Exhibit 3

Bogotá D.C., March 14, 2016

Republic of Colombia

Ministry of Finance and Public Credit

Carrera 8, No. 6C-38, Piso 1

Bogotá D.C., Colombia

Ladies and Gentlemen:

In my capacity as Head of the Legal Affairs Group of the General Directorate of Public Credit and National Treasury of the Ministry of Finance and Public Credit of the Republic of Colombia (the “Republic”), and in connection with the Republic’s offering, pursuant to its registration statement under Schedule B of the United States Securities Act of 1933, as amended (the “Securities Act”), filed by the Republic with the United States Securities and Exchange Commission (the “Commission”) on February 11, 2015 (Registration Statement No. 333-202025), as amended by Amendment No. 1 thereto, dated March 19, 2015 (as so amended, the “Registration Statement”), of U.S.$1,500,000,000 aggregate principal amount of the Republic’s 4.500% Global Bonds due 2026 (the “Securities”), I have reviewed the following documents:

(i) the Registration Statement and the related Prospectus dated September 21, 2015 included in the Registration Statement most recently filed with the Commission, as supplemented by the Prospectus Supplement dated September 21, 2015 relating to the Securities, as filed with the Commission pursuant to Rule 424(b)(5) under the Securities Act;

(ii) an executed copy of the Indenture, dated January 28, 2015 (the “Indenture”), between the Republic and The Bank of New York Mellon, as amended and supplemented by the Supplemental Indenture thereto, dated as of September 8, 2015, and as further amended and supplemented from time to time (as amended and supplemented, the “Indenture”);

(iii) the global Securities dated September 28, 2015 in the aggregate principal amount of U.S.$1,500,000,000, executed by the Republic;

(iv) an executed copy of the Authorization Certificate dated September 28, 2015 pursuant to which the terms of the Securities were established;

1

(v) all relevant provisions of the Constitution of the Republic and the following acts, laws and decrees of the Republic, under which the issuance of the Securities has been authorized:

(a) Law 80 of October 28, 1993 (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-13172 and incorporated herein by reference);

(b) Law 533 of November 11, 1999 (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-13172 and incorporated herein by reference);

(c) Law 185 of January 27, 1995 (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-13172 and incorporated herein by reference);

(d) Law 781 of December 20, 2002 (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-109215 and incorporated herein by reference); and

(e) Law 1366 of December 21, 2009 (a translation of which has been filed as part of Exhibit 3 to Amendment No. 2 to the Republic’s 2008 Annual Report on Form 18-K and incorporated herein by reference);

(f) Law 1624 of April 29, 2013 (a translation of which has been filed as part of Exhibit 3 to Amendment No. 1 to the Republic’s 2012 Annual Report on Form 18-K and incorporated herein by reference);

(vi) the following additional actions under which the issuance of the Securities has been authorized:

(a) External Resolution No. 11 of July 31, 2015 issued by the Board of Directors of the Central Bank of Colombia (a translation of which is attached as Exhibit A hereto); and

(b) Decree No. 1068 of May 26, 2015 (a summary of the material portion of which is attached as Exhibit C hereto)

(c) Approval No. 3842, dated August 14, 2015, of the Consejo Nacional de Política Económica y Social (“CONPES”) (a translation of which is attached as Exhibit D hereto)

(d) Resolution No. 3443 of September 17, 2015, of the Ministry of Finance and Public Credit (a translation of which is attached as Exhibit B hereto);

(e) Act of the Comisión Interparlamentaria de Crédito Público adopted at its meeting held on February 25, 2015 (a translation of which has been filed as part of Exhibit 3 to Amendment No. 4 to the Republic’s 2013 Annual Report on Form 18-K and incorporated herein by reference); and

2

(f) Approval No. 3818 dated October 2, 2014 of the Consejo Nacional de Política Económica y Social (“CONPES”) (a translation of which has been filed as part of Exhibit 3 to Amendment No. 2 to the Republic’s 2013 Annual Report on Form 18-K and incorporated herein by reference).

It is my opinion that under and with respect to the present laws of the Republic, the Securities have been duly authorized, executed and delivered by the Republic and, assuming due authentication thereof pursuant to the Indenture, constitute valid and legally binding obligations of the Republic.

I hereby consent to the filing of this opinion as an exhibit to the Republic’s Amendment No. 1 to its Annual Report on Form 18-K for its Fiscal Year ended December 31, 2014 and to the use of the name of the Acting Head of the Legal Affairs Group of the General Directorate of Public Credit and National Treasury of the Ministry of Finance and Public Credit of the Republic under the caption “Validity of the Securities” in the Prospectus and under the heading “General Information—Validity of the Bonds” in the Prospectus Supplement referred to above. In giving the foregoing consent, I do not thereby admit that I am in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission thereunder.

No opinion is expressed as to any law of any jurisdiction other than Colombia. With respect to the opinion set forth above, my opinion is limited to the laws of Colombia. This opinion is specific as to the transactions and the documents referred to herein and is based upon the law as of the date hereof. My opinion is limited to that expressly set forth herein, and I express no opinions by implication.

|

| Very truly yours, |

|

| /s/ LUCAS ARBOLEDA JARAMILLO |

Lucas Arboleda Jaramillo Head of the Legal Affairs Group of the General Directorate of Public Credit and National Treasury of the Ministry of Finance and Public Credit of the Republic of Colombia |

3

EXHIBIT A

CENTRAL BANK

EXTERNAL RESOLUTION No. 11, 2015

(July 31)

To establish the financial conditions that the Nation must comply with to place

public debt securities in international capital markets.

THE BOARD OF DIRECTORS OF THE CENTRAL BANK

exercising its constitutional and legal powers, in particular the powers conferred by

Law 31 of 1992, Article 16, Paragraphs c) and h)

DECIDES:

Article 1. Subject to compliance with all the other requirements established by current norms, particularly with regard to budget and public credit, and in order to ensure that placement is done under market conditions, the securities issued and placed by the Nation in international capital markets, whose funds are intended to finance budget allocations for fiscal year 2016, shall be subject to the following financial terms and conditions:

DEADLINE: Over two years, depending on the market.

INTEREST: Fixed or variable rate, depending on market conditions on the date of placement.

OTHER FEES AND CHARGES: Market standard for this type of transaction.

Paragraph. The Securities shall not be offered or placed if the above conditions are not met.

Article 2. Within ten days of the date of each issuance, the Ministry of Finance and Public Credit shall notify the Central Bank about the results of the placement referred to in this resolution.

Article 3. This Resolution shall be valid from the date of publication.

Given in Bogotá, D.C., July 31, 2015.

| | | | |

| [Signed] | | | | [Signed] |

| MAURICIO CÁRDENAS SANTAMARÍA | | | | ALBERTO BOADA ORTÍZ |

| President | | | | Secretary |

4

EXHIBIT B

Ministry of Finance

and Public Credit

Resolution 3443

SEPTEMBER 17. 2015

Whereby the Nation is authorized to issue, subscribe and place external public debt

securities in the international capital markets, up to the sum of ONE BILLION FIVE HUNDRED

MILLION U.S. DOLLARS (US$1,500,000,000), or its equivalent in other currency;

and other provisions are decreed.

THE MINISTEROF FINANCEAND PUBLIC CREDIT

Exercising its statutory powers,

particularly the powers conferred by Article 2.2.1.3.2., Decree 1068, 2015,

WHEREAS

Article 2.2.1.1.1, Decree 1068 of 2015 authorizes State entities to carry out public credit transactions, including, among others: issuance, subscription and placement of public debt securities;

Article 10, Law 533 of 1999, states that public debt securities are documents and securities with a credit content, and a maturity date, issued by State entities;

Article 2.2.1.3.2., Decree 1068 of 2005 states that the issuance and placement of public debt securities on behalf of the Nation requires an authorization given by a Ministry of Finance and Public Credit Resolution. The authorization may be given once a favorable opinion has been received from the Consejo Nacional de Política Económica y Social — CONPES — and the Comisión Interparlamentaria de Crédito Público, and if it is about foreign public debt securities with a maturity date over 1 year;

Article 24, Law 185 of 1995, states that for all purposes established under Law 80 of 1993, Article 41, Paragraph 2, Sub-paragraph 5, the Comisión Interparlamentaria de Crédito Público shall issue a preliminary opinion to start formalities with regard to any public credit transactions, and a final opinion to execute the transactions. However, the Comisión Interparlamentaria de Crédito Público shall only issue its opinion once with regard to the issuance, subscription and placement of bonds and securities;

5

Ministry of Finance and Public Credit

| | | | |

| Resolution No. 3443 | | SEPTEMBER 17, 2015 | | Page 2 of 3 |

(Cont.) Whereby the Nation is authorized to issue, subscribe and place external public debt securities in the international capital markets, up to the sum of ONE BILLION AND FIVE HUNDRED MILLION U.S. DOLLARS (US$1,500,000,000), or its equivalent in other currency; and other provisions are decreed.

According to CONPES Document 3818, dated October 2, 2014, the Consejo Nacional de Política Económica y Social — CONPES — issued a favorable opinion for the Nation to negotiate external public credit transactions to pre-finance and/or finance budget allocations for 2015 and 2016 for up to THREE BILLION US DOLLARS (US$3,000,000,000), or its equivalent in other currencies; of which there is an authorized and unused remaining quota of NINE HUNDRED MILLION US DOLLARS (US$900,000,000), or its equivalent in other currencies;

Under CONPES Document 3842 dated August 14, 2015, the Consejo Nacional de Política Económica y Social — CONPES — issued a favorable opinion for the Nation to issue foreign bonds to pre-finance or finance budget allocations for the years 2016 and 2017 for up to THREE BILLION US. DOLLARS (US$3,000,000,000), or its equivalent in other currencies, based on the fact that the Nation has not issued bonds in international capital markets;

In the February 25, 2015 session, the Comisión Interparlamentaria de Credito Público issued a sole favorable opinion to the Nation —the Ministry of Finance and Public Credit, to carry out foreign public debt transactions for up to TWO BILLION U.S. DOLLARS (US$2,000,000,000), or its equivalent in other currencies, to finance budgetary appropriations for the year 2015, and to prefinance and/or finance budgetary appropriations for the year 2016; of which there is an authorized and unused remaining quota of ONE BILLION FIVE HUNDRED MILLION U.S. DOLLARS (US$1,500,000,000), or its equivalent in other currencies;

According to the provision in Law 31 of 1992, Article 16, Paragraphs c) and h), by External Resolution No. 11, dated July 31, 2015, the Board of Directors of Central Bank established the financial terms to which the Nation shall be subject in order to place foreign public debt securities, which will fund budgetary allocations for the year 2016, in international capital markets;

RESOLVES

Article 1. Issuance Authorization. Authorizes the Nation to issue, subscribe, and place foreign public debt securities in international capital markets for a sum of up to ONE BILLION FIVE HUNDRED MILLION U.S. DOLLARS (US$1,500,000,000), or its equivalent in other currency, intended to pre-finance the budgetary allocations for Fiscal Year 2016;

Article 2. Characteristics, Terms and Conditions. The aforementioned foreign public debt securities shall have the following characteristics, terms and conditions:

Redemption Period: | Over two (2) years, depending on the market to be accessed; |

Interest Rate: | Fixed or variable, based on market conditions on the date of placement, subject to the limitations established by the Board of Directors of Central Bank. |

6

Other expenses and commissions: | Market standard for this type of transaction. |

Article 3. Remaining terms and conditions. Other terms, conditions and characteristics of the issuance authorized by this Resolution shall be established by the General Directorate of Public Credit and National Treasury of the Ministry of Finance and Public Credit.

Article 4. Authorization for related transactions. The Nation is authorized to carry out all related transactions described in Article 1 herein.

7

Ministry of Finance and Public Credit

| | | | |

| Resolution No. 3443 | | SEPTEMBER 17, 2015 | | Page 3 of 3 |

(Cont.) Whereby the Nation is authorized to issue, subscribe and place external public debt securities in the international capital markets, up to the sum of ONE BILLION FIVE HUNDRED MILLION U.S. DOLLARS (US$1,500,000,000), or its equivalent in other currency; and other provisions are decreed.

Article 5. Taxes. In accordance with the provisions in Article 7, Law 488 of 1998, payment of principal, interests, commissions and other payments related to foreign public credit transactions shall be exempt of any national tax, duties, contributions and levies when made to persons who are not resident in this country.

Article 6. Other norms. The Nation — through the Ministry of Finance and Public Credit — shall comply with all other applicable norms, in particular External Resolution No. 8 of 2000, from the Board of Directors of the Central Bank, and other norms that may modify, add or abolish it.

Article 7. Validity and publication. The present Resolution shall be valid from the date of its publication in the Official Journal. It is understood that the requirement was met through the instruction given by the Director General of Public Credit and National Treasury of the Ministry of Finance and Public Credit, as provided under Law 185 of 1995, Article 18.

LET IT BE PUBLISHED, NOTIFIED AND EXECUTED

Bogotá, D.C. on SEPT. 17, 2015

MINISTER OF FINANCE AND PUBLIC CREDIT

|

| [Signed] |

|

| MAURICIO CÁRDENAS SANTAMARÍA |

APPROVED: Cristhian Prado / Lucas Arboleda

PRODUCED: Camila Erazo

DEPARTMENT: Sub-Directorate, External Financing/Legal Matters Group

8

Exhibit C

Decree 1068 of 2015 is a compilation of several previously issued decrees and was issued in order to create a single regime for the Public Credit and Finance Sector. Included in the compilation is Decree 2681 of December 29, 1993, which prior to the issuance of the Decree 1068 of 2015 was the relevant decree for purposes of the issuance of global securities of the Republic of Colombia. The portion of Decree 1068 of 2015 corresponding to Decree 2681 of 1993 is the reviewed part of Decree 1068 of 2015 for purpose of the opinion. Decree 2681 of 1993 was previously translated as part of Exhibit F to the Republic’s Registration Statement No. 333-109215 and is incorporated herein by reference.

In connection with the issuance and promulgation of Decree 1068 of 2015, the following changes were made to the portions corresponding to the prior Decree 2681 of 1993: (i) references to “this Decree” were changed to the relevant references within the new decree and section and articles references were renumbered; (ii) Article 14, which referenced Law 38 of 1989 (part of the Organic Statute of the General Budget), has been modified in Article 2.2.1.2.1.8 to references the Organic Statute of the General Budget; and (iii) Article 37 stated that the publication is made in the “Diario Official” (the Official Journal) while Article 2.2.1.3.3(a) states that publication is made in the Sistema Electrónico para la Contratación Pública — SECOP (Electronic System for Public Procurement).

9

[Translation]

Exhibit D

NATIONAL COUNCILFOR ECONOMICAND SOCIAL POLICY

REPUBLICOF COLOMBIA

PLANNING DEPARTMENT

FAVORABLE OPINION FOR THE NATION

TO ISSUE FOREIGN BONDS, FOR UP TO

US$3 BILLION OR ITS EQUIVALENT IN OTHER CURRENCIES,

FOR THE PURPOSE OF PRE-FINANCING OR FINANCING

2015 AND 2016 BUDGET ALLOCATIONS.

Planning Department: SDS, SC, DDE, DIFP, OAJ

Ministry of Finance and Public Credit

Approved Version

Bogotá, D.C., August 14, 2015

10

CONPES

NATIONAL COUNCIL FOR ECONOMIC AND SOCIAL POLICY

Juan Manuel Santos Calderón

President of the Republic

Germán Vargas Llera

Vice-president of the Republic

María Lorena Gutiérrez Botero

Minister for the Presidency

| | |

Juan Fernando Cristo Bustos Minister of the Interior | | Maria Ángela Holguín Cuellar Minister of Foreign Affairs |

| |

Mauricio Cárdenas Santamaría Minister of Finance and Public Credit | | Yesid Reyes Alvarado Minister of Justice and Law |

| |

Luis Carlos Villegas Echeverri Minister of Defense | | Aurelio Iragorri Valencia Minister of Agriculture & Rural Development |

| |

Alejandro Gaviria Uribe Minister of Health & Social Welfare | | Luis Eduardo Garzón Minister of Labor |

| |

Tomas González Estrada Minister of Mines and Energy | | Cecilia Álvarez-Correa Minister of Commerce, Industry & Tourism |

| |

Gina Parody d’Echeona Minister of Education Development | | Gabriel Vallejo Lopez Minister of Environment & Sustainable |

| |

Luis Felipe Henao Cardona Minister of Housing, City & Territory | | David Luna Sánchez Minister of IT & Communications |

| |

Natalia Abello Vives Minister of Transport | | Mariana Garcés Cordoba Minister of Culture |

|

Simon Gaviria Muñoz Director General, Planning Department |

| |

Luis Fernando Mejia Alzate Sectoral Sub-director and Technical Secretary | | Manuel Fernando Castro Quiroz Territorial/Public Investment Sub-Director |

11

Executive Summary

In accordance with the provisions in Paragraph 2, Article 41, Law 80 of 19931, and Articles 2.2.1.3.1., 2.2.1.3.2 and 2.2.1.6, Decree 1068 of 20152, the present document submits to the consideration of CONPES — the National Council for Economic and Social Policy — a favorable Opinion for the Nation to issue foreign bonds to pre-finance or finance budget allocations for 2015 and 2016, up to the sum of US$3 Billion, or its equivalent in other foreign currencies.

The purpose of the foregoing is to enable the Nation to initiate financing or pre-financing the years 2015 and 2016 in a timely and adequate manner. In addition, with the requested authorization the Colombian Government will have flexibility to optimize the use of financing sources and continue maintaining liquid and efficient yield curves.

Classification: H63

Key Words: Foreign Bonds, Financing, Nation, International, Issuance, Sovereign Debt, Debt Service.

| 1 | Establishing the Public Administration’s General Procurement Statutes |

| 2 | Whereby the Finance and Public Credit Sector’s Sole Regulatory Decree was issued. It repealed Decree 1497 of 2002 and Decree 3160 of 2011. |

12

Table of Contents

| | | | | | |

| | |

| 1. | | INTRODUCTION | | | 15 | |

| | |

| 2. | | BACKGROUND | | | 16 | |

| | |

| 2.1. | | Reopening the 2024 and 2044 Global Bonds | | | 16 | |

| | |

| 2.2. | | Issuance of 2045 Global Bond | | | 16 | |

| | |

| 2.3. | | Reopening the 2045 Global Bond | | | 16 | |

| | |

| 3. | | JUSTIFICATION OF 2016 FUNDING NEEDS | | | 17 | |

| | |

| 4. | | MARKET CONTEXT | | | 18 | |

| | |

| 4.1. | | Performance of U.S. Economy | | | 19 | |

| | |

| 4.1.1. | | Macroeconomic Development in the U.S. and Interest Rates Performance | | | 19 | |

| | |

| 4.1.2. | | Expected U.S. Interest Rates and Monetary Policy | | | 20 | |

| | |

| 4.2. | | Behavior of Eurozone and Emerging Markets | | | 23 | |

| | |

| 4.2.1. | | Eurozone | | | 23 | |

| | |

| 4.2.2. | | Emerging Markets | | | 23 | |

| | |

| 4.3. | | Colombia’s Recent Performance in International Markets | | | 24 | |

| | |

| 4.3.1. | | Building Liquid, Efficient Curves | | | 26 | |

| | |

| 5. | | OBJECTIVES | | | 29 | |

| | |

| 6. | | RECOMMENDATION | | | 29 | |

| | |

| 7. | | BIBLIOGRAPHY | | | 30 | |

13

[Translation]

ACRONYMS AND ABREVIATIONS

| | |

| CONPES | | Consejo Nacional de Política Económica y Social |

| |

| COP | | Colombian Pesos |

| |

| DIFP | | Dirección de Inversiones y Finanzas Públicas, DNP |

| |

| DNP | | National Planning Department |

| |

| EC | | European Commission |

| |

| ECB | | European Central Bank |

| |

| EMBI | | Emerging Markets Bond Index |

| |

| EUR | | Euro |

| |

| FOMC | | Federal Open Market Committee |

| |

| GDP | | Gross Domestic Product |

| |

| IMF | | International Monetary Fund |

| |

| OAJ | | Legal Advisory Office, DNP |

| |

| OPEC | | Organization of the Petroleum Exporting Countries |

| |

| SC | | Credit Sub-Directorate, DNP |

| |

| SDS | | Sectoral Sub-Directorate, DNP |

| |

| U.S. | | United States of America |

14

1. INTRODUCTION

The present document submits to the consideration of the National Council for Social and Economic Policy (CONPES) [Consejo Nacional de Política Económica y Social] — a favorable opinion for the Nation to carry out transactions related to foreign public debt in order to pre-finance or finance budget allocations for the 2016 and 2017 budgets for a sum up to US$ 3 Billion, or its equivalent in other foreign currencies. The foregoing in accordance with the provisions of Law 80 of 1993, Article 413, Paragraph 2, and Decree 1068 of 2015, Articles 2.2.1.3.1.4, 2.2.1.3.2.5, and 2.2.1.6.6

Thus, it is possible for the Nation to start funding or pre-funding of the 2016 or 2017 budget in a timely manner. Also, with the requested authorization, the Government will have flexibility to optimize the use of the funding sources and still maintain efficient and liquid yield curves.

This document is divided into six main sections, including the Introduction. Section Two presents a Background, specifically relating to the Global Bond. Section Three justifies the need for funding for 2016. Section Four presents a market context, particularly the behavior of the U.S. economy, the Euro zone and the emerging markets, as well as the Colombian economy’s performance in international markets. Section Five presents the objectives outlined in the document, and Section Six sets forth recommendations to CONPES.

3 “Section 41, Paragraph 2. Public Credit Transactions. Notwithstanding the provisions of special laws, for the purposes of this law public credit transactions are transactions intended to provide the Entity with payable term resources, including loans; the issuance, underwriting and placement of bonds and securities; supplier credits; and guarantees granted for State entity obligations.

(,,,) The authorization by the Ministry of Finance and Public Credit, and prior favorable opinion by CONPES and the National Planning Department, will be required for State entities to manage and execute any foreign credit transaction and related similar transactions; and for the Nation and decentralized entities to execute any internal public credit transaction and related transactions; as well as for the Nation to grant a guarantee.

(...) In any case, external public credit operations executed and guaranteed by the Nation, beyond a one-year term, shall require a prior opinion by the Public Credit Interparliamentary Commission [Comisión Interparlamentaria de Crédito Público.]

(...) Any transactions referred to in this article to be executed abroad shall be subject to the jurisdiction agreed upon in the contract.

4 “Section 2.2.1.3.1. Public Debt Securities. Bonds, and any other credit securities with a redemption term, issued by state agencies are Public debt securities.

Any security issued by a credit institution, insurance company, or other State financial entity, in relation to transactions in the ordinary course of their own corporate activities are not considered public debt securities.

The placement of public debt securities shall be subject to the general financial conditions stipulated by the Board of the Central Bank.”

5 “Section 2.2.1.3.2.—The Nation’s Public Debt Securities. The issue and placement of public debt securities on behalf of the Nation shall require an authorization given by a Ministry of Finance and Public Credit resolution, which may be granted once the following has been obtained:

a) A favorable Opinion by CONPES; and

b) An Opinion by the Public Credit Commission for foreign public debt with a term exceeding one year.” (Emphasis added).

6 “Section 2.2.1.6. Issuance of Authorizations and Opinions. To issue the relevant opinions and authorizations CONPES, the National Planning Department, and the Ministry of Finance and Public Credit shall make sure that the respective transactions comply, among others, with Government policy on matters of public credit, and with the Macroeconomic Program and Financial Plan approved by CONPES and the Fiscal Policy Council (CONFIS).

Opinions by CONPES and the National Planning Department, when applicable, shall be issued based on the relevant entity’s technical, economic and social project justification, capacity for implementation, financial situation, funding plan through resources, and yearly expenditure schedule.”

15

2. BACKGROUND

Through CONPES Document 3781 of November 8, 2013, the Nation received a favorable opinion to carry out foreign public debt transactions to pre-finance or finance budget allocations for 2014 and 2015, up to the amount of US$3 Billion, or its equivalent in other currencies. Under this quota, the Nation reopened the US$ Global Bonds due in February 2024 and February 2044 for US$ 500 million each, as described below.

2.1. Reopening the 2024 and 2044 Global Bonds

On October 21, 2014, the Nation issued US$1 Billion through the reopening of the Global Bonds maturing in 2024 and 2044 for the sum of US$500 million each. The rate of the 30-year bond was 4.848%, the Nation’s lowest ever for a long-term debt, while the 10-year rate obtained was 3.673%, the second lowest in history for a 10-year rate. With this transaction, the bond maturing in 2044 was issued for a total amount of US$2.5 Billion, while the 2024 reached a total of US$ 2.1 Billion.

By CONPES Document 3818 of October 2, 2014, the Nation received a favorable opinion to issue foreign bonds for up to US$3 Billion, or its equivalent in other currencies, to pre-finance or finance budget allocations for 2015 and 2016. Based on this quota, the Nation conducted two transactions in foreign markets. The first transaction in January 2015, with the issuance of the 2045 Global Bond for $ 1.5 Billion, and the second transaction in March 2015 with the reopening of the same bond for US$ 1 Billion. The first transaction was partially financed by this quota, and the second transaction was fully financed by the quota. The transactions are described below.

2.2. Issuance of 2045 Global Bond

On January 21, 2015, the Nation issued a US$ Global Bond due in June 2045 in the amount of US$1.5 Billion, which was placed on the international capital market at a 5.064% rate and a 5.000% coupon, the lowest coupon achieved by the Republic at the long end of the curve. It is noteworthy that the operation reached a record peak demand in the history of long-term financing, with orders for more than US$5 Billion from 224 investors.

With the issuance of the 2045 Global Bond, the $ 400 million remaining quota from CONPES Document 3781 and US$1.1 Billion from CONPES Document 3818 were used up. Thus, a quota of US$1.9 Billion was available, or its equivalent in other currencies, to pre-finance or finance budget allocations for 2015 and 2016.

2.3. Reopening the 2045 Global Bond

On March 23, 2015, the Nation reopened the US$ Global Bond due in 2045 for an amount of US$1 Billion, at a 5.041% rate, which reached a total issued amount of US$2.5 Billion. This transaction had an approximate demand of US$4.9 Billion, with the participation of 236 accounts from U.S., Europe, Latin America and Asia.

16

With the reopening of the 2045 Global Bond, the current CONPES 3818 quota of for US$1 Billion was used up; an available US$ 900 million quota, or its equivalent in other currencies, remained to pre-finance or finance budget allocations for 2015 and 2016.

3. JUSTIFICATION OF 2016 FUNDING NEEDS

The financial plan for 2016 includes foreign funding sources for US$6 Billion, of which US$3 Billion will be financed through loans from multilateral banks, and US$3 Billion through the issuance of securities on the international market (Table 1).

Table 1. 2016 Financial Plan

| | | | |

Sources | | B COP

57.323 | |

Disbursements | | | 46.069 | |

Foreign (US$ 6 Billion) | | | 15.010 | |

Bonds (US$ 3 Billion) | | | 7.505 | |

Multilateral and others (US$3 Billion) | | | 7.505 | |

Domestic | | | 31.060 | |

TES | | | 31.042 | |

Tenders | | | 26.496 | |

Public Entities | | | 3.499 | |

Other TES | | | 1.047 | |

Other Domestic Debt | | | 17 | |

| |

Floating Debt | | | 2.767 | |

| |

Causation Adjustments | | | 968 | |

| |

Treasury Transactions | | | 4.209 | |

| |

Initial Availability | | | 3.309 | |

In Pesos | | | 2.603 | |

In Dollars (US$285 million) | | | 707 | |

| | | | |

Use | | B COP

57.323 | |

Deficit to be funded | | | 30.995 | |

Of which: | | | | |

Payment domestic interest | | | 18.020 | |

Payment foreign interest | | | 6.469 | |

Expenses in Dollars (US$ 679 million) | | | 1.700 | |

| |

Amortization | | | 20.343 | |

Foreign (US$1.164 Billion) | | | 2.913 | |

Domestic | | | 17.430 | |

| |

Central Bank losses | | | 662 | |

| |

Judgments | | | 385 | |

| |

Final Availability | | | 4.937 | |

In Pesos | | | 1.922 | |

In Dollars (US$ 1.205 Billion) | | | 3.105 | |

Source: 2015 Medium-Term Fiscal Framework.

As shown in the next section, it is important to have timely authorization for such transactions, taking into account current market conditions and expectations. This, in order to be able to access the market in a timely manner, take advantage of market windows, and avoid high volatility periods.

17

4. MARKET CONTEXT

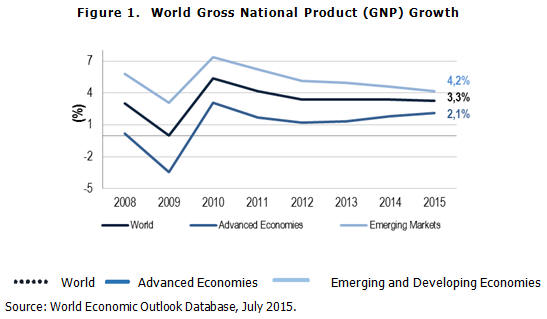

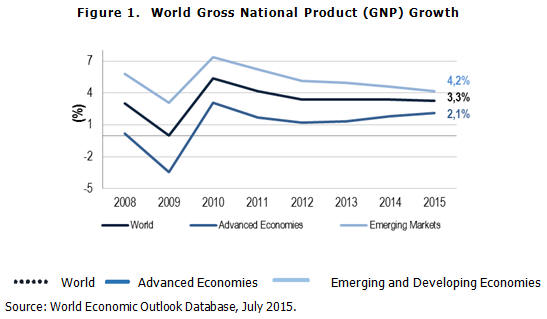

According to the International Monetary Fund’s updated forecast for July 2015 (IMF, 2015), global growth will remain moderate, reaching 3.3% in 2015 and 3.8% in 2016. Overall, economic developments matches last April’s forecast, and the prospect of recovery in advanced economies remains, while expectations of growth in emerging and developing economies are lower, owing to an economic slowdown in some major emerging economies such as China, Brazil, Russia, and the fall in prices of raw materials (Figure 1).

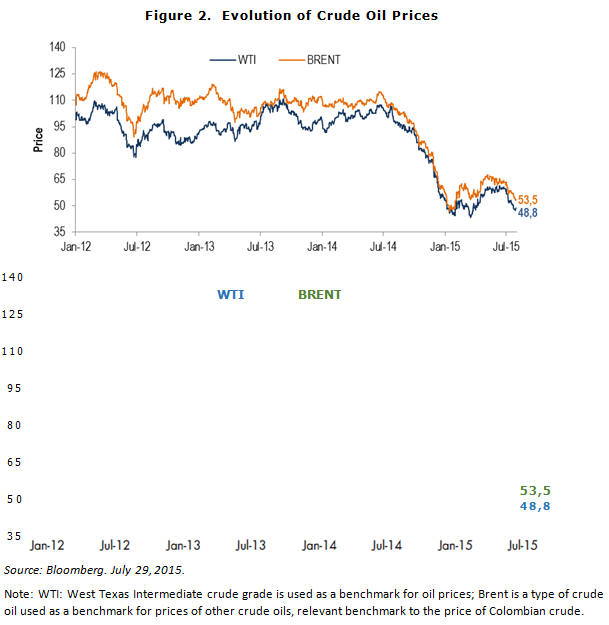

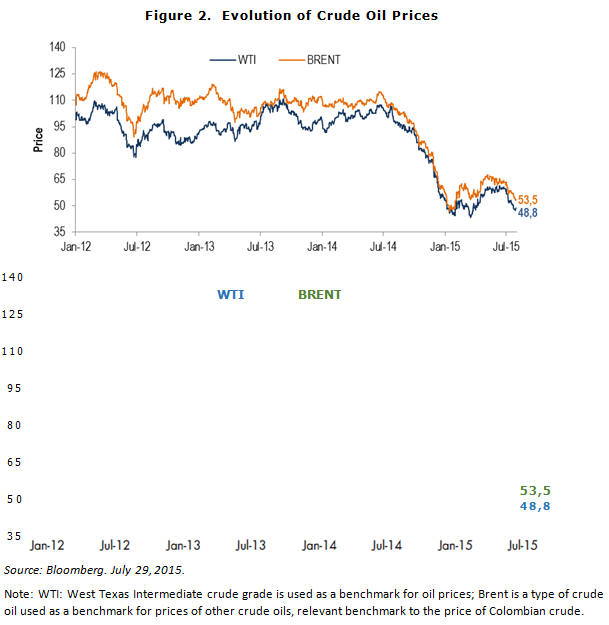

The fall in oil prices was the result of various external factors, such as: (i) the significant increase in U.S. oil production, which according to the U.S. Energy Information Administration, rose from 8.3 million barrels per day on average in 2005 to 14.0 million in 2014; (ii) the growth of world economy has been lower than expected, a situation that resulted in a lower energy demand; and (iii) the decision of the Organization of Petroleum Exporting Countries (OPEC) not to use, for now, its regulatory capacity regarding production, to alter this new situation of greater relative abundance of crude oil.

Thus, the price of Brent, the relevant benchmark for the price of Colombian crude, went from being consistently above $100 per barrel during the first half of 2014, and even reaching US$114.8 in the second half of last June, to US$48.8 in late January this year. Since then, it has been around US$53, which means that in the last year Brent suffered a price drop close to 47% (Figure 2).

As for monetary policy, interest rates in the U.S. are expected to rise in late 2015 or early 2016, unlike the Eurozone, which on March 9, 2015 began 60,000 million Euros’ monthly purchases of public and private debt, and is facing a Greek recovery. Similarly, Japan maintains its orientation toward an expansionary policy.

18

4.1. Performance of U.S. Economy

4.1.1. Macroeconomic Development in the U.S. and Interest Rates Performance

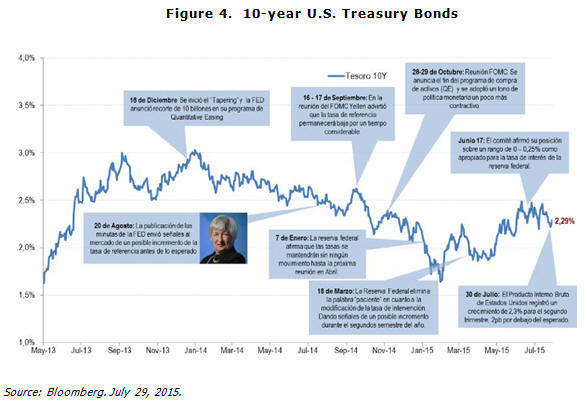

In December 2013, as a result of a better performance of the U.S. economy, the Federal Reserve announced the start of a gradual reduction of the asset purchase program that began in 2008 (Quantitative Easing), which ended in October 2014.

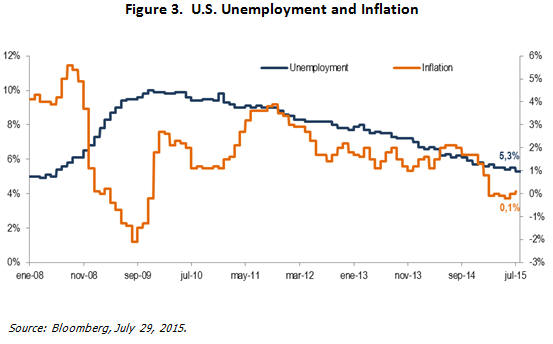

A better performance of the economy was reflected in the 2014 annual growth, which exceeded market expectations by reaching a level close to 2.4%. This growth is due to moderate job creation, rising incomes, falling oil prices and the strengthening of consumer confidence. During the first half of 2015, the U.S. economy continued this trend and achieved

19

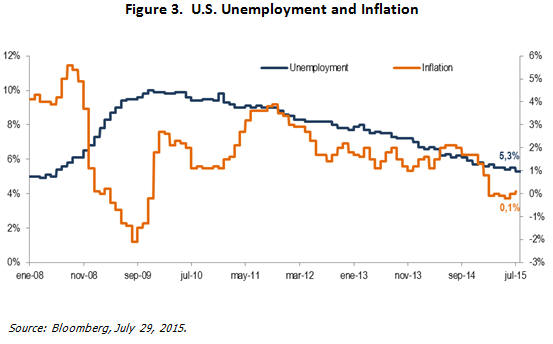

growth in the second quarter of 2.3%, and an unemployment rate of 5.3% in June, reaching levels not seen since June 2008 (Figure 3). However, the Federal Open Market Committee (FOMC7) is monitoring not only an increase in inflation, which is expected to rise gradually towards 2% during the year, but a strengthening of investment in some sectors of the economy and an improvement in the foreign sector, to make monetary policy decisions.

4.1.2. Expected U.S. Interest Rates and Monetary Policy

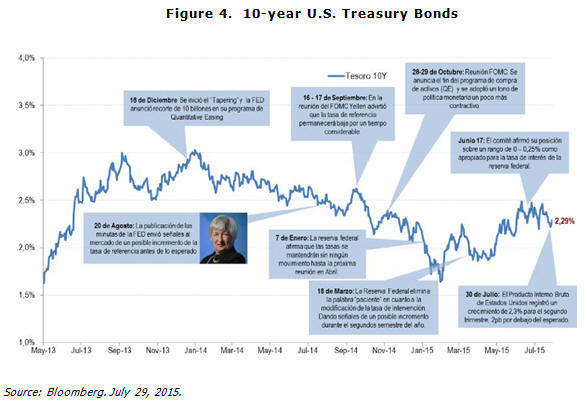

The rates on U.S. Treasury securities maintained a downward trend after the meeting on 16 and 17 September 2014, in which Janet Yellen, president of the Federal Reserve, stressed and warned that the benchmark rate would remain low for a considerable time. However, despite the January 7, 2015 decision not to increase rates, Treasury securities showed a change in trend from the first days of February, largely thanks to a U.S. growth indicator, which exceeded expectations and averaged 2.4% for 2014.

At the last meeting of the Federal Reserve last July, the FOMC members indicated that economic activity in recent months had expanded, largely driven by growth in household spending and a reactivation in the housing sector. However, results that are aligned with the Committee’s objectives of labor market stability and an increase in inflation close to 2% in the second half of the year will be needed for the Committee to decide to drop the expansionary policy.

In addition, William C. Dudley, Chairman of the Federal Reserve Bank of New York, who shares a position similar to that of President of the Federal Reserve, recently8 stated that if the economy maintains the growth achieved in the second quarter of 2015, it will have shown sufficient progress to meet Federal Reserve objectives at the end of the year. This has reinforced market expectations of a rate increase in the last quarter of 2015 (Figure 4).

| 7 | Federal Open Market Committee |

| 8 | Deutsche Bank Research (2015.) |

20

| | | | | | |

| December 18: Tapering began, and the FED announced a 10 Billion cut in their Quantitative Easing program. | | August 20: Published Fed Minutes sent signals to the market of an earlier than expected possible increase in the benchmark rate. | | September 16-17: At the FOMC meeting, Yellen warned that the benchmark rate would remain low for a considerable amount of time. | | October 28-29: FOMC Meeting. The end of the asset purchase program (QE) is announced. A monetary policy a bit more contractionary is adopted. |

| January 7: The Federal Reserve states that the rates will not vary until the next meeting in April. | | March 18: The Federal Reserve removes the word “patient” with regard to modifying the intervention rate. The Fed signals a possible increase during the second semester. | | June 17: The Committee confirmed its position about a 0-0.25% range being the appropriate interest rate for the Federal Reserve | | July 30: The U.S. GNP registered a 2.3% increase in the second quarter, 2 basic points below the expected figure. |

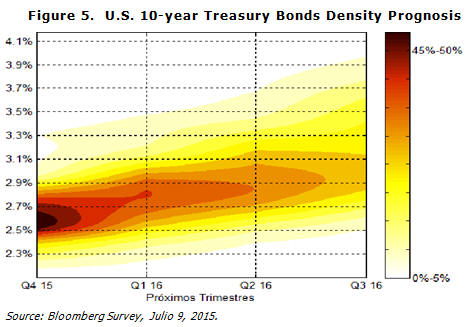

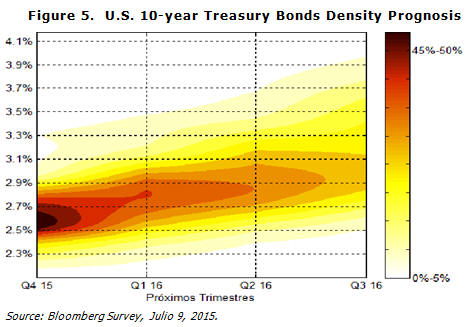

Results of the survey conducted by Bloomberg analysts in July 2015 regarding rate yield forecast for 10-year Treasury securities, clearly show a market consensus about an increase close to 2.6% in Q4, as shown in Figure 5.

21

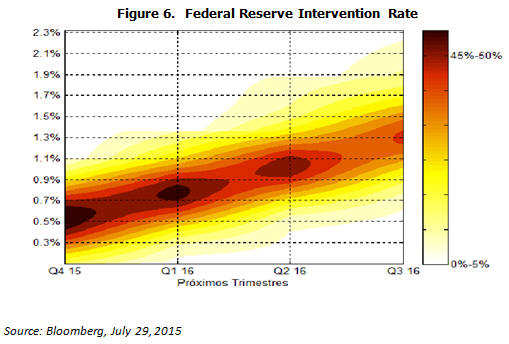

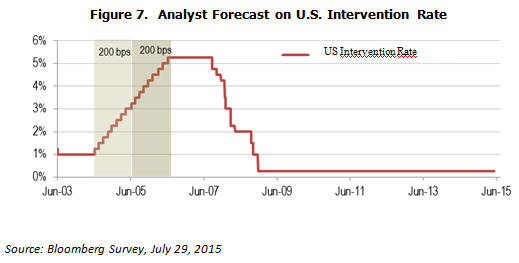

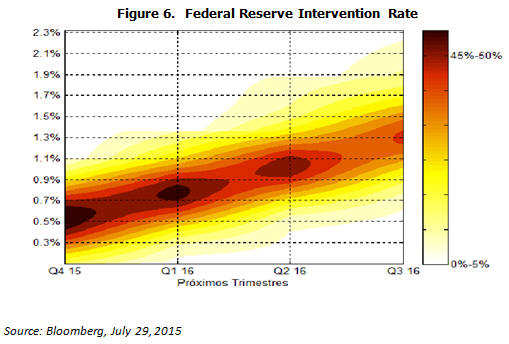

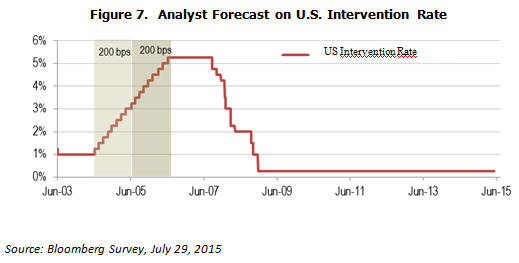

As to the latest survey carried in July about expectations on the intervention rate, after almost seven years without any movement (Figure 6), analysts consider there could be a possible increase in the Federal Reserve’s benchmark interest rate of about 25 to 45 basic points during Q4 2015 or Q1 2016, as a result of a positive economy performance (Figure 7).

22

It is worth noting that an increase in this interest rate will be reflected in higher financing costs for emerging economies and that further increases may occur, depending on the U.S. economy’s performance.

4.2. Behavior of the Eurozone and Emerging Markets

4.2.1. Eurozone

An economic recovery seems to be taking place in the Eurozone, as shown by a recovery in domestic demand, an increase in inflation, and an upward revision of growth projections in several countries in the region. The European Central Bank (ECB) keeps trying to achieve an inflation rate of about 2%, and stimulate the economies in the region through new, unconventional measures to stimulate the economy, like buying public and private debt for a total sum of 60,000 million Euros per month for at least 19 months.

However, recovery efforts in the region have been mitigated by the continued debt crisis in Greece. After several meetings to reach an agreement with the Greek government and prevent Greece’s exit from the Eurozone, the European Commission (EC) decided to disburse 7.160 Billion Euros in exchange for Greece’s commitment to continue with the relevant Congress approval for required reforms. These were resources that helped Greece face commitments with the IMF for US$ 2 Billion and the ECB for EUR 4.2 Billion.

4.2.2. Emerging Markets

Growth in emerging and developing markets will decrease from 4.6% in 2014 to 4.2% in 2015, according to the general projections in the IMF’s July 2015 Report. The deceleration reflects: (i) a cooling effect caused by a drop in commodity prices and a deterioration in external financing conditions, particularly in Latin America and the oil-exporting

23

countries; (ii) economic tensions linked to geopolitical factors, especially in the Commonwealth of Independent States and some countries Middle East and North Africa countries; and (iii) deceleration in China’s growth, which has an impact on growth in the region as well as world economy growth. The latter has led to episodes of high volatility, particularly in the equity markets.

4.3. Colombia’s Recent Performance in International Markets

The country has suffered a strong shock in terms of trade as a result of the drop in international oil prices. However, the Colombian economy has many tools to deal with this situation: i) on the foreign front, a flexible exchange rate regime allowed the country’s economy to absorb the oil shock and cushion its effects; ii) in terms of direct foreign investment, the investor base has diversified and, as a result of the devaluation, Peso-denominated assets have become more attractive to foreign investors; and iii) the Colombian financial system is sound.

The main challenges associated with the new situation are to be found in the fiscal front. The loss of tax income associated with hydrocarbons needs to be compensated to continue achieving the targets stipulated by the fiscal rule. Three elements point in this direction. First, the 2014 tax reform, which will enable the collection of an additional 0.5% of GDP in 2016. Second, a strategy that begins this year and runs through 2019, which will delivered strong results in the control of tax evasion due to an update in the DIAN. Third, from 2020 onwards the country will require additional revenue, which will be the product of a roadmap to be delivered to the Government by the Committee of Experts for Tax Equity and Competitiveness created by Act 1739 of 2014.9

As a result of this strategy, medium-term growth outlook for the Colombian economy remains favorable compared to other countries in the region. The country is well positioned to face the volatility of international markets and the normalization of the U.S. monetary policy. The perceived credit risk represented by the EMBI + (Emerging Markets Bonds Index10) has generally deteriorated due to: i) recent developments in Greece; ii) lowering of Russia’s long-term credit rating; iii) events in the Ukraine; vi) deceleration in Brazil’s growth; and v) a sharp drop in commodity prices. However, Colombia and Mexico are well perceived in the international market (Figure 8).

The country’s image in international places Colombia in a favorable position to benefit from market openings and capture attractive funding rates.

| 9 | Whereby the Tax Code and the 1607 Act of 2012 were amended, mechanisms to combat tax evasion, and other provisions, were created. |

| 10 | The index represents the difference between the interest rate of a basket of US$ bonds issued by emerging countries and the interest rate of a basket of U.S. Treasury Bonds with similar characteristics. |

24

25

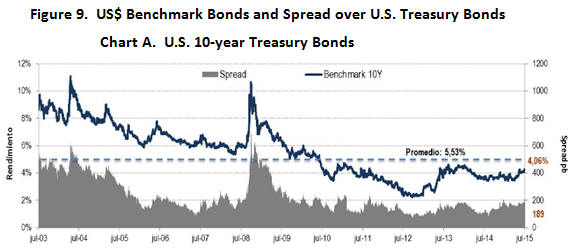

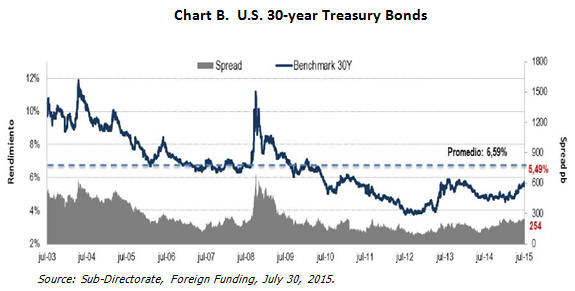

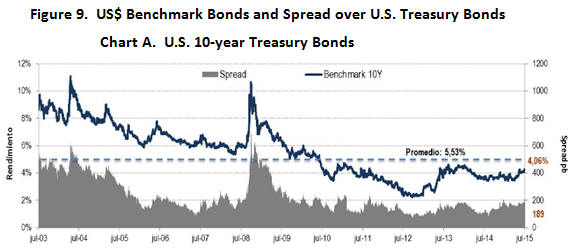

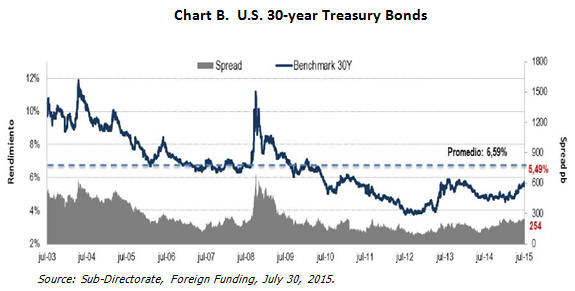

As shown in Figure 9, despite a rebound in August 2014, the rates and spreads versus the benchmark U.S. Treasury securities remain low compared to the registered historical levels. This is due to the fall suffered by said securities in recent months.

It is important for the Nation to have the capacity and flexibility to seize opportunities and avoid volatility periods associated with the aforementioned factors, minimize risks in the execution of transactions and, in turn, secure the most favorable funding costs.

4.3.1. Building Liquid and Efficient Curves

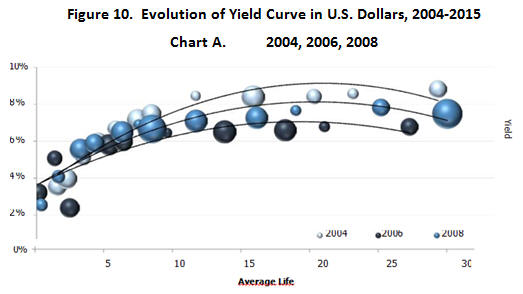

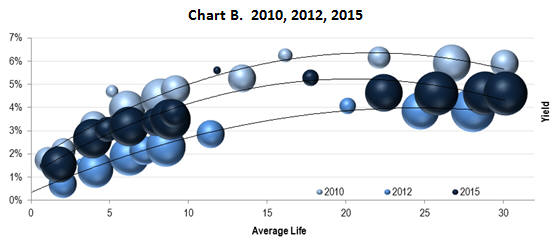

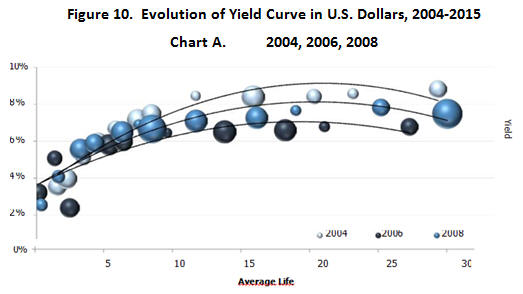

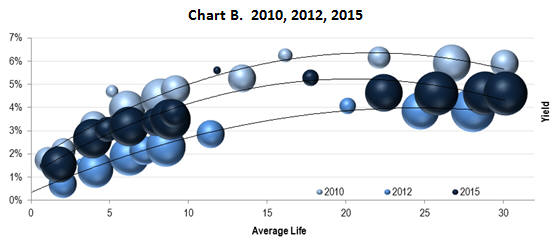

In recent years the Nation has achieved the strategic objective of building liquid and efficient yield curves while maintaining adequate benchmark bonds, as shown in Figure 10.

Source: Bloomberg; Sub-Directorate, Foreign Funding.

26

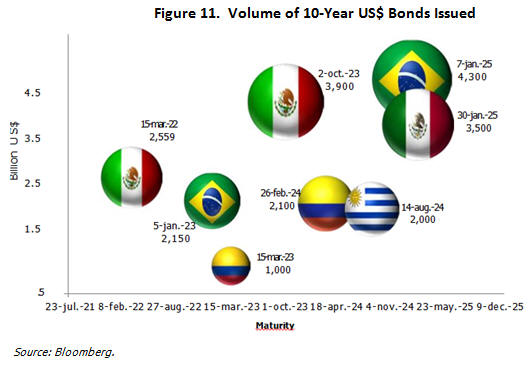

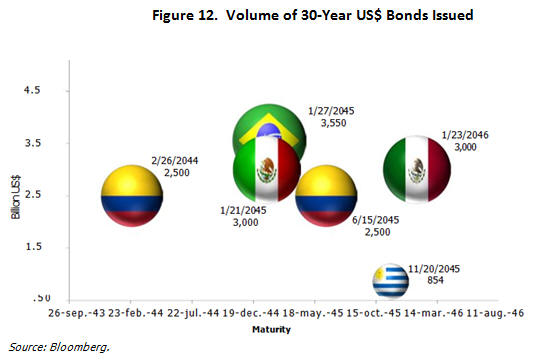

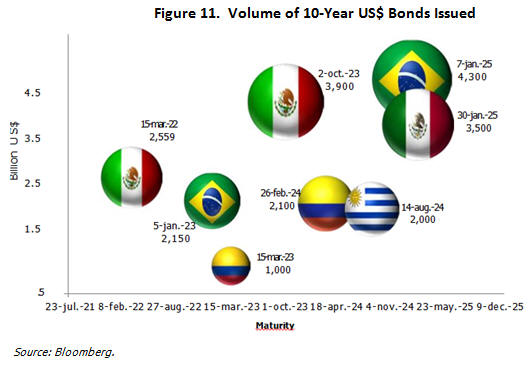

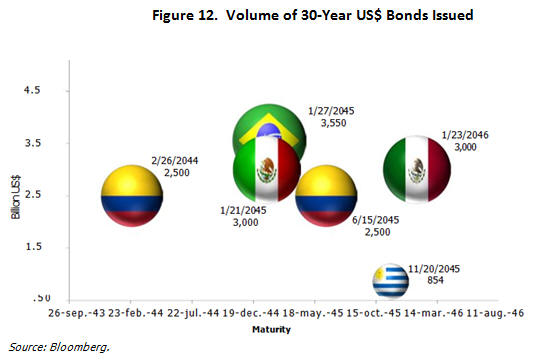

In recent years, Latin American emerging countries have aimed at creating Thirty-Year and Ten-Year benchmarks. Other, like Mexico, have chosen Fifty-Year and One Hundred-Year maturities. Similarly, they have focused on large issuances which, in the context of an expected interest rate increases, seek to ensure that from issuance their bonds have enough liquidity to avoid friction trading. Thus, they protect the efficiency of their curve in the long term. (Figure 11 and Figure 12).

27

28

For this reason, the Nation needs the ability to issue benchmark bonds of a representative size, so as not to sacrifice their liquidity and generate distortion in relative terms against other bonds in the curve, or in comparison with bonds from peer countries—which would also be negative.

5. OBJECTIVES

| | • | | Ensure that the nation is authorized early enough to issue foreign bonds in order to, first, not create market noise; and second, provide sufficient maneuvering space for pre-financing or financing transactions to provide strong cash flow for 2016 and 2017; |

| | • | | Have enough flexibility to use the most favorable financing source, according to market conditions; |

| | • | | Have timely and sufficient access to international markets, and continue fulfilling the Government’s strategic objective to build liquid and efficient yield curves. |

6. RECOMMENDATION

The Ministry of Finance and Public Credit and the National Planning Department submit the following recommendation to the National Council for Economic and Social Policy:

1. A favorable opinion should be issued for the Nation to issue foreign bonds in order to pre-finance or finance budget allocations for 2016 and 2017, up to US$3 Billion, or its equivalent in other currencies.

29

7. BIBLIOGRAPHY

Deutsche Bank Research (2015) “FOMC minutes to show policymakers are not in a rush to raise rates”, in U.S. Daily Economic Notes, July 7, 2015.

Decree 1068 of 2015 (May 26), issuing Decreto Único Reglamentario del Sector Hacienda y Crédito Público. Repealing Decrees 1497 of 2002 and 3160 of 2011. Taken from: http://wp.presidencia.gov.co/sitios/normativa/decretos/2015/ Decretos2015/

DECRETO%201068%20DEL%2026%20DE%20MAYO%20DE%202015.pdf

Law 80 of 1993 (October 28), issuing the Public Administration Procurement Statutes. Official Gazette 41.094. Taken from: http://www.secretariasenado.gov.co/senado/basedoc/ley_0080_1993.html

Law 1739 of 2014 (December 23), amending the Tax Code and Law 1607 of 2012, creating mechanisms to fight tax evasions, and issuing other provisions. Official Gazette 49.374. Taken from: http://www.secretariasenado.gov.co/senado/basedoc/ley_1739_2014.html

National Planning Department. (October 2014). Favorable opinion for the Nation to obtain a debt quota from foreign public credit transactions for up to US$ 3 Billion, or equivalent in other currencies, for the purpose of pre-financing of financing budget allocations for 2015 y 2016. CONPES Document 3818, Bogotá D.C., Colombia: DNP.

National Planning Department. (November 2014). Favorable opinion for the Nation to obtain a debt quota in foreign bonds for up to US$ 3 Billion, or equivalent in other currencies, to pre-finance or finance Budget allocations for 2014 y 2015. CONPES Document 3781, Bogotá D.C., Colombia: DNP.

International Monetary Fund (2015) “Deceleration of growth in emerging markets, gradual recovery of advanced economies”. World Economy Perspective — July 9, 2015 Taken from: http://www.imf.org/external/spanish/pubs/ft/weo/2015/update/02/pdf/0715s.pdf

30