Exhibit – 99.2 Randall C. Stuewe, Chairman and CEO Brad Phillips, EVP Chief Financial Officer Melissa A. Gaither, VP IR and Global Communications

2 This presentation contains “forward-looking” statements regarding the business operations and prospects of Darling Ingredients Inc. and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” and other words referring to events that may occur in the future. These statements reflect Darling Ingredient’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas(“GHG”) emissions that adversely affect programs like the U.S. government’s renewable fuel standard, low carbon fuel standards (“LCFS”) and tax credits for biofuels both in the Unites States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of 2009 H1N1 flu (initially known as “Swine Flu”), Highly pathogenic strains of avian influenza (collectively known as “Bird Flu”), bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign (including, without limitation, China) regulations (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations) affecting the industries in which the Company operates or its value added products; risks associated with the DGD Joint Venture, including possible unanticipated operating disruptions and issues relating to the announced expansion project; risks and uncertainties relating to international sales and operations, including imposition of tariffs, quotas, trade barriers and other trade protections imposed by foreign countries; difficulties or a significant disruption in our information systems or failure to implement new systems and software successfully, including our ongoing enterprise resource planning project; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; uncertainty regarding the likely exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

Consolidated Earnings 3 Q2 2018 Overview Q1 Q2 Q3 Q4 Total Q1 Q2 US$ (millions) except per share price 2017 2017 2017 2017 2017 2018 2018 • Total global volumes up 4.0% year over year Revenue $ 878.5 $ 894.9 $ 936.3 $ 952.6 $ 3,662.3 $ 875.4 (1) $ 846.6 (1) Gross Margin 190.5 195.7 193.8 206.8 786.8 197.3 193.6 • Fat pricing significantly weaker year over year. Seeing Gross Margin % 21.7% 21.9% 20.7% 21.7% 21.5% 22.5% 22.9% improvement late in the second quarter. SG&A 86.9 84.5 82.1 90.0 343.5 86.9 78.6 • Protein pricing steady year over year while sequentially SG&A Margin % 9.9% 9.4% 8.8% 9.4% 9.4% 9.9% 9.3% higher demand for specie specific meals. Operating Income 32.5 38.2 34.4 36.1 141.2 31.8 21.7 (2) Adj. EBITDA (3) 103.6 111.2 111.6 116.9 443.3 110.4 (4) 115.1 • Collagen sales stronger year over year with steady Adj. EBITDA Margin % 11.8% 12.4% 11.9% 12.3% 12.1% 12.6% 13.6% margins and improved pricing for specialty products. Interest Expense (21.7) (22.4) (22.5) (22.3) (88.9) (23.1) (23.0) Debt Extinguishment costs 0.0 0.0 0.0 0.0 0.0 0.0 (23.5) • Debt paydown of $44.0 million during the quarter Foreign Currency gain/(loss) (0.3) (2.1) (2.1) (2.4) (6.9) (1.5) (3.5) Loss on Sale of Subsidiary 0.0 0.0 0.0 0.0 0.0 0.0 (15.5) • Received $25 million partner dividend from Diamond Green Diesel (DGD) Other (Expense)/Income (5) (2.0) (4.0) (2.5) (1.3) (9.7) (2.6) 1.2 Equity in net income of unconsolidated 0.7 8.3 7.7 11.8 28.5 97.2 15.2 subsidiaries • Adjusted Net Income of $17.7 million net of: Income Tax (Expense)/Benefit (1.8) (7.7) (6.3) 85.0 69.2 (3.7) (1.7) - Refi Euro Bonds from 4.75% to 3.625% Net income attributable to noncontrolling - Sale of TRS (1.6) (1.2) (0.9) (1.2) (4.9) (0.8) (1.3) interests - Closure of Argentina gelatin facility Net income attributable to Darling $ 5.8 $ 9.1 $ 7.8 $ 105.7 $ 128.5 $ 97.3 $ (30.4) Earnings per share (fully diluted) $ 0.04 $ 0.05 $ 0.05 $ 0.63 $ 0.77 $ 0.58 $ (0.18) (1) Reflects revenue recognition for freight moved to cost of sales in Q1 and Q2 2018 (2) Reflects restructuring and impairment charges for the closure of the Argentina gelatin plant (3) Does not inlcude Unconsolidated Subsidiaries EBITDA (4) Includes $12.6M of 2017 BTC in Q1 2018 (5) Rounding captured in Other Expense

Second Quarter 2018 Financial Summary 4 $ in millions Q2 2018 Overview Gross Profit and Margin • Net sales - $846.6 million • Net income - $(30.4) million – adjusted (net of tax) to $17.7 million for: $(23.5) million debt refinance costs $(15.5) million sale of TRS $(15.0) closure of Argentina gelatin plant • EPS at $(0.18) per diluted share • Adjusted EBITDA - $115.1 million • DGD joint venture Adjusted EBITDA - $18.2 million (Darling’s share) $ in millions $ in millions Strong Free Cash Flow Generation Quarterly Adjusted EBITDA $140 $120 $116.9 $120 $25 $115.1 $100 $115 $111.2 $111.6 $110.4 $80 $110 $116.9 $110.4 $111.6 $60 $111.2 $105 $40 $115.1 $100 $82.5 $77.8 $65.5 $20 $68.6 $57.6 $53.8 $95 $56.6 $45.7 $39.1 $0 $43.0 $90 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 2Q17 3Q17 4Q17 1Q18 2Q18 Adjusted EBITDA is a Non-U.S. GAAP Measure (See slide 17) Adjusted EBITDA Capex Free Cash Flow (Adjusted EBITDA plus DGD cash dividend after Capex) 2Q 2018 DGD cash dividend

Feed Segment 5 US$ and metric tons Q2 Q3 Q4 Total Q1 Q2 (millions) 2017 2017 2017 2017 2018 2018 Adj. EBITDA Bridge Q2-2017 to Q2-2018 (millions) Revenue $549.1 $575.5 $562.3 $2,239.5 $485.8 (1) $498.8 (1) 100 Gross Margin 126.9 126.0 122.0 494.9 116.7 128.0 $84.0 ($57.9) $82.8 $1.3 $84.1 80 Gross Margin % 23.1% 21.9% 21.7% 22.1% 24.0% 25.7% ($0.4) $29.6 SG&A 42.9 44.8 45.8 178.3 48.3 43.9 60 $27.5 SG&A Margin % 7.8% 7.8% 8.1% 8.0% 9.9% 8.8% 40 Operating Income 39.7 34.2 26.9 132.3 21.7 37.3 20 Adj. EBITDA (2) $84.0 $81.1 $76.2 $316.5 $68.5 $84.1 0 Raw Material Processed EBITDA Price / Volumes Cost of Other Adjusted FX EBITDA 2.02 2.04 2.13 8.24 2.12 2.13 Q2 17 Yield Sales EBITDA Impact Q2 18 (million metric tons) (1) Reflects freight revenue reclass and deconsolidation of BestHides Note: Cost of Sales includes raw material costs, collection costs and factory costs. (2) Does not include Unconsolidated Subsidiaries EBITDA Key Drivers: Non-GAAP Adj. EBITDA Margin 18 Feed • Slaughter volumes remain strong with global raw material 17 16.9% volumes up 5.6% in the Feed Segment over Q2 2017 16 15.3% 15 14.1% 14.1% • N. American growth projects starting to show earnings support 14 13.6% 13 • Fat pricing rebounding late in the quarter in N. America with 12 Europe still dealing with supply/demand pressures 11 10 • Protein pricing improves year over year and sequentially with Q2 Q3 Q4 Q1 Q2 strong demand for higher protein specialty ingredients 2017 2017 2017 2018 2018

Food Segment 6 US$ and metric tons Q2 Q3 Q4 Total Q1 Q2 Adj. EBITDA Bridge Q2-2017 to Q2-2018 (millions) 2017 2017 2017 2017 2018 2018 (millions) $29.3 ($26.5) $2.3 $29.7 Revenue (1) $278.4 $298.9 $313.5 $1,157.0 $305.5 (2) $276.7 (2) 30 $27.4 Gross Margin 56.0 60.2 63.6 236.6 56.3 51.9 25 $10.4 Gross Margin % 20.1% 20.1% 20.3% 20.4% 18.4% 18.8% 20 $6.3 SG&A 26.7 25.5 27.4 104.6 23.9 22.2 15 SG&A Margin % 9.6% 8.5% 8.7% 9.0% 7.8% 8.0% $7.9 10 Operating Income 11.1 15.1 16.4 56.9 11.8 9.3 (3) 5 Adj. EBITDA $29.3 $34.6 $36.1 $131.9 $32.4 $29.7 (3) Raw Material Processed 0 0.28 0.29 0.28 1.12 0.28 0.28 EBITDA Price / Volumes Cost of Other Adjusted FX EBITDA (million metric tons) Q2 17 Yield Sales EBITDA Impact Q2 18 (1) Revenue adjusted for Brazil VAT reclass (2) Reflects freight revenue reclass Note: Cost of Sales includes raw material costs, collection costs and factory costs. (3) Adjusted for restructuring charges of $15.0 million for closure of Argentina gelatin plant Key Drivers: Non-GAAP Adj. EBITDA Margin Food • Continued macro economic challenges in Argentina forced strategic 14 decision to close Hurlingham gelatin facility. Significant portion of 12 11.6% 11.5% sales to be fulfilled from Rousselot system. 10.5% 10.6% 10.7% 10 • Global collagen business remains strong with improving demand for 8 specialty products 6 4 • Edible fats margins pressured in quarter due to declining palm oil and soybean oil 2 0 • Our natural casings business delivered slightly lower earnings due to Q2 Q3 Q4 Q1 Q2 margin compression 2017 2017 2017 2018 2018

7 Fuel Segment (Does not include Diamond Green Diesel JV) US$ and metric tons Q2 Q3 Q4 Total Q1 Q2 (millions) 2017 2017 2017 2017 2018 2018 Adj. EBITDA Bridge Q2-2017 to Q2-2018 (millions) Revenue $67.4 $61.9 $76.8 $265.8 $84.1 (1) $71.1 (1) Gross Margin 12.7 7.6 21.4 55.4 24.2 13.7 $4.5 15 $1.1 $13.6 Gross Margin % 18.8% 12.3% 27.9% 20.8% 28.8% 19.3% $12.5 SG&A 2.9 (0.5) 4.7 10.4 (1.4) 0.2 $9.9 10 ($3.9) SG&A Margin % 4.3% -0.8% 6.1% 3.9% -1.7% 0.2% ($0.7) $2.7 Operating Income 2.1 0.2 8.1 14.0 17.2 5.0 5 Adj. EBITDA (2) $9.9 $8.1 $16.6 $57.6 (3) $13.0 (3) $13.6 Raw Material Processed * 0.29 0.28 0.32 1.19 0.30 0.27 0 (million metric tons) EBITDA Price / Volumes Cost of Other Adjusted FX EBITDA (1) Reflects freight revenue reclass Q2 17 Yield Sales EBITDA Impact Q2 18 (2) Does not include DGD EBITDA (3) Reflects move of $12.6 million 2017 retrospective blenders tax credit from Q1 2018 approved in February 2018 to total 2017 EBITDA Note: Cost of Sales includes raw material costs, collection costs and factory costs. * Excludes raw material processed at the DGD joint venture. Key Drivers: Non-GAAP Adj. EBITDA Margin Fuel • Ecoson, European bioenergy business, continues to deliver 25 21.6% strong results with increased performance and strong sales 20 19.1% volumes 15.5% 15 14.7% 13.1% • N. American biodiesel improves results with operational 10 efficiencies and higher low sulfur diesel pricing. No BTC in 5 results. 0 • Rendac, European disposal rendering business, continues Q2 Q3 Q4 Q1 Q2 2017 2017 2017 2018 2018 to deliver consistent results with strong supply volumes Note: Moved $12.6 million of 2017 retrospective blenders tax credit from Q1 2018 approved in February 2018 to total 2017 EBITDA

8 DGD – ENTITY LEVEL DGD JV exploring phase ➢ Q2 2018 Entity EBITDA of $36.3 million or three expansion $1.05 per gallon on 34.8 million gallons of 600 - 700 million sales gallons ➢ Lower volumes, higher operating costs, hedge losses and supply chain disruption costs reflected in lower operating margin ➢ Received $25 million partner dividend from DGD ➢ Expansion in commissioning stage and anticipate being on line mid-August Diamond Green Diesel (50% Joint Venture) ➢ LCFS premium now around $189.5/metric ton or $1.90/gallon (per Jacobsen 7-27-18) Q1 Q2 US$ (millions) 2014 2015 2016 2017 2018 2018 ➢ No Blenders Tax Credit in results EBITDA (Entity) $163.3 $177.0 $174.4 * $246.8 $39.7 $36.3 EBITDA (Darling's share) 81.6 88.5 87.2 * 123.4 19.9 18.2 Gallons Produced 127.3 158.8 158.1 161.3 37.1 33.2 *Includes 2017 retroactive blenders tax credit of $160.4 million that was approved in February 2018 and recorded in Q1 2018

Balance Sheet Highlights and Debt Summary 9 (US$,Balance in thousands) Sheet HighlightsJune 30, 2018 Debt Summary (US$,Cash in thousands)(includes restricted cash Juneof $142) 30, 2018 (US$, in thousands) June 30, 2018 Cash (includes restricted cash$104,262 of $142) $ 104,262 Amended Credit Agreement Accounts receivable 371,291 Accounts receivable 371,291 Revolving Credit Facility $ 25,631 Total InventoriesTotal Inventories 370,555 370,555 Term Loan A 87,670 Net workingNet capitalworking capital 338,672 338,672 Term Loan B 485,300 Net property,Net property, plant and plant equipment and equipment 1,624,354 1,624,354 5.375% Senior Notes due 2022 494,397 Total assets 4,856,916 Total assets 4,856,916 3.625% Senior Notes due 2026 591,581 Total debt 1,695,289 Total debt 1,695,289 Other Notes and Obligations 10,710 Shareholders'Shareholders' equity equity $2,238,031$ 2,338,031 Total Debt: $ 1,695,289 Historical Leverage Ratios 2014 - 2018 Leverage Ratio Credit June 30, 2018 Actual Agreement Total Debt to EBITDA: 3.31x 5.50x

10 Appendix – Additional Information

11 US$ and metric tons Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 (millions) 2016 2016 2016 2016 2016 2017 2017 2017 2017 2017 2018 2018 Revenue $476.2 $543.0 $531.4 $538.5 $2,089.1 $552.6 $549.1 $575.5 $562.3 $2,239.5 $485.8 (1) $498.8 (1) Gross Margin 103.5 126.8 117.8 116.2 464.3 120.0 126.9 126.0 122.0 494.9 116.7 128.0 Gross Margin % 21.7% 23.4% 22.2% 21.6% 22.2% 21.7% 23.1% 21.9% 21.7% 22.1% 24.0% 25.7% SG&A 44.7 42.7 38.4 41.5 167.3 44.8 42.9 44.8 45.8 178.3 48.3 43.9 SG&A Margin % 9.4% 7.9% 7.2% 7.7% 8.0% 8.1% 7.8% 7.8% 8.1% 8.0% 9.9% 8.8% Operating Income 14.5 42.0 35.8 25.9 118.2 31.5 39.7 34.2 26.9 132.3 21.7 37.3 Adj. EBITDA (2) $58.9 $84.1 $79.5 $74.6 $297.1 $75.2 $84.0 $81.1 $76.2 $316.5 $68.5 $84.1 Adj. EBITDA Margin % 12.4% 15.5% 15.0% 13.9% 14.2% 13.6% 15.3% 14.1% 13.6% 14.1% 14.1% 16.9% Raw Material Processed 1.97 1.97 1.97 2.06 7.97 2.05 2.02 2.04 2.13 8.24 2.12 2.13 (millions of metric tons) (1) Reflects freight revenue reclass and deconsolidation of BestHides (2) Does not include Unconsolidated Subsidiaries EBITDA

Feed Ingredients Segment – Net Sales 12 Change in Net Sales – Year over Year Three Months Ended July 1, 2017 over June 30, 2018 Rendering Sales Change in Net Sales - 2Q17 to 2Q18 Total Used Fats Proteins Other (1) Rendering Cooking Oil Bakery Other (2) Total Net Sales Three Months Ended July 1, 2017 $ 160.2 $ 195.8 $ 73.5 $ 429.5 $ 45.4 $ 51.6 $ 22.6 $ 549.1 Changes: Increase/(Decrease) in sales volumes 12.7 13.9 - 26.6 1.7 (4.2) - 24.1 Increase/(Decrease) in finished product prices (29.4) 19.1 - (10.3) 3.6 1.9 - (4.8) Increase/(Decrease) due to currency exchange rates 2.4 6.4 0.3 9.1 - - - 9.1 Freight Revenue (revenue recognition) (8.8) (13.7) (1.5) (24.0) (2.7) (4.8) - (31.5) Other change - - (43.3) (43.3) - - (3.9) (47.2) Total Change: (23.1) 25.7 (44.5) (41.9) 2.6 (7.1) (3.9) (50.3) Net Sales Three Months Ended June 30, 2018 $ 137.1 $ 221.5 $ 29.0 $ 387.6 $ 48.0 $ 44.5 $ 18.7 $ 498.8 Change in Net Sales – Year over Year Six Months Ended July 1, 2017 over June 30, 2018 Rendering Sales Change in Six Months End Net Sales Total Used Q2 2017 to Q2 2018 Fats Proteins Other (1) Rendering Cooking Oil Bakery Other (2) Total Net Sales Six Months Ended July 1, 2017 $ 318.2 $ 394.0 $ 147.0 $ 859.2 $ 89.5 $ 107.7 $ 45.3 $ 1,101.7 Changes: Increase/(Decrease) in sales volumes 17.4 21.2 - 38.6 2.7 (8.7) - 32.6 Increase/(Decrease) in finished product prices (43.6) 19.9 - (23.7) (2.2) 2.8 - (23.1) Increase/(Decrease) due to currency exchange rates 6.8 16.7 0.8 24.3 0.1 - - 24.4 Freight Revenue (revenue recognition) (18.1) (26.9) (2.8) (47.8) (5.4) (10.6) - (63.8) Other change - - (84.7) (84.7) - - (2.5) (87.2) Total Change: (37.5) 30.9 (86.7) (93.3) (4.8) (16.5) (2.5) (117.1) Net Sales Six Months Ended June 30, 2018 $ 280.7 $ 424.9 $ 60.3 $ 765.9 $ 84.7 $ 91.2 $ 42.8 $ 984.6 (1) Rendering Net Sales- Other category includes hides, pet food, and service charges (2) Other Net Sales category includes trap services and industrial residual services through May 21, 2018 (Sale of TRS)

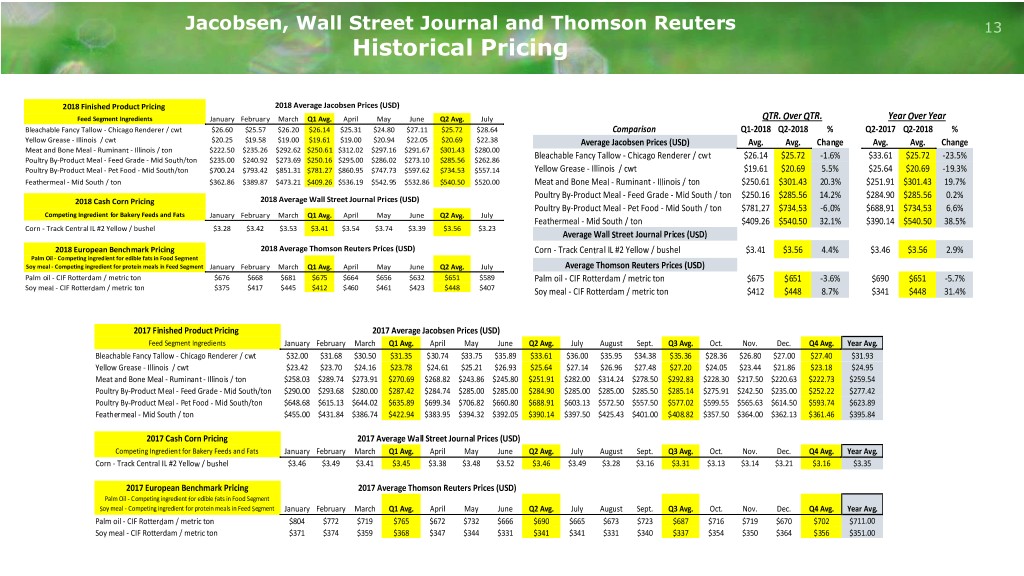

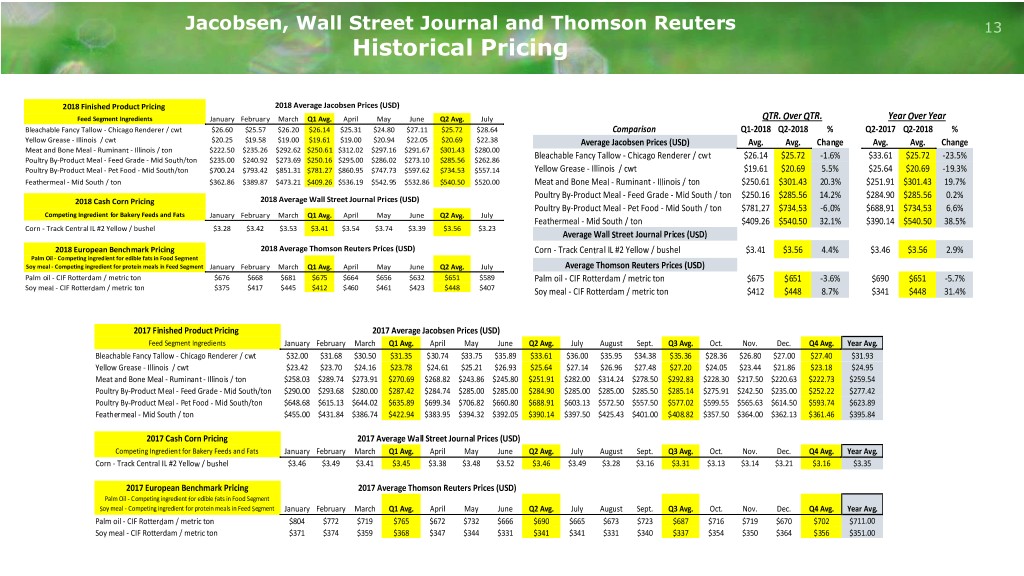

Jacobsen, Wall Street Journal and Thomson Reuters 13 Historical Pricing 2018 Finished Product Pricing 2018 Average Jacobsen Prices (USD) Feed Segment Ingredients January February March Q1 Avg. April May June Q2 Avg. July QTR. Over QTR. Year Over Year Bleachable Fancy Tallow - Chicago Renderer / cwt $26.60 $25.57 $26.20 $26.14 $25.31 $24.80 $27.11 $25.72 $28.64 Comparison Q1-2018 Q2-2018 % Q2-2017 Q2-2018 % Yellow Grease - Illinois / cwt $20.25 $19.58 $19.00 $19.61 $19.00 $20.94 $22.05 $20.69 $22.38 Average Jacobsen Prices (USD) Avg. Avg. Change Avg. Avg. Change Meat and Bone Meal - Ruminant - Illinois / ton $222.50 $235.26 $292.62 $250.61 $312.02 $297.16 $291.67 $301.43 $280.00 Poultry By-Product Meal - Feed Grade - Mid South/ton $235.00 $240.92 $273.69 $250.16 $295.00 $286.02 $273.10 $285.56 $262.86 Bleachable Fancy Tallow - Chicago Renderer / cwt $26.14 $25.72 -1.6% $33.61 $25.72 -23.5% Poultry By-Product Meal - Pet Food - Mid South/ton $700.24 $793.42 $851.31 $781.27 $860.95 $747.73 $597.62 $734.53 $557.14 Yellow Grease - Illinois / cwt $19.61 $20.69 5.5% $25.64 $20.69 -19.3% Feathermeal - Mid South / ton $362.86 $389.87 $473.21 $409.26 $536.19 $542.95 $532.86 $540.50 $520.00 Meat and Bone Meal - Ruminant - Illinois / ton $250.61 $301.43 20.3% $251.91 $301.43 19.7% Poultry By-Product Meal - Feed Grade - Mid South / ton $250.16 $285.56 14.2% $284.90 $285.56 0.2% 2018 Cash Corn Pricing 2018 Average Wall Street Journal Prices (USD) Poultry By-Product Meal - Pet Food - Mid South / ton $781.27 $734.53 -6.0% $688.91 $734.53 6.6% Competing Ingredient for Bakery Feeds and Fats January February March Q1 Avg. April May June Q2 Avg. July Feathermeal - Mid South / ton $409.26 $540.50 32.1% $390.14 $540.50 38.5% Corn - Track Central IL #2 Yellow / bushel $3.28 $3.42 $3.53 $3.41 $3.54 $3.74 $3.39 $3.56 $3.23 Average Wall Street Journal Prices (USD) 2018 European Benchmark Pricing 2018 Average Thomson Reuters Prices (USD) Corn - Track Central IL #2 Yellow / bushel $3.41 $3.56 4.4% $3.46 $3.56 2.9% Palm Oil - Competing ingredient for edible fats in Food Segment Soy meal - Competing ingredient for protein meals in Feed Segment January February March Q1 Avg. April May June Q2 Avg. July Average Thomson Reuters Prices (USD) Palm oil - CIF Rotterdam / metric ton $676 $668 $681 $675 $664 $656 $632 $651 $589 Palm oil - CIF Rotterdam / metric ton $675 $651 -3.6% $690 $651 -5.7% Soy meal - CIF Rotterdam / metric ton $375 $417 $445 $412 $460 $461 $423 $448 $407 Soy meal - CIF Rotterdam / metric ton $412 $448 8.7% $341 $448 31.4% 2017 Finished Product Pricing 2017 Average Jacobsen Prices (USD) Feed Segment Ingredients January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. Bleachable Fancy Tallow - Chicago Renderer / cwt $32.00 $31.68 $30.50 $31.35 $30.74 $33.75 $35.89 $33.61 $36.00 $35.95 $34.38 $35.36 $28.36 $26.80 $27.00 $27.40 $31.93 Yellow Grease - Illinois / cwt $23.42 $23.70 $24.16 $23.78 $24.61 $25.21 $26.93 $25.64 $27.14 $26.96 $27.48 $27.20 $24.05 $23.44 $21.86 $23.18 $24.95 Meat and Bone Meal - Ruminant - Illinois / ton $258.03 $289.74 $273.91 $270.69 $268.82 $243.86 $245.80 $251.91 $282.00 $314.24 $278.50 $292.83 $228.30 $217.50 $220.63 $222.73 $259.54 Poultry By-Product Meal - Feed Grade - Mid South/ton $290.00 $293.68 $280.00 $287.42 $284.74 $285.00 $285.00 $284.90 $285.00 $285.00 $285.50 $285.14 $275.91 $242.50 $235.00 $252.22 $277.42 Poultry By-Product Meal - Pet Food - Mid South/ton $648.68 $615.13 $644.02 $635.89 $699.34 $706.82 $660.80 $688.91 $603.13 $572.50 $557.50 $577.02 $599.55 $565.63 $614.50 $593.74 $623.89 Feathermeal - Mid South / ton $455.00 $431.84 $386.74 $422.94 $383.95 $394.32 $392.05 $390.14 $397.50 $425.43 $401.00 $408.82 $357.50 $364.00 $362.13 $361.46 $395.84 2017 Cash Corn Pricing 2017 Average Wall Street Journal Prices (USD) Competing Ingredient for Bakery Feeds and Fats January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. Corn - Track Central IL #2 Yellow / bushel $3.46 $3.49 $3.41 $3.45 $3.38 $3.48 $3.52 $3.46 $3.49 $3.28 $3.16 $3.31 $3.13 $3.14 $3.21 $3.16 $3.35 2017 European Benchmark Pricing 2017 Average Thomson Reuters Prices (USD) Palm Oil - Competing ingredient for edible fats in Food Segment Soy meal - Competing ingredient for protein meals in Feed Segment January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. Palm oil - CIF Rotterdam / metric ton $804 $772 $719 $765 $672 $732 $666 $690 $665 $673 $723 $687 $716 $719 $670 $702 $711.00 Soy meal - CIF Rotterdam / metric ton $371 $374 $359 $368 $347 $344 $331 $341 $341 $331 $340 $337 $354 $350 $364 $356 $351.00

Food Segment - Historical 14 US$ and metric tons Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 (millions) 2016 2016 2016 2016 2016 2017 2017 2017 2017 2017 2018 2018 Revenue (1) $246.6 $270.5 $260.2 $278.4 $1,055.7 $266.2 $278.4 $298.9 $313.5 $1,157.0 $305.5 (2) $276.7 (2) Gross Margin 62.4 57.9 50.7 56.6 227.6 56.8 56.0 60.2 63.6 236.6 56.3 51.9 Gross Margin % 25.3% 21.4% 19.5% 20.3% 21.6% 21.3% 20.1% 20.1% 20.3% 20.4% 18.4% 18.8% SG&A 24.9 20.4 25.3 26.6 97.2 25.0 26.7 25.5 27.4 104.6 23.9 22.2 SG&A Margin % 10.1% 7.5% 9.7% 9.6% 9.2% 9.4% 9.6% 8.5% 8.7% 9.0% 7.8% 8.0% Operating Income 20.8 19.7 8.0 11.8 60.3 14.3 11.1 15.1 16.4 56.9 11.8 $9.3 (3) Adj. EBITDA $37.5 $37.4 $25.4 $30.1 $130.4 $31.9 $29.3 $34.6 $36.1 $131.9 $32.4 $29.7 (3) Adj. EBITDA Margin % 15.2% 13.8% 9.8% 10.8% 12.4% 12.0% 10.5% 11.6% 11.5% 11.4% 10.6% 10.7% Raw Material Processed 0.27 0.27 0.26 0.28 1.08 0.27 0.28 0.29 0.28 1.12 0.28 0.28 (millions of metric tons) (1) Revenue adjusted for Brazil VAT reclass (2) Reflects freight revenue reclass (3) Adjusted for restructuring and impairment charges of $15.0 million for closure of Argentina gelatin plant

Fuel Segment - Historical 15 US$ and metric tons Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 (millions) 2016 2016 2016 2016 2016 2017 2017 2017 2017 2017 2018 2018 Revenue $55.6 $62.3 $60.4 $68.8 $247.1 $59.7 $67.4 $61.9 $76.8 $265.8 $84.1 (1) $71.1 (1) Gross Margin 14.9 15.6 14.2 19.9 64.6 13.7 12.7 7.6 21.4 55.4 24.2 13.7 Gross Margin % 26.8% 25.0% 23.5% 28.9% 26.1% 22.9% 18.8% 12.3% 27.9% 20.8% 28.8% 19.3% SG&A 1.8 1.8 1.3 1.9 6.8 3.3 2.9 (0.5) 4.7 10.4 (1.4) 0.2 SG&A Margin % 3.2% 2.9% 2.2% 2.8% 2.8% 5.5% 4.3% -0.8% 6.1% 3.9% -1.7% 0.2% Operating Income 6.2 6.6 6.0 10.5 29.3 3.6 2.1 0.2 8.1 14.0 17.2 5.0 Adj. EBITDA $13.1 $13.8 $12.9 $18.0 $57.8 $10.4 $9.9 $8.1 $16.6 $45.0 $25.6 (2) $13.6 Adj. EBITDA Margin % 23.6% 22.2% 21.4% 26.2% 23.4% 17.4% 14.7% 13.1% 21.6% 16.9% 30.4% 19.1% Pro forma Adjusted EBITDA (3) $13.1 $13.8 $12.9 $18.0 $57.8 $13.2 $13.1 $11.2 $20.1 $57.6 $14.6 $15.7 Raw Material Processed * (millions of metric tons) 0.28 0.30 0.29 0.31 1.18 0.30 0.29 0.28 0.32 1.19 0.30 0.27 *Excludes raw material processed at the DGD joint venture. Diamond Green Diesel (50% Joint Venture) Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Q2 US$ (millions) 2016 2016 2016 2016 2016 2017 2017 2017 2017 2017 2018 2018 EBITDA (Darling's share) $9.6 $18.3 $22.5 $36.7 $87.2 $5.0 $12.4 $10.6 $15.2 $43.2 $100.1 $18.2 Pro forma Adjusted EBITDA (3) $9.6 $18.3 $22.5 $36.7 $87.2 $21.4 $32.7 $32.1 $37.3 $123.4 $36.6 $35.6 Total Gallons Produced 28.5 43.8 43.8 42.0 158.1 32.6 43.7 41.7 43.3 161.3 37.1 33.2 Total Gallons Sold/Shipped 29.1 42.7 42.5 46.6 161.0 32.7 40.5 43.0 44.3 160.4 33.4 34.8 (1) Reflects freight revenue reclass (2) Q1 2018 Adj. EBITDA contains $12.6 M retroactive 2017 blenders tax credit approved in February 2018 (3) Pro forma Adjusted EBITDA assumes blenders tax credit was received during quarters earned in 2017 and 2018 for comparison to 2016 when the blenders tax credit was prospective

16 Adjusted EBITDA is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity, and is not intended to be a presentation in accordance with GAAP. Adjusted EBITDA is presented here not as an alternative to net income, but rather as a measure of the Company’s operating performance. Since EBITDA (generally, net income plus interest expenses, taxes, depreciation and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or Adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net income/(loss) plus depreciation and amortization, goodwill and long-lived asset impairment, interest expense, (income)/loss from discontinued operations, net of tax, income tax provision, other income/(expense) and equity in net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the Company’s operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing, income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance. As a result, the Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities and 5.375% Notes and 3.625% Notes that were outstanding at June 30, 2018. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities and 5.375% Notes and 3.625% Notes, as those definitions permit further adjustments to reflect certain other non-recurring costs, non-cash charges and cash dividends from the DGD Joint Venture. Additionally, the Company evaluates the impact of foreign exchange impact on operating cash flow, which is defined as segment operating income (loss) plus depreciation and amortization.

Adjusted EBITDA 17 Adjusted EBITDA and Pro Forma Adjusted EBITDA Three Months Ended - Year over Year (US$ in thousands) June 30, July 1, 2018 2017 Net income/(loss) attributable to Darling $ (30,420) $ 9,149 Depreciation and amortization 78,454 72,990 Interest expense 23,016 22,446 Income tax expense 1,683 7,742 Restructuring and impairment charges 14,965 - Foreign currency loss 3,495 2,111 Other expense/(income), net (1,199) 3,797 Debt extinguishment costs 23,509 - Loss on sale of subsidiary 15,538 - Equity in net income of unconsolidated subsidiaries (15,236) (8,260) Net income attributable to noncontrolling interests 1,282 1,179 Adjusted EBITDA $ 115,087 $ 111,154 Foreign currency exchange impact (3,764) - Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP) $ 111,323 $ 111,154 DGD Joint Venture Adjusted EBITDA (Darling's Share) $ 18,165 $ 12,406 (1) The average rates assumption used in this calculation was the actual fiscal average rate for the three months ended June 30, 2018 of €1.00:USD$1.20 and CAD$1.00:USD$0.77 as compared to the average rate for the three months ended July 1, 2017 of €1.00:USD $1.10 and CAD$1.00:USD$0.74, respectively. Note: See slide 16 for information regarding Darling’s use of Non-GAAP measures.

DAR Listed as a Green Revenue Stock 18 FTSE Russell US Green Revenues Index – June 2018 DAR listed: DAR listed: #2 Russell 2000 Green Revenues Index #1 Consumer Goods Industry per Russell 2000 Green Revenues Index Source: FTSE Russell Factsheet June 29, 2018

19 RENEWABLE DIESEL AVOIDED GHG EMISSIONS ENERGY PRODUCTION FROM FOSSIL FUEL METRICS CONSUMPTION (Used) CONTRIBUTION (Produced) (Bio) Energy Production Energy 161 million gallons 1.9 million MT Consumption 2017 production CO2e (Bio) Fuel Production 1.9 Mln metric tons fewer GHG emissions (RD emits 85% less than fossil diesel) = GHG Raw Material Emissions Carbon Capture a CO2 equivalent of removing 450,000 Fresh Water Water cars from the road for a year Consumption Production Note: One gallon of fossil diesel emits 10.21 kg CO2 Source: EPA Metric figures are for Diamond Green Diesel renewable diesel production in 2017.

20 NET CARBON GHG EMISSION FOSSIL FUEL RAW MATERIAL FOOTPRINT METRICS EMISSIONS CARBON CAPTURE CONSUMPTION (Used) CONTRIBUTION (Produced) (Bio) Energy Production Energy Consumption 1.8 Mln metric tonnes 5.3 Mln metric tonnes 3.5 Mln metric tonnes (Bio) Fuel CO e emissions 2 CO2e emissions CO2e emissions Production avoided avoided 3.5 Mln MT GHG Raw Material Emissions Carbon Capture of net AVOIDED emissions = a CO2 equivalent of planting Fresh Water Water 161 million trees Consumption Production Note: A tree can absorb up to 48 lbs. (21.8 kg) of CO2 per year. Source: EPA Metric figures are for global Darling Ingredients rendering operations in 2017.

21 NET WATER WATER FRESH WATER WATER CONTRIBUTION METRICS CONSUMPTION PRODUCTION CONSUMPTION (Used) CONTRIBUTION (Produced) (Bio) Energy Production Energy Consumption 1.53 Bln gallons 1.56 Bln gallons 30 Mln gallons (Bio) Fuel 5.8 Mln cubic meters 5.9 Mln cubic meters Production 100 K cubic meters 1.56 billion gallons GHG Raw Material of water PRODUCED = Emissions Carbon Capture equivalent of 2,363 Olympic-sized Fresh Water Water swimming pools Consumption Production Note: One pool has 660,253 gallons of water. Source: www.livestrong.com Metric figures are for Darling Ingredients rendering operations in 2017 (excludes Rousselot Gelatin Operations)

22 Darling Investor/Analyst Day October 11, 2018 Hotel Monteleone – New Orleans Tour of Diamond Green Diesel