UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-7139

Fidelity Hereford Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | October 31, 2012 |

Item 1. Reports to Stockholders

Fidelity® Government

Money Market

Fund

Semiannual Report

October 31, 2012

(Fidelity Cover Art)

Contents

Shareholder Expense Example | An example of shareholder expenses. | |

Investment Changes/Performance | A summary of major shifts in the fund's investments over the past six months and one year. | |

Investments | A complete list of the fund's investments. | |

Financial Statements | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. | |

Notes | Notes to the financial statements. | |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2012 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2012 to October 31, 2012).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Shareholder Expense Example - continued

| Annualized | Beginning | Ending | Expenses Paid |

Actual | .20% | $ 1,000.00 | $ 1,000.05 | $ 1.01** |

Hypothetical (5% return per year before expenses) |

| $ 1,000.00 | $ 1,024.20 | $ 1.02** |

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

** If certain fees were not voluntarily waived by Fidelity Management & Research Company (FMR) or its affiliates during the period, the annualized expense ratio would have been .42% and the expenses paid in the actual and hypothetical examples above would have been $2.12 and $2.14, respectively.

Semiannual Report

Investment Changes/Performance (Unaudited)

Effective Maturity Diversification | |||

Days | % of fund's | % of fund's | % of fund's |

1 - 7 | 58.9 | 65.5 | 51.0 |

8 - 30 | 9.1 | 1.6 | 12.7 |

31 - 60 | 6.1 | 1.0 | 12.1 |

61 - 90 | 4.8 | 4.1 | 6.5 |

91 - 180 | 10.1 | 18.0 | 8.8 |

> 180 | 11.0 | 9.8 | 8.9 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity | |||

| 10/31/12 | 4/30/12 | 10/31/11 |

Fidelity® Government Money Market Fund | 53 Days | 54 Days | 53 Days |

Government Retail Money Market Funds Average* | 49 Days | 48 Days | 46 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life | |||

| 10/31/12 | 4/30/12 | 10/31/11 |

Fidelity® Government Money Market Fund | 92 Days | 58 Days | 68 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

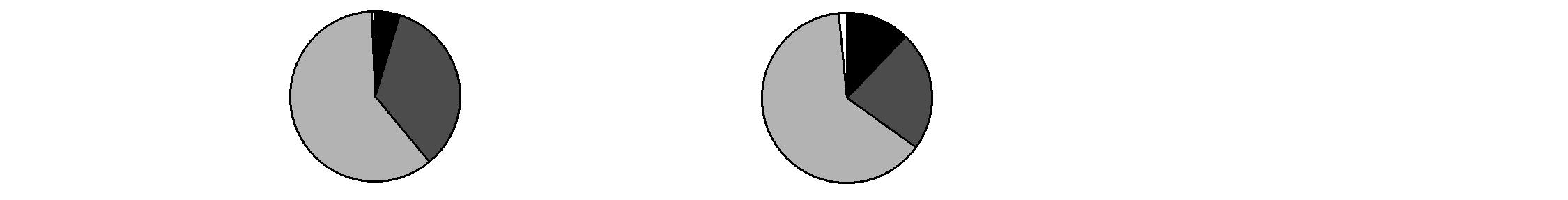

Asset Allocation (% of fund's net assets) | |||||||

As of October 31, 2012 | As of April 30, 2012 | ||||||

| Treasury Debt 4.6% |

|  | Treasury Debt 12.1% |

| ||

| Government |

|  | Government |

| ||

| Repurchase |

|  | Repurchase |

| ||

| Net Other Assets (Liabilities) 0.6% |

|  | Net Other Assets (Liabilities) 1.5% |

| ||

* Source: iMoneyNet, Inc.

† Includes Federal Financing Bank Supported Student Loan Short-Term Notes.

Semiannual Report

Investment Changes/Performance (Unaudited) - continued

Current and Historical Seven-Day Yields |

| 10/31/12 | 7/31/12 | 4/30/12 | 1/31/12 | 11/1/11 |

Fidelity Government Money Market Fund | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

Yield refers to income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending October 31, 2012, the most recent period shown in the table, would have been -0.18%.

Semiannual Report

Investments October 31, 2012 (Unaudited)

Showing Percentage of Net Assets

Treasury Debt - 4.6% | ||||

|

| Yield (a) | Principal | Value |

U.S. Treasury Obligations - 4.6% | ||||

U.S. Treasury Bills | ||||

| 12/20/12 | 0.15% | $ 35,000,000 | $ 34,992,854 |

U.S. Treasury Notes | ||||

| 11/15/12 to 8/31/13 | 0.13 to 0.24 | 261,000,000 | 261,283,889 |

TOTAL TREASURY DEBT | 296,276,743 | |||

Government Agency Debt - 34.4% | ||||

| ||||

Federal Agencies - 34.4% | ||||

Fannie Mae | ||||

| 11/19/12 to 9/11/14 | 0.18 to 0.24 (b) | 266,051,000 | 266,913,114 |

Federal Farm Credit Bank | ||||

| 11/29/12 to 8/12/14 | 0.14 to 0.35 (b) | 85,000,000 | 85,005,120 |

Federal Home Loan Bank | ||||

| 11/1/12 to 5/15/14 | 0.16 to 0.28 (b) | 1,464,415,000 | 1,466,503,319 |

Freddie Mac | ||||

| 11/2/12 to 11/27/13 | 0.15 to 0.23 (b) | 390,349,000 | 391,720,863 |

TOTAL GOVERNMENT AGENCY DEBT | 2,210,142,416 | |||

Government Agency Repurchase Agreement - 56.7% | ||

Maturity |

| |

In a joint trading account at 0.34% dated 10/31/12 due 11/1/12 Collateralized by (U.S. Government Obligations) # | $ 2,867,777,216 | 2,867,750,000 |

With: | ||

Barclays Capital, Inc. at: | ||

0.19%, dated 10/23/12 due 11/1/12 (Collateralized by U.S. Government Obligations valued at $19,380,922, 3.5% - 4%, 2/1/42 - 9/1/42) | 19,000,903 | 19,000,000 |

0.25%, dated 10/30/12 due 11/6/12 (Collateralized by U.S. Government Obligations valued at $19,380,270, 3.5%, 5/1/42 - 9/1/42) | 19,000,924 | 19,000,000 |

0.35%, dated 10/31/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $10,200,100, 3.5% - 4%, 9/1/37 - 8/1/42) | 10,000,681 | 10,000,000 |

Government Agency Repurchase Agreement - continued | ||

Maturity | Value | |

With: - continued | ||

BNP Paribas Securities Corp. at 0.25%, dated: | ||

10/16/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $17,341,927, 2.17% - 6.5%, 3/1/14 - 6/1/42) | $ 17,004,250 | $ 17,000,000 |

10/26/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $10,200,425, 2.39% - 7%, 6/1/14 - 1/1/42) | 10,003,125 | 10,000,000 |

Citibank NA at 0.24%, dated 10/30/12 due 11/5/12 (Collateralized by U.S. Government Obligations valued at $29,580,395, 2.5% - 4%, 11/1/27 - 11/1/42) | 29,001,160 | 29,000,000 |

Credit Suisse Securities (USA) LLC at: | ||

0.22%, dated 10/26/12 due 11/2/12 (Collateralized by U.S. Government Obligations valued at $5,102,314, 0%, 11/14/12 - 8/16/13) | 5,000,214 | 5,000,000 |

0.24%, dated: | ||

9/11/12 due 12/10/12 (Collateralized by U.S. Government Obligations valued at $72,444,513, 3.5%, 10/20/42) | 71,042,600 | 71,000,000 |

10/25/12 due 11/1/12 (Collateralized by U.S. Government Obligations valued at $5,104,438, 0%, 12/19/12) | 5,000,233 | 5,000,000 |

0.25%, dated 10/4/12 due 1/4/13 (Collateralized by U.S. Government Obligations valued at $55,093,578, 3.5%, 10/20/42) | 54,034,500 | 54,000,000 |

0.26%, dated 10/4/12 due 1/11/13 (Collateralized by U.S. Government Obligations valued at $55,093,222, 0% - 7.25%, 7/24/15 - 10/20/42) | 54,038,610 | 54,000,000 |

Deutsche Bank Securities, Inc. at 0.21%, dated 10/26/12 due 11/2/12 (Collateralized by U.S. Government Obligations valued at $9,206,644, 2.5%, 10/1/27) | 9,000,368 | 9,000,000 |

Goldman Sachs & Co. at 0.25%, dated 10/29/12 due 11/5/12 (Collateralized by U.S. Government Obligations valued at $19,380,404, 5%, 9/1/40) | 19,000,924 | 19,000,000 |

ING Financial Markets LLC at: | ||

0.22%, dated: | ||

10/22/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $10,200,624, 3.5%, 7/1/42 - 10/1/42) | 10,001,833 | 10,000,000 |

10/29/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $15,454,274, 4%, 9/25/41) | 15,002,750 | 15,000,000 |

Government Agency Repurchase Agreement - continued | ||

Maturity | Value | |

With: - continued | ||

ING Financial Markets LLC at: | ||

0.23%, dated: | ||

10/9/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $2,041,507, 2.07%, 1/1/36) | $ 2,000,383 | $ 2,000,000 |

10/31/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $10,200,109, 1.55% - 3.37%, 2/1/18 - 12/1/40) | 10,002,108 | 10,000,000 |

Merrill Lynch, Pierce, Fenner & Smith at: | ||

0.2%, dated 10/26/12 due 11/2/12 (Collateralized by U.S. Government Obligations valued at $28,560,952, 4%, 6/1/42) | 28,001,089 | 28,000,000 |

0.22%, dated 10/22/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $10,205,590, 2% - 2.71%, 6/1/42 - 9/1/42) | 10,001,833 | 10,000,000 |

0.23%, dated 10/4/12 due 11/5/12 (Collateralized by U.S. Government Obligations valued at $9,181,643, 3.5%, 7/1/42) | 9,001,840 | 9,000,000 |

Mitsubishi UFJ Securities (USA), Inc. at: | ||

0.26%, dated: | ||

10/4/12 due 11/2/12 (Collateralized by U.S. Government Obligations valued at $59,239,816, 2.69% - 4.5%, 5/1/25 - 8/1/42) | 58,012,148 | 58,000,000 |

10/10/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $20,442,287, 3.5% - 4%, 4/1/26 - 8/1/42) | 20,004,333 | 20,000,000 |

10/15/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $40,893,672, 0.16% - 4%, 6/17/13 - 9/1/42) | 40,008,667 | 40,000,000 |

10/22/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $82,625,968, 0.16% - 4%, 6/17/13 - 9/1/42) | 81,017,550 | 81,000,000 |

0.27%, dated 10/26/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $21,433,452, 2.11% - 5.66%, 5/1/35 - 2/1/36) | 21,004,883 | 21,000,000 |

Mizuho Securities USA, Inc. at 0.29%, dated 10/29/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $40,832,829, 3% - 3.5%, 7/1/32 - 7/15/42) | 40,037,378 | 40,000,000 |

RBC Capital Markets Corp. at: | ||

0.23%, dated: | ||

10/15/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $9,189,636, 2.5% - 5%, 9/1/22 - 8/20/41) | 9,001,725 | 9,000,000 |

10/19/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $19,458,111, 4%, 3/1/42 - 9/1/42) | 19,003,399 | 19,000,000 |

Government Agency Repurchase Agreement - continued | ||

Maturity | Value | |

With: - continued | ||

RBC Capital Markets Corp. at: | ||

0.25%, dated: | ||

10/15/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $41,824,938, 2.47% - 5.02%, 9/1/40 - 6/1/42) | $ 41,025,910 | $ 41,000,000 |

10/24/12 due 11/7/12 (Collateralized by U.S. Government Obligations valued at $10,217,522, 3.85% - 4%, 12/1/40 - 8/1/42) | 10,006,250 | 10,000,000 |

UBS Securities LLC at 0.21%, dated 10/26/12 due 11/2/12 (Collateralized by U.S. Government Obligations valued at $28,626,072, 3.5% - 4%, 3/1/26 - 6/1/42) | 28,001,143 | 28,000,000 |

TOTAL GOVERNMENT AGENCY REPURCHASE AGREEMENT | 3,639,750,000 | |

Treasury Repurchase Agreement - 3.7% | ||

|

|

|

With Commerz Markets LLC at 0.35%, dated 10/31/12 due 11/1/12 (Collateralized by U.S. Treasury Obligations valued at $239,701,419, 0.25% - 0.88%, 12/15/14 - 2/28/17) | 235,002,285 | 235,000,000 |

TOTAL INVESTMENT PORTFOLIO - 99.4% (Cost $6,381,169,159) |

| |

NET OTHER ASSETS (LIABILITIES) - 0.6% | 38,891,474 | |

NET ASSETS - 100% | $ 6,420,060,633 | |

Legend |

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value |

$2,867,750,000 due 11/01/12 at 0.34% | |

BNP Paribas Securities Corp. | $ 497,284,674 |

Bank of America NA | 511,459,059 |

Barclays Capital, Inc. | 15,355,584 |

Citibank NA | 62,603,534 |

Credit Agricole CIB New York Branch | 21,261,578 |

Deutsche Bank Securities, Inc. | 59,059,938 |

ING Financial Markets LLC | 64,965,931 |

Mizuho Securities USA, Inc. | 1,358,378,563 |

RBC Capital Markets Corp. | 25,986,373 |

RBS Securities, Inc. | 251,394,766 |

| $ 2,867,750,000 |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

| October 31, 2012 (Unaudited) | |

|

|

|

Assets | ||

Investment in securities, at value (including repurchase agreements of $3,874,750,000) - See accompanying schedule: Unaffiliated issuers (cost $6,381,169,159) |

| $ 6,381,169,159 |

Receivable for fund shares sold | 146,473,444 | |

Interest receivable | 4,544,700 | |

Total assets | 6,532,187,303 | |

|

|

|

Liabilities | ||

Payable to custodian bank | $ 216 | |

Payable for investments purchased | 64,115,565 | |

Payable for fund shares redeemed | 46,895,793 | |

Distributions payable | 2,704 | |

Accrued management fee | 1,111,420 | |

Other affiliated payables | 972 | |

Total liabilities | 112,126,670 | |

|

|

|

Net Assets | $ 6,420,060,633 | |

Net Assets consist of: |

| |

Paid in capital | $ 6,420,035,346 | |

Undistributed net investment income | 231 | |

Accumulated undistributed net realized gain (loss) on investments | 25,056 | |

Net Assets, for 6,419,910,900 shares outstanding | $ 6,420,060,633 | |

Net Asset Value, offering price and redemption price per share ($6,420,060,633 ÷ 6,419,910,900 shares) | $ 1.00 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

| Six months ended October 31, 2012 (Unaudited) | |

|

|

|

Investment Income |

|

|

Interest |

| $ 4,751,400 |

|

|

|

Expenses | ||

Management fee | $ 9,596,555 | |

Independent trustees' compensation | 7,258 | |

Interest | 102 | |

Total expenses before reductions | 9,603,915 | |

Expense reductions | (5,082,518) | 4,521,397 |

Net investment income (loss) | 230,003 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers |

| 25,062 |

Net increase in net assets resulting from operations | $ 255,065 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

| Six months ended October 31, 2012 (Unaudited) | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 230,003 | $ 93,243 |

Net realized gain (loss) | 25,062 | 2,906 |

Net increase in net assets resulting | 255,065 | 96,149 |

Distributions to shareholders from net investment income | (229,772) | (93,393) |

Share transactions at net asset value of $1.00 per share | 12,306,824,336 | 5,391,974,626 |

Reinvestment of distributions | 216,341 | 86,063 |

Cost of shares redeemed | (8,713,290,669) | (3,149,240,306) |

Net increase (decrease) in net assets and shares resulting from share transactions | 3,593,750,008 | 2,242,820,383 |

Total increase (decrease) in net assets | 3,593,775,301 | 2,242,823,139 |

|

|

|

Net Assets | ||

Beginning of period | 2,826,285,332 | 583,462,193 |

End of period (including undistributed net investment income of $231 and undistributed net investment income of $0, respectively) | $ 6,420,060,633 | $ 2,826,285,332 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

| Six months ended | Years ended April 30, | ||||

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 |

Selected Per-Share Data | ||||||

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment |

|

|

|

|

| |

Net investment income (loss) | - F | - F | - F | .001 | .015 | .042 |

Net realized and unrealized gain (loss) F | - | - | - | - | - | - |

Total from investment operations | - F | - F | - F | .001 | .015 | .042 |

Distributions from net investment income | - F | - F | - F | (.001) | (.015) | (.042) |

Distributions from net realized gain | - | - | - F | - F | - | - |

Total distributions | - F | - F | - F | (.001) | (.015) | (.042) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C,D | .01% | .01% | .01% | .09% | 1.48% | 4.31% |

Ratios to Average Net Assets E | ||||||

Expenses before reductions | .42% A | .42% | .42% | .42% | .45% | .42% |

Expenses net of fee waivers, if any | .20% A | .16% | .26% | .35% | .45% | .42% |

Expenses net of all reductions | .20% A | .16% | .26% | .35% | .44% | .41% |

Net investment income (loss) | .01% A | .01% | .01% | .10% | 1.39% | 4.02% |

Supplemental Data | ||||||

Net assets, end of period (000 omitted) | $ 6,420,061 | $ 2,826,285 | $ 583,462 | $ 700,145 | $ 1,144,433 | $ 837,409 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the account closeout fee.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended October 31, 2012 (Unaudited)

1. Organization.

Fidelity® Government Money Market Fund (the Fund) is a fund of Fidelity Hereford Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

2. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Investment Transactions and Income. The net asset value per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

2. Significant Accounting Policies - continued

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. A fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustees compensation and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ - |

Gross unrealized depreciation | - |

Net unrealized appreciation (depreciation) on securities and other investments | $ - |

|

|

Tax cost | $ 6,381,169,159 |

Repurchase Agreements. Fidelity Management & Research Company (FMR) has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements may be collateralized by government or non-government securities.

Semiannual Report

2. Significant Accounting Policies - continued

Repurchase Agreements - continued

Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Reverse Repurchase Agreements. To enhance its yield, the Fund may enter into reverse repurchase agreements whereby the Fund transfers securities to a counterparty who then agrees to transfer them back to the Fund at a future date and agreed upon price, reflecting a rate of interest below market rate. Securities sold under a reverse repurchase agreement, if any, are recorded as a liability in the accompanying Statement of Assets and Liabilities. The Fund receives cash proceeds, which are invested in other securities, and agrees to repay the proceeds plus any accrued interest in return for the same securities transferred. The Fund continues to receive interest payments on the transferred securities during the term of the reverse repurchase agreement. During the period that a reverse repurchase agreement is outstanding, the Fund identifies cash and liquid securities as segregated in its custodian records with a value at least equal to its obligation under the agreement. If the counterparty defaults on its obligation, because of insolvency or other reasons, the Fund could experience delays and costs in recovering the security or in gaining access to the collateral. The average balance during the period for which reverse repurchase agreements were outstanding subject to interest amounted to $14,554,286. The weighted average interest rate was .04% on such amounts. At period end, there were no reverse repurchase agreements outstanding.

3. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee that is based on an annual rate of .42% of the Fund's average net assets. Under the management contract, FMR pays all other expenses, except the compensation of the independent Trustees and certain other expenses such as interest expense. The management fee paid to FMR by the Fund is reduced by an amount equal to the fees and expenses paid by the Fund to the independent Trustees.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

4. Expense Reductions.

FMR or its affiliates voluntarily agreed to waive certain fees in order to maintain a minimum annualized yield of .01%. Such arrangements may be discontinued by FMR at any time. For the period, the amount of the waiver was $5,082,517.

In addition, through arrangements with the Fund's custodian, credits realized as a result of uninvested cash balances were used to reduce the Fund's management fee. During the period, these credits reduced the Fund's management fee by $1.

5. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees

Fidelity Government Money Market Fund

Each year, the Board of Trustees, including the Independent Trustees (together, the Board), votes on the renewal of the management contract and sub-advisory agreements (together, the Advisory Contracts) for the fund. The Board, assisted by the advice of fund counsel and Independent Trustees' counsel, requests and considers a broad range of information relevant to the renewal of the Advisory Contracts throughout the year.

The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and Board considers factors that are relevant to its annual consideration of the renewal of the fund's Advisory Contracts, including the services and support provided to the fund and its shareholders. The Board has established three standing committees, Operations, Audit, and Governance and Nominating, each composed of and chaired by Independent Trustees with varying backgrounds, to which the Board has assigned specific subject matter responsibilities in order to enhance effective decision-making by the Board. The Operations Committee, of which all of the Independent Trustees are members, meets regularly throughout the year and, among other matters, considers matters specifically related to the annual consideration of the renewal of the fund's Advisory Contracts. The Board, acting directly and through its Committees, requests and receives information concerning the annual consideration of the renewal of the fund's Advisory Contracts. The Board also meets as needed to consider matters specifically related to the Board's annual consideration of the renewal of Advisory Contracts. Members of the Board may also meet with trustees of other Fidelity funds through ad hoc joint committees to discuss certain matters relevant to the Fidelity funds.

At its September 2012 meeting, the Board of Trustees, including the Independent Trustees, unanimously determined to renew the fund's Advisory Contracts. In reaching its determination, the Board considered all factors it believed relevant, including (i) the nature, extent, and quality of the services to be provided to the fund and its shareholders (including the investment performance of the fund); (ii) the competitiveness of the fund's management fee and total expense ratio relative to peer funds; (iii) the total costs of the services to be provided by and the profits to be realized by Fidelity from its relationship with the fund; (iv) the extent to which economies of scale exist and would be realized as the fund grows; and (v) whether fee levels reflect these economies of scale, if any, for the benefit of fund shareholders.

In considering whether to renew the Advisory Contracts for the fund, the Board reached a determination, with the assistance of fund counsel and Independent Trustees' counsel and through the exercise of its business judgment, that the renewal of the Advisory Contracts is in the best interests of the fund and its shareholders and that the compensation payable under the Advisory Contracts is fair and reasonable. The Board's decision to renew the Advisory Contracts was not based on any single factor, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings throughout the year. The Board, in reaching its determination to renew the Advisory Contracts, was aware that shareholders in the fund have a broad range of investment choices available to them, including a wide choice among mutual funds offered by Fidelity's competitors, and that the fund's shareholders, who have the opportunity to review and weigh the disclosure provided by the fund in its prospectus and other public disclosures, have chosen to invest in this fund, managed by Fidelity.

Semiannual Report

Nature, Extent, and Quality of Services Provided. The Board considered the staffing within the investment adviser, FMR, and the sub-advisers (together, the Investment Advisers), including the backgrounds of the fund's investment personnel, and also considered the fund's investment objective, strategies, and related investment philosophy. The Independent Trustees also had discussions with senior management of Fidelity's investment operations and investment groups. The Board considered the structure of the portfolio manager compensation program and whether this structure provides appropriate incentives to act in the best interests of the fund.

Resources Dedicated to Investment Management and Support Services. The Board reviewed the general qualifications and capabilities of the Investment Advisers' investment staff, including its size, education, experience, and resources, as well as the Investment Advisers' approach to recruiting, managing, and compensating investment personnel. The Board also noted that FMR has continued to increase the resources devoted to non-U.S. offices, including expansion of Fidelity's global investment organization. The Board noted that Fidelity's analysts have extensive resources, tools and capabilities that allow them to conduct sophisticated quantitative and fundamental analysis, as well as credit analysis of issuers, counterparties and guarantors. The Board also believes that Fidelity's investment professionals have sufficient access to global information and data so as to provide competitive investment results over time, and that those professionals also have access to sophisticated tools that permit them to assess portfolio construction and risk and performance attribution characteristics continuously, as well as to transmit new information and research conclusions rapidly around the world. Additionally, in its deliberations, the Board considered the Investment Advisers' trading and risk management capabilities and resources, which are an integral part of the investment management process.

Shareholder and Administrative Services. The Board considered (i) the nature, extent, quality, and cost of advisory, administrative, and shareholder services performed by the Investment Advisers and their affiliates under the Advisory Contracts and under separate agreements covering transfer agency and pricing and bookkeeping services for the fund; (ii) the nature and extent of the supervision of third party service providers, principally custodians and subcustodians; and (iii) the resources devoted to, and the record of compliance with, the fund's compliance policies and procedures.

Semiannual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

The Board noted that the growth of fund assets over time across the complex allows Fidelity to reinvest in the development of services designed to enhance the value or convenience of the Fidelity funds as investment vehicles. These services include 24-hour access to account information and market information through telephone representatives and over the Internet, investor education materials and asset allocation tools, and the expanded availability of Fidelity Investor Centers.

Investment in a Large Fund Family. The Board considered the benefits to shareholders of investing in a Fidelity fund, including the benefits of investing in a fund that is part of a large family of funds offering a variety of investment disciplines and providing a large variety of mutual fund investor services. The Board noted that Fidelity had taken, or had made recommendations that resulted in the Fidelity funds taking, a number of actions over the previous year that benefited particular funds, including (i) continuing to dedicate additional resources to investment research and support of the senior management team that oversees asset management; (ii) persisting in efforts to enhance Fidelity's research capabilities, in particular, international research; (iii) launching new funds and making other enhancements to meet client needs for global and income-oriented solutions; (iv) continuing to launch dedicated lower cost underlying funds to meet investment management's portfolio construction needs related to expanding underlying fund options, specifically for the Freedom Fund product lines; (v) adopting a sector neutral investment approach for certain funds and utilizing a team of portfolio managers to manage certain sector-neutral funds; (vi) rationalizing product lines and gaining increased efficiencies through combinations of several funds with other funds; (vii) strengthening the Spartan Index Fund product line by adding new funds and/or new low-cost institutional share classes, restructuring fund expenses to accommodate new classes, and reducing investment minimums for certain classes of shares; (viii) modifying the eligibility criteria for Institutional Class shares to increase their appeal to government entities and charitable investors; and (ix) reducing certain transfer agent fee rates.

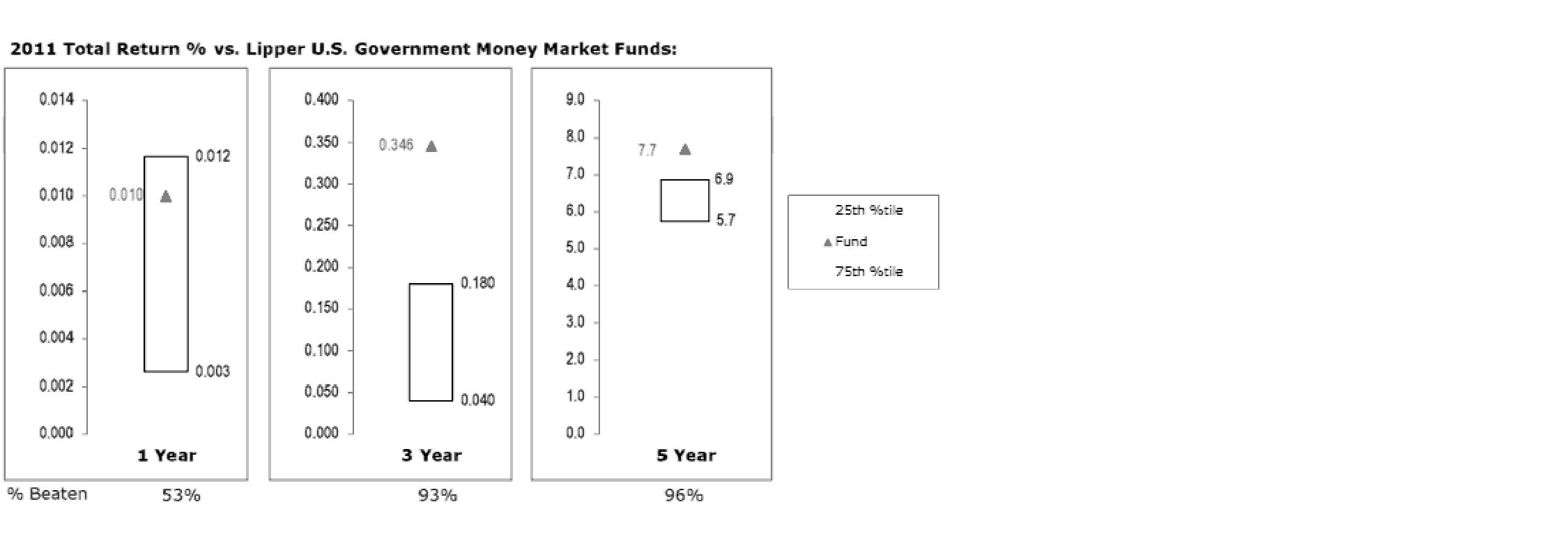

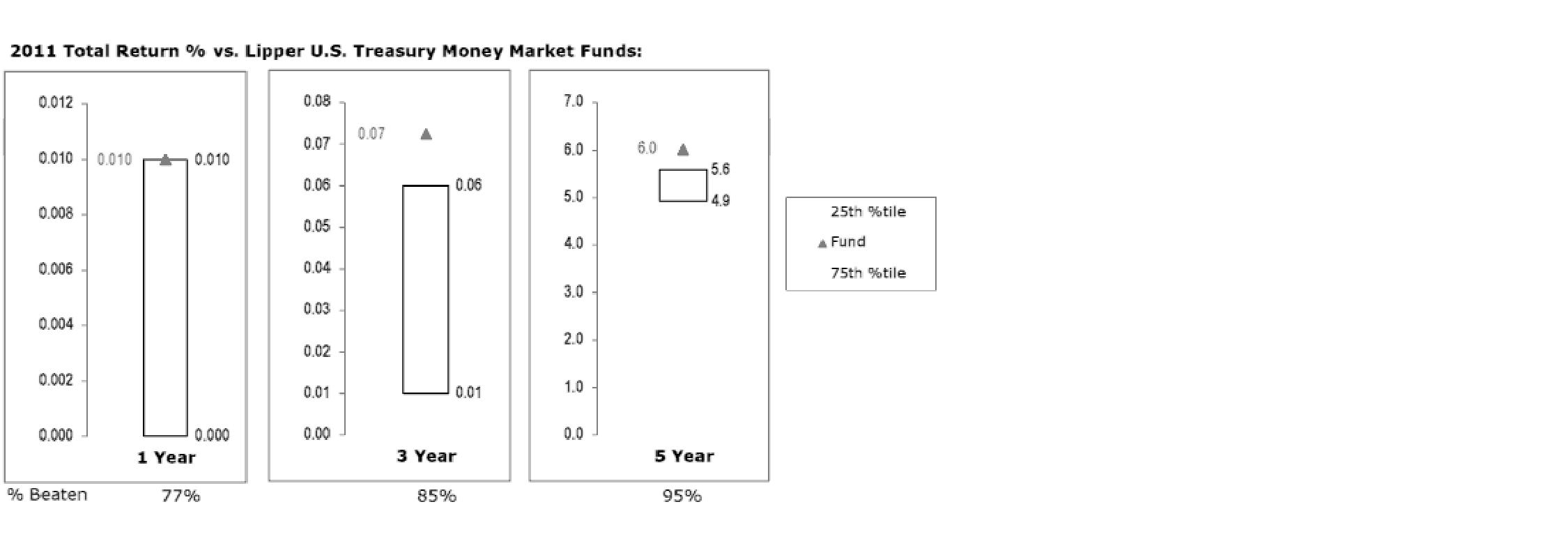

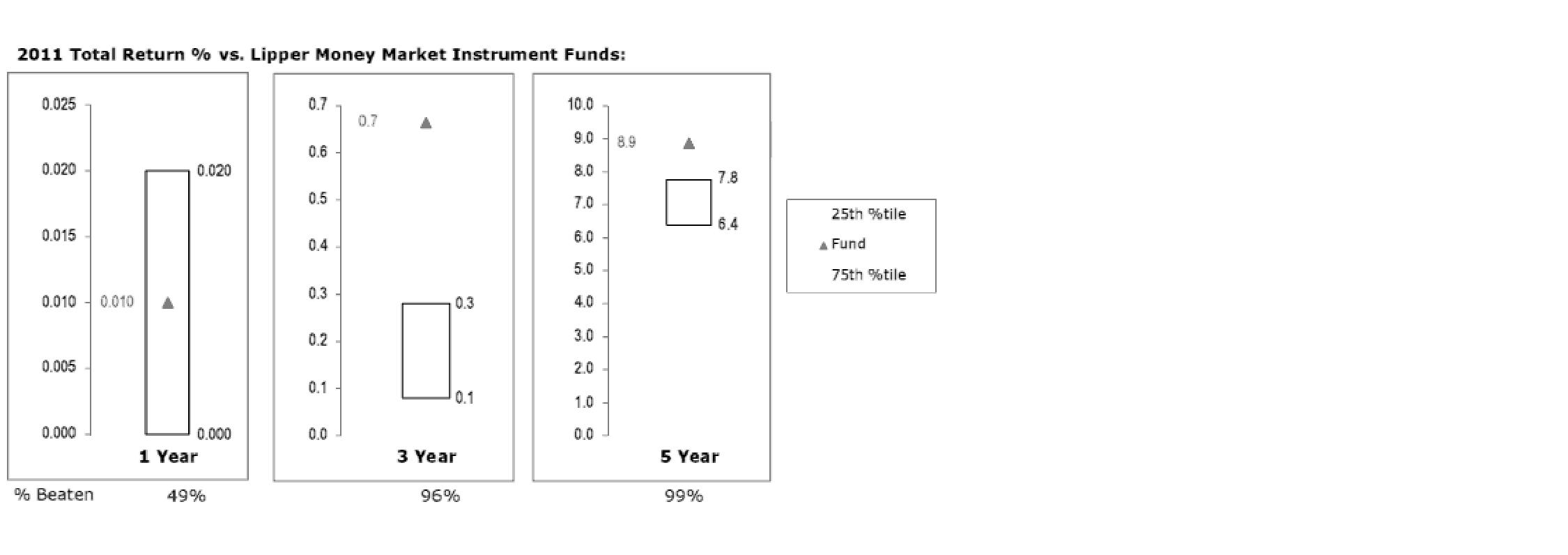

Investment Performance. The Board considered whether the fund has operated in accordance with its investment objective, as well as its record of compliance with its investment restrictions. It also reviewed the fund's absolute investment performance, as well as the fund's relative investment performance measured over multiple periods against a peer group of mutual funds deemed appropriate by Fidelity and reviewed by the Board. The following charts considered by the Board show, over the one-, three-, and five-year periods ended December 31, 2011, the fund's cumulative total returns and a range of cumulative total returns of a peer group of mutual funds identified by Lipper Inc. as having an investment objective similar to that of the fund. The box within each chart shows the 25th percentile return (top of box) and the 75th percentile return (bottom of box) of the peer group. Returns shown above the box are in the first quartile and returns shown below the box are in the fourth quartile. The percentage beaten number noted below each chart corresponds to the percentile box and represents the percentage of funds in the peer group whose performance was equal to or lower than that of the fund.

Semiannual Report

Fidelity Government Money Market Fund

The Board reviewed the fund's relative investment performance against its peer group and noted that the performance of the fund was in the second quartile for the one-year period and the first quartile for the three- and five-year periods. The Board noted that there was a portfolio management change for the fund in April 2012. The Board also reviewed the fund's performance since inception as well as performance in the current year.

The Board noted as a general matter that the percentage beaten numbers for money market funds in recent years were less meaningful than in earlier years, as many competitors have been waiving fees to maintain a one basis point yield and performance differences among funds may not be apparent due to rounding.

Based on its review, the Board concluded that the nature, extent, and quality of services provided to the fund under the Advisory Contracts should benefit the fund's shareholders.

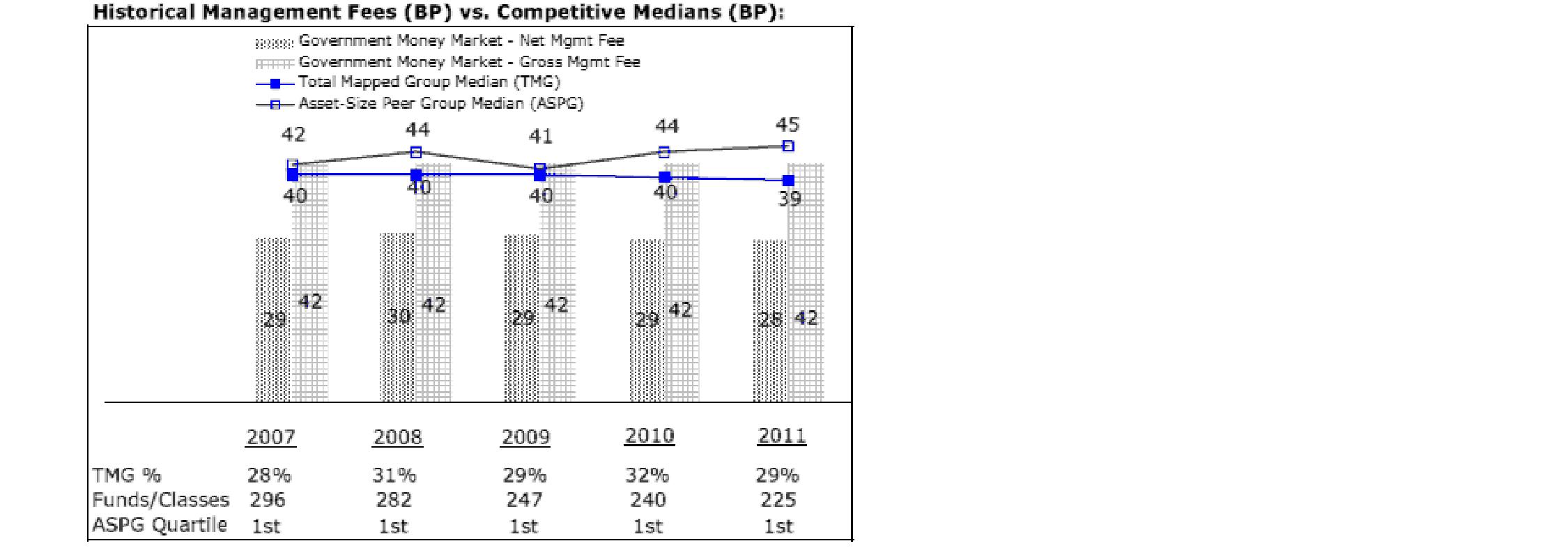

Competitiveness of Management Fee and Total Expense Ratio. The Board considered the fund's management fee and total expense ratio compared to "mapped groups" of competitive funds and classes. Fidelity creates "mapped groups" by combining similar Lipper investment objective categories that have comparable management fee characteristics. Combining Lipper investment objective categories aids the Board's management fee and total expense ratio comparisons by broadening the competitive group used for comparison and by reducing the number of universes to which various Fidelity funds are compared.

Semiannual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

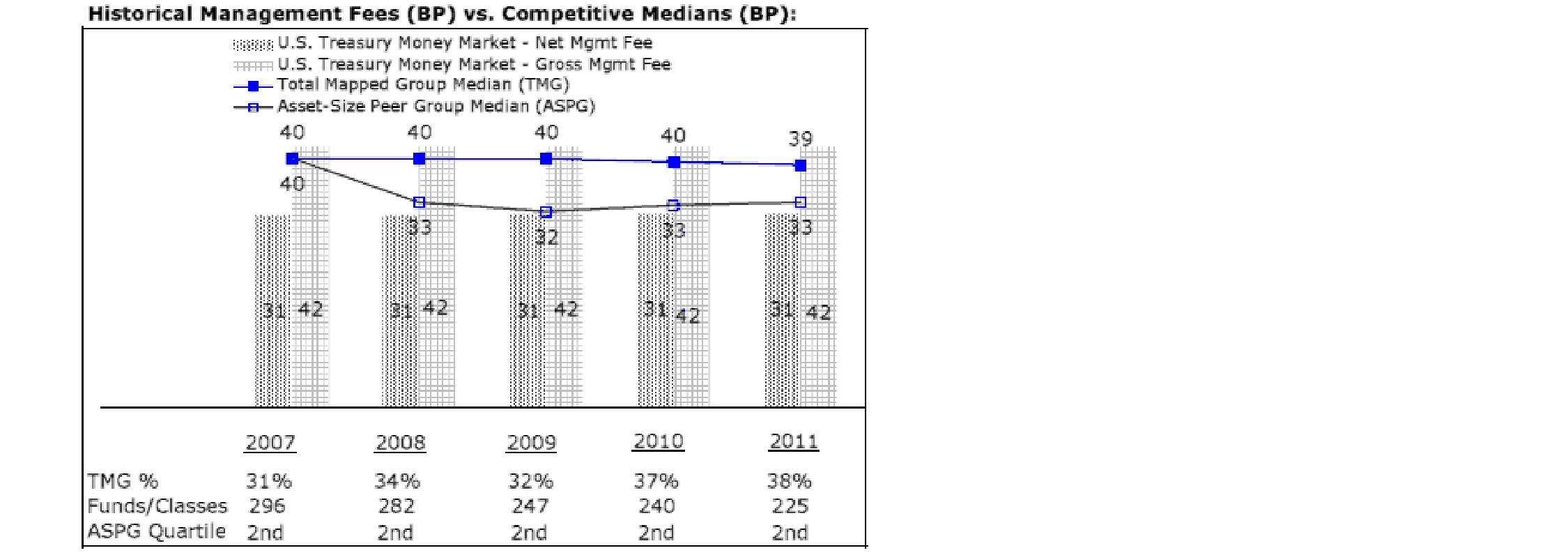

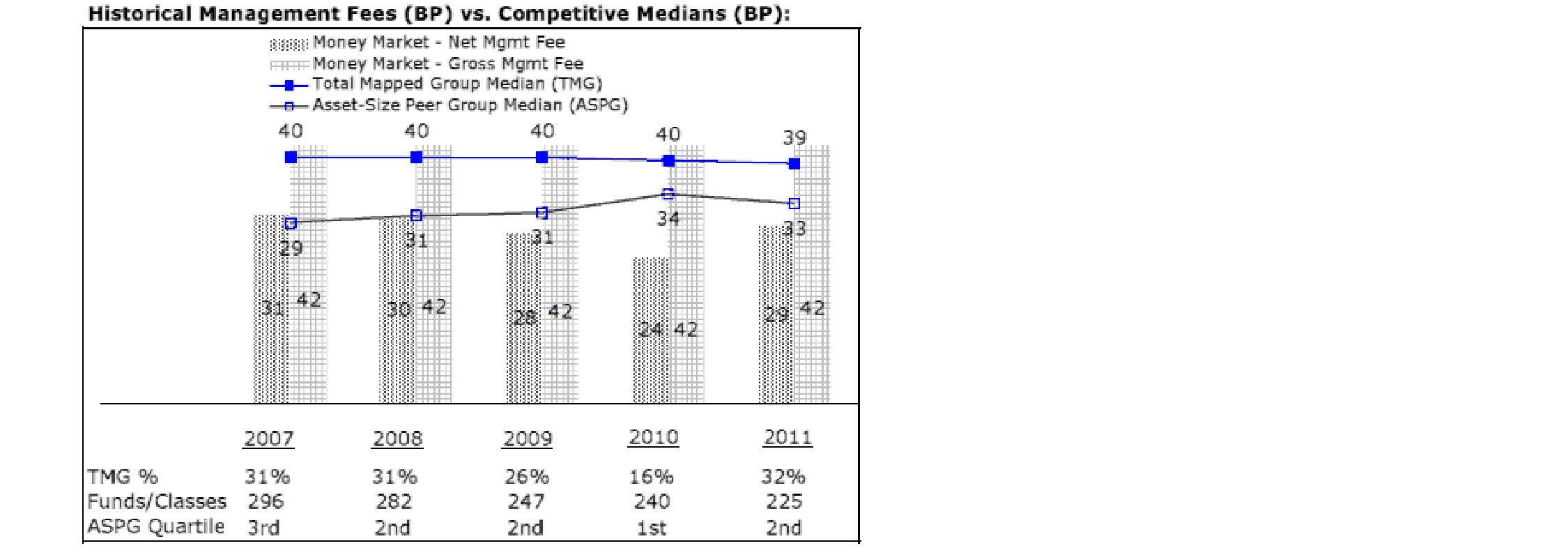

Management Fee. The Board considered two proprietary management fee comparisons for the 12-month periods shown in the chart below. The group of Lipper funds used by the Board for management fee comparisons is referred to below as the "Total Mapped Group" and, for the reasons explained above, is broader than the Lipper peer group used by the Board for performance comparisons. The Total Mapped Group comparison focuses on a fund's standing relative to the total universe of comparable funds available to investors in terms of gross management fees before expense reimbursements or caps. "TMG %" represents the percentage of funds in the Total Mapped Group that had management fees that were lower than the fund's. For example, a TMG % of 29% means that 71% of the funds in the Total Mapped Group had higher management fees than the fund. The "Asset-Size Peer Group" (ASPG) comparison focuses on a fund's standing relative to non-Fidelity funds similar in size to the fund within the Total Mapped Group. The ASPG represents at least 15% of the funds in the Total Mapped Group with comparable asset size and management fee characteristics, subject to a minimum of 50 funds (or all funds in the Total Mapped Group if fewer than 50). Additional information, such as the ASPG quartile in which the fund's management fee ranked, is also included in the chart and considered by the Board. Because the vast majority of competitor funds' management fees do not cover non-management expenses, for a more meaningful comparison of management fees, the fund is compared on the basis of a hypothetical "net management fee," which is derived by subtracting payments made by FMR for non-management expenses (including transfer agent fees, pricing and bookkeeping fees, and fees paid to non-affiliated custodians) from the fund's all-inclusive fee. In this regard, the Board considered that net management fees can vary from year to year because of differences in non-management expenses.

Semiannual Report

Fidelity Government Money Market Fund

The Board noted that the fund's hypothetical net management fee ranked below the median of its Total Mapped Group and below the median of its ASPG for 2011.

Based on its review, the Board concluded that the fund's management fee is fair and reasonable in light of the services that the fund receives and the other factors considered.

Total Expense Ratio. In its review of the fund's total expense ratio, the Board considered the fund's hypothetical net management fee as well as the fund's all-inclusive fee. The Board also considered other expenses, such as transfer agent fees, pricing and bookkeeping fees, and custodial, legal, and audit fees, paid by FMR under the all-inclusive arrangement. The Board also noted the effects of any waivers and reimbursements on fees and expenses. As part of its review, the Board also considered the current and historical total expense ratios of the fund compared to competitive fund median expenses. The fund is compared to those funds and classes in the Total Mapped Group (used by the Board for management fee comparisons) that have a similar sales load structure.

The Board noted that the fund's total expense ratio ranked below its competitive median for 2011. The Board considered that Fidelity has been voluntarily waiving part or all of the management fees to maintain a minimum yield, and also noted that Fidelity retains the ability to be repaid in certain circumstances.

Fees Charged to Other Fidelity Clients. The Board also considered Fidelity fee structures and other information with respect to clients of FMR and its affiliates, such as other mutual funds advised or subadvised by FMR or its affiliates, pension plan clients, and other institutional clients. The Board noted the findings of the 2010 ad hoc joint committee (created with the board of other Fidelity funds), which reviewed and compared Fidelity's institutional investment advisory business with its business of providing services to the Fidelity funds, including the differences in services provided, fees charged, and costs incurred, as well as competition in their respective marketplaces.

Semiannual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

Based on its review of total expense ratios and fees charged to other Fidelity clients, the Board concluded that the fund's total expense ratio was reasonable in light of the services that the fund and its shareholders receive and the other factors considered.

Costs of the Services and Profitability. The Board considered the revenues earned and the expenses incurred by Fidelity in conducting the business of developing, marketing, distributing, managing, administering and servicing the fund and its shareholders. The Board also considered the level of Fidelity's profits in respect of all the Fidelity funds.

On an annual basis, FMR presents to the Board Fidelity's profitability for the fund. Fidelity calculates the profitability for each fund, as well as aggregate profitability for groups of Fidelity funds and all Fidelity funds, using a series of detailed revenue and cost allocation methodologies which originate with the books and records of Fidelity on which Fidelity's audited financial statements are based. The Audit Committee of the Board reviews any significant changes from the prior year's methodologies.

PricewaterhouseCoopers LLP (PwC), independent registered public accounting firm and auditor to Fidelity and certain Fidelity funds, has been engaged annually by the Board as part of the Board's assessment of Fidelity's profitability analysis. PwC's engagement includes the review and assessment of Fidelity's methodologies used in determining the revenues and expenses attributable to Fidelity's mutual fund business, and completion of agreed-upon procedures surrounding the mathematical accuracy of fund profitability and its conformity to allocation methodologies. After considering PwC's reports issued under the engagement and information provided by Fidelity, the Board concluded that while other allocation methods may also be reasonable, Fidelity's profitability methodologies are reasonable in all material respects.

The Board also reviewed Fidelity's non-fund businesses and fall-out benefits related to the mutual fund business as well as cases where Fidelity's affiliates may benefit from or be related to the fund's business.

The Board considered the costs of the services provided by and the profits realized by Fidelity in connection with the operation of the fund and was satisfied that the profitability was not excessive in the circumstances.

Economies of Scale. The Board considered whether there have been economies of scale in respect of the management of the Fidelity funds, whether the Fidelity funds (including the fund) have appropriately benefited from any such economies of scale, and whether there is potential for realization of any further economies of scale. The Board considered the extent to which the fund will benefit from economies of scale through increased services to the fund, through waivers or reimbursements, or through fee or expense reductions. The Board also noted that in 2009, it and the board of other Fidelity funds created an ad hoc committee (the Economies of Scale Committee) to analyze whether FMR attains economies of scale in respect of the management and servicing of the Fidelity funds, whether the Fidelity funds have appropriately benefited from such economies of scale, and whether there is potential for realization of any further economies of scale.

Semiannual Report

The Board concluded, taking into account the analysis of the Economies of Scale Committee, that economies of scale, if any, are being appropriately shared between fund shareholders and Fidelity.

Additional Information Requested by the Board. In order to develop fully the factual basis for consideration of the Fidelity funds' Advisory Contracts, the Board requested and received additional information on certain topics, including: (i) Fidelity's fund profitability methodology, profitability trends for certain funds, and the impact of certain factors on fund profitability results; (ii) portfolio manager changes that have occurred during the past year and the amount of the investment that each portfolio manager has made in the Fidelity fund(s) that he or she manages; (iii) Fidelity's compensation structure for portfolio managers, research analysts, and other key personnel, including its effects on fund profitability, the rationale for the compensation structure, and the extent to which current market conditions have affected retention and recruitment; (iv) the compensation paid to fund sub-advisers on behalf of the Fidelity funds; (v) Fidelity's fee structures, including the group fee structure, and the rationale for recommending different fees among different categories of funds and classes; (vi) Fidelity's voluntary waiver of its fees to maintain minimum yields for certain money market funds and classes as well as contractual waivers in place for certain funds; (vii) regulatory and industry developments, including those affecting money market funds and target date funds, and the potential impact to Fidelity; (viii) Fidelity's transfer agent fees, expenses, and services, and drivers for determining the transfer agent fee structure of different funds and classes; (ix) management fee rates charged by FMR or Fidelity entities to other Fidelity clients; (x) the allocation of and historical trends in Fidelity's realization of fall-out benefits; and (xi) explanations regarding the relative total expense ratios of certain funds and classes, total expense competitive trends, and actions that might be taken by FMR to reduce total expense ratios for certain funds and classes or to achieve further economies of scale.

Based on its evaluation of all of the conclusions noted above, and after considering all factors it believed relevant, the Board ultimately concluded that the advisory fee structures are fair and reasonable, and that the fund's Advisory Contracts should be renewed.

Semiannual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Advisers

Fidelity Investments

Money Management, Inc.

Fidelity Management & Research

(U.K.) Inc.

Fidelity Management & Research

(Hong Kong) Limited

Fidelity Management & Research

(Japan) Inc.

General Distributor

Fidelity Distributors Corporation

Smithfield, RI

Transfer and Service Agents

Fidelity Investments Institutional

Operations Company, Inc.

Boston, MA

Fidelity Service Company, Inc.

Boston, MA

Custodian

JPMorgan Chase Bank

New York, NY

The Fidelity Telephone Connection

Mutual Fund 24-Hour Service

Exchanges/Redemptions

and Account Assistance 1-800-544-6666

Product Information 1-800-544-6666

Retirement Accounts 1-800-544-4774 (8 a.m. - 9 p.m.)

TDD Service 1-800-544-0118

for the deaf and hearing impaired

(9 a.m. - 9 p.m. Eastern time)

Fidelity Automated Service

Telephone (FAST®)

1-800-544-5555

Automated line for quickest service

(Fidelity Investment logo)(registered trademark)

Corporate Headquarters

82 Devonshire St., Boston, MA 02109

www.fidelity.com

SPU-USAN-1212 1.784869.109

U.S. Treasury Money Market

Fund

Semiannual Report

October 31, 2012

(Fidelity Cover Art)

Contents

Shareholder Expense Example | An example of shareholder expenses. | |

Investment Changes/Performance | A summary of major shifts in the fund's investments over the past six months and one year. | |

Investments | A complete list of the fund's investments. | |

Financial Statements | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. | |

Notes | Notes to the financial statements. | |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2012 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2012 to October 31, 2012).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Shareholder Expense Example - continued

| Annualized | Beginning | Ending | Expenses Paid |

Actual | .10% | $ 1,000.00 | $ 1,000.05 | $ .50** |

Hypothetical (5% return per year before expenses) |

| $ 1,000.00 | $ 1,024.70 | $ .51** |

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

** If certain fees were not voluntarily waived by Fidelity Management & Research Company (FMR) or its affiliates during the period, the annualized expense ratio would have been 0.42% and the expenses paid in the actual and hypothetical examples above would have been $2.12 and $2.14, respectively.

Semiannual Report

Investment Changes/Performance (Unaudited)

Effective Maturity Diversification | |||

Days | % of fund's | % of fund's | % of fund's |

1 - 7 | 10.6 | 10.3 | 12.5 |

8 - 30 | 45.0 | 20.4 | 35.7 |

31 - 60 | 15.3 | 19.7 | 20.8 |

61 - 90 | 12.2 | 34.5 | 9.7 |

91 - 180 | 14.3 | 14.3 | 15.2 |

> 180 | 2.6 | 0.8 | 6.1 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity | |||

| 10/31/12 | 4/30/12 | 10/31/11 |

Fidelity U.S. Treasury Money Market Fund | 50 Days | 55 Days | 51 Days |

Treasury Retail Money Market Funds Average* | 53 Days | 50 Days | 54 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life | |||

| 10/31/12 | 4/30/12 | 10/31/11 |

Fidelity U.S. Treasury Money Market Fund | 50 Days | 55 Days | 51 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

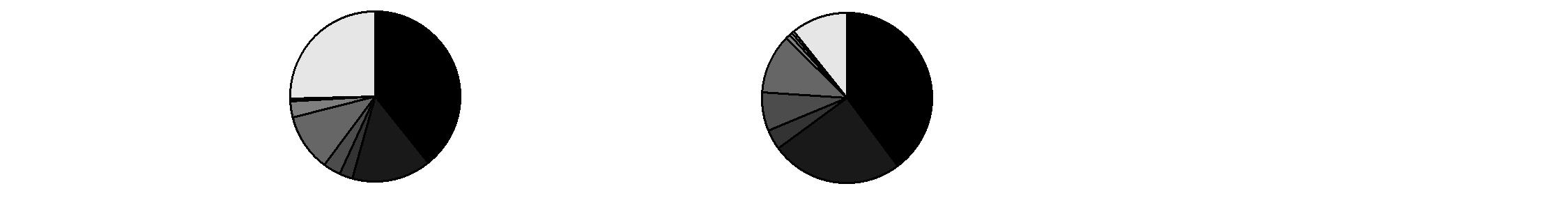

Asset Allocation (% of fund's net assets) | |||||||

As of October 31, 2012 | As of April 30, 2012 | ||||||

| Treasury |

|  | Treasury |

| ||

| Net Other |

|  | Net Other |

| ||

* Source: iMoneyNet, Inc.

** Net Other Assets (Liabilities) are not included in the pie chart

Semiannual Report

Investment Changes/Performance (Unaudited) - continued

Current and Historical Seven-Day Yields |

| 10/31/12 | 7/31/12 | 4/30/12 | 1/31/12 | 11/1/11 |

Fidelity U.S. Treasury Money Market Fund | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending October 31, 2012, the most recent period shown in the table, would have been -0.28%.

Semiannual Report

Investments October 31, 2012 (Unaudited)

Showing Percentage of Net Assets

Treasury Debt - 111.6% | ||||

|

| Yield (a) | Principal | Value (000s) |

U.S. Treasury Obligations - 111.6% | ||||

U.S. Treasury Bills | ||||

| 11/1/12 to 4/25/13 | 0.01 to 0.15% | $ 4,763,770 | $ 4,762,934 |

U.S. Treasury Notes | ||||

| 11/15/12 to 8/31/13 | 0.13 to 0.20 | 2,042,000 | 2,047,389 |

TOTAL INVESTMENT PORTFOLIO - 111.6% (Cost $6,810,323) | 6,810,323 | ||

NET OTHER ASSETS (LIABILITIES) - (11.6)% | (706,034) | ||

NET ASSETS - 100% | $ 6,104,289 | ||

Legend |

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | October 31, 2012 (Unaudited) | |

|

|

|

Assets | ||

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $6,810,323) |

| $ 6,810,323 |

Cash |

| 304,722 |

Receivable for fund shares sold | 6,270 | |

Interest receivable | 14,082 | |

Total assets | 7,135,397 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 1,024,874 | |

Payable for fund shares redeemed | 5,632 | |

Distributions payable | 5 | |

Accrued management fee | 595 | |

Other affiliated payables | 2 | |

Total liabilities | 1,031,108 | |

|

|

|

Net Assets | $ 6,104,289 | |

Net Assets consist of: |

| |

Paid in capital | $ 6,104,185 | |

Accumulated undistributed net realized gain (loss) on investments | 104 | |

Net Assets, for 6,103,580 shares outstanding | $ 6,104,289 | |

Net Asset Value, offering price and redemption price per share ($6,104,289 ÷ 6,103,580 shares) | $ 1.00 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Six months ended October 31, 2012 (Unaudited) | |

|

|

|

Investment Income |

|

|

Interest |

| $ 3,453 |

|

|

|

Expenses | ||

Management fee | $ 12,923 | |

Independent trustees' compensation | 11 | |

Total expenses before reductions | 12,934 | |

Expense reductions | (9,791) | 3,143 |

Net investment income (loss) | 310 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers |

| 61 |

Net increase in net assets resulting from operations | $ 371 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

Amounts in thousands | Six months ended October 31, 2012 (Unaudited) | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 310 | $ 601 |

Net realized gain (loss) | 61 | 30 |

Net increase in net assets resulting | 371 | 631 |

Distributions to shareholders from net investment income | (310) | (601) |

Share transactions at net asset value of $1.00 per share | 1,363,621 | 5,249,374 |

Reinvestment of distributions | 281 | 544 |

Cost of shares redeemed | (1,303,208) | (3,928,864) |

Net increase (decrease) in net assets and shares resulting from share transactions | 60,694 | 1,321,054 |

Total increase (decrease) in net assets | 60,755 | 1,321,084 |

|

|

|

Net Assets | ||

Beginning of period | 6,043,534 | 4,722,450 |

End of period | $ 6,104,289 | $ 6,043,534 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

| Six months ended | Years ended April 30, | ||||

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 |

Selected Per-Share Data | ||||||

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations |

|

|

|

|

|

|

Net investment income (loss) | - F | - F | - F | - F | .007 | .035 |

Net realized and unrealized gain (loss) F | - | - | - | - | - | - |

Total from investment operations | - F | - F | - F | - F | .007 | .035 |

Distributions from net investment income | - F | - F | - F | - F | (.007) | (.035) |

Distributions from net realized gain | - | - | - | - F | - | - |

Total distributions | - F | - F | - F | - F | (.007) | (.035) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C,D | .01% | .01% | .01% | .02% | .75% | 3.59% |

Ratios to Average Net Assets E | ||||||

Expenses before reductions | .42% A | .42% | .42% | .42% | .45% | .45% |

Expenses net of fee waivers, if any | .10% A | .05% | .17% | .27% | .45% | .45% |

Expenses net of all reductions | .10% A | .05% | .17% | .27% | .45% | .44% |

Net investment income (loss) | .01% A | .01% | .01% | .01% | .58% | 3.21% |

Supplemental Data | ||||||

Net assets, end of period (in millions) | $ 6,104 | $ 6,044 | $ 4,722 | $ 5,196 | $ 8,413 | $ 4,786 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the account closeout fee.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended October 31, 2012 (Unaudited)

(Amounts in thousands except percentages)

1. Organization.

Fidelity® U.S. Treasury Money Market Fund (the Fund) is a fund of Fidelity Hereford Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

2. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Investment Transactions and Income. The net asset value per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

2. Significant Accounting Policies - continued

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. A fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.