Exhibit - 99.1 Investor - Analyst Day October 2018 Randall C. Stuewe, Chairman and CEO Brad Phillips, EVP Chief Financial Officer John Bullock, EVP Chief Strategy Officer Melissa A. Gaither, VP IR and Global Communications

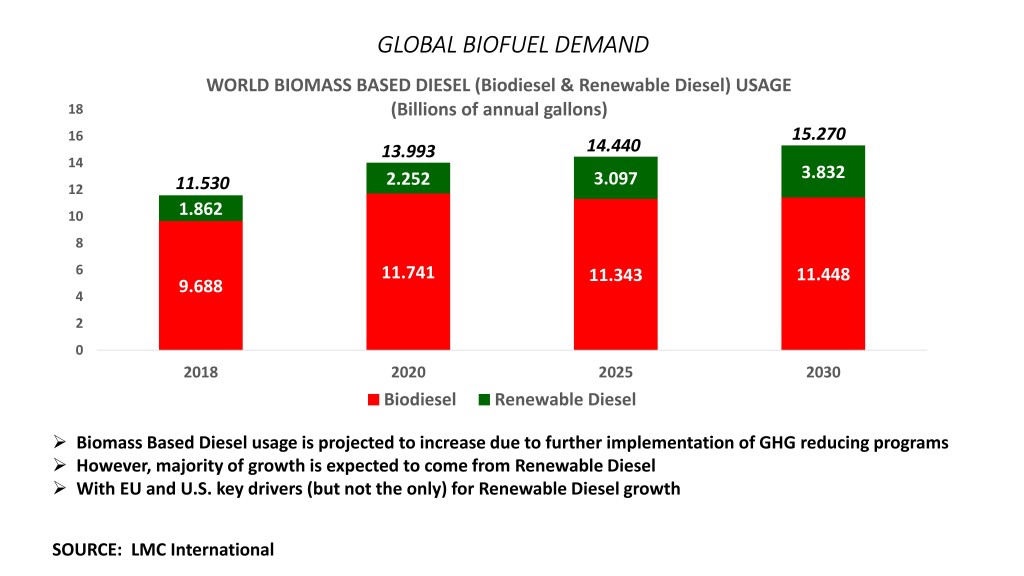

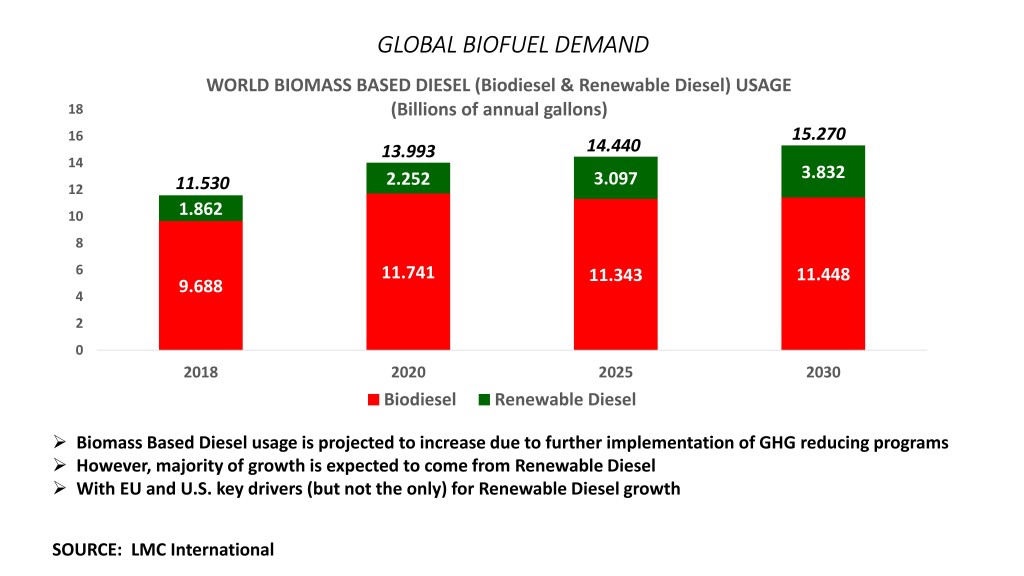

GLOBAL BIOFUEL DEMAND WORLD BIOMASS BASED DIESEL (Biodiesel & Renewable Diesel) USAGE 18 (Billions of annual gallons) 16 15.270 13.993 14.440 14 2.252 3.097 3.832 12 11.530 10 1.862 8 6 11.741 11.343 11.448 9.688 4 2 0 2018 2020 2025 2030 Biodiesel Renewable Diesel ➢ Biomass Based Diesel usage is projected to increase due to further implementation of GHG reducing programs ➢ However, majority of growth is expected to come from Renewable Diesel ➢ With EU and U.S. key drivers (but not the only) for Renewable Diesel growth SOURCE: LMC International

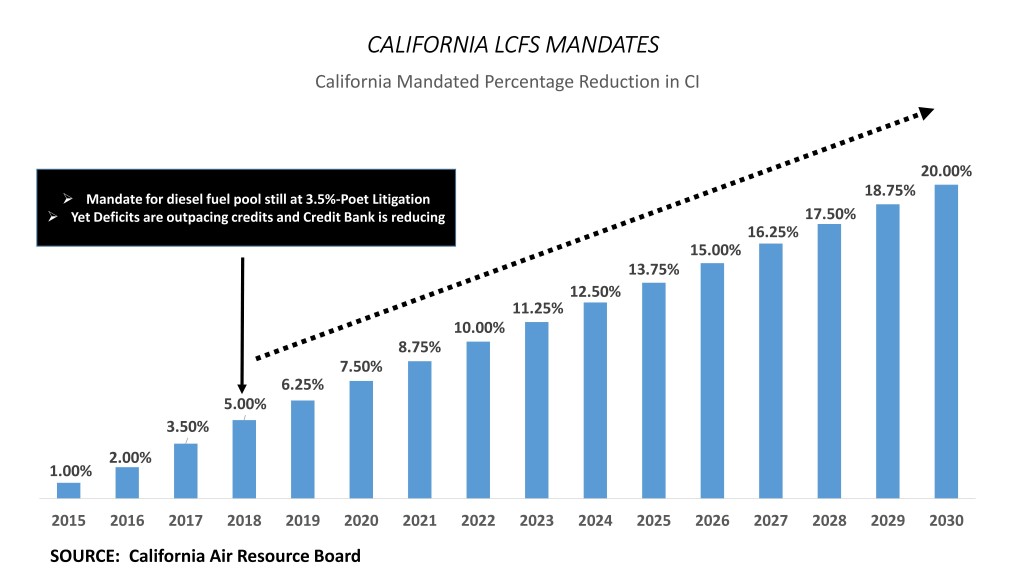

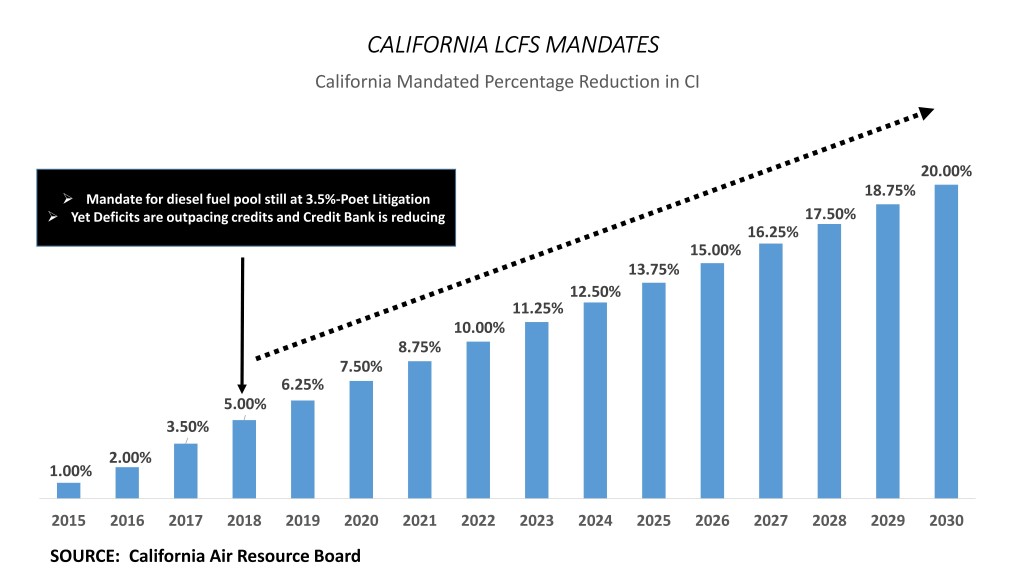

CALIFORNIA LCFS MANDATES California Mandated Percentage Reduction in CI 20.00% 18.75% ➢ Mandate for diesel fuel pool still at 3.5%-Poet Litigation ➢ Yet Deficits are outpacing credits and Credit Bank is reducing 17.50% 16.25% 15.00% 13.75% 12.50% 11.25% 10.00% 8.75% 7.50% 6.25% 5.00% 3.50% 2.00% 1.00% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 SOURCE: California Air Resource Board

California Air Resource Board Data GAS GALLON EQUIVALENT DEMAND/SUPPLY FUEL SCENARIO (Illustrative Model) Millions of Annual Gallons 4500 4000 3500 3000 2500 2000 1500 1000 500 0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Sugar Ethanol 70 106 106 106 70 35 0 0 0 0 0 35 70 Cellulosic Ethanol 1 3 5 8 11 16 21 29 36 49 67 84 106 Electricity 81 87 94 103 113 124 138 153 170 186 203 219 235 Alternative Jet Fuel 0 22 45 90 168 196 196 224 224 224 252 280 308 Biomethane 153 201 224 247 272 296 330 334 342 350 357 363 371 Biodiesel 218 299 381 463 544 544 544 544 544 544 544 544 544 Starch Ethanol 1,026 975 955 938 965 991 1,008 992 983 961 940 882 822 Renewable Diesel 504 616 728 839 953 1,063 1,063 1,119 1,119 1,231 1,343 1,511 1,679 SOURCE: California Air Resources Board-August 15 2018

SUPER DIAMOND DYNAMICS 275 million gallons annually increased to 675 million gallons annually INCREASE CAPACITY (increase of 400 million gallons-145%) Parallel Independent plant ➢ Ability to market Naphtha to low CI markets + ➢ Capture greater % of LCFS value ➢ Lower CI scores improving sales value per gallon ➢ Improved feedstock sourcing flexibility -CN rail unloading (in addition to existing KCS) IMPROVED -Ability to receive feedstock via water (domestic and international) COMPETITIVE CAPABILITY -Additional truck unloading capability ➢ Expanded ability to load renewable diesel by rail ➢ Reduced operating cost per gallon (fixed cost)

VALUE OF DARLING VERTICAL INTEGRATION Upstream & Downstream Darling Annual Sales-Feed Ingredients Segment F/H 2018 (000’s of $) • 37% of Darlings Feed Ingredients Segment Revenue is from sale of fats which are positively impacted by demand created by Super Diamond $365,387 • Darling’s is the ONLY company with BOTH a supply of $619,234 feedstock AND vertical integration into Renewable Diesel…it is the reason we can expand DGD as well as a primary (but not the only) driver to improvement in profitability of our Non-Biofuel business segments Animal Fats/UCO Proteins SOURCE: Company Financials

DIAMOND GREEN DIESEL-The Past and the Future (Entity Basis) EBITDA PER GALLON RENEWABLE DIESEL 160.6 Annual Gallons-Millions We believe DGD will have the opportunity to 126.2 improve its $/gallon margin 2019 forward for 156.6 161.0 the following reasons: 2019 FORWARD ➢ 4 year average EBITDA per gallon is $1.26 $1.54 with Blenders Tax Credit (BTC) $1.29 ➢ $1.13 FH 2018 averaged $1.12/gallon without $1.08 BTC ➢ Capturing greater % of LCFS ➢ Lowering CI scores ➢ Naphtha to Low CI Markets ➢ Reduced per gallon operating expenses 2014 2015 2016 2017 SOURCE: Company Financials

Accelerating growth through Super Diamond expansion 8 Ingredients Business Historical Free Cash FCF ($ in millions) Projected Darling Pro Forma EBITDA (est.) $ in millions $1,194 3 Year Average (2015 - 2017) $742 $742 $827 Ingredients EBITDA Average: $ 431 CAPEX: Maintenance CAPEX (195) Organic Growth CAPEX (54) 2019 2020 2021 2022 DARLING Share DGD BTC $138 $138 $175 $338 DARLING DGD EBITDA- Free Cash $ 182 $173 $173 $221 $425 WITHOUT BTC Darling Non-DGD EBITDA $431 $431 $431 $431 Solid FCF from Ingredients Business alone Note: DAR Ingredients business EBITDA held at $431. through 2022 Projected DGD Entity Pro Forma EBITDA (est.) $ in millions Projected Annual Production Gallons - Renewable Diesel $900 $851 ASSUMPTIONS: • Business operates at current 800 $800 675 commodity levels 700 $700 • Blenders tax credit (BTC) held $600 at $1.00 through 2022 600 $500 $441 • DGD EBITDA run rate at 500 historical $1.26/gal with BTC $347 $347 350 $400 • DGD fully de-levered by start 400 275 275 $300 up in back half 2021 300 Proforma Proforma EBITDA $200 200 $100 100 $- 2019 2020 2021 2022 0 2019 2020 2021 2022 Note: Assumes $1.26 /gal EBITDA without BTC included. The Super Diamond expansion project is subject to final approval by the Darling and Valero Board of Directors. Gallons in Millions

Safe Harbor Statement 9 This presentation contains “forward-looking” statements regarding the business operations and prospects of the Company, including its Diamond Green Diesel joint venture, and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” “assumption,” and other words referring to events that may occur in the future. These statements reflect the Company’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like the Renewable Fuel Standards Program (RFS2), low carbon fuel standards (LCFS) and tax credits for biofuels both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of 2009 H1N1 flu (initially known as “Swine Flu”), highly pathogenic strains of avian influenza (collectively known as “Bird Flu”), bovine spongiform encephalopathy (or “BSE”), porcine epidemic diarrhea (“PED”) or other diseases associated with animal origin in the United States or elsewhere; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign regulations (including, without limitation, China) affecting the industries in which the Company operates or its value added products (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations); risks associated with the renewable diesel plant in Norco, Louisiana owned and operated by a joint venture between the Company and Valero Energy Corporation, including possible unanticipated operating disruptions and issues related to the potential expansion project; risks and uncertainties relating to international sales and operations, including imposition of tariffs, quotas, trade barriers and other trade protection measures imposed by foreign countries; difficulties or a significant disruption in our information systems or failure to implement new systems and software successfully, including our ongoing enterprise resource planning project; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; uncertainty regarding the exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding the Company, its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. The Company cautions readers that all forward-looking statements speak only as of the date made, and the Company undertakes no obligation to update any forward-looking statements, whether as a result of changes in circumstances, new events or otherwise.

Non-U.S. GAAP Measures 10 Adjusted EBITDA is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity, and is not intended to be a presentation in accordance with GAAP. Adjusted EBITDA is presented here not as an alternative to net income, but rather as a measure of the Company’s operating performance. Since EBITDA (generally, net income plus interest expenses, taxes, depreciation and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or Adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net income/(loss) plus depreciation and amortization, goodwill and long-lived asset impairment, interest expense, (income)/loss from discontinued operations, net of tax, income tax provision, other income/(expense) and equity in net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the Company’s operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing, income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance. As a result, the Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities and 5.375% Notes and 3.625% Notes that were outstanding at June 30, 2018. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities and 5.375% Notes and 3.625% Notes, as those definitions permit further adjustments to reflect certain other non-recurring costs, non-cash charges and cash dividends from the DGD Joint Venture. Additionally, the Company evaluates the impact of foreign exchange impact on operating cash flow, which is defined as segment operating income (loss) plus depreciation and amortization.