815 Commerce Drive

Oak Brook, Illinois 60523

August 12, 2005

Dear Fellow Shareholder:

On behalf of the Board of Directors and management of United Financial Mortgage Corp., I cordially invite you to attend the Annual Meeting of Shareholders of United Financial, to be held on Thursday, September 1, 2005, at 2:00 P.M. local time, at the Wyndham Drake Hotel, 2301 York Road, Oak Brook, Illinois 60523. At the meeting, shareholders will be asked to consider and vote on matters including the election of directors and the ratification of our independent registered public accounting firm. In addition, we will report on our operations and provide our outlook for the year ahead.

Our Board of Directors has nominated seven persons to serve as directors for a term of one year, all of whom are incumbent directors. Additionally, our Audit Committee has selected, and we recommend that you ratify the engagement of, Crowe Chizek and Company LLC to continue as our independent registered public accounting firm. Accordingly, our Board of Directors recommends that you vote your shares for each of the director nominees and in favor of the ratification of the engagement of Crowe Chizek.

We encourage you to attend the meeting in person. However, whether or not you plan to attend, please complete, sign and date the enclosed proxy and return it in the accompanying postpaid return envelope as promptly as possible. This will ensure that your shares are represented at the meeting.

| | | Sincerely, |

|

|

|

| | | /s/ Joseph Khoshabe |

| | Joseph Khoshabe |

| | Chairman |

815 Commerce Drive

Oak Brook, Illinois 60523

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on September 1, 2005

To the Shareholders of United Financial Mortgage Corp.

Notice is hereby given that the Annual Meeting of Shareholders of United Financial Mortgage Corp., an Illinois corporation (the “Company”), will be held on Thursday, September 1, 2005, at 2:00 P.M. local time, at the Wyndham Drake Hotel, 2301 York Road, Oak Brook, Illinois 60523. The Annual Meeting will be held for the following purposes:

| 1. | to elect seven directors of the Company; |

| 2. | to ratify the engagement of Crowe Chizek and Company LLC as the independent registered public accounting firm of the Company for the year ending April 30, 2006; and |

| 3. | to transact such other business as may properly come before the meeting or any adjournment or postponements thereof. |

The Board of Directors has set the close of business on August 9, 2005, as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the meeting. In the event that there are not sufficient votes to establish a quorum or to approve or ratify the proposals to be considered at the Annual Meeting, the meeting may be adjourned or postponed in order to permit the further solicitation of proxies. The transfer books of the Company will not be closed.

| | | By Order of the Board of Directors, |

| | |

| August 12, 2005 | | |

| Oak Brook, Illinois | | /s/ Joseph Khoshabe |

| | Joseph Khoshabe |

| | Chairman |

YOUR VOTE IS IMPORTANT. PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON. WE HOPE THAT YOU WILL BE ABLE TO ATTEND THE MEETING, AND IF YOU DO YOU MAY VOTE YOUR STOCK IN PERSON IF YOU WISH. YOU MAY REVOKE THE PROXY CARD AT ANY TIME PRIOR TO ITS EXERCISE.

PROXY STATEMENT

These proxy materials are furnished in connection with the solicitation by the Board of Directors of United Financial Mortgage Corp. (the “Company”) of proxies to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Thursday, September 1, 2005, at 2:00 P.M. local time, at Wyndham Drake Hotel, 2301 York Road, Oak Brook, Illinois 60523, and any adjournment or postponement thereof. The Board of Directors would like to have all shareholders represented at this year’s Annual Meeting. Whether or not you plan to attend the Annual Meeting, you are urged to complete, date and sign your proxy, then return it to the Company in the accompanying envelope. No postage needs to be affixed if you mail your proxy in the United States. The mailing address of the Company’s principal executive office is 815 Commerce Drive, Suite 100, Oak Brook, Illinois 60523.

The Notice of Annual Meeting of Shareholders, this proxy statement and the enclosed form of proxy will first be mailed to the shareholders of the Company on or about August 12, 2005. Your proxy is solicited by the Board of Directors of the Company.

The following is information that we believe you will find to be informative with respect to the Annual Meeting and the voting process.

Why am I receiving this proxy statement and proxy form?

You are receiving a proxy statement and proxy form from us because on August 9, 2005, the record date, you owned shares of the Company’s Common Stock. This proxy statement describes the matters that will be presented for consideration by the shareholders at the Annual Meeting. It also gives you information concerning the matters to be considered to assist you in making an informed decision.

When you sign the enclosed proxy form, you appoint the proxy holder as your representative at the Annual Meeting. The proxy holder will vote your shares as you have instructed in the proxy form, thereby ensuring that your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, you should complete, sign and return your proxy form in advance of the Annual Meeting in case your plans change.

If you have signed and returned the proxy form and an issue comes up for a vote at the meeting that is not identified on the form, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his or her judgment.

What matters will be voted on at the Annual Meeting?

You are being asked to vote on the election of directors of the Company and the ratification of the engagement of Crowe Chizek and Company LLC (“Crowe Chizek”) as our independent registered public accounting firm for the 2006 fiscal year. These matters are more fully described in this proxy statement.

How do I vote?

You may vote either by mail or in person at the Annual Meeting. To vote by mail, complete and sign the enclosed proxy form and mail it in the enclosed pre-addressed envelope. No postage is required if mailed in the United States. If you mark your proxy form to indicate how you want your shares voted, your shares will be voted as you instruct.

If you sign and return your proxy form, but do not mark the form to provide voting instructions, the shares represented by your proxy form will be voted “FOR” the slate of directors named in this proxy statement and “FOR” the ratification of the engagement of Crowe Chizek as our independent registered public accounting firm.

If you want to vote in person, please come to the Annual Meeting. We will distribute written ballots to anyone who wants to vote at the Annual Meeting. Please note, however, that if your shares are held in the name of your broker (or in what is usually referred to as “street name”), you will need to arrange to obtain a proxy from your broker in order to vote in person at the Annual Meeting.

What does it mean if I receive more than one proxy form?

It means that you have multiple holdings reflected in our stock transfer records and/or in accounts with stockbrokers. Please sign and return ALL proxy forms to ensure that all your shares are voted.

If I hold shares in the name of a broker, who votes my shares?

If you received this proxy statement from your broker, your broker should have given you instructions for directing how your broker should vote your shares. It will then be your broker’s responsibility to vote your shares for you in the manner you direct.

Under the rules of various national and regional securities exchanges, brokers may generally vote on routine matters, such as the election of directors and the ratification of the engagement of the independent registered public accounting firm, but cannot vote on non-routine matters, such as an amendment to the articles of incorporation, unless they have received voting instructions from the person for whom they are holding shares. If your broker does not receive instructions from you on how to vote particular shares on matters on which your broker does not have discretionary authority to vote, your broker will return the proxy form to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a “broker non-vote” and will affect the outcome of the voting as described below, under “How many votes are needed for each proposal?” Therefore, we encourage you to provide directions to your broker as to how you want your shares voted on the matters to be brought before the Annual Meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the Annual Meeting.

What if I change my mind after I return my proxy?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| · | signing another proxy with a later date and returning that proxy to the attention of the President and Chief Executive Officer; |

| · | voting in person at the Annual Meeting; or |

| · | sending notice addressed to the attention of the President and Chief Executive Officer that you are revoking your proxy to the following address: |

United Financial Mortgage Corp.

815 Commerce Drive, Suite 100

Oak Brook, Illinois 60523

Attn: President and Chief Executive Officer

If you hold your shares in the name of a broker and desire to revoke your proxy, you will need to contact your broker to revoke your proxy.

How many votes do we need to hold the Annual Meeting?

A majority of the shares that are outstanding and entitled to vote as of the record date must be present in person or by proxy at the Annual Meeting in order to hold the Annual Meeting and conduct business. Abstentions are considered present at the Annual Meeting and counted in determining whether a quorum is present.

Shares are counted as present at the Annual Meeting if the shareholder either:

| · | is present and votes in person at the Annual Meeting; or |

| · | has properly submitted a signed proxy form or other proxy. |

On August 9, 2005, the record date, there were 6,219,643 shares of the Company Common Stock issued and outstanding. Therefore, at least 3,109,822 shares need to be present at the Annual Meeting.

What happens if a nominee is unable to stand for re-election?

The Board of Directors may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. Proxies cannot be voted for more than seven nominees. We have no reason to believe any nominee will be unable to stand for re-election.

What options do I have in voting on each of the proposals?

You may vote “FOR” or “WITHHOLD AUTHORITY” to vote for the nominees for director. You may vote “FOR,”“AGAINST” or “ABSTAIN” with respect to the ratification of the engagement of Crowe Chizek as the Company’s independent registered public accounting firm.

How many votes may I cast?

Generally, you are entitled to cast one vote for each share of stock you owned on the record date. The proxy form included with this proxy statement indicates the number of shares owned by an account attributable to you.

How many votes are needed for each proposal?

The Articles of Incorporation do not provide for cumulative voting. Accordingly, each share of the Company Common Stock is entitled to one vote on all matters submitted to the shareholders. Shares represented by broker non-votes are not considered present at the Annual Meeting and are not counted in determining whether a quorum is present. With respect to all matters, abstentions and broker non-votes will be counted for purposes of determining whether or not a quorum is present.

The seven individuals receiving the highest number of votes cast “FOR” their election will be elected as directors of the Company. The ratification of the engagement of our independent registered public accounting firm must receive the affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote, and abstentions and broker non-votes will have the effect of voting against this proposal.

Where do I find the voting results of the Annual Meeting?

We will announce voting results at the Annual Meeting. The voting results will also be disclosed in our quarterly report filed with the SEC for the quarter ended October 31, 2005.

Who bears the cost of soliciting proxies?

We will bear the cost of soliciting proxies. In addition to solicitations by mail, officers, directors or employees of the Company or its subsidiaries may solicit proxies in person or by telephone. These persons will not receive any special or additional compensation for soliciting proxies. We may reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

How does the Board recommend that I vote?

The Board of Directors recommends that you vote “FOR” each of the director nominees and “FOR” ratification of the engagement of Crowe Chizek as the Company’s independent registered public accounting firm.

ELECTION OF DIRECTORS

At the Annual Meeting on September 1, 2005, seven directors are to be elected to serve on the Board of Directors until the next annual meeting of shareholders or until their successors are elected and qualified. It is the intention of the persons named as proxies on the enclosed form of proxy to vote such proxy, unless indicated otherwise by the shareholder giving the proxy, in favor of the election of the nominees named below.

If for any reason any of the nominees shall become unavailable for election, the proxy will be voted for nominees selected by the Board of Directors. At this time, the Board of Directors knows of no reason why any nominee would not be available for election. The vote of a majority of a plurality of the votes cast at the Annual Meeting will be required to elect each of the nominees named below to the Board of Directors. The Board of Directors nominates individuals to serve on the Board of Directors. Additionally, the Board of Directors may consider nominations submitted in writing by shareholders.

The Board of Directors recommends that you vote your shares “FOR” the election of the nominees.

The Nominees

Information concerning the nominees for election to the Board of Directors, as of August 1, 2004, is set forth below:

Name | | Age | | Positions Held with the Company | | Director Since | | Years with the Company |

| Joseph Khoshabe | | 60 | | Chairman and Director | | 1986 | | 19 |

| John A. Clark | | 57 | | Director | | 1998 | | 7 |

| Robert S. Luce | | 58 | | Director | | 1998 | | 7 |

| Elliot R. Jacobs | | 60 | | Director | | 2001 | | 4 |

| James R. Zuhlke | | 59 | | Director | | 2001 | | 4 |

| Anthony W. Schweiger | | 63 | | Director | | 2004 | | 1 |

| Steve Y. Khoshabe | | 33 | | President and Chief Executive Officer and Director | | 2004 | | 11 |

The business experience of each of the above-mentioned nominees for the past five or more years, and certain other biographical information, is set forth below:

Joseph Khoshabe currently serves as the Company’s Chairman and a member of its Board of Directors. Prior to April 2003 and since 1986, Mr. Khoshabe served as the Company’s President and Chief Executive Officer. In addition to serving as Chairman, Mr. Khoshabe is also responsible for the Company’s commercial lending operations. Prior to the Company’s formation, Mr. Khoshabe was an executive with the Cracker Jack Division of Borden, Inc., where he was employed for approximately 17 years. Khoshabe holds a Bachelor of Arts Degree in Business Administration/ Economics from Governors State University and a Bachelor of Science/ Accounting from Tehran University. Mr. Khoshabe is the father of Mr. Steve Khoshabe, our President and Chief Executive Officer and a nominee for director.

John A. Clark was elected to the Company’s Board of Directors in 1998. Mr. Clark retired as the President and Chief Executive Officer of a Chicago area commercial banking organization in April of 1997. During his 17 year career as a senior executive with that organization, Mr. Clark helped develop or acquire a number of financial institutions and, on the date of his retirement, the organization was the largest bank holding company headquartered in DuPage County, Illinois. He is presently the President of SRJC, Inc., an organization that he formed in 1997 and that provides financial consulting services to small and medium sized businesses. Mr. Clark has a B.S. degree from the University of Wisconsin at Stevens Point, Wisconsin.

James R. Zuhlke was elected to the Company’s Board of Directors in 2001. Mr. Zuhlke has over 25 years of experience as an insurance executive. During that time, Mr. Zuhlke started and managed seven different insurance companies, including both domestic and overseas captives. Mr. Zuhlke was founder, President and Chairman of the Board of Intercargo Corporation, which became publicly-traded in 1988. Until January 2004, Mr. Zuhlke served as the President of Kingsway America, Inc., a holding company for six operating subsidiaries of the Kingsway Financial Services Group, which Mr. Zuhlke assisted in becoming a public company in 1995. Mr. Zuhlke also serves as a director of a number of other companies. Mr. Zuhlke is currently a private investor. Mr. Zuhlke received his BBA from the University of Wisconsin in 1968 and also received his law degree from the University of Wisconsin in 1971.

Robert S. Luce was elected to the Company’s Board of Directors in 1998. Mr. Luce is an attorney who has been practicing financial services law for 30 years. Mr. Luce attended the University of Illinois and received his law degree from Loyola University School of Law (Chicago) in 1972. Mr. Luce was an attorney with the United States Securities and Exchange Commission from 1972 to 1976 and was an adjunct professor of law at Loyola University of Law (Chicago) in the area of securities regulations from 1972 to 1980. Mr. Luce has served as corporate counsel to Fortune 500 companies and has been a partner in two Chicago area law firms. Mr. Luce founded the law offices of Robert S. Luce in 1989. In addition, Mr. Luce also serves as the President of MDR Mortgage, a mortgage broker located in Palatine, Illinois.

Elliot R. Jacobs was elected to the Company’s Board of Directors in 2001. Mr. Jacobs is a professional in the mortgage banking industry. Mr. Jacobs is a frequent speaker and contributing author on topics for the Mortgage Bankers Association of America. Mr. Jacobs has been a director of the mortgage banking strategies group of First Fidelity Capital Markets, Inc. of Boca Raton, Florida since 1998. During the period from 1993 to 1998, Mr. Jacobs was the director of the Mergers and Acquisitions group of CoreStates Capital Markets, a division of CoreStates Bank of Fort Lauderdale, Florida. Mr. Jacobs earned a B.S. in Accounting and an MBA in Management Information Systems, with honors, from the American University.

Anthony W. Schweiger was elected to the Company’s Board of Directors in 2004. Mr. Schweiger serves as the President and Chief Executive Officer of The Tomorrow Group, LLC, a governance and management consultancy. Since 1992, he has been a director and Governance Chair of Radian Group Inc., a NYSE traded global provider of credit enhancement products. He also serves on Radian's Audit and Executive Committees. Since 2001, Mr. Schweiger has served as a director of Paragon Technologies, Inc., an American Stock Exchange traded provider of automated solutions for material flow applications. He has also been an investor and director of Input Technologies, LLC, a supplier of human-to-machine interface products and services since February 1998. From 1983 until 1993, Mr. Schweiger served as Chief Executive Officer of Meridian Mortgage Corporation. In his capacity as a consultant, Mr. Schweiger advises various service and technology businesses on governance, operational and strategic issues. Mr. Schweiger is a graduate of the Wharton School of Finance & Commerce at the University of Pennsylvania.

Steve Y. Khoshabe was elected to the Company’s Board of Directors in 2004. In April 2003, Mr. Khoshabe was named President and Chief Executive Officer of the Company. Mr. Khoshabe is responsible for the day-to-day administration of all of the Company’s operating activities, other than its commercial lending operations, including supervision of its loan origination activities, personnel management and financial matters. Mr. Khoshabe joined the Company in December 1994 and was Executive Vice President and Chief Financial Officer from 1998 to 2003. Mr. Khoshabe holds a Bachelor of Science degree in Marketing/ Economics from Bradley University and a Masters of Business Administration/ Finance from Loyola University of Chicago. Mr. Steve Khoshabe is the son of Mr. Joseph Khoshabe, the Company’s Chairman and a member of its Board of Directors.

The business experience of each of the other named executive officers of the Company for the past five or more years, and certain other biographical information, is set forth below:

Robert L. Hiatt (age 39) was named Executive Vice President and Chief Financial Officer of the Company in August 2003. Prior to joining the Company, Mr. Hiatt served as Vice President and Chief Accounting Officer for Novamed Eyecare, Inc., a publicly-traded healthcare company, where he worked for six years. Prior to that, he worked at Arthur Andersen, LLP for nine years. Mr. Hiatt received a B.S. in Accounting from Miami University of Ohio.

Michael A. Kraft (age 45) has served as the Company’s Corporate Counsel since 2001. His responsibilities include advising the Company on general legal issues, including contract, employment and compliance matters. Mr. Kraft also manages any pending litigation matters in which the Company is involved. Prior to joining the Company, Mr. Kraft was a member of Kane & Fischer, Ltd., a Chicago, Illinois law firm concentrating in commercial, business and securities litigation matters from 1995 to 2001. In addition to receiving his J.D. from John Marshall Law School, Mr. Kraft holds a Masters in Business Administration degree from Rosary College and a Bachelor of Arts degree from Augustana College. Mr. Kraft has been a practicing attorney in Illinois since 1988.

Jason K. Schiffman (age 33) has been with the Company since 1995 and currently serves as Executive Vice President — Operations. Currently, he oversees loan underwriting, closing and funding and quality control and compliance functions, as well as heading up the Company’s technology efforts. Prior to managing the Company’s operations, Mr. Schiffman was responsible for one of its mortgage loan production units. Mr. Schiffman holds a B.S. in Finance and Psychology from Elmhurst College.

Christian P. Kloster (age 33) has been with the Company since 1995 and currently serves as Executive Vice President — Secondary Marketing. His current responsibilities include managing our mortgage loan pipeline, interest rate risk and loan delivery functions. Prior to joining the Company, Mr. Kloster served as an Account Executive for Bank One Financial Services. Mr. Kloster holds a B.S. in Finance from Wartburg College.

Compliance with Section 16(a) of the Securities Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s executive officers and directors and persons who own more than 10% of Common Stock file reports of ownership and changes in ownership with the Securities and Exchange Commission and with the exchange on which shares of the Company Common Stock are traded. Such persons are also required to furnish the Company with copies of all Section 16(a) forms they file. Based solely on the Company’s review of the copies of such forms furnished to the Company and, if appropriate, representations made to the Company by any such reporting person concerning whether a Form 5 was required to be filed for the 2005 fiscal year, the Company is not aware that any of its directors and executive officers or 10% shareholders failed to comply with the filing requirements of Section 16(a) during the 2005 fiscal year.

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

General

The Board of Directors is currently comprised of seven directors who are elected each year to serve on the board until the next annual meeting of shareholders or until their successors are elected and qualified. Currently, the directors are Messrs. Joseph Khoshabe, James R. Zuhlke, John A. Clark, Robert S. Luce, Elliot R. Jacobs, Anthony W. Schweiger and Steve Y. Khoshabe. The Board of Directors has determined that each of the directors meets the “independence” requirements of the Nasdaq Stock Market, Inc. with the exception of Mr. Joseph Khoshabe and Mr. Steve Khoshabe, who are executive officers of the Company and Mr. Jacobs, who is a principal of an entity with whom the Company has a business relationship. The Board of Directors has also determined that the independent directors do not have other relationships with the Company that prevent them from making objective, independent decisions.

The Board of Directors held four meetings during the Company’s 2005 fiscal year. All of the directors attended at least 75% of the meetings of the Board of Directors and each of the meetings of the committees on which they served. The Company encourages all of the members of the Board of Directors to attend its annual meeting. Last year, all seven of the members of the Board of Directors attended the Company’s annual meeting.

Audit Committee

The Company’s Audit Committee appoints, retains and reviews the results and services performed by the Company’s independent registered public accounting firm, reviews with management and the internal audit department the systems of internal control and internal audit reports and ensures that the Company’s books and records are kept in accordance with applicable accounting principles and standards. During the 2005 fiscal year, the members of the Company’s Audit Committee were Messrs. Schweiger (Chairman), Zuhlke, Clark and Luce, each of whom meets the “independence” requirements of the Nasdaq National Market, Inc. and the Securities and Exchange Commission. The Company’s Audit Committee met four times during fiscal year 2005. The Board of Directors and the Audit Committee has adopted a written charter, which is available on the Company’s website at www.ufmc.com.

Based on Mr. Schweiger’s education, his previous experience as a chief financial officer and chief executive officer, his participation on other audit committees and his professional experience, the Board of Directors has determined that Mr. Schweiger would qualify as an “audit committee financial expert”. The Board of Directors also believes that each of the members of the Audit Committee possesses knowledge and experience sufficient to understand the complexities of the financial statements of the Company.

Compensation and Human Resources Committee

The Company has established a Compensation and Human Resources Committee that sets the compensation and benefits for the chief executive officer as well as reviews the compensation and benefits for the other officers and employees of the Company. During the 2005 fiscal year, the members of this committee were Messrs. Zuhlke (Chairman), Jacobs and Luce and the committee met four times. As of September 1, 2005 the Compensation and Human Resources Committee consisted of Messrs. Zuhlke (Chairman), Luce and Clark. The Board of Directors has adopted a written charter for the Compensation and Human Resources Committee, which is available on the Company’s website at www.ufmc.com.

Nominating & Governance Committee

The Board of Directors of the Company has established a nominating and governance committee that (i) identifies and selects qualified individuals to serve as directors of the Company and nominate such individuals for election as directors at the Company’s annual meetings of shareholders and (ii) develops and establishes corporate governance policies. The Nominating and Governance committee held four meetings during the 2005 fiscal year. During the 2005 fiscal year, the members of this committee were Messrs. Schweiger (Chairman), Joseph Khoshabe and Clark. Mr. Clark and Mr. Schweiger meet the “independence” requirements of the Nasdaq National Market, Inc. Mr. Khoshabe, who does not meet the “independence” requirements of the Nasdaq National Market, Inc., was appointed to the nominating and governance committee as a result of the breadth of his relationships in the financial services industry. Effective as of September 1, 2005, the members of the Nominating and Governance Committee are Messrs. Schweiger (Chariman), Luce and Clark. The Board of Directors has adopted a written charter for the Nominating and Governance Committee, which is available on the Company’s website at www.ufmc.com.

The Nominating and Governance Committee does not currently have a formal policy regarding the handling or consideration of director candidate recommendations received from a shareholder or a formal policy for identifying and evaluating nominees for directors (including nominees recommended by shareholders). Although a formal policy has not yet been adopted, the nominating and governance committee believes that nominees for election to the Board of Directors must possess certain minimum qualifications and attributes. These qualifications and attributes include strong personal integrity, character and ethics and a commitment to ethical business and accounting practices, demonstrated leadership skills and sound judgment, exemplary management and communication skills, as well as an ability to meet the standards and duties set forth in our code of business conduct and ethics. It is also expected that directors should be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and that they should be committed to serve on the Board for an extended period of time. The Nominating and Governance Committee will evaluate potential nominees to determine if they have any conflicts of interest that may interfere with their ability to serve as an effective member of the Board of Directors and to ensure the nominees’“independence” as necessary. Currently, the Company does not pay any fees to any third party to identify or assist in identifying or evaluating nominees for directors.

Shareholder Communications; Nomination and Proposal Procedures

Shareholder Communication with the Board of Directors. Shareholders of the Company may contact any member of the Board of Directors, or the entire Board of Directors, through the President and Chief Executive Officer either in person, in writing or by phone at (630) 571-7222. Any communication will promptly be forwarded to the Board of Directors as a group or to the attention of a specified director. All letters should be mailed to United Financial Mortgage Corp., 815 Commerce Drive, Oak Brook, Illinois 60523, Attn: President and Chief Executive Officer and should indicate that the author is a shareholder of the Company.

Shareholder Nominations. In order for a shareholder nominee to be considered by the nominating & governance committee to be its nominee and included in the Company’s proxy statement, the nominating shareholder must file a written notice of the proposed director nomination with the President and Chief Executive Officer, at the above address, at least 120 days prior to the date the previous year’s proxy statement was mailed to shareholders. Nominations must include the full name and address of the proposed nominee and a brief description of the proposed nominee’s business experience for at least the previous five years and, as to the shareholder giving the notice, his or her name and address, and the class and number of shares of the Company’s capital stock owned by that shareholder. All submissions must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. The committee may request additional information in order to make a determination as to whether to nominate the person for director.

Other Shareholder Proposals. To be considered for inclusion in our proxy statement and form of proxy relating to our annual meeting of shareholders, the nominating stockholder must file a written notice of the proposal with the President and Chief Executive Officer, at the above address, at least 120 days prior to the date the previous year’s proxy statement was mailed to stockholders, and must otherwise comply with the rules and regulations set forth by the Securities and Exchange Commission.

Independent Director Sessions

Consistent with the Nasdaq listing requirements, the independent directors regularly have the opportunity to meet without Messrs. Joseph Khoshabe, Steve Khoshabe and Jacobs in attendance.

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics applicable to its directors, officers and employees, including its chief executive officer, chief financial officer and other senior financial officers performing accounting, auditing, financial management or similar functions. The Company’s Code of Business Conduct and Ethics is posted on the Investor Information page of its web site at www.ufmc.com. The Company intends to satisfy the disclosure requirements regarding any amendment to, or waiver from, a provision of its Code of Business Conduct and Ethics by disclosing such matters in the Investor Information page of its web site. Shareholders may request a free copy of the Company’s Code of Business Conduct and Ethics by writing United Financial Mortgage Corp., Attn: Code of Ethics, 815 Commerce Drive, Suite 100, Oak Brook, IL 60523.

Director Compensation

Each member of the Board of Directors is entitled to receive a monthly retainer of $1,000. In addition, each director is entitled to receive $500 for attendance at each meeting of the Board of Directors and each committee. The chairman of the Audit Committee will receive an additional annual retainer of $5,000. In addition, each member of the Board of Directors is entitled to participate in the United Financial Mortgage Corp. 2004 Stock Incentive Plan. Each director is entitled to receive an annual grant of 4,000 shares in the form of restricted stock. These awards vest 20% each on the grant date and the first four anniversaries of the grant date. After the annual meeting, the compensation of the Board of Directors will be a monthly retainer of $1,200, a per Board of Directors meeting fee of $750, a $500 fee for committee meetings, and 4,000 shares in the form of restricted stock to vest 20% each on the grant date and the first four anniversaries of the grant date. The Audit Committee chairman will receive an additional annual retainer of $10,000.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth information, to the knowledge of the Board of Directors, as of July 31, 2005, regarding share ownership of (i) those persons or entities known by the Company to beneficially own more than five percent of the Company’s Common Stock; (ii) each director and each executive officer named in the summary compensation table; and (iii) all directors and executive officers as a group.

| | | Shares Beneficially Owned (1) | |

Name and Address of Beneficial Owner | | Number | | Percent | |

| | | | | | |

| Joseph Khoshabe (2)(3) | | | 2,257,961 | | | 36.38 | % |

| Steve Y. Khoshabe (2) | | | 137,900 | | | 2.22 | % |

| Robert L. Hiatt (2) | | | 4,800 | | | * | |

| Michael A. Kraft (2)(4) | | | 9,060 | | | * | |

| Jason K. Schiffman (2)(5) | | | 24,720 | | | * | |

| Christian P. Kloster (2)(6) | | | 27,130 | | | * | |

| John A. Clark (2)(7) | | | 90,000 | | | 1.45 | % |

| Robert S. Luce (2)(8) | | | 16,100 | | | * | |

| Elliot R. Jacobs (2) | | | 25,000 | | | * | |

| James R. Zuhlke (2) | | | 21,000 | | | * | |

| Anthony W. Schweiger | | | 9,000 | | | * | |

| All directors and executive officers as a group (11 persons) | | | 2,622,671 | | | 42.32 | % |

Laurence B. Woznicki 1336 West George Street Chicago, Illinois 60657 | | | 374,870 | | | 6.04 | % |

| | | | | | | | |

* Less than 1%

| (1) | Calculated pursuant to Rule 13d-3(d) under the Securities Exchange Act of 1934. Unless otherwise stated in these notes, each person has sole voting and investment power with respect to all such shares. Under Rule 13d-3(d), shares not outstanding which are subject to options exercisable within 60 days are deemed outstanding for the purpose of computing the number and percentage owned by such person, but are not deemed outstanding for the purpose of computing the percentage owned by each other person listed. The following persons have the right to acquire within 60 days the following number of shares of the Company’s Common Stock upon the exercise of stock options: Mr. Joseph Khoshabe - 28,000; Mr. Steve Khoshabe - 91,200; Mr. Hiatt - 4,800; Mr. Schiffman - 10,200; Mr. Kraft - 7,200; Mr. Kloster - 26,100; Mr. Clark - 9,000; Mr. Luce - 16,000; Mr. Jacobs - 16,000; Mr. Zuhlke - 12,000: Mr. Schweiger - 4,000. |

| (2) | Each of the officers and directors may be contacted through the Company’s offices located at 815 Commerce Drive, Oak Brook, Illinois 60523. |

| (3) | Includes 2,225,961 shares held by The Joseph Khoshabe Trust, under Trust Agreement dated September 22, 1995, referred to as the J. K. Trust, of which Mr. Joseph Khoshabe, the Company’s Chairman, is trustee. Mr. Joseph Khoshabe originally purchased the shares and then had them registered in the name of the J. K. Trust for estate planning purposes. |

| (4) | Includes 10 shares held by Mr. Kraft’s spouse and 40 shares held by Mr. Kraft’s children. |

| (5) | Includes 70 shares held by members of Mr. Schiffman’s family. |

| (6) | Includes 10 shares held by Mr. Kloster’s spouse and 10 shares held by Mr. Kloster’s child. |

| (7) | Includes 77,000 shares held by the Rosalie E. Clark Trust under trust agreement dated October 22, 1990, as amended on May 9, 1997. |

| (8) | Includes 100 shares held by Mr. Luce’s spouse. |

EXECUTIVE COMPENSATION

Presented below is a Summary Compensation Table that sets forth the remuneration of the Company’s chief executive officer and the four most highly compensated executive officers of the Company whose salary and bonus exceeded $100,000 during the fiscal year ended April 30, 2005:

Summary Compensation Table

| | | Annual Compensation | | Long Term Compensation | |

| | | Fiscal Year | | Salary | | Bonus | | Other Compensation (1)(2) | | Securities Underlying Options (#) | | Restricted Stock Awards ($)(7) | |

Name and Principal Position | |

| | | | | | | | | | | | | | |

| Joseph Khoshabe, Chairman | | | 2005 | | $ | 450,000 | | $ | — | | $ | 21,372(3 | ) | | 10,000(4 | ) | | — | |

| | | | 2004 | | | 441,667 | | | — | | | 15,108(3 | ) | | 10,000(4 | ) | | — | |

| | | | 2003 | | | 250,000 | | | 546,054 | | | 8,401 | | | 25,000(4 | ) | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Steve Y. Khoshabe, | | | 2005 | | $ | 250,000 | | $ | — | | $ | 21,040(3 | ) | | 10,000(4 | ) | $ | 50,000 | |

| President | | | 2004 | | | 250,000 | | | 175,000 | | | 10,003 | | | 33,000 | | | — | |

| and Chief Executive Officer | | | 2003 | | | 165,000 | | | 465,792 | | | 3,664 | | | 90,000 | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Robert L. Hiatt, Executive | | | 2005 | | $ | 125,000 | | $ | 24,255 | | $ | 2,334 | | | 9,000 | | | — | |

| Vice President & Chief | | | 2004 | | | 88,542 | | | 36,110 | | | 240 | | | 3,000 | | | — | |

| Financial Officer (5) | | | 2003 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Michael A. Kraft, Executive | | | 2005 | | $ | 135,000 | | $ | 11,011 | | $ | 12,222 | | | 15,000 | | | — | |

| Vice President & Corporate | | | 2004 | | | 135,000 | | | 12,447 | | | 10,003 | | | 3,000 | | | — | |

| Counsel | | | 2003 | | | 135,000 | | | 5,000 | | | 12,977 | | | 3,000 | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Jason K. Schiffman, | | | 2005 | | $ | 125,000 | | $ | 16,405 | | $ | 8,436(6 | ) | | 9,000 | | | — | |

| Executive Vice President- | | | 2004 | | | 122,292 | | | 51,110 | | | 13,778(6 | ) | | 15,000 | | | — | |

| Operations | | | 2003 | | | 60,000 | | | 61,216 | | | 1,871 | | | 16,000 | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Christian P. Kloster, | | | 2005 | | $ | 60,000 | | $ | 105,505 | | $ | 8,964(6 | ) | | 9,000 | | | — | |

| Executive Vice President - | | | 2004 | | | 60,000 | | | 96,302 | | | 6,518(6 | ) | | 15,000 | | | — | |

| Secondary Marketing | | | 2003 | | | 60,000 | | | 61,216 | | | 3,038 | | | 22,500 | | | — | |

_______________________________

| (1) | Includes annual health insurance premiums paid for the named executive officers and their dependents. |

| (2) | Does not include annual car allowances payable as follows for each of the 2005, 2004 and 2003 fiscal years: Mr. Joseph Khoshabe - $25,000; Mr. Steve Khoshabe - $12,000; Mr. Schiffman - $5,000; Mr. Kloster - $5,000. Does not include annual car allowance of $5,000 for 2005 or $3,750 for 2004 for Mr. Hiatt. |

| (3) | For Mr. Joseph Khoshabe this amount includes compensation of $13,500 and $8,500 as a member of the Board of Directors for 2005 and 2004, respectively. For Mr. Steve Khoshabe, this amount includes $9,500, of compensation as a member of the Board of Directors for 2005. |

| (4) | 2005, 2004 and 2003 option grants include 10,000, 10,000 and 5,000 options, respectively, granted to Mr. Joesph Khoshabe as a member of the Company’s Board of Directors and 2005 option grants include 10,000 options granted to Mr. Steve Khoshabe as a member of the Company’s Board of Directors. |

| (5) | Mr. Hiatt was hired August 18, 2003. |

| (6) | Includes commissions received related to loans originated by the executive officers. |

| (7) | Includes 10,000 shares of restricted stock issued during fiscal year end April 30, 2005. All issued restricted stock awards aggregate 10,000 shares valued at fiscal year end price of $43,200. These shares have the same rights to receive dividends as all other common shares. |

Option Grants in Last Fiscal Year

Name | | Options Granted (#) | | % of Total Options Granted to Employees in Fiscal Year(1) | | Exercise or Base Price ($/Share) | | Expiration Date | |

| Joseph Khoshabe (2) | | | — | | | — | % | $ | — | | | — | |

| Steve Y. Khoshabe (2) | | | — | | | — | | | — | | | — | |

| Robert L. Hiatt | | | 9,000 | | | 12.6 | | | 4.74 | | | 09/23/2009 | |

| Michael A. Kraft | | | 15,000 | | | 21.0 | | | 4.74 | | | 09/23/2009 | |

| Jason K. Schiffman | | | 9,000 | | | 12.6 | | | 4.74 | | | 09/23/2009 | |

| Christian P. Kloster | | | 9,000 | | | 12.6 | | | 4.74 | | | 09/23/2009 | |

_______________________________

| (1) | Excludes 50,000 options granted in aggregate to the members (10,000 each) of the Company’s Board of Directors at an exercise price of $5.20. |

| (2) | Excludes 10,000 options granted to each of Messrs. Joseph Khoshabe and Steve Khoshabe as members of the Company’s Board of Directors at an exercise price of $5.20. |

No options were exercised by any of the named executive officers during the fiscal year ended April 30, 2005.

Fiscal Year End Option Values

| | | Number of Securities Underlying Unexercised Options

At Fiscal Year-End (#) | | Value of Unexercised In-The-Money Options

At Fiscal Year-End ($) | |

Name | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| Joseph Khoshabe | | | 25,000 | | | 25,000 | | $ | 19,440 | | $ | 12,960 | |

| Steve Y. Khoshabe | | | 85,200 | | | 67,800 | | | 133,400 | | | 69,800 | |

| Robert L. Hiatt | | | 3,000 | | | 9,000 | | | — | | | — | |

| Michael A. Kraft | | | 6,000 | | | 15,000 | | | 2,916 | | | 1,944 | |

| Jason K. Schiffman | | | 19,800 | | | 23,200 | | | 22,440 | | | 12,090 | |

| Christian P. Kloster | | | 23,700 | | | 25,800 | | | 28,758 | | | 16,302 | |

Stock Incentive Plan

On September 8, 2004, the shareholders of the Company approved the United Financial Mortgage 2004 Stock Incentive Plan (the “2004 Plan”). The 2004 Plan provides for the grant of options, stock appreciation rights, restricted stock, restricted stock units, performance shares and other stock based awards (each, an “award”), any of which may or may not require the satisfaction of performance objectives, to employees, officers, directors, consultants and advisors of the Company and its subsidiaries. The 2004 Plan is administered by the Compensation and Human Resources Committee of the Board of Directors, which has discretion to select the participants and to establish the terms and conditions of each award, subject to the provisions of the 2004 Plan. A total of 400,000 shares of the Company’s Common Stock were reserved for issuance under the 2004 Plan. Under this plan non-qualified stock options for 142,750 shares have been granted to employees and directors at a weighted average exercise price of $4.97 per shares, of which 141,500 remain outstanding as of April 30, 2005. In addition, 10,000 shares of restricted stock were issued and outstanding under the plan as of April 30, 2005.

Stock Option Plan

The Company maintained a Non-qualified and Incentive Stock Option Plan, which provided for the grant of non-qualified stock options and incentive stock options. This plan expired in December 2003. Under the plan, 500,000 shares of Common Stock were reserved for issuance. Each option granted under the plan vests as specified by the Company’s Board of Directors and has a term of not more than ten years. The exercise price of options granted is at least equal to market value on the date of grant. The plan also contained customary change in control provisions pursuant to which the holders of options may have the ability to exercise their options prior to the change in control regardless of vesting limitations. Under this plan, non-qualified stock options for 370,900 shares have been granted to employees and directors at a weighted average exercise price of $3.90 per share.

401(k) Plan

The Company sponsors a 401(k) defined contribution profit sharing plan, which covers substantially all employees that have attained the age of 18. Employee contributions are limited to the maximum contributions allowed by the Internal Revenue Service. The plan allows for the Company to make matching contributions of up to 15% of employee compensation. There was no employer matching contribution in the 2005 or 2004 fiscal years by the Company under the 401(k) plan sponsored by the Company.

Employment Agreements

General. The Company has entered into employment agreements with Messrs. Joseph and Steve Y. Khoshabe, who are referred to in this discussion as the executives. The purpose of the employment agreements is to ensure the continued employment of the executives with the Company. The employment agreements are substantially similar except for differences in the position, cash compensation and incentive payments for each of the executives.

Compensation and Benefits. The employment agreements provide for: (i) an initial annual base salary equal to $450,000 and $250,000 for Joseph Khoshabe and Steve Y. Khoshabe, respectively, which may be adjusted annually by the Company’s Board of Directors, but not below $250,000 and $200,000, respectively; (ii) medical and other benefits; (iii) four weeks of paid vacation; (iii) a monthly automobile allowance in the amount of up to $2,000 and $1,000, respectively, plus maintenance and insurance; (iv) life insurance of not less than $350,000 and (v) participation in the Company’s incentive bonus plans.

Term and Termination. Each employment agreement has an initial term of two years, with automatic one-year extensions on unless the Company or the executive provides a notice of non-extension at least 30 days prior to the extension date. The Company will not be obligated to pay or provide to the executive salary or benefits (other than those payable as of the date of termination) in the event that (i) the executive terminates his employment or (ii) the Company terminates the executive’s employment “for cause.” The term “for cause” is defined in the employment agreements to mean the death or disability of the executive, the executive’s serious misconduct in or habitual neglect of the performance of his duties, the conviction of the executive of a felony or act of fraud or breach of trust against the Company, the executive being guilty of any act of moral turpitude, a substance abuse problem of the executive that materially affects the performance of his duties or materially injures the Company and the willful or gross misconduct of the executive which causes financial harm or damage to the Company. In some cases, the executive may be entitled to cure the grounds that give rise to the “for cause” termination.

Covenant Not to Compete. The employment agreements also include a covenant that will limit the ability of each executive to compete with the Company during the executive’s employment with the Company and for a period of one year following the termination of the executive’s employment. In addition, for two years following the end of each of the executive’s employment, the executive will not directly or indirectly disclose any confidential information of the Company.

Compensation and Human Resources Committee Interlocks and Insider Participation

During the 2005 fiscal year, the Company’s Compensation and Human Resources Committee was comprised of Messrs. Zuhlke (Chairman), Jacobs and Luce. No member of the Compensation and Human Resources Committee was an officer or employee of the Company during the fiscal year 2005.

REPORT OF THE COMPENSATION AND HUMAN RESOURCES COMMITTEE ON EXECUTIVE COMPENSATION

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by the Company shall not be deemed to include the following report unless the report is specifically stated to be incorporated by reference into such document.

General

As members of the Compensation and Human Resources Committee, it is our duty to review in detail all aspects of compensation of our Chief Executive Officer and the other members of senior management, to evaluate the performance of management and to consider management succession and other related matters.

Compensation Overview

In reviewing an executive officer’s compensation, the Compensation and Human Resources Committee considers and evaluates all components of the executive officer’s total compensation package. This involves reviewing the executive officer’s salary, bonus, perquisites, award of stock options and restricted stock, payments due upon retirement or a change of control, if any, and all other payments and awards that the executive officer earns.

The Company has entered into employment agreements with the Chairman and the President and Chief Executive Officer. The Company has not entered into employment agreements with the other members of senior management. The employment agreement sets forth the parameters of the Chief Executive Officer’s compensation arrangements including the base salary and bonus structure. Generally, members of senior management are compensated in the form of annual salary, bonuses and other incentive compensation (consisting primarily of restricted stock grants). Additionally, the employment agreements of the Chairman and of the President and Chief Executive Officer provide for other perquisites, including an automobile allowance and life insurance.

Chief Executive Officer’s Compensation

Steve Khoshabe, the Company’s President and Chief Executive Officer, is a party to an employment agreement that was approved by the Compensation and Human Resources Committee. The terms of the employment agreement were established through negotiations with Mr. Khoshabe and reflect the Company’s belief and confidence in Mr. Khoshabe’s skill and expertise in serving as our Chief Executive Officer. During its review of Mr. Khoshabe’s compensation for fiscal 2006, the Compensation and Human Resources Committee reviewed the Company’s general performance, including return on equity, earnings per share and net income. The Compensation and Human Resources Committee also assessed Mr. Khoshabe’s effectiveness in leadership and communication skills, as demonstrated by the level at which the Company attains its targets for growth (organic and otherwise), and the effectiveness of the strategic and operating planning process. During fiscal 2005, the Company’s return on equity, earnings per share and net income available for common shareholders were 4%, $0.22 and $1,316,000, respectively.

As a result of Mr. Khoshabe’s individual performance as well as our financial results, the Compensation and Human Resources Committee approved a base salary of $325,000 for Mr. Khoshabe effective July 1, 2005. During the year ended April 30, 2005, Mr. Khoshabe received a base salary of $250,000. Mr. Khoshabe also received other compensation of $44,580, which included $11,540 of insurance benefits as well as $12,000 for automobile expenses. In addition, Mr. Khoshabe was granted 10,000 shares of restricted stock, which vested 20% on the date of grant and will vest an additional 20% on each of the first four anniversaries of the grant date.

Compliance with Section 162(m) of the Internal Revenue Code of 1986

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits the tax deduction to $1.0 million for compensation paid to certain executive officers of public companies. The limitations on the deductibility of executive compensation imposed under Section 162(m) did not affect the deductibility of compensation paid during fiscal 2005 to the Company’s executive officers. However, the Compensation Committee will continue to evaluate the impact which Section 162(m) may have on the Company and take such actions as it deems appropriate.

Conclusion

The Compensation Committee believes the executive compensation policies and programs described above effectively serve the interests of the Company and our shareholders. The Compensation Committee believes these policies motivate executive officers to contribute to our overall future success, thereby enhancing the value of the Company for the benefit of all shareholders.

| | | Compensation and Human Resources Committee |

|

| |

| | | James R. Zuhlke (Chairman) |

| | Robert S. Luce |

| | Elliot R. Jacobs |

STOCK PERFORMANCE PRESENTATION

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by the Company shall not be deemed to include the following report unless the report is specifically stated to be incorporated by reference into such document.

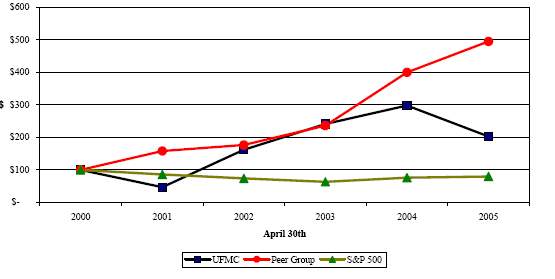

The following chart compares the total stockholder returns (stock price increase plus dividends) on the Company’s Common Stock from April 30, 2000 through April 30, 2005 with the total stockholder returns for the S&P 500 Index, as the broad market index, and a peer group selected by the Company.

Comparison of Total Return from April 30, 2000 Through April 30, 2005 (1)

United Financial Mortgage Corp., Peer Group Index (2) and S&P 500 Index

_______________________________

| (1) | Assumes $100.00 was invested on April 30, 2000 in the Company’s common stock and each index and that all dividends paid were reinvested. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns. |

| (2) | The self-determined Peer Group Index is composed of the following companies: Countrywide Financial Corp., American Home Mortgage Holdings, Inc., AmNet Mortgage, Inc. Indymac BNCP, Inc., E-Loan, Inc., Irwin Financial Corporation and Delta Financial Corporation. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has entered into a compensation agreement with First Fidelity Capital Markets, Inc. of which Mr. Elliot Jacobs, one of the Company’s directors, is a principal. This agreement provides for First Fidelity to receive ten percent of net revenues earned by any mortgage banking or other opportunity introduced to the Company by First Fidelity. The arrangement contemplates that First Fidelity’s services may include locating and analyzing mortgage banking transactions that may have potential interest to the Company and its present or future business operations; presenting this analysis to the Company’s senior management for their review and consideration; negotiating and coordinating with the prospective business candidates and the Company; and providing consulting services with respect to issues that arise during the course of contract negotiations and through the consummation of a transaction. During the 2005 fiscal year, the Company paid First Fidelity compensation in the amount of approximately $581,200 under this arrangement.

The Company has also entered into a letter agreement with SRJC, Inc. (“SRJC”), of which Mr. John Clark, one of the Company’s directors, is President. Pursuant to the letter agreement, SRJC provides consulting services from time to time. The Company pays SRJC a consulting fee of $5,000 per month only during the periods in which SRJC provides services. SRJC may be entitled to receive additional compensation in the event that certain strategic initiatives are implemented. Payments of $50,000 were made during the year and the last one was made in February, 2005. The Company does not currently have an active project with SRJC.

The Company also makes mortgage loans in the ordinary of business to its employees and its directors and executive officers. The Company makes these mortgage loans on terms that are no more favorable than those offered by the Company to the general public for similar mortgage loans.

AUDIT COMMITTEE REPORT

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by the Company shall not be deemed to include the following report unless the report is specifically stated to be incorporated by reference into such document.

The Audit Committee is comprised of four independent directors and operates under a written charter. The Audit Committee held four meetings in fiscal 2005. The Audit Committee held meetings with the independent registered public accounting firm, both with and without management present, on the results of their examinations and the overall quality of the Company’s financial reporting and internal controls.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent registered public accounting firm a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1 "Independence Discussions with Audit Committees" and discussed with the auditors any relationships that may impact their objectivity and independence. The Audit Committee discussed and reviewed with the independent registered public accounting firm all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, "Communication with Audit Committees". The Audit Committee reviewed and discussed the audited financial statements of the Company as of and for the fiscal year ended April 30, 2005, with management and the independent registered public accounting firm.

Management of the Company is responsible for the preparation, presentation and integrity of the Company's financial statements, the Company's accounting and financial reporting principles, and internal controls designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm are responsible for auditing the Company's financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States. Management has represented to the Audit Committee that the Company's financial statements were prepared in accordance with generally accepted accounting principles. It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles.

Based on the above-mentioned review and discussions with management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended April 30, 2005, for filing with the Securities and Exchange Commission.

| | | Audit Committee |

|

| |

| | | Anthony W. Schweiger (Chairman) |

| | James R. Zuhlke |

| | Robert S. Luce |

| | John A. Clark |

RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Company’s Audit Committee intends on engaging Crowe Chizek to audit the financial statements of the Company for the year ended April 30, 2006, subject to the ratification of the engagement by the Company’s shareholders. A representative of Crowe Chizek is expected to attend the Annual Meeting and will have the opportunity to make a statement, if he or she so desires, as well as to respond to appropriate questions that may be asked by a shareholder. If the appointment of the registered public accounting firm is not ratified, the matter of the appointment of the registered public accounting firm will be considered by the Company’s Audit Committee.

The Board of Directors recommends that you vote your shares “FOR” the ratification of the engagement of Crowe Chizek and Company LLC as our independent registered public accounting firm for the year ending April 30, 2006.

Accounting Fees and Services

The following table presents fees for professional services rendered by Crowe Chizek during the years ended April 30, 2005 and 2004.

| | | For the year ended April 30, | |

| | | 2005 | | 2004 | |

| Audit Fees (1) | | $ | 57,500 | | $ | 44,000 | |

| Audit-Related Fees (2) | | | 6,744 | | | 29,188 | |

| Tax Fees (3) | | | 23,900 | | | 19,375 | |

| All Other Fees (4) | | | 29,766 | | | 15,525 | |

______________________________________

| (1) | Audit Fees related to the audit of the Company’s annual financial statements for the years ended April 30, 2005 and 2004 and for the required review of the Company’s interim financial statements included in its quarterly reports for the years 2005 and 2004. |

| (2) | Audit-Related Fees in fiscal 2005 relate to consents on public filings and policy surrounding mortgage servicing rights. The majority of Audit-Related Fees in fiscal 2004 related to the performance of audit-related services in connection with the Company’s public offering that was consummated in December 2003 |

| (3) | Tax Fees generally related to professional services rendered for tax compliance, tax advice and tax planning. |

| (4) | All Other Fees generally related to various services provided by Crowe Chizek in connection with acquisitions made or contemplated by the Company as well as research related to the tax effects of these acquisitions and other miscellaneous tax matters. |

The Company’s Audit Committee generally pre-approves all audit, audit-related, tax and other services proposed to be provided by the Company’s independent auditor prior to engaging the auditor for that purpose. In the alternative, the Audit Committee may establish parameters pursuant to which management may engage the Company’s independent accountant. Approximately 10% of the audit-related fees, tax fees and all other non-audit fees were approved by the Company’s Audit Committee as a result of a waiver of the pre-approval requirement.

The Company’s Audit Committee, after consideration of the matter, does not believe that the rendering of these services by Crowe Chizek to be incompatible with maintaining its independence as the Company’s principal auditors.

PROPOSALS OF SHAREHOLDERS

Proposals of shareholders intended to be presented at the 2006 Annual Meeting of Shareholders must be received by the President and Chief Executive Officer, 815 Commerce Drive, Oak Brook, Illinois 60523, no later than June 15, 2006 in order for such proposal to be included in the Company’s 2006 proxy statement and form of proxy.

FAILURE TO INDICATE CHOICE

IF ANY SHAREHOLDER FAILS TO INDICATE A CHOICE IN PROPOSAL (1) ON THE PROXY, THE SHARES OF SUCH SHAREHOLDER SHALL BE VOTED (FOR) EACH OF THE NOMINEES. IF ANY SHAREHOLDER FAILS TO INDICATE A CHOICE IN PROPOSAL (2) ON THE PROXY, THE SHARES OF SUCH SHAREHOLDER SHALL BE VOTED (FOR) THE RATIFICATION OF THE ENGAGEMENT OF CROWE CHIZEK AND COMPANY LLC AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY.

FORM 10-K/A

The Company will furnish, without charge, a copy of its annual report on Form 10-K/A for the fiscal year ended April 30, 2005, including the financial statements and the schedules and exhibits thereto, upon written request of any shareholder of the Company. Requests for such materials should be directed to Robert Hiatt, Chief Financial Officer, United Financial Mortgage Corp., 815 Commerce Drive, Suite 100, Oak Brook, Illinois 60523. In addition, the Company’s annual report on Form 10-K is available through the Company’s website at www.ufmc.com and the SEC’s website at www.sec.gov.

OTHER BUSINESS

It is not anticipated that any matters will be presented to the shareholders other than those mentioned in this proxy statement. However, if other matters are brought before the meeting, it is intended that the persons named in the proxies will vote those proxies, insofar as the same are not limited to the contrary, in their discretion.

| | | By Order of the Board of Directors, |

| | |

| August 12, 2005 | | |

| Oak Brook, Illinois | | /s/ Joseph Khoshabe |

| | Joseph Khoshabe |

| | Chairman |

ALL SHAREHOLDERS ARE REQUESTED

TO SIGN AND MAIL THEIR PROXIES PROMPTLY

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF SHAREHOLDERS OF

UNITED FINANCIAL MORTGAGE CORP.

To Be Held on September 1, 2005

The undersigned hereby appoints Joseph Khoshabe and Robert S. Luce and each or either of them with power of substitution, attorneys and proxies for and in the name and place of the undersigned, to vote the number of shares that the undersigned would be entitled to vote if then personally present at the Annual Meeting of Shareholders of United Financial Mortgage Corp. to on Thursday, September 1, 2005, at 2:00 P.M. local time, at the Wyndham Drake Hotel, 2301 York Road, Oak Brook, Illinois 60523, or at any adjournment or postponement thereof, upon the matters set forth in the Notice of the Annual Meeting and proxy statement, receipt of which is hereby acknowledged:

| 1. | Election of directors. |

| | o Vote FOR all nominees listed below (except as directed to the contrary below) | | oVote WITHHELD from all nominees |

| | Joseph Khoshabe | | Joseph Khoshabe |

| | John A. Clark | | John A. Clark |

| | Robert S. Luce | | Robert S. Luce |

| | Elliot R. Jacobs | | Elliot R. Jacobs |

| | James R. Zuhlke | | James R. Zuhlke |

| | Anthony W. Schweiger | | Anthony W. Schweiger |

| | Steve Y. Khoshabe | | Steve Y. Khoshabe |

Instructions: To withhold vote for any individual nominee, write that nominee’s named in the space provided below.

2. | Ratification of Crowe Chizek and Company LLC as the Company’s independent registered public accounting firm. |

3. | In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

| THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED “FOR” THE NOMINEES LISTED UNDER PROPOSAL 1 AND “FOR” PROPOSAL 2. |

NOTE: | Please date proxy and sign it exactly as name or names appear on the Company’s records. All joint owners of shares MUST sign in order for the proxy to be valid. State full title when signing as executor, administrator, trustee, guardian, etc. Please return proxy in the enclosed envelope. |

Dated:______________________, 2005 |

| |

Please Sign Here:___________________________________ | |

| |

Print Name:_______________________________________ | |