NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Boss Holdings, Inc., a Delaware corporation (the “Company”), will be held at the Board Room of the Conference Center, 8235 Forsyth Blvd., Suite 801, St. Louis, Missouri, 63105 on Monday, June 11, 2007, at 10:00 A.M. Central Daylight Time for the following purposes:

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on April 20, 2007, are entitled to notice of and to vote at the Annual Meeting. A list of shareholders entitled to vote at the Annual Meeting shall be open to the examination of any shareholder, his agent or attorney for any purpose germane to the Annual Meeting upon written notice, and the list shall be available for inspection at the Annual Meeting by any shareholder that is present.

BOSS HOLDINGS, INC.

221 W. First Street, Kewanee, Illinois 61443

____________________

PROXY STATEMENT

____________________

GENERAL

This Proxy Statement is furnished to stockholders of Boss Holdings, Inc., a Delaware corporation(“Company”), in connection with the solicitation by the Board of Directors of the Company (“Board of Directors” or “Board”) of proxies for use at the Annual Meeting of Stockholders (the “Meeting”) scheduled to be held on Monday, June 11, 2007, at 10:00 A.M. local time at the Board Room of the Conference Center, 8235 Forsyth Blvd., Suite 801, St. Louis, MO 63105, and at any and all adjournments or postponements thereof. This Proxy Statement and the accompanying form of proxy initially will be mailed to stockholders on or about April 30, 2007.

The proxy, when properly executed and received by the Secretary of the Company prior to the Meeting, will be voted as therein specified unless revoked by filing with the Secretary prior to the Meeting a written revocation or a duly executed proxy bearing a later date. Unless authority to vote for one or more of the director nominees is specifically withheld according to the instructions, a signed proxy will be voted FOR the election of the five director nominees named herein and, unless otherwise indicated, FOR each other proposal described in this proxy statement and in the accompanying notice of meeting.

VOTING RIGHTS AND VOTES REQUIRED

The close of business on April 20, 2007, has been fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the Meeting. As of April 18, 2007, the Company had outstanding and entitled to vote approximately 2,006,535 shares of Common Stock, $0.25 par value per share (“Common Stock”).

A majority of the outstanding shares of Common Stock must be represented in person or by proxy at the Meeting in order to constitute a quorum for the transaction of business. The record holder of each share of Common Stock entitled to vote at the Meeting will have one vote for each share so held. There is no cumulative voting with respect to any matter submitted for vote of the stockholders. Abstentions will be treated as Common Stock present and entitled to vote for purposes of determining the presence of a quorum. If a broker indicates on a proxy that it does not have the discretionary authority as to certain Common Stock (a “broker nonvote”), those shares will not be considered present and entitled to vote with respect to that matter.

The affirmative vote of the holders of a majority of the shares of Common Stock represented at the Meeting in person or by proxy and entitled to vote at the Meeting will be required to approve the election of directors of the Company and the appointment of McGladrey & Pullen, LLP as the Company’s independent auditors for the fiscal year ending December 29, 2007. In determining whether a proposal has received the requisite number of affirmative votes, broker nonvotes will be disregarded and have no effect on the outcome of the vote. Abstentions will be included in the vote totals and, as such, will have the same effect as a negative vote.

VOTING OF PROXIES

Shares represented by properly executed proxies will be voted at the Meeting in accordance with the instructions specified thereon. If no instructions are specified, the shares represented by any properly executed proxy will be voted FOR the election of the directors of the Company and FOR each other proposal described in this proxy statement and in the accompanying notice of meeting.

The Board of Directors is not aware of any matter that will come before the Meeting other than as described above. If any such other matter is duly presented and in the absence of instructions to the contrary, such proxies will be voted in accordance with the judgment of the proxy holders with respect to such matter, including any shareholder proposal or other matter of which the Company did not receive proper notice prior to March 15, 2007.

Shareholder proposals or other communications with respect to the Meeting received less than 45 days prior to the date of first mailing of proxy materials with respect to the prior year’s annual meeting of shareholders are considered untimely.

REVOCATION OF PROXIES

Any proxy given pursuant to this solicitation may be revoked by a stockholder at any time before it is exercised. Any proxy may be revoked in writing, or by a valid proxy bearing a later date, delivered to the Secretary of the Company or by attending the Meeting and voting in person.

SOLICITATION OF PROXIES

The expenses of this solicitation will be paid by the Company. To the extent necessary to ensure sufficient representation at the Meeting, proxies may be solicited by any appropriate means by officers, directors and regular employees of the Company, who will receive no additional compensation therefore. The Company does not anticipate utilizing the services of any outside firm for the solicitation of proxies for the Meeting. The Company will pay persons holding stock in their names or in the names of their nominees, but not owning such stock beneficially (such as brokerage houses, banks and other fiduciaries), for the expense of forwarding soliciting material to their principals.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

A Board of Directors consisting of five directors is to be elected by the stockholders at the Meeting, each to hold office until the next Annual Meeting of Stockholders or until a successor is duly elected and qualified. The Board of Directors recommends the election of the five nominees named below, all of whom currently are directors of the Company. Unless authority to vote for one or more of the nominees is specifically withheld according to the instructions, proxies in the enclosed form will be voted FOR the election of each of the five nominees named below. The Board of Directors does not contemplate that any of the nominees will not be able to serve as a director, but if that contingency should occur prior to the voting of the proxies, the persons named in the enclosed proxy reserve the right to vote for such substitute nominee or nominees as they, in their discretion, shall determine.

G. Louis Graziadio III Age 57 - Chief Executive Officer and Chairman of the Board of the Company since June 1996. He is also the Chairman and CEO of Second Southern Corp., which is the manager of Ginarra Partners, LLC, a Los Angeles based holding company with investments in various corporations, including the Company. Mr. Graziadio also serves on the Boards of Directors of Acacia Research, Inc., True Religion Apparel, Inc. and Rosetta Resources, Inc.

Perry A. Lerner Age 64 - Director since June 1996. Mr. Lerner is the Managing Director of Convergent Financial Services, LLC, in New York, NY, a financial advisory firm. A graduate of Harvard Law School and Claremont McKenna College, Mr. Lerner is a member of the State Bar of New York, State Bar of California and American Bar Association.

Lee E. Mikles Age 51 - Director since June 1996. Mr. Mikles is Chief Executive Officer of FutureFuel Corp., a chemical and biofuels manufacturer located in Batesville, Arkansas. From 1999 through 2005, Mr. Mikles was the Chairman of Mikles/Miller Management, Inc., a registered investment adviser. He also serves on the Board of Directors of Pacific Capital Bancorp.

Paul A. Novelly Age 63 - Director since June 1996. Mr. Novelly is Chief Executive Officer of Apex Oil Company, Inc. a petroleum trading, storage and transportation company headquartered in St. Louis, Missouri, World Point Terminals Inc., a publicly-held Canadian company headquartered in Calgary, Alberta, and St. Albans Global Management LLLP, a privately held Delaware limited liability company. Mr. Novelly also is a director and Chairman of the Board of FutureFuel Corp. and serves on the Board of Directors of The Bear Stearns Companies Inc.

2

William R. LangAge 47 - Director since June 2006. Mr. Lang is a certified public accountant and currently is the President of GIC Enterprises, an investment company based in Los Angeles, California which manages commercial real estate. From June 1995 through May 2005 he was employed by the Los Angeles CPA firm of Balser, Horowitz, Frank & Wakeling, including serving as president of that firm from January 2000 through May 2005. From January 2000 through May 2005 he also was managing director of Ronald Blue & Co., a financial services firm also located in Los Angeles. Mr. Lang is the chief financial officer of Second Southern Corporation, a Los Angeles based holding company, which is controlled by Mr. Graziadio, the Company’s chairman and chief executive officer. GIC Enterprises is controlled by adult siblings of Mr. Graziadio. Mr. Lang also is a trustee of the Graziadio Family Trust, which owns in excess of 20% of the Company’s common stock.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE ELECTION OF EACH OF THE NOMINEES NAMED ABOVE

DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY

Following is a list of the names and ages of the executive officers of the Company and its principal subsidiaries as of the date of this Proxy Statement, indicating all positions and offices with the Company held by each such person, and each such person’s principal occupations or employment during the past five years.

Boss Holdings, Inc.

| | | | | Positions and Offices Held and |

| Name | | Age | | Principal Occupations or Employment during past 5 years |

| G. Louis Graziadio III | | 57 | | Chairman of the Board and Chief Executive Officer of the Company since June 1996. He is also the Chairman and CEO of Second Southern Corp., which is the manager of Ginarra Partners, LLC, a holding company with investments in various corporations, including the Company. |

| Steven G. Pont | | 52 | | Vice President – Finance since January, 2007. From August 2006 through January 2007, he served as vice president/finance of H.C. Duke & Son, Inc., a manufacturer and distributor of ice cream and frozen desert equipment, located in East Moline, Illinois. From 1999 through May, 2006, he was Vice President and Chief Financial Officer of Bomag Americas, Inc., a worldwide leader in the manufacture and distribution of compaction equipment, with headquarters in Kewanee, Illinois. |

| Terrence J. Brizz | | 52 | | President of Galaxy Balloons, Incorporated, a subsidiary of Boss Manufacturing Company, since the Company’s acquisition of this subsidiary in July 2004. Prior to the Company’s acquisition of Galaxy, Mr. Brizz was its sole shareholder and CEO. |

| James F. Sanders | | 50 | | Secretary and General Counsel of the Company since October 1998. Vice President of Boss Manufacturing Company since January 2007. Mr. Sanders also serves as corporate counsel for Apex Oil Company, Inc., an affiliate of Mr. Paul A. Novelly, a director of the Company. |

In addition to the named executive officers, Richard Bern, age 59, has served as an operations consultant to the Company since March 1999. In his capacity as a consultant, Mr. Bern currently exercises executive responsibilities in many sales and distribution functions under the review and direction of the Company’s chief executive officer. Mr. Bern has extensive experience in importing, distribution and sales of consumer goods and previously served as president of Boss Manufacturing Company during 1996 and 1997. Since then he has been a private investor and worked as a consultant to various manufacturing and distribution firms, including the Company.

3

RELATIONSHIPS AMONG DIRECTORS OR EXECUTIVE OFFICERS

Mr. Graziadio and Mr. Mikles are first cousins; otherwise, there are no family relationships existing between the officers and directors of the Company.

BOARD MEETINGS AND COMMITTEES OF THE BOARD

During the fiscal year ended December 30, 2006 (“Fiscal 2006”), there were three meetings of the Board of Directors. All of the directors attended at least 75% of the Board meetings, except for Mr. Novelly, Mr. Lerner and Mr. Mikles, each of whom attended two of the three meetings. The Company has an Executive Committee and standing Audit and Compensation Committees of the Board.

The members of the Audit Committee are Messrs. Mikles, Lerner and Lang. Mr. Mikles and Mr. Lerner are independent of the Company while Mr. Lang is employed by a company affiliated with Mr. Graziadio, the Company’s chief executive officer, and is not independent of the Company. The Audit Committee reviews the Company’s financial statements and internal accounting procedures with the Company’s independent auditors, McGladrey & Pullen, LLP. The Audit Committee also considers and discusses with McGladrey & Pullen, LLP all auditing procedures and fees, and the possible effects of professional services upon the independence of McGladrey & Pullen, LLP. The Audit Committee held five meetings during Fiscal 2006. The Board has determined that Mr. Lang qualifies as an audit committee financial expert under SEC Regulation S-K 401(h). The designation or identification of a person as an Audit Committee financial expert does not impose on such person any duties, obligations or liabilities greater than the duties, obligations and liabilities imposed on other members of the Audit Committee and does not affect the duties, obligations and liabilities of the other members of the Audit Committee.

The members of the Compensation Committee are Messrs. Lerner and Novelly, each of whom is independent of the Company. The Compensation Committee does not have a formal written charter. The Compensation Committee has the authority to determine and authorize the compensation and benefits paid to the Company’s senior management or may make recommendations to the Board concerning such matters for consideration by the entire Board. The Compensation Committee also makes determinations under the Company’s various plans providing incentive compensation for management, directors and consultants. See “Executive Compensation.” The Compensation Committee held one meeting during Fiscal 2006, which was attended by all members.

The members of the Executive Committee are Messrs. Graziadio, Lerner, Mikles and Lang. The Executive Committee generally has and may exercise all the powers and authority of the full Board in the management of the business and affairs of the Company, but specifically does not have the power or authority to do any of the following: (i) amend the Company’s certificate of incorporation (except as permitted by applicable law with respect to fixing the number, designations, preferences and rights of shares of stock to be issued by the Company in certain circumstances); (ii) adopt an agreement of merger or consolidation; (iii) recommend to the stockholders the sale, lease or exchange of all or substantially all of the Company’s property and assets; (iv) recommend to the stockholders a dissolution of the Company or a revocation of a dissolution; (v) amend the by-laws of the Company; (vi) declare a dividend; or (vii) authorize the issuance of stock. Authority with respect to the excepted matters is reserved to the Board. The full Board may act to rescind any actions previously taken by the Executive Committee.

The Company does not have a standing Nominating Committee. Given the Company’s size and its shareholder base, the Board believes it appropriate not to have a nominating committee at this time. All directors currently participate in consideration of director nominees. Alternatively, the Executive Committee of the Board can act as a nominating committee. Three of the five current Board members are independent of the Company and two of the four current members of the Executive Committee are independent. The Board of Directors will consider director nominees recommended by stockholders. Any such recommendations should be sent in writing to the Company at its principal executive offices, to the attention of the Secretary.

COMPENSATION OF DIRECTORS

During Fiscal 2006, each of the Company’s non-employee directors earned an annual stipend of $15,000 and quarterly directors’ fees of $2,000. In addition, the Company pays non-employee directors $1,200 per special Board meeting attended (i.e., non-regularly scheduled meeting) or for more than four regular board meetings per year. During Fiscal 2006 Committee members received compensation of $1,000 per committee meeting attended.

4

The total cash compensation paid to all non-employee directors during Fiscal 2006 was $103,000. The Company also may reimburse its directors for reasonable expenses incurred in connection with attending Board and committee meetings. Except as described under “Directors’ Stock Options” below, the Company had no other compensation arrangements with its non-employee directors during Fiscal 2006. Employee directors are not separately compensated for their service as a director. The Company does not require its directors to attend the annual meeting of shareholders. One director attended last year’s annual meeting.

DIRECTORS’ STOCK OPTIONS

The Company has adopted and maintains its 1998 Non-Employee Director Stock Option Plan (“1998 Director Plan”) and its 2004 Stock Incentive Plan for Employees, Directors and Consultants under which directors also may receive stock-based compensation. During Fiscal 2006 there were no awards to non-employee directors under either plan.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

To the best of the Company’s knowledge, during Fiscal 2006 all Forms 3, 4 or 5 required to be filed by directors and executive officers with the Securities & Exchange Commission were timely filed; except that Mr. William Lang filed one late Form 3 during Fiscal 2006 reporting his becoming a member of the Board of Directors.

CODE OF ETHICS

The Company has adopted a code of ethics for its principal executive officer, principal financial officer, and principal accounting officer or controller or persons performing similar functions. The code of ethics provides written standards reasonably designed to deter wrongdoing and promote (i) honest and ethical conduct (including handling actual or potential conflicts of interest), (ii) full, fair, accurate, timely and understandable public disclosure, (iii) compliance with applicable laws, rules and regulations, (iv) prompt reporting of code violations, and (v) accountability for adherence to the code.

REVIEW AND APPROVAL OF TRANSACTIONS WITH RELATED PERSONS

The Company’s Code of Ethics for its senior executive and financial officers requires that such persons engage in and promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, including any transactions in which the person has a direct or indirect personal interest reportable under Item 404 of SEC Regulation S-K. The Company does not have a formal written policy for the review or approval of such transactions because of the relative infrequency of such transactions. Typically such transactions would be reported to a senior executive officer or company counsel and if the interested person was an employee or non-executive officer, the transaction would require approval from a disinterested executive officer. If the interested person was a senior executive or if the amount involved was significant, the transaction would require approval by the Chief Executive Officer, the Board or a Board committee having authority over such matter.

5

EXECUTIVE COMPENSATION

Compensation paid in Fiscal 2006 to the Company’s Chief Executive Officer and to each of the other executive officers of the Company and its subsidiaries of over $100,000 was as follows:

| 2006 Summary Compensation Table |

| |

| | | | | | | | | | | | | | | | | Change in | | | | | |

| | | | | | | | | | | | | | | | | Pension | | | | | |

| | | | | | | | | | | | | | | | | Value and | | | | | |

| | | | | | | | | | | | | | Non-Equity | | Nonqualified | | | | | |

| | | | | | | | | | | | | | Incentive | | Deferred | | | | | |

| | | | | | | | | | | | | | Plan | | Compen- | | All Other | | |

| | | | | | | | | | Stock | | Option | | Compen- | | sation | | Compen- | | |

| | | | | Salary | | Bonus | | Awards | | Awards | | sation | | Earnings | | sation | | Total |

| Name and Principal Position | | Year | | ($)(1) | | ($) | | ($) | | ($)(2) | | ($) | | ($) | | ($) | | ($) |

| G. Louis Graziadio III | | 2006 | | 167,475 | | | — | | — | | 49,398 | | — | | | — | | | 1,581 | | | 218,454 |

| CEO and Chairman of | | 2005 | | 167,475 | | | — | | — | | 96,385 | | — | | | — | | | 1,590 | | | 265,450 |

| the Board | | 2004 | | 159,500 | | | — | | — | | 27,951 | | — | | | — | | | 846 | | | 188,297 |

| |

| J. Bruce Lancaster | | 2006 | | 167,475 | | | — | | — | | 13,267 | | — | | | 26,021 | | | 5,079 | | | 199,942 |

| Executive Vice | | 2005 | | 167,475 | | | — | | — | | 19,151 | | 92,176 | | | — | | | 5,222 | | | 284,024 |

| President & CFO | | 2004 | | 165,675 | | | — | | — | | 16,408 | | 50,000 | | | — | | | 4,296 | | | 236,379 |

| |

| Richard Bern | | 2006 | | 279,188 | | | — | | — | | 13,267 | | 156,811 | | | — | | | — | | | 449,266 |

| Operational Consultant | | 2005 | | 323,812 | | | — | | — | | 19,151 | | 92,176 | | | — | | | — | | | 435,139 |

| | | 2004 | | 301,580 | | | — | | — | | 16,408 | | 50,000 | | | — | | | — | | | 367,988 |

| |

| Terrence J. Brizz | | 2006 | | 125,000 | | | — | | — | | — | | — | | | — | | | 4,238 | | | 129,238 |

| President of Galaxy | | 2005 | | 125,000 | | | — | | — | | — | | — | | | — | | | 15,927 | | | 140,927 |

| Balloons, Incorporated | | 2004 | | 56,481 | | | — | | — | | — | | — | | | — | | | 11,800 | | | 68,281 |

| |

| James F. Sanders | | 2006 | | 103,479 | | | — | | — | | 12,800 | | — | | | — | | | — | | | 116,279 |

| Secretary and General | | 2005 | | 107,637 | | | — | | — | | 22,400 | | — | | | — | | | — | | | 130,037 |

| Counsel | | 2004 | | 111,081 | | | — | | — | | — | | — | | | — | | | — | | | 111,081 |

____________________

| (1) | | Amounts listed for Mr. Bern in this column reflect payment of fees under his consulting arrangement with the Company by which he performs services as an independent contractor. Amount listed for 2004 for Mr. Brizz in this column reflects payments made during the partial year following the Company’s acquisition of Galaxy Balloons, Incorporated in July 2004. Amounts listed for Mr. Sanders in this column reflect payment of legal fees for his services as legal counsel to the Company. |

| |

| (2) | | All figures in this column reflect the value of options issued to purchase shares of Common Stock as reflected in the Company’s financial statements. |

The Company has adopted and maintains its 1998 Incentive Stock Option Plan (the “1998 Employee Plan”) under which the Company may issue qualified or non-qualified stock options to employees, consultants and other key persons. Options granted to the named executives prior to 2005 were granted under the 1998 Employee Plan. The Company also has adopted its 2004 Stock Incentive Plan for employees, directors and consultants (“2004 Stock Plan”). Under the 2004 Stock Plan, the Company may issue long-term incentive compensation in the form of stock options, performance-based awards, stock appreciation rights (“SAR’s”) and/or restricted stock units to eligible persons. The Company has no SAR’s outstanding. There were no grants of options or other equity-based compensation under any plans during Fiscal 2006. The Company does not maintain any retirement or pension benefit plans for its executives, other than tax-qualified defined contribution plans and a non-qualified deferred compensation plan.

6

| Non-qualified Deferred Compensation |

| |

| | | Executive | | Registrant | | Aggregate | | Aggregate | | Aggregate |

| | | Contributions | | Contributions | | Earnings in | | Withdrawals or | | Balance at |

| Officer Name | | in Last FY | | in Last FY | | Last FY | | Distributions | | Last FYE |

| J. Bruce Lancaster | | 36,084 | | | 26,021 | | | 21,803 | | | — | | 172,652 | |

| James F. Sanders | | 6,421 | | | — | | | 1,353 | | | — | | 23,057 | |

All amounts listed above are with respect to the Company’s 2002 Non-Qualified Deferred Compensation Plan (“Deferred Comp Plan”), which is provided as an inducement to the Company’s directors, key managers and highly compensated employees and independent contractors. Under the Deferred Comp Plan, eligible participants (including directors, senior officers and consultants) voluntarily may defer up to 100% of their compensation from the Company by way of contribution to the plan with the plan assets administered by The Principal, an independent insurance company. Each participant designates one or more mutual funds or other sponsored investments he or she desires for the participant’s deferred compensation account. The Company generally does not provide matching contributions, but during Fiscal 2006 did agree to match a portion of Mr. Lancaster’s contributions to the Deferred Comp Plan. All earnings on account balances during Fiscal 2006 were market-based earnings. Withdrawals from the Deferred Comp Plan are permitted only upon death, retirement or termination of service with the Company.

| Director Compensation |

| |

| | | | | | | | | | | Change in Pension | | | | |

| | | Fees | | | | | | | | Value and | | | | |

| | | Earned | | | | | | | | Nonqualified | | | | |

| | | or Paid | | | | | | Non-Equity | | Deferred | | | | |

| | | in Cash | | Stock | | Option | | Incentive Plan | | Compensation | | All Other | | |

| Name | | ($) | | Awards | | Awards | | Compensation | | Earnings | | Compensation | | Total ($) |

| Perry A. Lerner | | 27,000 | | — | | 10,560 | | — | | — | | — | | 37,560 |

| Lee E. Mikles | | 26,000 | | — | | 10,560 | | — | | — | | — | | 36,560 |

| Paul A. Novelly | | 23,000 | | — | | 10,560 | | — | | — | | — | | 33,560 |

| William R. Lang | | 3,533 | | — | | — | | — | | — | | — | | 3,533 |

| Richard D. Squires | | 23,467 | | — | | 10,560 | | — | | — | | — | | 34,027 |

All cash consideration reflected in the “Fees Earned” column above was in respect of the directors’ annual stipends and committee meeting fees described above under the caption “Compensation of Directors.” There were no awards of restricted stock or stock options to any directors during Fiscal 2006. The amounts reflected in the “Option Awards” column above reflect the dollar amount recognized by the Company for financial statement reporting purposes with respect to the vesting during Fiscal 2006 of options previously awarded to the named directors. In June 2006, Mr. Lang replaced Mr. Squires on the Board of Directors.

7

The following sets forth information concerning outstanding unexercised options and other equity plan awards as of December 30, 2006:

| Outstanding Equity Awards at Fiscal Year-end 2006 |

| |

| | | Option Awards | | Stock Awards |

| | | | | | | | | Equity | | | | | | | |

| | | | | | | | | Incentive | | | | | | | |

| | | | | | | | | Plan Awards: | | | | | | | |

| | | Number of | | Number of | | Number of | | | | | | | |

| | | Securities | | Securities | | Securities | | | | | | | |

| | | Underlying | | Underlying | | Underlying | | | | | | | |

| | | Unexercised | | Unexercised | | Unexercised | | Option | | Option | | |

| | | Options (#) | | Options (#) | | Unearned | | Exercise | | Expiration | | |

Name | | Exercisable | | Unexercisable | | Options (#) | | Price | | Date | | None |

| G. Louis Graziadio III | | 30,000 | | | — | | | — | | 1.75 | | | 3/9/2009 | | None |

| | | 100,000 | | | — | | | — | | 1.90 | | | 3/27/2012 | | |

| | | 3,000 | | | 1,500 | (1) | | — | | 7.00 | | | 3/31/2014 | | |

| | | 20,000 | | | 10,000 | (2) | | — | | 7.50 | | | 3/31/2015 | | |

| J. Bruce Lancaster | | 5,000 | | | — | | | — | | 1.75 | | | 3/9/2009 | | None |

| | | 10,000 | | | — | | | — | | 3.625 | | | 12/31/2009 | | |

| | | 5,000 | | | — | | | — | | 3.75 | | | 12/27/2012 | | |

| | | 10,000 | | | — | | | — | | 3.20 | | | 3/17/2013 | | |

| | | 6,666 | | | 3,334 | (1) | | — | | 7.00 | | | 3/31/2014 | | |

| Richard Bern | | 5,000 | | | — | | | — | | 3.75 | | | 12/27/2012 | | None |

| | | 5,000 | | | — | | | — | | 3.20 | | | 3/17/2013 | | |

| | | 6,666 | | | 3,334 | (1) | | — | | 7.00 | | | 3/31/2014 | | |

| James F. Sanders | | 6,000 | | | — | | | — | | 1.75 | | | 3/9/2009 | | None |

| | | 4,000 | | | — | | | — | | 3.625 | | | 12/31/2009 | | |

| | | 6,666 | | | 3,334 | (2) | | — | | 7.50 | | | 3/14/2015 | | |

____________________(1) Exercisable on 3/31/2007.

(2) Exercisable on 3/14/2007.

EMPLOYMENT AGREEMENTS

The Company was a party to an Executive Severance Agreement dated July 16, 2001, with J. Bruce Lancaster, the Company’s former Executive Vice President. Mr. Lancaster resigned from the Company at the end of Fiscal 2006 and the Company incurred no liability or obligation under the Executive Severance Agreement. Mr. Lancaster is subject to a two year restriction on his ability to solicit any customers of the Company or otherwise compete with the Company and also is subject to a provision protecting the Company’s confidential information.

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee, composed entirely of independent directors, administers the Company’s executive compensation program. The role of the Committee is to oversee the Company’s executive compensation and benefit plans and policies, administer its stock plans (including reviewing and approving equity grants to executive officers) and review and approve annually the compensation relating to executive officers. Generally, the CEO makes recommendations to the Committee regarding compensation for all other executives and the Committee reviews the performance of all executive officers and makes a final determination on executive compensation for the CEO. The Committee then reports its decisions regarding compensation for the CEO to the Board for ratification.

8

The philosophy of the Committee relating to executive compensation is that the executive officers should be compensated in amounts and in a manner designed to (i) attract, motivate and retain talented executives who are capable of attaining the Company’s goals in a competitive and changing environment, (ii) encourage and reward superior performance, and (iii) strengthen the relationship between executive pay and shareholder value. For certain matters, the Committee periodically has retained management and benefits consultants, to provide advice on the type and amount of compensation to be paid to executive officers and concerning the Company’s equity compensation plans, but the Committee does not delegate it decision-making authority to such consultants.

The Company’s Fiscal 2006 and current total compensation programs for executive officers consist of both cash and stock-based compensation. Salary levels for Company executives are reviewed and may be adjusted annually. In determining appropriate salaries, the Committee considers the CEO’s recommendations as to compensation for other officers, the scope of responsibility and individual performance for each officer, overall corporate performance, and general pay practices of industry competitors and other companies similarly situated to the Company. The members of the Committee have strong backgrounds in the regulation and management of both private and publicly held companies and use their experience to help evaluate the Company’s executive pay practices. Evaluation of corporate performance takes into account special circumstances such as weather variations, competitive conditions and unusual events which can have a material effect on the Company’s operating results compared with budgeted levels. The Committee’s analysis is a subjective process that utilizes no specific weighting or formula for these factors in determining salary amounts.

Stock-based compensation for executive officers is provided under the Company’s 1998 Employee Plan, as amended, and the 2004 Stock Plan. Under these Plans, the stock-based compensation awarded and vesting periods are decided at the discretion of the Committee. The Committee has not utilized any specific formula for determining stock-based compensation. All stock-based compensation provided by the Company to date has been in the form of stock options, but under the Company’s 2004 Stock Plan the Committee has the flexibility to utilize restricted stock grants and/or SAR’s if it so determines. Any such grants and their timing are made by the Committee in its discretion.

Non-equity incentive plan compensation for Mr. Lancaster and Mr. Bern for Fiscal 2005 and Fiscal 2006 was set by an annual executive incentive plan approved by the Committee. Incentive amounts were determined based on the Company’s earnings before taxes, with each of the executives eligible to earn incentive compensation as a percentage of earnings for the full year. The Company’s earnings before taxes must exceed a predetermined hurdle amount before any amounts are payable. Percentages increase on a sliding scale as Company earnings increase. The hurdle amounts, percentages and payment terms are established by the Committee in its discretion after review and recommendation by the Company’s chief executive officer. Incentive amounts earned for Fiscal 2005 were payable in two equal installments, one in March, 2006 and the other in March, 2007, with the 2007 installment dependent upon the executive’s continued service to the Company and the Company’s continued profitability in Fiscal 2006. Incentive amounts earned for Fiscal 2006 are payable in two equal installments, one in March, 2007 and the other in March, 2008, with the 2008 installment dependent upon the executive’s continued service to the Company and the Company’s continued profitability in Fiscal 2007. Because Mr. Lancaster resigned from the Company at the end of Fiscal 2006, he forfeited all Fiscal 2006 incentive amounts and the remaining portion of his Fiscal 2005 incentive compensation.

In determining the total compensation package for the CEO for Fiscal 2006, the Compensation Committee considered all of the matters discussed above. The Compensation Committee also considered the attainment of budgeted corporate goals and in its discretion determined to utilize strictly cash compensation. From 1998 through March, 2002, Mr. Graziadio elected not to be paid a salary for his services as CEO. Beginning in April, 2002, Mr. Graziadio began to receive an executive salary approximately equal to Mr. Lancaster’s. Reimbursement of certain expenses incurred by Mr. Graziadio and a company affiliated with Mr. Graziadio in connection with the Company’s business is discussed below in the section titled “Certain Relationships and Related Transactions.”

Due to its relatively small size, the Company currently does not have any defined benefit retirement or pension programs for its executive officers. As the Company matures, such programs could be considered on an as needed basis in order to attract and retain senior management. Accordingly, the Committee’s decisions regarding the provision of equity-based compensation currently is not impacted by consideration of other retirement or pension benefits to which the executive officer may be entitled. The Company currently does not have any

9

contracts in place with executive officers that could result in the payment of compensation as a result of termination or a change-in-control. Although the Company encourages equity ownership by management, it does not have any program or policy requiring any particular form or amount of equity ownership. The Committee has not engaged in any benchmarking of total compensation for management as it is not aware of any similarly-sized, publicly-held, industry competitors in the gloves, boots and rainwear segment.

COMPENSATION COMMITTEE REPORT; COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

This report of the Compensation Committee shall not be deemed incorporated by reference by any prior or future statement incorporating this Proxy Statement by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under either such act.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management, and based on such review and discussions the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

None of the current members of the Company’s Compensation Committee is or has been an officer or an employee of the Company. There were no “Compensation Committee Interlocks” during Fiscal 2006.

Members of the Company’s Compensation Committee:

Perry A. Lerner Paul A. Novelly

10

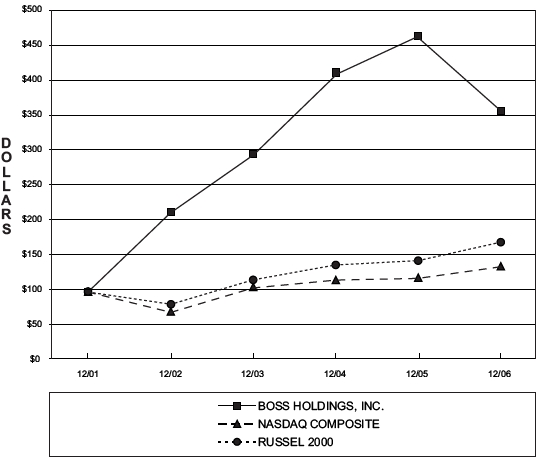

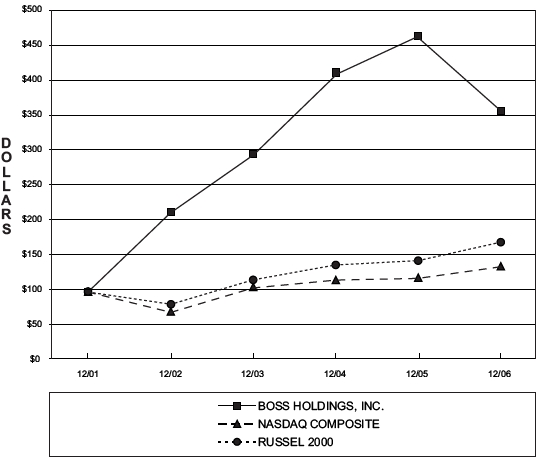

STOCK PRICE PERFORMANCE GRAPH

The following graph sets forth a comparison of the cumulative total return to stockholders on the Common Stock during the five year period ended December 31, 2006, based on the market price thereof and taking into account all stock splits in the form of stock dividends paid through Fiscal 2006, with the cumulative total return of companies on the NASDAQ Stock Market and the Russell 2000 Index.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Boss Holdings, Inc., The NASDAQ Composite Index

And The Russell 2000 Index

* $100 invested on 12/31/01 in stock or index-including reinvestment of dividends. Fiscal year ending December 31. |

Notes to Performance Graph:

| A. | | Information concerning the NASDAQ and Russell 2000 indices was provided by Research Data Group, Inc. |

| |

| B. | | Information concerning the Company’s stock price was provided by the OTC Bulletin Board system. |

| |

| C. | | The lines for the NASDAQ and Russell 2000 indices represent monthly index levels derived from compounded daily returns that include all dividends. The Russell 2000 index was used for comparison with other small-cap companies because the Company does not believe it reasonably can identify an industry peer group. |

11

| D. | | The indices are reweighted daily, using the market capitalization on the previous trading day. |

| |

| E. | | If the monthly interval for the indices, based on the fiscal year-end, is not a trading day, the preceding trading day is used. The index levels for all series were set to $100.00 on 12/31/2001. |

| |

| F. | | Produced on January 8, 2007, including data through 12/31/2006. |

There can be no assurance that the Company’s stock performance will continue into the future with the same or similar trends depicted in the graph above. The Company will neither make nor endorse any predictions as to future stock performance.

The Stock Price Performance Graph above shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates this information by reference and shall not otherwise be deemed filed under such Act.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company reimburses or pays costs and expenses incurred by Second Southern Corp. and/or Ginarra Partners, LLC, companies affiliated with Mr. Graziadio, in connection with Mr. Graziadio’s execution of his duties as chairman and chief executive officer of the Company. These costs include clerical and administrative support, travel and entertainment expenses, and certain direct overhead costs including, but not limited to, postage, communication charges and office supplies. Payments to such affiliates of Mr. Graziadio for such costs and expenses in fiscal years 2006, 2005 and 2004 were $130,998, $120,571 and $148,760, respectively. William R. Lang, a director of the Company, is the chief financial officer of Second Southern Corp.

James F. Sanders, corporate secretary of the Company, provides general counsel services to the Company. During Fiscal 2006, Mr. Sanders was paid $103,479 for legal services and reimbursement of related costs and expenses. Mr. Sanders also is employed by Apex Oil Company, Inc., a company controlled by P.A. Novelly, a director of the Company.

Richard Bern, a former president of the Company’s Boss Manufacturing Company subsidiary, currently provides executive services to the Company as an operations consultant. Mr. Bern provides services in all of the Company’s significant operational areas, including sales, production, distribution and purchasing, including relations with foreign vendors.

On July 30, 2004, the Company acquired all outstanding shares of common stock of Galaxy Balloons, Incorporated (“Galaxy”) from Terrence J. Brizz, who continues to serve as president of Galaxy. Under the stock purchase agreement, Mr. Brizz received payment of: (i) $200,000 of deferred purchase price, payable in two equal annual increments of $100,000 each on the first and second anniversaries of the purchase date, (ii) $50,000 under a non-compete agreement, similarly payable in two equal annual installments of $25,000 each, and (iii) up to an additional $400,000 of earn-out payments depending upon Galaxy’s financial performance during fiscal years 2005 through 2007. During Fiscal 2006, the Company paid $125,000 to Mr. Brizz in connection with the deferred purchase price and non-compete provisions of the Galaxy stock purchase agreement and $200,000 in earn-out payment with respect to Galaxy’s 2005 financial performance. Galaxy’s financial performance during Fiscal 2006 also exceeded the specified contractual benchmarks, thereby entitling Mr. Brizz to the final $200,000 earn-out payment, which amount was paid in March, 2007.

12

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Equity Compensation Plan Information as of the end of Fiscal 2006

| | | | | | | Number of securities |

| | | Number of securities to | | Weighted-average | | remaining available for |

| | | be issued upon exercise | | exercise price of | | future issuance under |

| | | of outstanding options, | | outstanding options, | | equity compensation plan |

Plan Category | | warrants and rights | | warrants and rights | | (excludes column a) |

| | | (a) | | (b) | | (c) |

| Equity Compensation | | | | | | |

| Plans approved by | | | | | | |

| security holders | | | 381,000 | | | | $3.31 | | | | 122,834 | |

| Equity Compensation | | | | | | |

| Plans not approved by | | | | | | |

| security holders | | | — | | | | N/A | | | | — | |

| Total | | | 381,000 | | | | $3.31 | | | | 122,834 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 1, 2007, certain information regarding the beneficial ownership of Common Stock by (i) each person known by the Company to be beneficial owner of more than five percent of the outstanding shares of Common Stock, (ii) each director; (iii) each named Executive Officer; and (iv) all directors and executive officers as a group.

| | | Stock Beneficially Owned |

| Name and Address of Beneficial Owner(1) | | No. of Shares | | % of Class(2) |

| Ginarra Partners, LLC(3) | | 576,388 | | | 28.73 | % |

| 2325 Palos Verdes Drive West, Suite 211 | | | | | | |

| Palos Verdes Estates, CA 90274 | | | | | | |

| Graziadio Family Trust u/d/t 10-13-1975(4) | | 410,519 | | | 20.46 | % |

| 16633 Ventura Boulevard, Suite 510 | | | | | | |

| Encino, CA 91436 | | | | | | |

| G. Louis Graziadio III(5) | | 287,500 | | | 13.24 | % |

| Chairman, President and CEO | | | | | | |

| Advisory Research, Inc.(6) | | 138,150 | | | 6.88 | % |

| 180 No. Stetson St., Suite 5500 | | | | | | |

| Chicago, IL 60601 | | | | | | |

| Perry A. Lerner(7) | | 78,283 | | | 3.85 | % |

| Director | | | | | | |

| Lee E. Mikles(7) | | 27,500 | | | 1.35 | % |

| Director | | | | | | |

| Paul A. Novelly(7) (8) | | 114,783 | | | 5.64 | % |

| Director | | | | | | |

| William R. Lang(9) | | — | | | * | |

| Director | | | | | | |

| Richard Bern(10) | | 28,500 | | | 1.41 | % |

| Operational Consultant | | | | | | |

| James F. Sanders(9) (11) | | 20,000 | | | * | |

| Secretary and General Counsel | | | | | | |

| All Directors and Executive Officers as a Group | | 1,543,473 | | | 67.3 | % |

| (Excludes Advisory Research, Inc.) | | | | | | |

13

____________________

| (1) | | Unless otherwise noted, the Company believes all persons named in the table have sole voting and investment power with respect to shares of common stock beneficially owned by them. Under the rules of the Securities and Exchange Commission, a person is deemed to be a “beneficial” owner of securities if he or she has or shares the power to vote or direct the voting of such securities or the power to direct the disposition of such securities. More than one person may be deemed to be a beneficial owner of the same securities. |

| |

| (2) | | Percent of class owned is based on the number of shares outstanding plus options exercisable by the named beneficial owners. An asterisk in this column indicates that the named person holds less than 1% of the issued and outstanding shares. |

| |

| (3) | | Mr. Graziadio has sole voting and investment power over these shares in his capacity as chief executive officer of Second Southern Corp., which is the manager of Ginarra Partners, LLC. Mr. Graziadio disclaims any pecuniary interest or beneficial ownership of the shares owned by Ginarra Partners, LLC. |

| |

| (4) | | Shares are owned by the Graziadio Family Trust, a trust established by Mr. Graziadio, but as to which he is neither a trustee nor a beneficiary. Mr. Graziadio disclaims beneficial ownership of all shares owned by the Graziadio Family Trust. Mr. Lang and Mr. Sanders serve as two of the three trustees of the Graziadio Family Trust. |

| |

| (5) | | Includes a total of 164,500 shares subject to options granted under the Company’s incentive stock plans. Does not include 576,388 shares held by Ginarra Partners, LLC, as to which Mr. Graziadio has sole voting and investment power by virtue of being the chief executive officer of the manager of Ginarra Partners. Does not include 410,519 shares which are owned by the Graziadio Family Trust, a trust established by Mr. Graziadio, but as to which he is neither a trustee nor a beneficiary. Mr. Graziadio disclaims beneficial ownership of all shares owned by the Graziadio Family Trust and Ginarra Partners, LLC. |

| |

| (6) | | Based on a Schedule 13G filed by Advisory Research, Inc. with the SEC on February 20, 2007. |

| |

| (7) | | Includes 27,500 shares subject to options granted under the Company’s 1998 Director Plan. |

| |

| (8) | | Includes 87,283 shares which are owned by St. Albans Global Management LLLP, a Delaware limited liability limited partnership, as to which Mr. Novelly is the chief executive officer. Mr. Novelly disclaims beneficial ownership of the shares owned by St. Albans Global Management LLLP. |

| |

| (9) | | Mr. Lang and Mr. Sanders serve as two of the three trustees of the Graziadio Family Trust (“Trust”) (see footnote 4 above). As a trustee, each shares voting and investment power with respect to the 410,519 shares owned by the Trust. Each of Mr. Lang and Mr. Sanders disclaims any pecuniary interest in or beneficial ownership of the shares owned by the Trust. |

| |

| (10) | | Includes 20,000 shares subject to options granted under the Company’s 1998 Employee Plan. |

| |

| (11) | | Includes 10,000 shares subject to options granted under the Company’s 2004 Stock Plan and 10,000 shares subject to options granted under the Company’s 1998 Employee Plan. |

14

PROPOSAL NO. 2

APPOINTMENT OF McGLADREY & PULLEN, LLP AS THE COMPANY’S INDEPENDENT

AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 29, 2007

The firm of McGladrey & Pullen, LLP, Certified Public Accountants (“McGladrey”), served as the independent auditors of the Company’s year-end financial statements for Fiscal 2006, and the Board of Directors recommends the appointment of McGladrey as the Company’s independent auditors for the fiscal year ending December 29, 2007. The Board of Directors recommends a vote in favor of the proposal to ratify this selection, and the persons named in the enclosed proxy (unless otherwise instructed therein) will vote such proxies FOR such proposal. If the stockholders do not approve this selection, the Board will consider other firms for this engagement. The Company has not yet formally engaged McGladrey for these services and the actual engagement will be dependent upon reaching a satisfactory agreement with the accounting firm on all terms, including the fees to be charged. The Audit Committee of the Board has determined that the provision of non-audit services to the Company by McGladrey is compatible with maintaining their independence as the Company’s principal accountants.

The Audit Committee approves the engagement of the Company’s independent auditors prior to their rendering of audit or non-audit services and sets their compensation. Pursuant to SEC regulations, the Audit Committee approves all fees payable to the independent auditors for all routine and non-routine services provided. The Audit Committee considers and approves the budget for the annual audit and financial statement review services on a fixed fee basis prior to initiation of the work. Non-routine services in the ordinary course of business which are not prohibited under SEC regulation, such as tax planning, tax compliance and other services, generally are pre-approved on a case-by-case basis; provided, however, that such services may be performed during fiscal year 2007 without the committee’s pre-approval in an amount not to exceed $25,000 in the aggregate, so long as the Audit Committee is informed of and reviews each such service. All of the fees paid to the independent auditors were pre-approved by the Audit Committee.

AUDIT FEES

During Fiscal 2006, the Company incurred fees of $111,000 for audit and financial statement review services from McGladrey. During Fiscal 2005, the Company incurred fees of $103,950 for audit and financial statement review services from McGladrey.

AUDIT-RELATED FEES

For Fiscal 2006, the Company incurred fees of $1,960 to McGladrey for audit related services. During Fiscal 2005, the Company incurred fees of $3,885 to McGladrey for audit related services.

TAX FEES

During Fiscal 2006, the Company incurred fees of $16,000 to RSM McGladrey, Inc. (RSM), an affiliate of McGladrey, for tax compliance, tax advice and tax planning. During Fiscal 2005, the Company incurred fees of $16,165 to RSM for such services.

ALL OTHER FEES

During Fiscal 2006 and Fiscal 2005, the Company incurred no fees for services other than audit, audit-related and tax-related services from McGladrey.

The Company has been advised by McGladrey & Pullen, LLP that they will not have a representative present at the Meeting and therefore will not be available to respond to shareholder questions.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE APPOINTMENT OF McGLADREY & PULLEN, LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 29, 2007. |

15

AUDIT COMMITTEE REPORT

The audit committee of the Board of Directors (“Audit Committee”) has reviewed and discussed the audited financial statements with management and with the Company’s independent auditors. The Audit Committee has discussed with the independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards). The Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with them their independence. Based on such review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for Fiscal 2006 for filing with the Securities and Exchange Commission. The Board of Directors has adopted a written charter for the Audit Committee. A majority of the current members of the Audit Committee are “independent” of the Company under the rules and regulations of the NASDAQ Stock Market.

| Audit Committee Members: | Lee E. Mikles | Perry A. Lerner | William R. Lang |

STOCKHOLDER COMMUNICATION AND PROXY PROPOSALS

Proposals of stockholders relating to the Company’s 2008 Annual Meeting must be received in writing by the Company at its principal executive offices no later than January 2, 2008 in order to be included in the Company’s Proxy Statement and form of proxy relating to that meeting. Other communications by shareholders intended for the Board of Directors or any particular Board members should be sent in writing to the Company’s principal executive offices to the attention of the corporate secretary. The corporate secretary will distribute such communications directly to Board members.

FORM 10-K

THE COMPANY, UPON WRITTEN REQUEST, WILL PROVIDE WITHOUT CHARGE TO EACH STOCKHOLDER A COPY OF ITS ANNUAL REPORT ON FORM 10-K FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE FISCAL YEAR ENDED DECEMBER 30, 2006. REQUESTS SHOULD BE DIRECTED TO:

Steven G. Pont

Vice President - Finance

Boss Holdings, Inc.

221 W. First Street

Kewanee, IL 61443

16

OTHER BUSINESS

The Board does not intend to bring any other business before the Meeting, and, so far as is known to the Board, no matters are to be brought before the Meeting except as specified in the notice of the Meeting. As to any business that may properly come before the Meeting, however, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE SO THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | |

| | | JAMESF. SANDERS, |

| Dated:April 30, 2007 | Corporate Secretary |

17

|

BOSS HOLDINGS, INC.

C/O PROXY SERVICES

17 BATTERY PLACE

NEW YORK, NY 10004 |

| VOTE BY MAIL |

| Mark, sign, and date your proxy card and return it in the postage-paid envelope we have provided or return it to Boss Holdings, Inc., c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | BOSSH1 | | KEEP THIS PORTION FOR YOUR RECORDS |

| | DETACH AND RETURN THIS PORTION ONLY |

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

| BOSS HOLDINGS, INC. |

| | |

| | THE DIRECTORS RECOMMEND A VOTE "FOR" | |

| ITEMS 1, 2 AND 3 | |

| | |

| Vote on Directors | |

| | |

| 1. | To elect as Directors of Boss Holdings, Inc. the nominees listed below. |

| | |

| | (1) | G. Louis Graziadio III | (4) | Lee E. Mikles | |

| | (2) | William R. Lang | (5) | P.A. Novelly | |

| | (3) | Perry A. Lerner | | | |

| | | |

| | | |

| | | | | | | | |

| | | | | | | | |

For

All | Withhold

All | For All

Except | | To withhold authority to vote for any individualnominee(s), mark “For All Except” and write thenumber(s) of the nominee(s) on the line below. | | | |

| |

| o | o | o | |

| | |

| |

| | Vote on Proposal | | For | Against | Abstain |

| |

| | 2. | Ratify the appointment of McGladrey & Pullen, LLP as independent auditors of the Company for the fiscal year ending December 29, 2007. | | o | o | o |

| | | | | | |

| 3. | In their discretion, upon such other matters that may properly come before the meeting or any adjournment or adjournments thereof. | | | | |

| |

| The shares represented by this proxy when properly executed will be voted in the manner directed herein by theundersigned Stockholder(s).If no direction is made, this proxy will be voted FOR items 1, 2 and 3.If any othermatters properly come before the meeting, or if cumulative voting is required, the person named in this proxy will vote in their discretion. | | | | |

| | | |

| | | |

| |

| | | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | | Signature (Joint Owners) | Date | |

| BOSS HOLDINGS, INC. JUNE 11, 2007 | |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder(s) of Boss Holdings, Inc., a Delaware corporation, hereby acknowledge(s) receipt of the Proxy Statement dated April 30, 2007 and hereby appoint(s) G. Louis Graziadio III and James F. Sanders and each of them, proxies and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Annual Meeting of Stockholders of Boss Holdings, Inc., to be held June 11, 2007 at 10:00 a.m. Central Daylight Time, at the Board Room of the Conference Center, 8235 Forsyth Blvd., Suite 801, St. Louis, Missouri 63105 and at any adjournment or adjournments thereof, and to vote (including cumulatively, if required) all shares of Common Stock which the undersigned would be entitled to vote if then and there personally present, on all matters set forth on the reverse side.

PLEASE MARK, SIGN AND DATE THIS PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

(continued, and to be signed and dated, on the reverse side)