Exhibit 99.1

Darling International Inc.

Lenders’ Presentation

December 2013

Creating Sustainable Food, Feed and Fuel Ingredients for a Growing Population

Forward-Looking Statements

This presentation contains forward-looking statements regarding the business, operations and prospects of Darling International and its subsidiaries and industry factors affecting them that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements. These statements are identified by words such as “may,” “will,” “begin,” “look forward,” “expect,” “believe,” “intend,” “anticipate,” “should,” “could,” “potential,” “estimate,” “continue,” “momentum,” “project,” “plan” and similar expressions and other words referring to events to occur in the future. These statements reflect Darling International’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control. Examples of forward-looking statements include, but are not limited to, statements regarding anticipated synergies, expected acquisition and integration costs, anticipated capital expenditures, potential markets and our combined strategies. Forward-looking statements (including oral representations) are only predictions or statements of current plans, which relate to the future and are therefore inherently uncertain. Forward-looking statements may differ from actual future results due to (but not limited to), and Darling’s, Rothsay’s, VION Ingredients’ and the combined company’s future results may be adversely affected by, among others, risks and uncertainties related to: disturbances in world financial, credit, commodities and stock markets; potential changes in national and foreign regulations affecting the company’s products; Darling International’s ability to successfully consummate and integrate its acquisition of Rothsay and planned acquisition of Vion, both of which are subject to conditions and circumstances beyond the control of Darling International; a decline in consumer confidence and discretionary spending; the general performance of the U.S. and global economies; global demands for biofuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs, and poultry, thus affecting available rendering feedstock; risks relating to possible third party claims of intellectual property infringement; risks associated with the development of competitive sources for alternative renewable diesel or comparable fuels; challenges associated with the Company’s ongoing enterprise resource planning system project; economic disruptions resulting from the European debt crisis; and continued or escalated conflict in the Middle East, North Korea, and: volatility of ingredient prices and their potential impact on the prices of our raw materials, our products or commodities that may be used as substitutes for our products; our continued ability to procure good quality raw materials for our products in adequate quantities; energy prices for natural gas and diesel fuel, which our operations are highly dependent on; the concentration of our revenue from a limited number of suppliers and customers; certain of our operating facilities’ dependence upon a few suppliers or a single supplier; global trendsrelating tomeat and poultry consumption and theireffect on raw material availabilityand demand for feed products; the international nature of our operations, including exchange rate and exchange control risks, general economic and political conditions, tax-related risks and export or import requirements for, or restrictions related to our products; the risks associated with the Diamond Green renewable diesel joint venture with Valero, including the potential for operational issues of the joint venture’s renewable diesel plant; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions; costs and liabilities associated with compliance with government regulations;

2

Forward Looking Statements (Cont’d)

the impact of Bovine Spongiform Encephalopathy (“BSE”) and other food safety issues on our business, including the implementation of related laws and regulations; the occurrence of any disease correctly or incorrectly linked to animals, such as Bird Flu; seasonal factors and weather which can impact the quality and volume of raw materials; potential product liability claims or product recalls; the continued service of key personnel; our dependence upon the continued and uninterrupted operation of a single operating facility in certain markets; our substantial level of indebtedness following the financing transactions related to the VION acquisition; our ability to incur additional indebtedness; the possibility of increased contributions to our multi-employer defined benefit pension plans; the occurrence of any material weaknesses in our internal control over financial reporting; any impairments in our goodwill or other intangible assets; the impact of terrorist attacks or acts of war; potential for work stoppages at our principal operating facilities, including due to labor union or works council issues; the outcome of litigation and other legal proceedings against us; any third party claims of intellectual property infringement against us; decline in consumer confidence and discretionary spending; regulatory agency approval and the satisfaction of other conditions for the completion of the VION acquisition; the lack of control Darling has over VION Ingredients until completion of the VION acquisition; uncertainty about the VION acquisition making it more difficult to maintain relationships with customers, employees or suppliers; our efforts to effectively integrate Darling’s business with Rothsay’s business and VION Ingredients’ business; our ability to realize growth opportunities and cost synergies as a result of the Rothsay and acquisitions; our ability to effectively manage our expanded operations following the Rothsay and VION acquisitions; any future acquisitions or strategic alliances; and the successful consummation of the VION acquisition and any future acquisitions.

3

Forward-Looking Statements (Cont’d)

Recipients are cautioned not to place undue reliance on any forward-looking statements contained herein, which reflect management’s opinions only as of the date hereof. Other risks and uncertainties regarding Darling, its business and the industry in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling is under no obligation to (and expressly disclaims any such obligation to) update, revise or publicly release the results of any forward-looking statements whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this prospectus supplement and the accompanying prospectus.

This presentation also contains information about Adjusted EBITDA, which is a not measure derived in accordance with GAAP and which excludes components that are important to understanding Darling’s financial performance. Investors should recognize that this non-GAAP measure might not be comparable to similarly titled measures of other companies. This measure should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flows or liquidity prepared in accordance with accounting principles generally accepted in the United States.

4

Agenda

Introduction Executive Summary Business Overview

Combined Company Highlights Financial Summary Transaction Overview Q&A

Executive Summary

Randall C. Stuewe

Chairman and Chief Executive Officer

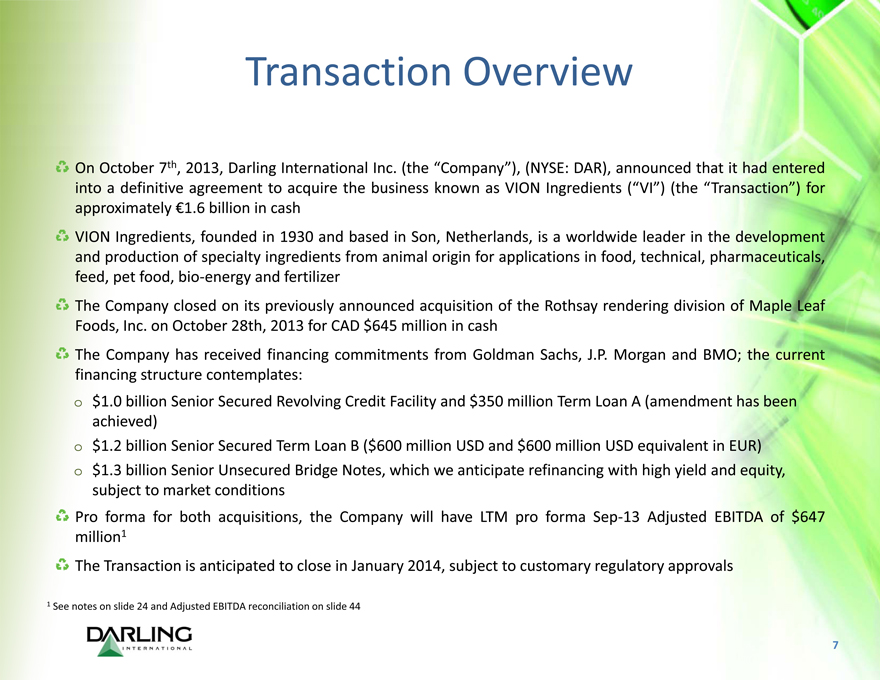

Transaction Overview

On October 7th, 2013, Darling International Inc. (the “Company”), (NYSE: DAR), announced that it had entered into a definitive agreement to acquire the business known as VION Ingredients (“VI”) (the “Transaction”) for approximately €1.6 billion in cash

VION Ingredients, founded in 1930 and based in Son, Netherlands, is a worldwide leader in the development and production of specialty ingredients from animal origin for applications in food, technical, pharmaceuticals, feed, pet food, bio-energy and fertilizer

The Company closed on its previously announced acquisition of the Rothsay rendering division of Maple Leaf Foods, Inc. on October 28th, 2013 for CAD $645 million in cash

The Company has received financing commitments from Goldman Sachs, J.P. Morgan and BMO; the current financing structure contemplates:

$1.0 billion Senior Secured Revolving Credit Facility and $350 million Term Loan A (amendment has been achieved) $1.2 billion Senior Secured Term Loan B ($600 million USD and $600 million USD equivalent in EUR) $1.3 billion Senior Unsecured Bridge Notes, which we anticipate refinancing with high yield and equity, subject to market conditions

Pro forma for both acquisitions, the Company will have LTM pro forma Sep-13 Adjusted EBITDA of $647 million1 The Transaction is anticipated to close in January 2014, subject to customary regulatory approvals

1 | | See notes on slide 24 and Adjusted EBITDA reconciliation on slide 44 |

“Legacy” Darling International is the

Oldest

Largest

Most Innovative

A Family Heritage

Darling & Co. was founded in 1882 by the Swift and Darling families to meet the needs of the growing Chicago meat-packing industry. Over 130 years old Listed as 984 on Fortune 1000

National Presence

Servicing all 50 states

Largest independent rendering company in US

One of the largest bakery residual recyclers in North America One of the largest used cooking oil recyclers in North America Top organic fertilizer company Operating one of the largest private trucking fleets in US

Pioneers

1998—Began the country’s first continuous biodiesel plant utilizing waste greases 2013 – In collaboration with Valero Energy Corporation, startup of the nation’s largest animal fat to hydrocarbon recycling facility, designed to produce 9,300 barrels of renewable diesel per day 2013– Commissioning “first of a kind” waste extraction unit

recycling solutions company

serving the nation’s food industry

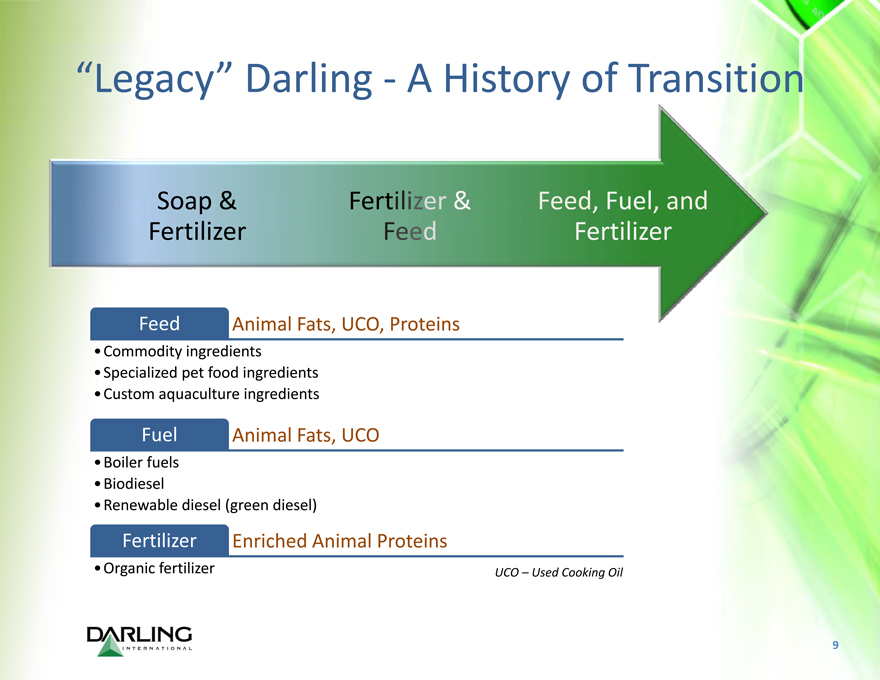

“Legacy” Darling -A History of Transition

Soap & Fertilizer

Fertilizer & Feed

Feed, Fuel, and Fertilizer

Feed

Animal Fats, UCO, Proteins

Commodity ingredients

Specialized pet food ingredients

Custom aquaculture ingredients

Fuel

Animal Fats, UCO

Boiler fuels

Biodiesel

Renewable diesel (green diesel)

Fertilizer

Enriched Animal Proteins

Organic fertilizer

UCO – Used Cooking Oil

9

“Legacy” Darling - Our Value Proposition

Transforming raw materials into value-added ingredients

Key Raw Material Streams

Beef Poultry Pork Lamb Bakery Grease Wastewater Sludges

Value Add Strategy

Pet foods

Aquaculture feeds Biofuels Animal feed Fertilizers

Grease management systems

Fresh oil delivery systems

Target

Suppliers:

Integrated packers

Regional/niche slaughterers

Markets:

Animal nutrition

Pet Food

Biofuels

Oleo-chemicals

10

The New Darling at a Glance1

Global growth platform transforming edible and inedible bio-nutrient streams into specialty products and ingredients for the food, feed, fuel, fertilizer and pharmaceutical industries

Worldwide position on five continents Global customer base Network of 140 production sites Differentiated supply chains Seeing the world through our eyes

Pro forma LTM September 2013 revenue of approximately $4.1 billion2

A substantial portion of the combined business is on a formula basis that provides a stable margin

Approximately 10,000 employees

The new Darling: Branded activities

1 | | Assumes closing of the VION acquisition |

11

Darling’s Mantra Evolves

DAR International: developed our corporate mission statement to reflect our unique position, best-in- class service and ‘green’ expertise to our raw material and supplier network:

“North America’s oldest, largest and most innovative recycling solutions company serving the food industry.”

DAR Ingredients: corporate mission statement changed to reflect our unique global positioning that is poised for growth, with expanded product, equipment, service and ingredient solutions to a diverse and worldwide marketplace:

“Global growth platform for development and production of sustainable natural ingredients from edible and inedible bio-nutrients creating a wide range of ingredients and customized specialty solutions for clients in the pharmaceutical, food, pet food, feed, fuel and fertilizer industries.”

12

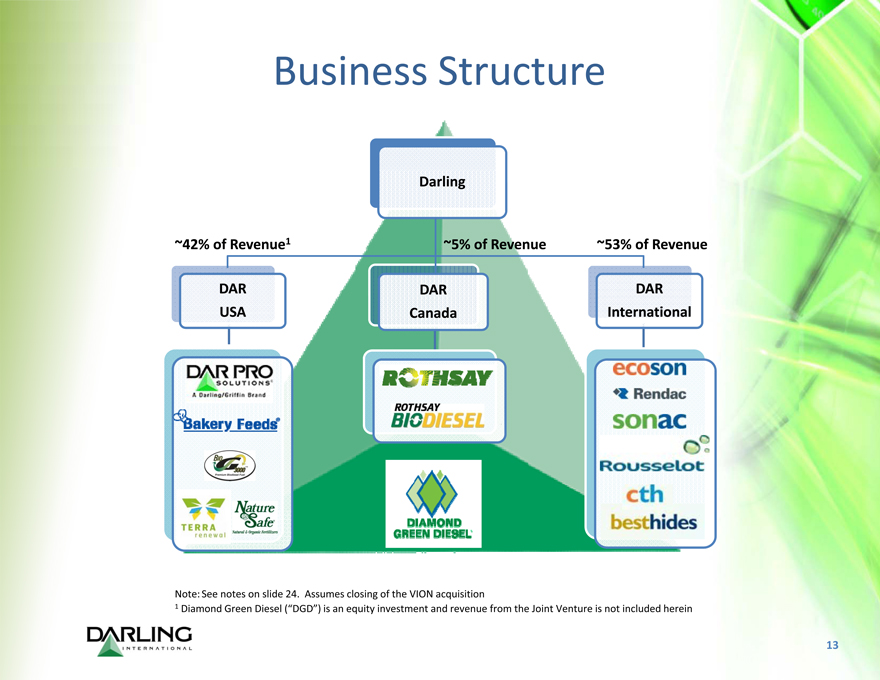

Business Structure

Darling

~42% of Revenue1

~5% of Revenue

~53% of Revenue

DAR USA

DAR

Canada

DAR International

Note: See notes on slide 24. Assumes closing of the VION acquisition

1 | | Diamond Green Diesel (“DGD”) is an equity investment and revenue from the Joint Venture is not included herein |

13

Key Investment Considerations1

Global growth platform transforming edible and inedible bio-nutrient streams into specialty products and ingredients for the food, feed, fuel, fertilizer and pharmaceutical industries

Integrated supply- chain with built- in margin management

Worldwide position on five continents with a network of 140 production sites

Access to new international markets and new product segments from recent acquisitions

Leading market positions in a diverse array of product categories with focus on continued growth

Global customer base consisting of long term relationships

Stable business platform which leads to consistent cash flow generation and a strong balance sheet

Diamond Green Diesel (“DGD”) renewable diesel production plant provides attractive growth opportunity and a value-add for Darling’s North American fat products

Strong industry fundamentals

Experienced management team

1 | | Assumes closing of the VION acquisition |

14

Business Overview

Randall C. Stuewe

Chairman and Chief Executive Officer

15

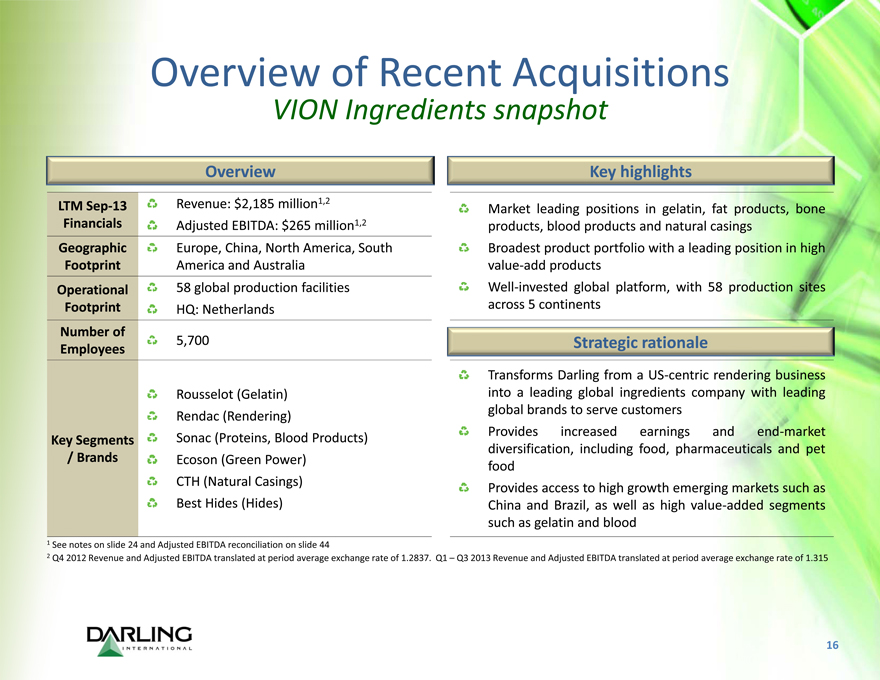

Overview of Recent Acquisitions

VION Ingredients snapshot

Overview

LTM Sep 13 Financials

Revenue: $2,185 million1,2 Adjusted EBITDA: $265 million1,2

Geographic Footprint

Europe, China, North America, South America and Australia

Operational Footprint

58 global production facilities HQ: Netherlands

Number of Employees

5,700

Key Segments

/ Brands

Rousselot (Gelatin) Rendac (Rendering)

Sonac (Proteins, Blood Products) Ecoson (Green Power) CTH (Natural Casings) Best Hides (Hides)

Key highlights

Market leading positions in gelatin, fat products, bone products, blood products and natural casings Broadest product portfolio with a leading position in high value add products Well-invested global platform, with 58 production sites across 5 continents

Strategic rationale

Transforms Darling from a US-centric rendering business into a leading global ingredients company with leading global brands to serve customers Provides increased earnings and end-market diversification, including food, pharmaceuticals and pet food Provides access to high growth emerging markets such as China and Brazil, as well as high value-added segments such as gelatin and blood

1 | | See notes on slide 24 and Adjusted EBITDA reconciliation on slide 44 |

2 Q4 2012 Revenue and Adjusted EBITDA translated at period average exchange rate of 1.2837. Q1 – Q3 2013 Revenue and Adjusted EBITDA translated at period average exchange rate of 1.315

16

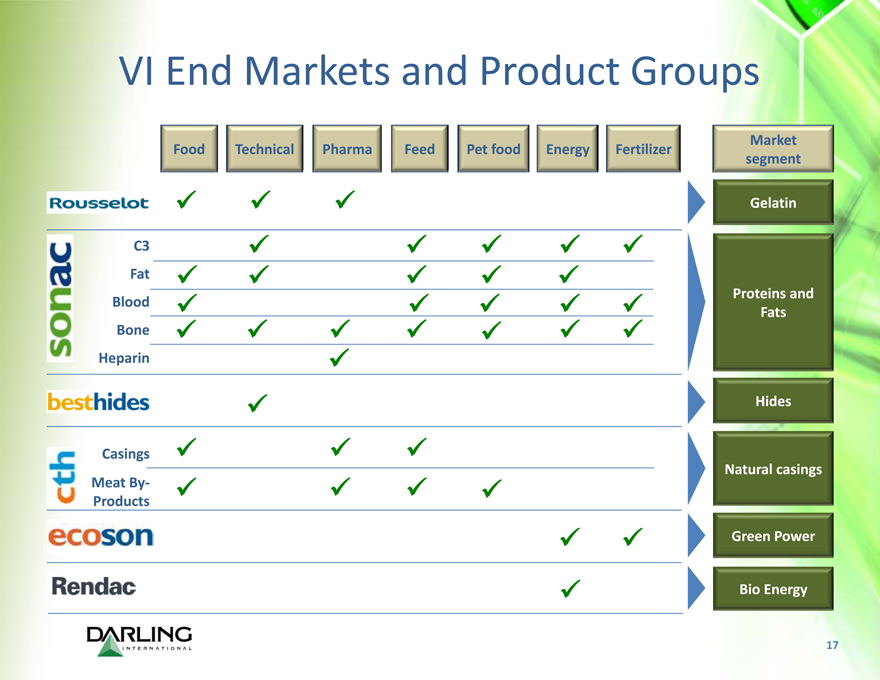

VI End Markets and Product Groups

Food

Technical

Pharma

Feed

Pet food

Energy

Fertilizer

Market segment

C3

Fat

Blood

Bone

Heparin

Casings

Meat By-Products

Gelatin

Proteins and Fats

Hides

Natural casings

Green Power

Bio Energy

17

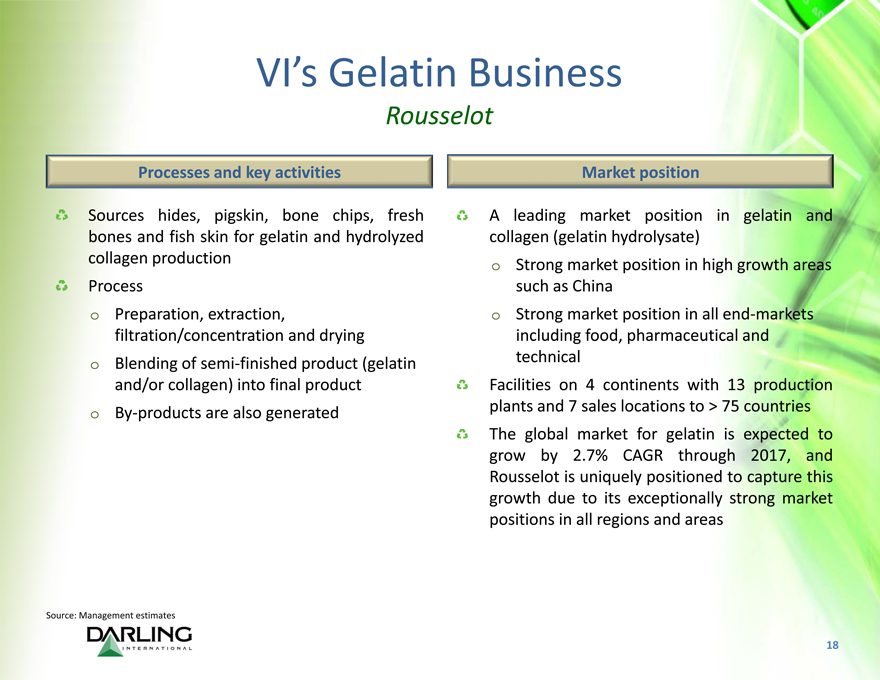

VI’s Gelatin Business

Rousselot

Processes and key activities

Sources hides, pigskin, bone chips, fresh bones and fish skin for gelatin and hydrolyzed collagen production Process

Preparation, extraction, filtration/concentration and drying Blending of semi-finished product (gelatin and/or collagen) into final product By-products are also generated

Market position

A leading market position in gelatin and collagen (gelatin hydrolysate)

Strong market position in high growth areas such as China Strong market position in all end- markets including food, pharmaceutical and technical

Facilities on 4 continents with 13 production plants and 7 sales locations to > 75 countries The global market for gelatin is expected to grow by 2.7% CAGR through 2017, and Rousselot is uniquely positioned to capture this growth due to its exceptionally strong market positions in all regions and areas

Source: Management estimates

18

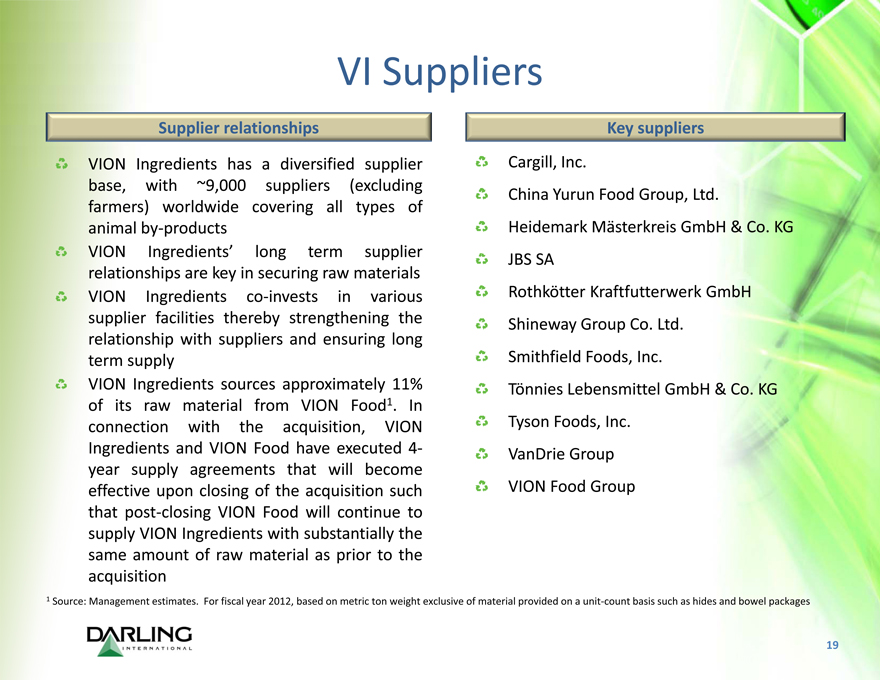

VI Suppliers

Supplier relationships

VION Ingredients has a diversified supplier base, with ~9,000 suppliers (excluding farmers) worldwide covering all types of animal by products VION Ingredients’ long term supplier relationships are key in securing raw materials VION Ingredients co invests in various supplier facilities thereby strengthening the relationship with suppliers and ensuring long term supply VION Ingredients sources approximately 11% of its raw material from VION Food1. In connection with the acquisition, VION Ingredients and VION Food have executed 4 year supply agreements that will become effective upon closing of the acquisition such that post-closing VION Food will continue to supply VION Ingredients with substantially the same amount of raw material as prior to the acquisition

Key suppliers

Cargill, Inc.

China Yurun Food Group, Ltd.

Heidemark Mästerkreis GmbH & Co. KG

JBS SA

Rothkötter Kraftfutterwerk GmbH

Shineway Group Co. Ltd.

Smithfield Foods, Inc.

Tönnies Lebensmittel GmbH & Co. KG

Tyson Foods, Inc.

Van-Drie Group

VION Food Group

1 Source: Management estimates. For fiscal year 2012, based on metric ton weight exclusive of material provided on a unit count basis such as hides and bowel packages

19

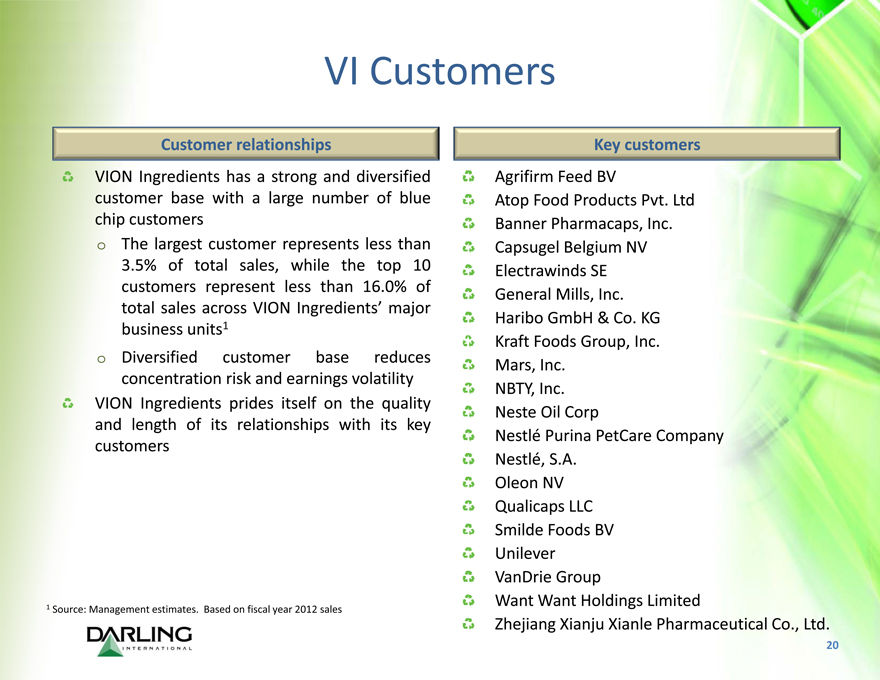

VI Customers

Customer relationships

VION Ingredients has a strong and diversified customer base with a large number of blue chip customers

The largest customer represents less than 3.5% of total sales, while the top 10 customers represent less than 16.0% of total sales across VION Ingredients’ major business units1 Diversified customer base reduces concentration risk and earnings volatility

VION Ingredients prides itself on the quality and length of its relationships with its key customers

Key customers

Agrifirm Feed BV

Atop Food Products Pvt. Ltd Banner Pharmacaps, Inc. Capsugel Belgium NV Electrawinds SE

General Mills, Inc. Haribo GmbH & Co. KG Kraft Foods Group, Inc. Mars, Inc.

NBTY, Inc. Neste Oil Corp

Nestlé Purina PetCare Company Nestlé, S.A.

Oleon NV Qualicaps LLC Smilde Foods BV Unilever VanDrie Group

Want Want Holdings Limited

Zhejiang Xianju Xianle Pharmaceutical Co., Ltd.

1 | | Source: Management estimates. Based on fiscal year 2012 sales |

20

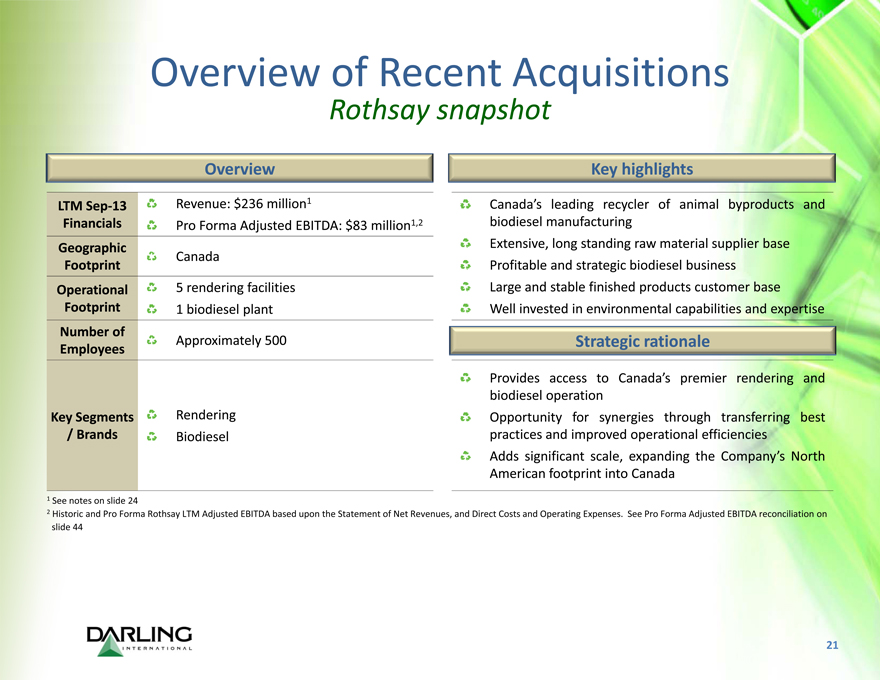

Overview of Recent Acquisitions

Rothsay snapshot

Overview

LTM Sep 13 Financials

Geographic Footprint

Operational Footprint

Number of Employees

Key Segments

/ Brands

Revenue: $236 million1

Pro Forma Adjusted EBITDA: $83 million1,2

Canada

5 rendering facilities 1 biodiesel plant

Approximately 500

Rendering Biodiesel

Key highlights

Canada’s leading recycler of animal byproducts and biodiesel manufacturing Extensive, long standing raw material supplier base Profitable and strategic biodiesel business Large and stable finished products customer base Well invested in environmental capabilities and expertise

Strategic rationale

Provides access to Canada’s premier rendering and biodiesel operation Opportunity for synergies through transferring best practices and improved operational efficiencies Adds significant scale, expanding the Company’s North American footprint into Canada

2 Historic and Pro Forma Rothsay LTM Adjusted EBITDA based upon the Statement of Net Revenues, and Direct Costs and Operating Expenses. See Pro Forma Adjusted EBITDA reconciliation on slide 44

21

Rothsay Suppliers and Customers1

Raw material suppliers

Rothsay is the exclusive or preferred processor to the majority of the raw material suppliers in its geographies Large and diverse raw material supplier base in Canada

Approximately 12,000 raw material supplier service locations that include leading abattoirs, food processors, restaurants and grocery store chains Rothsay’s top ten raw material suppliers account for approximately 59.0% of raw materials, and 37.5% excluding Maple Leaf Foods (“MFI”) Rothsay sources approximately 21.5% of its raw material from Maple Leaf Foods. On the closing date, Darling Canada and Maple Leaf Foods executed a 7 year supply agreement, such that Maple Leaf Foods will continue to supply Rothsay with substantially the same amount of raw material as provided prior to the Rothsay acquisition

Key raw material suppliers

Cargill, Inc.

Conestoga Meat Packers Ltd. Domingos Meat Packers Ltd. Erie Meat Products Ltd. Granny’s Poultry Cooperative (Manitoba) Ltd.

Loblaws, Inc.

Longo Brothers Fruit Markets Inc.

Maple Leaf Foods Inc.

NORPAC Foods, Inc. Parrish & Heimbecker, Ltd.

Pinty’s Delicious Foods, Inc.

Quality Meat Packers Limited Ryding Regency Meat Packers Ltd.

Sargent Farms Ltd.

Finished products customers

Rothsay has many large and stable finished products customers o The largest customer represents less than 12% of total sales, while the top 10 customers represent less than 56% of total sales Rothsay sells its products in domestic and international markets including the U.S., Europe, Mexico and South America

Key finished products customers

Elmira Pet Products Ltd. Emery Oleochemicals Group Floradale Feed Mill Ltd. Irving Oil, Corp.

Masterfeeds, Inc. Morrison’s Custom Feeds

Northeast Nutrition, Inc. Nutreco NV

Parrish & Heimbecker, Ltd. Royal Dutch Shell plc Superior Feed Ingredients Wallenstein Feed & Supply Ltd.

1 | | Based on fiscal year 2012 information |

22

Combined Company Highlights

Randall C. Stuewe

Chairman and Chief Executive Officer

23

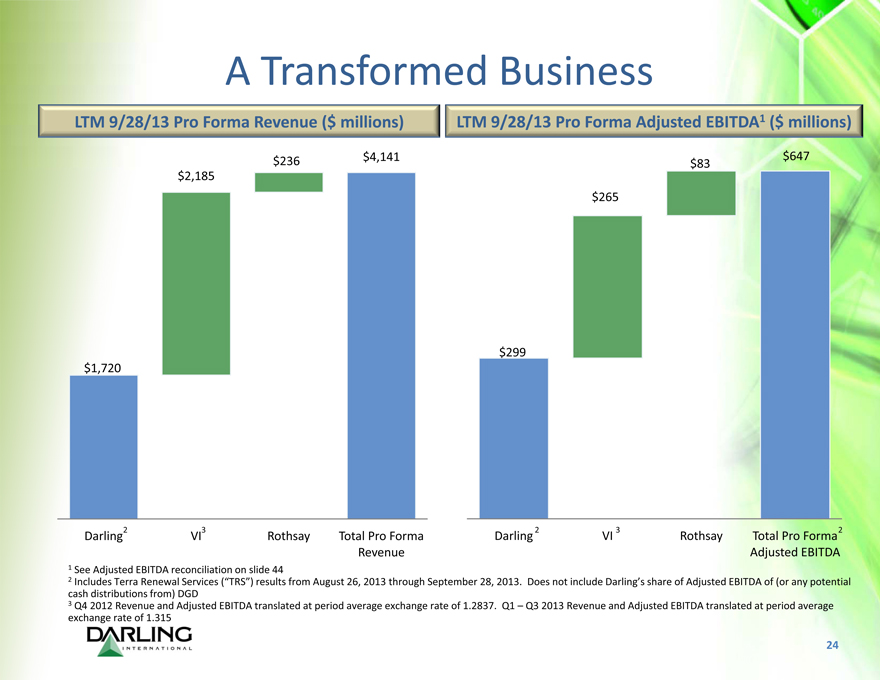

A Transformed Business

LTM 9/28/13 Pro Forma Revenue ($ millions)

LTM 9/28/13 Pro Forma Adjusted EBITDA1 ($ millions)

$236 $4,141 $83 $647

$2,185

$265

$299

$1,720

Darling VI Rothsay Total Pro Forma Darling VI Rothsay Total Pro Forma

Revenue Adjusted EBITDA

1 | | See Adjusted EBITDA reconciliation on slide 44 |

2 Includes Terra Renewal Services (“TRS”) results from August 26, 2013 through September 28, 2013. Does not include Darling’s share of Adjusted EBITDA of (or any potential cash distribution from) DGD

3 Q4 2012 Revenue and Adjusted EBITDA translated at period average exchange rate of 1.2837. Q1 – Q3 2013 Revenue and Adjusted EBITDA translated at period average exchange rate of 1.315

24

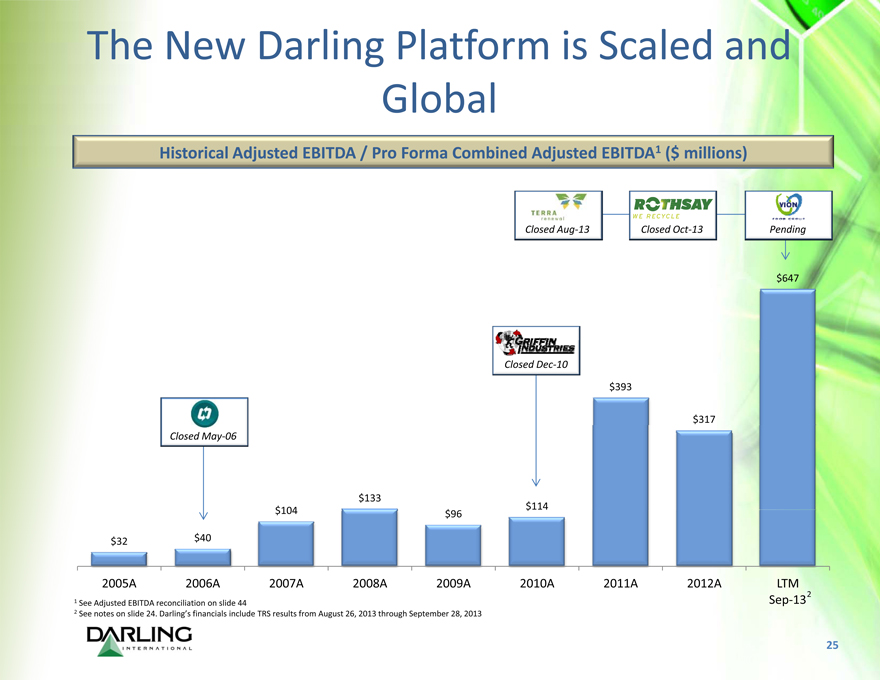

The New Darling Platform is Scaled and Global

Historical Adjusted EBITDA / Pro Forma Combined Adjusted EBITDA1 ($ millions)

Closed Aug13 Closed Oct13 Pending

$647

Closed Dec10

$393

$317

Closed May06

$133

$114

$96

$32 $40

2005A 2006A 2007A 2008A 2009A 2010A 2011A 2012A LTM

1 | | See Adjusted EBITDA reconciliation on slide 44 Sep13 |

2 | | See notes on slide 24. Darling’s financials include TRS results from August 26, 2013 through September 28, 2013 |

25

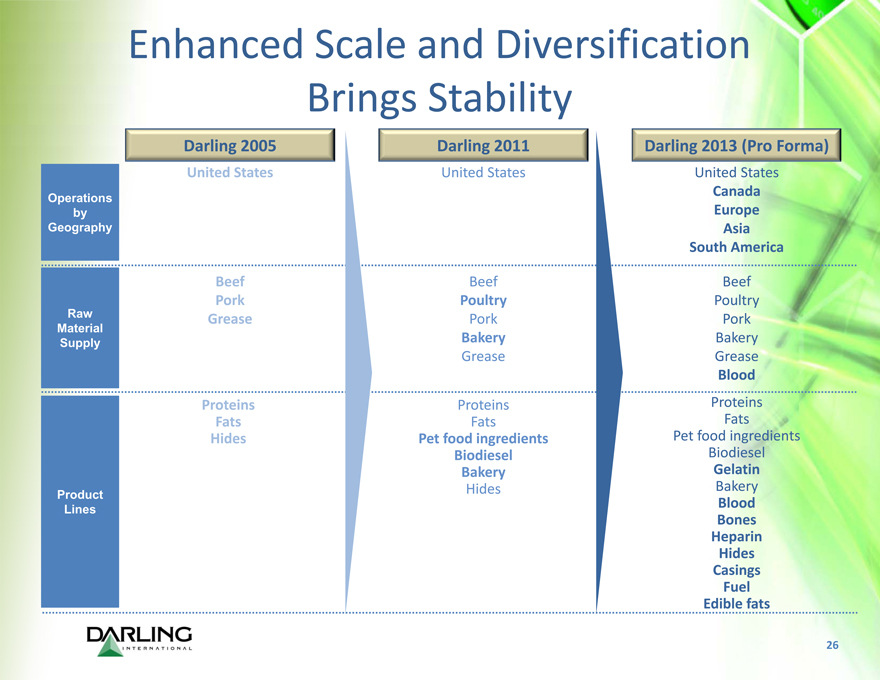

Enhanced Scale and Diversification Brings Stability

Darling 2005 Darling 2011 Darling 2013 (Pro Forma)

United States United States United States

Operations Canada

by Europe

Geography Asia

South America

Beef Beef Beef

Pork Poultry Poultry

Raw Grease Pork Pork

Material

Supply Bakery Bakery

Grease Grease

Blood

Proteins Proteins Proteins

Fats Fats Fats

Hides Pet food ingredients Pet food ingredients

Biodiesel Biodiesel

Bakery Gelatin

Product Hides Bakery

Blood

Bones

Heparin

Hides

Casings

Fuel

Edible fats

26

Global Brand Positioning

Specialty Products Commodity Products

Unique Specialty

Pharma Food Energy General Feed Products Feed

Peptan® Natural Leather Renewable Pet Proteins

Casings Diesel Food

Gelatin Gelatin Bone Green Plasma Fats

(Pharma) (Food) China Power

Heparin Edible Fats Fertilizer Biodiesel MucoPro® Cookie

Meal®

27

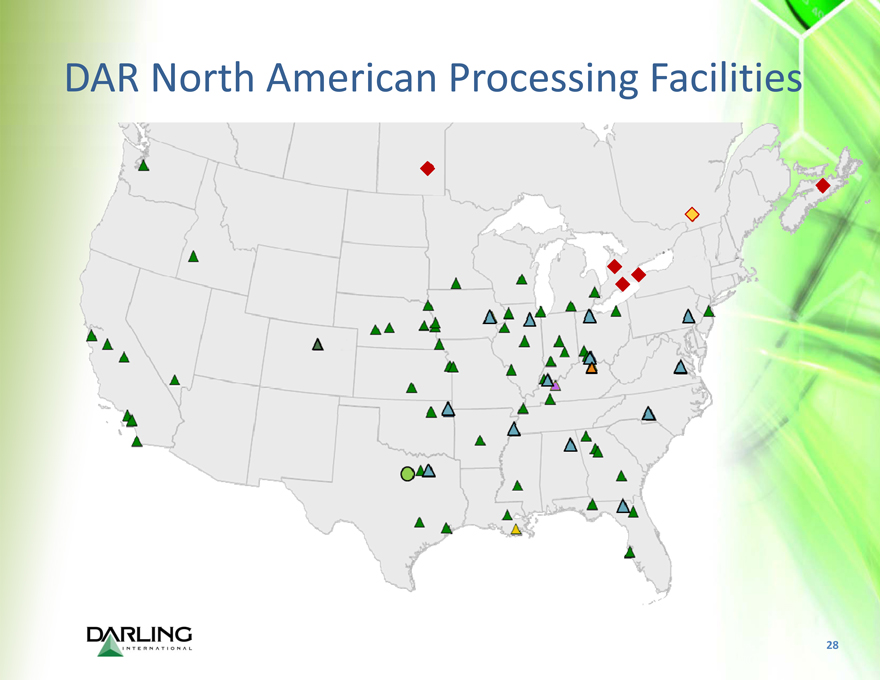

DAR North American Processing Facilities

28

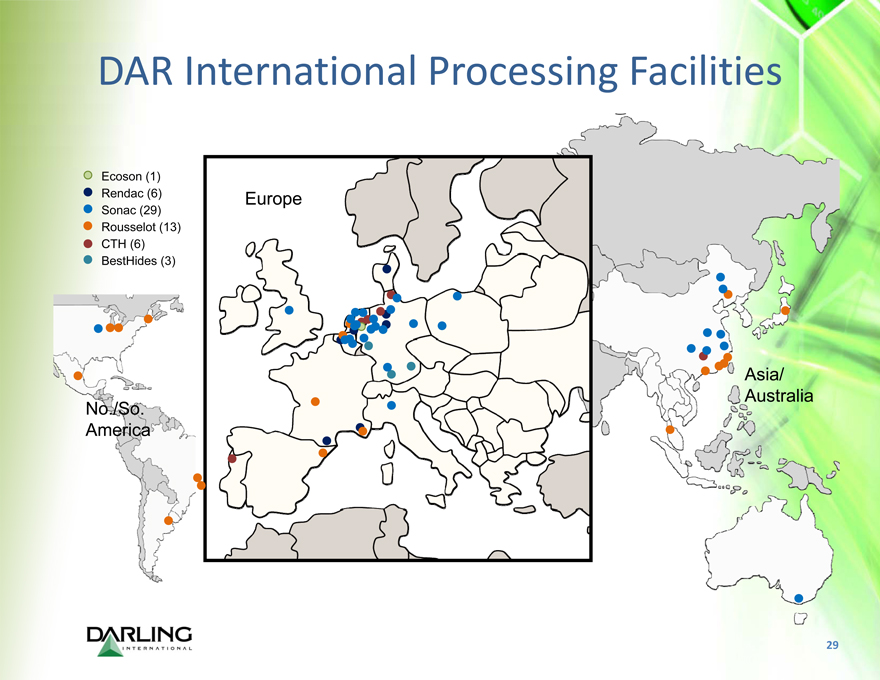

DAR International Processing Facilities

Ecoson (1) Rendac (6) Sonac (29) Rousselot (13) CTH (6) BestHides (3)

Europe

No./So. America

Asia/ Australia

29

DGD Update

DGD update

On June 26, 2013, the Company announced that DGD had reached mechanical completion and began production with a 9,300 barrelperday nameplate capacity once in full operation On August 27, 2013 Darling reported that after successful startup of DGD and initial achievement of nameplate continuous production of ~9,300 barrels per day, a heat exchanger failed and needed to be replaced to improve the plant’s reliability under actual process conditions DGD continued to operate during the replacement of the heat exchanger at approximately 6,000 – 7,000 barrels per day, but during this process, other metallurgical wear issues were identified. Installation of new equipment was completed on November 13, 2013, and soon thereafter the facility returned to nameplate capacity.

The installation of this equipment is expected to help DGD achieve improved production rates in the long term

DGD value proposition

Natural hedge for the Company: Darling is one of the largest suppliers of animal fats and used cooking oils in the United States and DGD is expected to consume ~9% of the current US supply of rendered fats and used cooking oil

Attractive economics: DGD will be a low cost producer due to lower cost feed stock, distribution through existing infrastructure, synergies from its location adjacent to the Valero St. Charles Refinery and valuable co products

Superior product: renewable diesel is the highest quality product capable of fulfilling the RFS2 biomass based diesel mandate and is superior to biodiesel (for example, no cold-flow issues that biodiesel has)

30

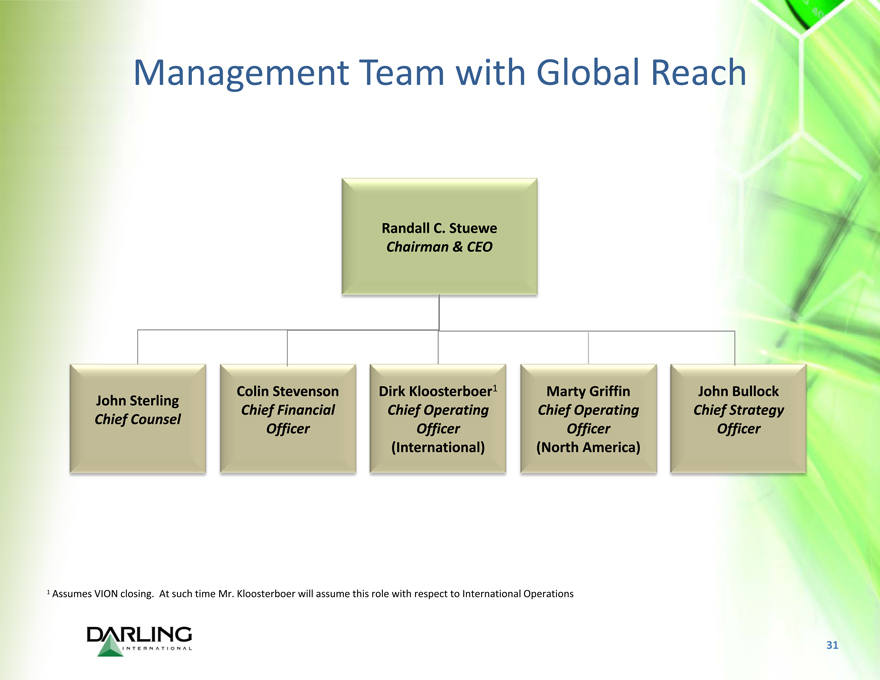

Management Team with Global Reach

Randall C. Stuewe

Chairman & CEO

John Sterling

Chief Counsel

Colin Stevenson

Chief Financial Officer

Dirk Kloosterboer1

Chief Operating Officer

(International)

Marty Griffin

Chief Operating Officer

(North America)

John Bullock

Chief Strategy Officer

. 1 Assumes VION closing. At such time Mr. Kloosterboer will assume this role with respect to International Operations

31

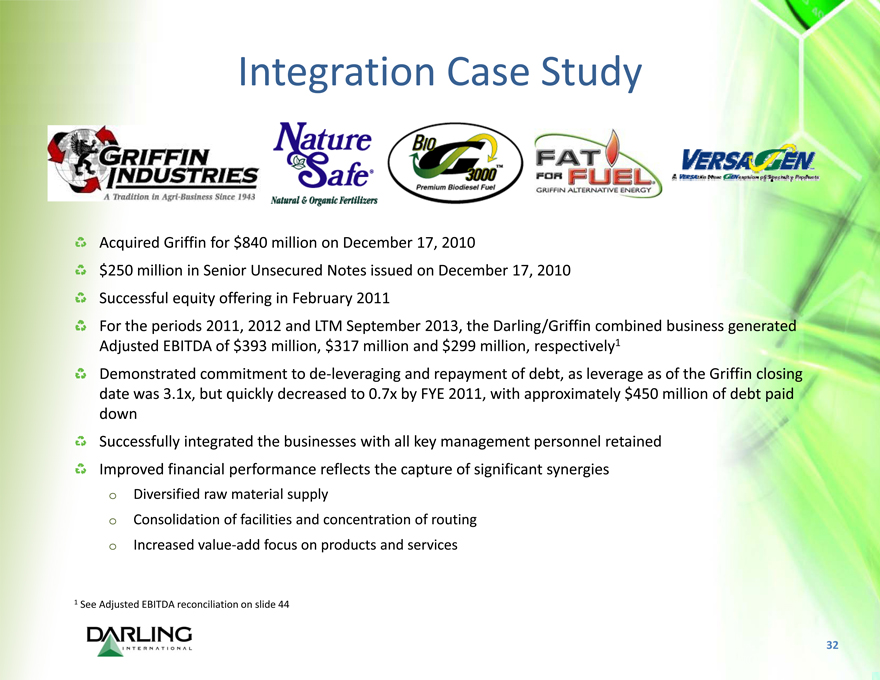

Integration Case Study

Acquired Griffin for $840 million on December 17, 2010 $250 million in Senior Unsecured Notes issued on December 17, 2010 Successful equity offering in February 2011

For the periods 2011, 2012 and LTM September 2013, the Darling/Griffin combined business generated Adjusted EBITDA of $393 million, $317 million and $299 million, respectively1 Demonstrated commitment to de leveraging and repayment of debt, as leverage as of the Griffin closing date was 3.1x, but quickly decreased to 0.7x by FYE 2011, with approximately $450 million of debt paid down Successfully integrated the businesses with all key management personnel retained Improved financial performance reflects the capture of significant synergies

Diversified raw material supply

Consolidation of facilities and concentration of routing Increased value-add focus on products and services

1 | | See Adjusted EBITDA reconciliation on slide 44 |

32

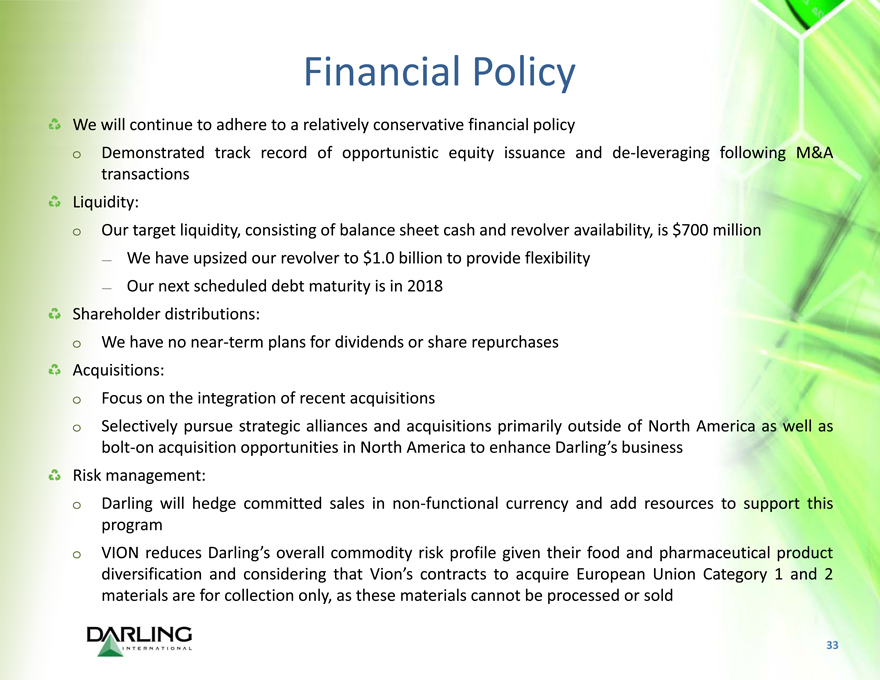

Financial Policy

We will continue to adhere to a relatively conservative financial policy

Demonstrated track record of opportunistic equity issuance and de leveraging following M&A transactions

Liquidity:

Our target liquidity, consisting of balance sheet cash and revolver availability, is $700 million

We have upsized our revolver to $1.0 billion to provide flexibility Our next scheduled debt maturity is in 2018

Shareholder distributions:

We have no near term plans for dividends or share repurchases

Acquisitions:

Focus on the integration of recent acquisitions

Selectively pursue strategic alliances and acquisition primarily outside of North America as well as bolt-on acquisition opportunities in North America to enhance Darling’s business

Risk management:

Darling will hedge committed sales in non functional currency and add resources to support this program VION reduces Darling’s overall commodity risk profile given their food and pharmaceutical product diversification and considering that Vion’s contracts to acquire European Union Category 1 and 2 materials are for collection only, as these materials cannot be processed or sold

33

Financial Summary

Colin Stevenson

Executive Vice President – Chief Financial Officer

34

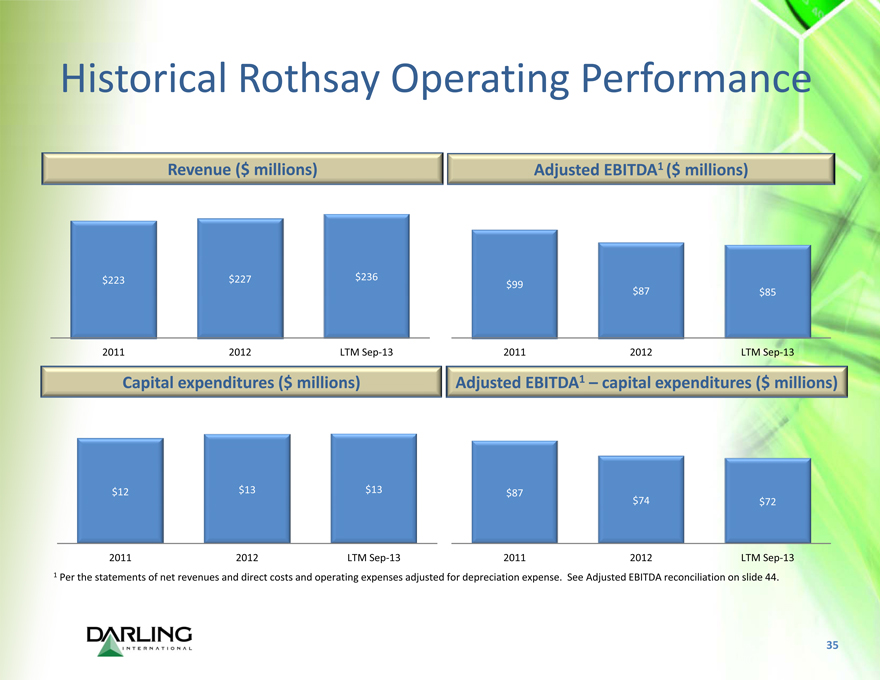

Historical Rothsay Operating Performance

Revenue ($ millions)

Adjusted EBITDA1 ($ millions)

$223 $227 $236 $99

$87 $85

2011 2012 LTM Sep 13 2011 2012 LTM Sep 13

Capital expenditures ($ millions)

Adjusted EBITDA1 – capital expenditures ($ millions)

$12 $13 $13 $87

$74 $72

2011 2012 LTM Sep 13 2011 2012 LTM Sep 13

1 Per the statements of net revenues and direct costs and operating expenses adjusted for depreciation expense. See Adjusted EBITDA reconciliation on slide 44.

35

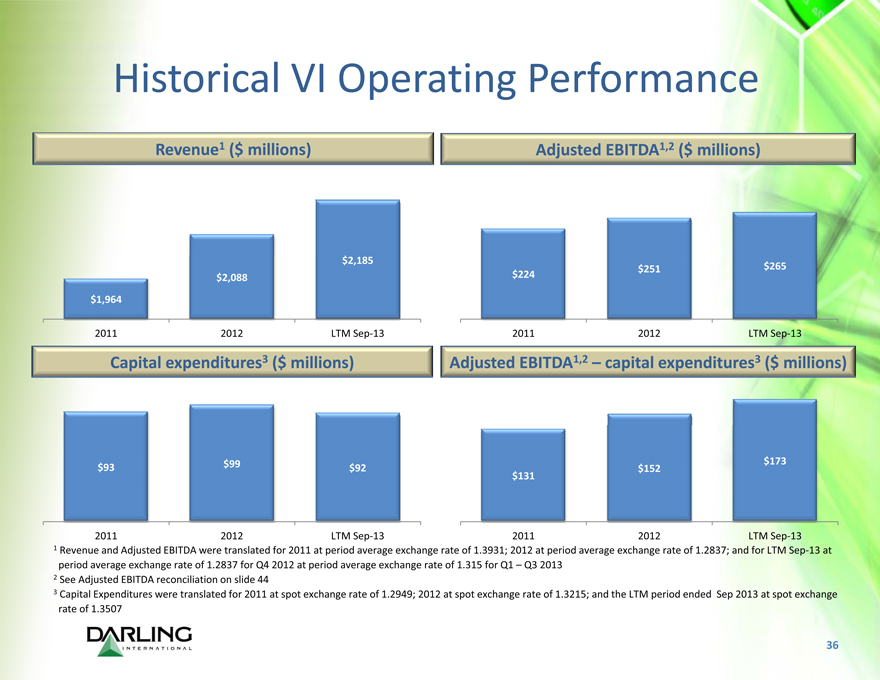

Historical VI Operating Performance

Revenue1 ($ millions)

$2,185

$251 $265

$2,088 $224

$1,964

2011 2012 LTM Sep 13 2011 2012 LTM Sep 13

Adjusted EBITDA1,2 ($ millions)

Capital expenditures3 ($ millions)

$93 $99 $92 $152 $173

$131

2011 2012 LTM Sep 13 2011 2012 LTM Sep 13

Adjusted EBITDA1,2 – capital expenditures3 ($ millions)

36

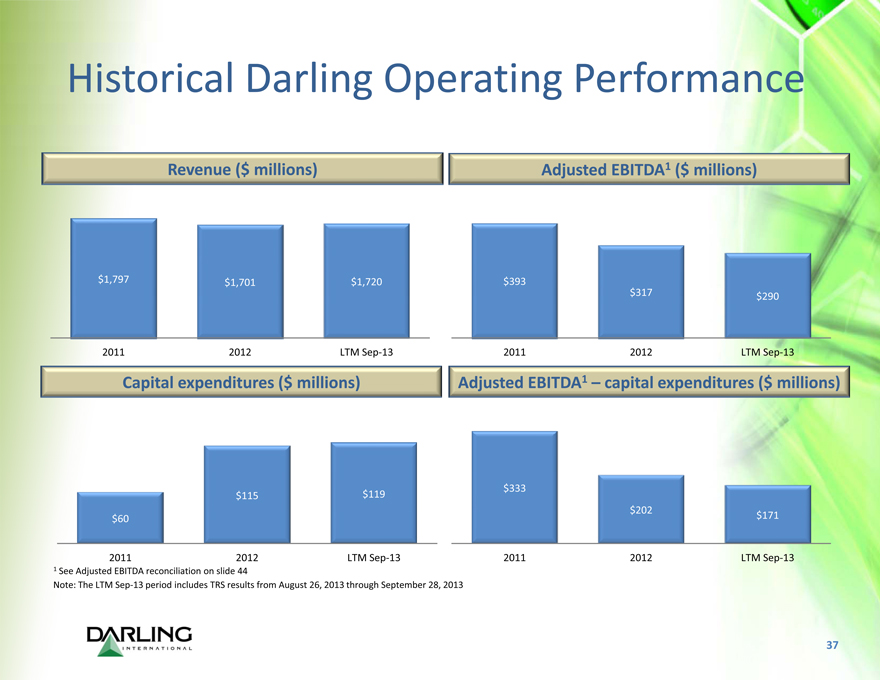

Historical Darling Operating Performance

Revenue ($ millions)

Adjusted EBITDA1 ($ millions)

$1,797 $1,701 $1,720 $393

$317 $290

2011 2012 LTM Sep 13 2011 2012 LTM Sep 13

Capital expenditures ($ millions)

Adjusted EBITDA1 – capital expenditures ($ millions)

$333

$115 $119

$202

$60 $171

2011 2012 LTM Sep 13 2011 2012 LTM Sep 13

1 | | See Adjusted EBITDA reconciliation on slide 44 |

1 | | See Adjusted EBITDA reconciliation on slide 44 |

Note: The LTM Sep 13 period includes TRS results from August 26, 2013 through September 28, 2013

37

Transaction Overview

J.P. Morgan

38

Transaction Overview

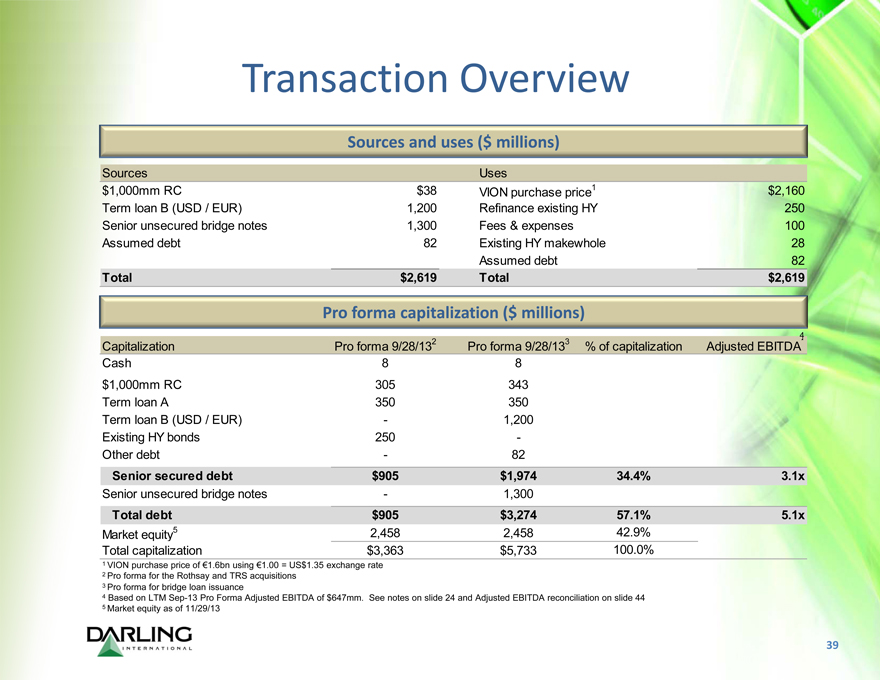

Sources and uses ($ millions)

Sources Uses

$1,000mm RC $38 VION purchase price1 $2,160

Term loan B (USD / EUR) 1,200 Refinance existing HY 250

Senior unsecured bridge notes 1,300 Fees & expenses 100

Assumed debt 82 Existing HY makewhole 28

Assumed debt 82

Total $2,619 Total $2,619

Pro forma capitalization ($ millions)

Capitalization Pro forma 9/28/132 Pro forma 9/28/133 % of capitalization Adjusted EBITDA

Cash 8 8

$1,000mm RC 305 343 6.0%

Term loan A 350 350 6.1%

Term loan B (USD / EUR)—1,200 20.9%

Existing HY bonds 250—

Other debt—82 1.4%

Senior secured debt $905 $1,974 34.4% 3.1x

Senior unsecured bridge notes—1,300 22.7%

Total debt $905 $3,274 57.1% 5.1x

Market equity5 2,458 2,458 42.9%

Total capitalization $3,363 $5,733 100.0%

1 | | VION purchase price of €1.6bn using €1.00 = US$1.35 exchange rate |

2 | | Pro forma for the Rothsay and TRS acquisitions |

3 | | Pro forma for bridge loan issuance |

4 Based on LTM Sep-13 Pro Forma Adjusted EBITDA of $647mm. See notes on slide 24 and Adjusted EBITDA reconciliation on slide 44

5 | | Market equity as of 11/29/13 |

39

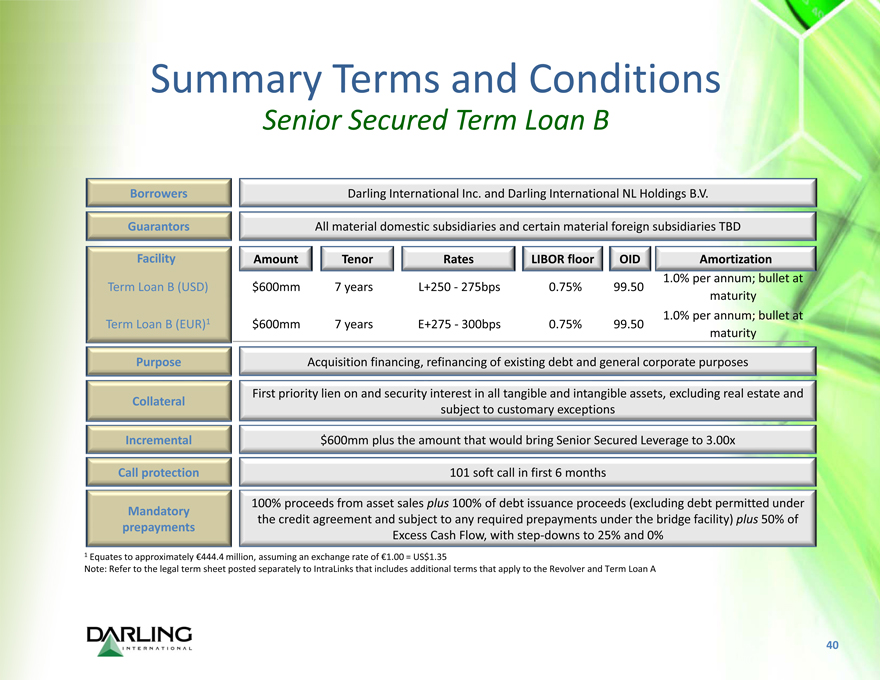

Summary Terms and Conditions

Senior Secured Term Loan B

Borrowers Darling International Inc. and Darling International NL Holdings B.V.

Guarantors All material domestic subsidiaries and certain material foreign subsidiaries TBD

Facility Amount Tenor Rates LIBOR floor OID Amortization

1.0% per annum; bullet at Term Loan B (USD) $600mm 7 years L+250 275bps 0.75% 99.50 maturity 1.0% per annum; bullet at Term Loan B (EUR)1 $600mm 7 years E+275- 300bps 0.75% 99.50 maturity

Purpose Acquisition financing, refinancing of existing debt and general corporate purposes

First priority lien on and security interest in all tangible and intangible assets, excluding real estate and

Collateral subject to customary exceptions

Incremental $600mm plus the amount that would bring Senior Secured Leverage to 3.00x

Call protection 101 soft call in first 6 months

100% proceeds from asset sales plus 100% of debt issuance proceeds (excluding debt permitted under

Mandatory the credit agreement and subject to any required prepayments under the bridge facility) plus 50% of prepayments

Excess Cash Flow, with step- downs to 25% and 0%

1 | | Equates to approximately €444.4 million, assuming an exchange rate of €1.00 = US$1.35 |

Note: Refer to the legal term sheet posted separately to IntraLinks that includes additional terms that apply to the Revolver and Term Loan A

40

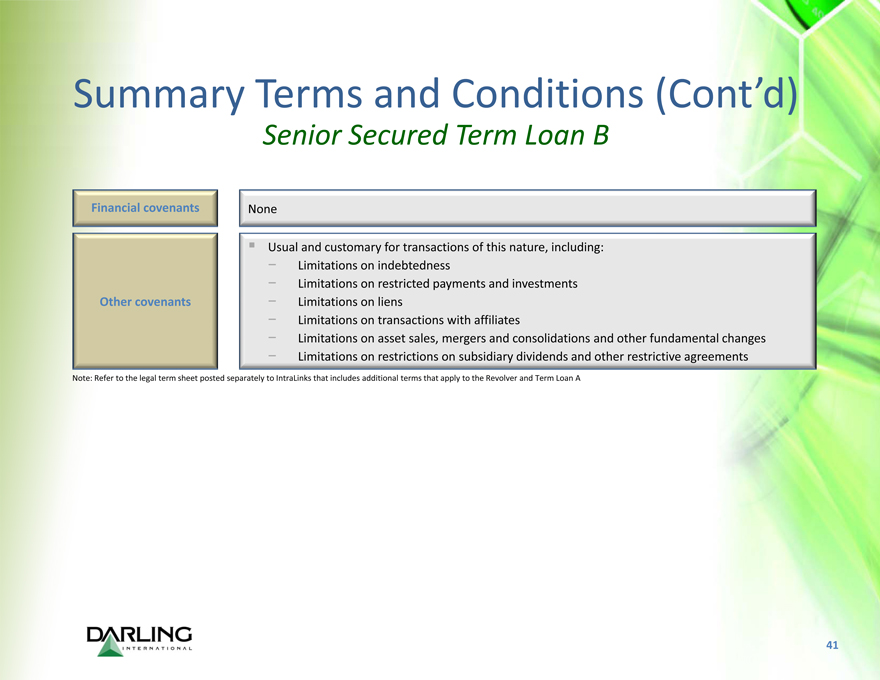

Summary Terms and Conditions (Cont’d)

Senior Secured Term Loan B

Financial covenants None

Usual and customary for transactions of this nature, including:

- Limitations on indebtedness

- Limitations on restricted payments and investments Other covenants—Limitations on liens

- Limitations on transactions with affiliates

- Limitations on asset sales, mergers and consolidations and other fundamental changes

- Limitations on restrictions on subsidiary dividends and other restrictive agreements

Note: Refer to the legal term sheet posted separately to IntraLinks that includes additional terms that apply to the Revolver and Term Loan A

41

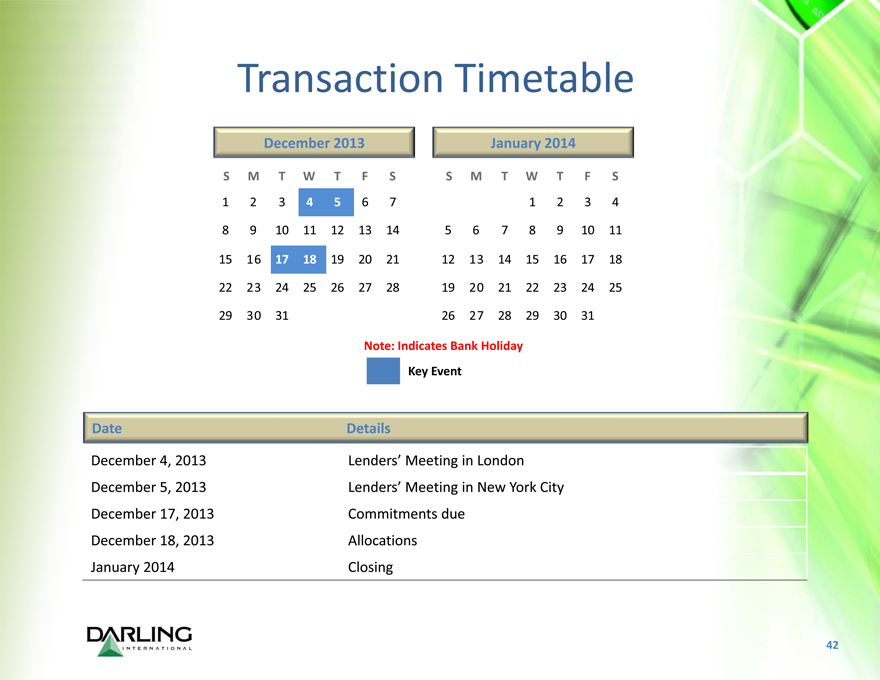

Transaction Timetable

December 2013 January 2014

S M T W T F S S M T W T F S

1 2 3 4 5 6 7 1 2 3 4

8 9 10 11 12 13 14 5 6 7 8 9 10 11

15 16 17 18 19 20 21 12 13 14 15 16 17 18

22 23 24 25 26 27 28 19 20 21 22 23 24 25

29 30 31 26 27 28 29 30 31

Note: Indicates Bank Holiday

Key Event

Date Details

December 4, 2013 Lenders’ Meeting in London

December 5, 2013 Lenders’ Meeting in New York City

December 17, 2013 Commitments due

December 18, 2013 Allocations

January 2014 Closing

42

Appendix

43

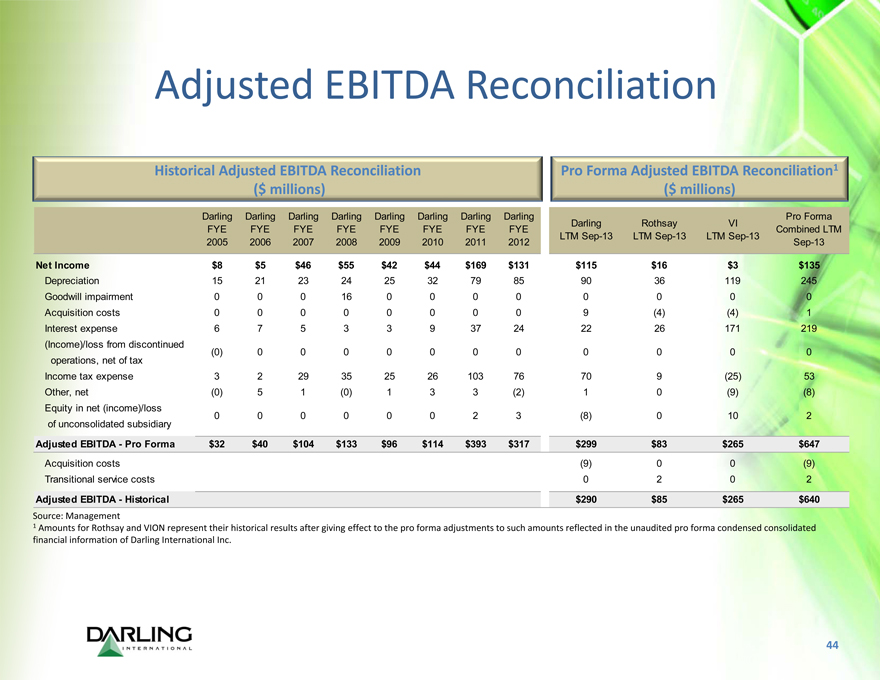

Adjusted EBITDA Reconciliation

Historical Adjusted EBITDA Reconciliation(1)

($ millions)

Pro Forma Adjusted EBITDA Reconciliation

($ millions)

Darling Darling Darling Darling Darling Darling Darling Darling Pro Forma

Darling Rothsay VI

FYE FYE FYE FYE FYE FYE FYE FYE Combined LTM

LTM Sep-13 LTM Sep-13 LTM Sep-13

2005 2006 2007 2008 2009 2010 2011 2012 Sep-13

Net Income $8 $5 $46 $55 $42 $44 $169 $131 $115 $16 $3 $135

Depreciation 15 21 23 24 25 32 79 85 90 36 119 245

Goodwill impairment 0 0 0 16 0 0 0 0 0 0 0 0

Acquisition costs 0 0 0 0 0 0 0 0 9 (4) (4) 1

Interest expense 6 7 5 3 3 9 37 24 22 26 171 219

(Income)/loss from discontinued

(0) | | 0 0 0 0 0 0 0 0 0 0 0 |

operations, net of tax

Income tax expense 3 2 29 35 25 26 103 76 70 9 (25) 53

Other, net (0) 5 1 (0) 1 3 3 (2) 1 0 (9) (8)

Equity in net (income)/loss

0 0 0 0 0 0 2 3 (8) 0 10 2

of unconsolidated subsidiary

Adjusted EBITDA—Pro Forma $32 $40 $104 $133 $96 $114 $393 $317 $299 $83 $265 $647

Acquisition costs (9) 0 0 (9)

Transitional service costs 0 2 0 2

Adjusted EBITDA—Historical $290 $85 $265 $640

Source: Management

1 Amounts for Rothsay and VION represent their historical results after giving effect to the pro forma adjustments to such amounts reflected in the unaudited pro forma condensed consolidated financial information of Darling International Inc.

44

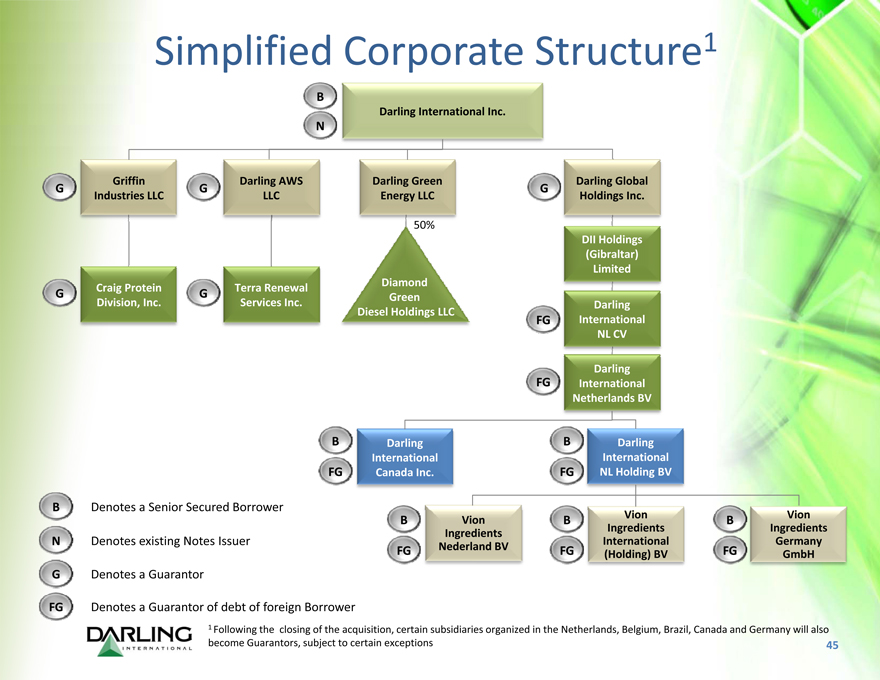

Simplified Corporate Structure1

B

Darling International Inc.

N

Griffin Darling AWS Darling Green

G G

Industries LLC LLC Energy LLC

50%

Craig Protein Terra Renewal Diamond

G G Green

Division, Inc. Services Inc.

Diesel Holdings LLC

Darling Global

G

Holdings Inc.

DII Holdings

(Gibraltar)

Limited

Darling

FG International

NL CV

Darling

FG International

Netherlands BV

B Darling

International

FG NL Holding BV

B Vion

Ingredients

International

FG (Holding) BV

B Darling

International

FG Canada Inc.

B Vion

Ingredients

FG Nederland BV

B Vion

Ingredients

Germany

FG GmbH

B Denotes a Senior Secured Borrower

N Denotes existing Notes Issuer

G Denotes a Guarantor

FG Denotes a Guarantor of debt of foreign Borrower

1 Following the closing of the acquisition, certain subsidiaries organized in the Netherlands, Belgium,

Brazil, Canada and Germany will also

become Guarantors, subject to certain exceptions

45

Management Team Biographies

Randall C. Stuewe – Mr. Stuewe has served as our Chairman and Chief Executive Officer since February 2003. From 1996 to 2002, Mr. Stuewe worked for ConAgra Foods, Inc. as executive vice president and most recently as president of Gilroy Foods. Prior to serving at ConAgra Foods, he spent twelve years in management, sales and trading positions at Cargill, Incorporated. Mr. Stuewe has extensive international management, operations, and sales experience.

Dirk Kloosterboer Mr. Kloosterboer is expected to join Darling on closing of the Vion transaction. He has been with VION Ingredients since 1984. He has been the chief operations officer of VION Ingredients and its predecessor entities, since 1997. Under Mr. Kloosterboer’s leadership and vision, VION Ingredients made more than 10 acquisitions expanding into the gelatin and casings businesses and extending VION Ingredients’ geographic presence to China, Brazil, United States, Argentina, Japan, and Australia. Mr. Kloosterboer is a highly seasoned international business executive.

Marty Griffin – Mr. Griffin has served as our Co-Chief Operations Officer since December 17, 2010. From 2006 to 2010, Mr. Griffin served as Chief Operating Officer of Griffin Industries, Inc. He has extensive experience in raw material procurement and plant operations. Mr. Griffin is involved in several state industry associations, as well as the Fats and Proteins Research Foundation and the National Renderers Association. Mr. Griffin has more than 30 years experience in the animal by product industry.

Colin Stevenson – Mr. Stevenson has served as our Chief Financial Officer since September 2012. From 1999 to September 2012, Mr. Stevenson worked at PricewaterhouseCoopers LLP, where he became a partner in 2002 and served as leader of its Dallas Financial Services Tax Group. Mr. Stevenson served many international clients in a wide variety of industries and geographies.

John Sterling – Mr. Sterling has been our General Counsel and Secretary since August 2007. From 1997 to July 2007, Mr. Sterling worked for Pillowtex Corporation, where he served as Vice President, General Counsel and Secretary since 1999. Mr. Sterling began his career with the law firm of Thompson & Knight, where he was a member of the firm’s corporate and securities practice area.

John Bullock – Mr. Bullock began his career at General Mills in 1978 in ingredient purchasing and risk management. In 1991, Mr. Bullock joined ConAgra Foods to lead the mergers and acquisitions group of the Trading and Processing Companies. John lead the company’s growth initiatives acquiring numerous businesses throughout the world. In 2004, Mr. Bullock formed JBULL INC., a boutique consulting firm specializing in enhancing margin opportunities for agricultural business expansions and developing renewable fuels. After consulting with Darling for four years and leading its effort in the development and construction of Diamond Green Diesel, Mr. Bullock joined Darling as our Chief Strategy Officer, responsible for overall corporate strategy, execution, growth and optimization.

46