total Increase in Net Assets | 4,895,699 | 4,610,831 | ||||||

Net Assets: | ||||||||

Beginning of year | 14,270,826 | 9,659,995 | ||||||

End of year | $ | 19,166,525 | $ | 14,270,826 | ||||

Accumulated Undistributed Net Investment Income | $ | 263,057 | $ | — | ||||

Shares of Capital Stock of the Fund Sold and Redeemed: | ||||||||

Shares Sold | 567,376 | 391,478 | ||||||

Shares Reinvested | 51,641 | 66,072 | ||||||

Shares Redeemed | (307,653 | ) | (104,473 | ) | ||||

Net Increase in Number of Shares Outstanding | 311,364 | 353,077 | ||||||

The accompanying notes are an integral part of these financial statements.

Timothy Plan Strategic Growth Variable Fund [20]

STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each period presented.

| year ended 12/31/07 | year ended 12/31/06 | year ended 12/31/05 | year ended 12/31/04 | year ended 12/31/03 | ||||||||||||||||

Per Share Operating Performance: | ||||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 12.07 | $ | 11.64 | $ | 11.18 | $ | 10.34 | $ | 8.25 | ||||||||||

Income from Investment Operations: | ||||||||||||||||||||

Net Investment Income (Loss) | 0.18 | 0.23 | (0.05 | ) (A) | (0.01 | ) (A) | (0.02 | ) (A) | ||||||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 1.04 | 0.91 | 0.71 | 0.85 | 2.11 | |||||||||||||||

Total from Investment Operations | 1.22 | 1.14 | 0.66 | 0.84 | 2.09 | |||||||||||||||

Less Distributions: | ||||||||||||||||||||

Dividends from Net Investment Income | — | (0.23 | ) | — | — | — | ||||||||||||||

Dividends from Realized Gains | (0.46 | ) | (0.48 | ) | (0.20 | ) | — | — | ||||||||||||

Total Distributions | (0.46 | ) | (0.71 | ) | (0.20 | ) | — | — | ||||||||||||

Net Asset Value at End of Period | $ | 12.83 | $ | 12.07 | $ | 11.64 | $ | 11.18 | $ | 10.34 | ||||||||||

Total Return(B) | 10.13 | % | 9.83 | % | 5.89 | % | 8.12 | % | 25.33 | % | ||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||

Net Assets, End of Period (in 000s) | $ | 19,167 | $ | 14,271 | $ | 9,660 | $ | 7,407 | $ | 4,162 | ||||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver / Recoupment of Expenses by Advisor (C) | 0.64 | % | 0.72 | % | 0.79 | % | 0.72 | % | 0.85 | % | ||||||||||

After Reimbursement and Waiver / Recoupment of Expenses by Advisor (C) | 0.64 | % | 0.72 | % | 0.85 | % | 0.85 | % | 0.85 | % | ||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver / Recoupment of Expenses by Advisor (C)(D) | 1.61 | % | 2.21 | % | (0.42 | )% | 0.03 | % | (0.41 | )% | ||||||||||

After Reimbursement and Waiver / Recoupment of Expenses by Advisor (C)(D) | 1.61 | % | 2.21 | % | (0.48 | )% | (0.10 | )% | (0.41 | )% | ||||||||||

Portfolio Turnover | 45.07 | % | 2.62 | % | 3.43 | % | 8.79 | % | 4.94 | % | ||||||||||

| (A) | Net Investment Income was calculated using average shares method. |

| (B) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. Total return would have been lower if certain expenses had not been reimbursed or waived for the years in which waiver/reimbursement occurred. |

| (C) | These ratios exclude the impact of expenses of the underlying security holdings as represented in the schedule of investments. |

| (D) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

Timothy Plan Strategic Growth Variable Fund [21]

DISCLOSURES

December 31, 2007

CONSERVATIVE & STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

Note 1 – Significant Accounting Policies

The Timothy Plan Conservative Growth Portfolio Variable Series (“Conservative Growth Portfolio”) and the Timothy Plan Strategic Growth Portfolio Variable Series (“Strategic Growth Portfolio”) (individually the “Fund”, collectively the “Funds”) were organized as diversified series of The Timothy Plan (the “Trust”). The Trust is an open-ended investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated December 16, 1993 (the “Trust Agreement”). The Conservative Growth Portfolio’s primary objective is moderate long-term capital growth, with a secondary objective of current income only to the extent that the Timothy Funds in which the Conservative Growth Portfolio invests seek current income. The Strategic Growth Portfolio’s primary investment objective is medium to high levels of long term capital growth, with a secondary objective of current income only to the extent that the Timothy Funds in which the Strategic Growth Portfolio invests seek current income. The Conservative Growth Portfolio seeks to achieve its investment objectives by investing primarily in the following Timothy Funds which are other series of the Trust: Small-Cap Value Fund, Large/Mid-Cap Value Fund, Large/Mid-Cap Growth Fund, Fixed Income Fund, Aggressive Growth Fund, High Yield Bond Fund, International Fund and the Money Market Fund. The Strategic Growth Portfolio seeks to achieve its investment objectives by investing primarily in the following Timothy Funds which are other series of the Trust: Small-Cap Value Fund, Large/Mid-Cap Value Fund, Large/Mid-Cap Growth Fund, Aggressive Growth Fund, High Yield Bond Fund, International Fund and the Money Market Fund. Each Fund is one of one series of funds currently authorized by the Board of Trustees (the “Board”). Timothy Partners, LTD., (“TPL” or the “Adviser”) is the Investment Adviser for the Funds. The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America for investment companies.

A. Security Valuation.

Each Fund purchases Class A Shares of the Timothy Funds at net asset value without any sales charges. With respect to securities owned by the Timothy Funds, securities listed or traded on a securities exchange for which representative market quotations are available will be valued at the last quoted sales price on the security’s principal exchange on that day. Listed securities not traded on an exchange that day, and other securities which are traded in the over-the-counter markets, will be valued at the last reported bid price in the market on that day, if any. Securities for which market quotations are not readily available and all other assets will be valued at their respective fair market values as determined by the Adviser in conformity with guidelines adopted by and subject to the review of the Board. Short-term obligations with remaining maturities of 60 days or less are valued at cost plus accrued interest, which approximates market value.

Each Fund generally determines the total value of its shares by using market prices for the securities comprising its portfolio. Securities for which quotations are not available and any other assets are valued at fair market value as determined in good faith by each Fund’s investment manager, in conformity with guidelines adopted by and subject to review and supervision of the Board.

The Board has delegated to the Adviser responsibility for determining the value of Fund portfolio securities under certain circumstances. Under such circumstances, the Adviser will use its best efforts to arrive at the fair value of a security held by the Fund under all reasonably ascertainable facts and circumstances. The Adviser must prepare a report for the Board not less than quarterly containing a complete listing of any securities for which fair value pricing was employed and detailing the specific reasons for such fair value pricing. The Trust has adopted written policies and procedures to guide the Adviser with respect to the circumstances under which, and the methods to be used, in fair valuing securities.

In September 2006, Financial Accounting Standards Board (FASB) issued Statement on Financial Accounting Standards (SFAS) No. 157 “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosure about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of December 31, 2007, the Trust does not believe the adoption of SFAS No. 157 will impact the amounts reported in the financial statements, however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain measurements reported on the statement of changes in net assets for a fiscal period.

Timothy Plan Disclosures [22]

DISCLOSURES

December 31, 2007

CONSERVATIVE & STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

B. Investment Income and Securities Transactions.

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Cost is determined and gains and losses are based on the identified cost basis for both financial statement and federal income tax purposes. Dividend income is recognized on the ex-dividend date. Interest income and expenses are recognized on an accrual basis.

C. Net Asset Value Per Share.

Net asset per share of the capital stock of each Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of its net assets by the number of Fund shares outstanding.

D. Federal Income Taxes.

It is the policy of the Funds to continue to comply with all requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders, therefore, no federal income tax provision is required.

Effective June 29, 2007, the Funds adopted the provisions of Financial Accounting Standards Board Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes, a clarification of FASB Statement No. 109, Accounting for Income Taxes. FIN 48 establishes financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. FIN 48 was applied to all open tax years as of the effective date. The adoption of FIN 48 had no impact on the Funds’ net assets or results of operations.

As of and during the year ended December 31, 2007, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statements of operations. During the year, the Funds did not incur any interest or penalties. The Funds are not subject to examination by U.S. federal tax authorities for tax years before 2004.

E. Use of Estimates.

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

F. Distributions to Shareholders.

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of the Funds.

G. Expenses.

Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or an appropriate basis (as determined by the Board).

Timothy Plan Disclosures [23]

DISCLOSURES

December 31, 2007

CONSERVATIVE & STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

Note 2 – Purchases and Sales of Securities

The following is a summary of the cost of purchases and proceeds from the sale of securities, other than short-term investments, for the year ended December 31, 2007:

funds | purchases | sales | ||||

Conservative Growth Portfolio | $ | 24,703,758 | $ | 10,992,480 | ||

Strategic Growth Portfolio | $ | 11,804,888 | $ | 7,360,398 | ||

Note 3 – Investment Management Fee and Other Transactions with Affiliates

Timothy Partners, LTD. is the Investment Adviser for the Funds pursuant to an Amended and Restated Investment Advisory Agreement (the “Agreement”) that was renewed by the Board on February 27, 2007. TPL supervises the investment of the assets of each Funds’ portfolio in accordance with the objectives, policies and restrictions of the Funds. Under the terms of the Agreement, TPL receives a fee, accrued daily and paid monthly, at an annual rate of 0.10% of the average daily net assets of each Fund. Total fees earned by TPL during the year ended December 31, 2007 were $32,945 and $16,330 for the Conservative Growth Portfolio and the Strategic Growth Portfolio, respectively. The Conservative Growth Portfolio and the Strategic Growth Portfolio owed TPL $3,177 and $1,587, respectively, at December 31, 2007. An officer and trustee of the Funds is also an officer of the Adviser.

TPL has contractually agreed to reduce fees payable to it by the Funds and reimburse other expenses to the extent necessary to limit each Funds’ aggregate annual operating expenses, excluding brokerage commissions and other portfolio transaction expenses, interest, taxes, capital expenditures and extraordinary expenses, to 0.85% of average daily net assets through April 30, 2008. The Funds have agreed to repay these expenses in the first, second and third fiscal years following the year of the waivers/reimbursements, to the extent the total expenses of the Funds for any such year or years do not exceed the expense limitation of 0.85%.

At December 31, 2007, there were no cumulative amounts available for recoupment that were previously paid and/or waived by TPL on behalf of the Funds.

Note 4 – Control Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund under Section 2(a) 9 of the Investment Company Act of 1940. As of December 31, 2007, American United Life Insurance Co. (“AUL”) held for the benefit of others in aggregate, approximately 84% of Conservative Growth Portfolio and approximately 64% of Strategic Growth Portfolio; Annuity Investors Life Insurance Co. (“AILIC”) held for the benefit of others in aggregate, approximately 16% of Conservative Growth Portfolio and approximately 36% of Strategic Growth Portfolio.

The Trust and TPL have entered into Participation Agreements with AUL and AILIC. Under the Participation Agreements, AUL and AILIC maintain the records related to the Funds’ shares in the insurance company separate accounts, process all purchases and redemptions within the accounts, and provide other administrative and shareholder services for an administrative services fee of 0.25% of each Fund’s assets.

Note 5 – Unrealized Appreciation (Depreciation)

At December 31, 2007, the cost for federal income tax purposes is and the composition of gross unrealized appreciation (depreciation) of investment securities is as follows:

funds | cost | appreciation | depreciation | net app. /dep. | ||||||||||

Conservative Growth | $ | 38,709,476 | $ | 938,034 | $ | (1,214,119 | ) | $ | (276,085 | ) | ||||

Strategic Growth | $ | 18,964,058 | $ | 757,346 | $ | (644,797 | ) | $ | 112,549 | |||||

Timothy Plan Disclosures [24]

DISCLOSURES

December 31, 2007

CONSERVATIVE & STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

Note 6 – Distributions to Shareholders

The tax characteristics of distributions paid during 2007 and 2006 were as follows:

| Conservative Growth Portfolio | Strategic Growth Portfolio | |||||

2007 | ||||||

Long-term Capital Gains | $ | 686,780 | $ | 654,294 | ||

| $ | 686,780 | $ | 654,294 | |||

2006 | ||||||

Ordinary Income | $ | 727,875 | $ | 261,404 | ||

Short-term Capital Gains | 21,033 | — | ||||

Long-term Capital Gains | 576,799 | 540,046 | ||||

| $ | 1,325,707 | $ | 801,450 | |||

As of December 31, 2007, the components of distributable earnings on a tax basis were as follows:

| Conservative Growth Portfolio | Strategic Growth Portfolio | ||||||

Undistributed Ordinary Income | $ | 943,193 | $ | 290,810 | |||

Undistributed Long-term Capital Gains | 2,814,871 | 2,142,908 | |||||

Unrealized Appreciation/Depreciation* | (276,085 | ) | 112,549 | ||||

| $ | 3,481,979 | $ | 2,546,267 | ||||

| * | The differences between book-basis and tax-basis unrealized appreciation are attributable to differing treatments of wash sales. |

Timothy Plan Disclosures [25]

| [GRAPHIC] | Cohen Fund Audit Services, Ltd. 800 Westpoint Pkwy., Suite 1100 Westlake, OH 44145-1524 | 440.835.8500 440.835.1093 fax | ||

| www.cohenfund.com | ||||

To The Shareholders and Board of Trustees

The Timothy Plan

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Timothy Plan Conservative Growth Portfolio Variable Series and Timothy Plan Strategic Growth Portfolio Variable Series, two of the series constituting The Timothy Plan (the “Funds”), as of December 31, 2007, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the three years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the periods indicated prior to December 31, 2005 were audited by another independent accounting firm who expressed unqualified opinions on those highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2007, by correspondence with the Funds’ custodian and broker. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of Timothy Plan Conservative Growth Portfolio Variable Series and Timothy Plan Strategic Growth Portfolio Variable Series, two of the series constituting The Timothy Plan, as of December 31, 2007, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the three years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

| /s/ Cohen Fund Audit Services, Ltd. |

| Cohen Fund Audit Services, Ltd. |

| Westlake, Ohio |

| February 15, 2008 |

| [GRAPHIC] | Registered with the Public Company Accounting Oversight Board | [GRAPHIC | ] |

DISCLOSURES

December 31, 2007

CONSERVATIVE & STRATEGIC GROWTH PORTFOLIO VARIABLE SERIES

N-Q Disclosure & Proxy Procedures (Unaudited)

The SEC has adopted the requirement that all Funds file a complete schedule of investments with the SEC for their first and third fiscal quarters on Form N-Q for fiscal quarters ending after July 9, 2004. For the Timothy Plan Funds this would be for the fiscal quarters ending March 31 and September 30. The Form N-Q filing must be made within 60 days of the end of the quarter. The Timothy Plan Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC (call 1-800-732-0330 for information on the operation of the Public Reference Room).

The Trust has adopted Portfolio Proxy Voting Policies and Procedures under which the Portfolio’s vote proxies related to securities (“portfolio proxies”) held by the Portfolios. A description of the Trust’s Portfolio Proxy Voting Policies and Procedures is available (i) without charge, upon request, by calling the Company toll-free at 1-800-846-7526 and (ii) on the SEC’s website at www.sec.gov. In addition, the Funds are required to file Form N-PX, with its complete voting record for the 12 months ended June 30th, no later than August 31st of each year. The first such filing was due August 31, 2004. The Trust’s current Form N-PX is available (i) without charge, upon request, by calling the Company toll-free at 1-800-846-7526 and (ii) on the SEC’s website at www.sec.gov.

Tax Information (Unaudited)

We are required to advise you within 60 days of each Fund’s fiscal year end regarding the federal tax status of certain distributions received by shareholders during such fiscal year. The information below is provided for the fiscal year ended December 31, 2007.

During the fiscal year ended December 31, 2007, the Funds paid distributions derived from long-term capital gains, and hereby designate as capital gain dividends pursuant to Internal Revenue Code Section 852(b)(3)(c) the following amounts:

| Conservative Growth Portfolio | Strategic Growth Portfolio | |||||

Long-term Capital Gains | $ | 686,780 | $ | 654,294 | ||

Per Share | $ | 0.2396 | $ | 0.4575 | ||

Individual shareholders are eligible for reduced tax rates on qualified dividend income. During the fiscal year ended December 31, 2007, the percentage of total ordinary income dividends qualifying for the 15% dividend tax rate is as follows:

| Conservative Growth Portfolio | |||

| Percentage | 100.00 | % |

Corporate shareholders may exclude from regular income a portion of qualifying dividends. During the fiscal year ended December 31, 2007, the percentage of total ordinary income dividends qualifying for the 15% dividend tax rate is as follows:

| Conservative Growth Portfolio | |||

| Percentage | 100.00 | % |

Dividends and distributions received by retirement plans such as IRAs, Keogh-type plans and 403(b) plans need not be reported as taxable income. However, many retirement plan trusts may need this information for their annual information reporting. Short term capital gain distributions are taxed as ordinary income. Shareholders should consult their own tax Advisers.

1055 Maitland Center Commons, #100

Maitland, Florida 32751

(800) TIM-PLAN

(800) 846-7526

Visit the Timothy Plan web site on the internet at:

www.timothyplan.com

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective Prospectus which includes the details regarding the Fund’s objectives, policies, expenses and other information.

Distributed by Timothy Partners, Ltd.

| Item 2. | Code of Ethics. |

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

| (1) | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| (2) | Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant; |

| (3) | Compliance with applicable governmental laws, rules, and regulations; |

| (4) | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| (5) | Accountability for adherence to the code. |

(c) Amendments: During the period covered by the report, there have not been any amendments to the provisions of the code of ethics.

(d) Waivers: During the period covered by the report, the registrant has not granted any express or implicit waivers from the provisions of the code of ethics.

(e) Posting: We do not intend to post the Code of Ethics for the Officers or any amendments or waivers on a website.

(f) Availability: The Code of Ethics for the Officers can be obtained, free of charge by calling the toll free number for the appropriate Fund.

| Item 3. | Audit Committee Financial Expert. |

(a) The registrant has an Audit committee currently composed of three independent Trustees, Mr. Wesley Pennington, Mr. John Mulder and Mr. Charles Nelson. The registrant’s board of trustees has determined that Mr. Charles Nelson is qualified to serve as an Audit Committee Financial Expert, and has designated him as such.

| Item 4. | Principal Accountant Fees and Services. |

(a) Audit Fees

The Timothy Plan | |||

FY 2007 | $ | 105,400 | |

FY 2006 | $ | 83,500 | |

(b) Audit-Related Fees

The Timothy Plan | Registrant | Adviser | ||||

FY 2007 | $ | 0 | $ | 0 | ||

FY 2006 | $ | 0 | $ | 0 | ||

Nature of the fees: | ||||||

(c) Tax Fees

The Timothy Plan | |||

FY 2007 | $ | 24,000 | |

FY 2006 | $ | 22,000 | |

Nature of the fees: preparation of the 1120 RIC

(d) All Other Fees

The Timothy Plan | Registrant | Adviser | |||

FY 2007 | $ | 0 | |||

FY 2006 | $ | 0 | |||

Nature of the fees:

| (e) (1) | Audit Committee’s Pre-Approval Policies |

The Audit Committee Charter requires the Audit Committee to be responsible for the selection, retention or termination of auditors and, in connection therewith, to (i) evaluate the proposed fees and other compensation, if any, to be paid to the auditors, (ii) evaluate the independence of the auditors, (iii) pre-approve all audit services and, when appropriate, any non-audit services provided by the independent auditors to the Trust, (iv) pre-approve, when appropriate, any non-audit services provided by the independent auditors to the Trust’s investment adviser, or any entity controlling, controlled by, or under common control with the investment adviser and that provides ongoing services to the Trust if the engagement relates directly to the operations and financial reporting of the Trust, and (v) receive the auditors’ specific representations as to their independence;

| (2) | Percentages of Services Approved by the Audit Committee |

| Registrant | |||

Audit-Related Fees: | 100 | % | |

Tax Fees: | 100 | % | |

All Other Fees: | 100 | % |

(f) During audit of registrant’s financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant’s engagement were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant:

| Registrant | Adviser | |||||

FY 2007 | $ | 0 | $ | 0 | ||

FY 2006 | $ | 0 | $ | 0 | ||

(h) Not applicable. The auditor performed no services for the registrant’s investment adviser or any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant.

| Item 5. | Audit Committee of Listed Companies. Not applicable. |

| Item 6. | Schedule of Investments. Not applicable – schedule filed with Item 1. |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. Not applicable. |

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. Not applicable. |

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. Not applicable. |

| Item 10. | Submission of Matters to a Vote of Security Holders |

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

| Item 11. | Controls and Procedures. |

(a) Based on an evaluation of the registrant’s disclosure controls and procedures as of February 29, 2007, the disclosure controls and procedures are reasonably designed to ensure that the information required in filings on Forms N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

| Item 12. | Exhibits. |

| (a)(1) | Code is filed herewith | |

| (a)(2) | Certifications by the registrant’s principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes- Oxley Act of 2002 and required by Rule 30a-2 under the Investment Company Act of 1940 are filed herewith. | |

| (a)(3) | Not Applicable | |

| (b) | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is filed herewith. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) The Timothy Plan | ||

| By* | /s/ Arthur D. Ally | |

| Arthur D. Ally, President | ||

Date 3/4/2008

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By* | /s/ Arthur D. Ally | |

| Arthur D. Ally, President | ||

Date 3/4/2008

| By* | /s/ Arthur D. Ally | |

| Arthur D. Ally, Treasurer | ||

Date 3/4/2008