In addition, the Board, including the Independent Directors, also considered information that the Investment Manager had provided concerning: (i) the Investment Manager’s investment personnel and operations, (ii) the Investment Manager’s financial condition and stability, (iii) the resources devoted by the Investment Manager to the Fund, (iv) the Fund’s investment objective and strategy and the Investment Manager’s record of compliance with the Fund’s investment policies and restrictions, (v) the Investment Manager’s and its affiliates’ compliance program, (vi) possible conflicts of interest, and (vii) the allocation of the Fund’s brokerage. Throughout the process, including at the meeting with the CIO, the Contract Review Meeting and the Quarterly Meeting, the Board members had and availed themselves of the opportunity to ask questions of and request additional information from the Investment Manager.

The Independent Directors were advised by independent legal counsel throughout the process and also consulted in executive sessions with their counsel regarding consideration of the renewal of the Management Agreement. In considering whether to approve the continuation of the Management Agreement, the Board, including the Independent Directors, did not identify any single factor as determinative. Individual Directors may have evaluated the information presented differently from one another and given different weights to various factors. Matters considered by the Board, including the Independent Directors, in connection with its approval of the continuation of the Management Agreement include the factors listed below.

The costs of the services provided and profits realized by the Investment Manager and its affiliates from their relationships with the Fund. The Board reviewed information compiled at the request of the Fund by ISS that compared the Fund’s effective annual management fee rate with the fees paid by its Peer Group. The Board reviewed with management the effective annual management fee rate paid by the Fund to the Investment Manager for investment management services. The Board considered the Fund’s management fee structure, and noted that management fees for the Fund were based on the Fund’s average weekly managed assets, defined as total assets of the Fund, including any assets attributable to leverage, minus all liabilities, but not excluding any liabilities or obligations attributable to leverage obtained by the Fund for investment purposes through: (i) the issuance or incurrence of indebtedness of any type (including, without limitation, borrowing through a credit facility or the issuance of debt securities), (ii) the issuance of preferred stock or other similar preference securities, and/or (iii) any other means, but not including any collateral received for securities loaned by the Fund. Management noted that due to the unique strategy and structure of the Fund, abrdn did not have any Securities and Exchange Commission (“SEC”)-registered closed-end funds that were directly comparable to the Fund. The Investment Manager provided information for other products or vehicles advised by aAL or its affiliates with similar investment strategies to those of the Fund. In evaluating the Fund’s management fees, the Board took into account the regulatory regime, demands, complexity and quality of the investment management of the Fund.

In addition to the foregoing, the Board considered the Fund’s fees and expenses as compared to its Peer Group. The Board also reviewed the profitability of the investment management relationship with the Fund to the Investment Manager, and received information on the profitability of the Fund’s other contractual relationships with the Investment Manager’s affiliates.

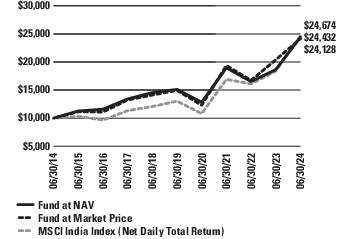

Investment performance of the Fund and the Investment Manager. The Board received and reviewed information that compared the Fund’s return over various time periods to those of comparable investment companies and discussed this information and other related performance data with management. The Board also received and considered information on performance compiled by ISS that compared the Fund to the other fund in the Fund’s Morningstar category (the “Morningstar Group”). Additionally, because of the limited number of funds in the Fund’s Morningstar Group, the Fund’s performance was also compared against the Peer Group, although the investment objectives and strategies of the funds in the Peer Group may have differed from those of the Fund due to, among other things, differences in the geographic focus of the funds in the Peer Group.

In addition, the Board received and reviewed information regarding the Fund’s total return on a net and gross basis and relative to the Fund’s benchmark and the Fund’s share performance and premium/discount information. The Board also received and considered information about the Fund’s total return against the respective Morningstar Group and Peer Group averages and against other abrdn-managed investment vehicles. The Directors considered management’s discussion of the factors contributing to differences in performance, including differences in the investment strategies, restrictions and risks of the other funds. The Directors noted that, while the Fund’s performance had trailed that of its Morningstar Group average for the periods under review, it had outpaced the performance average of its Peer Group. Additionally, the Board considered information about the Fund’s discount/premium ranking relative to its Morningstar Group and Peer Group, noting that the Fund’s discount/premium ranking had been at or near the top of the Peer Group, and management’s discussion of the Fund’s performance. The Board also considered the Investment Manager’s performance and reputation generally and the willingness of the Investment Manager to take steps intended to improve performance. The Board also considered the Investment Manager’s responsiveness to concerns about the Fund’s performance raised by Directors, if any. The Board considered the Fund’s overall performance, including the Investment Manager’s explanation for the performance and the actions taken by the Investment Manager, in determining to continue the Investment Management Agreement.

The nature, extent and quality of the services provided to the Fund under the Management Agreement. The Directors considered the nature, extent and quality of the services provided by the Investment Manager to the Fund. They reviewed information about the resources dedicated to the Fund by the Investment Manager and its affiliates. Among other things, the Board reviewed and discussed the background and experience of the Investment Manager’s senior management personnel who serviced the Fund and the qualifications, background and responsibilities of the portfolio managers primarily responsible for providing day-to-day portfolio management services for the Fund. The Directors also considered the