The allowance for losses on loans represents management's best estimate of probable losses in the existing loan portfolio. The allowance for losses on loans is increased by the provision for losses on loans charged to expense and reduced by loans charged off, net of recoveries.

The provision for losses on loans is determined based on management's assessment of several factors: reviews and evaluations of specific loans, changes in the nature and volume of the loan portfolio, current economic conditions and the related impact on specific borrowers and industry groups, historical loan loss experience, the level of classified and nonperforming loans and the results of regulatory examinations.

Integral to the methodology for determining the adequacy of the allowance for loan losses is portfolio segmentation and impairment measurement. Under the Company's methodology, loans are first segmented into 1) those comprising large groups of smaller-balance homogeneous loans, including single-family mortgages and installment loans, which are collectively evaluated for impairment and 2) all other loans which are individually evaluated. Those loans in the second category are further segmented utilizing a defined grading system which involves categorizing loans by severity of risk based on conditions that may affect the ability of the borrowers to repay their debt, such as current financial information, collateral valuations, historical payment experience, credit documentation, public information, and current trends. The loans subject to credit classification represent the portion of the portfolio subject to the greatest credit risk and where adjustments to the allowance for losses on loans as a result of provisions and charge-offs are most likely to have a significant impact on operations.

A periodic review of selected credits (based on loan size and type) is conducted to identify loans with heightened risk or probable losses and to assign risk grades. The primary responsibility for this review rests with the loan administration personnel. This review is supplemented with periodic examinations of both selected credits and the credit review process by applicable regulatory agencies and external auditors. The information from these reviews assists management in the timely identification of problems and potential problems and provides a basis for deciding whether the credit represents a probable loss or risk that should be recognized.

Loans are considered impaired if, based on current information and events, it is probable that Southern Missouri will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. The measurement of impaired loans is generally based on the fair value of the collateral for collateral-dependent loans. If the loan is not collateral-dependent, the measurement of impairment is based on the present value of expected future cash flows discounted at the historical effective interest rate or the observable market price of the loan. In measuring the fair value of the collateral, management uses the assumptions (i.e., discount rates) and methodologies (i.e., comparison to the recent selling price of similar assets) consistent with those that would be utilized by unrelated third parties. Impairment identified through this evaluation process is a component of the allowance for loan losses. If a loan that is individually evaluated for impairment is found to have none, it is grouped together with loans having similar characteristics (i.e., the same risk grade), and an allowance for loan losses is based upon historical average charge-offs for similar loans over the past five years, the historical average charge-off rate for developing trends in the economy, in industries and other factors. For portfolio loans that are evaluated for impairment as part of homogenous pools, an allowance is maintained based upon the average charge-offs for the past five years. | | Changes in the financial condition of individual borrowers, in economic conditions, in historical loss experience and in the conditions of the various markets in which collateral may be sold may all affect the required level of the allowance for losses on loans and the associated provision for losses on loans.

FINANCIAL CONDITION

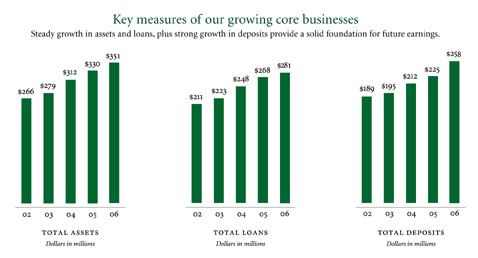

General. The Company's total assets increased $20.3 million, or 6.2%, to $350.7 million at June 30, 2006, when compared to $330.4 million at June 30, 2005. The growth was primarily due to growth in the loan portfolio of $13.4 million, or 5.0%, an increase in the investment portfolio of $3.7 million, or 10.7%, an increase in cash and cash equivalents of $2.5 million, or 63.8%, and an increase in premises and equipment of $1.0 million, or 13.3%. Asset growth was primarily funded by deposit growth of $33.4 million, or 14.9%, partially offset by a reduction of $15.5 million, or 25.2%, in FHLB advance repayments.

Loans. Loans increased $13.4 million, or 5.0%, to $280.9 million at June 30, 2006, from $267.5 million at June 30, 2005. The growth in the loan portfolio was comprised principally of commercial real estate and commercial business loans of $7.2 million and $5.8 million, respectively.

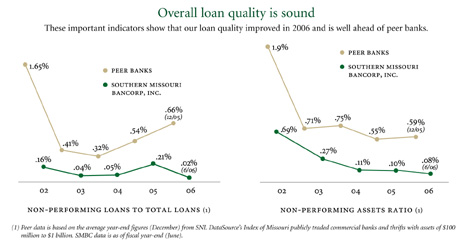

Allowance for Loan Losses. The allowance for loan losses increased $42,000, or 2.1%, from $2.0 million at June 30, 2005, to $2.1 million at June 30, 2006. The allowance for loan losses represented 0.7% of loans receivable at June 30, 2006, as compared to 0.8% at June 30, 2005. At June 30, 2006, nonperforming loans, which includes loans past due greater than 90 days and nonaccruing loans, were $53,000, compared to $571,000 at June 30, 2005 (see Provision for Loan Losses, under Comparison of Years Ended June 30, 2006 and 2005).

Investments. The investment portfolio increased $3.7 million, or 10.7%, to $38.4 million at June 30, 2006, from $34.7 million at June 30, 2005. The increase in the investment portfolio was primarily due to redeploying excess cash balances, resulting in increases in debt securities issued by government-sponsored agencies of $5.8 million, partially offset by a $2.8 million decrease in mortgage-backed securities.

Premises and Equipment. Premises and equipment increased $1.0 million to $8.9 million at June 30, 2006, from $7.9 million at June 30, 2005. The increase was primarily due to the acquisition and equipping of a facility for our new branch location in Sikeston, Missouri. Along with other equipment purchases, this expenditure was partially offset by depreciation expense for the year.

Bank Owned Life Insurance. The Bank purchased "key person" life insurance policies on six employees for a cash surrender value of $4.0 million in February, 2003. In addition, in October, 2004, the Bank purchased "key person" life insurance policies on 20 employees for $2.0 million. At June 30, 2006, the cash surrender value had increased to $6.7 million.

Intangible Assets. Intangible assets generated through branch acquisitions in 2000 decreased $255,000 to $2.3 million as of June 30, 2006, and will continue to be amortized in accordance with Statement of Financial Accounting Standards (SFAS) No. 142.

Deposits. Deposits increased $33.4 million, or 14.9%, to $258.1 million at June 30, 2006, from $224.7 million at June 30, 2005. The deposit growth was primarily comprised of increases in CDs, money market passbooks, and checking accounts of $25.7 million, $8.1 million, and $4.5 million, respectively, partially offset by a decrease in other money market deposit accounts of $5.7 million. Of the $25.7 million in increased CD balances, $10.7 million was due to brokered deposits. |