UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08228

Timothy Plan

(Exact name of registrant as specified in charter)

1055 Maitland Center Commons, Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219-8000

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-846-7526

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

ANNUAL REPORT | |

December 31, 2022 |

Ticker | |

TIMOTHY PLAN US SMALL CAP CORE ETF | TPSC |

TIMOTHY PLAN US LARGE/MID CAP CORE ETF | TPLC |

TIMOTHY PLAN HIGH DIVIDEND STOCK ETF | TPHD |

TIMOTHY PLAN INTERNATIONAL ETF | TPIF |

TIMOTHY PLAN US LARGE/MID CAP CORE ENHANCED ETF | TPLE |

TIMOTHY PLAN HIGH DIVIDEND STOCK ENHANCED ETF | TPHE |

Listed and traded on: The New York Stock Exchange |

Table of Contents

Shareholder Letter (Unaudited) | 1 |

Letters from the Manager (Unaudited) | 2 |

Fund Performance (Unaudited) | 8 |

Schedules of Portfolio Investments | 14 |

Statements of Assets and Liabilities | 43 |

Statements of Operations | 46 |

Statements of Changes in Net Assets | 49 |

Financial Highlights | 52 |

Notes to Financial Statements | 58 |

Report of Independent Registered Public Accounting Firm | 70 |

Other Information (Unaudited) | 72 |

Trustees and Principal Executive Officers of the Trust (Unaudited) | 74 |

December 31, 2022

Dear Timothy Plan Exchange Traded Fund Shareholder:

This report covers the fiscal year (01-01-22 thru 12-31-22). No doubt you are well aware that 2022 was a very difficult year in the capital markets. Economic recession created a lot of turbulence in both the equity and fixed income markets. The S&P 500 fell over 18% during the twelve-month period, inflation accelerated, the Fed raised Fed Funds rates, the Russia/ Ukraine war wreaked havoc in energy markets, we saw GDP contraction, the 10-year Treasury bond yields increased substantially, and the US dollar appreciated considerably during the year, hurting international equity returns for US dollar investors. As a result of the factors cited, performance in all our ETFs was negative for this past year. While I am never happy with negative performance, it appears we may have turned a corner at the beginning of 2023.

Victory Capital Management (“VCM”), the sub-advisor for our ETFs, employs the smart-beta approach for each of the portfolios and in our opinion, although the share values declined, they were very competitive in the markets. VCM’s reports on the following pages will give you more detailed information about each Fund.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is VCM has done their very best, and our team here at Timothy has worked very hard to provide you an investment in which we hope you felt comfortable.

Sincerely,

Arthur D. Ally

President

1

Timothy Plan US Small Cap Core ETF – TPSC

Letter from the Manager – December 31, 2022

The Timothy Plan US Small Cap Core ETF (TPSC) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

For the year ending December 31, 2022, the TPSC returned -13.45% outperforming the Russell 2000 Index (the “Index”), which was down -20.44%.

When comparing performance to the Index, TPSC’s stock selection in Technology was a positive contributor to relative performance. An underweight to Energy was a negative contributor.

Victory Capital Management, Inc.

2

Timothy Plan US Large/Mid Cap Core ETF – TPLC

Letter from the Manager – December 31, 2022

The Timothy Plan US Large/Mid Cap Core ETF (TPLC) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

For the year ending December 31, 2022, TPLC returned -12.48% outperforming the S&P 500® Index (the “Index”), which was down -18.11%.

When comparing performance to the Index, most of the TPLC’s outperformance came from an underweight to the largest market cap names in the Index. An underweight to Communication Services and overweight to Industrials were positive contributors. Stock selection in Health Care was negative contributor.

Victory Capital Management, Inc.

3

Timothy Plan High Dividend Stock ETF – TPHD

Letter from the Manager – December 31, 2022

The Timothy Plan High Dividend Stock ETF (TPHD) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

For the year ending December 31, 2022, TPHD returned -1.88%, outperforming the Russell 1000® Value Index (the “Index”), which was down -7.54%.

When comparing performance to the Index, an underweight to Communication Services and an overweight to Utilities were large positive contributors to relative performance. An underweight to Health Care was a negative contributor.

Victory Capital Management, Inc.

4

Timothy Plan International ETF – TPIF

Letter from the Manager – December 31, 2022

The Timothy Plan International ETF (TPIF) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

For the year ending December 31, 2022, TPIF returned -17.80%, underperforming the MSCI EAFE Index (the “Index”), which was down -14.45%.

At the country level, an overweight to Canada was a positive contributor while stock selection in the United Kingdom was a detractor.

At the sector level, an overweight to Consumer Staples was a positive contributor while stock selection in Industrials was a detractor.

Victory Capital Management, Inc.

5

Timothy Plan US Large/Mid Cap Core Enhanced ETF – TPLE

Letter from the Manager – December 31, 2022

The Timothy Plan US Large/Mid Cap Core ETF (TPLE) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

For the year ending December 31, 2022, TPLE returned -11.58%, outperforming the S&P 500® Index (the “Index”), which was down -18.11%.

When comparing performance to the Index, TPLE’s overweight to cash during the year was a positive contributor to relative performance. Stock selection in Health Care was a negative contributor.

Victory Capital Management, Inc.

6

Timothy Plan High Dividend Stock Enhanced ETF – TPHE

Letter from the Manager – December 31, 2022

The Timothy Plan High Dividend Stock Enhanced ETF (TPHE) seeks a rules- based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

For the year ending December 31, 2022, TPHE returned -10.44%, underperforming the Russell 1000® Value Index (the “Index”), which was down -7.54%.

When comparing performance to the Index, the overweight to cash was a large negative contributor to relative performance. An overweight to Utilities was a large positive contributor.

Victory Capital Management, Inc.

7

Fund Performance - (Unaudited)

December 31, 2022

Timothy Plan US Small Cap Core ETF

Average Annual Return | |||

Inception Date | Timothy Plan US Small Cap Core ETF | ||

| Net Asset Value | Market Price Value | Victory US Small |

One Year | -13.45% | -13.56% | -12.94% |

Since Inception | 8.23% | 8.23% | 8.88% |

Expense Ratio | |

Gross | 0.52% |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month’s end, please visit www.timothyplan.com.

The above expense ratio is from the Fund’s prospectus dated April 30, 2022. Additional information pertaining to the Fund’s expense ratio as of December 31, 2022 can be found in the financial highlights.

Comparison of the Change in Value of a $10,000 Investment

1 | The universe for the Victory US Small Cap Volatility Weighted BRI Index begins with the largest U.S. companies with market capitalizations less than $3 billion with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing (“BRI”) filtering criteria. A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting. It is not possible to invest directly in an unmanaged index. |

The graph reflects investment growth of a hypothetical $10,000 investment of the Fund. Past performance is no guarantee of future results.

8

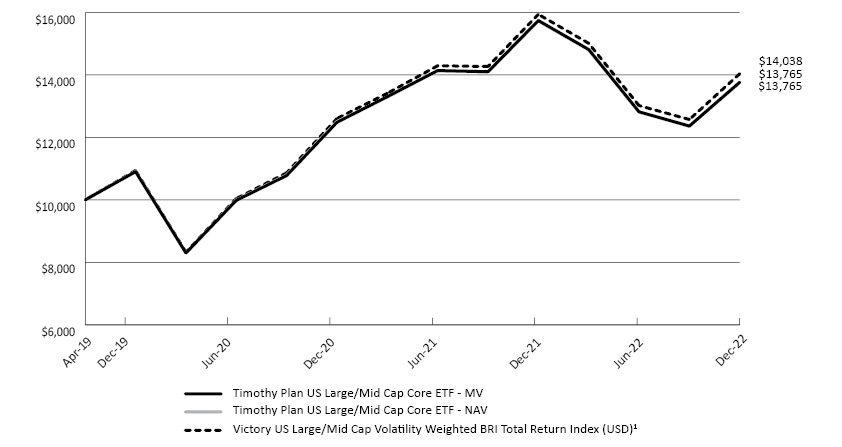

Fund Performance - (Unaudited)

December 31, 2022

Timothy Plan US Large/Mid Cap Core ETF

Average Annual Return | |||

Inception Date | Timothy Plan U.S. Large/Mid Cap Core ETF | ||

| Net Asset Value | Market Price Value | Victory US Large/ |

One Year | -12.48% | -12.57% | -11.94% |

Since Inception | 9.09% | 9.09% | 9.68% |

Expense Ratio | |

Gross | 0.52% |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month’s end, please visit www.timothyplan.com.

The above expense ratio is from the Fund’s prospectus dated April 30, 2022. Additional information pertaining to the Fund’s expense ratio as of December 31, 2022 can be found in the financial highlights.

Comparison of the Change in Value of a $10,000 Investment

1 | The universe for the Victory US Large/Mid Cap Volatility Weighted BRI Total Return Index begins with the largest U.S. companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing (“BRI”) filtering criteria. A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting. It is not possible to invest directly in an unmanaged index. |

The graph reflects investment growth of a hypothetical $10,000 investment of the Fund. Past performance is no guarantee of future results.

9

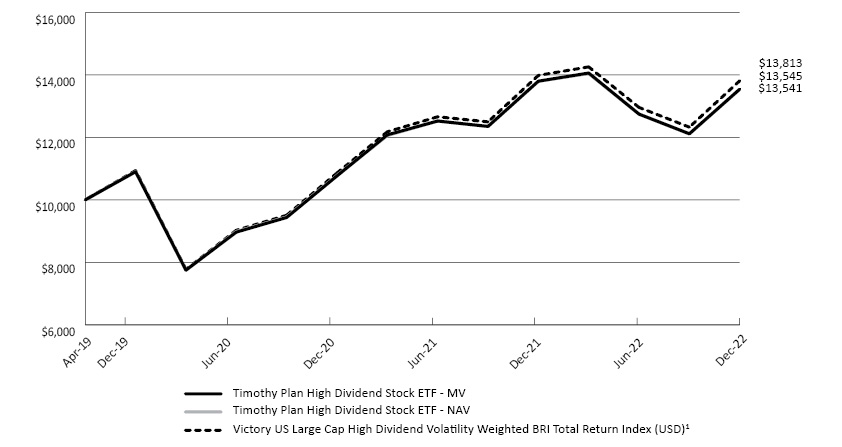

Fund Performance - (Unaudited)

December 31, 2022

Timothy Plan High Dividend Stock ETF

Average Annual Return | |||

Inception Date | Timothy Plan High Dividend Stock ETF | ||

| Net Asset Value | Market Price Value | Victory US Large |

One Year | -1.88% | -1.86% | -1.24% |

Since Inception | 8.61% | 8.62% | 9.20% |

Expense Ratio | |

Gross | 0.52% |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month’s end, please visit www.timothyplan.com.

The above expense ratio is from the Fund’s prospectus dated April 30, 2022. Additional information pertaining to the Fund’s expense ratio as of December 31, 2022 can be found in the financial highlights.

Comparison of the Change in Value of a $10,000 Investment

1 | The Victory US Large Cap High Dividend Volatility Weighted BRI Total Return Index is comprised of the 100 highest dividend yielding stocks from the Victory US Large/Mid Cap Volatility Weighted BRI Index. with positive earnings in each of the four most recent quarters. The universe for the Index begins with the largest U.S. companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing (“BRI”) filtering criteria. A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting. It is not possible to invest directly in an unmanaged index. |

The graph reflects investment growth of a hypothetical $10,000 investment of the Fund. Past performance is no guarantee of future results.

10

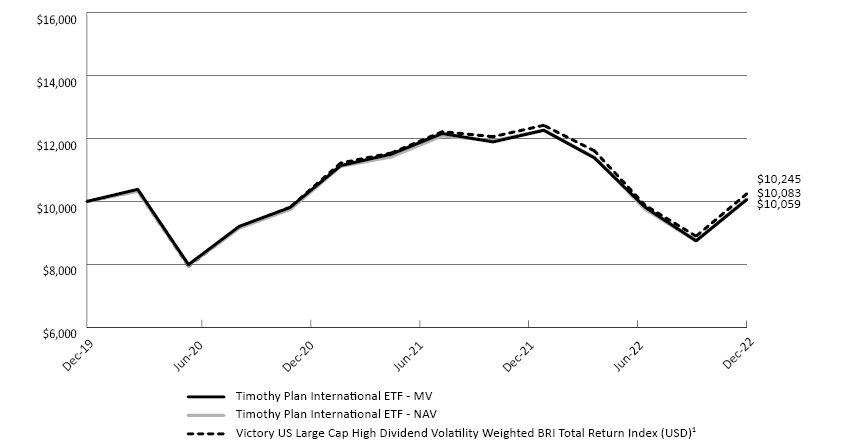

Fund Performance - (Unaudited)

December 31, 2022

Timothy Plan International ETF

Average Annual Return | |||

Inception Date | Timothy Plan International ETF | ||

| Net Asset Value | Market Price Value | Victory |

One Year | -17.80% | -17.96% | -17.50% |

Since Inception | 0.27% | 0.19% | 0.78% |

Expense Ratio | |

Gross | 0.62% |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month’s end, please visit www.timothyplan.com.

The above expense ratio is from the Fund’s prospectus dated April 30, 2022. Additional information pertaining to the Fund’s expense ratio as of December 31, 2022 can be found in the financial highlights.

Comparison of the Change in Value of a $10,000 Investment

1 | The universe for the Victory International 500 Volatility Weighted BRI Index begins with the largest developed international companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing (“BRI”) filtering criteria. A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting. It is not possible to invest directly in an unmanaged index. |

The graph reflects investment growth of a hypothetical $10,000 investment of the Fund. Past performance is no guarantee of future results.

11

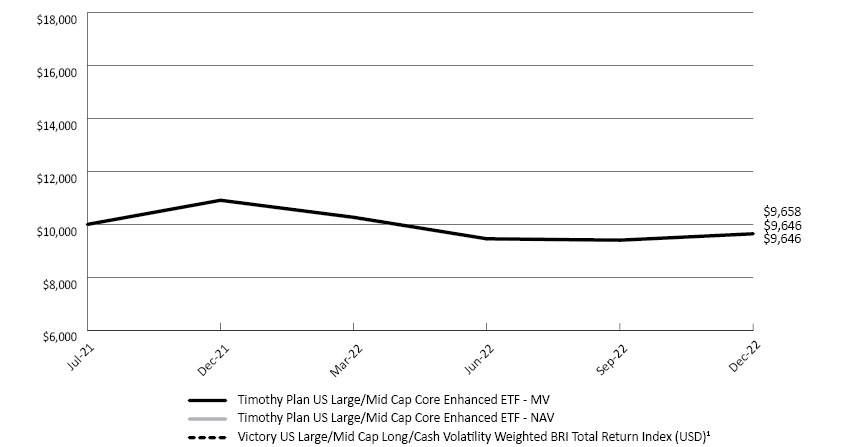

Fund Performance - (Unaudited)

December 31, 2022

Timothy Plan U.S. Large/Mid Cap Core Enhanced ETF

Average Annual Return | |||

Inception Date | Timothy Plan U.S. Large/Mid Cap Core | ||

| Net Asset Value | Market Price Value | Victory US Large/ |

One Year | -11.58% | -11.60% | -11.66% |

Since Inception | -2.49% | -2.49% | -2.40% |

Expense Ratio | |

Gross | 0.52% |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month’s end, please visit www.timothyplan.com.

The above expense ratio is from the Fund’s prospectus dated April 30, 2022. Additional information pertaining to the Fund’s expense ratio as of December 31, 2022 can be found in the financial highlights.

Comparison of the Change in Value of a $10,000 Investment

1 | The universe for the Victory US Large/Mid Cap Volatility Weighted BRI Total Return Index begins with the largest U.S. companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing (“BRI”) filtering criteria. A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting. It is not possible to invest directly in an unmanaged index. |

The graph reflects investment growth of a hypothetical $10,000 investment of the Fund. Past performance is no guarantee of future results.

12

Fund Performance - (Unaudited)

December 31, 2022

Timothy Plan High Dividend Stock Enhanced ETF

Average Annual Return | |||

Inception Date | Timothy Plan High Dividend Stock | ||

| Net Asset Value | Market Price Value | Victory US Large |

One Year | -10.44% | -10.54% | -10.23% |

Since Inception | -1.93% | -1.91% | -1.60% |

Expense Ratio | |

Gross | 0.52% |

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month’s end, please visit www.timothyplan.com.

The above expense ratio is from the Fund’s prospectus dated April 30, 2022. Additional information pertaining to the Fund’s expense ratio as of December 31, 2022 can be found in the financial highlights.

Comparison of the Change in Value of a $10,000 Investment

1 | The Victory US Large Cap High Dividend Volatility Weighted BRI Total Return Index is comprised of the 100 highest dividend yielding stocks from the Victory US Large/Mid Cap Volatility Weighted BRI Index. with positive earnings in each of the four most recent quarters. The universe for the Index begins with the largest U.S. companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing (“BRI”) filtering criteria. A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting. It is not possible to invest directly in an unmanaged index. |

The graph reflects investment growth of a hypothetical $10,000 investment of the Fund. Past performance is no guarantee of future results.

13

Schedule of Portfolio Investments

December 31, 2022

Timothy Plan US Small Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Common Stocks (99.7%) | ||||||||

| Communication Services (2.5%): | ||||||||

Advantage Solutions, Inc.(a) | 40,797 | 84,858 | ||||||

Cars.com, Inc.(a) | 10,003 | 137,741 | ||||||

| Cogent Communications Holdings, Inc. | 3,621 | 206,687 | ||||||

EchoStar Corp., Class A(a) | 8,574 | 143,014 | ||||||

Gogo, Inc.(a) | 9,489 | 140,058 | ||||||

| Gray Television, Inc. | 10,334 | 115,637 | ||||||

PubMatic, Inc.(a) | 4,376 | 56,057 | ||||||

Sciplay Corp., Class A(a) | 11,652 | 187,364 | ||||||

| Shenandoah Telecommunication Co. | 7,569 | 120,196 | ||||||

Stagwell, Inc.(a) | 16,932 | 105,148 | ||||||

TechTarget, Inc.(a) | 2,017 | 88,869 | ||||||

Thryv Holdings, Inc.(a) | 7,424 | 141,056 | ||||||

US Cellular Corp.(a) | 7,077 | 147,555 | ||||||

ZipRecruiter, Inc.(a) | 5,962 | 97,896 | ||||||

| 1,772,136 | ||||||||

| Consumer Discretionary (14.0%): | ||||||||

| American Eagle Outfitters, Inc. | 10,238 | 142,922 | ||||||

Arhaus, Inc.(a) | 10,614 | 103,487 | ||||||

| Arko Corp. | 15,222 | 131,823 | ||||||

| Bloomin’ Brands, Inc. | 5,329 | 107,219 | ||||||

Boot Barn Holdings, Inc.(a) | 1,751 | 109,473 | ||||||

Brinker International, Inc.(a) | 3,418 | 109,068 | ||||||

| Caleres, Inc. | 3,581 | 79,785 | ||||||

| Camping World Holdings, Inc., Class A | 3,846 | 85,843 | ||||||

| Carter’s, Inc. | 2,134 | 159,218 | ||||||

Cavco Industries, Inc.(a) | 608 | 137,560 | ||||||

| Century Communities, Inc. | 2,706 | 135,327 | ||||||

| Cheesecake Factory, Inc. | 3,383 | 107,275 | ||||||

| Cracker Barrel Old Country Store, Inc. | 1,460 | 138,320 | ||||||

Cricut, Inc., Class A(a) | 8,726 | 80,890 | ||||||

| Dana, Inc. | 8,273 | 125,171 | ||||||

Dave & Buster’s Entertainment, Inc.(a) | 2,715 | 96,220 | ||||||

| Designer Brands, Inc., Class A | 7,140 | 69,829 | ||||||

| Dine Brands Global, Inc. | 1,681 | 108,593 | ||||||

| Dorman Products, Inc. | 1,985 | 160,527 | ||||||

Dream Finders Homes, Inc., Class A(a) | 10,290 | 89,111 | ||||||

| European Wax Center, Inc., Class A | 5,922 | 73,729 | ||||||

First Watch Restaurant Group, Inc.(a) | 7,095 | 95,995 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Consumer Discretionary (14.0%): (continued) | ||||||||

| Franchise Group, Inc. | 4,398 | 104,760 | ||||||

Frontdoor, Inc.(a) | 7,291 | 151,653 | ||||||

Funko, Inc., Class A(a) | 4,327 | 47,208 | ||||||

Gentherm, Inc.(a) | 2,169 | 141,614 | ||||||

G-III Apparel Group Ltd.(a) | 6,709 | 91,980 | ||||||

GoPro, Inc., Class A(a) | 23,233 | 115,700 | ||||||

| Graham Holdings Co., Class B | 431 | 260,415 | ||||||

Grand Canyon Education, Inc.(a) | 2,343 | 247,561 | ||||||

Green Brick Partners, Inc.(a) | 5,234 | 126,820 | ||||||

| Group 1 Automotive, Inc. | 771 | 139,065 | ||||||

| Guess?, Inc. | 6,434 | 133,119 | ||||||

Helen of Troy Ltd.(a) | 1,606 | 178,121 | ||||||

| Installed Building Products, Inc. | 1,462 | 125,147 | ||||||

| Jack In The Box, Inc. | 1,744 | 118,993 | ||||||

| KB Home | 4,268 | 135,936 | ||||||

| Kontoor Brands, Inc. | 3,483 | 139,285 | ||||||

| La Z Boy, Inc. | 5,921 | 135,117 | ||||||

| LCI Industries | 1,204 | 111,310 | ||||||

Leslie’s, Inc.(a) | 8,150 | 99,512 | ||||||

LGI Homes, Inc.(a) | 1,425 | 131,955 | ||||||

M/I Homes, Inc.(a) | 3,307 | 152,717 | ||||||

Malibu Boats, Inc.(a) | 2,682 | 142,951 | ||||||

MarineMax, Inc.(a) | 4,025 | 125,661 | ||||||

| MDC Holdings, Inc. | 4,732 | 149,531 | ||||||

Meritage Homes Corp.(a) | 1,936 | 178,499 | ||||||

Modine Manufacturing Co.(a) | 7,233 | 143,647 | ||||||

| Monro, Inc. | 3,147 | 142,244 | ||||||

National Vision Holdings, Inc.(a) | 3,225 | 125,001 | ||||||

OneSpaWorld Holdings Ltd.(a) | 15,228 | 142,077 | ||||||

Overstock.com, Inc.(a) | 2,787 | 53,956 | ||||||

| Oxford Industries, Inc. | 1,530 | 142,565 | ||||||

| Papa John’s International, Inc. | 2,293 | 188,737 | ||||||

| Patrick Industries, Inc. | 2,714 | 164,468 | ||||||

Perdoceo Education Corp.(a) | 18,797 | 261,278 | ||||||

Playa Hotels & Resorts NV(a) | 21,450 | 140,069 | ||||||

Qurate Retail, Inc.(a) | 37,004 | 60,317 | ||||||

| Rent-A-Center, Inc. | 4,501 | 101,498 | ||||||

Revolve Group, Inc.(a) | 3,807 | 84,744 | ||||||

Sally Beauty Holdings, Inc.(a) | 9,599 | 120,179 | ||||||

Six Flags Entertainment Corp.(a) | 4,748 | 110,391 | ||||||

Solid Power, Inc.(a) | 16,699 | 42,415 | ||||||

| Sonic Automotive, Inc., Class A | 2,517 | 124,013 | ||||||

Sonos, Inc.(a) | 6,595 | 111,456 | ||||||

| Standard Motor Products | 4,756 | 165,509 | ||||||

| Steven Madden Ltd. | 4,897 | 156,508 | ||||||

See notes to financial statements.

14

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Small Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Consumer Discretionary (14.0%): (continued) | ||||||||

| Strategic Education, Inc. | 2,216 | 173,557 | ||||||

Stride, Inc.(a) | 2,564 | 80,202 | ||||||

| Sturm Ruger & Co. | 4,179 | 211,541 | ||||||

Target Hospitality Corp.(a) | 5,225 | 79,107 | ||||||

Taylor Morrison Home Corp.(a) | 4,792 | 145,437 | ||||||

| The Buckle, Inc. | 3,628 | 164,530 | ||||||

Tri Pointe Group, Inc.(a) | 8,641 | 160,636 | ||||||

Vista Outdoor, Inc.(a) | 5,341 | 130,160 | ||||||

Vivid Seats, Inc., Class A(a) | 12,395 | 90,484 | ||||||

| Winnebago Industries, Inc. | 1,981 | 104,399 | ||||||

| Wolverine World Wide, Inc. | 8,097 | 88,500 | ||||||

XPEL, Inc.(a) | 1,608 | 96,576 | ||||||

| 10,038,216 | ||||||||

| Consumer Staples (6.7%): | ||||||||

| B&G Foods, Inc. | 10,152 | 113,195 | ||||||

| Cal-Maine Foods, Inc. | 2,854 | 155,400 | ||||||

Central Garden And Pet Co., Class A(a) | 5,792 | 207,354 | ||||||

| Edgewell Personal Care Co. | 4,202 | 161,945 | ||||||

elf Beauty, Inc.(a) | 3,353 | 185,421 | ||||||

| Energizer Holdings, Inc. | 6,127 | 205,561 | ||||||

| Fresh Del Monte Produce, Inc. | 7,182 | 188,097 | ||||||

Herbalife Nutrition Ltd.(a) | 5,422 | 80,679 | ||||||

| Ingles Markets, Inc. | 2,243 | 216,360 | ||||||

| Inter Parfums, Inc. | 2,155 | 208,001 | ||||||

| J & J Snack Foods Corp. | 1,553 | 232,500 | ||||||

| John B. Sanfilippo & Son, Inc. | 2,766 | 224,931 | ||||||

| Medifast, Inc. | 1,090 | 125,731 | ||||||

Mission Produce, Inc.(a) | 11,925 | 138,568 | ||||||

| Nu Skin Enterprises, Inc., Class A | 4,138 | 174,458 | ||||||

| PriceSmart, Inc. | 3,250 | 197,535 | ||||||

| SpartanNash Co. | 5,237 | 158,367 | ||||||

| Spectrum Brands Holdings, Inc. | 3,606 | 219,678 | ||||||

| The Andersons, Inc. | 3,194 | 111,758 | ||||||

The Chefs’ Warehouse, Inc.(a) | 4,152 | 138,179 | ||||||

The Hain Celestial Group, Inc.(a) | 8,079 | 130,718 | ||||||

The Vita Coco Co., Inc.(a) | 7,257 | 100,292 | ||||||

| Tootsie Roll Industries, Inc. | 6,537 | 278,280 | ||||||

United Natural Foods, Inc.(a) | 3,681 | 142,491 | ||||||

Usana Health Sciences, Inc.(a) | 3,169 | 168,591 | ||||||

| Utz Brands, Inc. | 9,745 | 154,556 | ||||||

| WD-40 Co. | 901 | 145,250 | ||||||

| Weis Markets, Inc. | 2,398 | 197,331 | ||||||

| 4,761,227 | ||||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Energy (3.1%): | ||||||||

| Arch Resources, Inc. | 653 | 93,242 | ||||||

| Archrock, Inc. | 21,562 | 193,627 | ||||||

Bristow Group, Inc.(a) | 5,027 | 136,383 | ||||||

Callon Petroleum Co.(a) | 2,018 | 74,848 | ||||||

| CONSOL Energy, Inc. | 1,184 | 76,960 | ||||||

| Delek US Holdings, Inc. | 3,323 | 89,721 | ||||||

Earthstone Energy, Inc., Class A(a) | 5,795 | 82,463 | ||||||

Laredo Petroleum, Inc.(a) | 1,116 | 57,385 | ||||||

NexTier Oilfield Solutions, Inc.(a) | 8,815 | 81,451 | ||||||

Noble Corp. PLC(a) | 3,485 | 131,419 | ||||||

| Northern Oil and Gas, Inc. | 2,821 | 86,943 | ||||||

Par Pacific Holdings, Inc.(a) | 5,460 | 126,945 | ||||||

| Permian Resources Corp. | 10,261 | 96,453 | ||||||

| Ranger Oil Corp. | 2,251 | 91,008 | ||||||

| RPC, Inc. | 10,328 | 91,816 | ||||||

| Select Energy Services, Inc., Class A | 11,860 | 109,586 | ||||||

SilverBow Resources, Inc.(a) | 2,539 | 71,803 | ||||||

| Sitio Royalties Corp., Class A | 9,926 | 286,353 | ||||||

Talos Energy, Inc.(a) | 4,051 | 76,483 | ||||||

W&T Offshore, Inc.(a) | 9,373 | 52,301 | ||||||

| World Fuel Services Corp. | 5,110 | 139,656 | ||||||

| 2,246,846 | ||||||||

| Financials (23.8%): | ||||||||

| 1st Source Corp. | 5,001 | 265,503 | ||||||

| Artisan Partners Asset Management, Inc., Class A | 5,895 | 175,081 | ||||||

AssetMark Financial Holdings, Inc.(a) | 10,883 | 250,309 | ||||||

| Atlantic Union Bankshares Corp. | 6,451 | 226,688 | ||||||

Axos Financial, Inc.(a) | 3,977 | 152,001 | ||||||

| Financials (23.8%): (continued) | ||||||||

| BankUnited, Inc. | 4,955 | 168,321 | ||||||

| Banner Corp. | 3,299 | 208,497 | ||||||

| Berkshire Hills BanCorp, Inc. | 7,628 | 228,077 | ||||||

| BGC Partners, Inc., Class A | 42,027 | 158,442 | ||||||

| Bread Financial Holdings, Inc. | 3,545 | 133,505 | ||||||

| Capitol Federal Financial, Inc. | 34,687 | 300,043 | ||||||

| City Holding Co. | 3,116 | 290,068 | ||||||

| CNO Financial Group, Inc. | 9,147 | 209,009 | ||||||

| Columbia Banking System, Inc. | 5,981 | 180,208 | ||||||

Columbia Financial, Inc.(a) | 11,313 | 244,587 | ||||||

| Compass Diversified Holdings | 8,057 | 146,879 | ||||||

| Dime Community Bancshares, Inc. | 6,550 | 208,487 | ||||||

Donnelley Financial Solutions, Inc.(a) | 3,097 | 119,699 | ||||||

See notes to financial statements.

15

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Small Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Financials (23.8%): (continued) | ||||||||

Encore Capital Group, Inc.(a) | 3,518 | 168,653 | ||||||

| Enterprise Financial Services Corp. | 5,062 | 247,836 | ||||||

| FB Financial Corp. | 5,058 | 182,796 | ||||||

| Federal Agricultural Mortgage Corp., Class C | 1,879 | 211,782 | ||||||

| First BanCorp. | 9,739 | 123,880 | ||||||

| First BanCorp. | 5,014 | 214,800 | ||||||

| First Busey Corp. | 9,853 | 243,566 | ||||||

| First Commonwealth Financial Corp. | 17,373 | 242,701 | ||||||

| First Financial BanCorp. | 9,510 | 230,427 | ||||||

| First Foundation, Inc. | 10,870 | 155,767 | ||||||

| First Merchants Corp. | 5,366 | 220,596 | ||||||

| Fulton Financial Corp. | 13,037 | 219,413 | ||||||

Genworth Financial, Inc.(a) | 39,041 | 206,527 | ||||||

| German American BanCorp, Inc. | 6,318 | 235,661 | ||||||

Green Dot Corp., Class A(a) | 5,920 | 93,654 | ||||||

| Heartland Financial USA, Inc. | 5,124 | 238,881 | ||||||

| Hilltop Holdings, Inc. | 6,011 | 180,390 | ||||||

| Hope BanCorp, Inc. | 14,590 | 186,898 | ||||||

| Horace Mann Educators | 5,417 | 202,433 | ||||||

| Independent Bank Group, Inc. | 3,326 | 199,826 | ||||||

| International Bancshares Corp. | 4,359 | 199,468 | ||||||

| Jackson Financial, Inc., Class A | 3,577 | 124,444 | ||||||

| Lakeland BanCorp, Inc. | 14,355 | 252,792 | ||||||

| Lakeland Financial Corp. | 3,166 | 231,023 | ||||||

Lendingclub Corp.(a) | 7,015 | 61,732 | ||||||

| Live Oak Bancshares, Inc. | 3,450 | 104,190 | ||||||

| Merchants BanCorp | 8,179 | 198,913 | ||||||

| Moelis & Co., Class A | 4,176 | 160,233 | ||||||

| National Bank Holdings Corp., Class A | 5,384 | 226,505 | ||||||

| Navient Corp. | 8,708 | 143,247 | ||||||

| NBT BanCorp, Inc. | 6,643 | 288,439 | ||||||

NMI Holdings, Inc.(a) | 7,352 | 153,657 | ||||||

| Northwest Bancshares, Inc. | 19,780 | 276,524 | ||||||

| Oceanfirst Financial Corp. | 12,358 | 262,607 | ||||||

| OFG BanCorp | 7,209 | 198,680 | ||||||

Open Lending Corp.(a) | 12,569 | 84,841 | ||||||

Palomar Holdings, Inc.(a) | 1,307 | 59,024 | ||||||

| Park National Corp. | 1,779 | 250,394 | ||||||

| PennyMac Financial Services, Inc. | 3,542 | 200,690 | ||||||

| Piper Sandler Cos. | 1,414 | 184,089 | ||||||

| PJT Partners, Inc., Class A | 2,695 | 198,595 | ||||||

PRA Group, Inc.(a) | 8,924 | 301,453 | ||||||

| ProAssurance Corp. | 9,274 | 162,017 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Financials (23.8%): (continued) | ||||||||

| Provident Financial Services, Inc. | 11,619 | 248,182 | ||||||

| Renasant Corp. | 6,359 | 239,035 | ||||||

| S&T BanCorp, Inc. | 8,253 | 282,088 | ||||||

| Safety Insurance Group, Inc. | 3,512 | 295,921 | ||||||

| Sandy Spring BanCorp, Inc. | 5,980 | 210,675 | ||||||

| Seacoast Banking Corp. | 6,217 | 193,908 | ||||||

Silvergate Capital Corp., Class A(a) | 835 | 14,529 | ||||||

| Southside Bancshares, Inc. | 7,054 | 253,873 | ||||||

| StepStone Group, Inc., Class A | 5,218 | 131,389 | ||||||

| Stewart Information Services | 3,947 | 168,655 | ||||||

| Stock Yards BanCorp, Inc. | 3,225 | 209,560 | ||||||

StoneX Group, Inc.(a) | 2,143 | 204,228 | ||||||

Texas Capital Bancshares, Inc.(a) | 2,741 | 165,310 | ||||||

The BanCorp, Inc.(a) | 5,222 | 148,200 | ||||||

| Tompkins Financial Corp. | 3,210 | 249,032 | ||||||

| Towne Bank | 8,431 | 260,012 | ||||||

| TriCo Bancshares | 4,529 | 230,934 | ||||||

Triumph BanCorp, Inc.(a) | 2,195 | 107,270 | ||||||

| Trustmark Corp. | 7,808 | 272,577 | ||||||

Upstart Holdings, Inc.(a) | 1,791 | 23,677 | ||||||

| Veritex Holdings, Inc. | 6,210 | 174,377 | ||||||

| Virtus Investment Partners, Inc. | 922 | 176,508 | ||||||

| Washington Federal, Inc. | 6,751 | 226,496 | ||||||

| WesBanco, Inc. | 6,403 | 236,783 | ||||||

| Westamerica BanCorp. | 5,442 | 321,132 | ||||||

| 17,039,799 | ||||||||

| Health Care (8.5%): | ||||||||

AdaptHealth Corp.(a) | 4,355 | 83,703 | ||||||

Addus Homecare Corp.(a) | 1,466 | 145,852 | ||||||

Agiliti, Inc.(a) | 7,331 | 119,569 | ||||||

Alector, Inc.(a) | 9,675 | 89,300 | ||||||

Allscripts Healthcare Solutions, Inc.(a) | 10,243 | 180,687 | ||||||

Apollo Medical Holdings, Inc.(a) | 2,707 | 80,100 | ||||||

Arcus Biosciences, Inc.(a) | 2,865 | 59,248 | ||||||

AtriCure, Inc.(a) | 3,540 | 157,105 | ||||||

| Atrion Corp. | 318 | 177,905 | ||||||

Avid Bioservices, Inc.(a) | 5,166 | 71,136 | ||||||

Catalyst Pharmaceuticals, Inc.(a) | 7,663 | 142,532 | ||||||

Corcept Therapeutics, Inc.(a) | 4,750 | 96,472 | ||||||

CorVel Corp.(a) | 1,172 | 170,327 | ||||||

| Health Care (8.5%): (continued) | ||||||||

Cross Country Healthcare, Inc.(a) | 2,780 | 73,865 | ||||||

DocGo, Inc.(a) | 8,157 | 57,670 | ||||||

Dynavax Technologies Corp.(a) | 7,999 | 85,109 | ||||||

See notes to financial statements.

16

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Small Cap Core ETF

| SHARES | VALUE ($) | |||||||

| Health Care (8.5%): (continued) | ||||||||

| Embecta Corp. | 3,352 | 84,772 | ||||||

Emergent Biosolutions, Inc.(a) | 4,955 | 58,519 | ||||||

Enhabit, Inc.(a) | 6,294 | 82,829 | ||||||

Enovis Corp.(a) | 3,514 | 188,069 | ||||||

Figs, Inc., Class A(a) | 9,414 | 63,356 | ||||||

Fulgent Genetics, Inc.(a) | 3,051 | 90,859 | ||||||

Harmony Biosciences Holdings, Inc.(a) | 2,160 | 119,016 | ||||||

Innoviva, Inc.(a) | 11,904 | 157,728 | ||||||

Integer Holdings Corp.(a) | 3,299 | 225,850 | ||||||

Ironwood Pharmaceuticals, Inc.(a) | 18,786 | 232,759 | ||||||

iTeos Therapeutics, Inc.(a) | 4,600 | 89,838 | ||||||

| Lemaitre Vascular, Inc. | 3,514 | 161,714 | ||||||

Multiplan Corp.(a) | 31,933 | 36,723 | ||||||

| National Healthcare Corp. | 4,173 | 248,294 | ||||||

| National Research Corp. | 4,129 | 154,012 | ||||||

Neogen Corp.(a) | 13,854 | 210,996 | ||||||

Owens & Minor, Inc.(a) | 8,101 | 158,213 | ||||||

Pacira BioSciences, Inc.(a) | 3,061 | 118,185 | ||||||

| Patterson Cos., Inc. | 7,111 | 199,321 | ||||||

Pediatrix Medical Group, Inc.(a) | 8,207 | 121,956 | ||||||

Prestige Consumer Healthcare, Inc.(a) | 4,153 | 259,978 | ||||||

Prothena Corp. PLC(a) | 878 | 52,899 | ||||||

RadNet, Inc.(a) | 6,306 | 118,742 | ||||||

Regenxbio, Inc.(a) | 4,174 | 94,666 | ||||||

Senseonics Holdings, Inc.(a) | 50,693 | 52,214 | ||||||

| SIGA Technologies, Inc. | 5,223 | 38,441 | ||||||

| Simulations Plus, Inc. | 2,772 | 101,372 | ||||||

Supernus Pharmaceuticals, Inc.(a) | 5,182 | 184,842 | ||||||

Syndax Pharmaceuticals, Inc.(a) | 4,495 | 114,398 | ||||||

| Health Care (8.5%): (continued) | ||||||||

| U.S. Physical Therapy, Inc. | 1,725 | 139,777 | ||||||

Varex Imaging Corp.(a) | 8,853 | 179,716 | ||||||

Xencor, Inc.(a) | 4,437 | 115,539 | ||||||

| 6,046,173 | ||||||||

| Industrials (20.9%): | ||||||||

AAR Corp.(a) | 4,271 | 191,768 | ||||||

AerSale Corp.(a) | 6,998 | 113,508 | ||||||

Air Transport Services Group(a) | 5,862 | 152,295 | ||||||

| Alamo Group, Inc. | 1,604 | 227,126 | ||||||

| Albany International Corp. | 2,386 | 235,236 | ||||||

Allegiant Travel Co.(a) | 1,831 | 124,490 | ||||||

| Altra Industrial Motion Corp. | 3,767 | 225,078 | ||||||

| Apogee Enterprises, Inc. | 3,991 | 177,440 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Industrials (20.9%): (continued) | ||||||||

| ArcBest Corp. | 1,463 | 102,469 | ||||||

| Arcosa, Inc. | 2,776 | 150,848 | ||||||

| Astec Industries, Inc. | 4,105 | 166,909 | ||||||

| AZZ, Inc. | 5,878 | 236,296 | ||||||

| Barnes Group, Inc. | 5,887 | 240,484 | ||||||

| Boise Cascade Co. | 1,661 | 114,061 | ||||||

| Brady Corp. | 5,107 | 240,540 | ||||||

BrightView Holdings, Inc.(a) | 18,169 | 125,184 | ||||||

CBIZ, Inc.(a) | 4,985 | 233,547 | ||||||

| Columbus McKinnon Corp. | 5,808 | 188,586 | ||||||

Construction Partners, Inc., Class A(a) | 4,209 | 112,338 | ||||||

| CSW Industrials, Inc. | 1,867 | 216,441 | ||||||

| Deluxe Corp. | 9,590 | 162,838 | ||||||

| Encore Wire Corp. | 896 | 123,254 | ||||||

Energy Recovery, Inc.(a) | 8,005 | 164,022 | ||||||

| Enerpac Tool Group Corp. | 8,040 | 204,618 | ||||||

| EnerSys | 2,779 | 205,201 | ||||||

| EnPro Industries, Inc. | 1,944 | 211,293 | ||||||

| Esab Corp. | 4,043 | 189,698 | ||||||

| ESCO Technologies, Inc. | 2,415 | 211,409 | ||||||

| Federal Signal Corp. | 4,857 | 225,705 | ||||||

First Advantage Corp.(a) | 11,520 | 149,760 | ||||||

Forrester Research, Inc.(a) | 4,941 | 176,690 | ||||||

| Forward Air Corp. | 1,570 | 164,677 | ||||||

Gibraltar Industries, Inc.(a) | 2,949 | 135,300 | ||||||

| Global Industrial Co. | 4,786 | 112,615 | ||||||

GMS, Inc.(a) | 3,229 | 160,804 | ||||||

| GrafTech International, Ltd. | 26,998 | 128,510 | ||||||

| Granite Construction, Inc. | 7,139 | 250,365 | ||||||

| Griffon Corp. | 3,630 | 129,918 | ||||||

| H&E Equipment Services, Inc. | 4,116 | 186,866 | ||||||

Hayward Holdings, Inc.(a) | 12,804 | 120,358 | ||||||

| Healthcare Services Group | 10,158 | 121,896 | ||||||

| Heartland Express, Inc. | 15,116 | 231,879 | ||||||

| Helios Technologies, Inc. | 2,672 | 145,464 | ||||||

Heritage-Crystal Clean, Inc.(a) | 6,295 | 204,462 | ||||||

| Hillenbrand, Inc. | 4,549 | 194,106 | ||||||

HireRight Holdings Corp.(a) | 6,357 | 75,394 | ||||||

| HNI Corp. | 6,174 | 175,527 | ||||||

Huron Consulting Group, Inc.(a) | 2,864 | 207,926 | ||||||

| ICF International, Inc. | 2,011 | 199,190 | ||||||

Janus International Group, Inc.(a) | 13,314 | 126,749 | ||||||

Jeld-Wen Holding, Inc.(a) | 12,043 | 116,215 | ||||||

| Kadant, Inc. | 1,091 | 193,794 | ||||||

See notes to financial statements.

17

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Small Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Industrials (20.9%): (continued) | ||||||||

| Kaman Corp. | 5,293 | 118,034 | ||||||

| Kennametal, Inc. | 6,890 | 165,773 | ||||||

| Kforce, Inc. | 2,644 | 144,970 | ||||||

| Lindsay Corp. | 1,167 | 190,046 | ||||||

| Marten Transport Ltd. | 7,739 | 153,077 | ||||||

| Matson, Inc. | 1,698 | 106,142 | ||||||

| Maxar Technologies, Inc. | 5,203 | 269,203 | ||||||

| McGrath Rentcorp | 2,693 | 265,907 | ||||||

Mercury Systems, Inc.(a) | 3,234 | 144,689 | ||||||

| Moog, Inc., Class A | 2,768 | 242,920 | ||||||

| Mueller Water Products, Inc., Class A | 18,556 | 199,663 | ||||||

MYR Group, Inc.(a) | 2,177 | 200,436 | ||||||

NOW, Inc.(a) | 11,970 | 152,019 | ||||||

NV5 Global, Inc.(a) | 1,313 | 173,736 | ||||||

PGT Innovations, Inc.(a) | 6,728 | 120,835 | ||||||

| Primoris Services Corp. | 9,157 | 200,905 | ||||||

Proto Labs, Inc.(a) | 3,695 | 94,333 | ||||||

| Rush Enterprises, Inc., Class A | 4,084 | 213,512 | ||||||

SkyWest, Inc.(a) | 5,905 | 97,492 | ||||||

SPX Technologies, Inc.(a) | 3,282 | 215,463 | ||||||

| Standex International Corp. | 2,565 | 262,682 | ||||||

Sun Country Airlines Holdings, Inc.(a) | 7,164 | 113,621 | ||||||

| Tennant Co. | 3,431 | 211,247 | ||||||

| Terex Corp. | 4,168 | 178,057 | ||||||

The AZEK Co., Inc.(a) | 5,402 | 109,769 | ||||||

| The Brink’s Co. | 3,712 | 199,371 | ||||||

| The Greenbrier Cos., Inc. | 5,872 | 196,888 | ||||||

| The Shyft Group, Inc. | 5,604 | 139,315 | ||||||

Titan International, Inc.(a) | 6,488 | 99,396 | ||||||

| Trinity Industries, Inc. | 7,469 | 220,858 | ||||||

| Universal Logistics Holdings, Inc. | 3,813 | 127,507 | ||||||

V2X, Inc.(a) | 2,714 | 112,061 | ||||||

| Veritiv Corp. | 1,127 | 137,167 | ||||||

| Wabash National Corp. | 8,052 | 181,975 | ||||||

| Werner Enterprises, Inc. | 5,133 | 206,655 | ||||||

| 14,946,871 | ||||||||

| Information Technology (10.3%): | ||||||||

3D Systems Corp.(a) | 11,736 | 86,846 | ||||||

| A10 Networks, Inc. | 8,423 | 140,075 | ||||||

ACI Worldwide, Inc.(a) | 7,943 | 182,689 | ||||||

ACM Research, Inc., Class A(a) | 8,886 | 68,511 | ||||||

Agilysys, Inc.(a) | 2,334 | 184,713 | ||||||

Alpha & Omega Semiconductor, Ltd.(a) | 2,498 | 71,368 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Information Technology (10.3%): (continued) | ||||||||

Avid Technology, Inc.(a) | 3,914 | 104,073 | ||||||

Axcelis Technologies, Inc.(a) | 1,592 | 126,341 | ||||||

| Badger Meter, Inc. | 1,994 | 217,406 | ||||||

| Belden, Inc. | 2,495 | 179,391 | ||||||

| Benchmark Electronics, Inc. | 7,615 | 203,244 | ||||||

Clearfield, Inc.(a) | 851 | 80,113 | ||||||

Cohu, Inc.(a) | 4,238 | 135,828 | ||||||

CommVault Systems, Inc.(a) | 3,058 | 192,165 | ||||||

Conduent, Inc.(a) | 33,968 | 137,570 | ||||||

Consensus Cloud Solutions, Inc.(a) | 2,399 | 128,970 | ||||||

| CSG Systems International, Inc. | 3,491 | 199,685 | ||||||

Digi International, Inc.(a) | 4,131 | 150,988 | ||||||

Digital Turbine, Inc.(a) | 4,934 | 75,194 | ||||||

| Ebix, Inc. | 3,324 | 66,347 | ||||||

eplus, Inc.(a) | 3,791 | 167,866 | ||||||

| EVERTEC, Inc. | 6,003 | 194,377 | ||||||

Extreme Networks, Inc.(a) | 8,113 | 148,549 | ||||||

FormFactor, Inc.(a) | 4,464 | 99,235 | ||||||

Harmonic, Inc.(a) | 9,762 | 127,882 | ||||||

Ichor Holding Ltd.(a) | 4,008 | 107,495 | ||||||

| InterDigital, Inc. | 3,938 | 194,852 | ||||||

International Money Express, Inc.(a) | 6,597 | 160,769 | ||||||

MaxLinear, Inc.(a) | 2,962 | 100,560 | ||||||

| Methode Electronics, Inc. | 5,129 | 227,574 | ||||||

N-able, Inc.(a) | 12,064 | 124,018 | ||||||

Napco Security Technologies Inc.(a) | 5,184 | 142,456 | ||||||

NetScout Systems, Inc.(a) | 5,766 | 187,453 | ||||||

OSI Systems, Inc.(a) | 3,120 | 248,102 | ||||||

Paya Holdings, Inc.(a) | 15,802 | 124,362 | ||||||

Paymentus Holdings, Inc.(a) | 7,092 | 56,807 | ||||||

Payoneer Global, Inc.(a) | 9,790 | 53,551 | ||||||

| PC Connection, Inc. | 4,073 | 191,024 | ||||||

Perficient, Inc.(a) | 1,784 | 124,577 | ||||||

Photronics, Inc.(a) | 6,069 | 102,141 | ||||||

Plexus Corp.(a) | 2,127 | 218,932 | ||||||

| Progress Software Corp. | 4,036 | 203,616 | ||||||

Semtech Corp.(a) | 4,232 | 121,416 | ||||||

SiTime Corp.(a) | 857 | 87,088 | ||||||

SMART Global Holdings, Inc.(a) | 8,956 | 133,265 | ||||||

TaskUS, Inc., Class A(a) | 3,763 | 63,595 | ||||||

| TTEC Holdings, Inc. | 3,073 | 135,612 | ||||||

TTM Technologies(a) | 9,503 | 143,305 | ||||||

Ultra Clean Holdings, Inc.(a) | 3,986 | 132,136 | ||||||

Veeco Instruments, Inc.(a) | 7,386 | 137,232 | ||||||

See notes to financial statements.

18

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Small Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Information Technology (10.3%): (continued) | ||||||||

Verra Mobility Corp.(a) | 10,068 | 139,240 | ||||||

| Vishay Intertechnology, Inc. | 9,732 | 209,919 | ||||||

| 7,340,523 | ||||||||

| Materials (5.2%): | ||||||||

| AdvanSix, Inc. | 3,530 | 134,211 | ||||||

| Alpha Metallurgical Resources, Inc. | 482 | 70,560 | ||||||

Arconic Corp.(a) | 5,611 | 118,729 | ||||||

| Chase Corp. | 2,463 | 212,458 | ||||||

Ecovyst, Inc.(a) | 14,777 | 130,924 | ||||||

| Hawkins, Inc. | 4,154 | 160,344 | ||||||

| Hecla Mining Co. | 22,011 | 122,381 | ||||||

Ingevity Corp.(a) | 2,535 | 178,565 | ||||||

| Innospec, Inc. | 2,382 | 245,012 | ||||||

| Materion Corp. | 1,931 | 168,982 | ||||||

| Minerals Technologies, Inc. | 3,372 | 204,748 | ||||||

| NewMarket Corp. | 689 | 214,355 | ||||||

O-I Glass, Inc.(a) | 8,099 | 134,200 | ||||||

Origin Materials, Inc.(a) | 19,702 | 90,826 | ||||||

| Orion Engineered Carbons SA | 9,527 | 169,676 | ||||||

| Pactiv Evergreen, Inc. | 14,103 | 160,210 | ||||||

| Ryerson Holding Corp. | 2,879 | 87,119 | ||||||

| Schnitzer Steel Industries, Inc. | 3,991 | 122,324 | ||||||

| Stepan Co. | 2,312 | 246,136 | ||||||

| Sylvamo Corp. | 2,590 | 125,848 | ||||||

| TriMas Corp. | 7,743 | 214,791 | ||||||

| Trinseo PLC | 5,443 | 123,611 | ||||||

| Warrior Met Coal, Inc. | 3,301 | 114,347 | ||||||

| Worthington Industries, Inc. | 2,971 | 147,688 | ||||||

| 3,698,045 | ||||||||

| Real Estate (1.6%): | ||||||||

CoreCivic, Inc.(a) | 13,197 | 152,557 | ||||||

| eXp World Holdings, Inc. | 6,685 | 74,070 | ||||||

| Kennedy-Wilson Holdings, Inc. | 13,246 | 208,360 | ||||||

| Marcus & Millichap, Inc. | 4,610 | 158,814 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Real Estate (1.6%): (continued) | ||||||||

| Newmark Group, Inc., Class A | 14,668 | 116,904 | ||||||

| The RMR Group, Inc., Class A | 8,694 | 245,605 | ||||||

| The St. Joe Co. | 4,541 | 175,510 | ||||||

| 1,131,820 | ||||||||

| Utilities (3.1%): | ||||||||

Altus Power, Inc.(a) | 6,809 | 44,395 | ||||||

| Avista Corp. | 6,858 | 304,084 | ||||||

| Chesapeake Utilities Corp. | 2,031 | 240,024 | ||||||

| MGE Energy, Inc. | 4,193 | 295,187 | ||||||

| Middlesex Water Co. | 2,508 | 197,304 | ||||||

Montauk Renewables, Inc.(a) | 6,141 | 67,735 | ||||||

| Northwest Natural Holding Co. | 4,926 | 234,428 | ||||||

| NorthWestern Corp. | 5,084 | 301,685 | ||||||

| SJW Group | 4,013 | 325,815 | ||||||

| Unitil Corp. | 3,767 | 193,473 | ||||||

| 2,204,130 | ||||||||

| Total Common Stocks (Cost $71,082,172) | 71,225,786 | |||||||

Total Investments (Cost $71,082,172) — 99.7%(b) | 71,225,786 | |||||||

| Other assets in excess of liabilities — 0.3% | 195,936 | |||||||

| NET ASSETS - 100.00% | $ | 71,421,722 | ||||||

Percentages indicated are based on net assets as of December 31, 2022.

(a) | Non-income producing security. |

(b) | See Federal Tax Information listed in the Notes to Financial Statements. |

Futures Contracts

Long Futures

| Index Futures | Expiration Date | Number of Contracts | Notional Amount | Value | Unrealized Appreciation (Depreciation) | |||||||||||||

| E-Mini Russell 2000 Index | 3/17/23 | 2 | $ | 178,869 | $ | 177,090 | $ | (1,779 | ) | |||||||||

| $ | (1,779 | ) | ||||||||||||||||

See notes to financial statements.

19

Schedule of Portfolio Investments

December 31, 2022

Timothy Plan US Large/Mid Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Common Stocks (99.6%) | ||||||||

| Communication Services (0.9%): | ||||||||

Endeavor Group Holdings, Inc., Class A(a) | 20,149 | 454,158 | ||||||

| Lumen Technologies, Inc. | 67,451 | 352,094 | ||||||

| News Corp., Class A | 32,984 | 600,309 | ||||||

ZoomInfo Technologies, Inc.(a) | 6,670 | 200,834 | ||||||

| 1,607,395 | ||||||||

| Consumer Discretionary (7.8%): | ||||||||

Aptiv PLC(a) | 4,323 | 402,601 | ||||||

| Aramark | 16,646 | 688,146 | ||||||

AutoZone, Inc.(a) | 267 | 658,470 | ||||||

Burlington Stores, Inc.(a) | 2,875 | 582,935 | ||||||

CarMax, Inc.(a) | 5,828 | 354,867 | ||||||

Chipotle Mexican Grill, Inc.(a) | 288 | 399,597 | ||||||

| Darden Restaurants, Inc. | 3,894 | 538,657 | ||||||

| Dollar General Corp. | 2,296 | 565,390 | ||||||

Dollar Tree, Inc.(a) | 3,099 | 438,323 | ||||||

| Domino’s Pizza, Inc. | 1,825 | 632,180 | ||||||

| DR Horton, Inc. | 6,202 | 552,846 | ||||||

| Garmin Ltd. | 7,346 | 677,962 | ||||||

| Genuine Parts Co. | 4,862 | 843,606 | ||||||

| Lennar Corp. | 5,789 | 523,905 | ||||||

| LKQ Corp. | 10,289 | 549,535 | ||||||

| Lowe’s Cos., Inc. | 3,091 | 615,851 | ||||||

NVR, Inc.(a) | 136 | 627,311 | ||||||

O’Reilly Automotive, Inc.(a) | 815 | 687,884 | ||||||

| Pool Corp. | 1,470 | 444,425 | ||||||

| Pultegroup, Inc. | 11,414 | 519,679 | ||||||

| Ross Stores, Inc. | 4,861 | 564,216 | ||||||

| Service Corp. | 10,143 | 701,287 | ||||||

Tesla, Inc.(a) | 1,438 | 177,133 | ||||||

| Tractor Supply Co. | 2,580 | 580,423 | ||||||

| Vail Resorts, Inc. | 2,280 | 543,438 | ||||||

| 13,870,667 | ||||||||

| Consumer Staples (4.1%): | ||||||||

BJ’s Wholesale Club Holdings, Inc.(a) | 5,977 | 395,438 | ||||||

| Bunge, Ltd. | 6,598 | 658,282 | ||||||

| Campbell Soup Co. | 15,640 | 887,570 | ||||||

| Costco Wholesale Corp. | 1,280 | 584,320 | ||||||

Darling Ingredients, Inc.(a) | 5,622 | 351,881 | ||||||

| Hormel Foods Corp. | 18,748 | 853,971 | ||||||

| Lamb Weston Holdings, Inc. | 7,310 | 653,222 | ||||||

| McCormick & Co., Inc. | 9,443 | 782,730 | ||||||

Monster Beverage Corp.(a) | 7,043 | 715,076 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Consumer Staples (4.1%): (continued) | ||||||||

| Sysco Corp. | 8,366 | 639,581 | ||||||

| The JM Smucker Co. | 5,163 | 818,129 | ||||||

| 7,340,200 | ||||||||

| Energy (6.0%): | ||||||||

Antero Resources Corp.(a) | 8,894 | 275,625 | ||||||

| APA Corp. | 7,807 | 364,431 | ||||||

| Chesapeake Energy Corp. | 4,126 | 389,371 | ||||||

| ConocoPhillips | 3,700 | 436,600 | ||||||

| Coterra Energy, Inc. | 13,733 | 337,420 | ||||||

| Devon Energy Corp. | 4,987 | 306,750 | ||||||

| Diamondback Energy, Inc. | 2,724 | 372,589 | ||||||

| EOG Resources, Inc. | 3,391 | 439,202 | ||||||

| Halliburton Co. | 12,506 | 492,111 | ||||||

| Hess Corp. | 3,436 | 487,293 | ||||||

| HF Sinclair Corp. | 6,685 | 346,885 | ||||||

| Kinder Morgan, Inc. | 39,816 | 719,873 | ||||||

| Marathon Oil Corp. | 12,959 | 350,800 | ||||||

| Marathon Petroleum Corp. | 4,886 | 568,682 | ||||||

| Occidental Petroleum Corp. | 4,861 | 306,194 | ||||||

| ONEOK, Inc. | 9,874 | 648,722 | ||||||

| Ovintiv, Inc. | 6,044 | 306,491 | ||||||

| Phillips 66 | 4,897 | 509,680 | ||||||

| Pioneer Natural Resources Co. | 1,918 | 438,052 | ||||||

| Schlumberger Ltd. | 8,772 | 468,951 | ||||||

| Targa Resources Corp. | 6,936 | 509,796 | ||||||

| Texas Pacific Land Corp. | 181 | 424,306 | ||||||

| The Williams Cos., Inc. | 21,640 | 711,956 | ||||||

| Valero Energy Corp. | 3,552 | 450,607 | ||||||

| 10,662,387 | ||||||||

| Financials (11.7%): | ||||||||

| Aflac, Inc. | 13,749 | 989,103 | ||||||

| American Financial Group, Inc. | 5,386 | 739,390 | ||||||

Arch Capital Group Ltd.(a) | 15,895 | 997,888 | ||||||

| Ares Management Corp., Class A | 6,481 | 443,560 | ||||||

| Arthur J Gallagher & Co. | 4,154 | 783,195 | ||||||

| Brown & Brown, Inc. | 10,580 | 602,743 | ||||||

| Cboe Global Markets, Inc. | 6,468 | 811,540 | ||||||

| Cincinnati Financial Corp. | 5,729 | 586,592 | ||||||

| East West Bancorp, Inc. | 6,911 | 455,435 | ||||||

| Equitable Holdings, Inc. | 18,917 | 542,918 | ||||||

| Erie Indemnity Co., Class A | 3,195 | 794,660 | ||||||

| Everest Re Group, Ltd. | 2,536 | 840,101 | ||||||

| FactSet Research Systems, Inc. | 1,663 | 667,212 | ||||||

| First Citizens BancShares, Inc., Class A | 614 | 465,633 | ||||||

See notes to financial statements.

20

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Large/Mid Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Financials (11.7%): (continued) | ||||||||

| First Republic Bank | 4,766 | 580,928 | ||||||

| Franklin Resources, Inc. | 24,473 | 645,598 | ||||||

| Globe Life, Inc. | 6,919 | 834,085 | ||||||

| Interactive Brokers Group, Inc. | 7,570 | 547,690 | ||||||

| Intercontinental Exchange, Inc. | 7,182 | 736,801 | ||||||

| LPL Financial Holdings, Inc. | 1,876 | 405,535 | ||||||

Markel Corp.(a) | 678 | 893,258 | ||||||

| MarketAxess Holdings, Inc. | 2,208 | 615,789 | ||||||

| Morningstar, Inc. | 2,358 | 510,719 | ||||||

| MSCI, Inc. | 1,268 | 589,836 | ||||||

| Nasdaq, Inc. | 13,220 | 811,047 | ||||||

| Principal Financial Group, Inc. | 7,966 | 668,507 | ||||||

| Raymond James Financial, Inc. | 5,474 | 584,897 | ||||||

| Rocket Cos., Inc., Class A | 47,972 | 335,804 | ||||||

Ryan Specialty Holdings, Inc.(a) | 11,982 | 497,373 | ||||||

| Signature Bank | 2,336 | 269,154 | ||||||

SVB Financial Group(a) | 1,036 | 238,425 | ||||||

| Tradeweb Markets, Inc., Class A | 11,373 | 738,449 | ||||||

| WR Berkley Corp. | 11,062 | 802,769 | ||||||

| 21,026,634 | ||||||||

| Health Care (12.8%): | ||||||||

| Agilent Technologies, Inc. | 4,242 | 634,815 | ||||||

Align Technology, Inc.(a) | 1,629 | 343,556 | ||||||

| Amgen, Inc. | 3,590 | 942,878 | ||||||

Avantor, Inc.(a) | 24,930 | 525,774 | ||||||

| Baxter International, Inc. | 11,730 | 597,878 | ||||||

BioMarin Pharmaceutical, Inc.(a) | 6,144 | 635,843 | ||||||

Catalent, Inc.(a) | 6,169 | 277,667 | ||||||

Centene Corp.(a) | 7,990 | 655,260 | ||||||

Charles River Laboratories International, Inc.(a) | 2,107 | 459,115 | ||||||

| Danaher Corp. | 2,270 | 602,503 | ||||||

Dexcom, Inc.(a) | 3,591 | 406,645 | ||||||

Edwards Lifesciences Corp.(a) | 6,090 | 454,375 | ||||||

| HCA Healthcare, Inc. | 2,101 | 504,156 | ||||||

Henry Schein, Inc.(a) | 11,078 | 884,800 | ||||||

Horizon Therapeutics PLC(a) | 7,174 | 816,401 | ||||||

| Humana, Inc. | 1,415 | 724,749 | ||||||

IDEXX Laboratories, Inc.(a) | 1,396 | 569,512 | ||||||

Incyte Corp.(a) | 9,790 | 786,333 | ||||||

Insulet Corp.(a) | 1,533 | 451,300 | ||||||

Intuitive Surgical, Inc.(a) | 2,318 | 615,081 | ||||||

IQVIA Holdings, Inc.(a) | 3,058 | 626,554 | ||||||

Mettler-Toledo International, Inc.(a) | 464 | 670,689 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Health Care (12.8%): (continued) | ||||||||

Moderna, Inc.(a) | 1,950 | 350,259 | ||||||

Neurocrine Biosciences, Inc.(a) | 5,070 | 605,561 | ||||||

| PerkinElmer, Inc. | 4,214 | 590,887 | ||||||

R1 RCM, Inc.(a) | 23,510 | 257,434 | ||||||

Regeneron Pharmaceuticals, Inc.(a) | 711 | 512,979 | ||||||

Repligen Corp.(a) | 1,698 | 287,488 | ||||||

| ResMed, Inc. | 2,675 | 556,748 | ||||||

Shockwave Medical, Inc.(a) | 1,019 | 209,517 | ||||||

| STERIS PLC | 3,500 | 646,415 | ||||||

| Stryker Corp. | 2,895 | 707,799 | ||||||

| Teleflex, Inc. | 2,813 | 702,209 | ||||||

United Therapeutics Corp.(a) | 2,498 | 694,669 | ||||||

Veeva Systems, Inc., Class A(a) | 2,433 | 392,638 | ||||||

Vertex Pharamaceuticals, Inc.(a) | 2,031 | 586,512 | ||||||

Waters Corp.(a) | 2,011 | 688,928 | ||||||

| West Pharmaceutical Services, Inc. | 2,115 | 497,765 | ||||||

| Zimmer Biomet Holdings, Inc. | 5,619 | 716,422 | ||||||

| Zoetis, Inc. | 4,522 | 662,699 | ||||||

| 22,852,813 | ||||||||

| Industrials (22.6%): | ||||||||

| Advanced Drainage Systems, Inc. | 3,217 | 263,697 | ||||||

| AECOM | 9,088 | 771,844 | ||||||

| AMETEK, Inc. | 7,029 | 982,092 | ||||||

Builders FirstSource, Inc.(a) | 6,226 | 403,943 | ||||||

| Carlisle Companies, Inc. | 2,140 | 504,291 | ||||||

| Carrier Global Corp. | 16,803 | 693,124 | ||||||

| Caterpillar, Inc. | 3,131 | 750,062 | ||||||

| CH Robinson Worldwide, Inc. | 5,697 | 521,617 | ||||||

| Cintas Corp. | 1,850 | 835,497 | ||||||

Copart, Inc.(a) | 10,032 | 610,848 | ||||||

Costar Group, Inc.(a) | 5,622 | 434,468 | ||||||

| CSX Corp. | 23,974 | 742,715 | ||||||

| Deere & Co. | 1,389 | 595,548 | ||||||

| Dover Corp. | 5,564 | 753,421 | ||||||

| Eaton Corp. PLC | 4,928 | 773,450 | ||||||

| Equifax, Inc. | 3,345 | 650,134 | ||||||

| Expeditors International of Washington, Inc. | 6,798 | 706,448 | ||||||

| Fastenal Co. | 15,312 | 724,564 | ||||||

| Fortive Corp. | 10,587 | 680,215 | ||||||

Generac Holdings, Inc.(a) | 2,056 | 206,957 | ||||||

| General Dynamics Corp. | 3,565 | 884,512 | ||||||

| Graco, Inc. | 11,896 | 800,125 | ||||||

| HEICO Corp. | 4,863 | 747,151 | ||||||

| Honeywell International, Inc. | 4,306 | 922,776 | ||||||

See notes to financial statements.

21

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Large/Mid Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Industrials (22.6%): (continued) | ||||||||

| Howmet Aerospace, Inc. | 16,819 | 662,837 | ||||||

| Hubbell, Inc. | 3,007 | 705,683 | ||||||

| Huntington Ingalls Industries, Inc. | 3,280 | 756,630 | ||||||

| IDEX Corp. | 3,765 | 859,662 | ||||||

| Illinois Tool Works, Inc. | 3,883 | 855,425 | ||||||

| Ingersoll Rand, Inc. | 11,807 | 616,916 | ||||||

| J.B. Hunt Transport Services, Inc. | 3,363 | 586,373 | ||||||

| Johnson Controls International PLC | 11,569 | 740,416 | ||||||

| Leidos Holdings, Inc. | 8,242 | 866,976 | ||||||

| Masco Corp. | 12,074 | 563,494 | ||||||

| Nordson Corp. | 3,289 | 781,861 | ||||||

| Norfolk Southern Corp. | 3,075 | 757,742 | ||||||

| Old Dominion Freight Line, Inc. | 1,707 | 484,412 | ||||||

| Otis Worldwide Corp. | 10,887 | 852,561 | ||||||

| PACCAR, Inc. | 8,135 | 805,121 | ||||||

| Parker Hannifin Corp. | 2,342 | 681,522 | ||||||

| Quanta Services, Inc. | 3,808 | 542,640 | ||||||

| Regal Rexnord Corp. | 3,847 | 461,563 | ||||||

| Republic Services, Inc. | 6,675 | 861,008 | ||||||

| Rockwell Automation, Inc. | 2,259 | 581,851 | ||||||

| Rollins, Inc. | 18,548 | 677,744 | ||||||

| Snap-on, Inc. | 3,390 | 774,581 | ||||||

| Textron, Inc. | 9,063 | 641,660 | ||||||

| Trane Technologies PLC | 4,414 | 741,949 | ||||||

| TransDigm Group, Inc. | 1,055 | 664,281 | ||||||

| TransUnion | 9,032 | 512,566 | ||||||

| U-Haul Holding Co. | 13,238 | 796,795 | ||||||

| Union Pacific Corp. | 3,815 | 789,972 | ||||||

United Rentals, Inc.(a) | 1,620 | 575,780 | ||||||

| Verisk Analytics, Inc. | 4,343 | 766,192 | ||||||

| Waste Management, Inc. | 5,660 | 887,941 | ||||||

| Watsco, Inc. | 2,480 | 618,512 | ||||||

| Westinghouse Air Brake Technologies Corp. | 6,679 | 666,631 | ||||||

| WW Grainger, Inc. | 1,322 | 735,363 | ||||||

| Xylem, Inc. | 5,976 | 660,766 | ||||||

| 40,494,925 | ||||||||

| Information Technology (15.2%): | ||||||||

Advanced Micro Devices, Inc.(a) | 5,480 | 354,940 | ||||||

Akamai Technologies, Inc.(a) | 8,016 | 675,749 | ||||||

| Amphenol Corp., Class A | 9,689 | 737,720 | ||||||

| Analog Devices, Inc. | 3,795 | 622,494 | ||||||

ANSYS, Inc.(a) | 2,220 | 536,330 | ||||||

Arista Networks, Inc.(a) | 4,399 | 533,819 | ||||||

| Bentley Systems, Inc., Class B | 11,759 | 434,613 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Information Technology (15.2%): (continued) | ||||||||

| Broadcom, Inc. | 1,190 | 665,365 | ||||||

Cadence Design Systems, Inc.(a) | 3,106 | 498,948 | ||||||

| CDW Corp. | 3,948 | 705,034 | ||||||

| Cognizant Technology Solutions Corp., Class A | 10,059 | 575,274 | ||||||

Datadog, Inc., Class A(a) | 3,216 | 236,376 | ||||||

Dynatrace, Inc.(a) | 9,655 | 369,787 | ||||||

Enphase Energy, Inc.(a) | 1,038 | 275,028 | ||||||

| Entegris, Inc. | 4,626 | 303,419 | ||||||

EPAM Systems, Inc.(a) | 616 | 201,888 | ||||||

F5, Inc.(a) | 3,677 | 527,686 | ||||||

Fair Isaac Corp.(a) | 1,143 | 684,177 | ||||||

| Fidelity National Information Services, Inc. | 6,971 | 472,982 | ||||||

First Solar, Inc.(a) | 2,841 | 425,553 | ||||||

FleetCor Technologies, Inc.(a) | 3,338 | 613,124 | ||||||

Fortinet, Inc.(a) | 7,115 | 347,852 | ||||||

Gartner, Inc.(a) | 1,828 | 614,464 | ||||||

| Jack Henry & Associates, Inc. | 4,188 | 735,245 | ||||||

| Juniper Networks, Inc. | 23,931 | 764,835 | ||||||

Keysight Technologies, Inc.(a) | 3,667 | 627,314 | ||||||

| KLA Corp. | 1,418 | 534,629 | ||||||

| Lam Research Corp. | 1,146 | 481,664 | ||||||

| Microchip Technology, Inc. | 7,121 | 500,250 | ||||||

| Monolithic Power Systems, Inc. | 963 | 340,526 | ||||||

| NetApp, Inc. | 8,980 | 539,339 | ||||||

| NVIDIA Corp. | 2,624 | 383,471 | ||||||

| NXP Semiconductors NV | 2,983 | 471,403 | ||||||

ON Semiconductor Corp.(a) | 5,266 | 328,440 | ||||||

| Paychex, Inc. | 5,958 | 688,506 | ||||||

Paycom Software, Inc.(a) | 1,167 | 362,132 | ||||||

Paylocity Holding Corp.(a) | 1,521 | 295,469 | ||||||

PTC, Inc.(a) | 4,279 | 513,651 | ||||||

Qorvo, Inc.(a) | 5,088 | 461,176 | ||||||

| Roper Technologies, Inc. | 2,031 | 877,575 | ||||||

| Seagate Technology Holdings PLC | 8,743 | 459,969 | ||||||

ServiceNow, Inc.(a) | 984 | 382,058 | ||||||

| Skyworks Solutions, Inc. | 5,545 | 505,316 | ||||||

| SS&C Technologies Holdings, Inc. | 13,665 | 711,400 | ||||||

Synopsys, Inc.(a) | 1,607 | 513,099 | ||||||

| TD SYNNEX Corp. | 6,774 | 641,566 | ||||||

| TE Connectivity Ltd. | 5,379 | 617,509 | ||||||

Teledyne Technologies, Inc.(a) | 1,946 | 778,225 | ||||||

| Teradyne, Inc. | 4,890 | 427,142 | ||||||

The Trade Desk, Inc., Class A(a) | 4,028 | 180,575 | ||||||

See notes to financial statements.

22

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Large/Mid Cap Core ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Information Technology (15.2%): (continued) | ||||||||

Trimble, Inc.(a) | 9,358 | 473,140 | ||||||

Tyler Technologies, Inc.(a) | 1,449 | 467,172 | ||||||

Western Digital Corp.(a) | 12,027 | 379,452 | ||||||

Zebra Technologies Corp.(a) | 1,721 | 441,282 | ||||||

| 27,296,152 | ||||||||

| Materials (7.9%): | ||||||||

| Albemarle Corp. | 1,410 | 305,773 | ||||||

| Avery Dennison Corp. | 3,487 | 631,147 | ||||||

| Ball Corp. | 9,235 | 472,278 | ||||||

| Celanese Corp. | 5,645 | 577,145 | ||||||

| CF Industries Holdings, Inc. | 3,775 | 321,630 | ||||||

| Eastman Chemical Co. | 7,617 | 620,328 | ||||||

| Ecolab, Inc. | 4,065 | 591,701 | ||||||

| FMC Corp. | 5,653 | 705,494 | ||||||

| Freeport-McMoRan, Inc. | 12,773 | 485,374 | ||||||

| International Flavors & Fragrances, Inc. | 6,467 | 678,000 | ||||||

| International Paper Co. | 19,547 | 676,913 | ||||||

| LyondellBasell Industries NV, Class A | 7,054 | 585,694 | ||||||

| Martin Marietta Materials, Inc. | 1,963 | 663,435 | ||||||

| Newmont Corp. | 12,363 | 583,534 | ||||||

| Nucor Corp. | 3,327 | 438,532 | ||||||

| Packaging Corp. of America | 5,258 | 672,551 | ||||||

| PPG Industries, Inc. | 4,884 | 614,114 | ||||||

| Reliance Steel & Aluminum Co. | 2,990 | 605,296 | ||||||

| RPM International, Inc. | 7,488 | 729,706 | ||||||

| Steel Dynamics, Inc. | 5,259 | 513,804 | ||||||

| The Mosaic Co. | 7,088 | 310,950 | ||||||

| The Sherwin-Williams Co. | 2,612 | 619,906 | ||||||

| Vulcan Materials Co. | 4,108 | 719,352 | ||||||

| Westlake Chemical Corp. | 5,427 | 556,484 | ||||||

| Westrock Co. | 15,568 | 547,371 | ||||||

| 14,226,512 | ||||||||

| Utilities (10.6%): | ||||||||

| Alliant Energy Corp. | 16,925 | 934,429 | ||||||

| Ameren Corp. | 11,969 | 1,064,284 | ||||||

| American Electric Power Co., Inc. | 10,175 | 966,116 | ||||||

| American Water Works Co., Inc. | 5,543 | 844,864 | ||||||

| Atmos Energy Corp. | 8,964 | 1,004,595 | ||||||

| CenterPoint Energy, Inc. | 32,272 | 967,837 | ||||||

| CMS Energy Corp. | 15,548 | 984,655 | ||||||

| Consolidated Edison, Inc. | 10,696 | 1,019,436 | ||||||

| Constellation Energy Corp. | 4,599 | 396,480 | ||||||

| DTE Energy Co. | 8,708 | 1,023,451 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Utilities (10.6%): (continued) | ||||||||

| Entergy Corp. | 7,803 | 877,838 | ||||||

| Essential Utilities, Inc. | 18,656 | 890,451 | ||||||

| Evergy, Inc. | 15,679 | 986,679 | ||||||

| Eversource Energy | 11,570 | 970,029 | ||||||

| FirstEnergy Corp. | 23,111 | 969,275 | ||||||

| NextEra Energy, Inc. | 8,500 | 710,600 | ||||||

| NiSource, Inc. | 33,011 | 905,162 | ||||||

| NRG Energy, Inc. | 13,979 | 444,812 | ||||||

| The Southern Co. | 13,482 | 962,750 | ||||||

| WEC Energy Group, Inc. | 10,204 | 956,727 | ||||||

| Xcel Energy, Inc. | 14,730 | 1,032,720 | ||||||

| 18,913,190 | ||||||||

| Total Common Stocks (Cost $170,437,827) | 178,290,875 | |||||||

| Rights (0.0%)† | ||||||||

| Health Care (0.0%):† | ||||||||

ABIOMED, Inc., CVR, Expiring 01/02/26(a)(b) | 1,543 | 1,574 | ||||||

| 1,574 | ||||||||

| Total Rights (Cost $—) | 1,574 | |||||||

Total Investments (Cost $170,437,827) — 99.6%(c) | 178,292,449 | |||||||

| Other assets in excess of liabilities — 0.4% | 767,431 | |||||||

| NET ASSETS - 100.00% | $ | 179,059,880 | ||||||

Percentages indicated are based on net assets as of December 31, 2022.

† | Represents less than 0.05%. |

(a) | Non-income producing security. |

(b) | Security was fair valued based upon procedures approved by the Board of Trustees and represents 0.0% of the Fund’s net assets as of December 31,2022. This security is classified as Level 3 within the fair value hierarchy. (See Note 2) |

(c) | See Federal Tax Information listed in the Notes to Financial Statements. |

CVR — Contingent Value Rights

See notes to financial statements.

23

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan US Large/Mid Cap Core ETF

Futures Contracts

Long Futures

| Index Futures | Expiration Date | Number of Contracts | Notional Amount | Value | Unrealized Appreciation (Depreciation) | |||||||||||||

| S&P 500 Index E-mini | 3/17/23 | 4 | $ | 770,741 | $ | 772,200 | $ | 1,459 | ||||||||||

| $ | 1,459 | |||||||||||||||||

See notes to financial statements.

24

Schedule of Portfolio Investments

December 31, 2022

Timothy Plan High Dividend Stock ETF

| SHARES | VALUE ($) | |||||||

| Common Stocks (99.5%) | ||||||||

| Communication Services (0.5%): | ||||||||

| Lumen Technologies, Inc. | 174,525 | 911,020 | ||||||

| 911,020 | ||||||||

| Consumer Discretionary (4.6%): | ||||||||

| Darden Restaurants, Inc. | 10,075 | 1,393,675 | ||||||

| Garmin Ltd. | 19,006 | 1,754,064 | ||||||

| Genuine Parts Co. | 12,580 | 2,182,756 | ||||||

| LKQ Corp. | 26,623 | 1,421,934 | ||||||

| Vail Resorts, Inc. | 5,900 | 1,406,265 | ||||||

| 8,158,694 | ||||||||

| Consumer Staples (6.7%): | ||||||||

| Bunge, Ltd. | 17,072 | 1,703,274 | ||||||

| Campbell Soup Co. | 40,467 | 2,296,502 | ||||||

| Hormel Foods Corp. | 48,508 | 2,209,539 | ||||||

| McCormick & Co., Inc. | 24,433 | 2,025,251 | ||||||

| Sysco Corp. | 21,646 | 1,654,837 | ||||||

| The JM Smucker Co. | 13,359 | 2,116,867 | ||||||

| 12,006,270 | ||||||||

| Energy (9.9%): | ||||||||

| Chesapeake Energy Corp. | 10,402 | 981,637 | ||||||

| ConocoPhillips | 9,515 | 1,122,770 | ||||||

| Coterra Energy, Inc. | 35,533 | 873,046 | ||||||

| Devon Energy Corp. | 12,904 | 793,725 | ||||||

| Diamondback Energy, Inc. | 6,984 | 955,271 | ||||||

| EOG Resources, Inc. | 8,671 | 1,123,068 | ||||||

| Kinder Morgan, Inc. | 103,020 | 1,862,601 | ||||||

| Marathon Petroleum Corp. | 12,641 | 1,471,286 | ||||||

| ONEOK, Inc. | 25,547 | 1,678,438 | ||||||

| Phillips 66 | 12,670 | 1,318,694 | ||||||

| Pioneer Natural Resources Co. | 4,961 | 1,133,043 | ||||||

| Targa Resources Corp. | 17,946 | 1,319,031 | ||||||

| The Williams Cos., Inc. | 55,992 | 1,842,137 | ||||||

| Valero Energy Corp. | 9,190 | 1,165,843 | ||||||

| 17,640,590 | ||||||||

| Financials (11.3%): | ||||||||

| Aflac, Inc. | 35,574 | 2,559,194 | ||||||

| American Financial Group, Inc. | 13,740 | 1,886,227 | ||||||

| Ares Management Corp., Class A | 16,769 | 1,147,670 | ||||||

| Cincinnati Financial Corp. | 14,824 | 1,517,829 | ||||||

| East West Bancorp, Inc. | 17,881 | 1,178,358 | ||||||

| Equitable Holdings, Inc. | 48,945 | 1,404,722 | ||||||

| Erie Indemnity Co., Class A | 8,268 | 2,056,417 | ||||||

| Everest Re Group, Ltd. | 6,562 | 2,173,794 | ||||||

| Franklin Resources, Inc. | 63,322 | 1,670,434 | ||||||

| Principal Financial Group, Inc. | 20,610 | 1,729,591 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Financials (11.3%): (continued) | ||||||||

| Rocket Cos., Inc., Class A | 124,123 | 868,861 | ||||||

| WR Berkley Corp. | 28,623 | 2,077,171 | ||||||

| 20,270,268 | ||||||||

| Health Care (2.2%): | ||||||||

| Amgen, Inc. | 9,289 | 2,439,663 | ||||||

| Baxter International, Inc. | 30,349 | 1,546,888 | ||||||

| 3,986,551 | ||||||||

| Industrials (19.7%): | ||||||||

| Caterpillar, Inc. | 8,100 | 1,940,436 | ||||||

| CH Robinson Worldwide, Inc. | 14,741 | 1,349,686 | ||||||

| Eaton Corp. PLC | 12,751 | 2,001,270 | ||||||

| Fastenal Co. | 39,620 | 1,874,818 | ||||||

| General Dynamics Corp. | 9,225 | 2,288,815 | ||||||

| Honeywell International, Inc. | 11,141 | 2,387,516 | ||||||

| Huntington Ingalls Industries, Inc. | 8,487 | 1,957,781 | ||||||

| Illinois Tool Works, Inc. | 10,046 | 2,213,134 | ||||||

| Johnson Controls International PLC | 29,932 | 1,915,648 | ||||||

| Masco Corp. | 31,241 | 1,458,018 | ||||||

| Norfolk Southern Corp. | 7,955 | 1,960,271 | ||||||

| PACCAR, Inc. | 20,482 | 2,027,104 | ||||||

| Parker Hannifin Corp. | 6,059 | 1,763,169 | ||||||

| Regal Rexnord Corp. | 9,954 | 1,194,281 | ||||||

| Rockwell Automation, Inc. | 5,846 | 1,505,754 | ||||||

| Snap-on, Inc. | 8,770 | 2,003,857 | ||||||

| TransDigm Group, Inc. | 2,731 | 1,719,574 | ||||||

| Union Pacific Corp. | 9,871 | 2,043,988 | ||||||

| Watsco, Inc. | 6,418 | 1,600,649 | ||||||

| 35,205,769 | ||||||||

| Information Technology (8.4%): | ||||||||

| Analog Devices, Inc. | 9,818 | 1,610,447 | ||||||

| Broadcom, Inc. | 3,079 | 1,721,561 | ||||||

| Fidelity National Information Services, Inc. | 18,037 | 1,223,811 | ||||||

| Juniper Networks, Inc. | 61,920 | 1,978,963 | ||||||

| NetApp, Inc. | 23,234 | 1,395,434 | ||||||

| NXP Semiconductors NV | 7,718 | 1,219,676 | ||||||

| Paychex, Inc. | 15,415 | 1,781,357 | ||||||

| Seagate Technology Holdings PLC | 22,623 | 1,190,196 | ||||||

| Skyworks Solutions, Inc. | 14,348 | 1,307,533 | ||||||

| TE Connectivity Ltd. | 13,919 | 1,597,901 | ||||||

| 15,026,879 | ||||||||

| Materials (11.7%): | ||||||||

| Celanese Corp. | 14,606 | 1,493,317 | ||||||

| Eastman Chemical Co. | 19,708 | 1,605,019 | ||||||

| FMC Corp. | 14,627 | 1,825,450 | ||||||

See notes to financial statements.

25

Schedule of Portfolio Investments - continued

December 31, 2022

Timothy Plan High Dividend Stock ETF

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Materials (11.7%): (continued) | ||||||||

| Freeport-McMoRan, Inc. | 33,047 | 1,255,786 | ||||||

| International Flavors & Fragrances, Inc. | 16,734 | 1,754,393 | ||||||

| International Paper Co. | 50,577 | 1,751,481 | ||||||

| LyondellBasell Industries NV, Class A | 18,253 | 1,515,547 | ||||||

| Newmont Corp. | 31,989 | 1,509,881 | ||||||

| Packaging Corp. of America | 13,603 | 1,739,960 | ||||||

| PPG Industries, Inc. | 12,638 | 1,589,102 | ||||||

| Reliance Steel & Aluminum Co. | 7,737 | 1,566,278 | ||||||

| RPM International, Inc. | 19,375 | 1,888,094 | ||||||

| Westrock Co. | 40,280 | 1,416,245 | ||||||

| 20,910,553 | ||||||||

| Utilities (24.5%): | ||||||||

| Alliant Energy Corp. | 43,792 | 2,417,756 | ||||||

| Ameren Corp. | 30,969 | 2,753,764 | ||||||

| American Electric Power Co., Inc. | 26,328 | 2,499,844 | ||||||

| Atmos Energy Corp. | 23,193 | 2,599,240 | ||||||

| CenterPoint Energy, Inc. | 83,501 | 2,504,195 | ||||||

| CMS Energy Corp. | 40,229 | 2,547,703 | ||||||

| Consolidated Edison, Inc. | 27,675 | 2,637,704 | ||||||

| DTE Energy Co. | 22,531 | 2,648,068 | ||||||

| Entergy Corp. | 20,191 | 2,271,488 | ||||||

| Essential Utilities, Inc. | 48,272 | 2,304,023 | ||||||

| SECURITY DESCRIPTION | SHARES | VALUE ($) | ||||||

| Utilities (24.5%): (continued) | ||||||||

| Evergy, Inc. | 40,568 | 2,552,944 | ||||||

| Eversource Energy | 29,936 | 2,509,834 | ||||||

| FirstEnergy Corp. | 59,799 | 2,507,970 | ||||||

| NiSource, Inc. | 85,412 | 2,341,997 | ||||||

| NRG Energy, Inc. | 36,169 | 1,150,898 | ||||||

| The Southern Co. | 34,884 | 2,491,066 | ||||||

| WEC Energy Group, Inc. | 26,403 | 2,475,545 | ||||||

| Xcel Energy, Inc. | 38,113 | 2,672,102 | ||||||

| 43,886,141 | ||||||||

| Total Common Stocks (Cost $174,814,613) | 178,002,735 | |||||||

Total Investments (Cost $174,814,613) — 99.5%(a) | 178,002,735 | |||||||

| Other assets in excess of liabilities — 0.5% | 983,295 | |||||||

| NET ASSETS - 100.00% | $ | 178,986,030 | ||||||

Percentages indicated are based on net assets as of December 31, 2022.

(a) | See Federal Tax Information listed in the Notes to Financial Statements. |

Futures Contracts

Long Futures

| Index Futures | Expiration Date | Number of Contracts | Notional Amount | Value | Unrealized Appreciation (Depreciation) | |||||||||||||

| S&P 500 Index E-mini | 3/17/23 | 4 | $ | 785,139 | $ | 772,200 | $ | (12,939 | ) | |||||||||

| $ | (12,939 | ) | ||||||||||||||||

See notes to financial statements.

26