The Company does not have a separate nominating committee. The Board of Directors believes that the task of nominating prospective directors requires the participation of all current independent directors, rather than a separate committee consisting of only certain independent directors. The independent directors will consider all qualified director candidates identified by various sources, including members of the Board, management and stockholders. Candidates for directors recommended by stockholders will be given the same consideration as those identified from other sources. The independent directors are responsible for reviewing each candidate’s biographical information, meeting with each candidate and assessing each candidate’s independence, skills and expertise based on a number of factors. While we do not have a formal policy on diversity, when considering the selection of director nominees, the independent directors consider individuals with diverse backgrounds, viewpoints, accomplishments, cultural background, and professional expertise, among other factors.

Only persons who are nominated in accordance with the procedures set forth in Section 12 of our Bylaws shall be eligible for election as directors. Nominations of persons for election to the Board of Directors may be made at a meeting of stockholders at which directors are to be elected only (i) by or at the direction of the Board of Directors or (ii) by any stockholder of the Company entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in Section 12 of our Bylaws. Such nominations, other than those made by or at the direction of the Board of Directors, shall be made by timely notice in writing to the Secretary of the Company. To be timely, a stockholder’s notice must be delivered or mailed to and received at the principal executive offices of the Company not less than 30 days prior to the date of the meeting, provided, however, that in the event that less than 40 days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, to be timely, a stockholder’s notice must be so received not later than the close of business on the tenth day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made. Such stockholder’s notice shall set forth (i) as to each person whom such stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including each such person’s written consent to serving as a director if elected); and (ii) as to the stockholder giving the notice (x) the name and address of such stockholder as they appear on the Company’s books, and (y) the class and number of shares of the Company’s capital stock that are beneficially owned by such stockholder.

SELECTION OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The Audit Committee of our Board of Directors has selected Goldstein Schechter Koch, P.A. (“GSK”) as our independent certified public accountants for the year ending February 28, 2014. GSK has served as our independent certified public accountants since January 24, 2013. If the selection of GSK as our independent registered public accounting firm is not ratified by our stockholders, the Audit Committee will re-evaluate its selection, taking into consideration the stockholder vote on the ratification. However, the Audit Committee is solely responsible for selecting and terminating our independent registered public accounting firm, and may do so at any time at its discretion. A representative of GSK is expected to attend the Annual Meeting and be available to respond to appropriate questions. The representative also will be afforded an opportunity to make a statement, if he or she desires to do so.

Change in Independent Certified Public Accountants

Merger of Meeks and THF

Effective September 1, 2012, Meeks International, Inc. (“Meeks”), the prior independent registered public accounting firm of the Company, was acquired by Thomas, Howell, Ferguson, P.A. (“THF”) in a transaction pursuant to which Meeks merged its operations into THF and the professional staff and partners of Meeks joined THF as employees with Charlie M. Meeks becoming a partner of THF. As a result of the merger, Meeks effectively resigned as the Company’s independent registered public accounting firm on September 1, 2012. The Audit Committee of the Board of Directors of the Company was advised of the merger and approved the engagement of THF, as the Company’s independent registered public accounting firm, effective September 1, 2012.

Meeks audited the Company’s consolidated financial statements for the fiscal years ended February 29, 2012 and February 28, 2011. The reports of Meeks on the consolidated financial statements of the Company for the fiscal years ended February 29, 2012 and February 28, 2011 did not contain an adverse opinion nor a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

In connection with Meeks’ audits of the Company’s financial statements for the fiscal years ended February 29, 2012 and February 28, 2011, and through the interim period ended September 1, 2012, the Company has had no disagreement with Meeks on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of Meeks, would have caused Meeks to make a reference to the subject matter of the disagreements in connection with its reports on the consolidated financial statements for the fiscal years ended February 29, 2012 and February 28, 2011.

Prior to engaging THF, neither the Company nor anyone acting on the Company’s behalf consulted THF regarding either (i) the application of accounting principles to a specific completed or proposed transaction, or the type of audit opinion that might be rendered on the Company’s financial statements, and either a written report was provided to the Company or oral advice was provided that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issues, or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions to such item) or a reportable event (as described in Item 304 (a)(1)(v) of Regulation S-K).

Termination of THF

On January 24, 2013, we terminated the engagement of THF as the Company’s independent registered public accounting firm. The Audit Committee of the Board of Directors of the Company recommended and approved the decision to terminate THF.

THF was engaged on September 1, 2012 in connection with the merger of Meeks with and into THF. Meeks served as the Company’s independent registered public accounting firm from February 15, 2011 through September 1, 2012, the time of the merger with THF. As a result, THF has not audited any of the Company’s financial statements. Meeks previously audited the Company’s consolidated financial statements for the fiscal years ended February 29, 2012 and February 28, 2011. Also, in connection with THF’s service to the Company as its independent registered public accounting firm from September 1, 2012 to January 24, 2013, the Company has had no disagreement with THF on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure.

9

Engagement of GSK

The Company’s Audit Committee reviewed the qualifications of several potential applicants and chose GSK as the successor independent registered public accounting firm to be engaged effective January 24, 2013.

Prior to engaging GSK, neither the Company nor anyone acting on the Company’s behalf consulted GSK regarding either (i) the application of accounting principles to a specific completed or proposed transaction, or the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was provided to the Company that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issues, or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions to such item) or a reportable event (as described in Item 304 (a)(1)(v) of Regulation S-K).

Auditor Fees And Services

The following table sets forth the fees billed by Meeks, THF and GSK for the years ended February 28, 2013 and February 29, 2012.

| | | | 2013

| | 2012

|

|---|

| | | | $ | 57,500 | (1) | | $ | 57,131 | (2) |

| | | | | 523 | (3) | | | 1,828 | (2) |

| | | | | 562 | (3) | | | 2,500 | (3) |

| | | | | 5,000 | (4) | | | — | |

| | | | $ | 63,585 | | | $ | 61,459 | |

(1) | | Represents $50,000 for fees billed by GSK, $5,000 for fees billed by THF for quarterly reports, and $2,500 for fees billed by Meeks for quarterly reports. |

(2) | | Fees billed by Meeks. |

(4) | | Represents $5,000 for fees billed by Meeks in connection with the Annual Report on Form 10-K for the year ended February 28, 2013. |

Pre-Approval Policies and Procedures for Audit and Permitted Non-Audit Services

The Audit Committee has a policy of considering and, if deemed appropriate, approving, on a case by case basis, any audit or permitted non-audit service proposed to be performed by the Company’s principal accountant in advance of the performance of such service. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has not implemented a policy or procedure which delegates the authority to approve, or pre-approve, audit or permitted non-audit services to be performed by the Company’s principal accountant. In connection with making any pre-approval decision, the Audit Committee must consider whether the provision of such permitted non-audit services performed by the Company’s principal accountant is consistent with maintaining the Company’s principal accountant’s status as our independent auditors at such time.

Consistent with these policies and procedures, the Audit Committee approved all of the services rendered by Meeks, THF and GSK for the years ended February 28, 2013 and February 29, 2012, as described above.

Vote Required and Recommendation

The proposal to approve the selection of GSK as our independent accountant for the fiscal year ending February 28, 2014, requires the affirmative vote of a majority of the voting power of the issued and outstanding stock of the Company entitled to vote, present in person or represented by proxy at the Annual Meeting.

The Board of Directors recommends a vote“FOR” the proposal.

10

REPORT OF THE AUDIT COMMITTEE

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for establishing and maintaining adequate internal control over financial reporting, for preparing the financial statements and for the report process. The Audit Committee members do not serve as professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management or the independent public accounting firm. We have engaged Goldstein Schechter Koch, P.A. (“GSK”) as our independent public accountants to report on the conformity of the Company’s financial statements to accounting principles generally accepted in the United States. In this context, the Audit Committee hereby reports as follows:

1. The Audit Committee has reviewed and discussed the audited financial statements with management of the Company.

2. The Audit Committee has discussed with GSK, our independent registered public accounting firm, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T.

3. The Audit Committee has also received the written disclosures and the letter from GSK required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and the Audit Committee has discussed the independence of GSK with that firm.

4. Based on the review and discussion referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors and the Board of Directors approved the inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended February 28, 2013, for filing with the SEC.

The foregoing has been furnished by the Audit Committee:

Joseph Schlig, Chairman

Jacob A. Davis

This “Audit Committee Report” is not “Soliciting Material,” is not deemed filed with the SEC and it not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

11

MANAGEMENT

Executive Officers

Please refer to the biographical information for Mr. Saraf, our Chairman of the Board, Chief Executive Officer, President and Chief Financial Officer, listed above in the “Election of Directors” section.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides certain summary information concerning compensation paid by the Company, to or on behalf of the following named executive officer for the fiscal years ended February 28, 2013 and February 29, 2012.

Name and Principal Position

| | | | Year

| | Salary($)

| | Bonus($)

| | All Other

Compensation($)

| | Total($)

|

|---|

| | | | | 2013 | | | $ | 272,000 | | | $ | 104,000 | (1) | | $ | 27,000 | (2) | | $ | 403,000 | |

Chairman of the Board,

President, and CFO | | | | | 2012 | | | $ | 264,000 | | | $ | 90,000 | (3) | | $ | 26,000 | (2) | | $ | 380,000 | |

(1) | | The Company accrued $104,000 as a bonus to Mr. Saraf for the fiscal year ended February 28, 2013. $68,000 of the bonus was paid in December 2012 following approval by the Compensation Committee at a meeting held on December 12, 2012. The Compensation Committee approved the remainder of the bonus at a meeting held on May 13, 2013, which bonus will be paid during June 2013. |

(2) | | Represents Life, Disability, & Medical Insurance premiums plus personal car expenses. For the year ended February 28, 2013, Life, Disability, Medical Insurance premiums were $25,000 and car expenses were $2,000. For the year ended February 29, 2012, Life, Disability, Medical Insurance premiums were $24,000 and car expenses were $2,000. |

(3) | | The Company accrued $90,000 for a bonus to Mr. Saraf for the fiscal year ended February 29, 2012. The Compensation Committee met and approved the bonus and the bonus was paid during June 2012. |

Outstanding Equity Awards at Fiscal Year-End Table

The following table sets forth certain summary information concerning outstanding equity awards as of February 28, 2013 held by the following named executive officer.

Option Awards

| |

|---|

Name

| | | | Number of Securities

Underlying

Unexercised

Options

(#) Exercisable(1)

| | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexerciseable

| | Equity

Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

| | Option

Exercise

Price

($)

| | Option

Expiration

Date

|

|---|

| | | | | 254,624 | | | | — | | | | — | | | $ | .40 | | | |

| | | | | 175,636 | | | | — | | | | — | | | $ | 1.05 | | | |

(1) | | These options were fully exercisable as of February 28, 2013. |

(2) | | These options do not expire. |

12

Mr. Saraf’s Employment Agreement

On December 1, 2000, the Company entered into an employment agreement with Shevach Saraf, the President and Chief Executive Officer of the Company. On January 14, 2013, the Company amended the employment agreement with Mr. Saraf. The description below summarizes the employment agreement, as amended.

The initial term of employment agreement was five years. The employment agreement stipulates that the contract is automatically extended for one-year periods unless a notice is given by either party at least 180 days prior to the scheduled expiration of the initial term or any extensions. This agreement provides, among other things, for annual compensation of $240,000 and a bonus pursuant to a formula. The employment agreement stipulates that Mr. Saraf shall be entitled to a bonus equal to fifteen percent (15%) of the Company’s pre-tax income in excess of Two Hundred Fifty Thousand Dollars ($250,000). For purposes of the agreement, “pre-tax income” shall mean net income before taxes, excluding (i) all extraordinary gains or losses, (ii) gains resulting from debt forgiven associated with the buyout of unsecured creditors, and (iii) any bonus paid to Mr. Saraf. The bonus payable thereunder shall be paid within ninety (90) days after the end of the fiscal year.

Upon execution of the agreement, Mr. Saraf received a grant to purchase ten percent (10%) of the outstanding shares of the Company’s common stock, par value $.01 calculated on a fully diluted basis, at an exercise price per share equal to the closing asking price of the company’s common stock on the OTCBB on the date of the grant ($0.40). Fifty percent (50%) of the initial stock options granted vested immediately upon grant. The remaining fifty percent (50%) of the initial stock options vested in equal amount on each of the first five anniversaries of the date of grant. All of these options are now fully vested. These stock options are in addition to, and not in lieu of or in substitution for, the stock options (the “1992 Stock Options”) granted to Mr. Saraf pursuant to the Incentive Stock Option Plan Agreement dated October 20, 1992 under Solitron Devices, Inc. 1987 Stock Option Plan between the Company and Mr. Saraf.

Under the employment agreement, if Mr. Saraf’s employment is terminated due to his death, the Company will pay the following amounts to his estate: (i) his base salary through the last day of the calendar month in which he dies, (ii) his bonus for the prior year which has been earned but not paid, (iii) his bonus for the then current year of employment prorated for the actual number of days of such year he was employed during such year (which shall be calculated by assuming that the bonus for such year would be equal to the bonus for the previous year plus an amount equal to the percentage increase in the consumer price index for the prior twelve month period) and (iv) a death benefit in an amount equal to three times Mr. Saraf’s then current base salary (including any amount deferred under any deferred compensation plan) plus an amount equal to the most recent bonus awarded to him, to the extent funded by life insurance policies as provided for in the employment agreement.

Under the employment agreement, if Mr. Saraf’s employment is terminated due to his failure to perform his duties under the employment agreement due to Disability for a consecutive period of more than six months, the Company may terminate the employment agreement upon thirty (30) days written notice to him. Mr. Saraf shall continue to receive compensation until the end of the thirty (30) day notice period. For purposes of the employment agreement, the term “Disability” shall mean the inability to engage in any substantial gainful activity with the Company by reason of any medically determinable physical or mental impairment for at least six consecutive months. In addition, under the employment agreement, the Company shall maintain a disability policy providing employee payments in the event of a disability.

In the event Mr. Saraf terminates his employment agreement for Good Reason, the Company shall pay Mr. Saraf a lump sum equal to his base salary and bonus through the remainder of the term of the employment agreement. For purposes of the employment agreement, “Good Reason” shall mean (a) breach of any provision of the employment agreement by the employee including, without limitation, a reduction in his duties or responsibilities, (b) the appointment of any other person as Chairman of the Board, President or Chief Executive Officer of the Company or the removal of the employee from that position, (c) the failure of the stockholders to elect the employee as a director of the Company or the removal of the employee from the Board of Directors, or (d) the relocation of the Company’s business operations or principal office more than 30 miles from its present location.

In the event the Company terminates Mr. Saraf’s employment for “Cause” (other than a termination for Disability), the Company shall pay Mr. Saraf his base salary through the date of termination stated in the notice, and Mr. Saraf shall, if so requested by the Board of Directors, perform his duties under the employment agreement through the date of termination stated in the notice. As used herein, “Cause” shall mean any willful (a) dissemination

13

of genuine trade secrets or other material confidences of the employer by employee for the personal gain of the employee, (b) dishonesty of employee in the course of his employment which is punishable by criminal and civil law or is materially prejudicial to employer, (c) deliberate activity of employer which is materially prejudicial to the financial interests of the Company as reasonably determined by a majority of the Board of Directors of the Company, or any act, or failure to act, by employee involving fraud, willful malfeasance or gross negligence in the performance of his duties hereunder as reasonably determined by a majority of the disinterested members of the Board of Directors of employer, or (d) Disability of employee.

In the event the Company terminates Mr. Saraf’s employment for any reason other than for Cause or upon Mr. Saraf’s death or disability, then (a) the employment agreement shall nonetheless be deemed terminated, and the Company shall pay Mr. Saraf upon any such termination a lump sum equal to the larger of his base salary and bonus for the remaining term under the employment agreement and his base salary and bonus for three (3) years and (b) the Company will pay the premium for Mr. Saraf’s COBRA insurance benefits for Mr. Saraf and his family for 18 months or provide equivalent coverage. The foregoing payments shall also be made in the event that Mr. Saraf’s employment with the Company is terminated following a Change of Control notwithstanding the reason for such termination. For purposes of the employment agreement, “Change in Control” of the Company shall mean: (1) any “person” (other than Employee) as such term is used in Section 13(d) and 14(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) (other than the employee or any group of which the employee is a part, or any Company owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of stock of the Company) is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing thirty percent (30%) or more of the combined voting power of the Company’s then outstanding securities; (2) at any time, Incumbent Directors cease, for any reason, to constitute at least a majority of the Board of Directors of the Company. As used herein, “Incumbent Directors” means (a) the individuals who constitute the Board upon the execution of this Agreement and (b) any other director whose election by the Board or nomination for election by the Company’s stockholders was approved by a vote of at least two-thirds (2/3) of the Incumbent Directors then in office which two-thirds includes the employee; (3) the stockholders of the Company approve a merger or consolidation of the Company with any other corporation, other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) more than 80% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation; provided, however that no “Change of Control” shall be deemed to have occurred until the closing of any such transaction; and provided further, that a merger or consolidation effected to implement a recapitalization of the Company (or similar transaction) in which no person (as hereinabove defined) acquires more than 25% of the combined voting power of the Company’s then outstanding securities shall not constitute a Change in Control of the Company; (4) the stockholders of the Company approve a plan of complete liquidation of the Company or the sale or disposition by the Company of all or substantially all of the Company’s assets or (5) the Company, in one or a series of transactions, sells all or substantially all of its assets.

Any payments payable under the employment agreement to Mr. Saraf that are in the nature of compensation in the event of the Company’s termination of Mr. Saraf under the employment agreement shall not exceed the maximum amount which may be paid to Mr. Saraf without causing such payments or any other payments or benefits provided to Mr. Saraf to become subject to the deduction limitation provided for in Section 280G(a) of the Internal Revenue Code of 1986, as amended, or the excise tax provided for in Section 4999 of the Code, or any successor provisions of applicable law.

Under the employment agreement, upon a termination by Mr. Saraf for Cause, termination by the Company without Cause, or the effectuation of a Change of Control, all stock options of the Company held by Mr. Saraf upon the date of termination will immediately vest upon termination and upon the effectuation of a Change of Control.

At a meeting of the Compensation Committee on January 23, 2006, the Committee approved an increase to Mr. Saraf’s annual compensation to $280,000, effective March 1, 2006.

On January 14, 2013, Mr. Saraf exercised a cost-of-living increase clause in his contract increasing his annual compensation to $293,000.

14

Mr. Saraf may also participate in the Company’s 2000 Stock Option Plan, the Company’s 2007 Stock Incentive Plan, the Company’s deferred Compensation Plan and the Company’s Employee 401-K and Profit Sharing Plan (the “Profit Sharing Plan”). During the fiscal year ended February 28, 2013, no amounts were deferred by Mr. Saraf under the Company’s deferred Compensation Plan and the Company did not match any employee contributions to the Profit Sharing Plan.

Based upon the Compensation Committee’s review of the Company’s compensation design features, and the Company’s applied compensation philosophies and objectives, the Compensation Committee determined that risks arising from the Company’s compensation policies and practices for its employees are not reasonably likely to have a material adverse effect on the Company.

15

NON-BINDING ADVISORY VOTE ON

SAY ON PAY

Background of the Proposal

The DoddFrank Act requires all public companies to hold a separate nonbinding advisory stockholder vote to approve the compensation of executive officers as described in the executive compensation tables and any related information in each such company’s proxy statement (commonly known as a “Say on Pay” proposal). Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, we are holding a separate non-binding advisory vote on Say on Pay at the Annual Meeting.

Executive Compensation

The Board of Directors believes that our executive compensation programs are designed to secure and retain the services of high quality executives and to provide compensation to our executive that are commensurate and aligned with our performance and advances both the short and long-term interests of our company and our stockholders. We seek to achieve these objectives through three principal compensation programs: base salary, annual cash incentive bonus, and long-term equity incentives, in the form of grants of stock options. Base salaries are designed primarily to attract and retain talented executives. Annual cash incentive bonuses are designed to motivate and reward hard work and dedication to the Company. Grants of stock options are designed to provide a strong incentive for achieving long-term results by aligning the interests of our executive with those of our stockholders, while at the same time encouraging our executive to remain with us. The Board of Directors believes that our compensation program for our executive officer is appropriately based upon our performance and the individual performance and level of responsibility of the executive officer.

This Say on Pay proposal is set forth in the following resolution:

RESOLVED, that the stockholders of Solitron Devices, Inc. approve, on an advisory basis, the compensation of its named executive officer, as disclosed in the Solitron Devices, Inc.’s Proxy Statement for the 2013 Annual Meeting of Stockholders, pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables, and any related information found in the proxy statement of Solitron Devices, Inc.

Because your vote on this proposal is advisory, it will not be binding on the Board of Directors, the Compensation Committee or the Company. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

Vote Required and Recommendation

The advisory vote on the Say on Pay proposal requires the affirmative vote of a majority of the voting power of the issued and outstanding stock of the Company entitled to vote, present in person or represented by proxy at the Annual Meeting.

The Board of Directors recommends a vote“FOR” the Say on Pay proposal.

16

NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF

THE ADVISORY VOTE ON SAY ON PAY IN FUTURE YEARS

Background of the Proposal

The DoddFrank Act also requires all public companies to hold a separate nonbinding advisory stockholder vote with respect to the frequency of the vote on the Say on Pay proposal thereafter. Companies must give stockholders the choice of whether to cast an advisory vote on the Say on Pay proposal every year, every two years, or every three years (commonly known as the “Frequency Vote on Say on Pay”). Stockholders may also abstain from making a choice, pursuant to proposed rules recently issued by the SEC. After such initial votes are held, the DoddFrank Act requires all public companies to submit to their stockholders no less often than every six years thereafter the Frequency Vote on Say on Pay. Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, we are holding a separate non-binding advisory vote on the Frequency Vote on Say on Pay at the Annual Meeting.

Frequency Vote on Say on Pay

As discussed above, the Board of Directors believes that our executive compensation programs are designed to secure and retain the services of high quality executives and to provide compensation to our executive that are commensurate and aligned with our performance and advances both the short and long-term interests of our company and our stockholders. The Board of Directors believes that giving our stockholders the right to cast an advisory vote every three years on their approval of the compensation arrangements of our named executive officer provides the Board of Directors sufficient time to thoughtfully evaluate and respond to stockholder input and effectively implement changes, as needed, to our executive compensation program.

Although the Board of Directors recommends that the Say on Pay proposal be voted on every three years, our stockholders will be able to specify one of four choices for the frequency of the vote on the Say on Pay proposal as follows: (i) one year, (ii) two years, (iii) three years, or (iv) abstain. This is an advisory vote and will not be binding on the Board of Directors or the Company. The Board of Directors may determine that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than may be indicated by this advisory vote of our stockholders. Nevertheless, the Compensation Committee will take into account the outcome of this advisory vote when considering how frequently to seek an advisory vote on Say on Pay in future years.

Vote Required and Recommendation

The option receiving the highest number of votes will be deemed to be the preferred frequency of our stockholders.

The Board of Directors recommends the selection of every“THREE YEARS” as your preference for the frequency with which stockholders are provided an advisory vote on Say on Pay.

17

BENEFICIAL OWNERSHIP OF SECURITIES AND SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of Common Stock of the Company as of May 6, 2013 by (i) all directors, (ii) all executive officers, (iii) all executive officers and directors of the Company as a group, and (iv) each person known by the Company to beneficially own in excess of 5% of the Company’s outstanding Common Stock. Unless noted otherwise, the corporate address of each person listed below is 3301 Electronics Way, West Palm Beach, Florida 33407.

The Company does not know of any other beneficial owner of more than 5% of the outstanding shares of Common Stock other than as shown below. Unless otherwise indicated below, each stockholder has sole voting and investment power with respect to the shares beneficially owned. Except as noted below, all shares were owned directly with sole voting and investment power.

Name and Address

| | | | Number of Shares

Beneficially Owned(1)

| | Percentage of

Outstanding Shares(1)

|

|---|

| | | | | 650,415 | (2) | | | 24.9 | % |

| |

| | | | | 11,000 | (2) | | | * | |

| |

| | | | | — | | | | — | |

| |

| | | | | — | | | | — | |

| |

| | | | | 3,000 | (2) | | | * | |

| |

All Executive Officers and

Directors as a Group (5 persons) | | | | | 664,415 | (2) | | | 25.4 | % |

| |

| | | | | 195,000 | (3) | | | 9.0 | % |

c/o John Farina

1610 Forum Place #900

West Palm Beach, Florida 33401 | | | | | | | | | | |

| |

| | | | | 183,972 | (4) | | | 8.4 | % |

40 Spectacle Ridge Road

South Kent, Connecticut 06785 | | | | | | | | | | |

| |

| | | | | 170,768 | (5) | | | 7.8 | % |

10853 8th Avenue NW

Seattle, Washington 98177 | | | | | | | | | | |

| |

| | | | | 156,400 | (6) | | | 7.2 | % |

3033 Excelsior Blvd., Suite 560

Minneapolis, Minnesota 55416 | | | | | | | | | | |

| |

| | | | | 110,350 | (7) | | | 5.1 | % |

One Chagrin Highlands

2000 Auburn Drive, Suite 300

Cleveland, Ohio 44122 | | | | | | | | | | |

(1) | | Based on 2,177,832 shares of our common stock outstanding as of May 6, 2013. For purposes of this table, beneficial ownership is computed pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, as amended; the inclusion of shares beneficially owned should not be construed as an admission that such shares are beneficially owned for purposes of Section 16 of such Act. |

(2) | | Includes shares that may be acquired upon exercise of options that are exercisable within sixty (60) days of May 6, 2013 in the following amounts: Mr. Saraf — 432,260 shares; Mr. Schlig — 3,000 shares; Mr. Davis —3,000 shares. |

(3) | | This number is based solely on a verbal representation from the stockholder on May 16, 2012. Mr. Stayduhar has not filed a Section 16 or Schedule 13D filing since 2011. |

(4) | | This number is based solely on the Schedule 13G/A filed with the Commission on February 14, 2012. |

18

(5) | | This number is based solely on the Schedule 13D/A filed with the Commission on December 5, 2012. |

(6) | | This number is based solely on the Schedule 13G filed with the Commission on February 25, 2013. Nicholas J. Swenson and Groveland Capital LLC share beneficial ownership over 110,500 shares. Seth Barkett beneficially owns 45,900 shares. Mr. Barkett has sole power to vote and dispose of 15,000 shares and shared power to vote and dispose of 30,900 shares. |

(7) | | This number is based solely on the Schedule 13G filed with the Commission on March 14, 2013. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires directors and executive officers of the Company and ten percent stockholders of the Company to file initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company with the Securities and Exchange Commission. Directors, executive officers, and ten percent stockholders are required to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and representations that no other reports were required during the year ended February 28, 2013, all Section 16(a) filing requirements applicable to directors and executive officers of the Company and ten percent stockholders of the Company were timely filed.

19

EQUITY COMPENSATION PLAN INFORMATION

Plan Category

| | | | Number of securities

to be issued upon

exercise of outstanding

options, warrants

and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

|

|---|

| | | | | | | | |

Equity compensation plans approved by security holders | | | | | — | | | | — | | | | — | |

Equity compensation plans not approved by security holders | | | | | 451,560 | | | $ | 0.757 | | | | 739,940 | (1) |

| | | | | 451,560 | | | | | | | | 739,940 | (1) |

(1) | | Consists of 39,940 shares of common stock available under the Solitron Devices, Inc. 2000 Stock Option Plan (the “2000 Plan”) and 700,000 shares of common stock available under the Solitron Devices, Inc. 2007 Stock Incentive Plan (the “2007 Plan”). |

The 2000 Plan was created effective July 10, 2000 to provide employees with an opportunity to acquire a proprietary interest in the Company. Options issued under the 2000 Plan are for the purchase of Solitron Devices, Inc. common stock, par value of $0.01 per share, and are priced at the closing price on the date of the grant. Options may be granted under the 2000 Plan to any employee, officer, or director of the Company as well as to any independent contractor or consultant performing services for the Company. Options granted have a one-year vesting period and expire ten years from the date of grant. Options granted are not transferable and have restrictions placed on their exercise in the event of termination of employment, death, or disability. Each option granted under the 2000 Plan is a non-qualified stock option that is not intended to meet the requirements of Section 422 of the Code.

The 2007 Plan was created effective June 4, 2007 to enable the Company to attract, retain, reward and motivate eligible individuals by providing them with an opportunity to acquire or increase a proprietary interest in the Company and to incentivize them to expend maximum effort for the growth and success of the Company, so as to strengthen the mutuality of the interests between the eligible individuals and the stockholders of the Company. Pursuant to the 2007 Plan, the Company may grant common stock, options, restricted stock, stock appreciation rights to eligible individuals. Pursuant to the 2007 Plan, the Company is authorized to grant incentive awards for up to 700,000 shares of common stock subject to adjustment in the event of a stock split, stock dividend, recapitalization or similar capital change. All employees, officers, directors (employee or non-employee directors) of the Company are eligible to receive awards under the 2007 Plan.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company did not have any related party transactions, as described in Item 404(a) of Regulation S-K, during the fiscal years ended February 28, 2013 and February 29, 2012.

FINANCIAL STATEMENTS

A copy of our Form 10-K for the year ended February 28, 2013, without exhibits, is being mailed with this proxy statement. Stockholders are referred to the report for financial and other information about the Company.

Additional copies of our Form 10-K for the year ended February 28, 2013 may be obtained without charge by writing to Mr. Shevach Saraf, Chairman of the Board, Chief Executive Officer, President and Chief Financial Officer, c/o Solitron Devices, Inc., 3301 Electronics Way, West Palm Beach, Florida, 33407. Exhibits will be furnished upon request and upon payment of a handling charge of $.25 per page, which represents our reasonable cost of furnishing such exhibits. The Commission maintains a web site that contains reports, proxy and information statements and other information regarding registrants that file electronically with the Commission. The address of such site is http://www.sec.gov.

20

OTHER MATTERS

Other Matters to be Submitted

Our Board of Directors does not intend to present to the Annual Meeting any matters not referred to in the form of proxy. If any proposal not set forth in this proxy statement should be presented for action at the Annual Meeting, and is a matter which should come before the Annual Meeting, it is intended that the shares represented by proxies will be voted with respect to such matters in accordance with the judgment of the persons voting them.

Proxy Solicitation Costs

We will pay for preparing, printing and mailing this proxy statement. Proxies may be solicited on our behalf by our directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission, but such persons will not receive any special compensation for such services. We have also engaged Morrow & Co., LLC, a proxy solicitor, to assist us in the solicitation of proxies for the annual meeting for a fee of $11,000, plus reimbursement for out-of-pocket expenses. We will reimburse banks, brokers and other custodians, nominees and fiduciaries for their out-of-pocket costs of sending the proxy materials to our beneficial owners.

Deadline for Submission of Stockholder Proposals for the 2014 Annual Meeting

Proposals of stockholders intended to be presented at the 2014 Annual Meeting of Stockholders pursuant to SEC Rule 14a-8 must be received at our principal office not later than January 17, 2014 to be included in the proxy statement for that meeting.

In addition, pursuant to our Bylaws, to be timely, a stockholder proposal must be delivered or mailed to and received at the principal executive offices of the Company not less than 30 days prior to the date of an annual meeting; provided, however, that in the event that less than 40 days’ notice or prior public disclosure of the date of a meeting is given or made to stockholders, to be timely, a stockholder proposal must be so received not later than the close of business on the tenth day following the day on which such notice of the date of an annual meeting was mailed or such public disclosure was made.

21

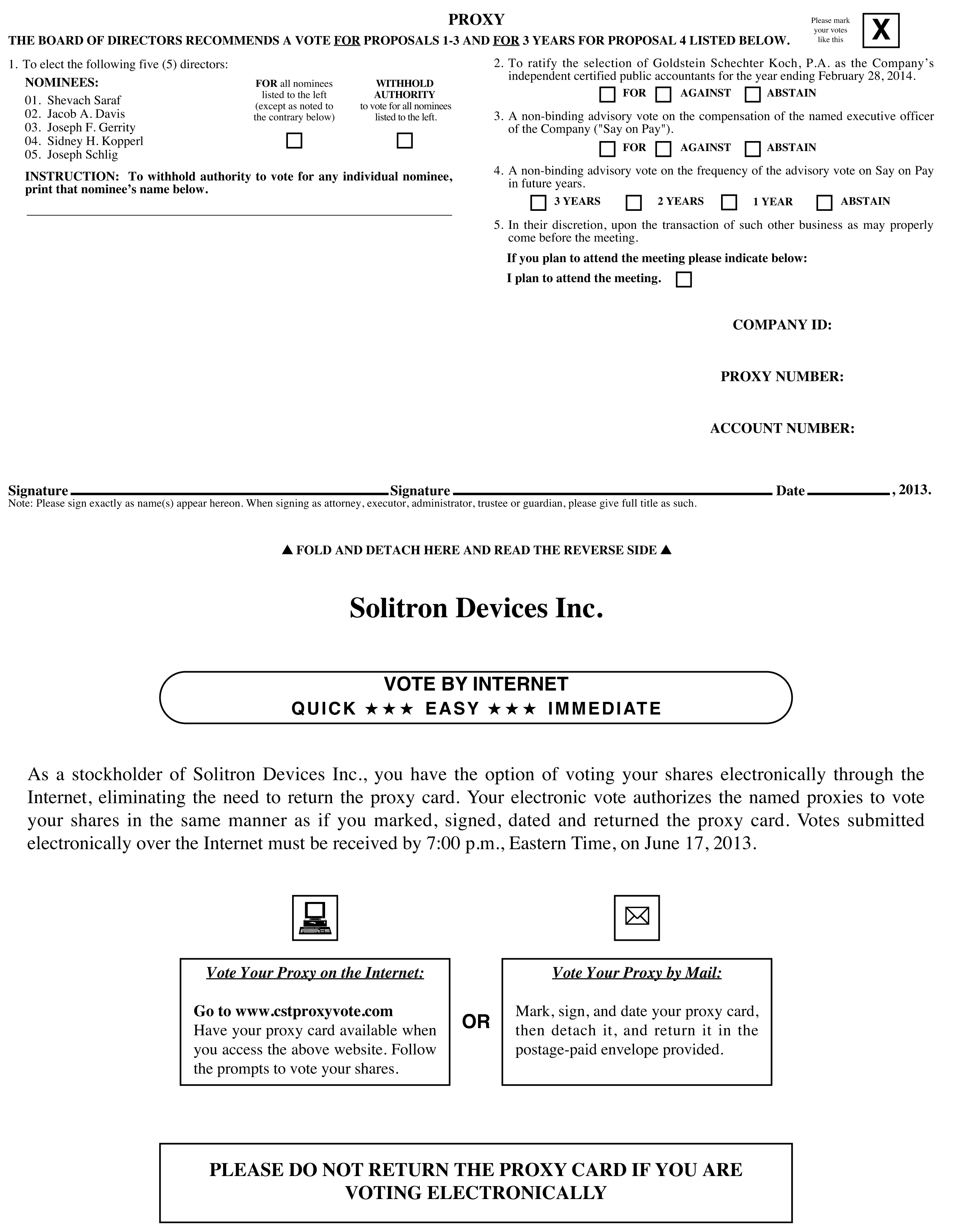

VOTE BY INTERNET QUICK EASY IMMEDIATE X Please mark your votes like this FOLD AND DETACH HERE AND READ THE REVERSE SIDE PROXY 1. To elect the following five (5) directors: 2. To ratify the selection of Goldstein Schechter Koch, P.A. as the Company’s independent certified public accountants for the year ending February 28, 2014. 3. A non-binding advisory vote on the compensation of the named executive officer of the Company ("Say on Pay"). FOR all nominees listed to the left (except as noted to the contrary below) WITHHOLD AUTHORITY to vote for all nominees listed to the left. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSALS 1-3 AND FOR 3 YEARS FOR PROPOSAL 4 LISTED BELOW. NOMINEES: 01. Shevach Saraf 02. Jacob A. Davis 03. Joseph F. Gerrity 04. Sidney H. Kopperl 05. Joseph Schlig INSTRUCTION: To withhold authority to vote for any individual nominee, print that nominee’s name below. Solitron Devices Inc. PLEASE DO NOT RETURN THE PROXY CARD IF YOU ARE VOTING ELECTRONICALLY As a stockholder of Solitron Devices Inc., you have the option of voting your shares electronically through the Internet, eliminating the need to return the proxy card. Your electronic vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed, dated and returned the proxy card. Votes submitted electronically over the Internet must be received by 7:00 p.m., Eastern Time, on June 17, 2013. Signature Signature Date , 2013. Note: Please sign exactly as name(s) appear hereon. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. COMPANY ID: PROXY NUMBER: ACCOUNT NUMBER: Vote Your Proxy on the Internet: Go to www.cstproxyvote.com Have your proxy card available when you access the above website. Follow the prompts to vote your shares. Vote Your Proxy by Mail: Mark, sign, and date your proxy card, then detach it, and return it in the postage-paid envelope provided. OR 4. A non-binding advisory vote on the frequency of the advisory vote on Say on Pay in future years. 5. In their discretion, upon the transaction of such other business as may properly come before the meeting. If you plan to attend the meeting please indicate below: 3 YEARS 2 YEARS 1 YEAR ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN I plan to attend the meeting.

SOLITRON DEVICES, INC. Annual Meeting of Stockholders to be held on June 18, 2013 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints Shevach Saraf with full power of substitution or revocation, proxy for the undersigned, to vote at the 2013 Annual Meeting of Stockholders of Solitron Devices, Inc. (the “Company”), to be held at 9:00 a.m., Eastern Time, on Tuesday, June 18, 2013, at the offices of Akerman Senterfitt, One Southeast Third Avenue, Suite 2500, Miami, FL 33131, and at any adjournment or adjournments thereof, according to the number of votes the undersigned might cast and with all powers the undersigned would possess if personally present. The shares represented by this proxy will be voted on Proposals 1 - 4 as directed by the stockholder, but if no direction is indicated, will be voted FOR Proposals 1 – 3 and for 3 years for Proposal 4. If you plan to attend the Annual Meeting, you can obtain directions to the Miami office of Akerman Senterfitt at http://www.akerman.com/locations/directions.asp?id=5. Please date, sign and mail this proxy in the enclosed envelope, which requires no postage if mailed in the United States. (Continued, and to be marked, dated and signed, on the other side) FOLD AND DETACH HERE AND READ THE REVERSE SIDE PROXY IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 18, 2013 The accompanying proxy statement and the 2013 Annual Report on Form 10-K are available on the Company's website on the Investor Relations page at http://www.solitrondevices.com