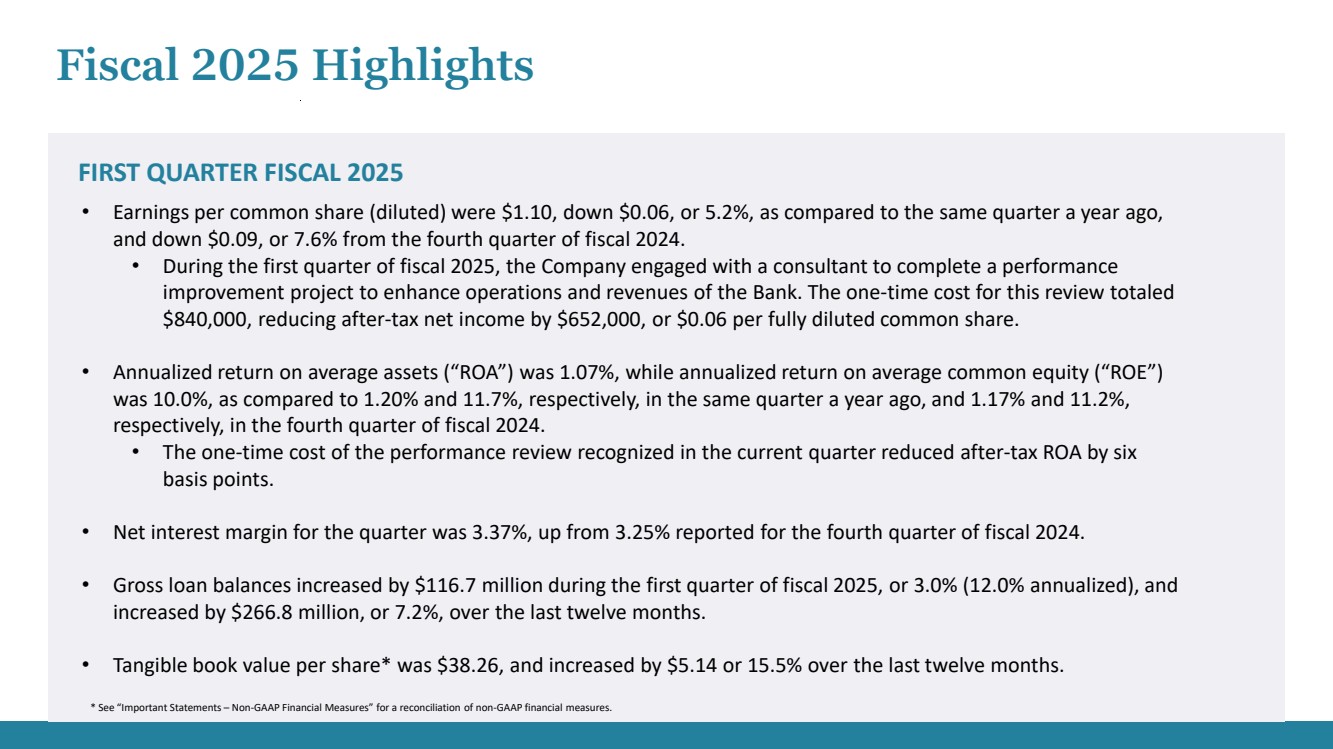

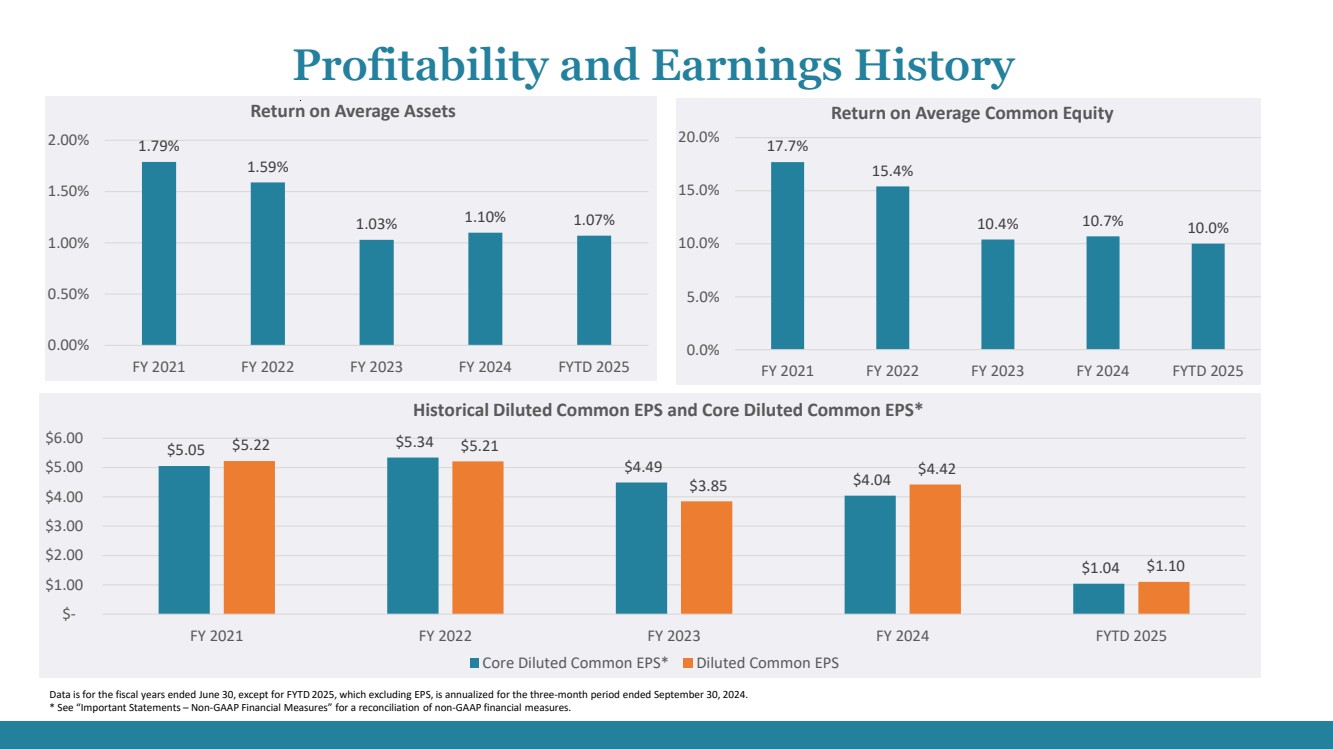

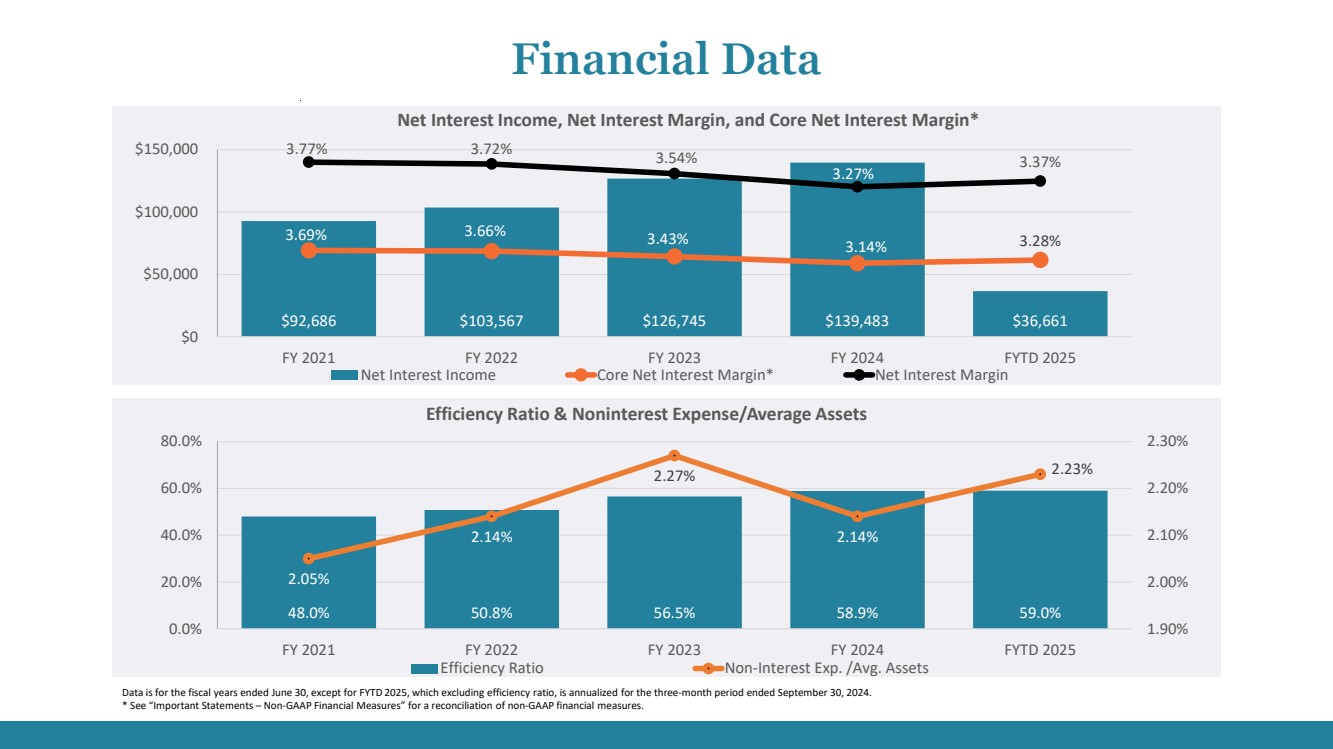

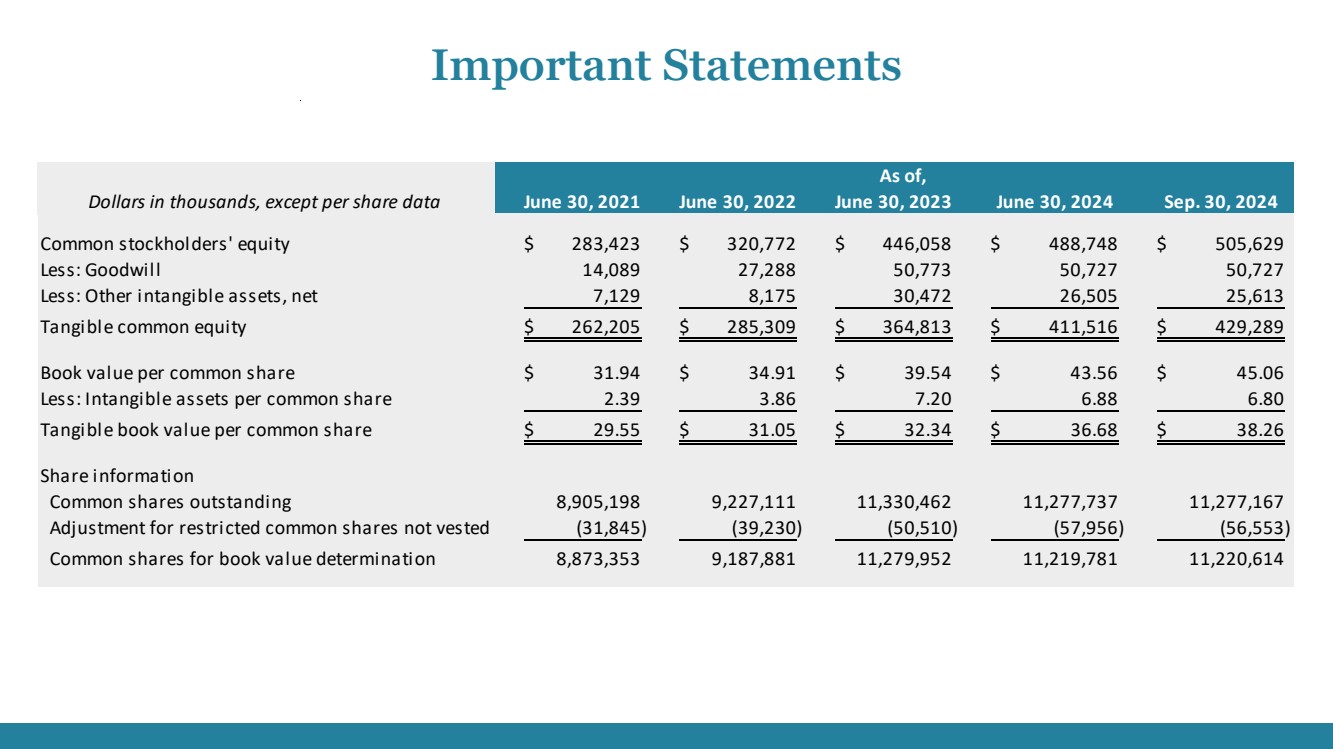

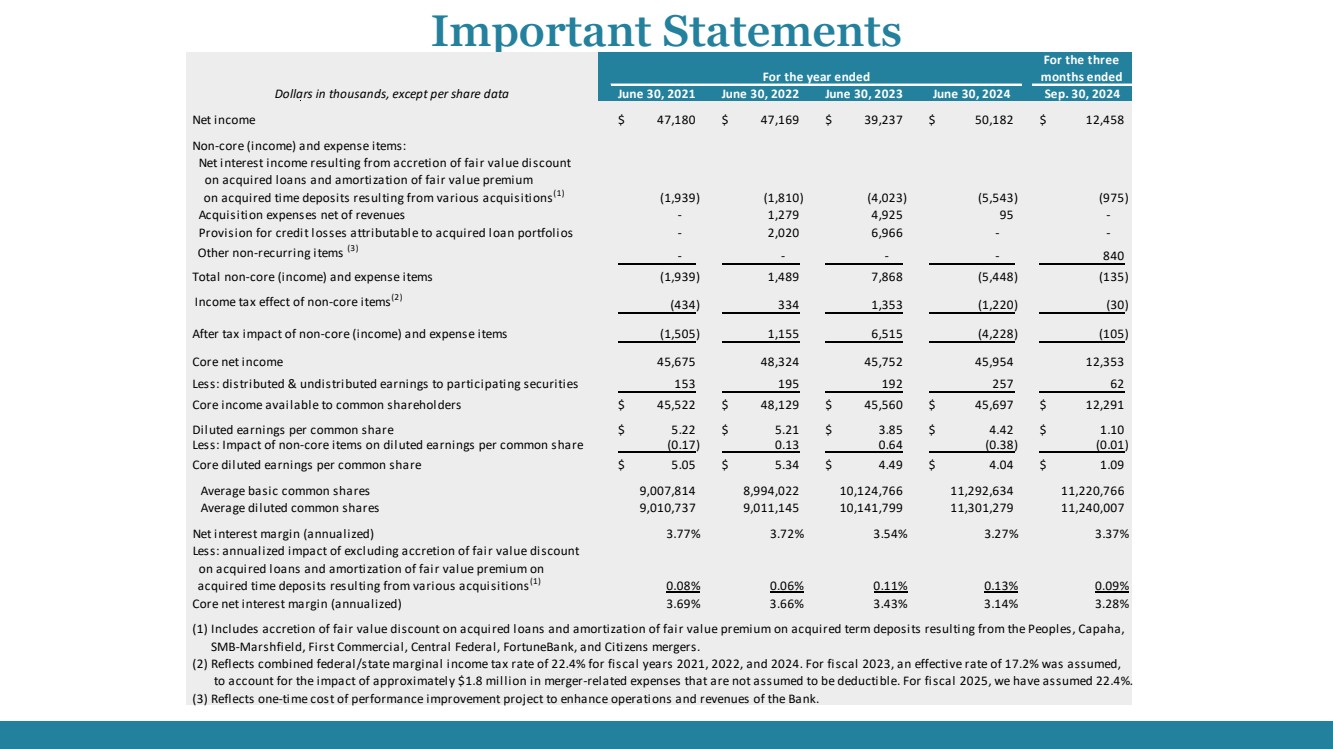

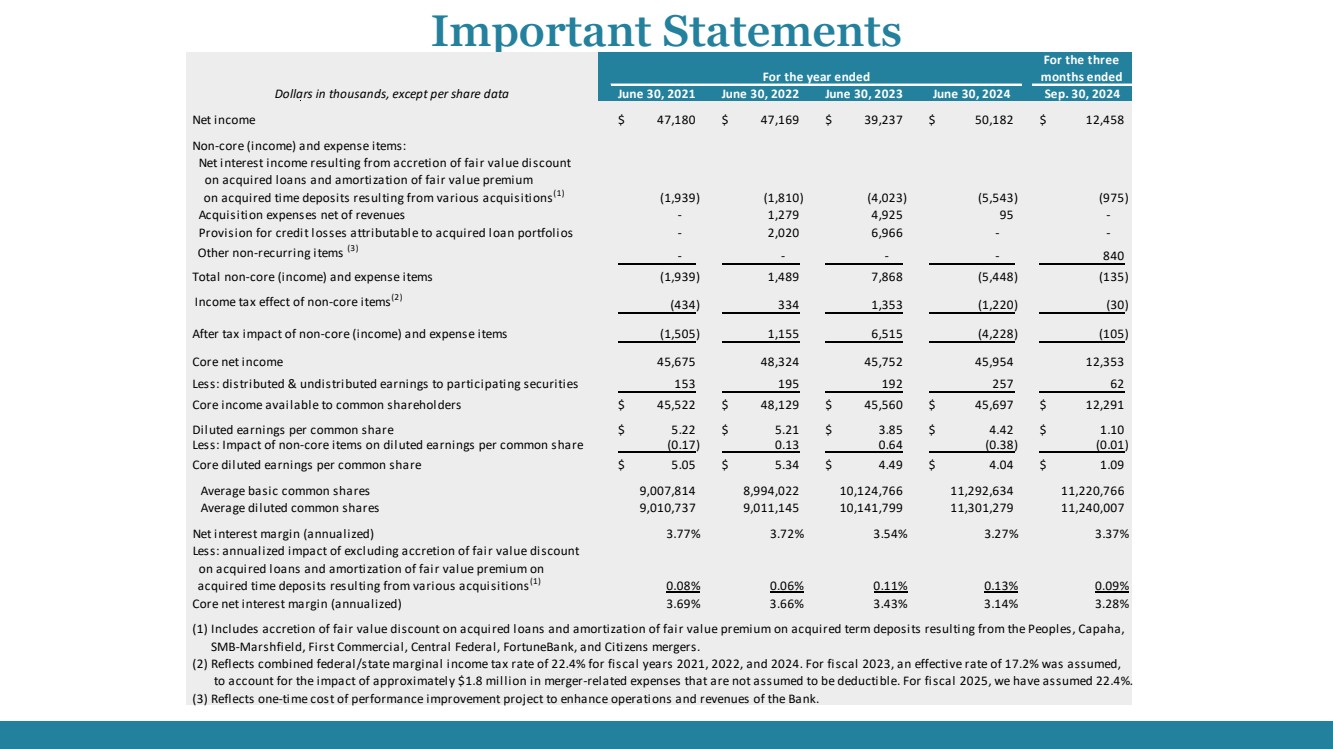

| Important Statements For the three months ended Dollars in thousands, except per share data June 30, 2021 June 30, 2022 June 30, 2023 June 30, 2024 Sep. 30, 2024 Net income $ 47,180 $ 47,169 $ 39,237 $ 50,182 $ 12,458 Non-core (income) and expense items: Net interest income resulting from accretion of fair value discount on acquired loans and amortization of fair value premium on acquired time deposits resulting from various acquisitions(1) (1,939) (1,810) (4,023) (5,543) (975) Acquisition expenses net of revenues - 1,279 4,925 95 - Provision for credit losses attributable to acquired loan portfolios - 2,020 6,966 - - Other non-recurring items (3) - - - - 840 Total non-core (income) and expense items (1,939) 1,489 7,868 (5,448) (135) Income tax effect of non-core items(2) (434) 334 1,353 (1,220) (30) After tax impact of non-core (income) and expense items (1,505) 1,155 6,515 (4,228) (105) Core net income 45,675 48,324 45,752 45,954 12,353 Less: distributed & undistributed earnings to participating securities 153 195 192 257 62 Core income available to common shareholders $ 45,522 $ 48,129 $ 45,560 $ 45,697 $ 12,291 Diluted earnings per common share $ 5.22 $ 5.21 $ 3.85 $ 4.42 $ 1.10 Less: Impact of non-core items on diluted earnings per common share (0.17) 0.13 0.64 (0.38) (0.01) Core diluted earnings per common share $ 5.05 $ 5.34 $ 4.49 $ 4.04 $ 1.09 Average basic common shares 9,007,814 8,994,022 10,124,766 11,292,634 11,220,766 Average diluted common shares 9,010,737 9,011,145 10,141,799 11,301,279 11,240,007 Net interest margin (annualized) 3.77% 3.72% 3.54% 3.27% 3.37% Less: annualized impact of excluding accretion of fair value discount on acquired loans and amortization of fair value premium on acquired time deposits resulting from various acquisitions(1) 0.08% 0.06% 0.11% 0.13% 0.09% Core net interest margin (annualized) 3.69% 3.66% 3.43% 3.14% 3.28% (1) Includes accretion of fair value discount on acquired loans and amortization of fair value premium on acquired term deposits resulting from the Peoples, Capaha, SMB-Marshfield, First Commercial, Central Federal, FortuneBank, and Citizens mergers. (2) Reflects combined federal/state marginal income tax rate of 22.4% for fiscal years 2021, 2022, and 2024. For fiscal 2023, an effective rate of 17.2% was assumed, to account for the impact of approximately $1.8 million in merger-related expenses that are not assumed to be deductible. For fiscal 2025, we have assumed 22.4%. (3) Reflects one-time cost of performance improvement project to enhance operations and revenues of the Bank. For the year ended |