North America’s oldest, largest and most innovative recycling solutions company serving the nation’s food industry 16th Annual Goldman Sachs Agricultural Biotech Forum March 7, 2012 Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements regarding the business, operations and prospects of Darling and industry factors affecting it, as well as forward-looking information regarding the Griffin Industries transaction and the combined company. These statements are identified by words such as “may,” “will,” “ begin,” “ look forward,” “expect,” “believe,” “intend,” “anticipate,” “should,” “potential,” “estimate,” “continue,” “momentum” and other words referring to events to occur in the future. These statements reflect Darling's current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, including disturbances in world financial, credit, commodities and stock markets; potential changes in national and foreign regulations affecting the company’s products; a decline in consumer confidence and discretionary spending; the general performance of the U.S. and global economies; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs, and poultry, thus affecting available rendering feedstock; risks, including future expenditure, relating to Darling’s joint venture with Valero Energy Corporation to construct and complete a renewable diesel plant in Norco, Louisiana and possible difficulties completing and obtaining operational viability with the plant on a timely basis, or at all; risks associated with the development of competitive sources for alternative renewable diesel or comparable fuels; economic disruptions resulting from the European debt crisis; and continued or escalated conflict in the Middle East, each of which could cause actual results to differ materially from those projected in the forward-looking statements. Other risks and uncertainties regarding Darling, its business and the industry in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise. This presentation also contains information about Darling’s adjusted EBITDA, adjusted net income and adjusted earnings per share, which are not measures derived in accordance with GAAP and which exclude components that are important to understanding Darling’s financial performance. Investors should recognize that these non-GAAP measures might not be comparable to similarly titled measures of other companies. These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flows or liquidity prepared in accordance with accounting principles generally accepted in the United States. 2 DAR Inv_v030712

recycling solutions company serving the nation’s food industry Darling International is the A Family Heritage ► Darling & Co. was founded in 1882 by the Swift and Darling families to meet the needs of the growing Chicago meat-packing industry. ► Taken public in 1994, Darling Intl has a 130 year history of growth. ► In 2010, another family business came under the Darling International umbrella with the acquisition of Griffin Industries, one of the largest renderers in the Southeastern US, doubling the size of the company and expanding our national footprint. National Presence Technology Pioneers ► 120 locations ► Facilities in 42 states ► Largest rendering company in US ► Largest bakery waste recycler in North America ► Largest waste cooking oil recycler in North America ► Operating one of the largest private trucking fleets in US ► Approximately 3,300 employees ► 1998 - Began the country’s first continuous biodiesel plant utilizing waste greases ► 2011 – Began construction of the nation’s largest animal fat to hydrocarbon recycling facility, designed to produce 9,300 barrels of renewable diesel per day ► 2012– Commissioning “first of a kind” waste extraction unit 3 DAR Inv_v030712

We are North America’s oldest, largest and most innovative recycling solutions company serving our nation’s food industry Our Model Recycling Waste Streams into “Value-Added” Ingredients for Feed and Fuel 4 DAR Inv_v030712 Darling International Route- based Service Provider Feed Ingredients Specialty Ingredients Renewable Fuels Food Industry Recycler

Darling International Our Lines of Business 5 DAR Inv_v030712 Darling Bio-Energy ? New Line Nature Safe Fertilizers Bakery Feeds DAR PRO Solutions a Darling–Griffin Company Introducing… TM TM

Source: NRA/Harvard Risk Assessment, Supplier Relations U.S. ► Used cooking oil recycling and grease trap maintenance ► Regulated recycling of used cooking oil and wastewater streams ► Approximately 2 billion pounds of waste cooking oil is recycled annually ► Restaurant equipment business to support ► Animal and food by-product recycling industry is “mission critical” in the food supply chain ► The most efficient and environmentally sound disposal alternative...reduces greenhouse gas (GHG) ► ~59 billion pounds of inedible by-products generated annually Rendering : the process of recycling meat by- products into useable ingredients Restaurant Services Rendering – turning this… ….into this a Darling – Griffin company 6 DAR Inv_v030712 TM

Bakery Recycling Bakery Industry ► 9 plants, primarily east of the Mississippi river ► Value-added nutrition approach producing animal feed for the poultry industry ► Creates an additional linkage to our raw material suppliers ► DAR real estate allows for new growth opportunities … new Dallas transfer station ► Approximately 3.0 million tons of bakery waste is created annually ► Servicing commercial baking, snacks, cookies and crackers producers ► Additional food safety regulations and traceability should help “scrape” rates grow Our Presence -4% -3% -2% -1% 0% 1% 2% 3% 4% Year-over-year changes in measured channel retail sales volume for bakery-related products Y -o -Y C hang e i n B a k e ry -r e la te d P roduc t V o lu m e S a le s i n M e a s ur e d C hann e ls Bakery Volume 7 DAR Inv_v030712 Source: IRI

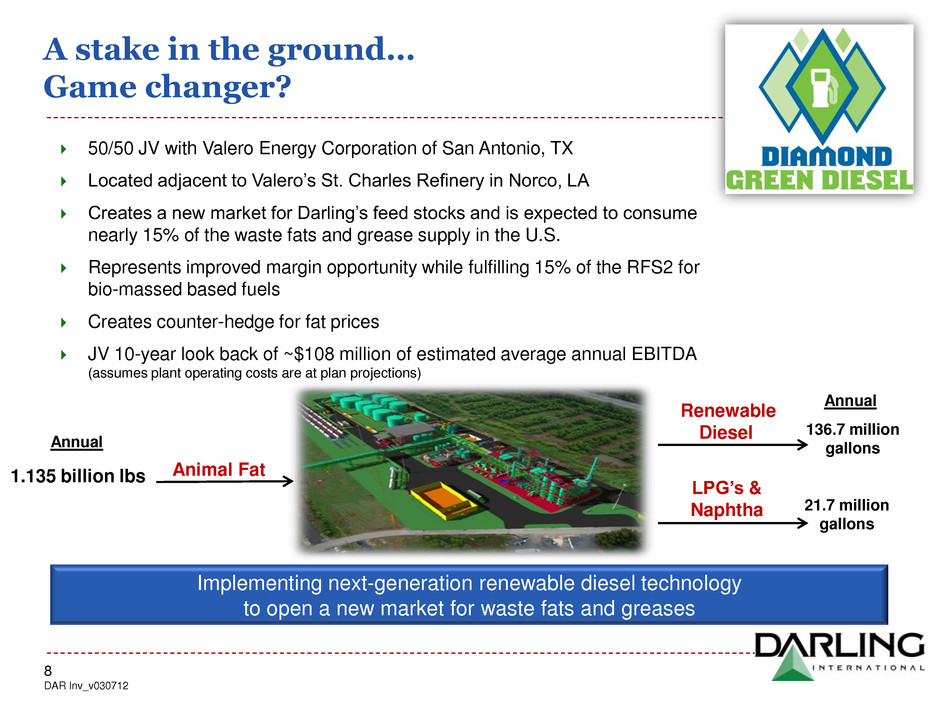

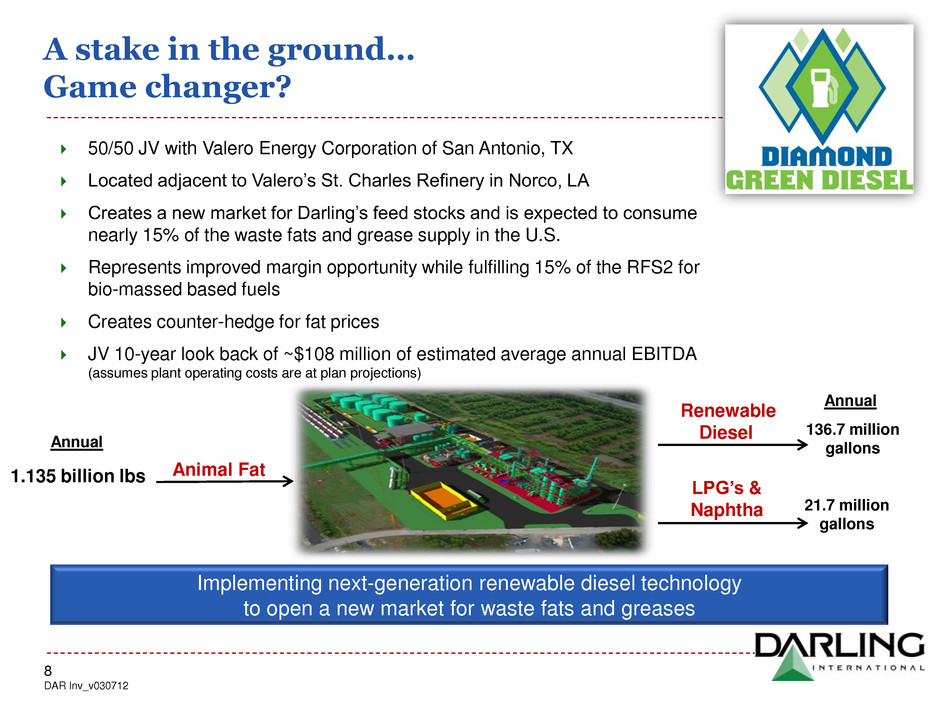

A stake in the ground… Game changer? 50/50 JV with Valero Energy Corporation of San Antonio, TX Located adjacent to Valero’s St. Charles Refinery in Norco, LA Creates a new market for Darling’s feed stocks and is expected to consume nearly 15% of the waste fats and grease supply in the U.S. Represents improved margin opportunity while fulfilling 15% of the RFS2 for bio-massed based fuels Creates counter-hedge for fat prices JV 10-year look back of ~$108 million of estimated average annual EBITDA (assumes plant operating costs are at plan projections) Implementing next-generation renewable diesel technology to open a new market for waste fats and greases Animal Fat 1.135 billion lbs Renewable Diesel LPG’s & Naphtha 136.7 million gallons 21.7 million gallons Annual Annual 8 DAR Inv_v030712

Anticipated start up in late fourth quarter 2012 or early 2013 9 DAR Inv_v030712

Nature Safe ► One of the largest suppliers of organic fertilizer ► Leverage animal nutrition principles and expertise and apply to soil and plant nutrition ► Develop a complete organic and organic-based product line derived from our animal proteins to serve: o Golf courses o Sports turf & municipalities o Lawn care o Organic agriculture o Retail (primarily private label relationships) ► Creates an internal hedge for our business as we pull supplies of protein from more traditional animal feed and pet food markets, resulting in upward price pressure for related ingredients 10 DAR Inv_v030712

Vortex of Value….. Positive industry fundamentals Innovators of value and technology; passionate about growth Robust financial performance & cash flow generation Business model reduces risk and protects margins “Best in Class” across the food recycling spectrum 1 2 3 4 5 11 DAR Inv_v030712

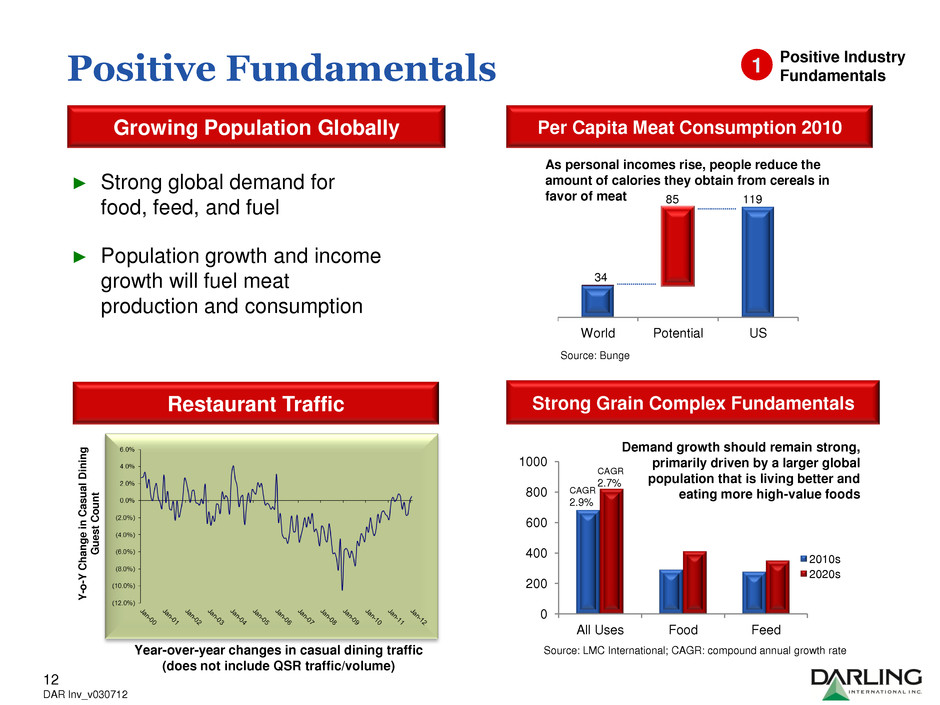

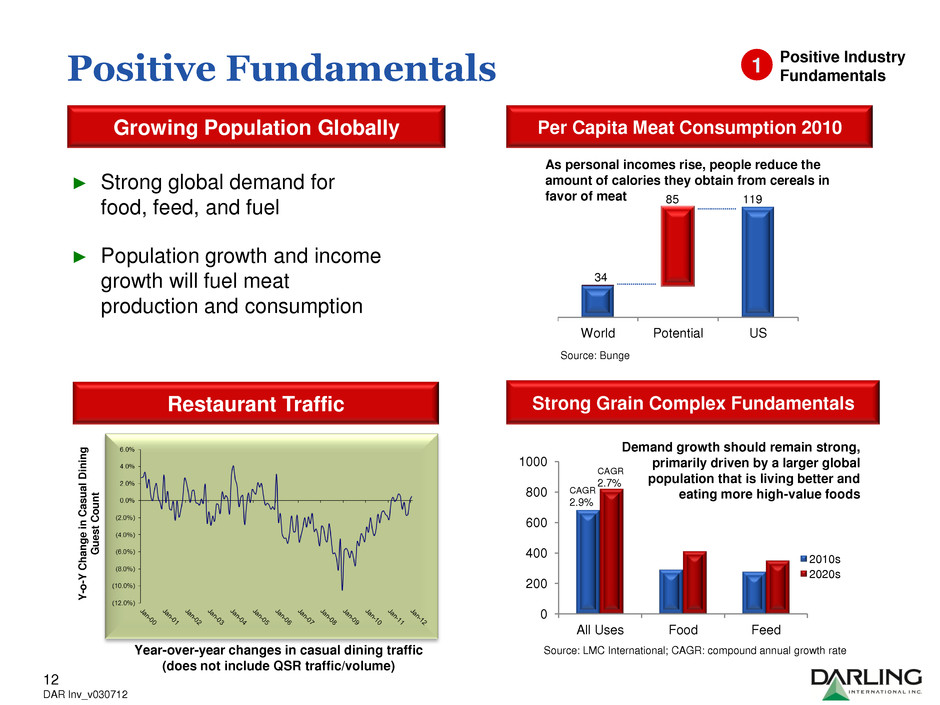

Demand growth should remain strong, primarily driven by a larger global population that is living better and eating more high-value foods As personal incomes rise, people reduce the amount of calories they obtain from cereals in favor of meat Positive Fundamentals Growing Population Globally Restaurant Traffic Y -o -Y C hang e i n C a s ual D in ing Gu e s t C oun t World Potential US 85 119 34 Source: Bunge Per Capita Meat Consumption 2010 0 200 400 600 800 1000 All Uses Food Feed 2010s 2020s CAGR 2.9% CAGR 2.7% Source: LMC International; CAGR: compound annual growth rate Strong Grain Complex Fundamentals Positive Industry Fundamentals 1 ► Strong global demand for food, feed, and fuel ► Population growth and income growth will fuel meat production and consumption 12 DAR Inv_v030712 Year-over-year changes in casual dining traffic (does not include QSR traffic/volume)

Global Biofuel Demand Positive Industry Fundamentals 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 OTHER ADVANCED BIOFUEL 0.2 0.3 0.5 0.75 1.0 1.5 2.0 2.5 3.0 3.5 3.5 3.5 4.0 BIOMASS BASED DIESEL 1.15 0.8 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 CELLULOSIC BIOFUEL 0.1 0.25 0.5 1.0 1.75 3.0 4.25 5.5 7.0 8.5 10.5 13.5 16.0 CORN BASED ETHANOL 12.0 12.6 13.2 13.8 14.4 15.0 15.0 15.0 15.0 15.0 15.0 15.0 15.0 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 Advanced Biofuels Billio n s o f G al lo n s Diamond Green Diesel satisfies both bio-mass and other advanced bio-fuel requirements RFS2 South Americ a North Americ a EU Asia Others Total 2010 2.5 2.4 12.1 2 0.5 19.5 2012 3.3 3.7 13.6 2 0.7 23.3 0 5 10 15 20 25 M M T o n s Source: EPA RFS2 1 ► Bio-fuel mandates are a global phenomenon ► RFS2 in the US is the primary driver of our commodity markets. US Mandates 13 DAR Inv_v030712

Darling’s National Platform – A superior platform to assist customers nationwide ► Coast to coast coverage by over 120 company facilities and a network of 3rd party providers* ► We are the preferred service provider to the BRANDS! ► Geographic diversity will create more opportunities for core and non-core growth #1 Platform Across the Food Recycling Spectrum 2 * 3rd party providers extend our coverage to Alaska, Hawaii and Puerto Rico 14 DAR Inv_v030712

0 10,000 20,000 30,000 40,000 50,000 1970 1977 1984 1991 1998 2005 2012 2019 Poultry Beef Pork 1 70-2009 CAGR: 3.8% 1970-2009 CAGR: 0.5% 1970-2009 CAGR: 1.2% ► Approximately 75% of our raw material is procured under a processing agreement, whereby margins are established and the risk is shared. The balance is a “fee for service” business. ► Diversified supply of raw material ► Profit sharing arrangement with key suppliers of value-added ingredients o Helps us lock in and grow our tonnage ► Diamond Green Diesel will provide ultimate built-in hedge for our fats and greases Business Model Business Model reduces Risk and protects Margins 3 US Protein Production (million pounds) Source: Equity Research, USDA 27.63% 25.48% 19.19% 10.04% 9.59% 6.36% 1.71% Beef Poultry Bakery Used Cooking Oil Pork 15 DAR Inv_v030712

Innovation driven… Creating non-commodity ingredients Strategic Focus on Premium and Value-Added Products Premium Products Pricing Relative to Commodity Meals Focus on Value-Add and Branding of Ingredients ► Opportunity to move more products into premium/value-added products ► Differentiated and value-added products drive premium pricing vs. commodity alternatives ► Provides margin expansion for Darling ► Creates improved economics for our raw material suppliers….(profit sharing) 10% 40% 2005 2011 Innovators of Value 4 16 DAR Inv_v030712 +20% +15-30% +60% +60% Commodity Feed Grade Meal Fertilizers Pet Grade Poultry Meal Aquaculture Grade Meal Source: Company Management Cookie Meal ®

Innovation through Technology Start up – February 2012 Solvent extraction plant in Hampton, Florida Focused on recovering fat from non-traditional waste streams Innovators of Value 4 17 DAR Inv_v030712

BOSS….Best Oil Storage System ► Creating an alternative to other fresh oil delivery systems ► Lower total supply chain cost ► Restaurant owns equipment ► Telemetry equipped ► Reduces theft and increases customer retention Innovators of Technology 4 18 DAR Inv_v030712

Aug 2008 API Recycling, div of American Proteins Inc. GA Oct 2005 Southeastern Maintenance & Construction Inc. FL, GA Feb 2009 Boca Transport, Inc. GA Dec 2009 Sanimax USA Great Lakes Dec 2010 Griffin Industries SE/Central US Passionate about Growth Dec 2004 Burrows Industries, Inc. dba Minuteman Pumping So CA Since 2003, Darling has acquired and integrated 10 companies investing over $1.1 Billion May 2006 National By-Products, LLC Midwest US 2004 2005 2006 2007 2008 2009 2010 Dec 2008 J&R Rendering, Inc. NYC metro June 2010 Nebraska By-Products NE, KS Growth and Margin Expansion Opportunities 4 July 2007 Ace Grease Service KC metro 2011 2003 2011 Stockholders’ Equity $55.3 mill Value creation Market Cap $1.55 bill Market Cap $179.4 mill Stockholders’ Equity $920.4 mill +1564% +767% 19 DAR Inv_v030712

Historical Financials Fiscal 2011 Key Highlights Key Financials Fiscal 2011 Business Results by Qtr Strong Financial Performance & Cash Flow Generation 5 ► Record setting earnings ► Robust balance sheet ► Strong finished product markets ► Improved raw material volumes ► Successful integration results ► Diamond Green Diesel construction commenced and progressing in $ Thousands Net sales 1,797,249$ Operating income 314,606$ Operating cash flow 393,515$ Net income 169,418$ EBITDA 21.90% Fiscal 2011 as % of sales 20 DAR Inv_v030712 in $ millions (except per share amounts) Q1 Q2 Q3 Q4 Net sales $439.89 470.61 455.87 430.86 et $46.56 52.22 41.13 29.49 EPS $0.43 0.44 0.35 0.25 prices from The Jacobsen $ p e r to n Meat and Bone Meal C e n ts p e r lb 3 36 38 40 42 44 46 48 Jan Feb Mar April May June July Aug Sept Oct Nov Dec YG Yellow Grease 2011 Monthly Average Prices

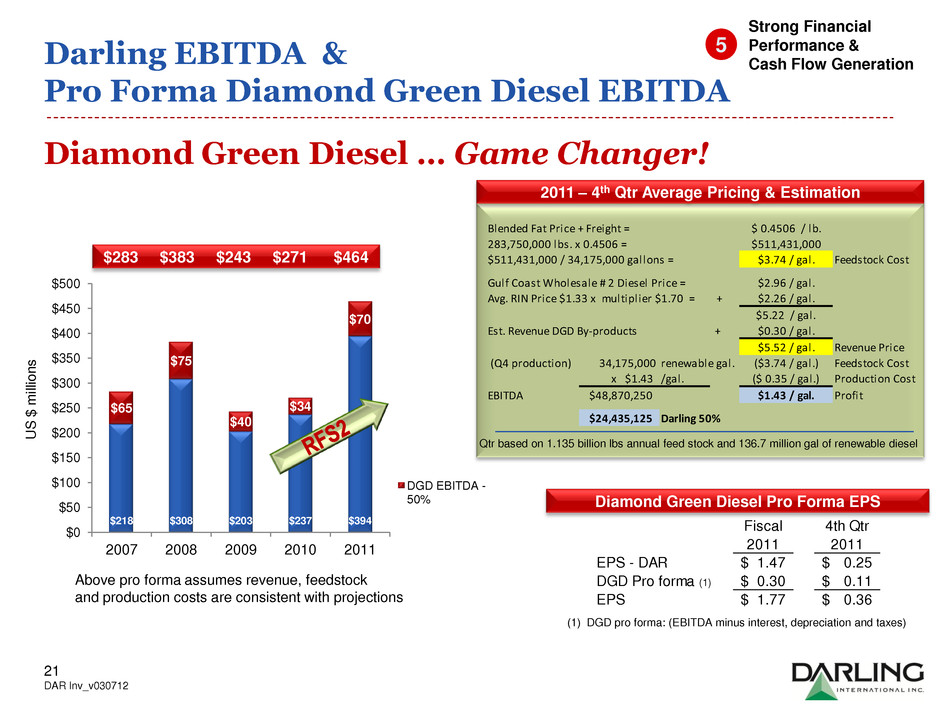

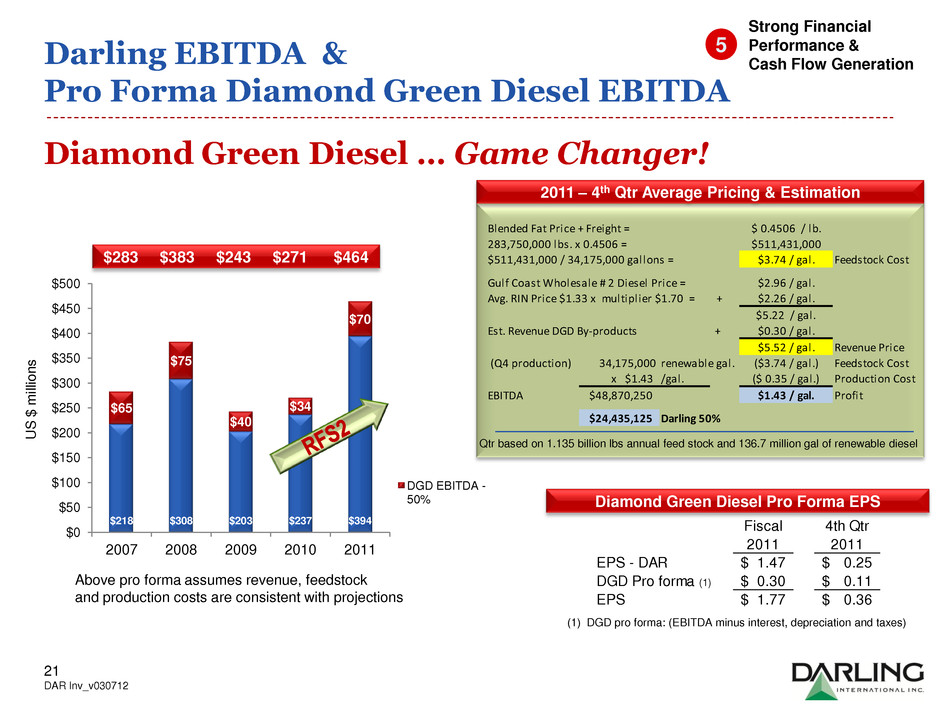

$218 $308 $203 $237 $394 $65 $75 $40 $34 $70 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2007 2008 2009 2010 2011 DGD EBITDA - 50% Darling EBITDA & Pro Forma Diamond Green Diesel EBITDA Strong Financial Performance & Cash Flow Generation 5 U S $ m ill ion s $283 $383 $243 $271 $464 21 DAR Inv_v030712 2011 – 4th Qtr Average Pricing & Estimation Diamond Green Diesel … Game Changer! Diamond Green Diesel Pro Forma EPS Above pro forma assumes revenue, feedstock and production costs are consistent with projections Blended Fat Price + Freight = $ 0.4506 / lb. 283,750,000 lbs. x 0.4506 = $511,431,000 $511,431,000 / 34,175,000 gallons = $3.74 / gal. Feedstock Cost Gulf Coast Wholesale # 2 Diesel Price = $2.96 / gal. Avg. RIN Price $1.33 x multiplier $1.70 = + $2.26 / gal. $5.22 / gal. Est. Revenue DGD By-products + $0.30 / gal. $5.52 / gal. Revenue Price (Q4 production) 34,175,000 renewable gal. ($3.74 / gal.) Feedstock Cost x $1.43 /gal. ($ 0.35 / gal.) Production Cost EBITDA $48,870,250 $1.43 / gal. Profit $24,435,125 Darling 50% Qtr based on 1.135 billion lbs annual feed stock and 136.7 million gal of renewable diesel (1) DGD pro forma: (EBITDA minus interest, depreciation and taxes) Fiscal 4th Qtr 2011 2011 EPS - DAR 1.47$ 0.25$ DGD Pro forma (1) 0.30$ 0.11$ EPS 1.77$ 0.36$

Historical Financials Revenue (US$ millions) Capex (US$ millions) EBITDA - Capex (US$ millions) EBITDA (US$ millions) Source: Company Management NOTE: 2007-2010 includes combined proforma of Griffin Industries. Strong Financial Performance & Cash Flow Generation 5 $213 $308 $190 $237 0 50 100 150 200 250 300 350 400 2007 2008 2009 2010 8 203 $394 2011 $178 $237 $121 $176 0 50 100 150 200 250 300 350 2007 2008 2009 2010 83 $237 $133 $176 $334 2011 $1143 $1489 $1123 $1340 0 200 400 600 800 1000 1200 1400 1600 1800 2000 2007 2008 2009 2010 2011 $1147 $1489 $1123 $1340 $1797 $35 $71 $69 $61 $0 $10 $20 $30 $40 $50 $60 $70 $80 2007 2008 2009 2010 $60 2011 22 DAR Inv_v030712

Balance Sheet Balance Sheet as of Fiscal 2011 and Fiscal YE 2010 (US$ in millions) Fiscal 2010 12/31/2011 1/1/2011 Cash and cash equivalents $38.9 $19.2 Restricted cash 0.4 0.4 Accounts receivables, net 95.8 103.7 Inventories 50.8 45.6 Other current assets 33.8 16.7 Total current assets $219.7 $185.6 Property, plant and equipment, net 400.2 393.4 Collection route and contracts, net 362.9 391.0 Goodwill 381.4 376.3 Investment in unconsolidated subsidiary 21.7 0.0 Other assets 31.1 36.0 Total assets $1,417.0 $1,382.3 Current portion of long-term debt $0.0 $3.0 Accounts payable $60.4 70.1 Accrued expenses 66.9 81.7 Total current liabilities $127.3 $154.8 Long-term debt 280.0 707.0 Deferred income taxes 31.1 5.4 Other non-current liabilities 58.2 50.8 Total liabilities $496.6 $918.0 Stockholder's equity 920.4 464.3 Total liabilities and equity $1,417.0 $1,382.3 Fiscal 2011 Strong Financial Performance & Cash Flow Generation Fiscal 2011 Fiscal 2010 12/31/2011 1/1/2011 5 23 DAR Inv_v030712 (1) Subsequent to year end, the Company paid down the remaining $30.0M of the Term B. Debt now at $250.0M. (1)

North America’s oldest, largest and most innovative recycling solutions company serving the nation’s food industry Q&A 24 DAR Inv_v030712