reflected in the Statement of Operations. As of December 31, 2024, the fund had securities on loan with an aggregate market value of $32,760,076; the total market value of collateral held by the fund was $33,685,986. The market value of the collateral held included non-cash collateral, in the form of U.S. Treasury securities, with a value of $21,546,514 and cash collateral, which was invested into the State Street Navigator Securities Lending Government Money Market Portfolio, with a value of $12,139,472.

11. Capital Share Transactions

While there are no sales commissions (loads) or 12b-1 fees, MAF previously assessed entry and exit fees on capital invested or redeemed. Effective December 1, 2021, the entry and exit fees for MAF were eliminated entirely.

12. Concentration of Risks

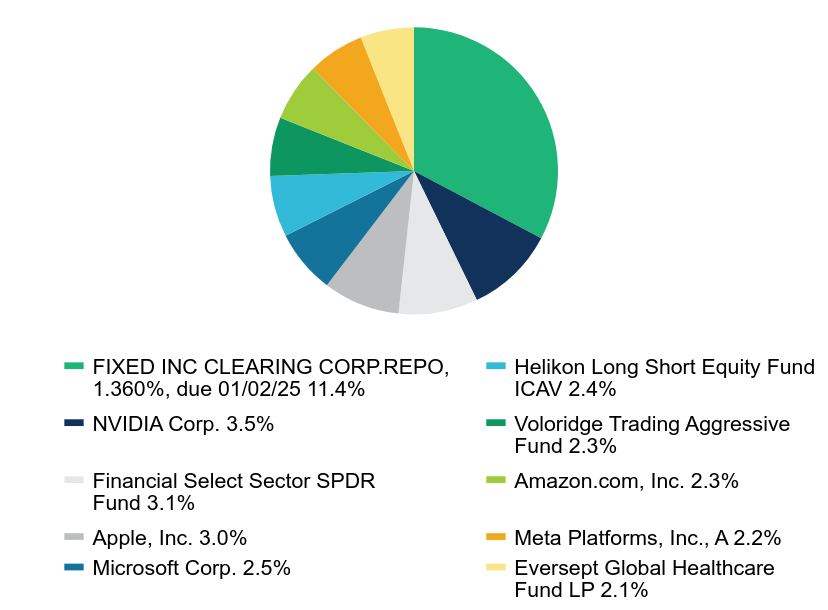

MAF may engage in transactions with counterparties, including but not limited to repurchase and reverse repurchase agreements, forward contracts, futures and options, and total return, credit default, interest rate, and currency swaps. The fund may be subject to various delays and risks of loss if the counterparty becomes insolvent or is otherwise unable to meet its obligations.

The fund engages multiple external money managers, each of which manages a portion of the fund’s assets. A multi-manager fund entails the risk, among others, that the advisor may not be able to (1) identify and retain money managers who achieve superior investment returns relative to similar investments; (2) combine money managers in the fund such that their investment styles are complementary; or (3) allocate cash among the money managers to enhance returns and reduce volatility or risk of loss relative to a fund with a single manager.

The fund invests in private investment funds that entail liquidity risk to the extent they are difficult to sell or convert to cash quickly at favorable prices.

The fund invests in fixed income securities issued by banks and other financial companies, the market values of which may change in response to interest rate fluctuations. Although the fund generally maintains a diversified portfolio, the ability of the issuers of the fund’s portfolio securities to meet their obligations may be affected by changing business and economic conditions in a specific industry, state, or region.

The fund invests in US Government securities. Because of the rising US Government debt burden, it is possible that the US Government may not be able to meet its financial obligations or that securities issued or backed by the US Government may experience credit downgrades. Such a credit event may adversely affect the financial markets.

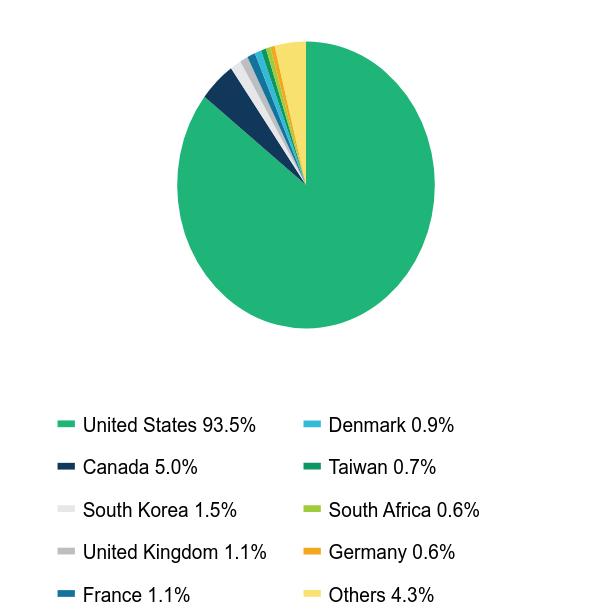

The fund invests in securities of foreign issuers in various countries. These investments may involve certain considerations and risks not typically associated with investments in the US, a result of, among other factors, the possibility of future political and economic developments and the level of governmental supervision and regulation of securities markets in the respective countries.

The fund invests in small capitalization stocks. These investments may entail different risks than larger capitalizations stocks, including potentially lesser degrees of liquidity.

The fund may engage in short sales in which it sells a security it does not own. To complete such a transaction, the fund must borrow or otherwise obtain the security to make delivery to the buyer. The fund then is obligated to replace the borrowed security by purchasing the security at the market price at the time of replacement. The price at such time may be more or less than the price at which the security was sold by the fund. The fund’s investment performance will suffer if a security that it has sold short appreciates in value.

13. Indemnifications

In the normal course of business, the fund enters into contracts that provide general indemnifications. The fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the fund and, therefore, cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

14. New Accounting Pronouncements

The Fund adopted Financial Accounting Standards Board Update 2023-07, Segment Reporting (Topic 280) — Improvements to Reportable Segment Disclosures (“ASU 2023-07”) during the period. The Fund’s adoption of the new standard impacted financial statement disclosures only and did not affect the Fund’s financial position or results of operations.

![[MISSING IMAGE: lg_pwc-4c.jpg]](https://capedge.com/proxy/N-CSR/0001104659-25-019164/lg_pwc-4c.jpg)

![[MISSING IMAGE: sg_pricewaterhousecoo-bw.jpg]](https://capedge.com/proxy/N-CSR/0001104659-25-019164/sg_pricewaterhousecoo-bw.jpg)

![[MISSING IMAGE: ft_pricewater-bw.jpg]](https://capedge.com/proxy/N-CSR/0001104659-25-019164/ft_pricewater-bw.jpg)