united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

1055 Maitland Center Commons, Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Art Ally, The Timothy Plan

1055 Maitland Center Commons, Maitland, FL 32751

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-846-7526

Date of fiscal year end: 12/31

Date of reporting period: 12/31/14

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

| A N N U A L R E P O R T |

| D e c e m b e r 3 1, 2 0 1 4 |

| TIMOTHY PLAN VARIABLE SERIES |

| |

| Strategic Growth |

| Conservative Growth |

| Letter from the President |

| December 31, 2014 |

| |

| Arthur D. Ally |

| |

Dear Timothy Plan Strategic Growth Variable and Conservative Growth Variable Shareholder:

I am pleased to report that the year of 2014 produced mixed returns in the capital markets and, as a result, our funds ended the year with rather low but positive performance. As a review, your Timothy Plan Variable Fund investment is a compilation of several of Timothy’s underlying funds and, as such, your performance is directly related to the performance of those underlying funds. Although the allocation percentages will vary slightly from time to time as a result of changing economic conditions, the allocation at December 31, 2014 was as follows:

| | | Conservative Growth | | Strategic Growth |

| ● Large/Mid-Cap Growth Fund | | | 8.95 | % | | | 14.20 | % |

| ● Large/Mid-Cap Value Fund | | | 8.45 | % | | | 13.49 | % |

| ● Small-Cap Value Fund | | | 5.77 | % | | | 7.03 | % |

| ● Aggressive Growth Fund | | | 2.45 | % | | | 6.13 | % |

| ● International Fund | | | 10.12 | % | | | 14.46 | % |

| ● High-Yield Bond Fund | | | 8.00 | % | | | 12.37 | % |

| ● Defensive Strategies Fund | | | 11.70 | % | | | 11.98 | % |

| ● Fixed Income Fund | | | 28.12 | % | | | 0.00 | % |

| ● Israel Common Values Fund | | | 3.74 | % | | | 4.69 | % |

| ● Emerging Markets Fund | | | 2.59 | % | | | 6.09 | % |

| ● Growth & Income Fund | | | 10.11 | % | | | 9.56 | % |

| | | | | | | | | |

Our 2014 performance (2.60% for Conservative and 1.59% for Strategic) was quite respectable and fairly comparable to their respective market benchmarks – especially when you consider our conservative investment style.

Even though these have been designed to be conservatively allocated funds, we understand that the volatility and uncertainty of the markets over the past several years has been unsettling for many investors. Please understand that our #1 concern is preservation of principal and, as a result of the economic uncertainty in both our domestic and international markets, we will be taking extraordinary defensive measures as we progress through the year of 2015.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of our sub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

| Sincerely, |

| |

|

| |

| Arthur D. Ally, |

| President |

| Fund Performance - (Unaudited) |

| December 31, 2014 |

| |

| Conservative Growth Portfolio Variable Series |

| | | | | 5 Year | | 10 Year | | Average Annual |

| | | 1 Year | | Average | | Average | | Total Return |

| Fund/Index | | Total Return | | Annual Return | | Annual Return | | Since Inception (a) |

| Timothy Conservative Growth Portfolio Variable Series | | 2.60% | | 6.89% | | 4.35% | | 4.36% |

| Dow Jones Global Moderate Portfolio Index (b) | | 5.35% | | 8.92% | | 6.35% | | 7.33% |

| (a) | For the period May 1, 2002 (commencement of investment in accordance with objective) to December 31, 2014. |

| (b) | Dow Jones Global Moderate Portfolio Index is based on the Dow Jones Relative Risk Index and consists of 60% equities and 40% fixed income. |

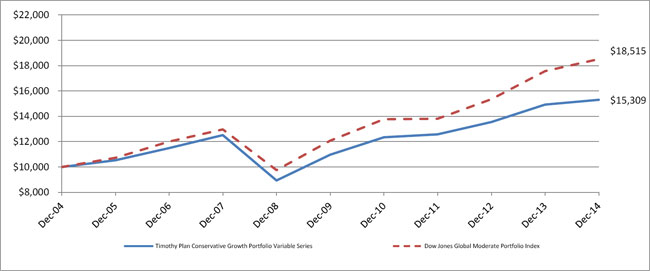

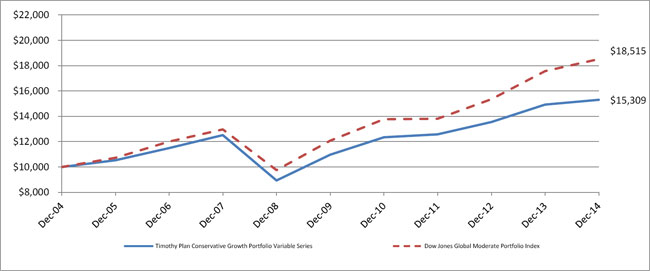

Timothy Plan Conservative Growth Portfolio Variable Series vs. Dow Jones Global Moderate Portfolio Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund and the Dow Jones Global Moderate Portfolio Index on December 31, 2004 and held through December 31, 2014. The Dow Jones Global Moderate Portfolio Index is a widely recognized index that measures global stocks, bonds and cash which are in turn represented by multiple sub-indexes. Performance figures include the change in value of the investments in the indexes and the reinvestment of dividends. The total operating expense ratio (including indirect expenses), as stated in the Fund’s Prospectus dated April 30, 2014, is 1.83%. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares as well as other charges and expenses of the insurance contract, or separate account. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

| Fund Performance - (Unaudited) |

| December 31, 2014 |

| |

| Strategic Growth Portfolio Variable Series |

| | | | | 5 Year | | 10 Year | | Average Annual |

| | | 1 Year | | Average | | Average | | Total Return |

| Fund/Index | | Total Return | | Annual Return | | Annual Return | | Since Inception (a) |

| Timothy Strategic Growth Portfolio Variable Series | | 1.59% | | 8.24% | | 4.06% | | 4.11% |

| Dow Jones Global Moderately Aggressive Portfolio Index (b) | | 5.90% | | 10.60% | | 7.14% | | 8.01% |

| (a) | For the period May 1, 2002 (commencement of investment in accordance with objective) to December 31, 2014. |

| (b) | Dow Jones Global Moderately Aggressive Portfolio Index is based on the Dow Jones Relative Risk Index and consists of 80% equities and 20% fixed income. |

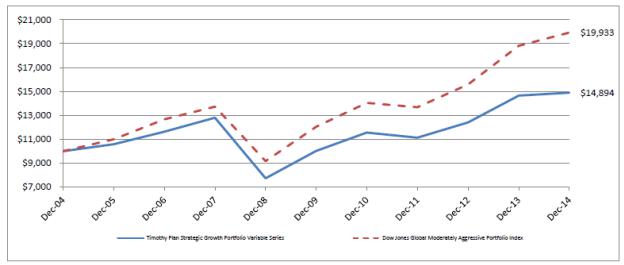

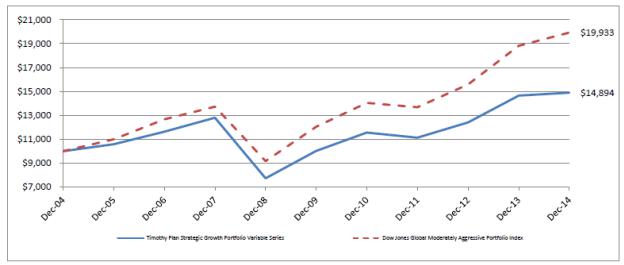

Timothy Plan Strategic Growth Portfolio Variable Series vs. Dow Jones Global Moderately Aggressive Portfolio Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund and the Dow Jones Global Moderately Aggressive Portfolio Index on December 31, 2004 and held through December 31, 2014. The Dow Jones Global Moderately Aggressive Portfolio Index is a widely recognized index that measures global stocks, bonds and cash which are in turn represented by multiple sub-indexes. Performance figures include the change in value of the investments in the indexes and the reinvestment of dividends. The total operating expense ratio (including indirect expenses), as stated in the Fund’s Prospectus dated April 30, 2014, is 2.05%. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares as well as other charges and expenses of the insurance contract, or separate account. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

| Fund Profile - Conservative Growth Portfolio Variable Series |

| December 31, 2014 (Unaudited) |

| Underlying Fund Allocations |

| (% of Net Assets) |

| Fixed Income | | | 27.91 | % |

| Defensive Strategies | | | 11.61 | % |

| International | | | 10.04 | % |

| Growth & Income | | | 10.03 | % |

| Large/Mid Cap Growth | | | 8.88 | % |

| Large/Mid Cap Value | | | 8.38 | % |

| High Yield Bond | | | 7.94 | % |

| Small Cap Value | | | 5.73 | % |

| Israel Common Values | | | 3.71 | % |

| Emerging Markets | | | 2.57 | % |

| Aggressive Growth | | | 2.43 | % |

| Money Market and Liabilities in Excess of Other Assets | | | 0.77 | % |

| | | | 100.00 | % |

Expense Example (Unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs” (in dollars), of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2014 through December 31, 2014.

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| | | Beginning Account | | | Ending Account | | | Expenses Paid | |

| | | Value | | | Value | | | During Period* | |

| | | | | | | | | 7/1/2014 through | |

| | | 7/1/2014 | | | 12/31/2014 | | | 12/31/2014 | |

| Actual | | $ | 1,000.00 | | | $ | 975.90 | | | $ | 2.39 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,022.79 | | | $ | 2.45 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.48%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/365 days (to reflect the partial year period). The Fund’s ending account value on the first line in the table is based on its actual total return of (2.41)% for the six-month period of July 1, 2014 through December 31, 2014. |

| ** | Assumes a 5% return before expenses. |

| Fund Profile - Strategic Growth Portfolio Variable Series |

| December 31, 2014 (Unaudited) |

| Underlying Fund Allocations |

| (% of Net Assets) |

| International | | | 14.41 | % |

| Large/Mid Cap Growth | | | 14.15 | % |

| Large/Mid Cap Value | | | 13.44 | % |

| High Yield Bond | | | 12.33 | % |

| Defensive Strategies | | | 11.94 | % |

| Growth & Income | | | 9.52 | % |

| Small Cap Value | | | 7.00 | % |

| Aggressive Growth | | | 6.11 | % |

| Emerging Markets | | | 6.06 | % |

| Israel Common Values | | | 4.68 | % |

| Money Market and Liabilities in Excess of Other Assets | | | 0.36 | % |

| | | | 100.00 | % |

Expense Example (Unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs” (in dollars), of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of July 1, 2014 through December 31, 2014.

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| | | Beginning Account | | | Ending Account | | | Expenses Paid | |

| | | Value | | | Value | | | During Period* | |

| | | | | | | | | 7/1/2014 through | |

| | | 7/1/2014 | | | 12/31/2014 | | | 12/31/2014 | |

| Actual | | $ | 1,000.00 | | | $ | 963.10 | | | $ | 2.18 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,022.99 | | | $ | 2.24 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.44%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 184 days/365 days (to reflect the partial year period). The Fund’s ending account value on the first line in the table is based on its actual total return of (3.69)% for the six-month period of July 1, 2014 through December 31, 2014. |

| ** | Assumes a 5% return before expenses. |

| Schedule of Investments |

| Conservative Growth Portfolio Variable Series |

| As of December 31, 2014 |

| Shares | | | | | Fair Value | |

| | | | | | | | | |

| | | | | MUTUAL FUNDS (A) - 99.2% | | | | |

| | 87,937 | | | Timothy Plan Aggressive Growth Fund | | $ | 759,775 | |

| | 324,136 | | | Timothy Plan Defensive Strategies Fund | | | 3,633,565 | |

| | 94,989 | | | Timothy Plan Emerging Markets Fund | | | 805,504 | |

| | 837,367 | | | Timothy Plan Fixed Income Fund | | | 8,733,738 | |

| | 285,132 | | | Timothy Plan Growth & Income Fund * | | | 3,139,307 | |

| | 274,493 | | | Timothy Plan High Yield Bond Fund | | | 2,484,158 | |

| | 358,265 | | | Timothy Plan International Fund * | | | 3,141,985 | |

| | 103,321 | | | Timothy Plan Israel Common Values Fund * | | | 1,161,326 | |

| | 342,102 | | | Timothy Plan Large/Mid Cap Growth Fund | | | 2,777,872 | |

| | 139,947 | | | Timothy Plan Large/Mid Cap Value Fund | | | 2,624,012 | |

| | 99,584 | | | Timothy Plan Small Cap Value Fund | | | 1,793,508 | |

| | | | | | | | | |

| | | | | TOTAL MUTUAL FUNDS (Cost $30,128,564) | | | 31,054,750 | |

| | | | | | | | | |

| | | | | MONEY MARKET FUND - 0.9% | | | | |

| | 294,276 | | | Fidelity Institutional Money Market Portfolio - Institutional Class, 0.02% (Cost $294,276)(B) | | | 294,276 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS (Cost $30,422,840)(C) - 100.1% | | $ | 31,349,026 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.1)% | | | (52,817 | ) |

| | | | | TOTAL NET ASSETS - 100.0% | | $ | 31,296,209 | |

| * | Non-income producing security. |

| (A) | Affiliated Funds - Class A. |

| (B) | Variable rate security; the rate shown represents the yield at December 31, 2014. |

| (C) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $30,626,442 and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized appreciation: | | $ | 1,477,222 | |

| Unrealized depreciation: | | | (754,638 | ) |

| Net unrealized appreciation | | $ | 722,584 | |

The accompanying notes are an integral part of these financial statements.

| Schedule of Investments |

| Strategic Growth Portfolio Variable Series |

| As of December 31, 2014 |

| Shares | | | | | Fair Value | |

| | | | | | | | | |

| | | | | MUTUAL FUNDS (A) - 99.7% | | | | |

| | 221,878 | | | Timothy Plan Aggressive Growth Fund | | $ | 1,917,029 | |

| | 334,337 | | | Timothy Plan Defensive Strategies Fund | | | 3,747,921 | |

| | 224,442 | | | Timothy Plan Emerging Markets Fund | | | 1,903,270 | |

| | 271,509 | | | Timothy Plan Growth & Income Fund* | | | 2,989,313 | |

| | 427,623 | | | Timothy Plan High Yield Bond Fund | | | 3,869,986 | |

| | 515,895 | | | Timothy Plan International Fund* | | | 4,524,399 | |

| | 130,565 | | | Timothy Plan Israel Common Values Fund* | | | 1,467,553 | |

| | 547,196 | | | Timothy Plan Large/Mid Cap Growth Fund | | | 4,443,234 | |

| | 224,990 | | | Timothy Plan Large/Mid Cap Value Fund | | | 4,218,556 | |

| | 122,052 | | | Timothy Plan Small Cap Value Fund | | | 2,198,155 | |

| | | | | | | | | |

| | | | | TOTAL MUTUAL FUNDS (Cost $30,151,779) | | | 31,279,416 | |

| | | | | | | | | |

| | | | | MONEY MARKET FUND - 0.4% | | | | |

| | 135,475 | | | Fidelity Institutional Money Market Portfolio - Institutional Class, 0.02% (Cost $135,475) (B) | | | 135,475 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS (Cost $30,287,254)(C) - 100.1% | | $ | 31,414,891 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.1)% | | | (23,448 | ) |

| | | | | TOTAL NET ASSETS - 100.0% | | $ | 31,391,443 | |

| * | Non-income producing security. |

| (A) | Affiliated Funds - Class A. |

| (B) | Variable rate security; the rate shown represents the yield at December 31, 2014. |

| (C) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $30,925,317 and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized appreciation: | | $ | 1,824,255 | |

| Unrealized depreciation: | | | (1,334,681 | ) |

| Net unrealized appreciation: | | $ | 489,574 | |

The accompanying notes are an integral part of these financial statements.

| Statements of Assets and Liabilities |

| December 31, 2014 |

| | | | | | | | | |

| | | CONSERVATIVE GROWTH | | STRATEGIC GROWTH |

| | | PORTFOLIO | | PORTFOLIO |

| | | VARIABLE SERIES | | VARIABLE SERIES |

| | | | | | | | | | |

| ASSETS: | | | | | | | | | | |

| Investments in affiliated securities, at cost | | | $ | 30,128,564 | | | | $ | 30,151,779 | |

| Investments in unaffiliated securities, at cost | | | | 294,276 | | | | | 135,475 | |

| Investments in affiliated securities, at value | | | $ | 31,054,750 | | | | $ | 31,279,416 | |

| Investments in unaffiliated securities, at value | | | | 294,276 | | | | | 135,475 | |

| Receivable for fund shares sold | | | | 647 | | | | | 6,701 | |

| Prepaid expenses | | | | 1,943 | | | | | 460 | |

| Total Assets | | | | 31,351,616 | | | | | 31,422,052 | |

| | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | |

| Accrued advisory fees | | | | 2,851 | | | | | 2,950 | |

| Payable for fund shares redeemed | | | | 575 | | | | | 13,852 | |

| Accrued expenses | | | | 51,981 | | | | | 13,807 | |

| Total Liabilities | | | | 55,407 | | | | | 30,609 | |

| | | | | | | | | | | |

| Net Assets | | | $ | 31,296,209 | | | | $ | 31,391,443 | |

| | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | |

| Paid in capital | | | $ | 28,316,737 | | | | $ | 29,279,795 | |

| Accumulated undistributed net investment income | | | | 367,115 | | | | | 346,276 | |

| Accumulated net realized gain from investments | | | | 1,686,171 | | | | | 637,735 | |

| Net unrealized appreciation on investments | | | | 926,186 | | | | | 1,127,637 | |

| Net Assets | | | $ | 31,296,209 | | | | $ | 31,391,443 | |

| | | | | | | | | | | |

| Net Assets | | | $ | 31,296,209 | | | | $ | 31,391,443 | |

| Shares of beneficial interest outstanding | | | | 2,602,167 | | | | | 2,695,361 | |

| Net Asset Value, offering price and redemption price per share | | | $ | 12.03 | | | | $ | 11.65 | |

The accompanying notes are an integral part of these financial statements.

| Statements of Operations |

| For the Year Ended December 31, 2014 |

| | | | | | | | | |

| | | CONSERVATIVE GROWTH | | STRATEGIC GROWTH |

| | | PORTFOLIO | | PORTFOLIO |

| | | VARIABLE SERIES | | VARIABLE SERIES |

| | | | | | | | | | | |

| Investment Income: | | | | | | | | | | |

| Dividend income from affiliated funds | | | $ | 524,608 | | | | $ | 484,314 | |

| Interest income from unaffiliated funds | | | | 12 | | | | | 23 | |

| Total Investment Income | | | | 524,620 | | | | | 484,337 | |

| | | | | | | | | | | |

| Operating Expenses: | | | | | | | | | | |

| Administration fees | | | | 82,253 | | | | | 81,036 | |

| Investment advisory fees | | | | 32,901 | | | | | 30,514 | |

| Audit fees | | | | 12,000 | | | | | 12,000 | |

| Custody fees | | | | 10,271 | | | | | 4,905 | |

| Printing expenses | | | | 8,870 | | | | | 2,625 | |

| Trustees’ fees | | | | 4,898 | | | | | 2,915 | |

| Compliance officer fees | | | | 4,217 | | | | | 2,410 | |

| Insurance expenses | | | | 562 | | | | | 562 | |

| Total Operating Expenses | | | | 155,972 | | | | | 136,967 | |

| Net Investment Income | | | | 368,648 | | | | | 347,370 | |

| | | | | | | | | | | |

| Net Realized and Unrealized Gain (Loss) from Investments: | | | | | | | | | | |

| Capital gain dividends from affiliated funds | | | | 772,867 | | | | | 1,179,973 | |

| Net realized gain from investments in affiliated funds | | | | 1,566,702 | | | | | 1,022,494 | |

| Change in unrealized appreciation (depreciation) on affiliated investments | | | | (1,820,050 | ) | | | | (2,137,235 | ) |

| Net Realized and Unrealized Gain from Investments | | | | 519,519 | | | | | 65,232 | |

| | | | | | | | | | | |

| Net Increase in Net Assets Resulting From Operations | | | $ | 888,167 | | | | $ | 412,602 | |

The accompanying notes are an integral part of these financial statements.

Statements of Changes in Net Assets

| | | CONSERVATIVE GROWTH | | | STRATEGIC GROWTH | |

| | | PORTFOLIO | | | PORTFOLIO | |

| | | VARIABLE SERIES | | | VARIABLE SERIES | |

| | | | | | | | | | | | | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

| Operations: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 368,648 | | | $ | 693,109 | | | $ | 347,370 | | | $ | 557,833 | |

| Capital gain dividends from affiliated investments | | | 772,867 | | | | 593,425 | | | | 1,179,973 | | | | 576,374 | |

| Net realized gain from investments in affiliated funds | | | 1,566,702 | | | | 3,050,714 | | | | 1,022,494 | | | | 616,469 | |

| Net change in unrealized appreciation (depreciation) on affiliated investments | | | (1,820,050 | ) | | | (780,656 | ) | | | (2,137,235 | ) | | | 2,060,242 | |

| Net increase in net assets resulting from operations | | | 888,167 | | | | 3,556,592 | | | | 412,602 | | | | 3,810,918 | |

| | | | | | | | | | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | | | | | | | | | |

| Net investment income | | | (694,481 | ) | | | (349,463 | ) | | | (548,757 | ) | | | (166,014 | ) |

| Net realized gain on Investments | | | (1,626,898 | ) | | | — | | | | — | | | | — | |

| Total dividends and distributions to shareholders | | | (2,321,379 | ) | | | (349,463 | ) | | | (548,757 | ) | | | (166,014 | ) |

| | | | | | | | | | | | | | | | | |

| Share Transactions of Beneficial Interest: | | | | | | | | | | | | | | | | |

| Net proceeds from shares sold | | | 2,970,612 | | | | 2,583,022 | | | | 8,731,416 | | | | 7,679,493 | |

| Reinvestment of dividends | | | 2,321,379 | | | | 349,463 | | | | 548,757 | | | | 156,014 | |

| Cost of shares redeemed | | | (7,721,359 | ) | | | (9,538,574 | ) | | | (5,175,375 | ) | | | (2,310,943 | ) |

| Net increase (decrease) in net assets from share transactions of beneficial interest | | | (2,429,368 | ) | | | (6,606,089 | ) | | | 4,104,798 | | | | 5,524,564 | |

| | | | | | | | | | | | | | | | | |

| Total Increase (Decrease) in Net Assets | | | (3,862,580 | ) | | | (3,398,960 | ) | | | 3,968,643 | | | | 9,169,468 | |

| | | | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | | | | | |

| Beginning of year | | | 35,158,789 | | | | 38,557,749 | | | | 27,422,800 | | | | 18,253,332 | |

| End of year* | | $ | 31,296,209 | | | $ | 35,158,789 | | | $ | 31,391,443 | | | $ | 27,422,800 | |

| * Includes undistributed net investment income at end of year | | $ | 367,115 | | | $ | 692,948 | | | $ | 346,276 | | | $ | 547,663 | |

| | | | | | | | | | | | | | | | | |

| Share Activity: | | | | | | | | | | | | | | | | |

| Shares sold | | | 229,459 | | | | 213,886 | | | | 732,974 | | | | 713,932 | |

| Shares reinvested | | | 192,485 | | | | 28,598 | | | | 46,942 | | | | 14,106 | |

| Shares redeemed | | | (597,234 | ) | | | (785,894 | ) | | | (434,350 | ) | | | (213,853 | ) |

| Net increase (decrease) in shares of beneficial interest outstanding | | | (175,290 | ) | | | (543,410 | ) | | | 345,566 | | | | 514,185 | |

The accompanying notes are an integral part of these financial statements.

| Financial Highlights |

| Conservative Growth Portfolio Variable Series |

Selected data based on a share outstanding throughout each year.

| | | For the Year | | | For the Year | | | For the Year | | | For the Year | | | For the Year | |

| | | ended | | | ended | | | ended | | | ended | | | ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.66 | | | $ | 11.61 | | | $ | 10.97 | | | $ | 10.94 | | | $ | 9.86 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (A) | | | 0.15 | | | | 0.23 | | | | 0.11 | | | | 0.20 | | | | 0.14 | |

| Net realized and unrealized gain on investments | | | 0.18 | | | | 0.94 | | | | 0.75 | | | | 0.01 | | | | 1.09 | |

| Total from investment operations | | | 0.33 | | | | 1.17 | | | | 0.86 | | | | 0.21 | | | | 1.23 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.29 | ) | | | (0.12 | ) | | | (0.22 | ) | | | (0.18 | ) | | | (0.15 | ) |

| From net realized gains on investments | | | (0.67 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.96 | ) | | | (0.12 | ) | | | (0.22 | ) | | | (0.18 | ) | | | (0.15 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 12.03 | | | $ | 12.66 | | | $ | 11.61 | | | $ | 10.97 | | | $ | 10.94 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (B) | | | 2.60 | % | | | 10.10 | % | | | 7.79 | % | | | 1.90 | % | | | 12.45 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 31,296 | | | $ | 35,159 | | | $ | 38,558 | | | $ | 37,007 | | | $ | 43,172 | |

| Expenses (C) | | | 0.47 | % | | | 0.39 | % | | | 0.42 | % | | | 0.41 | % | | | 0.41 | % |

| Net investment income (C)(D) | | | 1.12 | % | | | 1.86 | % | | | 0.90 | % | | | 1.77 | % | | | 1.41 | % |

| Portfolio turnover rate | | | 15 | % | | | 21 | % | | | 33 | % | | | 30 | % | | | 9 | % |

| (A) | Per share amounts calculated using average shares method, which more appropriately presents the per share data for the year. |

| (B) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (C) | These ratios exclude the impact of expenses of the underlying security holdings as represented in the Schedule of Investments. |

| (D) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

| Financial Highlights |

| Strategic Growth Portfolio Variable Series |

| |

| Selected data based on a share outstanding throughout each year. |

| | | For the Year | | | For the Year | | | For the Year | | | For the Year | | | For the Year | |

| | | ended | | | ended | | | ended | | | ended | | | ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 11.67 | | | $ | 9.94 | | | $ | 9.05 | | | $ | 9.45 | | | $ | 8.25 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (A) | | | 0.14 | | | | 0.26 | | | | 0.09 | | | | 0.12 | | | | 0.05 | |

| Net realized and unrealized gain (loss) on investments | | | 0.05 | | | | 1.54 | | | | 0.94 | | | | (0.47 | ) | | | 1.22 | |

| Total from investment operations | | | 0.19 | | | | 1.80 | | | | 1.03 | | | | (0.35 | ) | | | 1.27 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.21 | ) | | | (0.07 | ) | | | (0.14 | ) | | | (0.05 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 11.65 | | | $ | 11.67 | | | $ | 9.94 | | | $ | 9.05 | | | $ | 9.45 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (B) | | | 1.59 | % | | | 18.15 | % | | | 11.42 | % | | | (3.70 | )% | | | 15.37 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 31,391 | | | $ | 27,423 | | | $ | 18,253 | | | $ | 20,021 | | | $ | 19,090 | |

| Expenses (C) | | | 0.45 | % | | | 0.42 | % | | | 0.44 | % | | | 0.40 | % | | | 0.42 | % |

| Net investment income (C)(D) | | | 1.14 | % | | | 2.43 | % | | | 0.82 | % | | | 1.23 | % | | | 0.61 | % |

| Portfolio turnover rate | | | 15 | % | | | 17 | % | | | 30 | % | | | 32 | % | | | 8 | % |

| (A) | Per share amounts calculated using average shares method, which more appropriately presents the per share data for the year. |

| (B) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (C) | These ratios exclude the impact of expenses of the underlying security holdings as represented in the Schedule of Investments. |

| (D) | Recognition of net investment income (loss) by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

| December 31, 2014 |

| |

| Conservative and Strategic Growth Portfolio Variable Series |

| |

Note 1 | Significant Accounting Policies

The Timothy Plan Conservative Growth Portfolio Variable Series (“Conservative Growth Portfolio”) and the Timothy Plan Strategic Growth Portfolio Variable Series (“Strategic Growth Portfolio”) (individually the “Fund”, collectively the “Funds”) were organized as diversified series of The Timothy Plan (the “Trust”). The Trust is an open-ended investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated December 16, 1993 (the “Trust Agreement”). The Conservative Growth Portfolio’s primary objective is moderate long-term capital growth, with a secondary objective of current income only to the extent that the Timothy Funds in which the Conservative Growth Portfolio invests seek current income. The Strategic Growth Portfolio’s primary investment objective is medium to high levels of long-term capital growth, with a secondary objective of current income only to the extent that the Timothy Funds in which the Strategic Growth Portfolio invests seek current income. The Conservative Growth Portfolio seeks to achieve its investment objectives by investing primarily in the following Timothy Funds which are other series of the Trust: Small Cap Value Fund, Large/Mid Cap Value Fund, Large/Mid Cap Growth Fund, Fixed Income Fund, Aggressive Growth Fund, High Yield Bond Fund, International Fund, Israel Common Values Fund, Defensive Strategies Fund, Emerging Markets Fund and Growth & Income Fund. The Conservative Growth Portfolio also invests in the Fidelity Institutional Money Market Portfolio, an unaffiliated mutual fund. The Strategic Growth Portfolio seeks to achieve its investment objectives by investing primarily in the following Timothy Funds which are other series of the Trust: Small Cap Value Fund, Large/Mid Cap Value Fund, Large/Mid Cap Growth Fund, Aggressive Growth Fund, High Yield Bond Fund, International Fund, Israel Common Values Fund, Defensive Strategies Fund, Emerging Markets Fund and Growth & Income Fund. Each Fund is one of a series of Funds currently authorized by the Board of Trustees (the “Board”). Timothy Partners, Ltd., (“TPL” or the “Advisor”) is the Investment Advisor for the Funds.

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”) for investment companies.

A. SECURITY VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

VALUATION OF FUND OF FUNDS

A Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value based upon methods established by the Board of Directors of the Underlying Funds.

Open-ended funds are valued at their respective net asset values as reported by such investment companies. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed- end investment company purchased by the Fund will not change.

The Trust utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

| ● | Level 1 – quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including each Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| Notes to Financial Statements |

| December 31, 2014 |

| |

| Conservative and Strategic Growth Portfolio Variable Series |

| |

Each Fund purchases Class A Shares of the Timothy Funds at net asset value without any sales charges. Investments in mutual funds, including money market mutual funds, are generally priced at the ending Net Asset Value (“NAV”) provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

The Board has delegated to the Advisor responsibility for determining the value of Fund portfolio securities under certain circumstances. Under such circumstances, the Advisor will use its best efforts to arrive at the fair value of a security held by each Fund under all reasonably ascertainable facts and circumstances. The Advisor must prepare a report for the Board not less than quarterly containing a complete listing of any securities for which fair value pricing was employed and detailing the specific reasons for such fair value pricing. The Board has adopted written policies and procedures to guide the Advisor with respect to the circumstances under which, and the methods to be used, fair value pricing is utilized. Good faith pricing is permitted if, in the Advisor’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Funds’ NAV calculation that may affect a security’s value, or the Advisor is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Conservative Growth Portfolio’s investments as of December 31, 2014:

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Mutual Funds | | $ | 31,054,750 | | | $ | — | | | $ | — | | | $ | 31,054,750 | |

| Money Market Fund | | | 294,276 | | | | — | | | | — | | | | 294,276 | |

| Total | | $ | 31,349,026 | | | $ | — | | | $ | — | | | $ | 31,349,026 | |

The following is a summary of the inputs used to value the Strategic Growth Portfolio’s investments as of December 31, 2014:

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Mutual Funds | | $ | 31,279,416 | | | $ | — | | | $ | — | | | $ | 31,279,416 | |

| Money Market Fund | | | 135,475 | | | | — | | | | — | | | | 135,475 | |

| Total | | $ | 31,414,891 | | | $ | — | | | $ | — | | | $ | 31,414,891 | |

| | | | | | | | | | | | | | | | | |

Refer to the Schedule of Investments for underlying Fund allocations.

The Conservative Growth Portfolio and the Strategic Growth Portfolio did not hold any assets at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. During the year ended December 31, 2014, there were no transfers between Levels 1 and 2. The Funds’ policy is to recognize transfers at the end of the year.

B. INVESTMENT INCOME AND SECURITIES TRANSACTIONS

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Cost is determined and gains and losses are based on the identified cost basis for both financial statement and federal income tax purposes. Dividend income is recognized on the ex-dividend date. Interest income and expenses are recognized on an accrual basis.

C. NET ASSET VALUE PER SHARE

Net asset per share of the capital stock of each Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of its net assets by the number of Fund shares outstanding.

D. FEDERAL INCOME TAXES

It is the policy of each Fund to continue to comply with all requirements under subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Each Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income or gains. Therefore, no federal income tax or excise provision is required.

As of December 31, 2014, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the year ended December 31, 2014, the Funds did not incur any interest or penalties. The Funds are not subject to examination by U.S. federal tax authorities for tax years before 2011 and are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially within the next twelve months.

E. USE OF ESTIMATES

In preparing financial statements in conformity with GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| Notes to Financial Statements |

| December 31, 2014 |

| |

| Conservative and Strategic Growth Portfolio Variable Series |

| |

F. DISTRIBUTIONS TO SHAREHOLDERS

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of the Funds. There were no such reclassifications.

G. EXPENSES

Expenses incurred by the Trust that do not relate to a specific Fund of the Trust are allocated to the individual Funds based on each Fund’s relative net assets or an appropriate basis (as determined by the Board).

H. INDEMNIFICATION

The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnities. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss due to these warranties and indemnities to be remote.

Note 2 | Purchases and Sales of Securities

The following is a summary of the cost of purchases and proceeds from the sale of securities, other than short-term investments, for the year ended December 31, 2014:

| Funds | | Purchases | | | Sales | |

| Conservative Growth Portfolio | | $ | 5,131,955 | | | $ | 8,911,824 | |

| Strategic Growth Portfolio | | | 9,732,768 | | | | 4,619,283 | |

| | | | | | | | | |

Note 3 | Investment Management Fee and Other Transactions with Affiliates

Timothy Partners, Ltd. (“TPL”) is the Investment Advisor for the Funds pursuant to an Amended and Restated Investment Advisory Agreement (the “Agreement”) that was renewed by the Board on February 28, 2014. TPL supervises the investment of the assets of each Fund’s portfolio in accordance with the objectives, policies and restrictions of the Funds. Under the terms of the Agreement, TPL receives a fee, accrued daily and paid monthly, at an annual rate of 0.10% of the average daily net assets of each Fund. Total fees earned by TPL during the year ended December 31, 2014 were $32,901 and $30,514 for the Conservative Growth Portfolio and the Strategic Growth Portfolio, respectively. The Conservative Growth Portfolio and the Strategic Growth Portfolio owed TPL $2,851 and $2,950, respectively, at December 31, 2014. An officer and trustee of the Funds is also an officer of the Advisor.

Gemini Fund Services, LLC (“GFS”) provides administrative, fund accounting, and transfer agency services to the Funds pursuant to agreements with the Trust, for which it receives from each Fund: (i) basis points in decreasing amounts as assets reach certain breakpoints; and (ii) any related out-of-pocket expenses. Fees are billed monthly as follows:

Fund Accounting and Fund Administration Fees:

Fund Complex Base annual fee:

25 basis points (0.25%) on the first $200 million of net assets

15 basis points (0.15%) on the next $200 million of net assets;

8 basis points (0.08%) on the next $600 million of net assets; and

6 basis points (0.06%) on net assets greater than $1 billion.

Transfer agency fees for the Funds are combined with the Fund Accounting and Fund Administration fees under the Trust’s agreement with GFS. Therefore, there is no separate base annual fee per Fund.

An officer of the Trust is also an employee of GFS, and is not paid any fees directly by the Trust for serving in such capacity.

| Notes to Financial Statements |

| December 31, 2014 |

| |

| Conservative and Strategic Growth Portfolio Variable Series |

| |

Note 4 | Control Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates the presumption of control of the Fund under Section 2(a) 9 of the Investment Company Act of 1940. As of December 31, 2014, American United Life Insurance Co. (“AUL”) held for the benefit of others, in aggregate, approximately 84% of the Conservative Growth Portfolio and approximately 73% of the Strategic Growth Portfolio.

Note 5 | Distributions to Shareholders and Tax Components of Capital

The tax character of distributions paid during 2014 and 2013 were as follows:

| | | Conservative Growth | | | Strategic Growth | |

| | | Portfolio | | | Portfolio | |

| 2014 | | | | | | | | |

| Ordinary Income | | $ | 694,481 | | | $ | 548,757 | |

| Long-Term Capital Gain | | $ | 1,626,898 | | | | | |

| | | $ | 2,321,379 | | | $ | 548,757 | |

| | | | | | | | | |

| 2013 | | | | | | | | |

| Ordinary Income | | $ | 349,463 | | | $ | 166,014 | |

| | | $ | 349,463 | | | $ | 166,014 | |

As of December 31, 2014, the components of distributable earnings on a tax basis were as follows:

| | | Conservative Growth | | | Strategic Growth | |

| | | Portfolio | | | Portfolio | |

| Undistributed Ordinary Income | | $ | 411,190 | | | $ | 346,276 | |

| Undistributed Long-Term Capital Gains | | | 1,845,698 | | | | 1,275,798 | |

| Unrealized Appreciation (Depreciation) | | | 722,584 | | | | 489,574 | |

| | | $ | 2,979,472 | | | $ | 2,111,648 | |

The difference between book basis and tax basis unrealized appreciation (depreciation) is primarily attributable to the tax deferral of losses on wash sales in the amount of $203,602 and $638,063 for the Conservative Growth Portfolio and the Strategic Growth Portfolio, respectively.

Note 6 | SUBSEQUENT EVENTS

Subsequent events after the date of the Statements of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has concluded that there is no impact requiring adjustment or disclosure in the financial statements.

| Notes to Financial Statements |

| December 31, 2014 (Unaudited) |

| |

| Conservative and Strategic Growth Portfolio Variable Series |

Board Annual Approval/Renewals of Advisory and Sub-Advisory Agreements (Unaudited)

Timothy Partners, Ltd; Investment Advisor to all Funds.

The continuance of the Investment Advisory Agreement (the “IA Agreement”) on behalf of each series of the Trust between the Trust and Timothy Partners, Ltd. (“TPL”) was last approved by the Board of Trustees (“the Board”), including a majority of the Trustees who are not interested persons of the Trust or any person who is a party to the Agreement, at an in-person meeting held on February 28, 2014. The Trust’s Board considered the factors described below prior to approving the Agreement. The Trustees, including the Independent Trustees, noted the Advisor’s experience in incorporating and implementing the unique, biblically-based management style that is a stated objective as set forth in the Funds’ prospectus.

To further assist the Board in making its determination as to whether the IA Agreement should be renewed, the Board requested and received the following information: a description of TPL’s business and any personnel changes, a description of the compensation received by TPL from the Funds, information relating to the Advisor’s compliance and operational policies and procedures, and a description of any material legal proceedings or securities enforcement proceedings regarding TPL or its personnel (there were none of either). In addition, the Board requested and received financial statements of TPL for its fiscal year ended December 31, 2013. The Board also received a report from TPL relating to the fees charged by TPL, both as an aggregate and in relation to fees charged by other advisors to similar funds. The materials prepared by TPL were provided to the Board in advance of the meeting. The Board considered the fees charged by TPL in light of the services provided to the Funds by TPL, the unique nature of the Funds and their moral screening requirements, which are maintained by TPL, and TPL’s role as a manager of managers. After full and careful consideration, the Board, with the independent trustees separately concurring, agreed that the fees charged by TPL were fair and reasonable in light of the services provided to the Funds. The Board also discussed the nature, extent and quality of TPL’s services to the Funds. In particular, the Board noted with approval TPL’s commitment to maintaining certain targeted expense ratios for the Funds, its efforts in providing comprehensive and consistent moral screens to the investment managers, its efforts in maintaining appropriate oversight of the investment managers to each Fund, and its efforts to maintain ongoing regulatory compliance for the Funds. The Board also discussed TPL’s current fee structure and whether such structure would allow the Funds to realize economies of scale as they grow. The Board next considered the investment performance of each Fund and the Advisor’s performance in monitoring the investment managers of the Underlying Funds. The Board generally approved of each Fund’s performance, noting that the Funds invested in a manner that did not rely exclusively on investment performance. Further, the Board noted with approval that the investment managers of each Fund did not succumb to “style drift” in their management of each Fund’s assets, and that each Fund was committed to maintain its investment mandate, even if that meant under performance during periods when that style was out of favor. The Board noted with approval the Advisor’s ongoing efforts to maintain such consistent investment discipline. The Board also noted with approval that the Advisor’s business was devoted exclusively to serving the Funds, and that the Advisor did not realize any ancillary benefits or profits deriving from its relationship with the Funds. The Board further noted with approval the Advisor’s past activities on monitoring the performance of the underlying Funds’ various investment managers and the promptness and efficiency with which problems were brought to the Board’s attention and responsible remedies offered and executed. After careful discussion and consideration, the Board, including the separate concurrence of the independent Trustees, unanimously cast an affirmative vote, and determined that the renewal of the IA Agreement for another one- year period would be in the best interests of the Funds’ shareholders. In approving the renewal of the IA Agreement for an additional one year period, the Board did not place specific emphasis on any one factor discussed above, but considered all factors in equal light. Further, the Board had available and availed itself of the assistance of legal counsel at all times during its consideration of the IA Agreement renewal.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of and Board of Trustees of

The Timothy Plan

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Timothy Plan Conservative Growth Portfolio Variable Series and Timothy Plan Strategic Growth Portfolio Variable Series (the “Funds”), two of the series constituting The Timothy Plan, as of December 31, 2014, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2014, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position Timothy Plan Conservative Growth Portfolio Variable Series and Timothy Plan Strategic Growth Portfolio Variable Series, two of the series constituting The Timothy Plan, as of December 31, 2014, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

February 17, 2015

Officers and Trustees of the Trust

As of December 31, 2014 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

| | | | | | | |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Arthur D. Ally* 1055 Maitland Center Commons Maitland, FL | | Chairman, President and Treasurer | | Indefinite; Trustee and President since 1994 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1942 | | President and controlling shareholder of Covenant Funds, Inc. (“CFI”), a holding company. President and general partner of Timothy Partners, Ltd. (“TPL”), the investment advisor and principal underwriter to each Fund. CFI is also the managing general partner of TPL. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Kenneth Blackwell** 1055 Maitland Center Commons Maitland, FL | | Trustee | | Indefinite; Trustee since 2011 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1948 | | Currently serving as an independent consultant or Fellow with the Family Research Council and the American Civil Rights Union, and is a Visiting Professor at Liberty University, Lynchburg, VA. Former Secretary of State for the State of Ohio. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Joseph E. Boatwright*** 1055 Maitland Center Commons Maitland, FL | | Trustee, Secretary | | Indefinite; Trustee and Secretary since 1995 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1930 | | Retired Minister. Currently serves as a consultant to the Greater Orlando Baptist Association. Served as Senior Pastor to Aloma Baptist Church from 1970-1996. | | None |

| * | Mr. Ally is an “interested” Trustee, as that term is defined in the 1940 Act, because of his positions with and financial interests in CFI and TPL. |

| ** | Kenneth Blackwell brings his vast experience and unique perspective gained as the former mayor of Cincinnati, Ohio, and also served as former Secretary of State for Ohio. Mr. Blackwell was an overseas ambassador, author, and celebrated business entrepreneur. |

| *** | Messrs. Boatwright and Staver are “interested” Trustees, as that term is defined in the 1940 Act, because each has a limited partnership interest in TPL. |

Officers and Trustees of the Trust (Continued)

As of December 31, 2014 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

| | | | | | | |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Richard W. Copeland 1055 Maitland Center Commons Maitland, FL | | Trustee | | Indefinite; Trustee since 2005 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1947 | | Principal of Copeland & Covert, Attorneys at Law; specializing in tax and estate planning. B.A. from Mississippi College, JD from University of Florida and LLM Taxation from University of Miami. Associate Professor Stetson University for past 35 years. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Deborah Honeycutt 1055 Maitland Center Commons Maitland, FL | | Trustee | | Indefinite; Trustee since 2010 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1947 | | Dr. Honeycutt is a licensed physician currently serving as Medical Director of Clayton State University Health Services in Morrow, GA, CEO of Minority Health Services in Atlanta, and as a volunteer at Good Shepherd Clinic. Dr. Honeycutt received her B.A. and M.D. at the University of Illinois. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Bill Johnson 1055 Maitland Center Commons Maitland, FL | | Trustee | | Indefinite; Trustee since 2005 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1946 | | President (and Founder) of American Decency Association, Freemont, MI since 1999. Previously served as Michigan State Director for American Family Association (1987-1999). Previously a public school teacher for 18 years. B.S. from Michigan State University and a Masters of Religious Education from Grand Rapids Baptist Seminary. | | None |

Officers and Trustees of the Trust (Continued)

As of December 31, 2014 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

| | | | | | | |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

John C. Mulder 1055 Maitland Center Commons Maitland, FL | | Trustee | | Indefinite; Trustee since 2005 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

| Born: 1950 | | President of WaterStone (formerly the Christian Community Foundation and National Foundation) since 2001. Prior: 22 years of executive experience for a group of banks and a trust company. B.A. in Economics from Wheaton College and MBA from University of Chicago. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Charles E. Nelson 1055 Maitland Center Commons Maitland, FL | | Trustee | | Indefinite; Trustee since 2000 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1934 | | Certified Public Accountant, semi-retired. Former non-profit industry accounting officer. Former financial executive with commercial bank. Former partner national accounting firm. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Scott Preissler, Ph.D. * 1055 Maitland Center Commons Maitland, FL | | Trustee | | Indefinite; Trustee since 2004 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

Born: 1960 | | Director of Steward Leadership and Professor in Residence at Shorter University. Former Chairman of Stewardship Studies at Southwestern Baptist Theological Seminary, Ft. Worth, TX. Also serves as Founder and Chairman of the International Center for Biblical Stewardship. | | None |

| * | Scott Preissler, PhD is a former executive director of a worldwide ministry, and currently serves as Director of Steward Leadership and Professor in Residence at Shorter University. Dr. Preissler brings extensive organizational and public service experience to the Board. |

Officers and Trustees of the Trust (Continued)

As of December 31, 2014 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

| | | | | | | |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Alan M. Ross 1055 Maitland Center Commons Maitland, FL Born: 1951 | | Trustee, Vice Chairman | | Indefinite; Trustee since 2004 | | 13 |

| | Principal Occupation During Past 5 Years | | | | Other Directorships Held by Trustee |

| | Founder and CEO of Corporate Development Institute which he founded in 2000. Previously he served as President and CEO of Fellowship of Companies for Christ and has authored three books: Beyond World Class, Unconditional Excellence, Breaking Through to Prosperity. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Mathew D. Staver** 1055 Maitland Center Commons Maitland, FL Born: 1956 | | Trustee | | Indefinite; Trustee since 2000 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

| | Attorney specializing in free speech, appellate practice and religious liberty constitutional law. Founder of Liberty Counsel, a religious civil liberties education and legal defense organization. Host of two radio programs devoted to religious freedom issues. Editor of a monthly newsletter devoted to religious liberty topics. Mr. Staver has argued before the United States Supreme Court and has published numerous legal articles. | | None |

| Name, Age and Address | | Position(s) Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

Patrice Tsague 1055 Maitland Center Commons Maitland, FL Born: 1973 | | Trustee | | Indefinite; Trustee since 2011 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

| | President and Chief Servant Officer of the Nehemiah Project International Ministries Inc. since 1999. | | None |

Officers and Trustees of the Trust (Continued)

As of December 31, 2014 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

OFFICERS WHO ARE NOT TRUSTEES

| | | | | | | |

| Name, Age and Address | | Position(s)

Held With Trust | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Trustee |

David D. Jones, Esq. 422 Felming Street, Sute 7 Key West, FL 33040 | | Chief Compliance Officer | | Indefinite: Since 2004 | | 13 |

| | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustee |

| Born: 1957 | | Managing Member of Drake Compliance, LLC, a compliance consulting firm, since 2004. B.A. From University of Texas at Austin in Economics- 1983. Juris Doctorate, with honors, from Saint Mary’s University School of Law in San Antonio, TX- 1994. | | None |

The Portfolio’s Statement of Additional Information includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free at 1-800-846-7526.

Privacy Notice

| | | |

FACTS | | WHAT DOES THE TIMOTHY PLAN DO WITH YOUR PERSONAL INFORMATION? |

| | | |

| WHY? | | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some, but not all information sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this Notice carefully to understand what we do. |

| | | |

| WHAT? | | The types of information we collect and share depend on the product or service you have with us. This information can include: |

| | | |

| | | ● Social Security Number |

| | | |

| | | ● Assets |

| | | |

| | | ● Retirement Assets |

| | | |

| | | ● Transaction History |

| | | |

| | | ● Checking Account History |

| | | |

| | | ● Purchase History |

| | | |

| | | ● Account Balances |

| | | |

| | | ● Account Transactions |

| | | |

| | | ● Wire Transfer Instructions |

| | | |

| | | When you are no longer our customer, we continue to share your information as described in this Notice. |

| | | |

| HOW? | | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons The Timothy Plan chooses to share; and whether you can limit this sharing. |

| | | | | |

| Reasons we can share your personal information. | | Does The Timothy Plan share? | | Can you limit this sharing? |

For our everyday business purposes- Such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus. | | Yes | | No |

For our marketing purposes- to offer our products and services to you. | | No | | We don’t share |

| For joint marketing with other financial companies | | No | | We don’t share |

For our affiliates’ everyday business purposes- information about your transactions and experiences. | | Yes | | No |

For our affiliates’ everyday business purposes- information about your creditworthiness | | No | | We don’t share |

| For non-affiliates to market to you | | No | | We don’t share |

| | | | | |

| Questions? | | Call 800-662-0201 |

| Who we are | | |

| Who is providing this Notice? | | Timothy Plan Family of Mutual Funds Timothy Partners, Ltd. |

What we do | | |

How does The Timothy Plan protect your personal information? | | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse or your nonpublic personal information. |

How does The Timothy Plan collect your personal information? | | We collect your personal information, for example, when you

|

| | ● Open an account

|

| | ● Provide account information

|

| | | ● Give us your contact information

|

| | | ● Make deposits or withdrawals from your account

|

| | | ● Make a wire transfer

|

| | | ● Tell us where to send the money

|

| | | ● Tell us who receives the money

|

| | | ● Show your government-issued ID

|

| | | ● Show your drivers’ license

|

| | | We also collect your personal information from other companies. |

| Why can’t I limit all sharing? | | Federal law gives you the right to limit only: |

| | | |

| | | ● Sharing for affiliates’ everyday business purposes-information about your creditworthiness. |

| | | |

| | | ● Affiliates from using your information to market to you. |

| | | |

| | | ● Sharing for non-affiliates to market to you |

| | | |

| | | State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | | |

| Affiliates | | Companies related by common ownership or control. They can be financial and non-financial companies. Timothy Partners, Ltd. is an affiliate of The Timothy Plan |

| Non-affiliates | | Companies not related by common ownership or control. They can be financial and non-financial companies. ● The Timothy Plan does not share with non-affiliates so they can market to you. |

| Joint marketing | | A formal agreement between non-affiliated financial companies that together market financial products to you. ● The Timothy Plan does not jointly market. |

Customer Identification Program

The Board of Trustees of the Trust has approved procedures designed to prevent and detect attempts to launder money as required under the USA PATRIOT Act. The day-to-day responsibility for monitoring and reporting any such activities has been delegated to the transfer agent, subject to the oversight and supervision of the Board.

Disclosures

HOW TO OBTAIN PROXY VOTING INFORMATION

Information regarding how the Funds voted proxies relating to Fund securities during the period ended June 30 as well as a description of the policies and procedures that the Funds use to determine how to vote proxies is available without charge, upon request, by calling 1-800-8467526 - or by referring to the Security and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

HOW TO OBTAIN 1ST AND 3RD FISCAL QUARTER PORTFOLIO HOLDINGS

Each Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at t he SEC’s Public Reference Room in Washington, DC (1-800-SEC-0330). The information on Form N-Q is available without charge, upon request, by calling 1-800- 846-7526.

This Page Intentionally Left Blank.

This Page Intentionally Left Blank.

| BOARD OF TRUSTEES | |

| Arthur D. Ally | |

| Kenneth Blackwell | |

| Joseph E. Boatwright | |

| Rick Copeland | |

| Deborah Honeycutt | |

| Bill Johnson | |

| John C. Mulder | |

| Charles E. Nelson | |

| Scott Preissler | |

| Alan Ross | |

| Mathew D. Staver | |

| Patrice Tsague | |

| | |

| OFFICERS | |

| Arthur D. Ally, President | |

| Joseph E. Boatwright, Secretary | |

| | |

| INVESTMENT ADVISOR | |

| Timothy Partners, Ltd. | |

| 1055 Maitland Center Commons | |

| Maitland, FL 32751 | |

| | |

| DISTRIBUTOR | |

| Timothy Partners, Ltd. | |

| 1055 Maitland Center Commons | |

| Maitland, FL 32751 | |

| | |

| TRANSFER AGENT | |

| Gemini Fund Services, LLC | |

| 17605 Wright St., Suite 2 | |

| Omaha, NE 68130 | |

| | |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| Cohen Fund Audit Services, Ltd. | |

| 1350 Euclid Ave., Suite 800 | |

| Cleveland, OH 44115 | |

| | |

| LEGAL COUNSEL | |

| David Jones & Assoc., P.C. | |

| 422 Fleming St. | |

| Key West, FL 33040 |  |

For additional information or a prospectus, please call: 1-800-846-7526

Visit the Timothy Plan web site on the internet at: www.timothyplan.com This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective Prospectus which includes details regarding the Funds’ objectives, policies, expenses and other information. Distributed by Timothy Partners, Ltd. | | HEADQUARTERS

The Timothy Plan

1055 Maitland Center Commons

Maitland, Florida 32751

(800) 846-7526

www.timothyplan.com

invest@timothyplan.com SHAREHOLDER SERVICES

Gemini Fund Services, LLC

17605 Wright St., Suite 2

Omaha, NE 68130