• • • US $ (in millions) Q4 2023 Q4 2022 FY 2023 FY 2022 Net Sales $ 423,836 $ 387,733 $ 1,752,065 $ 1,459,630 Cost of sales & operating expenses 311,163 294,417 1,310,581 1,102,250 Gross Margin $ 112,673 $ 93,316 $ 441,484 $ 357,380 Gain on sale of assets (8,243) (117) (8,144) (1,008) Selling, general and administrative expenses 30,195 28,073 128,464 101,681 Restructuring and asset impairment charges 9,199 21,109 14,527 21,109 Depreciation and amortization 26,655 14,722 94,991 59,029 Segment Operating Income $ 54,867 $ 29,529 $ 211,646 $ 176,569 Segment EBITDA $ 90,721 $ 65,360 $ 321,164 $ 256,707 Raw material processed (mt)* 300,000 277,000 1,220,000 1,100,000

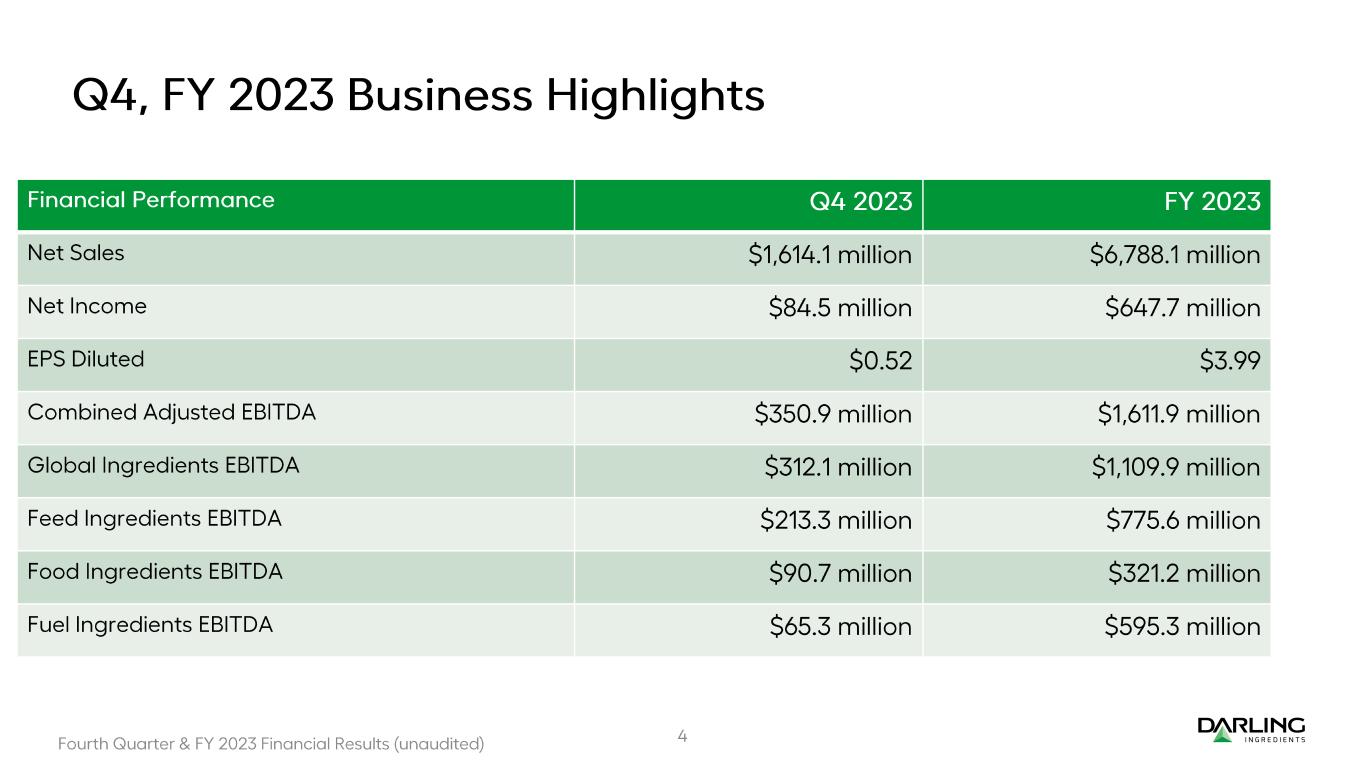

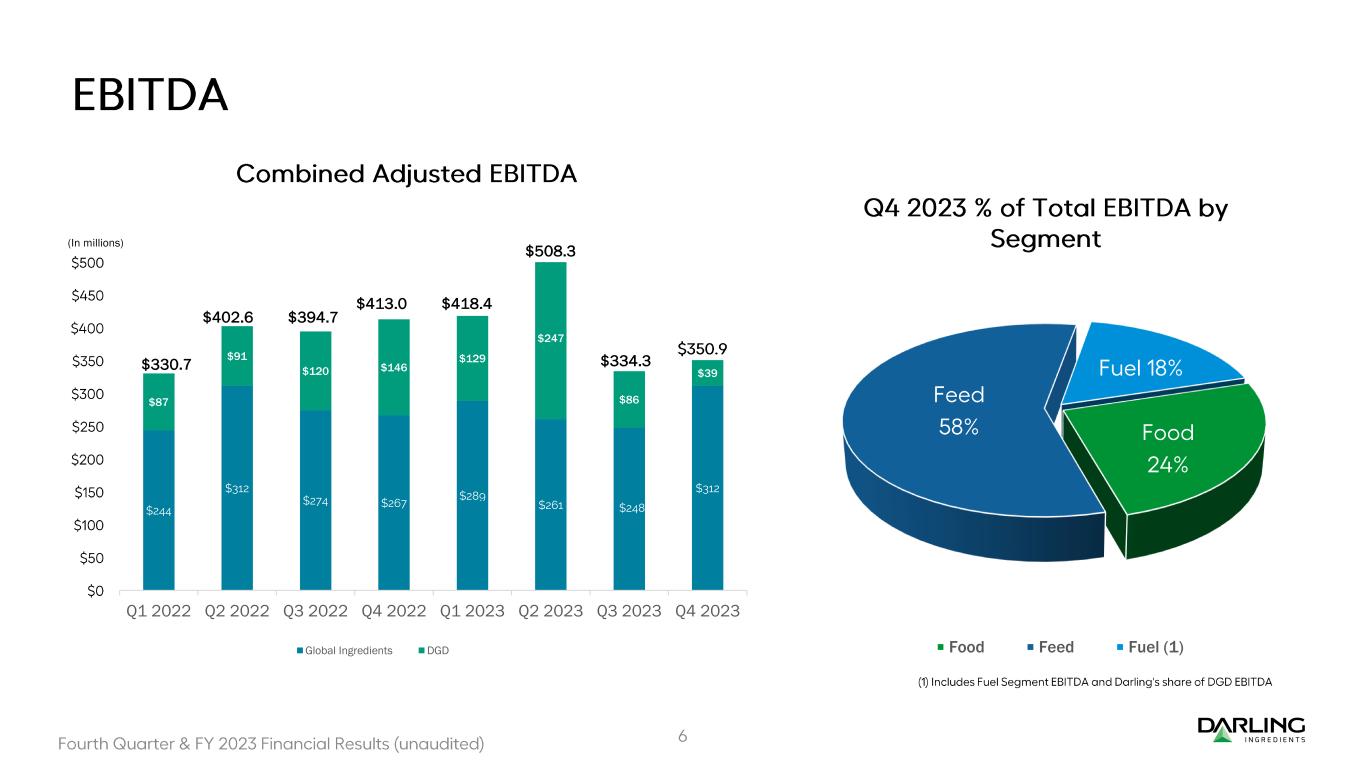

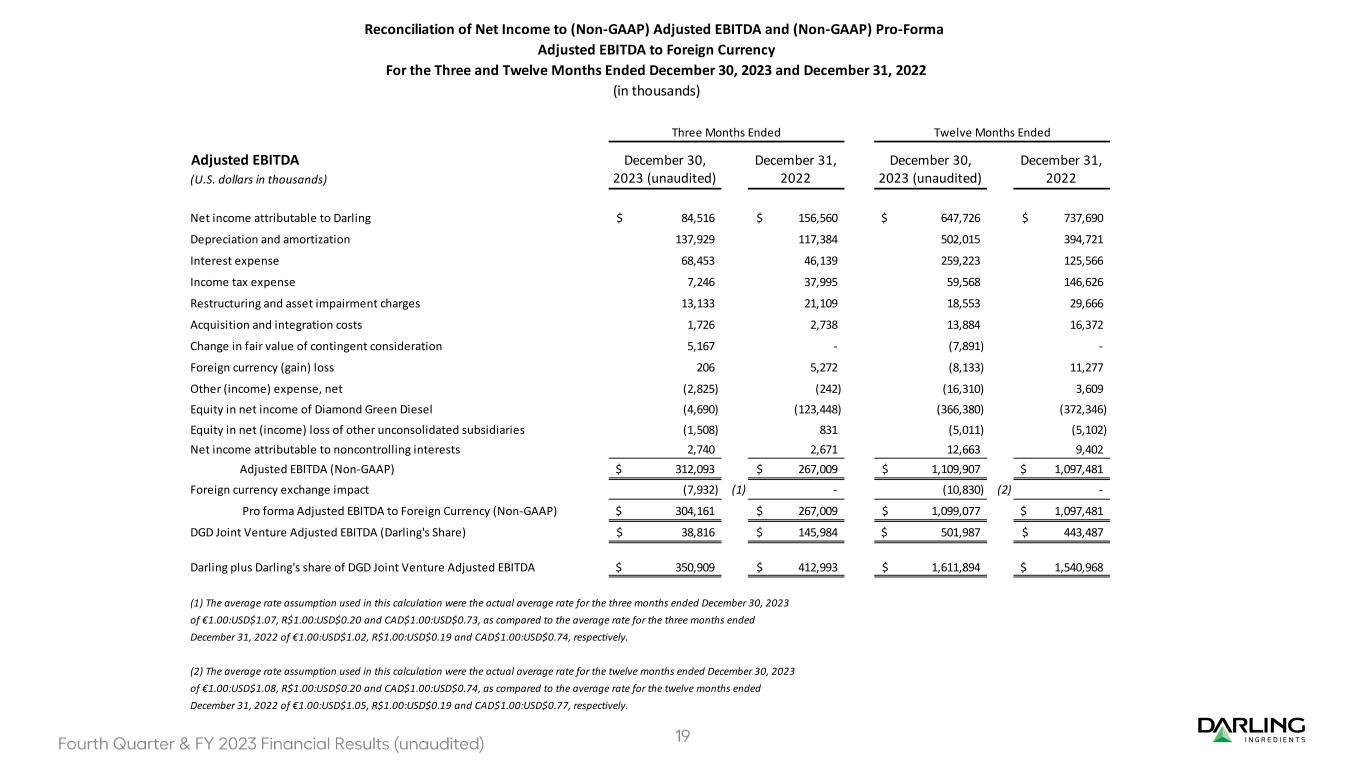

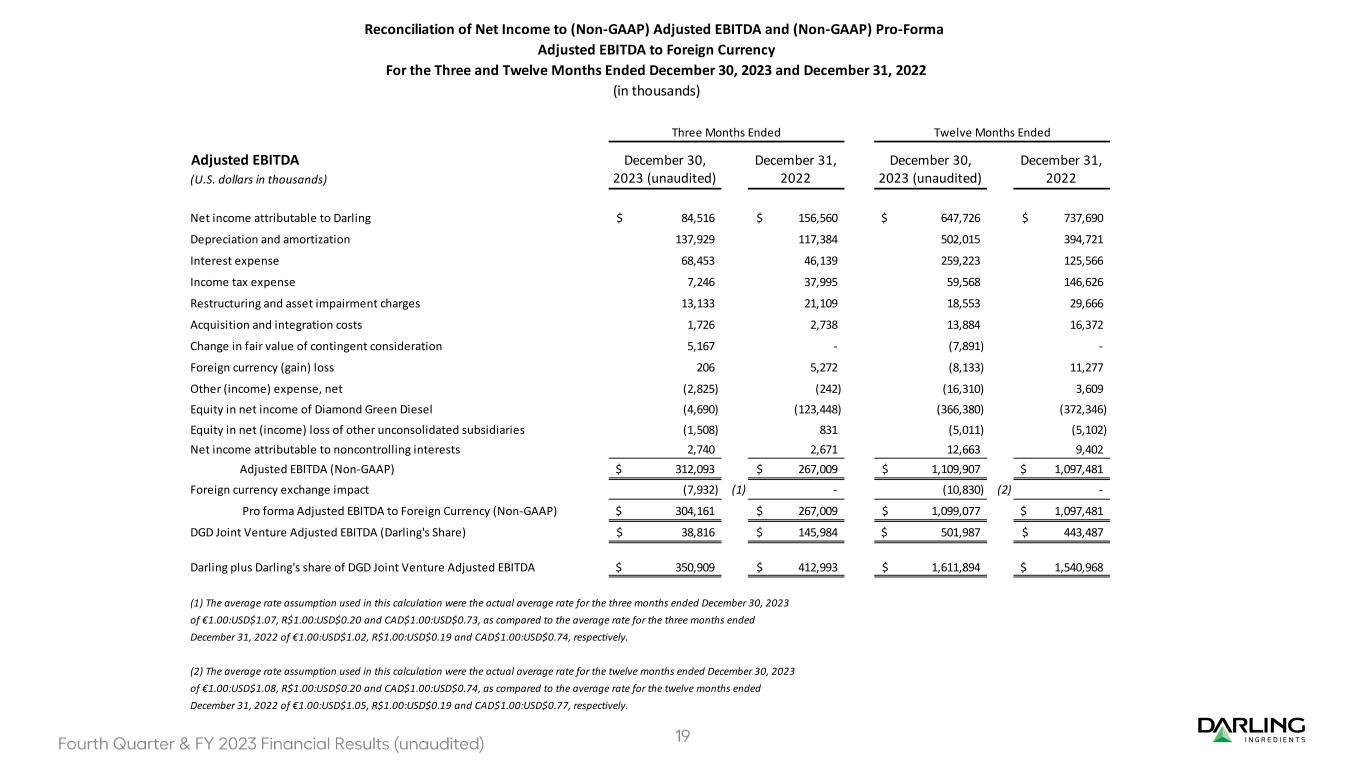

Adjusted EBITDA December 30, December 31, December 30, December 31, (U.S. dollars in thousands) 2023 (unaudited) 2022 2023 (unaudited) 2022 Net income attributable to Darling 84,516$ 156,560$ 647,726$ 737,690$ Depreciation and amortization 137,929 117,384 502,015 394,721 Interest expense 68,453 46,139 259,223 125,566 Income tax expense 7,246 37,995 59,568 146,626 Restructuring and asset impairment charges 13,133 21,109 18,553 29,666 Acquisition and integration costs 1,726 2,738 13,884 16,372 Change in fair value of contingent consideration 5,167 - (7,891) - Foreign currency (gain) loss 206 5,272 (8,133) 11,277 Other (income) expense, net (2,825) (242) (16,310) 3,609 Equity in net income of Diamond Green Diesel (4,690) (123,448) (366,380) (372,346) Equity in net (income) loss of other unconsolidated subsidiaries (1,508) 831 (5,011) (5,102) Net income attributable to noncontrolling interests 2,740 2,671 12,663 9,402 Adjusted EBITDA (Non-GAAP) 312,093$ 267,009$ 1,109,907$ 1,097,481$ Foreign currency exchange impact (7,932) (1) - (10,830) (2) - Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP) 304,161$ 267,009$ 1,099,077$ 1,097,481$ DGD Joint Venture Adjusted EBITDA (Darling's Share) 38,816$ 145,984$ 501,987$ 443,487$ Darling plus Darling's share of DGD Joint Venture Adjusted EBITDA 350,909$ 412,993$ 1,611,894$ 1,540,968$ (1) The average rate assumption used in this calculation were the actual average rate for the three months ended December 30, 2023 of €1.00:USD$1.07, R$1.00:USD$0.20 and CAD$1.00:USD$0.73, as compared to the average rate for the three months ended December 31, 2022 of €1.00:USD$1.02, R$1.00:USD$0.19 and CAD$1.00:USD$0.74, respectively. (2) The average rate assumption used in this calculation were the actual average rate for the twelve months ended December 30, 2023 of €1.00:USD$1.08, R$1.00:USD$0.20 and CAD$1.00:USD$0.74, as compared to the average rate for the twelve months ended December 31, 2022 of €1.00:USD$1.05, R$1.00:USD$0.19 and CAD$1.00:USD$0.77, respectively. Three Months Ended Twelve Months Ended Reconciliation of Net Income to (Non-GAAP) Adjusted EBITDA and (Non-GAAP) Pro-Forma Adjusted EBITDA to Foreign Currency For the Three and Twelve Months Ended December 30, 2023 and December 31, 2022 (in thousands)