Global Bond 2031 Issuance, Global Bond 2051 Issuance

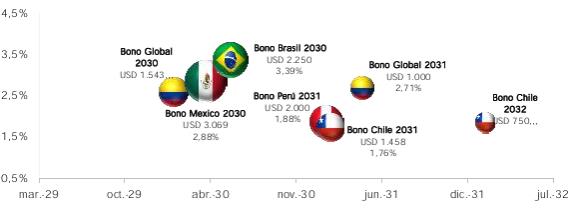

On June 1, 2020, the Nation issued a Global Bond maturing in April 2031 for an amount of US$ 1,000 million at a rate of 3.165% and coupon of 3.125%, and issued a Global Bond maturing in May 2051 for an amount of US$ 1,500 million at a rate of 4.202% and coupon of 4.125%. This transaction, to finance Budgetary allocations for the 2020 period, achieved an unprecedented demand, when orders were received for a total of US$ 13.3 billion and had the participation of institutional investors from the United States, Europe, Asia and Latin America.

As previously mentioned, this transaction was executed based on the authorizations granted by Article 6 of Legislative Decree 519 of April 5, 2020 and Article 1 of Resolution 1067 of 2020 of the Ministry of Finance and Public Credit, for which reason it did not affect the quota granted in CONPES Document 3967 approved in 2019.

Thus, once the transaction was completed, the same available quota of US$ 1,671,464,000 or its equivalent in other currencies, of the resources approved in CONPES Document 3967 of 2019, to pre-finance or finance Budgetary allocations for the 2020 and 2021 terms.

Global Bond 2061 Issuance, Reopening Global Bond 2031, and Partial Repurchase of Global Bonds 2021, 2024 and 2027

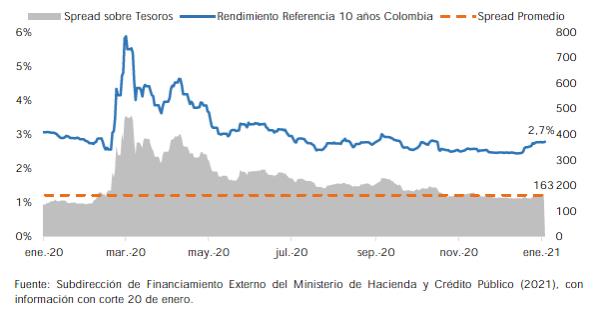

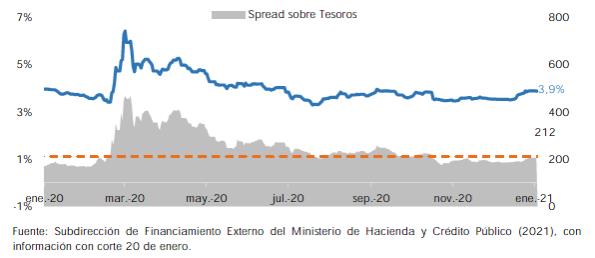

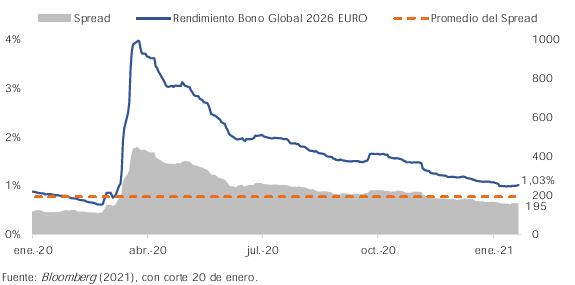

On January 12, 2021, the Nation issued a Global Bond maturing in February 2061 for an amount of US$ 1,300,000,000 at a rate of 3.990% and a coupon of 3.875%, becoming the longest-term security with the lowest coupon rate in history at the long end of the dollar curve; and made the reopening of the Global Bond maturing in April 2031 for an amount of US$ 1,539,952,000 at a rate of 2,800% and coupon of 3.125%. Of the latter, US$ 1,228,468,000 were part of a debt management transaction, consisting of the partial substitution of the Global Bonds maturing in 2021, 2024 and 2027 by the Global Bond 2031, as shown in Table 3.

Table 3 - Results of Debt Management Transaction

| | | | | | |

Características | | Bono Global 2021 | | Bono Global 2024 | | Bono Global 2027 |

Nominal recomprado | | USD 191.422.000 | | USD 533.738.000 | | USD 503.308.000 |

Vencimiento | | 12 de julio del 2021 | | 26 de febrero del 2024 | | 25 de abril del 2027 |

Cupón | | 4,375% | | 4,000% | | 3,875% |

Precio de recompra | | 101,928% | | 108,150% | | 110,900% |

Fuente: Ministerio de Hacienda y Crédito Público (2021), con información de la Subdirección Financiamiento Externo.

With this transaction, needs for 2021 were financed for a nominal amount of US$ 1,611,484,000. The financing transaction and debt management transaction extended the average life of the foreign bond portfolio from 13.5 years to 14.8 years and lowered the average coupon from 5.02% to 4.93%.

After the transaction, a quota of US$ 59,980,000 or its equivalent in other currencies remained available from the resources approved in the CONPES Document 3967 approved in 2019. This quota is insufficient to finance the Budgetary needs for 2021 and limits the flexibility to finance and/or pre-finance 2022 obligations, which is why it is necessary to expand the current available quota.

18