UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

The Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Bill Murphy

Unified Fund Services, Inc.

2960 N. Meridian St., Ste 300

Indianapolis, IN 46208

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-846-7526

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

ANNUAL

REPORT

DECEMBER 31, 2007

TIMOTHY PLAN FAMILY OF FUNDS:

Small Cap Value Fund Large/Mid Cap Value Fund Fixed Income Fund Aggressive Growth Fund Large/Mid Cap Growth Fund Strategic Growth Fund Conservative Growth Fund Money Market Fund

High Yield Bond Fund International Fund |

LETTER FROM THE PRESIDENT

December 31, 2007

ARTHUR D. ALLY

Dear Shareholder,

Since I am expected to comment on performance, I am pleased to report that 2007 turned out to be a good year for Timothy Plan. In most cases our funds out-performed their appropriate market index but there were two notable exceptions – our Large/Mid-Cap Growth Fund and Aggressive Growth Fund.

Our Board of Trustees have had these two funds under review for quite a while and finally reached the conclusion that a change of money managers would be in the best interests of our shareholders. Shareholders of those two funds approved the change in December and Chartwell Investment Partners (“Chartwell”), an impressive growth money management firm, assumed sub-advisory responsibility over those funds January 1, 2008. We believe Chartwell to be one of the best, top-tier growth management firms in the industry.

This action completes our efforts to upgrade the managers of all our funds and, I believe, we can now state with complete confidence that, in our opinion, all of our funds are managed by firms that are as good as, if not better than, any mutual fund family in the industry. Please refer to the individual manager’s comments within this report for more detailed information as to why each of the funds under their responsibility performed as they did.

I should also point out that we added two new funds to our family on May 1, 2007 – an International Fund and a High-Yield Bond Fund. We now believe we have every major asset category covered for asset-allocation purposes.

As a review, here is what we ask of our managers – in priority order:

| (1) | Do not violate our moral and ethical screens. We provide them with our continuously updated screen list and they apply their economic analysis to any company not on our screen list. |

| (2) | Preservation of principal is job #1 – ahead of performance. This does not mean that the value of your investment will not decline during times of market declines. What it does mean is that we expect them to manage our funds as conservatively as reasonably possible. Then, |

| (3) | Out-perform your market index over a full market cycle – which we consider to be approximately five years or so. |

I want to assure you in conclusion that Timothy is serious about our mission (to genuinely screen our investments) and our commitment to continuously pursue Kingdom Class quality in everything we do. Thank you for being part of the Timothy Plan family.

| Sincerely, |

|

Arthur D. Ally President |

Letter From The President [1]

RETURNS FOR THE YEAR ENDED

December 31, 2007

TIMOTHY PLAN SMALL CAP VALUE FUND (unaudited)

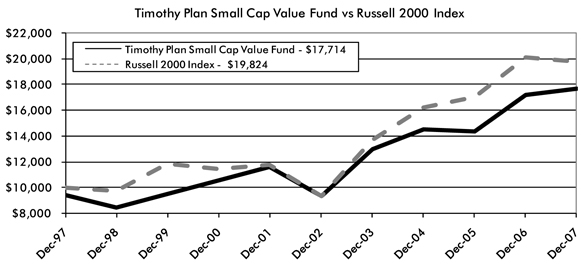

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | 10 Year Average Annual Return | ||||||

Timothy Small Cap Value Fund – Class A (With sales charge) | (2.79 | )% | 12.27 | % | 5.88 | % | |||

Russell 2000 Index | (1.57 | )% | 16.25 | % | 7.08 | % | |||

Timothy Small Cap Value Fund – Class B* | 0.18 | % | 12.74 | % | 5.67 | % | |||

Russell 2000 Index | (1.57 | )% | 16.25 | % | 7.08 | % | |||

Timothy Small Cap Value Fund – Class C* | 1.11 | % | N/A | 6.65 | %(a) | ||||

Russell 2000 Index | (1.57 | )% | N/A | 8.69 | %(a) |

| * | With Maximum Deferred Sales Charge. |

| (a) | For the period February 3, 2004 (commencement of investment in accordance with objective) to December 31, 2007. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell 2000 Index on December 31, 1996 and held through December 31, 2007. The Russell 2000 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [2]

RETURNS FOR THE YEAR ENDED

December 31, 2007

TIMOTHY PLAN LARGE/MID CAP VALUE FUND (unaudited)

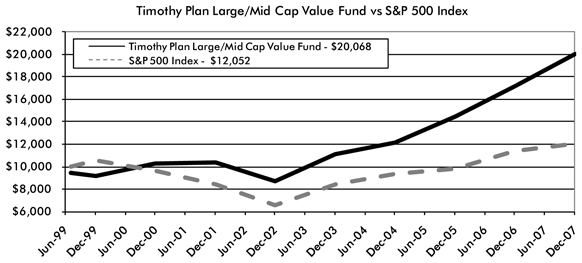

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Large/Mid Cap Value Fund – Class A (With sales charge) | 10.60 | % | 16.83 | % | 8.57 | %(a) | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 2.23 | %(a) | |||

Timothy Large/Mid Cap Value Fund – Class B* | 13.89 | % | 17.29 | % | 8.33 | %(b) | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 2.13 | %(b) | |||

Timothy Large/Mid Cap Value Fund – Class C* | 14.97 | % | N/A | 15.61 | %(c) | ||||

S&P 500 Index | 5.49 | % | N/A | 8.76 | %(c) |

| (a) | For the period July 14, 1999 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period July 15, 1999 (commencement of investment in accordance with objective) to December 31, 2007. |

| (c) | For the period February 3, 2004 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on July 14, 1999 and held through December 31, 2007. The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [3]

RETURNS FOR THE YEAR ENDED

December 31, 2007

TIMOTHY PLAN FIXED INCOME FUND (unaudited)

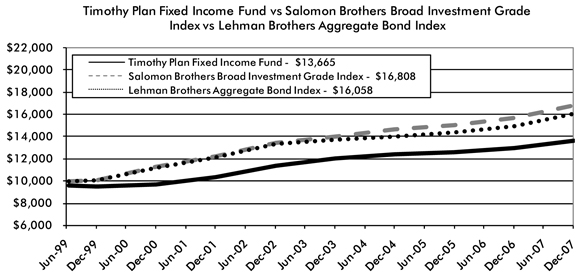

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Fixed Income Fund – Class A (With sales charge) | 0.44 | % | 2.75 | % | 3.75 | %(a) | |||

Salomon Brothers Broad Investment Grade Index | 7.22 | % | 4.55 | % | 6.36 | %(a) | |||

Lehman Brothers Aggregate Bond Index | 6.97 | % | 4.42 | % | 6.16 | %(a) | |||

Timothy Fixed Income Fund – Class B* | 2.38 | % | 2.91 | % | 3.49 | %(b) | |||

Salomon Brothers Broad Investment Grade Index | 7.22 | % | 4.55 | % | 6.43 | %(b) | |||

Lehman Brothers Aggregate Bond Index | 6.97 | % | 4.42 | % | 6.16 | %(b) | |||

Timothy Fixed Income Fund – Class C* | 3.32 | % | N/A | 2.35 | %(c) | ||||

Salomon Brothers Broad Investment Grade Index | 7.22 | % | N/A | 4.51 | %(c) | ||||

Lehman Brothers Aggregate Bond Index | 6.97 | % | N/A | 4.35 | %(c) |

| (a) | For the period July 14, 1999 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period August 5, 1999 (commencement of investment in accordance with objective) to December 31, 2007. |

| (c) | For the period February 3, 2004 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Salomon Brothers Broad Investment Grade Index on July 14, 1999 and held through December 31, 2007. The Salomon Brothers Broad Investment Grade Index and Lehman Brothers Aggregate Bond Index are widely recognized, unmanaged indexes of bond prices. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [4]

RETURNS FOR THE YEAR ENDED

December 31, 2007

TIMOTHY PLAN AGGRESSIVE GROWTH FUND (unaudited)

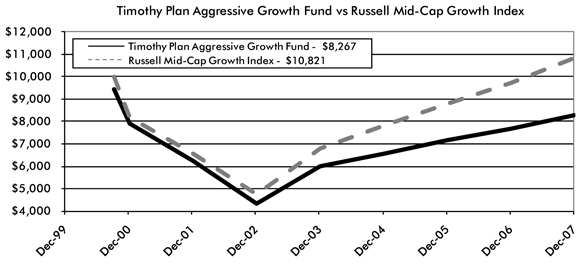

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Aggressive Growth Fund – Class A (With sales charge) | 1.73 | % | 12.61 | % | (2.59 | )%(a) | |||

Russell Mid-Cap Growth Index | 11.43 | % | 17.90 | % | 1.10 | %(a) | |||

Timothy Aggressive Growth Fund – Class B* | 4.73 | % | 13.12 | % | (2.55 | )%(b) | |||

Russell Mid-Cap Growth Index | 11.43 | % | 17.90 | % | 1.37 | %(b) | |||

Timothy Aggressive Growth Fund – Class C* | 5.79 | % | N/A | 7.58 | %(c) | ||||

Russell Mid-Cap Growth Index | 11.43 | % | N/A | 11.80 | %(c) |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (c) | For the period February 3, 2004 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell Mid-Cap Growth Index on October 5, 2000 and held through December 31, 2007. The Russell Mid-Cap Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [5]

RETURNS FOR THE YEAR ENDED

December 31, 2007

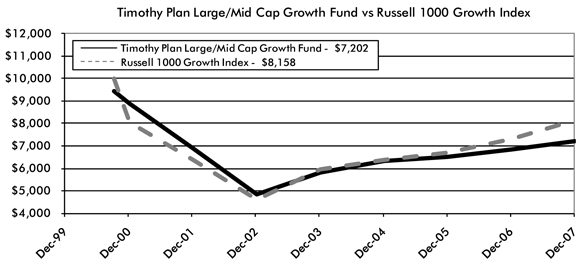

TIMOTHY PLAN LARGE/MID CAP GROWTH FUND (unaudited)

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Large/Mid Cap Growth Fund – Class A (With sales charge) | (0.66 | )% | 6.97 | % | (4.43 | )%(a) | |||

Russell 1000 Growth Index | 11.81 | % | 12.10 | % | (2.77 | )%(a) | |||

Timothy Large/Mid Cap Growth Fund – Class B* | 2.07 | % | 7.39 | % | (4.39 | )%(b) | |||

Russell 1000 Growth Index | 11.81 | % | 12.10 | % | (2.40 | )%(b) | |||

Timothy Large/Mid Cap Growth Fund – Class C* | 3.11 | % | N/A | 3.95 | %(c) | ||||

Russell 1000 Growth Index | 11.81 | % | N/A | 7.72 | %(c) |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (c) | For the period February 3, 2004 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Russell 1000 Growth Index on October 5, 2000 and held through December 31, 2007. The Russell 1000 Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [6]

RETURNS FOR THE YEAR ENDED

December 31, 2007

TIMOTHY PLAN STRATEGIC GROWTH FUND (unaudited)

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Strategic Growth Fund – Class A (With sales charge) | 4.41 | % | 11.11 | % | 0.99 | %(a) | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 2.03 | %(a) | |||

Dow Jones Moderately Aggressive Portfolio Index | 8.33 | % | 16.23 | % | 7.30 | %(a) | |||

Timothy Strategic Growth Fund – Class B* | 7.46 | % | 11.51 | % | 1.06 | %(b) | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 2.37 | %(b) | |||

Dow Jones Moderately Aggressive Portfolio Index | 8.33 | % | 16.23 | % | 7.55 | %(b) | |||

Timothy Strategic Growth Fund – Class C* | 8.51 | % | N/A | 7.82 | %(c) | ||||

S&P 500 Index | 5.49 | % | N/A | 8.76 | %(c) | ||||

Dow Jones Moderately Aggressive Portfolio Index | 8.33 | % | N/A | 11.80 | %(c) |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (c) | For the period February 3, 2004 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on October 5, 2000 and held through December 31, 2007. The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. The Dow Jones Global Moderately Aggressive Portfolio Index is a widely recognized index that measures global stocks, bonds, and cash which are in turn represented by multiple subindexes. Performance figures include the change in value of the investments in the indexes and the reinvestment of dividends. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [7]

RETURNS FOR THE YEAR ENDED

December 31, 2007

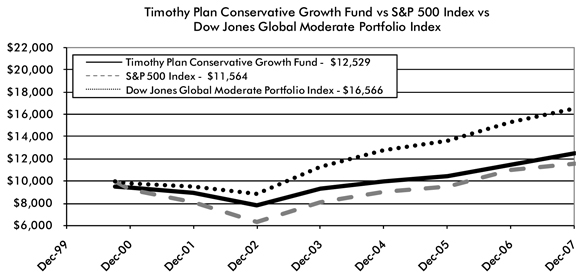

TIMOTHY PLAN CONSERVATIVE GROWTH FUND (unaudited)

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Average Annual Total Return Since Inception | ||||||

Timothy Conservative Growth Fund – Class A (With sales charge) | 2.83 | % | 8.81 | % | 3.16 | %(a) | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 2.03 | %(a) | |||

Dow Jones Global Moderate Portfolio Index | 8.02 | % | 13.28 | % | 7.22 | %(a) | |||

Timothy Conservative Growth Fund – Class B* | 5.89 | % | 9.22 | % | 3.18 | %(b) | |||

S&P 500 Index | 5.49 | % | 12.81 | % | 2.37 | %(b) | |||

Dow Jones Global Moderate Portfolio Index | 8.02 | % | 13.28 | % | 7.40 | %(b) | |||

Timothy Conservative Growth Fund – Class C* | 6.90 | % | N/A | 6.81 | %(c) | ||||

S&P 500 Index | 5.49 | % | N/A | 8.76 | %(c) | ||||

Dow Jones Global Moderate Portfolio Index | 8.02 | % | N/A | 9.71 | %(c) |

| (a) | For the period October 5, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period October 9, 2000 (commencement of investment in accordance with objective) to December 31, 2007. |

| (c) | For the period February 3, 2004 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the S&P 500 Index on October 5, 2000 and held through December 31, 2007. The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. The Dow Jones Global Moderate Portfolio Index is a widely recognized index that measures stocks, bonds, and cash which in turn are represented by multiple subindexes. Performance figures include the change in value of the investments in the indexes and the reinvestment of dividends. The index returns do not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [8]

RETURNS FOR THE YEAR ENDED

December 31, 2007

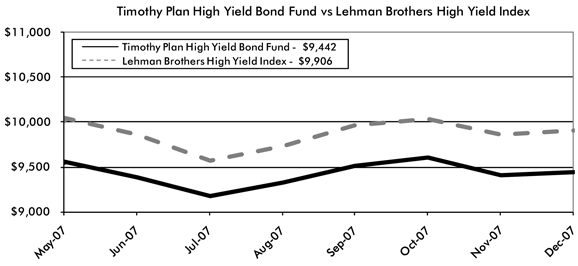

TIMOTHY PLAN HIGH YIELD BOND FUND (unaudited)

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Total Return Since Inception | ||||

Timothy High Yield Bond Fund – Class A (With sales charge) | N/A | N/A | (5.59 | )%(a) | |||

Lehman Brothers U.S. Corporate High Yield Index | N/A | N/A | (0.92 | )%(a) | |||

Timothy High Yield Bond Fund – Class C* | N/A | N/A | (3.76 | )%(b) | |||

Lehman Brothers U.S. Corporate High Yield Index | N/A | N/A | (0.92 | )%(b) |

| (a) | For the period May 7, 2007 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period May 7, 2007 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the Lehman Brothers U.S. Corporate High Yield Index on May 7, 2007 and held through December 31, 2007. The Lehman Brothers U.S. Corporate High Yield Index is a widely recognized, unmanaged index of non-investment grade, fixed rate, taxable corporate bonds. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [9]

RETURNS FOR THE YEAR ENDED

December 31, 2007

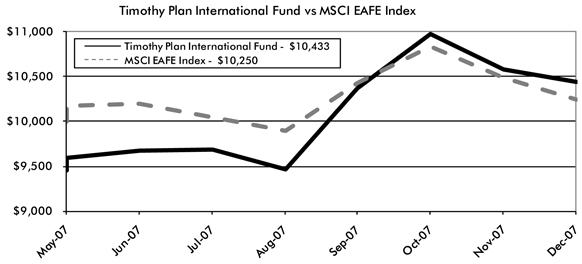

TIMOTHY PLAN INTERNATIONAL FUND (unaudited)

Fund/Index | 1 Year Total Return | 5 Year Average Annual Return | Total Return Since Inception | ||||

Timothy International Fund – Class A (With sales charge) | N/A | N/A | 4.31 | %(a) | |||

MSCI EAFE Index | N/A | N/A | 2.50 | %(a) | |||

Timothy International Fund – Class C* | N/A | N/A | 8.61 | %(b) | |||

MSCI EAFE Index | N/A | N/A | 2.50 | %(b) |

| (a) | For the period May 3, 2007 (commencement of investment in accordance with objective) to December 31, 2007. |

| (b) | For the period May 3, 2007 (commencement of investment in accordance with objective) to December 31, 2007. |

| * | With Maximum Deferred Sales Charge. |

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund A shares, and the MSCI EAFE Index on May 3, 2007 and held through December 31, 2007. The MSCI EAFE Index is a widely recognized unmanaged index of equity prices and is representative of equity market performance of developed countries, excluding the U.S. and Canada. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on fund distributions or the redemption of the fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

Timothy Plan Performance Graphs [10]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Arthur D. Ally* 1055 Maitland Center Commons Maitland, FL

Born: 1942 | Chairman and President | Indefinite; Trustee and President since 1994 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| President and controlling shareholder of Covenant Funds, Inc. (“CFI”), a holding company. President and general partner of Timothy Partners, Ltd. (“TPL”), the investment adviser and principal underwriter to each Fund. CFI is also the managing general partner of TPL. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Joseph E. Boatwright** 1410 Hyde Park Drive Winter Park, FL

Born: 1930 | Trustee, Secretary | Indefinite; Trustee and Secretary since 1995 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Retired Minister. Currently serves as a consultant to the Greater Orlando Baptist Association. Served as Senior Pastor to Aloma Baptist Church from 1970-1996. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Mathew D. Staver** 210 East Palmetto Avenue Longwood, FL

Born: 1956 | Trustee | Indefinite; Trustee since 2000 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Attorney specializing in free speech, appellate practice and religious liberty constitutional law. Founder of Liberty Counsel, a religious civil liberties education and legal defense organization. Host of two radio programs devoted to religious freedom issues. Editor of a monthly newsletter devoted to religious liberty topics. Mr. Staver has argued before the United States Supreme Court and has published numerous legal articles. | None | |||||

| * | Mr. Ally is an “interested” Trustee, as that term is defined in the 1940 Act, because of his positions with and financial interests in CFI and TPL. |

| ** | Messrs Boatwright and Staver are “interested” Trustees, as that term is defined in the 1940 Act, because each has a limited partnership interest in TPL. |

Timothy Plan Officers and Trustees [11]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Richard W. Copeland 631 Palm Springs Drive Altamonte Springs, FL

Born: 1947 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Principal of Richard W. Copeland, Attoney at Law for 31 years specializing in tax and estate planning. B.A. from Mississippi College, JD and LLM Taxation from University of Miami. Associate Professor Stetson University for past 29 years. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of | Number of Portfolios in Fund | |||

Bill Johnson 903 S. Stewart Street Fremont, MI

Born: 1946 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| President (and Founder) of American Decency Association, Freemont, MI since 1999. Previously served as Michigan State Director for American Family Association (1987-1999). Previously a public school teacher for 18 years. B.S. from Michigan State University and a Masters of Religious Education from Grand Rapids Baptist Seminary. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office and Length of | Number of Portfolios in Fund | |||

Kathryn Tindal Martinez 4398 New Broad Street Orlando, FL

Born: 1949 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Served on board of directors from 1991 to present, including House of Hope, B.E.T.A., Childrens’ Home Society, and Susan B. Anthony List. Previously a private school teacher and insurance adjuster. B.A. received from Florida State University State University and MAT from Rollins College, FL. | None | |||||

Timothy Plan Officers and Trustees [12]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

John C. Mulder 2925 Professional Place Colorado Springs, CO

Born: 1950 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by Trustee | |||||

| President WaterStone “Formerly, Christian Community Foundation and National Foundation” since 2001. Prior: 22 years of executive experience for a group of banks and a trust company. B.A. in Economics from Wheaton College and MBA from University of Chicago. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Charles E. Nelson 1145 Cross Creek Circle Altamonte Springs, FL

Born: 1934 | Trustee | Indefinite; Trustee since 2000 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Certified Public Accountant. Director of Operations, National Multiple Sclerosis Society Mid Florida Chapter. Formerly Director of Finance, Hospice of the Comforter, Inc. Formerly Comptroller, Florida United Methodist Children’s Home, Inc. Formerly Credit Specialist with the Resolution Trust Corporation and Senior Executive Vice President, Barnett Bank of Central Florida, N.A. Formerly managing partner, Arthur Andersen, CPA firm, Orlando, Florida branch. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Wesley W. Pennington 442 Raymond Avenue Longwood, FL

Born: 1930 | Trustee | Indefinite; Trustee since 1994 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Retired Air Force Officer. Past President, Westwind Holdings, Inc., a development company, since 1997. Past President and controlling shareholder, Weston, Inc., a fabric treatment company, form 1979-1997. President, Designer Services Group 1980-1988. | None | |||||

Timothy Plan Officers and Trustees [13]

OFFICERS AND TRUSTEES OF THE TRUST

As of December 31, 2007 (unaudited)

TIMOTHY PLAN FAMILY OF FUNDS

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Scott Preissler, Ph.D. 608 Pintail Place Flower Mound, TX

Born: 1960 | Trustee | Indefinite; Trustee since 2004 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Chairman Biblical Stewardship Dept. South Western Baptist Theological Seminary. Previously, President and CEO of Christian Stewardship Association where he was affiliated for 14 years. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Alan M. Ross 11210 West Road Roswell, GA

Born: 1951 | Trustee | Indefinite; Trustee since 2004 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Founder and CEO of Corporate Development Institute which he founded five years ago. Previously he served as President and CEO of Fellowship of Companies for Christ and has authored three books: Beyond World Class, Unconditional Excellence, Breaking Through to Prosperity. | None | |||||

Name, Age and Address | Position(s) Held With Trust | Term of Office | Number of Portfolios in Fund | |||

Dr. David J. Tolliver 4000 E. Maplewood Drive Excelsior Springs, MO

Born: 1951 | Trustee | Indefinite; Trustee since 2005 | 12 | |||

Principal Occupation During Past 5 Years | Other Directorships Held by | |||||

| Executive Director Missouri Baptist Convention. Previously, Senior Pastor Pisgah Baptist Church, Excelsior Springs, MO since 1999. Previously pastored three churches in St. Louis, MO area (1986-1999). Currently serves on Board of Trustees Midwestern Baptist Theological Seminary. Past President Missouri Baptist Convention (2003-2004) | None | |||||

Timothy Plan Officers and Trustees [14]

LETTER FROM THE MANAGER

December 31, 2007

SMALL CAP VALUE FUND

For the year ended December 31, 2007, the Timothy Plan Small Cap Value Fund Class A produced a return of 2.87%, which exceeded the (1.57%) produced by the Russell 2000 Index.

Accelerating credit losses associated with sub-prime debt, combined with continued weakness in the U.S. housing market and softening broad economic data, led to losses in the equity markets. The weak fourth quarter of 2007, combined with the lower third quarter, created the weakest results for the second half of a year since the market downturn earlier in the decade. Despite a degree of confidence given by Fed rate cuts during the year, investors continued to price in the potential for an economic recession in 2008. Economically-sensitive sectors were impacted on fears of a slower economy, both domestically and possibly even internationally and, as a result, the Russell 2000 Index fell almost 2% for the year.

An overweight and strong performance in the Producer Durables, Materials & Processing, Autos & Transportation and Consumer Discretionary sectors coupled with strong security selection in the Financial Services sector aided performance. The best performing securities included Washington Group, Layne Christensen, Cleveland-Cliffs, which responded well to strength in commodity prices and merger & acquisition activity within the Materials & Processing sector. Foundation Coal, in the Energy sector, also benefitted from commodity price strength while Genco Shipping & Trading benefited from strength in demand and shipping rates.

Relative performance was hindered by our exposure to selected securities within the Health Care, Utilities and Consumer Staples sectors. Laggards for the period were Superior Offshore International, NCI Building Systems and General Communications, all of which saw their prices fall as investors feared fundamentals were weakening within end markets and after reporting earnings that were disappointing relative to investor expectations.

The small cap markets experienced large price swings through 2007 with a 10% rally in the first six months of the year that was entirely erased by mid-July. A second rally that began in September was short lived and small caps ended the year down as investors priced in the potential for economic weakness. Market movements tended to favor different types of companies throughout the year with the largest, moderately priced companies posting the best performances for the year. However, as our investment philosophy dictates, our portfolios are built with a longer-term focus and therefore, our holdings did not materially change to accommodate the market’s favored investment style.

Our expectation for corporate operating profit growth in the small cap sector is a mid single-digit to low double digit gain over the 2007 level. Equities remain attractive; however, a slower pace of economic growth may disappoint some investors, leading to continued market volatility and a renewed preference for high-quality securities with solid fundamentals.

With the risk matrix our capital market outlook presents, we will continue to focus our investment strategy on only the highest-quality companies and to invest in companies that have healthy balance sheets, generate strong levels of free cash flow and efficiently utilize that cash to reduce debt, repurchase stock or initiate or increase dividends. As in prior years, we continue to expect to find more of these companies within the manufacturing sector as worldwide demand for their products boosts profits. We also expect to find more companies exhibiting these characteristics in the Technology sector, as these companies have spent many years strengthening balance sheets, generate large amounts of free cash flow and are currently experiencing strong demand.

As you know, we focus our investment efforts on finding high-quality securities at valuations that significantly discount the future prospects of a company. We believe that such a strategy will again be rewarded in 2008.

WESTWOOD MANAGEMENT CORPORATION

Letter From The Manager[15]

FUND PROFILE

December 31, 2007

TIMOTHY PLAN SMALL CAP VALUE FUND

FUND PROFILE (unaudited):

Top Ten Holdings

(% of Net Assets)

Timothy Money Market Fund | 13.88 | % | |

ManTech International Corp. - Class A | 3.09 | % | |

Foundation Coal Holdings, Inc. | 2.92 | % | |

Cleco Corp. | 2.59 | % | |

Macquarie Infrastructure Co., LLC | 2.22 | % | |

Moog, Inc. - Class A | 2.21 | % | |

The Middleby Corp. | 2.21 | % | |

Boston Private Financial Holdings, Inc. | 2.18 | % | |

Northwest Pipe Co. | 2.17 | % | |

Five Star Quality Care, Inc. | 2.17 | % | |

| 35.64 | % | ||

Industries

(% of Net Assets)

Financial | 18.43 | % | |

Services | 15.08 | % | |

Basic Materials | 14.71 | % | |

Technology | 10.78 | % | |

Industrial Goods | 10.56 | % | |

Consumer Goods | 9.45 | % | |

Utilities | 2.59 | % | |

Healthcare | 4.19 | % | |

Short-Term Investments | 13.88 | % | |

Other Assets Less Liabilities | 0.33 | % | |

| 100.00 | % | ||

EXPENSE EXAMPLE (unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs,” (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2007, through December 31, 2007.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Timothy Plan Top Ten Holdings / Industries [16]

FUND PROFILE

December 31, 2007

TIMOTHY PLAN SMALL CAP VALUE FUND

Hypothetical example for comparison purposes (unaudited)

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account Value 7/1/2007 | Ending Account Value 12/31/2007 | Expenses Paid During Period* 7/1/2007 through 12/31/2007 | |||||||

Actual - Class A | $ | 1,000.00 | $ | 923.64 | $ | 7.13 | |||

Hypothetical - Class A | $ | 1,000.00 | $ | 1,017.79 | $ | 7.48 | |||

(5% return before expenses) | |||||||||

Actual - Class B | $ | 1,000.00 | $ | 920.54 | $ | 10.74 | |||

Hypothetical - Class B | $ | 1,000.00 | $ | 1,014.02 | $ | 11.26 | |||

(5% return before expenses) | |||||||||

Actual - Class C | $ | 1,000.00 | $ | 919.73 | $ | 10.74 | |||

Hypothetical - Class C | $ | 1,000.00 | $ | 1,014.01 | $ | 11.27 | |||

(5% return before expenses) | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.47% for Class A, 2.22% for Class B, and 2.22% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/365 days (to reflect the partial year period.) The Fund’s ending account value on the first line of each share class in the table is based on its actual total return of (7.64)% for Class A, (7.95)% for Class B, and (8.03)% for Class C for the six-month period of July 1, 2007, to December 31, 2007. |

Timothy Plan Top Ten Holdings / Industries [17]

SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2007

COMMON STOCKS - 76.93%

number of shares | market value | ||||

| AEROSPACE/DEFENSE - 4.35% | |||||

| 36,800 | Moog, Inc. - Class A * | $ | 1,685,808 | ||

| 30,500 | Teledyne Technologies, Inc. * | 1,626,565 | |||

| 3,312,373 | |||||

| APPAREL MANUFACTURERS - 0.69% | |||||

| 39,000 | Maidenform Brands, Inc. * | 527,670 | |||

| BUILDING PRODUCTS - LIGHT FIXTURES - 0.97% | |||||

| 7,800 | Genlyte Group, Inc. * | 742,560 | |||

| BUILDING & CONSTRUCTION - 1.85% | |||||

| 28,700 | Layne Christensen Co. * | 1,412,327 | |||

| COAL - 2.92% | |||||

| 42,400 | Foundation Coal Holdings, Inc. | 2,226,000 | |||

| COMMERCIAL BANKS - SOUTHERN US - 0.86% | |||||

| 55,800 | Virginia Commerce Bancorp * | 654,534 | |||

| COMMERCIAL BANKS - WESTERN US - 1.95% | |||||

| 29,000 | Cathay General Bancorp | 768,210 | |||

| 24,200 | Columbia Banking System, Inc. | 719,466 | |||

| 1,487,676 | |||||

| COMMERCIAL SERVICES - FINANCE - 2.22% | |||||

| 41,800 | Macquarie Infrastructure Co., LLC | 1,694,154 | |||

| COMPUTER SERVICES - 1.96% | |||||

| 54,500 | SI International, Inc. * | 1,497,115 | |||

| COSMETICS & TOILETRIES - 1.09% | |||||

| 33,900 | Alberto-Culver Co. | 831,906 | |||

| DIVERSIFIED MANUFACTURING OPERATIONS - 0.96% | |||||

| 20,800 | AO Smith Corp. | 729,040 | |||

| ELECTRIC UTILITIES - 2.59% | |||||

| 70,900 | Cleco Corp. | 1,971,020 | |||

| ELECTRONIC COMPONENTS - MISCELLANEOUS - 1.73% | |||||

| 74,200 | Benchmark Electronics, Inc. * | 1,315,566 | |||

| ELECTRONIC SECURITY DEVICES - 2.13% | |||||

| 96,400 | LoJack Corp. * | 1,620,484 | |||

| ENTERPRISE SOFTWARE/SERVICES - 4.19% | |||||

| 71,200 | Epicor Software Corp. * | 838,736 | |||

| 53,800 | ManTech International Corp. - Class A * | 2,357,516 | |||

| 3,196,252 | |||||

| FIDUCIARY BANKS - 2.18% | |||||

| 61,300 | Boston Private Financial Holdings, Inc. | 1,660,004 | |||

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [18]

SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2007

COMMON STOCKS - 76.93% (continued)

number of shares | market value | ||||

| FINANCE - INVESTMENT BANKER/BROKER - 2.92% | |||||

| 27,000 | KBW, Inc. * | $ | 690,930 | ||

| 29,200 | Stifel Financial Corp. * | 1,535,044 | |||

| 2,225,974 | |||||

| FOOD - MISCELLANEOUS/DIVERSIFIED - 2.04% | |||||

| 49,802 | J & J Snack Foods Corp. | 1,557,807 | |||

| HOTELS & MOTELS - 3.53% | |||||

| 83,100 | Marcus Corp. | 1,283,895 | |||

| 24,500 | Orient-Express Hotels, Ltd. - Class A | 1,409,240 | |||

| 2,693,135 | |||||

| INDUSTRIAL AUTOMATION/ROBOTICS - 1.07% | |||||

| 18,700 | Hurco Companies, Inc. * | 816,255 | |||

| INTIMATE APPAREL - 1.91% | |||||

| 41,800 | The Warnaco Group, Inc. * | 1,454,640 | |||

| . | |||||

| MACHINERY - GENERAL INDUSTRY - 2.21% | |||||

| 22,000 | The Middleby Corp. * | 1,685,640 | |||

| MEDICAL - OUTPATIENT/HOME MEDICINE - 2.03% | |||||

| 81,200 | Gentiva Health Care Services, Inc. * | 1,546,048 | |||

| METAL PROCESSORS & FABRICATORS - 2.15% | |||||

| 30,100 | Kaydon Corp. | 1,641,654 | |||

| NON-FERROUS METALS - 0.90% | |||||

| 10,000 | RTI International Metals, Inc. * | 689,300 | |||

| OFFICE FURNISHINGS - ORIGINAL - 1.78% | |||||

| 82,700 | Knoll, Inc. | 1,358,761 | |||

| OIL COMPANY - EXPLORATION & PRODUCTION - 4.26% | |||||

| 37,600 | Penn Virginia Corp. | 1,640,488 | |||

| 34,700 | Unit Corp. * | 1,604,875 | |||

| 3,245,363 | |||||

| OIL FIELD MACHINERY & EQUIPMENT - 1.27% | |||||

| 17,900 | NATCO Group, Inc. - Class A * | 969,285 | |||

| OIL - FIELD SERVICES - 1.89% | |||||

| 42,200 | Oil States International, Inc. * | 1,439,864 | |||

| PROPERTY/CASUALTY INSURANCE - 1.92% | |||||

| 97,000 | SeaBright Insurance Holdings * | 1,462,760 | |||

| REINSURANCE - 1.86% | |||||

| 49,000 | IPC Holdings, Ltd. | 1,414,630 | |||

| RETIREMENT/AGED CARE - 2.17% | |||||

| 198,900 | Five Star Quality Care, Inc. * | 1,650,870 | |||

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [19]

SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2007

COMMON STOCKS - 76.93% (continued)

number of shares | market value | ||||

| STEEL PIPE & TUBE - 2.17% | |||||

| 42,300 | Northwest Pipe Co. * | $ | 1,655,622 | ||

| STEEL - PRODUCERS - 1.30% | |||||

| 42,400 | Claymont Steel Holdings, Inc. * | 990,040 | |||

| TELECOMMUNICATION SERVICES - 1.83% | |||||

| 85,700 | Iowa Telecommunications Services, Inc. | 1,393,482 | |||

| TRANSPORT - MARINE - 5.08% | |||||

| 64,100 | Arlington Tankers, Ltd. | 1,418,533 | |||

| 55,000 | Horizon Lines, Inc. - Class A | 1,025,200 | |||

| 74,400 | OceanFreight, Inc. | 1,430,712 | |||

| 3,874,445 | |||||

| Total Common Stocks (cost $55,213,913) | 58,644,256 | ||||

| MASTER LIMITED PARTNERSHIPS - 2.12% | |||||

number of shares | market value | ||||

| 23,400 | MarkWest Energy Partners LP | $ | 790,452 | ||

| 27,900 | Targa Resource Partners LP | 826,398 | |||

| Total Master Limited Partnerships (cost $1,509,189) | 1,616,850 | ||||

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [20]

SMALL CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2007

REITs - 6.74%

number of shares | market value | ||||

| REITS - APARTMENTS - 1.87% | |||||

| 40,500 | Post Properties, Inc. | $ | 1,422,360 | ||

| REITS - DIVERSIFIED - 0.86% | |||||

| 45,200 | Lexington Realty Trust | 657,208 | |||

| REITS - HOTELS - 1.91% | |||||

| 79,800 | Sunstone Hotel Investors, Inc. | 1,459,542 | |||

| REITS - RETAIL - 2.10% | |||||

| 60,000 | Getty Realty Corporation | 1,600,800 | |||

| Total REITs (cost $6,307,339) | 5,139,910 | ||||

| SHORT TERM INVESTMENTS - 13.88% | |||||

number of shares | market value | ||||

| 10,581,525 | Timothy Plan Money Market Fund, 3.34% (A) (B) | $ | 10,581,525 | ||

| Total Short Term Investments (cost $10,581,525) | 10,581,525 | ||||

| TOTAL INVESTMENTS (cost $73,611,966) - 99.67% | $ | 75,982,541 | |||

| OTHER ASSETS LESS LIABILITIES - 0.33% | 253,654 | ||||

| NET ASSETS - 100.00% | $ | 76,236,195 | |||

| * | Non-income producing securities. |

| (A) | Variable rate security; the rate shown represents the yield at December 31, 2007. |

| (B) | Affiliated fund. |

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [21]

SMALL CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2007

ASSETS

| amount | ||||

Investments in Unaffiliated Securities at Value (cost $63,030,441) [NOTE 1] | $ | 65,401,016 | ||

Investments in Affiliated Securities at Value (cost $10,581,525) [NOTE 1] | 10,581,525 | |||

Receivables for: | ||||

Interest | 26,857 | |||

Dividends | 225,213 | |||

Fund Shares Sold | 429,049 | |||

Prepaid Expenses | 14,982 | |||

Total Assets | $ | 76,678,642 | ||

LIABILITIES | ||||

| amount | ||||

Payable for Investments Purchased | $ | 231,670 | ||

Payable for Fund Shares Redeemed | 70,874 | |||

Accrued Advisory Fees | 52,413 | |||

Accrued 12b-1 Fees Class A | 13,191 | |||

Accrued 12b-1 Fees Class B | 5,448 | |||

Accrued 12b-1 Fees Class C | 5,350 | |||

Accrued Expenses | 63,501 | |||

Total Liabilities | $ | 442,447 | ||

| NET ASSETS | ||||

| amount | ||||

Class A Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 4,711,052 shares outstanding) | $ | 62,524,604 | ||

Net Asset Value and Redemption Price Per Class A Share ($62,524,604 / 4,711,052 shares) | $ | 13.27 | ||

Offering Price Per Share ($13.27 / 0.945) | $ | 14.04 | ||

Class B Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 629,102 shares outstanding) | $ | 7,370,474 | ||

Net Asset Value and Offering Price Per Class B Share ($7,370,474 / 629,102 shares) | $ | 11.72 | ||

Minimum Redemption Price Per Class B Share ($11.72 * 0.98) | $ | 11.49 | ||

Class C Shares: | ||||

Net Assets (unlimited shares of $0.001 par beneficial interest authorized; 537,249 shares outstanding) | $ | 6,341,117 | ||

Net Asset Value and Offering Price Per Class C Share ($6,341,117 / 537,249 shares) | $ | 11.80 | ||

Minimum Redemption Price Per Share ($11.80 * 0.99) | $ | 11.68 | ||

Net Assets | $ | 76,236,195 | ||

| SOURCES OF NET ASSETS | ||||

| amount | ||||

At December 31, 2007, Net Assets Consisted of: | ||||

Paid-in Capital | $ | 73,896,215 | ||

Accumulated Undistributed Net Realized Loss on Investments | (30,595 | ) | ||

Net Unrealized Appreciation in Value of Investments | 2,370,575 | |||

Net Assets | $ | 76,236,195 | ||

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [22]

SMALL CAP VALUE FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2007

INVESTMENT INCOME

| amount | ||||

Interest on Affiliated Investments | $ | 288,881 | ||

Dividends | 1,090,567 | |||

Total Investment Income | 1,379,448 | |||

| EXPENSES | ||||

| amount | ||||

Investment Advisory Fees [NOTE 3] | 698,080 | |||

Fund Accounting, Transfer Agency, & Administration Fees | 142,776 | |||

12b-1 Fees (Class A = $166,412, Class B = $96,148, Class C = $59,475) [NOTE 3] | 322,035 | |||

Miscellaneous Expense | 50,698 | |||

Audit Fees | 12,989 | |||

Registration Fees | 28,320 | |||

Printing Expense | 7,478 | |||

CCO Fees | 7,435 | |||

Legal Expense | 1,861 | |||

Trustee Fees | 7,008 | |||

Custodian Fees | 18,480 | |||

Insurance Expense | 3,520 | |||

Total Net Expenses | 1,300,680 | |||

Net Investment Income | 78,768 | |||

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | ||||

| amount | ||||

Capital Gain Dividends from REIT’s | 168,117 | |||

Net Realized Gain on Unaffiliated Investments | 10,221,870 | |||

Change in Unrealized Appreciation (Depreciation) of Investments | (7,505,450 | ) | ||

Net Realized and Unrealized Gain on Investments | 2,884,537 | |||

Net Increase in Net Assets Resulting from Operations | $ | 2,963,305 | ||

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [23]

SMALL CAP VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

INCREASE (DECREASE) IN NET ASSETS

| year ended 12/31/07 | year ended 12/31/06 | |||||||

Operations: | ||||||||

Net Investment Income | $ | 78,768 | $ | 924,395 | ||||

Capital Gain Dividends from REIT’s | 168,117 | — | ||||||

Net Realized Gain on Investments | 10,221,870 | 13,978,898 | ||||||

Change in Unrealized Appreciation (Depreciation) of Investments | (7,505,450 | ) | (1,506,702 | ) | ||||

Net Increase in Net Assets (resulting from operations) | 2,963,305 | 13,396,591 | ||||||

Distributions to Shareholders From: | ||||||||

Net Investment Income: | ||||||||

Class A | (121,858 | ) | (820,792 | ) | ||||

Class B | — | (105,079 | ) | |||||

Class C | — | (20,127 | ) | |||||

Net Capital Gains: | ||||||||

Class A | (8,305,482 | ) | (11,271,142 | ) | ||||

Class B | (1,106,005 | ) | (2,288,809 | ) | ||||

Class C | (932,321 | ) | (726,071 | ) | ||||

Total Distributions | (10,465,666 | ) | (15,232,020 | ) | ||||

Capital Share Transactions: | ||||||||

Proceeds from Shares Sold: | ||||||||

Class A | 18,486,727 | * | 15,544,541 | ** | ||||

Class B | 62,488 | 18,972 | ||||||

Class C | 3,383,795 | 1,612,470 | ||||||

Dividends Reinvested: | ||||||||

Class A | 8,131,543 | 11,625,870 | ||||||

Class B | 1,032,903 | 2,226,485 | ||||||

Class C | 868,022 | 737,045 | ||||||

Cost of Shares Redeemed: | ||||||||

Class A | (24,191,844 | ) | (8,491,371 | ) | ||||

Class B | (4,906,273 | )* | (6,541,612 | )** | ||||

Class C | (1,029,804 | ) | (335,061 | ) | ||||

Net Increase (Decrease) in Net Assets (resulting from capital share transactions) | 1,837,557 | 16,397,339 | ||||||

Total Increase (Decrease) in Net Assets | (5,664,804 | ) | 14,561,910 | |||||

Net Assets: | ||||||||

Beginning of period | 81,900,999 | 67,339,089 | ||||||

End of period | $ | 76,236,195 | $ | 81,900,999 | ||||

Accumulated Undistributed Net Investment Income | $ | — | $ | — | ||||

Shares of Capital Stock of the Fund Sold and Redeemed: | ||||||||

Shares Sold: | ||||||||

Class A | 1,172,591 | * | 947,995 | ** | ||||

Class B | 4,292 | 1,225 | ||||||

Class C | 236,102 | 106,268 | ||||||

Shares Reinvested: | ||||||||

Class A | 622,152 | 781,834 | ||||||

Class B | 89,506 | 165,784 | ||||||

Class C | 74,699 | 54,515 | ||||||

Shares Redeemed: | ||||||||

Class A | (1,508,848 | ) | (513,525 | ) | ||||

Class B | (335,637 | ) * | (436,662 | ) ** | ||||

Class C | (72,154 | ) | (22,115 | ) | ||||

Net Increase (Decrease) in Number of Shares Outstanding | 282,703 | 1,085,319 | ||||||

| * | Includes automatic conversion of Class B shares ($3,722,878 representing 252,808 shares) to Class A shares ($3,722,878 representing 227,751 shares). |

| ** | Includes automatic conversion of Class B shares ($4,719,360 representing 316,223 shares) to Class A shares ($4,719,360 representing 290,254 shares). |

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [24]

SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each period presented.

SMALL CAP VALUE FUND - CLASS A SHARES

| year ended 12/31/07 | year ended 12/31/06 | year ended 12/31/05 | year ended 12/31/04 | year ended 12/31/03 | ||||||||||||||||

Per Share Operating Performance: | ||||||||||||||||||||

Net Asset Value at Beginning of Year | $ | 14.94 | $ | 15.27 | $ | 15.59 | $ | 15.45 | $ | 11.13 | ||||||||||

Income from Investment Operations: | ||||||||||||||||||||

Net Investment Income (Loss) | 0.04 | 0.22 | 0.01 | (A) | (0.04 | )(A) | (0.07 | )(A) | ||||||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 0.36 | 2.77 | (0.17 | ) | 1.83 | 4.39 | ||||||||||||||

Total from Investment Operations | 0.40 | 2.99 | (0.16 | ) | 1.79 | 4.32 | ||||||||||||||

Less Distributions: | ||||||||||||||||||||

Dividends from Realized Gains | (2.04 | ) | (3.10 | ) | (0.16 | ) | (1.65 | ) | — | |||||||||||

Dividends from Net Investment Income | (0.03 | ) | (0.22 | ) | — | — | — | |||||||||||||

Total Distributions | (2.07 | ) | (3.32 | ) | (0.16 | ) | (1.65 | ) | — | |||||||||||

Net Asset Value at End of Year | $ | 13.27 | $ | 14.94 | $ | 15.27 | $ | 15.59 | $ | 15.45 | ||||||||||

Total Return (B)(C) | 2.87 | % | 19.69 | % | (1.01 | )% | 11.60 | % | 38.81 | % | ||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||

Net Assets, End of Year (in 000s) | $ | 62,525 | $ | 66,097 | $ | 49,008 | $ | 42,542 | $ | 34,185 | ||||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver/Recoupment of Expenses by Adviser | 1.44 | % | 1.52 | % | 1.56 | % | 1.48 | % | 1.71 | % | ||||||||||

After Reimbursement and Waiver/Recoupment of Expenses by Adviser | 1.44 | % | 1.52 | % | 1.56 | % | 1.48 | % | 1.71 | % | ||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver/Recoupment of Expenses by Adviser | 0.24 | % | 1.39 | % | 0.05 | % | (0.30 | )% | (0.55 | )% | ||||||||||

After Reimbursement and Waiver/Recoupment of Expenses by Adviser | 0.24 | % | 1.39 | % | 0.05 | % | (0.30 | )% | (0.55 | )% | ||||||||||

Portfolio Turnover | 59.84 | % | 148.02 | % | 44.24 | % | 57.59 | % | 47.99 | % | ||||||||||

| (A) | Per share amounts calculated using average shares method. |

| (B) | Total return calculation does not reflect sales load. |

| (C) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [25]

SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each period presented.

SMALL CAP VALUE FUND - CLASS B SHARES

| year ended 12/31/07 | year ended 12/31/06 | year ended 12/31/05 | year ended 12/31/04 | year ended 12/31/03 | ||||||||||||||||

Per Share Operating Performance: | ||||||||||||||||||||

Net Asset Value at Beginning of Year | $ | 13.49 | $ | 14.09 | $ | 14.51 | $ | 14.59 | $ | 10.59 | ||||||||||

Income from Investment Operations: | ||||||||||||||||||||

Net Investment Income (Loss) | (0.08 | ) | 0.14 | (0.10 | )(A) | (0.15 | )(A) | (0.16 | )(A) | |||||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 0.35 | 2.50 | (0.16 | ) | 1.72 | 4.16 | ||||||||||||||

Total from Investment Operations | 0.27 | 2.64 | (0.26 | ) | 1.57 | 4.00 | ||||||||||||||

Less Distributions: | ||||||||||||||||||||

Dividends from Realized Gains | (2.04 | ) | (3.10 | ) | (0.16 | ) | (1.65 | ) | — | |||||||||||

Dividends from Net Investment Income | — | (0.14 | ) | — | — | — | ||||||||||||||

Total Distributions | (2.04 | ) | (3.24 | ) | (0.16 | ) | (1.65 | ) | — | |||||||||||

Net Asset Value at End of Year | $ | 11.72 | $ | 13.49 | $ | 14.09 | $ | 14.51 | $ | 14.59 | ||||||||||

Total Return (B)(C) | 2.22 | % | 18.82 | % | (1.77 | )% | 10.78 | % | 37.77 | % | ||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||

Net Assets, End of Year (in 000s) | $ | 7,370 | $ | 11,750 | $ | 16,072 | $ | 19,306 | $ | 18,738 | ||||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver/Recoupment of Expenses by Adviser | 2.19 | % | 2.27 | % | 2.31 | % | 2.23 | % | 2.47 | % | ||||||||||

After Reimbursement and Waiver/Recoupment of Expenses by Adviser | 2.19 | % | 2.27 | % | 2.31 | % | 2.23 | % | 2.47 | % | ||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | ||||||||||||||||||||

Before Reimbursement and Waiver/Recoupment of Expenses by Adviser | (0.57 | )% | 0.69 | % | (0.70 | )% | (1.05 | )% | (1.39 | )% | ||||||||||

After Reimbursement and Waiver/Recoupment of Expenses by Adviser | (0.57 | )% | 0.69 | % | (0.70 | )% | (1.05 | )% | (1.39 | )% | ||||||||||

Portfolio Turnover | 59.84 | % | 148.02 | % | 44.24 | % | 57.59 | % | 47.99 | % | ||||||||||

| (A) | Per share amounts calculated using average shares method. |

| (B) | Total return calculation does not reflect redemption fee. |

| (C) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [26]

SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for one share of capital stock outstanding throughout each period presented.

SMALL CAP VALUE FUND - CLASS C SHARES

| year ended 12/31/07 | year ended 12/31/06 | year ended 12/31/05 | period ended 12/31/04 (A) | |||||||||||||

Per Share Operating Performance: | ||||||||||||||||

Net Asset Value at Beginning of Year | $ | 13.58 | $ | 14.12 | $ | 14.55 | $ | 15.00 | ||||||||

Income from Investment Operations: | ||||||||||||||||

Net Investment Income (Loss) | (0.05 | ) | 0.09 | (0.10 | )(B) | (0.05 | )(B) | |||||||||

Net Realized and Unrealized Gain (Loss) on Investments | 0.31 | 2.56 | (0.17 | ) | 1.25 | |||||||||||

Total from Investment Operations | 0.26 | 2.65 | (0.27 | ) | 1.20 | |||||||||||

Less Distributions: | ||||||||||||||||

Dividends from Realized Gains | (2.04 | ) | (3.10 | ) | (0.16 | ) | (1.65 | ) | ||||||||

Dividends from Net Investment Income | — | (0.09 | ) | — | — | |||||||||||

Total Distributions | (2.04 | ) | (3.19 | ) | (0.16 | ) | (1.65 | ) | ||||||||

Net Asset Value at End of Period | $ | 11.80 | $ | 13.58 | $ | 14.12 | $ | 14.55 | ||||||||

Total Return (C)(D) | 2.13 | % | 18.80 | % | (1.84 | )% | 8.02 | %(E) | ||||||||

Ratios/Supplemental Data: | ||||||||||||||||

Net Assets, End of Year (in 000s) | $ | 6,341 | $ | 4,054 | $ | 2,258 | $ | 1,442 | ||||||||

Ratio of Expenses to Average Net Assets: | ||||||||||||||||

Before Reimbursement and Waiver/Recoupment of Expenses by Adviser | 2.19 | % | 2.27 | % | 2.31 | % | 2.23 | %(F) | ||||||||

After Reimbursement and Waiver/Recoupment of Expenses by Adviser | 2.19 | % | 2.27 | % | 2.31 | % | 2.23 | %(F) | ||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | ||||||||||||||||

Before Reimbursement and Waiver/Recoupment of Expenses by Adviser | (0.47 | )% | 0.61 | % | (0.70 | )% | (1.05 | )%(F) | ||||||||

After Reimbursement and Waiver/Recoupment of Expenses by Adviser | (0.47 | )% | 0.61 | % | (0.70 | )% | (1.05 | )%(F) | ||||||||

Portfolio Turnover | 59.84 | % | 148.02 | % | 44.24 | % | 57.59 | % | ||||||||

| (A) | For the period February 3, 2004 (Commencement of Operations) to December 31, 2004. |

| (B) | Per share amounts calculated using average shares method. |

| (C) | Total return calculation does not reflect redemption fee. |

| (D) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (E) | For periods of less than one full year, total return is not annualized. |

| (F) | Annualized. |

The accompanying notes are an integral part of these financial statements.

The Timothy Small Cap Value Fund [27]

LETTER FROM THE MANAGER

December 31, 2007

LARGE / MID CAP VALUE FUND

For the year ended December 31, 2007, the Timothy Plan Large/Mid Cap Value Fund Class A produced a return of 17.02%, which exceeded the 5.49% produced by the S&P 500 Index.

An overweight and strong performance in the Energy and Materials & Processing sectors coupled with strong performance in the Financial Services, Technology and Consumer Discretionary sectors aided performance. The best performing securities included Freeport-McMoRan Copper & Gold, Murphy Oil, Apache and Precision Castparts, all of which responded well to the strength in commodity prices. Additionally, within Financial Services, asset management and brokerage firms Eaton Vance and BlackRock were bid higher as their results continued to beat expectations.

Relative performance was hindered by our exposure to the REITs, Consumer Staples and Health Care sectors. Within the Financial Services and REIT sectors, BB&T, Zions Bancorp, Comerica and Equity Residential all saw their share prices decline as investors worried over the credit crisis. Other detractors included Lam Research, which was pressured by fears over a weaker economy.

Large amounts of liquidity, a function of low, short-term interest rates among other things, flowed into public markets in 2006 and well into 2007. Companies had their share prices boosted by strong mutual fund inflows as well as by merger & acquisition activity among industry peers and from private equity funds. But, increased liquidity creates an atmosphere that favors risk and, after more than three years of free-flowing liquidity, valuations for more speculative assets reached lofty levels, while the appetite for high-quality securities decreased. As 2007 came to an end, it was apparent the environment had drastically changed. The financial and credit crisis that began last summer sparked significantly higher levels of volatility and, despite a significant reduction in the Fed Funds rate, we saw a huge reduction in risk appetite that pummeled stock prices and has had an adverse impact on the price of all kinds of risky assets.

The reflating of global rates has served as the catalyst for lower liquidity, slower growth and an increase in risk premiums in 2008. Within the U.S., we expect growth to slow from 2007’s pace and continue below its potential in 2008, thereby alleviating pressure on resource utilization rates and allowing inflation to continue to recede. We view housing as a remaining headwind for the domestic economy in 2008, but do not believe it will cause a recession and excess inventory should be slowly reduced throughout the year. Unemployment is expected to drift higher as firms focus on reducing costs, but capital expenditures should remain a source of strength despite the need to shore up balance sheets. Additionally, we continue to believe global growth will exceed that of the U.S., and global excess liquidity, which has artificially depressed interest rates and risk premiums for the past 5 years, is beginning to mature and is resulting in higher rates and a return to a positively-sloped yield curve.

Our expectations for the combined 2008 operating profits of the 500 companies that comprise the S&P 500 Index is $104.00 per share on a market capitalization-weighted basis, a gain of 9% over 2007, or $3.65 per share on an equal-weighted basis. Under this scenario, equities are more attractive, particularly relative to bonds and we believe, the markets will begin to assign a premium to companies showing unit growth and high cash margins.

With the risk matrix our capital market outlook presents, we will continue to focus our investment strategy on only the highest quality companies and to invest in companies that have healthy balance sheets, generate strong levels of free cash flow and efficiently utilize that cash to reduce debt, repurchase stock or initiate or increase dividends. As in prior years, we continue to expect to find more of these companies within the manufacturing sector as worldwide demand for their products boosts profits. We also expect to find more companies exhibiting these characteristics in the Technology sector, as these companies have spent many years strengthening balance sheets, generate large amounts of free cash flow and are currently experiencing strong demand.

As you know, we focus our investment efforts on finding high-quality securities at valuations that significantly discount the future prospects of a company. We believe that such a strategy will again be rewarded in 2008.

WESTWOOD MANAGEMENT CORPORATION

Letter From The Manager [28]

FUND PROFILE

December 31, 2007

TIMOTHY PLAN LARGE / MID CAP VALUE FUND

FUND PROFILE (unaudited):

Top Ten Holdings

(% of Net Assets)

Exxon Mobil Corp. | 3.20 | % | |

Murphy Oil Corp. | 2.49 | % | |

MEMC Electronic Materials, Inc. | 2.47 | % | |

Constellation Energy Group, Inc. | 2.30 | % | |

BlackRock, Inc. | 2.30 | % | |

McDermott International, Inc. | 2.29 | % | |

Occidental Petroleum Corp. | 2.24 | % | |

Covidien, Ltd. | 2.24 | % | |

ConocoPhillips | 2.20 | % | |

HCP, Inc. | 2.16 | % | |

| 23.89 | % | ||

| Industries | |||

| (% of Net Assets) | |||

Financial | 24.47 | % | |

Basic Materials | 20.40 | % | |

Technology | 16.06 | % | |

Industrial Goods | 12.21 | % | |

Utilities | 8.42 | % | |

Healthcare | 8.25 | % | |

Services | 6.24 | % | |

Consumer Goods | 2.15 | % | |

Short-Term Investments | 1.33 | % | |

Other Assets Less Liabilities | 0.47 | % | |

| 100.00 | % | ||

EXPENSE EXAMPLE (unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs,” (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2007, through December 31, 2007.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Timothy Plan Top Ten Holdings / Industries [29]

FUND PROFILE

December 31, 2007

TIMOTHY PLAN LARGE / MID CAP VALUE FUND

Hypothetical example for comparison purposes (unaudited)

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account Value 7/1/2007 | Ending Account Value 12/31/2007 | Expenses Paid During Period* 7/1/2007 through 12/31/2007 | |||||||

Actual – Class A | $ | 1,000.00 | $ | 1,036.86 | $ | 7.54 | |||

Hypothetical – Class A | $ | 1,000.00 | $ | 1,017.80 | $ | 7.47 | |||

(5% return before expenses) | |||||||||

Actual – Class B | $ | 1,000.00 | $ | 1,032.81 | $ | 11.34 | |||

Hypothetical – Class B | $ | 1,000.00 | $ | 1,014.05 | $ | 11.24 | |||

(5% return before expenses) | |||||||||

Actual – Class C | $ | 1,000.00 | $ | 1,032.27 | $ | 11.38 | |||

Hypothetical – Class C | $ | 1,000.00 | $ | 1,014.01 | $ | 11.27 | |||

(5% return before expenses) | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.47% for Class A, 2.21% for Class B, and 2.22% for Class C, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/365 days (to reflect the partial year period.) The Fund’s ending account value on the first line of each share class in the table is based on its actual total return of 3.69% for Class A, 3.28% for Class B, and 3.23% for Class C for the six-month period of July 1, 2007, to December 31, 2007. |

Timothy Plan Top Ten Holdings / Industries [30]

LARGE / MID CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2007

COMMON STOCKS – 92.69%

number of shares | market value | ||||

| AEROSPACE/DEFENSE - 2.02% | |||||

| 34,300 | Rockwell Collins, Inc. | $ | 2,468,571 | ||

| COMMERCIAL BANKS - SOUTHERN US - 1.73% | |||||

| 69,000 | BB&T Corp. | 2,116,230 | |||

| COMPUTERS - INTEGRATED SYSTEMS - 1.87% | |||||

| 93,900 | Jack Henry & Associates, Inc. | 2,285,526 | |||

| COSMETICS & TOILETRIES - 2.15% | |||||

| 33,800 | Colgate-Palmolive Co. | 2,635,048 | |||

| DATA PROCESSING/MANAGEMENT - 3.96% | |||||

| 54,100 | Automatic Data Processing, Inc. | 2,409,073 | |||

| 87,400 | Total System Services. Inc. | 2,447,200 | |||

| 4,856,273 | |||||

| DISTRIBUTION / WHOLESALE - 1.93% | |||||

| 51,100 | Genuine Parts Co. | 2,365,930 | |||

| DIVERSIFIED MANUFACTURING OPERATIONS - 4.10% | |||||

| 46,200 | Cooper Industries, Ltd. - Class A | 2,443,056 | |||

| 39,100 | ITT Corp. | 2,582,164 | |||

| 5,025,220 | |||||

| ELECTRIC - INTEGRATED - 6.51% | |||||

| 27,500 | Constellation Energy Group, Inc. | 2,819,575 | |||

| 54,600 | Dominion Resources, Inc. | 2,590,770 | |||

| 66,300 | Southern Co. | 2,569,125 | |||

| 7,979,470 | |||||

| ELECTRIC PRODUCTS - MISCELLANEOUS - 2.10% | |||||

| 45,400 | Emerson Electric Co. | 2,572,364 | |||

| ELECTRONIC COMPONENTS - SEMICONDUCTORS - 2.47% | |||||

| 34,200 | MEMC Electronic Materials, Inc. * | 3,026,358 | |||

| ELECTRONIC DESIGN AUTOMATION - 1.85% | |||||

| 133,400 | Cadence Design Systems, Inc. * | 2,269,134 | |||

| ENGINEERING/R&D SERVICES - 2.29% | |||||

| 47,500 | McDermott International, Inc. * | 2,803,925 | |||

| FINANCE - INVESTMENT BANKER/BROKER - 1.85% | |||||

| 55,700 | Lazard, Ltd. - Class A | 2,265,876 | |||

| INSURANCE BROKERS - 2.00% | |||||

| 64,600 | Willis Group Holdings, Ltd. | 2,452,862 | |||

| INVESTMENT MANAGEMENT/ADVISORY SERVICES - 8.22% | |||||

| 31,200 | AllianceBernstein Holding LP | 2,347,800 | |||

| 13,000 | BlackRock, Inc. | 2,818,400 | |||

| 58,200 | Eaton Vance Corp. | 2,642,862 | |||

| 19,700 | Franklin Resources, Inc. | 2,254,271 | |||

| 10,063,333 | |||||

The accompanying notes are an integral part of these financial statements.

The Timothy Large/Mid Cap Value Fund [31]

LARGE / MID CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2007

COMMON STOCKS – 92.69% (continued)

number of shares | market value | ||||

| MACHINERY - PUMPS - 2.01% | |||||

| 25,600 | Flowserve Corp. | $ | 2,462,720 | ||

| MEDICAL - BIOMEDICAL/GENETICS - 2.16% | |||||

| 35,500 | Genzyme Corp. * | 2,642,620 | |||

| MEDICAL - DRUGS - 1.94% | |||||

| 37,000 | Allergan, Inc. | 2,376,880 | |||

| MEDICAL PRODUCTS - 4.15% | |||||

| 62,000 | Covidien, Ltd. | 2,745,980 | |||

| 35,400 | Zimmer Holdings, Inc. * | 2,341,710 | |||

| 5,087,690 | |||||

| METAL - DIVERSIFIED - 1.99% | |||||

| 23,800 | Freeport-McMoRan Copper & Gold, Inc. | 2,438,072 | |||

| METAL PROCESSORS & FABRICATION - 1.98% | |||||

| 17,500 | Precision Castparts Corp. | 2,427,250 | |||

| MULTI-LINE INSURANCE - 2.11% | |||||

| 41,800 | ACE, Ltd. | 2,582,404 | |||

| OIL COMPANY - EXPLORATION & PRODUCTION - 6.52% | |||||

| 24,400 | Apache Corp. | 2,623,976 | |||

| 35,700 | Occidental Petroleum Corp. | 2,748,543 | |||

| 51,000 | XTO Energy, Inc. | 2,619,360 | |||

| 7,991,879 | |||||

| OIL COMPANY - INTEGRATED - 9.98% | |||||

| 30,500 | ConocoPhillips | 2,693,150 | |||

| 41,800 | Exxon Mobil Corp. | 3,916,242 | |||

| 42,300 | Marathon Oil Corp. | 2,574,378 | |||

| 35,900 | Murphy Oil Corp. | 3,045,756 | |||

| 12,229,526 | |||||

| PROPERTY/CASUALTY INSURANCE - 0.98% | |||||

| 17,000 | Arch Capital Group, Ltd. * | 1,195,950 | |||

| REINSURANCE - 2.09% | |||||

| 65,600 | Axis Capital Holdings, Ltd. | 2,556,432 | |||

| RETAIL - JEWELRY - 2.02% | |||||

| 53,700 | Tiffany & Co. | 2,471,811 | |||

| SEMICONDUCTOR EQUIPMENT - 1.93% | |||||

| 54,600 | Lam Research Corp. * | 2,360,358 | |||

| STEEL - SPECIALTY - 1.90% | |||||

| 26,900 | Allegheny Technologies, Inc. | 2,324,160 | |||

| SUPER-REGIONAL BANKS - US - 1.94% | |||||

| 54,700 | Comerica, Inc. | 2,381,091 | |||

The accompanying notes are an integral part of these financial statements.

The Timothy Large/Mid Cap Value Fund [32]

LARGE / MID CAP VALUE FUND

SCHEDULE OF INVESTMENTS

As of December 31, 2007

COMMON STOCKS – 92.69% (continued)

number of shares | market value | ||||

| TELECOMMUNICATION EQUIPMENT - 2.03% | |||||

| 39,700 | Harris Corp. | $ | 2,488,396 | ||

| WATER - 1.91% | |||||

| 110,366 | Aqua America, Inc. | 2,339,759 | |||

| Total Common Stocks (cost $90,862,837) | 113,543,118 | ||||

| REITs - 5.51% | |||||

number of shares | market value | ||||

| REITS - DIVERSIFIED - 1.50% | |||||

| 50,400 | Equity Residential | $ | 1,838,088 | ||

| REITS - HEALTHCARE - 2.16% | |||||

| 76,000 | HCP, Inc. | 2,643,280 | |||

| REITS - WAREHOUSE/INDUSTRIAL - 1.85% | |||||

| 35,700 | Prologis | 2,262,666 | |||

| Total REITs (cost $7,543,513) | 6,744,034 | ||||

| SHORT-TERM INVESTMENTS - 1.33% | |||||

number of shares | market value | ||||

| 1,634,778 | Timothy Plan Money Market Fund, 3.34% (A) (B) | $ | 1,634,778 | ||

| Total Short-Term Investments (cost $1,634,778) | 1,634,778 | ||||

| TOTAL INVESTMENTS (cost $100,041,128) - 99.53% | $ | 121,921,930 | |||

| CASH & OTHER ASSETS LESS LIABILITIES - 0.47% | 573,644 | ||||

| NET ASSETS - 100.00% | $ | 122,495,574 | |||

| * | Non-income producing securities. |

| (A) | Variable rate security; the rate shown represents the yield at December 31, 2007. |

| (B) | Affiliated fund. |

The accompanying notes are an integral part of these financial statements.

The Timothy Large/Mid Cap Value Fund [33]

LARGE / MID CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2007

ASSETS

| amount | |||

Investments in Unaffiliated Securities at Value (cost $98,406,350) [NOTE 1] | $ | 120,287,152 | |