Exhibit 4

Bogotá D.C. January 18, 2019

Republic of Colombia

Ministry of Finance and Public Credit

Carrera 8, No. 6C-38, Piso 1

Bogotá D.C., Colombia

Ladies and Gentlemen:

In my capacity as Head of the Legal Affairs Group of the General Directorate of Public Credit and National Treasury of the Ministry of Finance and Public Credit of the Republic of Colombia (the “Republic”), and in connection with the Republic’s offering, pursuant to its registration statement under Schedule B of the United States Securities Act of 1933, as amended (the “Securities Act”), filed by the Republic with the United States Securities and Exchange Commission (the “Commission”) on September 28, 2017 (Registration Statement No. 333-220694), (the “Registration Statement”), of $1,500,000,000 aggregate principal amount of the Republic’s 4.500% Global Bonds due 2029 and $500,000,000 aggregate principal amount of the Republic’s 4.500% Global Bonds due 2045 (the “Securities”), I have reviewed the following documents:

(i) the Registration Statement and the related Prospectuses dated October 19, 2017 and October 3, 2018 included in the Registration Statement most recently filed with the Commission, as supplemented by the Prospectus Supplement dated October 3, 2018 relating to the Securities, as filed with the Commission pursuant to Rule 424(b)(5) under the Securities Act;

(ii) an executed copy of the Indenture, dated January 28, 2015 (the “Indenture”), between the Republic and The Bank of New York Mellon, as amended and supplemented by the Supplemental Indenture thereto, dated as of September 8, 2015, and as further amended and supplemented from time to time (as amended and supplemented, the “Indenture”);

(iii) the global Securities dated October 12, 2018 in the aggregate principal $1,500,000,000 and $500,000,000 executed by the Republic;

(iv) an executed copy of the Authorization Certificate dated October 12, 2018 pursuant to which the terms of the Securities were established;

(v) all relevant provisions of the Constitution of the Republic and the following acts, laws and decrees of the Republic, under which the issuance of the Securities has been authorized:

| | a) | Law 80 of October 28, 1993 (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-13172 and incorporated herein by reference); |

| | b) | Law 533 of November 11, 1999, (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-13172 and incorporated herein by reference); |

| | c) | Law 185 of January 27, 1995 (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-13172 and incorporated herein by reference); |

| | d) | Law 781 of December 20, 2002, (a translation of which has been filed as part of Exhibit F to the Republic’s Registration Statement No. 333-109215 and incorporated herein by reference); |

| | e) | Law 1366 of December 21, 2009, (a translation of which has been filed as part of Exhibit 3 to Amendment No. 2 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2008 and incorporated herein by reference); |

| | f) | Law 1624 of April 29, 2013, (a translation of which has been filed as part of Exhibit 3 to Amendment No. 1 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2012 and incorporated herein by reference); |

2

| | g) | Decree No 1068 of May 26, 2015, (a summary of the material portion of which has been filed as part of Exhibit 3 of Amendment No. 1 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2014); |

| | h) | Approval No. 3842, dated August 14, 2015, of the Consejo Nacional de Política Económica y Social (“CONPES”) (a translation of which has been filed as Exhibit D of Amendment No. 1 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2014); |

| | i) | Law 1771 of December 30, 2015, (a translation of which has been filed as Exhibit A of Exhibit 3 of Amendment No. 2 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2014); |

| | j) | Article 16 (c) and (h) of Law 31 of 1992 issued by the Board of Directors of the Central Bank of Colombia (a translation of which has been filed as Exhibit D of Exhibit 3 of Amendment No. 2 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2014); |

| | k) | Resolution No. 087 dated January 18, 2017 of the Ministry of Finance and Public Credit (a translation of which has been filed as Exhibit D of Exhibit 4 of Amendment No. 1 to the Republic’s Annual Report on Form 18-K for fiscal year ended December 31, 2015); |

| | l) | Act of the Comisión Interparlamentaria de Crédito Público adopted at its meeting held on June 15, 2016 (a translation of which is attached as Exhibit B of Exhibit 4 of Amendment No. 1 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2015); |

| | m) | Approval No. 3865, dated July 14, 2016 of the Consejo Nacional de Política Económica y Social (“CONPES”) (a translation of which is attached as Exhibit C of Exhibit 4 of Amendment No. 1 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2015); |

| | n) | Resolution No. 2275 of August 1, 2017, of the Ministry of Finance and Public Credit (a translation of which is attached to Exhibit A of Exhibit 3 of Amendment No. 2 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2015); and |

3

| | o) | Act of the Comisión Interparlamentaria de Crédito Público adopted at its meetings held on June 14, 2017 and June 20, 2017 (a translation of which is attached as Exhibit B of Exhibit 3 of Amendment No. 2 to the Republic’s Annual Report on Form 18-K for the fiscal year ended December 31, 2015). |

(vi) the following additional actions under which the issuance of the Securities has been authorized:

| | a) | Resolution No. 3348 of October 2, 2018, of the Ministry of Finance and Public Credit (a translation of which is attached to Exhibit A hereto); |

| | b) | Approval No. 3928, dated May 28, 2018, of the Ministry of Finance and Public Credit (a translation of which is attached to Exhibit B hereto); and |

| | c) | Act Comisión Interparlamentaria de Crédito Público adopted at its meetings held on June 6, 2018 and June 14, 2018 (a translation of which is attached to Exhibit C hereto). |

It is my opinion that under and with respect to the present laws of the Republic, the Securities have been duly authorized, executed and delivered by the Republic and, assuming due authentication thereof pursuant to the Indenture, constitute valid and legally binding obligations of the Republic.

I hereby consent to the filing of this opinion as an exhibit to the Republic’s Amendment No. 1 to its Annual Report on Form 18-K for its Fiscal Year ended December 31, 2017 and to the use of the name of the Head of the Legal Affairs Group of the General Directorate of Public Credit and National Treasury of the Ministry of Finance and Public Credit of the Republic under the caption “Validity of the Securities” in the Prospectuses and under the heading “General Information—Validity of the Bonds” in the Prospectus Supplements referred to above. In giving the foregoing consent, I do not thereby admit that I am in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission thereunder.

No opinion is expressed as to any law of any jurisdiction other than Colombia. With respect to the opinion set forth above, my opinion is limited to the laws of Colombia. This opinion is specific as to the transactions and the documents referred to herein and is based upon the law as of the date hereof. My opinion is limited to that expressly set forth herein, and I express no opinions by implication.

4

|

| Very truly yours |

|

| /s/ Juan Pablo Puerto Reyes |

|

| Juan Pablo Puerto Reyes |

| Head of the Legal Affairs Group of the General Directorate of Public Credit and National Treasury of the Ministry of Finance and Public Credit of the Republic of Colombia |

5

EXHIBIT A

| | |

| GOVERNMENT OF | | MINISTRY OF FINANCE |

| |

| COLOMBIA | | |

Resolution 3348

OCTOBER 2, 2018

Whereby the Nation is authorized to issue, endorse, and place foreign public debt

securities in the international capital markets, for up to TWO BILLION

United States DOLLARS (US$2,000,000,000), or its equivalent in another currency;

and to carry out an external public debt management transaction for up to

ONE BILLION United States DOLLARS (US$ 1,000,000,000,) or its equivalent

in other currencies; and other provisions as decreed.

THE MINISTRYOF FINANCEAND PUBLIC CREDIT

Exercising its statutory powers, particularly the powers conferred by

Article 2.2.1.3.2. and Article 2.2.1.4.2, Decree 1068 of 2015,

WHEREAS

Article 2.2.1.1.1, Decree 1068 of 2015, authorizes State entities to carry out public credit transactions, including, among others: issue, endorse, and place public debt securities;

Article 10, Law 533 of 1999, states that public debt securities are documents and securities, issued by State entities, with a credit content, and a maturity date;

Article 2.2.1.3.2., Decree 1068 of 2015 states that the issuance and placement of public debt securities on behalf of the Nation require an authorization given by a Resolution by the Ministry of Finance and Public Credit. The authorization may be granted once a favorable opinion has been received from the National Council for Economic and Social Policy [Consejo Nacional de Política Económica y Social] - CONPES, and from the Inter-Parliamentary Public Credit Commission [Comisión Interparlamentaria de Crédito Público] if the foreign public debt securities’ maturity is longer than 1 year;

Article 24, Law 185 of 1995, states that for all purposes established under Law 80 of 1993, Article 41, Paragraph 2, Sub-paragraph 5, the Inter-Parliamentary Public Credit Commission shall issue a preliminary opinion to begin formalities with regard to any public credit transactions, and a final opinion to execute each transaction. However, the Inter-Parliamentary Public Credit Commission shall only issue an opinion once with regard to the issuance, endorsement, and placement of bonds and securities;

6

| | | | |

| Resolution No. 3348 | | OCT. 2, 2018 | | Page 2 of 4 |

(Cont.) “Whereby the Nation is authorized to issue, endorse, and place external public debt securities on international capital markets, for up to TWO BILLION United States DOLLARS (US$2,000,000,000), or its equivalent in another currency; and to carry out an external public debt management transaction for up to ONE BILLION United States DOLLARS (US$1,000,000,000,) or its equivalent in another currency; and other provisions as decreed.”

According to CONPES Document 3928, dated May 28, 2018, the National Council for Economic and Social Policy - CONPES - issued a favorable opinion for the Nation to negotiate foreign public credit transactions to pre-finance and/or finance budget allocations for 2018 and 2019 for up to THREE BILLION United States DOLLARS (US$3,000,000,000), or its equivalent in another currency;

In the June 6, 2018 and June 14, 2016 session, the Inter-Parliamentary Public Credit Commission issued a unanimous, sole favorable opinion to the Nation - the Ministry of Finance and Public Credit - to carry out transactions related to foreign public credit for up to THREE BILLION United States DOLLARS (US$3,000,000,000),, or its equivalent in another currency, intended to pre-finance and/or finance budgetary allocations for 2019;

Under the foregoing authorization, the Nation has not issued any external bonds on international capital markets;

Through External Resolution No. 17 of 2015 and External Regulatory DODM Circular 145, of October 30, 2015, the Republic’s Bank’s Board of Directors and the Republic’s Bank itself, respectively, stated the financial conditions for the issuance and placement of the titles and the foreign debt transactions for the Nation, territorial entities and decentralized entities;

In accordance with the provisions of Article 2.2.1.1.3, Decree 1068 of 2015, public debt management transactions do not increase a State entity’s net indebtedness and help to improve debt profile. In addition, the transactions, given that they are not new financing, do not affect the indebtedness quota;

Article 2.2.1.4.2, Decree 1068 of 2015, provides that the execution of transactions to manage the Nation’s external debt will require an authorization, issued by resolution by the Ministry of Finance and Public Credit. The authorization will be granted provided the transactions’ advantages and financial justification, and its effects on debt profile can be demonstrated;

The Nation - Ministry of Finance and Public Credit - plans to carry out a debt management transaction to substitution and/or repurchase foreign public debt securities, conditioned on the issuance of foreign public debt securities that the Nation intends to do based on the authorization herein;

7

| | | | |

| Resolution No. 3348 | | OCT. 2, 2018 | | Page 3 of 4 |

(Cont.) “Whereby the Nation is authorized to issue, endorse, and place external public debt securities on international capital markets, for up to TWO BILLION United States DOLLARS (US$2,000,000,000), or its equivalent in another currency; and to carry out an external public debt management transaction for up to ONE BILLION United States DOLLARS (US$1,000,000,000,) or its equivalent in another currency; and other provisions as decreed.”

In accordance with the provisions of articles 2.2.1.1.3 and 2.2.1.4.2, Decree 1068 of 2015, by memorandum 3-2018-017302 of October 1, 2018, the Sub-directorate for External Financing, General Directorate of Public Credit and National Treasury, Ministry of Finance and Public Credit, developed a technical document to show the convenience and financial justification of the foreign debt management transaction mentioned in previous recital and its effects on debt profile;

Through memoranda 3-2018-017477 and 3-2018-017594 of October 2, 2018, the Risk Sub-directorate stated that a repurchase and/or substitution of the 2019 Global Bond, proposed by the Foreign Financing Sub-directorate, General Directorate for Public Credit and National Treasury, Ministry of Finance and Public Credit, complies with the two management transaction principles set by Decree 1068 of 2015, since it would represent an improvement in the Nation’s debt profile and would not increase the Nation’s indebtedness;

DECIDES

Article 1. Authorization. To authorize the Nation to issue, endorse, and place foreign public debt securities on international capital markets for a sum of up to TWO BILLION United States DOLLARS (US$2,000,000,000), or its equivalent in another currency; intended to pre-finance 2019 budgetary allocations, and to carry out an external public debt management transaction for up to ONE BILLION United States DOLLARS (US$1,000,000,000,) or its equivalent in another currency; consisting in the substation and/or repurchase of a Global Bond, maturity March 18, 2019, coupon 7.375%, and TWO BILLION United States DOLLARS (US$2,000,000,000) current value.

Paragraph. For the purposes established in this Resolution, the public credit transaction, and the debt management transaction, shall be carried out simultaneously.

Article 2. Financial Terms. Foreign public debt titles to be issued, as referred to in the preceding article, shall be subject to financial conditions set out in the rules issued by Board of Directors of the Central Bank, or the Central Bank itself, in compliance with the guidelines set forth by the Board.

8

| | | | |

| Resolution No. 3348 | | OCT. 2, 2018 | | Page 4 of 4 |

(Cont.) “Whereby the Nation is authorized to issue, endorse, and place external public debt securities on international capital markets, for up to TWO BILLION United States DOLLARS (US$2,000,000,000), or its equivalent in another currency; and to carry out an external public debt management transaction for up to ONE BILLION United States DOLLARS (US$1,000,000,000,) or its equivalent in another currency; and other provisions as decreed.”

Article 3. Other Terms and Conditions. The other terms, conditions and characteristics of the issuance being authorized by the present Resolution shall be established by the General Directorate of Public Credit and Treasury, Ministry of Finance and Public Credit, taking the following into account:

| | |

| Redemption Period: | | Over two (2) years, depending on the market to be accessed; |

| |

| Interest Rate: | | Fixed or Variable |

| |

| Other expenses and commissions: | | Market standard for this type of transaction. |

Article 4. Authorization for related transactions. The Nation is authorized to carry out any transaction related to the transactions described in Article 1 herein.

Article 5. Taxes. In accordance with the provisions in Article 7, Law 488 of 1998, payment of principal, interests, commissions and other payments related to foreign public credit transactions shall be exempt of any national tax, duty, contribution or levy when made to persons who are not resident in the country.

Article 6. Other norms. The Nation - through the Ministry of Finance and Public Credit - shall comply with all other applicable standards, in particular External Resolution No. 1 of 2018 by the Central Bank’s Board of Directors, as amended.

Article 7. Validity and publication. The present Resolution shall be valid from the date of its publication in the Official Journal. This requirement is understood to have been met upon instruction given by the Director General of Public Credit and National Treasury, Ministry of Finance and Public Credit, as provided by Article 18, Law 185 of 1995.

9

LET IT BE PUBLISHED, NOTIFIED AND EXECUTED

Bogotá, D.C. on OCT. 2, 2018

THE MINISTEROF FINANCEAND PUBLIC CREDIT

|

| [Signed] |

|

| ALBERTO CARRASQUILLA BARRERA |

APPROVED: Miguel Ángel Gómez / Juan Pablo Puerto

DRAFTED: Manuel Ruiz / Natalia Gomez

DEPARTMENT: Sub-Directorate, External Financing/Legal Matters Group

10

EXHIBIT B

NATIONAL COUNCILFOR ECONOMICAND SOCIAL POLICY

REPUBLIC OF COLOMBIA

PLANNING DEPARTMENT

FAVORABLE OPINION, FOR THE NATION

TO ENGAGE IN FOREIGN PUBLIC DEBT TRANSACTIONS

TO PRE-FINANCE, OR FINANCE, 2018 AND 2019 BUDGET ALLOCATIONS

FOR UP TO US$ 3 BILLION, OR EQUIVALENT IN OTHER CURRENCIES

Planning Department: SDS, SC, DDE, DIFP, OAJ

Ministry of Finance and Public Credit

Approved Version

Bogotá, D.C., July 14, 2016

11

CONPES

NATIONAL COUNCIL FOR ECONOMIC AND SOCIAL POLICY

Juan Manuel Santos Calderón

President of the Republic

General ® Oscar Adolfo Naranjo Trujillo

Vice-President of the Republic

| | |

Guillermo Abel Rivera Flórez Minister of the Interior | | María Ángela Holguín Cuéllar Minister of Foreign Affairs |

| |

Mauricio Cárdenas Santamaría Minister of Finance and Public Credit | | Enrique de Jesús Gil Botero Minister of Justice and Law |

| |

Luis Carlos Villegas Echeverri Minister of Defense | | Juan Guillermo Zuloaga Cardona Minister of Agriculture & Rural Development |

| |

Alejandro Gaviria Uribe Minister of Health & Social Welfare | | Griselda J Restrepo Gallego Minister of Labor |

| |

Germán Arce Zapata Minister of Mines and Energy | | Maria Lorena Gutierrez Botero Minister of Commerce, Industry & Tourism |

| |

Yaneth Giha Tovar Minister of Education | | Luis Gilberto Murillo Urrutia Minister of the Environment & Sustainable Development |

| |

Camilo Armando Sánchez Ortega Minister of Housing, City & Territory | | Juan Sebastián Rozo Rengifo Minister of IT & Communications |

| |

Germán Cardona Gutierrez Minister of Transport | | Mariana Garcés Córdoba Minister of Culture |

Luis Fernando Mejía Alzate

Director General, Planning Department

| | |

| Alejandra Corchuelo Marmolejo | | Santiago Matallana Méndez |

| General Sectoral Sub-Director | | Territorial Sub-Director |

12

EXECUTIVE SUMMARY

In accordance with Paragraph 2, Article 41, Law 80 of 19931 and Articles 2.2.1.3.1., 2.2.1.3.2. y 2.2.1.6, Decree 1068 of 2015,2 the present document submits to the consideration of CONPES - the National Council for Economic and Social Policy - and seeks a favorable opinion for the Nation to engage in transactions for the purpose of pre-financing, or financing, 2018 and 2019 budget allocations for up to US$3 Billion, or its equivalent in another currency. The purpose of the foregoing is to enable the Nation to initiate financing or pre-financing for 2018 and 2019 in a timely manner. In addition, with the request authorization the Colombian Government will have flexibility to optimize the use of financing sources and continue maintaining liquid and efficient yield curves.

Classification H63.

Key Words: Foreign Bonds, Financing, Nation, International, Issuance, Sovereign Debt, Debt Service..

| 1 | Establishing the Public Administration’s General Procurement Statutes. |

| 2 | Whereby the Finance and Public Credit Sector’s Sole Regulatory Decree was issued. It repealed Decree 1497 of 2002 and 3160 of 2011. |

13

TABLE OF CONTENTS

| | | | | | |

1. | | INTRODUCTION | | | 3 | |

| | |

2. | | BACKGROUND | | | 3 | |

| | |

2.1 | | Issuance of a 2027 Global Bond and Reopening of 2045 Global Bond | | | 4 | |

| | |

2.2 | | Re-opening 2027 Global Bond | | | 4 | |

| | |

3. | | JUSTIFICATION OF FUNDING NEEDS | | | 4 | |

| | |

4. | | MARKET CONTEXT | | | 5 | |

| | |

4.1 | | Global Macroeconomic Performance | | | 5 | |

| | |

4.2 | | United States | | | 7 | |

| | |

4.2.1 | | Macroeconomic Evolution | | | 7 | |

| | |

4.2.2 | | Interest Rates and Monetary Policy Expectations | | | 9 | |

| | |

4.3 | | Euro Zone | | | 12 | |

| | |

4.3.1 | | Macroeconomic Evolution | | | 12 | |

| | |

4.3.2 | | Monetary Policy and Interest Rates | | | 13 | |

| | |

4.4 | | Japan | | | 14 | |

| | |

4.4.1 | | Macroeconomic Evolution | | | 14 | |

| | |

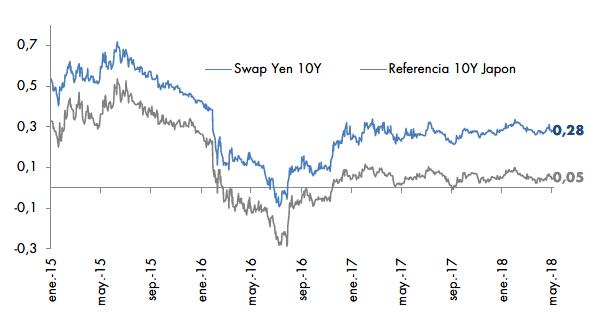

4.4.2 | | Monetary Policy and Interest Rates | | | 14 | |

| | |

4.5 | | Emerging Markets | | | 15 | |

| | |

4.5.1 | | Macroeconomic Evolution | | | 15 | |

| | |

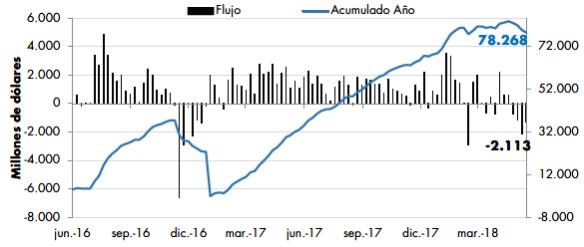

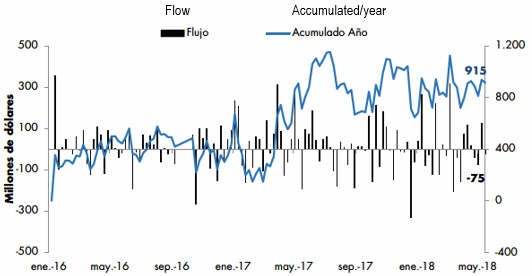

4.5.2 | | Investment Flow Toward Emerging Markets, and Market Performance | | | 16 | |

| | |

4.6 | | Colombia | | | 19 | |

| | |

4.6.1 | | Macro-Economic Performance | | | 19 | |

| | |

4.6.2 | | Colombia’s Recent Performance in International Markets | | | 20 | |

| | |

4.6.3 | | Issuance Strategy | | | 21 | |

| | |

5. | | OBJECTIVES | | | 23 | |

| | |

6. | | RECOMMENDATIONS | | | 23 | |

| | |

7. | | BIBLIOGRAPHY | | | 24 | |

i

| | | | |

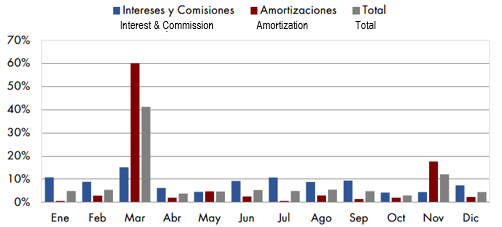

CHART INDEX | | | | |

| |

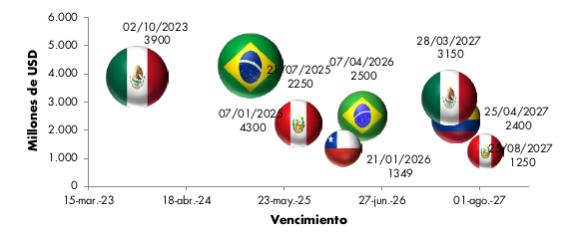

Graph 1. 2019 Monthly Debt Service | | | 5 | |

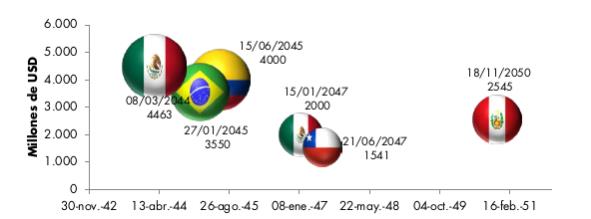

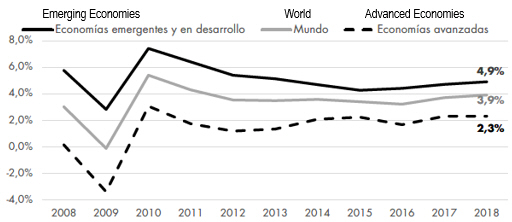

Graph 2. 2008-2017(a) Yearly World GNP Growth- | | | 6 | |

Graph 3. Oil Price Performance | | | 7 | |

Graph 4. USA-Unemployment and Inflation | | | 8 | |

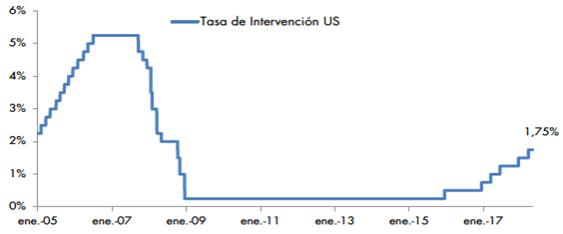

Graph 5. Federal Reserve Intervention Rate | | | 10 | |

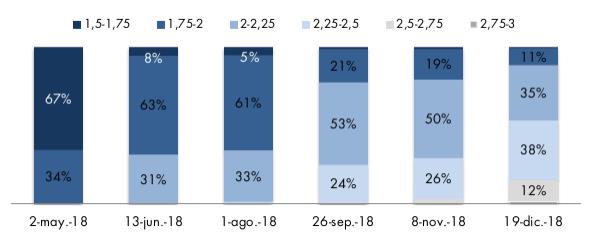

Graph 6. FED Reference | | | 10 | |

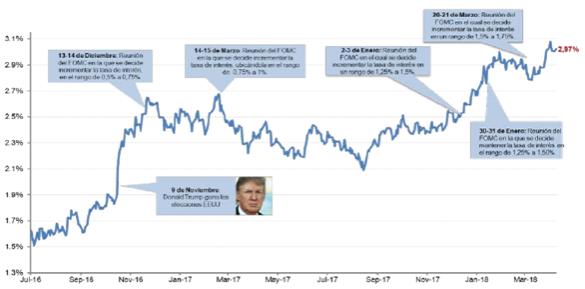

Graph 7. USA-10-Year Treasury Bonds | | | 11 | |

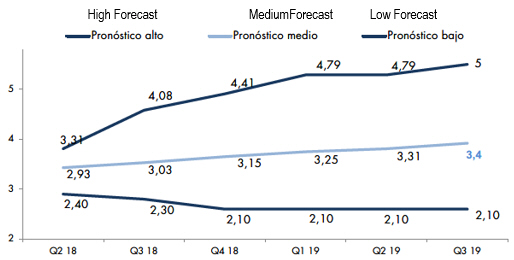

Graph 8. USA 10-Year Bond Forecast | | | 11 | |

Graph 9.USA 30-Year Treasury Bond Forecast | | | 12 | |

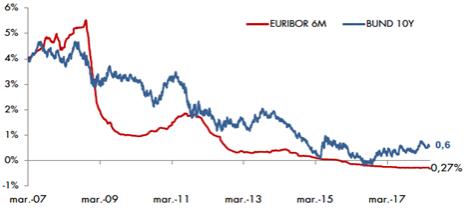

Graph 10. EURIBOR 6M Performance & 10-Year Germany Reference | | | 13 | |

Graph 11. Yen Swap Performance & 10-Year Japan Reference | | | 15 | |

Graph 12. Emerging Markets Cash Flow-Bonds (US$ million) | | | 17 | |

Graph 13. Colombia-Cash Flow-(US$ million) | | | 18 | |

Graph 14. EMBI 20215-2018 | | | 19 | |

Graph 15. Reference Bonds in Dollars; Differential on Treasury Bonds | | | 21 | |

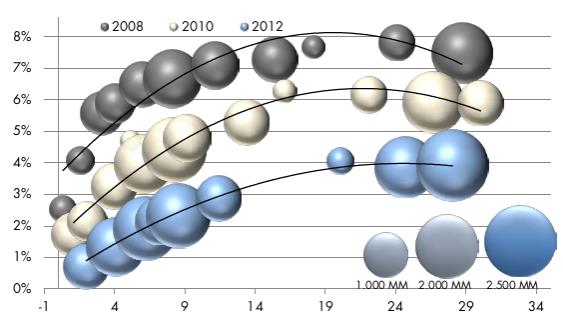

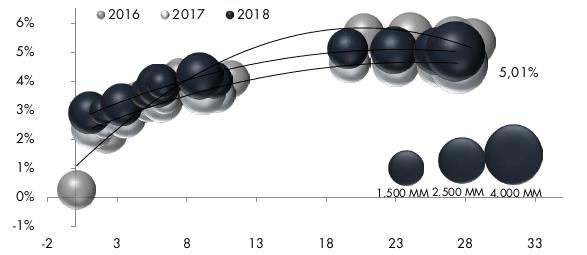

Graph 16. Evolution of Performance Curve-US$-2008/2018 | | | 21 | |

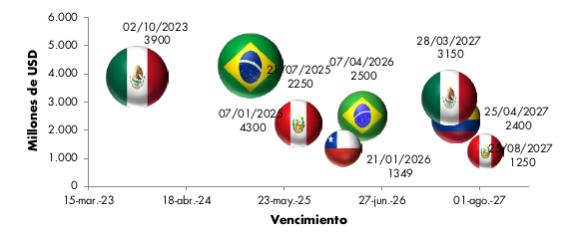

Graph 17. 10-Year Dollar Issuances-Latin American countries | | | 22 | |

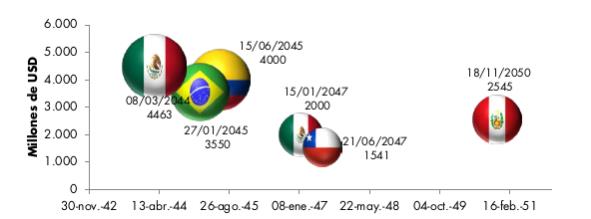

Graph 18. 30-Year Dollar Issuances-Latin American countries | | | 23 | |

1

ACRONYMS AND ABBREVIATIONS

| | |

CONPES | | Consejo Nacional de Política Económica y Social |

| |

COP | | Colombian Pesos |

| |

DANE | | National Administrative Statistics Department |

| |

DNP | | National Planning Department |

| |

EC | | European Commission |

| |

ECB | | European Central Bank |

| |

EMBI | | Emerging Markets Bond Index |

| |

EUR | | Euro |

| |

FED | | Federal Reserve System |

| |

FOMC | | Federal Open Market Committee |

| |

GNP | | Gross National Product |

| |

IMF | | International Monetary Fund |

| |

JPY | | Japanese Yen |

| |

NAFTA | | North America Free Trade Agreement |

| |

OCDE | | Organization for Economic Cooperation and Development |

| |

OPEC | | Organization of Petroleum Exporting Countries |

| |

USA | | United States of America |

| |

US$ | | US Dollar |

| |

VAT | | Value Added Tax |

| |

WTI | | West Texas Intermediate |

2

INTRODUCTION

The present document is submitted to the consideration of the National Council for Social and Economic Policy (CONPES) for the purpose of obtaining a favorable opinion for the Nation to engage in transactions related to foreign public credit, in order to pre-finance or finance fiscal years 2018 and 2019 for up to US$ 3 Billion, or equivalent in another currency. The foregoing in accordance with the provisions in Paragraph 2, Article 413, Law 80 of 1993, and Articles 2.2.1.3.14, 2.2.1.3.25 and 2.2.1.66 of Decree 1068 of 2015.

Thus, the Nation will be able to pre-finance or finance the 2018 or 2019 budget in a timely manner. Also, the Government will have the required flexibility to optimize the use of funding sources whilst maintaining efficient and liquid yield curves.

The present document is divided into six main sections, including this Introduction. Section Two is a background, specifically relating to issuances made by Colombia. Section Three justifies the need for funding in 2018 and 2019. Section Four presents a market context, particularly the performance of the US economy, the Euro zone, and the emerging markets, as well as the performance of the Colombian economy in international markets. Section Five presents the objectives outlined in the document. Section Six sets forth recommendations to CONPES.

| 3 | “Section 41, Paragraph 2. Public Credit Transactions. Notwithstanding the provisions of special laws, for the purposes of this law public credit transactions are transactions intended to provide the Entity with payable term resources, including loans; the issuance, underwriting and placement of bonds and securities; supplier credits; and guarantees granted for State entity obligations. |

| (...) | The authorization by the Ministry of Finance and Public Credit, and prior favorable opinion by CONPES and the National Planning Department, will be required for State entities to manage and execute any foreign credit transaction and related similar transactions; and for the Nation and decentralized entities to execute any internal public credit transaction and related transactions; as well as for the Nation to grant a guarantee. |

| (...) | In any case, external public credit operations executed and guaranteed by the Nation, beyond a one-year term, shall require a prior opinion by the Public Credit Inter-parliamentary Commission [Comisión Interparlamentaria de Crédito Público.] |

| (...) | Any transactions referred to in this article to be executed abroad shall be subject to the jurisdiction agreed upon in the contract. |

| 4 | “Section 2.2.1.3.1. Public Debt Securities. Bonds, and any other credit securities with a redemption term, issued by state agencies are Public debt securities. |

Any security issued by a credit institution, insurance company, or other State financial entity, in relation to transactions in the ordinary course of their own corporate activities are not considered public debt securities.

The placement of public debt securities shall be subject to the general financial conditions stipulated by the Board of the Central Bank.”

| 5 | “Section 2.2.1.3.2. - The Nation’s Public Debt Securities. The issue and placement of public debt securities on behalf of the Nation shall require an authorization given by a Ministry of Finance and Public Credit resolution, which may be granted once the following has been obtained: |

| a) | A favorable Opinion by CONPES; and b) An Opinion by the Public Credit Commission for foreign public debt with a term exceeding one year.” (Emphasis added.) |

| 6 | “Section 2.2.1.6. Issuance of Authorizations and Opinions. To issue the relevant opinions and authorizations CONPES, the National Planning Department, and the Ministry of Finance and Public Credit shall make sure that the respective transactions comply, among others, with Government policy on matters of public credit, and with the Macroeconomic Program and Financial Plan approved by CONPES and the Fiscal Policy Council (CONFIS). |

Opinions by CONPES and the National Planning Department, when applicable, shall be issued based on the relevant entity’s technical, economic and social project justification, capacity for implementation, financial situation, funding plan through resources, and yearly expenditure schedule.”

3

BACKGROUND

Through CONPES Document 3865, approved on October 2, 2014, the Nation received a favorable opinion to engage in transactions related to foreign public credit to pre-finance or finance 2017 and 2018 budget allocations, up to the sum of US$ 3 Billion, or its equivalent in another currency. Under this quota, the Nation carried out to foreign market transactions: the first one on January 18, 2017, issuing a 2027 Global Bond for US$ 1 Billion, and reopened the 2045 Global Bond for US$ 1.5 Billion, for a total of US$2.5 Billion. For this issuance there was also an authorized, unused quota of US$900 million, through document CONPES 3842—Favorable Opinion to the Nation to Issue Foreign Bonds for up to US$ 3 Billion, or its equivalent in another currency, in order to pre-finance or finance 2016 and 2017 budget allocations, approved on August 4, 2015. The second transaction was the reopening of the 2027 Global Bond, for the amount of US$1.4 Billion.

Issuance of a 2027 Global Bond and Reopening of 2045 Global Bond

On January 18, 2017, the Nation issued a Global Bond due April 2027 for US$ 1 Billion, 4.042%, and 3.875% coupon; and reopened a Global Bond due June 2045 for the sum of US$ 1.5 billion, at 5.164% and a 5.000% coupon. This transaction reached a greatest demand record in the history of Colombia’s long-term financing, US$ 8.500 million, and participation by 224 institutional investors from Europe, USA, Latin America and Asia.

After the transaction a 1.4 billion quota was available, or equivalent in another currency, pertaining to CONPES Document 3865, to pre-finance or finance budget allocations for 2017 and 2018.

Re-opening 2027 Global Bond

On August 2, 2017, the Nation reopened a US$ Global Bond, due in 2027 for US$ 1.4 billion at a rate of 3.816%. The transaction had the largest demand in the Nation’s latest 10 years’ transactions. Total orders received were approximate US$ 5.6 billion, with the participation of 236 accounts from the US, Europe, Latin America and Asia.

With the aforementioned issuance, the Nation completed its foreign financing needs in the international markets of capital for 2017, and pre-financed US$900 million of its requirements. Once the transaction was over, there was a US$ 5 million, or equivalent in another currency, related to CONPES Document 3865. Thus, it is important for the Nation to have the flexibility to pre-finance and/or finance its obligations for 2018 and 2019.

JUSTIFICATION OF FUNDING NEEDS

The Nation has maintained a proactive management in order to ensure the necessary resources to service foreign debt, foreseeing adverse changes in market conditions. This management is more important in the context of the current highly uncertain, volatile market, even more so when the annual foreign financing needs, through the issuance of bonds, have represented more than half of the Nation’s foreign needs in the last few years.7

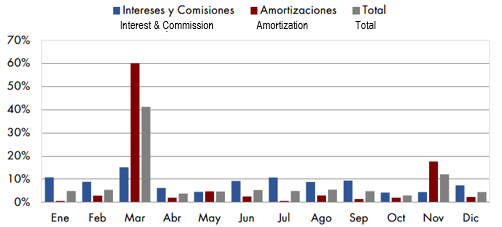

In 2019, foreign debt amortization will be approximately US$ 3.471 Billion, concentrated mainly in March due to the maturity of the 2019 Global Bond. In addition, foreign interest projection is approximately US$2.499 billion for January, March and July (Table 1.)

| 7 | In the 2014-2017 period, foreign debt payments were US$ 21.557 Billion, of which 58% were resources obtained through bond issuance. |

4

Chart 1. 2019 Monthly Debt Service, as a Percentage of Total

Source: Projection by Sub-Directorate for Risk, Ministry of Finance and Public Credit (2018).

Note: Projected figures to December 2019.

Bearing in mind that there will be a change in Administration in 2018, it is important to allow greater flexibility in terms of financing options so that, in the event of any macroeconomic or market change at a global level, the financing plan may be reconstructed in light of the circumstances.

Thus, considering that there will be a relatively high amount of amortizations and interest in the first three months of 2019, and also that the new administration may want to recompose its financing sources, it is important for the Nation to have flexibility and room to maneuver, to: (i) refinance and / or finance 2018 and 2019 allocations; (ii) achieve timely access to international markets; (iii) obtain financing on favorable terms; and (iv) comply with the strategic objective of building liquid and efficient curves.

MARKET CONTEXT

This section presents the market context, in particular the behavior of the US economy, the Euro zone and emerging markets, as well as the performance of the Colombian economy in international markets. It is necessary to take into account the current international context in order to identify inherent risks in the Nation’s foreign financing; and bear in mind the flexibility required by the Ministry of Finance and Public Credit to fund itself in a context of increasing interest rates in the international market.

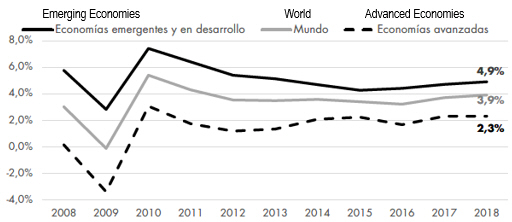

Global Macroeconomic Performance

During 2017, the dynamics of international financial markets were influenced by economic and political factors. First, developed economies showed positive growth data that favored expectations about a more contractive monetary policy, whose consolidation was moderated in principle by the low inflation levels present until the beginning of 2018. Second, the arrival of Donald Trump to the US presidency and his tax reform

5

proposal, the opening of Brexit negotiations, and various electoral processes in Europe, mainly in France, the Netherlands, the United Kingdom and Germany, among others, kept political uncertainty at high levels, which affected medium and long term performance projections (Graph 2.)

Chart 2. 2008-2017(a) Yearly World GNP Growth

Source: FMI Growth Bulletin-January 2018.

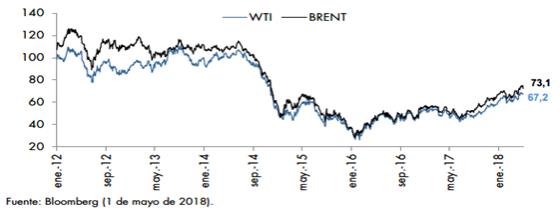

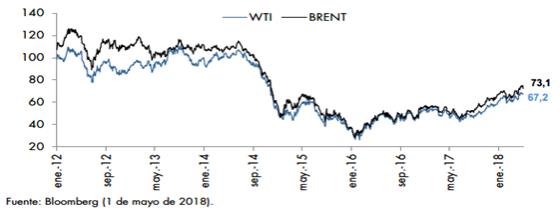

During 2017, in the energy context, West Texas Intermediate (WTI) and Brent oil prices increased approximately by 12% and 17%, respectively. Their average price was close to US$ 51 and US$ 55 per barrel, after reaching a minimum in June 2017, with values of US$ 43 and US$ 45 per barrel, respectively.8 This behavior was mainly due to growth in world demand and cuts agreed by the Organization of Petroleum Exporting Countries (OPEC) and other producers.

So far in 2018, WTI and Brent prices have been placed an average of US$ 64 and US$ 69 per barrel, respectively. The increase has been stable due to a better global growth outlook, meteorological phenomena in the United States and Europe in the last three months, a possible extension of the OPEC agreement to limit oil production until the first half of 2019, and geopolitical tensions in the Middle East (Chart 3.)

| 8 | Bloomberg - WTI and Brent Reference Prices (May 1, 2018.) |

6

Chart 3. Oil Price Performance

Finally, in line with the best international economic environment, monetary policies worldwide have been changing as economies recover. Market expectations about the trajectory of the FED rates have changed since August 2016, which was reflected in the anticipated increase in rates in December 2016 and gradual increases of 2017 and 2018, an upward trend that is expected to continue during 2018 and 2019.9 On the other hand, in England the Central Bank at its meeting in November 2017 raised its monetary policy rate for the first time since 2008 in view of the region’s economic recovery, and above target inflation driven by the depreciation of the pound sterling. Likewise, as of January of this year, a reduction in net asset purchases began.10

For its part, the European Central Bank intends to keep intervention rates at historically low levels until the quantitative expansion ends.11 In Asia, the Bank of Japan maintained its stable monetary policy and offered a slightly more optimistic view of price expectations, which underscores its belief that the economy is moving towards its 2% target inflation.

United States

Macroeconomic Evolution

For the first 2017quarter, the US gross domestic product (GDP) grew at an annual rate of 0.7% according to a first review in April 2017. This figure was the lowest for the first quarter in three years; well below the 1.1% expected by analysts after recording a 2.1% in the fourth quarter of 2016. This phenomenon was mainly due to the fact that consumer spending fell to its lowest level in eight years, with a contribution of only 0.03% to GDP, while spending on services was the lowest in four years and durable goods orders had the lowest level since 2011. On the other hand, defense spending contracted by 4%, its worst performance in four years, generating a drop in federal government spending by 1.7%, the lowest quarterly result in almost four years. Although the figure was then revised upwards and stood at 1.4%, the figure is still lower than the 2.1% growth registered between October and December in the previous year.

Subsequently, in the second quarter of 2017, the US economy grew by 3.1%; higher than the expected 3.0%. The GDP progress between April and June far exceeded the previous quarter’s figure. According to a report released by the Department of Commerce, consumer spending, which accounts for two thirds of economic activity in the United States, rose between April and June by 3.3%. On the other hand, company

| 9 | IMF. World Economy Perspective (January 2018.) |

| 10 | IMF. World Economy Perspective (January 2018.) |

| 11 | Quantitative easing is a stimulus program whose main element is the purchase of public debt as an investment by a central bank. |

7

investments showed a 8.8% growth. The foreign sector also contributed with an increase of 3.5% in exports, compared to an increase of 1.5% in imports. For the third quarter of 2017, US GDP growth was 3.2%, despite the fact that analysts had forecast 3.3%. This behavior was driven by a lower increase in consumer spending, which grew 2.2%, compared to an expected 2.3%.

The US economy’s progressive recovery continued in the last quarter of 2017 with a 2.9% growth, relatively in line with previous quarters, largely thanks to an increase in external demand and the impact of tax reform; particularly, the reduction of taxes paid by companies and the provisional authorization to account for the investment as an expense. This acceleration, in accordance with the International Monetary Fund (IMF) expectations, will have continuity in 2018 (2.7%) and 2019 (2.5%)12, due to the fundamental solid features of the American economy: non-dependence on public spending, great investment contribution, increased consumption (which expected to grow at 3.0% levels in the coming years) favored by an evolution in the labor market and stronger industrial production.

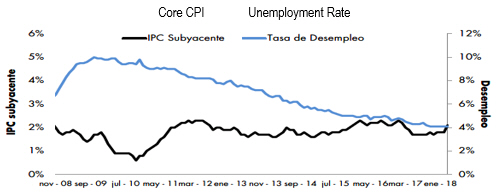

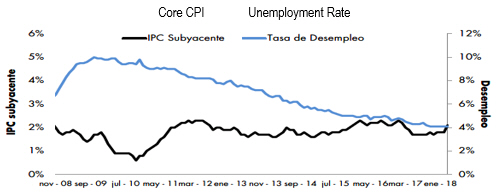

For January 2018, job creation continues to be strong. The lowest unemployment rate was reached in about 17 years (4.1% annual average), with the private sector as the main generator of employment. On the other hand, accumulated inflation was 2.1%, 10 basis points higher than the FED target, which is 2%, and 20 basis points above the consensus of analysts who expected a cumulative 1.9 %. However, January’s figure for this indicator does not represent any change compared to the previous month, while 12-month inflation13 for the United States in December 2017 was also 2.1%. In addition, annual inflation without food or energy for the month of February 2018 was 1.8%, just 10 percentage points higher than what the market expected and still lower than the long-term goal. In conclusion, labor market behavior and inflation are indicators that should be monitored to anticipate possible increases in US reference rates (Graph 4).

Chart 4. USA - Unemployment and Inflation

Source: Bloomberg (May 1, 2018).

Note: Core CPI is defined as an index that does not take into account energy or food products.

| 12 | IMF - World Economy Perspective (January 2018.) |

| 13 | 12-month inflation: percentage change with respect to inflation 12 months ago. |

8

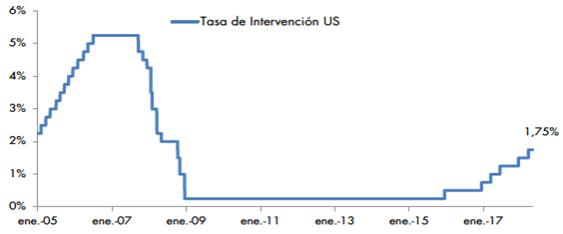

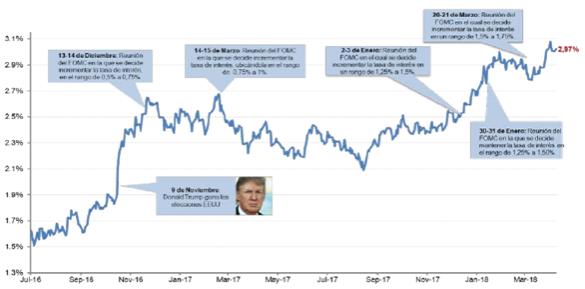

Interest Rates and Monetary Policy Expectations

At the FOMC meeting in April 2017, a raise in interest rate again by 25 basis points was decided, to a range between 0.75% - 1%. It was the third increase, after increases in December 2015 and 2016, each of 25 basis points. This increase was mainly due to: (i) a continuous strengthening of the labor market, together with a moderate expansion of economic activity; (ii) expectations that inflation will stabilize around the (2%)target range in the medium term; and (iii) expectations of a continuous increase in household spending14.

Subsequently, and in line with what was established in April, at the June meeting the committee decided to raise the target range of its reference rate, , for the fourth time, to a range between 1% and 1.25%, due to an improvement, albeit moderate, in labor market and economic. Consequently, the committee decided to maintain the reference rates unchanged at the July and September meeting, evidencing in the published minutes a concern about a stagnation of inflation. Likewise, they reiterated that the next rate movement will depend to a large extent on the progress of inflation toward the 2% target15.

The July minutes also reported that balance reduction would begin in October 2017, through a decrease of US$ 4.5 billion. The program would start with a monthly US$ 6,000 million in US Treasury bonds, an amount that will increase by US$ 6,000 million in three-month intervals for 1 year until reaching US$ 30,000 million per month. For mortgage-backed debt assets, the reduction will initially be US$ 4,000 million per month, an amount that will increase by another US$ 4,000 million in quarterly intervals for 1 year to add up to US$ 20,000 million per month.

At the December 2017 meeting, as expected by the markets, the FOMC raised reference rates by 25 basis points, reaching a range of 1.25%-1.50%, under the argument that the committee is still hoping that the progressive adjustments of monetary policy, economic activity and labor market conditions remain strong16.

Finally, at its last meeting on March 21, 2018, the FOMC decided to raise the reference rate by 0.25% to be in the range of 1.50%-1.75% (Graph 5). At a press conference, Jerome Powell, FED President, stressed that labor market remains strong, the economy continues to expand and inflation seems to be moving towards the FOMC’s 2% target in the longer term. He also clarified that raising rates too slowly would increase the risk that monetary policy would have to adjust abruptly in the future, which could jeopardize economic expansion. He added that they want to prevent inflation from falling below the FED’s target, which could reduce the chances of counteracting an economic slowdown in the future17.

When stimulus reduction and an already effective increase in the FED rates materialize, there could be a steep rise in the US Treasury curve, generating higher indebtedness costs for emerging countries such as Colombia.

| 14 | Federal Reserve Press Release meeting. April 2017. |

htpps://www.federalreserve.gov/newsevents/pressreleases.htm

| 15 | Federal Reserve Press Release meeting. June 2017. |

htpps://www.federalreserve.gov/newsevents/pressreleases.htm

| 16 | Federal Reserve Press Release meeting. December 2017. |

htpps://www.federalreserve.gov/newsevents/pressreleases.htm

| 17 | Federal Reserve Press Release meeting. March 2018. |

htpps://www.federalreserve.gov/newsevents/pressreleases.htm

9

Chart 5. FED Intervention Rate

Source: Bloomberg (May 1, 2018.)

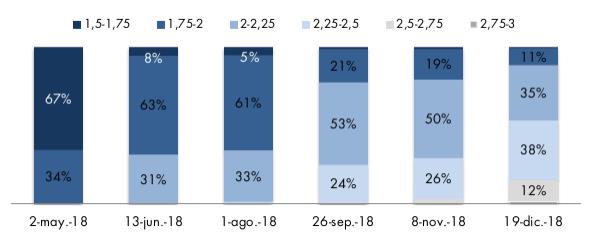

Taking into account an implicit probability of futures market behavior, it is expected, with a 72% probability, that the FED intervention rate will be maintained at the next meeting in late May 2018 (Graph 6). However, it is worth bearing in mind that the market expects between 2 and 3 rate increases in the following meetings, movements that, as explained by the committee members, would be linked to results in the labor market, US growth, and world economic performance.

Chart 6. FED Reference - Forecast Density

Source: Bloomberg Survey (May 1, 2018.)

As of May 2017, following the Fed’s announcement to increase reference rates, the treasury rate in the United States has shown a continuous increase of approximately 52 basis points (Chart 7).

10

Chart 7. USA 10-Year Treasury Bonds

Source: Bloomberg (May 1, 2018.)

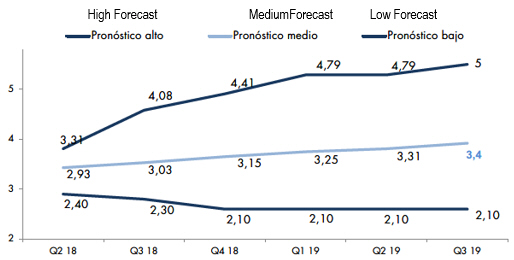

On the other hand, it is worth mentioning that the results of a survey carried out in March 2018 by Bloomberg and directed to analysts, on the rate yield forecasts of US Treasury securities at 10 years and 30 years, estimated 3.31% and 3.% average levels in the second quarter of 2019 for 10 years and 30 years respectively.

Chart 8. USA 10-Year Treasury Bonds Forecast

Source: Bloomberg Survey (May 1, 2018.)

11

Chart 9. USA 30-Year Treasury Bonds Forecast

Source: Bloomberg Survey (May 1, 2018.)

If economists’ projections materialize, the treasury curve will present upward pressures that will cause increases in financing cost for all agents, particularly sovereign and corporate issuers of emerging economies.

Euro Zone

Macroeconomic Evolution

According to a financial markets report by the Bank of the Republic of Colombia for the month of December 2017, in that year in the European continent there were several events of political uncertainty in Spain, the United Kingdom, Germany and Italy.

(i) In Spain, political tensions increased following the results of the referendum in Catalonia, which opened the door to a political process whose goal is to achieve regional independence. Given this news, there were devaluations in the Spanish stock market due to uncertainty regarding continuity of major Catalan banks in the European Union.

(ii) At the beginning of December there was a significant progress in the negotiations for the separation of the United Kingdom from the European Union. Points were established regarding financial costs, a commitment not to create a customs border between Ireland and Northern Ireland, and the rights of European Union citizens. This announcement strengthened the pound sterling.

However, and despite the uncertainty, according to the IMF report, the activity in 2018 and 2019 of the Euro Zone it is expected to continue to be stronger than expected, driven by higher growth in Poland and Turkey. These reviews reflect a favorable external environment, with easy financial conditions and a stronger export demand in Europe. Estimates expect GDP to grow 2.2% in 2018 and 2.0% in 2019. Growth would remain stable in Germany (2.3% in 2018 and 2.0% in 2019), Italy (1.4%) in 2018 and 1.1% in 2019), Spain (2.4% in 2018 and 2.1% in 2019), and France (1.9% in 2018 and 2019), according to the International Monetary Fund (2018)18. On the other hand, inflation could oscillate around current levels (1.3%), during the next months before rising again, while core inflation, i.e. inflation that does not include more volatile prices such as food and energy, remains tenuous, but will rise gradually in the medium term.

| 18 | For further Information, see: |

Htpps://www.imf.org/es/Publications/WEO/Issues/2018/01/11/world-economic-outlook-update-january-2018

12

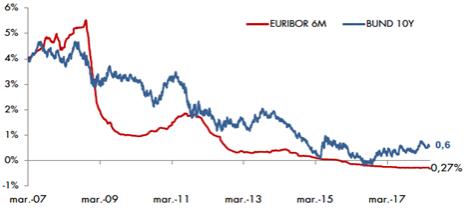

Monetary Policy and Interest Rates

At its December 2017 meeting, the European Central Bank (ECB) decided to expand its program for quantitative easing stimuli until September 2018, but to reduce the flow of purchases as of January 2018 from EUR 60,000 million up to EUR 30,000 million. Thus, the ECB will acquire a total of EUR 270,000 million until September 2018, an amount that turns out to be lower than the amount expected by the market. However, the ECB stated that it is willing to acquire assets beyond September if necessary, and also pointed out that any increase in the monetary policy rate would occur once its asset purchase program ends.19

In March 2018, the ECB ratified the decision to maintain stimuli and interest rates applicable to the main refinancing operations until September; the marginal credit facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40%, respectively. The Governing Council expects the official interest rates of the ECB to remain at current levels for a prolonged period that will far exceed the horizon of its net purchases of assets. This will contribute to favorable liquidity conditions and to an adequate orientation of the monetary policy.20

Indeed, the ECB’s expansionist policy’s conventional and unconventional measures kept the EURIBOR rate, as well as rates for sovereign bonds of some countries in the zone, at historically low levels during the end of 2015 and in a negative zone during 2016. However, in 2017 and until 2018, the markets, anticipating a possible progressive stabilization of monetary policies worldwide, generated an increase in the yield of German treasury bonds and market benchmarks (Graph 10). If this recovery continues, the financing costs for emerging countries in this market, and the American market, would increase.

Chart 10. EURIBOR 6M Performance and 10-year Germany Reference

Source: Bloomberg (May 1, 2018.)

| 19 | European Central Bank. Decisions on Monetary Policy. December 2017. |

Htpps://www.ecb.europa.eu/press/govcdec/mopo/2017/html/index.en.html

| 20 | European Central Bank. Decisions on Monetary Policy. March 2018. |

Htpps://www.ecb.europa.eu/press/govcdec/mopo/2017/html/index.en.html

13

Japan

Macroeconomic Evolution

The growth of Japan in 2017 was 2.1%, with a 2.7% reduction in unemployment rate, the second largest growth phase after World War II. Japan’s growth forecast was revised upwards by the IMF for 2018 (1.2%) and 2019 (0.9%), taking into account possible increases in external demand thanks to solid exports growth, a supplementary 2018 budget, and the effects of economic activity, which lately exceeded expectations21. Likewise, according to the Organization for Economic Cooperation and Development (OECD), employment is expected to peak in 2018 as the decline in working-age population accelerates.22

For its part, Japan’s Nikkei achieved a 19% annual valuation in 201723, supported by a solid global economy, a stable internal environment, and continuous expansionary policies by the Bank of Japan leading to a significant growth in the profits of listed companies.

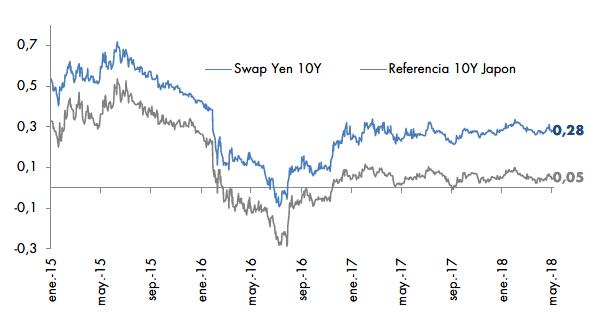

Monetary Policy and Interest Rates

As for monetary policy, in February 2018 the Government of Japan proposed the appointment of Haruhiko Kuroda for a second term as governor of the Bank of Japan, a position Kuroda assumed for the first time in March 2013, thus becoming a fundamental piece in expansive politics promoted by Japanese Prime Minister Shinzo Abe, known as Abenomics24.

The governor of the Bank of Japan declared that the institution will take into consideration the withdrawal of the stimulus measures applied since 2013, should the inflation rate reach the bank’s April 2019 target level25.

At the last meeting, the Bank of Japan’s committee decided to leave its monetary policy rate at 0.10%, maintained asset purchase at JPY 80 billion a year, and kept a return rate policy on the yield curve at 10 years close to 0%. However, the committee stressed that the Japanese economy is in a period of expansion26 (Graph 11.)

| 21 | IIMF. World Economy Perspective (January 2018.) |

| 22 | Republic’s Bank, Colombia, Report on Financial Markets (2017.) |

| 23 | Bloomberg (May 1, 2018.) |

| 24 | Reuters. BOJ will struggle to raise rates this year: ex-central banker Shirai. Htpps://www.reuters.com/article/us-japan-economu-boj/boj-will-sruggle-to-raise-this-year-ex-central-banker-shirai-idUSKCN1G50HM |

| 25 | Reuters. BOJ governor signals debate on conditions for stimulus exit. |

Htpps://www.reuters.com/article/us-japan-economy-boj-kurod/boj-governor-signals-debate-on-conditions-for-stimulus-exit-idUSKBN1IB0C3

| 26 | Reuters. RPT-BOJ keeps policy steady, removes timeframe for price goal. Htpps://www/reuters.com/araticle/japan-economy-boj/rpt-boj-keeps-policy-steady-removes-timeframe-for-price-goal-idUST9N1RW03X |

14

Chart 11. Yen Swap Behavior and 10-year Japan Reference

Source: Bloomberg (May 1, 2018.)

Emerging Markets

Macroeconomic Evolution

In its most recent report the IMF considers that the aggregate growth forecast for emerging markets and developing economies for 2018 and 2019 has not changed with respect to the previous year, but there are pronounced differences among the regions. Asia’s emerging economies will grow around 6.5% in 2018 and 2019; that is, at the same pace as in 2017. As for European emerging economies, whose growth in 2017 exceeded 5% according to the latest estimates, activity in 2018 and 2019 would be less dynamic than projected, 4.0% and 3 , 8%, respectively27.

In China, despite the fact that third quarter 2017 GDP showed an annual 6.8% growth, in line with market expectations, its monetary and financial authorities are concerned about high levels of corporate indebtedness and an accelerated growth of household debt. For this reason, the IMF forecasts that growth for 2018 and 2019 will gradually moderate to 6.6% and 6.4%, respectively, with a slight upward revision compared to the October IMF forecasts, thanks to a consolidation of external demand.28

As for Latin America, recovery is expected to be stronger, and growth to be 1.9% in 2018 and 2.6% in 2019, 0.2 percentage points higher than IMF October projections. This change is attributable to the improvement in Mexico’s outlook, which went from 2.0% in 2017 to 2.3% in 2018, in view of the expected benefits due to the strengthening of US demand. On the other hand, the consolidation of Brazil’s recovery, expected to grow 1.9% in 2018, the favorable effects of a rise in commodity prices, and the relaxation in financial conditions for some commodity-exporting countries also help.29. However, political uncertainty in the region increased during the last quarter of the year in most countries, especially Mexico, Brazil, Colombia and Peru.

| 27 | IMF. World Economy Perspective (January 2018.) |

| 28 | IMF. World Economy Perspective (January 2018.) |

| 29 | IMF. World Economy Perspective (January 2018.) |

15

In Mexico, uncertainty was mainly associated with the renegotiations of the North American Free Trade Agreement (NAFTA). In this regard, in the fourth round of negotiations, the US submitted conditions to the Mexico and Canada negotiating team that they could not accept, so a definitive agreement was impossible to reach. Additionally, federal elections increased political risk in the country. On the one hand, at the end of 2017 there were news about the current government being linked with a case of diversion of public resources. On the other hand, a percentage increase in opinion polls for Andrés Manuel López Obrador in the presidential election.

In Chile, uncertainty was centered on the December 2017 presidential elections. Although initially the market took Piñera’s victory for granted, after the first round elections Piñera (the market’s favorite candidate) did not obtain the percentage expected by surveys, increasing uncertainty about who would be Chile’s next president. This fact was supported by an increase in Guiller’s voting percentage in the polls days before the election. On December 17, 2017, once Piñera was known to be Chile’s president, uncertainty decreased because this candidate was associated with more pro-market policies.

In Peru uncertainty revolved around political instability which began in December 2017, after the first presidential interim period, and has become stronger after the President’s resignation on March 21, 2018. The decision was taken after videos were broadcast showing some congressmen, among them Kenji Fujimori, son of former president Alberto Fujimori, negotiating their votes with a legislator of the Popular Force party (grouping led by Keiko Fujimori), against the presidential vacancy in exchange for public works in their province.

After the resignation of President Pedro Pablo Kuczynski, the country is in the hands of the new president, Martin Vizcarra, with limited political support in Congress. The President faces several difficulties, such as: (i) generating measures to boost tax collection to face a current fiscal deficit in the country (3.2% of GDP); (ii) boost consumption, which could be achieved through greater private investment (which has decreased since December 2017 due to a first stage of political instability); and (iii) build trust and good expectations among businessmen and citizens.

In Brazil uncertainty revolved around the approval of a pension reform, which would reduce the country’s debt levels. At this point the government decided to postpone the vote on this reform to 2018, which was not appreciated by the market.

Investment Flow Toward Emerging Markets, and Market Performance

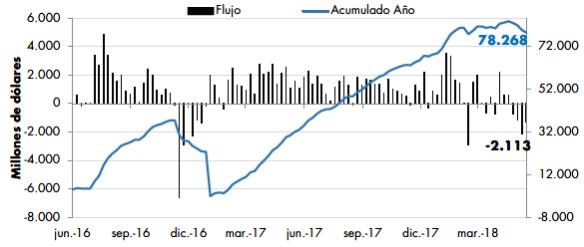

After a constant flow influx to emerging markets in 2017, in 2018 there was influx in the first months that caused the accumulated to be above US$80,000 million. However, in recent weeks, as a result of a deterioration in market perception, associated mainly with nervousness generated by the situation of countries such as Argentina and Turkey, as well as an increase in US Treasury rates, there have been capital outflows that lowered the accumulated to US$78,.268 million30 (Graph 12.)

| 30 | Itaú BBA (May 22, 2018.) |

16

Chart 12. Emerging Markets Cash Flow - Bonds (US$ million)

Source: Itaú BBA (May 22, 2018.)

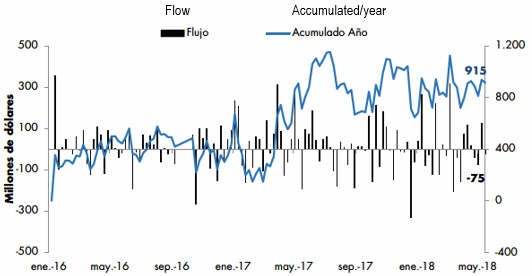

As for Colombia, the behavior of cash flow into the country was variable last year. However, it remains positive and accumulated US$ 915 million as of May 22, 2018 (Graph 13.)

17

Chart 13. Colombia - Cash Flow - Bonds (US$ million)

Source: Itaú BBA (May 22, 2018.)

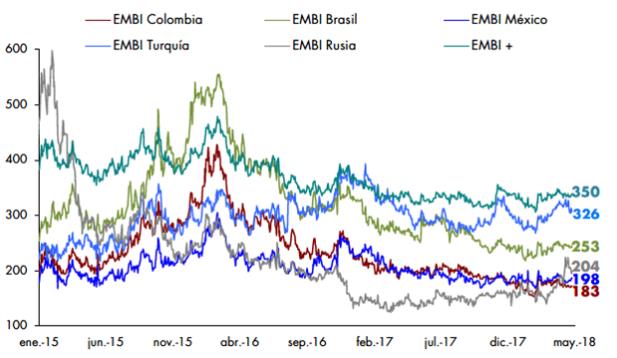

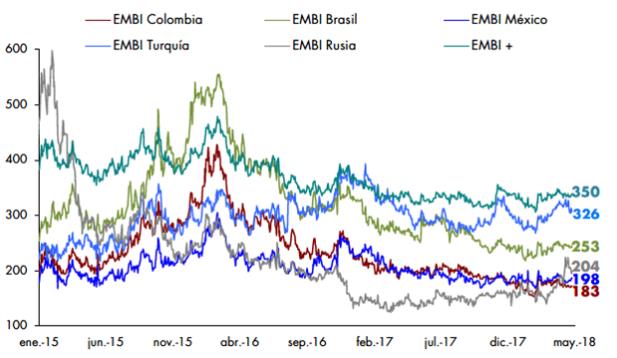

On the other hand, credit risk perception, represented by the market bond indicator (EMBI +) 31 was favorable for the region due to: (i) prospects of growth recovery in Brazil; (ii) recovery of raw material prices; and (iii) improvements in some economies in the region (Graph 14). On average, during the last year, the EMBIs for a sample of emerging countries decreased 16.5 basis points (8%), while the EMBI + increased 4 basis points (1.2%).

This favorable perception of the country in international markets, which has been in line with activity in the region, allows Colombia to be in a favorable position to take advantage of market windows and capture attractive financing rates.

| 31 | The index represents the difference between the interest rates of a basket of dollar bonds issued by emerging countries and a basket of US Treasury bonds with similar characteristics. |

18

Chart 14. EMBI 2015-2018

Source: JP Morgan (May 1, 2018.)

Colombia

Macro-Economic Performance

According to information by the National Administrative Department of Statistics (DANE), in 2017 GDP registered a 1.8% annual expansion. The figure shows a slight deceleration compared to 2016 (2.0%). The result of GDP growth was supported by a better performance of external demand, favorable international financial conditions and higher terms of trade, especially due to higher oil and coal prices.

Domestically, a decline in inflation contributed to maintaining the purchasing power of household income, despite the effect of an increase in Value Added Tax (VAT) and other indirect taxes on private consumption included in the tax reform.32 In addition, there was greater investment in public works and an acceleration of public consumption, which contributed positively to the growth of the Colombian economy. Thus, the increase in domestic demand accelerated in 2017, with a slight increase in the level of imports.

By 2018, a better economic performance of the country is expected, as well as an improvement in the terms of trade thanks to a recovery in oil prices which, together with an economic growth recovery of the main trading partners, can promote better performance of net Dollar exports, and accelerating the adjustment of current account deficit.

| 32 | The main changes in the Tax Reform contained in the 2016 Law 1819 are: (i) increase VAT from 16% to 19%; (ii) modify income taxes for individuals by creating a tax on dividends, with a 5% rate for persons receiving more than 18 million and 10% for those who receive more than 30 million. For their part, companies will have a single 33% income tax starting in 2019; (iii) generate mechanisms to promote formalization: monotax and presumptive costs for coffee production; and (iv) establish controls on tax evasion by the DIAN and penalizing tax evasion at a criminal level. |

19

Colombia’s Recent Performance in International Markets

Colombia managed to maintain a degree of investment, in a scenario where it showed a solid the economic policy, and was able to absorb one of the greatest trade shocks in the country’s history. On a fiscal front, the impact was mitigated with the approval of structural tax reform at the end of 2016, while the current account deficit was gradually adjusted, driven by exchange rate adjustments. However, rating agencies S & P and Moody’s alerted the country to a perspective of lower growth and a possible breach of fiscal rules.

In February 2017, Fitch Ratings increased Colombia’s outlook from negative to stable, given that the country has shown improvements in its macroeconomic balance, through the reduction of its current account deficit. Thus, uncertainty about fulfillment of fiscal goals is lower, and inflation expectations are converging to the target range established by the Republic’s Bank.

However, on December 11, 2017, the rating agency Standard & Poor’s lowered the country’s foreign currency debt rating to BBB-, the short-term foreign currency debt rating was also revised from A2 to A3, and the long-term local currency rating from BBB + to BBB. This adjustment was justified by uncertainty generated by elections, and doubts about the next government’s discipline in meeting fiscal targets starting 2019.33 On the other hand, the agency improved the rating outlook from “negative” to “stable”, which implies that there will be no further downward revisions in the near future.

Additionally, on February 22, 2018, Moody’s changed Colombia’s outlook from “stable” to “negative”, but ratified the long-term foreign currency Baa2 rating. The change in outlook was driven by: (i) an expectation of a lower rate of fiscal consolidation, and a weakening of fiscal metrics explained by lower growth and lower tax revenues than those contemplated in the Medium Term Fiscal Framework, and (ii) ) a risk that the next government may have a weak mandate, preventing it from adopting additional fiscal measures to preserve Colombia’s fiscal strength.34

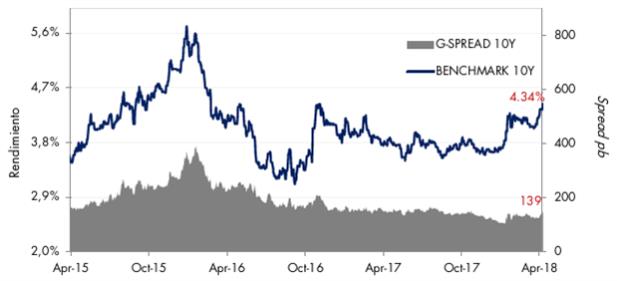

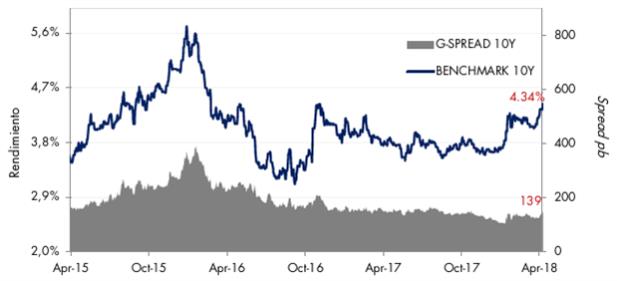

Despite the rating agencies’ actions, spreads against the benchmark US Treasury securities remain at stable levels, compared to recorded historical levels (Graph 15.) However, as stated above, given the possibility of additional increases in the US reference rate, treasuries could see increases in their listing levels, as evidenced in recent months. Consequently, issuance levels could increase significantly.

| 33 | Research Update: Colombia Foreign Currency Issuer Credit Ratings Lowered to ‘BBB/A-3’ On Weaker Policy Flexibility; Outlook Stable. |

| 34 | Rating Action: Moody’s changes Colombia’s rating outlook to negative; Baa2 ratings affirmed. |

20

Chart 15. Reference Bonds in Dollars; Differential on Treasury Bonds

Source: Foreign Financing Sub-Directorate, Ministry of Finance and Public Credit (May 1, 2018.)

Issuance Strategy

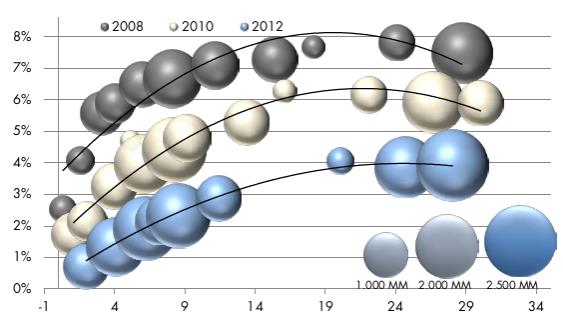

In the last years the Nation fulfilled its strategic goal of building liquid and efficient performance curves, maintaining adequate amounts in reference bonds (Graph 16.)

Chart 16. Performance Curve Evolution - US$ 2008-2018

21

Source: Bloomberg. Foreign Financing Sub-Directorate, Ministry of Finance and Public Credit (2018.)

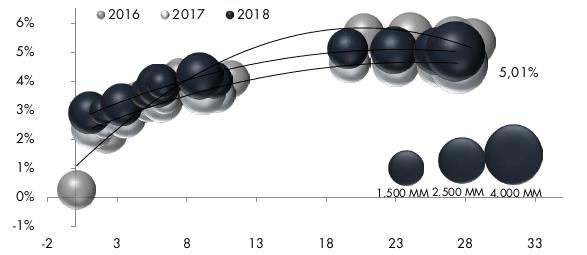

With respect to Dollar curves, during the last years Latin American emerging countries have been moving towards the creation of 30-year and 10-year benchmarks. Others, such as Mexico, have opted for 50-year and 100- year maturities. Likewise, they have focused on large issues that, in a context of expectations of an increase in interest rates, seek to guarantee that bonds have the necessary liquidity from their issuance, to avoid friction and protect the efficiency of their curve in the long term (Graphs 17 and 18.)

Chart 17. 10-Year Dollar Issuances - Latin American Countries

Source: Bloomberg. Foreign Financing Sub-Directorate, Ministry of Finance and Public Credit (2018.)

22

Chart 18. 30-Year Dollar Issuances - Latin American Countries

Due

Source: Bloomberg. Foreign Financing Sub-Directorate, Ministry of Finance and Public Credit (2018.)

Thus, it is essential for Colombia to have the capacity to issue reference bonds of representative size, in order not to sacrifice its liquidity, or create distortions in relative terms against the rest of the bonds on the curve; or, what would also be negative, compared to other Latin American countries’ bonds.

OBJECTIVES

| | • | | Guarantee that the Nation receives the authorization to issue foreign bonds well in advance in order to, first, not generate any market noise and; secondly, provide enough maneuvering space to carry out pre-financing or financing transactions to maintain a strong cash position for 2018 and 2019. |

| | • | | Have sufficient flexibility to use the most favorable financing source for the Nation, according to market conditions. |

| | • | | Access international markets in a timely and efficient manner, and continue to fulfill the Government’s strategic objective of constructing liquid and efficient performance curves. |

RECOMMENDATIONS

The Ministry of Finance and Public Credit and the National Planning Department recommend that the National Council of Economic and Social Policy (CONPES):

| | 1. | Issue a favorable Opinion for the Nation to engage in transactions related to foreign public credit to pre-finance and finance 2018 and 2019 budget allocations, up to the sum of US$ 3 billion, or its equivalent in another currency. |

23

BIBLIOGRAPHY

European Central Bank. Monetary Policy Decisions. (December 2017.)

European Central Bank. Monetary Policy Decisions. (December 2018.)

Bloomberg. WTI and BRENT Oil Reference Prices (May 1, 2018.)

International Monetary Fund. Perspective on World Economy. (January 2018.)

https://www.inf.org/es/Publications/WEP/Issues/2018/01/11/world-economic-outlook-update-january-2018

Itaú BBA. (May 22, 2018.) Colombia Cash Flow - Bonds.

Itaú BBA. (May 22, 2018.) Emerging Markets Cash Flow - Bonds.

JPMorgan (May 1, 2018.) Fixed income market indicator, emerging economies (EMBI.)

Minutes and Press Releases. Federal Reserve Monetary Policy.

htpps://www.federalreserve.gov/newsevents/pressreleases/monetary20180131a.html

Minutes European Central Bank:

htpps://www.ecb.europa.eu/press/pr/date/2018/html/ecb.mp180308.es.html

Report on Financial Markets - Bank of the Republic of Colombia (December 2017.)

Reuters. (February 2018.) BOJ will struggle to raise rates this year: ex central banker Shirai. Available at:

Htpps://www.reuters.com/article/us-japan-economy-boj-boj-will-struggle-to-raise-rates-this-year-ex-central-banker-shirai-idUSKCN1G50HM

Reuters (April 2018.) RPT-BOJ keeps policy steady, removes timeframe for price goal. Available at:

htpps:/wwww.reuters.com/article/us-japan-economy-boj/rpt-boj-keeps-policy-steady-removes-timeframe-for-price-goal-idUST9N1RW03X

Reuters (May 2018.) BOJ governor signals debate on conditions for stimulus exit. Available at:

htpps:/wwww.reuters.com/article/us-japan-economy-boj-kuroda/boj-governor-signals-debate-on-conditions-for-stimulus-exit-idUSKBN11B0C3

24

EXHIBIT C

| | | | |

| | MINISTRYOF FINANCE | | All for a New Country |

| | | | Peace Equity Education |

THE UNDERSIGNED, TECHNICAL SECRETARY TO THE

PUBLIC CREDIT INTERPARLIAMENTARY COMMITTEE

[COMISIÓN INTERPARLAMENTARIA DE CRÉDITO PÚBLICO]

ATTESTS:

That in the June 6, 2018 and June 14, 2018 sessions, the Public Credit Inter-Parliamentary Committee unanimously issued a sole, favorable opinion to the Nation - Ministry of Finance and Public Credit - to carry out Foreign Public Debt Transactions for up to US$ 3 Billion, or its equivalent in other currencies, intended to pre-finance and/or finance budgetary allocations for fiscal year 2019.

Sincerely,

[Signed]

JUAN PABLO PUERTO REYES

Technical Secretary

Bogotá, D.C., June 14, 2018.

Carrera 8 No. 6 C 39 Bogotá D.C., Colombia

Código Postal 111711

Conmutador (57 1) 381 1700

atencioncliente@minhacienda.gov.co

www.minhacienda.gov.co

24