As filed with the Securities and Exchange Commission on May 19, 2017

File No.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | |

☐ | | Pre-Effective Amendment No. | | |

☐ | | Post-Effective Amendment No. | | |

(Check appropriate box or boxes)

NORTHERN FUNDS

(Exact Name of Registrant as Specified in Charter)

50 South LaSalle Street

Chicago, Illinois 60603

(Address of Principal Executive Offices)

800-595-9111

(Registrant’s Telephone Number, including Area Code)

| | |

| Name and Address of Agent for Service: | | With a copy to: |

| Diana E. McCarthy | | Kevin O’Rourke |

| Drinker Biddle & Reath LLP | | Jose J. Del Real |

| One Logan Square | | Northern Trust Investments, Inc. |

| Suite 2000 | | 50 South LaSalle Street |

| Philadelphia, Pennsylvania 19103-6996 | | Chicago, Illinois 60603 |

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: Shares of Beneficial Interest, par value of $0.0001, of the Large Cap Core Fund.

An indefinite amount of the Registrant’s securities has been registered under the Securities Act of 1933 pursuant to Rule 24f-2 under the Investment Company Act of 1940. In reliance upon such Rule, no filing fee is being paid at this time.

It is proposed that this filing will become effective on June 19, 2017 pursuant to Rule 488 under the Securities Act of 1933.

NORTHERN FUNDS

50 SOUTH LASALLE STREET

CHICAGO, IL 60603

1-800-637-1380

June [ ], 2017

Dear Shareholder:

The Board of Trustees (the “Board”) of Northern Funds (the “Trust”) has approved the reorganization of the Large Cap Equity Fund, a series of the Trust (the “Acquired Fund”), with and into the Large Cap Core Fund, also a series of the Trust (the “Acquiring Fund and, together with the Acquired Fund, the “Funds”). It is expected that the reorganization will be completed on or about July 21, 2017.

The reorganization will be effected pursuant to a Plan of Reorganization (the “Plan”). In the reorganization, all of the assets of the Acquired Fund will be transferred to the Acquiring Fund, in exchange for shares of the Acquiring Fund of equal aggregate value and the Acquiring Fund’s assumption of all of the liabilities of the Acquired Fund. The shares of the Acquiring Fund then will be distributed to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund. Holders of shares of the Acquired Fund will hold, immediately after the reorganization, shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the shares the shareholder held in the Acquired Fund immediately prior to the reorganization. It is expected that the reorganization of the Acquired Fund should be effected on a tax-free basis for federal income tax purposes. This tax treatment, however, does not extend to transactions that occur prior to, or after the reorganization. Northern Trust Investments, Inc. (“NTI”), the Funds’ investment adviser, currently expects that the Acquired Fund will sell up to 66% of its portfolio securities prior to the reorganization. It is expected that the disposition of these portfolio securities will generate capital gains that will be taxable to Acquired Fund shareholders (aside from tax-exempt accounts) prior to the reorganization. NTI will bear any out-of-pocket costs related to the reorganization, including legal and audit expenses and the expenses of preparation, assembling and mailing the enclosed Combined Prospectus/Information Statement.

NTI believes that the Acquired Fund has minimal growth prospects and that shareholders of the Acquired Fund will benefit from the increased commercial viability, significantly lower contractual management fees and overall expenses, and potential operating efficiencies and economies of scale that may be achieved by combining the Acquired Fund’s assets with the Acquiring Fund, rather than continuing to operate the Acquired Fund separately. NTI also believes that the Acquiring Fund’s substantially identical investment objective and similar strategies make it compatible with the Acquired Fund. NTI also considered the future prospects of the Acquired Fund if the reorganization is not effected, including the possibility that the Acquired Fund might be liquidated because of a lack of commercial viability.

After considering NTI’s recommendation, the Board concluded that the reorganization would be in the best interests of the Acquired Fund and the Acquiring Fund and their respective shareholders and that the shareholders’ interests will not be diluted as a result of the reorganization.

The reorganization does not require a shareholder vote, and you are not being asked to vote. However, we ask that you review the enclosed Combined Prospectus/Information Statement, which contains information about the Acquiring Fund, outlines differences between the Acquired Fund and the Acquiring Fund, and provides details about the terms and conditions of the reorganization, including the reasons for the reorganization. If you have any questions about the reorganization, please do not hesitate to contact Northern Funds at 1-800-595-9111.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Sincerely,

/s/

Peter K. Ewing

President

IMPORTANT NOTICE

To Shareholders of the Large Cap Equity Fund

Q U E S T I O N S & A N S W E R S

The enclosed Combined Prospectus/Information Statement describes the contemplated reorganization of the Large Cap Equity Fund of Northern Funds (the “Acquired Fund”) into the Large Cap Core Fund of Northern Funds (the “Acquiring Fund” and together with the Acquired Fund, the “Funds”). We recommend that you read the complete Combined Prospectus/Information Statement. For your convenience, we have provided a brief overview of the reorganization.

A: Northern Trust Investments, Inc. (“NTI”), each Fund’s investment adviser, is proposing to combine the assets of the Acquired Fund with the Acquiring Fund.

Under the reorganization, the Acquired Fund will transfer all of its assets in exchange for shares of the Acquiring Fund and the assumption by the Acquiring Fund of the Acquired Fund’s liabilities. The Acquired Fund will then distribute the shares of the Acquiring Fund to shareholders of the Acquired Fund in complete liquidation of the Acquired Fund.

| Q: | | HOW WILL THE REORGANIZATION AFFECT ME? |

A: In connection with the reorganization, an account will be set up in your name with the Acquiring Fund and you will receive shares of the Acquiring Fund. The aggregate net asset value of the shares you receive in the reorganization relating to your Acquired Fund shares will equal the aggregate net asset value of the shares you own immediately prior to the reorganization. As a result of the reorganization, however, a shareholder of the Acquired Fund will hold a smaller percentage of ownership in the combined fund than he or she held in the Acquired Fund prior to the reorganization.

| Q. | | WHY IS THE REORGANIZATION OCCURRING? |

A. After careful consideration, the Board of Trustees of the Northern Funds (the “Board”), including a majority of the independent Trustees by separate vote, has determined that the reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and their shareholders and the interests of their respective shareholders will not be diluted as a result of the reorganization. The Board has determined that, after the reorganization, shareholders of the Acquired Fund may benefit among other things from (i) the increased commercial viability of the combined Fund; (ii) significantly lower contractual management fees and overall Fund expenses; and (iii) potential operating efficiencies and economies of scale of the combined Fund.

The Board also considered the Funds’ substantially identical investment objectives and similar, but not identical, investment strategies. The Acquiring Fund uses a primarily quantitative methodology that it applies to its fundamental research, while the Acquired Fund uses both fundamental research and quantitative analysis. Despite these differences in investment strategies, the Board concluded that there were sufficient similarities between the Funds, including that the Funds invest at least 80% of their assets in large capitalization companies within the range of capitalization of the S&P 500 Index, to provide a sound basis for the reorganization.

The Board also considered that the Acquired Fund will be required to distribute its realized capital gains to shareholders, which will be a taxable event to shareholders (other than tax-exempt accounts), prior to the reorganization. While the Board considered other options for the Acquired Fund, including liquidation of the Fund, a reorganization with the Acquiring Fund was determined to be the most beneficial outcome for shareholders. The Board also considered the future prospects of the Acquired Fund if the reorganization was not effected, including the possibility that the Fund might be liquidated because of a lack of commercial viability.

- i -

| Q: | | WHO WILL ADVISE THE ACQUIRING FUND ONCE THE REORGANIZATION IS COMPLETED? |

A: As you know, the Acquired Fund is advised by NTI. The Acquiring Fund also is advised by NTI and will continue to be advised by NTI once the reorganization is completed.

| Q: | | WILL I HAVE TO PAY ANY SALES LOAD, COMMISSION OR OTHER SIMILAR FEE IN CONNECTION WITH THE REORGANIZATION? |

A: No, you will not pay any sales load, commission or other similar fee in connection with the reorganization.

| Q: | | HOW WILL THE FEES AND EXPENSES OF THE ACQUIRED FUND CHANGE AS A RESULT OF THE REORGANIZATION? |

A. The combined Fund will pay a significantly lower contractual management fee than is currently paid by the Acquired Fund. Following the reorganization, the estimated pro forma gross annual operating expenses and pro forma net annual operating expenses (i.e., after contractual waivers and/or expense reimbursements) for the Acquiring Fund will also be significantly below those of the Acquired Fund.

The following tables show (i) the Acquired Fund’s contractual management fee and gross annual and net annual operating expenses and (ii) the contractual management fee and the estimated pro forma gross annual and net annual operating expenses of the Acquiring Fund after the reorganization.

[to be completed by amendment]

| | | | | | | | | | | | |

Acquired Fund/

Acquiring Fund

(before

reorganization) | | Management

Fee | | | Gross

Annual

Operating

Expenses | | | Net

Annual

Operating

Expenses | |

Large Cap Equity Fund | | | 0.83 | % | | | 0.[ ]% | | | | 0.[ ]% | |

| | | | | | | | | | | | |

Large Cap Core Fund | | | 0.44 | % | | | 0.[ ]% | | | | 0.[ ]% | |

| | | | | | | | | | | | |

Acquiring Fund

(after the

reorganization) | | Management

Fee | | | Pro Forma

Gross

Annual

Operating

Expenses | | | Pro Forma

Net

Annual

Operating

Expenses | |

Large Cap Core Fund | | | 0.44 | % | | | 0.[ ]% | | | | 0.[ ]% | |

| Q: | | HOW DOES THE PERFORMANCE OF THE ACQUIRING FUND COMPARE TO THE PERFORMANCE OF THE ACQUIRED FUND? |

A: [To be completed by amendment]

| Q: | | WILL I HAVE TO PAY ANY FEDERAL TAXES AS A RESULT OF THE REORGANIZATION? |

A: The reorganization is currently expected to qualify as a tax-free “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. If the reorganization so qualifies, in general, the Acquired Fund will not recognize any gain or loss as a result of the transfer of all of its assets and liabilities in exchange solely for shares of the Acquiring Fund and the assumption of the Acquired Fund’s liabilities by the Acquiring Fund under the reorganization or as a result of the Acquired Fund’s liquidation. You also will not recognize any gain or loss upon your receipt of shares of the Acquiring Fund in connection with the reorganization. Acquired Fund shareholders, however, are expected to incur capital gains immediately prior to the reorganization as described below.

NTI expects to reposition the Acquired Fund’s portfolio to more closely align with the portfolio of the Acquiring Fund. Based on the Acquired Fund’s current holdings, up to 66% of the Fund’s portfolio is currently expected to turn over, which will result in recognition of a portion of the Acquired Fund’s unrealized capital gains. As of March 31, 2017, the Acquired Fund had net unrealized appreciation of $34.7 million. The Acquired Fund will be required to distribute its realized capital gains to shareholders, which will be a taxable event to shareholders (other than tax-exempt accounts), prior to the closing of the reorganization. Total transaction costs, capital gains and losses realized, and distributions to shareholders are not measurable in advance.

To the extent that, prior to the reorganization, the portfolio holdings of the Acquired Fund are sold by the Acquired Fund in anticipation of the reorganization, the tax impact of such sales will depend on the difference between the price at which such portfolio holdings are sold and the Acquired Fund’s basis in such holdings. Any capital gains recognized in these sales on a net basis will be

- ii -

distributed, if required, to the Acquired Fund’s shareholders as either capital gain distributions (to the extent of net realized long-term capital gains) or ordinary income dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale, and these distributions, along with any distributions of the Acquired Fund’s net investment income, will generally be taxable to Acquired Fund shareholders as ordinary income, long-term capital gains, or qualified dividends, as applicable.

| Q: | | ARE THERE ANY OTHER POTENTIAL DISADVANTAGES TO ME FROM THE REORGANIZATION? |

A: The Acquiring Fund is currently a defendant in a securities litigation matter involving the Tribune Company (the “Tribune litigation”), as discussed more fully in the accompanying Combined Prospectus/Information Statement. The Acquired Fund shareholders will become subject to the Tribune litigation after the reorganization. The Acquiring Fund cannot predict the outcome of these proceedings, and, it is possible, although not probable, that an adverse decision could have a material impact on the Acquiring Fund’s net asset value.

| Q: | | WHO WILL PAY FOR THE REORGANIZATION? |

A: NTI will bear any out-of-pocket costs related to the reorganization, including legal and audit expenses and the expenses of preparation, assembling and mailing the Combined Prospectus/Information Statement.

| Q: | | WHAT IF I REDEEM MY SHARES BEFORE THE REORGANIZATION TAKES PLACE? |

A: If you choose to redeem your shares before the reorganization takes place, the redemption will be treated as a normal redemption of shares and, generally, will be a taxable transaction on which gain or loss may be recognized.

| Q: | | WHOM DO I CONTACT FOR FURTHER INFORMATION? |

A: You may call the Northern Funds at 1-800-595-9111.

Important additional information about the reorganization is set forth in the accompanying Combined Prospectus/Information Statement. Please read it carefully.

- iii -

NORTHERN FUNDS

50 SOUTH LASALLE STREET

CHICAGO, IL 60603

1-800-595-9111

COMBINED PROSPECTUS/INFORMATION STATEMENT

This Combined Prospectus/Information Statement is being furnished to shareholders of the Large Cap Equity Fund (the “Acquired Fund”) in connection with a Plan of Reorganization (the “Plan”) that has been approved by the Board of Trustees (the “Board”) of Northern Funds (the “Trust”). Under the Plan, (1) all of the assets of the Acquired Fund will be transferred to the Large Cap Core Fund of the Trust (the “Acquiring Fund”), in exchange for shares of the Acquiring Fund of equal aggregate value and the Acquiring Fund’s assumption of all of the liabilities of the Acquired Fund; and (2) such shares of the Acquiring Fund will be distributed to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund (the “Reorganization”). Holders of shares of the Acquired Fund will hold, immediately after the Reorganization, shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the shares such shareholder held in the Acquired Fund immediately prior to the Reorganization. The Reorganization is expected to be completed on or about July 21, 2017.

Northern Trust Investments, Inc. (“NTI”), the investment adviser and administrator of the Acquired Fund and the Acquiring Fund, has undertaken to pay any out-of-pocket costs related to the reorganization, including legal and audit expenses and the expenses of preparation, assembling and mailing the Combined Prospectus/Information Statement.

The Board believes that the Reorganization is in the best interests of the Acquired Fund and Acquiring Fund and their respective shareholders, and that the interests of the shareholders will not be diluted as a result of the Reorganization. For federal income tax purposes, the Reorganization is structured as a tax-free transaction for the Acquired Fund and its shareholders. This tax treatment, however, does not extend to transactions that occur prior to, or after the Reorganization. NTI currently expects that the Acquired Fund will sell up to 66% of its portfolio securities prior to the Reorganization. It is expected that the disposition of these portfolio securities will generate capital gains that will be taxable to Acquired Fund shareholders (aside from tax-exempt accounts) prior to the reorganization. Shareholders of the Acquired Fund are not being asked to vote on the Plan or approve the Reorganization.

The Acquired Fund and Acquiring Fund are series of the Trust, a Delaware statutory trust registered with the Securities and Exchange Commission (the “SEC”) as an open-end management investment company. The Trust currently consists of 44 separate series including the Acquired Fund and Acquiring Fund. The Board is responsible for the management and business and affairs of the Acquired Fund and the Acquiring Fund.

This Combined Prospectus/Information Statement, which you should read carefully and retain for future reference, sets forth concisely the information that you should know about the Acquired Fund, the Acquiring Fund and the Reorganization. This Combined Prospectus/Information Statement incorporates by reference the following documents, which contain additional information about the Acquired Fund and the Acquiring Fund:

| | - | a Statement of Additional Information dated [ ], 2017 (the “Reorganization SAI”), relating to this Combined Prospectus/Information Statement; |

| | - | The Prospectus dated July 31, 2016, as supplemented to date, of the Northern Funds- Equity Funds, including the Acquired Fund and Acquiring Fund; and |

| | - | The Statement of Additional Information dated July 31, 2016, as supplemented to date, of the Northern Funds, including the Acquired Fund and Acquiring Fund. |

[To be completed by amendment]

You can obtain a free copy of documents listed above by contacting Northern Funds at P.O. Box 75986, Chicago, IL 60675-5986 or by calling 1-800-595-9111. You may also request copies of any of the foregoing documents by email request to: northern-funds@ntrs.com

You may also copy and review information about the Funds at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. Reports and other information about the Funds are available on the EDGAR Database on the SEC’s Internet site at www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request to the following e-mail address: publicinfo@sec.gov, or by writing the Commission’s Public Reference Section, Washington, D.C. 20549-1520.

This Combined Prospectus/Information Statement and the enclosures are expected to be first sent to shareholders on or about [ ], 2017. THIS IS NOT A REQUEST FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

AN INVESTMENT IN A FUND IS NOT A DEPOSIT OF ANY BANK AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION (“FDIC”) OR ANY OTHER GOVERNMENT AGENCY, OR THE NORTHERN TRUST COMPANY, ITS AFFILIATES, SUBSIDIARIES OR ANY OTHER BANK. AN INVESTMENT IN A FUND INVOLVES INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL.

THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS COMBINED PROSPECTUS/INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Combined Prospectus/Information Statement is [ ], 2017.

TABLE OF CONTENTS

NORTHERN FUNDS

50 SOUTH LASALLE STREET

CHICAGO, IL 60603

TELEPHONE: 1-800-595-9111

COMBINED PROSPECTUS/INFORMATION STATEMENT

DATED JUNE [ ], 2017

SYNOPSIS

THE REORGANIZATION

The Board of Trustees (the “Board”) of the Northern Funds (the “Trust”), including a majority of the independent Trustees, by separate vote, reviewed and approved the Plan of Reorganization (the “Plan”) that provides for the reorganization (the “Reorganization”) of the Large Cap Equity Fund (the “Acquired Fund”) with and into the Large Cap Core Fund (the “Acquiring Fund”), the closing date (the “Closing Date”) of which is expected to be on or about July 21, 2017.

Pursuant to the Plan, the Acquired Fund will transfer all of its assets to the Acquiring Fund in exchange for shares of the Acquiring Fund and the Acquiring Fund’s assumption of all of the liabilities of the Acquired Fund. The Acquired Fund will then distribute the shares of the Acquiring Fund to its shareholders in complete liquidation of the Acquired Fund. Immediately after the Reorganization, each person who held shares in the Acquired Fund will hold shares in the Acquiring Fund with the same aggregate value as that person’s interest in the Acquired Fund as of the Closing Date.

The implementation of the Reorganization is subject to a number of conditions set forth in the Plan. Among the significant conditions is the receipt by the Funds of an opinion of counsel to the effect that the Reorganization will be treated as a tax-free transaction to the Acquired Fund and the Acquiring Fund and their shareholders for federal income tax purposes as described further below. This tax treatment, however, does not extend to transactions that occur prior to, or after the Reorganization. NTI currently expects that the Acquired Fund will sell up to 66% of its portfolio securities prior to the Reorganization. It is expected that the disposition of these portfolio securities will generate capital gains that will be taxable to Acquired Fund shareholders (aside from tax-exempt accounts) prior to the reorganization.

This description of the Reorganization is qualified by reference to the full text of the Plan, which is attached hereto as Appendix A.

Northern Trust Investments, Inc. (“NTI”), the Funds’ investment adviser, will bear any out-of-pocket costs related to the reorganization, including legal and audit expenses and the expenses of preparation, assembling and mailing the Combined Prospectus/Information Statement.

The Board determined that the Reorganization is in the best interest of the Acquired Fund and Acquiring Fund and their shareholders, and that interests of the shareholders of the Funds will not be diluted as a result of the Reorganization.

COMPARISON OF INVESTMENT OBJECTIVES AND POLICIES

This section will help you compare the investment objectives, principal investment strategies and limitations of the Acquired Fund and the Acquiring Fund. Please be aware that this is only a brief discussion. More complete information may be found in the Funds’ Prospectus and Statement of Additional Information.

The Acquired Fund and Acquiring Fund have substantially identical investment objectives, similar, although not identical, investment strategies, and identical fundamental investment restrictions, as discussed below and at Appendix B. The investment objective of each Fund may be changed by the Board without shareholder approval. Shareholders will, however, be notified of any changes. Any such change may result in a Fund having an investment objective different than the objective that the shareholder considered appropriate at the time of investment in the Fund. Each Fund’s investment objective and principal investment strategies are provided in the table below.

- 1 -

| | |

Large Cap Equity Fund (Acquired Fund) | | Large Cap Core Fund (Acquiring Fund) |

Investment Objective | | Investment Objective |

| |

| The Fund seeks to provide long-term capital appreciation. Any income received is incidental to this objective. | | The Fund seeks long-term growth of capital. Any income received is incidental to this objective. |

| |

| Principal Investment Strategies | | Principal Investment Strategies |

| |

In seeking long-term capital appreciation, the Fund will invest, under normal circumstances, at least 80% of its net assets in equity securities of large capitalization companies. Large capitalization companies generally are considered to be those whose market capitalization is, at the time the Fund makes an investment, within the range of the market capitalization of the companies in the S&P 500® Index. Companies whose capitalization no longer meets this definition after purchase may continue to be considered large capitalization companies. As of May 31, 2016, the market capitalization of the companies in the S&P 500 Index was between $1.3 billion and $553.7 billion. The size of companies in the S&P 500 Index changes with market conditions. In addition, changes to the composition of the S&P 500 Index can change the market capitalization range of companies in the Index. The Fund is not limited to the stocks included in the S&P 500 Index and may invest in other stocks that meet the Fund’s investment adviser’s criteria discussed below. Using fundamental research and quantitative analysis, the Fund’s investment adviser buys securities of a broad mix of companies that it believes have favorable growth and valuation characteristics relative to their peers. Similarly, the Fund’s investment adviser sells securities it believes no longer have these or other favorable characteristics. The team also may sell securities in order to maintain the desired portfolio securities composition of the Fund. In determining whether a company has favorable characteristics, the Fund’s investment adviser uses an evaluation process that includes, but is not limited to: • Quantitative review of fundamental factors such as earnings metrics, valuation and capital deployment; • Qualitative fundamental analysis, including assessment of management, products, markets and costs in order to develop an investment thesis and key metrics for future performance; • Risk management analysis in which risk exposures are measured and managed at the security, industry, sector and portfolio levels; and | | In seeking its investment objective, the Fund will invest, under normal circumstances, at least 80% of its net assets in a broadly diversified portfolio of equity securities in large capitalization U.S. companies, including foreign issuers that are traded in the U.S. Large capitalization companies generally are considered to be those whose market capitalization is, at the time the Fund makes an investment, within the range of the market capitalization of the companies in the S&P 500® Index. As of May 31, 2016, the market capitalization of the companies in the S&P 500 Index was between $1.3 billion and $553.7 billion. The size of companies in the S&P 500 Index changes with market conditions. In addition, changes to the composition of the S&P 500 Index can change the market capitalization range of companies in that index. The Fund is not limited to the stocks included in the S&P 500 Index and may invest in other stocks that meet the Fund’s investment adviser’s criteria discussed below. The Fund’s investment strategy attempts to create a portfolio with similar risk, style, capitalization and industry characteristics as the S&P 500 Index with the potential to provide excess returns by allowing the Fund to hold a portion, but not all of the securities in the S&P 500 Index. In managing the Fund, the Fund’s investment adviser attempts to achieve the Fund’s objective by overweighting those stocks that it believes will outperform the S&P 500 Index and underweighting (or excluding entirely) those stocks that it believes will underperform the S&P 500 Index. The Fund seeks to accomplish this goal by employing a strategy that uses statistics and advanced econometric methods to determine which fundamental and quantifiable stock or firm characteristics (such as relative valuation, price momentum and earnings quality) are predictive of future stock performance. The characteristics are combined to create a proprietary multifactor quantitative stock selection model which generates stock specific forecasts that are used along with risk controls to determine security weightings. The |

- 2 -

| | |

Large Cap Equity Fund (Acquired Fund) | | Large Cap Core Fund (Acquiring Fund) |

• Systematic evaluations of new securities with attractive attributes and reevaluations of portfolio holdings. Standard & Poor’s® Rating Service does not endorse any of the securities in the S&P 500 Index. It is not a sponsor of the Large Cap Equity Fund and is not affiliated with the Fund in any way. | | investment management team’s approach, based primarily on applying quantitative methods to fundamental research (e.g., selecting stocks based on economic, financial, and market analysis), is applied within a risk constrained environment that is intended to increase return and result in a portfolio having characteristics similar to the S&P 500 Index. The team will normally sell a security that it believes is no longer attractive based upon the evaluation criteria described above. Standard & Poor’s® Rating Service does not endorse any of the securities in the S&P 500 Index. It is not a sponsor of the Large Cap Core Fund and is not affiliated with the Fund in any way. |

Each Fund has an investment strategy to invest in equity securities of large capitalization companies within the range of the market capitalization of the companies in the S&P 500 Index. However, there are some important differences between the Funds’ investment strategies as follows:

| | • | | The Acquired Fund employs an investment strategy using fundamental research and quantitative analysis while the investment team’s investment strategy approach for the Acquiring Fund is based primarily on applying quantitative methods to fundamental research. |

| | • | | The Acquiring Fund seeks to achieve its investment objective by overweighting those stocks that it believes will outperform the S&P 500 Index and underweighting (or excluding entirely) those stocks that it believes will underperform the S&P 500 Index, while the Acquired Fund buys securities of companies that it believes have favorable growth and valuation characteristics relative to their peers based on its evaluation process. |

| | • | | The Acquired Fund may sell securities to maintain the desired portfolio securities composition of the Fund, while the Acquiring Fund will normally sell a security that it believes is no longer attractive based upon its evaluation criteria described above. |

The Funds have identical fundamental investment restrictions with respect to borrowings and certain other matters. These fundamental investment restrictions are set forth in Appendix B to this Combined Prospectus/Information Statement.

PRINCIPAL RISK FACTORS

All investments carry some degree of risk that will affect the value of a Fund’s investments, its investment performance and the price of its shares. As a result, loss of money is a risk of investing in each Fund.

AN INVESTMENT IN A FUND IS NOT A DEPOSIT OF ANY BANK AND IS NOT INSURED OR GUARANTEED BY FEDERAL DEPOSIT INSURANCE CORPORATION (“FDIC”), ANY OTHER GOVERNMENT AGENCY, OR THE NORTHERN TRUST COMPANY, ITS AFFILIATES, SUBSIDIARIES OR ANY OTHER BANK.

The Acquiring Fund has identical principal risk factors as the Acquired Fund. The combined Fund will use the same investment strategies as the Acquiring Fund, and will have the same principal investment risks as the Acquiring Fund. These risk factors are summarized below. For more information on the risks associated with the Acquiring Fund, see the Acquiring Fund’s Prospectus and SAI.

- 3 -

Comparison of Principal Risk Factors of the Acquired Fund and Acquiring Fund

| | |

Large Cap Equity Fund (Acquired Fund) | | Large Cap Core Fund (Acquiring Fund) |

| Market Risk | | Market Risk |

| Management Risk | | Management Risk |

| Cybersecurity Risk | | Cybersecurity Risk |

| Market Events Risk | | Market Events Risk |

| Large Cap Stock Risk | | Large Cap Stock Risk |

| Sector Risk | | Sector Risk |

Fund Risk Descriptions

The following provides a description of the various risks referenced in the section above.

MARKET RISK is the risk that general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets, volatility in the equities market or adverse investor sentiment could cause the value of your investment in the Fund to decline. It includes the risk that a particular style of investing, such as growth or value, may underperform the market generally.

MANAGEMENT RISK is the risk that a strategy used by the Fund’s investment adviser may fail to produce the intended results or that imperfections, errors or limitations in the tools and data used by the investment adviser may cause unintended results.

CYBERSECURITY RISK is the risk of an unauthorized breach and access to fund assets, customer data (including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the Fund, the investment adviser, custodian, transfer agent, distributor and other service providers and financial intermediaries to suffer data breaches, data corruption or lose operational functionality. Successful cyber-attacks or other cyber-failures or events affecting the Fund or its service providers may adversely impact the Fund or its shareholders.

MARKET EVENTS RISK relates to the increased volatility, depressed valuations, decreased liquidity and heightened uncertainty in the financial markets during the past several years. These conditions may continue, recur, worsen or spread. The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken steps to support financial markets, including by keeping interest rates at historically low levels. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The U.S. government and the Federal Reserve have recently reduced market support activities. Further reduction, including interest rate increases, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Fund invests. Policy and legislative changes in the United States and in other countries may also continue to contribute to decreased liquidity and increased volatility in the financial markets. The impact of these changes on the markets, and the practical implications for market participants, may not be fully known for some time.

LARGE CAP STOCK RISK is the risk that large-capitalization stocks as a group could fall out of favor with the market, causing the fund to underperform investments that focus solely on small- or medium-capitalization stocks.

SECTOR RISK is the risk that companies in similar businesses may be similarly affected by particular economic or market events, which may, in certain circumstances, cause the value of securities of all companies in a particular sector of the market to decrease. While the Fund may not concentrate in any one industry, the Fund may invest without limitation in a particular market sector.

- 4 -

COMPARATIVE FEES AND EXPENSES

The following tables: (1) compare the fees and expenses of the Acquired Fund and the Acquiring Fund for the twelve-month period ended March 31, 2017; and (2) show the estimated fees and expenses for the Acquiring Fund combined with the Acquired Fund on an estimated pro forma basis after giving effect to the Reorganization as if the Reorganization had occurred on March 31, 2017. Pro forma expense levels should not be considered an actual representation of future expenses or performance. Pro forma levels project anticipated expense levels but actual expenses may be greater or less than those shown. As shown by the table, there are no transaction charges when you buy or sell shares of either Fund, nor will there be any such charges following the Reorganization. THERE WILL NOT BE ANY FEE IMPOSED ON SHAREHOLDERS IN CONNECTION WITH THE REORGANIZATION.

Large Cap Equity Fund and Large Cap Core Fund:

[to be completed by amendment]

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Large Cap Equity Fund | | |

Current Large Cap Core Fund | | | Large Cap Core Fund After

Reorganization (Pro Forma Combined) | |

Current Fee Table: | | | | | | | | | | Current Fee Table: | | | | | | | | | | Pro Forma Fee Table: | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | |

| | | | | | | | |

Management Fees | | | | | | | 0.83 | % | | Management Fees | | | | | | | 0.44 | % | | Management Fees | | | | | | | 0.44 | % |

Other Expenses | | | | | | | [ ] | % | | Other Expenses | | | | | | | [ ] | % | | Other Expenses | | | | | | | [ ] | % |

Transfer Agency

Fees | | | 0.02% | | | | | | | Transfer Agency Fees | | | 0.02% | | | | | | | Transfer Agency Fees | | | 0.02% | | | | | |

| Other Operating Expenses | | | [ ]% | | | | | | | Other Operating Expenses | | | [ ]% | | | | | | | Other Operating Expenses | | | [ ]% | | | | | |

Total Annual Fund Operating

Expenses | | | | | | | [ ] | % | | Total Annual Fund Operating Expenses | | | | | | | [ ] | % | | Total Annual Fund Operating

Expenses | | | | | | | [ ] | % |

| Expense Reimbursement(1) | | | | | | | [ ] | % | | Expense Reimbursement(1) | | | | | | | [ ] | % | | Expense Reimbursement(1) | | | | | | | [ ] | % |

| Total Annual Fund Operating Expenses After Expense Reimbursement | | | | | | | [ ] | % | | Total Annual Fund Operating Expenses After Expense Reimbursement | | | | | | | [ ] | % | | Total Annual Fund Operating Expenses After Expense Reimbursement | | | | | | | [ ] | % |

| (1) | Northern Trust Investments, Inc. (the “Investment Adviser”) has contractually agreed to reimburse a portion of the operating expenses of each Fund (other than certain excepted expenses, i.e., acquired fund fees and expenses, the compensation paid to each Independent Trustee of the Trust, expenses of third party consultants engaged by the Board, membership dues paid to the Investment Company Institute and Mutual Fund Directors Forum, expenses in connection with the negotiation and renewal of the revolving credit facility, extraordinary expenses and interest) to the extent the “Total Annual Fund Operating Expenses After Expense Reimbursement” exceed 0.85% and 0.45% for the NF Large Cap Equity Fund and the NF Large Cap Core Fund, respectively. The “Total Annual Fund Operating Expenses After Expense Reimbursement” may be higher than the contractual limitation as a result of certain excepted expenses that are not reimbursed. This contractual limitation may not be terminated before July 31, 2018 without the approval of the Board. |

- 5 -

EXPENSE EXAMPLES

The examples are intended to help you compare the cost of investing in the Acquired Fund versus the Acquiring Fund, and the Acquiring Fund (Pro Forma) assuming the Reorganization takes place. The examples assume that you invest $10,000 for the time periods indicated (with reinvestment of all dividends and distributions) and then redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year and that the operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs are described below for the Acquired Fund and Acquiring Fund.

Large Cap Equity Fund (Acquired Fund) and Large Cap Core Fund (Acquiring Fund)

[to be completed by amendment]

| | | | | | | | | | | | | | | | |

| | | 1 YEAR | | | 3 YEARS | | | 5 YEARS | | | 10 YEARS | |

Acquired Fund | | $ | [ | ] | | $ | [ | ] | | $ | [ | ] | | $ | [ | ] |

Acquiring Fund | | $ | [ | ] | | $ | [ | ] | | $ | [ | ] | | $ | [ | ] |

Acquiring Fund (Pro Forma) | | $ | [ | ] | | $ | [ | ] | | $ | [ | ] | | $ | [ | ] |

PORTFOLIO TURNOVER

Each Fund pays transaction costs, such as commissions, when it buys or sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual portfolio operating expenses or in the Examples above, affect a Fund’s performance. During each Fund’s most recent fiscal year ended March 31, 2017, the Fund’s portfolio turnover rate was as follows (expressed as a percentage of the average value of its portfolio):

[to be completed by amendment]

| | | | | | | | | | | | |

Acquired Fund | | Portfolio

Turnover

Rate | | | | | Acquiring Fund | | Portfolio

Turnover

Rate | |

Large Cap Equity Fund | | | [ | ]% | | | | Large Cap Core Fund | | | [ | ]% |

COMPARISON OF PURCHASE/REDEMPTION/EXCHANGE POLICIES

You generally may buy and sell shares in the Acquiring Fund or the Acquired Fund on any day when the New York Stock Exchange is open for trading. This section will help you compare the purchase/redemption and exchange policies of the Acquired Fund and the Acquiring Fund. Please be aware that this is only a brief discussion. For more complete information concerning purchase and redemption procedures and exchange privileges, please see the Acquiring Fund’s Prospectus, which accompanies this Prospectus/Information Statement, its Statement of Additional Information and the Acquired Fund’s Prospectus and Statement of Additional Information.

- 6 -

The procedures to purchase, redeem and exchange shares of the Funds are identical:

| | | | |

| | | Acquired Fund | | Acquiring Fund |

| Initial Investment Minimum | | $2,500 ($500 for an IRA; $250 under the Automatic Investment Plan; and $500 for employees of Northern Trust and its affiliates) | | $2,500 ($500 for an IRA; $250 under the Automatic Investment Plan; and $500 for employees of Northern Trust and its affiliates) |

| | |

| Subsequent Investment Minimum | | $50 (except for reinvestments of distributions for which there is no minimum). | | $50 (except for reinvestments of distributions for which there is no minimum). |

| | |

| Purchasing and Selling Shares | | Shares may be purchased or sold through an: - Account at Northern Trust - Account at an Authorized Intermediary - Account at Northern Funds | | Shares may be purchased or sold through an: - Account at Northern Trust - Account at an Authorized Intermediary - Account at Northern Funds |

| | |

| Exchange Privileges | | No investment minimum | | No investment minimum |

| | |

| Other Features | | Automatic Investment Systematic Withdrawal Northern Trust Private Passport Program | | Automatic Investment Systematic Withdrawal Northern Trust Private Passport Program |

Shareholder Servicing Plan of the Acquiring Fund and Acquired Fund

Both Funds may enter into agreements with certain financial intermediaries, including affiliates of NTI, that perform support services for their customers who own Acquired and Acquiring Fund shares (“Service Organizations”).

For their services, Service Organizations may receive fees from the Acquired Fund and Acquiring Fund at annual rates of up to 0.15% of the average daily net asset value of the shares covered by their agreements. Because these fees are paid out of the Acquired Fund’s or Acquiring Fund’s assets on an on-going basis, they may increase the cost of your investment in the Acquired Fund or Acquiring Fund. The Acquired Fund’s or Acquiring Fund’s arrangements with Service Organizations under the agreements are governed by a Service Plan, which has been adopted by the Board.

COMPARISON OF DIVIDENDS AND OTHER DISTRIBUTIONS

Dividends from net investment income are declared and paid quarterly for both the Acquired Fund and the Acquiring Fund. Distributions from realized net capital gains (if any) are declared and paid by each Fund annually. Each Fund will make additional payments to shareholders, if necessary, to avoid the imposition of any federal income or excise tax on the Funds. For more complete information concerning dividends and distributions and tax considerations, please see the Funds’ Prospectus and Statement of Additional Information.

- 7 -

SERVICE PROVIDERS

NTI, a subsidiary of Northern Trust Corporation, serves as the investment adviser to the Acquired Fund and the Acquiring Fund, and is located at 50 South LaSalle Street, Chicago, IL 60603. NTI is an Illinois State Banking Corporation and an investment adviser registered under the Investment Advisers Act of 1940, as amended. It primarily manages assets for institutional and individual separately managed accounts, investment companies and bank common and collective funds.

The managers for the Acquired Fund are Thomas D. Wooden, CFA, Senior Vice President of NTI and Christopher D. Shipley, Senior Vice President of NTI. Messrs. Wooden and Shipley have been managers since July 2014 and March 2011, respectively. Since joining Northern Trust Investments, Inc. in 2014, Mr. Wooden has been the lead portfolio manager for the Northern Large Cap Core portfolio. Prior to joining NTI, Mr. Wooden was a portfolio manager at Wells Capital Management, LLC, where he managed core equity strategies. After joining NTI in April 2000, Mr. Shipley served as an equity analyst until December 2010, when he became the director of equity research.

The manager for the Acquiring Fund is Mark C. Sodergren, CFA, Senior Vice President of NTI. Mr. Sodergren has managed the Acquiring Fund since July 31, 2011. Mr. Sodergren joined NTI in 2007 and is the head of the quantitative equity portfolio management team and responsible for research and implementation of several quantitative equity strategies. Prior to this, Mr. Sodergren was a portfolio manager at Barclays Global Investors focused on active U.S. large cap strategies.

Additional information about each manager’s compensation, other accounts managed by the manager and the manager’s ownership of securities issued by the Funds managed by the manager is available in the Funds’ Statement of Additional Information.

The Board oversees both the Acquired Fund and Acquiring Fund. The following table lists the service providers for each Acquired Fund and each Acquiring Fund.

[to be completed by amendment]

| | | | |

Service Provider | | Acquired Fund | | Acquiring Fund |

| Distributor | | Northern Funds Distributors, LLC | | Northern Funds Distributors, LLC |

| Custodian | | The Northern Trust Company | | The Northern Trust Company |

| Transfer Agent | | The Northern Trust Company | | The Northern Trust Company |

| Fund and Independent Trustees’ Counsel | | Drinker Biddle & Reath LLP | | Drinker Biddle & Reath LLP |

| Independent Registered Public Accounting Firm | | [ ] | | [ ] |

For a detailed description of the Funds’ other services providers, see the Funds’ Prospectus and Statement of Additional Information.

LEGAL PROCEEDINGS

The Acquiring Fund is currently a defendant in a securities litigation matter involving the Tribune Company (“Tribune”). In 2007, the Acquiring Fund was a shareholder of Tribune. In December 2007, as a part of a leveraged buy-out transaction (the “LBO”), Tribune was converted from a public company to a privately held company. Tribune later filed for bankruptcy.

On December 7, 2010, Northern Funds was named as a defendant and a putative member of the proposed defendant class of shareholders named in an adversary proceeding (the “Committee Action”) brought by The Official Committee of Unsecured Creditors of Tribune Company (the “Committee”) in the U.S. Bankruptcy

- 8 -

Court for the District of Delaware, in connection with Tribune’s bankruptcy proceeding. On June 2, 2011, a second suit was initiated by certain creditors of Tribune in the Delaware Superior Court with respect to claims related to the LBO (Niese et al. v. A.G. Edwards, Inc. et al.), in which Northern Funds was named as a defendant. On June 2, 2011, the indenture trustees, on behalf of certain noteholders of Tribune, filed a third suit and named Northern Funds as a defendant in the U.S. District Court for the Northern District of Illinois (Deutsche Bank Trust Co. et al. v. Ohlson Enterprises et al.) and a fourth suit and named Northern Funds as a defendant in the U.S. District Court for the Southern District of New York (Deutsche Bank Trust Co. et al. v. Sirius International Insurance Corp. et al.).. Each of these cases, along with others brought by the indenture trustees and other individual creditors, has now been consolidated into a Multi-District Litigation proceeding, pending in the Southern District of New York (the “District Court”). The cases attempt to “clawback” the proceeds paid out to the Acquiring Fund in connection with the LBO. The Tribune bankruptcy plan was confirmed by the U.S. Bankruptcy Court on July 23, 2012, and became effective on December 31, 2012.

The former shareholder defendants filed motions to dismiss, each of which were granted by the District Court. The District Court’s order dismissing the actions by the individual creditors was affirmed on appeal by the Second Circuit Court of Appeals (the “Second Circuit Decision”). The Plaintiffs in the individual creditor actions have filed a Petition for Writ of Certiorari requesting review of the Second Circuit Decision by the United States Supreme Court, which Petition remains pending. The motion to dismiss the Committee Action was also granted by the District Court. It is expected that the Plaintiff in the Committee Action will seek appellate review in the Second Circuit Court of Appeals.

The Acquired Fund shareholders will become subject to the Tribune litigation after the Reorganization. The value of the proceeds received by the Acquiring Fund in the LBO was approximately $308,000. The Acquiring Fund cannot predict the outcome of these proceedings, and, it is possible, although not probable, that an adverse decision could have a material impact on the Acquiring Fund’s net asset value. The Acquiring Fund intends to vigorously defend these actions.

MANAGEMENT FEES

As compensation for advisory and administration services and the assumption of related expenses, NTI is entitled to a management fee, computed daily and payable monthly, at annual rates set forth in the tables below (expressed as a percentage of each Fund’s respective average daily net assets).

A discussion regarding the Board’s basis for its most recent approval of the Funds’ Management Agreement is available in the Funds’ Semi-Annual Report to shareholders for the six-month period ending September 30, 2016.

| | | | | | | | | | | | |

| | | Contractual Management Fee Rate | |

Fund | | First $1

Billion | | | Next $1

Billion | | | Over $2

Billion | |

Acquired Fund | | | 0.83 | % | | | 0.805 | % | | | 0.781 | % |

| | | | |

Fund | | Contractual Management

Fee Rate

| |

Acquiring Fund | | | 0.44 | % |

FUND PERFORMANCE

THE BAR CHARTS AND TABLES THAT FOLLOW PROVIDE AN INDICATION OF THE RISKS OF INVESTING IN A FUND BY SHOWING: (A) CHANGES IN THE PERFORMANCE OF A FUND FROM YEAR TO YEAR; AND (B) HOW THE AVERAGE ANNUAL RETURNS OF A FUND COMPARE TO THOSE OF A BROAD-BASED SECURITIES MARKET INDEX.

- 9 -

In calculating the federal income taxes due on redemptions, capital gains taxes resulting from redemptions are subtracted from the redemption proceeds and the tax benefits from capital losses resulting from the redemption are added to the redemption proceeds. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns After Taxes on Distributions and Sale of Fund Shares to be greater than the Returns After Taxes on Distributions or even the Returns Before Taxes.

Each Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information for the Funds is available and may be obtained on the Funds’ Web site at www.northernfunds.com or by calling 800-595-9111.

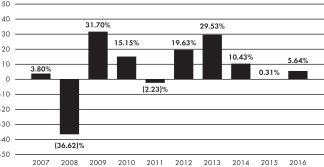

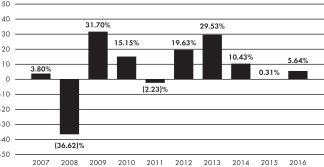

LARGE CAP EQUITY FUND (Acquired Fund)

CALENDAR YEAR TOTAL RETURN*

| * | Calendar year to date total return for the three months ended March 31, 2017 is 5.19%. For the periods shown in the bar chart above, the highest quarterly return was 18.34% in the second quarter of 2009, and the lowest quarterly return was (19.86)% in the fourth quarter of 2008. |

AVERAGE ANNUAL TOTAL RETURN

(For the periods ended December 31, 2016)

| | | | | | | | | | | | | | | | | | | | |

| | | INCEPTION

DATE | | | 1-Year | | | 5-Year | | | 10-Year | | | SINCE

INCEPTION | |

Large Cap Equity Fund | | | 4/1/94 | | | | | | | | | | | | | | | | | |

Return before taxes | | | | | | | 5.64 | % | | | 12.64 | % | | | 5.87 | % | | | 7.66 | % |

Return after taxes on distributions | | | | | | | 2.97 | % | | | 11.74 | % | | | 5.12 | % | | | 6.66 | % |

Return after taxes on distributions and sale of Fund shares | | | | | | | 5.16 | % | | | 10.06 | % | | | 4.62 | % | | | 6.29 | % |

S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | | | | | | | 11.96 | % | | | 14.66 | % | | | 6.95 | % | | | 9.46 | % |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

- 10 -

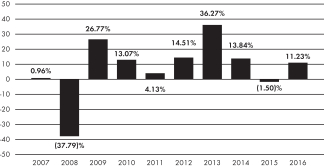

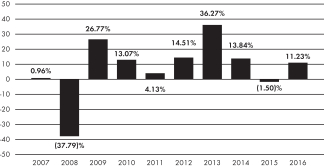

LARGE CAP CORE FUND (Acquiring Fund)

CALENDAR YEAR TOTAL RETURN*

| * | Calendar year to date total return for the three months ended March 31, 2017 is 4.76%. For the periods shown in the bar chart above, the highest quarterly return was 16.65% in the second quarter of 2009, and the lowest quarterly return was (23.19)% in the fourth quarter of 2008. |

AVERAGE ANNUAL TOTAL RETURN

(For the periods ended December 31, 2016)

| | | | | | | | | | | | | | | | | | | | |

| | | INCEPTION

DATE | | | 1-Year | | | 5-Year | | | 10-Year | | | SINCE

INCEPTION | |

Large Cap Core Fund | | | 12/16/05 | | | | | | | | | | | | | | | | | |

Return before taxes | | | | | | | 11.23 | % | | | 14.25 | % | | | 6.20 | % | | | 6.91 | % |

Return after taxes on distributions | | | | | | | 10.75 | % | | | 13.80 | % | | | 5.69 | % | | | 6.39 | % |

Return after taxes on distributions and sale of Fund shares | | | | | | | 6.73 | % | | | 11.41 | % | | | 4.87 | % | | | 5.49 | % |

S&P 500® Index (reflects no deduction for fees, expenses, or taxes) | | | | | | | 11.96 | % | | | 14.66 | % | | | 6.95 | % | | | 7.55 | % |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

THE REORGANIZATION

THE PLAN

The terms and conditions under which the Reorganization will be implemented are set forth in the Plan. Significant provisions of the Plan are summarized below; however, this summary is qualified in its entirety by reference to the Plan, which is attached as Appendix A to this Combined Prospectus/Information Statement.

The Plan contemplates:

| | • | | the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund and the assumption by the Acquiring Fund of all of the Acquired Fund’s liabilities as of the Closing Date, and |

| | • | | the distribution of such shares of the Acquiring Fund to shareholders of the Acquired Fund. |

- 11 -

The value of the Acquired Fund’s assets to be acquired and the amount of its liabilities to be assumed by the Acquiring Fund and the net asset value of a share of the Acquiring Fund will be determined on the Closing Date in accordance with the valuation procedures described in the then-current Acquiring Fund Prospectus and Statement of Additional Information.

On, or as soon as practicable after, the Closing Date, the Acquired Fund will distribute pro rata to its shareholders of record the shares of the Acquiring Fund it receives in the Reorganization in complete liquidation of the Acquired Fund. As a result of this distribution, each holder of shares of the Acquired Fund will receive a number of full and fractional shares of the Acquiring Fund equal in value to his or her interest in the Acquired Fund. This distribution will be accomplished by opening accounts on the books of the Acquiring Fund in the names of the Acquired Fund shareholders and by transferring thereto the shares of the Acquiring Fund previously credited to the account of the Acquired Fund on those books. Each shareholder account shall be credited with the pro rata number of Acquiring Fund’s shares due to that shareholder.

The stock transfer books for the Acquired Fund will be permanently closed as of the close of business on the day immediately preceding the Closing Date. Redemption requests received thereafter with respect to the Acquired Fund will be deemed to be redemption requests for the Acquiring Fund.

The implementation of the Reorganization is subject to a number of conditions set forth in the Plan. In addition, the Plan may be terminated by the Board, and the Funds may abandon the Reorganization contemplated by the Plan, at any time before the closing if circumstances develop that, in the Board’s judgment, make proceeding with the Plan inadvisable.

The Plan may be amended, modified or supplemented in such manner as may be determined by the Trustees. In addition, the Trust, after consultation with counsel and by consent of the Board, or any officer, may waive any condition to the obligations under the Plan if, in its or such officer’s judgment, such waiver will not have a material adverse effect on the interests of the shareholders of the Funds. The Board, or an authorized officer of the Trust, may change or postpone the Closing Date.

Acquired Fund shareholders who do not wish to receive shares of the Acquiring Fund as part of the Reorganization should redeem their shares prior to the consummation of the Reorganization. If you redeem your shares, you will recognize a taxable gain or loss for federal income tax purposes based on the difference between your tax basis in the shares and the amount you receive for them.

REASONS FOR THE REORGANIZATION

The Reorganization proposal was reviewed and considered by the Board, including a majority of the independent Trustees by separate vote, at a meeting held on May 17, 2017. In advance of the meeting, the Trustees received information about the investment objectives, principal investment strategies and principal risks of the Acquired Fund and Acquiring Fund, their comparative contractual management fees and operating expense ratios, asset size and investment performance, and an analysis of certain tax information and the projected benefits and disadvantages to shareholders of the Reorganization. The Trustees also considered the projected benefits to NTI and its affiliates. NTI responded to questions at the meeting. Throughout the process, the Trustees had numerous opportunities to ask questions of and request additional materials from NTI with respect to the Reorganization. During the meeting, Trustees who are not “interested persons” of the Funds, as that term is defined in the Investment Company Act of 1940 (“Independent Trustees”), met in executive session with their independent legal counsel to consider the Reorganization.

After extensive discussion based upon NTI’s recommendation, the Trustees unanimously approved the Plan on behalf of the Acquired Fund and Acquiring Fund. The Board determined that the Reorganization would be in the best interests of each Fund and that the interests of existing shareholders of each Fund would not be diluted as a result of the Reorganization. The approvals were made separately for each Fund on the basis of each Trustee’s business judgment after consideration of all of the factors taken as a whole, though individual Trustees may have placed different weight on various factors and assigned different degrees of materiality to various determinations.

- 12 -

The Board’s determination and approval were based on a number of factors, including but not limited to the following:

| | • | | NTI had determined that the Acquired Fund had minimal growth prospects, including because its investment strategy was out of favor with investors, and that the combined Fund had better prospects for future growth under the Acquiring Fund’s investment strategy. |

| | • | | The performance of the Acquired Fund and Acquiring Fund over the 1-year, 3-year, 5-year, 10-year and since-inception periods ended March 31, 2017. |

| | • | | The Board determined that the Acquired Fund would be unlikely to achieve the scale necessary to remain commercially viable. |

| | • | | While the Board considered other options for the Acquired Fund, including liquidation of the Fund, a reorganization with the Acquiring Fund was determined to be the most beneficial outcome for shareholders. |

| | • | | The investment objectives of the Acquired Fund and Acquiring Fund are substantially identical, with the Acquired Fund seeking to provide long-term capital appreciation and the Acquiring Fund seeking long-term growth of capital. The investment strategies of the Funds are similar, but not identical, in that the Acquired Fund employs an investment strategy that uses fundamental research and quantitative analysis, while NTI’s approach for the Acquiring Fund is based primarily on applying quantitative methods to fundamental research. Despite these differences in investment strategies, the Board concluded that there were sufficient similarities between the Funds, including that the Funds invest at least 80% of their assets in large capitalization companies within the range of capitalization of the S&P 500 Index, to provide a sound basis for the reorganization. |

| | • | | Currently, the total annual operating expense ratio (before contractual expense reimbursements) is [ ] for the Acquired Fund and Acquiring Fund, respectively, and, the total net operating expense ratio (after contractual expense reimbursements) is [ ] for the Acquired Fund and Acquiring Fund, respectively. The Board determined that shareholders of the Acquired Fund will benefit from the substantial decrease in gross and net operating expenses following the Reorganization. [to be completed by amendment] |

| | • | | Currently, the contractual management fee is 0.83% and 0.44% for the Acquired Fund and Acquiring Fund, respectively. The management fee for the Acquiring Fund does not contain breakpoints, but is significantly lower than the management fee for the Acquired Fund at its lowest breakpoint. The Board determined that shareholders of the Acquired Fund will benefit from the substantial decrease in management fees following the Reorganization. |

| | • | | For federal income tax purposes, the Reorganization is to be structured as a tax-free transaction for the Acquired Fund and its shareholders. The Board considered that the tax treatment, however, did not extend to transactions that occur prior to, or after the Reorganization. Prior to the Reorganization, the Acquired Fund intends to liquidate a substantial portion of its portfolio securities, and it was expected that the disposition of those portfolio securities would generate capital gains that would be taxable to Acquired Fund shareholders (aside from tax-exempt accounts) prior to the Reorganization. |

| | • | | The Acquired Fund shareholders will become subject to the Tribune litigation described above, and it is possible, although not probable, that an adverse decision could have a material impact on the Acquiring Fund’s net asset value. |

| | • | | Shareholders of the Acquired Fund will receive shares of the Acquiring Fund having an aggregate net asset value equal to that of their Acquired Fund shares and will not bear any costs of the Reorganization. |

| | • | | No sales or other charges will be imposed in connection with the Reorganization. |

| | • | | The Trustees also considered the future prospects of the Acquired Fund if the Reorganization is not effected, including the possibility that the Fund might be liquidated because of a lack of commercial viability. |

- 13 -

FEDERAL INCOME TAX CONSEQUENCES

The transfer of all of the assets and liabilities of the Acquired Fund to the Acquiring Fund in exchange for the issuance of the Acquiring Fund shares, followed by the distribution in liquidation by the Acquired Fund of the Acquiring Fund shares pursuant to the Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Internal Revenue Code (“Code”). As a condition to the closing of the Reorganization, the Trust will receive the opinion of Drinker Biddle & Reath LLP, counsel to the Trust and the Funds, to the effect that on the basis of the existing provisions of the Code, Treasury Regulations thereunder, current administrative rulings and pronouncements and court decisions, and certain facts, qualifications, assumptions and representations with respect to the Reorganization, for federal income tax purposes:

| | • | | The Reorganization will constitute a reorganization within the meaning of Section 368(a) of the Code, and the Acquired Fund and the Acquiring Fund will each be “a party to a reorganization” within the meaning of Section 368(b) of the Code; |

| | • | | No gain or loss will be recognized by the Acquired Fund upon (i) the transfer of its assets to the Acquiring Fund in exchange for the issuance of Acquiring Fund shares to the Acquired Fund and the assumption by the Acquiring Fund of the Acquired Fund’s liabilities, if any, or (ii) the distribution by the Acquired Fund of the Acquiring Fund shares to the Acquired Fund shareholders; |

| | • | | No gain or loss will be recognized by the Acquiring Fund upon its receipt of the Acquired Fund’s assets in exchange for the issuance of the Acquiring Fund shares to the Acquired Fund and the assumption by the Acquiring Fund of the liabilities, if any, of the Acquired Fund; |

| | • | | The tax basis in the hands of the Acquiring Fund of each asset of the Acquired Fund transferred to the Acquiring Fund will be the same as the tax basis of that asset in the Acquired Fund’s hands immediately before the transfer; |

| | • | | The tax holding period in the hands of the Acquiring Fund of each asset of the Acquired Fund transferred to the Acquiring Fund will include the Acquired Fund’s tax holding period for that asset; |

| | • | | The Acquired Fund’s shareholders will not recognize gain or loss upon the exchange of their Acquired Fund shares for Acquiring Fund shares as part of the Reorganization; |

| | • | | The aggregate tax basis of the Acquiring Fund shares received by each shareholder of the Acquired Fund will equal the aggregate tax basis of the Acquired Fund shares surrendered by that shareholder in the Reorganization; |

| | • | | The tax holding periods of the Acquiring Fund shares received by each Acquired Fund shareholder will include the tax holding periods of the Acquired Fund shares surrendered by that shareholder in the Reorganization, provided that the Acquired Fund shares were held as capital assets on the date of the Reorganization; |

| | • | | The Acquired Fund’s final taxable year will end on the date of the Reorganization; and |

| | • | | The Acquiring Fund will succeed to and take into account the tax attributes of the Acquired Fund described in Section 381(c) of the Code, subject to the conditions and limitations specified in Sections 381, 382, 383 and 384 of the Code and the Treasury Regulations thereunder. |

Internal Revenue Service Regulations require that the Acquiring Fund provides to the Internal Revenue Service and the Fund’s shareholders information regarding the effect of the Reorganization on the Fund shareholders’ tax basis for the shares issued in the Reorganization. The Acquiring Fund can satisfy this obligation by posting a completed IRS Form 8937 on its website for 10 years. The Acquiring Fund intends to post the required IRS Form 8937 on its website for at least 10 years. Shares held for the purpose of investment are generally considered to be capital assets.

- 14 -

The Trust has not sought, and will not seek, a tax ruling from the Internal Revenue Service (“IRS”) on the tax treatment of the Reorganization. The opinion of counsel will not be binding on the IRS, nor will it preclude the IRS (or a court) from adopting a contrary position.

Immediately before the Reorganization, the Acquired Fund will pay a dividend or dividends that, together with all previous distributions, will have the effect of distributing to its shareholders all of its remaining undistributed net investment company taxable income and net capital gain, if any, recognized in taxable years ending on or before the day of the Reorganization. Any such dividends will generally be included in the taxable income of the Acquired Fund’s shareholders.

The Acquiring Fund has a capital loss carry forward as of March 31, 2017, which may be subject to limitations on use after the Reorganization. Shareholders should consult their own tax advisers concerning any potential tax consequences of the Reorganization that may result from their particular circumstances, including the tax treatment of the Reorganization under the tax laws of any foreign country, state or locality where a shareholder may reside.

DESCRIPTION OF THE SECURITIES TO BE ISSUED

Under the terms of its Agreement and Declaration of Trust (the “Trust Agreement”), the Trust is authorized to issue shares of beneficial interest in separate series, including the Funds.

Under the terms of the Trust Agreement, each share of each Fund has a par value of $0.0001, represents a proportionate interest in the particular Fund with each other share of its class in the same Fund and is entitled to such dividends and distributions out of the income belonging to the Fund as are declared by the Trustees. Upon any liquidation of a Fund, shareholders of each class of a Fund are entitled to share pro rata in the net assets belonging to that class available for distribution. Shares do not have any preemptive or conversion rights. Shares, when issued as described in this combined Prospectus/Information Statement, are validly issued, fully paid and nonassessable. In the interests of economy and convenience, certificates representing shares of the Funds are not issued.

The proceeds received by each Fund for each issue or sale of its shares, and all net investment income, realized and unrealized gain and proceeds thereof, subject only to the rights of creditors, are specifically allocated to and constitute underlying assets of that Fund. The underlying assets of each Fund are segregated on the books of account, and are charged with the liabilities in respect to that Fund and with a share of the general liabilities of the Trust.

The Trust is not required to hold annual meetings of shareholders and does not intend to hold such meetings, although it does hold special meetings of shareholders as necessary. In the event that a meeting of shareholders is held, each share of the Trust will be entitled, as determined by the Trustees without the vote or consent of shareholders, either to one vote for each share held or to one vote for each dollar of net asset value represented by such shares on all matters presented to shareholders, including the election of Trustees (this method of voting being referred to as “dollar-based voting”). However, to the extent required by the 1940 Act or otherwise determined by the Trustees, series or classes of the Trust will vote separately from each other. Shareholders of the Trust do not have cumulative voting rights in the election of Trustees and, accordingly, the holders of more than 50% of the aggregate voting power of the Trust may elect all of the Trustees, irrespective of the vote of the other shareholders. Meetings of shareholders of the Trust, or any series or class thereof, may be called by the Trustees, certain officers or upon the written request of holders of 10% or more of the shares entitled to vote at such meeting. To the extent required by law, the Trust will assist in shareholder communications in connection with a meeting called by shareholders. The shareholders of the Trust will have voting rights only with respect to the limited number of matters specified in the Trust Agreement and such other matters as the Trustees may determine or as may be required by law.

- 15 -

The Trust Agreement authorizes the Trustees, without shareholder approval (except as stated in the next paragraph), to cause the Trust, or any series thereof, to merge or consolidate with any corporation, association, trust or other organization or sell or exchange all or substantially all of the property belonging to the Trust, or any series thereof. In addition, the Trustees, without shareholder approval, may adopt a “master-feeder” structure by investing substantially all of the assets of a series of the Trust in the securities of another open-end investment company or pooled portfolio.

The Trust Agreement also authorizes the Trustees, in connection with the merger, consolidation, termination or other reorganization of the Trust or any series or class, to classify the shareholders of any class into one or more separate groups and to provide for the different treatment of shares held by the different groups, provided that such merger, consolidation, termination or other reorganization is approved by a majority of the outstanding voting securities (as defined in the 1940 Act) of each group of shareholders that are so classified.

The Trust Agreement permits the Trustees to amend the Trust Agreement without a shareholder vote, except in certain circumstances. Shareholders of the Trust have the right to vote on any amendment: (i) that would adversely affect the voting rights of shareholders; (ii) that is required by law to be approved by shareholders; (iii) that would amend the voting provisions of the Trust Agreement; or (iv) that the Trustees determine to submit to shareholders. The Trust Agreement permits the termination of the Trust or of any series or class of the Trust: (i) by a majority of the affected shareholders at a meeting of shareholders of the Trust, series or class; or (ii) by a majority of the Trustees without shareholder approval if the Trustees determine that such action is in the best interest of the Trust or its shareholders. The factors and events that the Trustees may take into account in making such determination include: (i) the inability of the Trust or any series or class to maintain its assets at an appropriate size; (ii) changes in laws or regulations governing the Trust, or any series or class thereof, or affecting assets of the type in which it invests; or (iii) economic developments or trends having a significant adverse impact on their business or operations.